LOAN AGREEMENT

Exhibit 4.18

MASLAND CARPETS, LLC

(a limited liability company formed and

existing under the laws of

the State of Georgia) as Lender

and

DEVELOPMENT AUTHORITY OF XXXXXX COUNTY

(a public body corporate and politic duly created and existing under the laws of the State of Georgia)

as Borrower

Dated December 28, 2012

1

This LOAN AGREEMENT (this "Agreement") dated December 28, 2012, by and between the Development Authority of Xxxxxx County, a Georgia public body corporate and politic (the "Borrower"), whose address for purposes of this Agreement shall be 000 Xxxxx Xxxx Xxxxxx, Xxxxxxx, Xxxxxxx 00000, and Masland Carpets, LLC, a Georgia limited liability company (the "Lender"), whose address for purposes of this Agreement shall be 0000 Xxxxx Xxxxxxxx Xxxxxx Xxxxxxxxx, Xxxxxx, Xxxxxxx 00000.

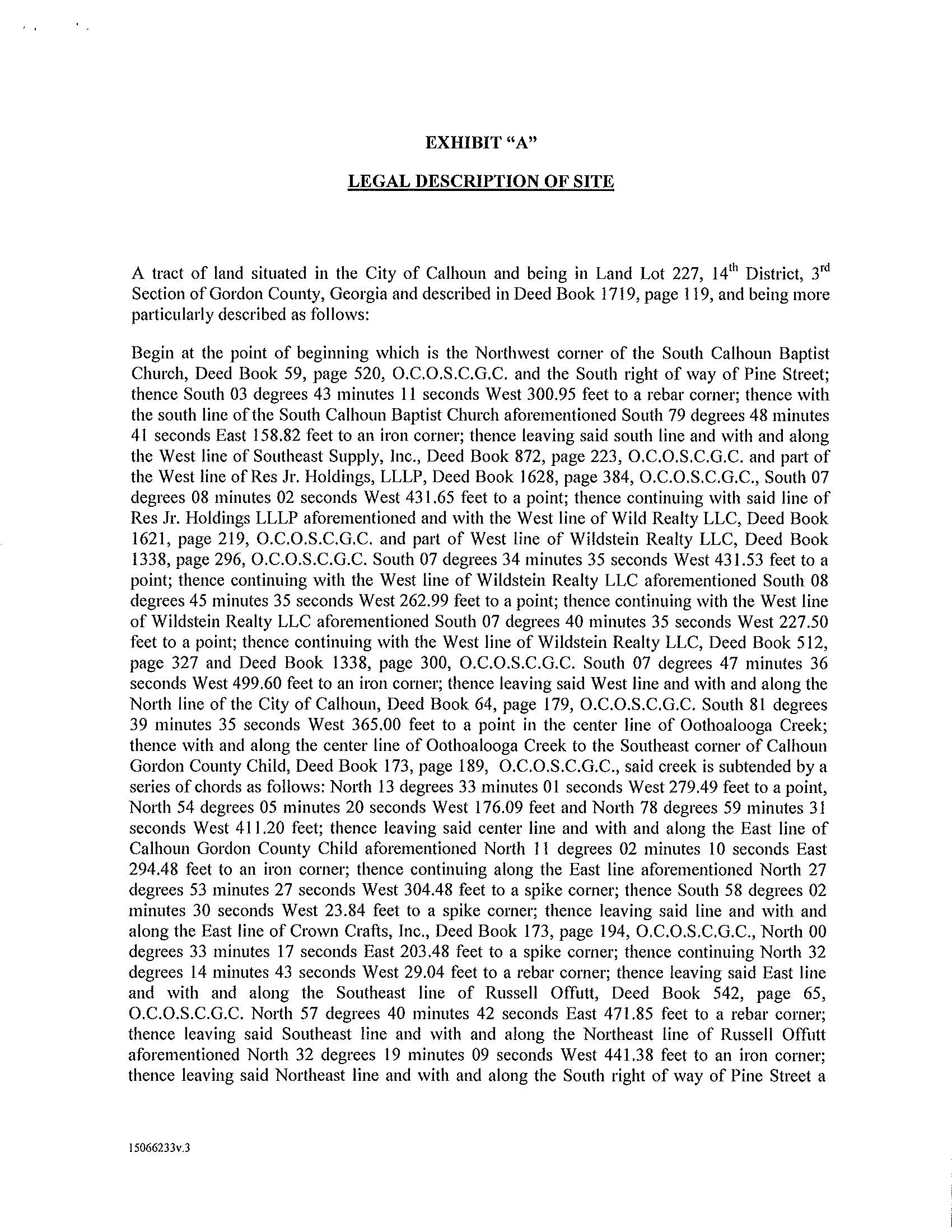

1. Background - The Lender desires to loan to the Borrower $5,339,217.03 to finance the costs of purchasing several carpet-dyeing buildings (the "Improvements"), located on an approximately 46.44 acre site more particularly described in Exhibit A attached to this Agreement (the "Site"), and related equipment more particularly described in Exhibit B attached to this Agreement (the "Equipment"), from Masland Carpets, LLC (the "Seller"), pursuant to the terms of a Purchase and Sale Agreement, dated this date (the "Purchase Agreement"), between the Seller and the Borrower, as purchaser. Pursuant to the terms of a Lease Agreement, dated as of December 1, 2012 (the "Lease"), between the Borrower, as lessor, and Masland Carpets, LLC (the "Lessee"), as lessee, the Lessee will lease the Site, the Improvements, and the Equipment (collectively the "Facilities") from the Borrower for rental payments sufficient in time and amount to enable the Borrower to pay principal of and interest on its Taxable Revenue Bond (Masland Carpets, LLC Real Estate Project), Series 2012B (the "Series 2012B Bond"), when the same become due and payable. Pursuant to the terms of a Loan and Security Agreement, dated this date (the "Credit Agreement"), between the Lessee, as lender, and the Borrower, as borrower, the Lessee has agreed to make advances to the Borrower sufficient in time and amount to enable the Borrower to repay the Loan (as hereinafter defined) and to pay interest on the Loan and all other amounts owed by the Borrower to the Lender pursuant to this Agreement. The Borrower's obligation to repay the advances made pursuant to the Credit Agreement and to pay interest on such advances will be evidenced by the Series 2012B Bond.

2.Loan - Subject to the terms and conditions of this Agreement, the Lender agrees to make the following loan (the "Loan") available to the Borrower:

(a)The Lender agrees to advance to the Borrower, on or prior to December 31, 2012, the Loan in a principal amount of $5,339,217.03, which Loan shall be disbursed in one advance, and such disbursement shall reduce the Lender's loan commitment hereunder and any sums advanced hereunder may not be repaid and then re-borrowed. The advance of the Loan shall be disbursed directly to the Seller for the account of the Borrower, to satisfy the Borrower's obligations under the Purchase Agreement. In lieu of advancing moneys to the Borrower pursuant to this Section 2(a) to enable the Borrower to purchase the Facilities from the Seller, the Borrower may exchange the Series 2012A Bond described below for the Facilities, in which case the Loan shall be deemed to have been made.

(b)The Borrower's obligation to pay the Lender the principal of and interest on the Loan shall be evidenced by the records of the Lender and by the Series 20 I 2A Bond described below.

1

3.Series 2012A Bond and Security Documents - The Loan shall be evidenced by the Borrower's Taxable Revenue Bond (Masland Carpets, LLC Real Estate Project), Series 2012A, dated this date, executed by the Borrower in favor of the Lender in an original stated principal amount equal to the maximum amount of the Loan as described above (the "Series 2012A Bond," which term shall include any extensions, renewals, modifications, or replacements thereof). The Series 2012A Bond shall be in substantially the form attached to this Agreement as Exhibit C. The Loan shall be secured by the Deed to Secure Debt and Security Agreement, dated this elate (the "Security Deed"), to be entered into between the Borrower and the Lender, granting to the Lender a first lien on and first security title to certain real property constituting the Facilities, assigning and pledging to the Lender, on a first priority basis, the Borrower's interest in certain rents and leases derived from the Facilities, and granting to the Lender a first priority security interest in certain personal property constituting the Facilities. The Loan shall also be secured by the Assignment and Security Agreement, dated this date (the "Assignment"), to be entered into between the Borrower and the Lender, assigning and pledging to the Lender, on a first priority basis, and granting a first priority security interest in, all of the Borrower's right, title, and interest in the Credit Agreement. The Loan shall also be unconditionally and absolutely guaranteed by the Lessee and The Xxxxx Group, Inc., as guarantors (collectively the "Guarantors"), jointly and severally, pursuant to the terms of the Guaranty Agreement, dated this date (the "Guaranty"), to be entered into by the Guarantors in favor of Lineage PCR, Inc., as assignee of the Lender.

4.Interest, Fees, and Other Charges - In consideration of the Loan, and subject to the provisions of Section 9 hereof, the Borrower shall pay the Lender the following interest, fees, and other charges:

(a)The Loan shall bear interest at the rate or rates per annum specified in the Series 20 l 2A Bond, and such interest shall be calculated in the manner specified in the Series 20 l 2A Bond.

(b)The Borrower agrees to pay all reasonable out-of-pocket costs and expenses of the Lender incurred in connection with its negotiation, structuring, documenting, and closing the Loan, including, without limitation, the reasonable fees and disbursements of counsel for the Lender. The Borrower agrees to pay all reasonable out-of-pocket costs and expenses of the Lender incurred in connection with its administration or modification of, or in connection with the preservation of its rights under, enforcement of, or any refinancing, renegotiation, restructuring, or termination of, any Credit Document (as hereinafter defined) or the Guaranty or any instruments referred to therein or any amendment, waiver, or consent relating thereto, including, without limitation, the reasonable fees and disbursements of counsel for the Lender. Such additional loan payments shall be billed to the Borrower by the Lender from time to time, together with a statement certifying that the amount billed has been incurred or paid by the Lender for one or more of the above items. Amounts so billed shall be paid by the Borrower within thirty (30) days after receipt of the xxxx by the Borrower.

(c)On the date of the initial advance of the Loan, the Borrower shall pay the Lender an origination fee for the Loan in the amount of $-0-, which fee shall be deemed fully earned upon the initial advance of the Loan.

2

5.Prepayment - The Loan shall be prepayable in accordance with the terms and conditions of the Series 2012A Bond.

6.Application of Payments - Unless applicable law provides otherwise, all payments received by the Lender from the Borrower under the Series 20 l 2A Bond or this Agreement shall be applied by the Lender in the following order of priority: (i) as specified in the Series 00 x 0X Xxxx, (xx) interest payable on advances made pursuant to any provision of any Credit Document or the Guaranty, (iii) principal of advances made pursuant to any provision of any Credit Document or the Guaranty, and (iv) any other sums secured by any Credit Document in such order as the Lender, at the Lender's option, may determine.

7.Conditions to the Loan - At the time of the making of the advance under the Loan by the Lender to the Borrower under this Agreement (the "Advance"), the following conditions shall have been fulfilled to the Lender's satisfaction:

(a)Representatives of the Borrower, the Seller, and the Lessee shall certify to the Lender that the Purchase Agreement, the Lease Agreement, and the Credit Agreement are in full force and effect and that there shall then exist no event of default under any such agreement (or other event that, with the giving of notice or passage of time, or both, would constitute such an event of default).

(b)There shall then exist no Event of Default under this Agreement (or other event that, with the giving of notice or passage of time, or both, would constitute such an Event of Default).

(c)All representations and warranties by the Borrower in this Agreement, the Security Deed, the Assignment, and the Series 2012A Bond (collectively the "Credit Documents") shall be true and correct in all material respects with the same effect as if such representations and warranties had been made on and as of the date of such advance.

(d)All representations and warranties by the Guarantors in the Guaranty shall be true and correct in all material respects with the same effect as if such representations and warranties had been made on and as of the date of such advance.

(e)The Advance to be made and the use of the proceeds thereof shall not violate any applicable law, regulation, injunction, or order of any government or court.

8.Representations and Warranties - The Borrower hereby represents and warrants to the Lender:

(a)Creation and Authority. The Borrower is a public body corporate and politic duly created and validly existing under the laws of the State of Georgia and has all requisite power and authority to execute and deliver the Credit Documents, the Purchase Agreement, the Lease Agreement, and the Credit Agreement (collectively the "Borrower Contracts") and to perform its obligations thereunder.

(b)Pending Litigation. Except as disclosed in writing to the Lender, there are no actions, suits, proceedings, inquiries, or investigations pending or, to the knowledge of the Borrower, after making due inquiry with respect thereto, threatened against or affecting the

3

Borrower in any court or by or before any governmental authority or arbitration board or tribunal, which involve the possibility of materially and adversely affecting the acquisition or leasing of the Facilities, or the ability of the Borrower to perform its obligations under the Borrower Contracts, or the transactions contemplated by the Borrower Contracts or which, in any way, would adversely affect the validity or enforceability of the Borrower Contracts or any agreement or instrument to which the Borrower is a party and which is used or contemplated for use in the consummation of the transactions contemplated hereby or thereby, nor is the Borrower aware of any facts or circumstances presently existing that would form the basis for any such actions, suits, or proceedings. Except as disclosed in writing to the Lender, the Borrower is not in material default with respect to any judgment, order, writ, injunction, decree, demand, rule, or regulation of any court, governmental authority, or arbitration board or tribunal.

(c)Borrower Contracts are Legal and Authorized. The execution and delivery by the Borrower of the Borrower Contracts, the consummation of the transactions therein contemplated, and the fulfillment of or the compliance with all of the provisions thereof (i) are within the power, legal right, and authority of the Borrower; (ii) are legal and will not conflict with or constitute on the part of the Borrower a violation of or a breach of or a default under, in any material respect, any organic document, indenture, mortgage, security deed, pledge, note, lease, loan, or installment sale agreement, contract, or other agreement or instrument to which the Borrower is a party or by which the Borrower or its properties are otherwise subject or bound, or any license, law, statute, rule, regulation, judgment, order, writ, injunction, decree, or demand of any court or governmental agency or body having jurisdiction over the Borrower or any of its activities or properties; and (iii) have been duly authorized by all necessary and appropriate official action on the part of the governing body of the Borrower. The Borrower Contracts are the valid, legal, binding, and enforceable obligations of the Borrower. The officials of the Borrower executing the Borrower Contracts are duly and properly in office and are fully authorized and empowered to execute the same for and on behalf of the Borrower.

(d)Governmental Consents. Neither the Borrower nor any of its activities or properties, nor any relationship between the Borrower and any other person, nor any circumstances in connection with the execution, delivery, and performance by the Borrower of its obligations under the Borrower Contracts, is such as to require the consent, approval, permission, order, license, or authorization of, or the filing, registration, or qualification with, any governmental authority on the part of the Borrower in connection with the execution, delivery, and performance of the Borrower Contracts or the consummation of any transaction therein contemplated, except as shall have been obtained or made and as are in full force and effect and except as are not presently obtainable. To the knowledge of the Borrower, after making due inquiry with respect thereto, the Borrower will be able to obtain all such additional consents, approvals, permissions, orders, licenses, or authorizations of governmental authorities as may be required on or prior to the date the Borrower is legally required to obtain the same.

(e)No Defaults. No event has occurred and no condition exists that would constitute an Event of Default (as defined in Section 11 hereof) or that, with the lapse of time or with the giving of notice or both, would become an Event of Default. To the knowledge of the Borrower, after making due inquiry with respect thereto, the Borrower is not in default or violation in any material respect under any organic document or other agreement or instrument to which it is a party or by which it may be bound, which default or violation might materially and adversely

4

affect the ability of the Borrower to perform its obligations under the Borrower Contracts, or the transactions contemplated by the Borrower Contracts.

(f)Compliance with Law. To the knowledge of the Borrower, after making due inquiry with respect thereto, the Borrower is not in violation of any laws, ordinances, or governmental rules or regulations to which it or its properties are subject and has not failed to obtain any licenses, permits, franchises, or other governmental authorizations (which are presently obtainable) necessary to the ownership of its properties or to the conduct of its affairs, which violation or failure to obtain might materially and adversely affect the ability of the Borrower to perform its obligations under the Borrower Contracts or the transactions contemplated by the Borrower Contracts, and there have been no citations, notices, or orders of noncompliance issued to the Borrower under any such law, ordinance, rule, or regulation, except as disclosed in writing to the Lender.

(g)Restrictions on the Borrower. The Borrower is not a party to or bound by any contract, instrument, or agreement, or subject to any other restriction, that might materially and adversely affect the ability of the Borrower to perform its obligations under the Borrower Contracts or the transactions contemplated by the Borrower Contracts, except as disclosed in writing to the Lender. The Borrower is not a party to any contract or agreement that restricts the right or ability of the Borrower to incur indebtedness for borrowed money or to enter into loan agreements.

(h)Disclosure. The representations of the Borrower contained in this Agreement and any certificate, document, written statement, or other instrument furnished by or on behalf of the Borrower to the Lender in connection with the transactions contemplated hereby, do not contain any untrue statement of a material fact and do not omit to state a material fact necessary to make the statements contained herein or therein not misleading. There is no fact that the Borrower has not disclosed to the Lender in writing that materially and adversely affects or in the future may (so far as the Borrower can now reasonably foresee) materially and adversely affect the acquisition or leasing of the Facilities, or the ability of the Borrower to perform its obligations under the Borrower Contracts or any of the documents or transactions contemplated hereby or thereby or any other transactions contemplated by this Agreement, which has not been set forth in writing to the Lender or in the certificates, documents, and instruments furnished to the Lender by or on behalf of the Borrower prior to the date of execution of this Agreement in connection with the transactions contemplated hereby.

9.Limited Liability - Notwithstanding any other provision of the Series 2012A Bond or the Credit Documents, the Borrower shall have no personal liability for the payment of the Series 2012A Bond or any other obligations of the Borrower under this Agreement or the other Credit Documents (including, without limitation, Sections 4 and 10(c) hereof) beyond the interest of the Borrower in the collateral encumbered by the Security Deed or the Assignment. The Lender agrees that: (i) the Lender will rely for payment of the Series 2012A Bond or any other obligations of the Borrower under this Agreement or the other Credit Documents solely on the collateral encumbered by the Security Deed and the Assignment and the Guaranty; (ii) the Lender shall not seek to enforce any money judgment obtained by the Lender for the payment of the Series 2012A Bond or any other obligations of the Borrower under the Credit Documents against any property of the Borrower other than the collateral encumbered by the Security Deed

5

or the Assignment; and (iii) the Lender shall not xxx or otherwise seek recourse against the Borrower for any deficiency remaining after a foreclosure of the Security Deed or the Assignment under power of sale or a judicial sale of any collateral encumbered by the Security Deed or the Assignment. The foregoing provisions concern only the personal liability of the Borrower and do not in any manner, and shall not be interpreted or construed to, diminish, affect, impede, or impair, in any manner whatsoever: (i) the right, title, or interest of the Lender in and to the collateral encumbered by the Security Deed or the Assignment; (ii) the pursuit or exercise by the Lender of any rights and remedies that the Lender may have under the Credit Documents or the Guaranty; or (iii) the priority and enforceability, by judicial or extrajudicial means, of the lien, security interest, and security title of the Security Deed or the Assignment.

10.Borrower Covenants - The Borrower agrees to comply with the following covenants so long as this Agreement is in effect:

(a)Information. The Borrower shall promptly provide the Lender with such information relating to the Borrower and the Facilities as the Lender may reasonably request from time to time.

(b)Access to Property and Records. The Borrower agrees that the Lender and its duly authorized representatives and agents shall have the right, upon reasonable prior notice, to enter the Borrower's property at all reasonable times for the purpose of examining and inspecting the Facilities, including any renovation thereof. The Lender shall also have the right at all reasonable times to examine and make extracts from the books and records of the Borrower, insofar as such books and records relate to the Facilities or insofar as necessary to ascertain compliance with this Agreement, and to discuss with the Borrower's officers, employees, accountants, and engineers the Facilities and the Seller's and the Lessee's performance under the Purchase Agreement, the Lease Agreement, and the Credit Agreement.

(c)Reimbursement of Costs. (1) In addition to the other amounts payable by the Borrower under this Agreement (including, without limitation, Section 4 hereof), and subject to the provisions of Section 9 hereof, the Borrower hereby agrees to pay and reimburse the Lender for all claims, liabilities, losses, costs, and expenses (including, without limitation, reasonable attorneys' fees and expenses) that the Lender may (other than as a result of the negligence or willful misconduct of the Lender) incur or be subjected to as a consequence, directly or indirectly, of (i) any actual or proposed use of any proceeds of the Loan or the Borrower's entering into or performing under any Credit Document; (ii) any breach by the Borrower of any representation, warranty, covenant, or condition in, or the occurrence of any other default under, any of the Credit Documents, including without limitation all reasonable attorneys' fees or expenses resulting from the settlement or defense of any claims or liabilities arising as a result of any such breach or default; (iii) allegations of participation or interference by the Lender in the management, contractual relations, or other affairs of the Borrower; (iv) allegations that the Lender has joint liability with the Borrower to any third xxxxx as a result of the transactions contemplated by the Credit Documents; (v) any suit, investigation, or proceeding as to which the Lender is involved as a consequence, directly or indirectly, of its execution of any of the Credit Documents, the making of the Loan, or any other event or transaction contemplated by any of the Credit Documents; or (vi) the conduct or management of or any work or thing done on the Facilities and any condition of or operation of the Facilities.

6

(2) Nothing contained in this paragraph (c) shall require the Borrower to reimburse the Lender for any claim or liability that the Borrower was not given any opportunity to contest or for any settlement of any such action effected without the Borrower's consent. The covenants of the Borrower contained in this paragraph (c) shall survive the termination of this Agreement.

11.Events of Default and Remedies - (a) Each of the following events shall constitute an "Event of Default" under this Agreement:

(1)Failure by the Borrower to make any payment with respect to the Loan or under the terms of any Credit Document (whether principal, interest, fees, or other amounts) when and as the same becomes due and payable (whether at maturity, on demand, or otherwise).

(2)The Borrower shall (A) apply for or consent to the appointment of or the taking of possession by a receiver, custodian, trustee, or liquidator of the Borrower or of all or a substantial part of the property of the Borrower; (B) admit in writing the inability of the Borrower, or be generally unable, to pay the debts of the Borrower as such debts become due; (C) make a general assignment for the benefit of the creditors of the Borrower; (D) commence a voluntary case under the federal bankruptcy law (as now or hereafter in effect); (E) file a petition seeking to take advantage of any other law relating to bankruptcy, insolvency, reorganization, winding-up, or composition or adjustment of debts; (F) fail to controvert in a timely or appropriate manner, or acquiesce in writing to, any petition filed against the Borrower in an involuntary case under such federal bankruptcy law; or (G) take any action for the purpose of effecting any of the foregoing.

(3)A proceeding or case shall be commenced, without the application of the Borrower, in any court of competent jurisdiction, seeking (A) the liquidation, reorganization, dissolution, winding-up, or composition or readjustment of debts of the Borrower; (B) the appointment of a trustee, receiver, custodian, liquidator, or the like of the Borrower or of all or any substantial part of the assets of the Borrower or of the Facilities; or (C) similar relief in respect of the Borrower under any law relating to bankruptcy, insolvency, reorganization, winding-up, or composition and adjustment of debts, and such proceeding or case shall continue undismissed, or an order, judgment, or decree approving or ordering any of the foregoing shall be entered and continue in effect, for a period of sixty (60) days from commencement of such proceeding or case or the date of such order, judgment, or decree, or any order for relief against the Borrower shall be entered in an involuntary case or proceeding under the federal bankruptcy law.

(4)The Borrower's breach in any material respect of any representation or warranty contained in the Credit Documents or the Borrower's failure in any material respect to observe, perform, or comply with any covenant, condition, or agreement in the Credit Documents on the part of the Borrower to be observed or performed, other than as referred to in clauses (1) through (3) above, for a period of thirty (30) days after written notice specifying such breach or failure and requesting that it be remedied, given to the Borrower by the Lender, unless the Lender shall agree in writing to an extension of such time prior to its expiration. In the case of any such breach or default that cannot with due diligence be cured within such thirty (30) day period but can be wholly cured within a period of time not materially detrimental to the rights of

7

the Lender, to be determined conclusively by the Lender, it shall not constitute an Event of Default if corrective action is instituted by the Borrower within the applicable period and diligently pursued until the breach or default is corrected in accordance with and subject to any directions or limitations of time established by the Lender.

(5) The occurrence of an "event of default" under the Guaranty (as defined in the Guaranty).

(6)Any material provision of any Credit Document shall at any time for any reason cease to be valid and binding in accordance with its terms on the Borrower, or the validity or enforceability thereof shall be contested by the Borrower, or the Borrower shall terminate or repudiate (or attempt to terminate or repudiate) any Credit Document.

(7)The dissolution of the Borrower.

(8)Any material adverse change in the Borrower's means or ability to perform under the Credit Documents.

(9)The occurrence of any other event as a result of which the Lender in good faith believes that the prospect of payment in full of the Loan is impaired.

(b) Upon the occurrence of an Event of Default, the Lender, at its option, without demand or notice of any kind, may declare the Loan immediately due and payable, whereupon all outstanding principal and accrued interest shall become immediately due and payable.

(c) Upon the occurrence of an Event of Default, the Lender, without notice or demand of any kind, may from time to time take whatever action at law or in equity or under the terms of the Credit Documents or the Guaranty may appear necessary or desirable to collect the Loan and other amounts payable by the Borrower hereunder then due or thereafter to become due, or to enforce performance and observance of any obligation, agreement, or covenant of the Borrower under the Credit Documents or of the Guarantors under the Guaranty.

12.Assignment or Sale by Lender - (a) The Credit Documents and the Guaranty, and the obligations of the Borrower and the Guarantors to make payments thereunder, may be sold, assigned, or otherwise disposed of in whole or in part to one or more successors, grantors, holders, assignees, or subassignees by the Lender. Upon any sale, disposition, assignment, or reassignment, the Borrower and the Guarantors shall be provided with a notice of such assignment.

(b) The Borrower agrees to make all payments to the assignee designated in the assignment, notwithstanding any claim, defense, setoff, or counterclaim whatsoever that the Borrower may from time to time have against the Lender. The Borrower agrees to execute all documents, including notices of assignment, which may be reasonably requested by the Lender or its assignee to protect its interests in the Credit Documents.

13.Miscellaneous - (a) This Agreement shall be governed by and construed in accordance with the laws of the State of Georgia, exclusive of such state's rules regarding choice of law.

8

(b) This Agreement shall be binding upon and shall inure to the benefit of the Borrower, the Lender, and their respective legal representatives, successors, and assigns, but the Borrower may not assign or transfer any of its rights or obligations hereunder without the express prior written consent of the Lender.

(c) This Agreement may not be waived or amended except by a writing signed by authorized officers of the parties hereto.

(d) This Agreement shall be effective on the date on which the Borrower and the Lender have signed one or more counterparts of it and the Lender shall have received the same. At such time as the Lender is no longer obligated under this Agreement to make any further advances under the Loan and all principal, interest, or other amounts owing with respect to the Loan and hereunder have been finally and irrevocably repaid by the Borrower to the Lender, this Agreement shall terminate.

(e) All notices, certificates, requests, demands, or other communications hereunder shall be sufficiently given and shall be deemed given upon receipt, by hand delivery, mail, overnight delivery, telecopy, or other electronic means, addressed as provided at the beginning of this Agreement. Any party to this Agreement may, by notice given to the other party, designate any additional or different addresses to which subsequent notices, certificates, or other communications shall be sent. For purposes of this Section, "electronic means" shall mean telecopy or facsimile transmission or other similar electronic means of communication that produces evidence of transmission.

(f) This Agreement may be executed in one or more counterparts.

(g) All pronouns used herein include all genders, and all singular terms used herein include the plural (and vice versa).

(h) In the event any provision of this Agreement shall be held invalid or unenforceable by any court of competent jurisdiction, such holding shall not invalidate or render unenforceable any other provision hereof.

(i) This Agreement and the other Credit Documents constitute the entire agreement between the Borrower and the Lender with respect to the Loan and supersede all prior agreements, negotiations, representations, or understandings between such parties with respect to such matters.

[Signatures And Seals To Follow]

9

10

11

12

13

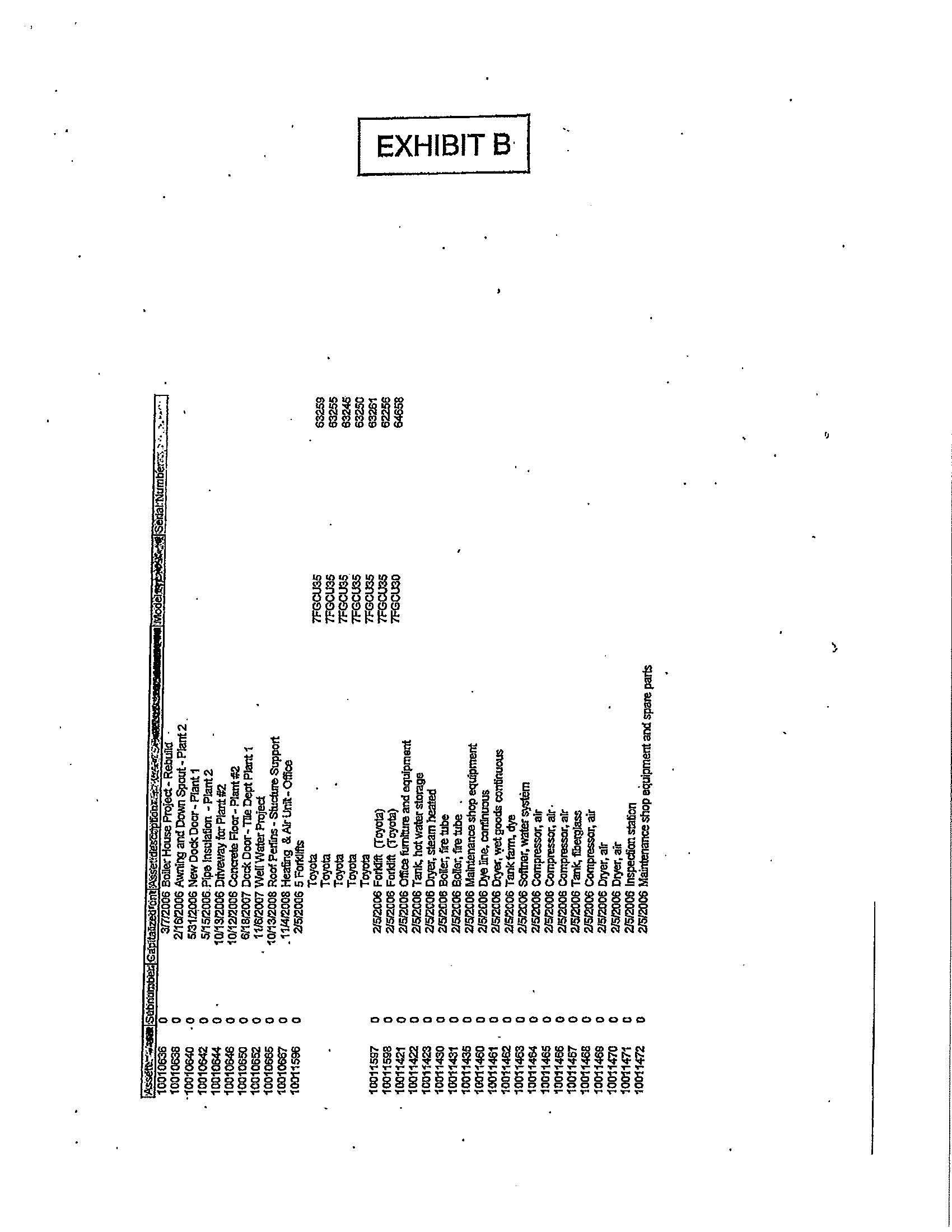

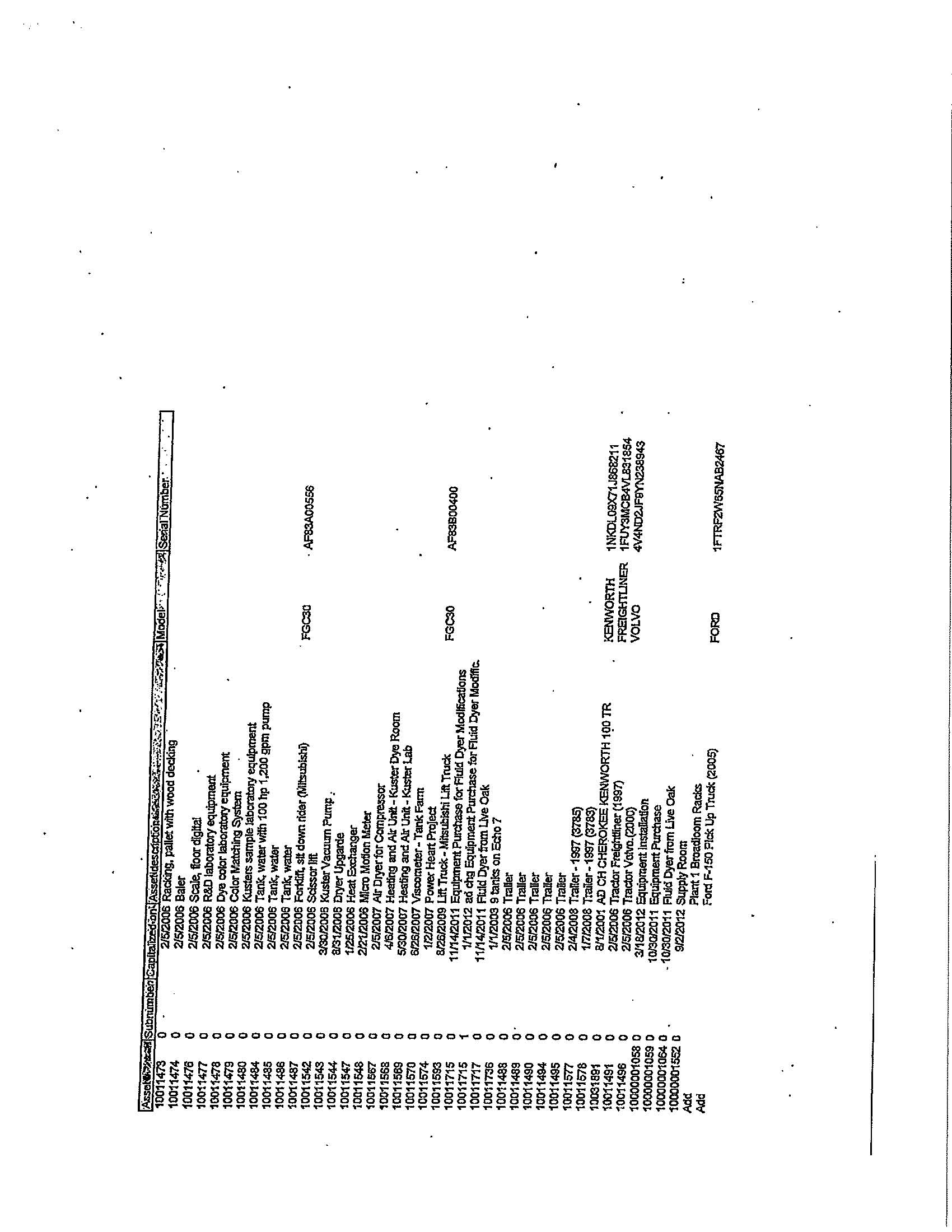

EXHIBIT B

DESCRIPTION OF THE EQUIPMENT

[Attached]

14

15

16

EXHIBIT C

FORM OF REVENUE BOND

THIS BOND IS SUBJECT TO AN INVESTMENT LETTER AGREEMENT AND MAY NOT BE SOLD, TRANSFERRED, ASSIGNED, OR OTHERWISE DISPOSED OF EXCEPT PURSUANT TO THE TERMS OF SUCH INVESTMENT LETTER AGREEMENT.

DEVELOPMENT AUTHORITY OF XXXXXX COUNTY TAXABLE REVENUE BOND (MASLAND CARPETS, LLC REAL ESTATE PROJECT), SERIES 2012A

$5,339,217 .03

FOR VALUE RECEIVED, the Development Authority of Xxxxxx County (hereinafter referred to as the "Borrower") promises to pay, but only from the source as hereinafter provided, to the order of Masland Carpets, LLC (hereinafter referred to as the "Lender") at the Lender's office located in Dalton, Georgia, or at such other place as the holder hereof may designate, the principal sum of $5,339,217.03, or so much thereof as shall be outstanding, together with interest on so much of the principal balance of this Bond as may be outstanding and unpaid from time to time, calculated at the rate per annum indicated below.

The unpaid principal balance of this Bond shall bear interest at a rate per annum equal to six percent (6.00%), calculated on the basis of a 360-day year and actual days elapsed.

Principal of and interest on this Bond shall be payable in fifty-seven (57) consecutive monthly installments equal to $106,330.41, commencing on February l, 2013, and continuing to be due on the first day of each succeeding calendar month thereafter, together with a final installment equal to the entire remaining unpaid principal balance of and all accrued interest on this Bond, which shall be due and payable on November 1, 2017.

This Bond shall bear interest on any overdue installment of principal and, to the extent permitted by applicable law, on any overdue installment of interest, at the aforesaid rate plus five percent (5.00%) per annum. The Borrower shall pay a late fee equal to five percent (5%) of the amount of the overdue payment, for any installment payment or other amount due hereunder that is not paid in full within five (5) days after such payment is due, for the purpose of reimbursing the Lender for a portion of the expense incident to handling the overdue payment. This late charge shall apply individually to all payments past due, and there will be no daily prorated adjustment. This provision shall not be deemed to excuse a late payment or be deemed a waiver of any other rights the Lender may have, including the right to declare the entire unpaid principal and interest immediately due and payable. The Borrower agrees that the "late charge" is a provision for liquidated damages and represents a fair and reasonable estimate of the damages the Lender will incur by reason of the late payment, considering all circumstances known to the

C- 1

Borrower and the Lender on the date hereof. The Borrower further agrees that proof of actual damages will be difficult or impossible.

All payments or prepayments on this Bond shall be applied first to unpaid fees and late fees, then to interest accrued on this Bond through the date of such payment or prepayment, and then to principal (and partial principal prepayments shall be applied to such installments in the inverse order of their maturity).

The Borrower may prepay the principal balance of this Bond in whole or in part at any time without premium or penalty, after at least three (3) business days' prior written notice from the Borrower to the Lender of the date of prepayment.

This Bond constitutes the Borrower's Taxable Revenue Bond (Masland Carpets, LLC Real Estate Project), Series 2012A issued under and pursuant to and is entitled to the benefits and subject to the conditions of a Loan Agreement, dated this date (the "Loan Agreement"), between the Borrower and the Lender, to which Loan Agreement reference is hereby made for a description of the circumstances under which principal shall be advanced under this Bond. Reference is hereby made to the Loan Agreement for a description of the security for this Bond and the options and obligations of the Borrower and the Lender hereunder. Upon an Event of Default (as defined in the Loan Agreement), the entire principal of and interest on this Bond may be declared or may become immediately due and payable as provided in the Loan Agreement.

The obligation of the Borrower to make the payments required to be made under this Bond and to perform and observe any and all of the other covenants and agreements on its part contained herein shall be a limited obligation of the Borrower, as provided in the Loan Agreement, and shall be absolute and unconditional irrespective of any defense or any rights of setoff, counterclaim, or recoupment, except for payment, it may otherwise have against the Lender.

THIS BOND SHALL NEVER CONSTITUTE AN INDEBTEDNESS, DEBT, OR GENERAL OBLIGATION OF THE STATE OF GEORGIA, XXXXXX COUNTY, GEORGIA, OR ANY OTHER POLITICAL SUBDIVISION OF THE STATE OF GEORGIA, WITHIN THE MEANING OF ANY CONSTITUTIONAL PROVISION OR STATUTORY DEBT LIMITATION WHATSOEVER, NOR A PLEDGE OF THE FAITH AND CREDIT OR TAXING POWER OF ANY OF THE FOREGOING, NOR SHALL ANY OF THE FOREGOING BE SUBJECT TO ANY PECUNIARY LIABILITY HEREON. THE BORROWER HAS NO TAXING POWER. THIS BOND SHALL NOT BE PAYABLE FROM NOR A CHARGE UPON ANY FUNDS OTHER THAN THE REVENUES PLEDGED TO THE PAYMENT HEREOF AS CONTEMPLATED IN THE LOAN AGREEMENT AND SHALL BE A LIMITED OR SPECIAL OBLIGATION OF THE BORROWER PAYABLE SOLELY FROM THE FUNDS PROVIDED THEREFOR IN THE LOAN AGREEMENT. NO OWNER OF THIS BOND SHALL EVER HAVE THE RIGHT TO COMPEL THE EXERCISE OF THE TAXING POWER OF THE STATE OF GEORGIA, XXXXXX COUNTY, GEORGIA, OR ANY OTHER POLITICAL SUBDIVISION OF THE STATE OF GEORGIA TO PAY THE PRINCIPAL OF THIS BOND OR THE INTEREST OR ANY PREMIUM HEREON, OR TO ENFORCE PAYMENT HEREOF AGAINST ANY PROPERTY OF THE FOREGOING, NOR SHALL THIS BOND CONSTITUTE A CHARGE, LIEN, OR

C- 2

ENCUMBRANCE, LEGAL OR EQUITABLE, UPON ANY PROPERTY OF THE FOREGOING. NEITHER THE MEMBERS OF THE GOVERNING BODY OF THE BORROWER NOR ANY PERSON EXECUTING THIS BOND SHALL BE LIABLE PERSONALLY ON THIS BOND BY REASON OF THE ISSUANCE HEREOF.

In case this Bond is collected by or through an attorney-at-law, all costs of such collection incurred by the Lender, including reasonable attorney's fees actually incurred, shall be paid by the Borrower.

Time is of the essence of this Bond. Demand, presentment, notice, notice of demand, notice for payment, protest, and notice of dishonor are hereby waived by each and every maker, guarantor, surety, and other person or entity primarily or secondarily liable on this Bond. The Lender shall not be deemed to waive any of its rights under this Bond unless such waiver be in writing and signed by the Lender. No delay or omission by the Lender in exercising any of its rights under this Bond shall operate as a waiver of such rights, and a waiver in writing on one occasion shall not be construed as a consent to or a waiver of any right or remedy on any future occasion.

This Bond shall be governed by and construed and enforced in accordance with the laws of the State of Georgia (without giving effect to its conflicts of law rules). Whenever possible, each provision of this Bond shall be interpreted in such manner as to be effective and valid under applicable law, but if any provision of this Bond shall be prohibited by or invalid under applicable law, such provision shall be ineffective only to the extent of such prohibition or invalidity, without invalidating the remainder of such provision or the remaining provisions of this Bond.

Words importing the singular number hereunder shall include the plural number and vice versa, and any pronoun used herein shall be deemed to cover all genders. The word "Lender" as used herein shall include transferees, successors, and assigns of the Lender, and all rights of the Lender hereunder shall inure to the benefit of its transferees, successors, and assigns. All obligations of the Borrower hereunder shall bind the Borrower's successors and assigns.

X- 0

X- 0

X- 0

X- 0