Performance Share Unit Master Frame Agreement

Exhibit 10.7.6

Performance Share Unit Master Frame Agreement

This Performance Share Unit Master Frame Agreement (this “Master Frame Agreement”) is made and entered into as of the date stated at the bottom of this document by and between Gatos Silver Inc, a Delaware corporation (the “Company”) and (the “Grantee”).

WHEREAS, the Company has adopted the Gatos Silver Amended and Restated Long Term Incentive Plan as amended from time to time (the “Plan”) pursuant to which Performance Awards (“PSUs”) may be granted.

NOW, THEREFORE, the parties hereto, intending to be legally bound, agree as follows:

1.Capitalized terms that are used but not defined herein have the meanings ascribed to them in the Plan.

2.Structure. This Master Frame Agreement together with a corresponding grant schedule substantially in the form of Exhibit 2 (“Grant Schedule”) duly executed by the Parties shall constitute an individual and independent agreement between the Parties relative to the particular Award of PSUs in such schedule (“Award Agreement”).

3.Grant of PSUs. Pursuant to Section 7E of the Plan, the Company hereby grants to the Grantee an Award of the number of PSUs set forth in a Grant Schedule. The following terms shall apply to the PSUs granted under an Award Agreement:

3.1The Grant Date shall be the date set forth in the corresponding Grant Schedule

3.2The Vesting Date shall be the date set forth in the corresponding Grant Schedule, unless stated otherwise in Section 7 below (“Vesting Date”).

4.Performance Period. For purposes of each Award Agreement, the term “Performance Period” shall be the period commencing on the Grant Date and ending on the Vesting Date.

5.Performance Goals.

5.1The number of PSUs that shall vest on the Vesting Date shall be determined by the Committee based on the level of Performance Goals achievement in accordance with Exhibit 1. All determinations of whether Performance Goals have been achieved, the number of PSUs that shall vest, and all other matters related to this Section 5 shall be made by the Committee in its sole discretion.

5.2Promptly following completion of the Performance Period (and no later than thirty (30) days following the end of the Performance Period), the Committee will review and certify in writing (a) whether, and to what extent, the Performance Goals for the Performance Period have been achieved, and (b) the number of PSUs that shall vest, if any.. Such certification shall be final, conclusive and binding on the Grantee, and on all other persons, to the maximum extent permitted by law.

6.Vesting of PSUs. The PSUs are subject to forfeiture until they vest. Except as otherwise provided herein and in the Plan, the PSUs determined to have vested by the Committee in accordance with Section 5.2 will become nonforfeitable as of the Vesting Date

provided the Grantee has provided Continuous Service from the Grant Date through the last day of the Performance Period.

7.Termination of Continuous Service.

7.1Except as otherwise expressly provided in this Master Frame Agreement, if the Grantee’s Continuous Service terminates for any reason at any time before the Vesting Date, the Grantee’s PSUs shall be automatically forfeited upon such termination of Continuous Service and neither the Company nor any Affiliate shall have any further obligations to the Grantee under any Award Agreement.

7.2Notwithstanding Section 7.1, if the Grantee’s Continuous Service terminates during the Performance Period as a result of:

(a)Xxxxxxx’s termination by the Company without Cause (as defined in the Employment Agreement between the Company and the Grantee (the “Employment Agreement”) or the Grantee terminates employment for Good Reason (as defined in the Employment Agreement), the outstanding PSUs will vest pro-rated for the period of actual employment during the Performance Period. Specifically, the Committee shall determine the number of PSUs vested in accordance with Section 5.2 as of the Vesting Date which number will be multiplied by a fraction, the numerator of which is the period from the Grant Date to the date of termination of Continuous Service and the denominator of which is the Performance Period.

(b)Xxxxxxx’s death or Disability, it shall be considered that Xxxxxxx’s Continuous Service lasted throughout the entire Performance Period and one hundred percent (100%) of all of Grantee’s outstanding PSUs will vest in accordance with Section 5.2.

(c)If there is a Change of Control during the Performance Period, the Vesting Date for purposes of determining the Performance Period shall be deemed to be the date of the Change of Control and the Committee shall calculate the number of PSUs vesting as of that date using the price being paid for Common Stock on the Change of Control transaction compared to the Comparators (as defined in Exhibit 1).

8.Payment of PSUs. Payment in respect of the PSUs vested at the end of the Performance Period shall be made in the form of cash or Common Stock or a combination thereof as determined by the Committee within thirty (30) days following the Vesting Date. Since no shares of Common Stock can be issued in excess of the maximum Award payable pursuant to Exhibit 1 (i.e 200%), if any dividend equivalents are earned in excess of such maximum Award payable, they will be paid in cash.

9.Transferability. Subject to any exceptions set forth in this Section 9 (“Transferability”) or the Plan, the PSUs or the rights relating thereto may not be assigned, alienated, pledged, attached, sold or otherwise transferred or encumbered by the Grantee, except by will or the laws of descent and distribution or transfers to Grantee’s family trusts, and upon any such transfer by will or the laws of descent and distribution or to a family trust, the transferee shall hold such PSUs subject to all the terms and conditions that were applicable to the Grantee immediately prior to such transfer. For purposes of this Section “family trust” shall mean a trust

2

where Grantee is the settlor and the exclusive beneficiaries are either of or a combination of Grantee’s spouse or household partner, Xxxxxxx’s direct descendants or Xxxxxxx’s parents.

10.Rights as Shareholder; Dividend Equivalents.

10.1Except as otherwise provided herein, the Grantee shall not have any rights of a shareholder with respect to any shares of Common Stock which may underly the PSUs, including, but not limited to, voting rights and dividends except that dividend equivalents on the underlying Common Stock are accrued during the Performance Period corresponding to the number of PSUs actually earned during the Performance Period including any dividends that would have been paid shall be deemed to compound in proportion to the value of the underlaying Common Stock.

10.2In the event of the issuance of Common Stock upon and following the vesting of the PSUs, the Grantee shall be the record owner of such shares of Common Stock unless and until such shares are sold or otherwise disposed of, and as record owner shall be entitled to all rights of a shareholder of the Company (including voting and dividend rights).

00.Xx Right to Continued Service. Neither the Plan, this Master Frame Agreement or any Award Agreement shall confer upon the Grantee any right to be retained in any position, as an employee, consultant or director of the Company. Further, nothing in the Plan, this Master Frame Agreement or Award Agreement shall be construed to limit the discretion of the Company to terminate the Grantee’s Continuous Service at any time, with or without Cause.

12.Adjustments. If any change is made to the outstanding Common Stock or the capital structure of the Company, if required, the PSUs shall be adjusted or terminated in any manner as contemplated by Section 9 of the Plan.

00.Xxx Liability and Withholding.

13.1The Grantee shall be required to pay to the Company through withholdings or otherwise, and the Company shall have the right to deduct from any compensation paid to the Grantee pursuant to the Plan, the amount of any required withholding taxes in respect of the PSUs and to take all such other action as the Committee deems necessary to satisfy all obligations for the payment of such withholding taxes. The Committee may permit the Grantee to satisfy any federal, state or local tax withholding obligation by authorizing the Company to withhold shares of Common Stock from the shares of Common Stock otherwise issuable or deliverable to the Grantee as a result of the vesting of the PSUs; provided, however, that no shares of Common Stock shall be withheld with a value exceeding the maximum amount of tax required to be withheld by law.

13.2Notwithstanding any action the Company takes with respect to any or all income tax, social security, payroll tax, or other tax-related withholding (“Tax-Related Items”), the ultimate liability for all Tax-Related Items is and remains the Grantee’s responsibility and the Company (a) makes no representation or undertakings regarding the treatment of any Tax-Related Items in connection with the grant, vesting or settlement of the PSUs or the subsequent sale of any shares, and (b) does not commit to structure the PSUs to reduce or eliminate the Grantee’s liability for Tax-Related Items.

3

14.Compliance with Law. The issuance and transfer of shares of Common Stock in connection with the PSUs shall be subject to compliance by the Company and the Grantee with all applicable requirements of federal and state securities laws and with all applicable requirements of any stock exchange on which the Company’s shares of Common Stock may be listed. No shares of Common Stock shall be issued or transferred unless and until any then applicable requirements of state and federal laws and regulatory agencies have been fully complied with to the satisfaction of the Company and its counsel.

15.Notices. Any notice required to be delivered to the Company under this Master Frame Agreement shall be in writing and addressed to the General Counsel or Chief Financial Officer of the Company at the Company’s principal corporate offices. Any notice required to be delivered to the Grantee under this Master Frame Agreement or any Award Agreement shall be in writing and addressed to the Grantee at the Grantee’s address as shown in the records of the Company. Either party may designate another address in writing (or by such other method approved by the Company) from time to time.

16.Governing Law. This Master Frame Agreement and any Award Agreement will be construed and interpreted in accordance with the laws of the State of Delaware without regard to conflict of law principles.

17.Interpretation. Any dispute regarding the interpretation of this Master Frame Agreement or any Award Agreement shall be submitted by the Grantee or the Company to the Committee for review. The resolution of such dispute by the Committee shall be final and binding on the Grantee and the Company.

18.PSUs Subject to Plan. Any Award Agreement is subject to the Plan. The terms and provisions of the Plan as it may be amended from time to time are incorporated herein by reference. In the event of a conflict between any term or provision contained herein and a term or provision of the Plan, the applicable terms and provisions of the Plan will govern and prevail.

19.Successors and Assigns. The Company may assign any of its rights under this Master Frame Agreement and any Award Agreement. All Award Agreements will be binding upon and inure to the benefit of the successors and assigns of the Company. Subject to the restrictions on transfer set forth herein, all Award Agreements will be binding upon the Grantee and the Grantee’s beneficiaries, executors, administrators and the person(s) to whom the PSUs may be transferred by will or the laws of descent or distribution or corresponding family trusts.

20.Severability. The invalidity or unenforceability of any provision of the Plan or any Award Agreement shall not affect the validity or enforceability of any other provision of the Plan or any Award Agreement, and each provision of the Plan and any Award Agreement shall be severable and enforceable to the extent permitted by law.

21.Discretionary Nature of Plan. The Plan is discretionary and may be amended, cancelled or terminated by the Company at any time, in its discretion. The grant of the PSUs in any Award Agreement does not create any contractual right or other right to receive any PSUs or other Awards in the future. Future Awards, if any, will be at the sole discretion of the Company. Any amendment, modification, or termination of the Plan shall not constitute a change or impairment of the terms and conditions of the Grantee’s employment with the Company.

4

22.Amendment. The Committee has the right to amend, alter, suspend, discontinue, or cancel the PSUs, prospectively or retroactively; provided, that, no such amendment shall adversely affect the Grantee’s material rights under an Award Agreement without the Grantee’s consent.

23.Section 409A. All Award Agreements are intended to comply with Section 409A of the Code or an exemption thereunder and shall be construed and interpreted in a manner that is consistent with the requirements for avoiding additional taxes or penalties under Section 409A of the Code. Notwithstanding the foregoing, the Company makes no representations that the payments and benefits provided under any Award Agreement comply with Section 409A of the Code and in no event shall the Company be liable for all or any portion of any taxes, penalties, interest or other expenses that may be incurred by the Grantee on account of non-compliance with Section 409A of the Code.

00.Xx Impact on Other Benefits. The value of the Grantee’s PSUs is not part of Grantee’s normal or expected compensation for purposes of calculating any severance, retirement, welfare, insurance or similar employee benefit.

25.Counterparts. This Master Frame Agreement and any Grant Schedule may be executed in counterparts, each of which shall be deemed an original but all of which together will constitute one and the same instrument. Counterpart signature pages to this Master Frame Agreement or Grant Schedules transmitted by facsimile transmission, by electronic mail in portable document format (.pdf), or by any other electronic means intended to preserve the original graphic and pictorial appearance of a document, will have the same effect as physical delivery of the paper document bearing an original signature.

26.Acceptance. The Grantee hereby acknowledges receipt of a copy of the Plan and this Master Frame Agreement. The Grantee has read and understands the terms and provisions thereof, and accepts the PSUs subject to all of the terms and conditions of the Plan and this Master Frame Agreement. The Grantee acknowledges that there may be adverse tax consequences upon the vesting or settlement of the PSUs or disposition of the underlying shares and that the Grantee has been advised to consult a tax advisor prior to such vesting, settlement or disposition.

IN WITNESS WHEREOF, the parties hereto have executed this Master Frame Agreement as of , 20 :

| | ||

| | [GRANTEE] | |

| |

| |

Name: | | | |

| | | |

Title: | | | |

5

EXHIBIT 1

Performance Period

The Performance Period shall be three years commencing on the Grant Date.

Performance Measures

The number of PSUs that shall vest on the Vesting Date shall be determined by reference to the Company’s relative Total Shareholder Return (“TSR”) compared to the constituents of the GDXJ mining index on the Grant Date (“Comparators”). A table with the Comparators shall be included in the corresponding Grant Schedule.

TSR Calculation.

TSR is calculated assuming dividend reinvestment on any ex-dividend date and is measured point-to-point from the closing price on the Grant Date to the Vesting Date using a twenty (20) trading-day volume weighted average price as the price at the Vesting Date to neutralize the effect of daily price volatility on the ending outcome. This TSR averaging at the end of any Performance Period shall be used for both the Company and for Comparators.

Determining PSUs Vested

Except as otherwise provided in the Plan or the Award Agreement, the number of PSUs vested with respect to the Performance Period shall be determined by the Committee in accordance with Section 5 of this Master Frame Agreement as follows:

PSU’s “cliff-vest” upon the Committee’s determination and certification of the Performance Goals achieved during the Performance Period. (i.e. no additional vesting requirements)

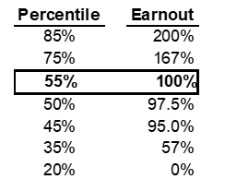

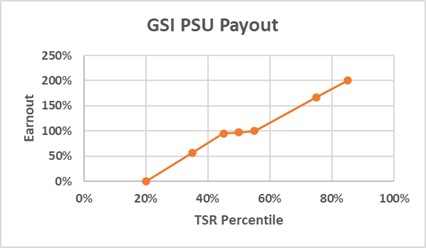

PSU’s vest at 100% of the grant amount for the 55th percentile relative TSR versus the constituents of the GDXJ over a three-year performance period. The actual number of PSU’s that vest will range from 0% to 200% of the PSU’s granted based on the schedule below (rounded up to the nearest full number.):

Payout to be proportional between the stated targets as shown graphically below:

6

No shares earned if three-year relative TSR is below the 20th percentile

Capped at target if relative TSR is above the 55P, but is also negative.

Performance Peer Set

| - | The Comparators are the GDXJ companies at the beginning of the Performance Period with changes required for the following events: |

| - | Companies acquired during the Performance Period are eliminated from the peer set. |

| - | Companies that go bankrupt during the Performance Period are treated with having a negative 100% TSR |

| - | New companies added to the GDXJ during the Performance Period are ignored and not added to the peer set |

| - | In the event there is a spinoff during the Performance Period, the parent and the spun off company will both be removed from the GDXJ for purpose of the TSR calculation. |

7

Exhibit 2 – Form of Grant Schedule

This Grant Schedule is entered into by and between Gatos Silver Inc, a Delaware corporation (the “Company”) and (the “Grantee”). This Grant Schedule together with the Performance Share Unit Master Frame Agreement executed by the Parties forms an independent agreement between the Parties in connection with the Award of PSUs in this Grant Schedule.

PSU Award Grant terms:

1.- | The Company grants the Grantee of PSUs |

2.- | The Grant Date shall be , 20 |

3.- | The Vesting Date shall be , 20 |

4.- | The Comparators table is attached to this Grant Schedule. |

| | ||

| | [GRANTEE] | |

| |

| |

Name: | | | |

| | | |

Title: | | | |

(Comparator Table follows)

8