FIFTH AMENDMENT TO AMENDED AND RESTATED MASTER LEASE AGREEMENT (LEASE NO. 2)

Exhibit 10.6

FIFTH AMENDMENT TO

AMENDED AND RESTATED MASTER LEASE AGREEMENT

(LEASE NO. 2)

THIS FIFTH AMENDMENT TO AMENDED AND RESTATED MASTER LEASE AGREEMENT (LEASE NO. 2) (this “Amendment”) is made and entered into as of August 31, 2012, by and among each of the parties identified on the signature pages hereof as a landlord (collectively, “Landlord”) and each of the parties identified on the signature pages hereof as a tenant (jointly and severally, “Tenant”).

W I T N E S S E T H:

WHEREAS, pursuant to the terms of that certain Amended and Restated Master Lease Agreement (Lease No. 2), dated as of August 4, 2009, as amended by that certain Partial Termination of and First Amendment to Amended and Restated Master Lease Agreement (Lease No. 2), dated as of November 1, 2009, that certain Partial Termination of and Second Amendment to Amended and Restated Master Lease Agreement (Lease No. 2), dated as of August 1, 2010, that certain Third Amendment to Amended and Restated Master Lease Agreement (Lease No. 2), dated as of June 20, 2011, and that certain Fourth Amendment to Amended and Restated Master Lease Agreement (Lease No. 2), dated as of July 22, 2011 (as so amended, “Amended Lease No. 2”), Landlord leases to Tenant, and Tenant leases from Landlord, the Leased Property (this and other capitalized terms used but not otherwise defined herein having the meanings given such terms in Amended Lease No. 2), all as more particularly described in Amended Lease No. 2; and

WHEREAS, simultaneously herewith, SNH/LTA Properties Trust (“SNH/LTA”) has acquired certain senior living facilities known as: (i) Forum at Desert Harbor, located at 00000 Xxxxx Xxxxxx Xxxxxx Xxxxx, Xxxxxx, XX 00000, as more particularly described on Exhibit A-53 attached hereto (“Desert Harbor”); (ii) Forum at Tucson, located at 0000 Xxxxx Xxxxxxxx Xxxx., Xxxxxx, XX 00000, as more particularly described on Exhibit A-54 attached hereto (“Tucson”); (iii) Park Summit at Coral Springs, located at 0000 Xxxxx Xxxx Xxxx., Xxxxx Xxxxxxx, XX 00000, as more particularly described on Exhibit A-55 attached hereto (“Coral Springs”); (iv) Gables at Winchester, located at 000 Xxxxxxxxx Xxxxxx, Xxxxxxxxxx, XX 00000, as more particularly described on Exhibit A-56 attached hereto (“Winchester”); and (v) Forum at Memorial Xxxxx, located at 000 Xxxxx Xxxx Xxx Xxxx, Xxxxxxx, XX 00000, as more particularly described on Exhibit A-57 attached hereto (“Memorial Xxxxx” and together with Desert Harbor, Tucson, Coral Springs and Winchester, the “Acquired Properties”); and

WHEREAS, SNH/LTA wishes to lease the Acquired Properties to Five Star Quality Care Trust (“FSQC Trust”) and FSQC Trust wishes to lease the Acquired Properties from SNH/LTA; and

WHEREAS, SNH/LTA and the other entities comprising Landlord, and FSQC Trust and the other entities comprising Tenant, wish to amend Amended Lease No. 2 to include the Acquired Properties;

NOW, THEREFORE, in consideration of the mutual covenants herein contained and other good and valuable consideration, the mutual receipt and legal sufficiency of which are

hereby acknowledged, Landlord and Tenant hereby agree that, effective from and after the date hereof, Amended Lease No. 2 is hereby amended as follows:

1. Definition of Minimum Rent. The defined term “Minimum Rent” set forth in Section 1.67 of Amended Lease No. 2 is deleted in its entirety and replaced with the following:

“Minimum Rent” shall mean the sum of Sixty-Nine Million Eight Hundred Ninety Thousand Two Hundred Sixty and 00/100 Dollars ($69,890,260.00) per annum.

2. Leased Property. Section 2.1 of Amended Lease No. 2 is amended by deleting subsection (a) therefrom in its entirety and replacing it with the following:

(a) those certain tracts, pieces and parcels of land as more particularly described on Exhibits A-1 through A-57 attached hereto and made a part hereof (the “Land”);

3. Arbitration. Article 22 of Amended Lease No. 1 is deleted in its entirety and replaced with the following:

ARTICLE 22

ARBITRATION

(a) Any disputes, claims or controversies between or among the parties hereto (i) arising out of or relating to this Agreement, or (ii) brought by or on behalf of any shareholder of the parties hereto (which, for purposes of this Article 22, shall mean any shareholder of record or any beneficial owner of shares of the parties hereto, or any former shareholder of record or beneficial owner of shares of the parties hereto), either on his, her or its own behalf, on behalf of the parties hereto or on behalf of any series or class of shares of the parties hereto or shareholders of the parties hereto against the parties hereto or any trustee, director, officer, manager (including Reit Management & Research LLC or its successor), agent or employee of the parties hereto, including disputes, claims or controversies relating to the meaning, interpretation, effect, validity, performance or enforcement of this Agreement, including this arbitration agreement, the declaration of trust, limited liability company agreement, partnership agreement or analogous governing instruments, as applicable, of the parties hereto, or the bylaws of the parties hereto (all of which are referred to as “Disputes”), or relating in any way to such a Dispute or Disputes, shall on the demand of any party to such Dispute be resolved through binding and final arbitration in accordance with the Commercial Arbitration Rules (the “Rules”) of the American Arbitration Association (“AAA”) then in effect, except as those Rules may be modified in this Article 22. For the avoidance of doubt, and not as a limitation, Disputes are intended to include derivative actions against trustees, directors, officers or managers of the parties hereto and class actions by a shareholder against those individuals or entities and the parties hereto. For the avoidance of doubt, a Dispute shall include a Dispute made derivatively on behalf of one party against another party.

(b) There shall be three arbitrators. If there are only two parties to the Dispute (with, for purposes of this Article 22, any and all parties involved in the Dispute and owned by the same ultimate parent entity treated as one party), each party shall select one arbitrator within 15 days after receipt by respondent of a copy of the demand for arbitration. Such arbitrators may be affiliated or interested persons of such parties. If either party fails to timely select an arbitrator, the other party to the Dispute shall select the second arbitrator who shall be neutral and impartial and shall not be affiliated with or an interested person of either party. If there are more than two parties to the Dispute, all claimants, on the one hand, and all respondents, on the other hand, shall each select, by the vote of a majority of the claimants or the respondents, as the case may be, one arbitrator. Such arbitrators may be affiliated or interested persons of the claimants or the respondents, as the case may be. If either all claimants or all respondents fail to timely select an arbitrator then such arbitrator (who shall be neutral, impartial and unaffiliated with any party) shall be appointed by the AAA. The two arbitrators so appointed shall jointly appoint the third and presiding arbitrator (who shall be neutral, impartial and unaffiliated with any party) within 15 days of the appointment of the second arbitrator. If the third arbitrator has not been appointed within the time limit specified herein, then the AAA shall provide a list of proposed arbitrators in accordance with the Rules, and the arbitrator shall be appointed by the AAA in accordance with a listing, striking and ranking procedure, with each party having a limited number of strikes, excluding strikes for cause.

(c) The place of arbitration shall be Boston, Massachusetts unless otherwise agreed by the parties.

(d) There shall be only limited documentary discovery of documents directly related to the issues in dispute, as may be ordered by the arbitrators.

(e) In rendering an award or decision (the “Award”), the arbitrators shall be required to follow the laws of the Commonwealth of Massachusetts. Any arbitration proceedings or Award rendered hereunder and the validity, effect and interpretation of this arbitration agreement shall be governed by the Federal Arbitration Act, 9 U.S.C. §1 et seq. The Award shall be in writing and may, but shall not be required to, briefly state the findings of fact and conclusions of law on which it is based.

(f) Except to the extent expressly provided by Article 22 or as otherwise agreed by the parties, each party involved in a Dispute shall bear its own costs and expenses (including attorneys’ fees), and the arbitrators shall not render an award that would include shifting of any such costs or expenses (including attorneys’ fees) or, in a derivative case or class action, award any portion of Assignor’s or Assignee’s award to the claimant or the claimant’s attorneys. Except to the extent otherwise agreed by the parties, each party (or, if there are more than two parties to the Dispute, all claimants, on the one hand, and all respondents, on the other hand, respectively) shall bear the costs and expenses of its (or their) selected arbitrator and the parties (or, if there are more than two parties to the Dispute, all claimants, on the one hand, and all respondents, on the other hand) shall equally bear the costs and expenses of the third appointed arbitrator.

(g) An Award shall be final and binding upon the parties thereto and shall be the sole and exclusive remedy between such parties relating to the Dispute, including any claims,

counterclaims, issues or accounting presented to the arbitrators. Judgment upon the Award may be entered in any court having jurisdiction. To the fullest extent permitted by law, no application or appeal to any court of competent jurisdiction may be made in connection with any question of law arising in the course of arbitration or with respect to any award made except for actions relating to enforcement of this agreement to arbitrate or any arbitral award issued hereunder and except for actions seeking interim or other provisional relief in aid of arbitration proceedings in any court of competent jurisdiction.

(h) Any monetary award shall be made and payable in U.S. dollars free of any tax, deduction or offset. Each party against which the Award assesses a monetary obligation shall pay that obligation on or before the 30th day following the date of the Award or such other date as the Award may provide.

(i) This Article 22 is intended to benefit and be enforceable by the shareholders, trustees, directors, officers, managers (including Reit Management & Research LLC or its successor), agents or employees of any party and the parties and shall be binding on the shareholders of any party and the parties, as applicable, and shall be in addition to, and not in substitution for, any other rights to indemnification or contribution that such individuals or entities may have by contract or otherwise.

4. Schedule 1. Schedule 1 to Amended Lease No. 2 is deleted in its entirety and replaced with Schedule 1 attached hereto.

5. Exhibit A. Exhibit A to Amended Lease No. 2 is amended by adding Exhibits A-53 through A-57, attached hereto, immediately following Exhibit A-52 to Amended Lease No. 2.

6. Ratification. As amended hereby, Amended Lease No. 2 is hereby ratified and confirmed.

[Remainder of page intentionally left blank; signature pages follow]

IN WITNESS WHEREOF, the parties have executed this Amendment as a sealed instrument as of the date above first written.

|

|

LANDLORD: | |

|

|

| |

|

|

SPTIHS PROPERTIES TRUST | |

|

|

| |

|

|

By: |

/s/ Xxxxx X. Xxxxxxx |

|

|

|

Xxxxx X. Xxxxxxx |

|

|

|

President |

|

|

| |

|

|

SPTMNR PROPERTIES TRUST | |

|

|

| |

|

|

By: |

/s/ Xxxxx X. Xxxxxxx |

|

|

|

Xxxxx X. Xxxxxxx |

|

|

|

President |

|

|

| |

|

|

SNH/LTA PROPERTIES GA LLC | |

|

|

| |

|

|

By: |

/s/ Xxxxx X. Xxxxxxx |

|

|

|

Xxxxx X. Xxxxxxx |

|

|

|

President |

|

|

| |

|

|

SNH/LTA PROPERTIES TRUST | |

|

|

| |

|

|

By: |

/s/ Xxxxx X. Xxxxxxx |

|

|

|

Xxxxx X. Xxxxxxx |

|

|

|

President |

|

|

| |

|

|

O.F.C. CORPORATION | |

|

|

| |

|

|

By: |

/s/ Xxxxx X. Xxxxxxx |

|

|

|

Xxxxx X. Xxxxxxx |

|

|

|

President |

|

|

| |

|

|

SNH CHS PROPERTIES TRUST | |

|

|

| |

|

|

By: |

/s/ Xxxxx X. Xxxxxxx |

|

|

|

Xxxxx X. Xxxxxxx |

|

|

|

President |

|

|

| |

|

|

CCC OF KENTUCKY TRUST | |

|

|

| |

|

|

By: |

/s/ Xxxxx X. Xxxxxxx |

|

|

|

Xxxxx X. Xxxxxxx |

|

|

|

President |

|

|

LEISURE PARK VENTURE LIMITED PARTNERSHIP | |||

|

|

| |||

|

|

By: |

CCC Leisure Park Corporation, | ||

|

|

|

its General Partner | ||

|

|

| |||

|

|

|

By: |

/s/ Xxxxx X. Xxxxxxx | |

|

|

|

|

Xxxxx X. Xxxxxxx | |

|

|

|

|

President | |

|

|

| |||

|

|

CCDE SENIOR LIVING LLC | |||

|

|

| |||

|

|

By: |

/s/ Xxxxx X. Xxxxxxx | ||

|

|

|

Xxxxx X. Xxxxxxx | ||

|

|

|

President | ||

|

|

| |||

|

|

CCOP SENIOR LIVING LLC | |||

|

|

| |||

|

|

By: |

/s/ Xxxxx X. Xxxxxxx | ||

|

|

|

Xxxxx X. Xxxxxxx | ||

|

|

|

President | ||

|

|

| |||

|

|

CCC PUEBLO NORTE TRUST | |||

|

|

| |||

|

|

By: |

/s/ Xxxxx X. Xxxxxxx | ||

|

|

|

Xxxxx X. Xxxxxxx | ||

|

|

|

President | ||

|

|

| |||

|

|

CCC RETIREMENT COMMUNITIES II, L.P. | |||

|

|

| |||

|

|

By: |

Crestline Ventures LLC, | ||

|

|

|

its General Partner | ||

|

|

| |||

|

|

|

By: |

/s/ Xxxxx X. Xxxxxxx | |

|

|

|

|

Xxxxx X. Xxxxxxx | |

|

|

|

|

President | |

|

|

| |||

|

|

CCC INVESTMENTS I, L.L.C. | |||

|

|

| |||

|

|

By: |

/s/ Xxxxx X. Xxxxxxx | ||

|

|

|

Xxxxx X. Xxxxxxx | ||

|

|

|

President | ||

|

|

CCC FINANCING I TRUST | |||

|

|

| |||

|

|

By: |

/s/ Xxxxx X. Xxxxxxx | ||

|

|

|

Xxxxx X. Xxxxxxx | ||

|

|

|

President | ||

|

|

| |||

|

|

CCC FINANCING LIMITED, L.P. | |||

|

|

| |||

|

|

By: |

CCC Retirement Trust, | ||

|

|

|

its General Partner | ||

|

|

| |||

|

|

|

By: |

/s/ Xxxxx X. Xxxxxxx | |

|

|

|

|

Xxxxx X. Xxxxxxx | |

|

|

|

|

President | |

|

|

| |||

|

|

SNH SOMERFORD PROPERTIES TRUST | |||

|

|

| |||

|

|

By: |

/s/ Xxxxx X. Xxxxxxx | ||

|

|

|

Xxxxx X. Xxxxxxx | ||

|

|

|

President | ||

|

|

| |||

|

|

HRES1 PROPERTIES TRUST | |||

|

|

| |||

|

|

By: |

/s/ Xxxxx X. Xxxxxxx | ||

|

|

|

Xxxxx X. Xxxxxxx | ||

|

|

|

President | ||

|

|

TENANT: | |

|

|

| |

|

|

FIVE STAR QUALITY CARE TRUST | |

|

|

| |

|

|

By: |

/s/ Xxxxx X. Xxxxxx Xx. |

|

|

|

Xxxxx X. Xxxxxx Xx. |

|

|

|

President |

|

|

| |

|

|

FS TENANT HOLDING COMPANY TRUST | |

|

|

| |

|

|

By: |

/s/ Xxxxx X. Xxxxxx Xx. |

|

|

|

Xxxxx X. Xxxxxx Xx. |

|

|

|

President |

|

|

| |

|

|

FS COMMONWEALTH LLC | |

|

|

| |

|

|

By: |

/s/ Xxxxx X. Xxxxxx Xx. |

|

|

|

Xxxxx X. Xxxxxx Xx. |

|

|

|

President |

|

|

| |

|

|

FS PATRIOT LLC | |

|

|

| |

|

|

By: |

/s/ Xxxxx X. Xxxxxx Xx. |

|

|

|

Xxxxx X. Xxxxxx Xx. |

|

|

|

President |

SCHEDULE 1

PROPERTY-SPECIFIC INFORMATION

|

Exhibit |

|

Property Address |

|

Base Gross Revenues |

|

Base Gross Revenues |

|

Commencement |

|

Interest |

| |

|

A-1 |

|

Ashton Gables in Riverchase Xxxxxxxxxx, XX 00000 |

|

2009 |

|

N/A |

|

08/01/2008 |

|

8% |

| |

|

X-0 |

|

Xxxxxxxx Xxxxxxx 0000 Xxxxxxxxxx Xxxx Xxxxxxxxxx, XX 00000 |

|

2009 |

|

N/A |

|

08/01/2008 |

|

8% |

| |

|

A-3 |

|

Forum at Pueblo Norte 0000 Xxxx Xxxxxx Xxxxxx Xxxxxxxxxx, XX 00000 |

|

2005 |

|

$ |

11,470,312 |

|

01/11/2002 |

|

10% |

|

|

A-4 |

|

La Salette Health and Rehabilitation Center 000 Xxxx Xxxxxx Xxxxxx Xxxxxxxx, XX 00000 |

|

2005 |

|

$ |

7,726,002 |

|

12/31/2001 |

|

10% |

|

|

A-5 |

|

Thousand Oaks Health Care Center 93 West Avenida de Los Arboles Xxxxxxxx Xxxx, XX 00000 |

|

2005 |

|

$ |

8,087,430 |

|

12/31/2001 |

|

10% |

|

|

A-6 |

|

Skyline Ridge Nursing & Rehabilitation Center 000 Xxxxxxxx Xxxxxx Xxxxx Xxxx, XX 00000 |

|

2005 |

|

$ |

4,104,100 |

|

12/31/2001 |

|

10% |

|

|

X-0 |

|

Xxxxxxx Xxxxxxx Care Center 000 Xxxx Xxx Xxxxx Xxxxxx Xxxxxxxx Xxxxxxx, XX 00000 |

|

2005 |

|

$ |

4,799,252 |

|

12/31/2001 |

|

10% |

|

|

A-8 |

|

Willow Tree Care Center 0000 Xxxxx Xxxx Xxxxxx Xxxxx, XX 00000 |

|

2005 |

|

$ |

4,310,982 |

|

12/31/2001 |

|

10% |

|

|

A-9 |

|

Cedars Healthcare Center 0000 Xxxxxxx Xxxxxx Xxxxxxxx, XX 00000 |

|

2005 |

|

$ |

6,964,007 |

|

12/31/2001 |

|

10% |

|

|

X-00 |

|

Xxxxxxxxx 000 Xxxxxx Xxxx Xxxx Xxxxxx, XX 00000 |

|

2005 |

|

$ |

11,410,121 |

|

01/11/2002 |

|

10% |

|

|

A-11 |

|

Xxxxxxx Manor 0000 Xxxxx Xxxx Xxxxxxxxxx, XX 00000 |

|

2005 |

|

$ |

13,446,434 |

|

01/11/2002 |

|

10% |

|

|

X-00 |

|

Xxxxx Xxxxx Xxxxx 000 Xxxxx Xxxx Xxxxxxxxxx, XX 00000 |

|

2005 |

|

$ |

4,430,251 |

|

01/11/2002 |

|

10% |

|

|

A-13 |

|

Xxxxxxx Manor 0000 Xxxxxxx Xxxx Xxxxxxxxxx, XX 00000 |

|

2005 |

|

$ |

9,333,057 |

|

01/11/2002 |

|

10% |

|

|

A-14 |

|

Forum at Deer Creek 0000 Xxxx Xxxxx Xxxxxxx Xxxx Xxxx. Xxxxxxxxx Xxxxx, XX 00000 |

|

2005 |

|

$ |

12,323,581 |

|

01/11/2002 |

|

10% |

|

|

A-15 |

|

Springwood Court 00000 Xxxxxxx Xxxx Xxxx Xxxxx, XX 00000 |

|

2005 |

|

$ |

2,577,612 |

|

01/11/2002 |

|

10% |

|

|

A-16 |

|

Fountainview 000 Xxxxxxxxx Xxxxxx Xxxxx Xxxx Xxxx Xxxxx, XX 00000 |

|

2005 |

|

$ |

7,920,202 |

|

01/11/2002 |

|

10% |

|

|

Exhibit |

|

Property Address |

|

Base Gross Revenues |

|

Base Gross Revenues |

|

Commencement |

|

Interest |

| |

|

A-17 |

|

Morningside of Athens 0000 Xxxxx Xxxxxx Xxxxx Xxxxxx, XX 00000 |

|

2006 |

|

$ |

1,560,026 |

|

11/19/2004 |

|

9% |

|

|

X-00 |

|

Xxxxx View Senior Living 0000 Xxxxxxxx Xxxx Xxxxxxxx, XX 00000 |

|

2007 |

|

$ |

2,108,378 |

|

11/01/2006 |

|

8.25% |

|

|

A-19 |

|

Pacific Place 00000 Xxxx Xxxxxx Xxxxxxx Xxxxxxxx, XX 00000 |

|

2005 |

|

$ |

848,447 |

|

12/31/2001 |

|

10% |

|

|

A-20 |

|

West Bridge Care & Rehabilitation 0000 Xxxx Xxxxxx Xxxxxx Xxxxxxxxx, XX 00000 |

|

2005 |

|

$ |

3,157,928 |

|

12/31/2001 |

|

10% |

|

|

A-21 |

|

Meadowood Retirement Community 0000 Xxxxxxxx Xxxxx Xxxxxxxxxxx, XX 00000 |

|

2009 |

|

N/A |

|

11/01/2008 |

|

8% |

| |

|

A-22 |

|

Woodhaven Care Center 000 Xxxx 0xx Xxxxxx Xxxxxxxxx, XX 00000 |

|

2005 |

|

$ |

2,704,674 |

|

12/31/2001 |

|

10% |

|

|

A-23 |

|

Lafayette at Country Place 000 Xxxxx Xxxxxxx Xxxx Xxxxxxxxx, XX 00000 |

|

2005 |

|

$ |

4,928,052 |

|

01/11/2002 |

|

10% |

|

|

A-24 |

|

Lexington Country Place 000 Xxxxx Xxxxxxx Xxxx Xxxxxxxxx, XX 00000 |

|

2005 |

|

$ |

8,893,947 |

|

01/11/2002 |

|

10% |

|

|

A-25 |

|

Braintree Rehabilitation Hospital 000 Xxxx Xxxxxx Xxxxxxxxx, XX 00000 |

|

N/A |

|

N/A |

|

10/01/2006 |

|

9% |

| |

|

A-26 |

|

New England Rehabilitation Hospital 0 Xxxxxxxxxxxxxx Xxx Xxxxxx, XX 00000 |

|

N/A |

|

N/A |

|

10/01/2006 |

|

9% |

| |

|

A-27 |

|

HeartFields at Bowie 0000 Xxxxxx Xxxxx Xxxx Xxxxx, XX 00000 |

|

2005 |

|

$ |

2,436,102 |

|

10/25/2002 |

|

10% |

|

|

A-28 |

|

HeartFields at Xxxxxxxxx 0000 Xxxxxx Xxxxx Xxxxxxxxx, XX 00000 |

|

2005 |

|

$ |

2,173,971 |

|

10/25/2002 |

|

10% |

|

|

A-29 |

|

Intentionally deleted. |

|

X/X |

|

X/X |

|

X/X |

|

X/X |

| |

|

A-30 |

|

Intentionally deleted. |

|

X/X |

|

X/X |

|

X/X |

|

X/X |

| |

|

A-31 |

|

Morys Haven 0000 00xx Xxxxxx Xxxxxxxx, XX 00000 |

|

2005 |

|

$ |

2,440,714 |

|

12/31/2001 |

|

10% |

|

|

A-32 |

|

Intentionally deleted. |

|

N/A |

|

N/A |

|

N/A |

|

N/A |

| |

|

A-33 |

|

Wedgewood Care Center 000 Xxxxxxx Xxxxx Xxxxx Xxxxxx, XX 00000 |

|

2005 |

|

$ |

4,000,565 |

|

12/31/2001 |

|

10% |

|

|

A-34 |

|

Intentionally deleted. |

|

X/X |

|

X/X |

|

X/X |

|

X/X |

| |

|

X-00 |

|

Xxxxxxxxx Xxxxxxxxxx Center 0000 Xxxx Xxxxx Xxxxxx Xxxxxxx, XX 00000 |

|

2005 |

|

$ |

2,284,407 |

|

12/31/2001 |

|

10% |

|

|

A-36 |

|

Utica Community Care Center 0000 Xxxxxxxxxx Xxxxxx Xxxxx, XX 00000 |

|

2005 |

|

$ |

1,950,325 |

|

12/31/2001 |

|

10% |

|

|

X-00 |

|

Xxxxxxx Xxxx 0000 Xxxxx 00 Xxxxxxxx, XX 00000 |

|

2005 |

|

$ |

14,273,446 |

|

01/07/2002 |

|

10% |

|

|

Exhibit |

|

Property Address |

|

Base Gross Revenues |

|

Base Gross Revenues |

|

Commencement |

|

Interest |

| |

|

A-38 |

|

Franciscan Manor 00 Xxxxxxxxxx Xxxx Xxxxxxxxx Xxxxxxxx Xxxxxx Xxxxx, XX 00000 |

|

2006 |

|

$ |

4,151,818 |

|

10/31/2005 |

|

9% |

|

|

X-00 |

|

Xxxxx Xxxxxx of Xxxxxxxxx 000 Xxxxxxxxx Xxxxx Xxxxxxxxx, XX 00000 |

|

2006 |

|

$ |

2,332,574 |

|

10/31/2005 |

|

9% |

|

|

A-40 |

|

Overlook Green 0000 Xxxxxxxxxxx Xxxxx Xxxxxxxxx, XX 00000 |

|

2006 |

|

$ |

3,878,300 |

|

10/31/2005 |

|

9% |

|

|

X-00 |

|

Xxxxxx Xxxxx Xxxxx 0000 Xxxxxxx 00 Xxxxx Xxxxxx Xxxxx, XX 00000 |

|

2005 |

|

$ |

6,138,714 |

|

01/11/2002 |

|

10% |

|

|

A-42 |

|

Morningside of Xxxxxxxx 0000 XxXxxx Xxxx Xxxxxxxx, XX 00000 |

|

2006 |

|

$ |

1,381,775 |

|

11/19/2004 |

|

9% |

|

|

X-00 |

|

Xxxxxxxx Xxxxx at Boerne 000 Xxxxxxxxxx Xxxxx Xxxxxx, XX 00000 |

|

2009 |

|

N/A |

|

02/07/2008 |

|

8% |

| |

|

A-44 |

|

Forum at Park Lane 0000 Xxxx Xxxx Xxxxxx, XX 00000 |

|

2005 |

|

$ |

13,620,931 |

|

01/11/2002 |

|

10% |

|

|

X-00 |

|

Xxxxxxxx Xxxxx at Fredericksburg 00 Xxxxxxxxx Xxxx Xxxxxxxxxxxxxx, XX 00000 |

|

2009 |

|

N/A |

|

02/07/2008 |

|

8% |

| |

|

X-00 |

|

Xxxxxxxxx Xxxxxx & Xxxxxxxxxxxxxx Xxxxxx 00 Xxxxxxxxx Xxxx Xxxxxxxxxxxx, XX 00000 |

|

2005 |

|

$ |

3,038,761 |

|

12/31/2001 |

|

10% |

|

|

A-47 |

|

Pine Manor Health Care Center Village of Embarrass 0000 Xxxx Xxxx Xxxxxx Xxxxxxxxxxxx, XX 00000 |

|

2005 |

|

$ |

4,337,113 |

|

12/31/2001 |

|

10% |

|

|

A-48 |

|

ManorPointe - Oak Creek 000 Xxxx Xxxxxxxxx Xxxxx and 000 Xxxx Xxxxx Xxxx Xxx Xxxxx, XX 00000 |

|

2009 |

|

N/A |

|

01/04/2008 |

|

8% |

| |

|

X-00 |

|

Xxxxx Xxxxx Xxxx Healthcare Center 000 Xxxxxxxxx Xxxxx Xxxxxxxx, XX 00000 |

|

2005 |

|

$ |

9,211,765 |

|

12/31/2001 |

|

10% |

|

|

A-50 |

|

The Virginia Health & Rehabilitation Center 0000 Xxxxxxxxx Xxxxxx Xxxxxxxx, XX 00000 |

|

2005 |

|

$ |

6,128,045 |

|

12/31/2001 |

|

10% |

|

|

A-51 |

|

0000 Xxxxxxx Xxxxx Xxxxxxxxxx, Xxxxxxxx |

|

0000 |

|

N/A |

|

06/20/2011 |

|

7.5% |

| |

|

X-00 |

|

Xxxxx xx Xx. Xxxxx Xxxx 000 X.X. Cashmere Boulevard Port St. Lucie, Florida |

|

2012 |

|

N/A |

|

07/22/2011 |

|

7.5% |

| |

|

A-53 |

|

Forum at Desert Harbor 00000 Xxxxx Xxxxxx Xxxxxx Xxxxx Xxxxxx, XX 00000 |

|

2005 |

|

$ |

9,830,918 |

|

01/11/2002 |

|

10.0% |

|

|

A-54 |

|

Forum at Tucson Xxxxxx, XX 00000 |

|

2005 |

|

$ |

13,258,998 |

|

01/11/2002 |

|

10.0% |

|

|

Exhibit |

|

Property Address |

|

Base Gross Revenues |

|

Base Gross Revenues |

|

Commencement |

|

Interest |

| |

|

A-55 |

|

Park Summit at Coral Springs Xxxxx Xxxxxxx, XX 00000 |

|

2005 |

|

$ |

11,229,677 |

|

01/11/2002 |

|

10.0% |

|

|

A-56 |

|

Gables at Winchester Xxxxxxxxxx, XX 00000 |

|

2005 |

|

$ |

6,937,852 |

|

01/11/2002 |

|

10.0% |

|

|

A-57 |

|

Forum at Memorial Xxxxx Xxxxxxx, XX 00000 |

|

2005 |

|

$ |

19,734,400 |

|

01/11/2002 |

|

10.0% |

|

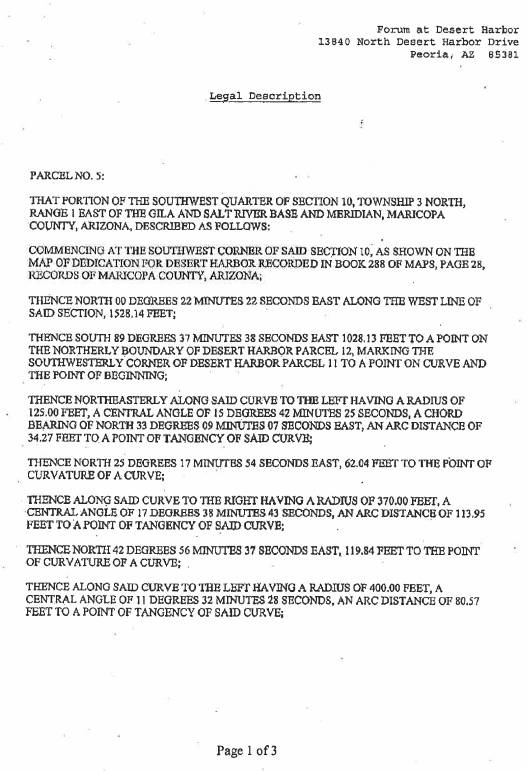

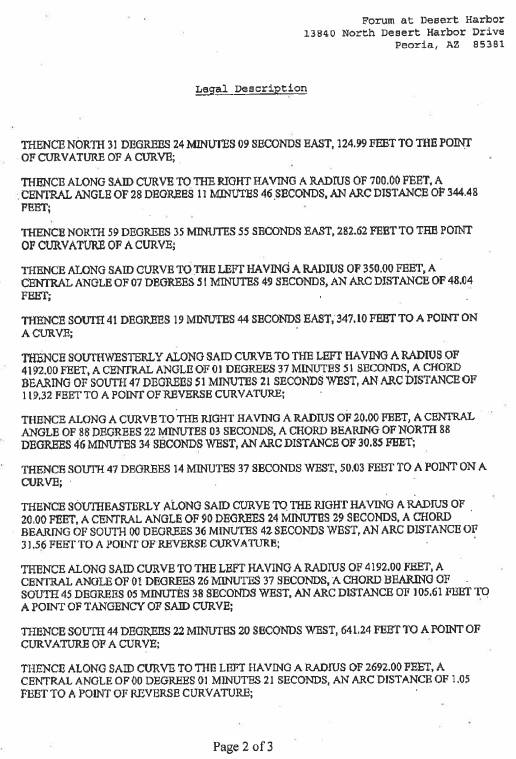

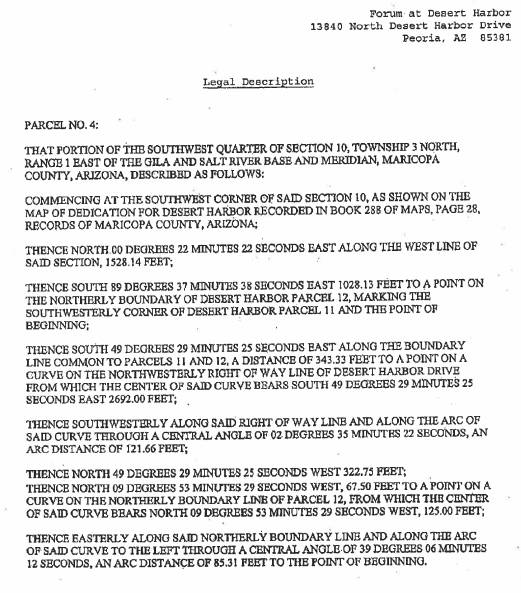

EXHIBIT A-53

Forum at Desert Harbor

00000 Xxxxx Xxxxxx Xxxxxx Xxxxx

Xxxxxx, XX 00000

LEGAL DESCRIPTION

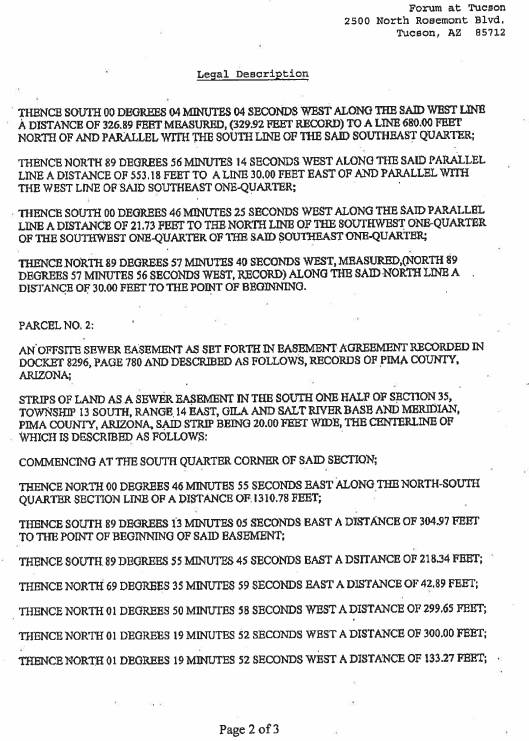

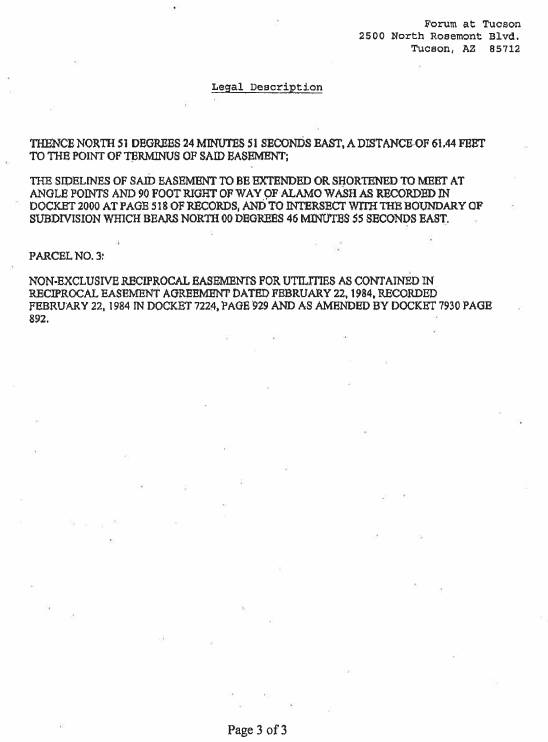

EXHIBIT A-54

Forum at Tucson

0000 Xxxxx Xxxxxxxx Xxxx.

Xxxxxx, XX 00000

LEGAL DESCRIPTION

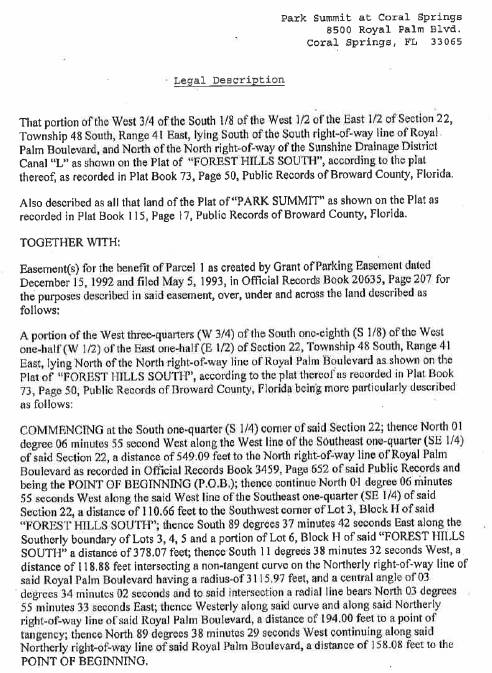

EXHIBIT X-00

Xxxx Xxxxxx at Coral Springs

0000 Xxxxx Xxxx Xxxx.

Xxxxx Xxxxxxx, XX 00000

LEGAL DESCRIPTION

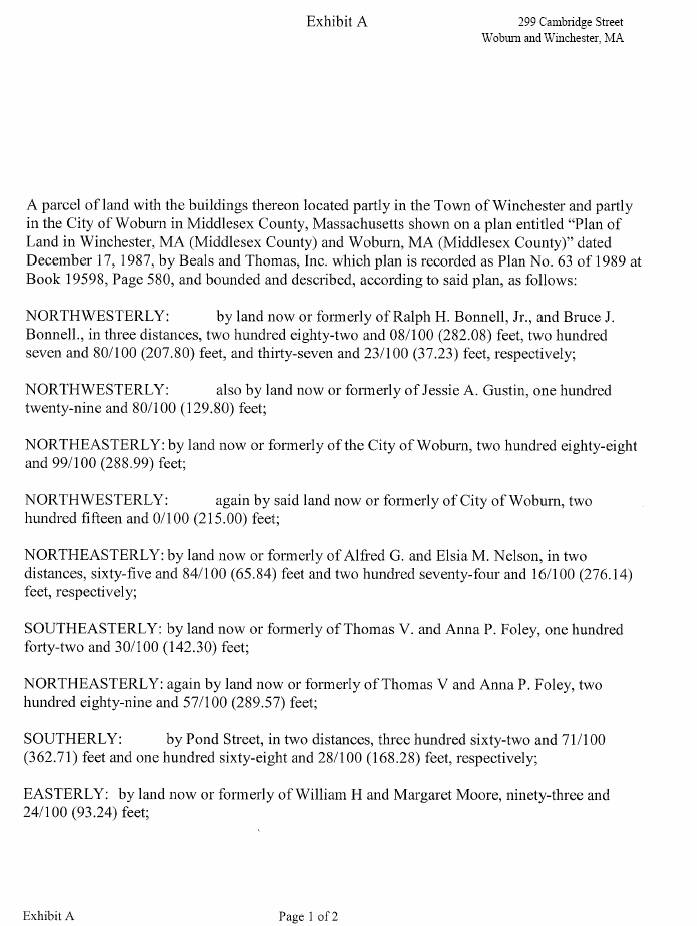

EXHIBIT A-56

Gables at Winchester

000 Xxxxxxxxx Xxxxxx

Xxxxxxxxxx, XX 00000

LEGAL DESCRIPTION

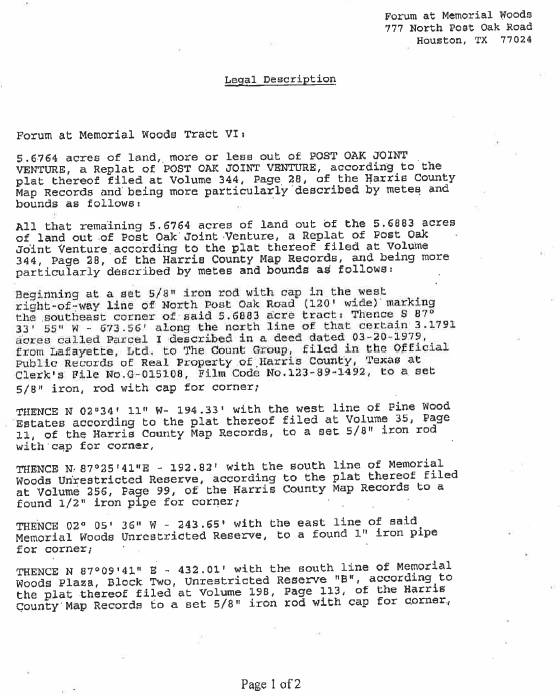

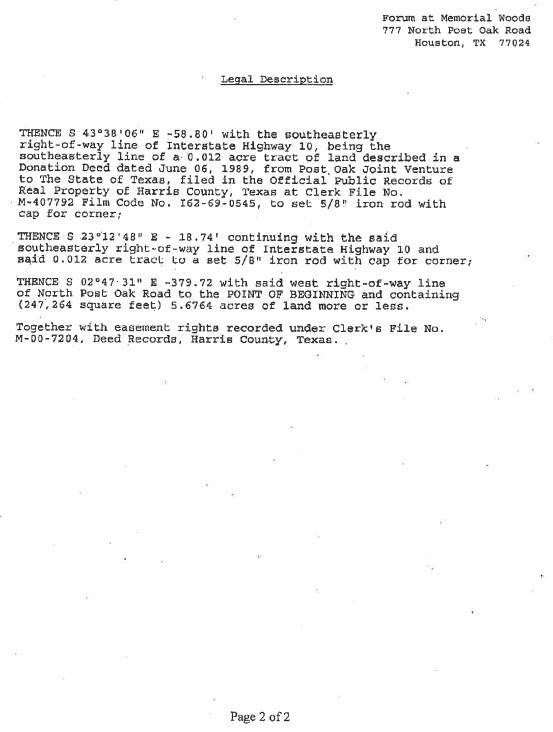

EXHIBIT A-57

Forum at Memorial Xxxxx

000 Xxxxx Xxxx Xxx Xxxx

Xxxxxxx, XX 00000

LEGAL DESCRIPTION