Contract

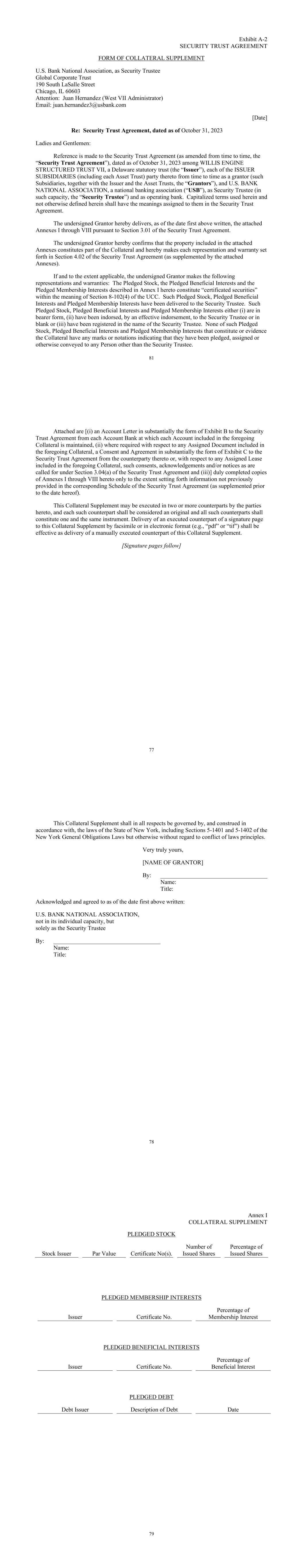

[*] Indicates that certain information in this exhibit has been excluded because it is both (i) not material and (ii) is the type that the registrant treats as private or confidential. EXECUTION VERSION SECURITY TRUST AGREEMENT dated as of October 31, 2023 among XXXXXX ENGINE STRUCTURED TRUST VII, as the Issuer EACH OF THE ADDITIONAL GRANTORS REFERRED TO HEREIN AND FROM TIME TO TIME MADE A PARTY HERETO and U.S. BANK NATIONAL ASSOCIATION as Security Trustee and Operating Bank i Table of Contents Page ARTICLE I DEFINITIONS ........................................................................................................... 1 Section 1.01 Definitions................................................................................................ 1 Section 1.02 Terms Defined in the Cape Town Convention ........................................ 2 Section 1.03 Construction and Usage ........................................................................... 2 ARTICLE II SECURITY ............................................................................................................... 2 Section 2.01 Grant of Security ...................................................................................... 2 Section 2.02 Security for Obligations ........................................................................... 4 Section 2.03 Grantors Remain Liable ........................................................................... 5 Section 2.04 Security Trustee Appointed Attorney-in-Fact ......................................... 5 Section 2.05 Voting Rights; Dividends; Etc ................................................................. 5 Section 2.06 Performance of Obligations ..................................................................... 7 ARTICLE III COVENANTS ......................................................................................................... 7 Section 3.01 Collateral Supplements and Grantor Supplements .................................. 7 Section 3.02 Delivery of Collateral .............................................................................. 8 Section 3.03 Accounts .................................................................................................. 9 Section 3.04 Covenants Regarding Assigned Documents .......................................... 12 Section 3.05 Covenants Regarding Intangible Collateral ........................................... 14 Section 3.06 Further Assurances................................................................................. 16 Section 3.07 Place of Perfection; Records .................................................................. 17 Section 3.08 Transfers and Other Encumbrances; Additional Shares or Interests .................................................................................................. 17 Section 3.09 Security Trustee May Perform ............................................................... 18 Section 3.10 Covenant to Pay and Perform ................................................................ 18 Section 3.11 Annual Opinion ...................................................................................... 18 Section 3.12 Perfection Standards .............................................................................. 18 ARTICLE IV REPRESENTATIONS AND WARRANTIES ..................................................... 21 Section 4.01 Representations and Warranties of the Issuer ........................................ 21 Section 4.02 Representations and Warranties of the Grantors ................................... 24 ARTICLE V REMEDIES ............................................................................................................. 27 Section 5.01 Remedies ................................................................................................ 27 ii Section 5.02 Delivery of Collateral, Power of Sale, etc ............................................. 29 Section 5.03 Right to Possession, etc.......................................................................... 30 Section 5.04 Application of Proceeds ......................................................................... 30 Section 5.05 Matters Involving Manner of Sale ......................................................... 31 Section 5.06 Relief Under Cape Town Convention.................................................... 32 Section 5.07 Issuer as Trustee ..................................................................................... 32 ARTICLE VI SECURITY INTEREST ABSOLUTE .................................................................. 33 Section 6.01 Security Interest Absolute ...................................................................... 33 ARTICLE VII THE SECURITY TRUSTEE AND OPERATING BANK.................................. 33 Section 7.01 Authorization and Action ....................................................................... 33 Section 7.02 Absence of Duties .................................................................................. 34 Section 7.03 Representations or Warranties ............................................................... 34 Section 7.04 Reliance; Agents; Advice of Counsel .................................................... 35 Section 7.05 No Individual Liability .......................................................................... 37 Section 7.06 Cape Town Convention ......................................................................... 37 Section 7.07 Operating Bank ...................................................................................... 37 Section 7.08 French Security ...................................................................................... 37 Section 7.09 Force Majeure ........................................................................................ 38 ARTICLE VIII SUCCESSOR TRUSTEES ................................................................................. 38 Section 8.01 Resignation and Removal of Security Trustee ....................................... 38 Section 8.02 Appointment of Successor ..................................................................... 39 ARTICLE IX INDEMNITY; EXPENSES; SUBORDINATION ................................................ 40 Section 9.01 Indemnity ............................................................................................... 40 Section 9.02 Survival .................................................................................................. 41 Section 9.03 No Compensation from Secured Parties ................................................ 42 Section 9.04 Security Trustee Fees ............................................................................. 42 Section 9.05 Subordination and Priority ..................................................................... 42 Section 9.06 Exercise of Remedies ............................................................................. 42 Section 9.07 Further Agreements of Subordination ................................................... 43 Section 9.08 Rights of Subrogation ............................................................................ 45 Section 9.09 Further Assurances of Subordinated Representatives............................ 45 Section 9.10 Miscellaneous Subordination Provisions ............................................... 45 iii ARTICLE X MISCELLANEOUS ............................................................................................... 46 Section 10.01 Amendments; Xxxxxxx; Etc ................................................................... 46 Section 10.02 Addresses for Notices ............................................................................ 47 Section 10.03 No Waiver; Remedies ............................................................................ 48 Section 10.04 Severability ............................................................................................ 48 Section 10.05 Continuing Security Interest; Assignments ........................................... 48 Section 10.06 Release and Termination........................................................................ 48 Section 10.07 Currency Conversion ............................................................................. 49 Section 10.08 Governing Law ...................................................................................... 49 Section 10.09 Jurisdiction; Waiver of Jury Trial .......................................................... 50 Section 10.10 Counterparts ........................................................................................... 51 Section 10.11 Table of Contents, Headings, Etc .......................................................... 51 Section 10.12 Limited Recourse ................................................................................... 51 Section 10.13 Compliance with Applicable Regulations ............................................. 51 Section 10.14 Security Agent ....................................................................................... 52 Section 10.15 Senior Representative Direction ............................................................ 52 APPENDIX Appendix A Definitions SCHEDULES Schedule I Pledged Stock, Pledged Beneficial Interest, Pledged Membership Interest and Pledged Debt Schedule II Account Information Schedule III Principal Offices Schedule IV Process Agent Schedule V Asset Trusts Schedule VI Other Issuer Subsidiaries Schedule VII Leases Schedule VIII Assets EXHIBITS Exhibit A-1 Form of Secured Party Supplement Exhibit A-2 Form of Collateral Supplement Exhibit A-3 Form of Grantor Supplement Exhibit B Form of Account Letter Exhibit C Form of Consent and Agreement Exhibit D-1 Form of Asset Mortgage

iv Exhibit D-2 Form of Asset Mortgage and Lease Security Assignment Exhibit D-3 Form of Lease Security Assignment Exhibit E Form of FAA Opinion 1 SECURITY TRUST AGREEMENT This SECURITY TRUST AGREEMENT (as amended, supplemented and otherwise modified from time to time, this “Agreement”), dated as of October 31, 2023, is made by and among XXXXXX ENGINE STRUCTURED TRUST VII, a Delaware statutory trust (the “Issuer”), each of the ISSUER SUBSIDIARIES (including each Asset Trust) party hereto from time to time as a grantor (such Issuer Subsidiaries, together with the Issuer, the “Grantors”), and U.S. BANK NATIONAL ASSOCIATION, a national banking association (“USB”), as Security Trustee (in such capacity, the “Security Trustee”) and Operating Bank (in such capacity, the “Operating Bank”). WITNESSETH THAT: WHEREAS, the Issuer and USB, as Trustee, among others, entered into a Trust Indenture, dated as of October 31, 2023 (as amended, supplemented and otherwise modified from time to time, the “Indenture”); WHEREAS, pursuant to the Indenture, the Issuer is issuing the Initial Notes; WHEREAS, the Issuer is the owner, directly or indirectly, of all of the beneficial, membership and equity interests, as applicable, in the Asset Trusts and the other Issuer Subsidiaries, including any Subsidiary of the Issuer that becomes a party to this Agreement by the execution and delivery of a Grantor Supplement; WHEREAS, in order to secure the payment of the Notes by the Issuer and the payment and performance of all obligations of the Issuer and the other Grantors under the Related Documents, the Issuer and the other Grantors are entering into this Agreement to grant a security interest in the Collateral in favor of the Security Trustee for the benefit of the Secured Parties; WHEREAS, each Grantor will derive substantial direct and indirect benefit from the issuance of the Notes by the Issuer and from the execution, delivery and performance of the Related Documents, whether or not such Grantor is a party thereto; and WHEREAS, it is a condition precedent to the issuance of the Notes by the Issuer and the making of any Loans to the Issuer that each Grantor grant the security interests contemplated by this Agreement; NOW, THEREFORE, in consideration of the foregoing, and for other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged each Grantor hereby agrees with the Security Trustee, for its benefit and for the benefit of the other Secured Parties, as follows: ARTICLE I DEFINITIONS Section 1.01 Definitions. For all purposes of this Agreement, the capitalized terms set forth in Appendix A shall have the meanings specified therein, and all other capitalized terms 2 used, but not defined, in this Agreement shall have the respective meanings assigned to such terms in the Indenture. Section 1.02 Terms Defined in the Cape Town Convention. The following terms shall have the respective meanings ascribed thereto in the Cape Town Convention: “Administrator”, “Aircraft Object”; “associated rights”, “Contracting State”, “Contract of Sale”, “International Interest”, “International Registry”; “power to dispose”, “Professional User Entity”, “Prospective Sale”, “Prospective International Interest”, “situated in” and “Transacting User Entity”. Section 1.03 Construction and Usage. The conventions of construction and usage set forth in Section 1.02 of the Indenture are hereby incorporated by reference in this Agreement. ARTICLE II SECURITY Section 2.01 Grant of Security. To secure the payment and performance of the Secured Obligations, each Grantor hereby grants, assigns, conveys, mortgages, pledges, hypothecates and transfers to the Security Trustee, for the benefit of the Secured Parties (except as limited by the proviso at the end of this section in respect of certain Secured Parties in their capacity as Collateral Obligors), a security interest in and to all of such Grantor’s right, title and interest in, to and under the following, whether now existing or hereafter created or acquired: (a) with respect to such Grantor, all of such Grantor's right, title and interest in and to the following (the “Asset Collateral”): (i) each Asset and Part as the same is now and will hereafter be constituted, and in the case of any such Asset that is an Engine or Part, whether or not any such Engine or Part shall be installed in or attached to any Airframe, aircraft or Engine, and including in each case all Aircraft Objects and all Related Asset Documents in respect of each such Asset and Part; (ii) all proceeds from the sale or other disposition of, all proceeds of insurance due to such Grantor on, and all proceeds of the total or partial loss or physical destruction, confiscation, condemnation or requisition due to such Grantor with respect to, each such Asset and all Parts, equipment, attachments, accessories, replacement and added Parts and components described in the preceding clause (i); (iii) each Lease of an Asset, whether or not owned by such Grantor, under which such Grantor is or may from time to time be the lessor, together with any and all such Related Asset Documents relating to such Lease (any such Leases, together with all Related Asset Documents, an “Assigned Lease”), including without limitation (A) all rights of such Grantor to all Lease Payments, however denominated, under such Assigned Leases, (B) all rights of such Grantor to receive proceeds of any insurance, indemnity, warranty or guaranty pursuant to or with respect to such Assigned Leases, (C) claims of such Grantor for damages arising out of or for breach or default under such Assigned Leases, (D) all rights of such Grantor to receive and any and all rights to amend, waive, modify and give notices, approvals and consents under such Assigned Leases, (E) all 3 rights of such Grantor under any such Assigned Lease with respect to any sublease of any such Asset, (F) all rights of such Grantor to terminate such Assigned Leases and to compel performance of, and otherwise to exercise all remedies under, any such Assigned Lease, whether arising under such Assigned Leases or by statute or at law or in equity, (G) all rights of such Grantor to discharge any registration of an International Interest with respect to such Asset or any such Assigned Lease made with the International Registry (except to the extent that after use of commercially reasonable efforts, the Lessee under any Assigned Lease will not consent to the right to discharge such Assigned Lease to be held by any person other than the Lessor) and (H) all other rights and property of such Grantor included therein together with all payments, including without limitation all rent, damages, expenses, indemnities and other amounts due to such Grantor (or any person claiming by, through or under such Grantor) thereunder; and (iv) each Part-Out Agreement relating to an Asset, whether or not owned by such Grantor, under which such Grantor is or may from time to time be a party (each an “Assigned Part-Out Agreement”), including, without limitation, (A) all rights of such Grantor to all disposition proceeds or lease payments, however denominated, under such Assigned Part-Out Agreement or related thereto or to any Asset which is the subject of an Assigned Part-Out Agreement, (B) all rights of such Grantor to receive proceeds of any insurance, indemnity, warranty or guaranty pursuant to or with respect to such Assigned Part-Out Agreement, (C) claims of such Grantor for damages arising out of or for breach or default under such Assigned Part-Out Agreement, (D) all rights of such Grantor to receive any and all rights to amend, waive, modify and give notices, approvals and consents under such Assigned Part-Out Agreement, (E) all rights of such Grantor to terminate such Assigned Part-Out Agreement and to compel performance of, and otherwise to exercise all remedies under, any such Assigned Part-Out Agreement, whether arising under such Assigned Part-Out Agreement or by statute or at law or in equity, (F) all rights of such Grantor to possession of any Asset under an Assigned Part- Out Agreement, and (G) all other rights and property of such Grantor included therein together with all payments, including, without limitation, all sales or disposition proceeds, rent, damages, expenses, indemnities and other amounts due to such Grantor (or any Person claiming by, through or under such Grantor) thereunder; (b) all Stock Collateral now owned or hereafter from time to time acquired by such Grantor; (c) all Debt Collateral now owned or hereafter from time to time acquired by such Grantor: (d) all Beneficial Interest Collateral now owned or hereafter from time to time acquired by such Grantor; (e) all Membership Interest Collateral now owned or hereafter from time to time acquired by such Grantor; (f) all Account Collateral now owned or hereafter from time to time acquired by such Grantor;

4 (g) all Assigned Agreement Collateral now owned or hereafter from time to time acquired by such Grantor; (h) all of such Grantor’s right, title and interest in and to all Service Provider Documents (the “Servicing Collateral”), subject to the proviso set forth below in respect of any Collateral Obligor with obligations to such Grantor under the Service Provider Documents; (i) all of such Grantor’s right, title and interest in and to the Asset Purchase Agreement and the other Acquisition Agreements (the “Asset Purchase Collateral”), subject to the proviso set forth below in respect of any Collateral Obligor with obligations to such Grantor under the Asset Purchase Collateral; (j) all of such Grantor’s right, title and interest in and to all Hedge Agreements, and all rights to administer and otherwise deal with each such Hedge Agreement (the “Hedge Collateral”), subject to the proviso set forth below in respect of any Collateral Obligor with obligations to such Grantor under the Hedge Collateral; (k) all of such Grantor’s right, title and interest in and to the personal property identified in a Grantor Supplement or a Collateral Supplement executed and delivered by such Grantor to the Security Trustee; (l) all of such Grantor’s right, title and interest in and to all other accounts, chattel paper, payment intangibles, commercial tort claims, documents, goods, fixtures, general intangibles, instruments, inventory, investment property, letters of credit, supporting obligations, deposit account rights (as all of the foregoing are defined in the UCC) and other property not described in clauses (a) through (k) of Section 2.01; and (m) all income, payments and proceeds of any and all of the foregoing (including income, payments and proceeds that constitute property of the types described in any of the subsections of this Section 2.01); all of the foregoing constituting the “Collateral,” provided, however, that to the extent the Collateral consists of the obligations of any Collateral Obligor to such Grantor, such security interest in such Collateral shall not be for the benefit of such Collateral Obligor; and provided further that the Collateral shall not include Excluded Payments. Section 2.02 Security for Obligations. This Agreement and the FAA Security Documents secure the payment and performance of all Secured Obligations of each of the Grantors to each of the Secured Parties (subject to the subordination provisions of this Agreement, the Indenture and the other Related Documents) and shall be held by the Security Trustee in trust for the Secured Parties. Without limiting the generality of the foregoing, this Agreement and the FAA Security Documents secure the payment of all amounts that constitute part of the Secured Obligations and would be owed by any Grantor to any Secured Party without regard to the fact that they are unenforceable or not allowable due to the existence of a bankruptcy, reorganization or similar proceeding involving such Grantor. Each of the Secured Parties is an express intended third party beneficiary of this Agreement and the FAA Security Documents; provided that the rights of each individual Secured Party shall be subject to the terms and conditions of the Indenture, including without limitation the provisions of Article III 5 and Sections 4.02 and 4.03 of the Indenture with respect to the manner in which proceeds of the Collateral will be distributed, Article IV of the Indenture governing the exercise of remedies under the Indenture and this Agreement, and Article X of the Indenture providing for the subordination of claims to Senior Claims; provided further that each Secured Service Provider, each Secured Hedge Provider, each Secured Credit Facility Provider and each Secured Seller shall enter into a Secured Party Supplement (if not a party hereto). Section 2.03 Grantors Remain Liable. Anything contained herein to the contrary notwithstanding, (a) each Grantor shall remain liable under the contracts and agreements included in the Collateral to which it is a party or by which it is bound to the extent set forth therein to perform all of its duties and obligations thereunder to the same extent as if this Agreement, the FAA Security Documents and each other Security Document had not been executed, (b) the exercise by the Security Trustee of any of its rights hereunder shall not release any Grantor from any of its duties or obligations under the contracts and agreements included in the Collateral to which it is a party or by which it is bound, and (c) no Secured Party shall have any obligation or liability under the contracts and agreements included in the Collateral by reason of this Agreement, any FAA Security Document or any Security Document nor shall any Secured Party be obligated to perform any of the obligations or duties of any Grantor under the contracts and agreements included in the Collateral or to take any action to collect or enforce any claim for payment assigned under this Agreement. Section 2.04 Security Trustee Appointed Attorney-in-Fact. Each Grantor hereby irrevocably appoints the Security Trustee by way of security such Grantor’s attorney-in-fact, with full authority in the place and stead of such Grantor and in the name of such Grantor or otherwise, following the delivery of a Default Notice (and so long as such Default Notice shall not have been rescinded and annulled as set forth in Section 4.02 of the Indenture), but not prior to the expiration of any Cure Period under the Indenture, or during the continuation of an Acceleration Default, to take any action and to execute any instrument that the Security Trustee may deem necessary, advisable or desirable to accomplish the purposes of this Agreement or any other Related Document, including: (i) to ask for, demand, collect, sue for, recover, compromise, receive and give acquaintance and receipts for monies due and to become due under or in respect of any of the Collateral; (ii) to receive, indorse and collect any drafts or other instruments and documents in connection included in the Collateral; and (iii) to file any claims or take any action or institute any proceedings that the Security Trustee may deem necessary, advisable or desirable for the collection of any of the Collateral or otherwise to enforce the rights of the Security Trustee with respect to any of the Collateral. Section 2.05 Voting Rights; Dividends; Etc. (a) So long as (x) no Default Notice shall have been delivered to the Issuer (or, if a Default Notice shall have been delivered, such Default Notice shall have been rescinded and annulled as set forth in Section 4.02 of the Indenture), and 6 prior to the expiration of any Cure Period under the Indenture, and (y) no Acceleration Default shall have occurred and be continuing: (i) Each of the Grantors shall be entitled to exercise any and all voting and other consensual rights pertaining to all or any part of the Stock Collateral, Debt Collateral, Membership Interest Collateral and Beneficial Interest Collateral pledged by such Grantor for any purpose not inconsistent with the terms of this Agreement, the organizational documents of such Grantor, the Indenture or any other Related Document; provided, however, that such Grantor shall not exercise or shall refrain from exercising any such right if such action would reasonably be expected to have a material adverse effect on the value of all or any part of the Stock Collateral, Debt Collateral, Membership Interest Collateral or the Beneficial Interest Collateral; and (ii) The Security Trustee shall execute and deliver (or cause to be executed and delivered) to such Grantor all such proxies and other instruments as such Grantor may reasonably request in writing and provide for the purpose of enabling such Grantor to exercise the voting and other rights that it is entitled to exercise pursuant to Section 2.05(a)(i). (b) Whether or not any Default or Event of Default shall have occurred, any and all distributions, dividends, interest, income, payments and proceeds paid or received in respect of the Collateral, including any and all (i) distributions, dividends and interest paid or payable other than in cash in respect of, and instruments and other property received, receivable or otherwise distributed in respect of, or in exchange for, such Collateral; (ii) distributions, dividends and other distributions paid or payable in cash in respect of such Stock Collateral, Membership Interest Collateral or Beneficial Interest Collateral in connection with a partial or total liquidation or dissolution or in connection with a reduction of capital, capital surplus or paid-in surplus; and (iii) cash paid, payable or otherwise distributed in respect of principal of, or in redemption of, or in exchange for, any Collateral shall be paid into the Collections Account or shall be forthwith delivered to the Security Trustee, as applicable and, if received by such Grantor, shall be received in trust for the benefit of the Security Trustee, be segregated from the other property or funds of such Grantor and be forthwith paid to the Collections Account or delivered to the Security Trustee in the same form as so received (with any necessary indorsement). (c) Upon the delivery of a Default Notice to the Issuer or any of its Subsidiaries (and so long as such Default Notice shall not have been rescinded and annulled as set forth in Section 4.02 of the Indenture), but not prior to the expiration of any Cure Period under the Indenture, or during the continuance of an Acceleration Default, all rights of each Grantor to exercise or refrain from exercising the voting and other consensual rights that it would otherwise be entitled to exercise pursuant to Section 2.05(a)(i) shall cease, and the Security Trustee thereupon shall have the sole right to exercise or refrain from exercising such voting and other consensual rights (including, but not limited to, the right, subject to the restrictions set forth in the applicable organizational documents, to remove or appoint any trustee, directors and officers of any Issuer Subsidiary), provided, however, the Security Trustee shall have no obligation to exercise such voting or consensual right without instruction from the Noteholders. 7 Section 2.06 Performance of Obligations. If any Grantor fails to perform or comply with any of its agreements contained in the Related Documents, then the Security Trustee may perform or comply with such agreement but shall not be obligated to do so, and the amount of such payment and the amount of the reasonable expenses of Security Trustee incurred in connection with the performance of or compliance with such agreement, as the case may be shall be deemed an Expense, to be paid out of the Available Collections on the next succeeding Payment Date in accordance with Section 3.09 of the Indenture. ARTICLE III COVENANTS Section 3.01 Collateral Supplements and Grantor Supplements. (a) Upon the acquisition by any Grantor of any Collateral, such Grantor shall concurrently execute and deliver to the Security Trustee a Collateral Supplement duly completed with respect to such Collateral and shall take such steps with respect to the perfection of the security interest in such Collateral as are called for by this Agreement for Collateral of the same type, consistent with the Perfection Standards; provided that the foregoing shall not be construed to impair or otherwise derogate from any restriction on any such action in any Related Document and provided further that the failure of any Grantor to deliver any Collateral Supplement as to any such Collateral shall not impair the lien of this Agreement to attach and otherwise extend as to such Collateral. Each Collateral Supplement shall be required to set out in the annexes thereof only such information as has not been reflected in the schedules to this Agreement as supplemented prior to the date of such Collateral Supplement. Notwithstanding the foregoing, no Grantor shall be required to deliver a Collateral Supplement solely in respect of a Lease. (b) Upon the acquisition, formation or other organization of any Issuer Subsidiary, the Issuer shall cause such Issuer Subsidiary to execute and deliver to the Security Trustee a Grantor Supplement, and upon such acquisition, formation or other organization, each such Issuer Subsidiary (i) shall be referred to as an “Additional Grantor” and shall be and become a Grantor hereunder, and each reference in this Agreement to “Grantor” shall also mean and be a reference to such Additional Grantor, (ii) shall be deemed to have granted a security interest to the Security Trustee in all of its assets and other property, including, without limitation, all of its right, title and interest in, to and under each type of Collateral described in Section 2.01, and (iii) shall be a Grantor for all purposes under this Agreement and shall be bound by the obligations of the Grantors hereunder. (c) The Issuer undertakes with the Security Trustee to enter into a Local Law Security Document in respect of the Stock held by it of any Issuer Subsidiary governed by the laws of the jurisdiction in which such Issuer Subsidiary is incorporated (other than any Asset Trust or any other Issuer Subsidiary organized in the United States), in each case on the date on which the Issuer acquires such Stock.

8 Section 3.02 Delivery of Collateral. (a) All certificates, instruments, documents or chattel paper representing or evidencing any Collateral (other than Account Collateral) shall be delivered to and held by the Security Trustee at the Designated Address, and held by or on behalf of the Security Trustee in the United States and shall be in suitable form for transfer by delivery, or shall be accompanied by duly executed instruments of transfer or assignment in blank, all in form and substance satisfactory to evidence the security interests granted hereby or under such other Security Document, as applicable, or as may be reasonably requested by the Security Trustee. Upon the delivery of a Default Notice (and so long as such Default Notice shall not have been rescinded and annulled as set forth in Section 4.02 of the Indenture), but not prior to the expiration of any Cure Period under the Indenture, or during the continuance of an Acceleration Default, the Security Trustee shall have the right, without notice to any Grantor, to transfer to or to register in the name of the Security Trustee or any of its nominees any or all of the Pledged Stock, the Pledged Debt, Pledged Membership Interest and Pledged Beneficial Interest, subject only to the revocable rights specified in Section 2.05(a). In addition, the Security Trustee shall have the right at any time to exchange certificates or instruments representing or evidencing any Collateral (other than Account Collateral) for certificates or instruments of smaller or larger denominations. (b) To the extent that any Assigned Lease constitutes “tangible chattel paper” and is not a Cape Town Lease, the Grantors shall cause the original of such Assigned Lease to be designated and to be delivered to the Security Trustee promptly (and in any case no later than 10 Business Days) (i) after the Initial Closing Date, in the case of the Initial Leases of the Initial Assets delivered on such date, (ii) after the Delivery Date of the applicable Asset, Asset Trust or other Issuer Subsidiary in the case of the Initial Leases of the other Assets, or (iii) after the execution and delivery of any other Assigned Lease by all its parties, provided that, in the case of any Initial Lease, if the Issuer represents in writing to the Security Trustee that no fully executed counterpart of the Assigned Lease has been designated as a chattel paper original or that the chattel paper original of an Assigned Lease has been lost or destroyed, the Grantor that is the lessor under such Assigned Lease shall be excused from the obligation to deliver a chattel paper original of such Assigned Lease, and provided further that the Grantor also shall be excused from the obligation to deliver a chattel paper original under any Assigned Lease that has an initial term or remaining term of less than one year. The Grantors shall deliver to the Security Trustee a certified true copy of any Assigned Lease in respect of which a chattel paper original is not delivered to the Security Trustee pursuant to the preceding sentence. Any obligation to deliver any chattel paper original Assigned Lease to the Security Trustee hereunder shall be satisfied by the applicable Grantor delivering such original to the Custodian, it being understood and agreed that in no event shall the Security Trustee have any responsibility or liability in connection with such delivery or the maintenance of any chattel paper original by the Custodian. (c) With respect to any Assigned Lease that is a Future Lease, the Grantors shall (a) cause the lessor and the lessee of such Future Lease to designate one executed copy thereof the original by adding language in substantially the following form to the cover page thereof; provided that, where such Future Lease incorporates the terms of a general terms agreement or master agreement, on the cover page only of the specific lease agreement constituting the Future Lease and need not appear on the cover page of such general terms 9 agreement or such master agreement: “COUNTERPART NO. __ OF [__] SERIALLY NUMBERED, MANUALLY EXECUTED COUNTERPARTS. TO THE EXTENT, IF ANY, THAT THIS LEASE CONSTITUTES CHATTEL PAPER UNDER THE UCC, NO SECURITY INTEREST IN THIS LEASE MAY BE CREATED THROUGH THE TRANSFER AND POSSESSION OF ANY COUNTERPART OTHER THAN COUNTERPART NO. 1”, (b) notify the Lessee in writing of the security assignment of such Future Lease to the Security Trustee pursuant to the Security Trust Agreement (which notice may be contained in such Future Lease or in a separate document) and (c) obtain from the Lessee a written acknowledgement (which may be contained in such Future Lease or in a separate document) addressed to, or for the benefit of, the Security Trustee (1) acknowledging receipt of notification of such security assignment and (2) containing the agreement of the Lessee to continue to make all payments required to be made to the Lessor under such Future Lease to the account specified in such Future Lease unless and until the applicable Lessor or, if a Default Notice shall have been delivered (and so long as such Default Notice shall not have been rescinded and annulled as set forth in Section 4.02 of the Indenture), but not prior to the expiration or termination of any Cure Period under the Indenture, or if an Acceleration Default shall have occurred and be continuing, the Security Trustee, otherwise directs (it being understood that the account specified in such Future Lease will be the account specified by the Administrative Agent to the Servicer as contemplated by Section 1.1(a) of Schedule 2.02(a) to the Servicing Agreement and subject in each case to applicable legal or tax constraints). Each Grantor hereby instructs the Security Trustee to enter into all lease-related documents and instruments on this date and as may arise from time to time, as reasonably requested by such Grantor, for the purposes of, subject to the Perfection Standards, assisting the applicable Grantor in establishing and maintaining the Security Trustee’s security interest for and on behalf of itself and for the benefit of the other Secured Parties in respect of any Assigned Lease. In connection with any Assigned Lease, each Grantor and the Security Trustee shall (x) cooperate with the Servicer by providing upon request of the Servicer a letter of quiet enjoyment by such Grantor or the Security Trustee, as applicable, addressed to the relevant Lessee with respect to such Assigned Lease in a form reasonably acceptable to such Lessee and, if to be provided by the Security Trustee, the Security Trustee and (y) provide all other reasonable assistance and cooperation to the Servicer in connection with the foregoing. Section 3.03 Accounts. (a) Security Trustee Accounts. (i) USB hereby agrees to act as the Operating Bank under this Agreement. Upon the execution of this Agreement and from time to time thereafter as called for by Section 3.01 of the Indenture, the Operating Bank shall establish and maintain on the books and records of its office specified in Section 10.02 and maintain for the benefit of the Security Trustee (on behalf of the Secured Parties) each respective Security Trustee Account (as an Eligible Account) to be established on the Initial Closing Date or at such other time. If, at any time, any Security Trustee Account ceases to be an Eligible Account, the Operating Bank shall, promptly after notice from the Administrative Agent, cooperate with the Administrative Agent to facilitate its establishment of a new Security Trustee Account having the same characteristics as such other Account and transfer all property related to such old Account to such new Account. The Operating Bank also agrees to cooperate with any replacement Operating Bank as to the transfer of any property in, or records relating to, any Security Trustee Account maintained by it. Except as a Secured Party in accordance with the provisions of this Agreement and the Indenture, the Operating Bank waives any claim or lien 10 against any Account it may have, by operation of law or otherwise, for any amount owed to it by any Grantor. (ii) The Operating Bank hereby agrees that (A) it is a “bank” (as defined in Section 9-102(a)(8) of the UCC) and a “securities intermediary” (as defined in Section 8-102(a)(14) of the UCC) and is acting as a securities intermediary with respect to each Security Trustee Account, (B) each Security Trustee Account is and will be maintained as a Securities Account of which it is the Securities Intermediary and in respect of which the Security Trustee is the “entitlement holder” (as defined in Section 8-102(a)(7) of the UCC) of the “security entitlement” (as defined in Section 8-102(a)(17) of the UCC) with respect to each “financial asset” (as defined in Section 8-102(a)(9) of the UCC) credited to such Account and the Operating Bank shall comply with all “entitlement orders” (as defined in Section 8-102(a)(8) of the UCC) and “instructions” (as defined in Section 8- 102(a)(12) of the UCC) issued by the Security Trustee without further consent of the Grantors or any other Person, (C) all Collections and other cash required to be deposited in any such Account and Permitted Account Investments and all other property acquired with cash credited to any such Account will be credited to such Account, (D) all items of property (whether cash, investment property, Permitted Account Investments, other investments, securities, instruments or other property credited to each Security Trustee Account will be treated as a “financial asset” (as defined in Section 8-102(a)(9) of the UCC) under Article 8 of the UCC, (E) its “securities intermediary’s jurisdiction” (as defined in Section 8-110(e) of the UCC) and the “bank’s jurisdiction” (within the meaning of Section 9-304 of the UCC) with respect to each Account is the State of New York, (F) (1) the law of the State of New York governs all issues specified in Article 2(1) of the Hague Convention on the Law Applicable to Certain Rights in Respect of Securities Held with an Intermediary and, to the extent not so provided in any account agreement governing the Security Trustee Accounts established pursuant to this Section 3.03, such account agreement is hereby amended to so provide and (2) it will not modify the law applicable to such issues or (so long as this Agreement is in effect) under such account agreement, and (G) all securities, instruments and other property in order or registered from and credited to any Security Trustee Account shall be payable to or to the order of, or registered in the name of, the Operating Bank or shall be indorsed to the Operating Bank or in blank, and in no case whatsoever shall any “financial asset” (as defined in Section 8-102(a)(9) of the UCC) credited to any Security Trustee Account be registered in the name of any Grantor, payable to or to the order of any Grantor or specially indorsed to any Grantor except to the extent the foregoing have been specially endorsed by a Grantor to the Operating Bank or in blank. (iii) The Operating Bank acknowledges that the Security Trustee has appointed the Administrative Agent pursuant to the Administrative Agency Agreement, as its agent for, among other things, dealings with respect to the Security Trustee Accounts. The Operating Bank agrees that, until otherwise notified in writing by the Security Trustee, the Operating Bank will follow the written directions and instructions of the Administrative Agent, as the agent for the Security Trustee, to the extent it is required to follow those of the Security Trustee except that, with respect to withdrawals from any Series Account, the Operating Bank agrees that it will follow the directions and instructions of the Trustee, as the agent for the Security Trustee (the Security Trustee 11 hereby appoints the Trustee as its agent for such purposes and the Trustee by executing a Secured Party Supplement hereto accepts such appointment). (iv) The Security Trustee agrees that it will hold its “security entitlement” to the “financial asset” credited to each Security Trustee Account in trust (A) to the extent of any Segregated Funds in the Lessee Funded Account or the Security Deposit Account, for the benefit of the relevant Lessees, (B) in the case of the Series Account for each Series of Notes, the respective Series Account for such Series of Notes, for the benefit of the Holders holding such Series of Notes, respectively, and (to the extent applicable) each Secured Credit Facility Provider the proceeds of which funded such applicable Account, (C) in the case of the Asset Purchase Account, for the Secured Parties, and (D) in the case of any other Account, for the benefit of the Secured Parties (but subject to the subordination provisions hereof and of the Indenture). (b) Lessor Accounts. So long as any Secured Obligations remain unpaid: (i) Other than accounts with a nominal balance established by a Grantor in its jurisdiction of organization or incorporation solely to comply with local laws or regulations relating to its establishment, no Grantor shall establish any Account except to the extent that it is entitled, pursuant to the Indenture and in compliance with this Section 3.03(b)(i), to establish one or more Lessor Accounts. Except to the extent that any payment is permitted by the Indenture to be deposited in a Lessor Account, each Grantor shall instruct each Obligor to make such payment to the Collections Account in accordance with the Indenture and shall instruct each other Person obligated to make any other payment to such Grantor to the Collections Account in accordance with the Indenture. (ii) With respect to each Lessor Account: (A) Each Grantor shall maintain (or cause the Administrative Agent on such Grantor’s behalf to maintain) each Lessor Account (as an Eligible Account) in its name only with (x) the Operating Bank, (y) an Eligible Institution or (z) another bank or financial institution so long as such Lessor Account meets the definition of an Eligible Account at all times (a “Lessor Account Bank”). Unless not required pursuant to Section 3.01(l) of the Indenture, each Grantor shall cause any such Lessor Account Bank to establish and maintain such Lessor Account in the name of such Grantor on its books and records and to enter into a letter agreement in substantially the form of Exhibit B (or such other form as is reasonably acceptable to the Security Trustee) (the “Account Letter”) or a Local Law Security Document, or to make such other arrangements as are acceptable to the Security Trustee and consistent with the requirements of Section 3.01(l) of the Indenture with respect to such Lessor Account. Each Grantor shall cause the Administrative Agent to direct the transfer of funds on deposit in any Lessor Account in accordance with Section 3.01(l) of the Indenture. (B) Each Grantor shall immediately instruct each Obligor to make any Lease Payment not required, as provided in Section 3.03(b)(i), to be

12 made to a Security Trustee Account to a Lessor Account meeting the requirements of Section 3.03(b)(ii)(A). (C) Upon any termination of any Account Letter, Local Law Security Document or other agreement with respect to the maintenance of a Lessor Account by any Grantor or any Lessor Account Bank or other bank or financial institution pursuant to clause (ii)(A) above, such Grantor shall immediately notify all Obligors that were making payments to such Lessor Account to make all future payments to another Account meeting the requirements of this Section 3.03(b)(ii). Subject to the terms of any Lease, upon request by the Security Trustee, each Grantor shall, and if prohibited from doing so by the terms of any Lease, shall use commercially reasonable efforts to seek the consent of the relevant Lessee to, terminate any or all of its Lessor Accounts, in which case Section 3.03(b)(i) shall apply (c) Covenant Regarding Control. No Grantor shall cause or permit any Person other than the Security Trustee to have “control” (as defined in Section 9-104, 9-105, 9 106, or 9-107 of the UCC) of any Collateral consisting of a “deposit account,” “electronic chattel paper,” “investment property,” “supporting obligations” or “letter of credit right” (as such terms are defined in Article 9 of the UCC); provided that the Servicer on behalf of, and under the directions and control of, the Security Trustee shall be permitted to hold any letter of credit provided by a Lessee or otherwise pursuant to a Lease Section 3.04 Covenants Regarding Assigned Documents. (a) Upon the inclusion of any Assigned Document in the Collateral, the relevant Grantor will deliver to the Security Trustee a Consent and Agreement, in substantially the form of Exhibit C and executed by each party to such Assigned Document or (where the terms of such Assigned Document expressly provide for a consent to its assignment for security purposes to substantially the same effect as Exhibit C) will give due notice to each such other party to such Assigned Document of its assignment pursuant to this Agreement. Each Grantor shall file any UCC financing statement or amendments thereto in any jurisdiction required to perfect the security interest in such Assigned Document and also ratifies its authorization for the Security Trustee to have filed in any jurisdiction any UCC financing statement or amendments thereto if filed prior to the date hereof. (b) Upon the inclusion of any Assigned Lease in the Collateral, the relevant Grantor will deliver to the Security Trustee (or the applicable Lease shall contain) a notice and acknowledgement of the applicable Lessee of (and to the extent required under the Assigned Lease, consent of the applicable Lessee to) the security interest of the Security Trustee in such Assigned Lease which reflects that all Lease Payments under such Assigned Lease will be paid to the appropriate Account in accordance with the terms of the Indenture; provided that, to the extent not required for perfection, such Grantor shall not be required to provide an acknowledgment of the applicable Lessee if the same is not obtainable after using commercially reasonable efforts, so long as the insurance requirements set out in the relevant notice to such Lessee are satisfied and notice thereof has been provided to the Rating Agencies. 13 (c) Upon written request of any Grantor, the Security Trustee (solely in its capacity as such) will execute such undertakings of quiet enjoyment in favor of the Lessee under any Assigned Lease as are (in the case of any Assigned Lease that is an Initial Lease) provided for in the Lease Assignment Documents or as are (in the case of any other Assigned Lease) substantially to the same effect as such undertakings or otherwise agreed with the Lessee, in each case, to the extent otherwise reasonably acceptable to the Security Trustee, and will cooperate with such Grantor and such Lessee in the filing or registration of interests in, including any International Interests in respect of, such Assigned Lease or the related Aircraft Objects that are the subject of such Assigned Lease so as to preserve such Lessee’s rights of quiet enjoyment under such Assigned Lease as may be reasonably requested from time to time hereunder, in each case at the sole expense of the Issuer, provided that the Security Trustee shall have no liability to any Issuer Group Member or any Secured Party in respect of any such undertakings or to any Person lawfully claiming by, through or under any of the foregoing Persons in respect of any such undertakings. The Security Trustee shall be deemed to have the authority, on its own behalf and on behalf of the other Secured Parties, to execute and agree to the terms and conditions (including, without limitation, representations, warranties, covenants and undertakings that must be made or performed by the Secured Parties) set forth in any such undertakings provided to it by a Grantor for execution in accordance with this Section 3.04 and the Indenture. (d) Upon (i) the inclusion of any Assigned Document in the Collateral, (ii) the amendment or replacement of any Assigned Document or (iii) the entering into of any new Assigned Document, the relevant Grantor will deliver a copy thereof to the Security Trustee and will take such other action as may be necessary, advisable or, if reasonably requested by the Security Trustee, desirable to perfect the lien of this Agreement as to such Assigned Document. (e) Each Grantor shall, at its expense but subject to the Indenture and the other Related Documents: (i) perform and observe (or cause to be performed or observed) all the terms and provisions of the Assigned Documents to be performed or observed by it, enforce (or cause to be enforced) the Assigned Documents in accordance with their terms and take all such action to such end as may be from time to time requested by the Security Trustee; and (ii) furnish (or cause to be furnished) to the Security Trustee promptly upon receipt copies of all notices, requests and other documents received by such Grantor under or pursuant to the Assigned Documents, and from time to time, furnish (or cause to be furnished) to the Security Trustee such information and reports regarding the Collateral as the Security Trustee may reasonably request and, upon request of the Security Trustee make (or cause to be made) to each other party to any Assigned Document such demands and requests for information and reports or for action as such Grantor is entitled to make thereunder. (f) Each Grantor will, at its expense and upon the request of the Security Trustee on behalf of any Secured Party that is a Service Provider, pursue for the benefit of such Secured Party and each other Secured Party that is a Service Provider any claim that such 14 Secured Party (or the Security Trustee on their behalf) has or may have under any Assigned Document for indemnity or otherwise. Section 3.05 Covenants Regarding Intangible Collateral. (a) All Intangible Collateral shall be delivered by the Issuer or the applicable Grantor to the Security Trustee, as follows: (i) in the case of each Certificated Security, Instrument or other item of Intangible Collateral for which a security interest is granted and/or perfected by delivery to or possession by the Security Trustee, by (A) causing the delivery of such Certificated Security, Instrument or other item of Intangible Collateral to the Security Trustee at the Designated Address registered in the name of the Security Trustee or duly endorsed by an appropriate person to the Security Trustee or in blank and, in each case, held by the Security Trustee in the United States, or (B) if such Certificated Security, Instrument or other item of Intangible Collateral is registered in the name of any securities intermediary of any Securities Intermediary on the books of the issuer thereof or on the books of any securities intermediary of a Securities Intermediary, by causing such Securities Intermediary to continuously credit by book entry such Certificated Security, Instrument or other item of Intangible Collateral to a Securities Account maintained by such Securities Intermediary for the benefit of the Security Trustee (on behalf of the Secured Parties) and confirming to the Security Trustee that it has been so credited; (ii) in the case of each Uncertificated Security not perfected by delivery thereof to the Security Trustee, by (A) causing such Uncertificated Security to be continuously registered on the books of the issuer thereof in the name of the Security Trustee and causing such issuer to agree that it will comply with the instructions originated by the Security Trustee without further consent of any other Person or (B) if such Uncertificated Security is registered in the name of a Securities Intermediary on the books of the issuer thereof or on the books of any securities intermediary of a Securities Intermediary, by causing such Securities Intermediary to continuously credit by book entry such Uncertificated Security to a Securities Account maintained by such Securities Intermediary for the benefit of the Security Trustee (on behalf of the Secured Parties) and confirming to the Security Trustee that it has been so credited and causing each such securities intermediary to agree that it will comply with the instructions originated by the Security Trustee without further consent of any other Person; (iii) in the case of each Government Security registered in the name of any Securities Intermediary on the books of the Federal Reserve Bank of New York or on the books of any securities intermediary of such Securities Intermediary or any “securities entitlement” (as defined in Section 8-102(a)(17) of the UCC), by causing such Securities Intermediary to continuously credit by book entry such security to the Securities Account maintained by such Securities Intermediary for the benefit of the Security Trustee (on behalf of the Secured Parties), confirming to the Security Trustee that it has been so credited and confirming that it will comply with the “entitlement orders” (as defined in Section 8-102(a)(8) of the UCC) originated by the Security Trustee without further consent of any other Person; and 15 (iv) in the case of any Instrument, Beneficial Interest Collateral or Membership Interest Collateral by (A) to the extent that the grant of the security interest to the Security Trustee in any Instrument, Beneficial Interest Collateral or Membership Interest Collateral or the transfer of any Instrument, Beneficial Interest Collateral or Membership Interest Collateral upon exercise of remedies by the Security Trustee is subject to any restrictions on transfer or any consent requirements, by obtaining all necessary consents and approvals thereof and (B)(1) if any Instrument, Beneficial Interest Collateral or Membership Interest Collateral constitutes a securities entitlement (as defined above), Certificated Security, Instrument or Uncertificated Security, complying with clauses (i) or (ii) above, as applicable or (2) if Beneficial Interest Collateral or Membership Interest Collateral constitutes a general intangible, by causing an appropriate financing statement covering each such Beneficial Interest Collateral or Membership Interest Collateral to be filed in the appropriate office necessary to perfect the security interest of the Security Trustee therein. (b) Each Grantor consents to the grant by each other Grantor of a lien in all Intangible Collateral to the Security Trustee and without limiting the generality of the foregoing consents to the transfer of any Stock Collateral, Beneficial Interest Collateral or Membership Interest Collateral to the Security Trustee or its designee following an Event of Default and to the substitution of the Security Trustee or its designee as a partner in any partnership or as a member in any limited liability company with all the rights and powers related thereto. (c) Each of the Issuer and the Security Trustee hereby represents and warrants, with respect to the Intangible Collateral, that it has not entered into, and hereby agrees that it will not enter into, any agreement (i) with any Person specifying any jurisdiction other than the State of New York or California as the jurisdiction of each Securities Intermediary in connection with each Securities Account for purposes of 31 C.F.R. Section 357.11(b), Section 8- 110(e) of the UCC or any similar state or Federal or Applicable Law, or (ii) with any other person relating to any Securities Account or the financial assets credited thereto pursuant to which it has agreed that any Securities Intermediary may comply with entitlement orders made by such Person. The Security Trustee represents that, to the extent requested by the Administrative Agent, the Issuer or the applicable Grantor, it will, by express agreement with each Securities Intermediary, provide for each item of property constituting Intangible Collateral held in and/or credited to the applicable Securities Account, including cash, to be treated as a “financial asset” within the meaning of Section 8-102(a)(9) of the UCC for the purposes of Article 8 of the UCC. (d) In addition to the foregoing, each applicable Grantor organized or incorporated under the laws of any jurisdiction located outside of the United States shall take all steps required under the laws of such jurisdiction in order to ensure the validity, perfection, priority and enforceability of the security interests and charge granted hereunder, including entering into one or more Local Law Security Documents, if any, but, notwithstanding anything to the contrary herein, no such actions shall be required to be taken in respect of a De Minimis Account. (e) Without limiting the foregoing, the Issuer shall cause each Securities Intermediary to take such different or additional action as may be required based upon any Opinion of Counsel received pursuant to Section 3.11 in order to maintain the perfection and

16 priority of the security interest of the Security Trustee in the Intangible Collateral in the event of any change in Applicable Law or regulation, including Articles 8 and 9 of the UCC and regulations of the U.S. Department of the Treasury governing transfers of interests in Government Securities. The Security Trustee agrees, upon written request of the Issuer, the applicable Grantor or the Administrative Agent, to provide any authorization required to effect such actions. (f) Each Grantor agrees that it will not acquire an ownership, equity or any similar interest in any Person that would not be described in the definitions of “Beneficial Interest Collateral,” “Membership Interest Collateral” or “Stock Collateral.” Section 3.06 Further Assurances. (a) Provided that with respect to the Assets and the Assigned Leases no Grantor shall be required to take any additional actions not required by the Perfection Standards, and other than with respect to any De Minimis Account, each Grantor agrees that from time to time, at the expense of such Grantor and the Issuer, such Grantor shall promptly execute and deliver all further instruments and documents, and take all further action (including under the laws of any foreign jurisdiction), that may be necessary, advisable or desirable, or that the Security Trustee may reasonably request, in order to better assure, grant or perfect, protect the priority of and protect any pledge, assignment or security interest granted or purported to be granted hereby or any other Related Document or to enable the Security Trustee to exercise and enforce its rights, powers and remedies hereunder or under any other Related Document with respect to any Collateral. Without limiting the generality of the foregoing, each Grantor shall: (i) if any Collateral shall be evidenced by a promissory note or other instrument or tangible chattel paper (as defined in Section 9-102(a)(78) of the UCC), deliver and pledge to the Security Trustee hereunder such note or instrument or tangible chattel paper duly endorsed and accompanied by duly executed instruments of transfer or assignment; (ii) execute and file such financing or continuation statements, or amendments thereto, and such other instruments or notices, as may be necessary or desirable, or as the Security Trustee may reasonably request, in order better to assure, grant, perfect, protect the priority of and/or preserve the pledge, assignment and security interest granted or purported to be granted hereby; and (iii) execute, file, record, or register such additional instruments, documents and supplements to this Agreement, including any further assignments, security agreements pledges, grants and transfers, as may be required by or desirable under the laws of any foreign jurisdiction, or as the Security Trustee may reasonably request, to create, attach, perfect, validate, render enforceable, protect or establish the priority of the security interest and lien of this Agreement. (b) Each Grantor hereby irrevocably authorizes (without imposing any obligation on) the Security Trustee to file one or more financing or continuation statements, and amendments thereto, from time to time relating to all or any part of the Collateral without the signature of such Grantor where permitted by law, and such other instruments or notices, as may 17 be necessary or desirable, including as identified to the Security Trustee pursuant to the Opinion of Counsel described in Section 3.11 hereof in order to better assure, xxxxx, perfect, perfect the priority of and preserve the pledge, assignment and security interest granted hereby, in each case as provided in the Perfection Standards. Such financing or continuation statements, or amendments thereto, may describe the collateral as “all assets” or words of similar import. A photocopy or other reproduction of this Agreement or any financing statement covering the Collateral or any part thereof shall be sufficient as a financing statement where permitted by law. Each Grantor also ratifies its authorization for the Security Trustee to have filed in any jurisdiction any UCC financing statement or amendments thereto if filed prior to the date hereof or any applicable Delivery Date. (c) Each Grantor shall furnish or cause to be furnished to the Security Trustee from time to time statements and schedules further identifying and describing the Collateral and such other reports in connection with the Collateral as the Security Trustee may reasonably request, all in reasonable detail; provided that, to the extent that (in the case of any Assigned Lease) such statements, schedules or reports (or the data needed to prepare them) can be obtained only from the Servicer, no Grantor shall be required to obtain any such statements, schedules, reports or data beyond those to which it is entitled under the Servicing Agreement. (d) In addition to the foregoing, other than in respect of any De Minimis Account, the Issuer and each applicable Grantor shall take all steps required under the laws of the jurisdiction in which it is formed, organized or incorporated in order to ensure the validity, perfection, priority and enforceability of the security interests and charge granted hereunder or under any other Security Document, as applicable, including, without limitation, entering into one or more Local Law Security Documents (e) Each Grantor (including each Asset Trustee) shall, during the term of this Agreement, establish and maintain a valid and existing account as a Transacting User Entity with the International Registry and appoint an Administrator and/or a Professional User Entity to make registrations in regard to the Collateral as required by this Agreement in accordance with the Perfection Standards. Section 3.07 Place of Perfection; Records. Each Grantor shall keep its jurisdiction of organization or incorporation, as the case may be, chief place of business and chief executive office (if any) and the office where it keeps its records concerning the Collateral at the location therefor specified in Schedule III or, upon 30 days’ prior written notice to the Security Trustee, at such other locations in a jurisdiction where all actions required to maintain the Security Trustee’s first priority perfected security interest in, to and under the Collateral shall have been taken in accordance with the Perfection Standards. Each Grantor shall hold and preserve such records and shall permit representatives of the Security Trustee at any time during normal business hours to inspect and make abstracts from such records, all at the sole cost and expense of such Grantor. Section 3.08 Transfers and Other Encumbrances; Additional Shares or Interests. (a) No Grantor shall (i) sell, assign (by operation of law or otherwise) or otherwise dispose of, or grant any option with respect to, any of the Collateral or (ii) create or suffer to exist any Encumbrance upon or with respect to any of the Collateral other than the 18 pledge, assignment and security interest created by this Agreement and as otherwise provided herein or any other Related Document. (b) Except as otherwise provided pursuant to Section 5.02(i) of the Indenture, the Issuer Subsidiaries shall not, and the Issuer shall not permit the Issuer Subsidiaries to, issue, deliver or sell any shares, interests, participations, options, warrants or other equivalents. Any beneficial interest or capital stock or other securities or interests issued in respect of or in substitution for the Pledged Stock, Pledged Membership Interest or Pledged Beneficial Interest shall be issued or delivered (with any necessary endorsement) to the Security Trustee. Section 3.09 Security Trustee May Perform. If any Grantor fails to perform or comply with any agreement contained in this Agreement or any other Related Document, the Security Trustee may (but shall not be obligated to) itself perform, or cause performance of, such agreement, and the expenses of the Security Trustee incurred in connection with doing so shall be deemed an Expense, to be paid out of Available Collections on the next succeeding Payment Date in accordance with Section 3.09 of the Indenture. Section 3.10 Covenant to Pay and Perform. Each Grantor covenants with the Security Trustee (for the benefit of the Security Trustee and the Secured Parties) that (a) it will pay any monies or discharge any liabilities whatsoever that are now, or at any time hereafter may be, due, owing or payable by such Grantor in any currency, actually or contingently, solely and/or jointly, and/or severally with another or others, as principal or surety on any account whatsoever pursuant to the Notes, the Indenture, the Service Provider Documents, the Hedge Agreements and the other Related Documents in accordance with their terms and (b) it will perform and comply with all covenants in the Indenture that by their terms obligate the Issuer to cause such Grantor to take or not to take specified actions, including without limitation all covenants relating to the ownership, leasing, disposition, acquisition and maintenance of the Assets. Section 3.11 Annual Opinion. Within 10 days after each anniversary of the Initial Closing Date, the Issuer shall cause to be delivered to the Security Trustee an Opinion of Counsel to the effect that (i) during the preceding year there has not occurred any change in New York or Delaware that would require the taking of any action in order to maintain the perfection or priority of the lien of this Agreement on the Collateral (it being agreed that each such opinion shall not be required to address the actual priority of such lien and that the Grantors shall not be obligated to take any action described in such opinion that is inconsistent with the Perfection Standards) or, if there has been such a change, setting forth the actions so to be taken and (ii) no additional UCC financing statement, continuation statement or amendment thereof, consistent with the Perfection Standards, will be necessary during the next twelve months to maintain the perfected security interest of the Security Trustee or identify any such required UCC financing statement, continuation statement or amendment. The Issuer agrees to take all such actions as may be indicated in any such opinion, subject to the Perfection Standards, except that, as provided in Section 3.03, the Security Trustee shall take any such actions as may be required with respect to any Securities Intermediary. Section 3.12 Perfection Standards. The parties hereto agree that for all purposes of this Agreement, the perfection of the security interest of the Security Trustee in the Assets and the 19 Assigned Leases shall be accomplished in accordance with the following terms (the “Perfection Standards”): (a) Each Grantor shall register or cause to be registered or consent to the registration with the International Registry of, and shall take such further actions as may be necessary or desirable, or that the Security Trustee may reasonably request, to effect the registration with the International Registry of: (i) if agreed with the seller of an Asset to be acquired by such Grantor pursuant to an Acquisition Agreement, the Prospective International Interest, if any, created by this Agreement with respect to such Asset; (ii) if a Prospective International Interest with respect to any Asset owned by such Grantor has not been registered, the International Interest, if any, created by this Agreement with respect to such Asset; (iii) the International Interest provided for in any Cape Town Lease to which such Grantor is a lessor or lessee; (iv) the assignment to the Security Trustee of each International Interest described in clause (iii); and (v) the Contract of Sale with respect to any Asset by which title to such Asset is conveyed by or to such Grantor; provided that no Grantor shall be required to register any interest (or assignment thereof) with the International Registry with respect to any Aircraft Engine relating to an aircraft that is registered in a jurisdiction which is a “title grabbing” or “title accession” jurisdiction if the applicable Lease in respect of such aircraft or Engine prohibits such registration; provided further that, if the relevant transaction relating to any Prospective International Interest is not consummated, such Grantor will take such actions as may be necessary or desirable to discharge such Prospective International Interest; provided further that, if the relevant Grantor is advised by legal counsel in the jurisdiction of registration of an Asset that is an Airframe (other than the United States) that a registration described in any of clauses (i) through (iv) above with the International Registry cannot properly be made so long as the applicable aircraft is registered in such jurisdiction unless a security agreement governed by the laws of such jurisdiction is entered into, then such registration with the International Registry shall not be required for so long as such aircraft is registered in such jurisdiction (collectively, the “Required Cape Town Registrations”), provided further that (1) on or prior to the Delivery Date for an Asset, the relevant Grantor shall cause its Administrator (acting directly or through a Transacting User Entity or a Professional User Entity to whom it has given an authorization) to commence effecting the applicable registrations with the International Registry described in clauses (ii) through (v) above and (2) in connection with any registrations with the International Registry described in clause (iii) and (iv) above, the Security Trustee shall be registered as the holder of the right to discharge such registrations (except to the extent that, after use of commercially reasonable efforts by the lessor or its representatives, the Lessee under any Assigned Lease will not consent to the right to discharge the registrations with the International Registry described in