THIRD AMENDMENT TO LEASE

Exhibit 10.14

THIRD AMENDMENT TO LEASE

THIS THIRD AMENDMENT TO LEASE (this “Amendment”), dated as of June 26, 2009, is between SC XXXX ASSOCIATES LIMITED PARTNERSHIP, a Delaware limited partnership (“Landlord”), and TIGERDIRECT, INC., a Florida corporation, doing business as TigerDirect (“Tenant”).

RECITALS

A. Landlord (as successor in interest to Keystone-Miami Property Holding Corp.) and Tenant entered into a Lease, dated September 17, 1998, as amended by a Settlement Agreement and Mutual Release dated June 8, 2001, a First Amendment to Lease dated as of September 5, 2003, and a [Second Amendment to Lease] dated March 22, 2007 (collectively, the “Lease”), pursuant to the terms of which Landlord leased to Tenant an aggregate of 82,866 rentable square feet of space comprised of Suite 235 containing 63,882 rentable square feet (the “Office Premises”), Bay M33D containing 15,984 rentable square feet (the “Original Retail Premises”), and Bay E33C containing 3,000 rentable square feet (the “Storage Premises”), all as more particularly described in the Lease and located in Mall of the Americas (which, as of the date hereof, contains 651,011 rentable square feet of space), Miami — Dade County, State of Florida, on the land described on Exhibit “A” to this Amendment.

B. Tenant desires to (i) extend the term of the Lease for the Office Premises, the Original Retail Premises and the Storage Premises (collectively, the “Original Remaining Premises”) for a period of ten (10) years, (ii) lease additional retail space known as Bay M34 containing 25,320 rentable square feet of space and marked as such on Exhibit “B” attached hereto (the “Additional Retail Premises”) for a period co-terminus with the term of the Original Remaining Premises, and (iii) modify certain other provisions of the Lease.

C. Landlord agrees to such extension, lease of additional space and modifications pursuant to the terms and conditions set forth herein.

D. Therefore, for good and valuable considerations, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

AGREEMENT

1. Recitals; Capitalized Terms. The foregoing Recitals are true and correct and are hereby incorporated into this Amendment. Capitalized terms used but not otherwise defined in this Amendment will have the meanings set forth in the Lease.

2. Leasing of Additional Retail Premises. Landlord hereby agrees to lease to Tenant, and Tenant hereby agrees to lease from Landlord, the Additional Retail Premises upon the following terms and conditions, subject to the other terms and conditions in the Lease that affect the Additional Retail Premises:

(a) Additional Retail Premises. Landlord and Tenant agree that for the purposes of all calculations in the Lease, the rentable square footage of the Additional Retail Premises shall be deemed to be 25,320 rentable square feet.

(b) Additional Retail Term. The lease term (the “Additional Retail Term”) for the Additional Retail Premises shall commence on the Additional Retail Commencement Date and end on January 31, 2020 such that the last day of the Additional Retail Term shall be co-terminus with the Original Extension Term (as defined below), subject to Tenant’s extension options in Section 4 of this Amendment.

(c) Additional Retail Commencement Date. The “Additional Retail Commencement Date” shall be the earlier to occur of the date that (i) possession of the Additional Retail Premises is tendered to Tenant by Landlord and (ii) Tenant shall occupy any portion of the Additional Retail Premises. Tenant’s failure to accept possession of the Additional Retail Premises within five (5) days after the date on which Landlord tenders possession in accordance with this Amendment will constitute an Event of Default under the Lease. Landlord may confirm the Additional Retail Commencement Date and the Additional Retail Rent Commencement Date (as hereinafter defined) in writing by sending notice to Tenant. If the Additional Retail Commencement Date or the Additional Retail Rent Commencement Date in such notice is not disputed by Tenant within five (5) days of receipt, such date(s) shall be deemed correct.

(d) Additional Retail Rent Commencement Date. Notwithstanding anything set forth herein to the contrary, but provided no Event of Default exists (beyond any applicable notice and cure period), Tenant’s obligations for Annual Rent, Tenant’s Percentage Share of Operating Expenses (as defined below) and Tenant’s Percentage Share of Real Estate Taxes (as defined below) shall be abated for a period (the “Free Rent Period”) of twelve (12) months commencing on the Additional Retail Commencement Date. Tenant’s obligations for Annual Rent, Tenant’s Percentage Share of Operating Expenses and Tenant’s Percentage Share of Real Estate Taxes shall commence on the first day following the Free Rent Period; provided, however, that if an Event of Default occurs during the Free Rent Period, Tenant shall have no further right to the abatement set forth in this Section 2(d) and shall commence the payment of Monthly Installments of Annual Rent, Tenant’s Percentage Share of Operating Expenses and Tenant’s Percentage Share of Real Estate Taxes for the Additional Retail Premises on the first day following the occurrence of such Event of Default. Furthermore, if Event of Default occurs during or after the Free Rent Period, then in addition to any other costs, damages and unpaid rent that Tenant may owe to Landlord, Tenant shall further owe to Landlord the total sum of the Annual Rent and other rent abated by Landlord during the Free Rent Period. The date on which Tenant’s obligation to commence paying Annual Rent, Tenant’s Percentage Share of Operating Expenses and Tenant’s Percentage Share of

Real Estate Taxes for the Additional Retail Premises under this Section is referred to as the “Additional Retail Rent Commencement Date”

(e) Delivery of Additional Retail Premises. If Landlord is unable to deliver possession of the Additional Retail Premises to Tenant on or before March 1, 2010 (the “Anticipated Completion Date”) because the Landlord’s Work (as defined below) has not been Substantially Completed (as defined below), Tenant shall receive two days abatement of Annual Rent and additional rent for each day from and after the Anticipated Completion Date until the Additional Retail Premises are Substantially Completed. In the event the Additional Retail Premises are not Substantially Completed on or before June 1, 2010 (the “Outside Completion Date”), Tenant shall have the right to terminate its obligation to lease the Additional Retail Premises from Landlord under this Section 2 by giving Landlord thirty (30) days prior written notice of such termination within fifteen (15) days following the Outside Completion Date, with time being of the essence. If Tenant timely exercises its termination right under this Section 2(e), but the Additional Retail Premises are Substantially Completed within thirty (30) days of such notice, then Tenant’s termination will be null and void and of no force or effect. If Tenant timely exercises its termination right under this Section 2(e), and the Additional Retail Premises are not Substantially Completed within thirty (30) days of such notice, then such termination shall not affect the Original Remaining Premises or any other terms or conditions under the Lease or this Amendment affecting the Original Remaining Premises. If Tenant fails to deliver such termination to Landlord within such fifteen (15) day period. Tenant will be deemed to have waived its termination right under this Section 2(e). Substantially Completed is defined as receipt of final inspections from the applicable governmental authorities having jurisdiction over the permits issued for Landlord’s Work such that Tenant may take possession of the Additional Retail Premises.

(f) Annual Rent for Additional Retail Premises. Tenant agrees to pay to Landlord, as Annual Rent for the Additional Retail Premises, the amount of Five Hundred Six Thousand Four Hundred and 00/100 Dollars ($506,400.00) per annum (based on $20.00 per rentable square foot of the Additional Retail Premises), payable in Monthly Installments of Rent equal to Forty Two Thousand Two Hundred and 00/100 Dollars ($42,200.00). The Annual Rent for the Additional Retail Premises will not increase during the Additional Retail Term.

(g) Additional Rent for Additional Retail Premises. In addition to the Annual Rent payable on the Additional Retail Premises, Tenant shall, at its sole cost and expense, pay as additional rent with each Monthly Installment of Rent, one-twelfth (1/12) of Landlord’s estimate of Tenant’s Percentage Share of any Operating Expenses and any Real Estate Taxes on the Additional Retail Premises. Tenant shall not be obligated to pay Tenant’s Percentage Share of any Operating Expenses or any Real Estate Taxes attributable to the Original Remaining Premises, but rather will continue to pay Direct Expenses and Taxes attributable to the Original Remaining Premises in accordance with the Lease. Within one hundred twenty (120) days after the end of each calendar year, Landlord shall furnish to Tenant a statement setting forth the Operating Expenses and Real Estate Taxes applicable to such period and Landlord or Tenant shall within thirty (30) days thereafter make such payment or allowance necessary to adjust estimated payment to the actual amount of Tenant’s actual Percentage Share of Operating Expenses and Real Estate Taxes as shown on such statement. Any amount due Tenant shall be credited against installments next coming due of rent or by payment to Tenant when adjustment is to be made in the last year of the Lease. The calculation of Operating Expenses and Real Estate Taxes for less than a full calendar year shall be based upon the pro-rata share of Operating Expenses and Real Estate Taxes for the calendar year in which the Lease commences and expires. If at any time during any year of the Lease the rates of any Operating Expenses items or Real Estate Taxes for the Center are increased to rate(s) or amount(s) greater than that used in calculating the estimated amounts for such year, Landlord shall have the right to adjust Tenant’s monthly payments of Tenant’s Percentage Share of such items so that the same shall increase concomitantly. Tenant shall pay such increases to Landlord as part of Tenant’s monthly payments of estimated Operating Expenses and Real Estate Taxes commencing with the month in which such increase shall be effective. Landlord agrees to keep true and accurate records of Operating Expenses for each year. Tenant shall have the right to dispute Landlord’s Operating Expense statement provided such notice is given within one hundred eighty (180) days after the receipt by Tenant of such statement. During any such dispute, Tenant shall continue to make payments on account of Operating Expenses in accordance with Landlord’s most recent statement thereof. In connection with such dispute, Tenant shall be permitted to examine such records, during reasonable business hours and upon not less than fifteen (15) business days’ prior written notice to Landlord, at Landlord’s corporate office currently located in Palm Beach, Florida. Tenant shall not be allowed to use any third party audit recovery company acting wholly or partly on a contingency fee basis to perform such audit or examination of Landlord’s books and records and shall evidence the same to Landlord’s satisfaction. If the parties are unable to resolve any dispute as to the correctness of such statement within thirty (30) days following such notice of dispute, either party may refer the issues raised to a nationally recognized independent public accounting firm selected by Landlord and reasonably acceptable to Tenant, and the decision of such accountants shall be conclusively binding upon Landlord and Tenant. In connection therewith, Tenant and such accountants shall execute and deliver to Landlord a confidentiality agreement, in form and substance reasonably satisfactory to Landlord, whereby such parties agree not to disclose to any third party any of the information obtained in connection with such review. Tenant shall pay the fees and expenses relating to such procedure, unless such accountants determine that Landlord overstated Operating Expenses by more than ten percent (10%) with respect to such statement, in which case Landlord shall pay such fees and expenses. Upon expiration of the thirty (30) day period following delivery of Landlord’s Operating Expense statement to Tenant, Landlord’s Operating Expense statement shall be deemed conclusive by Tenant, unless Tenant has theretofore timely delivered a notice of dispute.

(h) Limitation on Increase in Real Estate Taxes. Notwithstanding anything set forth herein to the contrary, if (i) the Center is sold, or there is a change in control of Landlord, on or before the fifth (5th) anniversary of the Additional Retail Commencement Date, and (ii) there is an increase in Real Estate Taxes directly attributable to such sale or change in control, then, in such event, Tenant shall not be responsible for paying Tenant’s Percentage Share of such increase for the remainder of the Additional Retail Term. There shall be no limitation on Tenant’s obligation to pay Tenant’s Percentage Share of any increase in Real Estate Taxes as a result of any sale or change in control after the fifth (5th) anniversary of the Additional Retail Commencement Date or during any renewal term of the Lease.

(i) Defined Terms: As to the Additional Retail Premises, the following terms shall have the following meanings:

(i) Center: shall mean Mall of the Americas, as legally described on Exhibit “A” to this Amendment, together with all improvements and other appurtenances relating thereto currently located or hereinafter erected thereon, plus such modifications thereto as Landlord may from time to time designate.

(ii) Common Areas: shall mean those areas and facilities which, from time to time, may be furnished by Landlord in or near the Center for the non-exclusive general common use of tenants and other occupants of the Center, their agents, employees and customers, including, without limitation, parking areas, driveways, loading docks, passageways, walkways (interior and exterior), roofs, ramps, common seating areas, landscaped areas, stairways, escalators, elevators, sewage treatment facilities (if any), restrooms, fountains, play areas, meeting rooms and other similar areas or facilities.

(iii) Majors: Shall mean any store other than the Additional Retail Premises within the Center containing more than 15,000 square feet of space.

(iv) Operating Expenses: shall mean all costs and expenses incurred by or on behalf of Landlord (less any contribution, if any, to such costs and expenses made by any Majors, any tenants occupying space on the second floor of the Center, or any tenants who pay their respective costs and expenses directly) in operating, managing, insuring and maintaining the Common Areas and other portions of the Center that are the responsibility of Landlord, including, without limitation, all costs and expenses of operating, managing (Tenant agreeing that such management may be undertaken by an entity affiliated with Landlord, in which case such affiliate shall be compensated in a commercially reasonable manner and amount as any third party manager), maintaining, repairing, lighting, signing, cleaning, painting, and striping of the Common Areas (including, without limitation, the cost of uniforms, equipment and employment taxes and benefits); alarm and life safety systems; insurance, including, without limitation, rental abatement insurance, liability insurance for bodily injury, death, personal injury and property damage, special form or all-risk property insurance (including coverage for losses due to fire, flood, wind or other casualties covered by such insurance), worker’s compensation insurance or similar insurance covering personnel; maintenance of sprinkler systems; removal of water, trash and debris; regulation of traffic; payments as required by any governmental authorities; costs and expenses in connection with maintaining ambient air and environmental standards of any governmental authority; costs and expenses incurred, if any, which are designed to protect or enhance the health, safety and welfare of the tenants of the Center or their employees; the costs of all materials, supplies and services purchased or hired therefor; operation of public toilets; installing and renting of signs; fire protection; maintenance, repair and replacement of utility systems serving the Center, including, without limitation, water, sanitary sewer and storm water lines and other utility lines, pipes and conduits and any fees associated therewith; costs and expenses of maintaining, repairing, or replacing machinery and equipment used in the operation and maintenance of the Common Areas and personal property taxes and other charges (including, but not limited to, financing, leasing or rental costs) incurred in connection with such equipment; costs and expenses of maintenance, repair or replacement of awnings, paving, curbs, walkways, landscaping, roofs, walls, drainage, pipes, ducts, conduits and similar items, plate glass, lighting shrubbery and planters; costs and expenses incurred in the purchases or rental of music program services and loudspeaker systems; costs of providing light and power to the Common Areas; cost of water services, if any, furnished by Landlord for the non-exclusive use of all tenants; and administrative costs attributable to the Common Areas for on-site personnel and an overhead cost equal to five percent (5%) of the total costs and expenses of operating and maintaining the Common Areas. With respect to any of the foregoing costs which are capital in nature, Landlord shall amortize or depreciate such costs and expenses over a useful life in accordance with general accounting principles, and the amount of such amortization or depreciation shall be included in Operating Expenses.

(v) Real Estate Taxes: shall mean all federal, state, local, governmental, special district and special service area taxes, assessments (special or otherwise), charges, governmental liens, surcharges and levies, general and special, ordinary and extraordinary, foreseen and unforeseen (and substitutes therefor), of any kind whatsoever (including interest thereon whenever same shall be payable in installments) that Landlord shall be obligated to pay arising out of the use, occupancy, ownership, leasing, management, repair or replacement of the Center, or any property, fixtures or equipment thereon, as well as all taxes attributable to the Additional Retail Premises or rent imposed on the Center from time to time by any governmental authority. Notwithstanding the foregoing, Real Estate Taxes shall exclude inheritance, transfer or gift taxes imposed upon Landlord and any income taxes attributable to the Center or any rent).

(vi) Retail Lease Year: shall mean each period (during the Additional Retail Term) of twelve (12) calendar months, commencing as of (A) the Additional Retail Rent Commencement Date, if the Additional Retail Rent Commencement Date is the first day of a calendar month, or (B) the first day of the month next following the month in which the Additional Retail Rent Commencement Date occurred if the Additional Retail Rent Commencement Date is other than the first day of a calendar month, in which event the first Retail Lease Year shall include the partial month commencing on the Additional Retail Rent Commencement Date.

(vii) Tenant’s Percentage Share: shall mean that fraction, the numerator of which is the total number of rentable square feet of space contained within the Additional Retail Premises and the denominator of which is the total number of rentable square feet within the Center less (A) the area leased to Majors, and (B) the square footage occupied by tenants on the second floor of the Center. Commencing on the first day of the third full calendar year of the Additional Retail Term, in no event shall Tenant’s payment of Tenant’s Percentage Share of Operating Expenses increase by more than 5% over the previous calendar years’ Operating Expenses due hereunder (excluding from the foregoing cap taxes, insurance, utilities, and any other expense not controllable by Landlord).

(j) Utilities for Additional Retail Premises. Tenant shall be responsible, at Tenant’s sole cost and expense, for all utility services that exclusively serve the Additional Retail Premises irrespective of whether the utility services are located inside or outside the Additional Retail Premises. If any such utilities are not separately metered or submetered and/or are used in common with other tenant’s in the Center, Tenant will pay Tenant’s share of same as Additional rent.

(k) Prepaid Rent. Concurrently with Tenant’s execution of this Amendment, Tenant shall pay to Landlord the Prepaid Rent in the amount of Sixty Eight Thousand Five Hundred Seventy Five and 00/100 Dollars ($68,575.00), which represents Tenant’s first Monthly Installment of Rent.

(l) Landlord’s Work in the Additional Retail Premises. Landlord will complete the work designated as the “Landlord’s Work” in accordance with Exhibit “C” hereto. If requested by Landlord in writing, Tenant shall within ten (10) days after such written request provide all information required in order to enable Landlord to complete the Landlord’s Work. There shall be no postponement or the Additional Retail Commencement Date (or the Additional Retail Rent Commencement Date) for the Additional Retail Premises for (i) any delay in the delivery of possession of the Additional Retail Premises which results from any act or omission of Tenant, including delays due to changes in, additions to or interference with any work to be done by Landlord, or delays by Tenant in submission of information or approving working drawings or estimates or giving authorizations or approvals, or (ii) any delay by Landlord in the performance of any punch list items relating to the Landlord’s Work. If there is a dispute as to (A) the completion of the Landlord’s Work, or (B) the availability of the Additional Retail Premises for possession by Tenant, a certificate of Landlord’s architect will be final and binding on the parties. Tenant will examine the Additional Retail Premises before taking possession and will furnish Landlord with written notice specifying any defects within ten (10) days after taking possession otherwise, Tenant will be deemed to have agreed that the Additional Retail Premises are in good order and have been completed. Notwithstanding anything herein to the contrary, during the first twelve (12) months following the completion of the Landlord’s Work, Landlord shall be responsible to correct any latent defects in the Landlord’s Work. There is no promise, representation or undertaking by or binding upon Landlord with respect to any alteration, remodeling or redecorating of or installation of equipment or fixtures in the Additional Retail Premises, unless expressly set forth in this Amendment.

(m) HVAC. Tenant shall be responsible for the maintenance and repair of existing HVAC units serving the Additional Retail Premises during the Additional Retail Term and any extensions thereto including (i) belt and filter replacement, (ii) charging of the coolant systems, if required, (iii) performing quarterly inspections using a licensed HVAC contractor reasonably acceptable to the Landlord, and (iv) for all maintenance, repairs and replacement cost of less than Two Thousand Five Hundred and 00/100 Dollars ($2,500.00) to any existing HVAC units serving the Additional Retail Premises (i.e., Tenant shall be responsible for paying the first $2,500 of any such costs). If any maintenance, repair or replacement costs to the HVAC units exceed Two Thousand Five Hundred and 00/100 Dollars ($2,500.00), then Tenant shall have the option to either (A) require Landlord to repair and/or replace such HVAC unit and Landlord shall amortize the cost of such repair and/or replacement over the useful life of the unit or part and Tenant shall pay such cost to Landlord as additional rent, or (B) repair and/or replace such HVAC unit at Tenant’s sole cost and expense.

(n) Permitted Use. Tenant may use the Additional Retail Premises for the retail sale, rental and servicing of the following uses (collectively, the “Permitted Retail Use”): (i) computer hardware and software; (ii) general business office equipment; (iii) multi media electronics and equipment and interactive games and equipment; (iv) telecommunications equipment; (v) consumer electronics and equipment; (vi) audio, video and game software, compact discs, laser discs, digital hardware and software; (vii) digital photographic equipment; and (viii) wireless and broadband phone and data services, and for other hardware, software products and accessories, including without limitation, those for sending, receiving, viewing, and playback and those created by changing technologies related to categories (i) through (viii) above. Tenant may also use the Additional Retail Premises to offer services or events related to the technology products that Tenant sells and incidental thereto (the “Incidental Services & Events”), which Incidental Services & Events shall include, but not limited to, trainings, seminars and computer gaming events, and video or photographic production. Notwithstanding anything herein to the contrary, Tenant shall not use the Additional Retail Premises in violation of the exclusive and prohibited uses set forth on Exhibit “D” attached hereto.

(o) Operating Covenant. Tenant shall occupy the Additional Retail Premises upon the Additional Retail Commencement Date. Tenant may only use the Additional Retail Premises for the Permitted Retail Use under the Permitted Trade Name (as defined below) and for no other purpose or name whatsoever without Landlord’s prior written consent. Tenant covenants and agrees that the Additional Retail Premises shall be fully staffed and stocked and open for business to the general public for at least one (1) day within the first three (3) months after the Additional Retail Commencement Date. Furthermore, at all times that Tenant is open and operating for business, Tenant shall maintain an access point between the Additional Retail Premises and the enclosed portion of the Center (to allow ingress and egress of Tenant’s customers and invitees), which access point shall have no less than two (2) cash register check out stations. If Tenant fails to maintain such access point in accordance with this Section 2(o), and such failure continues for five (5) days after written notice from Landlord, then such failure will be an Event of Default under the Lease. For purposes of the Additional Retail Premises, the term “Permitted Trade Name” shall mean CompUSA, Tiger Xxxxxx.xxx Discount Computers or other trade name used or may be used by Tenant at a majority of its retail locations in the United States. If Tenant fails to continuously operate the Additional Retail Premises for more than sixty (60) days, then Landlord shall have the right (but shall not have any obligation), at any time thereafter, to terminate Tenant’s right to possession of the Additional Retail Premises by written notice to Tenant (the “Re-Capture Notice”). The Re-Capture Notice will set forth the date (the “Re-Capture Date”) on which Tenant’s right to possession of the Additional Retail Premises will terminate. If Landlord delivers a Re-Capture Notice, Tenant’s rights to occupy the Additional Retail Premises will terminate on the Re-Capture Date, and Tenant will then vacate and surrender the Additional Retail

Premises to Landlord in the condition required by the Lease. If Landlord delivers a Re-Capture Notice, then from and after the date on which Tenant surrenders the Additional Retail Premises in accordance with this Section 2(o), Tenant shall have no further obligations under the Lease with respect to the Additional Retail Premises, except for those obligations that expressly survive the expiration or termination of the Lease. If Tenant fails to vacate and surrender the Additional Retail Premises on the Re-Capture Date in accordance with this Section 2(o), and such failure continues for five (5) days after written notice from Landlord, then such failure will be an Event of Default under the Lease.

(p) Sublease of Additional Retail Premises. Tenant shall have the right to sublease the Additional Retail Premises in accordance with Section 9 of the Lease.

(q) Signage. Tenant shall have the right, at its sole costs and expense, to install signage on the building in which the Additional Retail Premises are located, subject to (i) obtaining Landlord’s prior written consent, which consent will not be unreasonably withheld or delayed, and (ii) complying with all applicable governmental requirements (including building codes).

3. Extension of Term of Original Remaining Premises

(a) Original Extension Term. As to the Original Remaining Premises, consisting of an aggregate of 82,866 rentable square feet, the Term of the Lease is hereby extended for a period (the “Original Extension Term”) of ten (10) years, commencing February I, 2010 (the “Original Extension Term Commencement Date”) and ending January 31, 2020. Tenant shall have the right to further extend the Term of the Lease under Section 4 of this Amendment. Section R-5 of the Lease Rider is hereby deleted and will be of no further force or effect.

(b) Annual Rent for Original Remaining, Premises. Tenant agrees to pay to Landlord, as Annual Rent for the Original Remaining Premises for the first five (5) years of the Original Extension Term, without notice, demand, deduction, setoff or counterclaim, plus all applicable sales, rent, use and/or other taxes thereon, the sum of One Million Two Hundred Twenty Eight Thousand Seventy Four and 10/100 Dollars ($1,228,074.10) based upon the rate of $14.82 per square foot, payable in Monthly Installments of Rent equal to One Hundred Two Thousand Three Hundred Thirty Nine and 50/100 Dollars ($102,339.50). The Annual Rent shall be increased on February 1, 2015 to One Million Six Hundred Fifty Seven Thousand Three Hundred Twenty and 00/100 Dollars ($1,657,320.00) based upon the rate of $20.00 per square foot, payable in Monthly installments of Rent equal to One Hundred Thirty Eight Thousand One Hundred Ten and 00/100 Dollars ($138,110.00). Monthly Installments of Rent at the rate set forth above shall be payable to Landlord in advance, on the first day of each calendar month during the Original Extension Term.

(c) Additional Rent for Original Remaining Premises. In addition to the Annual Rent payable on the Original Remaining Premises, Tenant hereby further agrees to pay to Landlord during the Original Extension Term, all Direct Expenses, Taxes and other charges due and payable by Tenant pursuant to the Lease (including, without limitation, Tenant’s Percentage Share of the cost associated with the Property Insurance as to the Storage Premises only). Upon the Original Extension Term Commencement Date, the Base Year for Direct Expenses and Taxes shall be changed to the calendar year 2010. On February 1, 2015, the Base Year for Direct Expenses and Taxes shall be changed to the calendar year 2015.

(d) Original Remaining Premises Accepted by Tenant “AS IS” Subject to Landlord’s maintenance and repair obligations under the Lease for the Original Remaining Premises, Tenant acknowledges and agrees that: (i) Tenant has been in occupancy oldie Original Remaining Premises for an extended period of time; and (ii) Tenant is fully familiar with the Original Remaining Premises and the Center and accepts the same now, and at the Original Extension Term Commencement Date in an “AS IS” condition. Within three hundred sixty (360) days of the occurrence of the Original Extension Term Commencement Date. Tenant, at its sole option, shall have the right upon written notice to Landlord to perform the following work (collectively, the “Reimbursable Improvements”) to the Office Premises, the Original Retail Premises and the Additional Retail Premises: install new carpeting in the Office Premises to equal or better quality as when first installed at inception of the Lease; repaint the Office Premises to equal or better quality as when first painted at inception of the Lease; and/or make other tenant improvements to the Office Premises, the Original Retail Premises and the Additional Retail Premises which are permanent in nature, all in accordance with the terms of the Lease. If Tenant performs any of the Reimbursable Improvements within such three hundred sixty (360)-day period, then Landlord shall reimburse Tenant for the cost of the Reimbursable Improvements, in an amount not to exceed. Three Hundred Twenty Five Thousand and 00/100 Dollars ($325,000.00), within thirty (30) days of Landlord’s receipt of reasonable documentary evidence that the Reimbursable Improvements was performed in accordance with the Lease and the cost of the same has been paid in full (as evidenced by unconditional lien waivers from the trades performing the Reimbursable Improvements); provided, however, that Landlord will only be obligated to reimburse Tenant up to an amount of One Hundred Sixty Two Thousand Five Hundred and 00/100 Dollars ($162,500.00) for any Reimbursable Improvements to the Original Retail Premises and the Additional Retail Premises. If Tenant fails to perform the Reimbursable Improvements within such three hundred sixty (360)-day period, then Landlord will have no obligation to reimburse Tenant for any of the Reimbursable Improvements. For purposes of Tenant’s reimbursement under this Section 3(d), the term Reimbursable Improvements shall specially exclude any furniture, equipment or similar removable personal property.

4. Options to Renew the Original Extension Term and the Additional Retail Term.

(a) First Renewal Term. Provided Tenant is not in default under the Lease at the time of its exercise thereof, Tenant shall have the right to extend the Original Extension Term for the Original Remaining Premises and the Additional Retail Term for the Additional Retail Premises (together but not separately) for an additional five (5) year period (“First Renewal Term”) which shall commence immediately upon expiration of the Original Extension Term and the Additional Retail Term. Tenant will not have the right to extend the Original Extension Term for the Original

Remaining Premises without also extending the Additional Retail Term for the Additional Retail Premises (and vice versa). If Tenant fails to notify Landlord in writing on or before two hundred seventy (270) days prior to the end of the Original Extension Term and the Additional Retail Term (time being of the essence with respect thereto), then Tenant’s right to extend the Lease for the First Renewal Term (as well as for the Second Renewal Term) shall lapse, and the Lease shall terminate upon expiration or earlier termination of the Original Extension Term and the Additional Retail Term. If Tenant extends the term of the Lease for the First Renewal Term, all terms and conditions of the Lease shall remain the same except as set forth in this Amendment and reference to the Term of the Lease shall include the First Renewal Term; provided, however that, subject to Section 4(e) below, the Base Year for Direct Expenses and Taxes shall be changed to the calendar year 2020 with respect to the Original Remaining Premises only.

(b) Second Renewal Term. Provided Tenant had exercised its option for the First Renewal Term and is not in default under the Lease at the time of the exercise of its option for the Second Renewal Term, Tenant shall have the right to extend the Term for an additional five (5) year period (“Second Renewal Term”) which shall commence immediately upon expiration of the First Renewal Term. Tenant will not have the right to extend the First Renewal Term for the Original Remaining Premises without also extending the First Renewal Term for the Additional Retail Premises (and vice versa). If Tenant fails to notify Landlord in writing on or before two hundred seventy (270) days prior to the end of the First Renewal Term (time being of the essence with respect thereto), then Tenant’s right to extend the Lease for the Second Renewal Term shall lapse, and the Lease shall terminate upon expiration or early termination of the First Renewal Term. If Tenant extends the Term of the Lease for the Second Renewal Term, all terms and conditions of the Lease shall remain the same except as set forth in this Amendment and reference to the Term of the Lease shall include the Second Renewal Term; provided, however that, subject to Section 4(e) below, the Base Year for Direct Expenses and Taxes shall be changed to the calendar year 2025 with respect to the Original Remaining Premises only.

(c) Rent During Renewal Terms. The Annual Rent for the renewal terms shall be as follows:

For the Original Remaining Premises:

|

|

|

Rent Per Rentable |

|

|

|

|

|

|||

|

|

|

Square Foot |

|

Annual Rent |

|

Monthly Rent |

|

|||

|

First Renewal Term |

|

$ |

23.00 |

|

$ |

1,905,918.00 |

|

$ |

158,826.50 |

|

|

Second Renewal Term |

|

$ |

26.45 |

|

$ |

2,191,805.70 |

|

$ |

182,650.47 |

|

For the Additional Retail Premises:

|

|

|

Rent Per Rentable |

|

|

|

|

|

|||

|

|

|

Square Foot |

|

Annual Rent |

|

Monthly Rent |

|

|||

|

First Renewal Term |

|

$ |

22.50 |

|

$ |

569,700.00 |

|

$ |

47,475.00 |

|

|

Second Renewal Term |

|

$ |

25.31 |

|

$ |

640,849.20 |

|

$ |

53,404.10 |

|

(d) Reminder Notice. Notwithstanding the above, if (i) Landlord fails to provide a written reminder notice (a “Reminder Notice”) to Tenant not less than thirty (30) days before the expiration of the 270-day notice deadline in Section 4(a) and 4(b) above (each such deadline being referred to as an “Option Notice Deadline”), and (ii) Tenant fails to give Landlord an extension notice before the expiration the Option Notice Deadline, then Tenant’s option to extend shall nevertheless remain in full force and effect for an additional period of thirty (30) days after written notice from Landlord (given by Landlord after the expiration of the Option Notice Deadline) advising Tenant that the extension notice has not been received; provided, however, that in no event will Tenants option to extend remain in full force or effect beyond the expiration of the then current Term. lf, however, Landlord sends Tenant a Reminder Notice, and Tenant nevertheless fails to give Landlord an extension notice prior to the expiration the Option Notice Deadline, then Tenant’s option to extend shall lapse and not remain in full force or effect beyond the Option Notice Deadline. It is agreed between Landlord and Tenant that it is the intention of the parties under this Section 4(d) to avoid forfeiture of Tenant’s right to exercise its option to extend through Tenant’s inadvertent or negligent failure to give notice of extension prior to the expiration of the Option Notice Deadline.

(e) No Decrease in Rent. Notwithstanding anything set forth in this Section 4 to the contrary (including the resetting of the Base Year under Section 4(a) and 4(b) above), in no event shall the Annual Rent, additional rent and other recurring amounts payable by Tenant to Landlord in any Lease Year during the First Renewal Term (including the first Lease Year of the First Renewal Term) or the Second Renewal Term (including the first Lease Year of the Second Renewal Term) be less than the Annual Rent, additional rent and other recurring amounts payable by Tenant to Landlord in the immediately preceding Lease Year.

5. Parking. Subject to complying with all applicable governmental requirements (including building codes), in addition to the reserved parking set forth in Section R-10 of the Lease, Tenant shall have the right, at its sole cost and expense, to designate twenty five (25) additional parking spaces exclusively for the use by Tenant’s customers and marked on the parking bumper “TigerDirect Visitor” in the location shown on the parking plan attached as Exhibit “E” to this Amendment (the “Additional Parking Spaces”). Notwithstanding anything set forth in this Section 5 to the contrary, (a) if any person or entity has a contractual right, as of the date hereof, to object to the designation or location of any Additional Parking Spaces, and (b) without prior communication from Landlord to such person or entity of the granting of the Additional Parking Spaces to Tenant, such person or entity notifies Landlord in writing that the designation or location of any Additional Parking Spaces violates such contractual right, then Landlord will notify Tenant in writing of such violation and Tenant will cease to have the right to use such Additional Parking Spaces, and will remove the designation on all such parking bumpers, within thirty (30) days of such written notice from Landlord. Furthermore, if Tenant is unable to use any of the Additional Parking Spaces because of applicable governmental requirements (including building codes) or any of the conditions set forth in this Section 5, the same will not constitute a

default by Landlord under the Lease, will not reduce or otherwise modify Tenant’s obligations under the Lease and will not be grounds for Tenant to terminate the Lease or any of Tenant’s obligations with respect to the Additional Retail Premises.

6. References. From and after the Additional Retail Commencement Date, all references to the “Premises” in the Lease shall mean and refer to the Original Remaining Premises and the Additional Retail Premises.

7. Confidentiality. Tenant agrees not to disclose any of the terms or provisions of this Amendment to other present or future tenants or prospective tenants of the Center or their respective representatives, nor to anyone else, excepting professionals (i.e., attorneys and accountants) who require knowledge thereof in furtherance of Tenant’s bona fide interests.

8. Broker Indemnification. Tenant agrees to indemnify Landlord against any loss, expense (including reasonable attorneys’ fees), cost or liability incurred by Landlord as a result of a claim by any broker, agent or finder representing Tenant or otherwise negotiating this Amendment on behalf of Tenant.

9. Ratification. Landlord and Tenant hereby ratify and confirm the Lease, as amended by this Amendment, and expressly acknowledge and agree that the Lease, as amended by this Amendment, remains and shall continue in full force and effect. In the event of any conflict between the terms and provisions of the Lease and the terms and provisions of this Amendment, the terms and provisions of this Amendment shall take precedence and control.

10. Counterparts. This Amendment may be executed in counterparts, each of which shall be deemed an original and all of which, when taken together, shall constitute one and the same instrument.

11. Amendments. The provisions of this Amendment (including this Section 11) may only be amended, supplemented or waived by a further agreement in writing duly executed and delivered by Landlord and Tenant.

12. Advice of Counsel. Each of Landlord and Tenant has reviewed this Amendment with its legal counsel or had an opportunity to review this Agreement with its legal counsel. This Amendment shall be interpreted without regard to any presumption or rule requiring construction against the party causing this Amendment to be drafted.

13. INTEGRATION. THE LEASE AND THIS AMENDMENT CONSTITUTE THE ENTIRE UNDERSTANDING AND AGREEMENT BETWEEN LANDLORD AND TENANT WITH RESPECT TO THE SUBJECT MATTER OF THE LEASE AND THIS AMENDMENT. ALL PRIOR UNDERSTANDINGS AND AGREEMENTS BETWEEN LANDLORD AND TENANT WITH RESPECT TO THE SUBJECT MATTER OF THIS AMENDMENT ARE MERGED INTO THIS AMENDMENT. AS TO THIS AMENDMENT, LANDLORD ACKNOWLEDGES THAT NO REPRESENTATION, WARRANTY, INDUCEMENT, PROMISE OR AGREEMENT HAS BEEN MADE, ORALLY OR OTHERWISE, BY TENANT OR ANYONE ACTING ON BEHALF OF TENANT, UNLESS SUCH REPRESENTATION, WARRANTY, INDUCEMENT, PROMISE OR AGREEMENT IS EXPRESSLY SET FORTH IN THIS AMENDMENT. LIKEWISE, AS TO THIS AMENDMENT, TENANT ACKNOWLEDGES THAT NO REPRESENTATION, WARRANTY, INDUCEMENT, PROMISE OR AGREEMENT HAS BEEN MADE, ORALLY OR OTHERWISE, BY LANDLORD OR ANYONE ACTING ON BEHALF OF LANDLORD, UNLESS SUCH REPRESENTATION, WARRANTY, INDUCEMENT, PROMISE OR AGREEMENT IS EXPRESSLY SET FORTH IN THIS AMENDMENT. IN ADDITION TO EXECUTING AND DELIVERING THIS AMENDMENT, A DULY AUTHORIZED REPRESENTATIVE OF LANDLORD AND TENANT IS INITIALING THIS SECTION 13 WHERE INDICATED BELOW TO AVOID ANY DOUBT WHATSOEVER THAT LANDLORD AND TENANT UNDERSTAND THE PROVISIONS OF THIS SECTION 13.

|

INITIALS |

|

INITIALS |

|

|

|

|

|

/s/ [ILLEGIBLE] |

|

/s/ [ILLEGIBLE] |

|

LANDLORD |

|

TENANT |

[The remainder of this page is intentionally blank.]

THE PARTIES have executed and delivered this Amendment as of the day and year first written above.

|

WITNESSES: |

|

LANDLORD: |

||

|

|

|

|

||

|

|

|

SC XXXX ASSOCIATES LIMITED |

||

|

|

|

PARTNERSHIP, a Delaware limited partnership |

||

|

|

|

|

||

|

|

|

By: SC XXXX XX, Inc., a Delaware corporation |

||

|

|

|

|

||

|

|

|

|

||

|

/s/ Xxxxx Xxxxx |

|

By: |

/s/ Xxxxx Xxxxx |

|

|

Print Name: |

Xxxxx Xxxxx |

|

Print Name: |

Xxxxx Xxxxx |

|

|

|

|

Title: |

President |

|

/s/ XxXxx Xxxxxxx |

|

|

|

|

|

Print Name: |

XxXxx Xxxxxxx |

|

|

|

|

|

|

|

TENANT: |

|

|

|

|

|

|

|

|

|

|

|

TIGERDIRECT, INC., a Florida corporation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Xx Xxxxxxx |

|

By: |

/s/ Xxxxxxx Xxxxxxxxxx |

|

|

Print Name: |

Xx Xxxxxxx |

|

Print Name: |

Xxxxxxx Xxxxxxxxxx |

|

|

|

|

Title: |

CEO |

|

/s/ Xxxxxx Fongyee |

|

|

|

|

|

Print Name: |

Xxxxxx Fongyee |

|

|

|

ACKNOWLEDGMENT OF GUARANTY

The undersigned, as the guarantor of the Lease pursuant to the Guaranty attached to the Lease, hereby acknowledges the terms of this Amendment, and further acknowledges the continuing liability of the undersigned during the term of the Guaranty as guarantor with respect to the Lease, as modified by this Amendment. Nothing herein shall be deemed to limit any provisions of the Guaranty or the continuing liability of the undersigned for all obligations of Tenant under the Lease, as modified by this Amendment.

|

WITNESSES: |

|

GUARANTOR: |

||

|

|

|

|

||

|

|

|

SYSTEMAX, INC., formerly known as Global Direct Mail, Inc., a Delaware corporation |

||

|

|

|

|

||

|

|

|

|

||

|

/s/ Xx Xxxxxxx |

|

By: |

/s/ Xxxx Xxxx |

|

|

Print Name: |

Xx Xxxxxxx |

|

Print Name: |

Xxxx Xxxx |

|

|

|

|

Title: |

Secretary |

|

/s/ Xxxxxx Fongyee |

|

|

|

|

|

Print Name: |

Xxxxxx Fongyee |

|

|

|

EXHIBIT “A”

LEGAL DESCRIPTION OF THE CENTER

Tract “A” of MALL OF THE AMERICAS, according to the Plat thereof as recorded in Plat Book 159, Page 70, of the Public Records of Miami-Dade County, Florida.

EXHIBIT “C”

LANDLORD’S WORK

LANDLORD’S WORK FOR ADDITIONAL RETAIL PREMISES

The Tenant acknowledges that it accepts the Additional Retail Premises in an “as is” condition and that all alterations, renovations, decorations or other work required in connection with the Additional Retail Premises will be performed by the Tenant, at its sole cost and expense, and in accordance with Exhibit “C”.

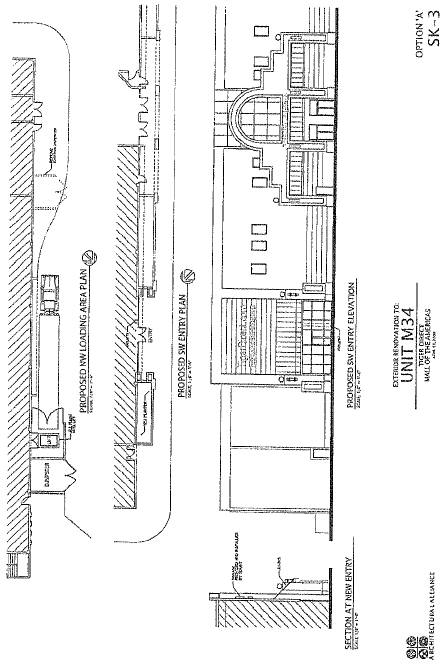

Notwithstanding the immediately preceding paragraph, and subject to obtaining requisite approvals from the appropriate governmental authorities, Landlord agrees to (i) construct a loading area with a hydraulic lift adjacent to the west wall of the Additional Retail Premises, and (ii) install entry doors and entry façade on the southern wall of the Additional Retail Premises (including the installation of overhead security doors and bollards consistent with the overhead security doors and bollards currently installed in the Original Retail Premises), all as more particularly shown on the plans and specifications listed on or attached to Exhibit “C-1”

The Landlord’s Work below has been described solely for the purpose of determining and outlining the extent of the Landlord’s repair and restoration obligations under Section 22 of the Lease in case of damage and destruction.

1. Washroom:

Washrooms to code (fan, light, ceiling and accessories to be supplied and installed by the Landlord).

2. Electrical:

150 amp., 3 phase, 4 wire electrical service at 120/208 V. Location to be determined by the Landlord. The Landlord will also provide 2 foot by 4 foot lay in fixtures based on one fixture per 80 square feet of area and install receptacles per code. The tenant shall provide all other electrical work including, but not limited to, additional lighting, outlets and wiring required.

3. Heating and Air Conditioning Equipment:

One (1) ton of cooling capacity per 300 square feet of area will be supplied and installed on the roof of the Leased Premises. All duct work and other work required to hook up the system to be completed by the Landlord based on an open retail unit (i.e. no partition walls, bulkheads, etc.). The Tenant is required to make its own inquiries regarding the adequacy of the HVAC capacity provided by the Landlord above. The Tenant will be responsible for the costs of any additional HVAC equipment and distribution in which it requires.

4. Walls:

Unpainted plasterboard on interior face of demising walls, finished to a maximum height of ten (10) feet, ready for paint. Masonry fire walls (Landlord’s obligation will be to a maximum 1-hour rating) and exterior walls will be concrete block with flush joints ready for paint.

5. Floor:

Concrete floor with a smooth finish.

6. Storefront:

Landlord’s standard storefront.

7. Ceiling:

Standard 2 foot by 4 foot T-Bar ceiling with acoustical tile

8. Sprinklers:

If required by code, the Landlord will provide a complete sprinkler system within the unit based on open area. (i.e. no partition walls, bulkheads, etc.). The tenant will be responsible for any alterations to the system to maintain proper coverage as per code due to the construction or installation of any obstruction such as walls, bulkheads, shelving, etc.

9. General:

If the Tenant requests a credit in lieu of any work which the Landlord was to have provided, the credit shall, at the option of the Landlord, be determined either (a) by an estimate by the Landlord as to the amount of the credit, or (b) to equal the amount offered by the Landlord’s contractor as a credit to delete the work from its contract, in each case, less fifteen percent (15%) which the Landlord shall retain for co-ordination charges.

TENANT’S WORK

A. Structure

Landlord has provided a single level structure designed in accordance with all governing building codes. All elements and dimensions must be verified by Tenant’s architect due to the previous occupancy of the space and subsequent modifications.

1. Columns shall be un-primed structural steel shapes as depicted in lease outline drawing showing Tenant’s demised area.

2. Roof structure over space leased shall be structural steel framing bar joist, metal deck, insulation, and built-up roofing.

3. Exterior walls are masonry concrete block with #5 REBAR split face brick veneer.

4. Floor Slab on grade 4' hand troweled concrete surface with 6" x 6' wire mesh approximately 1/2' below finished mall areas.

5. Roof penetration shall be held to a minimum. All required Tenant penetrations of roofing system shall be made by Landlord’s roofing contractor at Tenant’s expense after notification to Landlord for approval. Any structural framing required by Landlord’s Engineer due to Tenant’s roof penetrations for roof mounted equipment shall be by Landlord’s Contractor at Tenant’s expense. All engineering costs for modification to Landlord’s structure are Tenant’s responsibility.

6. Should an expansion joint occur in the leased premises, Tenant is responsible for all construction affected by such joint including floor, walls, and ceiling. Tenant shell maintain integrity of all such expansion joints In a manner consistent with acceptable construction design practices.

7. Tenant areas will be left exposed to the steel and metal deck structure above. Approximate height, slab to deck, is 28'.

8. All drilling, welding, or other attachment to the structural system must be approved by Landlord in writing before work is begun, and must be clearly identified on Tenant’s drawings. Landlord approval of drawings does not relieve Tenant of responsibility to make this request in writing.

B. Demising Walls and Storefronts

1. Each Tenant must furnish and install 5/8' fire code gypboard, taped and bedded, up to the structural deck and airtight against the deck, on Tenant’s side of all common dividing partitions. Tenant must seal gypboard airtight and seal in an airtight manner all structural shapes, ducts, piping, and penetrations through the demising walls. Demising walls shall be installed to roof deck and shall be airtight, since the space between the deck and the finished ceiling is used as a return air plenum. Tenant shall provide openings in demising walls above the ceiling as directed by the Landlord for proper circulation of air. Storefront bulkhead must remain open to permit return airflow.

2. Vertical neutral strips separating Tenant storefront construction are erected in front of storefront at lease line, contiguous with dividing partitions. The storefront area left open between the edges of the neutral strips and between the mall finished floor and the under-side of the soffit, is for storefront work by Tenant. Tenant shall be responsible for constructing a complete storefront or remodeling an existing storefront in the full height of the opening and making suitable attachment or termination of construction to the soffit and proper closure against each neutral strip. All aluminum on Tenant storefront must be anodized with a dark bronze finish, including exposed portions of security gates.

3. All storefront glass must be safety plate or tempered. Use of plate glass mirrors on storefront will be permitted only if solidly bonded to non-combustible backing material subject to Landlords approval. Storefront glass of any type will not be permitted to terminate directly against flooring. A durable kickplate is required.

4. Construction or design elements of the storefront construction will not be allowed to project beyond Tenant’s lease line.

5. Tenant must furnish and install a minimum of 3'0" x 7'0' service door connecting to service corridors. This shall be a class ‘B” labeled door and frame, complying with uniform building code. This door’s secondary use is that of an exit, and must be recessed the full width of Tenant’s door, swing in the direction of travel, and be equipped with the necessary hardware. Tenant is required to make complete installation, including proper anchorage of frame, providing hole in sheet rock on corridor side, necessary headers and other accessories for a proper installation.

Locking hardware on exterior entrances or exits must function from the inside of Tenant’s lease space only. such that after hours access cannot be gained to Tenant’s space except through the common area.

6. Tenant whose normal operations generate moderate or high sound levels, i.e., pet shops, coin operated

amusement centers, musical instrument showrooms, stereo centers, etc., are required to insulate their demising walls against sound transmission.

7. Key switches for motorized grilles shall be mounted as inconspicuously as possible. Switch covers are to match adjacent storefront material or covers. Approximate maximum height 6f switch above finished floor shall be twelve (12) inches. All switches shall be flush mounted and not located on front face of storefront. Manual override is required for emergency operation.

C. Interior Finishes

1. Floors

a. All Tenant finish floor covering materials must be selected or adapted in thickness to correspond exactly with the level of the finished mail floor.

b. Tenant may elect to set its show window, grille, or other storefront elements back from the lease line within the premises. If such set-back storefront configuration is established, Tenant is encouraged to install flooring material identical In color, quality, and pattern to the adjacent mall flooring.

c. Tenant’s drawing, submitted for Landlord’s approval, must show the exact dimensions and locations of all floor penetrations. Tenant will be required to complete all penetrations in such manner that odors or liquids will not permeate the slab at these openings. Tenant shall provide liquid tight sleeves at all floor penetrations at Tenant’s expense.

d. If Tenant elects to install carpeting it must not extend past center line of door track to lease line.

e. All slab on grade concrete installed by Tenant shall be 3,000 psi, reinforced with 6' x 6' wire mesh. Any cutting and patching of the slab requires written approval by Landlord before work by Tenant can be initiated.

2. Walls

a. Interior partitions shall be constructed of noncombustible materials. If non-combustible wood is used, it shall bear the U.L. approval and mill stamp indicating it is treated, must be completely enveloped, and solidly locked with 5/8' fire core gypboard. Field applied treatment to combustible material is not permitted.

b. Interior metal studs should be a minimum of 3-5/8'.

c. Partition wall must be anchored.

3. Ceiling

a. Combustible material of any nature will not be allowed above finished ceilings. Organic material, either treated or non-treated will not be allowed above finished ceilings.

b. All non-combustible ceiling material must be equal to class ‘A’ fire rating.

c. Ceiling not terminating tight against wall surface must be returned to the deck above and sealed as required.

D. Heating, Ventilating and Air Conditioning

1. Design criteria of premises

a. Heating

1. Outside dry bulb temperature: 28 F.

2. Inside dry bulb temperature: prevailing minimum temperature of substantially 70 F + I in merchandising areas.

b. Cooling

1. Outside dry bulb temperature: 96 F.

2. Outside wet bulb temperature: 78 F.

3. Inside dry bulb temperature: prevailing minimum temperature of substantially 78 F + I in merchandising areas.

4. Inside relative humidity: 50%.

c. Total electrical heat producing load: Maximum ten (10) xxxxx per square foot of gross Tenant area. Total electrical load shall be based on the total wattage from lighting, appliances, equipment and miscellaneous electrical items in the premises. Food service areas maximum electrical load is 30 wafts per square foot of gross Tenant area.

d. Number of people for internal sensible latent heat gains: Maximum fifty (50) square foot of leased area per person.

e. Air supply: Total cool air supply to the Tenant’s premises is based on the total internal sensible heat load calculated from the design criteria established in paragraphs b, c, d, and where applicable on exposed outside wall ‘U’ value of 0.2 and a roof ceiling assembly ‘U’ value of 0.12 and a supply air diffusion temperature difference of 18 F +/-2.

2. Landlord System

a. Packaged rooftop air-cooled air conditioning units furnish 56 F +/- 2 supply air. Supply air from the units through Landlord’s common duct system is delivered at the premises by providing a duct connection point for Tenant’s distribution system. Air is returned to Landlord’s air conditioning unit via ceiling plenum.

b. Ventilation: Outside fresh air is provided at not less than 1 0% during occupied cycle.

c. Air supply is quantified in cubic feet per minute or CFM’S.

3. Tenant System

a. Tenant shall design and install a complete supply air distribution system. Such system shall be complete with variable volume boxes and controls, supply and return diffusers, supply grilles and registers, return air grilles, return air openings with fire dampers, insulated ductwork, thermostat(s) and electric controls for temperature control In the premises.

b. Tenant’s air distribution system including ductwork, variable volume air control devices, electric reheat coils, diffusers, grilles and registers shall be designed such that the static pressure loss in Tenant distribution system does not exceed 0.35'W..C.

c. Variable volume boxes, supplied and installed by Tenant, shall be equal to Xxxxx ESC1000.

d. Ductwork: Tenant’s ductwork shall be designed, furnished and installed in strict accordance with the standards described in the latest edition of the ASHRAE Guide and Data Book and in the latest editions of the Duct Manual and Sheet Metal Construction for Ventilating and Air Conditioning Systems, published by SMACNA and/or local codes. No fiberglass ductwork shall be used. Maximum length of flex is 48'. Ductwork from Landlord’s main supply duct to VAV Box shall be hard pipe only.

e. Diffusers, registers, grilles: Shall be of adjustable type for volume and direction control.

f. Thermostat(s) shall be located in an accessible location and not obstructed by any merchandising or appliances nor shall it have light fixtures or other similar heat producing elements directed or adjacent to it. Thermostat(s) shall act to control variable volume box(es).

g. Tenant shall provide 24" x 24" access panels for service to Landlord’s and/or Tenant’s equipment and/or facilities, and all connections to Landlord’s services and facilities above the ceiling level within the premises.

h. Tenant is responsible for air balance of the HVAC system in their premises.

E. Exhaust System

1. Each Tenant will provide its own toilet duct with ceiling grille in accordance with the requirements of all applicable codes. In no cases shall Tenant system exhaust be less then 2 CFM per square foot of toilet room area. Landlord has provided had provided sheet metal exhaust stacks through the roof at various locations. Tenant shall install a toilet fan(s) within its space, sized for code toilet exhaust quantities as a minimum. Tenant shall install one (1) back draft damper in the discharge duct, and shall extend the discharge duct to the nearest exhaust and shall connect thereto, providing a capped inlet for connection of future Tenants.

2. Exhaust systems for food services:

a. Maximum exhaust air shall be based on codes and special requirements. Food or other odors

from kitchen, dining room and cafeteria areas must be exhausted to atmosphere through Tenant-furnished and installed upblast exhaust fan equal to the Penn Ventilator Co. Fume-X fan. The manufactured fan unit shall be modified by the addition of a fabricated venture type duct adapter to assure a minimum discharge velocity of 2000 FPM. The exhaust fan shall be provided with a drainage area at the bottom of the unit complete with a residue trough equipped to be cleaned periodically by Tenant. The location of the exhaust fan shall be no less than 20'-O’ from any air intakes so as to avoid contaminating air supplied to other Tenants. If necessary, an additional duct extension on the fan discharge may be required if odors become a problem within the mall. Exhaust duet and fan location shall be submitted to Landlord for approval.

b. Tenant shall clean its filter and duct system on a regular program so that grease is not deposited on the roof. All exhaust system ductwork and exhaust fans used for exhausting cooking odors and grease-contaminated air shall be cleaned on a regular schedule by an established contractor engaged in that type of service. This cleaning will occur at intervals often enough to insure against grease accumulation in exhaust system, thus eliminating the probability of fires in this system. Tenant will provide to Landlord a copy of the service agreement between Tenant and authorized service dealer. Any grease related damage shall be corrected at Tenant’s expense.

c. Tenant shall provide an electrical interlock so that its kitchen exhaust fan shall run at all times that the lights in the kitchen area are on.

d. Tenant is required to run exhaust fans so that no odors are allowed to enter the public mall or any adjacent Tenant spaces.

e. Makeup air for exhaust system from kitchen, dining room, and cafeteria areas must be accomplished by Tenant-furnished and installed makeup air systems.

3. Exhaust system fire protection, food service:

a. The automatic extinguishing equipment should be installed in accordance with the National Fire Protection Association Standards. The extinguishing system shall be Underwriters’ Laboratories, Inc. CO2 or dry chemical pre-engineered system. Underwriter’s Laboratories approved grease extracting hoods with water washdown cycle are suggested. However, a properly designed conventional range hood with washable grease filters is acceptable, provided that fire protection sprinkler heads or chemical fire protection is provided above the filters and within the exhaust duct run between the hood and the roof mounted exhaust fan, and is approved by Landlord’s fire protection engineer.

b. Automatic devices for shutting down fuel or power supply to the appliances must be of the manual reset type and not automatic reset. In addition, gas fire cooking comment must have a permanent notice posted at the reset device cautioning the operator to shut off the gas at all appliances before resetting the device.

c. A readily accessible means to manually actuate the fire extinguishing equipment shall be provided in a path of ingress or egress and shall be clearly identified. This means shall be mechanical and shall not rely on electric power for actuation.

d. The installation of the above systems to be made only by persons properly trained and qualified by the manufacturer of the system being installed. Tenant shall also have an inspection agreement with the firm whose personnel are properly trained and qualified (by the manufacturer) to make such inspections.

e. If dry chemical systems are used, the exhaust fan must run during the actuation of the extinguishing system in order to draw the dry chemical extinguishant up through the ductwork.

f. Before the system is fabricated and installed, the systems vendor shall submit plans and other pertinent information on the proposed system to Landlord for review and approval.

F. Electrical

1. Electrical service and design

a. Landlord will provide an electric distribution system of 480/277 volts, three phases, 60 cycle, electrical distribution to electrical meter rooms. Tenant will furnish all necessary labor, disconnects, branch and main circuit breakers, panels, transformer, conduit, wire, etc., to provide a complete approved electric distribution system within the leased premises.

b. Landlord has sized electrical service sufficient to accommodate an electrical installation of 10

xxxxx per square foot for retail Tenants, 30 xxxxx per square foot for fast

food Tenants, and 60 wafts per square foot for restaurants and cafeterias.

c. Tenant’s electrical drawing submittal must include a tabulation of the electrical load including quantities and sizes Of 12MPS, appliances, signs, water heaters, equipment, etc., and a KW demand for each installed item. A complete electrical panel schedule is required for each installation. Tenant plan shall provide a single line diagram showing electrical distribution with method of grounding of Tenant’s system clearly shown.

2. Electrical construction

a. General material: All electrical materials shall be new and shall be National Electrical Code Standard unless better grade is required by local, code, and shall bear the Underwriters’ Laboratories label.

b. Lighting fixtures shall bear Underwriters’ label and be of a type approved by City and NEC codes. Recessed fixtures installed in furred spaces shall be connected by means of flexible conduit with wire run to a branch circuit outlet box which is independent of the fixture. Fluorescent ballast shall be energy efficient.

c. The following equipment shall be identified with engraved bakelite nameplates: distribution panels, motor starters, lighting panels, and push button stations.

d. Electric hot water heaters, if needed, shall be provided by Tenant for its domestic water requirements, shall be automatic and shall be limited to 12 gallon capacity. Special approval for heaters of larger capacity will be required. Unit shall be U.L. approved. Heaters will have a pressure relief piped to nearest drain in Tenant space. All water heaters above ceiling must have overflow drain pan piped to nearest drain.

e. All fluorescent fixtures shall, be provided and installed by Tenant with switch legs and local switches rated 20 amps at 277 volts. All fluorescent fixtures must have internal protection devices.

f. Panel board furnished and installed by Tenant for 120/208 volt lighting within the [eased premises shall be equal to type NLAB class panels and 277/480 volt panels shall be equal to type NHB class with single or multiple pole bolted thermal magnetic breakers.

g. Transformer shall be furnished and installed by Tenant, as required.

G. Plumbing

1. Domestic cold water will be provided by Landlord at or near the boundary of the leased premises. The location for this point of service shall be in Tenant’s blackout area. Tenant shall connect at this point and extend service according to Tenant’s requirements. All runs downstream of Landlord’s valve shall be insulated to prevent condensation.

2. Tenant’s plumbing facilities shall be confined to the limits of the leased premises and in the immediate vicinity of adjacent service corridors. Plumbing installation shall be in accordance with all applicable codes.

3. Sanitary sewer

a. Sanitary sewer taps to which Tenant may connect will be provided by Landlord, under each leased premises. All Tenants are required to provide toilet facilities within their leased premises, at Tenant’s expense.

b. Tenants are encouraged to locate toilets in areas where sewer taps are provided. Tenant shall excavate for sewer taps, complete plumbing connections, and backfill to a 90 percent density. If Tenant’s design does not work with location established by Landlord, then Tenant shall remove existing stab according to accepted construction practice.

c. Common vents are provided at strategically located points. Tenant shall connect to these vents and provide “T” connection with plug to allow connection by other Tenants.

d. All Tenants shall provide floor drains in toilets, however, boutique and restaurant Tenants shall also provide floor drains in kitchen areas. Local codes shall govern; however, a minimum of one (I) drain shall be required.

e. All Tenants shall provide accessible clean-outs in toilet and kitchen areas.

f. Tenant shall provide access to all Landlord clean-outs that may occur in Tenant’s leased premises.

4. Grease trap

All food service Tenants are required to use the Landlord’s grease distribution system. Landlord provides the grease line tap within the Tenants premises. Connection to this system will be at Tenant’s expense.

5. Water consumption

Large water consumers such as food preparation establishments, hair salons, and other large water consumers in the judgment of Landlord, shall furnish and install a water meter conforming to American Water Works Association specifications for domestic service. If a meter is required, it shall be installed by Tenant at Tenant’s expense in an area easily accessible to Landlord’s personnel. The meter reading shall be used to calculate Tenant’s xxxx in accordance with established utility rates.

H. Telephone System

All telephone services shall be provided by Tenant. All telephone charges shall be paid by Tenant directly to the telephone utility company furnishing the service. Complete conduit system, if required, shall be provided by Tenant for utility company with pull wires installed in all conduit. Outlet boxes shall be 4" square minimum with single device cover and telephone plate.

I. Gas Service

Gas service will be available from the local gas company at a designated area. All piping and associated work for extension of services from the designated area to the Tenant’s leased space is by Tenant contractor at Tenant’s expense subject to Landlord’s approval and governing code requirements.

J. Fire Life Safety

1. Landlord has installed within the leased premises a fire protection system with standard head spacing in accordance with code requirements. Modifications made to Landlord’s system due to Tenant requirements, requirements of governing agencies or for any other reason shall be at Tenant’s expense. The final system shall be engineered in accordance with the codes and standards of all governing bodies.

Tenant’s contractor shall notify Landlord’s local authority 24 hours in advance to each shut down of sprinkler system. Tenant shall reimburse Landlord for the cost of each shut down sprinkler system in the amount of One Hundred Fifty Dollars (S150.00) for each occurrence.

2. Exit requirements and exit identifications within Tenant’s premises shall be furnished and installed by Tenant in accordance with requirements of the governing building code as it may be revised and amended, up to the time that construction is completed by Tenant, and approved by the local building authority. Exit lights will have auxiliary battery power provided with individual battery units for each fixture. Exit lights must be illuminated at all times, exit lights must also have auxiliary battery power.

3. Tenant shall furnish and install a minimum of one fire extinguisher throughout Its leased premises. The requirement is one extinguisher per 3000 square feet of space with a maximum separation of 75'- O' walking distance. Type of extinguisher shall be Class ABC, 10 lb. dry chemical. This requirement is necessary for insurance ratings. Locations must be approved by Landlord’s fire protection consultant.

K. General

1. Tenant must submit design and construction documents in two phases. For the first phase, Tenant will submit preliminary drawings. For the second phase, Tenant will submit Working Drawings sealed by a Registered Architect. Three (3) sets of plans and one (1) set of sepias shall be submitted to Landlord for approval. Work shall not commence until Landlord has received and approved Tenants drawings.

2. Landlord, Tenant or utility company shall have the right, subject to Landlord’s approval, to run utility lines, pipes, roof drainage pipes, and conduit, wire or ductwork where necessary, above ceiling space, column space, or other parts of the leased premises, and to maintain same in a manner which does not interfere unnecessarily with Tenant’s use. It shall be Tenant’s responsibility to provide access panels in its finish work where required by Landlord.

3. Tenant shall prepare all its plans and perform all its work to comply with all governing statutes, ordinances, regulations, codes and insurance rating boards; obtain all necessary permits and obtain Certificates of Occupancy for the work performed. Landlord’s approval of Tenant’s plans does not relieve Tenant of its obligation to complete the construction in accordance with the terms of the Lease Agreement, nor does it relieve Tenant of complying with the laws, rules, regulations, and requirement of local governing authorities. Certificates of Occupancy or copy is mandatory and shall be filed with Landlord before Tenant opens for business.

4. All drilling, welding, or other attachment to the structural system must be approved by Landlord in writing before work is begun, and must be clearly identified on Tenant’s drawings. Landlord’s approval of drawings does not relieve Tenant of the responsibility to make the request in writing.

5. Tenant’s contractor shall be responsible for providing and maintaining a temporary storefront barricade made of paneling or painted sheetrock during Tenant construction. The temporary storefront shall completely enclose Tenant storefront and is subject to approval by Landlord. If Landlord has previously constructed a temporary barricade, then Tenant shall reimburse Landlord for Landlord’s cost.

6. Existing materials, fixtures and equipment planned to be reused must be of quality level equal to new, and are subject to Landlord’s approval. Used materials other than that which is existing on the premises will not be permitted. Any damaged materials must be replaced as directed by Landlord.

7. Tenant’s contractor will be held responsible for all clean-up in the common mall or joint use area. Tenant’s contractor must provide a walk-off mat.

8. All construction plans in the field must bear the Landlord’s approval.

9. All work performed in the leased premises is contingent upon final approval by the Landlord.

10. Tenant shall repaint neutral piers and soffit after completion of Tenant construction if required by Landlord.

11. All construction work shall be done within Tenant’s leased premises. All materials shall be stored and confined within Tenant’s leased premises.