OFFICE LEASE

Exhibit 10.21

This Office Lease (“Lease”) is entered into by and between Bedford Property Investors, Inc., a Maryland corporation (“Landlord”), and Impinj, Inc., a Washington corporation “Tenant” (collectively the “Parties”) and dated for reference purposes only as of November 17, 2004.

ARTICLE 1. BASIC LEASE TERMS

In addition to the terms defined in Article 2 and elsewhere in this Lease, the terms set forth below shall have the meanings herein specified when referred to in this Lease:

| 1.1 | Rent Payment Address: | Bedford Property Investors, Inc., Lockbox No. 73048 - [Adobe II], X.X. Xxx 00000, Xxx Xxxxxxxxx, XX 00000-0000. | ||||||||||

| 1.2 | Landlord Notice Address: | Bedford Property Investors, Inc., 000 Xxxxxxxxx Xxxxxx, Xxxxxxxxx, XX 00000; facsimile number (000) 000-0000, with a copy to Bedford Property Investors, 000 X. 00xx Xxxxxx, Xxxxx 000, Xxxxxxx, XX 00000, Attn. Regional Manager, fax (000) 000-0000. | ||||||||||

| 1.3 | Tenant Notice Address: | Impinj, Inc., Suite 300, 000 Xxxxx 00xx Xxxxxx, Xxxxxxx, XX 00000; facsimile number 000-000-0000. | ||||||||||

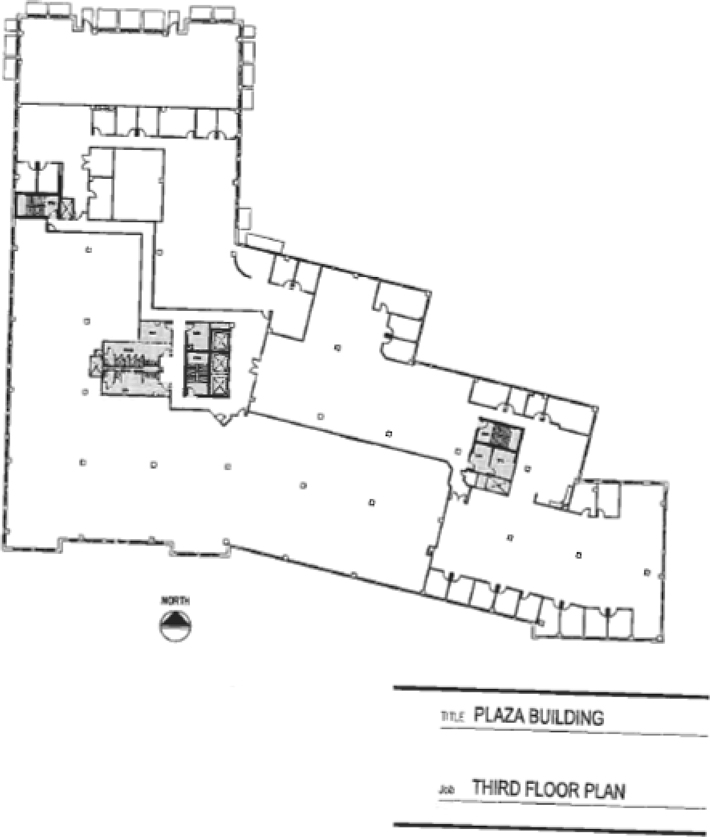

| 1.4 | Premises: | Suite 300 on the third floor of the Building, deemed to contain 20,966 square feet of Rentable Area, as outlined in Exhibit B (see Section 2.23). | ||||||||||

| 1.5 | Building: | Plaza Building, 000 Xxxxx 00xx Xxxxxx, Xxxxxxx, XX 00000, in which the Premises are located. The Plaza Building is deemed to contain 136,111 square feet of Rentable Area (see Section 2.18). | ||||||||||

| 1.6 | Complex: | Waterfront Building and Plaza Building, also known as Building 1 and Building 2 of Quadrant Lake Union Center, located in the City of Seattle in the State of Washington (“State”), consisting of: (i) that parcel of real property on which the Premises are located, (ii) the Common Area, and (iii) any contiguous parcels owned by Landlord, as more particularly described in Exhibit A. | ||||||||||

| 1.7 | Term: | (A) July 1, 2005 (the “Estimated Commencement Date”). | ||||||||||

| (B) 62 months | ||||||||||||

| (C) Tenant has one option to extend for 3 or 5 years (See Paragraph A of Addendum No. 1) | ||||||||||||

| 1.8 | Base Rent: | (A) Minimum Monthly: | ||||||||||

| Prior to Commencement Date |

$ | 20,966 | ||||||||||

| Months |

$ | 0 | ||||||||||

| Months 3-14 |

$ | 38,438 | ||||||||||

| Months 15-26 |

$ | 40,185 | ||||||||||

| Months 27-38 |

$ | 41,932 | ||||||||||

| Months 39-50 |

$ | 43,679 | ||||||||||

| Months 51-62 |

$ | 45,426 | ||||||||||

|

(B) Advance Rent: $38,438 |

||||||||||||

| /s/ SS |

/s/ EF | |||

| Landlord’s Initials | Tenant’s Initials | |||

| 1 |

| 1.9 | Security Deposit: | $250,000 within 5 business days of mutual execution of this Lease, and with periodic reduction thereafter (See Article 6 and Paragraphs E and F of Addenda No. 1) | ||

| 1.10 | Permitted Use: | Office, administrative and high-tech research and development uses consistent with a Class A office building and otherwise permitted under the CC&Rs and applicable laws. (See also Paragraph I of Addendum No. 1 for additional restrictions on use and occupancy). | ||

| 1.11 | Pro Rata %: | 15.40% | ||

| 1.12 | Landlord’s Allowance: | $366,905.00 for Tenant Improvements $41,932.00 for Moving Expenses | ||

| 1.13 | CC&Rs: | Amended and Restated Declaration of Covenants, Conditions, Easements and Restrictions Applicable to Quadrant Lake Union Center with an effective date of October 31, 1996 and recorded under King County Recording No. 9802231707 as may have been amended from time to time. | ||

| 1.14 | Management Fee: | 4% of gross rental revenue | ||

| 1.15 | Broker: | Xxxxxx Xxxxxxxx of Pacific Real Estate Partners Inc. (Landlord) | ||

| Xxxxxx X. Xxxxxxxx of Pacific Real Estate Partners Inc. (Tenant) | ||||

| 1.16 | Contents: | This Lease consists of Pages 1 through 26; Articles 1 through 30; Addendum No. 1; and the following Exhibits attached hereto and incorporated herein by this reference: | ||

| Exhibit A – Legal Description of Complex | ||||

| Exhibit B – Plan of the Complex and Floor Plan of the Premises | ||||

| Exhibit C – Work Letter for Construction Obligations | ||||

| Exhibit D – Acknowledgment of Commencement of Term | ||||

| Exhibit E – Expenses | ||||

| Exhibit F – Rules and Regulations | ||||

| Exhibit G – Form of Letter of Credit | ||||

| Exhibit H – List of Permitted Hazardous Materials | ||||

ARTICLE 2. DEFINITIONS

The terms defined in this Article 2 shall, for all purposes of this Lease and all agreements supplemental hereto, have the meanings herein specified unless expressly stated otherwise.

2.1 “Additional Rent” means all items specified as Additional Rent in Sections 5.2, 7.5, 8.4, 10.2, 17.3, 18.2, 23.5, Exhibit E, and elsewhere in this Lease.

2.2 A “Bankruptcy Event” is (1) a court filing by or against Tenant, of pleadings to initiate a bankruptcy petition of any kind, or the appointment of a receiver or trustee of any or all of Tenant’s assets, or (2) a receiver or trustee taking possession of any of the assets of Tenant, or if the leasehold interest herein passes to a receiver or trustee, or (3) Tenant making an assignment for the benefit of creditors or petitioning for or entering into an arrangement with creditors during the Term.

2.3 “Building” means the structure that contains the Premises.

2.4 “Building Standard Work” means the typical interior improvements constructed or to be constructed by Landlord, which are of the nature and quality required by specifications developed for the Complex by Landlord’s architect.

| /s/ SS |

/s/ EF | |||

| Landlord’s Initials | Tenant’s Initials | |||

| 2 |

2.5 “Capital Costs” mean the following: (i) costs for capital improvements or replacements to the Complex of a type which do not normally recur more frequently than every five years in the normal course of operation and maintenance of facilities such as the Complex; (ii) exterior wall painting for buildings in the Complex; (iii) costs incurred for the purpose of reducing other operating expenses or utility costs payable by Tenant; and/or (iv) costs of capital improvements made by Landlord that are required by Laws or Regulations enacted or interpreted to apply to the Premises after the reference date of this Lease. Capital Costs are includable in Operating Costs each year only to the extent of that fraction allocable to the year in question calculated by amortizing such Capital Costs over the reasonably useful life of the improvement resulting therefrom, with interest on the unamortized balance at ten percent per annum.

2.6 “Commencement Date” means the later of: (i) July 1, 2005 or (ii) the date when the Leasehold Improvements have been Substantially Completed or are deemed Substantially Completed.

2.7 “Common Areas” include all areas and facilities outside the Premises, within the exterior boundaries of the Complex, that are provided by Landlord for the general use and convenience of Tenant and of other Complex tenants and their authorized representatives and invitees. Common Areas include corridors, stairways, elevator shafts, janitor rooms, driveways, parking areas, and landscaped areas, all as generally described or shown on Exhibit B attached hereto. Common Areas also include systems within the Premises and Complex that also serve other tenants such as plumbing, fire sprinkler or non-exclusive HVAC. Exhibit B is tentative, and Landlord reserves the right to make additions, changes and alterations to it from time to time. Regardless of the foregoing, Landlord may not unilaterally modify the Common Areas or any other area inside the Premises in any way that materially and adversely affects Tenant’s operation of its business upon the Premises for any period of time in excess of 60 days.

2.8 “Complex” is that parcel of real property of which the Premises forms a part, together with the parcels in common ownership therewith, and contiguous thereto, which property is described with particularity in Exhibit A attached hereto and made a part hereof by reference. Landlord may remove any lot and building or buildings thereon from the Complex at its sole discretion.

2.9 “Electrical Costs” mean: (a) charges paid by Landlord for electricity; (b) costs incurred in connection with an energy management program for the Property; and (c) if and to the extent permitted by Law, a fee for the services provided by Landlord in connection with the selection of utility companies and the negotiation and administration of contracts for electricity, provided that such fee shall not exceed 50% of any savings obtained by Landlord. Electrical Costs shall be adjusted as follows: (i) amounts received by Landlord as reimbursement from tenants for above standard electrical consumption shall be deducted from Electrical Costs; (ii) the cost of electricity incurred to provide overtime HVAC to specific tenants (as reasonably estimated by Landlord) shall be deducted from Electrical Costs; and (iii) if any tenants of the Complex, including Tenant, are billed directly by a utility company for the cost of electricity to their premises as a separate charge, the cost of electricity to such tenant spaces in the Complex shall be deducted from Electrical Costs.

2.10 “Environmental Laws” mean any federal, State, local or administrative agency ordinance, law, rule or regulation, order or requirement relating to Hazardous Materials, radioactive materials, medical wastes, or which deal with air or water quality, air emissions, soil or ground conditions or other environmental matters of any kind.

2.11 “Hazardous Materials” mean any substance, chemical, waste or material which is now or hereafter listed, defined or otherwise identified as “hazardous” or “toxic” under any of the Environmental Laws, including formaldehyde, urea, polychlorinated biphenyls, petroleum, petroleum products, crude oil, natural gas, radioactive materials, radon, asbestos, or any by-product of same.

2.12 “Landlord Parties” means Landlord’s directors, officers, members, employees, shareholders, contractors, property managers, agents, Lenders, and other lien holders, but excluding other tenants in the Complex.

| /s/ SS |

/s/ EF | |||

| Landlord’s Initials | Tenant’s Initials | |||

| 3 |

2.13 “Laws and Regulations” mean all municipal ordinances and state and federal statutes, laws and regulations now or hereafter in force, including the Environmental Laws and the Americans with Disabilities Act, 42 U.S.C. §§ 12101-12213 as well as any requirements of municipal, state, federal, or quasi-governmental authorities or utility providers now in force, or which may hereafter be in force, affecting the Complex, the Premises and/or Tenant’s use thereof.

2.14 “Lease Year” means any calendar year, or portion thereof, following the commencement hereof, the whole or any part of which period is included within the Term.

2.15 “Leasehold Improvements” mean the aggregate of the Building Standard Work and the Building nonstandard work done in accordance with the work letter agreement, which agreement is attached hereto as Exhibit C (the “Work Letter”).

2.16 “Lines” mean communications, computer, audio and video, security and electrical (other than electrical wiring terminating at or connected to Building standard electrical outlets), cables, wires, lines, duct work, sensors, switching equipment, control boxes and related improvements at the Complex, Building or the Premises.

2.17 “Losses” mean Claims (defined in Section 12.3), liability, damages (to the extent reasonably foreseeable and proximately caused), penalties, fines, liabilities, losses (including property damage, diminution in value of Landlord’s interest in the Premises, Building or Complex, damages for the loss of use of any space or amenity within the Premises, Building, or Complex, damages arising from any adverse impact on marketing space in the Complex, sums paid in settlement of claims and any costs and expenses associated with injury, illness or death to or of any person), suits, administrative proceedings, costs and fees, including Professional Fees and expenses.

2.18 [Intentionally deleted.]

2.19 “Operating Costs” mean all reasonable costs and expenses incurred by or on behalf of Landlord in each Lease Year in connection with the maintenance, repair, replacement, management or operation of the Complex (including all areas and facilities within the exterior boundaries of the Complex) including: (a) Electrical Costs and the charges for water, gas, steam, sewer, but excluding those charges for which Landlord is otherwise directly reimbursed by tenants; (b) the cost of periodic relamping and reballasting of lighting fixtures; (c) the total charges of any independent contractors employed in the repair, care, operation, maintenance, and cleaning of the Complex; (d) the amount paid or payable for all supplies occasioned by everyday wear and tear; (e) the costs of climate control, window and exterior wall cleaning for buildings in the Complex; (f) costs of maintenance, repair and replacement of all improvements and structures in the Complex, including the Building and the Common Areas (subject to the requirements set forth herein on amortizing Capital Costs); (g) fees for legal, accounting, inspection and consulting services; (h) the cost of operating, repairing, replacing and maintaining elevators and utility and mechanical systems, including Lines; (i) the cost of porters, guards and other protection services, if provided by Landlord; (j) the cost of supplying all services pursuant to Article 7 hereof to the extent not paid directly by individual tenants; (k) property owner’s association dues or assessments imposed upon Landlord by any Restrictions; (1) the cost of property, liability and other insurance for the Complex and any deductibles or self insurance related thereto, including earthquake and flood if Landlord elects to obtain such coverage; (m) Taxes; (n) the Management Fee set forth in Section 1.14; (o) any other costs or fees reasonably related to the use, operation or enjoyment of any part of the Complex; (p) amortized Capital Costs; (q) the repair and replacement, resurfacing and repaving of any paved areas, curbs, gutters or other surfaces or areas within the Complex; and (r) the repair and replacement of any equipment or facilities located in or serving the Complex. Operating Costs shall not include any Excluded Costs as defined in Exhibit E.

2.20 “Premises” means the portion of space in the Complex leased to Tenant hereunder, as depicted on Exhibit B-3.

2.21 “Release” means the generation, discharge, disposal, release, deposit, transport, or storage of Hazardous Materials.

| /s/ SS |

/s/ EF | |||

| Landlord’s Initials | Tenant’s Initials | |||

| 4 |

2.22 “Rent” means Base Rent, Additional Rent, and all other sums required to be paid by Tenant pursuant to the terms of this Lease.

2.23 “Rentable Area” as used in the Lease shall be determined as follows:

(a) Single Tenant Floor. As to each floor of the Building on which the entire space rentable to tenants is leased to one tenant, Rentable Area shall be (i) the entire area bounded by the centerline of exterior walls on such floor, including all areas used for elevator lobbies, corridors, stairways and elevators for the exclusive use of such tenant, restrooms, mechanical rooms, electrical rooms and telephone closets, without deduction for columns and other structural portions of the Building or vertical penetrations that are included for the special use of such tenant, but excluding the area contained within the interior walls of the common Building stairs, fire towers, vertical ducts, common elevator shafts, flues, vents, stacks, pipe shafts, and (ii) the rentable square footage in Section 2.23 (c).

(b) Multi-Tenant Floor. As to each floor of the Building on which space is leased to more than one tenant, Rentable Area attributable to each such premises shall be the total of (i) the entire area included within the premises covered by such lease, being the area bounded by the centerline of any exterior walls, the exterior of all walls separating such premises from any public corridors or other public areas on such floor, and the centerline of all walls separating such premises from other areas leased or to be leased to other tenants on such floors, (ii) a pro rata portion of the area within the elevator lobbies, corridors, restrooms, mechanical rooms, electrical rooms, telephone closets and their enclosing walls situated on such floor and (iii) the rentable square footage in Section 2.23 (c).

(c) Building Load. In any event, Rentable Area shall also include Tenant’s Pro Rata Percent (defined in Exhibit E) of the lobbies of the Building and Tenant’s Pro Rata Percent of the area of the emergency equipment, fire pump equipment, electrical switching gear, telephone equipment and mail delivery facilities serving the Building.

(d) Deemed Square Footage. As of the date of this Lease, the Rentable Area of the Premises and the Rentable Area of the Building are deemed to be the square footages set forth in Sections 1.4 and 1.5, respectively.

2.24 “Restrictions” mean any covenants, conditions, restrictions, easements, Security Instruments, and any other matters or documents of record, including the CC&Rs, and all amendments or modifications thereto affecting the Complex. Landlord agrees not to modify the CC&Rs in any manner that would have a material adverse impact on Tenant’s use of the Premises.

2.25 “Structural” as herein used means any portion of the Premises or Complex which provides bearing support to any other integral member of the Complex such as, by limitation, the roof structure (trusses, joists, beams), posts, load bearing walls, foundations, girders, floor joists, footings, and other load bearing members constructed by Landlord.

2.26 “Substantial Completion” or “Substantially Completed” shall have the meaning provided in Exhibit C hereto. If Landlord is delayed in the Substantial Completion of the Leasehold Improvements as a result of any Tenant Delay, the Leasehold Improvements shall be deemed Substantially Complete on that date Landlord could have reasonably been expected to complete the Leasehold Improvements absent any Tenant Delay.

2.27 “Taxes” mean: (1) all real estate taxes and other assessments on the Building and/or Complex, as well as the real property upon which the Building and Complex are located (hereinafter the “Property”), including assessments for special improvement districts and building improvement districts, taxes and assessments levied in substitution or supplementation in whole or in part of any such taxes and assessments and the Property’s share of any real estate taxes and assessments under any reciprocal easement agreement, common area agreement or similar agreement as to the Property; (2) all personal property taxes for property that is owned by Landlord and used in connection with the operation, maintenance and repair of the Property; (3) if included in the taxes for the Building or Complex, the cost or value of any Leasehold Improvements made in or to the Premises by or for Tenant,

| /s/ SS |

/s/ EF | |||

| Landlord’s Initials | Tenant’s Initials | |||

| 5 |

regardless of whether title to such improvements shall be in Tenant or Landlord; and (4) all costs and fees incurred in connection with seeking reductions in any tax liabilities described in (1), (2) and (3), including any costs incurred by Landlord for compliance, review and appeal of tax liabilities. Taxes do not include any income, gross receipts, business and occupation, capital levy, franchise, capital stock, gift, estate or inheritance tax; provided, however, if after the date of this Lease, any new taxes or assessments are imposed that are based upon rents received from real property, Landlord shall be entitled to include such taxes or assessments as part of Taxes. If an assessment is payable in installments, Taxes for the year shall include the amount of the installment and any interest due and payable during that year. For all other real estate taxes, Taxes for that year shall, at Landlord’s election, include either the amount accrued, assessed or otherwise imposed for the year or the amount due and payable for that year, provided that Landlord’s election shall be applied consistently throughout the Term. If a change in Taxes is obtained for any year of the Term, then Taxes for that year will be retroactively adjusted and Landlord shall provide Tenant with a credit, if any, based on the adjustment.

2.28 “Tenant Delay” shall have the meaning provided in Exhibit C hereto.

2.29 “Tenant Parties” means Tenant’s directors, officers, employees, members, partners, shareholders, invitees, agents, contractors, assigns, subtenants or occupants.

2.30 “Term” means the term of the lease as specified in Section 4.4 hereof.

ARTICLE 3. PREMISES

3.1 Demising Clause. Landlord leases to Tenant and Tenant leases from Landlord the Premises upon the terms and conditions set forth in this Lease. Landlord may change the shape, size, location, number and extent of the improvements to any portion of the Complex, including the Building (but not the interior of the Premises), without the consent of Tenant and without affecting Tenant’s obligations hereunder if such change does not have a material adverse impact on Tenant’s access to or parking for the Premises. Landlord reserves the area beneath and above the Building with the right to install, maintain, use, repair and replace pipes, ducts, Lines, and structural elements leading through the Premises serving other parts of the Complex, so long as such items are concealed by walls, flooring or ceilings and Landlord uses reasonable efforts to minimize their effect on Tenant’s operation of its business in the Premises, which measures shall include, without limitation, scheduling any such work for weekends or nights, whenever reasonably possible, accelerating the work whenever reasonably possible, and daily clean up of the affected portions of the Premises. Such reservation in no way affects the maintenance obligations imposed herein.

3.2 Restrictions. The Parties agree that this Lease is subject and subordinate to the effect of and Tenant will comply with: (a) any Restrictions; (b) zoning and other laws of the city, county and State where the Complex is situated; and (c) general and special taxes not delinquent.

ARTICLE 4. TERM AND POSSESSION

4.1 Commencement Date. The Estimated Commencement Date specified in Section 1.7 (A) is the date the Parties anticipate that the Tenant Improvements will be Substantially Completed. On the date that the Premises are or are deemed to be Substantially Completed, Tenant shall execute a written acknowledgment the Commencement Date in the form of Exhibit D.

4.2 Compliance with Laws; Possession; Landlord Delay. Landlord warrants that the Premises, after completion of Tenant Improvements to be constructed by Landlord within the Premises, shall comply with all Laws and Regulations in effect as of the date of issuance of the building permit for the Tenant Improvements. Landlord shall promptly correct, at Landlord’s sole cost and expense, any violations of Laws and Regulations in breach of the foregoing warranty and in no event shall Tenant shall any liability in connection with any breach of the foregoing warranty. Other than the foregoing warranty, the Premises are accepted by Tenant in “AS IS” condition and configuration without any representations or warranties by Landlord. By signing Exhibit D Tenant agrees that the Premises are in such condition are in good and sanitary order, condition and repair. Except as

| /s/ SS |

/s/ EF | |||

| Landlord’s Initials | Tenant’s Initials | |||

| 6 |

otherwise provided in Paragraph J of Xxxxxxxx Xx. 0, Xxxxxxxx is not liable for any loss or damage of Tenant if Landlord cannot deliver possession of the Premises on the Estimated Commencement Date, as extended for Force Majeure Delay (defined in Exhibit C, Section 3). If Substantial Completion of the Tenant Improvements does not occur within six months after the Estimated Commencement Date (as extended for Force Majeure Delay) due to a cause other than a Tenant Delay (defined in Exhibit C, Section 3), Tenant shall have the right to cancel this Lease upon Notice to Landlord given within ten days after the expiration of the six-month period. The parties acknowledge that it of critical importance to Tenant that the Premises are ready for occupancy on or before the Estimated Commencement Date, and accordingly, both parties shall use diligent, good faith and reasonable efforts to abide by the project schedule attached as Schedule B to Exhibit C, which project schedule provides for a target substantial completion date for the Tenant Improvements of April 30, 2005.

4.3 Tenant Delay. If Landlord cannot deliver possession of the Premises on the Estimated Commencement Date because of a Tenant Delay, the Commencement Date will be the date the Tenant Improvements would have been Substantially Completed but for the Tenant Delay. In no event shall a Tenant Delay excuse Tenant’s performance hereunder.

4.4 Term. The Term of this Lease shall start on the Commencement Date and shall be for the term specified in Section 1.7 (B) hereof, plus any partial month at the commencement of the Tenn.

4.5 Pre-Term Possession. If Landlord is to construct or remodel the Premises, Landlord may notify Tenant when the Premises are ready for Tenant’s fixture installation or Tenant’s work. Tenant shall be granted access to the Premises as soon as reasonably possible (subject to not interfering with Landlord’s construction of the Tenant Improvements) and in any event at least fifteen (15) days prior to the Commencement Date for the purpose of installing Tenant’s furniture, fixtures and equipment. Tenant may then enter the Premises at its own risk to make such improvements, to install fixtures, supplies, inventory and other property. Tenant will not interfere with the progress of Landlord’s work by such entry. Should Landlord determine such entry interferes with its work, Landlord may demand that Tenant vacate the Premises until Landlord’s work is complete. Tenant shall promptly comply with this demand. During any pre-term possession all terms and conditions of the Lease shall apply, including Tenant indemnities under the Lease and Tenant’s payment of utilities, but excluding the payment of other Rent; provided, however, if Tenants opens for business in the Premises prior to the Commencement Date, Tenant shall pay Rent in the amount specified in Section 1.8(A).

4.6 Closures. Landlord has the right, but not the obligation, in its sole and absolute discretion to temporarily close the Building or access to portions thereof, including any Common Area and the Premises, if there is any act or threat of any act of terrorism, war, violence, vandalism, civil unrest, riot or other event that may pose a threat to the public safety or damage to the Building, including any advisory warning or notice from the Office of Homeland Security or any other federal, state or local governmental or enforcement agency (herein referred to as an event of “Civil Unrest”). Tenant agrees to comply with any notice from Landlord or any governmental agency to close the Building or portions thereof and to immediately cause all of its employees, agents, contractors and invitees to vacate the Building. Landlord will not be responsible for any loss or damage to Tenant’s business as a result, and Tenant will not be entitled to any abatement in rent or other relief of its obligations under this Lease for any period of time when Tenant may not have access to the Premises or Building due to any Civil Unrest.

ARTICLE 5. RENT

5.1 Payment. As consideration for this Lease, Tenant shall pay Landlord all Rent specified in this Lease. Base Rent is payable in advance on the first day of each month of the Term at the Rent Payment Address or such other address specified by Landlord. Additional Rent or sums other than Rent requested by Landlord under the terms of this Lease are payable within ten days of Notice or demand unless a different time period is expressly specified in the Lease. If the Term commences on other than the first day of the month, the Rent for the first partial month shall be prorated accordingly.

| /s/ SS |

/s/ EF | |||

| Landlord’s Initials | Tenant’s Initials | |||

| 7 |

5.2 No Set Off. All Rent due under this Lease shall be paid without prior notice, demand, deduction, setoff, offset, counterclaim, suspension or abatement except as expressly provided in Articles 13 and 19.

5.3 Advance Rent. The sum specified in Section 1.8 (B) is paid to Landlord upon execution of this Lease as advance Rent; provided, however, that Landlord shall hold such amount as a Security Deposit pursuant to the Lease until Landlord applies it to the Base Rent.

5.4 Late Charges; Interest. Tenant acknowledges that late payment of Rent or other sums due under the Lease will cause Landlord to incur costs not contemplated by this Lease, the exact amount being extremely difficult and impractical to fix. Such costs include processing and accounting charges, late charges that may be imposed on Landlord by the terms of any encumbrance covering the Premises, and interest costs. If Landlord does not receive Rent or any other payment due from Tenant on the due date, Tenant shall pay to Landlord an additional sum of five percent of such Rent or other payment as a late charge. The Parties agree that this late charge represents a fair and reasonable estimate of the cost Landlord will incur by reason of Tenant’s late payment. Accepting any late charge does not waive Tenant’s default with respect to the overdue amount or prevent Landlord from exercising any other rights or remedies available to Landlord. In addition to the late charge, Tenant shall pay interest at the rate of 10 percent per annum on any Rent or other sum not paid within 30 days of the date due.

ARTICLE 6. SECURITY DEPOSIT

Tenant shall deliver to Landlord the Security Deposit within five business days following execution of the Lease. As provided in Paragraph E of Addendum No 1, the Security Deposit shall initially be in the form of a letter of credit. The Security Deposit will be held pursuant to this Section. The Security Deposit, if or when in the form of cash, is Landlord’s separate property and Landlord is not required to keep it separate from its general accounts or pay interest for its use. The Security Deposit is not an advance or other payment of Rent (except as set forth in Section 5.3 or when applied to Rent by Landlord) or a measure of damages. If Tenant fails to pay Rent or otherwise defaults with respect to any provision of this Lease, Landlord may apply such portion of the Security Deposit as it reasonably deems necessary to satisfy past due Rent or otherwise cure the default. If Landlord elects to so apply all or any portion of the Security Deposit, Tenant shall pay to Landlord an amount equal to that portion of the Security Deposit applied by Landlord ten days after written demand; Tenant’s failure to so do is a material breach of this Lease. Landlord shall return the unapplied portion of the Security Deposit to Tenant within 30 days after the later of (i) receipt of the final Rent due from Tenant or (ii) the date that Tenant has surrendered the Premises to Landlord in compliance with the provisions of Article 24.

ARTICLE 7. SERVICE AND EQUIPMENT

7.1 Climate Control. Landlord shall provide climate control to the Premises from 7:00 a.m. to 6:00 p.m. on weekdays and from 9:00 a.m. to 1:00 p.m. on Saturdays (Sundays and holidays excepted) (the “Climate Control Hours”) to maintain a temperature adequate for comfortable occupancy, provided that Landlord shall have no responsibility or liability for failure to supply climate control service when making repairs, alterations or improvements or when prevented from so doing by strikes or any cause beyond Landlord’s reasonable control, so long as Landlord uses reasonable and diligent efforts to restore service and minimize any interruptions after receiving notice of any failure or interruption of service from Tenant. Any climate control furnished for periods not within the Climate Control Hours pursuant to Tenant’s request shall be at Tenant’s sole cost and expense in accordance with rate schedules promulgated by Landlord from time to time, which rate schedules shall not include any markup for Landlord. As of the date of mutual execution of this Lease, the rate for after hours service is $30 per hour. Tenant acknowledges that Landlord has installed in the Building a system for the purpose of climate control. Any use of the Premises not in accordance with the design standards or any arrangement of partitioning which interferes with the normal operation of such system may require changes or alterations in the system or ducts through which the climate control system operates. Any changes or alterations so occasioned, if such changes can be accommodated by Landlord’s equipment, shall be made by Tenant at its cost and expense but only with the written consent of Landlord first had and obtained, and in accordance with drawings and specifications

| /s/ SS |

/s/ EF | |||

| Landlord’s Initials | Tenant’s Initials | |||

| 8 |

and by a contractor first approved in writing by Landlord. If installation of partitions, equipment or fixtures by Tenant necessitates the re-balancing of the climate control equipment in the Premises, Landlord will perform the re-balancing at Tenant’s expense. Tenant acknowledges that up to one year may be required after Tenant has fully occupied the Premises in order to adjust and balance the climate control systems. Any charges to be paid by Tenant hereunder shall be due within ten days of receipt of an invoice from Landlord, which invoice may precede Landlord’s expenditure for the benefit of Tenant.

7.2 Elevator Service. Landlord shall provide elevator service (which may be with or without operator at Landlord’s option) provided that Tenant, its employees, and all other persons using such services shall do so at their own risk. Usage after normal business hours may require a card or other form of identification for access to the elevator.

7.3 Cleaning Public Areas. Landlord will maintain and keep clean the street level lobbies, sidewalks, truck dock, public corridors and other public portions of the Building.

7.4 Refuse Disposal. Tenant shall pay Landlord as Additional Rent the cost of any removal from the Premises and the Building of such refuse and rubbish of Tenant that is disproportionate in quantity or unusual in nature to what is being generated by other tenants in the Building.

7.5 Janitorial Service. Landlord shall provide cleaning and janitorial service in and about the Complex and Premises after hours Sunday through Thursday (holidays excepted) in accordance with standards in Class “A” office buildings in the city in which the Building is located. To the extent that Tenant shall require special or more frequent cleaning and/or janitorial service (hereinafter referred to as “Special Cleaning Service”) Landlord may, upon reasonable advance notice from Tenant, elect to furnish such Special Cleaning Service and Tenant agrees to pay Landlord’s cost for providing such additional service as Additional Rent.

Special Cleaning Service shall include the following:

(a) The cleaning and maintenance of Tenant eating facilities, including the removal of refuse and garbage therefrom.

(b) The cleaning and maintenance of Tenant computer centers, including peripheral areas, and removal of waste paper therefrom.

(c) The cleaning and maintenance of special equipment areas, kitchen areas, private toilets and locker rooms, medical centers and large scale duplicating rooms.

(d) The cleaning and maintenance in areas of special security such as storage units.

(e) The provision of consumable supplies for private toilet rooms located inside the Premises.

7.6 Interruptions. Landlord does not warrant that any of the services referred to above or any other services and/or utilities that Landlord may supply or which are supplied will be free from interruption and/or the need for maintenance and repairs or replacement. Landlord shall not be responsible or liable for any interruption or failure in utility, telecommunication or other services, including the Lines, so long as Landlord uses reasonable and diligent efforts to restore service and minimize any interruptions after receiving notice of any failure or interruption of service from Tenant, nor shall such interruption or failure affect the continuation or validity of this Lease. Tenant acknowledges that any one or more such services may be suspended or reduced by reason of unavoidable emergency repairs, by strikes or accidents, by any cause beyond the reasonable control of Landlord, or by orders or regulations of any federal, state, county or municipal authority. In addition, Landlord shall have no liability for damages arising from, and Landlord does not warrant that Tenant’s use of any Lines will be free from, (a) any eavesdropping or wire-tapping by unauthorized parties, (b) any failure of any Lines to satisfy Tenant’s requirements, or (c) any shortages, failures, variations, interruptions, disconnections, loss or damage caused by installation, maintenance, replacement, use or removal of Lines by or for other occupants of the Complex, by any failure of the environmental conditions or the power supply for the Building to conform to any requirements for the Lines or any associated equipment or any other problems associated with any Lines by any other cause. Landlord

| /s/ SS |

/s/ EF | |||

| Landlord’s Initials | Tenant’s Initials | |||

| 9 |

shall use reasonable, diligent and good faith efforts to minimize the impact and duration of any shortages, failures, variations, interruptions, disconnections. Any such interruption or suspension of services shall not be deemed an eviction or disturbance of Tenant’s use and possession of the Premises or any part thereof, nor render Landlord liable to Tenant for damages by abatement of Rent, nor relieve Tenant of performance of Tenant’s obligations under this Lease.

ARTICLE 8. ASSIGNMENT AND SUBLETTING

8.1 Restriction on Transfer. Except as expressly provided in Article 8, Tenant will not, either voluntarily or by operation of law, assign, mortgage, hypothecate, encumber or otherwise transfer this Lease or any interest herein or sublet or license the Premises or any part thereof, or permit the use or occupancy of the Premises by any party other than Tenant (each a “Transfer”), without the prior written consent of Landlord, which Landlord agrees it shall not unreasonably withhold. For purposes of this Article, if Tenant is a corporation, limited liability company, partnership or other entity any transfer, assignment, encumbrance or hypothecation of fifty percent or more (individually or in the aggregate) of any stock or other ownership or beneficial interest in such entity, if made for the purpose of circumventing the restrictions on Transfer contained in this Article 8, will be deemed a Transfer and will be subject to all of the restrictions and provisions contained in this Article. The immediately preceding sentence will not apply to public corporations, the stock of which is traded through a public exchange.

8.2 Transfer Notice. If Tenant desires to effect a Transfer, at least 30 days prior to the date when Tenant desires the Transfer to be effective (the “Transfer Date”), Tenant will give Notice (the “Transfer Notice”), stating the name, address and business of the proposed assignee, subtenant or other transferee (the “Transferee”) and a description of the Premises, or portion thereof, to be Transferred (the “Transfer Premises”). The Notice must contain information in such detail as Landlord may reasonably require concerning the character, ownership, and financial condition of Transferee (including references, financial statements), the Transfer Date, and a description of the relationship between Tenant and Transferee.

8.3 Landlord’s Options. Within 15 days of receipt of a Transfer Notice and all financial information, Landlord will notify Tenant of its election to do one of the following: (i) consent to the proposed Transfer subject to such reasonable conditions as Landlord may impose in providing such consent (which shall not entail changes to the rights or the obligations of either party under the Lease); (ii) refuse such consent, which refusal shall be on reasonable grounds; or (iii) terminate this Lease as to the portion of the Premises which is proposed to be sublet or assigned and recapture that portion of the Premises for reletting by Landlord.

8.4 Additional Conditions. A condition precedent to any Transfer will be the delivery to Landlord of evidence of insurance as required under the Lease and the correct legal name and notice address for the Transferee. Except in the case of a Permitted Transfer, as defined in Section 8.6 below, Tenant undertaking the transfer (“Transferor”) agrees to pay Landlord, as Additional Rent, 50 percent of all sums and other consideration payable to and for the benefit of Tenant by the Transferee in excess of the Rent payable under the Lease for the same period and portion of the Premises. In calculating excess Rent or other consideration which may be payable to Landlord under this paragraph, Tenant will be entitled to deduct a monthly amortization of commercially reasonable third party brokerage commissions and attorney’s fees and other amounts reasonably and actually expended by Tenant in connection with the Transfer if acceptable written evidence of such expenditures is provided to Landlord. No Transfer will release Transferor (or any prior Transferor) of Tenant’s obligations under this Lease or alter the primary liability of Transferor (or any prior Transferor) to perform all obligations to be performed by Tenant hereunder. Landlord may require that Transferee remit directly to Landlord on a monthly basis, all monies due Transferor by said Transferee. Consent by Landlord to one Transfer will not be deemed consent to any subsequent Transfer. In the event of default by Transferee, Tenant or any successor of Tenant in the performance of any other terms hereof, Landlord may proceed directly against Transferor without the necessity of exhausting remedies against Transferee or successor. If Tenant requests the consent of Landlord to a Transfer, Tenant will pay Landlord a review fee of $500.00, which shall include all Landlord’s attorney’s fees.

8.5 Recapture. By Notice to Tenant (the “Termination Notice”) within thirty days after Landlord receives the information specified in Section 6.2, Landlord may terminate this Lease in the event of a Transfer of

| /s/ SS |

/s/ EF | |||

| Landlord’s Initials | Tenant’s Initials | |||

| 10 |

the Lease as to the entire Premises, or terminate this Lease as to the portion of the Premises to be transferred, if the Transfer is for less than the entire Premises. If Landlord elects to terminate this Lease as to the Transfer Premises, an amendment to this Lease shall be executed restating the description of the Premises and reducing Tenant’s obligations for Rent and other charges in proportion to the reduction in rentable area of the Premises. In such event, unless the parties otherwise agree, the date, on which the termination shall take effect, shall be the date of the proposed transfer identified in Tenant’s notice. If Landlord elects a whole or partial termination hereunder, Landlord may enter into a new lease with the intended Transferee or any other person covering the Transfer Premises on such terms as Landlord and such person may agree. In such event, Tenant shall not be entitled to any portion of the profit that Landlord may realize on account of such termination and reletting. Upon the termination of this Lease, the Parties shall have no further obligations to each other under this Lease except for matters occurring or obligations arising prior to the date of such termination. This Section 8.5 shall not apply to Permitted Transfers, as defined in Section 8.6 below.

8.6 Permitted Transfers. Notwithstanding anything herein to the contrary, Tenant may, without Landlord’s prior consent, assign this Lease or sublet all or a portion of the Premises to: (i) a subsidiary, parent, affiliate, division, or corporation controlled or under common control of Tenant, (ii) a successor corporation related to Tenant by merger, consolidation, non bankruptcy reorganization, or governmental action, or (iii) a purchaser of substantially all of the Tenant’s assets (each a “Permitted Transfer”); provided, (1) The financial strength of the proposed Transferee is comparable to or better than that of Tenant, measured as of the date of mutual execution of this Lease; (2) Tenant shall provide advance written notice of the Permitted Transfer to Landlord; and (3) shall within 10 days after the Permitted Transfer deliver a document reasonably satisfactory to Landlord that (a) evidences such Permitted Transfer, (b) provides the legal name and address of the transferee and (c) confirms the transferee’s assumption of all obligations of Tenant under this Lease. For the purpose of this Lease, the sale, transfer, issuance, or resale of Tenant’s capital stock of any class shall not be deemed a Transfer, nor require Landlord’s consent. Tenant shall remain liable under this Lease following any Permitted Transfer.

ARTICLE 9. PROPERTY INSURANCE

9.1 Landlord’s Insurance. Landlord (i) shall maintain (a) Real Property — Special Form (All Risk) or comparable insurance covering the full replacement cost of the Building and 12 months rental income and (b) Commercial General Liability insurance in amounts not less than that required of Tenant, and (ii) may maintain earthquake, pollution legal liability, terrorism, boiler and machinery, and any other insurance as is commonly maintained by intuitional owners of commercial real estate or that is required by Lender (collectively “Landlord Insurance”). Such insurance shall be issued in the names of Landlord and Lender, as their interests appear, shall be for the sole benefit of such parties and under their sole control, and shall provide for waiver of subrogation consistent with Section 12.2 of this Lease.

9.2 Use of Premises. No use shall be made or permitted to be made on the Premises, nor acts done, by Tenant or any of its invitees, contractors or agents which will increase the existing rate of insurance upon the Building in which the Premises are located or upon any other building or improvement in the Complex or cause the cancellation of any Landlord Insurance. Tenant or Tenant Parties shall not sell, or permit to be kept, used or sold, in or about the Premises, any article that may be prohibited by Landlord Insurance. At its sole cost and expense, Tenant shall comply with all requirements of any insurance company, necessary to maintain property damage and commercial general liability insurance covering the Premises, Building, or Complex.

9.3 Increase in Premiums. Tenant agrees to pay to Landlord, as Additional Rent and not as part of Operating Costs, any increase in premiums on policies which may be carried by Landlord on the Premises, the Building or the Complex, or any blanket policies which include the Building or Complex, covering damage thereto and loss of Rent caused by fire and other perils resulting from the nature of Tenant’s occupancy or any act or omission of Tenant. These payments are in addition to any insurance payments under Exhibit E.

| /s/ SS |

/s/ EF | |||

| Landlord’s Initials | Tenant’s Initials | |||

| 11 |

ARTICLE 10. TENANT’S INSURANCE

At its expense, Tenant shall obtain and keep in force during the Term, and provide coverage after expiration of the Term for events occurring during the Term, insurance as set forth below against claims for injuries to persons or damages to property arising from or in connection with Tenant’s operation and use of the Premises. If Tenant fails to obtain any insurance required of it under this Lease, Landlord may, at its option, but is not obligated to, obtain such insurance on behalf of Tenant and xxxx the cost to Tenant, as Additional Rent.

(a) Commercial Property policy with Special Form causes of loss covering: (i) business personal property, leasehold improvements on a replacement cost basis, subject to a deductible no greater than $5,000; (ii) one year’s business income and extra expense from Tenant’s operations on the Premises; which policy shall include waiver of subrogation rights of insurer against Landlord consistent with Section 12.2.

(b) Commercial General Liability policy for bodily injury, personal injury and property damage with limits of not less than $1,000,000 per occurrence and $2,000,000 annual aggregates on a per location basis. Endorsements satisfying the following requirements shall be affixed: (i) Landlord, Lender and, if specifically designated by Landlord in writing, Landlord’s affiliates and Landlord’s property manager, shall be named as additional insureds; (ii) Tenant’s policy shall be primary, not contributing with, and not in excess of any other applicable insurance carried by Landlord; (iii) Tenant’s policy shall extend to and include injuries to persons and damage to property arising in connection with any alterations or improvements to or about the Premises performed by or on behalf of Tenant; and (iv) Tenant’s policy shall include contractual liability coverage.

(c) Business Auto Liability covering all owned, non-owned and hired vehicles with a limit of $1,000,000 per accident.

(d) Workers’ Compensation on a statutory basis.

(e) Umbrella Liability with a $3,000,000 per occurrence/annual aggregate limit.

ARTICLE 11. INSURANCE POLICY REQUIREMENTS

All insurance policies to be carried by Tenant hereunder shall conform to the following requirements:

(a) The insurer in each case shall carry a designation in “Best’s Insurance Reports” as issued from time to time throughout the Term as follows: Policyholders’ rating of A-; financial rating of not less than VII;

(b) The insurer shall be qualified to do business in the State;

(c) Certificates of insurance shall be delivered to Landlord at commencement of the term and certificates of renewal at least 30 days prior to the expiration of each policy; and

(d) Each policy shall require that the insurer notify Landlord in writing at least 30 days prior to any cancellation or expiration of such policy, or any reduction in the amounts of insurance carried.

ARTICLE 12. INDEMNIFICATION, WAIVER OF CLAIMS AND SUBROGATION

12.1 Intent and Purpose. The Parties intend that the indemnity and waiver of claims provisions of this Lease assigns the risk for a particular casualty to the party obligated to carry the insurance for such risk (which is not a limitation of the assignment of the risk), without respect to the causation (other than due to the intentional and wrongful acts of a party), but including the Parties’ negligence.

12.2 Waiver of Subrogation. The Parties release each other from any claims for damage to the Premises, Building and Complex, and to the furniture, fixtures, and other business personal property, Tenant’s

| /s/ SS |

/s/ EF | |||

| Landlord’s Initials | Tenant’s Initials | |||

| 12 |

improvements and alterations of either Landlord or Tenant, in or on the Premises, Building and Complex, and for loss of income, to the extent such damages or loss are actually covered and proceeds are actually paid by insurance policies maintained by the Parties or that would have been covered by insurance policies required of the Parties under this Lease.

12.3 Indemnity.

12.3.1 Tenant’s Indemnity. Except to the extent caused by Landlord’s negligence or willful acts and subject to the waiver of subrogation set forth in Section 12.2, Tenant shall indemnify, defend, protect and hold harmless Landlord from and against all actions, claims, demands, damages, liabilities, Losses, penalties, or expenses of any kind (“Claims”) brought or imposed upon Landlord or which Landlord may pay or incur by reason of injury to person or property, from whatever cause including the negligence of the Parties hereto, in any way connected with (a) the use of the Premises or Alterations, improvements or personal property therein or thereon, by Tenant or Tenant Parties; (b) any violation or alleged violation by Tenant or any Tenant Parties of any Laws and Regulations; (c) any liability under any Laws and Regulations by Tenant or any Tenant Parties; (d) any breach of the provisions of Article 16 by Tenant or any Tenant Parties; or (e) any Release of Hazardous Materials on the Premises, Building or Complex by Tenant or Tenant Parties. Tenant shall also reimburse Landlord costs of cleanup, remediation, removal and restoration that are in any way related to any matter covered by the foregoing indemnity; provided, however, in the event a Claim was caused by the concurrent negligence of Landlord or Landlord Parties, Tenant’s indemnification obligation with respect to Landlord shall be limited to the extent of the negligence of Tenant and Tenant Parties, and provided further that in no event shall Tenant be obligated to indemnify Landlord for a Claim which arises out of or results from the sole negligence of Landlord or a Landlord Party. For the sole purpose of giving full force and effect to the indemnification obligations under this Agreement and not for the benefit of any employees of Tenant or any third parties unrelated to the parties indemnified under this Agreement, Tenant specifically and expressly waives any immunity that may be granted under the Washington State Industrial Insurance Act, Title 51 RCW. (TENANT’S INITIALS /s/ EF ). Further the indemnification obligations under this Agreement shall not be limited in any way by any limitation on the amount or type of damages, compensation or benefits payable to or for any third party under Worker Compensation Acts, Disability Benefit Acts or other employee benefit acts. Tenant’s obligations under this Section survive the expiration or termination of the Lease.

12.3.2 Landlord’s Indemnity. Except to the extent cause by Tenant’s negligence or willful acts and subject to the waiver of subrogation set forth in Section 12.2, Landlord shall indemnify, defend, protect and hold harmless Tenant from and against all Claims brought or imposed upon Tenant or which Tenant may pay or incur by reason of injury to person or property, in any way connected with (a) the gross negligence or willful misconduct of Landlord, (b) any violation or alleged violation by Landlord or any Landlord Parties of any Laws and Regulations; (c) any liability under any Laws and Regulations by Landlord or any Landlord Parties; and (d) any Release of Hazardous Materials on the Premises, Building or Complex by Landlord or Landlord Parties. Landlord shall also reimburse Tenant’s costs of cleanup, remediation, removal and restoration that are in any way related to any matter covered by the foregoing indemnity; provided, however, in the event a Claim was caused by the concurrent negligence of Tenant or Tenant Parties, Landlord’s indemnification obligation with respect to Tenant shall be limited to the extent of the negligence of Landlord and Landlord Parties, and provided further that in no event shall Landlord be obligated to indemnify Tenant for a Claim which arises out of or results from the sole negligence of Tenant or a Tenant Party. For the sole purpose of affecting the indemnification obligations under this Agreement and not for the benefit of any employees of Landlord or any third parties unrelated to the parties indemnified under this Agreement, Landlord specifically and expressly waives any immunity that may granted it under the Washington State Industrial Insurance Act, Title 51 RCW. (LANDLORD’S INITIALS /s/ SS ). Further the indemnification obligations under this Agreement shall not be limited in any way by any limitation on the amount or type of damages, compensation or benefits payable to or for any third party under Worker Compensation Acts, Disability Benefit Acts or other employee benefit acts. Landlord’s obligations under this Section survive the expiration or termination of the Lease.

| /s/ SS |

/s/ EF | |||

| Landlord’s Initials | Tenant’s Initials | |||

| 13 |

12.4 Waiver of Claims. Except as arising from the gross negligence or willful misconduct of Landlord, the breach of any express warranties made by Landlord, or as otherwise covered in the indemnity set forth in Section 12.3.2 above, Tenant releases and waives all Claims against Landlord for damages or injury from any cause arising at any time, including the negligence of the Parties, for damages to goods, wares, merchandise and loss of business in, upon or about the Premises or Complex and injury to Tenant, its agents, employees, invitees or third persons, in, upon, or about the Premises or Complex. It is understood and agreed that the release set forth herein extends to all claims of every nature and kind whatsoever, known or unknown, suspected or unsuspected.

12.5 References. Wherever the term Landlord, Tenant or the Parties is used in this Article, and such party is to receive the benefit of a provision of this Article, such term shall also refer also to the Party’s officers, directors, shareholders, employees, partners, agents, mortgagees and other lien holders.

ARTICLE 13. DESTRUCTION

13.1 Rights of Termination. If the Premises suffer an Uninsured Property Loss or a property loss which cannot be repaired within 195 days from the date of destruction, as determined by Landlord, Landlord may terminate this Lease as of the date of the damage (the “Loss Date”) upon Notice to Tenant. If the Premises cannot be repaired within 195 days of the Loss Date, as determined by Landlord and stated in Landlord’s Notice to Tenant, Tenant may elect to terminate this Lease by Notice to Landlord given within 20 days of Landlord’s Notice that the restoration time will exceed 195 days. Landlord’s Notice shall be given within 45 days of the Loss Date or as soon thereafter as the restoration time can be determined. “Uninsured Property Loss” is any damage or destruction for which the insurance proceeds available to Landlord are insufficient to pay for the repair or reconstruction of the Premises.

13.2 Repairs. In the event of a casualty that may be repaired within 195 days from the Loss Date, or if the Parties do not elect to terminate this Lease under Section 13.1, this Lease shall continue in full force and effect and Landlord shall promptly undertake to make repairs to reconstitute the Premises to as near as practicable to the condition as existed prior to the Loss Date. The partial destruction shall in no way void this Lease except, to the extent of Landlord’s recovery under its rent abatement insurance for the Premises, Tenant shall be entitled to a proportionate reduction of Base Rent and any Additional Rent following the property loss until the time the Premises are restored. The reduction amount will reflect the degree of interference with Tenant’s business. As long as Tenant conducts business in the Premises, there shall be no abatement until the Parties agree on the amount thereof. If the Parties cannot agree within 45 days of the Loss Date, the matter shall be submitted to arbitration under the rules of the American Arbitration Association. Upon the resolution of the dispute, the settlement shall be retroactive and Landlord shall within ten days thereafter refund to Tenant any sums due in respect of the reduced Rent from the date of the property loss. Landlord’s obligations to restore shall in no way include any construction originally performed by Tenant or subsequently undertaken by Tenant, but shall include solely that property constructed by Landlord prior to commencement of the Term.

13.3 Repair Costs. The cost of any repairs to be made by Landlord pursuant to Section 13.2 shall be paid by Landlord using available insurance proceeds.

13.4 Waiver. Tenant hereby waives all statutory or common law rights of termination in respect to any partial destruction or property loss which Landlord is obligated to repair or may elect to repair under the terms of this Article. Further, in event of a property loss occurring during the last two years of the original term hereof or of any extension, Landlord need not undertake any repairs and may cancel this Lease unless Tenant has the right under the terms of this Lease to extend the term for an additional period of at least five years and does so within 30 days of the date of the property loss.

13.5 Landlord’s Election. If the Complex or Building is destroyed by more than 35 percent of the replacement cost, Landlord may elect to terminate this Lease, whether the Premises are damaged or not, as set forth in Section 13.1. A total destruction of the Complex terminates this Lease.

| /s/ SS |

/s/ EF | |||

| Landlord’s Initials | Tenant’s Initials | |||

| 14 |

ARTICLE 14. ACCORD AND SATISFACTION

No payment by Tenant or receipt by Landlord of less than the full Rent due hereunder shall be deemed to be other than on account of the earliest due Rent. No endorsement or statement on any check or any letter accompanying any check or payment will be deemed an accord and satisfaction and Landlord may accept such payment without prejudice to Landlord’s right to recover the balance of such Rent or pursue any other remedy available in this Lease, at law or in equity. Landlord may accept partial payment from Tenant without invalidation of any contractual notice required to be given herein and without invalidation of any notice required to be given by law.

ARTICLE 15. USE

The Premises may be used and occupied only for the Permitted Use and for no other use. Tenant shall not use or permit the use of the Premises in any manner that will disturb any other tenant in the Building or Complex, or obstruct or interfere with the rights of other tenant or occupants of the Building or Complex, or injure or annoy them or create any unreasonable smells, noise or vibrations (taking into account the nature and tenant-mix of the Building). Tenant shall not allow the Premises to be used for any unlawful or objectionable purpose, nor shall Tenant cause, maintain, or permit any nuisance or waste in, on or about the Premises, Building or Complex. Tenant shall comply with all statutes, codes, ordinances, orders, rules and regulations of any municipal or governmental entity including the Americans with Disabilities Act (“Laws”), regarding the operation of Tenant’s business and the use, condition, configuration and occupancy of the Premises. Tenant shall comply with the rules and regulations of the Building attached as Exhibit F (the “Rules and Regulations”) and such other reasonable rules and regulations adopted by Landlord from time to time. Landlord represents and warrants to Tenant that, to Landlord’s actual knowledge as of the date of mutual execution of this Lease, neither Laws and Regulations nor the CC&Rs prohibit use of the Premises for general office use.

ARTICLE 16. COMPLIANCE WITH LAWS AND REGULATIONS

16.1 Tenant’s Obligations. Except as otherwise provided in Section 4.2, at its sole cost and expense, Tenant shall comply with and faithfully observe in the use or occupancy of the Premises the Laws and Regulations. Tenant’s obligation to comply with and observe the Laws and Regulations shall apply regardless of whether such Laws and Regulations regulate or relate to Tenant’s particular use of the Premises or relate to the use of premises in general, and regardless of the cost thereof. A judgment of any court of competent jurisdiction, or the admission of Tenant in any action or proceeding against Tenant, whether Landlord be a party thereto or not, that any Laws and Regulations pertaining to the Premises have been violated, is conclusive of that fact as between Landlord and Tenant.

16.2 Condition of Premises. Subject to the express warranties made by Landlord elsewhere herein, and subject to performance of Landlord’s work, if any, as stated in Exhibit C, Tenant hereby accepts the Premises in “AS IS” condition as of the date of occupancy, subject to all applicable Laws and Regulations, Restrictions, and requirements in effect during any part of the Term regulating the Premises, and without other representation, warranty or covenant by Landlord, express or implied, as to the condition, habitability or safety of the Premises, the suitability or fitness thereof for their intended purposes. Tenant acknowledges that the Premises in such condition are in good and sanitary order, condition and repair.

16.3 Hazardous Materials. Tenant shall use and store in the Premises and Complex only ordinary and general office and cleaning supplies containing Hazardous Materials in normal and customary amounts, those Hazardous Materials listed in Exhibit H attached hereto, and such other Hazardous Materials as have been previously approved by Landlord in writing (which approval may be withheld in Landlord’s sole and absolute discretion) and which are reasonably necessary for Tenant’s business. All such Hazardous Materials approved by Landlord shall be limited to quantities consistent with the approved use of the Premises and shall be used, stored and disposed of in full compliance with all Environmental Laws. Tenant shall not suffer or allow the introduction of any contaminating agent that would adversely impact the indoor air quality in the building, and shall at its sole

| /s/ SS |

/s/ EF | |||

| Landlord’s Initials | Tenant’s Initials | |||

| 15 |

cost and expense, provide any venting or any other precautionary measures for the Hazardous Materials stored and used by it in the Premises, as may be required under applicable Laws and Regulations and as is otherwise consistent with standard industry practice.

16.4 Mold. Tenant shall give Landlord Notice of any evidence of Mold, water leaks or water infiltration in the Premises within three business days of their discovery. To the extent that Tenant fails to give such Notice to Landlord on a timely basis or the mold is attributable to the use and occupancy of the Premises by Tenant or any Tenant Parties, then, at its expense, Tenant shall investigate, clean up and remediate any such Mold in the Premises. Investigation, clean up and remediation may be performed only after Tenant has Landlord’s written approval of a plan. If Tenant gives timely Notice of the discovery of Mold and such Mold is not attributable to the use and occupancy of the Premises by Tenant or any Tenant Parties, then at its expense, Landlord shall investigate, clean up and remediate any such Mold in the Premises. All clean up and remediation shall be done in compliance with any applicable Laws and to the reasonable satisfaction of Landlord and Lender.

ARTICLE 17. ALTERATIONS

17.1 Consent of Landlord; Ownership. Tenant shall not make or allow alterations, additions or improvements to the Premises (collectively “Alterations”), including any increasing telecommunication demands or requiring the addition or expansion of Lines dedicated to the Premises without the prior written consent of Landlord. Tenant may not make any Alterations that affect Structural elements. Upon expiration or termination of this Lease, all Alterations shall be removed by Tenant unless: (i) Landlord has approved the Alteration in writing stating that they need not be so removed, or (ii) prior to the end of the Term Landlord, in its sole and subjective discretion, advises Tenant in writing that all or some portion of the Alterations need not be removed and in which cases such Alterations shall become a part of the realty and belong to Landlord. Except as otherwise provided in this Lease, Tenant shall have the right to remove its trade fixtures placed upon the Premises provided that Tenant restores the Premises as indicated below.

17.2 Requirements. Landlord may condition its consent for any Alterations upon Tenant complying at its expense with reasonable conditions and requirements, including preparation of all construction plans, drawings and specifications for approval by Landlord; the use of contractors and subcontractors approved by Landlord; the delivery of performance and payment bonds showing Landlord as a beneficiary; and the delivery to Landlord of duplicate originals of all marked construction drawings. In requesting Landlord’s consent, Tenant may (x) ask Landlord to provide the approval set forth in Section 17.1 (i) and if Landlord does not so approve, in writing, it shall be deemed that Tenant must remove the Alteration unless Landlord later exercises its right under Section 17.1 (ii) or (y) condition Tenant’s willingness to do the Alteration on Landlord’s written agreement that Tenant can remove the Alteration at the end of the Lease Term. Tenant shall obtain all necessary permits for any Alterations as its sole obligation and expense, and strictly comply with the following requirements:

(a) Following approval by Landlord of Alterations, Tenant shall give Landlord at least ten days’ prior Notice of commencement of work in the Premises so that Landlord may post notices of non-responsibility in or upon the Premises as provided by law;

(b) The Alterations must use materials of at least equal quality to Leasehold Improvements at the Commencement Date, and must be performed in compliance with all laws, ordinances, rules and regulation now or hereafter in effect and in a manner such that they will not interfere with the quiet enjoyment of the other tenants in the Complex; and

(c) All costs and expenses incurred by Landlord in altering, repairing or replacing any portion of the Premises, Building or Complex in connection with approving any Alterations shall be paid solely by Tenant to Landlord prior to commencing any Alterations.

17.3 Liens. Tenant will keep the Premises and the Complex free from any liens arising out of any Alterations done by Tenant. If a mechanic’s or other lien is filed against the Premises, Building or Complex through Tenant, Landlord may demand that Tenant furnish a satisfactory lien release bond in such form and

| /s/ SS |

/s/ EF | |||

| Landlord’s Initials | Tenant’s Initials | |||

| 16 |

amount as necessary to accomplish the release of such contested lien claim under RCW 64.04.161. Such bond must be posted ten days after Notice from Landlord. In addition, Landlord may require Tenant to pay Landlord’s attorneys’ fees and costs in participating in any action contesting such lien or the foreclosure thereof, if Landlord elects to do so. Landlord may pay the claim prior to the enforcement thereof, in which event Tenant shall reimburse Landlord in full, including attorneys’ fees, for any such expense, as Additional Rent, with the next due Rent payment.

ARTICLE 18. MAINTENANCE AND REPAIRS

18.1 Landlord’s Obligations. Subject to the other provisions of this Lease imposing obligations in this respect upon Tenant, Landlord shall repair, replace and maintain the external and structural parts of the Complex and are not leased to others, janitor and equipment closets and shafts within the Premises designated by Landlord for use by it in connection with the operation and maintenance of the Complex, and all Common Areas. Landlord shall perform such repairs, replacements and maintenance with reasonable dispatch, in a good and workmanlike manner; but Landlord shall not be liable for any damages, direct, indirect or consequential, or for damages for personal discomfort, illness or inconvenience of Tenant by reason of failure of equipment, Lines, facilities or systems or reasonable delays in the performance of such repairs, replacements and maintenance, unless caused by the gross negligence or deliberate act or omission of Landlord, its servants, agents, or employees or unless Landlord fails to use reasonable and diligent efforts to perform any necessary repairs, replacements and maintenance after receiving Notice of such necessary repairs, replacements and maintenance from Tenant. The cost for such repairs, maintenance and replacement shall be included in Operating Costs in accordance with Section 2.19 hereof.

18.2 Negligence of Tenant. If the Building, the elevators, boilers, engines, pipes or apparatus used for the purpose of climate control of the Building or operating the elevators, or if the water pipes, drainage pipes, electric lighting or other equipment, Lines, systems and/or facilities of the Building or the Complex, or the roof or the outside walls of the Building, fall into a state of disrepair or become damaged or destroyed through the negligence, carelessness or misuse of Tenant, its agents, employees or anyone permitted by it to be in the Complex, or through it in any way, the cost of the necessary repairs, replacements or alterations shall be borne by Tenant who shall pay the same to Landlord as Additional Rent.

18.3 Tenant’s Obligations. Tenant shall repair and maintain the Premises (excluding any structural elements thereof), but including all interior partitions and walls, fixtures, Leasehold Improvements and alterations in the Premises and all electrical and telephone outlets and conduits, fixtures and shelving, and special mechanical and electrical equipment which equipment is not a normal part of the Premises installed by or for Tenant, excepting only reasonable wear and tear and damage which Landlord has an obligation to repair as provided in Sections 13.2 and 18.1. Prior to commencement of any repairs, Tenant shall give Landlord at least ten days’ prior Notice so that Landlord may post notices of non-responsibility in or upon the Premises as provided by law. Tenant must obtain the prior written approval from Landlord for Tenant’s contractor before the commencement of the repair. Landlord may require that Tenant use a specific contractor for repairs that affect the mechanical, heating, air conditioning, or electrical systems. Landlord may enter and view the state of repair and Tenant will repair in a good and workmanlike manner. Notwithstanding the foregoing, Tenant shall not make any repairs to the equipment, Lines, facilities or systems of the Building or Complex which are outside of the Premises or which do not exclusively serve the Premises.

18.4 Cleaning. At the end of each business day Tenant will leave the Premises in a reasonably clean condition for the purpose of the performance of Landlord’s cleaning services. Tenant shall maintain the appearance of the Premises consistent with the character, use and appearance of the Complex.

18.5 Common Areas. Subject to reimbursement as an Operating Cost, Landlord shall maintain the Common Area, establish and enforce reasonable rules and regulations therefor, close any of the Common Areas to whatever extent required in Landlord’s opinion to prevent a dedication of or the accrual of any rights of any person

| /s/ SS |

/s/ EF | |||

| Landlord’s Initials | Tenant’s Initials | |||

| 17 |

or of the public to the Common Areas, close temporarily any of the Common Areas for maintenance purposes, and make changes to the Common Areas including changes in the location of driveways, entrances, exits, vehicular parking spaces, parking area, the designation of areas for the exclusive use of others, the direction of the flow of traffic or construction of additional buildings thereupon, except that Landlord may not modify the Common Areas or any other area inside the Premises in any way that materially and adversely affects Tenant’s operation of its business upon the Premises for any extended period of time. Tenant acknowledges that Landlord is under no obligation to provide security for the Common Areas.

18.6 Waiver. Tenant waives all rights it may have under law or at equity to make repairs or to perform any obligation of Landlord arising under this Lease at Landlord’s expense.

ARTICLE 19. CONDEMNATION

Either party may terminate this Lease if any material part of the Premises is taken or condemned for any public or quasi-public use under Law, by eminent domain or private purchase in lieu thereof (a “Taking”). Landlord shall also have the right to terminate this Lease if there is a Taking of any portion of the Building or Property which would have a material adverse effect on Landlord’s ability to profitably operate the remainder of the Building. The terminating party shall provide written notice of termination to the other party within 45 days after it first receives notice of the Taking. The termination shall be effective on the date the physical taking occurs. All compensation awarded for a Taking, or sale proceeds, shall be the property of Landlord, including any award for the leasehold value. Tenant may seek a separate award for Tenant’s trade fixtures, tangible personal property, tenant improvements and relocation expenses, if specified in the award by the condemning authority and so long as it does not reduce Landlord’s award.

ARTICLE 20. ENTRY BY LANDLORD