SETTLEMENT AGREEMENT

Exhibit 10.13

This Settlement Agreement (the “Agreement”) is made as of the 10th day of February, 2015 (the “Execution Date”), by and among NovoCure Limited, a company incorporated under the Companies (Jersey) Law, 1991, as amended (“Novocure”), NovoCure (Israel) Ltd., a company incorporated under Israeli law and a wholly-owned subsidiary of Novocure (“NC-IL”), the Technion Research and Development Foundation (“TRDF”), and the Technion – Israel Institute of Technology (the “Technion,” and together with TRDF, the “Technion Parties”). Novocure, NC-IL, TRDF and the Technion are each referred to as “Party” and collectively referred to as the “Parties.”

WHEREAS, Professor Yoram Palti, a resident of the State of Israel and a professor emeritus at the Technion (“Dr. Palti”), has assigned to Novocure certain intellectual property rights that Novocure has further developed, for the treatment of tumor with electrical fields, all as described by the patents and patent applications listed in Annex A attached hereto (collectively, the “Technology”); and

WHEREAS, the Parties have agreed to resolve certain potential disputes between the Technion Parties, Novocure and Dr. Palti with respect to the Technology, as provided hereinbelow; and

NOW, THEREFORE, the Parties hereto, intending to be legally bound, hereby agree as follows:

1. Settlement. In consideration for the waiver and release by the Technion Parties contemplated by Section 11 hereof, Novocure shall pay to TRDF certain cash amounts, shall issue to TRDF certain Ordinary Shares, nominal value £ 0.01 (One Xxxxx) per share of Novocure (“Ordinary Shares”) and shall grant TRDF with an option to purchase additional Ordinary Shares, all as provided herein.

2. Cash Payments. Novocure shall pay to TRDF an aggregate amount of US$7,500,000, by wire transfer of immediately available funds to TRDF’s bank account in Israel designated from time to time by TRDF in writing to Novocure, as follows:

2.1 On the Execution Date, the sum of US$1,000,000;

2.2 An additional sum of US$1,000,000, upon the occurrence of the earlier of any one of the following: (a) the date that is eighteen (18) months following the Execution Date; (b) five (5) business days after the consummation of an IPO (as defined below) of Novocure or any of its subsidiaries or Controlled Affiliates (as defined below) (with Novocure and its subsidiaries and Controlled Affiliates being collectively referred to herein as the “Novocure Group”); or (c) the date on which payment is to be made pursuant to Section 2.3 hereof;

2.3 An additional aggregate sum of US$5,500,000, within five (5) business days after the earliest to occur of any one of the following events: (a) the consummation of an M&A Transaction (as defined below) of any members of the Novocure Group; (b) the lapse of 15 days as of the end of the first calendar quarter in which the aggregate Net Sales (as defined below) of the members of

the Novocure Group, since their respective inception, equals US$250,000,000 (two hundred fifty million US Dollars) (the “250 Million Sales Quarter”), if Novocure has not yet consummated an IPO; or (c) the earlier of, the lapse of 45 days as of the end of the first 250 Million Sales Quarter or such time that Novocure’s quarterly financial information is publicly made available, if Novocure has consummated an IPO and is publicly traded.

2.4 If Novocure fails to pay to TRDF any amount that is due pursuant to Sections 2.1 to 2.3 within five (5) business days of receipt of written demand thereof from TRDF, then TRDF shall be entitled to be paid, and Novocure shall pay to TRDF, in addition to the payment of such past due amount, an additional amount equal to such past due amount (such that TRDF shall receive a total amount equal to the product of (a) such past due amount, multiplied by (b) two (2)). The Parties confirm and agree that the liquidated damages provided for in this Section 2.4 represent reasonable and fair compensation for TRDF’s damages anticipated at the date hereof as a result of Novocure’s failure to pay the amounts due under this Section 2, considering, inter alia, the costs of collection and enforcement against Novocure and the waiver granted by TRDF under Section 11.

For purposes of this Agreement, the term “Controlled Affiliate” shall mean, with respect to any Party, any person, organization or entity that is Controlling, Controlled by or under common Control by such Party. “Control” of another person, organization or entity shall mean when a person, organization or entity (i) owns twenty five percent (25%) or more of the outstanding shares of the other organization or entity, (ii) owns twenty five percent (25%) or more of the voting power in the other organization or entity, or (iii) possesses, directly or indirectly the power to elect or appoint twenty five percent (25%) or more of the members of the governing body of the other organization or entity; provided however that the above shall not include shareholders owning twenty five percent (25%) or more of the outstanding shares of Novocure who are financial investors that received such shares in Novocure in consideration for bona fide equity investments and do not have any rights with respect to the Technology or any other technology or products of Novocure or any of its subsidiaries.

For purposes of this Agreement, the “Net Sales” of an entity for any period shall mean such entity’s cash collections (or, in the case of consideration that is not in the form of cash, the fair market value thereof as determined in good faith by Novocure’s board of directors, or as reflected in the books of the applicable entity, the higher of the two) from worldwide gross sales, services, licensing and other transactions (determined on a consolidated basis excluding intra-Novocure Group transactions) during such period (excluding sales or reimbursements in connection with clinical trials), less the following amounts:

(i) cash rebates actually paid to customers in respect of amounts previously collected from such customers for volume purchases, advertising, trade promotion, or other accommodations;

2

(ii) cash refunds actually paid to customers in respect of amounts previously collected from such customers in connection with the rejection, recall or return of previously sold products;

(iii) shipping, freight charges and insurance which are separately identified on the applicable invoice and paid by customers in connection with shipment and delivery; and

(iv) duties and taxes or other governmental charges levied on or measured by the invoiced amount (including without limitation value added tax), which are separately identified on the applicable invoice (or otherwise independently established) and paid by customers.

Novocure shall provide to TRDF a quarterly report, within fifteen (15) days following the end of each calendar quarter (or, following an IPO, such time that Novocure’s quarterly financial information is publicly made available), which quarterly report shall be certified by the chief financial officer of Novocure and shall set forth in reasonable detail the aggregate Net Sales of the Novocure Group, from their respective inception and until the end of that quarter.

3. Equity Issuances. Novocure hereby undertakes that TRDF shall be issued Ordinary Shares and be granted an option to purchase additional Ordinary Shares, in each case in accordance with this Section 3, at a closing (the “Equity Closing”) that shall take place on a date that is no later than thirty (30) days following the Execution Date (as the Parties mutually agree in writing) (the “Equity Closing Date”).

3.1 At the Equity Closing, Novocure shall issue to TRDF 170,000 Ordinary Shares (the “Shares”), and, in connection therewith, Novocure shall cause the delivery to TRDF of a share certificate in the name of TRDF representing TRDF’s ownership of the Shares and a copy of its shareholders register recording TRDF as the owner of the Shares that is certified by its secretary.

3.2 Novocure hereby, effective as of the Equity Closing, grants TRDF the right and option (the “Option”) to acquire, on the terms and subject to the conditions set forth hereinafter, an additional 170,000 Ordinary Shares (the “Underlying Shares”). For purposes of clarification, the grant of the Option shall be effective automatically upon the Equity Closing and the terms and conditions of the Option shall be as set forth hereinbelow.

The Option shall be exercisable by TRDF, in whole or in part, at any time and from time to time after the Equity Closing Date until the earliest to occur of (the “Option Term” and each of the following a “Terminating Event”): (a) 12 months following the closing of the sale of Novocure’s Ordinary Shares to the public in an initial public offering pursuant to a registration statement under the U.S. Securities Act of 1933, as amended, or the securities laws of another jurisdiction (“IPO”); or (b) immediately prior to the consummation of a sale of all or substantially all of the shares of Novocure solely for cash and/or stock that is traded on a recognized public national (e.g., United States or Israeli) securities exchange or on the NASDAQ National Market and provided that TRDF shall not be restricted from publicly re-selling such securities; provided with respect to both (a) and (b), that TRDF received at least fifteen

3

(15) business days’ prior written notice of the anticipated occurrence of such Terminating Event; and provided, further, that TRDF’s exercise of the Option may be conditioned (at TRDF’s sole discretion) upon the consummation of the Terminating Event.

The Option shall be exercised for no additional consideration (i.e. zero exercise price). The Option shall be exercised by providing Novocure with a written notice to such effect (the “Exercise Notice”) stating the number of Underlying Shares for which the exercise is being made (the “Exercised Shares”) and without any payment, whereupon Novocure shall issue to TRDF the Exercised Shares and shall promptly deliver to TRDF a share certificate representing the Exercised Shares and a copy of its shareholders register reflecting such issuance that is certified by its secretary.

TRDF shall be deemed the record owner of the Exercised Shares as of and from the close of business on the date on which the Exercise Notice is given (whether or not recorded by Novocure in its books); and its right to exercise the Option shall automatically be deemed to be exercised in full with respect to all of the Underlying Shares with respect to which the Option has not already been exercised, without any required action by TRDF, immediately prior to the lapse of the Option Term, and accordingly TRDF shall be deemed the record owner of all of the Underlying Shares as of such time, unless TRDF shall have notified Novocure in writing that it does not wish to exercise the Option following Novocure’s prior written notice of at least fifteen (15) business days given to TRDF with respect to the occurrence of any of the Terminating Events.

3.3 The Equity Closing shall not be deemed consummated unless and until all actions, covenants, obligations, agreements, undertakings and conditions contained in this Agreement that are required to be taken, performed and/or complied with by Novocure prior to or at the Equity Closing shall have been taken, performed or complied with in all respects by Novocure prior to or at the Equity Closing.

4. Representations and Warranties as to Equity Issuances. Novocure hereby represents, warrants and undertakes to each of the Technion Parties that: (i) at the Equity Closing, TRDF shall receive the Shares free and clear of all liens, pledges, claims, security interests, charges, encumbrances, attachments, restrictions or any other third party right of any kind or nature whatsoever (other than restrictions on transfer under applicable securities laws, rules and regulations and as provided in the Organizational Documents) and TRDF shall be vested with the full and valid ownership, rights, title and interest thereto, and such Shares will, when issued, be duly authorized, validly issued, fully paid and non-assessable; and (ii) all Exercised Shares issued to TRDF upon exercise of the Option will be duly authorized, validly issued, fully paid and non-assessable, free from any liens and charges (other than restrictions on transfer under applicable securities laws, rules and regulations and as provided in the Organizational Documents), and entitling TRDF to all rights, preferences and privileges accruing to the holders of Ordinary Shares as reflected in the Articles of Association of Novocure (as the same may be amended, modified, restated or replaced in accordance with the terms and

4

conditions thereof, the “Novocure Articles,” and a true, complete and current copy of which is attached as Annex 4).

5. Additional Representations and Warranties by Novocure. Novocure hereby further represents, warrants and undertakes to each of the Technion Entities the following:

5.1 Novocure is duly organized, validly existing and in good standing under the laws of the State of Jersey, has the full right, power and authority to execute and deliver this Agreement and any and all other agreements, instruments and/or commitments the execution and delivery of which by Novocure is contemplated hereby (the “Ancillary Agreements”), and will have, as of the Equity Closing, the full right, power and authority to perform this Agreement and the Ancillary Agreements.

Annex 5.1 attached hereto states all of Novocure’s subsidiaries and Controlled Affiliates.

5.2 This Agreement and the Ancillary Agreements have been duly authorized, executed and delivered by Novocure and constitute the legal, valid and binding obligations of Novocure, legally enforceable against Novocure in accordance with their respective terms.

5.3 All corporate action on the part of Novocure, its officers, directors and shareholders necessary for the authorization, execution and delivery by Novocure of this Agreement and the Ancillary Agreements, the performance of all obligations of Novocure hereunder and thereunder, including, without limitation, the authorization and issuance to TRDF of the Shares, the Option and the Underlying Shares issuable upon exercise of the Option, has (or will, as of the Equity Closing, have) been taken; and, following the Equity Closing, no additional corporate resolution or approval or other action on the part of Novocure will be required in order to issue the Exercised Shares upon the exercise of the Option (subject to the amendment of the register of members of Novocure in respect of such issue which Novocure shall effect immediately following the exercise of the Option).

5.4 Except for the consents which have been, or will be, as of the Equity Closing, obtained, no consent, approval, authorization or order of or filing with any person, entity or authority is required for the execution, delivery or performance of this Agreement and the Ancillary Agreements by Novocure, including, without limitation, for the issuance to TRDF of the Shares, Option and the Exercised Shares upon exercise of the Option (subject to the amendment of the register of members of Novocure in respect of such issue which Novocure shall effect immediately following the exercise of the Option); and neither the execution nor delivery nor, effective as of the Equity Closing and thereafter, the performance of this Agreement by it, including, without limitation, the issuance to TRDF of the Shares, the Option and of the Exercised Shares upon exercise of the Option, will (A) conflict with, or result in a breach of, or constitute a default under, or result in a violation of, any organizational document of Novocure or any agreement or instrument to which it is a party or by which it is or its property is bound, or (B)

5

result in the violation of any applicable law or order, judgment, writ, injunction, decree, ruling or award.

5.5 The issued share capital of Novocure, after giving effect to the issuance, exercise, exchange or conversion in full of all options, warrants, convertible securities and other rights to acquire or receive securities and/or shares in Novocure outstanding or reserved for issuance, both immediately before and after the Equity Closing, is as set forth in the capitalization table attached hereto as Annex 5.5.

5.6 The issuance to TRDF of the Shares, the Option and the Exercised Shares upon exercise of the Option will not trigger any pre-emptive rights, anti-dilution rights or similar rights.

5.7 On the Execution Date, the current Articles of Association of Novocure are attached hereto as Annex 4 and same have not amended, changed or revoked.

5.9 The last round of investment in Novocure was made at a price per Series I Convertible Preferred Share of the Company of US$85.94 (eighty-five US Dollars and ninety-four cents) (the “Last Round”) and, since December 20, 2013 (which the date of the last closing of the Last Round and is sometimes referred to as the “Last Round Closing Date”), there has been no material adverse change in the business, assets, property, liabilities, prospects, condition (financial or otherwise) or results of operations of Novocure, in each case taken as a whole.

5.10 On the Execution Date (as of immediately prior to the redemption of Ordinary Shares described in the Section 5.13 hereof), to the knowledge of Novocure: (a) Bennet Enterprises Ltd., which, to the knowledge of Novocure, is an affiliate of Dr. Palti, holds of record 600,600 Ordinary Shares and 22,007 Series A Preferred Shares, par value £0.01 per share, of Novocure, and (b) Dr. Palti holds of record options to acquire up to 25,000 Ordinary Shares. On the Execution Date, to the knowledge of Novocure, neither Dr. Palti nor any of his family members, or affiliated entities of Dr. Palti or any of his family members, whether directly or indirectly, has beneficially or of record any other shares or rights for shares or other securities in Novocure and none of Dr. Palti, any of his family members, or affiliated entities of Dr. Palti or any of his family members ever had, directly or indirectly, beneficially or of record, shares or rights for shares or other securities in Novocure that were sold, transferred, assigned or otherwise disposed of.

5.11 Dr. Palti has and had no right to receive any consideration or other benefit in connection with the Technology or on account of any sales or other transactions of Novocure, including, without limitation, in any transaction for the sale of shares, assets, IP and/or business of Novocure, other than by virtue of the ownership of his shares and on the same basis as any other holder of shares in Novocure.

5.12 The rights of the investors that participated in the Last Round are only those provided in (i) the Novocure Articles, (ii) in that certain Eighth Amended and Restated Registration Rights Agreement, dated as of July 10, 2013, by and among Novocure and the other parties listed therein (as the same may be amended, modified, restated or replaced in accordance with the terms and conditions thereof, the “RRA,” a true, complete and current copy of which is attached hereto

6

as Annex 5.12(i)), (iii) in that certain Ninth Amended and Restated Investors Rights Agreement dated as of July 10, 2013, by and among Novocure and the other parties listed therein (as the same may be amended, modified, restated or replaced in accordance with the terms and conditions thereof, the “XXX,” and a true, complete and current copy of which is attached hereto as Annex 5.12(ii), and collectively with the Novocure Articles and the RRA, the “Organizational Documents”), and (iv) as otherwise provided pursuant to applicable law.

5.13 The aggregate Net Sales of the members of the Novocure Group, since their respective inception through December 31, 2014, amounts to, as of the Execution Date, US $28,274,000. Without limiting Section 5.12, since the Last Round Closing Date, there has been no declaration or payment by Novocure of dividends, or any other distribution of assets of any kind to, or redemption of shares of any of its shareholders, other than the redemption of 340,000 Ordinary Shares held of record by Bennet Enterprises Ltd., at a price per share of £0.01, for an aggregate redemption price of £3,400, and since its inception, there has been no declaration or payment by Novocure of cash dividends.

5A. Representations and Warranties by the Technion Parties.

The Technion Parties hereby represent and warrant that they have no knowledge that the Xxxxxxxxx Family Institute for Research in the Medical Sciences raised claims for rights to the Technology.

It being provided that any breach of this representation and warranty, if any, will not release Novocure and NC-IL from their obligations and undertakings hereunder, nor will it grant them any right to delay or withhold the performance of, or terminate, any of their obligations and undertakings hereunder.

6. Additional Agreements.

6.1 Organizational Documents. Promptly following the date hereof, and in any event on or prior to the Equity Closing Date, Novocure shall obtain the necessary consents and approvals of its shareholders to, and shall: (i) adopt the articles of association attached hereto as Annex 6.1(i) (the “Amended Articles”); (ii) amend and restate the XXX in the form attached hereto as Annex 6.1(ii) (the “Amended and Restated XXX”); and (iii) amend and restate the RRA in the form attached hereto as Annex 6.1(iii) (the “Amended and Restated RRA”). Simultaneously with its execution and delivery of this Agreement, TRDF and Novocure shall execute a joinder agreement, in the form attached hereto as Annex 6.1(iii), joining TRDF as a party to the Amended and Restated XXX and Amended and Restated RRA and which shall automatically become effective upon the issuance of Ordinary Shares to TRDF at the Equity Closing pursuant to Section 3 hereof. Novocure shall deliver to TRDF at the Equity Closing: (i) executed copies of the Amended and Restated XXX and Amended and Restated RRA, duly executed by the requisite parties thereto; and (ii) a copy of the Amended Articles, as adopted and certified as a true copy of the original document by Novocure’s secretary.

6.2 Corporate Action. Promptly following the date hereof, and in any event on or prior to the Equity Closing Date, Novocure shall obtain all consents and approvals

7

of its shareholders necessary to consummate the transactions to occur at the Equity Closing (which Novocure represents to be the only consents and approvals on the part of Novocure which have not been obtained prior to execution hereof).

7. Reservation of Shares: Preservation of Rights of Holder.

7.1 Novocure hereby undertakes that at all times it will maintain and reserve, free from pre-emptive rights, such number of authorized but unissued Ordinary Shares such that the Option may be exercised without additional authorization of Ordinary Shares.

7.2 Novocure further undertakes that it will not, by amendment of its Articles of Association, as amended from time to time, or through reorganization, consolidation, merger, dissolution or sale of assets, or by any other voluntary act, avoid or seek to avoid the observance or performance of any of the covenants, stipulations or conditions to be observed or performed hereunder by Novocure.

8. Adjustments.

The number of Underlying Shares issuable upon the exercise of the Option shall be automatically adjusted from time to time until immediately after a Terminating Event upon the occurrence of any of the events mentioned below:

8.1 Rights Offer: If Novocure’s shareholders are offered by Novocure to purchase any of Novocure’s securities whatsoever, the number of the Underlying Shares will not be adjusted, provided that Novocure shall offer identical rights in respect of the Underlying Shares on the same terms and conditions to TRDF as if TRDF had exercised the Option in full immediately prior to the date of conferring the right to participate in the rights issue.

8.2 Combination and Division: If Novocure combines any of its securities as to which purchase rights exist under the Option into a lesser number of shares, or subdivides them into a greater number of shares, then the number of Underlying Shares to be issued on exercise of the Option after such combination or subdivision will be proportionately reduced or increased, as the case may be, effective immediately after the opening of business on the day following the day upon which such subdivision or combination becomes effective.

8.3 Dividend of Additional Shares: If Novocure pays a dividend or distribution in the form of Novocure shares to holders of Novocure’s shares of the same class or series as the Underlying Shares, the Option shall, effective immediately after the opening of business on the day following the day upon which such dividend or distribution becomes effective, represent the right to acquire (without consideration), in addition to the number of the Underlying Shares otherwise represented by the Option, the amount of such additional shares to which TRDF would have been entitled to receive in respect of such dividend or distribution had the Option been exercised prior to the dividend or distribution of the additional shares.

8

8.4 Merger or Reorganization etc.: If at any time there shall be (i) a reorganization (other than a reclassification, exchange, combination or subdivision of shares otherwise provided for herein), (ii) a merger or consolidation of Novocure with or into another corporation whether or not Novocure is the surviving entity, (iii) a sale or transfer of, or grant of an exclusive license to, Novocure’s all or substantially all assets or technology, to any other person, or (iv) any transaction or series of related transactions that result in the transfer of fifty percent (50%) or more of the outstanding voting power of the share capital of Novocure; then, as a part of such reorganization, merger, consolidation, sale or transfer, lawful provision shall be made so that TRDF shall thereafter be entitled to receive upon exercise of the Option, the number of shares or other securities or property of the successor corporation resulting from such reorganization, merger, consolidation, sale or transfer that a holder of the shares deliverable upon exercise of the Option would have been entitled to receive in such reorganization, consolidation, merger, sale or transfer, if the Options had been exercised immediately before such reorganization, merger, consolidation, sale or transfer, all subject to further adjustment as provided in this Section 8.

8.5 Reclassification, Etc.: In the event of any reclassification, exchange, substitution or other change of the securities as to which purchase rights exist under the Option, into the same or a different number of securities of any other class or series, the Option will thereafter represent the right to acquire, in lieu of the securities receivable upon the exercise of the Option prior to the consummation of such event, such number and kind of securities as TRDF would have been entitled upon such consummation if TRDF had exercised the Option immediately prior thereto.

8.6 Notices: Whenever the number of the Underlying Shares for which the Option is exercisable, is adjusted as provided in this Section 8, Novocure shall promptly compute such adjustment and mail to TRDF a certificate signed by a principal financial officer of Novocure, setting forth the number of the Underlying Shares for which the Option is exercisable, a brief statement of the facts requiring such adjustment and the computation thereof and when such adjustment has or will become effective.

8.7 Fractional Shares: No fractional shares shall be issued upon any exercise of the Option, including as a consequence of any adjustment pursuant hereto. In lieu of any fractional shares which would otherwise be issuable, Novocure shall pay cash equal to the product of such fraction multiplied by the fair market value of one Underlying Share on the date of exercise, as determined in good faith by Novocure’s board of directors.

9. Notice of Certain Actions: In the event that Novocure shall propose (a) to pay any dividend in cash or other distribution payable in securities of any class or other property to its shareholders or to the holders of Ordinary Shares, or (b) to offer to its shareholders rights to subscribe for or to purchase any securities convertible into shares, or (c) to effect any IPO or any M&A Transaction, then Novocure shall give written notice of such proposed action to TRDF, which notice shall also specify the date on which a record is to be taken for the purposes of such dividend, distribution or rights, or the date such issuance is to take place and the date of participation therein by the holders of

9

shares if any, is to be fixed. Such notice shall be so given in the case of any action covered by clause (a) or (b) above at least twenty (20) business days prior to the record date for determining holders of shares for purposes of such action and, in the case of any other such action, at least twenty (20) business days prior to the date of the taking of such proposed action or the date of participation therein by the holders of shares, whichever shall be the earlier.

“M&A Transaction” shall mean (a) any merger, consolidation or reorganization of Novocure with or into another company or entity whether Novocure is the surviving entity or not, other than any such merger, consolidation or reorganization in which the shareholders of Novocure immediately prior to such merger, consolidation or reorganization, continue to hold at least a majority of the voting power of the surviving entity (or, if the surviving entity is a wholly owned subsidiary, its parent) immediately after such merger, consolidation or reorganization and as a result of which the surviving entity is bound by the undertakings of Novocure hereunder; (b) the sale or other disposition of all or substantially all of the assets of Novocure or the sale of or exclusive license to its intellectual property and/or technology or similar transaction; (c) the sale or other disposition of all or substantially all of the shares of Novocure; or (d) any transaction or series of related transactions to which Novocure is a party that result in the transfer of fifty percent (50%) or more of the voting power or the share capital of Novocure; provided, however, that: (i) for purposes of each of the foregoing sub-clauses(b), (c) and (d) an M&A Transaction shall not include any transaction (or series of transactions) with any company or entity that is an affiliate of Novocure that is made for internal corporate reorganization purposes only (resulting in no change in the ultimate ownership and economic interest of the shareholders of Novocure immediately prior to such reorganization), with no consideration, or with nominal consideration required by applicable law, and provided that such affiliate shall, and to the extent Novocure shall survive any such reorganization, such affiliate and Novocure shall, jointly and severally, undertake towards the Technion Parties to be bound by the undertakings and obligations hereunder towards the Technion Parties (it being understood that royalties or other payments on a one-time or on an ongoing basis being paid to Novocure by such affiliate as a wholly owned subsidiary of such affiliate (and not being ultimately distributed to the pre-reorganization shareholders of Novocure) pursuant to a commercially reasonable agreement to be executed as part of such reorganization between such affiliate and Novocure will not deemed consideration paid in the M&A Transaction); and (ii) for purposes of sub-clause (d), an M&A Transaction shall not include any transaction (or series of transactions) that is (or are) effected principally for bona fide equity financing purposes in which cash is received by Novocure or indebtedness of Novocure is cancelled or converted or a combination thereof.

10. Information Rights.

10.1 For so long as TRDF holds the Option and/or shares in Novocure, Novocure shall deliver to TRDF all of the following:

(a) as and when delivered to other shareholders of Novocure, an audited consolidated balance sheet of Novocure as at the end of each fiscal year and audited statements of income and of cash flows of Novocure for such year, audited by a firm of certified public accountants of established regional reputation and prepared in accordance with GAAP.

(b) as and when delivered to other shareholders of Novocure, a management-prepared consolidated compiled balance sheet of Novocure as of the end of each fiscal quarter and management-prepared compiled statements of income and of cash flows of Novocure for such fiscal quarter and for the current fiscal year to date with comparisons to budget and prior year (excluding adjustments for compensation expenses due to shares reserved for issuance under Novocure’s share option plan), and a management summary of operations for such quarterly period. Such financial statements shall be accompanied by a certificate of Novocure’s Chief Financial Officer (or, if Novocure does not at such time have a Chief Financial Officer, by its President or Chief Executive Officer) stating that such statements have been prepared in accordance with GAAP consistently applied (except as noted) and fairly present the financial condition and results of operations of Novocure at the date thereof and for the periods covered thereby.

10

(c) any and all other notifications, information and material with respect to Novocure and its subsidiaries and other Controlled Affiliates, delivered, as when delivered, to all other holders of Ordinary Shares of Novocure pursuant to any obligation towards such shareholders.

10.2 Novocure shall, and shall cause its subsidiaries and Controlled Affiliates to keep accurate and complete books and records reflecting their Net Sales. TRDF shall have the right once during each fiscal year, for so long as the obligations under Section 2 remain outstanding, at reasonable times and upon at least thirty (30) days prior written notice, access to such books and records of Novocure, its subsidiaries and Controlled Affiliates, as shall be reasonably necessary for TRDF and its independent accountants to ascertain that Novocure complies with its obligations under Section 2 of this Agreement. Novocure shall use its best efforts to cause its subsidiaries and Controlled Affiliates to comply with the aforesaid.

11. Waiver & Release. Upon execution hereof, the Technion Parties, Dr. Palti, Novocure and NC-IL shall each sign and deliver a waiver & release of claims and rights in favor of the persons specified therein, in the forms attached hereto as Annex 11 (the “Release”); provided, however, that the effectiveness of such Release shall be conditional and become effective only upon (i) the consummation of the Equity Closing pursuant to Section 3 hereof by the Equity Closing Date, and (ii) the execution of the Release by each and all of the above persons and entities simultaneously with the execution of this Agreement. Notwithstanding the foregoing, none of the Parties will act in contradiction with the provisions of the Release as of the date of its execution and until the last date set herein for the Equity Closing to be consummated (i.e. until the lapse of thirty (30) days following the Execution Date), subject to the compliance by all other Parties with the provisions of this Agreement, including, without limitation, the payment by Novocure of the sum of US$1,000,000 pursuant to Section 2.1 and the compliance with the provisions of this Section 11 (including the compliance by Dr. Palti with the provisions of this Section 11).

12. Counsel Opinion. At the Equity Closing, Novocure shall deliver to TRDF and the Technion an opinion of its legal counsel in the form and substance attached hereto as Annex 12.

13. Publicity. Each Party hereby agrees to keep in strict confidence and not disclose, by any means of communication, the existence and terms and conditions of this Agreement or any other information with respect to the subject matter hereof, except that, each Party may disclose same as permitted in Annex 13 attached hereto. Novocure shall generally identify Dr. Palti as a former professor of the Technion Israel Institute of Technology in its publicity and press releases that refer to Dr. Palti. The Technion Parties shall be entitled to publish that the core Technology of Novocure that is used for treating tumors was invented by Dr. Palti, while he was a professor of the Technion. Dr. Palti shall when making public statements about himself in the context of the Technology shall also generally identify himself as a former professor of the Technion Israel Institute of Technology.

11

14. Confidentiality. Each of the Technion Parties agrees that it shall keep confidential, and shall not disclose to any person who is unaffiliated with Novocure or use for its own benefit, without the prior consent or authorization of Novocure, any non-public information with respect to the Novocure Group that is disclosed to the Technion Parties by or on behalf of the Novocure Group; provided, however, that, any each of the Technion Parties may disclose any such information: (a) as has become generally available to the public, other than as a result of a breach of this Section 14; (b) to its employees, partners and professional advisers who need to know such information; (c) to the extent necessary to comply with any law, rule, regulation or governmental order applicable to such Technion Party (and the Technion Party shall notify Novocure of such disclosure); (d) to the extent required to exercise, protect or enforce its rights hereunder; and (e) as may be required in response to any summons or subpoena or in connection with any litigation, or pursuant to applicable law, rule, regulation or pursuant to a request by a court of competent jurisdiction or any regulatory or governmental authority; it being agreed that, unless such information has become generally available to the public: (i) the Technion Party shall, to the extent possible, give Novocure notice of such request and shall cooperate with Novocure at Novocure’s request so that Novocure may, in its discretion, seek a protective order or other appropriate remedy, if available, and (ii) in the event that such protective order is not obtained (or sought by Novocure after notice), the Technion Party (A) shall furnish only that portion of the information that, in accordance with the advice of counsel, is legally required to be furnished and (B) will exercise its reasonable efforts to obtain assurances that confidential treatment will be accorded such information. The confidentiality obligations set forth in this Section 14 shall survive with respect to each Technion Party until two years after such date that a Technion Party shall no longer hold any shares of Novocure.

15. Termination by the Technion Parties.

In the event that either the Equity Closing is not consummated by no later than thirty (30) days following the Execution Date, or not all actions, covenants, obligations, agreements, undertakings and conditions contained in this Agreement that are required to be taken, performed and/or complied with hereunder prior to or at the Equity Closing shall have been performed or complied with in all respects prior to or at the Equity Closing, then the Technion Parties shall have the right, at their sole discretion, and without derogating from any other remedy or relief available to it (including, without limitation, with respect to breaches of representations, warranties, undertakings and covenants which should have been complied with or taken up to such time), to either terminate this Agreement, or to agree (at their sole discretion) to postpone the Equity Closing (for up to two additional periods of seven (7) days) and reset it to such later date, in each of those cases, upon written notice to Novocure.

It is hereby clarified that in the event that the Technion Parties elect and/or agree to postpone the Equity Closing in accordance with the terms hereof, all provisions in connection with the Equity Closing shall apply to such postponed Equity Closing, including the rights of the Technion Parties under this Section 15.

16. Miscellaneous.

16.1 Further Cooperation. The parties agree to execute any and all instruments, certificates and documents necessary in order to consummate, implement and give full force and

12

effect to this Agreement, and to all matters, actions and transactions envisaged and contemplated herein including, filings with governmental or regulatory bodies, corporate resolutions and such other instruments, certificates and documentation as may be reasonably necessary from time to time.

16.2 Taxes. Novocure reasonably believes that, under currently applicable law, no withholding for any tax is currently required in respect of any payment made by Novocure hereunder; provided, that no additional payment shall be required to be made by Novocure in respect of any tax imposed on any such payment; provided, further, that in the event that such withholding is determined to be required, or becomes required as a result of any change in law, Novocure agrees to cooperate with the Technion Parties in taking commercially reasonable steps as may be necessary for the Technion Parties to reduce or eliminate such withholding tax, and to the extent that amounts are withheld by Novocure, Novocure shall give written notice to the Technion Parties of such withholding, promptly pay the amount withheld to the proper tax authority and, to the extent reasonably available, shall obtain and deliver to the Technion Parties a receipt and evidence that the amount withheld were paid to the proper tax authority and all other documents reasonably requested by the Technion Parties as are necessary for the Technion Parties to claim a tax credit and for the Technion Parties’ tax filings. For the avoidance of doubt, each Party agrees that it is responsible for its own taxes, and no Party shall be entitled to any indemnification or other payment in respect of any tax from any other Party.

16.3 No Right of Set-Off. All payments to be made hereunder to the Technion Parties, or any of them, shall be made free and clear of, and without any deductions for or on account of, any set-off or counterclaim, except for tax withholding permitted, if any, by Section 16.2 above.

16.4 Counterparts; Facsimile. This Agreement may be executed in any number of counterparts and at one or more times, each of which containing the signature of any of the parties shall be deemed an original but all of which together shall constitute one and the same instrument. Any signed counterpart transmitted via facsimile or other electronic transmission shall also be deemed for all purposes as constituting good and valid execution and delivery of this Agreement by such party.

16.5 Delays or Omissions. The failure of any party at any time or times to require performance of any provision hereof or to enforce any right with respect thereto, shall in no manner affect the right of such party at a later time to enforce the same and shall in no way be construed to be a waiver of such provision or right. Any waiver, consent, or approval of any kind or character on the part of any party of any breach or default under this Agreement, or any waiver on the part of any party of any provisions or conditions of this Agreement, must be in writing and shall be effective only to the extent specifically set forth in such writing.

16.6 Successors and Assigns. Except as otherwise provided herein, the terms and conditions of this Agreement shall inure to the benefit of and be binding upon the respective successors and assigns of the parties.

16.7 Entire Agreement & Amendments. This Agreement and the Annexes attached hereto constitute the entire agreement between the parties with respect to the subject

13

matters hereof and supersede all prior agreements, understandings and negotiations, both written and oral, between the parties with respect to the subject matter hereof. Each Party acknowledges and agrees that (i) the representations and warranties of the other Parties (the “Representing Parties”) expressly set forth in this Agreement constitute the sole and exclusive representations and warranties made by or on behalf of the Representing Party or any of its affiliates or representatives to the other Parties with respect to the Representing Party, the Technology and the transactions contemplated hereby, (ii) that all other representations and warranties with respect to the Representing Party, the Technology or the transactions contemplated hereby of any kind or nature expressed or implied are specifically disclaimed by the Representing Party, and (iii) the other Parties, their respective affiliates, and their respective officers, representatives, successors and permitted assigns have not relied, and will not rely, on any other information, or other representations and warranties with respect to the Representing Party, the Technology or the transactions contemplated hereby. Any term of this Agreement may be amended with the written consent of all the Parties.

16.8 Notices. All notices and other communications required or permitted hereunder shall be in writing, shall be effective when given, and shall in any event be deemed to be given upon receipt or, if earlier, (a) three (3) business days after the day of deposit with the applicable postal service, if delivered by first class mail, postage prepaid if addressed to a party in the same country or five (5) business days after deposit with the applicable postal service, if delivered by first class mail, postage prepaid if addressed to a party in a different country, (b) upon delivery, if delivered by hand, (c) three (3) business days after the day of deposit with Federal Express or similar overnight courier, freight prepaid or (d) one (1) business day after the day of facsimile or e-mail transmission and electronic confirmation of receipt, if delivered by facsimile or e-mail transmission (provided, however, that any notice of change of address shall only be valid upon receipt), and shall be addressed to the Parties’ address as provided below:

| If to Novocure or NC-IL: | Novocure Limited Le Masurier House La Rue le Masurier St. Helier, Jersey JE2 4YE Fax: x00.00.00000000 Email: xxxx@xxxxxxxx.xxx Attn: Chief Executive Officer

with a copy to:

Novocure Inc. 0000 Xxxxxxxx, 00xx Xxxxx Xxx Xxxx, XX 00000 Fax: 0.000.000.0000 Email: xxxxxxxxxxx@xxxxxxxx.xxx Attn: General Counsel |

14

| and to:

Proskauer Rose LLP | ||

| Eleven Times Square Xxx Xxxx, XX 00000 Fax: 0.000.000.0000 Email: xxxxxxxx@xxxxxxxxx.xxx; xxxxxxxx@xxxxxxxxx.xxx Attn: Xxxx X. Xxxxxxx, Esq.; Xxxx Xxxxxxx, Esq. | ||

| If to TRDF: | Technion Research and Development Foundation Legal Department Fax: x000-0-00-000-0000 Email: xxxxx@xx.xxxxxxxx.xx.xx

Attn: Xxxx Xxxxxxxx, Legal Counsel | |

| If to the Technion: | the Technion – Israel Institute of Technology Executive Vice President for Research Fax: x000-0-0000000

Email: xxxx@xx.xxxxxxxx.xx.xx | |

16.9 Governing Law and Forum. This Agreement, its interpretation, validity and breach shall be governed by the laws of the State of Israel, without regard to its conflict of laws rules, and any claim or dispute with respect thereto shall be solely submitted to the exclusive jurisdiction of the competent courts of Tel Aviv, Israel, which shall have exclusive jurisdiction over any dispute or claim arising in connection with or as a result of this Agreement; and each of the parties hereby submits irrevocably to the jurisdiction of such court to the exclusion of any other jurisdiction.

16.10 Interpretation. Definitions in this Agreement apply equally to both the singular and plural forms of the defined terms. The words “include” and “including” shall be deemed to be followed by the phrase “without limitation.” The terms “herein,” “hereof” and “hereunder” and other words of similar import refer to this Agreement as a whole and not to any particular Section, paragraph or subdivision. Each accounting term used herein that is not specifically defined herein shall have the meaning given to it under United States generally accepted accounting principles as applied by Novocure. The headings, subheadings and captions contained in this Agreement are included for convenience of reference only, and in no way define, limit or describe the scope of this Agreement or the intent of any provision hereof. All Section, paragraph, clause, and Annex references not attributed to a particular document shall be references to such parts of this Agreement.

16.11 In the event that any provision of this Agreement is adjudicated to be illegal, invalid or unenforceable, such provision will be enforced to the maximum extent permitted by applicable law given the intent of the parties. In addition, if any particular provision contained in this Agreement shall for any reason be held to be excessively broad, it shall be construed and enforced by limiting and reducing the scope of such provision so that the provision is enforceable to the fullest extent compatible with applicable law or judicial decision.

15

16.12 As between Novocure and the Technion Parties, Novocure and NC-IL shall be jointly and severally liable for the compliance by Novocure with its obligations and undertakings hereunder, it being understood and agreed that as between Novocure and NC-IL, Novocure shall be solely and exclusively responsible for carrying out the obligations of Novocure hereunder.

[End of text]

16

Execution Copy

IN WITNESS WHEREOF, the Parties hereto have entered into this Agreement as of the date mentioned above.

| NOVOCURE LIMITED | ||

| By: | /s/ Xxxxxxx X. Xxxxx | |

| Name: | Xxxxxxx X. Xxxxx | |

| Title: | Executive Chairman | |

| NOVOCURE (ISRAEL) LTD. | ||

| By: | /s/ Xxxxxxx X. Xxxxx | |

| Name: | Xxxxxxx X. Xxxxx | |

| Title: | Director | |

| THE TECHNION RESEARCH AND DEVELOPMENT FOUNDATION | ||

| By: |

| |

| Name: | ||

| Title: | ||

| THE TECHNION – ISRAEL INSTITUTE OF TECHNOLOGY | ||

| By: |

| |

| Name: | ||

| Title: | ||

17

Execution Copy

IN WITNESS WHEREOF, the Parties hereto have entered into this Agreement as of the date mentioned above.

| NOVOCURE LIMITED | ||

| By: |

| |

| Name: | ||

| Title: | ||

| NOVOCURE (ISRAEL) LTD. | ||

| By: |

| |

| Name: | ||

| Title: | ||

| THE TECHNION RESEARCH AND DEVELOPMENT FOUNDATION | ||

| By: | /s/ Xxxxx X. Xxxxxx /s/ Xxxxxxxx Xxxxxx | |

| Name: | Xxxxx X. Xxxxxx/Xxxxxxxx Xxxxxx | |

| Title: | Managing Director/Technology Transfer Office, Manager | |

| THE TECHNION – ISRAEL INSTITUTE OF TECHNOLOGY | ||

| By: | /s/ Matanyahu Englman /s/ Xxxxx Sidi | |

| Name: | Matanyahu Englman/Xxxxx Sidi | |

| Title: | Exec. VP & Director Gen./Senior Exec. VP | |

17

Execution Copy

Annex 11

Release and Covenant Not To Xxx

(Technion Parties in favor of Not to Xxx)

TO ALL TO WHOM THESE PRESENTS SHALL COME OR MAY CONCERN, KNOW THAT:

This Release and Covenant Not to Xxx is made in connection with that certain Settlement Agreement of even date hereof, made and entered between The Technion-Israel Institute of Technology, the Technion Research and Development Foundation, Novocure Limited and Novocure (Israel) Ltd. (the “Agreement”);

The Technion-Israel Institute of Technology and the Technion Research and Development Foundation (together, the “Technion”), for themselves and their past, present and/or future successors, assigns, and anyone claiming any right through or under them, whether acting on behalf of the Technion or in their individual capacities as successor or assignee of the rights of the Technion (collectively, the “Releasors”), for good and valuable consideration (the receipt and sufficiency of which is hereby acknowledged):

1. Hereby irrevocably and unconditionally release and discharge Novocure Limited and Novocure (Israel) Ltd. and all of their respective affiliates, agents, successors, heirs and assigns (together, the “Releasees”) from any and all claims, actions, causes of action, suits, liabilities, rights, debts, demands, damages, covenants, contracts, controversies, agreements, promises, and complaints whatsoever, in law, equity or otherwise, under Israeli law, United States law, or otherwise, whether known or unknown, which the Releasors ever had, now have, or hereafter may have, for, upon, or by any matter, cause or thing whatsoever, from the beginning of the World to the date of this Release and Covenant Not to Xxx, arising out of or based upon the activities of Dr. Yoram Palti at any time prior to the date of the Agreement with respect to and solely with respect to the Intellectual Property Rights (as defined below), including, without limitation, activities carried out by Dr. Palti with respect to the Intellectual Property Rights (as defined below), by himself or in concert with others, while Dr. Palti was engaged in research and development or in any other capacity whatsoever at the Technion (the “Released Claims”). It being provided, that the Released Claims shall not include and the preceding sentence shall not apply to claims, actions, causes of action, suits, liabilities, rights, debts, demands, damages, covenants, contracts, controversies, agreements, promises, and complaints whatsoever, in law, equity or otherwise, under Israeli law, United States law, or otherwise, pursuant to, under, arising out of or based upon the Agreement.

2. Without limiting the generality of the release of claims set forth above, each of the Releasors hereby quitclaims, releases, and remises unto Novocure Limited, to have and to hold for Novocure Limited’s and its assigns’ own use and benefit forever, any right, title or interest in or to, and irrevocably confirms that it shall have no right, title or interest in or to the patent applications or patents described in Annex A attached hereto (including any reissues, continuations, substitutions, divisionals, reexaminations or other extensions of any such patent applications or patents)(collectively, “Intellectual Property Rights”). The Releasor acknowledges and agrees that, other than compensation and payments made under the

18

Execution Copy

Agreement, it shall have no claim for or entitlement to any compensation or payment for or in respect of any such Intellectual Property Rights, including without limitation any compensation in the form of royalties, the issuance of securities in any entity owned or controlled by the Releasee or in any other form whatsoever.

3. The Releasors also hereby covenant not to xxx, bring any claim of action or otherwise participate in any action against, and shall not assist in the instigation, commencement, maintenance, or prosecution of any claim of action, of any nature whatsoever, against the Releasees in any forum based on, relating to or arising out of the Released Claims.

4. The Releasors agree that they will not make any oral or written negative or derogatory statements or disparage or induce others to disparage (whether or not such statement legally constitutes libel or slander) the Releasees in connection with the subject matter of the Released Claims.

This Release and Covenant Not To Xxx xxx not be changed or modified orally.

The Releasors hereby represent and warrant that (i) the Releasors have read and understand the terms of the Release and Covenant Not To Xxx, (ii) the Releasors have been advised by counsel as to the nature and legal effect of this Release and Covenant Not To Xxx, (iii) this Release and Covenant Not To Xxx has been duly authorized, executed and delivered, and (iv) this Release and Covenant Not To Xxx is a valid and binding obligation of said Releasors, enforceable against said Releasors in accordance with its terms.

This Release and Covenant Not to Xxx shall become effective following the execution of the Agreement by all Parties thereto and upon and subject to: (i) the receipt by TRDF of the amount under Section 2.1 to the Agreement and of signed copies of the Release and Covenant Not to Xxx by all applicable parties in accordance with Section 11 to the Agreement; and (ii) the consummation of the Equity Closing, as defined in and pursuant to Section 3 of the Agreement.

[signature page follows]

19

Execution Copy

| TECHNION ISRAEL INSTITUTE OF TECHNOLOGY | ||

| By: | /s/ Matanyahu Englman /s/ Xxxxx Sidi | |

| Name: | Matanyahu Englman/Xxxxx Sidi | |

| Title: | Executive V.P. and Director General/Jr. Exec. VP | |

| Dated: | 5/2/2015 / 3/2/2015 | |

| TECHNION RESEARCH AND DEVELOPMENT FOUNDATION LTD. | ||

| By: | /s/ Xxxxx X. Xxxxxx /s/ Xxxxxxxx Xxxxxx | |

| Name: | Xxxxx X. Xxxxxx/ Xxxxxxxx Xxxxxx | |

| Title: | Managing Director/Technology Transfer Office, Manager | |

| Dated: | 1/2/15 | |

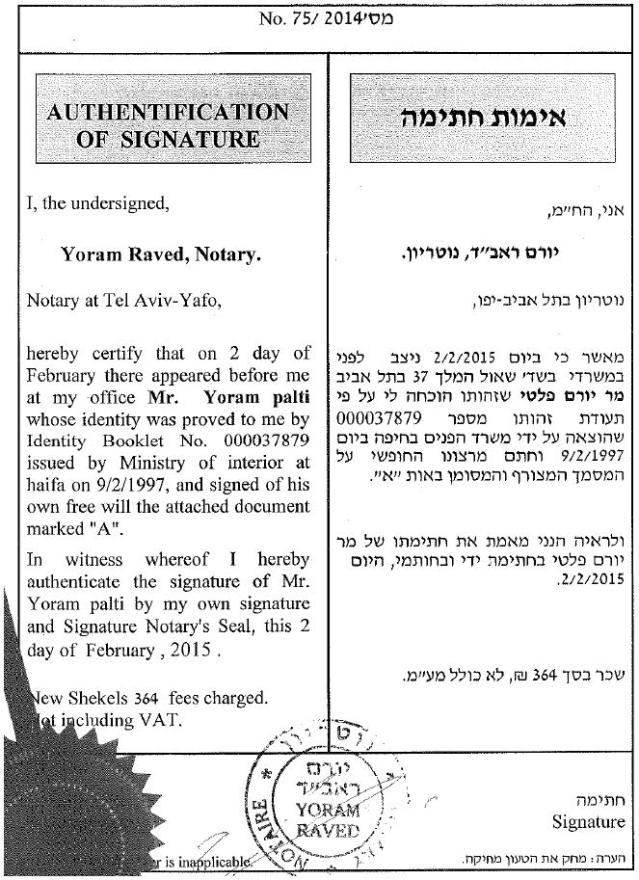

[NOTARIZATION]

20

Execution Copy

Release and Covenant Not To Xxx

(Technion Parties in favor of Dr. Palti)

TO ALL TO WHOM THESE PRESENTS SHALL COME OR MAY CONCERN, KNOW THAT:

This Release and Covenant Not to Xxx is made in connection with that certain Settlement Agreement of even date hereof, made and entered between The Technion-Israel Institute of Technology, the Technion Research and Development Foundation and Novocure Limited and Novocure (Israel) Ltd. (the “Agreement”);

The Technion-Israel Institute of Technology and the Technion Research and Development Foundation (together, the “Technion”), for themselves and their past, present and/or future successors, assigns, and anyone claiming any right through or under them, whether acting on behalf of the Technion or in their individual capacities as successor or assignee of the rights of the Technion (collectively, the “Releasors”), for good and valuable consideration (the receipt and sufficiency of which is hereby acknowledged):

1. Hereby irrevocably and unconditionally release and discharge Dr. Yoram Palti and all of his affiliates, agents, heirs and assigns, including, but not limited to, any past or present corporations or partnerships in which they hold an interest in (the “Releasee” or “Dr. Palti”), from any and all claims, actions, causes of action, suits, liabilities, rights, debts, demands, damages, covenants, contracts, controversies, agreements, promises, and complaints whatsoever, in law, equity or otherwise, under Israeli law, United States law, or otherwise, whether known or unknown, which the Releasors ever had, now have, or hereafter may have, for, upon, or by any matter, cause or thing whatsoever, from the beginning of the World to the date of this Release and Covenant Not to Xxx, arising out of or based upon the activities of Dr. Yoram Palti at any time prior to the date of the Agreement with respect to and solely with respect to the patent applications or patents described in Annex A attached hereto (including any reissues, continuations, substitutions, divisionals, reexaminations or other extensions of any such patent applications or patents) (collectively, “Intellectual Property Rights”), , including, without limitation, activities carried out by Dr. Palti with respect to the Intellectual Property Rights, by himself or in concert with others, while Dr. Palti was engaged in research and development or in any other capacity whatsoever at the Technion (the “Released Claims”).

2. The Releasors also hereby covenant not to xxx, bring any claim of action or otherwise participate in any action against, and shall not assist in the instigation, commencement, maintenance, or prosecution of any claim of action, of any nature whatsoever, against the Releasees in any forum based on, relating to or arising out of the Released Claims.

3. The Releasors agree that they will not make any oral or written negative or derogatory statements or disparage or induce others to disparage (whether or not such statement legally constitutes libel or slander) the Releasee in connection with the subject matter of the Released Claims.

This Release and Covenant Not To Xxx xxx not be changed or modified orally.

21

Execution Copy

The Releasors hereby represent and warrant that (i) the Releasors have read and understand the terms of the Release and Covenant Not To Xxx, (ii) the Releasors have been advised by counsel as to the nature and legal effect of this Release and Covenant Not To Xxx, (iii) this Release and Covenant Not To Xxx has been duly authorized, executed and delivered, and (iv) this Release and Covenant Not To Xxx is a valid and binding obligation of said Releasors, enforceable against said Releasors in accordance with its terms.

This Release and Covenant Not to Xxx shall become effective following the execution of the Agreement by all Parties thereto and upon and subject to: (i) the receipt by TRDF of the amount under Section 2.1 to the Agreement and of signed copies of the Release and Covenant Not to Xxx by all applicable parties in accordance with Section 11 to the Agreement; and (ii) the consummation of the Equity Closing, as defined in and pursuant to Section 3 of the Agreement.

[signature page follows]

22

Execution Copy

| TECHNION ISRAEL INSTITUTE OF TECHNOLOGY | ||

| By: | /s/ Matanyahu Englman / /s/ Xxxxx Sidi | |

| Name: | Matanyahu Englman / Xxxxx Sidi | |

| Title: | Exec. V.P. and Director General / Sr. Exec. V.P. | |

| Dated: | 3/2/2015 / 5/2/15 | |

| TECHNION RESEARCH AND DEVELOPMENT FOUNDATION LTD. | ||

| By: | /s/ Xxxxx X. Xxxxxx / /s/ Xxxxxxxx Xxxxxx | |

| Name: | Xxxxx X. Xxxxxx / Xxxxxxxx Xxxxxx | |

| Title: | Managing Dir. / Tech. Transfer Office, Manager | |

| Dated: | 1/2/15 | |

[NOTARIZATION]

23

Execution Copy

Annex 11

Release and Covenant Not To Xxx

(Novocure in favor of Technion Parties)

TO ALL TO WHOM THESE PRESENTS SHALL COME OR MAY CONCERN, KNOW THAT:

This Release and Covenant Not to Xxx is made in connection with that certain Settlement Agreement of even date hereof, made and entered between The Technion-Israel Institute of Technology, the Technion Research and Development Foundation, Novocure Limited and Novocure (Israel) Ltd. (the “Agreement”);

Novocure Limited and Novocure (Israel) Ltd. (together, “Novocure”), for themselves and their past, present and/or future successors, assigns, and anyone claiming any right through or under them, whether acting on behalf of Novocure or in their individual capacities as successor or assignee of the rights of Novocure (collectively, the “Releasors”), for good and valuable consideration (the receipt and sufficiency of which is hereby acknowledged):

1. Hereby irrevocably and unconditionally release and discharge The Technion-Israel Institute of Technology and the Technion Research and Development Foundation and all of their respective affiliates, agents, successors, heirs and assigns (together, the “Releasees”), including, but not limited to, any past or present corporations or partnerships in which they hold an interest in, from any and all claims, actions, causes of action, suits, liabilities, rights, debts, demands, damages, covenants, contracts, controversies, agreements, promises, and complaints whatsoever, in law, equity or otherwise, under Israeli law, United States law, or otherwise, whether known or unknown, which the Releasors ever had, now have, or hereafter may have, for, upon, or by any matter, cause or thing whatsoever, from the beginning of the World to the date of this Release and Covenant Not to Xxx, that are either: (i) being released by the Releasees pursuant to the Release and Covenant Not to Xxx delivered simultaneously herewith by the Releasees in favor of, inter alia, Novocure; or (ii) with respect to, in connection with, or as a result of either: (a) the claims of the Releasees with respect to and/or in connection with the alleged rights of the Releasees in the Technology (as defined in the Agreement) and the activities of Dr. Yoram Palti and the Releasors at any time prior to the date of the Agreement with respect to the Technology, including, without limitation, activities carried out by Dr. Palti with respect to the Technology, by himself or in concert with others, while Dr. Palti was engaged in research and development or in any other capacity whatsoever at the Technion; or (b) the actions of the Releasees with respect to and/or in connection with that which is described in clause (a) above and the negotiations and execution of the Agreement (all of the above, the “Released Claims in Favor of the Technion”).

2. The Releasors also hereby covenant not to xxx, bring any claim of action or otherwise participate in any action against, and shall not assist in the instigation, commencement, maintenance, or prosecution of any claim of action, of any nature whatsoever, against the Releasees in any forum based on, relating to or arising out of the Released Claims in Favor of the Technion.

24

Execution Copy

3. The Releasors agree that they will not make any oral or written negative or derogatory statements or disparage or induce others to disparage (whether or not such statement legally constitutes libel or slander) the Releasees in connection with the subject matter of the Released Claims in Favor of the Technion.

This Release and Covenant Not To Xxx xxx not be changed or modified orally.

The Releasors hereby represent and warrant that (i) the Releasors have read and understand the terms of the Release and Covenant Not To Xxx, (ii) the Releasors have been advised by counsel as to the nature and legal effect of this Release and Covenant Not To Xxx, (iii) this Release and Covenant Not To Xxx has been duly authorized, executed and delivered, and (iv) this Release and Covenant Not To Xxx is a valid and binding obligation of said Releasors, enforceable against said Releasors in accordance with its terms.

This Release and Covenant Not to Xxx shall become effective following the execution of the Agreement by all Parties thereto and upon and subject to the Release and Covenant Not to Xxx delivered simultaneously herewith by the Releasees in favor of, inter alia, Novocure becoming effective.

[signature page follows]

25

Execution Copy

| NOVOCURE LIMITED | ||

| By: | /s/ Xxxxxxx X. Xxxxx | |

| Name: | Xxxxxxx X. Xxxxx | |

| Title: | Executive Chairman | |

| Dated: | ||

| NOVOCURE ISRAEL (LTD.) | ||

| By: | /s/ Xxxxxxx X. Xxxxx | |

| Name: | Xxxxxxx X. Xxxxx | |

| Title: | Director | |

| Dated: | ||

| STATE OF NEW YORK | ) | |||||||

| ) | ss. | |||||||

| COUNTY OF NEW YORK | ) |

I HEREBY CERTIFY, that on this day, before me, an officer duly authorized in the State and County aforesaid to take acknowledgments, personally appeared Xxxxxxx X. Xxxxx, known to me to be the person described in and who executed the foregoing instrument, and she acknowledged to and before me that she executed the same. She is personally known to me or has produced a valid driver’s license as identification and did take an oath.

SWORN TO AND SUBSCRIBED before me this 30th day of January, 2015.

| /s/ Xxxxxxxxxx X. Xxxxx |

| Notary Public |

| (Seal) |

26

27

Execution Copy

Release and Covenant Not To Xxx & Undertaking

(Dr. Palti in favor of Technion Parties)

To ALL TO WHOM THESE PRESENTS SHALL COME OR MAY CONCERN, KNOW THAT:

This Release and Covenant Not to Xxx is made in connection with that certain Settlement Agreement of even date hereof, made and entered between The Technion-Israel Institute of Technology, the Technion Research and Development Foundation, Novocure Limited and Novocure (Israel) Ltd. (the “Agreement”);

Dr. Yoram Palti, for himself and his past, present and/or future heirs, successors, assigns, and anyone claiming any right through or on his behalf, whether acting on his behalf or in their individual capacities, as successor, heir or assignee of the rights of Dr. Yoram Palti (collectively, the “Releasors”), for good and valuable consideration (the receipt and sufficiency of which is hereby acknowledged):

1. Hereby irrevocably and unconditionally releases and discharges The Technion-Israel Institute of Technology and the Technion Research and Development Foundation and all of their respective affiliates, agents, successors, heirs and assigns (together, the “Releasees”), including, but not limited to, any past or present corporations or partnerships in which they hold an interest in, from any and all claims, actions, causes of action, suits, liabilities, rights, debts, demands, damages, covenants, contracts, controversies, agreements, promises, and complaints whatsoever, in law, equity or otherwise, under Israeli law, United States law, or otherwise, whether known or unknown, which the Releasors ever had, now have, or hereafter may have, for, upon, or by any matter, cause or thing whatsoever, from the beginning of the World to the date of this Release and Covenant Not to Xxx, that are either: (i) being released by the Releasees pursuant to the Release and Covenant Not to Xxx delivered simultaneously herewith by the Releasees in favor of, inter alia, Dr. Yoram Palti (the “Technion Release”); or (ii) with respect to, in connection with, or as a result of either: (a) the claims of the Releasees with respect to and/or in connection with the alleged rights of the Releasees in the Technology (as defined in the Agreement) and the activities of Dr. Yoram Palti and the Releasors at any time prior to the date of the Agreement with respect to the Technology, including, without limitation, activities carried out by Dr. Palti with respect to the Technology, by himself or in concert with others, while Dr. Palti was engaged in research and development or in any other capacity whatsoever at the Technion; or (b) the actions of the Releasees with respect to and/or in connection with that which is described in clause (a) above and the negotiations and execution of the Agreement (all of the above, the “Released Claims in Favor of the Technion”). The Releasor hereby further confirms that he has no and shall have no right, claim or entitlement with respect to, and hereby waive any such right, claim or entitlement, if any, with respect to any and all rights, benefits and considerations granted to the Technion Parties under the Agreement.

2. The Releasors also hereby covenant not to xxx, bring any claim of action or otherwise participate in any action against, and shall not assist in the instigation, commencement, maintenance, or prosecution of any claim of action, of any nature whatsoever, against the Releasees in any forum based on, relating to or arising out of the Released Claims in Favor of the Technion.

28

Execution Copy

3. The Releasors agree that they will not make any oral or written negative or derogatory statements or disparage or induce others to disparage (whether or not such statement legally constitutes libel or slander) the Releasees in connection with the subject matter of the Released Claims in Favor of the Technion.

This Release and Covenant Not To Xxx xxx not be changed or modified orally.

The Releasors hereby represent and warrant that (i) the Releasors have read and understand the terms of the Release and Covenant Not To Xxx, (ii) the Releasors have been advised by counsel as to the nature and legal effect of this Release and Covenant Not To Xxx, (iii) this Release and Covenant Not To Xxx has been duly authorized, executed and delivered, and (iv) this Release and Covenant Not To Xxx is a valid and binding obligation of said Releasors, enforceable against said Releasors in accordance with its terms.

This Release and Covenant Not to Xxx shall become effective following the execution of the Agreement by all Parties thereto and upon and subject to the Release and Covenant Not to Xxx delivered simultaneously herewith by the Releasees in favor of, inter alia, Dr. Yoram Palti becoming effective. Notwithstanding, the Releasors will not act in contradiction with the provisions of this Release and Covenant Not to Xxx as of the date of its execution and for so long as the Technion-Israel Institute of Technology and the Technion Research and Development Foundation are similarly bound under the Agreement not to act in contradiction with the Technion Release.

Additionally, Dr. Palti shall when making public statements about himself in the context of the Technology shall also generally identify himself as a former professor of the Technion Israel Institute of Technology.

[signature page follows]

29

Execution Copy

| By: | /s/ Yoram Palti | |

| Name: | Dr. Yoram Palti | |

| Dated: | ||

| [NOTARIZATION] | ||

30