SECURITY AGREEMENT

Exhibit 10.2

This SECURITY AGREEMENT, dated as of October __, 2019 (this “Security Agreement”) is entered into by and among Telemynd, Inc., a Delaware corporation limited liability company (“Obligor”) and the holders of the Notes (as defined below) (collectively, the “Secured Parties”) under the ]Purchase Agreement (defined below).

W I T N E S S E T H

WHEREAS, Obligor and the Secured Parties are parties to that certain Note Purchase Agreement, dated as of October __, 2019 by and among Obligor and Secured Parties (the “Purchase Agreement”), pursuant to which the Obligor issued up to $2,500,000 of those certain 12% Senior Secured Promissory Notes to each of the Secured Parties (the “Notes”); and

WHEREAS, the parties hereto acknowledge that the Notes, as well as the obligations under the Purchase Agreement, shall be entitled to the benefits of the security interest provided for the benefits of the holders of the Notes, all on a pari passu basis.

WHEREAS, in order to induce the Secured Parties to purchase the Notes, the Obligor agreed to execute and deliver to the Secured Parties this Agreement for the benefit of the Secured Parties and to grant to them a first priority security interest in certain property of the Obligor to secure the prompt payment, performance, and discharge in full of the Obligor’s obligations under the Notes (as defined below).

NOW, THEREFORE, in consideration of the agreements herein contained and for other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the parties hereto hereby agree as follows:

1. Certain Definitions. As used in this Agreement, the following terms shall have the meanings set forth in this Section 1. Terms used but not otherwise defined in this Agreement that are defined in Article 9 of the UCC (such as “general intangibles” and “proceeds”) shall have the respective meanings given such terms in Article 9 of the UCC.

(a) “Collateral” means the collateral in which the Secured Parties are granted a security interest by this Agreement and which shall include all of the assets set forth on Exhibit A attached hereto.

(b) “Obligations” means all of the Obligor’s obligations under this Agreement and the Notes in each case, whether now or hereafter existing, voluntary or involuntary, direct or indirect, absolute or contingent, liquidated or unliquidated, whether or not jointly owed with others, and whether or not from time to time decreased or extinguished and later increased, created or incurred, and all or any portion of such obligations or liabilities that are paid, to the extent all or any part of such payment is avoided or recovered directly or indirectly from the Secured Parties as a preference, fraudulent transfer or otherwise as such obligations may be amended, supplemented, converted, extended or modified from time to time.

(c) “Obligor” shall have the meaning set forth in the preamble of this Agreement.

(d) “UCC” means the Uniform Commercial Code, as currently in effect in the State of Delaware.

2. Grant of Security Interest. As an inducement for the Secured Parties to purchase the Notes from Obligor and to advance funds to Obligor and to secure the complete and timely payment, performance and discharge in full, as the case may be, of all of the Obligations, Obligor hereby, unconditionally and irrevocably, pledges, grants and hypothecates to the Secured Parties a continuing security interest in, a first lien upon, and a right of set-off against all of each Obligor’s right, title, and interest of whatsoever kind and nature in and to the Collateral (the “Security Interest”).

3. Representations Warranties Covenants and Agreements of the Obligor. Obligor represents and warrants to, and covenants and agrees with, the Secured Parties as follows:

(a) Obligor has the requisite corporate power and authority to enter into this Agreement and otherwise to carry out its obligations thereunder. The execution, delivery and performance by Obligor of this Agreement and the filings contemplated therein have been duly authorized by all necessary action on the part of Obligor and no further action is required by the Obligor.

(b) Obligor represents and warrants that it has no place of business or offices where its respective books of account and records are kept (other than temporarily at the offices of its attorneys or accountants) or places where Collateral is stored or located, except as set forth on Schedule A attached hereto;

(c) Obligor is the sole owner of the Collateral (except for non-exclusive licenses granted by Obligor in the ordinary course of business), free and clear of any liens, security interests, encumbrances, rights or claims, and is fully authorized to grant the Security Interest in and to pledge the Collateral. There is not on file in any governmental or regulatory authority, agency or recording office an effective financing statement, security agreement, license or transfer or any notice of any of the foregoing (other than those that have been filed in favor of the Secured Parties pursuant to this Agreement) covering or affecting any of the Collateral. So long as this Agreement shall be in effect, the Obligor shall not execute and shall not knowingly permit to be on file in any such office or agency any such financing statement or other document or instrument (except to the extent filed or recorded in favor of the Secured Parties pursuant to the terms of this Agreement).

2

(d) No part of the Collateral has been judged invalid or unenforceable. No written claim has been received that any Collateral or Obligor’s use of any Collateral violates the rights of any third Parties. There has been no adverse decision to Obligor’s claim of ownership rights in or exclusive rights to use the Collateral in any jurisdiction or to the Obligor’s right to keep and maintain such Collateral in full force and effect, and there is no proceeding involving said rights pending or, to the best knowledge of any Obligor, threatened before any court, judicial body, administrative or regulatory agency, arbitrator or other governmental authority.

(e) Obligor shall at all times maintain its books of account and records relating to the Collateral at its principal place of business and its Collateral at the locations set forth on Schedule A attached hereto and may not relocate such books of account and records or tangible Collateral unless it delivers to the Secured Parties at least 30 days prior to such relocation (i) written notice of such relocation and the new location thereof (which must be within the United States) and (ii) evidence that appropriate financing statements and other necessary documents have been filed and recorded and other steps have been taken to perfect the Security Interest to create in favor of the Secured Parties valid, perfected and continuing first priority liens in the Collateral.

(f) This Agreement creates in favor of the Secured Parties a valid security interest in the Collateral securing the payment and performance of the Obligations and, upon making the filings described in the immediately following sentence, a perfected security interest in such Collateral. Except for the filing of financing statements on Form UCC-I under the UCC with the jurisdictions indicated on Schedule B, attached hereto, no authorization or approval of or filing with or notice to any governmental authority or regulatory body is required either (i) for the grant by any Obligor of, or the effectiveness of, the Security Interest granted hereby or for the execution, delivery and performance of this Agreement by such Obligor or (ii) for the perfection of or exercise by the Secured Parties of their rights and remedies hereunder.

(g) On the date of execution of this Agreement, Obligor will deliver to the Secured Parties one or more executed UCC financing statements on Form UCC-1 under the UCC with respect to the Security Interest for filing with the jurisdictions indicated on Schedule B, attached hereto and in such other jurisdictions as may be requested by the Secured Parties.

(h) The execution, delivery, and performance of this Agreement does not conflict with or cause a breach or default, or an event that with or without the passage of time or notice, shall constitute a breach or default, under any agreement to which such Obligor is a party or by which such Obligor is bound. No consent (including, without limitation, from stockholders or creditors of any Obligor) is required for any Obligor to enter into and perform its obligations hereunder.

3

(i) Obligor shall at all times maintain the liens and Security Interest provided for hereunder as valid and perfected liens and security interests in the Collateral in favor of the Secured Parties until this Agreement and the Security Interest hereunder shall be terminated pursuant to Section 12 hereof. Obligor hereby agrees to defend the same against any and all persons. Such Obligor shall safeguard and protect all Collateral for the account of the Secured Parties. At the request of the Secured Parties, the Obligor will sign and deliver to the Secured Parties at any time or from time to time one or more financing statements pursuant to the UCC (or any other applicable statute) in form reasonably satisfactory to the Secured Parties and will pay the cost of filing the same in all public offices wherever filing is, or is deemed by the Secured Parties to be, necessary or desirable to effect the rights and obligations provided for herein. Without limiting the generality of the foregoing, such Obligor shall pay all fees, taxes and other amounts necessary to maintain the Collateral and the Security Interest hereunder, and the Obligor shall obtain and furnish to the Secured Parties from time to time, upon demand, such releases and/or subordinations of claims and liens which may be required to maintain the priority of the Security Interest hereunder.

(j) Obligor will not transfer, pledge, hypothecate, encumber, license (except for non-exclusive licenses granted by such Obligor in the ordinary course of business), sell or otherwise dispose of any of the Collateral without the prior written consent of the Secured Parties.

(k) Obligor shall keep and preserve their Equipment, Inventory, and other tangible Collateral in good condition, repair and order and shall not operate or locate any such Collateral (or cause to be operated or located) in any area excluded from insurance coverage.

(l) Obligor shall, within ten (10) days of obtaining knowledge thereof, advise the Secured Parties promptly, in sufficient detail, of any substantial change in the Collateral, and of the occurrence of any event which would have a material adverse effect on the value of the Collateral or on the Secured Parties’ security interest therein.

(m) Obligor shall promptly execute and deliver to the Secured Parties such further deeds, mortgages, assignments, security agreements, financing statements or other instruments, documents, certificates and assurances and take such further action as the Secured Parties may from time to time request and may in its sole discretion deem necessary to perfect, protect or enforce its security interest in the Collateral.

(n) Obligor shall permit the Secured Parties and their representatives and agents to inspect the Collateral at any time, and to make copies of records pertaining to the Collateral as may be requested by the Secured Parties from time to time.

(o) Obligor will take all steps reasonably necessary to diligently pursue and seek to preserve, enforce and collect any rights, claims, causes of action and accounts receivable in respect of the Collateral.

(p) Obligor shall promptly notify the Secured Parties in sufficient detail upon becoming aware of any attachment, garnishment, execution or other legal process levied against any Collateral and of any other information received by the Obligor that may materially affect the value of the Collateral, the Security Interest or the rights and remedies of the Secured Parties hereunder.

4

(q) All information heretofore, herein or hereafter supplied to the Secured Parties by or on behalf of the Obligor with respect to the Collateral is accurate and complete in all material respects as of the date furnished.

4. Defaults. The following events shall be “Events of Default”:

(a) The occurrence of an Event of Default (as defined in the Notes) under the Notes;

(b) Any representation or warranty of any Obligor in this Agreement shall prove to have been incorrect in any material respect when made; and

(c) The failure by Obligor to observe or perform any of its obligations hereunder or the Notes, for five (5) days after receipt by Obligor of notice of such failure from the Secured Parties.

5. Duty To Hold In Trust. Upon the occurrence of any Event of Default and at any time thereafter, Obligor shall, upon receipt by it of any revenue, income or other sums subject to the Security Interest, whether payable pursuant to the Notes or otherwise, or of any check, draft, note, trade acceptance or other instrument evidencing an obligation to pay any such sum, hold the same in trust for the Secured Parties and shall forthwith endorse and transfer any such sums or instruments, or both, to the Secured Parties for application to the satisfaction of the Obligations.

6. Rights and Remedies Upon Default. Upon the occurrence of any Event of Default and at any time thereafter, the Secured Parties shall have the right to exercise all of the remedies conferred hereunder and under the Notes, and the Secured Parties shall have all the rights and remedies of a secured Parties under the UCC and/or any other applicable law (including the Uniform Commercial Code of any jurisdiction in which any Collateral is then located). Without limitation, the Secured Parties shall have the following rights and powers:

(a) The Secured Parties shall have the right to take possession of the Collateral and, for that purpose, enter, with the aid and assistance of any person, any premises where the Collateral, or any part thereof, is or may be placed and remove the same, and the Obligor shall assemble the Collateral and make it available to the Secured Parties at places which the Secured Parties shall reasonably select, whether at the Obligor’s premises or elsewhere, and make available to the Secured Parties, without rent, all of the Obligor’s respective premises and facilities for the purpose of the Secured Parties taking possession of, removing or putting the Collateral in saleable or disposable form.

(b) The Secured Parties shall have the right to operate the business of the Obligor using the Collateral and shall have the right to assign, sell, lease or otherwise dispose of and deliver all or any part of the Collateral, at public or private sale or otherwise, either with or without special conditions or stipulations, for cash or on credit or for future delivery, in such parcel or parcels and at such time or times and at such place or places, and upon such terms and conditions as the Secured Parties may deem commercially reasonable, all without (except as shall be required by applicable statute and cannot be waived) advertisement or demand upon or notice to the Obligor or right of redemption of the Obligor, which are hereby expressly waived. Upon each such sale, lease, assignment or other transfer of Collateral, the Secured Parties may, unless prohibited by applicable law which cannot be waived, purchase all or any part of the Collateral being sold, free from and discharged of all trusts, claims, right of redemption and equities of the Obligor, which are hereby waived and released.

5

7. Applications of Proceeds. The proceeds of any such sale, lease or other disposition of the Collateral hereunder shall be applied first, to the expenses of retaking, holding, storing, processing and preparing for sale, selling, and the like (including, without limitation, any taxes, fees and other costs incurred in connection therewith) of the Collateral, to the reasonable attorneys’ fees and expenses incurred by the Secured Parties in enforcing their rights hereunder and in connection with collecting, storing and disposing of the Collateral, and then to satisfaction of the Obligations, and to the payment of any other amounts required by applicable law, after which the Secured Parties shall pay to the Obligor any surplus proceeds. If, upon the sale, license or other disposition of the Collateral, the proceeds thereof are insufficient to pay all amounts to which the Secured Parties is legally entitled, such Obligor will be liable for the deficiency, together with interest thereon, at the rate of 12% per annum or such lesser amount permitted by applicable law (the “Default Rate”), and the reasonable fees of any attorneys employed by the Secured Parties to collect such deficiency. To the extent permitted by applicable law, such Obligor waives all claims, damages and demands against the Secured Parties arising out of the repossession, removal, retention or sale of the Collateral, unless due to the gross negligence or willful misconduct of the Secured Parties.

8. Costs and Expenses. The Obligor agree to pay all out-of-pocket fees, costs, and expenses incurred in connection with any filing required hereunder, including without limitation, any financing statements, continuation statements, partial releases and/or termination statements related thereto or any expenses of any searches reasonably required by the Secured Parties. The Obligor shall also pay all other claims and charges which in the reasonable opinion of the Secured Parties might prejudice, imperil or otherwise affect the Collateral or the Security Interest therein. The Obligor will also, upon demand, pay to the Secured Parties the amount of any and all reasonable expenses, including the reasonable fees and expenses of its counsel and of any experts’ and agents, which the Secured Parties may incur in connection with (i) the enforcement of this Agreement, (ii) the custody or preservation of, or the sale of, collection from, or other realization upon, any of the Collateral, or (iii) the exercise or enforcement of any of the rights of the Secured Parties under the Notes. Until so paid, any fees payable hereunder shall be added to the principal amount of the Notes and shall bear interest at the Default Rate.

9. Responsibility for Collateral. Obligor assumes all liabilities and responsibility in connection with all Collateral, and the obligations of the Obligor hereunder or under the Notes shall in no way be affected or diminished by reason of the loss, destruction, damage or theft of any of the Collateral or its unavailability for any reason.

6

10. Security Interest Absolute. All rights of the Secured Parties and all Obligations of the Obligor hereunder, shall be absolute and unconditional, irrespective of: (a) any lack of validity or enforceability of this Agreement, the Notes or any agreement entered into in connection with the foregoing, or any portion hereof or thereof; (b) any change in the time, manner, or place of payment or performance of, or in any other term of, all or any of the Obligations, or any other amendment or waiver of or any consent to any departure from the Notes, the Transaction Documents or any other agreement entered into in connection with the foregoing; (c) any exchange, release or nonperfection of any of the Collateral, or any release or amendment or waiver of or consent to departure from any other collateral for, or any guaranty, or any other security, for all or any of the Obligations; (d) any action by the Secured Parties to obtain, adjust, settle and cancel in its sole discretion any insurance claims or matters made or arising in connection with the Collateral; or (e) any other circumstance which might otherwise constitute any legal or equitable defense available to the Obligor, or a discharge of all or any part of the Security Interest granted hereby. Until the Obligations shall have been paid and performed in full, the rights of the Secured Parties shall continue even if the Obligations are barred for any reason, including, without limitation, the running of the statute of limitations or bankruptcy. Each Obligor expressly waives presentment, protest, notice of protest, demand, notice of nonpayment and demand for performance. In the event that at any time any transfer of any Collateral or any payment received by the Secured Parties hereunder shall be deemed by final order of a court of competent jurisdiction to have been a voidable preference or fraudulent conveyance under the bankruptcy or insolvency laws of the United States, or shall be deemed to be otherwise due to any Parties other than the Secured Parties, then, in any such event, the Obligor’s obligations hereunder shall survive cancellation of this Agreement, and shall not be discharged or satisfied by any prior payment thereof and/or cancellation of this Agreement, but shall remain a valid and binding obligation enforceable in accordance with the terms and provisions hereof. The Obligor waives all right to require the Secured Parties to proceed against any other person or to apply any Collateral which the Secured Parties may hold at any time, or to marshal assets, or to pursue any other remedy. The Obligor waives any defense arising by reason of the application of the statute of limitations to any obligation secured hereby.

11. Term of Agreement. This Agreement and the Security Interest shall terminate on the date on which all payments under the Notes have been made in full and all other Obligations have been paid or discharged. Upon such termination, the Secured Parties, at the request and at the expense of the Obligor, will join in executing any termination statement with respect to any financing statement executed and filed pursuant to this Agreement.

12. Power of Attorney; Further Assurances.

(a) The Obligor authorizes the Secured Parties, and does hereby make, constitute and appoint it, and its respective officers, agents, successors or assigns with full power of substitution, as each Obligor’s true and lawful attorney-in-fact, with power, in its own name or in the name of the Obligor, to, after the occurrence and during the continuance of an Event of Default, (i) endorse any notes, checks, drafts, money orders, or other instruments of payment (including payments payable under or in respect of any policy of insurance) in respect of the Collateral that may come into possession of the Secured Parties; (ii) to sign and endorse any UCC financing statement or any invoice, freight or express xxxx, xxxx of lading, storage or warehouse receipts, drafts against debtors, assignments, verifications and notices in connection with accounts, and other documents relating to the Collateral; (iii) to pay or discharge taxes, liens, security interests or other encumbrances at any time levied or placed on or threatened against the Collateral; (iv) to demand, collect, receipt for, compromise, settle and xxx for monies due in respect of the Collateral; and (v) generally, to do, at the option of the Secured Parties, and at the Obligor’ expense, at any time, or from time to time, all acts and things which the Secured Parties deems necessary to protect, preserve and realize upon the Collateral and the Security Interest granted therein in order to effect the intent of this Agreement, the Notes and the Transaction Documents all as fully and effectually as the Obligor might or could do; and each Obligor hereby ratifies all that said attorney shall lawfully do or cause to be done by virtue hereof. This power of attorney is coupled with an interest and shall be irrevocable for the term of this Agreement and thereafter as long as any of the Obligations shall be outstanding.

7

(b) On a continuing basis, Obligor will make, execute, acknowledge, deliver, file and record, as the case may be, in the proper filing and recording places in any jurisdiction, including, without limitation, the jurisdictions indicated on Schedule B, attached hereto, all such instruments, and take all such action as may reasonably be deemed necessary or advisable, or as reasonably requested by the Secured Parties, to perfect the Security Interest granted hereunder and otherwise to carry out the intent and purposes of this Agreement, or for assuring and confirming to the Secured Parties the grant or perfection of a security interest in all the Collateral.

(c) Obligor hereby irrevocably appoints the Secured Parties as its attorney-in-fact, with full authority in the place and stead of the Obligor and in the name of the Obligor, from time to time in the Secured Parties’ discretion, to take any action and to execute any instrument which the Secured Parties may deem necessary or advisable to accomplish the purposes of this Agreement, including the filing, in its sole discretion, of one or more financing or continuation statements and amendments thereto, relative to any of the Collateral without the signature of the Obligor where permitted by law.

13. Notices. All notices, requests, demands and other communications hereunder shall be in writing, with copies to all the other parties hereto, and shall be deemed to have been duly given when (i) if delivered by hand, upon receipt, (ii) if sent by facsimile, upon receipt of proof of sending thereof, (iii) if sent by nationally recognized overnight delivery service (receipt requested), the next business day or (iv) if mailed by first-class registered or certified mail, return receipt requested, postage prepaid, four days after posting in the U.S. mails, in each case if delivered to the following addresses:

| If to Obligor: | Telemynd, Inc. |

| 00000 Xx Xxxxxxx, Xxxxx 000 | |

| Xxxxxxx Xxxxx, XX 00000 | |

| Attention: Xxxxxxx Xxxxxxx | |

| Email: xxxxxxx@xxxxxxxx.xxx |

If to Secured Parties: At the address set forth opposite their name on the signature page

14. Other Security. To the extent that the Obligations are now or hereafter secured by property other than the Collateral or by the guarantee, endorsement or property of any other person, firm, corporation or other entity, then the Secured Parties shall have the right, in its sole discretion, to pursue, relinquish, subordinate, modify or take any other action with respect thereto, without in any way modifying or affecting any of the Secured Parties’ rights and remedies hereunder.

8

15. Miscellaneous.

(a) No course of dealing between the Obligor and the Secured Parties, nor any failure to exercise, nor any delay in exercising, on the part of the Secured Parties, any right, power or privilege hereunder or under the Notes shall operate as a waiver thereof; nor shall any single or partial exercise of any right, power or privilege hereunder or thereunder preclude any other or further exercise thereof or the exercise of any other right, power or privilege.

(b) All of the rights and remedies of the Secured Parties with respect to the Collateral, whether established hereby or by the Notes or by any other agreements, instruments or documents or by law shall be cumulative and may be exercised singly or concurrently.

(c) This Agreement constitutes the entire agreement of the parties with respect to the subject matter hereof and is intended to supersede all prior negotiations, understandings and agreements with respect thereto. Except as specifically set forth in this Agreement, no provision of this Agreement may be modified or amended except by a written agreement specifically referring to this Agreement and signed by the parties hereto.

(d) In the event that any provision of this Agreement is held to be invalid, prohibited or unenforceable in any jurisdiction for any reason, unless such provision is narrowed by judicial construction, this Agreement shall, as to such jurisdiction, be construed as if such invalid, prohibited or unenforceable provision had been more narrowly drawn so as not to be invalid, prohibited or unenforceable. If, notwithstanding the foregoing, any provision of this Agreement is held to be invalid, prohibited or unenforceable in any jurisdiction, such provision, as to such jurisdiction, shall be ineffective to the extent of such invalidity, prohibition or unenforceability without invalidating the remaining portion of such provision or the other provisions of this Agreement and without affecting the validity or enforceability of such provision or the other provisions of this Agreement in any other jurisdiction.

(e) No waiver of any breach or default or any right under this Agreement shall be considered valid unless in writing and signed by the Parties giving such waiver, and no such waiver shall be deemed a waiver of any subsequent breach or default or right, whether of the same or similar nature or otherwise.

(f) This Agreement shall be binding upon and inure to the benefit of each Parties hereto and its successors and assigns.

(g) Each Parties shall take such further action and execute and deliver such further documents as may be necessary or appropriate in order to carry out the provisions and purposes of this Agreement.

(h) This Agreement shall be construed in accordance with the laws of the State of Delaware except to the extent the validity, perfection or enforcement of a security interest hereunder in respect of any particular Collateral which are governed by a jurisdiction other than the State of Delaware in which case such law shall govern. Each of the parties hereto irrevocably submits to the exclusive jurisdiction of any Delaware State or United States Federal court over any action or proceeding arising out of or relating to this Agreement, and the parties hereto hereby irrevocably agree that all claims in respect of such action or proceeding may be heard and determined in such Delaware State or Federal court. The parties hereto agree that a final judgment in any such action or proceeding shall be conclusive and may be enforced in other jurisdictions by suit on the judgment or in any other inner provided by law. The parties hereto further waive any objection to venue in the State of Delaware and any objection to an action or proceeding in the State of Delaware, on the basis of forum non convenient.

(i) This Agreement may be executed in any number of counterparts, each of which when so executed shall be deemed to be an original and, all of which taken together shall constitute one and the same Agreement in the event that any signature is delivered by facsimile transmission, such signature shall create a valid binding obligation of the Parties executing (or on whose behalf such signature is executed) the same with the same force and effect as if such facsimile signature were the original thereof.

************

9

IN WITNESS WHEREOF, the parties hereto have caused this Security Agreement to be duly executed and delivered as of the date first above written.

| OBLIGOR: | |

| TELEMYND, INC. |

| By | ||

| Name: | ||

| Title: |

| SECURED PARTIES: |

| Name: RSJ Investments SICAV a.s. | |

| Address: |

| Name: Xxxx Xxxxxxxxx Revocable Trust | |

| Address: 0000 Xxx Xxxxxx Xxxxx. Xxxx 0000, Xxxxxx, XX 00000 |

| Name: Xxxxx Xxxxxx Unanue | |

| Address: 00 Xxxxxx Xx., Xxx Xxxxxx, XX 00000 |

| Name: Xxxxxxxx Xxxxxx | |

| Address: 0 Xxxxxxx Xxxxx Xxxx, Xxxxxxxxxx, XX 00000 |

| Name: Xxxxxxx Xxxxxxx | |

| Address: 0 Xxxx Xxxx, Xxxxxxx, XX 00000 |

10

SCHEDULE A

Principal Place of Business of the Obligor:

California

Locations Where Collateral is Located or Stored:

Massachusetts

11

SCHEDULE B

Jurisdictions:

12

Exhibit A

Collateral

(see attached)

13

Friday, October 25, 2019

PEER background + asset summary

| 1. | Scientific principle |

| ● | Quantitative EEG (QEEG) detects physiological sensitivity and resistance to psychotropic medication classes and agents: mechanism has been well established in independent studies, but institutional Psychiatry has yet to embrace testing as standard of care. |

| ● | Background: Since the 1990s, PEER (also known as xXXX) has been a registry that collects outcomes of patients on specific medications referenced to known pathophysiology as defined by QEEG. Outcome data and machine learning technologies accelerate our knowledge of individual patient medication response. |

| 2. | PEER Outcomes Database & Machine Learning Methods |

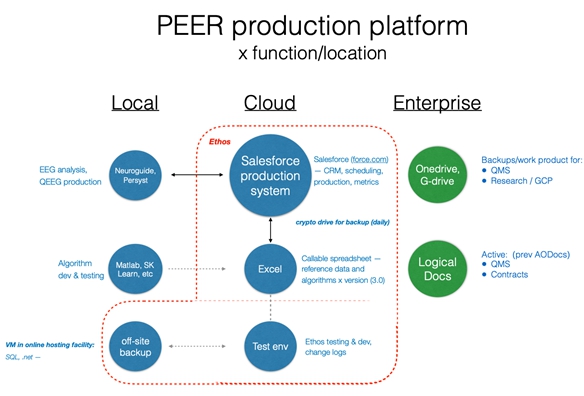

| ● | Operating platform (see chart): |

| ● | Salesforce (xxxxx.xxx) — CRM, scheduling, production, metrics. This is the basic operating system for delivering PEER Reports, using xxxxx.xxx as essentially a lab information system, maintained by Ethos. Reports and dashboards are run within Salesforce, with analytics performed using PowerBI. |

| ● | Excel is used as a fixed, callable database for release 3.0 PEER algorithms and analytics. The reference database used to produce each PEER Report remains an Excel spreadsheet hosted online by Ethos. |

| ● | EEG/QEEG — Raw EEGs are uploaded, converted and compared to a normative dataset using Neuroguide from Applied Neuroscience Inc. Data quality is inspected and artifacts are removed using Neuroguide and Persyst. |

| ● | PowerBI — product and research analytics are performed on PEER datasets for current book of business, clinical studies and updates. |

| ● | MatLab, SK Learn libraries — used for basic algorithm development and independent validation. |

1

Friday, October 25, 2019

| ● | Quality Management System — LogicalDocs houses all quality-related materials, including Quality Manual, SOPs, training records, and Trial Master Files for clinical studies. |

| 3. | PEER Clinical trials |

| ● | MYND - sponsored randomized clinical trials |

| - | VA/Xxxxxxxxx 2007: demonstrated early separation between xXXX-guided therapy and standard practice. n = 18, study was halted when Principal Investigator died unexpectedly. |

| - | Depression Efficacy Pilot 2009: randomized controlled trial comparing xXXX-guided therapy vs TMAP algorithm (a treatment algorithm popularized by the largest NIMH Depression study, STAR*D). Early statistically significant separation was achieved at n = 18. |

| - | Depression Efficacy Study 2011: full randomized controlled trial comparing xXXX vs a modified STAR*D algorithm, demonstrated statistically significant separation on primary and 9/11 secondary endpoints, n = 114. Publication in Journal of Psychiatric Research, Jan 2011. |

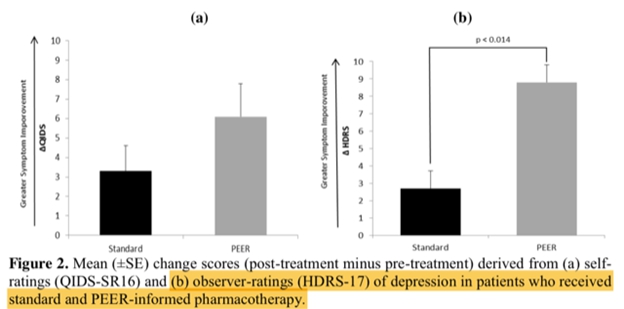

| - | Xxxxxx Xxxx Interim and Ongoing. Interim results of randomized controlled trial at n = 150 demonstrated statistically significant improvement for subjects whose physicians followed PEER (formerly xXXX) vs physicians who did not follow PEER-recommended therapy. PEER therapies resulted in 144% better improvement in depression scores (QIDS-16) over six months of care, with 75% lower suicidality and significantly better adherence to treatment visits. | |

| Continuation of Xxxxxx Xxxx protocol is currently being pursued by Xxxxxxx Health and other providers. |

| - | Canadian Forces & Brockville Prison studies, 2019: Replication study designed for military population, using Xxxxxx Xxxx protocol. Designed for 150 subjects, interim review by Royal Ottawa Hospital determined statistically significant improvement in depression and suicidal ideation had been achieved early at n = 30, as reported in January 2019. |

| - | MHSRS Poster Presentations 2015-2018 (see link) — ongoing research updates have been provided to US military and JSOC at the annual military health services research symposium. |

2

Friday, October 25, 2019

| ● | Payer analyses: |

| - | Stanford econometric analysis performed in 2018, which formed the basis of Population Health Management publication by found: |

| ● | A high level of evidence (XXX 1A) for 4 PEER studies |

| ● | Effect size in PEER studies was significantly higher than pivotal drug studies submitted for FDA approval |

| ● | Using national claims datasets and published efficacy results from PEER, and assuming a $600 ASP for PEER, payer net returns for each PEER Report were estimated at 4.7:1 i.e. $4.70 saved for each dollar spent on PEER. |

| - | United Biosource 2010: evidence at the time of this review was determined to equal or exceed evidence supporting drug approval. |

| - | United Health Evidence Review 2011: Optum Behavioral Health technology review determined that PEER is “not unproven”, with sufficient evidence to be used on a limited basis i.e. to be used by self-insured accounts on a case by case basis. |

| ● | Independent studies, meta-studies and reviews |

| - | EMBARC Trial, Trivedi, 2018: the first, large NIMH-sponsored multi-biomarker study finds QEEG features to be statistically significant predictors of antidepressant response. |

| - | Widge et al, American Journal of Psychiatry 2018: meta study finding 81 acceptable controlled trials of QEEG/treatment response prediction, conceding a predictive value of .76 for QEEG biomarkers. Nevertheless, concludes QEEG is “not ready for prime time” for use on all patients, without further study. Study excludes all PEER studies and EMBARC results. |

| 4. | Regulatory status/Quality Management Systems |

| ● | Class 1 MDDS — PEER has been registered since October, 2011 as a Class 1 Medical Device Data System, on the basis of its open registry and publication of drug models/outcomes for physicians to examine with each report. |

3

Friday, October 25, 2019

| ● | Class II pre-submission package was submitted in 2019 under the FDA’s new Breakthrough Device program, and is currently under review by CDRH. |

| ● | Emerging regulatory guidance has been drafted by FDA for use of machine learning for “Software as a Medical Device”, or SAMD. These draft guidelines formalize risk-based requirements for quality and labeling of device like PEER. |

| ● | Cites/location of records: LogicalDocs (prior versions: AODocs, G-drive) |

| 5. | PEER Intellectual Property |

| ● | Summary of Issued and Provisional Patents: |

| - | Portfolio I and II: basic process and methods patents covering use of quantitative EEG data with a reference database to predict treatment response in mental disorders. Both portfolios are linked to the original 2003 issued Xxxxxx and Xxxxx patent, with patent expirations having begun in 2017 and continuing through 2023. Successfully defended against Covidian (through acquisition of Aspect Medical) in 2009. |

| - | Portfolio III extends use of QEEG biomarkers to predict non-response to neuromodulation therapies such as TMS, an expensive non-pharmacologic treatment which was approved by FDA in 2008 and is now covered by most payers. Issued in Canada and EU through 2029, pending in the United States. |

| - | Portfolio IV applies to a combined neuropsychiatric battery of QEEG predictors and Pharmacogenomic (PGx) analysis, yielding superior response prediction based on better pharmacokinetics (drug metabolism in the liver) and better pharmacodynamics (medication action in the brain) through PEER-based treatment selection. Pending Office Action. |

4

Friday, October 25, 2019

Attachments:

Production system - high level resources

Canadian Interim analysis 1/19

References

5

Friday, October 25, 2019

Canadian Forces Interim Analysis, Xx. Xxxxxx Xxxxx, 1/19

6