COMMON STOCK PURCHASE WARRANT DYNARESOURCE, INC.

Exhibit 99.9

NEITHER THIS SECURITY NOR THE SECURITIES FOR WHICH THIS SECURITY IS EXERCISABLE HAVE BEEN REGISTERED WITH THE SECURITIES AND EXCHANGE COMMISSION OR THE SECURITIES COMMISSION OF ANY STATE IN RELIANCE UPON AN EXEMPTION FROM REGISTRATION UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), AND, ACCORDINGLY, MAY NOT BE OFFERED OR SOLD EXCEPT PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE SECURITIES ACT OR PURSUANT TO AN AVAILABLE EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND IN ACCORDANCE WITH APPLICABLE STATE SECURITIES LAWS.

DYNARESOURCE, INC.

| Warrant Shares: 2,166,527 | Initial Issuance Date: June 30, 2015 |

THIS COMMON STOCK PURCHASE WARRANT (this “Warrant”) certifies that, for value received, Golden Post Rail, LLC or its assigns (the “Holder”) is entitled, upon the terms and subject to the limitations on exercise and the conditions hereinafter set forth, at any time on or after the date hereof (the “Initial Issuance Date”) and on or prior to the close of business on the five (5) year anniversary of the Initial Issuance Date (the “Termination Date”) but not thereafter, to subscribe for and purchase from DynaResource, Inc., a Delaware corporation (the “Company”), up to 2,000,000 shares (as subject to adjustment hereunder, the “Warrant Shares”) of the Company’s common stock, par value $0.01 per share (the “Common Stock”). The purchase price of one Warrant Share of Common Stock under this Warrant shall be equal to the Exercise Price, as defined in Section 2(b).

Section 1. Definitions. Capitalized terms used and not otherwise defined herein shall have the meanings set forth in that certain Securities Purchase Agreement (the “Purchase Agreement”), dated May 6, 2015, by and between the Company and the Holder.

Section 2. Exercise.

(a) Exercise of Warrant. Exercise of the purchase rights represented by this Warrant may be made, in whole or in part, at any time or times on or after the Initial Issuance Date and on or before the Termination Date by delivery to the Company (or such other office or agency of the Company as it may designate by notice in writing to the registered Holder at the address of the Holder appearing on the Warrant Register (as defined below) of the Company) of a duly executed facsimile or electronic copy of the Notice of Exercise in the form attached hereto as Exhibit A and within three (3) Trading Days of the date said Notice of Exercise is delivered to the Company, the Company shall have received payment of the aggregate Exercise Price of the Warrant Shares thereby purchased by wire transfer or cashier’s check drawn on a United States bank. No ink-

1

original Notice of Exercise shall be required, nor shall any medallion guarantee (or other type of guarantee or notarization) of any Notice of Exercise form be required. Notwithstanding anything herein to the contrary, the Holder shall not be required to physically surrender this Warrant to the Company until the Holder has purchased all of the Warrant Shares available hereunder and this Warrant has been exercised in full, in which case, the Holder shall surrender this Warrant to the Company for cancellation within three (3) Trading Days of the date the final Notice of Exercise is delivered to the Company. Partial exercises of this Warrant resulting in purchases of a portion of the total number of Warrant Shares available hereunder shall have the effect of lowering the outstanding number of Warrant Shares purchasable hereunder in an amount equal to the number of Warrant Shares purchased. The Holder and the Company shall maintain records showing the number of Warrant Shares purchased and the date of such purchases. The Company shall deliver any objection to any Notice of Exercise within one (1) Business Day of receipt of such notice. The Holder and any assignee, by acceptance of this Warrant, acknowledge and agree that, by reason of the provisions of this paragraph, following the purchase of a portion of the Warrant Shares hereunder, the number of Warrant Shares available for purchase hereunder at any given time may be less than the amount stated on the face hereof.

“Business Day” shall mean any day other than Saturday, Sunday or other day on which commercial banks in the City of New York are authorized or required by law to remain closed.

“Trading Day” shall mean 9:30 a.m. to 3:59 p.m. on any day on which the Common Stock is traded on the over-the-counter market on the electronic bulletin board or a securities exchange, or, if the Common Stock is not so traded, a Business Day.

(b) Exercise Price. The exercise price per Warrant Share of Common Stock under this Warrant shall be $2.50, subject to adjustment hereunder (the “Exercise Price”).

(c) Mechanics of Exercise.

(i) Delivery of Warrant Shares Upon Exercise. The Company shall, promptly upon receipt of a Notice of Exercise (but in any event, not less than one (1) Trading Day after receipt of such Notice of Exercise), (i) send, via facsimile, e-mail or other electronic means, a confirmation of receipt of such Notice of Exercise to the Holder and the Company’s transfer agent, which confirmation shall constitute an instruction to the Company’s transfer agent to process such Notice of Exercise in accordance with the terms herein, and (ii) on or before the third (3rd) Trading Day following the date of receipt by the Company of such Notice of Exercise and the aggregate Exercise Price (such date, the “Warrant Share Delivery Date”), the Company shall credit the aggregate number of Warrant Shares to which the Holder shall be entitled to such Holder’s or its designee’s balance account with The Depository Trust Company via its Deposit Withdrawal Agent

2

Commission system (“DWAC”) if the Company is then a participant in such system and either (A) there is an effective Registration Statement permitting the issuance of the Warrant Shares to, or resale of the Warrant Shares by, the Holder or (B) the Warrant Shares are eligible for resale by the Holder without volume or manner-of-sale limitations and without the need for the Company to be in compliance with the current public information requirements pursuant to Rule 144 promulgated under the Securities Act (“Rule 144”), and otherwise by physical delivery to the address specified by the Holder in such Notice of Exercise on or before the Warrant Share Delivery Date. The Warrant Shares shall be deemed to have been issued, and Holder or any other person so designated to be named therein shall be deemed to have become a holder of record of such Warrant Shares for all purposes, as of the date this Warrant has been exercised, with payment to the Company of the Exercise Price and all taxes required to be paid by the Holder, if any, pursuant to Section 2(c)(vi) prior to the issuance of such Warrant Shares, having been paid. If the Company fails for any reason to deliver to the Holder the Warrant Shares pursuant to a Notice of Exercise following receipt of the Exercise Price by the Warrant Share Delivery Date, the Company shall pay to the Holder, in cash, as liquidated damages and not as a penalty, for each $1,000 of Warrant Shares subject to such exercise (based on the VWAP on the date of the applicable Notice of Exercise), $10 per Trading Day (increasing up to a maximum of $180 for each $1,000 of Warrant Shares subject to such exercise) for each Trading Day after such Warrant Share Delivery Date until such Warrant Shares are delivered or Holder rescinds such exercise.

“VWAP” shall mean the dollar volume-weighted average price for the Common Stock on the over-the-counter market on the electronic bulletin board, or if the Common Stock becomes listed on an exchange, such exchange, during the period beginning at 9:30:01 a.m., New York City time, and ending at 4:00:00 p.m., New York City time, as reported by Bloomberg, L.P. (“Bloomberg”). If the VWAP cannot be calculated for the Common Stock on such date on the foregoing basis, the VWAP of the Common Stock on such date shall be the last reported closing sales price for such date. All such determinations shall be appropriately adjusted for any stock splits, stock dividends, stock combinations, recapitalizations or other similar transactions during the relevant period.

(ii) Delivery of New Warrants Upon Exercise. If this Warrant shall have been exercised in part, the Company shall, at the request of the Holder and upon surrender of this Warrant certificate, at the time of delivery of the Warrant Shares, deliver to the Holder a new Warrant evidencing the rights of the Holder to purchase the unpurchased Warrant Shares called for by this Warrant, which new Warrant shall in all other respects be identical with this Warrant.

3

(iii) Rescission Rights. If the Company fails to cause its transfer agent to transmit to the Holder the Warrant Shares pursuant to Section 2(c)(i) by the Warrant Share Delivery Date, then the Holder will have the right to rescind such exercise.

(iv) Compensation for Buy-In on Failure to Timely Deliver Warrant Shares Upon Exercise. In addition to any other rights available to the Holder, if the Company fails to cause its transfer agent to transmit to the Holder the Warrant Shares pursuant to an exercise on or before the Warrant Share Delivery Date, and if after such date the Holder is required by its broker to purchase (in an open market transaction or otherwise), or the Holder’s brokerage firm otherwise purchases, shares of Common Stock to deliver in satisfaction of a sale by the Holder of the Warrant Shares which the Holder anticipated receiving upon such exercise (a “Buy-In”), then the Company shall (A) pay in cash to the Holder the amount, if any, by which (x) the Holder’s total purchase price (including brokerage commissions, if any) for the shares of Common Stock so purchased exceeds (y) the amount obtained by multiplying (1) the number of Warrant Shares that the Company was required to deliver to the Holder in connection with the exercise at issue by (2) the price at which the sell order giving rise to such purchase obligation was executed, and (B) at the option of the Holder, either reinstate the portion of this Warrant and the equivalent number of Warrant Shares for which such exercise was not honored (in which case such exercise shall be deemed rescinded) or deliver to the Holder the number of shares of Common Stock that would have been issued had the Company timely complied with its exercise and delivery obligations hereunder. For example, if the Holder purchases Common Stock having a total purchase price of $11,000 to cover a Buy-In with respect to an attempted exercise of Warrant Shares with an aggregate sale price giving rise to such purchase obligation of $10,000, under clause (A) of the immediately preceding sentence the Company shall be required to pay the Holder $1,000. The Holder shall provide the Company written notice indicating the amounts payable to the Holder in respect of the Buy-In and, upon request of the Company, evidence of the amount of such loss. Nothing herein shall limit the Holder’s right to pursue any other remedies available to it hereunder, at law or in equity including, without limitation, a decree of specific performance and/or injunctive relief with respect to the Company’s failure to timely deliver Warrant Shares upon exercise of this Warrant as required pursuant to the terms hereof.

(v) No Fractional Shares or Scrip. No fractional shares or scrip representing fractional shares shall be issued upon the exercise of this Warrant. As to any fraction of a share which the Holder would otherwise be entitled to purchase upon such exercise, the Company shall, at its election, either pay a cash adjustment in respect of such final fraction in an amount equal to such fraction multiplied by the Exercise Price or round up to the next whole share.

4

(vi) Charges, Taxes and Expenses. The issuance of Warrant Shares shall be made without charge to the Holder for any issue or transfer tax or other incidental expense in respect of the issuance of Warrant Shares, all of which taxes and expenses shall be paid by the Company, and such Warrant Shares shall be issued in the name of the Holder or in such name or names as may be directed by the Holder; provided, that in the event that Warrant Shares are to be issued in a name other than the name of the Holder, this Warrant when surrendered for exercise shall be accompanied by the Assignment Form attached hereto duly executed by the Holder and the Company may require, as a condition thereto, the payment of a sum sufficient to reimburse it for any transfer tax incidental thereto. The Company shall pay all transfer agent fees required for same-day processing of any Notice of Exercise and all fees to the Depository Trust Company (or another established clearing corporation performing similar functions) required for same-day electronic delivery of the Warrant Shares.

(vii) Closing of Books. The Company will not close its stockholder books or records in any manner that prevents the timely exercise of this Warrant, pursuant to the terms hereof.

Section 3. Certain Adjustments.

(a) Stock Dividends and Splits. If the Company, at any time while this Warrant is outstanding: (i) makes or issues or sets a record date for the determination of holders of Common Stock entitled to receive a dividend or other distribution payable in Common Stock, (ii) makes or issues or sets a record date for the determination of holders of Common Stock entitled to receive a dividend or other distribution payable in securities or property other than Common Stock, (iii) effects a stock split of the outstanding shares of Common Stock or (iv) combines the outstanding shares of Common Stock, then in each case the Exercise Price shall be multiplied by a fraction of which the numerator shall be the number of shares of Common Stock (excluding treasury shares, if any) outstanding immediately before such event and of which the denominator shall be the number of shares of Common Stock (excluding treasury shares, if any) outstanding immediately after such event, and the number of Warrant Shares issuable upon exercise of this Warrant shall be proportionately adjusted such that the aggregate Exercise Price of this Warrant shall remain unchanged. Any adjustment made pursuant to this Section 3(a) shall become effective immediately after the record date for the determination of stockholders entitled to receive such dividend or distribution and shall become effective immediately after the effective date in the case of a subdivision, combination or re-classification.

(b) Subsequent Equity Sales. If the Company or any Subsidiary thereof, as applicable, at any time while this Warrant is outstanding, shall sell or grant any option to purchase, or sell or grant any right to reprice, or otherwise dispose of or issue, including, without limitation, (i) any issuance as a result of the settlement or resolution (by judgment or otherwise) of any litigation or threatened litigation or (ii) the issuance of

5

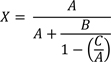

Common Stock or Common Stock Equivalents to any Subsidiary after the Initial Issuance Date, or announce any offer, sale, grant or any option to purchase or other disposition, any Common Stock or Common Stock Equivalents other than Excluded Securities (such issuances collectively, a “Dilutive Issuance”), then simultaneously with the consummation of each Dilutive Issuance the Exercise Price shall be multiplied according to the following equation:

where:

| A = | the aggregate number of shares of Common Stock outstanding prior to the Dilutive Issuance, on a fully-diluted basis; | |

| B = | the number of new shares of Common Stock or Common Stock Equivalents issued in the Dilutive Issuance, on a fully-diluted basis; | |

| C = | the aggregate number of shares of Common Stock into which this Warrant is exercisable prior to the Dilutive Issuance; and | |

| X = | the number by which to multiply the Exercise Price in effect immediately prior to the Dilutive Issuance. | |

In addition, simultaneously with the consummation of each Dilutive Issuance, the number of Warrant Shares issuable hereunder shall be increased such that the aggregate Exercise Price payable hereunder, after taking into account the decrease in the exercise Price, shall be equal to the aggregate Exercise Price prior to such adjustment. The Company shall notify the Holder, in writing, no later than the Trading Day following the issuance or deemed issuance of any Common Stock or Common Stock Equivalents subject to this Section 3(b), indicating therein the calculation of the equation in this Section 3(b) (such notice, the “Dilutive Issuance Notice”). For purposes of clarification, whether or not the Company provides a Dilutive Issuance Notice pursuant to this Section 3(b), upon the occurrence of any Dilutive Issuance, the Holder is entitled to receive a number of Warrant Shares based upon the adjusted Exercise Price regardless of whether the Holder accurately refers to the adjusted Exercise Price in the Notice of Exercise.

“Excluded Securities” shall mean (i) shares of Common Stock or Common Stock Equivalents issued in the transactions contemplated by the Purchase Agreement, including pursuant to the Company’s Certificate of Designations of Series C Senior Convertible Preferred Stock (the “Certificate of Designations”) other than Common Stock Equivalents issued pursuant to the antidilution adjustment provisions in Section 6(d)(iv) and Section 6(d)(vi) of the Certificate of Designations, and (ii) any of the Company’s equity securities issued to a holder of shares of the Company’s Series C Preferred Stock pursuant to the preemptive rights provided by the Certificate of Designations.

6

In the event the Company shall issue or sell any shares of preferred stock of the Company that are not convertible into Common Stock, then an appropriate adjustment to the securities to be received upon exercise of this Warrant (by adjustments of the Exercise Price or otherwise) shall be made, as the Holder and the Company shall mutually agree.

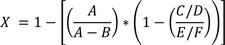

(c) Subsequent Equity Issuances of Subsidiary. If at any time while this Warrant is outstanding, (i) the Company’s ownership of DynaMexico Shares shall decrease (by forfeiture or shifting of ownership or otherwise) or (ii) DynaResource de Mexico S.A. de C.V. (the “Mexican Subsidiary”) shall issue or sell any DynaMexico Shares or DynaMexico Share Equivalents to any person other than the Company, in each case including, without limitation, as a result of the settlement or resolution (by judgment or otherwise) of any litigation or threatened litigation (such decreases or issuances collectively, a “Subsidiary Dilutive Event”), then simultaneously with the consummation of each Subsidiary Dilutive Event the Exercise price shall be multiplied according to the following equation:

where:

| A = | the aggregate number of shares of Common Stock outstanding prior to the Subsidiary Dilutive Event, on a fully-diluted basis; | |

| B = | the aggregate number of shares of Common Stock for which this Warrant is exercisable prior to the Subsidiary Dilutive Event; | |

| C = | the number of shares in the Mexican Subsidiary held by the Company following the Subsidiary Dilutive Event; | |

| D = | the aggregate number of shares in the Mexican Subsidiary outstanding following the Subsidiary Dilutive Event; | |

| E = | the number of shares in the Mexican Subsidiary held by the Company prior to the Subsidiary Dilutive Event; | |

| F = | the aggregate number of shares in the Mexican Subsidiary outstanding prior to the Subsidiary Dilutive Event; and | |

| X = | the number by which to multiply the Exercise Price in effect immediately prior to the Subsidiary Dilutive Event; provided, however, that if X is less than or equal to zero (0), then X shall equal .001. | |

In addition, simultaneously with the consummation of each Subsidiary Dilutive Event, the number of Warrant Shares issuable hereunder shall be increased such that the aggregate Exercise Price payable hereunder, after taking into account the decrease in the exercise Price, shall be equal to the aggregate Exercise Price prior to such adjustment. The Company shall notify the Holder, in writing, no later than the Trading Day following the Subsidiary Dilutive Event, indicating therein the calculation of the

7

equation in this Section 3(c) (such notice, the “Subsidiary Dilution Notice”). For purposes of clarification, whether or not the Company provides a Subsidiary Dilution Notice pursuant to this Section 3(c), upon the occurrence of any Subsidiary Dilution Event, the Holder is entitled to receive a number of Warrant Shares based upon the adjusted Exercise Price regardless of whether the Holder accurately refers to the adjusted Exercise Price in the Notice of Exercise.

“DynaMexico Shares” means the Fixed Capital “Series A” Shares or the Variable Capital “Series B” Shares issued by the Mexican Subsidiary.

“DynaMexico Share Equivalent” means any rights, warrants or options to purchase or other securities convertible into or exchangeable or exercisable for, directly or indirectly, any (1) DynaMexico Shares or (2) securities convertible into or exchangeable or exercisable for, directly or indirectly, DynaMexico Shares.

(d) Subsequent Rights Offerings. If the Company, at any time while this Warrant is outstanding, shall issue rights, options or warrants to all holders of Common Stock entitling them to subscribe for or purchase shares of Common Stock (the “Purchase Rights”), then, upon any exercise of this Warrant, the Holder will be entitled to acquire, upon the terms applicable to such Purchase Rights, the aggregate Purchase Rights that the Holder could have acquired if the Holder had held the number of Warrant Shares issued upon such exercise of this Warrant immediately before the date on which a record is taken for the grant, issuance or sale of such Purchase Rights, or, if no such record is taken, the date as of which the record holders of shares of Common Stock are to be determined for the grant, issue or sale of such Purchase Rights. For the term of this Warrant, the Company shall hold such Purchase Rights for the benefit of the Holder until the Holder exercises this Warrant or any portion thereof.

(e) Pro Rata Distributions. If the Company, at any time while this Warrant is outstanding, shall distribute to all holders of Common Stock evidences of its indebtedness or assets (including cash and cash dividends) or rights or warrants to subscribe for or purchase any security other than the Common Stock (a “Distribution”), then, upon any exercise of this Warrant, the Holder shall be entitled to participate in such Distribution to the same extent that the Holder would have participated therein if the Holder had held the number of Warrant Shares issued upon such exercise of this Warrant immediately before the date on which a record is taken for such Warrant, or, if no such record is taken, the date as of which the record holders of shares of Common Stock are to be determined for the participation in such Distribution. For the term of this Warrant, the Company shall hold such Distribution for the benefit of the Holder until the Holder exercises this Warrant or any portion thereof.

(f) Fundamental Transaction. If, at any time while this Warrant is outstanding, (i) the Company, directly or indirectly, in one or more related transactions effects any merger or consolidation of the Company with or into another Person, (ii) the Company, directly or indirectly, effects any sale, lease, license, assignment, transfer, conveyance or other disposition of all or substantially all of its assets in one or a series of related transactions, (iii) the Company’s board of directors gives its consent to a

8

transaction whereby an individual or legal entity or “group” (as described in Rule 13d-5(b)(1) promulgated under the Exchange Act) acquires effective control (whether through legal or beneficial ownership of capital stock of the Company, by contract or otherwise) of in excess of 50% of the voting securities of the Company (other than by means of conversion or exercise of the Series C Preferred or this Warrant), provided, this clause (iii) does not include an unsolicited takeover bid, (iv) the Company, directly or indirectly, in one or more related transactions effects any reclassification, reorganization or recapitalization of the Common Stock or any compulsory share exchange pursuant to which the Common Stock is effectively converted into or exchanged for other securities, cash or property, or (v) the Company, directly or indirectly, in one or more related transactions consummates a stock or share purchase agreement or other business combination (including, without limitation, a reorganization, recapitalization, spin-off or scheme of arrangement) with another Person or group of Persons whereby such other Person or group acquires more than 50% of the outstanding shares of Common Stock (not including any shares of Common Stock held by the other Person or other Persons making or party to, or associated or affiliated with the other Persons making or party to, such stock or share purchase agreement or other business combination) (each a “Fundamental Transaction”), then, upon any subsequent exercise of this Warrant, the Holder shall have the right to receive, for each Warrant Share that would have been issuable upon such exercise immediately prior to the occurrence of such Fundamental Transaction, at the option of the Holder (without regard to any limitation in Section 2(e) on the exercise of this Warrant), the number of shares of Common Stock of the successor or acquiring corporation or of the Company, if it is the surviving corporation, and any additional consideration (the “Alternate Consideration”) receivable as a result of such Fundamental Transaction by the holder of the number of Warrant Shares for which this Warrant is exercisable immediately prior to such Fundamental Transaction (without regard to any limitation in Section 2(e) on the exercise of this Warrant). For purposes of any such exercise, the determination of the Exercise Price shall be appropriately adjusted to apply to such Alternate Consideration based on the amount of Alternate Consideration issuable in respect of one share of Common Stock in such Fundamental Transaction, and the Company shall apportion the Exercise Price among the Alternate Consideration in a reasonable manner reflecting the relative value of any different components of the Alternate Consideration. If holders of Common Stock are given any choice as to the securities, cash or property to be received in a Fundamental Transaction, then the Holder shall be given the same choice as to the Alternate Consideration it receives upon any exercise of this Warrant following such Fundamental Transaction. Notwithstanding anything to the contrary, in the event of a Fundamental Transaction, the Company or any Successor Entity (as defined below) shall, at the Holder’s option, exercisable at any time concurrently with, or within thirty (30) calendar days after, the consummation of the Fundamental Transaction, purchase this Warrant from the Holder by paying to the Holder an amount of cash equal to the Black Scholes Value of the remaining unexercised portion of this Warrant on the date of the consummation of such Fundamental Transaction. “Black Scholes Value” means the value of this Warrant based on the Black and Scholes Option Pricing Model obtained from the “OV” function on Bloomberg determined as of the calendar day of consummation of the applicable Fundamental Transaction for pricing purposes and reflecting (A) a risk-free interest rate corresponding to the U.S. Treasury

9

rate for a period equal to the time between the date of the public announcement of the applicable Fundamental Transaction and the Termination Date, (B) an expected volatility equal to the greater of 100% and the 100 day volatility obtained from the HVT function on Bloomberg as of the Trading Day immediately following the public announcement of the applicable Fundamental Transaction, (C) the underlying price per share used in such calculation shall be the sum of the price per share being offered in cash, if any, plus the value of any non-cash consideration, if any, being offered in such Fundamental Transaction and (D) a remaining option time equal to the time between the date of the public announcement of the applicable Fundamental Transaction and the Termination Date. The Company shall cause any successor entity in a Fundamental Transaction in which the Company is not the survivor (the “Successor Entity”) to assume in writing all of the obligations of the Company under this Warrant and the other Transaction Documents in accordance with the provisions of this Section 3(f) pursuant to written agreements in form and substance reasonably satisfactory to the Holder and approved by the Holder (without unreasonable delay) prior to such Fundamental Transaction and shall, at the option of the Holder, deliver to the Holder in exchange for this Warrant a security of the Successor Entity evidenced by a written instrument substantially similar in form and substance to this Warrant which is exercisable for a corresponding number of shares of capital stock of such Successor Entity (or its parent entity) equivalent to the Warrant Shares acquirable and receivable upon exercise of this Warrant (without regard to any limitations on the exercise of this Warrant) prior to such Fundamental Transaction, and with an exercise price which applies the exercise price hereunder to such shares of capital stock (but taking into account the relative value of the shares of Common Stock pursuant to such Fundamental Transaction and the value of such shares of capital stock, such number of shares of capital stock and such exercise price being for the purpose of protecting the economic value of this Warrant immediately prior to the consummation of such Fundamental Transaction), and which is reasonably satisfactory in form and substance to the Holder. Upon the occurrence of any such Fundamental Transaction, the Successor Entity shall succeed to, and be substituted for (so that from and after the date of such Fundamental Transaction, the provisions of this Warrant and the other Transaction Documents referring to the “Company” shall refer instead to the Successor Entity), and may exercise every right and power of the Company and shall assume all of the obligations of the Company under this Warrant and the other Transaction Documents with the same effect as if such Successor Entity had been named as the Company herein.

(g) Calculations. All calculations under this Section 3 shall be made to the nearest cent or the nearest 1/100th of a share, as the case may be. For purposes of this Section 3, the number of shares of Common Stock deemed to be issued and outstanding as of a given date shall be the sum of the number of shares of Common Stock (excluding treasury shares, if any) issued and outstanding.

(h) Notice to Holder.

(i) Adjustment to Exercise Price. Whenever the Exercise Price is adjusted pursuant to any provision of this Section 3, the Company shall promptly mail to the Holder a notice setting forth the Exercise Price after such adjustment and any resulting adjustment to the number of Warrant Shares and setting forth a brief statement of the facts requiring such adjustment.

10

(ii) Notice to Allow Exercise by Holder. If (A) the Company shall declare a dividend (or any other distribution in whatever form) on the Common Stock, (B) the Company shall declare a special nonrecurring cash dividend on or a redemption of the Common Stock, (C) the Company shall authorize the granting to all holders of the Common Stock rights or warrants to subscribe for or purchase any shares of capital stock of any class or of any rights, (D) the approval of any stockholders of the Company shall be required in connection with any reclassification of the Common Stock, any consolidation or merger to which the Company is a party, any sale or transfer of all or substantially all of the assets of the Company, or any compulsory share exchange whereby the Common Stock is converted into other securities, cash or property, (E) the Company shall otherwise effect a Fundamental Transaction, or (F) the Company shall authorize the voluntary or involuntary dissolution, liquidation or winding up of the affairs of the Company, then, in each case, the Company shall cause to be mailed to the Holder at its last address as it shall appear upon the Warrant Register (as defined below) of the Company, at least 20 calendar days prior to the applicable record or effective date hereinafter specified, a notice stating (x) the date on which a record is to be taken for the purpose of such dividend, distribution, redemption, rights or warrants, or if a record is not to be taken, the date as of which the holders of the Common Stock of record to be entitled to such dividend, distributions, redemption, rights or warrants are to be determined or (y) the date on which such reclassification, consolidation, merger, sale, transfer or share exchange is expected to become effective or close, and the date as of which it is expected that holders of the Common Stock of record shall be entitled to exchange their shares of the Common Stock for securities, cash or other property deliverable upon such reclassification, consolidation, merger, sale, transfer or share exchange; provided that the failure to mail such notice or any defect therein or in the mailing thereof shall not affect the validity of the corporate action required to be specified in such notice. To the extent that any notice provided hereunder constitutes, or contains, material, non-public information regarding the Company or any of the Subsidiaries, the Company shall simultaneously file such notice with the Commission pursuant to a Current Report on Form 8-K. The Holder shall remain entitled to exercise this Warrant during the period commencing on the date of such notice to the effective date of the event triggering such notice except as may otherwise be expressly set forth herein.

Section 4. Transfer of Warrant.

(a) Transferability. Subject to compliance with any applicable securities laws and the conditions set forth in Section 4(d) hereof and to the provisions of the Purchase Agreement, this Warrant and all rights hereunder (including, without limitation, any registration rights) are transferable, in whole or in part, upon surrender of this Warrant at the principal office of the Company or its designated agent, together with a written assignment of this Warrant substantially in the form attached hereto duly executed by the

11

Holder or its agent or attorney and funds sufficient to pay any transfer taxes payable upon the making of such transfer. Upon such surrender and, if required, such payment, the Company shall execute and deliver a new Warrant or Warrants in the name of the assignee or assignees, as applicable, and in the denomination or denominations specified in such instrument of assignment, and shall issue to the assignor a new Warrant evidencing the portion of this Warrant not so assigned, and this Warrant shall promptly be cancelled. Notwithstanding anything herein to the contrary, the Holder shall not be required to physically surrender this Warrant to the Company unless the Holder has assigned this Warrant in full, in which case, the Holder shall surrender this Warrant to the Company within three (3) Trading Days of the date the Holder delivers an assignment form to the Company assigning this Warrant in full. This Warrant, if properly assigned in accordance herewith, may be exercised by a new holder for the purchase of Warrant Shares without having a new Warrant issued.

(b) New Warrants. This Warrant may be divided or combined with other Warrants upon presentation hereof at the aforesaid office of the Company, together with a written notice specifying the names and denominations in which new Warrants are to be issued, signed by the Holder or its agent or attorney. Subject to compliance with Section 4(a) as to any transfer which may be involved in such division or combination, the Company shall execute and deliver a new Warrant or Warrants in exchange for this Warrant or the Warrants to be divided or combined in accordance with such notice. All Warrants issued on transfers or exchanges shall be dated as of the Initial Issuance Date and identical with this Warrant except as to the number of Warrant Shares issuable pursuant thereto.

(c) Warrant Register. The Company shall register this Warrant, upon records to be maintained by the Company for that purpose (the “Warrant Register”), in the name of the record Holder hereof from time to time. The Company may deem and treat the registered Holder of this Warrant as the absolute owner hereof for the purpose of any exercise hereof or any distribution to the Holder, and for all other purposes, absent actual notice to the contrary.

(d) Transfer Restrictions. If, at the time of the surrender of this Warrant in connection with any transfer of this Warrant, the transfer of this Warrant shall not be either (i) registered pursuant to an effective registration statement under the Securities Act and under applicable state securities or blue sky laws or (ii) exempt from registration under the Securities Act, the Company may require, as a condition of allowing such transfer, that the Holder or transferee of this Warrant, as the case may be, comply with the provisions of the Purchase Agreement.

(e) Representation by the Holder. The Holder, by the acceptance hereof, represents and warrants that it is acquiring this Warrant and, upon any exercise hereof, will acquire the Warrant Shares issuable upon such exercise, for its own account and not with a view to or for distributing or reselling such Warrant Shares or any part thereof in violation of the Securities Act or any applicable state securities law, except pursuant to sales registered or exempted under the Securities Act.

12

Section 5. Miscellaneous.

(a) No Rights as Stockholder Until Exercise. This Warrant does not entitle the Holder to any voting rights, dividends or other rights as a stockholder of the Company prior to the exercise hereof as set forth in Section 2(c)(i), except as expressly set forth in Section 3.

(b) Loss, Theft, Destruction or Mutilation of Warrant. The Company covenants that upon receipt by the Company of evidence reasonably satisfactory to it of the loss, theft, destruction or mutilation of this Warrant or any stock certificate relating to the Warrant Shares, and in case of loss, theft or destruction, of indemnity or security reasonably satisfactory to it (which, in the case of this Warrant, shall not include the posting of any bond), and upon surrender and cancellation of such Warrant or stock certificate, if mutilated, the Company will make and deliver a new Warrant or stock certificate of like tenor and dated as of such cancellation, in lieu of such Warrant or stock certificate.

(c) Saturdays, Sundays, Holidays, etc. If the last or appointed day for the taking of any action or the expiration of any right required or granted herein shall not be a Business Day, then, such action may be taken or such right may be exercised on the next succeeding Business Day.

(d) Authorized Shares. The Company covenants that, during the period this Warrant is outstanding, it will reserve from its authorized and unissued Common Stock a sufficient number of shares to provide for the issuance of the Warrant Shares upon the exercise of any purchase rights under this Warrant. The Company further covenants that its issuance of this Warrant shall constitute full authority to its officers who are charged with the duty of issuing the necessary Warrant Shares upon the exercise of the purchase rights under this Warrant. The Company will take all such reasonable action as may be necessary to assure that such Warrant Shares may be issued as provided herein without violation of any applicable law or regulation, or of any requirements of the trading market upon which the Common Stock may be listed. The Company covenants that all Warrant Shares which may be issued upon the exercise of the purchase rights represented by this Warrant will, upon exercise of the purchase rights represented by this Warrant and payment for such Warrant Shares in accordance herewith, be duly authorized, validly issued, fully paid and nonassessable and free from all taxes, liens and charges created by the Company in respect of the issue thereof (other than taxes in respect of any transfer occurring contemporaneously with such issue).

Except and to the extent as waived or consented to by the Holder, the Company shall not by any action, including, without limitation, amending its Amended and Restated Certificate of Incorporation or through any reorganization, transfer of assets, consolidation, merger, dissolution, issue or sale of securities or any other voluntary action, avoid or seek to avoid the observance or performance of any of the terms of this Warrant, but will at all times in good faith assist in the carrying out of all such terms and in the taking of all such actions as may be necessary or appropriate to protect the rights of Holder as set forth in this Warrant against impairment. Without limiting the generality of

13

the foregoing, the Company will (i) not increase the par value of any Warrant Shares above the amount payable therefor upon such exercise immediately prior to such increase in par value, (ii) take all such action as may be necessary or appropriate in order that the Company may validly and legally issue fully paid and nonassessable Warrant Shares upon the exercise of this Warrant and (iii) use commercially reasonable efforts to obtain all such authorizations, exemptions or consents from any public regulatory body having jurisdiction thereof, as may be, necessary to enable the Company to perform its obligations under this Warrant.

Before taking any action which would result in an adjustment in the number of Warrant Shares for which this Warrant is exercisable or in the Exercise Price, the Company shall obtain all such authorizations or exemptions thereof, or consents thereto, as may be necessary from any public regulatory body or bodies having jurisdiction thereof.

(e) Jurisdiction. All questions concerning the construction, validity, enforcement and interpretation of this Warrant shall be determined in accordance with the provisions of the Purchase Agreement.

(f) Restrictions. The Holder acknowledges that the Warrant Shares acquired upon the exercise of this Warrant, if not registered, will have restrictions upon resale imposed by state and federal securities laws.

(g) Nonwaiver and Expenses. No course of dealing or any delay or failure to exercise any right hereunder on the part of Holder shall operate as a waiver of such right or otherwise prejudice the Holder’s rights, powers or remedies, notwithstanding the fact that all rights hereunder terminate on the Termination Date. If the Company willfully and knowingly fails to comply with any provision of this Warrant, which results in any material damages to the Holder, the Company shall pay to the Holder such amounts as shall be sufficient to cover any costs and expenses including, but not limited to, reasonable attorneys’ fees, including those of appellate proceedings, incurred by the Holder in collecting any amounts due pursuant hereto or in otherwise enforcing any of its rights, powers or remedies hereunder.

(h) Notices. Any notice, request or other document required or permitted to be given or delivered to the Holder by the Company shall be delivered in accordance with the notice provisions of the Purchase Agreement.

(i) Limitation of Liability. No provision hereof, in the absence of any affirmative action by the Holder to exercise this Warrant to purchase Warrant Shares, and no enumeration herein of the rights or privileges of the Holder, shall give rise to any liability of the Holder for the purchase price of any Common Stock or as a stockholder of the Company, whether such liability is asserted by the Company or by creditors of the Company.

14

(j) Remedies. The Holder, in addition to being entitled to exercise all rights granted by law, including recovery of damages, will be entitled to specific performance of its rights under this Warrant. The Company agrees that monetary damages would not be adequate compensation for any loss incurred by reason of a breach by it of the provisions of this Warrant and hereby agrees to waive and not to assert the defense in any action for specific performance that a remedy at law would be adequate.

(k) Successors and Assigns. Subject to applicable securities laws, this Warrant and the rights and obligations evidenced hereby shall inure to the benefit of and be binding upon the successors and permitted assigns of the Company and the successors and permitted assigns of Holder. The provisions of this Warrant are intended to be for the benefit of any Holder from time to time of this Warrant and shall be enforceable by the Holder.

(l) Amendment. Any provision of this Warrant may be waived by the Holder in writing, which waiver shall be binding on all of the Holder’s successors and assigns. Any provision of this Warrant may be amended by a written instrument executed by the Company and the Holder, which amendment shall be binding on all of the Holder’s successors and assigns.

(m) Severability. Wherever possible, each provision of this Warrant shall be interpreted in such manner as to be effective and valid under applicable law, but if any provision of this Warrant shall be prohibited by or invalid under applicable law, such provision shall be ineffective to the extent of such prohibition or invalidity, without invalidating the remainder of such provisions or the remaining provisions of this Warrant.

(n) Headings. The headings used in this Warrant are for the convenience of reference only and shall not, for any purpose, be deemed a part of this Warrant.

********************

(Signature Page Follows)

15

IN WITNESS WHEREOF, the Company has caused this Warrant to be executed by its officer thereunto duly authorized as of the date first above indicated.

| DYNARESOURCE, INC. | ||||

| By: | /s/ ▇.▇. ▇▇▇▇▇▇▇▇ | |||

| Name: | K.W. (“K.D.”) Diepholz | |||

| Title: | Chairman & CEO | |||

Warrant Signature Page

EXHIBIT A

NOTICE OF EXERCISE

| TO: | DYNARESOURCE, INC. |

(1) The undersigned hereby elects to purchase Warrant Shares of the Company pursuant to the terms of the attached Warrant (only if exercised in full), and tenders herewith payment of the exercise price in full, together with all applicable transfer taxes, if any.

(2) Please issue said Warrant Shares in the name of the undersigned or in such other name as is specified below:

|

|

The Warrant Shares shall be delivered to the following DWAC Account Number:

|

|

||||

|

|

||||

|

|

||||

(3) Accredited Investor. The undersigned is an “accredited investor” as defined in Regulation D promulgated under the Securities Act of 1933, as amended.

[SIGNATURE OF HOLDER]

| Name of Investing Entity: |

|

| Signature of Authorized Signatory of Investing Entity: |

|

| Name of Authorized Signatory: |

|

| Title of Authorized Signatory: |

|

| Date: |

|

EXHIBIT B

ASSIGNMENT FORM

(To assign the foregoing Warrant, execute this form and supply required information. Do not use this form to purchase shares.)

FOR VALUE RECEIVED, the foregoing Warrant and all rights evidenced thereby are hereby assigned to

| Name: |

| |||||

| (Please Print) | ||||||

| Address: |

| |||||

| (Please Print) | ||||||

| Dated: , | ||||||

| Holder’s Signature: |

|

|||||

| Holder’s Address: |

|

|||||