LEASE AGREEMENT (Single Tenant; Triple Net) BETWEEN a California limited liability company AND PHC FACILITIES, INC., a California corporation

Exhibit 10.3

(Single Tenant; Triple Net)

BETWEEN

MM DOWNTOWN FACILITY, LLC,

a California limited liability company

AND

PHC FACILITIES, INC.,

a California corporation

(Single Tenant; Triple Net)

THIS LEASE AGREEMENT (“Lease”) is made and entered into effective as of the 1st day of April 10, 2019, by and between MM DOWNTOWN FACILITY, LLC, a California limited liability company (“Landlord”), and PHC FACILITIES, INC., a California corporation doing business as (“Tenant”).

ARTICLE I. BASIC LEASE PROVISIONS

Each reference in this Lease to the “Basic Lease Provisions” shall mean and refer to the following collective terms, the application of which shall be governed by the provisions in the remaining Articles of this Lease.

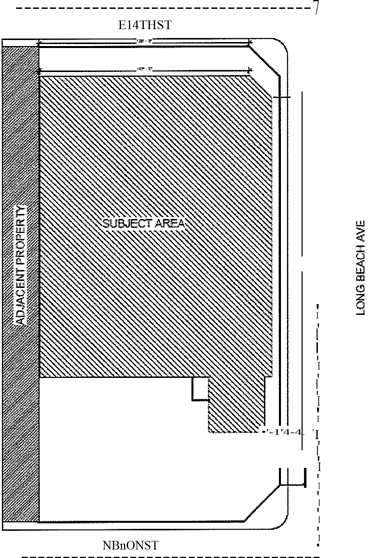

| 1. | Overall Land: Approximately 26,790 square feet of land (the “Overall Land”) more particularly described on Exhibit “A” attached hereto, upon which is constructed a two (2) story building containing approximately 36,153 square feet (the “Building”). The Overall Land has a street address of 0000 Xxxx Xxxxx Xxxxxx, Xxx Xxxxxxx, Xxxxxxxxxx 00000 and is depicted on the Site Plan attached hereto as Exhibit “B”. The portion of the Overall Land that is not part of the Premises (defined below) (the “Grow Premises”) is concurrently being leased to Tenant under a separate lease. |

| 2. | Premises: That portion of the Overall Land and Building depicted on the Site Plan attached hereto as Exhibit “C” (the “Premises”), containing approximately 18,000 square feet. |

| 3. | Use of Premises: Retail Sales, storage, warehousing and distribution of medical marijuana and related products, including related office uses. Tenant acknowledges that the specification of such uses means only that Landlord has no objection to the specified use and does not include any representation or warranty by Landlord as to whether or not such specified use complies with applicable laws and/or requires special governmental permits. |

| 4. | Commencement Date: April 10, 2019 |

| 5. | Term: Thirty-Six (36) months from and after the Commencement Date, subject to extension as provided in Section 3.2 and Section 15.1 or earlier termination as provided herein, but subject to adjustment as set forth in Section 4.1(b). |

| 6. | Basic Rent: |

| Lease Year |

Annual Basic Rent | Monthly Basic Rent | ||||||

| 1 |

$120,000.00 | $10,000.00 | ||||||

| 2 |

$120,000.00 | $10,000.00 | ||||||

| 3 |

$120,000.00 | $10,000.00 | ||||||

| 7. | Percentage Rent: See Section 4.2 below. |

| 8. | Security Deposit: $10,000.00 |

| 9. | Broker(s): None |

| 10. | Payments and Notices: |

| LANDLORD | TENANT | |

| MM Downtown Facility, LLC | PHC Facilities, Inc. 1425 Long | |

| 9301 Wilshire Blvd., Suite 000 | Xxxxx Xxxxxx | |

| Xxxxxxx Xxxxx, Xxxxxxxxxx 00000 | Xxx Xxxxxxx, Xxxxxxxxxx 00000 | |

| with a copy of notices to: | with a copy of notices to: | |

| Xxxxx Xxxx | ||

| Xxxxx & Xxxxxxxxx LLP | ||

| 000 Xxxxx Xxxx. | ||

| Xxxxx 000 | ||

| Xxxxx Xxxx, XX 00000 | ||

| For payments made by ACH: | ||

| MM Downtown Facility, LLC | ||

| 0000 Xxxxxxxx Xxxx., Xxxxx 000 | ||

| Xxxxxxx Xxxxx, Xxxxxxxxxx 00000 | ||

EXHIBITS

| EXHIBIT A |

Legal Description of Overall Land | |

| EXHIBIT B |

Site Plan for Overall Land | |

| EXHIBIT C |

Site Plan for Premises | |

| EXHIBIT D |

Tenant’s Insurance |

ARTICLE II. PREMISES

SECTION 2.1. PREMISES. Landlord hereby leases the Premises to Tenant and Tenant hereby leases the Premises from Landlord, on the terms and conditions set forth in this Lease.

SECTION 2.2. ACCEPTANCE OF PREMISES. Tenant acknowledges that neither Landlord nor any representative of Landlord has made any representation or warranty with respect to the Premises or its suitability or fitness for any purpose, including without limitation any representations or warranties regarding the compliance of Tenant’s use of the Premises with the applicable zoning or regarding any other land use matters, and Tenant shall be solely responsible as to such matters. Landlord shall deliver the Premises to Tenant on the Commencement Date and shall not be required to alter, remodel, improve, repair, decorate or paint the Premises or any part thereof in connection therewith. As of the Commencement Date, Tenant shall be conclusively deemed to have accepted the Premises in its “as-is” condition.

ARTICLE III. TERM

SECTION 3.1. GENERAL. The term of this Lease (“Term”) shall be for the period shown in Item 5 of the Basic Lease Provisions. The Term shall commence on the Commencement Date. The date on which this Lease is scheduled to terminate is referred to as the “Expiration Date.”

For the purposes of this Lease, the term “Lease Year” means each twelve (12) month period during the Term, commencing on the Commencement Date, subject to adjustment as set forth in Section 3.2(b).

SECTION 3.2. RIGHT TO EXTEND THE TERM.

(a) Provided that Tenant is not in default under any provision of this Lease at the time of exercise of the extension right granted herein or as of the commencement of the extension period, Tenant may extend the Term of this Lease for one (1) period of thirty-six (36) months. Tenant shall exercise its right to extend the Term by delivering to Landlord, not less than twelve (12) months prior to the then-scheduled Expiration Date, Tenant’s written notice of its election to extend the Term. The Basic Rent payable under this Lease during the extension of the Term shall be as follows:

| Lease Year |

Annual Basic Rent | Monthly Basic Rent | ||||||

| 4 |

$126,000.00 | $10,500.00 | ||||||

| 5 |

$126,000.00 | $10,500.00 | ||||||

| 6 |

$126,000.00 | $10,500.00 | ||||||

(b) If Tenant fails to timely exercise its extension right under subsection (a) above within the time periods set forth above, Tenant’s right to extend the Term shall be extinguished and this Lease shall automatically terminate on the Expiration Date.

ARTICLE IV. BASIC RENT AND PROPERTY TAXES

SECTION 4.1. BASIC RENT.

(a) Commencing on the Commencement Date, Tenant shall pay to Landlord, without deduction or offset, the amount of Basic Rent shown in Item 6 of the Basic Lease Provisions (or if the Term is extended, the Basic Rent shown in Section 3.2 above). The Basic Rent shall be due and payable monthly in advance commencing on the Commencement Date and continuing thereafter on the same day of each successive calendar month of the Term. No demand, notice or invoice shall be required.

(b) Notwithstanding the foregoing, at the option of Landlord, upon notice to Tenant on or prior to the Commencement Date, Basic Rent shall be due and payable on the first day of each month during the Term. In such event, the Basic Rent payable on the Commencement Date shall be prorated and shall cover the period from the Commencement Date through the end of the month in which the Commencement Date occurs (the “Proration Period”) with the next payment of Basic Rent due on the first day of the immediately following month. Further, in such event, the Term of this Lease shall run thirty-six (36) months from the first (1”1) day of the month following the end of the Proration Period, and the first Lease Year shall include the Proration Period.

SECTION 4.2. PERCENTAGE RENT.

(a) Rate. Commencing on the Commencement Date and continuing until the expiration or earlier termination of this Lease, Tenant shall pay to Landlord (without deduction, setoff, prior notice or demand, except as otherwise provided in this Lease) percentage rent (“Percentage Rent”) equal to five percent (5%) of the dollar amount of the Gross Sales (as defined in Section 4.2(e) below) made in the Premises during each Lease Year of the Term.

(b) Quarterly Reports. On or before the forty-fifth (45th) day following the end of each calendar quarter during the Term, Tenant shall mail to Landlord, at the place where Rent is payable, a statement showing Gross Sales made in the Premises for the preceding calendar quarter.

(c) Annual Reports and Payment. On or before the ninetieth (90th) day following (i) the end of each Lease Year during the Term, and (ii) the last day of the Term, Tenant shall mail to Landlord, at the place where Rent is payable, a statement showing Gross Sales made in the Premises for the preceding Lease Year (or if applicable, the portion thereof prior to the termination of this Lease), together with any Percentage Rent due.

(d) Record Keeping and Audits. Tenant shall maintain complete and accurate books of account and records of Gross Sales, which books of account and records shall be maintained by Tenant for at least two (2) years. Landlord, at its sole cost, shall be entitled to have an audit made of such books of account and records of Gross Sales by qualified representatives of Landlord. Such audit may be made only by Landlord giving Tenant at least thirty (30) days’ prior written notice; there shall be no more than one (1) audit for each Lease Year; and such audit must be completed within three (3) years from the expiration of the Lease Year being audited. No auditor engaged by Landlord shall be compensated in whole or in part on a contingency basis. If the audit discloses that any payment of Percentage Rent by Tenant for the period audited was not correct, Tenant shall immediately pay any additional amount due Landlord as disclosed by the audit and Landlord shall immediately refund Tenant the amount of any over payment as disclosed by the audit. In addition, if the audit discloses an underpayment of Percentage Rent by Tenant in excess of three percent (3%) of Percentage Rent paid by Tenant, then Tenant shall reimburse Landlord’s reasonable audit cost.

(e) Gross Sales. “Gross Sales” means the actual sales price of, or other consideration paid for, all merchandise, and the actual charges for all services performed or benefits received, on or from the Premises, by Tenant or by any subtenant, licensee or concessionaire, whether for cash, or otherwise (without deduction for inability or failure to collect) including, but not limited to, such sales and services (a) where the orders therefor originate on or from the Premises, whether delivery or performance is made from the Premises or from some other place, (b) made pursuant to orders mailed, telephoned, e-mailed to or otherwise received at, or filled from, the Premises, (c) by means of mechanical or other vending devices in the Premises, (d) take-out orders and (e) as a result of transactions originated on or from the Premises. Each sale upon installment or credit shall be treated as part of Gross Sales for the full price in the month in which said sale is made, irrespective of the time when Tenant shall receive payment therefor. Gross Sales does not include any of the following:

(i) The selling price of all merchandise returned by customers and accepted for full credit or the amount of discounts and allowances made thereon;

(ii) Goods returned to sources, or transferred to another store or warehouse owned by or affiliated with Tenant;

(iii) Sums and credits received in the settlement of claims for loss of or damage to merchandise, to the extent previously reported as Gross Sales;

(iv) Alteration workroom charges and delivery charges;

(v) Cash refunds made to customers in the ordinary course of business, but this exclusion shall not include any amount paid or payable for what are commonly referred to as “trading stamps”;

(vi) Interest, service or sales carrying charges or other charges, however denominated, paid by customers for extension of credit on sales and where not included in the merchandise sales price;

(vii) Receipts from public telephones, stamp machines, public toilet locks, or vending machines installed solely for use by Tenant’s employees;

(viii) Sales taxes, so-called luxury taxes, consumers’ excise taxes, gross receipts taxes and other similar taxes now or hereafter imposed upon the sale of merchandise or imposed upon the sale of merchandise or services, but only if collected separately from the selling price of merchandise or services and collected from customers;

(ix) Sales of fixtures, equipment or property which are not stock in trade; and

(x) Gift certificate or like vouchers until such time as the same shall have been converted into a sale by redemption;

(xi) The amount of bad debts and bad checks resulting from sales made from the Premises which previously have been included in reported Gross Sales, after Tenant has made its customary collections efforts and written off such amounts as uncollectible;

(xii) Bulk sales or sales of Tenant’s inventory, or Tenant’s furniture, fixtures or equipment, incidental to the cessation of business at the Premises or otherwise occurring other than in the ordinary course of business;

(xiii) Merchandise returned for credit to shippers, jobbers, wholesalers and manufacturers;

(xiv) Tips or other gratuities given by customers to Tenant’s employees and which are actually distributed to such employees;

(xv) Any service charge paid by customers to Tenant to the extent actually distributed to employees in lieu of such employees receiving tips or gratuities from customers;

(xvi) Non-cash giveaways or donations or giveaways to non-profit, charitable or religious organizations;

(xvii) Sale of employee uniforms;

(xviii) Merchandise purchased by employees at a discount;

(xix) Refunds and trade-in allowances given to customers;

(xx) The discounted portion of the sales price of food and beverages given to a customer as compensation for unsatisfactory food or service;

(xxi) Where coupons, courtesy discounts given to customers or Tenant, or other comps or discount promotions are used, only the actual sale price paid to Tenant shall be included in Gross Sales;

(xxii) The portion of the cost of meals provided at no or reduced cost to Tenant’s employees; and

(xxiii) Proceeds of insurance.

SECTION 4.3. PROPERTY TAXES.

(a) In addition to Basic Rent, Tenant shall pay (directly to the taxing authorities) an amount equal to each installment of Property Taxes (as defined below) due or accruing during the Term, at least thirty (30) days prior to the applicable delinquency date for such installment. Any installment which covers any period of time after the Expiration Date shall be prorated. Landlord will provide Tenant with a copy of all Property Tax bills promptly after receipt by Landlord, and in any event in sufficient time for Tenant to pay each installment of Property Taxes timely. Tenant will provide Landlord with evidence of payment of each installment of Property Taxes at least ten (10) business days prior to the delinquency date. Upon request by Landlord, if any installment of Property Taxes is paid past the delinquency date (other than because Landlord did not timely submit the Property Tax xxxx to Tenant), Tenant shall be responsible for any penalties incurred.

(b) The term “Property Taxes” as used herein shall include any form of federal, state, county or local government or municipal taxes, fees, charges or other impositions of every kind (whether general, special, ordinary or extraordinary) related to the ownership, leasing or operation of the Premises, including without limitation, the following: (i) all real estate taxes or personal property taxes levied against the Premises, as such property taxes may be reassessed from time to time; and (ii) other taxes, charges and assessments which are levied with respect to this Lease or to the improvements, fixtures and equipment and other property of Landlord located on the Premises, (iii) all assessments and fees for public improvements, services, and facilities and impacts thereon, including without limitation arising out of any Community Facilities Districts, “Xxxxx Xxxx” districts, similar assessment districts, and any traffic impact mitigation assessments or fees; (iv) any tax, surcharge or assessment which shall be levied in addition to or in lieu of real estate or personal property taxes, other than taxes covered by Article VIII; (v) taxes based on the receipt of rent (including gross receipts or sales taxes applicable to the receipt of rent) and (vi) costs and expenses incurred in contesting the amount or validity of any Property Tax by appropriate proceedings. Notwithstanding the foregoing, general net income or franchise taxes imposed against Landlord shall be excluded. Also excluded are any penalties, interest or other costs incurred by Landlord as a result of the late payments of Property Taxes. For purposes hereof, Tenant’s share of Property Taxes for the Premises shall be 49.8% of the Property Taxes assessed on the Overall Land.

(c) Tenant shall have the right to request that Landlord contest (or apply for a reduction of) any Property Tax xxxx, at Tenant’s expense. If Landlord does not decide to contest (or apply for a reduction) of any Property Tax xxxx, then Landlord shall permit Tenant to contest (or apply for a reduction of) any Property Tax xxxx in Landlord’s name, but at Tenant’s expense and provided Tenant pays all such Property Taxes during the pendency of such contest.

SECTION 4.4. RENT. As used herein, the term “additional rent” shall be deemed to include any and all monetary obligations of any type whatsoever other than Basic Rent to be paid by Tenant pursuant to the terms of this Lease. Basic Rent together with additional rent shall be referred to herein as “rent”.

ARTICLE V. USE

SECTION 5.1. PERMITTED USE. Tenant shall use the Premises only for the purposes stated in Item 3 of the Basic Lease Provisions, or any other use reasonably related thereto (the “Permitted Use”). Notwithstanding anything contained herein to the contrary, Tenant shall not use or allow the Premises to be used for any unlawful purpose, other than as permitted by the laws of the State of California and ordinances of the City of Los Angeles, nor shall Tenant permit any nuisance or commit any waste on the Premises. Tenant shall comply, at its expense, with all present and future laws, statutes, ordinances and requirements of all local, municipal and state governmental authorities that pertain to the Premises, Tenant or its specific use of the Premises (collectively, “Applicable Law”). Tenant’s obligation under the immediately preceding sentence shall specifically require Tenant to make any structural repairs to the Building, or to clean up or remediate any Hazardous Materials in, on, under or about the Premises.

SECTION 5.2. SIGNS. Tenant shall have the exclusive right to install (at Tenant’s expense) any signage on the exterior of the Building that Tenant desires, subject only to compliance with Applicable Law and, except for temporary signage, subject to Landlord’s prior written consent. Tenant shall maintain and repair any such signs, and shall remove same from the Building upon the expiration or earlier termination of this Lease (and shall repair any damage caused by such removal).

SECTION 5.3. HAZARDOUS MATERIALS.

(a) For purposes of this Lease, the term “Hazardous Materials” means (i) any “hazardous material” as defined in Section 25501(o) of the California Health and Safety Code, (ii) hydrocarbons, polychlorinated biphenyls or asbestos, and (iii) any toxic or hazardous materials, substances, wastes or materials which are regulated by any other applicable state, federal or local law or regulation because they are potentially hazardous to the health, safety or welfare of humans or the environment.

(b) Tenant shall not cause or permit any Hazardous Materials to be brought upon, stored, used, generated, released or disposed of on, under, from or about the Premises (including without limitation the soil and groundwater thereunder) without the prior written consent of Landlord, which consent may be given or withheld in Landlord’s sole and absolute discretion. Notwithstanding the foregoing, Tenant shall have the right, without obtaining prior written consent of Landlord, to utilize or store within the Premises the following products and materials which may contain Hazardous Materials, to the extent normally and customarily utilized by Tenant at the Premises for the Permitted Uses in connection with its business operations therein: (A) a reasonable quantity of standard office products (such as photocopy toner, “White Out”, and the like) (collectively, “Office Products”}, (B) inventory held for resale (“Inventory”) and (C) products and materials used in connection with Tenant’s usual and customary maintenance operations on the Premises (collectively, “Maintenance Products”), provided however that (i) Tenant shall comply with all Applicable Law with respect to such products and materials, (ii) all Inventory containers shall remain unopened (for clarification, the foregoing does not prohibit Tenant from unpackaging cartons of Inventory or breaking down shrink-wrapped bundles of Inventory, or performing like activities to prepare the Inventory for re-sale}, and (iii) to the extent applicable, the other provisions of this Section 5.3 shall apply. Tenant shall not be entitled or permitted to install any underground tanks under, on or about the Premises for storage of Hazardous Materials

without the express written consent of Landlord, which may be given or withheld in Landlord’s sole and absolute discretion but exercised in good faith. However, Landlord’s consent shall not be required to replace either of the existing underground storage tanks with new underground storage tanks of the same or lesser capacity. Landlord may place such reasonable conditions as Landlord deems appropriate (giving due consideration to Tenant’s business operations) with respect to Tenant’s use, storage and/or disposal of any Hazardous Materials requiring Landlord’s consent.

(c) Landlord and its agents shall have the right, but not the obligation (at Landlord’s expense unless Tenant is determined to be in breach of this Lease in connection with Hazardous Materials), to inspect, sample and/or monitor the Premises and/or the soil or groundwater thereunder at any reasonable time with reasonable prior notice to determine whether Tenant is complying with the terms of this Section 5.3, and in connection therewith Tenant shall provide Landlord with full access to all facilities, records and personnel related thereto (except for attorney-client privileged communications or documents otherwise protected as provided in this Section 5.3(c)). If Tenant is not in compliance with any of the provisions of this Section 5.3, or in the event of a release of any Hazardous Material on, under, from or about the Premises caused or permitted by Tenant, its agents, employees, contractors, licensees or invitees, Landlord and its agents shall have the right, but not the obligation, after reasonable advance notice affording Tenant a reasonable opportunity to cure or correct the condition, wit out limitation upon any of Landlord’s other rights and remedies under this Lease, to immediately enter upon the Premises and to discharge Tenant’s obligations under this Section 5.3, including without limitation the taking of emergency or long-term remedial action. All amounts paid by Landlord and all costs and expenses incurred by Landlord in connection with Landlord’s cure rights set forth in the preceding sentence, together with a fifteen percent (15%) management fee and interest at the rate of ten percent (10%) from the date of Landlord’s paying the amount or incurring each cost or expense until the date offull repayment by Tenant, will be payable by Tenant to Landlord as additional rent on demand. Landlord and its agents shall endeavor to minimize interference with Tenant’s business in connection therewith, but shall not be liable for any such interference. In addition, Landlord, at Tenant’s expense, shall have the right, but not the obligation, to join and participate in any legal proceedings or actions initiated in connection with any claims arising out of the storage, generation, use, release and/or disposal by Tenant or its agents, employees, contractors, licensees or invitees of Hazardous Materials on, under, from or about the Premises.

(d) If the presence of any Hazardous Materials on, under, from or about the Premises or caused or permitted by Tenant or its agents, employees, contractors, licensees or invitees results in (i) injury to any person, (ii) injury to or any contamination of the Premises, or (iii) injury to or contamination of any real or personal property wherever situated, Tenant, at its expense (using contractors and/or consultants selected by Tenant but reasonably acceptable to Landlord), shall promptly take all actions necessary to return the Premises and the Project and any other affected real or personal property owned by Landlord or otherwise to the “Required Condition” (as hereinafter defined), and to remedy or repair any such injury or contamination, including without limitation, any cleanup, remediation, removal, disposal, neutralization or other treatment of any such Hazardous Materials (subject to the conditions set forth in this Section 5.3(d)). Notwithstanding the foregoing, Tenant shall not, without Landlord’s prior written consent, which consent shall not be unreasonably withheld, take any remedial action in response to the presence of any Hazardous Materials on, under, from or about the Premises or any other affected real or personal property owned by Landlord or enter into any similar agreement, consent, decree or other compromise with any governmental agency with respect to any Hazardous Materials claims; provided however, Landlord’s prior written consent shall not be necessary in the event that the presence of Hazardous Materials on, under, from or about the Premises or any other affected real

or personal property owned by Landlord (i) imposes an immediate threat to the health, safety or welfare of any individual and (ii) is of such a nature that an immediate remedial response is necessary and it is not possible to obtain Landlord’s consent before taking such action. As used herein, “Required Condition” shall mean returning the Premises and any other directly affected real or personal property owned by Landlord to a condition that is both (A) required by applicable federal, state or local law, regulation or order, including without limitation, performing any required cleanup, remediation, removal, disposal, neutralization or other treatment of Hazardous Materials, and (B) consistent with Landlord’s operation, use and leasing of the Premises (and any other directly affected real or personal property owned by Landlord) for those uses described in Item 3 of the Basic Lease Provisions. To the fullest extent permitted by law, Tenant shall indemnify, hold harmless, protect and defend (with attorneys reasonably acceptable to Landlord) Landlord and any successors to all or any portion of Landlord’s interest in the Premises and any other real or personal property owned by Landlord from and against any and all liabilities, losses, damages, diminution in value, judgments, fines, demands, claims, recoveries, deficiencies, costs and expenses (including without limitation attorneys’ fees, court costs and other professional expenses), whether foreseeable or unforeseeable, arising directly or indirectly out of the use, generation, storage, treatment, release, on- or off-site disposal or transportation of Hazardous Materials on, into, from, under or about the Premises and any other real or personal property owned by Landlord or any other party caused or permitted by Tenant, its agents, employees, contractors, subtenants, licensees or invitees. Such indemnity obligation shall specifically include, without limitation, the cost of any required or necessary repair, restoration, cleanup or detoxification of the Premises, and any other real or personal property owned by Landlord, the preparation of any closure or other required plans, whether such action is required or necessary during the Term or after the expiration of this Lease and any loss of.rental due to the inability to lease the Premises as a result of such Hazardous Materials the remediation thereof or any repair, restoration or cleanup related thereto. If it is at any time discovered that Tenant or its agents, employees, contractors, subtenants, licensees or invitees may have caused or permitted the release of any Hazardous Materials on, under, from or about the Premises, or any other real or personal property owned by Landlord, Tenant shall, at Landlord’s request, immediately prepare and submit to Landlord a comprehensive plan, subject to Landlord’s approval (which shall not be unreasonably withheld), specifying the actions to be taken by Tenant to return the Premises, or any other real or personal property owned by Landlord to the Required Condition. Upon Landlord’s approval of such plan, Tenant shall, at its expense, and without limitation of any rights and remedies of Landlord under this Lease or at law or in equity, immediately implement such plan and proceed to cleanup, remediate and/or remove all such Hazardous Materials in accordance with all applicable laws and as required by such plan and this Lease. The provisions of this Section 5.3/d) shall expressly survive the expiration or sooner termination of this Lease, but Landlord agrees to allow Tenant reasonable entry rights to the Premises, and to otherwise cooperate with Tenant but at no cost or expense to Landlord, to the extent that clean up or remediation work is required after the expiration of or termination of this Lease.

(e) Inasmuch as Tenant was the prior occupant of the Premises, it is understood and agreed that Tenant shall be responsible for the cleanup or remediation of any Hazardous Materials which exist in, on, under or about the Premises on the Commencement Date, but Tenant shall not be liable to Landlord, or otherwise responsible under this Lease for the cleanup or remediation of any Hazardous Materials which are caused to exist in, on, under or about the Premises by Landlord or anyone acting on behalf of Landlord.

SECTION 5.4. USE OF ROOF. Tenant shall have the right to access the roof of the Premises for the limited purposes of performing its maintenance obligations hereunder, including performing the Building Systems repairs and replacements, and installing and maintaining

reasonable communications equipment as is reasonably required by Tenant for use by Tenant in connection with its normal and customary business operations at the Premises, subject to reasonable standards and procedures imposed by Landlord to prevent damage to the roof and to preserve any roof warranty and the terms and conditions of Section 7.3 of this Lease. Landlord shall have the right to access the roof of the Premises for the limited purposes of inspecting the same and performing its obligations and exercising its rights under this Lease.

SECTION 5.5. EASEMENT FOR ACCESS. During the Term of this Lease, Landlord hereby establishes, grants and reserves a non-exclusive easement for vehicular and pedestrian ingress and egress over the drive aisles, curb cuts and walkways, as they may exist from time to time on the Grow Premises for the benefit of the Premises, and as they may exist from time to time on Premises for the benefit of the Grow Premises.

SECTION 5.6. EASEMENT FOR PARKING During the Term of this Lease, Landlord hereby establishes, grants and reserves a non-exclusive easement for parking over the parking areas on the Grow Premises, as they may exist from time to time, for the benefit of the Premises. Landlord also hereby establishes, grants and reserves a non-exclusive easement for parking over the parking areas on the Premises, as they may exist from time to time, for the benefit of the Grow Premises.

ARTICLE VI. UTILITIES AND SERVICES

SECTION 6.1. UTILITIES AND SERVICES. Tenant shall be responsible for and shall pay promptly, directly to the appropriate supplier, all charges for water, gas, electricity, sewer, heat, light, power, telephone, telecommunications service, refuse pickup, janitorial service, landscape maintenance and all other utilities, materials and services furnished directly to Tenant or the Premises or used by Tenant in, on or about the Premises during the Term, together with any taxes thereon. If any utilities or services are not separately assessed to Tenant, Tenant shall pay such amount to Landlord, as an item of additional rent, within ten (10) days after delivery of Landlord’s statement or invoice therefor.

ARTICLE VII. MAINTENANCE AND REPAIRS

SECTION 7.1. TENANT OBLIGATIONS. Except as provided in Article XI (Damage or Destruction) and Article XII (Eminent Domain), Tenant, at its sole expense, shall maintain, repair and replace (to the extent required hereunder) the entire Premises, including but not limited to, the foundations, footings, load bearing walls and other structural elements of the Premises, the roof of the Premises, the paved areas of the Premises, landscaping and the heating, air conditioning, ventilating systems, mechanical, electrical, plumbing or life safety systems of the Building (collectively, the “Building Systems”}, so as to keep same in substantially the condition that existed on the Commencement Date, ordinary wear and tear excepted. As used in this Section 7.1, the obligation to repair and maintain includes the obligation to replace any item which is determined to have outlived its useful life and is no longer capable of being repaired to its normal functionality, or the cost to repair exceeds fifty percent (50%) of the cost of replacing such item. If Tenant fails to perform Tenant’s obligations under this Section 7.1, Landlord may enter upon the Premises after ten (10) days’ prior written notice to Tenant (except in the event of an emergency, in which case no notice shall be required}, perform such obligations on Tenant’s behalf, and put the Premises in good order, condition and repair, and Tenant shall promptly pay to Landlord a sum equal to 115% of the cost thereof in addition to interest at the rate of ten percent (10%) from the date the work is commenced until the date of full repayment by Tenant, as additional rent on demand. Notwithstanding anything contained herein, Tenant shall also be

solely responsible for the cost of painting of the exterior of the Building. It is agreed that Tenant shall be obligated hereunder to pay for at least one (1) complete painting of the exterior of the Building during the initial Term, and at last one (1) additional complete painting of the exterior of the Building during any extension of the Term under Section 3.2.

(a) Except as provided in Section 12.1 below, there shall be no abatement of rent and no liability of Landlord by reason of any injury to or interference with Tenant’s business arising from the making of any repairs, alterations or improvements to any portion of the Premises, nor shall any related activity by Landlord constitute an actual or constructive eviction; provided, however, that in making repairs, alterations or improvements, Landlord shall interfere as little as reasonably practicable with the conduct of Tenant’s business in the Premises.

SECTION 7.2. SERVICES COMPANY. Tenant shall be obligated to hire PHC Service Co., LLC, a California limited liability company (the “Services Company”), to carry out all of Tenant’s maintenance and repair obligations described in Section 7.1 above and perform any Alterations in accordance with Section 7.3 below and administrative services.

SECTION 7.3. ALTERATIONS. Tenant shall make no alterations, additions or improvements (collectively and individually, “Alterations”) to the Premises (including the roof of the Building) without the prior written consent of Landlord. In all cases, Tenant shall provide Landlord with written notice prior to performing any Alteration. Landlord’s consent may be granted or withheld by Landlord in its reasonable discretion. Landlord shall respond to Tenant’s request to make Alterations within thirty (30) days after receipt of such request, as long as the request includes reasonably detailed plans and specifications (as described below) and Landlord’s failure to object to any proposed Alterations within such time period shall be deemed approval of such Alterations. Tenant shall obtain all required permits for the Alterations and shall perform the Alterations in compliance with all Applicable Law. Any request for Landlord’s consent shall be made in writing and shall contain architectural plans describing the work in detail reasonably satisfactory to Landlord. All Alterations affixed to the Premises (excluding trade fixtures) shall become the property of Landlord and shall be surrendered with the Premises at the end of the Term, unless Landlord notifies Tenant that such Alterations must be removed by written notice delivered to Tenant at the time that Landlord approves of such Alterations or, in the event Landlord’s approval of such Alterations is not required hereunder, within thirty (30) days following the date on which Tenant provides Landlord with written notice of such Alterations. Landlord shall oversee all Alterations performed pursuant to this Section 7.3 by either Tenant or the Services Company, and Tenant shall pay Landlord as compensation for its efforts a non-refundable management fee in the amount of fifteen percent (15%) of the cost and expense incurred by Tenant and/or Services Company in connection with such Alterations no later than ten (10) days after written demand thereof.

SECTION 7.4. MECHANIC’S LIENS. Tenant shall keep the Premises free from any liens arising out of any work performed, materials furnished, or obligations incurred by or for Tenant. Upon request by Landlord, Tenant shall promptly cause any such lien to be released by payment or posting a bond in accordance with California Civil Code Section 3143 or any successor statute. In the event that Tenant has not, within thirty (30) days following the imposition of any lien, caused the lien to be released of record by payment or posting of a proper bond, regardless of whether Landlord has requested that Tenant release same, Landlord shall have, in addition to all other available remedies, the right to cause the lien to be released by any reasonable means it deems proper, including payment of or defense against the claim giving rise to the lien. All reasonable expenses so incurred by Landlord, including Landlord’s reasonable attorneys’ fees, shall be reimbursed by Tenant within thirty (30) days following Landlord’s demand. Tenant shall give Landlord no less than twenty (20) days’ prior notice in writing before commencing construction of any kind on the Premises so that Landlord may post and maintain notices of nonresponsibility on the Premises.

SECTION 7.5. ENTRY AND INSPECTION. Landlord shall at all reasonable times, and upon prior written notice (except in emergencies, in which event no such notice shall be required), have the right to enter the Premises to inspect same, to perform Landlord’s maintenance and repair obligations in accordance with this Lease, and to submit the Premises to prospective or actual purchasers or encumbrance holders (or, during the last one hundred and eighty (180) days of the Term, to prospective tenants), all without being deemed to have caused an eviction of Tenant and without abatement of rent except Tenant shall have the right to accompany Landlord during any such entry (provided that the unavailability or lack of cooperation of a representative of Tenant shall not limit Landlord’s rights to exercise its rights or perform its obligations under this Section 7.5). Notwithstanding the foregoing, Landlord shall endeavor to coordinate any entry onto the Premises with Tenant so that it does not unreasonably interfere with Tenant’s business.

ARTICLE VIII. TAXES AND ASSESSMENTS ON TENANT’S PROPERTY

Tenant shall be liable for and shall pay before delinquency, all taxes and assessments levied against all personal property (including trade fixtures) of Tenant located on the Premises. When possible, Tenant shall cause its personal property to be assessed and billed separately from the real property of which the Premises form a part. If any taxes on Tenant’s personal property are levied against Landlord or Landlord’s property and if Landlord pays the same, or if the assessed value of Landlord’s property is increased by the inclusion of a value placed upon the personal property of Tenant and if Landlord pays the taxes based upon the increased assessment, Tenant shall pay to Landlord within ten (10) days after written demand therefor the taxes so levied against Landlord or the proportion of the taxes resulting from the increase in the assessment

ARTICLE IX. ASSIGNMENT AND SUBLETTING

SECTION 9.1. RIGHTS OF PARTIES.

(a) Notwithstanding any provision of this Lease to the contrary, but except as provided in subsection (e) below, Tenant will not, either voluntarily or by operation of law, assign, sublet, encumber, or otherwise transfer (any or all of which are sometimes referenced to herein as a “Transfer”) all or any part of Tenant’s interest in this Lease, or permit the Premises to be occupied by anyone other than Tenant, without Landlord’s prior written consent, which Landlord may withhold in its sole discretion. No assignment (whether voluntary, involuntary or by operation of law) and no subletting shall be valid or effective without Landlord’s prior written consent and, at Landlord’s election, shall constitute a material default of this Lease. To the extent not prohibited by provisions of the Bankruptcy Code, 11 U.S.C. Section 101 et seq. (the “Bankruptcy Code”), including Section 365(1)(1), Tenant on behalf of itself and its creditors, administrators and assigns waives the applicability of Section 365(e) of the Bankruptcy Code unless the proposed assignee of the Trustee for the estate of the bankrupt meets Landlord’s standard for consent as set forth in Section 9.1(cl of this Lease. If this Lease is assigned to any person or entity pursuant to the provisions of the Bankruptcy Code, any and all monies or other consideration to be delivered in connection with the assignment shall be delivered to Landlord, shall be and remain the exclusive property of Landlord and shall not constitute property of Tenant or of the estate of Tenant within the meaning of the Bankruptcy Code. Any person or entity to which this Lease is assigned pursuant to the provisions of the Bankruptcy Code shall be deemed to have assumed all of the obligations arising under this Lease on and after the date of the assignment, and shall upon demand execute and deliver to Landlord an instrument confirming that assumption.

(b) If Tenant is a corporation, or is an unincorporated association, partnership or limited liability company (other than a publicly traded corporation or other entity), the transfer of any stock or ownership interest in the corporation, association, partnership or limited liability company which results in a change in the voting control of Tenant, if any, shall be deemed a Transfer within the meaning and provisions of this Article IX.

(c) Notwithstanding the provisions of subsection (c) above, in lieu of consenting to a proposed assignment of this Lease or to a subletting of all or substantially all of the Premises for all or substantially the remainder of the Term (other than an assignment or subletting to a “Tenant Affiliate” pursuant to subsection (e) below), Landlord may elect to (i) sublease the Premises (or the portion proposed to be so subleased), or take an assignment of Tenant’s interest in this Lease, upon the same terms as offered to the proposed subtenant or assignee, or (ii) terminate this Lease as to the portion of the Premises proposed to be subleased or assigned with a proportionate abatement in the rent payable under this Lease, effective on the date that the proposed sublease or assignment would have become effective. Landlord may thereafter, at its option, assign or relet any space so recaptured to any third party, including without limitation the proposed transferee of Tenant. Should Landlord elect to exercise its rights under this subsection (d). then Tenant shall have the right, by written notice to Landlord given within five (5) business days following such election by Landlord, to rescind its request to effect an assignment or subletting, in which event Tenant’s proposed assignment or subletting shall not be consummated and Landlord’s recapture election shall be null and void.

(d) Provided (i) Tenant is not in material default hereunder, and (ii) no such transaction is undertaken with the intent of circumventing the Transfer restrictions under this Section 9.1, Tenant may, without Landlord’s consent but with prior written notice to Landlord, assign this Lease or sublease all or any portion of the Premises to (a) any entity resulting from a merger or consolidation with Tenant, (b) any entity succeeding to the business and assets of Tenant (including a sale of stock or other ownership interests of Tenant to such successor entity), or (c) any entity controlling, controlled by, or under common control with, Tenant, or the principal owners (shareholders, partners, members, etc.) of Tenant (collectively, a “Tenant Affiliate”) effecting such Transfer.

(e) In the event of any assignment or subletting of the Premises, one hundred percent (100%) of any excess rent received by the Tenant from the assignment or subletting, whether during or after the Term, shall be paid to Landlord when received.

SECTION 9.2. EFFECT OF TRANSFER. No Transfer, even with the consent of Landlord, shall relieve Tenant, or any successor-in-interest to Tenant hereunder, of its obligation to pay rent and to perform all its other obligations under this Lease. Moreover, Tenant shall indemnify and hold Landlord harmless, as provided in Section 10.3, for any act or omission by an assignee or subtenant. Each assignee shall be deemed to assume all obligations of Tenant under this Lease and shall be liable jointly and severally with Tenant for the payment of all rent, and for the due performance of all of Tenant’s obligations, under this Lease. Such joint and several liability shall not be discharged or impaired by any subsequent modification or extension of this Lease. No Transfer shall be binding on Landlord unless any document memorializing the Transfer is delivered to Landlord and, except with respect to a Transfer to a Tenant Affiliate, both the assignee/subtenant and Tenant deliver to Landlord an executed consent to Transfer instrument prepared by Landlord and consistent with the requirements of this Article IX. The acceptance by

Landlord of any payment due under this Lease from any other person shall not be deemed to be a waiver by Landlord of any provision of this Lease or to be a consent to any Transfer. Consent by Landlord to one or more Transfers shall not operate as a waiver or estoppel to the future enforcement by Landlord of its rights under this Lease.

SECTION 9.3. SUBLEASE REQUIREMENTS. The following terms and conditions shall apply to any subletting by Tenant of all or any part of the Premises:

(a) Tenant hereby irrevocably assigns to Landlord all of Tenant’s interest in all rentals and income arising from any sublease of the Premises, and Landlord may collect such rent and income and apply same toward Tenant’s obligations under this Lease; provided, however, that until a default occurs in the performance of Tenant’s obligations under this Lease, Tenant shall have the right to receive and collect the sublease rentals. Landlord shall not, by reason of this assignment or the collection of sublease rentals, be deemed liable to the subtenant for the performance of any of Tenant’s obligations under the sublease. Tenant hereby irrevocably authorizes and directs any subtenant, upon receipt of a written notice from Landlord stating that an uncured default exists in the performance of Tenant’s obligations under this Lease, to pay to Landlord all sums then and thereafter due under the sublease. Tenant agrees that the subtenant may rely on that notice without any duty of further inquiry and notwithstanding any notice or claim by Tenant to the contrary. Tenant shall have no right or claim against the subtenant or Landlord for any rentals so paid to Landlord. In the event Landlord collects amounts from subtenants that exceed the total amount then due from Tenant hereunder, Landlord shall promptly remit the excess to Tenant.

(b) In the event of the termination of this Lease, Landlord may, at its sole option, take over Tenant’s entire interest in any sublease and, upon notice from Landlord, the subtenant shall attorn to Landlord. In no event, however, shall Landlord be liable for any previous act or omission by Tenant under the sublease or for the return of any advance rental payments or deposits under the sublease that have not been actually delivered to Landlord, nor shall Landlord be bound by any sublease modification executed without Landlord’s consent or for any advance rental payment by the subtenant in excess of one month’s rent. The general provisions of this Lease, including without limitation those pertaining to insurance and indemnification, shall be deemed incorporated by reference into the sublease despite the termination of this Lease.

ARTICLE X. INSURANCE AND INDEMNITY

SECTION 10.1. TENANT’S INSURANCE. Tenant, at its sole cost and expense, shall provide and maintain in effect during the Term the insurance described in Exhibit “D”. Evidence of such insurance must be delivered to Landlord prior to the Commencement Date, and upon each renewal date of the applicable policies.

SECTION 10.2. INDEMNITY.

(a) To the fullest extent permitted by law, Tenant shall defend, indemnify and hold harmless Landlord, its agents, lenders, and any and all affiliates of Landlord, from and against any and all claims, liabilities, costs or expenses arising on or after the Commencement Date from Tenant’s use or occupancy of the Premises, or from the conduct of its business, or from any activity, work, or thing done, permitted or suffered by Tenant or its agents, employees, subtenants, invitees or licensees in or about the Premises, or from any default in the performance of any obligation on Tenant’s part to be performed under this Lease, or from any negligence or willful misconduct of Tenant or its agents, employees, invitees or licensees. Landlord may, at its option, require Tenant to assume Landlord’s defense in any action covered by this Section 10.2.

(b) To the fullest extent permitted by law, but subject to Section 10.3, Landlord shall indemnify and hold harmless Tenant from and against any and all claims, liabilities, costs or expenses arising on or after the Commencement Date from the gross negligence or willful misconduct of Landlord or anyone acting on behalf of or under the direction of Landlord.

(c) Unless otherwise expressly provided in this Lease, neither Landlord nor Tenant will be liable for punitive damages, consequential damages or special damages (it being expressly acknowledged and agreed that any damages incurred by a party hereto arising out of third party claims for which indemnification is required pursuant to this Lease shall be deemed actual damages of the party which incurs them and not subject to the foregoing exclusion). Tenant shall be fully liable for any and all consequential damages relating to or arising out of any failure of Tenant to vacate and surrender the Premises on or prior to the expiration of the Term in accordance with the terms and provisions of this Lease (collectively, “Holdover Consequential Damages”); provided, however, Tenant’s liability for Holdover Consequential Damages shall not exceed an amount equal to the monthly Basic Rent payable during the period immediately preceding the Expiration Date multiplied by thirty (30).

(d} The terms of this Section 10.2 shall survive the expiration or earlier termination of this Lease.

SECTION 10.3. LANDLORD’S NONLIABILITY. Except only to the extent arising from the gross negligence (which includes, without limitation, the grossly negligent failure to comply with Applicable Laws) or willful misconduct of Landlord or its employees or agents, Landlord shall not be liable to Tenant, its employees, agents and invitees, and Tenant hereby waives all claims against Landlord, its employees and agents for loss of or damage to any property, or any injury to any person, resulting from fire, explosion, falling plaster, steam, gas, electricity, water or rain which may leak or flow from or into any part of the Premises or from the breakage, leakage, obstruction or other defects of the pipes, sprinklers, wires, appliances, plumbing, air conditioning, electrical works or other fixtures in the Premises, whether the damage or injury results from conditions arising in the Premises, it being agreed that Tenant shall be responsible for obtaining appropriate insurance to protect its interests.

ARTICLE XI. DAMAGE OR DESTRUCTION

SECTION 11.1. RESTORATION.

(a) If the Building is damaged as the result of an event of casualty, Tenant shall repair such damage at Tenant’s sole cost and expense and without seeking reimbursement from Landlord.

(b) A casualty event shall not entitle the Tenant to any abatement of Basic Rent, Percentage Rent or any additional rent to be paid under this Lease.

SECTION 11.2. LEASE GOVERNS. Tenant agrees that the provisions of this Lease, including without limitation Section 11.1, shall govern any damage or destruction and shall accordingly supersede any contrary statute or rule of law.

ARTICLE XII. EMINENT DOMAIN

SECTION 12.1. TOTAL OR PARTIAL TAKING. If all or a material portion of the Premises is taken by any lawful authority by exercise of the right of eminent domain, or sold to prevent a taking, or if a taking or sale in lieu thereof occurs which substantially interferes with Tenant’s use and occupancy of the Premises, either Tenant or Landlord may terminate this Lease by notice to the other party prior to the date possession is required to be surrendered to the authority and effective as of the date of such surrender of possession. In the event title to a portion of the Premises is taken or sold in lieu of taking, and if Landlord elects to restore the Premises in such a way as to alter the Premises in a manner which materially interferes with Tenant’s use and occupancy of the Premises, Tenant may terminate this Lease, by written notice to Landlord, effective on the date of vesting of title. In the event neither party has elected to terminate this Lease as provided above, then Landlord shall promptly proceed to restore the Premises to substantially its condition prior to the taking (at Landlord’s sole cost and expense), but excluding any Alterations made by Tenant, and a proportionate abatement of rent shall be made to Tenant for the rent corresponding to the time during which, and to the part of the Premises of which, Tenant is deprived on account of the taking and restoration. In the event of a taking, Landlord shall be entitled to the entire amount of the condemnation award without deduction for any estate or interest of Tenant; provided that nothing in this Section 12.1 shall be deemed to give Landlord any interest in, or prevent Tenant from seeking any award against the taking authority for, the taking of personal property and trade fixtures belonging to Tenant or for relocation or business interruption expenses recoverable from the taking authority, or for any other claim for which Tenant is entitled to compensation by the taking authority under Applicable Law.

SECTION 12.2. TEMPORARY TAKING. No temporary taking of the Premises shall terminate this Lease, but any award specifically attributable to a temporary taking of the Premises shall belong entirely to Tenant. A temporary taking shall be deemed to be a taking of the use or occupancy of the Premises for a period of not to exceed ninety (90) days.

ARTICLE XIII. SUBORDINATION; ESTOPPEL CERTIFICATE

SECTION 13.1. SUBORDINATION. At the option of Landlord or any of its mortgagees/deed of trust beneficiaries, this Lease shall be either superior or subordinate to all ground or underlying leases, mortgages and deeds of trust, if any, which may hereafter affect the Premises, and to all renewals, modifications, consolidations, replacements and extensions thereof; provided, that so long as Tenant is not in default under this Lease, this Lease shall not be terminated or Tenant’s quiet enjoyment of the Premises disturbed in the event of termination of any such ground or underlying lease, or the foreclosure of any such mortgage or deed of trust, to which Tenant has subordinated this Lease pursuant to this Section 13.1. In the event of a termination or foreclosure, Tenant shall become a tenant of and attorn to the successor-in-interest to Landlord upon the same terms and conditions as are contained in this Lease, and shall promptly execute any reasonable instrument required by Landlord’s successor for that purpose. Tenant shall also, within ten (10) business days following written request of Landlord (or the beneficiary under any deed of trust encumbering the Premises), execute and deliver all reasonable instruments as may be required from time to time by Landlord or such beneficiary (including without limitation any commercially reasonable subordination, nondisturbance and attornment agreement) to subordinate this Lease and the rights of Tenant under this Lease to any ground or underlying lease or to the lien of any mortgage or deed of trust; provided, however, that any such beneficiary may, by written notice to Tenant given at any time, subordinate the lien of its deed of trust to this Lease. Notwithstanding this Section 13.1, Tenant shall only be obligated to subordinate its leasehold interest to any mortgage, deed of trust, or underlying lease now or

hereafter placed upon the Premises if the instrument evidencing such subordination does not require Tenant to increase its leasehold obligations and if the holder of such mortgage or deed of trust or the landlord under such underlying lease will grant to Tenant a commercially reasonable non-disturbance agreement, which will provide that Tenant, notwithstanding any default of Landlord hereunder, shall have the right to remain in possession of the Premises in accordance with the terms and provisions of this Lease for so long as Tenant shall not be in default under this Lease. Tenant acknowledges that Landlord’s mortgagees and successors-in-interest and all beneficiaries under deeds of trust encumbering the Premises are intended third party beneficiaries of this Section 13.1.

SECTION 13.2. ESTOPPEL CERTIFICATE. Tenant shall, at any time upon not less than ten (10) business days prior written notice from Landlord, execute, acknowledge and deliver to Landlord, in any form that Landlord may reasonably require, a statement in writing in favor of Landlord and/or any prospective purchaser or encumbrancer of the Premises (i) certifying that this Lease is unmodified and in full force and effect (or, if modified, stating the nature of the modification and certifying that this Lease, as modified, is in full force and effect) and the dates to which the rental, additional rent and other charges have been paid in advance, if any, and (ii) acknowledging that, to Tenant’s actual best knowledge, there are no material uncured defaults on the part of Landlord, or specifying each default if any are claimed, and (iii) acknowledging, to Tenant’s best knowledge, such further factual information that Landlord may reasonably request, provided Tenant is not thereby required to increase its obligations under this Lease. Tenant’s statement may be relied upon by any prospective purchaser or encumbrancer of all or any portion of the Premises.

SECTION 13.3. MEMORANDUM OF LEASE. It is agreed that if there is any purchase money financing, a memorandum of lease shall be executed by Landlord and Tenant concurrently with the execution of this Lease, which shall be recorded in the offices of the Recorder of Los Angeles County, California prior to the recordation of any mortgage or deed of trust which secures any purchase money financing obtained in connection with Landlord’s acquisition of the Premises, such that this Lease will be senior to such mortgage or deed of trust (subject to the obligation of Tenant to execute a subordination agreement pursuant to Section 13.1 above). Alternatively, this Lease may be subordinate to such purchase money financing, if Tenant receives a commercially reasonable non-disturbance agreement from the mortgagee/beneficiary at or prior to the recordation of such mortgage or deed of trust, in which event a memorandum of lease shall not be recorded.

SECTION 13.4. FINANCIAL STATEMENTS. Within ten (10) business days following the request of Landlord, at any time during the Term that Tenant is not a “publicly traded company” (i.e., ownership interests are listed on a public securities exchange), but not more than one time during each Lease Year (other than in connection with a sale or refinancing of the Premises), then Tenant shall furnish to Landlord copies of Tenant’s financial statements, showing the complete results of Tenant’s operations for its immediately preceding fiscal year, certified as true and correct by the officer of Tenant with primary responsibility as to financial matters and prepared in accordance with generally accepted accounting principles applied on a consistent basis.

ARTICLE XIV. DEFAULTS AND REMEDIES

SECTION 14.1. TENANT’S DEFAULTS. In addition to any other event of default set forth in this Lease, the occurrence of any one or more of the following events shall constitute a default by Tenant:

(a) The failure by Tenant to make any payment of Basic Rent or additional rent required to be made by Tenant, as and when due, or the failure of Tenant to perform any of its obligations under Article XIII within the time periods specified therein, where the failure continues for a period of five (5) business days after written notice from Landlord to Tenant; provided, however, that any such notice shall be in lieu of, and not in addition to, any notice required under California Code of Civil Procedure Section 1161 and 1161(a) as amended.

(b) Assignment, sublease, encumbrance or other transfer of the Lease by Tenant, either voluntarily or by operation of law, whether by judgment, execution, transfer by intestacy or testacy, or other means, without the prior written consent of Landlord.

(c) The failure or inability by Tenant to observe or perform any of the covenants or provisions of this Lease to be observed or performed by Tenant, other than as specified in any other subsection of this Section 14.1, where the failure continues for a period of ten (10) days after written notice from Landlord to Tenant; provided, however, that any such notice shall be in lieu of, and not in addition to, any notice required under California Code of Civil Procedure Section 1161 and 1161(a) as amended.

(d) (i) The making by Tenant of any general assignment for the benefit of creditors; (ii) the filing by or against Tenant of a petition to have Tenant adjudged a Chapter 7 debtor under the Bankruptcy Code or to have debts discharged or a petition for reorganization or arrangement under any law relating to bankruptcy (unless, in the case of a petition filed against Tenant, the same is dismissed within sixty (60) days); (iii) the appointment of a trustee or receiver to take possession of substantially all of Tenant’s assets located at the Premises or of Tenant’s interest in this Lease, if possession is not restored to Tenant within sixty (60) days; (iv) the attachment, execution or other judicial seizure of substantially all of Tenant’s assets located at the Premises or of Tenant’s interest in this Lease, where the seizure is not discharged within sixty (60) days; or (v) Tenant’s convening of a meeting of its creditors for the purpose of effecting a moratorium upon or composition of its debts. Landlord shall not be deemed to have knowledge of any event described in this subsection (d) unless notification in writing is received by Landlord, nor shall there be any presumption attributable to Landlord of Tenant’s insolvency. In the event that any provision of this subsection (d) is contrary to applicable law, the provision shall be of no force or effect.

SECTION 14.2. LANDLORD’S REMEDIES.

(a) In the event of any default by Tenant, then in addition to any other remedies available to Landlord at law or equity, Landlord may exercise the following remedies:

(i) Landlord may terminate Tenant’s right to possession of the Premises by any lawful means, in which case this Lease shall terminate and Tenant shall immediately surrender possession of the Premises to Landlord. Such termination shall not affect any accrued obligations of Tenant under this Lease. Upon termination, Landlord shall have the right to reenter the Premises and remove all persons and property. Landlord shall also be entitled to recover from Tenant:

(1) The unpaid Basic Rent and additional rent which had been earned at the time of termination together with interest at the rate of five percent (5%) per annum;

(2) The unpaid Basic Rent and additional rent for the balance of the Term together with interest at the rate of five percent (5%) per annum;

(3) Any other amount necessary to compensate Landlord for all the detriment proximately caused by Tenant’s failure to perform its obligations under this Lease or which in the ordinary course of things would be likely to result from Tenant’s default, including, but not limited to, the cost of recovering possession of the Premises, commissions and other expenses of reletting, including necessary and reasonable repair, renovation, improvement and alteration of the Premises for a new tenant, the unamortized portion of any tenant improvements and brokerage commissions funded by Landlord in connection with this Lease, reasonable attorneys’ fees, and any other reasonable costs, with the foregoing amounts to be discounted at the discount rate of the Federal Reserve Bank of San Francisco at the time of award plus one percent (1%); and

(4) At Landlord’s election, all other amounts in addition to or in lieu of the foregoing as may be permitted by law. For purposes of this Section 14.2, any sum, other than Basic Rent, shall be computed on the basis of the average monthly amount accruing during the twenty-four (24) month period immediately prior to default, except that if it becomes necessary to compute such rental before the twenty-four (24) month period has occurred, then the computation shall be on the basis of the average monthly amount during the shorter period.

(ii) Landlord may elect not to terminate Tenant’s right to possession of the Premises, in which event Landlord may continue to enforce all of its rights and remedies under this Lease, including the right to collect all rent as it becomes due. Efforts by the Landlord to maintain, preserve or relet the Premises, or the appointment of a receiver to protect the Landlord’s interests under this Lease, shall not constitute a termination of the Tenant’s right to possession of the Premises. In the event that Landlord elects to avail itself of the remedy provided by this subsection {iil. Landlord shall not unreasonably withhold its consent to an assignment or subletting of the Premises.

(b) The various rights and remedies reserved to Landlord in this Lease or otherwise shall be cumulative and, except as otherwise provided by California law, Landlord may pursue any or all of its rights and remedies at the same time. No delay or omission of Landlord to exercise any right or remedy shall be construed as a waiver of the right or remedy or of any default by Tenant. The acceptance by Landlord of rent shall not be a (i) waiver of any preceding breach or default by Tenant of any provision of this Lease, other than the failure of Tenant to pay the particular rent accepted, regardless of Landlord’s knowledge of the preceding breach or default at the time of acceptance of rent, or (ii) a waiver of Landlord’s right to exercise any remedy available to Landlord by virtue of the breach or default. The acceptance of any payment from a debtor in possession, a trustee, a receiver or any other person acting on behalf of Tenant or Tenant’s estate shall not waive or cure a default under Section 14.1. No payment by Tenant or receipt by Landlord of a lesser amount than the rent required by this Lease shall be deemed to be other than a partial payment on account of the earliest due stipulated rent, nor shall any endorsement or statement on any check or letter be deemed an accord and satisfaction and Landlord shall accept the check or payment without prejudice to Landlord’s right to recover the balance of the rent or pursue any other remedy available to it. Tenant hereby waives any right of redemption or relief from forfeiture under California Code of Civil Procedure Section 1174 or 1179, or under any other present or future law, in the event this Lease is terminated by reason of any default by Tenant. No act or thing done by Landlord or Landlord’s agents during the Term shall be deemed an acceptance of a surrender of the Premises, and no agreement to accept a surrender shall be valid unless in writing and signed by Landlord. No employee of Landlord or of Landlord’s agents shall have any power to accept the keys to the Premises prior to the termination of this Lease, and the delivery of the keys to any employee shall not operate as a termination of the Lease or a surrender of the Premises.

SECTION 14.3. LATE PAYMENTS. Any rent due under this Lease that is not paid to Landlord within five (5) days of the date when due shall bear interest at the rate of ten percent (10%) per annum from the date due until fully paid. The payment of the interest and late charge shall not cure any default by Tenant under this Lease. In addition, Tenant acknowledges that the late payment by Tenant to Landlord of rent will cause Landlord to incur costs not contemplated by this Lease, the exact amount of which will be extremely difficult and impracticable to ascertain. Those costs may include, but are not limited to, administrative, processing and accounting charges, and late charges which may be imposed on Landlord by the terms of any ground lease, mortgage or trust deed covering the Premises. Accordingly, if any rent due from Tenant shall not be received by Landlord or Landlord’s designee within five (5) days after the date due, then Tenant shall pay to Landlord, in addition to the interest provided above, a late charge in the amount of $1,000.00 for each delinquent payment during each Lease Year. Acceptance of a late charge by Landlord shall not constitute a waiver of Tenant’s default with respect to the overdue amount, nor shall it prevent Landlord from exercising any of its other rights and remedies.

SECTION 14.4. RIGHT OF LANDLORD TO PERFORM. All.covenants and agreements to be performed by Tenant under this Lease shall be performed at Tenant’s sole cost and expense and without any abatement of rent or right of set-off. If Tenant fails to pay any sum of money, or fails to perform any other act on its part to be performed under this Lease, and the failure continues beyond any applicable notice and cure period, then in addition to any other available remedies, Landlord may, at its election make the payment or perform the other act on Tenant’s part. Landlord’s election to make the payment or perform the act on Tenant’s part shall not give rise to any responsibility of Landlord to continue making the same or similar payments or performing the same or similar acts. Tenant shall, within thirty (30) days following demand by Landlord, reimburse Landlord for all sums paid by Landlord.

SECTION 14.5. DEFAULT BY LANDLORD. Except as otherwise specifically provided in this Lease, Landlord shall not be deemed to be in default in the performance of any obligation under this Lease unless and until it has failed to perform the obligation within thirty (30) days after written notice by Tenant to Landlord specifying in reasonable detail the nature and extent of the failure; provided, however, that if the nature of Landlord’s obligation is such that more than thirty (30) days are required for its performance, then Landlord shall not be deemed to be in default if it commences performance within the thirty (30) day period and thereafter diligently pursues the cure to completion. In the event of a default by Landlord beyond any applicable notice and cure period, Tenant shall have all rights and remedies at law and in equity.

SECTION 14.6. EXPENSES AND LEGAL FEES. Should either Landlord or Tenant bring any action in connection with this Lease, the prevailing party shall be entitled to recover as a part of the action its reasonable attorneys’ fees, and all other costs. The prevailing party for the purpose of this Section shall be determined by the trier of the facts.

SECTION 14.7. JUDICIAL REFERENCE.

IT IS THE DESIRE AND INTENTION OF THE PARTIES TO AGREE UPON A MECHANISM AND PROCEDURE UNDER WHICH CONTROVERSIES AND DISPUTES ARISING OUT OF THIS LEASE OR RELATED TO THE PREMISES WILL BE RESOLVED IN A PROMPT AND EXPEDITIOUS MANNER. ACCORDINGLY, EXCEPT WITH RESPECT TO ACTIONS FOR UNLAWFUL OR FORCIBLE DETAINER OR WITH RESPECT TO THE PREJUDGMENT REMEDY OF ATTACHMENT, ANY ACTION, PROCEEDING OR COUNTERCLAIM BROUGHT BY EITHER PARTY HERETO AGAINST THE OTHER (AND/OR AGAINST ITS OFFICERS, DIRECTORS, EMPLOYEES, AGENTS OR SUBSIDIARY OR

AFFILIATED ENTITIES) ON ANY MATTERS WHATSOEVER ARISING OUT OF OR IN ANY WAY CONNECTED WITH THIS LEASE, TENANT’S USE OR OCCUPANCY OF THE PREMISES AND/OR ANY CLAIM OF INJURY OR DAMAGE, SHALL BE HEARD AND RESOLVED BY A REFEREE UNDER THE PROVISIONS OF THE CALIFORNIA CODE OF CIVIL PROCEDURE, SECTIONS 638-645.1, INCLUSIVE (AS SAME MAY BE AMENDED, OR ANY SUCCESSOR STATUTE(S) THERETO) (THE “REFEREE SECTIONS”). ANY FEE TO INITIATE THE JUDICIAL REFERENCE PROCEEDINGS SHALL BE PAID BY THE PARTY INITIATING SUCH PROCEDURE; PROVIDED HOWEVER, THAT THE COSTS AND FEES, INCLUDING ANY INITIATION FEE, OF SUCH PROCEEDING SHALL ULTIMATELY BE BORNE IN ACCORDANCE WITH SECTION 14.6 ABOVE. THE VENUE OF THE PROCEEDINGS SHALL BE IN THE COUNTY IN WHICH THE PREMISES ARE LOCATED. WITHIN TEN (10) DAYS OF DELIVERY BY ANY PARTY TO THE OTHER PARTY OF A WRITTEN REQUEST TO RESOLVE ANY DISPUTE OR CONTROVERSY PURSUANT TO THIS SECTION 14.7, THE PARTIES SHALL AGREE UPON A SINGLE REFEREE WHO SHALL TRY ALL ISSUES, WHETHER OF FACT OR LAW, AND REPORT A FINDING AND JUDGMENT ON SUCH ISSUES AS REQUIRED BY THE REFEREE SECTIONS. IF THE PARTIES ARE UNABLE TO AGREE UPON A REFEREE WITHIN SUCH TEN (10) DAY PERIOD, THEN ANY PARTY MAY THEREAFTER FILE A LAWSUIT IN THE COUNTY IN WHICH THE PREMISES ARE LOCATED FOR THE PURPOSE OF APPOINTMENT OF A REFEREE UNDER CALIFORNIA CODE OF CIVIL PROCEDURE SECTIONS 638 AND 640, AS SAME MAY BE AMENDED OF ANY SUCCESSOR STATUTE(S) THERETO.. IF THE REFEREE IS APPOINTED BY THE COURT, THE REFEREE SHALL BE A NEUTRAL AND IMPARTIAL RETIRED JUDGE WITH SUBSTANTIAL EXPERIENCE IN THE RELEVANT MATTERS TO BE DETERMINED, FROM JAMS/ENDISPUTE, INC., THE AMERICAN ARBITRATION ASSOCIATION OR SIMILAR MEDIATION/ARBITRATION ENTITY. THE PROPOSED REFEREE MAY BE CHALLENGED BY ANY PARTY FOR ANY OF THE GROUNDS LISTED IN SECTION 641 OF THE CALIFORNIA CODE OF CIVIL PROCEDURE, AS SAME MAY BE AMENDED OR ANY SUCCESSOR STATUTE(S) THERETO. PENDING THE APPOINTMENT OF THE REFEREE, THE COURT HAS POWER TO ISSUE PROVISIONAL REMEDIES. THE REFEREE SHALL HAVE THE POWER TO DECIDE ALL ISSUES OF FACT AND LAW AND REPORT HIS OR HER DECISION ON SUCH ISSUES, AND TO ISSUE ALL RECOGNIZED REMEDIES AVAILABLE AT LAW OR IN EQUITY FOR ANY CAUSE OF ACTION THAT IS BEFORE THE REFEREE, INCLUDING PROVISIONAL REMEDIES, EQUITABLE ORDERS, AND INCLUDING AN AWARD OF ATTORNEYS’ FEES AND COSTS IN ACCORDANCE WITH CALIFORNIA LAW. THE REFEREE SHALL NOT, HOWEVER, HAVE THE POWER TO AWARD PUNITIVE DAMAGES, NOR ANY OTHER DAMAGES WHICH ARE NOT PERMITTED BY THE EXPRESS PROVISIONS OF THIS LEASE, AND THE PARTIES HEREBY WAIVE ANY RIGHT TO RECOVER ANY SUCH DAMAGES. THE PARTIES SHALL BE ENTITLED TO CONDUCT ALL DISCOVERY AS PROVIDED IN THE CALIFORNIA CODE OF CIVIL PROCEDURE, AND THE REFEREE SHALL OVERSEE DISCOVERY AND MAY ENFORCE ALL DISCOVERY ORDERS IN THE SAME MANNER AS ANY TRIAL COURT JUDGE, WITH RIGHTS TO REGULATE DISCOVERY AND TO ISSUE AND ENFORCE SUBPOENAS, PROTECTIVE ORDERS AND OTHER LIMITATIONS ON DISCOVERY AVAILABLE UNDER CALIFORNIA LAW. NOTWITHSTANDING THE FOREGOING, THE REFEREE SHALL HAVE THE POWER TO EXPAND OR LIMIT THE AMOUNT AND DURATION OF DISCOVERY. THE REFERENCE PROCEEDING SHALL BE CONDUCTED IN ACCORDANCE WITH CALIFORNIA LAW (INCLUDING THE RULES OF EVIDENCE), AND IN ALL REGARDS, THE REFEREE SHALL FOLLOW CALIFORNIA LAW APPLICABLE AT THE TIME OF THE REFERENCE PROCEEDING. HOWEVER, EXCEPT AS EXPRESSLY SET FORTH HEREIN, THE REFEREE SHALL DETERMINE THE MANNER IN WHICH THE REFERENCE PROCEEDING IS CONDUCTED, INCLUDING THE TIME AND PLACE OF HEARINGS, THE

ORDER OF PRESENTATION OF EVIDENCE, AND ALL OTHER QUESTIONS THAT ARISE WITH RESPECT TO THE COURSE OF THE REFERENCE PROCEEDING. ALL PROCEEDINGS SHALL BE CONDUCTED WITHOUT A COURT REPORTER, UNLESS EITHER PARTY REQUESTS THAT A COURT REPORTER TRANSCRIBE ALL OR ANY PART OF THE PROCEEDINGS, IN WHICH CASE THE PARTY MAKING THE REQUEST SHALL ARRANGE AND PAY FOR THE COURT REPORTER. IN ACCORDANCE WITH SECTION 644 OF THE CALIFORNIA CODE OF CIVIL PROCEDURE, THE DECISION OF THE REFEREE UPON THE WHOLE ISSUE MUST STAND AS THE DECISION OF THE COURT, AND UPON THE FILING OF THE STATEMENT OF DECISION WITH THE CLERK OF THE COURT, OR WITH THE JUDGE IF THERE IS NO CLERK, JUDGMENT MAY BE ENTERED THEREON IN THE SAME MANNER AS IF THE ACTION HAD BEEN TRIED BY THE COURT. THE PARTIES SHALL PROMPTLY AND DILIGENTLY COOPERATE WITH ONE ANOTHER AND THE REFEREE, AND SHALL PERFORM SUCH ACTS AS MAY BE NECESSARY TO OBTAIN A PROMPT AND EXPEDITIOUS RESOLUTION OF THE DISPUTE OR CONTROVERSY IN ACCORDANCE WITH THE TERMS OF THIS SECTION 14.7. TO THE EXTENT THAT NO PENDING LAWSUIT HAS BEEN FILED TO OBTAIN THE APPOINTMENT OF A REFEREE, ANY PARTY, AFTER THE ISSUANCE OF THE DECISION OF THE REFEREE, MAY APPLY TO THE COURT OF THE COUNTY IN WHICH THE PREMISES ARE LOCATED FOR CONFIRMATION BY THE COURT OF THE DECISION OF THE REFEREE IN THE SAME MANNER AS A PETITION FOR CONFIRMATION OF AN ARBITRATION AWARD PURSUANT TO CODE OF CIVIL PROCEDURE SECTION 1285 ET SEQ. (AS SAME MAY BE AMENDED OR ANY SUCCESSOR STATUTE(S) THERETO). THE PARTIES RESERVE THE RIGHT TO APPEAL FROM THE FINAL JUDGMENT OR ORDER, OR FROM ANY OTHER APPEALABLE DECISION OR ORDER ENTERED BY THE REFEREE.