Contract

Exhibit 10.16

Execution Version

4 January 2011

| (1) | ALCAN RHENALU as French Seller |

| (2) | ALCAN AEROSPACE as French Seller |

| (3) | ALCAN SOFTAL as French Seller |

| (4) | ALCAN FRANCE EXTRUSIONS as French Seller |

| (5) | ALCAN AVIATUBE as French Seller |

| (6) | OMEGA HOLDCO II B.V. as Parent Company |

| (7) | ENGINEERED PRODUCTS SWITZERLAND A.G. as Sellers’ Agent |

| (8) | GE FACTOFRANCE as Factor |

|

| 72208170 |

|

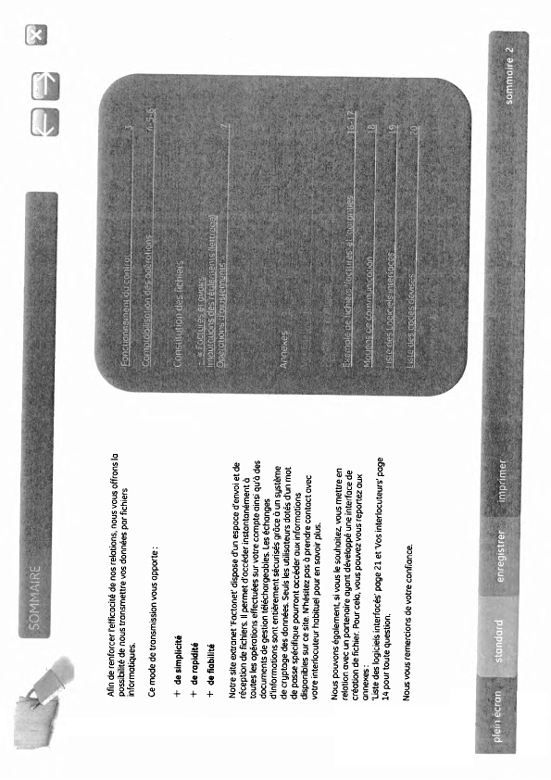

TABLE OF CONTENTS

| Clause | Page | |||||

| 1 |

Definitions and Interpretation | 4 | ||||

| 2 |

Purpose | 15 | ||||

| 3 |

Scope | 16 | ||||

| 4 |

Representations, warranties and undertakings | 20 | ||||

| 5 |

Payment and financing of Receivables | 26 | ||||

| 6 |

Approval | 33 | ||||

| 7 |

Collection Mandate and Cashing Mandate | 35 | ||||

| 8 |

Factoring Accounts | 43 | ||||

| 9 |

Remuneration of the ▇▇▇▇▇▇ | ▇▇ | ||||

| ▇▇ |

▇▇▇▇▇ | ▇▇ | ||||

| ▇▇ |

▇▇▇▇ and Termination | 51 | ||||

| 12 |

Revision of the allocation of the Maximum Financing Amount | 55 | ||||

| 13 |

Access to Web Services | 56 | ||||

| 14 |

Costs and expenses | 57 | ||||

| 15 |

Confidentiality - Utilisation of information collected by the Factor – Substitution | 57 | ||||

| 16 |

Applicable law - Jurisdiction | 59 | ||||

| 17 |

Miscellaneous provisions | 60 | ||||

| 72208170 | 2 |

|

THIS FACTORING AGREEMENT is made on 4 January 2011

BETWEEN:

| (i) | ALCAN RHENALU S.A.S., a company incorporated under the laws of France as a société par actions simplifiée with a share capital of EUR 123,547,875.00, whose registered office is located at La Défense, ▇-▇▇ ▇▇▇▇▇ ▇▇▇ ▇▇▇▇▇▇▇, ▇▇▇▇▇ ▇▇▇▇▇▇▇▇▇▇, ▇▇▇▇▇▇, registered with the Trade and Companies Registry of Nanterre under number 672 014 081, whose seller codes (codes vendeur) are No. 24862 (for domestic invoices) and No. 24861 (for export invoices) (“Alcan Rhenalu”); |

| (ii) | ALCAN AEROSPACE S.A.S., a company incorporated under the laws of France as a société par actions simplifiée with a share capital of EUR 26,296.90, whose registered office is located at La Défense, ▇-▇▇ ▇▇▇▇▇ ▇▇▇ ▇▇▇▇▇▇▇, ▇▇▇▇▇ ▇▇▇▇▇▇▇▇▇▇, ▇▇▇▇▇▇, registered with the Trade and Companies Registry of Nanterre under number 479 791 931, whose seller codes (codes vendeur) are No. 24876 (for domestic invoices) and No. 24875 (for export invoices) (“Alcan Aerospace”); |

| (iii) | ALCAN SOFTAL S.A.S., a company incorporated under the laws of France as a société par actions simplifiée with a share capital of EUR 22,265,000.00, whose registered office is located at ▇▇▇▇▇ ▇▇ ▇▇▇▇▇▇▇▇, ▇▇▇▇▇▇▇▇, ▇▇▇▇▇ ▇▇▇▇▇-▇▇▇▇▇▇▇▇▇, ▇▇▇▇▇▇, registered with the Trade and Companies Registry of Auxerre under number 662 032 374, whose seller codes (codes vendeur) are No. 24865 (for domestic invoices) and No. 24864 (for export invoices) (“Alcan Softal”); |

| (iv) | ALCAN FRANCE EXTRUSIONS S.A.S., a company incorporated under the laws of France as a société par actions simplifiée with a share capital of EUR 15,000,000, whose registered office is located at ▇▇▇▇▇ ▇▇ ▇▇▇▇▇▇▇▇, ▇▇▇▇▇▇▇▇, ▇▇▇▇▇ ▇▇▇▇▇-▇▇▇▇▇▇▇▇▇, ▇▇▇▇▇▇, registered with the Trade and Companies Registry of Auxerre under number 352 610 646, whose seller codes (codes vendeur) are No. 24872 (for domestic invoices) and No. 24871 (for export invoices) (“Alcan France Extrusions”); |

| (v) | ALCAN AVIATUBE S.A.S., a company incorporated under the laws of France as a société par actions simplifiée with a share capital of EUR 3,284,400, whose registered office is located at ▇▇▇▇ ▇▇▇▇▇▇▇▇▇▇▇▇, ▇▇▇▇▇ ▇▇▇▇▇▇▇▇▇, ▇▇▇▇▇▇, registered with the Trade and Companies Registry of Nantes under number 712 032 705, whose seller codes (codes vendeur) are No. 24869 (for domestic invoices) and No. 24867 (for export invoices) (“Alcan Aviatube”) |

(Alcan Rhenalu, Alcan Aerospace, Alcan Softal, Alcan France Extrusions and Alcan Aviatube hereinafter collectively referred to as the “French Sellers” and individually, as a “French Seller”);

| (vi) | OMEGA HOLDCO II B.V., a company incorporated under the laws of the Netherlands as a besloten vennootschap, whose registered office is located at ▇▇▇▇▇▇▇▇▇▇ ▇▇▇, ▇▇▇▇▇▇ ▇▇▇▇▇▇▇▇▇, ▇▇▇ ▇▇▇▇▇▇▇▇▇▇▇, registered with the Trade and Companies Registry of The Netherlands under number 34393946 0000, in its capacity of holding company of the French Sellers as from completion of the Acquisition (the “Parent Company”); |

| (vii) | ENGINEERED PRODUCTS SWITZERLAND AG, a company incorporated under the laws of Switzerland with a share capital of CHF 600,000.00, whose registered office is located at Max ▇▇▇▇▇▇-▇▇▇▇▇▇▇ ▇ ▇▇▇▇ ▇▇▇▇▇▇, ▇▇▇▇▇▇▇▇▇▇▇, registered with the Commercial Registry of Zürich under number CH17030058406, acting as agent of the French Sellers pursuant to Clause 1.3 for certain matters relating to the Agreement (the “Sellers’ Agent”); |

| 72208170 | 3 |

|

AND

| (viii) | GE FACTOFRANCE S.N.C., a company incorporated under the laws of France as a société en nom collectif and licensed as a credit institution (établissement de crédit), whose registered office is located at Tour Facto, ▇▇, ▇▇▇ ▇▇▇▇▇, ▇▇▇▇▇ ▇▇▇▇▇-▇▇ Défense Cedex, France, registered with the Trade and Companies Registry of Nanterre under number 063 802 466 (the “Factor”) |

(the French Sellers, the Parent Company, the Sellers’ Agent and the Factor hereinafter collectively referred to as the “Parties” and individually, as a “Party”).

WHEREAS:

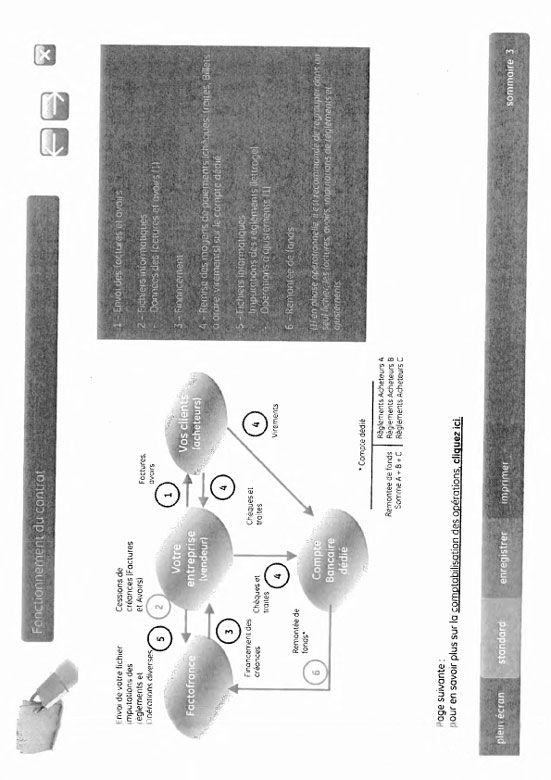

| (A) | Each of the French Sellers have decided to finance their general corporate requirements by entering into Financing Facilities provided by the Factor. |

| (B) | Subject to the terms and conditions of the Agreement, (i) the French Sellers will assign the Relevant Receivables to the Factor pursuant to the provisions of Article L. 313-23 et seq. of the French Monetary and Financial Code, (ii) the Factor will pay the Transferred Receivables to the French Sellers by way of Payments and will Finance the Financeable Amounts prior to the collection of the Transferred Receivables, it being understood that the Financing Facilities made available by the Factor to the French Sellers shall not exceed the Maximum Financing Amount. |

| (C) | The Parties have therefore decided to enter into this Agreement in order to set out the terms and conditions applicable to the assignment of the Relevant Receivables to the Factor and the Financing Facilities resulting therefrom. |

IT IS HEREBY AGREED AS FOLLOWS:

| 1 | DEFINITIONS AND INTERPRETATION |

| 1.1 | Definitions |

In this Agreement, the following expressions used with a capital letter shall, except where the context otherwise requires, have the following meanings:

“Acquisition” means the purchase, directly or indirectly, by the Parent Company from Alcan Holdings Switzerland A.G. and others, of inter alia all the shares and other equity interests in the capital of the Sellers pursuant to the terms of a share sale agreement dated 4 August 2010.

“Acquisition Steps Paper” means the steps paper (reasonably satisfactory to the Factor and based on the draft acquisition steps paper provided to the Factor on 4 August 2010) to be delivered by the Parent Company to the Factor pursuant to the Agreement evidencing that the funds raised from the Financing Facilities (i) will be used for general corporate purposes (including the refinancing of any of working capital facilities and, subject to compliance with financial assistance rules, the financing or refinancing of any debt used to finance the Acquisition of any of the German Sellers and Swiss Seller (other than the French Sellers and the shareholders of the French Sellers) or of any of their respective direct or indirect shareholders) and (ii) will not be used for the financing or refinancing of any equity used to capitalize Omega Holdco B.V. (which equity will be used, among other, to acquire the French Sellers).

“Additional Tax Payment” has the meaning ascribed to such term in Clause 10(g).

| 72208170 | 4 |

|

“Affected Receivables” has the meaning ascribed to such term in Clause 5.7.

“Affiliate” means as to a specified entity, an entity that directly, or indirectly through one or more intermediaries, controls or is controlled by, or is under common control with, the entity specified.

“Agreement” means the present factoring agreement dated the date hereof, as amended from time to time.

“Apollo” means Apollo Management VII, L.P.; each Affiliate of Apollo Management VII, L.P.; and/or any individual who is a partner or employee of Apollo Management, L.P. or of Apollo Management VII, L.P.

“Apollo/FSI Term Loan” means the USD 135,000,000 term loan made available by AIF VII Euro Holdings L.P and the Fonds Stratégique d’Investissement to the Group on or about the completion of the Acquisition.

“Approval” means the approval given by the Credit Insurer in relation to a particular Debtor whereby the Credit Insurer agrees to insure the Approved Receivables up to the Approval Limit in accordance with the Credit Insurance Policy.

“Approval Limit” has the meaning ascribed to such term in Clause 6.3.

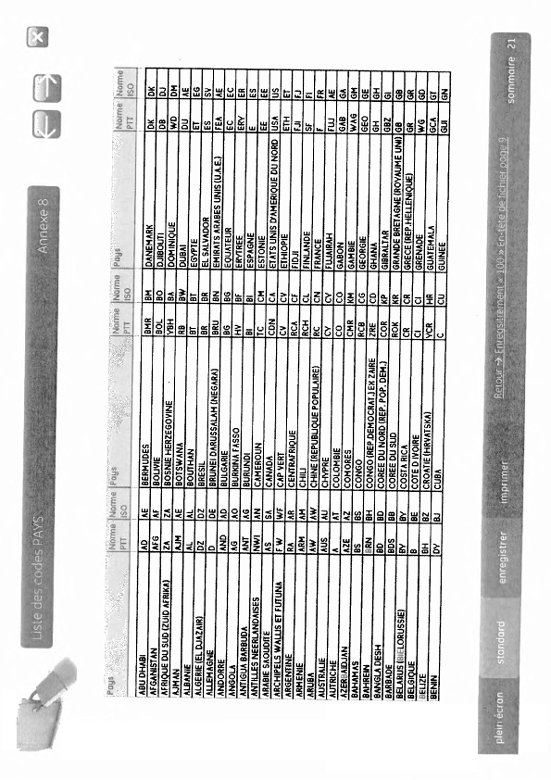

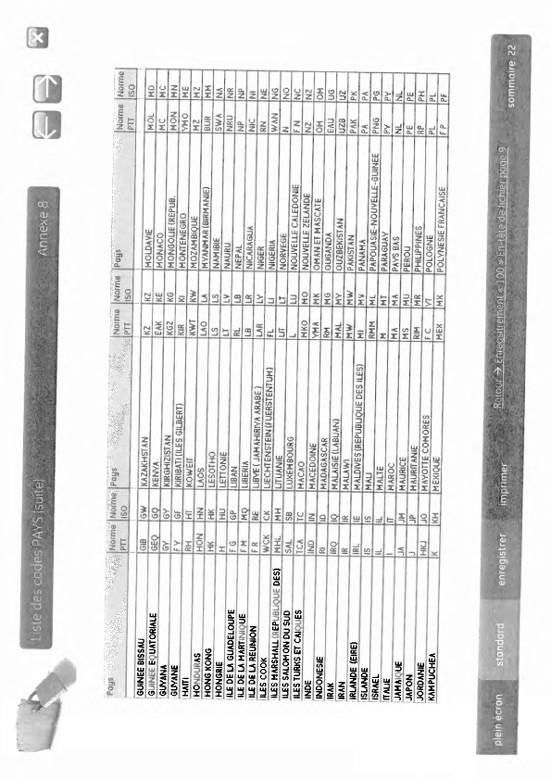

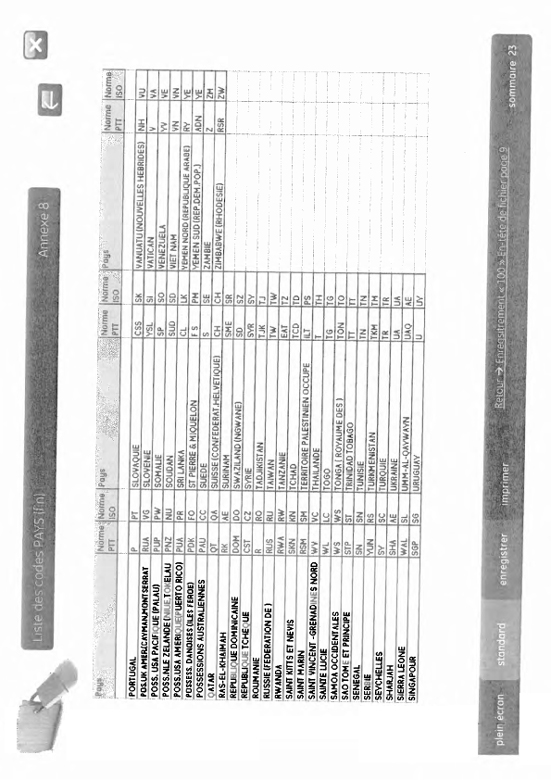

“Approved Jurisdiction” means any of the jurisdictions contemplated in the column “Jurisdiction of incorporation of the Debtor” of the Jurisdiction Matrix (as listed in Annex 13 and amended from time to time); or such other jurisdiction that may be approved by the Factor from time to time upon receiving satisfactory legal advice to that effect.

“Approved Law” means any of the laws referred to in the column “Governing Law of the Transferred Receivable” of the Jurisdiction Matrix (as listed in Annex 13 and amended from time to time); or such other law that may be approved by the Factor from time to time upon receiving satisfactory legal advice to that effect.

“Approved Receivables” has the meaning ascribed to such term in Clause 6.3.

“Arrangement Fee” has the meaning ascribed to such term in Clause 9.3.

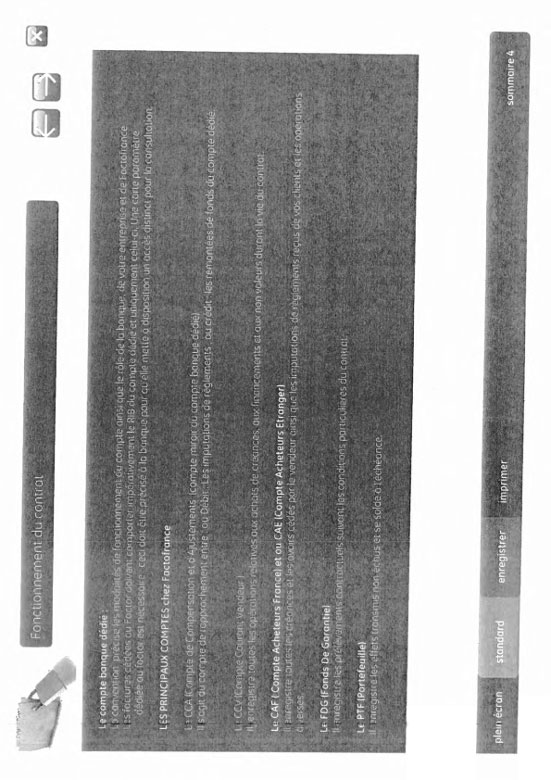

“Asset Account” means the account recording the outstanding amounts of Transferred Receivables.

“Authority” has the meaning ascribed to such term in Clause 10(f).

“Assignment” means any assignment of receivables (cession á titre d’escompte) made by any French Seller to the Factor in accordance with article L. 313-23 et seq. of the French Monetary and Financial Code, the Agreement and each Deed of Transfer executed and remitted or electronically transferred, as the case may be, to the Factor in relation thereto; and to “Assign” means the making of an Assignment pursuant to the Agreement.

“Authorized Assignee” means any entity in the GE Group, any special purpose vehicle created pursuant to Articles L. 214-42-1 et seq. of the French Monetary and Financial Code, or any other securitization vehicle, or any regulatory or banking institution, as set out in Clause 17.5.

“Availability Account” means the Sub-Account to which Payments corresponding to Financeable Amounts for which no Funding Request has been made are transferred.

| 72208170 | 5 |

|

“Average Dilution Rates” means, in relation to any French Seller, as observed over the last three (3) calendar months, the average rate of the Dilutions calculated by the Factor on a monthly basis as a percentage of the aggregate amount of all Transferred Receivables relating to that French Seller.

“Ban on Assignment” means, for the purposes of any Assignment under this Agreement, any requirement of any prior consent from the relevant Debtor or from any third parties which would validly prevent the legal transfer of the Receivable if such consent would not be obtained.

“Banks” means the credit institutions in the books of which the Collection Accounts are opened, that is, BNP Paribas, HSBC and Deutsche Bank, together with any other credit institution that may be agreed from time to time between the Factor and the relevant French Seller.

“Business Day” means a day (other than a Saturday or a Sunday) on which banks are generally open in Paris for normal business.

“Capital Structure” means the features of the capital structure of Omega Holdco B.V. and the Parent Company to be met on completion of the Acquisition, that is, the fact that, on or about the date of completion of the Acquisition, (a) a cash equity contribution of seventy-six million two hundred and fifty thousand United States Dollars (USD 76,250,000) has been made in satisfaction of the purchase price of shares and/or assets from Rio Tinto corresponding to sixty-one per cent (61%) of the equity of Omega Holdco B.V., (b) a final long form credit agreement has been signed between Omega Holdco B.V. and Apollo for the term loan substantially in the form agreed by the Factor on 4 August 2010 and (c) the gross proceeds of at least one hundred and thirty five million United States Dollars (USD 135,000,000) from the Apollo/FSI Term Loan have been funded into the Parent Company.

“Cashing Mandate” has the meaning ascribed to such term in Clause 7.3.

“Change of Control” has the meaning ascribed to such term in Clause 11.2.2(c)(vi).

“Client Guide” means the guide which has been given by the Factor to the French Sellers and which is also accessible through Web Services.

“Closing Date” has the meaning ascribed to such term in Clause 11.1(a).

“Collectability” means the right to demand or claim payment to the Debtor in respect of a Transferred Receivable.

“Collectability List” means the list of countries attached as Annex 12; as amended and updated from time to time by the Factor (acting reasonably).

“Collection Accounts” means, for each French Seller, the bank accounts listed in Annex 11 hereto (as amended from time to time) opened in the name of each of the French Sellers for each relevant currency in the books of the Banks and under which the settlements that each of the French Sellers will receive under the Collection Mandate will be credited or any other bank account opened after the date hereof for the purposes of receiving the settlements under the Transferred Receivables originated by the French Sellers, as agreed from time to time between the relevant French Seller and the Factor.

“Collection Accounts Guarantee Agreements” means the agreements entered into between each of the French Sellers and the Factor and which provide for the assignment for the benefit of the Factor of the receivable arising from the positive balance of the Collection Accounts, in accordance with the provisions of Article L.313-23 to L.313-35 of the French Monetary and Financial Code.

“Collection Accounts Opening Agreements” means the agreements relating to the Collection Accounts entered into between each of the French Sellers, the relevant Bank and the Factor and setting forth, together with the principles detailed in Clause 7.3 below, the main terms and conditions for the operation of the Collection Accounts.

| 72208170 | 6 |

|

“Collection Mandate” has the meaning ascribed to such term in Clause 7.2.

“Commitment Period” means a period of sixty (60) months from the Closing Date (unless this Agreement is terminated earlier).

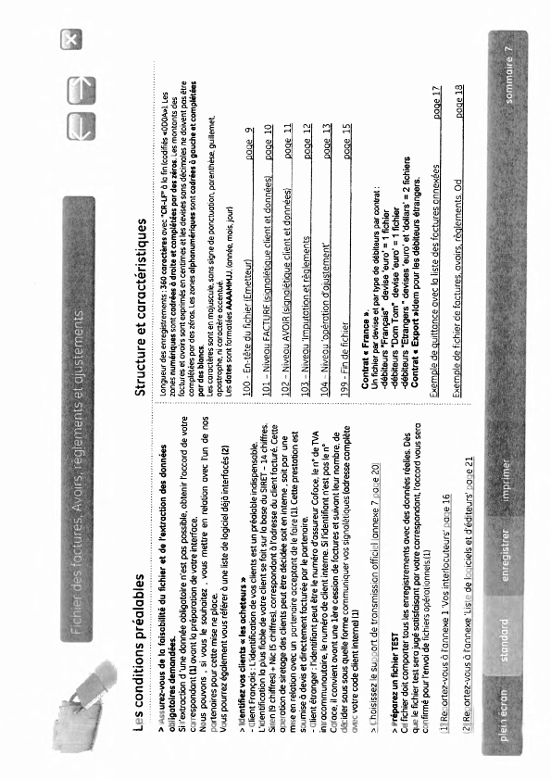

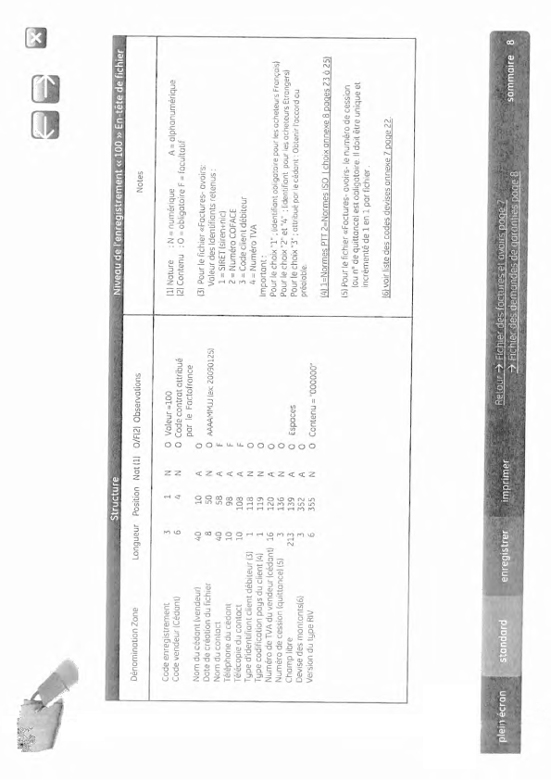

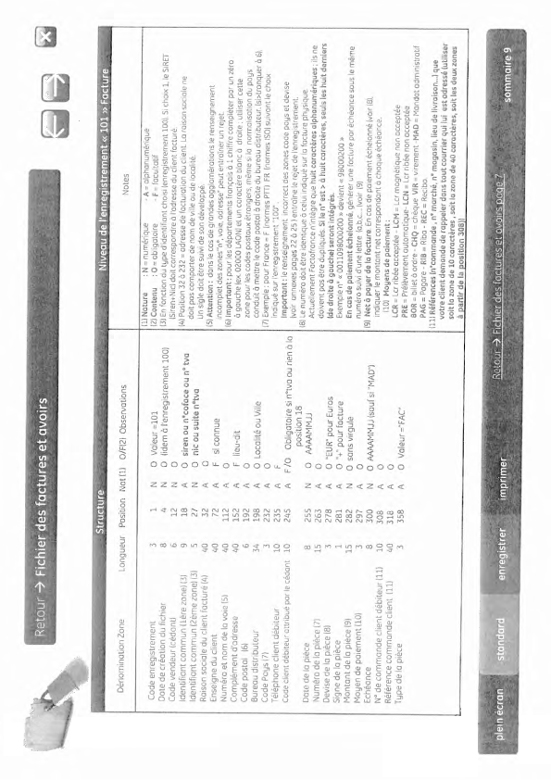

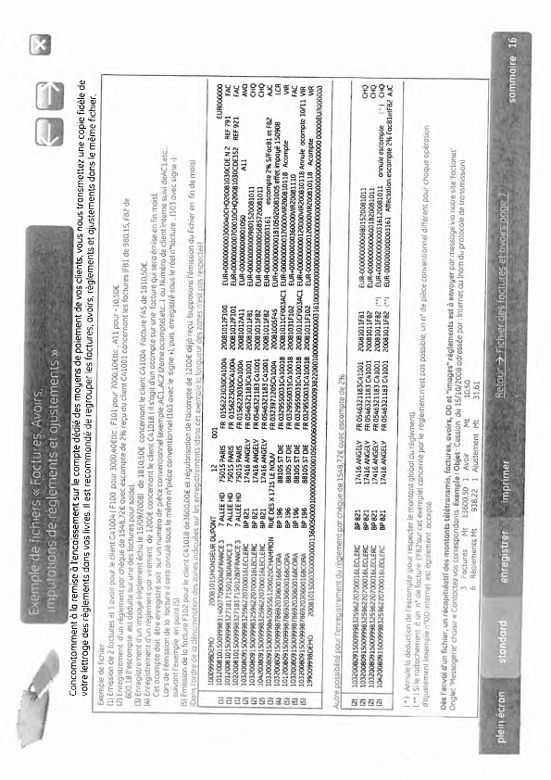

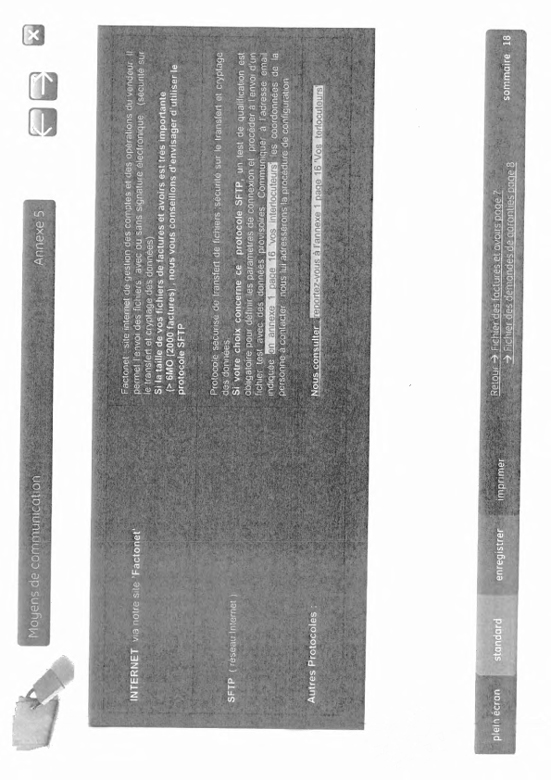

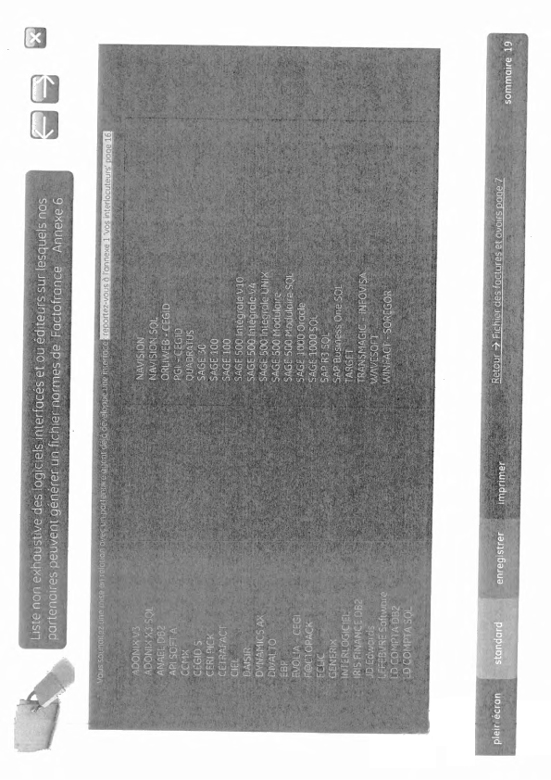

“Computer Relationship Guide” means the procedures and outlines as set out by the Factor, as amended from time to time, that shall be used by the French Sellers for formatting and tele-transmitting information to the Factor in accordance with the Client Guide specifications, as set out in Annex 8 hereto.

“Concentration Limit” means, for all French Sellers, that the maximum (including VAT) of the Financeable Amounts in respect of a Debtor shall not exceed forty percent (40%) of the total amount of the Transferred Receivables in respect of all Debtors.

“Confidential Information” has the meaning ascribed to such term in Clause 15.

“Credit and Collection Procedures” means the French Sellers’ own credit and collection procedures and processes, as amended from time to time, as set out in Annex 7 hereto.

“Credit Insurance Assignment Agreements” means the credit insurance assignment agreements entered into at the latest on 4 January 2011 by and between (i) the Factor, (ii) each of the French Sellers and (iii) the Credit Insurer, by which each of the French Sellers delegates to the Factor its rights to Insurance Indemnification under the Credit Insurance Policy to the Factor.

“Credit Insurance Policy” means the credit insurance policy of the Credit Insurer subscribed by each French Seller with the Credit Insurer in relation to the Transferred Receivables.

“Credit Insurer” means (i) COFACE, a French société anonyme, with registered offices at 12, cours Michelet, La Défense 10, 92800 Puteaux (postal address being Coface, ▇▇▇▇▇ ▇▇▇▇▇ ▇▇ Défense Cedex), registered with the Trade and Companies Registry of Nanterre under number 552 069 791; (ii) EULER-HERMES, a French société anonyme, with registered offices at ▇, ▇▇▇ ▇▇▇▇▇, ▇▇▇▇▇ ▇▇▇▇▇, registered with the Trade and Companies Registry of Paris under number 552 040 594; or (iii) any other credit insurer whose long term unguaranteed and unsubordinated debt obligations are being rated at least “A-” by Standard & Poor’s or “A3” by ▇▇▇▇▇’▇ and capable of making electronic data transfers with the Factor.

“Credit Note” means any credit note issued by a French Seller to a Debtor in respect of an invoice relating to a Transferred Receivable for the same or lower amount than the invoice.

“Cross-Default” means (i) with respect to the GE US ABL, any event of default or termination event that has occurred and is continuing thereunder; and (ii) with respect to the German Agreements and the Swiss Agreement, any event of default or termination event that has occurred and is continuing thereunder which has led the German Purchaser to notify the German Sellers and the Swiss Seller of the termination of all of the German Agreements and the Swiss Agreement.

“Cure Notice” has the meaning ascribed to such term in Clause 11.2.1(a).

“Current Accounts” means the accounts opened in the Factor’s books in the name of each of the French Sellers and recording the amounts paid or payable by the Factor to each French Seller pursuant to the Agreement and those which are due for any reason whatsoever by each of the French Sellers.

| 72208170 | 7 |

|

“Debtor” means, with respect to each Transferred Receivable, any legal entity being primarily obliged to pay all or part of the amount due under the corresponding Transferred Receivable, as clearly identified at any time in the records of the relevant French Seller.

“Debtor Outstanding Threshold” means five per cent (5%) of the aggregate outstanding amount of all Transferred Receivables of all French Sellers.

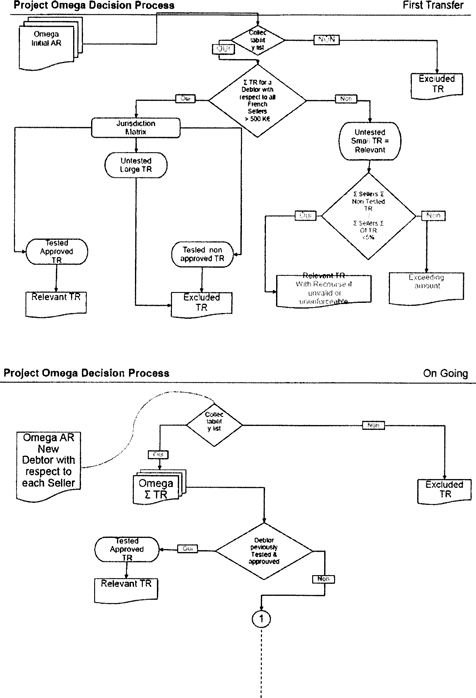

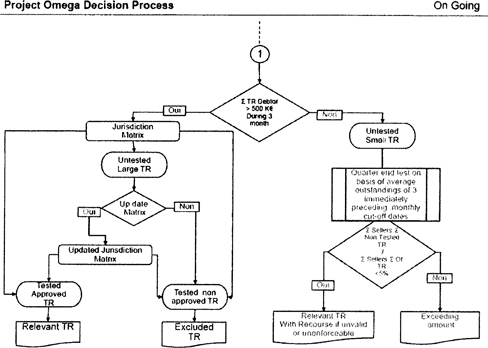

“Decision Process Charts” means the charts, attached as Annex 14, for illustration purposes only, showing the eligibility procedure for the Untested Receivables.

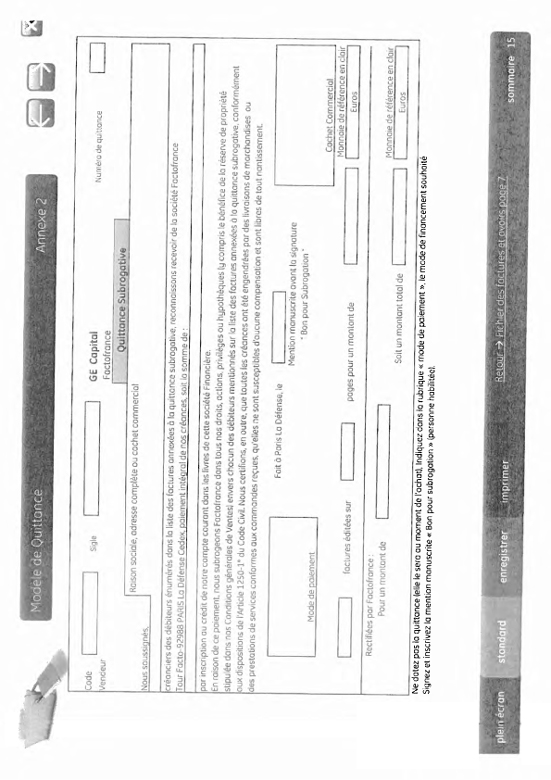

“Deed of Transfer” means any deed of transfer (acte de cession de créances professionnelles) of Relevant Receivables pursuant to the provisions of Article L. 313-23 et seq of the French Monetary and Financial Code, in the form described in Annex 3.

“Default” means any event or circumstance which, with the expiry of a grace period (if any), the giving of notice (if any), the satisfaction of any condition (if any) or combination of the foregoing, would constitute an Event of Default.

“Default Notice” has the meaning ascribed to such term in Clause 11.2.

“Defaulted Receivable” has the meaning ascribed to such term in Clause 5.4.

“Deferred Availability Accounts (or Reserves)” has the meaning ascribed to such term in Clause 8.5.1.

“Definance” means, for each Transferred Receivable to be definanced pursuant to the terms of the Agreement, the fact of debiting, from the relevant Current Account, an amount equal to the amount of that Transferred Receivable and of crediting such amount to the relevant Deferred Availability Account.

“Determination Date” has the meaning ascribed to such term in Clause 3.3(d).

“Dilution” means, with respect to the Transferred Receivables of any specific French Seller, (i) all Reductions or Cancellations Items as well as (ii) all Transfer-Backs of Receivables occurring pursuant to the Agreement. For the avoidance of doubt, the Dilutions shall exclude (i) any Reductions or Cancellations Items due to Insolvency Proceedings or protracted default (carence) of the relevant Debtor and (ii) such amounts accounted for in the Specific Reserve.

“Disputed Receivable” means, with respect to any Transferred Receivable, a refusal to pay by a Debtor of all or part of the net amount of a Transferred Receivable to a French Seller on the Collection Account, for a reason other than (i) its “insolvency” (as such term is defined in the Credit Insurance Policy) or (ii) all amounts already taken into account into the Specific Reserve. Such Transferred Receivable shall be deemed to be a “Disputed Receivable” up to the relevant amount so disputed.

“Embraer Receivable” means any Receivable arising from time to time from any contract between the relevant French Sellers and Embraer and its Affiliates located in Brazil.

“Effective Global Rate” has the meaning ascribed to such term in Clause 9.6.

“EURIBOR” means, in respect of the Special Financing Commission, on any day:

| (i) | the applicable percentage rate per annum determined by the Banking Federation of the European Union for Euros on such day and for a three month term, as displayed on the appropriate page of the Reuters screen (being specified that if the relevant page is replaced or the service ceases to be available, the Factor, after consultation with the Parent Company and the relevant French Seller(s), may specify another page or service displaying the appropriate rate); or |

| 72208170 | 8 |

|

| (ii) | (if no such rate is available) the arithmetic mean of the rates (rounded upwards to four decimal places) as supplied to the Factor at its request quoted by Société Générale, Natixis and Crédit Industriel et Commercial to leading banks in the European interbank market, |

at such time as is customary for fixing the rate applicable to such term for the offering of deposits in Euro for a period comparable to that term.

“Event(s) of Default” means an event referred to in Clause 11.2.1(c) (for all French Sellers and the Parent Company) or in Clause 11.2.2(c) (for any French Seller).

“Exceeding Amount” means the amount calculated by the Factor on each date an Assignment is made pursuant to the Agreement and which shall be equal to:

| (i) | the positive difference between the Financeable Amounts with respect to a Debtor and the Concentration Limit for such Debtor; and |

| (ii) | the outstanding amount of all Untested Small Receivables which exceed the Debtor Outstanding Threshold. |

“Excluded Receivables” has the meaning ascribed to such term in Clause 3.2.

“Factoring Commission” has the meaning ascribed to such term in Clause 9.1.

“Finance” means the fact, for the Factor, of making the Financing available to the French Sellers pursuant to the terms of Clause 5.2 of the Agreement.

“Financeable Amounts” has the meaning ascribed to such term in Clause 5.2.1.

“Financed Amounts” means such amounts referred to in Clauses 5.2.4(a) and 5.2.4(b).

“Financing” means the financing made available by the Factor to the French Sellers in respect of Financeable Amounts pursuant to the terms of Clause 5.2 of the Agreement.

“Financing Facilities” means the financing facilities made available by the Factor to the French Sellers under the Agreement.

“Financing Facilities Documents” means (i) the Agreement, (ii) the Intercreditor Agreement, (iii) the Parent Performance Guarantee, (iv) the Collection Account Opening Agreements, (v) the Collection Account Guarantee Agreements, (vi) the Credit Insurance Assignment Agreements, (vii) any Deed of Transfer and (viii) the reporting file(s) (including the Transferred Receivables Ledgers, the reports on Tolling and Pseudo Tolling referred to in Clause 4.2(m)(ii)(c) transmitted by any French Seller to the Factor pursuant to the Agreement.

“First Assignment Date” has the meaning ascribed to such term in Clause 5.1.3(b).

“Foreign Eligibility Conditions” means, in relation to any Receivable purported to be Assigned under the Agreement, the following eligibility conditions: (i) it must be governed by an Approved Law, (ii) the Debtor thereof must be incorporated in an Approved Jurisdiction and (iii) no Ban on Assignment shall be preventing its Assignment to the Factor (unless the relevant Debtor has given its consent in accordance with Clause 3.1 (vi) below).

“Funding Request” has the meaning ascribed to such term in Clause 5.2.3.

| 72208170 | 9 |

|

“GE Group” means any entity which is an Affiliate of the Factor.

“GE US ABL” means the GE US ABL/Credit Facility made available by General Electric Capital Corporation to the US Seller pursuant to the terms of a credit facility agreement dated at the latest on 4 January 2011 by and between General Electric Capital Corporation and the US Seller.

“German Agreements” means the factoring agreements entered into on 16 December 2010 between GE Capital Bank AG and each of Alcan Singen GmbH and Alcan Aluminium Presswerke GmbH.

“German Purchaser” means GE Capital Bank AG, ▇▇▇▇▇▇▇▇-▇▇▇-▇▇▇▇▇▇▇▇-Straße 2, 55130 Mainz, Amtsgericht Mainz HRB 0224.

“German Sellers” means Alcan Singen GmbH and Alcan Aluminium Presswerke GmbH.

“Group” means Omega Holdco B.V., the Parent Company (or, as the case may be, any holding company of the French Sellers that may be substituted subsequently to the rights and obligations of the Parent Company), the US Seller, the French Sellers, the German Sellers, the Swiss Seller, together with any entities owned or controlled directly or indirectly by Omega Holdco B.V., the Parent Company or by any such subsequent holding company.

“Holdback Reserve” has the meaning ascribed to such term in Clause 8.4.

“Indemnification Basis” has the meaning ascribed to such term in Clause 6.3.

“Indirect Payment” means any payment by a Debtor in respect of a Transferred Receivable which is not remitted to a Collection Account.

“Indirect Payment and Dilutions Threshold” has the meaning ascribed to such term in Clause 7.7.1.2.

“Insolvency Proceeding” means, in respect of any person, (a) any of the following procedures specified in Livre VI of the French Commercial Code as amended from time to time: (i) a safeguard procedure (procédure de sauvegarde), (ii) a judicial restructuring (redressement judiciaire), or (iii) a liquidation procedure (liquidation judiciaire), or (b) any analogous procedures under the law of the jurisdiction applicable to that person.

“Insurance Indemnification” has the meaning ascribed to such term in Clause 6.3.

“Intercreditor Agreement” means the intercreditor agreement entered into on 4 January 2011 by and among, Omega Holdco B.V., the Parent Company, the French Sellers, the German Sellers, the Swiss Seller, the Factor and the German Purchaser.

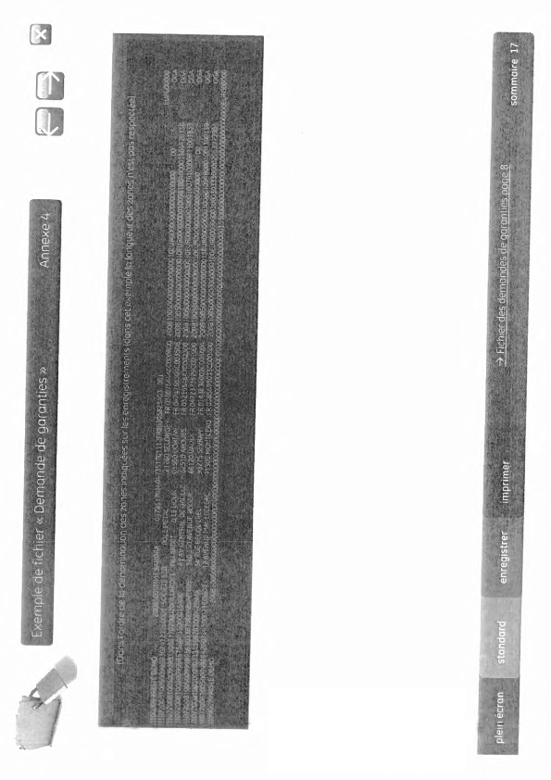

“Jurisdiction Matrix” means the document attached in Annex 13 hereto, as amended from time to time by the French Sellers’ external counsel, at the French Sellers’ costs.

“Legal Reservations” means any legal reservations that are inserted in the legal opinions delivered in relation to this Agreement.

“Liquidity Test” means the liquidity to be available at the level of the Group on any Quarter Date, being calculated so that the sum of (i) cash and (ii) any unfunded availability under the Transaction Documents, the GE US ABL, the Apollo/FSI Term Loan and any other financing available to the Group is equal to a minimum of the Euro equivalent of fifty million United States Dollars (USD 50,000,000).

“Mandates” means the Collection Mandate and the Cashing Mandate.

| 72208170 | 10 |

|

“Material Adverse Effect” means a material adverse effect on:

| (i) | the ability of the Parent Company or the French Sellers to perform their payment or other material obligations (including with respect to their obligations pursuant to the Mandates) under the Financing Facilities Documents; or |

| (ii) | the Collectability or credit quality of the Transferred Receivables (taken as a whole), on a French Seller by French Seller basis; or |

| (iii) | the validity or the enforceability of any of the Financing Facilities Documents. |

“Maximum Financeable Amount” has the meaning ascribed to such term in Clause 5.2.2(b).

“Maximum Financing Amount” means, on the date of signature of the Agreement, three hundred million Euros (EUR 300,000,000), allocated among the Sellers as follows:

| (i) | two hundred million Euros (EUR 200,000,000), collectively available to the French Sellers; and |

| (ii) | one hundred million Euros (EUR 100,000,000), collectively available to the German Sellers and the Swiss Seller, |

as such allocation may be revised pursuant to Clause 12.

“Monthly Cut-off Date” means, in relation to any calendar month, the last day of such month.

“Non-Approved Receivables” has the meaning ascribed to such term in Clause 6.3.

“Non-Cooperative Jurisdiction” means a “non-cooperative state or territory” (Etat ou territoire non coopératif), as set out in the list referred to in Article 238-0 A of the French Tax Code (Code Général des Impóts), as such list may be amended from time to time.

“Non-Financeable Amounts” means the sum of (without double counting):

| (i) | the amounts of the Non-Approved Receivables; and |

| (ii) | the Exceeding Amount. |

“Non-Utilization Fee” means, for each given French Seller, one per cent (1%) per annum (excluding VAT) of the monthly average credit balance of the relevant Availability Account.

“Offset and Adjustment Account” or “OAA” is a Sub-Account the characteristics of which are set out in Clause 8.3.

“Outstandings Test” has the meaning ascribed to such term in Clause 3.3(c).

“Overdue Threshold” has the meaning ascribed to such term in Clause 7.7.1.2.

“Parent Performance Guarantee” means the performance guarantee dated the Closing Date, an agreed form copy of which is attached hereto as Annex 5, granted to the Factor by the Parent Company, in order to guarantee the performance of all the obligations of, notably, the French Sellers under the Financing Facilities Documents.

“Pay” means the making of a Payment in respect of the Transferred Receivables.

| 72208170 | 11 |

|

“Payment” means the payment of any Transferred Receivables by way of the credit of any amount on the Current Account.

“Pseudo Tolling” means any repurchase by the relevant French Seller of inventory from any Debtor.

“Quarter Date” means 31 March, 30 June, 30 September and 31 December of each calendar year.

“Receivables” means any indebtedness owed to a French Seller by a Debtor as the price for goods or services supplied by such French Seller to such Debtor in the ordinary course of its business (including, without limitation, any applicable value added tax), together with all rights to payment and the proceeds thereof including (i) all records related to such Receivable, (ii) all accessory rights, guarantees and security interests, (iii) the right to demand payment of principal, interest (except late payment interest, as indicated in Clause 3.2(iii)) and any other sum howsoever due in respect of such Receivable and all proceeds at any time howsoever arising out of the resale, redemption or other disposal of (net of collection costs) such Receivable and (iv) to the extent applicable and permitted under French law, the French Seller’s rights to refunds from the relevant tax authorities on account of, if applicable, value added tax in respect of any goods sold or services rendered to a Debtor.

“Reductions or Cancellation Items” means, with respect to the Transferred Receivables, all reductions or cancellations materialized or not by Credit Notes granted by a French Seller resulting inter alia from invoicing error, volume rebates, bonuses, premiums or monthly discounts.

“Relevant Receivables” means the Receivables (i) which are eligible for assignment to the Factor, in accordance with the eligibility criteria and procedures specified in Clause 3.1 and Clause 3.3 (as the case may be); and (ii) which shall not be Excluded Receivables.

“Remaining Indemnification Amount” has the meaning ascribed to such term in Clause 6.3.

“Reserves” means the Deferred Availability Accounts.

“Sellers” means the French Sellers, the German Sellers, the Swiss Seller and the US Seller.

“Sellers Code” means the following seller codes (codes vendeur) to be used by each French Seller to record the invoices relating to the Transferred Receivables:

| Alcan Rhenalu |

24862 | |||

| Alcan Aerospace |

24876 | |||

| Alcan Softal |

24865 | |||

| ▇▇▇▇▇ ▇▇▇▇▇▇▇▇ |

▇▇▇▇▇ | |||

| ▇▇▇▇▇ ▇▇▇▇▇▇ Extrusion |

24872 |

“Special Financing Commission” or “SFC” has the meaning ascribed to such term in Clause 9.2.

“Specific Reserve” has the meaning ascribed to such term in Clause 8.5.2.

“Sub-Account(s)” means any sub-account(s) opened by the Factor under each of the Current Accounts.

“Substitute Sellers’ Agent” has the meaning ascribed to such term in Clause 1.3(f).

“Swiss Agreement” means the factoring agreement entered into on 16 December 2010 between the Swiss Seller and the German Purchaser.

“Swiss Seller” means Alcan Aluminium Valais S.A., a company incorporated under the laws of Switzerland as a société anonyme, whose registered office is located at 3960 Sierre, Switzerland, registered under number CH-626.3.000.048-9.

| 72208170 | 12 |

|

“Tax” has the meaning ascribed to such term in Clause 10(a).

“Tax Deduction” has the meaning ascribed to such term in Clause 10(c).

“Tax Saving” has the meaning ascribed to such term in Clause 10(g).

“Tax Saving Risk” has the meaning ascribed to such term in Clause 10(h).

“Termination Notice” has the meaning ascribed to such term in Clause 11.2.1(b).

“Tested Approved Receivables” means any Receivables offered for Assignment by a French Seller pursuant to this Agreement (either as at the First Assignment Date or at any time thereafter) and for which it has been effectively determined by the relevant French Seller (pursuant to their testing under the Jurisdiction Matrix or any legal analysis provided to the Factor (and satisfactory to it)) that all the Foreign Eligibility Conditions have been met in respect thereof.

“Tolling” means any provision of services by the relevant French Seller to any Debtor out of inventory owned by such Debtor.

“Top Five Debtors” means, for all French Sellers, the five Debtors in respect of which the largest outstanding amounts of Receivables are expected to be Assigned to the Factor under the Agreement for the twelve (12) coming months from each anniversary date of the relevant Credit Insurance Policy, as determined by the Sellers’ Agent and communicated to the Factor pursuant to Clause 6.1(b).

“Transaction” means the financing facilities provided by the Factor and the German Purchaser to the French Sellers, the German Sellers and the Swiss Seller pursuant to the Transaction Documents.

“Transaction Document(s)” means (i) the Financing Facilities Documents, (ii) the German Agreements and (iii) the Swiss Agreement.

“Transferred Back” and “Transferring Back” means any retransfer of Transferred Receivables from the Factor to the relevant French Sellers arising as a result of Clauses 2.2. and 5.3. to 5.6. and made pursuant to the procedure set forth in Clause 5.7.

“Transfer-Back File” has the meaning ascribed to such term in Clause 5.7.

“Transfer-Back Price” has the meaning ascribed to such term in Clause 5.7.

“Transferred Receivable Ledgers” means the monthly reportings of the outstanding Transferred Receivables into the French Seller’s account receivable ledger including the month end balance of each Transferred Receivable and to be provided in the manner set forth in Clause 7.4., substantially in the form of Annex 9 hereto.

“Transferred Receivables” means the Relevant Receivables assigned to the Factor pursuant to the Agreement and which have not been Transferred Back.

“Untested Large Receivables” has the meaning ascribed to such term in Clause 3.3(c).

“Untested Receivables” has the meaning ascribed to such term in Clause 3.3(a).

“Untested Small Receivables” has the meaning ascribed to such term in Clause 3.3(b).

“US Seller” means Alcan Rolled Products Ravenswood, LLC.

“Value Dates” has the meaning ascribed to such term in Clause 9.2.3. and Annex 1.

| 72208170 | 13 |

|

“VAT” means value added tax.

“Web Services” has the meaning ascribed to such term in Clause 13.

| 1.2 | Interpretation |

| (a) | The Agreement sets forth all the rights and obligations of the Parties. It replaces and substitutes any and all prior letters, proposals, offers and agreements between the Parties. |

| (b) | In this Agreement, unless the contrary intention appears, any reference to: |

| (i) | this Agreement includes a reference to its Recitals and the Annexes; |

| (ii) | a Clause, a Paragraph or an Annex is a reference to a clause, a paragraph or an annex of this Agreement; |

| (iii) | the singular shall include the plural and vice-versa; and |

| (iv) | time in this Agreement are to local time in Paris (France), unless expressly provided to the contrary. |

| (c) | Words appearing therein in French shall have the meaning ascribed to them under French law and such meaning shall prevail over their translation into English, if any. |

| (d) | Where an obligation is expressed in a Financing Facility Document to be performed on a date which is not a Business Day, such date shall be postponed to the first following day that is a Business Day unless that day falls in the next month in which case that date will be the first preceding day that is a Business Day. |

| (e) | Unless expressly provided to the contrary in a Financing Facility Document, any reference in a Financing Facility Document to: |

| (i) | any agreement or other deed, arrangement or document shall be construed as a reference to the relevant agreement, deed, arrangement or document as the same may have been, or may from time to time be, replaced, extended, amended, varied, supplemented or superseded; |

| (ii) | any statutory provision or legislative enactment shall be deemed also to refer to any re-enactment, modification or replacement and any statutory instrument, order or regulation made thereunder or under any such re-enactment; and |

| (iii) | any party to a Financing Facility Document shall include references to its successors, permitted assigns and any person deriving title under or through it; references to the address of any person shall, where relevant, be deemed to be a reference to the location of its then registered office or equivalent as current from time to time. |

| (f) | Unless expressly provided to the contrary, all references made in this Agreement to a day, are references to a calendar day. |

| (g) | A Default or an Event of Default is “continuing” if it has not been remedied (within the applicable grace period, if any) or waived. |

| 72208170 | 14 |

|

| 1.3 | Appointment of Sellers’ Agent |

| (a) | Each French Seller hereby appoints the Sellers’ Agent as its lawful agent (mandataire) in order to do all such things that may be specifically delegated to it under this Agreement for and on behalf of such French Seller. |

| (b) | The Sellers’ Agent hereby accepts its appointment to act as lawful agent (mandataire) of each French Seller in respect of the foregoing tasks. |

| (c) | Subject to sub-paragraph (f) below, the appointment, duties and authority of the Sellers’ Agent shall be valid and effective as from the date of its appointment and remain in full force and effect until the termination of this Agreement. |

| (d) | The Sellers’ Agent shall have such rights, powers and authorities and discretions as are conferred on it by this Agreement, together with such rights, powers and discretions as are reasonably incidental thereto. |

| (e) | The performance of its obligations by the Sellers’ Agent shall release and discharge the relevant French Seller with respect to, and to the extent of, the obligations, duties and liabilities so performed by the Sellers’ Agent. |

| (f) | The Sellers’ Agent may be replaced by another member of the Group (a “Substitute Sellers’ Agent”) upon written request sent by all French Sellers to the Factor subject to 30 days’ prior written notice and provided that such Substitute Sellers’ Agent has accepted in writing to perform all obligations of the Sellers’ Agent hereunder. |

| (g) | The Sellers’ Agent shall not be liable to any person for any breach by any French Seller of this Agreement (or any other document) or be liable to any French Seller for any breach by any other person of this Agreement or any other document. |

| (h) | The Sellers’ Agent shall not be remunerated. |

| 2 | PURPOSE |

| 2.1 | Services provided by the Factor |

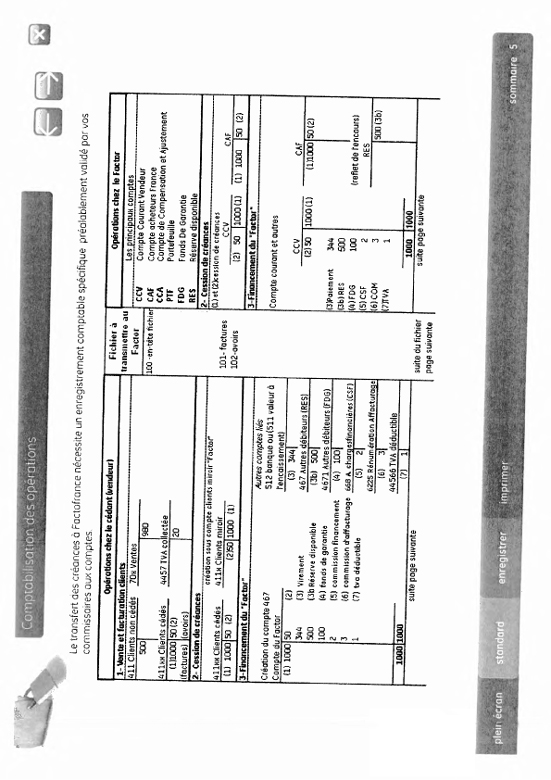

| (a) | The Agreement sets forth the terms and conditions upon and subject to which (i) each French Seller assigns to the Factor, Relevant Receivables pursuant to articles L. 313-23 to L. 313-34 and R. 313-15 et seq. of the French Monetary and Financial Code and (ii) the Factor will purchase Relevant Receivables from the French Sellers. The Agreement shall apply automatically to any Deed of Transfer delivered by each French Seller to the Factor. |

| (b) | Subject to the terms and conditions of the Agreement, and for all Relevant Receivables assigned to it by the French Sellers pursuant to the Agreement, the Factor shall: |

| (i) | Pay the Transferred Receivables to the relevant French Seller; and |

| (ii) | Finance the Financeable Amounts prior to the collection of the Transferred Receivables. |

| (c) | It is agreed between the Parties that (i) no notice of Assignment shall be sent to Debtors and (ii) the Factor grants Mandates to each of the French Sellers for the collection and cashing of the Transferred Receivables assigned by it to the Factor. However, in case of revocation of the Mandates, the Factor shall be responsible for: |

| (i) | notifying the Debtors of the Assignment of the Transferred Receivables; |

| 72208170 | 15 |

|

| (ii) | ensuring the collection and cashing of the Transferred Receivables; and |

| (iii) | managing the Debtors’ positions. |

| 2.2 | Exclusive rights |

| (a) | As consideration for the services provided by the Factor, each of the French Sellers undertakes to transfer title to the Transferred Receivables exclusively to the Factor. Consequently, the French Sellers undertake not to enter into any agreement which would grant rights to third parties over such Transferred Receivables which would negatively affect the rights granted to the Factor hereunder over those Transferred Receivables. For the avoidance of doubt, this Clause 2.2. does not affect the right for a French Seller to grant Reductions or Cancellations Items in respect of a Transferred Receivable. |

| (b) | In addition, once a Transferred Receivable has been assigned to the Factor in relation to a Debtor, the French Sellers undertake to subsequently offer to transfer to the Factor all the Relevant Receivables related to such Debtor. |

| (c) | Should Financed Amounts in respect of Transferred Receivables over a given Debtor represent less than seventy per cent (70%) of the total amount of Transferred Receivables over that Debtor, any French Seller may request the Factor in writing to no longer transfer Receivables over such given Debtor. The Factor shall consent to such request within ten (10) Business Days of receipt thereof, it being understood that, upon the Factor agreeing to such request, all Transferred Receivables over that Debtor shall be Transferred Back to the relevant French Seller pursuant to Clause 5.7. |

| (d) | The Parties agree that, in the event any portfolio of outstanding Receivables over a given Debtor is no longer included in the scope of the Agreement (including as a result of all Transferred Receivables relating to that Debtor having been Transferred-Back), the relevant French Seller may raise financing with third parties (by way of assignment, pledge or transfer) out of the Receivables over such Debtor, provided that, in case such French Seller intends to raise financing out of Receivables which have been previously Assigned pursuant to the Agreement, it shall inform the Factor prior to raising that financing. |

| 3 | SCOPE |

| 3.1 | Relevant Receivables |

Each Relevant Receivable under this Agreement shall meet, on the date on which it is transferred to the Factor, the following eligibility criteria:

| (i) | it shall correspond to the firm sale of products (or to the related provision of services) by each of the French Sellers in the ordinary course of its business and in accordance with any document evidencing the origination of the Receivables; |

| (ii) | it shall have been originated and monitored pursuant to the Credit and Collection Procedures; |

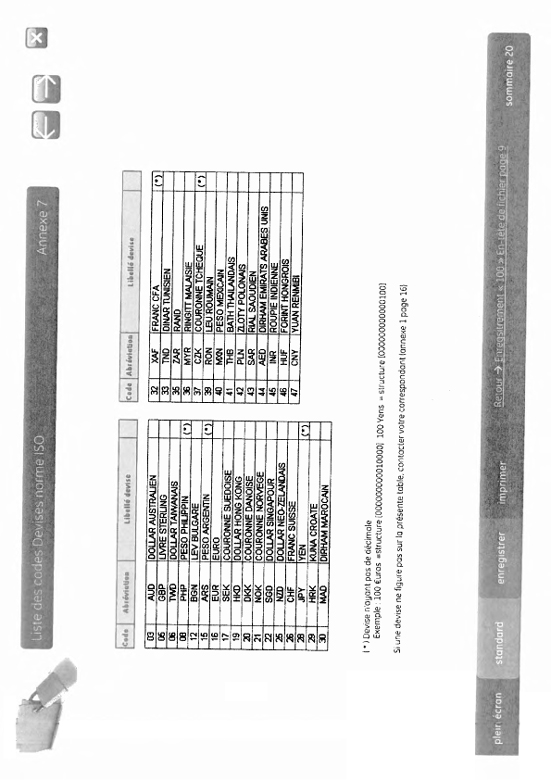

| (iii) | it shall be denominated in Euros (EUR), Great Britain Pounds (GBP), United States Dollars (USD) or Swiss Francs (CHF) or any other currency approved by the Factor; |

| (iv) | it shall be a Receivable (1) on a Debtor incorporated in a jurisdiction appearing in the Collectability List and (2) which is either a Tested Approved Receivable or an Untested Receivable which complies with the eligibility procedure set forth in Clause 3.3 below; it |

| 72208170 | 16 |

|

| being understood that the Embraer Receivables, on the basis of the legal analysis carried out as at the date hereof showing that they do not comply with the Foreign Eligibility Conditions, will be treated as Tested Unapproved Receivables and will not be eligible for Assignment to the Factor (i) unless the Factor, at its entire discretion, accept at the request of the relevant French Seller to purchase such Receivables (provided that the Factor may at any time cease to purchase such Receivables) and (ii) provided that the Factor shall have recourse against the relevant French Seller pursuant to Clause 5.5 in case the Assignment of those Embraer Receivables to the Factor proves to be invalid and/or would prove to be unenforceable after notification is made to the relevant Debtor by way of a letter; |

| (v) | the relevant Debtor shall not be an affiliated company of any of the Sellers (an affiliate being the Parent Company and any other entities that are controlled by the Parent Company); |

| (vi) | it shall be fully capable of transfer without any Ban on Assignment; and when a consent is required (such as in case of a Ban on Assignment), such consent must have been obtained (a) to the satisfaction of the Factor, in a form and substance substantially similar to the model form of consent letter set out in Annex 10, and (b) from the relevant Debtor (acting on its behalf) or from the relevant Affiliate of that Debtor (acting on behalf of the relevant Debtor), on or prior to the date on which the Receivable is intended to be Assigned (for the avoidance of doubt, failing to receive such consent, the Receivables shall not be eligible for Assignment to the Factor), it being understood that the consent letters received as of the date of signature of the Agreement in respect of the contracts existing with Rexam and Crown shall be deemed to be satisfactory; |

| (vii) | each Receivable shall exist and constitute legal valid, binding and enforceable payment obligations of the relevant Debtor; |

| (viii) | it shall be free from any security interest, rights of third parties or adverse claims, and shall not have been previously assigned to third parties or as the case may be, such security interest, rights of third parties or adverse claims will have been waived to the satisfaction of the Factor prior to the transfer of the relevant Transferred Receivable; |

| (ix) | subject to Clause 5.1.3, the invoice documenting it shall have been issued less than 30 calendar days prior to the contemplated assignment to the Factor; |

| (x) | its maturity date shall fall after the date of the contemplated assignment to the Factor and its maturity shall not be contrary to applicable law and in no case exceed one hundred and twenty (120) calendar days from the date of the invoice (except as specifically set out in the Credit and Collection Procedures); and |

| (xi) | except for the Receivables deriving from contractual relationships with Debtors that include Tolling and/or Pseudo Tolling transactions (such Receivables being subject to the application of Clause 8.5.2 below), a Receivable shall not be subject to a right of set-off or counterclaim of the relevant Debtor (except if it is strictly related to such Receivables (such as Reductions or Cancellations Items)). In particular, for so long as a prepayment (or similar arrangement) including from Airbus Operation SAS or Airbus Operation Limited is outstanding, such Receivables held against each entity having granted such outstanding prepayment will not be eligible for assignment to the Factor unless, prior to any proposed transfer, such Debtor has written to the relevant French Seller and the Factor in terms satisfactory to the Factor agreeing that it will not set off any such prepayment (or similar arrangement) due to it from the French Seller against monies payable by it in respect of that Receivable to the Factor. |

| 72208170 | 17 |

|

| 3.2 | Excluded Receivables |

The following Receivables shall be excluded from the scope of application of the Agreement:

| (i) | receivables arising from a contract of which the performance has been wholly or partly subcontracted under French law n°75-1334 of 31 December 1975, or any similar applicable law or regulation granting to the subcontractor a direct claim on the relevant Debtor for the payment owed to it by the relevant French Seller under the subcontract (save if, to the reasonable satisfaction of the Factor, bank guarantees (to guarantee payments to the relevant subcontractors) or other relevant arrangements have been implemented in advance in accordance with the above laws and regulations so as to avert the exercise of any such direct claim); |

| (ii) | receivables the payment of which, even if unconditionally accepted by the Debtor, is on the date on which is transferred to the Factor, is the subject of verifying the performance of an obligation by the relevant French Seller; |

| (iii) | receivables evidenced by invoices solely corresponding to penalties and late payment interests; |

| (iv) | receivables evidenced by invoices corresponding to Receivables which are, on the date on which it is transferred to the Factor, Disputed Receivables. |

| 3.3 | Eligibility Procedure for the Untested Receivables |

| (a) | Untested Receivables |

| (i) | Any Receivable on any Debtor (whether it is a new Debtor or an existing Debtor) that any French Seller wishes to offer for Assignment pursuant to this Agreement (either as at the First Assignment Date or at any time thereafter) and in relation to which no effective determination has been made by such French Seller as to its compliance with the Foreign Eligibility Conditions shall be deemed to be an “Untested Receivable”. |

| (ii) | For the avoidance of doubt, subject to Clauses 3.1 and 3.2 above, the relevant French Seller shall not be obliged, in relation to such Untested Receivables, to carry out any audit or analysis to assess their compliance with the Foreign Eligibility Conditions for the purposes of their Assignment under the Agreement until such date as they become Untested Large Receivables. |

| (b) | Untested Small Receivables |

All Untested Receivables on any Debtor (whether it is a new Debtor or an existing Debtor and with respect to all French Sellers) the aggregate outstanding amount of which is below five hundred thousand Euros (EUR 500,000) as at any date on which an Assignment is made under this Agreement shall be deemed to be “Untested Small Receivables”.

| (c) | Outstandings Test and Untested Large Receivables |

| (i) | On each Quarter Date, each French Seller (or the Sellers’ Agent) shall carry out a test (the “Outstandings Test”) over each Debtor whose Receivables are currently Assigned to the Factor under the Agreement as Untested Small Receivables. |

| (ii) | If it appears that, on such Quarter Date, the aggregate outstanding amount of the Receivables Assigned by such French Seller(s) over a given Debtor on such Quarter Date and as at the two (2) immediately preceding Monthly Cut-off Dates exceeds five hundred thousand Euros (EUR 500,000), then, the Receivables to be Assigned to the Factor over that Debtor shall as from such date be treated as “Untested Large Receivables”. |

| 72208170 | 18 |

|

| (iii) | Each French Seller (or the Sellers’ Agent) shall communicate the results of the Outstandings Test to the Factor in the manner and timing set forth in Clause 4.2(m)(iv). |

| (d) | Eligibility procedure for the Untested Receivables |

| (i) | Subject to Clause 3.1 and 3.2 above and this Clause 3.3(d), all Untested Receivables shall be eligible for Assignment pursuant to the Agreement, provided that: |

| (A) | with respect to Untested Small Receivables: |

| (i) | the Factor shall have recourse against the relevant French Seller (by way of Definancing or Transfer-Back, as the case may be) with respect to Untested Small Receivables, in accordance with the terms and subject to the conditions set out in Clause 5.5 below, in case the Assignment of such Untested Small Receivables to the Factor proves to be invalid and/or would prove to be unenforceable after appropriate notification is made to the relevant Debtor; |

| (ii) | the portion of the outstanding amount of the Untested Small Receivables exceeding the Debtor Outstanding Threshold shall be considered as Exceeding Amounts (such excess portion to be allocated among the French Sellers by applying, for each French Seller, the pro rata share of such French Seller in the aggregate balance of the Asset Accounts of all French Sellers, unless otherwise notified by the Sellers’ Agent to the Factor); |

| (B) | with respect to the Untested Large Receivables: |

| (i) | within 20 Business Days from the Quarter Date on which Untested Receivables are deemed Untested Large Receivables pursuant to Clause 3.3(c) above (the “Determination Date”), the relevant French Seller shall (A) determine on the basis of any appropriate audit (and having regard in particular to the Jurisdiction Matrix and provided that such French Seller may decide to provide the Factor with additional legal analysis for the purpose of updating the Jurisdiction Matrix in case the Jurisdiction Matrix does not contemplate the relevant governing law and/or jurisdiction of incorporation of the relevant Debtor) whether such Untested Large Receivables are (a) eligible for Assignment to the Factor or (b) not eligible for Assignment to the Factor (in particular if any of the Foreign Eligibility Conditions has failed to be met) and (B)communicate to the Factor the results of such determination in the manner and timing set forth in Clause 4.2(m)(iv); |

| (ii) | subject to Clause 3.1 and 3.2 above, all Untested Large Receivables Assigned or intended to be Assigned over such Debtor under the Agreement shall be eligible for Assignment pursuant to the Agreement only to the extent it has been effectively determined by the relevant French Seller (on the basis of its audit and provided that any additional legal analysis made for the purpose of the updating of the Jurisdiction Matrix that may be requested by such French Seller (if any) shall have been approved by the Factor, acting reasonably) that, as at the relevant Determination Date, such Untested Large Receivables qualify as Tested Approved Receivables (it being understood that Untested Large Receivables (i) for which it has been determined in the manner set out above that at least one of the Foreign Eligibility Conditions has failed to |

| 72208170 | 19 |

|

| be met or is no longer met, shall not be eligible for Assignment to the Factor; or (ii) for which no effective determination has been made on the Foreign Eligibility Conditions, shall not be Financed by the Factor so long as and until the time the determination on the Foreign Eligibility Conditions has not been completed in the manner set out above to the satisfaction of the Factor (acting reasonably). |

| (ii) | For the avoidance of doubt, any Receivables on a new Debtor the aggregate outstanding amount of which is above five hundred thousand Euros (EUR 500,000) (with respect to all French Sellers) as at any date on which an Assignment is purported to be made for the first time pursuant to Clause 5.1.3 of this Agreement must be a Tested Approved Receivable to be eligible for Assignment pursuant to the Agreement. |

| (e) | The Parties agree (i) that the Factor shall inform the French Sellers and the Sellers’ Agent (x) promptly, each time the Collectability List is being updated and (y) as soon as practicable upon being aware that the Collectability List will be updated; and (ii) to update the Jurisdiction Matrix from time to time to include the results of any additional legal analysis reasonably satisfactory to it provided by any French Seller. |

| (f) | The Parties have agreed to attach the Decision Process Charts, as Annex 14, to summarise the provisions of Clause 3.1(iv) and this Clause 3.3. The Parties further agree that the Decision Process Charts are attached herein for illustration purposes only and that, in case of discrepancy between the provisions of Clause 3.1(iv) or this Clause 3.3 and the Decision Process Charts, the provisions of Clause 3.1(iv) and this Clause 3.3, as applicable, shall prevail. |

| 4 | REPRESENTATIONS, WARRANTIES AND UNDERTAKINGS |

| 4.1 | Representations and warranties |

Each of the French Sellers, the Sellers’ Agent and the Parent Company (each only for itself) represents and warrants to the Factor as follows in Clause 4.1.1 and Clause 4.1.2 These representations and warranties are made by the French Sellers, the Sellers’ Agent and the Parent Company as of the Closing Date, and they shall be repeated in the manner set out in Clause 4.1.3 below.

| 4.1.1 | Representations and warranties relating to the French Sellers |

| (a) | Status: it is a company validly incorporated and existing under the laws of its place of incorporation, it is in compliance with all of the applicable laws and regulations relating to its incorporation; |

| (b) | Powers, authorisations and consents: it has full power and authority to enter into the Financing Facilities Documents to which it is a party, and no governmental or regulatory consent is required in order to enter into the Financing Facilities Documents to which it is a party, and it has taken all action necessary to authorise the execution, delivery and performance by it of the Financing Facilities Documents to which it is a party; |

| (c) | Non-violation: the execution, delivery and performance of the Financing Facilities Documents to which it is a party do not contravene or violate (i) its memorandum and Articles of association, (ii) any law, rule, regulation or orders applicable to it, (iii) any restrictions under any agreement, contract, deed or instrument to which it is a party or by which it or any of its property is bound, or (iv) any order, writ, judgement, award, injunction or decree binding on or affecting it or its property, and do not result in the creation or imposition of any adverse claim on or with respect to any of its assets or undertakings to the extent that such contravention, violation or result would have a Material Adverse Effect; |

| 72208170 | 20 |

|

| (d) | Legal validity: Subject to the Legal Reservations, its obligations under the Financing Facilities Documents currently in force to which it is a party constitute legal, valid and binding obligations enforceable against it in accordance with their respective terms; |

| (e) | Accounts: each of the French Sellers’ most recent audited annual accounts, and the Parent Company’s most recent non audited consolidated quarterly accounts and audited consolidated annual accounts, copies of which have been furnished to the Factor pursuant to the Agreement, respectively (i) present a true and fair view of each of the French Sellers’ and the Parent Company’s financial condition (for the audited accounts) or (ii) have been prepared in good faith by the Parent Company pursuant to the Group’s accounting policy and practice (for the unaudited accounts), as applicable, as at that date and of the results of their operations for the period then ended, all in accordance with applicable accounting standards consistently applied; |

| (f) | No litigation: there are to its knowledge no current material actions, suits or proceedings pending against or affecting it, in or before any judicial or administrative court, arbitrator or regulatory authority, which, based on information provided by it as well as any public information relating to such actions, suits or proceedings, which has a Material Adverse Effect; |

| (g) | No default: it is not in default with respect to any order of any court, arbitrator or governmental body, or under any contractual or other obligation, which is material to its business or operations and which has a Material Adverse Effect; |

| (h) | Accuracy of information: to its best knowledge, all information furnished in writing by it to the Factor (excluding the accounts mentioned in Clause 4.1.1(e)), and including the information provided in connection with each Assignment) for the purposes of or in connection with the Financing Facilities Documents, is true and accurate in every material respect on the date such information is stated or certified and does not contain any material misstatement of fact; |

| (i) | Principal place of business: in relation to the French Sellers only, its principal place of business and main executive office and the offices where it keeps all its books, records and documents evidencing the Transferred Receivables and the related contracts are located at the addresses stated in Annex 15; |

| (j) | Capacity to identify and individualise: in relation to the French Sellers only, it has operating systems capable of identifying and individualising in a clear and precise manner each Transferred Receivable and all collections received in respect thereof; |

| (k) | Records: in relation to the French Sellers only, all IT and accounting records are accurate in all material respects and all back-up systems are accessible to the Factor and are regularly updated in light of the Group’s current business practices; |

| (l) | No VAT: in relation to the French Sellers only, no VAT or equivalent tax is applicable in respect of any sale of Transferred Receivables by it to the Factor. |

4.1.2 Representations and warranties relating to the Receivables

| (a) | No fraud, etc: (i) each of the Relevant Receivables has not been offered for Assignment to the Factor as a result of fraud, gross negligence or wilful misconduct (dol) from the relevant French Seller and (ii) subject to the Untested Receivables which have been Assigned to the Factor pursuant to the Agreement, the relevant French Seller has not knowingly offered Receivables for Assignment that do not comply, at the time of the relevant offer and assignment date, with the criteria set out in Clause 3.1 or are Excluded Receivables and to the extent only that such offer affect a material portion of the outstanding amount of Transferred Receivables in respect of such French Seller (for the avoidance of doubt, it is specified that the Factor shall not be responsible for verifying such compliance); |

| 72208170 | 21 |

|

| (b) | No Violation: upon any Assignment of Relevant Receivables, such Transferred Receivables will not be available any longer to the creditors of the relevant French Seller in the context of an Insolvency Proceeding or any other procedure under Livre VI of the French Commercial Code, as amended from time to time; and |

| (c) | Transfer of title: subject to the Legal Reservations, upon the assignment of any Transferred Receivables, the Factor will have all the rights, interests and title of the relevant French Seller in respect thereof as well as the related and accessory security then existing in respect thereof. |

4.1.3 Repetition

The representations and warranties in this Clause 4.1 are made by the French Sellers, the Sellers’ Agent and the Parent Company as of the Closing Date, and they shall be repeated in the frequency set out below, in each case, by reference to the facts and circumstances existing on that date, as long as any amount or any obligation is outstanding towards the Factor under the Agreement:

| (a) | the representations and warranties set out in Clauses 4.1.1(e) and 4.1.1(l) shall not be repeated after the Closing Date; |

| (b) | the representation and warranty set out in Clause 4.1.1(e) shall be repeated on each date of remittance to the Factor of the relevant annual or quarterly or accounts; |

| (c) | the representations and warranties set out in Clauses 4.1.1(f), 4.1.1(g), 4.1.1(h), 4.1.1(k) shall be repeated on the first Business Day of each calendar month; and |

| (d) | the representations and warranties set out in Clauses 4.1.1(a), 4.1.1(b), 4.1.1(c), 4.1.1(d), 4.1.1(j) and 4.1.2(a) to 4.1.2(c) shall be repeated on each date of Assignment of Relevant Receivables. |

| 4.2 | Undertakings |

Each of the French Sellers, the Sellers’ Agent and the Parent Company (each only for itself) undertakes to the Factor as follows. These undertakings are to be complied by each of the French Sellers, the Sellers’ Agent and the Parent Company as long as any amount or any obligation is outstanding towards the Factor under the Agreement.

| (a) | Obligation of transfer: following any assignment of a Transferred Receivable regarding a specific Debtor, it shall be obliged to offer to transfer to the Factor all Relevant Receivables arising from time to time in respect of the said Debtor, except if all Transferred Receivables relating to that Debtor have been Transferred Back, in particular, pursuant to Clause 2.2; |

| (b) | Delivery of documents, obligation of information and access: (i) it shall supply to the Factor (or to any person appointed by the Factor) such documents and information with respect to itself and to the Transferred Receivables and the related security as the Factor may reasonably request, notably, in order to verify each of the French Sellers’ compliance with its obligations under the Agreement; (ii) it shall, as soon as possible upon becoming aware of such facts or events, notify the Factor of any facts or events concerning the Transferred Receivables or the Parent Performance Guarantee which has a Material Adverse Effect; and (iii) it shall permit the Factor and its agents or representatives, upon reasonable notice, to visit its operational offices at least twice a year for field audits during normal office hours, to carry out a financial review with respect to it and the relevant Transferred Receivables (such review |

| 72208170 | 22 |

|

| being on field or not, as the case may be) and to examine, make and take away copies of the records that are in its possession or under its control including, without limitation, any contracts related to the transactions under the Agreement, and to discuss matters relating to the Transferred Receivables or its performance under the Financing Facilities Documents, with any of the officers or employees designated by it as having knowledge of such matters (provided that if the delivery of any document is not possible or may, in such French Seller’s reasonable opinion, affect the best commercial interests of the relevant French Seller, then the French Sellers undertake to make available any such document for inspection by the Factor or its agents in every instance (provided that each French Seller is entitled not to disclose the parts of the documents that it in good faith considers as (a) commercially sensitive information and (b) not necessary for the purpose of the Factor preserving or exercising its rights under the Transferred Receivables)) |

| (c) | Collection and cashing: as far as each French Seller is concerned, it shall maintain and implement the Credit and Collection Procedures, and procure that they are maintained and implemented (including, without limitation, an ability to recreate records in the event of their destruction), and it shall keep and maintain, all documents, computer discs, books, records and other information necessary for the collection of all Transferred Receivables, and procure that they be kept and maintained (including, without limitation, records adequate to permit the daily identification of all collections); |

| (d) | Payment of taxes (Transferred Receivables): it shall pay punctually all amounts of VAT, if any, and other taxes in connection with any Transferred Receivables or any related contract and shall comply with all obligations with respect thereto; |

| (e) | No assignment: it shall not (otherwise than in accordance with the Agreement) (a) sell, assign or otherwise dispose of, or create or suffer to exist any adverse claim upon or in respect to any Transferred Receivable or any contracts relating thereto, nor (b) assign any right to receive payment in respect thereof and it shall defend the title and interest of the Factor in, to and under any of the foregoing property relating to any Transferred Receivable, against all claims of third parties as if it were the owner of such Transferred Receivable; |

| (f) | No change in business: it shall not make any change in its business which might materially and adversely impair (a) the Collectability of any of the Transferred Receivables or (b) the enforcement of any related contracts against the underlying Debtors or (c) the operation of the Agreement or which might materially and adversely decrease the credit quality of the Transferred Receivables (taken as a whole) or otherwise materially and adversely affect the interests or remedies of the Factor; |

| (g) | Preservation of corporate existence: it shall preserve and maintain its corporate existence and shall maintain all licences, authorizations and certifications necessary to the performance of its business, where failure to maintain or preserve would have a Material Adverse Effect; |

| (h) | Safe-keeping of documents: it shall hold in a reasonably secure and safe from damage location all documents relating to Transferred Receivables; |

| (i) | No amendment to the contracts: it shall not modify the terms and conditions of any contract relating to any Relevant Receivable to be offered for assignment or, any Transferred Receivable, which adversely affect or could adversely affect the eligibility or the Collectability thereof, unless it has received the prior written approval of the Factor (not to be unreasonably withheld); |

| (j) | No change in place of storage: it will not change any office or location mentioned in Annex 15 where books, records and documents evidencing the Transferred Receivables are kept without prior notifying the Factor at the latest thirty (30) calendar days before making such change of the new location of such books, record and documents; |

| 72208170 | 23 |

|

| (k) | Notification: it will notify the Factor within ninety (90) calendar days prior to changing its name, identity or corporate structure or relocating its registered office; |

| (l) | No merger: it shall not, if it would have a Material Adverse Effect, operate a legal reorganization, merge or consolidate with or into, or contribute, transfer or otherwise dispose of (whether in one transaction or in a series of transactions, and except as otherwise contemplated herein) all or substantially all of its assets (whether now owned or hereafter acquired) to, or acquire all or substantially all of the assets of, any person, it being understood that should a voluntary reorganization or restructuration of companies of the Group (including by a way of amalgamation, merger, demerger, spin-off or voluntary liquidation) involving one or more French Sellers is intended to take place, the relevant French Sellers shall notify the Factor of any such event as soon as possible after all internal corporate approvals have been obtained and being legally entitled to do so; |

| (m) | Provision of financial information: |

| (i) | each of the French Sellers and the Parent Company, as applicable, will deliver to the Factor: |

| (a) | if applicable, as from the Closing Date and until the First Assignment Date, monthly, and no more than 30 days after its month end (and forty-five (45) days for the first six (6) monthly statements to be remitted as from the Closing Date), an interim unaudited monthly income statement and balance sheet for each French Seller (on a reporting unit basis); |

| (b) | the Transferred Receivable Ledgers, in the manner set out in Clause 7.4 below; |

| (ii) | each of the French Sellers and the Parent Company, as applicable, will deliver to the Factor: |

| (a) | annually, as soon as reasonably practicable and no more than one hundred and fifty (150) days from its year end (and one hundred and eighty (180) days from year end in respect of the 2010 financial year), copies of (A) the audited consolidated annual financial statements (balance sheet, related income statement and cash flow statement) of the Parent Company (including its consolidated subsidiaries and the French Sellers), and (B) the audited statutory annual financial statements prepared under French GAAP (balance sheet and related income statement) of each of the French Sellers and each of their respective subsidiaries (to the extent that filing of the same is required under applicable law), in each case together with the relevant auditors’ reports; |

| (b) | as from 30 June 2011, quarterly, and no more than forty-five (45) days after each Quarter Date (seventy-five (75) days for the Quarter Date occurring on 30 June 2011 and sixty (60) days for the Quarter Dates occurring on 30 September 2011 and 31 December 2011), copies of (A) the Parent Company’s unaudited and unreviewed consolidated quarterly balance sheet and related income statement (including its consolidated subsidiaries and the French Sellers) (together with a quarterly cash flow statement), (B) each of the French Seller’s (to the extent that filing of the same is required under applicable law) unaudited and unreviewed quarterly balance sheet and related income statement (on a reporting unit basis) and (C) a certificate from the Parent Company in an agreed form justifying compliance of the Group with (i) the Liquidity Test as at the preceding Quarter Date and (ii) the covenants set out in Clause 8.2(b) of the Intercreditor Agreement; |

| 72208170 | 24 |

|

| (c) | monthly, and no more than thirty (30) days after its month end, copies of the monthly account payable ledger and monthly Tolling, Pseudo Tolling and scrap report of each of the French Sellers; |

| (d) | monthly, and no more than thirty (30) days after its month end (and forty-five (45) days for the first six (6) monthly statements to be remitted as from the Closing Date), copies of each of the French Seller’s (to the extent that filing of the same is required under applicable law) unaudited and unreviewed monthly balance sheet and related income statement (on a reporting unit basis); and |

| (e) | such other financial information as the Factor may reasonably request in writing; |

It being understood that the Parties agree to reconsider the terms of this sub-paragraph (ii) within one (1) year after the date of signature of the Agreement in order to amend, in light of the Group’s current practices and as required for the performance of the Agreement, the relevant reporting obligations of the French Sellers and the Parent Company;

| (iii) | it undertakes to the Factor, in relation to any financial projection or forecast transmitted or to be transmitted to the Factor, if any, to prepare such financial projection or forecast on the basis of recent historical information and on the basis of reasonable assumptions; |

| (iv) | each French Seller (or the Sellers’ Agent) shall, no later than each Determination Date occurring after each Quarter Date, communicate to the Factor (A) the

results of the Outstandings Test and (B) the results of the appropriate audits made by it pursuant to Clause 3.3(d)(i)(B) to determine whether the relevant Untested Large Receivables are eligible for Assignment to the Factor or not and, on that

basis, it shall indicate to the Factor the names of the Debtors in relation to which Untested Large Receivables have been determined as non-eligible for Assignment or eligible for Assignment pursuant to Clause 3.3(d) above. |

| (n) | Authorisations: it will promptly obtain, maintain and comply with the terms of, any authorisation required under any law or regulation (i) to enable it to perform its obligations under, or (ii) for the validity or enforceability of, the relevant Financing Facility Documents; |

| (o) | No security interest: it will not create or allow to exist any pledge, lien, charge, assignment or security interest, or any other agreement or arrangement having a similar effect, on the Transferred Receivables or on the Collection Account (except as contemplated in the Financing Facility Documents); |

| (p) | Financial records: it will record the Assignment of a Transferred Receivable pursuant to the Agreement in its financial records; |

| (q) | Rebates: it shall supply to the Factor, (i) prior to the First Assignment Date (if applicable) and (ii) thereafter on a monthly basis, no more than thirty (30) days after the relevant month end, reports listing the accrued rebates or rebate payments remaining due to the Debtors; |