OPTION AGREEMENT

This Option Agreement is made as of January 29, 2024.

BETWEEN:

ACME LITHIUM INC., a corporation under the laws of British Columbia, having an office at 000 - 0000 Xxxx Xxxxxx Xx., Xxxxxxxxx, Xxxxxxx Xxxxxxxx X0X 0X0

("ACME Lithium")

AND:

SNOW LAKE RESOURCES LTD. a corporation under the laws of Manitoba having an office at 000 Xxxx Xx., 00xx Xxxxx, Xxxxxxxx, Xxxxxxxx X0X 0X0

("Snow Lake")

WHEREAS:

A. ACME Lithium is the sole recorded and beneficial owner of a one hundred percent (100%) undivided interest in and to the Property (as hereinafter defined).

B. ACME Lithium wishes to grant to Snow Lake the right to earn up to a ninety percent (90%) undivided interest in the Property, all in accordance with the terms and conditions set forth in this Agreement.

NOW THEREFORE in consideration of the mutual covenants and agreements herein contained, and other good and valuable consideration, the parties covenant and agree as follows:

ARTICLE 1

DEFINITIONS

1.1 Definitions: In this Agreement, the following words and terms where capitalized will have the following meanings unless the context clearly indicates a contrary meaning:

a) "Agreement" means this agreement between ACME Lithium and Snow Lake, including any schedules attached hereto and any amendments as permitted hereunder, and the expressions this "Agreement" "herein" "hereto" and other similar expressions refer to all of this Agreement and not to any particular Article, Section or Subsection;

b) "Anniversary Date" means January 29, 2025 with respect to the first anniversary date, January 29, 2026 with respect to the second anniversary date;

c) "Area of Mutual Interest" or "AMI" means that area within five kilometres of the outer boundaries of the Property as of the date of this Agreement, all as more fully described in Section 7.2 hereto and reflected in Schedule "A";

d) "Environmental Laws" means all laws, statutes, regulations, ordinances, rules, requirements, policies, guidelines, by-laws, codes, orders, permits, directives, licenses, notices and approvals of all federal, territorial, provincial, municipal or local governmental or administrative authorities related to environmental or occupational or public health or safety matters; the generation, handling, treatment, storage, transportation, disposal or clean-up of pollutants, contaminants, hazardous or toxic substances, dangerous goods, ozone-depleting substances or other harmful substances or materials; or the reclamation, site rehabilitation, restoration, remediation, or other mine and related facilities or exploration project closure requirements;

e) "Expenditures" means the costs and expenses that are incurred for the purposes of determining the existence, location, quantity or grade of a mineral deposit, and expenses incurred in the course of prospecting, carrying out geological or geophysical surveys and drilling;

f) "First Stage Option" has the meaning set forth in Section 3.1(a);

g) "Formation Date" has the meaning set forth in Section 3.7 (b);

h) "Joint Venture" has the meaning set forth in Section 3.7 (b);

i) "Party or Parties" means ACME Lithium or Snow Lake and their successors or permitted assigns;

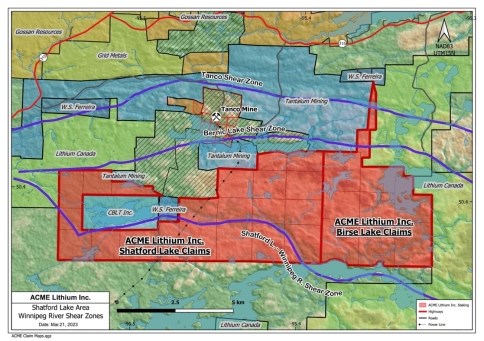

j) "Property" means the following mineral claims, all as more particularly described in Schedule A attached hereto;

-

21 mineral claims totaling 8,883 acres (3,595 hectares) (the "Shatford Lake Mineral Claims")

-

10 mineral claims totaling 5,196 acres (2,102 hectares) (the "Birse Lake Mineral Claims")

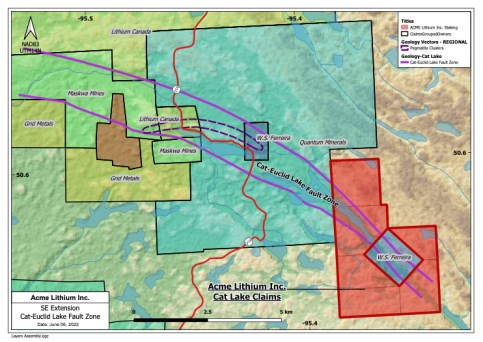

- 6 mineral claims totaling 2,930 acres (1,186 hectares) (the "Cat-Euclid Lake Mineral Claims")

k) "Royalty" means the 2% gross overriding royalty in favor of Lithium Royalty Corporation over the Shatford Lake Mineral Claims and the Cat-Euclid Lake Mineral Claims;

l) "Sagkeeng Agreement" means that agreement between ACME Lithium and Sagkeeng Anicinabe Company Inc. dated October 17, 2022 pertaining to mineral exploration activities on the Property with the support of the Sagkeeng;

m) "Second Stage Option" has the meaning set forth in Section 3.1(b); and

n) "Technical Data" means: (a) all records, information and data relating to title to the Property or environmental conditions at or pertaining to the Property; and (b) all maps, assays, surveys, technical reports, drill logs, samples, mine, mill, processing and smelter records, and metallurgical, geological, geophysical, geochemical, and engineering data relating to the Property, but which will not include interpretive reports derived from such data.

1.2 Currency: All monies referred to in this Agreement, unless otherwise noted, are expressed in Canadian dollars.

ARTICLE 2

REPRESENTATIONS AND WARRANTIES

2.1 ACME Lithium: ACME Lithium represents and warrants to Snow Lake that, as of the date of this Agreement:

a) it is the sole recorded and beneficial owner of the Property and, save for any rights granted to Snow Lake, is in exclusive possession thereof;

b) the Property is free and clear of all liens, charges, encumbrances, royalties or other third-party interests of any kind whatsoever, except for the Royalty;

c) to the best of its knowledge, there are no pending or threatened actions, suits, claims or proceedings affecting the Property;

d) except for the Royalty and the Sagkeeng Agreement, it has not entered into any agreements in respect of the Property save for any agreements entered into with Snow Lake;

e) all taxes, rates and assessments owing on the Property have been paid and discharged in full;

f) ACME Lithium is not a party to any judicial or administrative proceedings which could have an adverse effect on its ownership of the Property or Snow Lake's rights under this Agreement;

g) the Property, as described in this Agreement, is correct as to claim number and all of the claims comprising the Property have been validly and properly staked, tagged and recorded in accordance with applicable law;

h) except for the Royalty and the Sagkeeng Agreement, there are no commitments of ACME Lithium to third parties relating to the Property which do or could have any direct or indirect effect on the rights granted to Snow Lake hereunder; and

i) to the best of ACME Lithium's knowledge, there have been no past material violations by it or by any of its predecessors in title of any Environmental Laws affecting or pertaining to the Property, nor any past creation of damage or threatened damage to the air, soil, surface waters, groundwater, flora, fauna, or other natural resources on, about or in the general vicinity of the Property; and ACME Lithium has not received inquiry from or notice of a pending investigation from any governmental agency or of any administrative or judicial proceeding concerning the violation of any such Environmental Laws.

2.2 Snow Lake: Snow Lake represents and warrants to ACME Lithium that, as of the date of this Agreement:

a) it is duly incorporated and validly existing under the laws of Manitoba;

b) the execution of this Agreement and compliance with its provisions do not breach or contravene any provision of its constating documents and by-laws or any of its licenses, permits, agreements or privileges pursuant to which consent is necessary or which has not been obtained;

c) its directors or officers do not have any undisclosed relationship or agreement with any other group or company that may be interested in acquiring the Property; and

d) it is not, to its knowledge, a party to any actual judicial or administrative procedure which is materially adverse to this Agreement.

ARTICLE 3

OPTION

3.1 Option: ACME Lithium hereby grants to Snow Lake the sole, exclusive option (the "Option") to earn up to a ninety percent (90%) undivided interest in the Property, together with all mining rights held by ACME Lithium appertaining thereto, subject to Snow Lake incurring Expenditures and making payments to ACME Lithium in two stages as follows:

a) First Stage Option: Snow Lake has the option (the "First Stage Option") to earn a fifty-one percent (51%) undivided interest in and to the Property by incurring Expenditures and making payments to ACME Lithium as follows:

(i) payment of $150,000, of which: (a) $20,000 has been paid prior to the date of this Agreement (receipt of which is acknowledged by ACME Lithium); and (b) $130,000 upon execution of this Agreement;

(ii) incurring Expenditures on the Property of $600,000 on or before the first Anniversary Date; and

(iii) payment of an additional $150,000 in cash to ACME Lithium on or before the first Anniversary Date.

b) Second Stage Option: Snow Lake has the option (the "Second Stage Option") to earn an additional thirty-nine percent (39%) undivided interest in and to the Property by incurring additional Expenditures and making additional payments to ACME Lithium as follows:

(i) incurring additional Expenditures of $1,200,000 on or before the second Anniversary Date; and

(ii) payment of an additional $500,000 in cash to ACME Lithium on or before the second Anniversary Date.

3.2 Carry Over of Expenditures: Any Expenditures incurred by Snow Lake in excess of the minimum Expenditures required to exercise the First Stage Option will be credited or carried forward against the Expenditures required to exercise the Second Stage Option.

3.3 Acceleration: Snow Lake will have the sole right to accelerate the Expenditures and payment obligations described in Section 3.1 in order to acquire its interest in the Property in a shorter period of time than as set out in this Agreement.

3.4 Non-Exercise and Termination - First Stage Option: Snow Lake's right to exercise the First Stage Option will become null and void and this Agreement will automatically terminate if:

a) Snow Lake notifies ACME Lithium in writing of Snow Lake's election to terminate the First Stage Option, which notice must be given on or before September 1, 2024; or

b) Snow Lake fails to incur all of the Expenditures and make the payments described in Section 3.1(a) above in accordance with the time frames set out in Section 3.1(a);

in which case, Snow Lake will:

(a) leave the Property:

(i) in good standing and in accordance with the applicable laws and Environmental Laws;

(ii) having filed all work with the appropriate government entity to the maximum permissible extent for assessment credits, and having paid all related fees pertaining to work done on the Property;

(iii) free and clear of all liens, charges and encumbrances arising from this Agreement or its operations hereunder;

(iv) in a safe and orderly condition; and

(v) in a condition which is in compliance with all applicable rules and orders of governmental entities with respect to reclamation and restoration of the surface to the Property;

(b) pay (i) all claim maintenance fees and recording fees for the following six months, and (ii) property taxes, if any, due for the current year;

(c) deliver to ACME Lithium, within 90 calendar days of termination, a report on all work carried out by Snow Lake on the Property, copies of all assessment reports or filings, together with copies of all maps, drill-hole logs and sections, assay results and original assay certificates, reports (including interpretations thereof) and all other information compiled or prepared by or on behalf of Snow Lake with respect to work on or with respect to the Property, and make available to ACME Lithium (at the place of storage) all core, samples and sample pulps and rejects;

(d) unless otherwise agreed by ACME Lithium, remove from the Property within six months of the effective date of termination all materials, equipment and facilities erected, installed or brought upon the Property by or at the instance of Snow Lake;

(e) deliver to ACME Lithium a duly executed quitclaim of all right, title and Interest of Snow Lake in and to the Property in favor of ACME Lithium; and

(f) if Snow Lake holds any AMI Interest in its own name, assign all of its rights and obligations thereto, and with property taxes paid to the date of transfer, to ACME Lithium, whereupon ACME Lithium will assume responsibility for all obligations thereunder.

3.5 Non-Exercise and Termination - Second Stage Option: Snow Lake's right to exercise the Second Stage Option will become null and void if and this Agreement will automatically terminate if:

a) Snow Lake notifies ACME Lithium in writing of Snow Lake's election to terminate the Second Stage Option; or

b) Snow Lake fails to incur all of the Expenditures and make the payments described in Section 3.1(b) above in accordance with the time frames set out in Section 3.1(b).

in which case, a Joint Venture will be formed between the Parties in accordance with section 3.7(b) below, and Snow Lake will ensure the Property is in good standing for a period of one (1) year following termination.

3.6 Option Exercise Dates:

a) The First Stage Option will be deemed to be exercised upon the date (the "First Stage Option Exercise Date") upon which Snow Lake has incurred all of the Expenditures and made all of the payments described in Section 3.1(a); and

b) The Second Stage Option will be deemed to be exercised upon the date (the "Second Stage Option Exercise Date") upon which Snow Lake has incurred all of the Expenditures and made all of the payments described in Section 3.1(b).

3.7 Effect of Exercise of Options:

a) As of the First Stage Option Exercise Date, Snow Lake will be deemed to have earned a fifty-one percent (51%) undivided interest in the Property, which interest will automatically and immediately vest in Snow Lake without any further act by either Snow Lake or ACME Lithium.

b) If Snow Lake only exercises the First Stage Option, and does not exercise the Second Stage Option, then as of the First Stage Option Exercise Date (the "Formation Date"), the Parties will be deemed to have entered into an unincorporated joint venture ("Joint Venture") substantially in accordance with the terms and conditions set forth in Schedule B, and a current market standard formal joint venture agreement (the "Joint Venture Agreement") will be negotiated in good faith amongst the Parties immediately following the Formation Date.

c) As of the Second Stage Option Exercise Date, Snow Lake will be deemed to have earned a ninety percent (90%) undivided interest in the Property, which interest will automatically and immediately vest in Snow Lake without any further act by either Snow Lake or ACME Lithium.

d) As of the Second Stage Option Exercise Date, the Parties will be deemed to have entered into the Joint Venture and will negotiate the Joint Venture Agreement as described in Section 3.7(b). After the Second Stage Option Exercise Date, Snow Lake will be responsible for 100 percent (100%) of all ongoing costs and expenditures of the Joint Venture until Snow Lake completes a positive definitive feasibility study on the Property.

3.8 Interests in the Joint Venture: Upon formation of the Joint Venture:

a) In accordance with Section 3.7(b), Snow Lake will hold a 51% interest and ACME Lithium will hold a 49% interest in the Joint Venture;

i) Snow Lake's interest will be a 51% participating interest (a "Participating Interest") in the Joint Venture, and Snow Lake will fund 100% of all Expenditures until Snow Lake completes a positive definitive feasibility study on the Property; and

ii) ACME Lithium's interest will be a 49% free carried interest (a "Free Carried Interest"), without the need to contribute to Expenditures until the completion by Snow Lake of a positive definitive feasibility study on the Property.

b) In accordance with Section 3.7(d), Snow Lake will hold a 90% interest and ACME Lithium will hold a 10% interest in the Joint Venture;

i) Snow Lake's interest will be a 90% Participating Interest in the Joint Venture, and Snow Lake will fund 100% of all Expenditures until Snow Lake completes a positive definitive feasibility study on the Property; and

iii) ACME Lithium's interest will be a 10% Free Carried Interest, without the need to contribute to Expenditures until the completion by Snow Lake of a positive definitive feasibility study on the Property; and

c) Once Snow Lake completes a positive definitive feasibility study on the Property, AMCE Lithium's Free Carried Interest will convert to a 49% or 10% Participating Interest, as applicable.

ARTICLE 4

TRANSFER OF TITLE

4.1 Transfer of Title: Upon the Joint Venture being formed, ACME Lithium will forthwith transfer either a 51% interest, or a 90% interest, as the case may be, to the Joint Venture and register it with the appropriate government office and deliver to Snow Lake documentation verifying the Joint Venture's ownership of such undivided interest in the Property free of all liens, encumbrances, charges and claims of any nature or kind whatsoever, other than the Royalty. ACME Lithium will also transfer its Free Carried Interest to the Joint Venture, and execute and deliver to the Joint Venture, all other documents, and will do or cause to be taken all such further actions in order to properly register such ownership.

ARTICLE 5

COVENANTS OF SNOW LAKE

5.1 Covenants of Snow Lake: During the term of this Agreement, Snow Lake will:

a) maintain the Property in good standing by the payment of taxes, assessments and rentals, including minimum annual expenditures and assessment work prior to March 1 of each calendar year (which shall be deemed to be Expenditures for the purposes of this Agreement and which will be paid by Snow Lake), submit assessment work with respect to the Expenditures set out in Section 3 hereof according to applicable laws and regulations and perform all other actions which may be reasonably necessary in that regard;

b) obtain the prior written consent of the other Party hereto before permitting any mining claims relating to the Property to lapse;

c) permit the other Party hereto and its authorized representatives, at their own risk, with five (5) days prior written notice to Snow Lake, to access to the Property at all reasonable times, provided that the other Party hereto agrees to indemnify Snow Lake against and to save them harmless from all costs, claims, liabilities and expenses that the other Party hereto or its authorized representatives may incur or suffer as a result of any property or other damage or injury (including injury causing death) to the other Party hereto or its authorized representatives while on the Property, except for any costs, claims, liabilities and expenses incurred as a result of any negligent act or omission of Snow Lake or their employees and agents;

d) do all work on the Property in accordance with the highest industry standards for exploration, engineering and mining practices, and in a careful and workmanlike manner, in accordance with all applicable laws, regulations, orders and ordinances of any governmental authority;

e) comply with all Environmental Laws without limitation including any environmental license, approval or permit;

f) carry third party liability insurance of not less than $5,000,000 in respect of its operations on the Property for the benefit of Snow Lake and ACME Lithium as their interests may appear;

g) provide ACME Lithium with all up-to-date exploration results in its possession on at least a quarterly basis. These results shall include, but not be limited to, internal and public reports whether or not of an interpretive nature, maps, cross-sections, original assay certificates, and all similar data;

h) not make any agreement whereby any third party may acquire any portion of its interest in the Property other than in accordance with the provisions of this Agreement;

i) not act or fail to do any act which it is required to do under this Agreement or otherwise which would result in the Property or any part thereof, not being free and clear of all liens, charges, encumbrances, obligations or liabilities, including those pursuant to applicable Environmental Laws; and

j) not act or fail to do any act which it is required to do under this Agreement or otherwise which would result in an undivided interest in the Property not being transferred to the Joint Venture pursuant to Section 3 free and clear of all liens, charges, encumbrances or liabilities, including those pursuant to applicable Environmental Laws, of any kind whatsoever;

ARTICLE 6

RIGHT OF FIRST REFUSAL

6.1 Right of First Refusal: Once this Agreement is signed, and once Snow Lake has earned a ninety percent (90%) undivided interest in the Property, Snow Lake will have a right of first refusal (the "ROFR") to acquire ACME Lithium's Free Carried Interest if ACME Lithium decides to dispose of its interest in the Property pursuant to an unsolicited bona fide third-party offer.

6.2 ROFR Offer: If ACME Lithium receives an unsolicited bona fide third-party offer (a "ROFR Offer") to sell or transfer any of its Free Carried Interest to any third party (the "Third Party"), then ACME Lithium will promptly notify Snow Lake in writing (including a copy of the third party offer or agreement) of such Third Party and Snow Lake will have the opportunity to purchase the Free Carried Interest on the same terms and conditions, or equivalent value, as the ROFR Offer. The ROFR Offer must be in the form of a binding definitive agreement. Snow Lake may, within 30 business days from the date of receipt of the ROFR Offer, accept the terms of the ROFR Offer by written notice delivered to ACME Lithium, in which event it will then become a binding agreement of purchase and sale between Snow Lake and ACME Lithium. If Snow Lake does not accept the ROFR Offer, or does not give notice in accordance with the provisions of this Agreement that it is willing to purchase the Free Carried Interest, then ACME Lithium will be free to sell all of the Free Carried Interest to the applicable Third Party under the ROFR Offer.

ARTICLE 7

MISCELLANEOUS

7.1 Assignment: This Agreement is not assignable by either party. Either party may assign this Agreement to any continuing or successor corporation resulting from any amalgamation, consolidation, merger, arrangement or other corporate restructuring of the party.

7.2 Area of Mutual Interest:

a) If ACME Lithium, during the term of this Agreement, directly or indirectly or in concert with any other party, acquires, options, leases, or otherwise obtains or controls, or becomes entitled to acquire, obtain, option, lease, or otherwise obtain or control, any mineral rights, any present or future interest in any exploration or mining property, or other interest in property or rights of any kind or nature relating to the exploration of minerals within the Area of Mutual Interest (an "AMI Interest"), then (i) ACME Lithium will give notice thereof to Snow Lake, together with the details of the nature and direct costs of acquisition, (ii) Snow Lake may, at its election within 30 days, reimburse ACME Lithium for its cost of acquiring the same (which will qualify as "Expenditures" hereunder), and (iii) such acquired AMI Interests shall form part of the Property.

b) If Snow Lake, during the term of this Agreement, directly or indirectly or in concert with any other party, acquires, options, leases, or otherwise obtains or controls, or becomes entitled to acquire, obtain, option, lease, or otherwise obtain or control, any AMI Interest, Snow Lake shall immediately offer ACME Lithium in writing the right to include such acquired AMI Interest at no direct cost to ACME Lithium. ACME Lithium shall have 30 days after receipt of such offer to accept the same. If ACME Lithium accepts the offer, the acquired AMI Interest shall thereupon be included in the Property, and the costs of acquisition and operations thereon shall qualify as Expenditures. If ACME Lithium declines the offer, the acquired AMI Interest shall be retained by Snow Lake for its own exclusive use.

7.3 Notices: Any notice or other communication required or permitted to be given or made hereunder will be in writing and will be well and sufficiently given or made if: (a) enclosed in a sealed envelope and delivered in person to the party hereto to whom it is addressed at the relevant address set forth below; or (b) sent by email or other means of recorded electronic communications:

|

If to the ACME Lithium Inc.: ACME Lithium Inc. 000 - 0000 Xxxx Xxxxxx Xx. Xxxxxxxxx, Xxxxxxx Xxxxxxxx X0X 0X0 Attention: Chief Executive Officer Email: xxxxxxx@xxxxxxxxxxx.xxx |

If to Snow Lake Resources Ltd.: 000 Xxxx Xx. 00xx Xxxxx, Xxxxxxxx, Xxxxxxxx X0X 0X0 Attention: Chief Executive Officer Email: xxxxxxxxx@xxxxxxxxxxxxxxx.xxx |

Any notice or other communication so given will be deemed to have been given and to have been received on the day of delivery, if delivered, and on the day of sending, if sent by email or other means of recorded electronic communication (provided such delivery or sending is during normal business hours on a business day and, if not, then on the first business day thereafter). Either party hereto may change its address for notice by notice to the other party hereto given in the manner aforesaid.

7.4 Modification and Waiver: No provision of this Agreement may be modified or amended unless such modification or amendment is agreed to in writing by the parties. No waiver by either party hereto of any breach by the other party hereto of any condition or provision of this Agreement will be deemed a waiver of any other breach of that or any other provision or condition.

7.5 Entire Agreement: This Agreement, together with Schedules A and B, contains all the terms and conditions agreed upon by the parties hereto with respect to the subject matter hereof and supersedes all prior agreements and understandings with respect thereto. There are no agreements collateral or supplementary hereto.

7.6 Governing Law: This Agreement will be subject to and governed by the laws of the Province of Manitoba, and the laws of Canada applicable therein.

7.7 Time of Essence. Time is and will be of the essence of this Agreement.

7.8 Invalidity: The invalidity, illegality or unenforceability of any provision in this Agreement will not in any way affect or impair the validity, legality or enforceability of the remaining provisions of this Agreement.

7.9 Headings: The headings contained in this Agreement are for reference purposes only and will not in any way affect the construction or interpretation of this Agreement.

7.10 Counterparts: This Agreement may be executed and delivered in two (2) or more counterparts by original or facsimile or electronic signature each of which so executed will be deemed to be an original and all such originals and all such counterparts together will be deemed to constitute one and the same document.

IN WITNESS WHEREOF the parties hereto have executed this Agreement as of the date and year first above written.

| ACME LITHIUM INC. | ||

| By: |  |

|

| Name: Xxxxx Xxxxxx | ||

| Title: CEO |

| SNOW LAKE RESOURCES LTD. | ||

| By: |  |

|

| Name: Xxxxx Xxxxxxxx | ||

| Title: CEO |

Schedule A

The Property

- Shatford Lake Mineral Claims: 21 claims totalling 8,883 acres (3,595 hectares)

- Birse Lake Mineral Claims: 10 claims totalling 5,196 acres (2,102 hectares)

- Cat-Euclid Lake Mineral Claims: 6 claims totalling 2,930 acres (1,186 hectares)

|

CLAIM NAME |

NUMBER |

DATE |

HECTARES |

EVENT # |

|

ACME 1 |

MB13931 |

SEPT16/21 |

256 |

522669 |

|

ACME 2 |

MB13932 |

SEPT16/21 |

247 |

522658 |

|

ACME 3 |

MB13933 |

SEPT17/21 |

168 |

522667 |

|

ACME 4 |

MB13934 |

SEPT18/21 |

152 |

522671 |

|

ACME 5 |

MB13935 |

SEPT18/21 |

139 |

522668 |

|

ACME 6 |

MB13936 |

SEPT17/21 |

220 |

522672 |

|

ACME 7 |

MB13937 |

SEPT22/21 |

180 |

522830 |

|

ACME 8 |

MB13938 |

SEPT22/21 |

132 |

522840 |

|

ACME9 |

MB13939 |

SEPT21/21 |

92 |

522841 |

|

ACME 10 |

MB13940 |

SEPT21/21 |

120 |

522831 |

|

ACME 11 |

MB13941 |

SEPT23/21 |

182 |

522832 |

|

ACME 12 |

MB13942 |

SEPT23/21 |

156 |

522842 |

|

ACME 13 |

MB13943 |

SEPT24/21 |

208 |

522843 |

|

ACME 14 |

MB13944 |

SEPT24/21 |

140 |

522833 |

|

ACME 15 |

MB13945 |

SEPT25/21 |

248 |

522834 |

|

ACME 16 |

MB13946 |

SEPT25/21 |

192 |

522844 |

|

ACME17 |

MB13947 |

SEPT26/21 |

163 |

522845 |

|

ACME 18 |

MB13928 |

OCT 1/21 |

210 |

522846 |

|

ACME 19 |

MB13949 |

SEPT29/21 |

192 |

522847 |

|

ACME 20 |

MB13950 |

SEPT30/21 |

240 |

522848 |

|

ACME 21 |

MB13951 |

SEPT29/21 |

192 |

522835 |

|

ACME 22 |

MB13952 |

SEPT30/21 |

240 |

522836 |

|

ACME 23 |

MB13953 |

SEPT26/21 |

142 |

522837 |

|

ACME 24 |

MB13954 |

SEPT28/21 |

160 |

522849 |

|

ACME 25 |

MB13955 |

SEPT28/21 |

160 |

522838 |

|

ACME 26 |

MB13926 |

SEPT27/21 |

111 |

522850 |

|

ACME 27 |

MB13927 |

SEPT27/21 |

135 |

522839 |

|

ACME 27 |

MB13927 |

SEPT27/21 |

135 |

522839 |

|

ACME 28 |

MB14707 |

MAR14/23 |

256 |

549435 |

|

ACME 29 |

MB14708 |

MAR14/23 |

182 |

549436 |

|

ACME 30 |

MB14709 |

MAR14/23 |

64 |

549437 |

|

ACME 31 |

MB14704 |

FEB06/23 |

224 |

546505 |

|

ACME 32 |

MB14705 |

FEB10/23 |

234 |

547020 |

|

ACME 33 |

MB14706 |

MAR14/23 |

245 |

549430 |

|

ACME 34 |

MB14701 |

MAR14/23 |

239 |

549431 |

|

ACME 35 |

MB14702 |

MAR14/23 |

247 |

549434 |

|

ACME 36 |

MB14703 |

FEB06/23 |

256 |

546503 |

|

ACME 37 |

MB14710 |

MAR14/23 |

140 |

549438 |

Schedule B

Joint Venture Terms and Conditions

|

Structure and Purpose |

If Snow Lake only exercises the First Stage Option, and does not exercise the Second Stage Option, then a joint venture (the "Joint Venture") will be deemed to be formed as at the First Stage Option Exercise Date, to advance and hold the Property and all related assets (including legal title and all related permits and approvals) and liabilities. Its operations will be governed by the terms of an industry standard joint venture agreement (the "Joint Venture Agreement"). If Snow Lake exercises the Second Stage Option, then a joint venture will be deemed to be formed as at the Second Stage Option Exercise Date. |

|

Governance, Operation and Management |

Oversight Committee Membership A committee appointed by the participants (the “Oversight Committee”) will have oversight of the Property. The Oversight Committee will be comprised of three (3) members. Each participant will be entitled to representation on the Oversight Committee proportionate to its participating interest, provided that ACME Lithium will be entitled to one (1) member. The Chair will be selected by the participant with the larger participating interest. Each participant will have the right to appoint alternative representatives who will represent such party should a representative of such party be unable to attend an Oversight Committee meeting. At such time as either participant ceases to own at least a 10% participating interest, that participant will cease to be entitled to appoint any members to the Oversight Committee and its appointees then serving on the Committee will resign. Approvals A quorum at any meeting of the Oversight Committee will consist of at least one representative (or alternative representative) appointed by each participant. If a quorum is not present for a meeting, the meeting will be adjourned for 2 days or such shorter period as the participants may agree and quorum at such meeting will consist of at least one representative (or alternative representative) representing more than 50% of the participating interest. All questions before the Oversight Committee will be decided by a simple majority of the votes cast with representatives of each participant voting collectively in proportion to each participant’s interest; provided that the following matters will require a special majority of 90% approval: |

|

(i) material amendments to Joint Venture Agreement; and (ii) admitting new participants in a manner that is dilutive to existing participants. In the event of an even vote, the Chair will have a casting vote. Meetings Meetings of the Oversight Committee will be called on 7 days' notice by the Chair or on 7 days' notice by any other member of the Oversight Committee. All meetings will be either virtual or in person, and if in person, will be held in Toronto, Canada or such other location as agreed to by the members of the Oversight Committee. Operator Snow Lake will act as the Operator for so long as it has a majority participating interest in the Joint Venture. The Operator will have broad control of management and operations of the Joint Venture and will operate and supply services to the Property. The Operator's obligations will be set out in the Joint Venture Agreement or a separate operator agreement and will include administrative and operational support. The Operator will operate the Joint Venture in accordance with international industry practice, its policies and procedures and in material compliance with law and in material compliance with the conditions of the license to the Property. The Operator will provide the Oversight Committee with regular annual reporting updates. All financial reporting of the Joint Venture will be based on the fiscal year of the Operator. The participants will severally indemnify the Operator for all losses incurred by the Operator (excluding indirect or consequential damages) other than as a result of the Operator's gross negligence or wilful misconduct. |

|

|

Budgets and Approvals |

The Operator will submit annually a program and budget for Oversight Committee approval. An approved program and budget will be authority for the Operator to undertake the activities specified in and incidental thereto and to incur on behalf of the participants the expenditures estimated in and incidental to thereto. The Operator will be permitted to incur expenses not provided for in an approved program and budget if approved by the Operator in good faith (i) within a 10% buffer of the approved program and budget, (ii) in reasonable response to emergency or disaster, (iii) to meet legal or contractual obligations, or (iv) to protect or preserve Property assets. |

|

Production Decision |

The Oversight Committee will make the production decision. |

|

Funding |

If Snow Lake only exercises the First Stage Option, and does not exercise the Second Stage Option, then after the Formation Date, Snow Lake will be responsible for funding 100% of the costs and expenses of any approved program and budget for the Property until such time as it completes a positive definitive feasibility study (the "Study") on the Property. If Snow Lake exercises the Second Stage Option, then Snow Lake will be responsible for funding 100% of costs and expenses any approved program and budget for the Property until such time as it completes a Study. After completion of a Study, each of Snow Lake and ACME Lithium will be responsible for their pro-rata share of the costs and expenses of in accordance with their respective participating interests. |

|

Dilution |

Once both Snow Lake and ACME Lithium hold participating interests in the Joint Venture then, if a party does not wish to contribute to expenditures, or defaults in payment of their pro-rata share of expenditures, then such Party's participating interest in the Joint Venture will be reduced in accordance with an industry standard dilution formula. Contributions to the Joint Venture will be as follows; Snow Lake: Actual Expenditures ACME Lithium: Deemed to be equal to its percentage interest in the Joint Venture multiplied by Snow Lake's actual Expenditures. |

|

Distributions |

The Oversight Committee will have responsibility for determining the distribution policy of the Joint Venture from time to time. |

|

Restrictions on Transfer |

Neither party will be entitled to transfer any portion of its participating interest without the prior consent of the other party. |

|

Right of First Refusal |

Each participant will grant a pro rata right of first refusal on its interest to the other participants. |

|

Default |

Customary non-funding events of default, including: (i) material breaches of the representations and warranties of the participant or any material default in the performance of the participant's obligations or duties under the Joint Venture Agreement (other than a funding failure); and (ii) insolvency, liquidation and winding up. |

|

Force Majeure |

Each participant and the Operator will be excused for failure to perform its obligations in the event of customary force majeure events. Notwithstanding the foregoing, a lack of finances or credit shall not be considered a force majeure nor will any force majeure suspend any obligation for the payment of additional contributions or other money due under the Joint Venture Agreement. |

|

Dispute Resolution |

Ontario arbitration provision to apply in the event of a dispute. Any arbitration proceeding will be held in Toronto, Canada and conducted in English. |

|

Compliance |

The Joint Venture will adopt compliance policies and standards, including an anti-corruption compliance framework, and the participants will be required to comply with these policies and standards in respect of the investment in, management of and dealings with or relating to the Joint Venture. |

|

Termination and Rehabilitation Costs |

The Joint Venture will be wound up in an orderly fashion following a determination by the Oversight Committee that mining operations should be wound down or the Property is otherwise no longer economically viable. After commencement of commercial production, the Joint Venture will establish and fund a rehabilitation fund for the Property which the Operator will manage. |