FEDERAL HOME LOAN MORTGAGE CORPORATION GLOBAL DEBT FACILITY AGREEMENT

Exhibit 4.1

AGREEMENT, dated as of February 22, 2023, among the Federal Home Loan Mortgage Corporation (“▇▇▇▇▇▇▇ ▇▇▇”) and Holders of Debt Securities (each as hereinafter defined).

Whereas:

(a) Freddie Mac is a corporation duly organized and existing under and by virtue of the laws of the United States (Title III of the Emergency Home Finance Act of 1970, as amended (the “Freddie Mac Act”)) and has full corporate power and authority to enter into this Agreement and to undertake the obligations undertaken by it herein;

(b) Pursuant to Section 306(a) of the Freddie Mac Act, Freddie Mac is authorized, upon such terms and conditions as it may prescribe, to borrow, to pay interest or other return, and to issue notes, bonds or other obligations or securities; and

(c) To provide funds to permit Freddie Mac to engage in activities consistent with its statutory purposes, Freddie Mac has established a Global Debt Facility (the “Facility”) and authorized the issuance, from time to time, pursuant to this Agreement, of unsecured general obligations of Freddie Mac or, if so provided in the applicable Supplemental Agreement (as hereinafter defined), secured obligations of Freddie Mac (“Debt Securities”).

NOW, THEREFORE, in consideration of the premises and mutual covenants herein contained, it is hereby agreed that the following terms and conditions of this Agreement (including, as to each issue of the Debt Securities, the applicable Supplemental Agreement) shall govern the Debt Securities and the rights and obligations of Freddie Mac and Holders with respect to the Debt Securities.

ARTICLE I

Definitions

Whenever used in this Agreement, the following words and phrases shall have the following meanings, unless the context otherwise requires.

Additional Debt Securities: Debt Securities issued by Freddie Mac with the same terms (other than Issue Date, interest commencement date and issue price) and conditions as Debt Securities for which settlement has previously occurred so as to form a single series of Debt Securities as specified in the applicable Supplemental Agreement.

Agreement: This Global Debt Facility Agreement dated as of February 22, 2023, as it may be amended or supplemented from time to time, and successors thereto pursuant to which Freddie Mac issues the Debt Securities.

Amortizing Debt Securities: Debt Securities on which Freddie Mac makes periodic payments of principal during the terms of such Debt Securities as described in the related Supplemental Agreement.

Beneficial Owner: The entity or individual that beneficially owns a Debt Security.

Bonds: Callable or non-callable, puttable or non-puttable Debt Securities with maturities of more than ten years.

Book-Entry Rules: FHFA regulations, 12 C.F.R. Part 1249, applicable to the Fed Book-Entry Debt Securities, and such procedures as to which Freddie Mac and the FRBNY may agree.

Business Day: (i) With respect to Fed Book-Entry Debt Securities, any day other than (a) a Saturday, (b) a Sunday, (c) a day on which the FRBNY is closed, (d) as to any Holder of a Fed Book-Entry Debt Security, a day on which the Federal Reserve Bank that maintains the Holder’s account is closed, or (e) a day on which Freddie Mac’s offices are closed; and (ii) with respect to Registered Debt Securities, any day other than (a) a Saturday, (b) a Sunday, (c) a day on which banking institutions are closed in (i) the City of New York, if the Specified Payment Currency is U.S. dollars or (2) the Principal Financial Center of the country of such Specified Payment Currency, if the Specified Payment Currency is other than U.S. dollars or euro, (d) if the Specified Payment Currency is euro, a day on which the TARGET2 system is not open for settlements, or a day on which payments in euro cannot be settled in the international interbank market as determined by the Global Agent, (e) for any required payment, a day on which banking institutions are closed in the place of payment, or (f) a day on which Freddie Mac’s offices are closed.

Calculation Agent: Freddie Mac or a bank or broker-dealer designated by Freddie Mac in the applicable Supplemental Agreement as the entity responsible for determining the interest rate on a Variable Rate Debt Security.

Calculation Date: In each year, each of those days in the calendar year that are specified in the applicable Supplemental Agreement as being the scheduled Interest Payment Dates regardless, for this purpose, of whether any such date is in fact an Interest Payment Date and, for the avoidance of doubt, a “Calculation Date” may occur prior to the Issue Date or after the last Principal Payment Date.

Cap: A maximum interest rate at which interest may accrue on a Variable Rate Debt Security during any Interest Reset Period.

Citibank — London: Citibank, N.A., London branch, the Global Agent for Registered Debt Securities.

Citigroup — Frankfurt: Citigroup Global Markets Europe AG, the Registrar for Registered Debt Securities.

Clearstream, Luxembourg: Clearstream Banking, société anonyme, which holds securities for its participants and facilitates the clearance and settlement of securities transactions between its participants through electronic book-entry changes in accounts of its participants.

CMT Determination Date: The second New York Banking Day preceding the applicable Reset Date.

CMT Rate: The rate determined by the Calculation Agent in accordance with Section 2.07(i)(M).

Code: The Internal Revenue Code of 1986, as amended.

Common Depositary: Citibank Europe plc will act as the common depositary for Euroclear, Clearstream, Luxembourg and/or any other applicable clearing system, which will hold Other Registered Debt Securities on behalf of Euroclear, Clearstream, Luxembourg and/or any such other applicable clearing system.

Convertible Debt Securities: An issue of Debt Securities that may be convertible to a new security, which may or may not be a debt security of Freddie Mac, as described in the related Supplemental Agreement.

CUSIP Number: A unique nine-character designation assigned to each Debt Security by the CUSIP Service Bureau and used to identify each issuance of Debt Securities on the records of the Federal Reserve Banks or DTC, as applicable.

2

Dealers: Firms that engage in the business of dealing or trading in debt securities as agents, brokers or principals.

Debt Securities: Unsecured subordinated or unsubordinated notes, bonds and other debt securities issued from time to time by Freddie Mac under the Facility, or if so provided in the applicable Supplemental Agreement, secured obligation issued from time to time by Freddie Mac under the Facility.

Deleverage Factor: A Multiplier of less than one by which an applicable Index is multiplied.

Depository: DTC or any successor.

Deposits: Deposits commencing on the applicable Reset Date.

Determination Date: The date as of which the rate of interest applicable to an Interest Reset Period is determined.

Determination Period: The period from, and including, one Calculation Date to, but excluding, the next Calculation Date.

DTC: The Depository Trust Company, a limited-purpose trust company, which holds securities for DTC participants and facilitates the clearance and settlement of transactions between DTC participants through electronic book-entry changes in accounts of DTC participants.

DTC Registered Debt Securities: Registered Debt Securities registered in the name of a nominee of DTC, which will clear and settle through the system operated by DTC.

Euroclear: Euroclear System, a depositary that holds securities for its participants and clears and settles transactions between its participants through simultaneous electronic book-entry delivery against payment.

Extendible Variable Rate Securities: Variable Rate Debt Securities, the maturity of which may be extended at a Beneficial Owner’s option effective as of certain specified dates, subject to a final maturity date, and that bear interest at variable rates subject to different Spreads for different specified periods.

Facility: The Global Debt Facility described in the Offering Circular dated February 22, 2023 under which Freddie Mac issues the Debt Securities.

Fed Book-Entry Debt Securities: U.S. dollar denominated Debt Securities issued and maintained in book-entry form on the Fed Book-Entry System.

Fed Book-Entry System: The book-entry system of the Federal Reserve Banks which provides book-entry holding and settlement for U.S. dollar denominated securities issued by the U.S. Government, certain of its agencies, instrumentalities, government-sponsored enterprises and international organizations of which the United States is a member.

Federal Funds Rate (Daily): The rate determined by the Calculation Agent in accordance with Section 2.07(i)(N).

Federal Funds Rate (Daily) Determination Date: The applicable Reset Date; provided, however, that if the Reset Date is not a Business Day, then the Federal Funds Rate (Daily) Determination Date means the Business Day immediately following the applicable Reset Date.

Federal Reserve: The Board of Governors of the Federal Reserve System.

3

Federal Reserve Bank: Each U.S. Federal Reserve Bank that maintains Debt Securities in book-entry form.

Federal Reserve Banks: Collectively, the Federal Reserve Banks.

Fiscal Agency Agreement: The Uniform Fiscal Agency Agreement between Freddie Mac and the FRBNY.

Fiscal Agent: The FRBNY is fiscal agent for Fed Book-Entry Debt Securities.

Fixed Principal Repayment Amount: An amount equal to 100% of the principal amount of a Debt Security, payable on the applicable Maturity Date or earlier date of redemption or repayment or a specified amount above or below such principal amount, as provided in the applicable Supplemental Agreement.

Fixed Rate Debt Securities: Debt Securities that bear interest at a single fixed rate.

Fixed/Variable Rate Debt Securities: Debt Securities that bear interest at a single fixed rate during one or more specified periods and at a variable rate determined by reference to one or more Indices, or otherwise, during one or more other periods. As to any such fixed rate period, the provisions of this Agreement relating to Fixed Rate Debt Securities shall apply, and, as to any such variable rate period, the provisions of this Agreement relating to Variable Rate Debt Securities shall apply.

Floor: A minimum interest rate at which interest may accrue on a Debt Security during any Interest Reset Period.

Freddie Mac: Federal Home Loan Mortgage Corporation, a government-sponsored enterprise chartered by Congress pursuant to the Freddie Mac Act.

Freddie Mac Act: Title III of the Emergency Home Finance Act of 1970, as amended, 12 U.S.C. § 1451-1459.

FRB: The Board of Governors of the Federal Reserve System.

FRBNY: The Federal Reserve Bank of New York.

FRBNY’s Website: The website of the FRBNY, currently at ▇▇▇▇://▇▇▇.▇▇▇▇▇▇▇▇▇▇.▇▇▇, or any successor source.

Global Agency Agreement: The agreement between Freddie Mac, the Global Agent and the Registrar.

Global Agent: The entity selected by Freddie Mac to act as its fiscal, transfer and paying agent for Registered Debt Securities.

H.15: The statistical release entitled “Statistical Release H.15, Selected Interest Rates” as published by the Federal Reserve, or any successor publication of the Federal Reserve available on its website at ▇▇▇▇://▇▇▇.▇▇▇▇▇▇▇▇▇▇▇▇▇▇.▇▇▇/▇▇▇▇▇▇▇▇/▇▇▇/▇▇ any successor site.

Holder: In the case of Fed Book-Entry Debt Securities, the entity whose name appears on the book-entry records of a Federal Reserve Bank as Holder; in the case of Registered Debt Securities in global registered form, the depository, or its nominee, in whose name the Registered Debt Securities are registered on behalf of a related clearing system; and, in the case of Registered Debt Securities in definitive registered form, the person or entity in whose name such Debt Securities are registered in the Register.

Holding Institutions: Entities eligible to maintain book-entry accounts with a Federal Reserve Bank.

4

Index: SOFR, Prime Rate, Treasury Rate, CMT Rate, or Federal Funds Rate (Daily) or other specified interest rate, exchange rate or other index, as the case may be.

Index Currency: The currency or currency unit specified in the applicable Supplemental Agreement with respect to which an Index will be calculated for a Variable Rate Debt Security. If no such currency or currency unit is specified in the applicable Supplemental Agreement, the Index Currency will be U.S. dollars.

Index Maturity: The period with respect to which an Index will be calculated for a Variable Rate Debt Security that is specified in the applicable Supplemental Agreement.

Interest Component: Each future interest payment, or portion thereof, due on or prior to the Maturity Date, or if the Debt Security is subject to redemption or repayment prior to the Maturity Date, the first date on which such Debt Security is subject to redemption or repayment.

Interest Payment Date: The date or dates on which interest on Debt Securities will be payable in arrears.

Interest Payment Period: Unless otherwise provided in the applicable Supplemental Agreement, the period beginning on (and including) the Issue Date or the most recent Interest Payment Date, as the case may be, and ending on (but excluding) the earlier of the next Interest Payment Date or the Principal Payment Date.

Interest Reset Period: The period beginning on the applicable Reset Date and ending on the calendar day preceding the next Reset Date.

Issue Date: The date on which Freddie Mac wires an issue of Debt Securities to Holders or other date specified in the applicable Supplemental Agreement.

Leverage Factor: A Multiplier of greater than one by which an applicable Index is multiplied.

London Banking Day: Any day on which commercial banks are open for business (including dealings in foreign exchange and deposits in the Index Currency) in London.

Maturity Date: The date, one day or longer from the Issue Date, on which a Debt Security will mature unless extended, redeemed or repaid prior thereto.

Mortgage Linked Amortizing Debt Securities: Amortizing Debt Securities on which Freddie Mac makes periodic payments of principal based on the rate of payments on referenced mortgage or mortgage-related assets, as described in the related Supplemental Agreement.

Multiplier: A constant or variable number (which may be greater than or less than one) to be multiplied by the relevant Index for a Variable Rate Debt Security.

Notes: Callable or non-callable, puttable or non-puttable Debt Securities with maturities of more than one day.

New York Banking Day: Any day other than (a) a Saturday, (b) a Sunday, (c) a day on which banking institutions in the City of New York are required or permitted by law or executive order to close, or (d) a day on which the FRBNY is closed.

Offering Circular: The ▇▇▇▇▇▇▇ Mac Global Debt Facility Offering Circular dated February 22, 2023 (including any related Offering Circular Supplement) and successors thereto.

OID Determination Date: The last day of the last accrual period ending prior to the date of the meeting of Holders (or, for consents not at a meeting, prior to a date established by Freddie Mac). The accrual period

5

will be the same as the accrual period used by Freddie Mac to determine its deduction for accrued original issue discount under section 163 (e) of the Code.

Other Registered Debt Securities: Registered Debt Securities that are not DTC Registered Debt Securities, that are deposited with a Common Depositary and that will clear and settle through the systems operated by Euroclear, Clearstream, Luxembourg and/or any such other applicable clearing system other than DTC.

Pricing Supplement: A supplement to the Offering Circular that describes the specific terms of, and provides pricing information and other information for, an issue of Debt Securities or which otherwise amends, modifies or supplements the terms of the Offering Circular.

Prime Rate: The rate determined by the Calculation Agent in accordance with Section 2.07(i)(K).

Prime Rate Determination Date: The New York Banking Day preceding the applicable Reset Date.

Principal Component: The principal payment plus any interest payments that are either due after the date specified in, or are specified as ineligible for stripping in, the applicable Supplemental Agreement.

Principal Financial Center: (1) with respect to U.S. dollars, Sterling, Yen and Swiss francs, the City of New York, London, Tokyo and Zurich, respectively; or (2) with respect to any other Index Currency, the city specified in the related Pricing Supplement.

Principal Payment Date: The Maturity Date, or the earlier date of redemption or repayment, if any (whether such redemption or repayment is in whole or in part).

Range Accrual Debt Securities: Variable Rate Debt Securities on which no interest may accrue during periods when the applicable Index is outside a specified range as described in the related Supplemental Agreement.

Record Date: As to Registered Debt Securities issued in global form, the close of business on the Business Day immediately preceding such Interest Payment Date. As to Registered Debt Securities issued in definitive form, the fifteenth calendar day preceding an Interest Payment Date. Interest on a Registered Debt Security will be paid to the Holder of such Registered Debt Security as of the close of business on the Record Date.

Reference Bonds: U.S. dollar denominated non-callable and non-puttable Reference Securities with maturities of more than ten years.

Reference Notes: U.S. dollar denominated non-callable and non-puttable Reference Securities with maturities of more than one year.

Reference Securities: Scheduled U.S. dollar denominated issues of Debt Securities in large principal amounts, which may be either Reference Bonds or Reference Notes.

Register: A register of the Holders of Registered Debt Securities maintained by the Registrar.

Registered Debt Securities: Debt Securities issued and maintained in global registered or definitive registered form on the books and records of the Registrar.

Registrar: The entity selected by Freddie Mac to maintain the Register.

Representative Amount: A principal amount of not less than U.S. $1,000,000 that, in the Calculation Agent’s sole judgment, is representative for a single transaction in the relevant market at the relevant time.

6

Reset Date: The date on which a new rate of interest on a Debt Security becomes effective.

Reuters: Reuters Group PLC or any successor service.

Reuters USAUCTION10 Page: The display designated as “USAUCTION10” (or any successor page) provided by Reuters.

Reuters USAUCTION11 Page: The display designated as “USAUCTION11” (or any successor page) provided by Reuters.

Reuters US PRIME1 Page: The display designated as page “USPRIME1”’ (or any successor page) provided by Reuters

Secured Overnight Financing Rate: The secured overnight financing rate published by the FRBNY on the FRBNY’s Website.

Social Debt Securities: Debt Securities that are designated as Social Debt Securities in the related Supplemental Agreement.

SOFR: The rate determined by the Calculation Agent in accordance with Section 2.07(i)(H).

Specified Currency: The currency or currency unit in which a Debt Security may be denominated and in which payments of principal of and interest on a Debt Security may be made.

Specified Interest Currency: The Specified Currency provided for the payment of interest on Debt Securities.

Specified Payment Currency: The term to which the Specified Interest Currency and Specified Principal Currency are referred collectively.

Specified Principal Currency: The Specified Currency provided for the payment of principal on Debt Securities.

Spread: A constant or variable percentage or number to be added to or subtracted from the relevant Index for a Variable Rate Debt Security.

Step Debt Securities: Debt Securities that bear interest at different fixed rates during different specified periods.

▇▇▇▇▇▇▇▇: British pounds sterling.

Supplemental Agreement: An agreement which, as to the related issuance of Debt Securities, supplements the other provisions of this Agreement and identifies and establishes the particular offering of Debt Securities issued in respect thereof. A Supplemental Agreement may be documented by a supplement to this Agreement, a Pricing Supplement, a confirmation or a terms sheet. A Supplemental Agreement may, as to any particular issuance of Debt Securities, modify, amend or supplement the provisions of this Agreement in any respect whatsoever. A Supplemental Agreement shall be effective and binding as of its publication, whether or not executed by Freddie Mac.

TARGET2: The Trans-European Automated Real-Time Gross Settlement Express Transfer payment system which utilizes a single shared platform and which was launched on November 19, 2007.

Treasury Auction: The most recent auction of Treasury Bills prior to a given Reset Date.

Treasury Bills: Direct obligations of the United States.

7

Treasury Department: United States Department of the Treasury.

Treasury Rate: The rate determined by the Calculation Agent in accordance with Section 2.07(i)(L).

Treasury Rate Determination Date: The day of the week in which the Reset Date falls on which Treasury Bills would normally be auctioned or, if no auction is held for a particular week, the first Business Day of that week. Treasury Bills are normally sold at auction on Monday of each week, unless that day is a legal holiday, in which case the auction is normally held on the following Tuesday, except that the auction may be held on the preceding Friday; provided, however, that if an auction is held on the Friday of the week preceding the Reset Date, the Treasury Rate Determination Date will be that preceding Friday; and provided, further, that if the Treasury Rate Determination Date would otherwise fall on the Reset Date, that Reset Date will be postponed to the next succeeding Business Day.

U.S. Government Securities Business Day: Any day except for (i) a Saturday, (ii) a Sunday, (iii) a day on which the Securities Industry and Financial Markets Association recommends that the fixed income departments of its members be closed for the entire day for purposes of trading in United States government securities, or (iv) a day on which the FRBNY is closed for business.

Variable Principal Repayment Amount: The principal amount determined by reference to one or more Indices or otherwise, payable on the applicable Maturity Date or date of redemption or repayment of a Debt Security, as specified in the applicable Supplemental Agreement.

Variable Rate Debt Securities: Debt Securities that bear interest at a variable rate, and reset periodically, determined by reference to one or more Indices or otherwise. The formula for a variable rate may include a Spread.

Yen: Japanese yen.

Zero Coupon Debt Securities: Debt Securities that do not bear interest and may be issued at a discount to their principal amount.

ARTICLE II

Authorization; Certain Terms

Section 2.01. Authorization.

Debt Securities shall be issued by Freddie Mac in accordance with the authority vested in Freddie Mac by Section 306(a) of the Freddie Mac Act. The indebtedness represented by the Debt Securities shall be unsecured general obligations of Freddie Mac, or, if so provided in the applicable Supplemental Agreement, secured obligations of Freddie Mac. Debt Securities shall be offered from time to time by Freddie Mac in an unlimited amount and shall be known by the designation given them, and have the Maturity Dates stated, in the applicable Supplemental Agreement. Freddie Mac, in its discretion and at any time, may offer Additional Debt Securities having the same terms and conditions as Debt Securities previously offered. The Debt Securities may be issued as Reference Securities, which includes Reference Notes and Reference Bonds, or may be issued as any other Debt Securities denominated in U.S. dollars or other currencies, with maturities of one day or longer and may be in the form of Notes or Bonds or otherwise. Issuances may consist of new issues of Debt Securities or reopenings of an existing issue of Debt Securities.

8

Section 2.02. Other Debt Securities Issued Hereunder.

Freddie Mac may from time to time create and issue Debt Securities including Convertible Debt Securities hereunder which contain terms and conditions not specified in this Agreement. Such Debt Securities shall be governed by the applicable Supplemental Agreement and, to the extent that the terms of this Agreement are not inconsistent with Freddie Mac’s intent in creating and issuing such Debt Securities, by the terms of this Agreement. Such Debt Securities shall be secured or unsecured obligations of Freddie Mac. If the Debt Securities are secured obligations of Freddie Mac, the provisions of Article V hereof shall apply to such Debt Securities.

Section 2.03. Specified Currencies and Specified Payment Currencies.

(a) Each Debt Security shall be denominated and payable in such Specified Currency as determined by Freddie Mac. Fed Book-Entry Debt Securities will be denominated and payable in U.S. dollars only.

(b) Except under the circumstances provided in Article VI hereof, Freddie Mac shall make payments of any interest on Debt Securities in the Specified Interest Currency and shall make payments of the principal of Debt Securities in the Specified Principal Currency. The Specified Currency for the payment of interest and principal with respect to any Debt Security shall be set forth in the applicable Supplemental Agreement.

Section 2.04. Minimum Denominations.

The Debt Securities shall be issued and maintained in the minimum denominations of U.S. $1,000 and additional increments of U.S. $1,000 for U.S. dollar denominated Debt Securities, unless otherwise provided in the applicable Supplemental Agreement and as may be allowed or required from time to time by the relevant regulatory authority or any laws or regulations applicable to the relevant Specified Currency. In the case of Zero Coupon Debt Securities, denominations will be expressed in terms of the principal amount payable on the Maturity Date.

Section 2.05. Maturity.

(a) Each Debt Security shall mature on its Maturity Date, as provided in the applicable Supplemental Agreement, unless redeemed at the option of Freddie Mac or repaid at the option of the Holder prior thereto in accordance with the provisions described under Section 2.06. Debt Securities may be issued with minimum or maximum maturities allowed or required from time to time by the relevant regulatory or stock exchange authority or clearing systems or any laws or regulations applicable to the Specified Currency.

(b) If so provided in the applicable Supplemental Agreement, certain Debt Securities may have provision permitting their Beneficial Owner to elect to extend the initial Maturity Date specified in such Supplemental Agreement, or any later date to which the maturity of such Debt Securities has been extended, on specified dates. However, the maturity of such Debt Securities may not be extended beyond the final Maturity Date specified in the Supplemental Agreement.

(c) The principal amount payable on the Maturity Date of a Debt Security shall be a Fixed Principal Repayment Amount or a Variable Principal Repayment Amount, in each case as provided in the applicable Supplemental Agreement.

Section 2.06. Optional Redemption and Optional Repayment.

(a) The Supplemental Agreement for any particular issue of Debt Securities shall provide whether such Debt Securities may be redeemed at Freddie Mac’s option or repayable at the Holder’s option, in whole or in part, prior to their Maturity Date. If so provided in the applicable Supplemental Agreement, an issue of Debt Securities shall be subject to redemption at the option of Freddie Mac, or repayable at the option of the Holders, in whole or in part, on one or more specified dates, at any time on or after a specified date, or during one or

9

more specified periods of time. The redemption or repayment price for such Debt Securities (or such part of such Debt Securities as is redeemed or repaid) shall be an amount provided in, or determined in a manner provided in, the applicable Supplemental Agreement, together with accrued and unpaid interest to the date fixed for redemption or repayment.

(b) Unless otherwise provided in the applicable Supplemental Agreement, notice of optional redemption shall be given to Holders of the related Debt Securities not less than 5 Business Days prior to the date of redemption in the manner provided in Section 7.07. The date that we provide such notice constitutes the first Business Day for purposes of this minimum notice period. Freddie Mac also announces its intent to redeem certain Debt Securities on the Freddie Mac website at ▇▇▇▇://▇▇▇.▇▇▇▇▇▇▇▇▇▇.▇▇▇/▇▇▇▇/▇▇▇▇/▇▇▇▇▇▇▇▇▇▇_▇▇▇▇▇▇▇.▇▇▇▇.

(c) In the case of a partial redemption of an issue of Fed Book-Entry Debt Securities by Freddie Mac, such Fed Book-Entry Debt Securities shall be redeemed pro rata. In the case of a partial redemption of an issue of Registered Debt Securities by Freddie Mac, one or more of such Registered Debt Securities shall be reduced by the Global Agent in the amount of such redemption, subject to the principal amount of such Registered Debt Securities after redemption remaining in an authorized denomination. The effect of any partial redemption of an issue of Registered Debt Securities on the Beneficial Owners of such Registered Debt Securities will depend on the procedures of the applicable clearing system and, if such Beneficial Owner is not a participant therein, on the procedures of the participant through which such Beneficial Owner owns its interest.

(d) If so provided in the applicable Supplemental Agreement, certain Debt Securities shall be repayable, in whole or in part, by Freddie Mac at the option of the relevant Holders thereof or otherwise, on one or more specified dates, at any time on or after a specified date, or during one or more specified periods of time, upon terms and procedures provided in the applicable Supplemental Agreement. Unless otherwise provided in the applicable Supplemental Agreement, in the case of a Registered Debt Security, to exercise such option, the Holder shall deposit with the Global Agent (i) such Registered Debt Security; and (ii) a duly completed notice of optional repayment in the form obtainable from the Global Agent, in each case not more than the number of days nor less than the number of days specified in the applicable Supplemental Agreement prior to the date fixed for repayment. Unless otherwise specified in the applicable Supplemental Agreement, no such Registered Debt Security (or notice of repayment) so deposited may be withdrawn without the prior consent of Freddie Mac or the Global Agent. Unless otherwise provided in the applicable Supplemental Agreement, in the case of a Fed Book-Entry Debt Security, if the Beneficial Owner wishes to exercise such option, then the Beneficial Owner shall give notice thereof to Freddie Mac through the relevant Holding Institution as provided in the applicable Supplemental Agreement.

(e) The principal amount payable upon redemption or repayment of a Debt Security shall be a Fixed Principal Repayment Amount or a Variable Principal Repayment Amount, in each case as provided in the applicable Supplemental Agreement.

Section 2.07. Payment Terms of the Debt Securities.

(a) Debt Securities shall bear interest at one or more fixed rates or variable rates or may not bear interest. If so provided in the applicable Supplemental Agreement, Debt Securities may be separated by a Holder into one or more Interest Components and Principal Components. The Offering Circular or the applicable Supplemental Agreement for such Debt Securities shall specify the procedure for stripping such Debt Securities into such Interest and Principal Components.

(b) The applicable Supplemental Agreement shall specify the frequency with which interest, if any, is payable on the related Debt Securities. Interest on Debt Securities shall be payable in arrears on the Interest Payment Dates specified in the applicable Supplemental Agreement and on each Principal Payment Date.

10

(c) Each issue of interest-bearing Debt Securities shall bear interest during each Interest Payment Period. No interest on the principal of any Debt Security will accrue on or after the Principal Payment Date on which such principal is repaid.

(d) The determination by the Calculation Agent of the interest rate on, or any Index in relation to, a Variable Rate Debt Security and the determination of any payment on any Debt Security (or any interim calculation in the determination of any such interest rate, index or payment) shall, absent manifest error, be final and binding on all parties. If a principal or interest payment error occurs, Freddie Mac may correct it by adjusting payments to be made on later Interest Payment Dates or Principal Payment Dates (as appropriate) or in any other manner Freddie Mac considers appropriate. If the source of an Index changes in format, but the Calculation Agent determines that the Index source continues to disclose the information necessary to determine the related interest rate substantially as required, the Calculation Agent will amend the procedure for obtaining information from that source to reflect the changed format. All Index values used to determine principal or interest payments are subject to correction within 30 days from the applicable payment. The source of a corrected value must be the same source from which the original value was obtained. A correction might result in an adjustment on a later date to the amount paid to the Holder.

(e) Payments on Debt Securities shall be rounded, in the case of U.S. dollars, to the nearest cent or, in the case of a Specified Payment Currency other than U.S. dollars, to the nearest smallest transferable unit (with one-half cent or unit being rounded upwards).

(f) In the event that any jurisdiction imposes any withholding or other tax on any payment made by Freddie Mac (or our agent or any other person potentially required to withhold) with respect to a Debt Security, Freddie Mac (or our agent or such other person) will deduct the amount required to be withheld from such payment, and Freddie Mac (or our agent or such other person) will not be required to pay additional interest or other amounts, or redeem or repay the Debt Securities prior to the applicable Maturity Date, as a result.

(g) Fixed Rate Debt Securities

Fixed Rate Debt Securities shall bear interest at a single fixed interest rate. The applicable Supplemental Agreement shall specify the fixed interest rate per annum on a Fixed Rate Debt Security. Unless otherwise specified in the applicable Supplemental Agreement, interest on a Fixed Rate Debt Security shall be computed on the basis of a 360-day year consisting of twelve 30-day months.

(h) Step Debt Securities

Step Debt Securities shall bear interest from their Issue Date to a specified date at their initial fixed interest rate and from that date to their Maturity Date at one or more different fixed interest rates that shall be prescribed as of the Issue Date. A Step Debt Security will have one or more step periods. The applicable Supplemental Agreement shall specify the fixed interest rate per annum payable on Step Debt Securities for each related period from issuance to maturity. Unless otherwise specified in the applicable Supplemental Agreement, interest on a Step Debt Security shall be computed on the basis of a 360-day year consisting of twelve 30-day months.

(i) Variable Rate Debt Securities

(A) Variable Rate Debt Securities shall bear interest at a variable rate determined on the basis of a direct or an inverse relationship to one or more specified Indices or otherwise, (x) plus or minus a Spread, if any, or (y) multiplied by one or more Leverage or Deleverage Factors, if any, as specified in the applicable Supplemental Agreement. Variable Rate Debt Securities also may bear interest in any other manner described in the applicable Supplemental Agreement.

(B) Variable Rate Debt Securities may have a Cap and/or a Floor.

11

(C) The applicable Supplemental Agreement shall specify the accrual method (i.e., the day count convention) for calculating interest or any relevant accrual factor on the related Variable Rate Debt Securities. The accrual method may incorporate one or more of the following defined terms:

“Actual/360” shall mean that interest or any other relevant accrual factor shall be calculated on the basis of the actual number of days elapsed in a year of 360 days.

“Actual/365 (fixed)” shall mean that interest or any other relevant accrual factor shall be calculated on the basis of the actual number of days elapsed in a year of 365 days, regardless of whether accrual or payment occurs during a calendar leap year.

“Actual/Actual” shall mean, unless otherwise indicated in the applicable Supplemental Agreement, that interest or any other relevant accrual factor shall be calculated on the basis of (x) the actual number of days elapsed in the Interest Payment Period divided by 365, or (y) if any portion of the Interest Payment Period falls in a calendar leap year, (A) the actual number of days in that portion divided by 366 plus (B) the actual number of days in the remaining portion divided by 365. If so indicated in the applicable Supplemental Agreement, “Actual/Actual” shall mean interest or any other relevant accrual factor shall be calculated in accordance with the definition of “Actual/Actual” adopted by the International Securities Market Association (“Actual/Actual (ISMA)”), which means a calculation on the basis of the following:

(1) where the number of days in the relevant Interest Payment Period is equal to or shorter than the Determination Period during which such Interest Payment Period ends, the number of days in such Interest Payment Period divided by the product of (A) the number of days in such Determination Period and (B) the number of Interest Payment Dates that would occur in one calendar year; or

(2) where the Interest Payment Period is longer than the Determination Period during which the Interest Payment Period ends, the sum of (A) the number of days in such Interest Payment Period falling in the Determination Period in which the Interest Payment Period begins divided by the product of (X) the number of days in such Determination Period and (Y) the number of Interest Payment Dates that would occur in one calendar year; and (B) the number of days in such Interest Payment Period falling in the next Determination Period divided by the product of (X) the number of days in such Determination Period and (Y) the number of Interest Payment Dates that would occur in one calendar year.

(D) The applicable Supplemental Agreement shall specify the frequency with which the rate of interest on the related Variable Rate Debt Securities shall reset. The applicable Supplemental Agreement also shall specify the Reset Date. If the interest rate will reset within an Interest Payment Period, then the interest rate in effect on the sixth Business Day preceding an Interest Payment Date will be the interest rate for the remainder of that Interest Payment Period and the first day of each Interest Payment Period also will be a Reset Date. Variable Rate Debt Securities may bear interest prior to the initial Reset Date at an initial interest rate, if any, specified in the applicable Supplemental Agreement. If so, then the first day of the first Interest Payment Period will not be a Reset Date. The rate of interest applicable to each Interest Reset Period shall be determined as provided below or in the applicable Supplemental Agreement.

Except for a Variable Rate Debt Security as to which the rate of interest thereon is determined by reference to SOFR, Prime Rate, Treasury Rate, CMT Rate, or Federal Funds Rate (Daily) or as otherwise set forth in the applicable Supplemental Agreement, the Determination Date for a Variable Rate Debt Security means the second Business Day preceding the Reset Date applicable to an Interest Reset Period.

12

(E) If the rate of interest on a Variable Rate Debt Security is subject to adjustment within an Interest Payment Period, accrued interest shall be calculated by multiplying the principal amount of such Variable Rate Debt Security by an accrued interest factor. Unless otherwise specified in the applicable Supplemental Agreement, this accrued interest factor shall be computed by adding the interest factor calculated for each Interest Reset Period in such Interest Payment Period and rounding the sum to nine decimal places. The interest factor for each such Interest Reset Period shall be computed by (1) multiplying the number of days in the Interest Reset Period by the interest rate (expressed as a decimal) applicable to such Interest Reset Period; and (2) dividing the product by the number of days in the year referred to in the accrual method specified in the applicable Supplemental Agreement.

(F) For each issue of Variable Rate Debt Securities, the Calculation Agent shall also cause the interest rate for the applicable Interest Reset Period and the amount of interest accrued on the minimum denomination specified for such issue to be made available to Holders as soon as practicable after its determination but in no event later than two Business Days thereafter. Such interest amounts so made available may subsequently be amended (or appropriate alternative arrangements made by way of adjustment) without notice in the event of an extension or shortening of the Interest Reset Period.

(G) If the applicable Supplemental Agreement specifies SOFR as the applicable Index for determining the rate of interest for the related Variable Rate Debt Security, the following provisions shall apply (unless otherwise specified in the applicable Supplemental Agreement):

“SOFR” means the Secured Overnight Financing Rate published by the FRBNY on the FRBNY’s Website. With respect to any U.S. Government Securities Business Day:

(1) the Secured Overnight Financing Rate published for such U.S. Government Securities Business Day as such rate appears on the FRBNY’s Website at 3:00 p.m. (New York time) on the immediately following U.S. Government Securities Business Day (the “SOFR Determination Time”);

(2) if the rate specified in (1) above does not so appear, the Secured Overnight Financing Rate as published in respect of the first preceding U.S. Government Securities Business Day for which the Secured Overnight Financing Rate was published on the FRBNY’s Website;

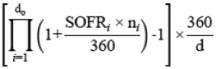

“Compounded SOFR” means the rate of return of a daily compound interest investment computed in accordance with the following formula (and the resulting percentage will be rounded, if necessary, to the nearest one hundred-thousandth of a percentage point, with 0.000005 being rounded upwards to 0.00001):

where, for purposes of applying the above formula:

“d0,” for any Observation Period, is the number of U.S. Government Securities Business Days in the relevant Observation Period;

“i” is a series of whole numbers from one to d0, each representing the relevant U.S. Government Securities Business Day in chronological order from, and including, the first U.S. Government Securities Business Day in the relevant Observation Period;

13

“SOFRi,” for any U.S. Government Securities Business Day “i” in the relevant Observation Period, is equal to SOFR in respect of that day “i”;

“ni,” for any U.S. Government Securities Business Day “i” in the relevant Observation Period, is the number of calendar days from, and including, such U.S. Government Securities Business Day “i” to, but excluding, the following U.S. Government Securities Business Day (“i+1”); and

“d” is the number of calendar days in the relevant Observation Period.

The following definitions solely apply to the preceding description of SOFR and Compounded SOFR:

“FRBNY’s Website” means the website of the FRBNY, currently at ▇▇▇▇://▇▇▇.▇▇▇▇▇▇▇▇▇▇.▇▇▇, or any successor source.

“Observation Period” means, in respect of each Interest Period, the period from, and including, the date two U.S. Government Securities Business Days preceding the first date in such Interest Period to, but excluding, the date two U.S. Government Securities Business Days preceding the Interest Payment Date for such Interest Period.

“U.S. Government Securities Business Day” means any day except for a Saturday, a Sunday or a day on which the Securities Industry and Financial Markets Association recommends that the fixed income departments of its members be closed for the entire day for purposes of trading in U.S. government securities.

Effect of Benchmark Transition Event — SOFR

Benchmark Replacement. Notwithstanding the foregoing, if Freddie Mac determines on or prior to the relevant Reference Time that a Benchmark Transition Event and its related Benchmark Replacement Date have occurred with respect to the then-current Benchmark, the Benchmark Replacement will replace the then-current Benchmark for all purposes relating to the notes in respect of all determinations on such date and for all determinations on all subsequent dates.

Benchmark Replacement Conforming Changes. In connection with the implementation of a Benchmark Replacement, Freddie Mac will have the right to make Benchmark Replacement Conforming Changes from time to time.

Decisions and Determinations. Any determination, decision or election that may be made by Freddie Mac pursuant to this Section titled “Effect of Benchmark Transition Event — SOFR,” including any determination with respect to a tenor, rate or adjustment or of the occurrence or non-occurrence of an event, circumstance or date and any decision to take or refrain from taking any action or any selection, will be conclusive and binding absent manifest error, may be made in Freddie Mac’s sole discretion, and, notwithstanding anything to the contrary in the documentation relating to the Debt Securities, shall become effective without consent from any other party.

Certain Defined Terms. As used in this Section titled “Effect of Benchmark Transition Event — SOFR,” and solely for purposes of this section:

“Benchmark” means, initially, SOFR, as such term is defined in Section titled “SOFR”; provided that if Freddie Mac determines on or prior to the Reference Time that a Benchmark Transition Event and its related Benchmark Replacement Date have occurred with respect to SOFR or the then-current Benchmark, then “Benchmark” means the applicable Benchmark Replacement.

14

“Benchmark Replacement” means the first alternative set forth in the order below that can be determined by Freddie Mac as of the Benchmark Replacement Date.

(1) the sum of: (a) the alternate rate of interest that has been selected or recommended by the Relevant Governmental Body as the replacement for the then-current Benchmark and (b) the Benchmark Replacement Adjustment;

(2) the sum of: (a) the ISDA Fallback Rate and (b) the Benchmark Replacement Adjustment; or

(3) the sum of: (a) the alternate rate of interest that has been selected by Freddie Mac as the replacement for the then-current Benchmark giving due consideration to any industry-accepted rate of interest as a replacement for the then-current Benchmark for U.S. dollar-denominated floating rate notes at such time and (b) the Benchmark Replacement Adjustment.

“Benchmark Replacement Adjustment” means the first alternative set forth in the order below that can be determined by Freddie Mac as of the Benchmark Replacement Date:

(1) the spread adjustment (which may be a positive or negative value or zero), or method for calculating or determining such spread adjustment, that has been selected or recommended by the Relevant Governmental Body for the applicable Unadjusted Benchmark Replacement;

(2) if the applicable Unadjusted Benchmark Replacement is equivalent to the ISDA Fallback Rate, the ISDA Fallback Adjustment; or

(3) the spread adjustment (which may be a positive or negative value or zero) that has been selected by Freddie Mac giving due consideration to any industry-accepted spread adjustment, or method for calculating or determining such spread adjustment, for the replacement of the then-current Benchmark with the applicable Unadjusted Benchmark Replacement for U.S. dollar- denominated floating rate notes at such time.

“Benchmark Replacement Conforming Changes” means, with respect to any Benchmark Replacement, any technical, administrative or operational changes (including changes to the timing and frequency of determining rates and making payments of interest, rounding of amounts or tenors, and other administrative matters) that Freddie Mac decides may be appropriate to reflect the adoption of such Benchmark Replacement in a manner substantially consistent with market practice (or, if Freddie Mac decides that adoption of any portion of such market practice is not administratively feasible or if Freddie Mac determines that no market practice for use of the Benchmark Replacement exists, in such other manner as Freddie Mac determines is reasonably necessary).

“Benchmark Replacement Date” means the earliest to occur of the following events with respect to the then-current Benchmark (including the daily published component used in the calculation thereof):

(1) in the case of clause (1) or (2) of the definition of “Benchmark Transition Event,” the later of (a) the date of the public statement or publication of information referenced therein and (b) the date on which the administrator of the Benchmark permanently or indefinitely ceases to provide the Benchmark (or such component); or

(2) in the case of clause (3) of the definition of “Benchmark Transition Event,” the date of the public statement or publication of information referenced therein.

For the avoidance of doubt, if the event that gives rise to the Benchmark Replacement Date occurs on the same day as, but earlier than, the Reference Time in respect of any determination, the Benchmark Replacement Date will be deemed to have occurred prior to the Reference Time for such determination.

15

“Benchmark Transition Event” means the occurrence of one or more of the following events with respect to the then-current Benchmark (including the daily published component used in the calculation thereof):

(1) a public statement or publication of information by or on behalf of the administrator of the Benchmark (or such component) announcing that such administrator has ceased or will cease to provide the Benchmark (or such component), permanently or indefinitely, provided that, at the time of such statement or publication, there is no successor administrator that will continue to provide the Benchmark (or such component); or

(2) a public statement or publication of information by the regulatory supervisor for the administrator of the Benchmark (or such component), the central bank for the currency of the Benchmark (or such component), an insolvency official with jurisdiction over the administrator for the Benchmark (or such component), a resolution authority with jurisdiction over the administrator for the Benchmark (or such component) or a court or an entity with similar insolvency or resolution authority over the administrator for the Benchmark, which states that the administrator of the Benchmark (or such component) has ceased or will cease to provide the Benchmark (or such component) permanently or indefinitely, provided that, at the time of such statement or publication, there is no successor administrator that will continue to provide the Benchmark (or such component); or

(3) a public statement or publication of information by the regulatory supervisor for the administrator of the Benchmark announcing that the Benchmark is no longer representative.

“ISDA Definitions” means the 2006 ISDA Definitions published by the International Swaps and Derivatives Association, Inc. or any successor thereto, as amended or supplemented from time to time, or any successor definitional booklet for interest rate derivatives published from time to time.

“ISDA Fallback Adjustment” means the spread adjustment (which may be a positive or negative value or zero) that would apply for derivatives transactions referencing the ISDA Definitions to be determined upon the occurrence of an index cessation event with respect to the Benchmark.

“ISDA Fallback Rate” means the rate that would apply for derivatives transactions referencing the ISDA Definitions to be effective upon the occurrence of an index cessation date with respect to the Benchmark for the applicable tenor excluding the applicable ISDA Fallback Adjustment.

“Reference Time” with respect to any determination of the Benchmark means (1) if the Benchmark is Compounded SOFR, the SOFR Determination Time, and (2) if the Benchmark is not Compounded SOFR, the time determined by Freddie Mac after giving effect to the Benchmark Replacement Conforming Changes.

“Relevant Governmental Body” means the Federal Reserve Board and/or the Federal Reserve Bank of New York, or a committee officially endorsed or convened by the Federal Reserve Board and/or the Federal Reserve Bank of New York or any successor thereto.

“Unadjusted Benchmark Replacement” means the Benchmark Replacement excluding the Benchmark Replacement Adjustment.

(H) If the applicable Supplemental Agreement specifies the Prime Rate as the applicable Index for determining the rate of interest for the related Variable Rate Debt Securities, the following provisions shall apply:

The “Prime Rate” means, with respect to any Reset Date (in the following order of priority):

16

(1) the rate for the Prime Rate Determination Date, as published in H.15 or other recognized electronic source used for the purpose of displaying that rate opposite the caption “Bank prime loan”;

(2) if the rate is not published in H.15 by 5:00 p.m., New York City time, on the Reset Date, then the Prime Rate will be the arithmetic mean, determined by the Calculation Agent, of the rates (after eliminating certain rates, as described below in this clause (2)) that appear, at 11:00 a.m., New York City time, on the Prime Rate Determination Date, on Reuters USPRIME1 Page as the U.S. dollar prime rate or base lending rate of each bank appearing on that page; provided, that at least three rates appear. In determining the arithmetic mean:

(i) if 20 or more rates appear, the highest five rates (or in the event of equality, five of the highest) and the lowest five rates (or in the event of equality, five of the lowest) will be eliminated,

(ii) if fewer than 20 but 10 or more rates appear, the highest two rates (or in the event of equality, two of the highest) and the lowest two rates (or in the event of equality, two of the lowest) will be eliminated, or

(iii) if fewer than 10 but five or more rates appear, the highest rate (or in the event of equality, one of the highest) and the lowest rate (or in the event of equality, one of the lowest) will be eliminated;

(3) if fewer than three rates so appear on Reuters USPRIME1 Page pursuant to clause (2) above, then the Calculation Agent will request five major banks in the City of New York selected by the Calculation Agent (after consultation with Freddie Mac, if Freddie Mac is not then acting as Calculation Agent) to provide a quotation of such banks’ U.S. dollar prime rates or base lending rates on the basis of the actual number of days in the year divided by 360 as of the close of business on the Prime Rate Determination Date. If at least three quotations are provided, then the Prime Rate will be the arithmetic mean determined by the Calculation Agent of the quotations obtained (and, if five quotations are provided, eliminating the highest quotation (or in the event of equality, one of the highest) and the lowest quotation (or in the event of equality, one of the lowest));

(4) if fewer than three quotations are so provided pursuant to clause (3) above, the Calculation Agent will request five banks or trust companies organized and doing business under the laws of the United States or any state, each having total equity capital of at least U.S. $500,000,000 and being subject to supervision or examination by federal or state authority, selected by the Calculation Agent (after consultation with Freddie Mac, if Freddie Mac is not then acting as Calculation Agent), to provide a quotation of such banks’ or trust companies’ U.S. dollar prime rates or base lending rates on the basis of the actual number of days in the year divided by 360 as of the close of business on the Prime Rate Determination Date. In making such selection of five banks or trust companies, the Calculation Agent will include each bank, if any, that provided a quotation as requested in clause (3) above and exclude each bank that failed to provide a quotation as requested in clause (3). If at least three quotations are provided, then the Prime Rate will be the arithmetic mean determined by the Calculation Agent of the quotations obtained; and

(5) if fewer than three quotations are so provided pursuant to clause (4) above, then the Prime Rate will be the Prime Rate determined for the immediately preceding Reset Date. If the applicable Reset Date is the first Reset Date, then the Prime Rate will be the rate calculated pursuant to clause (1) for the most recent New York Banking Day preceding the Reset Date for which such rate was published in H.15.

17

(I) If the applicable Supplemental Agreement specifies the Treasury Rate as the applicable Index for determining the rate of interest for the related Variable Rate, the following provisions shall apply:

The “Treasury Rate” means, with respect to any Reset Date (in the following order of priority):

(1) the rate for the Treasury Rate Determination Date of Treasury Bills having the Index Maturity, as published in H.15, or other recognized electronic source used for the purpose of displaying that rate under the caption “U.S. government securities/Treasury bills (secondary market)”;

(2) if the rate described in clause (1) above is not so published by 3.00 p.m., New York City time, on the Reset Date, then the rate from Treasury Auction of Treasury Bills having the Index Maturity, as that rate appears under the caption “INVEST RATE” on the display on Reuters USAUCTION10 Page or Reuters USAUCTION11 Page;

(3) if the rate described in clause (2) above is not published by 5:00 p.m., New York City time, on the Reset Date, then the auction average rate for Treasury Bills having the Index Maturity obtained from the applicable Treasury Auction as announced by the Treasury Department in the form of a press release under the heading “Investment Rate” by 5:00 p.m. on such Reset Date;

(4) if the rate described in clause (3) above is not so announced by the Treasury Department by 5:00 p.m., New York City time, on the Reset Date, then auction average rate obtained from the Treasury Auction of the applicable Treasury Bills, as otherwise announced by the Treasury Department by 5:00 p.m., New York City time, on the Reset Date as determined by the Calculation Agent;

(5) if such rate described in clause (4) is not so announced by the Treasury Department by 5:00 p.m., New York City time, on the Reset Date, the Calculation Agent will request five leading primary United States government securities dealers in the City of New York selected by the Calculation Agent (after consultation with Freddie Mac, if Freddie Mac is not then acting as Calculation Agent) to provide a quotation of such dealers’ secondary market bid yields, as of 3:00 p.m. on the Reset Date, for Treasury Bills with a remaining maturity closest to the Index Maturity (or, in the event that the remaining maturities are equally close, the longer remaining maturity). If at least three quotations are provided, then the Treasury Rate will be the arithmetic mean determined by the Calculation Agent of the quotations obtained; and

(6) if fewer than three quotations are so provided pursuant to clause (5) above, then the Treasury Rate for the immediately preceding Reset Date. If the applicable Reset Date is the first Reset Date, then the Treasury Rate will be the auction average rate for Treasury Bills having the Index Maturity from the most recent auction of Treasury Bills prior to the Reset Date for which such rate was announced by the Treasury Department in the form of a press release under the heading “Investment Rate.”

The rate (including the auction average rate) for Treasury Bills and the secondary market bid yield for Treasury Bills will be obtained and expressed as a bond equivalent on the basis of a year of 365 or 366 days, as applicable (or, if not so expressed, will be converted by the Calculation Agent to such a bond equivalent yield).

(J) If the applicable Supplemental Agreement specifies the CMT Rate as the applicable Index for determining the rate of interest for the related Variable Rate, the following provisions shall apply:

The “CMT Rate” means, with respect to any Reset Date (in the following order of priority):

(1) for any CMT Determination Date, the daily rate for the Index Maturity that appears on page “FRBCMT” on Reuters (or any other page that replaces the FRBCMT page on that service or any

18

successor service) under the heading “...Treasury Constant Maturities. Federal Reserve Board Release H.15...Mondays Approximately 3:45 p.m.”;

(2) if the applicable rate described in clause (1) is not displayed on Reuters page FRBCMT at 3:45 p.m., New York City time, on the CMT Determination Date, then the CMT Rate will be the Treasury constant maturity rate for the Index Maturity applicable for the CMT Determination Date as published in H.15;

(3) if the CMT Rate is not determined pursuant to clause (1) and the applicable rate described in clause (2) does not appear in H.15 at 3:45 p.m., New York City time, on the CMT Determination Date, then the CMT Rate will be the Treasury constant maturity rate, or other U.S. Treasury rate, applicable to an Index Maturity with reference to the CMT Determination Date, that:

(i) is published by the Federal Reserve or the Treasury Department; and

(ii) Freddie Mac has determined to be comparable to the applicable rate formerly displayed on the FRBCMT page on Reuters and published in H.15;

(4) if the CMT Rate is not determined pursuant to clause (1) or (2) and the rate described in clause (3) above does not appear at 3:45 p.m., New York City time, on the CMT Determination Date, then the CMT Rate will be the yield to maturity of the arithmetic mean of the secondary market offered rates for U.S. Treasury securities with an original maturity of approximately the Index Maturity and a remaining term to maturity of no more than one year shorter than the Index Maturity, and in a Representative ▇▇▇▇▇▇, as of approximately 3:45 p.m., New York City time, on the CMT Determination Date, as quoted by three primary U.S. government securities dealers in New York City that Freddie Mac selects. In selecting these offered rates, Freddie Mac will request quotations from five primary dealers and will disregard the highest quotation or, if there is equality, one of the highest and the lowest quotation or, if there is equality, one of the lowest. If two U.S. Treasury securities with an original maturity longer than the Index Maturity have remaining terms to maturity that are equally close to the Index Maturity, Freddie Mac will obtain quotations for the U.S. Treasury security with the shorter remaining term to maturity;

(5) if the CMT Rate is not determined pursuant to clause (1), (2) or (3) and fewer than five but more than two primary dealers are quoting offered rates as described in clause (4), then the CMT Rate for the CMT Determination Date will be based on the arithmetic mean of the offered rates so obtained, and neither the highest nor the lowest of those quotations will be disregarded;

(6) if the CMT Rate is not determined pursuant to clause (1), (2), (3) or (4) and two or fewer primary dealers are quoting offered rates as described in clause (5), then the CMT Rate will be the yield to maturity of the arithmetic mean of the secondary market offered rates for U.S. Treasury securities having an original maturity longer than the Index Maturity and a remaining term to maturity closest to the Index Maturity, and in a Representative Amount, as of approximately 3:45 p.m., New York City time, on the CMT Determination Date, as quoted by three primary U.S. government securities dealers in New York City that Freddie Mac selects. In selecting these offered rates, Freddie Mac will request quotations from five primary dealers and will disregard the highest quotation, or, if there is equality, one of the highest and the lowest quotation or, if there is equality, one of the lowest;

(7) if the CMT Rate is not determined pursuant to clauses (1) through (6) above and fewer than five but more than two primary dealers are quoting offered rates as described in clause (6), then the CMT Rate for the CMT Determination date will be based on the arithmetic mean of the offered rates so obtained, and neither the highest nor the lowest of those quotations will be disregarded;

19

(8) if the Calculation Agent obtains fewer than three quotations of the kind described in clause (6), the CMT Rate in effect for the new Interest Reset Period will be the CMT Rate in effect for the prior Interest Reset Period, or if the applicable Reset Date is the first Reset Date, the rate of interest payable for the new Interest Reset Period will be the initial interest rate; and

(9) if the CMT Rate in its present form ceases to exist and the provisions described in this Agreement for determining a fallback rate are found to be unreliable or result in a fallback rate that is not comparable to the CMT Rate, Freddie Mac, as the Calculation Agent, is authorized to designate an alternative determination method or index to the CMT Rate. If, prior to the time the CMT Rate may cease to exist, a new industry standard index is adopted, the Calculation Agent may elect, in its sole discretion, to use such standard index in lieu of the CMT Rate. If the Calculation Agent has designated an alternative determination method or index to the CMT Rate in accordance with the foregoing, the Calculation Agent in its sole discretion may determine the business day convention, the definition of business day and the interest determination date to be used and any other relevant methodology, including any adjustment factor needed to make such alternative determination method or index comparable to the CMT Rate base rate, in a manner that is consistent with industry-accepted practices. The Calculation Agent’s designation of an alternative determination method or index as described herein will be final and binding on all parties.

(K) If the applicable Supplemental Agreement specifies the Federal Funds Rate (Daily) as the applicable Index for determining the rate of interest for the related Variable Rate, the following provisions shall apply:

The “Federal Funds Rate (Daily)” means, with respect to any Reset Date:

(1) the rate for the Business Day preceding the Federal Funds Rate (Daily) Determination Date for U.S. dollar federal funds, as published in the latest H.15 or other recognized electronic source used for the purpose of displaying that rate opposite the caption “Federal funds (effective)”;

(2) if the rate specified in clause (1) is not published by 5:00 p.m., New York City time, on the Federal Funds Rate Determination Date, then the Calculation Agent will request five leading brokers (which may include the related Dealers or their affiliates) of federal funds transactions in the City of New York selected by the Calculation Agent (after consultation with Freddie Mac, if Freddie Mac is not then acting as Calculation Agent) each to provide a quotation of the broker’s effective rate for transactions in overnight federal funds arranged by the broker settling on the Business Day preceding the Federal Funds Rate (Daily) Determination Date. If at least two quotations are provided, then the Federal Funds Rate (Daily) will be the arithmetic mean determined by the Calculation Agent of the quotations obtained (and, if five quotations are provided, eliminating the highest quotation (or, in the event of equality, one of the highest) and the lowest quotation (or, in the event of equality, one of the lowest));

(3) if fewer than two quotations are so provided pursuant to clause (2) above, then the Calculation Agent will request five leading brokers (which may include the related Dealers or their affiliates) of federal funds transactions in the City of New York selected by the Calculation Agent (after consultation with Freddie Mac, if Freddie Mac is not then acting as Calculation Agent) each to provide a quotation of the broker’s rates for the last transaction in overnight federal funds arranged by the broker as of 11:00 a.m., New York City time, on the Business Day preceding the Federal Funds Rate (Daily) Determination Date. If at least two quotations are provided, then the Federal Funds Rate (Daily) will be the arithmetic mean determined by the Calculation Agent of the quotations obtained (and, if five quotations are provided, eliminating the highest quotation (or, in the event of equality, one of the highest) and the lowest quotation (or, in the event of equality, one of the lowest)); and

20

(4) if fewer than two quotations are so provided pursuant to clause (3) above, then the Federal Funds Rate (Daily) as of such Federal Funds Rate (Daily) Determination Date will be the Federal Funds Rate (Daily) determined for the immediately preceding Reset Date. If the applicable Reset Date is the first Reset Date, then the rate of interest payable for the new Interest Rate Period will be the initial interest rate.

(j) Fixed/Variable Rate Debt Securities

Fixed/Variable Rate Debt Securities shall bear interest at a single fixed rate for one or more specified periods and at a rate determined by reference to one or more Indices, or otherwise, for one or more other specified periods. Fixed/Variable Rate Debt Securities also may bear interest at a rate that Freddie Mac may elect to convert from a fixed rate to a variable rate or from a variable rate to a fixed rate, if so provided in the applicable Supplemental Agreement.

If Freddie Mac may convert the interest rate on a Fixed/Variable Rate Debt Security from a fixed rate to a variable rate, or from a variable rate to a fixed rate, accrued interest for each Interest Payment Period may be calculated using an accrued interest factor in the manner described in Section 2.07(i)(E).

(k) Zero Coupon Debt Securities

Zero Coupon Debt Securities shall not bear interest.

(l) Amortizing Debt Securities

Amortizing Debt Securities are those on which Freddie Mac makes periodic payments of principal during the terms of such Debt Securities as described in the related Supplemental Agreement. Amortizing Debt Securities may bear interest at fixed or variable rates.

(m) Debt Securities with Variable Principal Repayment Amounts

Variable Principal Repayment Amount Debt Securities are those on which the amount of principal payable is determined with reference to an Index specified in the related Supplemental Agreement.

(n) Mortgage Linked Amortizing Debt Securities

Mortgage Linked Amortizing Debt Securities are Amortizing Debt Securities on which Freddie Mac makes periodic payments of principal based on the rate of payments on referenced mortgage or mortgage-related assets, as described in the related Supplemental Agreement. Mortgage Linked Amortizing Debt Securities may bear interest at fixed or variable rates.

(o) Range Accrual Debt Securities

Range Accrual Debt Securities are Variable Rate Debt Securities on which no interest may accrue during periods when the applicable Index is outside a specified range as described in the related Supplemental Agreement.

(p) Extendible Variable Rate Debt Securities

Extendible Variable Rate Debt Securities’ are Variable Rate Debt Securities, the maturity of which may be extended at a Beneficial Owner’s option effective as of specified dates, subject to a final maturity date, and that bear interest at variable rates subject to different Spreads for different specified periods, as described in the related Supplemental Agreement.

21

Section 2.08. Business Day Convention.

Unless otherwise specified in the applicable Supplemental Agreement, in any case in which an Interest Payment Date or Principal Payment Date is not a Business Day, payment of any interest on or the principal of the Debt Securities shall not be made on such date but shall be made on the next Business Day with the same force and effect as if made on such Interest Payment Date or Principal Payment Date, as the case may be. Unless otherwise provided in the applicable Supplemental Agreement, no interest on such payment shall accrue for the period from and after such Interest Payment Date or Principal Payment Date, as the case may be, to the actual date of such payment.

Section 2.09. Reopened Issues and Repurchases.

Freddie Mac reserves the right, in its discretion and at any time, to offer additional Debt Securities which have the same terms (other than Issue Date, interest commencement date and issue price) and conditions as Debt Securities for which settlement has previously occurred or been scheduled so as to form a single series of Debt Securities as specified in the applicable Supplemental Agreement.

Freddie Mac reserves the right, in its discretion and at any time, to purchase Debt Securities or otherwise acquire (either for cash or in exchange for securities) some or all of an issue of Debt Securities at any price or prices in the open market or otherwise. Such Debt Securities may be held, resold or canceled by Freddie Mac.

Section 2.10. No Acceleration Rights

The Debt Securities shall not contain any provision permitting the Holders to accelerate the maturity of the Debt Securities upon the occurrence of a default or other event.

ARTICLE III

Form; Clearance and Settlement Procedures

Section 3.01. Form of Fed Book-Entry Debt Securities.

(a) General

Fed Book-Entry Debt Securities shall be issued and maintained only on the Fed Book-Entry System. Fed Book-Entry Debt Securities shall not be exchangeable for definitive Debt Securities. The Book-Entry Rules are applicable to Fed Book-Entry Debt Securities.

(b) Title

Fed Book-Entry Debt Securities shall be held of record only by Holding Institutions. Such entities whose names appear on the book-entry records of a Federal Reserve Bank as the entities to whose accounts Fed Book-Entry Debt Securities have been deposited shall be the Holders of such Fed Book-Entry Debt Securities. The rights of the Beneficial Owner of a Fed Book-Entry Debt Security with respect to Freddie Mac and the Federal Reserve Banks may be exercised only through the Holder of the Fed Book-Entry Debt Security. Freddie Mac and the Federal Reserve Banks shall have no direct obligation to a Beneficial Owner of a Fed Book-Entry Debt Security that is not also the Holder of the Fed Book-Entry Debt Security. The Federal Reserve Banks shall act only upon the instructions of the Holder in recording transfers of a Debt Security maintained on the Fed Book-Entry System. Freddie Mac and the Federal Reserve Banks may treat the Holders as the absolute owners of Fed Book-Entry Debt Securities for the purpose of making payments in respect thereof and for all other purposes, whether or not such Fed Book-Entry Debt Securities shall be overdue and notwithstanding any notice to the contrary.

22

The Holders and each other financial intermediary holding such Fed Book-Entry Debt Securities directly or indirectly on behalf of the Beneficial Owners shall have the responsibility of remitting payments for the accounts of their customers. All payments on Fed Book-Entry Debt Securities shall be subject to any applicable law or regulation.

(c) Fiscal Agent

The FRBNY shall be the Fiscal Agent for Fed Book-Entry Debt Securities.

In acting under the Fiscal Agency Agreement, the FRBNY shall act solely as Fiscal Agent of Freddie Mac and does not assume any obligation or relationship of agency or trust for or with any Holder of a Fed Book-Entry Debt Security.

Section 3.02. Form of Registered Debt Securities.

(a) General

As specified in the applicable Supplemental Agreement, Registered Debt Securities shall be deposited with (i) a custodian for, and registered in the name of a nominee of, DTC, or (ii) a Common Depositary, and registered in the name of such Common Depositary or a nominee of such Common Depositary.

(b) Title

The person in whose name a Registered Debt Security is registered in the Register shall be the Holder of such Registered Debt Security. Beneficial interests in a Registered Debt Security shall be represented, and transfers thereof shall be effected, only through book-entry accounts of financial institutions acting on behalf of the Beneficial Owners of such Registered Debt Security, as a direct or indirect participant in the applicable clearing system for such Registered Debt Security.