Contract

Certain identified information has been excluded from the exhibit because it is both (i) not material and (ii) would likely cause competitive harm to the Company, if publicly disclosed. Brackets with triple asterisks denote omissions.

Exhibit 10.2

| Dated June 1, 2021 | |||||

| Execution Version | |||||

Agreement for the Sale and Purchase of Shares in Nordeus Limited (1)Nordeus Holding Limited (2)The Guarantors (3)Take-Two Interactive Software, Inc. | |||||

▇▇▇▇▇▇▇▇▇ & ▇▇▇▇▇ LLP ▇ ▇▇▇▇▇ ▇▇▇▇▇ ▇▇▇▇▇▇ ▇▇▇▇ ▇▇▇ Ref: 018/607/330274/2 | T + 44 (0)20 7667 5000 F + ▇▇ (▇)▇▇ ▇▇▇▇ ▇▇▇▇ ▇▇▇.▇▇▇▇▇▇▇▇▇.▇▇▇ | ||||

16789313

Certain identified information has been excluded from the exhibit because it is both (i) not material and (ii) would likely cause competitive harm to the Company, if publicly disclosed. Brackets with triple asterisks denote omissions.

Table of Contents

1 | |||||

4 | |||||

8 | |||||

16789313

Certain identified information has been excluded from the exhibit because it is both (i) not material and (ii) would likely cause competitive harm to the Company, if publicly disclosed. Brackets with triple asterisks denote omissions.

14 | |||||

18 | |||||

20 | |||||

32 | |||||

Certain identified information has been excluded from the exhibit because it is both (i) not material and (ii) would likely cause competitive harm to the Company, if publicly disclosed. Brackets with triple asterisks denote omissions.

THIS AGREEMENT is made by deed on the 1st day of June 2021

(the Agreement)

(the Agreement)

BETWEEN:

(1)NORDEUS HOLDING LIMITED, a private limited company incorporated in Ireland under registered number 526420 with its registered office at ▇▇▇ ▇▇▇▇▇, ▇▇▇▇▇▇▇ ▇▇▇▇▇, ▇▇▇▇ ▇▇▇▇, ▇▇▇▇▇▇▇ Dock, Dublin 1, Dublin, Ireland (the Seller);

(2)THOSE PERSONS whose names and addresses are set out in column (1) of Schedule 1 (together, the Guarantors) and

(3)TAKE-TWO INTERACTIVE SOFTWARE, INC. , a company registered in the State of Delaware, USA under number 2353224, with its registered office at ▇▇▇ ▇▇▇▇▇▇ ▇▇▇▇▇ ▇▇▇▇▇, ▇▇▇▇▇▇▇▇▇▇, ▇▇▇▇▇▇▇▇, ▇▇▇▇▇, ▇▇▇ (the Purchaser).

RECITALS:

(A)The Seller is at the date of this Agreement, and will be at Completion, the legal and beneficial owner of 1,000 ordinary shares of €0.001 in the capital of the Company (representing the entire issued share capital of the Company), with 945 ordinary shares (the Shares) to be sold pursuant to this Agreement and the remaining 55 ordinary shares (the Call Option Shares) that are subject to the Call Option Agreement.

(B)The Company owns at the date of this Agreement, and will own at Completion, directly or indirectly, all or part of the issued share capital of the companies listed in Part B of Schedule 2 (the Subsidiaries).

(C)The Seller has agreed to sell and the Purchaser has agreed to purchase the Shares on the terms and conditions set out in this Agreement.

IT IS AGREED as follows:

1.Interpretation

1.1In this Agreement, including the Recitals and Schedules, the following words and expressions shall have the following meanings:

Accounts | means the unaudited accounts of each of the Group Companies for the financial year ended on the Accounts Date (copies of which are included in the Data Room); | |||||||

Accounts Date | means 31 December 2020; | |||||||

| Affiliate | means with respect to any person, any person that directly or indirectly controls, is controlled by, or is under common control with, the relevant person (and, for the avoidance of doubt a person shall be deemed to control another person if the first such person possesses the power to direct or cause the direction of the management and policies of the second person, whether through the ownership of voting securities, control of voting rights, by contract or otherwise); | |||||||

Certain identified information has been excluded from the exhibit because it is both (i) not material and (ii) would likely cause competitive harm to the Company, if publicly disclosed. Brackets with triple asterisks denote omissions.

| Borrowings | means, in relation to a person, financial indebtedness, owed by that person including: (a) borrowings from, and debit balances at, banks or other financial institutions; (b) indebtedness under bonds (including performance bonds and surety bonds), notes, debentures, loan stock, or any similar instrument; (c) indebtedness under any leases required to be classified as finance or capital leases in accordance with IFRS or recorded as capital or finance leases in the Accounts or Management Accounts (excluding the impact of IFRS 16); (d) the amount of receivables sold or discounted (otherwise than on a non-recourse basis); (e) the amount of any counter-indemnity obligation in respect of any guarantee, bond, standby or documentary letter of credit or any similar instrument issued by a bank or financial institution; (f) any amount raised by the issue of redeemable shares in a Subsidiary held by any person other than a wholly owned Group Company; (g) the amount of any unpaid dividends or distributions declared or made in favour of any person other than a wholly owned Group Company (including any amounts owed to the Seller or any Seller Affiliate or any Guarantor or Guarantor Affiliate); (h) the amount of any deferred, unpaid or contingent consideration outstanding in relation to the acquisition of any business, property, service, asset, or securities in another entity or business (including “earn-outs”, “seller notes” payable and any post-closing true-up obligations with respect to such acquisition, assuming maximum amounts earned); provided that, the foregoing shall not include deferred revenue; (i) the amount of any obligation under any indemnity, guarantee or similar commitment given in respect of any obligation of any other person (other than a wholly owned Group Company) of any kind referred to above in this definition; (j) interest (or similar amounts) accrued or unpaid in respect of the matters referred to above in this definition, including any increased amount of interest (or other amount) payable by reference to any obligation to deduct or withhold Tax; (k) liabilities related to any interest rate, currency or other hedging or derivative instruments; (l) Tax liabilities relating to any Pre-Completion Tax Period; (m) obligations with respect to deferrals (including VAT and rent deferrals) pursuant to any law or actions intended to address the consequences of Covid-19; (n) any Transaction Costs and Tax liabilities relating to any Transaction Costs; (o) any payables to the Seller, any Guarantor or any Seller Affiliates or Guarantor Affiliates (including shareholders of the Seller); and (p) any premium, fees, costs and expenses (including prepayment fees, penalties and break costs) paid or payable in connection with the termination, release, discharge or repayment of facilities, borrowings or other indebtedness referred to above in this definition, and references in this Agreement to “repayment” of any Borrowings shall mean the taking of any action necessary to eliminate the liability of that person for such financial indebtedness or amounts in the nature of financial indebtedness, and any related words or phrases shall be construed accordingly; | |||||||

Certain identified information has been excluded from the exhibit because it is both (i) not material and (ii) would likely cause competitive harm to the Company, if publicly disclosed. Brackets with triple asterisks denote omissions.

| Business | means any business or businesses carried on by the Group Companies; | |||||||

Business Day | means a day (other than a Saturday or Sunday) on which banks are open for business in ▇▇▇ ▇▇▇▇, ▇▇▇▇▇▇ ▇▇▇▇▇▇ ▇▇ ▇▇▇▇▇▇▇, ▇▇▇▇▇▇, ▇▇▇▇▇▇▇ and Belgrade, Serbia; | |||||||

| Business Plan | means a business and strategic plan (including a budget) for the Group covering the period from Completion to the expiry of the Second Earn-Out Period in the agreed form; | |||||||

| Business Warranties | means those warranties of the Seller listed in Schedule 4-A excluding the Fundamental Warranties; | |||||||

| Business Warranty Claim | means a claim by the Purchaser (or its permitted assigns) in respect of a breach of any of the Business Warranties; | |||||||

| Call Option Agreement | means the call option agreement to be entered into on the date hereof between the Purchaser and the Seller in the agreed form; | |||||||

| Call Option Consideration | means $12,375,000; | |||||||

| Call Option Shares | has the meaning given to it in Recital (A); | |||||||

| Cash Consideration | has the meaning given in Clause 3.2.1; | |||||||

| Claim | means any claim, proceeding, right of action or demand of any kind (and whether under contract, statute, common law or otherwise); | |||||||

| Commercial Information | means customer details, prices and quantities and other information of a confidential nature (including all proprietary, industrial and commercial information and techniques in whatever form held, such as paper, electronically stored data, magnetic media film and microfilm or orally); | |||||||

| Company | means Nordeus Limited, a private limited company incorporated in Ireland under registered number 526421 with its registered office at ▇▇▇ ▇▇▇▇▇, ▇▇▇▇▇▇▇ ▇▇▇▇▇, ▇▇▇▇ ▇▇▇▇, ▇▇▇▇▇▇▇ Dock, ▇▇▇▇▇▇ ▇, ▇▇▇▇▇▇, ▇▇▇▇▇▇▇; | |||||||

| Company Completion Board Minutes | means the minutes of the meeting of the board of directors of the Company to take place at or before Completion in the agreed form; | |||||||

| Company Products | all products or services (including, without limitation, the Games) currently designed, developed, produced, marketed, sold, distributed or performed by or on behalf of the Group Companies and all products or services currently under design or development by the Group Companies, in the form they exist as of the Completion Date; | |||||||

Certain identified information has been excluded from the exhibit because it is both (i) not material and (ii) would likely cause competitive harm to the Company, if publicly disclosed. Brackets with triple asterisks denote omissions.

Companies Act | means the Companies ▇▇▇ ▇▇▇▇, all enactments which are to be read as one with, or construed or read together as one with, the Companies ▇▇▇ ▇▇▇▇, including the Companies (Miscellaneous Provisions (Covid-19)) ▇▇▇ ▇▇▇▇; | |||||||

| Competition Law | means any national and directly effective legislation of any jurisdiction which governs the conduct of companies or individuals in relation to restrictive or other anti-competitive agreements or practices (including cartels, pricing, resale pricing, market sharing, bid rigging, terms of trading, purchase or supply and joint ventures), dominant or monopoly market positions (whether held individually or collectively) and the control of acquisitions or mergers; | |||||||

Completion | means the completion of the performance by the parties of their respective obligations set out in Clause 7.2; | |||||||

| Completion Accounts | means the accounts of the Group Companies to be prepared in accordance with the provisions of Clause 5 and Schedule 7; | |||||||

| Completion Accounts Pack | means the Completion Accounts and a statement of the Completion Cash, the Completion Debt, the Completion Net Cash and the Net Working Capital; | |||||||

| Completion Cash | means the cash and cash equivalents of the Group Companies (in each case beneficially held by the Group Companies), net of any outstanding checks/cheques, drafts and wires and excluding any Trapped Cash, as at the Effective Time and free from any Encumbrance as derived from and stated in the Completion Accounts; | |||||||

Completion Date | means the date on which Completion actually occurs; | |||||||

| Completion Debt | means the aggregate amount (if any) of the Borrowings of the Group Companies as at the Effective Time; | |||||||

| Completion Net Cash | means an amount equal to the Completion Cash less the Completion Debt; | |||||||

| Confidential Information | means any information (in whatever form and whether transferred, held or obtained orally, visually, electronically or by any other means) known or acquired by the Seller or any of the Guarantors (whether before, on or after the date of this Agreement) which relates to: | |||||||

(i) the Purchaser, any of the Purchaser’s Affiliates or Representatives and/or their respective affairs and/or business (including any Commercial Information) relating to the Purchaser and/or any of the Purchaser’s Affiliates; | ||||||||

Certain identified information has been excluded from the exhibit because it is both (i) not material and (ii) would likely cause competitive harm to the Company, if publicly disclosed. Brackets with triple asterisks denote omissions.

(ii) any Group Company and/or its affairs and/or business including any Commercial Information relating to any Group Company; or | ||||||||

(iii) the provisions of, and negotiations leading to, this Agreement and/or any of the other Transaction Documents; provided that, Confidential Information does not include information that was or comes in the public domain other than by reason of a breach of Clause 20 or any other obligation by or duty or wrongful or tortious act or omission of the Seller or a Guarantor. | ||||||||

| Consideration | the Shares Consideration together with (if the Purchaser purchases the Call Option Shares) the Call Option Consideration; | |||||||

| Consideration Shares | has the meaning given in Clause 3.2.2; | |||||||

| Contract | means any legally binding deed, contract, agreement, arrangement, obligation and commitment of any kind whatsoever (and whether written or not) to which any Group Company is a party or to which any Group Company is bound; | |||||||

| Contractor | has the meaning given in Clause 10.1.4; | |||||||

| Covered Warranty Claim | means any claim by the Purchaser (or its permitted assigns) in respect of a Business Warranty Claim either (a) marked as ‘Included’ or (b) marked as ‘Included as re-written below’ in the Warranty and Indemnity Schedule of the W&I Policy; | |||||||

| COVID-19 | means the novel coronavirus disease 2019 caused by SARS-CoV-2 including any variants thereof and known as “COVID-19;” | |||||||

| COVID-19 Pandemic | means the epidemic, pandemic or disease outbreak associated with COVID-19; | |||||||

| Current Period | means the taxable period of the Group commencing prior to and ending after the Completion Date; | |||||||

| Data Protection Authority | means any body responsible for enforcing Data Protection Laws; | |||||||

| Data Protection Laws | means the following legislation relating to data protection and privacy, to the extent applicable to any Group Company: (a) the GDPR; (b) the Personal Data Protection ▇▇▇ ▇▇▇▇ of Serbia; (c) the Data Protection Acts 1988 to 2018 of Ireland; (d) the Privacy and Electronic Communications (EC Directive) Regulations 2011 of Ireland; (e) the Data Protection Acts 1988 to 2018 of the United Kingdom and all other national laws implementing the Directive on Privacy and Electronic Communications (2002/58/EC), Directive 95/46/EC and (f) any other data protection law or regulation or decisions applicable to the processing of Personal Data or data privacy; | |||||||

Certain identified information has been excluded from the exhibit because it is both (i) not material and (ii) would likely cause competitive harm to the Company, if publicly disclosed. Brackets with triple asterisks denote omissions.

| Data Room | means the electronic data room containing documents and information relating to the Group made available by the Seller at [***] the contents of which, as such contents existed as of the Effective Time, are listed in the appendix to the Disclosure Letter and which has been copied onto a USB device and delivered to the Purchaser within ten (10) Business Days following execution of this Agreement; | |||||||

| Deed of Termination | means the deed of termination in relation to the Shareholders’ Agreement in the agreed form; | |||||||

| Designated Exchange Rate | means, the ▇▇▇▇▇ Fargo All-in Rate at the time of conversion by the Purchaser; | |||||||

| Disclosed | means in respect of any fact, matter or circumstance fairly disclosed to the Purchaser in the Disclosure Letter with sufficient explanation and detail to enable a prudent buyer to identify the nature and scope of the relevant fact, matter or circumstance; | |||||||

Disclosure Letter | means the letter of today’s date in the agreed form from the Seller to the Purchaser (together with any attachments); | |||||||

| Dissolved Entities | means the following dissolved or to be dissolved entities: Nordeus WIN (Gibraltar) Limited, Nordeus Luxembourg S.à ▇.▇. (including its Irish branch) and Nordeus LLC, Nordeus Skopje and Nordeus Limited (UK); | |||||||

| Draft Completion Accounts Pack | has the meaning given in Paragraph 1 of Part B of Schedule 7; | |||||||

| Due Amount | means either (a) the amount (if any) due for payment by the Seller to the Purchaser in respect of a Resolved Claim or (b) the amount due (if any) from the Seller to the Purchaser under Clause 5.3.1 or Clause 5.3.3; | |||||||

| Earn-Out Calculation Date | means the date on which an Earn-Out Payment is agreed or determined in accordance with Schedule 10; | |||||||

| Earn-Out Payments | has the meaning given to it in Paragraph 1 of Schedule 10; | |||||||

| Earn-Out Retention Pool | means the retention pool to be established following Completion for the benefit of the Group’s employees from time to time on terms to be agreed between the Purchaser and the Seller; | |||||||

| Effective Time | means immediately prior to Completion; | |||||||

| Employee Tax Liability | means the amount of any income tax and/or employee (but not employer) National Insurance /social security tax and/or contributions, levy or equivalents in any jurisdiction arising in connection with the payment of the Transaction Bonuses and/or Success Sharing Milestone; | |||||||

| Employees | means all those individuals employed or engaged as employees or workers by any Group Company immediately prior to Completion; | |||||||

Certain identified information has been excluded from the exhibit because it is both (i) not material and (ii) would likely cause competitive harm to the Company, if publicly disclosed. Brackets with triple asterisks denote omissions.

Encumbrance | means any claim, charge, mortgage, pledge, trust, security, lien, option, equity, power of sale, hypothecation or other third party rights, retention of title, right of pre-emption, right of first refusal, right of set off or withholding or any other security interest of any kind; | |||||||

| Estimated Net Cash | means [***]; | |||||||

| Estimated Liability | means in relation to an Outstanding Claim, a bona fide estimate based on the information actually known to the Purchaser at the time of the preparation of the relevant Claim Certificate of the amount of Losses that Purchaser has incurred, sustained or paid, or in good faith believes that it will incur, sustain or pay, as set forth in a Claim Certificate delivered in accordance with Schedule 6; | |||||||

| Excluded Warranty Claim | means: (a) any claim by the Purchaser (or its permitted assigns) in respect of a breach of any of the Business Warranties or Tax Warranties marked as ‘Not Included’ in the W&I Policy; and (b) any Warranty Claim in respect of which the Purchaser is not able to recover under the W&I Policy as a result of the relevant Warranty, Warranty Claim and/or relevant fact, matter or circumstance giving rise to the Warranty Claim being excluded from coverage under the W&I Policy by one or more of the exclusions set out in clauses 4.1.4, 4.1.5, 4.1.6, 4.1.7, 4.1.9, 4.1.10, 4.1.11, 4.1.12, 4.1.14, 4.1.15, 4.1.16, 4.1.17 or 4.1.18 of the W&I Policy; | |||||||

| Exploit | means to reproduce, manufacture, publish, market, distribute, sell, licence, disseminate, communicate, make available, diffuse, perform, display, exhibit, show, play, transmit, re-transmit, download, stream, rent, hire, lend, issue to the public and otherwise exploit and authorise any third party to do any of the foregoing and Exploitation shall be construed accordingly; | |||||||

| Founder Guarantor | means each of ▇▇▇▇▇▇ ▇▇▇▇▇▇▇▇▇▇▇, ▇▇▇▇ ▇▇▇▇▇▇▇▇▇▇▇▇▇▇ and ▇▇▇▇▇ ▇▇▇▇▇▇▇ and the Founder Guarantors shall mean all of them; | |||||||

| Fundamental Warranties | means the Warranties listed at Paragraphs 1.1, 1.2, 1.3.1, 1.3.2, 1.3.4, 1.3.6, 1.4, 2, 3.1 to 3.8 (inclusive), 3.9, 3.10.4, 3.10.5, 3.12 and 30 of Schedule 4-A; | |||||||

| Fundamental Warranty Claim | means any claim by the Purchaser (or its permitted assigns) in respect of a breach of any of the Fundamental Warranties; | |||||||

Certain identified information has been excluded from the exhibit because it is both (i) not material and (ii) would likely cause competitive harm to the Company, if publicly disclosed. Brackets with triple asterisks denote omissions.

| Games | means all video, mobile and computer games and all other interactive entertainment software products made in whole or part by, for and/or on behalf of, any Group Company or otherwise assigned to any Group Company or in respect of which any Group Company has rights to Exploit including (without limitation) Top Eleven; | |||||||

| Game Technology | (a) the development tools, Software libraries, game engines, rendering engines, meshes and models, textures, physics engines, emulator code, generic sound libraries (excluding voice and music), subroutines and back end materials of the Group which are of general use or applicability in video games (and interactive entertainment products and services) or are reused from or in its other projects; and (b) any modification, adaptation or improvement thereto; | |||||||

| GDPR | means the General Data Protection Regulation (EU) 2016/679; | |||||||

| Group | means the Company and any subsidiaries of the Company from time to time and Group Company shall mean each of the Company and any subsidiary of the Company; | |||||||

| Guarantor Affiliate | means any person who is either connected with or an Affiliate of any Guarantor, but excluding any person that is a Seller Affiliate; | |||||||

| Guarantor Warranties | means those warranties listed in Schedule 4-B; | |||||||

| Guarantor Warranty Claim | means any claim by the Purchaser (or its permitted assigns) in respect of a breach of any of the Guarantor Warranties; | |||||||

| IFRS | means International Accounting Standards and International Financial Reporting Standards issued by the International Accounting Standards Board (or a predecessor body) and related interpretations issued by the IFRS Interpretations Committee (or a predecessor body), each as adopted by the European Commission in accordance with EU Regulation 1606/2002; | |||||||

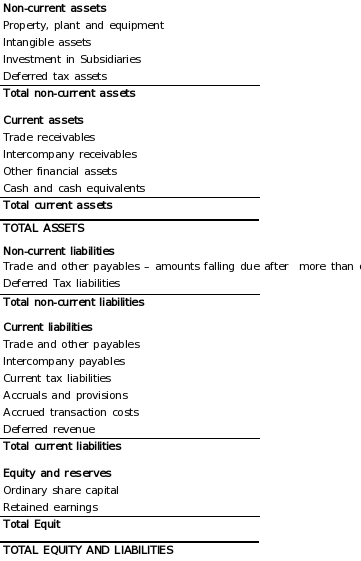

| Illustrative Pro-Forma Balance Sheet | means the illustrative pro-forma balance sheet set out at part C of Schedule 7; | |||||||

| Indemnity Claim | means a claim by the Purchaser (or its permitted assigns) in respect of any of the indemnities in Clause 10; | |||||||

| Independent Accountant | means any independent chartered accountant appointed pursuant to and in accordance with Schedule 8; | |||||||

| Insurer | means Liberty Mutual Insurance Europe SE; | |||||||

Certain identified information has been excluded from the exhibit because it is both (i) not material and (ii) would likely cause competitive harm to the Company, if publicly disclosed. Brackets with triple asterisks denote omissions.

Intellectual Property | means any and all intellectual property rights or analogous intangible rights including all patents, trade marks, service marks, business names, trade names, domain names, logos and get-up, emblems, registered designs, unregistered designs, copyrights (including copyright in any computer programs), rights relating to layout, design graphics, and text, rights relating to look and feel, formulas and rights to any underlying source code and object code, all database rights, Software programmes and source codes, topography rights and all other forms of intellectual or industrial property (whether or not registered or registerable and for the full period thereof and all extensions and renewals thereof and applications for registration of or otherwise in connection with the foregoing), know-how, inventions, formulae, confidential or secret processes and information (in each case in any part of the world), unfair competition rights and rights to ▇▇▇ for passing off or past infringements, rights under licences, consents, order, statutes or otherwise in respect of any rights of the nature specified above and rights of the same or similar effect or nature as the foregoing in any jurisdiction; | |||||||

| IP Assignment | means the intellectual property assignment between Nordeus Serbia and the Company dated 1 May 2013 (with all annexes), by which Nordeus Serbia transferred the copyright and trade marks referred to therein to the Company; | |||||||

| IT Contracts | means all written arrangements and agreements under which any third party (including, without limitation, any source code deposit agents) provides to any Group Company any element of, or services relating to, the IT System, including leasing, hire-purchase, licensing, maintenance and services agreements; | |||||||

| IT System | means all computer and other information technology infrastructure owned, used, licensed or controlled by any Group Company including all hardware (including network and telecommunications equipment), Software (in both source code and object code), firmware, networks, connecting media and storage media and all manuals or other documents relating thereto as used in the operation of the Business as currently conducted; | |||||||

Certain identified information has been excluded from the exhibit because it is both (i) not material and (ii) would likely cause competitive harm to the Company, if publicly disclosed. Brackets with triple asterisks denote omissions.

| Key Person | means any person who is on or after Completion (in the case of the Seller) at any time and (in the case of a Guarantor) at any time whilst relevant Guarantor is employed or engaged by any member of the Purchaser’s Group: (a) employed or engaged as an employee, director, consultant of or freelancer for a Relevant Business; and/or (b) employed or engaged as an employee, director, consultant of or freelancer of any member of the Purchaser’s Group and with whom at such time or at any time in the period commencing at Completion and ending on such time the Seller or relevant Guarantor dealt; | |||||||

Know-How | means all information not publicly known which is owned and/or used by any Group Company and/or the Business, existing in any form (including paper, electronically stored data, magnetic media, film and microfilm); | |||||||

| Liabilities | means all liabilities, debts, duties, commitments and obligations of every description, whether deriving from contract, common law, statute or otherwise, whether present or future, actual, accrued or contingent or ascertained or unascertained and whether owed or incurred severally, jointly or jointly and severally or as a principal or surety; | |||||||

| Loss | means in relation to any matter, any loss, liabilities, cost, fee, charge, damage, award, interest, penalty, fine, tax or expense (including all reasonable and vouched expenses of investigations and enforcement, and reasonable and vouched legal or other professional fees and expenses) relating to that matter; provided that the foregoing shall exclude in all cases punitive, special and exemplary damages, unless actually paid; | |||||||

Management Accounts | means the management accounts of the Group Companies for the period from the Accounts Date until the Management Accounts Date, comprising a balance sheet and profit and loss account; | |||||||

| Management Accounts Date | means 31 March 2021; | |||||||

Certain identified information has been excluded from the exhibit because it is both (i) not material and (ii) would likely cause competitive harm to the Company, if publicly disclosed. Brackets with triple asterisks denote omissions.

| Material Adverse Change | means any material adverse change in the business, operations, assets, or financial condition of any Group Company or any event or circumstances that may result in such a material adverse change; provided that no change, event or circumstance relating to or arising from any of the following shall be taken into account in determining whether there has been a Material Adverse Change: (i) changes in the industry in which any Group Company operates, (ii) general economic conditions, or changes in any financial, debt, credit, capital, banking or securities markets or conditions, in any location where any Group Company’s business is conducted, (iii) any natural disaster, disease outbreaks, epidemics and pandemics (including the COVID-19 Pandemic) government shutdown or any acts of terrorism, sabotage, cyber-intrusion, military action or war (whether or not declared) or any escalation or worsening thereof, (iv) changes in applicable law or IFRS, or in either case, the enforcement or interpretation thereof, or (v) any item or matter to the extent disclosed in the Disclosure Schedule; provided, further, that with respect to clauses (i), (ii) and (iv), the Group Company taken as a whole is not disproportionately affected thereby relative to other similarly situated companies, but if so disproportionately affected, then, to the extent not otherwise excluded from the definition of Material Adverse Change, only such incremental disproportionate impact or impacts shall be taken into account in determining whether there has been a Material Adverse Change; | |||||||

Material Contract | means any Contract which is of material importance to the business, financial position or profits or assets of any Group Company, other than (a) non-disclosure and confidentiality agreements entered into by the Company in the ordinary and usual course of business, (b) employee invention assignment agreements and consulting agreements based on the Company’s standard form of agreement, copies of such forms which have been made available to Purchaser in the Data Room, and (c) contracts with customers and end users on the Company’s standard forms of customer agreement, copies of such forms which have been made available to Purchaser in the Data Room; and (d) licenses for Open Source Software ((a)-(d) collectively, Standard IP Agreements)); | |||||||

| Net Working Capital | has the meaning given in Paragraph 1.5 of Part A of Schedule 7; | |||||||

Certain identified information has been excluded from the exhibit because it is both (i) not material and (ii) would likely cause competitive harm to the Company, if publicly disclosed. Brackets with triple asterisks denote omissions.

| Nordeus Serbia | means Preduzeće za projektovanje i razvoj softvera Nordeus doo Beograd (Novi Beograd) (corporate identification number: 20622849); | |||||||

| Nordeus Serbia SPA | means the share purchase agreement dated 27 July 2020 (with all annexes) and made between the Company and ▇▇▇▇▇▇ ▇▇▇▇▇▇▇▇▇▇▇, ▇▇▇▇▇ ▇▇▇▇▇▇▇ and ▇▇▇▇ ▇▇▇▇▇▇▇▇▇▇▇▇▇▇; | |||||||

| Nordeus UK | means Nordeus Limited, a private limited company incorporated in England under company number 09242278 with its registered office at 8th Floor ▇▇ ▇▇▇▇▇▇▇▇▇▇ ▇▇▇▇▇▇, ▇▇▇▇▇▇, ▇▇▇▇▇▇ ▇▇▇▇▇▇▇, ▇▇▇▇ ▇▇▇; | |||||||

| Open Source Software | means software which is subject to any license meeting the definition of “Open Source” promulgated by the Open Source Initiative, available online at ▇▇▇▇://▇▇▇.▇▇▇▇▇▇▇▇▇▇.▇▇▇/▇▇▇.▇▇▇▇, or which has a substantially similar effect, including (without limitation) any GNU General Public License, Library General Public License, Lesser General Public License, Mozilla Public License, Berkeley Software Distribution license, MIT, and the Apache License; | |||||||

Other Transaction Bonus Liability | means any Loss incurred by any Group Company (other than an Employee Tax Liability) including employer tax related liabilities, security contributions, Tax, Apprenticeship Levy or equivalents in any other jurisdiction, in connection with the payment of any of the Transaction Bonuses and/or Success Sharing Plan Milestone; | |||||||

| Outstanding Claim | means a Relevant Claim that has been notified by the Purchaser to the Guarantors’ Representative pursuant to a Claim Certificate delivered in accordance with the terms of Schedule 6, but which is not a Resolved Claim as at a Relevant Payment Date; | |||||||

Percentage Personal Data | means 94.5% or, if the Purchaser purchases the Call Option Shares pursuant to the Call Option Agreement, 100%; has the meaning given in Article 4(1) of the GDPR; | |||||||

| Post-Completion Tax Period | means any taxable period (or portion thereof) beginning after the Completion Date; | |||||||

| Pre-Completion Tax Period | means any taxable period (or portion thereof) ending on or before the Completion Date; | |||||||

| Premises | means the properties in respect of which details are set out in Schedule 3; | |||||||

| Prospective Equity Recipients | means the following employees, former employees and advisors of the Group: [***] | |||||||

| Purchaser Common Stock | means shares of common stock, par value $0.01 per share, of the Purchaser; | |||||||

Certain identified information has been excluded from the exhibit because it is both (i) not material and (ii) would likely cause competitive harm to the Company, if publicly disclosed. Brackets with triple asterisks denote omissions.

| Purchaser’s Group | means the Purchaser and any Affiliate of the Purchaser including, without limitation, any direct or indirect holding company of the Purchaser and any direct or indirect subsidiary of the Purchaser or of any such holding company and shall include, from Completion, any Group Company; | |||||||

| Purchaser’s Solicitors | means ▇▇▇▇▇▇▇▇▇ & ▇▇▇▇▇ LLP of ▇ ▇▇▇▇▇ ▇▇▇▇▇, ▇▇▇▇▇▇ ▇▇▇▇ ▇▇▇; | |||||||

| Relevant Agreements | means any option, profit sharing or other agreement or arrangement entered into between the Seller, a Seller Affiliate, any one or more Guarantors or Guarantor Affiliates (on the one hand) and any Group Company (on the other hand), but excluding any contract of employment between or among any such parties; | |||||||

| Relevant Business | means the business of developing, producing and Exploiting video games on any platform (including, without limitation, mobile) or by any means howsoever carried out; | |||||||

| Relevant Claim | means a Warranty Claim, Indemnity Claim or a Tax Covenant Claim; | |||||||

| Relevant Holding Company | means: (a) in respect of ▇▇▇▇▇▇ ▇▇▇▇▇▇▇▇▇▇▇, Pilot’s Dream Limited (registered number 526417); (b) in respect of ▇▇▇▇ ▇▇▇▇▇▇▇▇▇▇▇▇▇▇, Samurai Actor Limited (registered number 526419); and (c) in respect of Milan Jovović, ▇▇▇▇▇▇ ▇▇▇▇▇▇ Limited (registered number 526418); | |||||||

| Relevant Indemnity Claim | means the covenants to pay set out in clauses 10.1.2, 10.1.3, 10.1.4 and 10.1.5; | |||||||

| Relevant Payment | means the Retention Payment, an Earn-Out Payment or any payment by the Purchaser pursuant to Clause 5; | |||||||

| Relevant Payment Date | means the Retention Payment Date or any Earn-Out Calculation Date or the date of any payment by the Purchaser pursuant to Clause 5; | |||||||

| Relevant Percentage | means, in respect of a Guarantor, the percentage listed against that Seller in column (2) of Schedule 1; | |||||||

| Relevant Period | means the period from Completion until the date falling three years after Completion; | |||||||

Certain identified information has been excluded from the exhibit because it is both (i) not material and (ii) would likely cause competitive harm to the Company, if publicly disclosed. Brackets with triple asterisks denote omissions.

Relief Reorganisation | has the meaning given to it in Paragraph 1 of Schedule 9; means (i) the reorganisation of the Group whereby Nordeus Serbia was transferred to the Company pursuant to the Nordeus Serbia SPA and all transactions in connection with such reorganisation and any of the documents to implement such reorganisation and transactions including the Nordeus Serbia SPA and (ii) the winding-up, liquidation or dissolution of the Dissolved Entities and all transactions in connection with such winding-up, liquidation or dissolution and any of the documents to implement such winding-up, liquidation or dissolution and transactions; | |||||||

| Representatives | means, in relation to a person, its respective directors, officers, employees, agents, consultants and professional advisers; | |||||||

| Reserved Sum | has the meaning given to it in clause 4.1.2(a); | |||||||

| Resolved Claim | means a Relevant Claim that has been: (i) agreed in writing between the Purchaser and the Seller as to both liability and quantum, in accordance with the terms of Schedule 6; (ii) determined by a court of competent jurisdiction and each of the applicable parties thereto either has no right to appeal such determination (or the time for exercising such right of appeal has expired or terminated) or has confirmed in writing that it does not intend to exercise any right to appeal such determination; or (iii) unconditionally withdrawn by the Purchaser in writing; | |||||||

| Restricted Supplier | means in respect of the Seller or a Guarantor any person at any particular time: | |||||||

| (i) who, during the period of 24 months ending on the Completion Date was a licensor or material supplier of goods, services and/or rights to any Group Company; | ||||||||

| (ii) who, during the period commencing on Completion and ending at such time was a licensor or material supplier of goods, services and/or rights to any Group Company; | ||||||||

| Retention Payment | means an amount equal to [***]; | |||||||

| Retention Payment Date | means the date falling 18 months after the Completion Date; | |||||||

| Securities Act | means the Securities Act of 1933, as amended; | |||||||

| SEC | means the United States Securities and Exchange Commission; | |||||||

Certain identified information has been excluded from the exhibit because it is both (i) not material and (ii) would likely cause competitive harm to the Company, if publicly disclosed. Brackets with triple asterisks denote omissions.

| SEC Documents | means the Purchaser’s Annual Report on Form 10-K for the fiscal year ended March 31, 2020 and any other reports, proxy statements and information the Purchaser filed with or furnished to the SEC since March 31, 2020; | |||||||

| Seller Affiliate | means any person who is either connected with or an Affiliate of the Seller, but excluding, following Completion, the Group Companies; | |||||||

| Seller Shareholder | means any person that is a shareholder of the Seller as at Completion; | |||||||

| Seller’s Attorneys | means (i) Fenwick & West LLP of ▇▇▇ ▇▇▇▇▇▇▇▇▇▇ ▇▇▇▇▇▇, ▇▇▇▇▇▇▇▇ ▇▇▇▇, ▇▇ ▇▇▇▇▇, ▇▇▇▇▇▇ ▇▇▇▇▇▇ and (ii) ▇▇▇▇▇▇ ▇▇▇ LLP of Ten ▇▇▇▇▇▇▇▇▇ ▇▇▇▇▇▇▇, ▇▇▇▇▇▇ ▇, ▇▇▇ ▇▇▇▇, ▇▇▇▇▇▇▇; | |||||||

| Seller’s Attorneys’ Bank Account | means the client account of ▇▇▇▇▇▇ ▇▇▇ LLP with the following details: [***] However, if any payment under this Agreement is to be made to the Seller Attorneys’ Bank Account in EUR, then the client account of ▇▇▇▇▇▇ ▇▇▇ LLP with the following details shall be the Seller’s Attorneys’ Bank Account: [***] | |||||||

| Serbian Subsidiary Shareholder Resolutions | means the shareholder resolutions of each of the Subsidiaries incorporated in Serbia approving and effecting the appointment of Seb ▇▇▇▇▇▇▇ and ▇▇▇▇▇▇ ▇▇▇▇ as directors of each of such Subsidiaries in the agreed form; | |||||||

| Shares | has the meaning given to it in Recital (A); | |||||||

| Shares Consideration | has the meaning given in Clause 3.1; | |||||||

| Shareholders’ Agreement | means the shareholders’ agreement entered in relation to the Seller and Group dated 18 December 2013 (as amended); | |||||||

| Software | any and all computer programs in both source and object code form, including all modules, routines and sub-routines and all source and other preparatory materials relating to the above, including user requirements, functional specifications and programming specifications, ideas, principles, programming languages, algorithms, flow charts, logic, logic diagrams, orthographic representations, file structures, coding sheets, coding and including any manuals or other documentation relating to the above, and computer generated works; | |||||||

| Subsidiary | means any subsidiary of the Company, including (without limitation) those subsidiaries listed in Part B of Schedule 2; | |||||||

Certain identified information has been excluded from the exhibit because it is both (i) not material and (ii) would likely cause competitive harm to the Company, if publicly disclosed. Brackets with triple asterisks denote omissions.

| Subsidiary Completion Board Minutes | means the minutes of the meetings of the board of directors of Almost There Entertainment Limited (registered number 618750) to take place at or before Completion in the agreed form; | |||||||

| Success Sharing Plan | means the cash bonus plan adopted by the Group in March 2020 and known as the ‘Nordeus Success Sharing Plan’ (as amended); | |||||||

| Success Sharing Plan Milestone | means the bonuses to be paid to certain Employees in connection with the milestone reached in February 2021 pursuant to the Success Sharing Plan up to a maximum aggregate amount of [***] and (together with all Employee Tax Liability and Other Transaction Bonus Liabilities payable in connection with such bonuses) not exceeding in aggregate the Success Sharing Plan Milestone Amount; | |||||||

| Success Sharing Plan Milestone Amount | means [***], being the February milestone payment amount under the Success Sharing Plan; | |||||||

| Target Net Working Capital | means [***]; | |||||||

Tax or Taxation | have the meaning attributed to them in the Tax Covenant; | |||||||

| Tax Authority | has the meaning given to it in Paragraph 1 of Schedule 9; | |||||||

| Tax Covenant | means the deed of covenant against Taxation set out in Schedule 9; | |||||||

| Tax Covenant Claim | means a claim pursuant to the Tax Covenant; | |||||||

| Tax Returns | means all tax returns of the Company and any Subsidiary as required by a Tax Authority and any accompanying documentation required to be filed with any such tax returns; | |||||||

| Tax Warranties | means those warranties of the Seller listed in Schedule 5; | |||||||

| Tax Warranty Claim | means a claim in respect of a breach of any of the Tax Warranties; | |||||||

| Transaction Bonuses | means the bonuses to be paid to certain Employees in connection with the sale of the Shares following Completion pursuant to the Success Sharing Plan and other objective business criteria up to a maximum aggregate amount of [***] and (together with all Employee Tax Liability and Other Transaction Bonus Liabilities payable in connection with such bonuses) not exceeding in aggregate the Transaction Bonus Amount; | |||||||

| Transaction Bonus Amount | means [***]; | |||||||

Certain identified information has been excluded from the exhibit because it is both (i) not material and (ii) would likely cause competitive harm to the Company, if publicly disclosed. Brackets with triple asterisks denote omissions.

| Transaction Costs | means (a) an amount equal to 50% of the premium and any other reasonable and vouched fees, costs and expenses (including professional fees of any adviser engaged by the Insurer) payable by the Purchaser to the Insurer in connection with the preparation, negotiation, execution and binding of the W&I Policy; plus (b) without duplication and to the extent unpaid as of the Effective Time, the amount of all fees, commissions, costs and expenses payable or reimbursable by the Group Companies in connection with this Agreement, any Transaction Document and transactions contemplated thereby, whether accrued or not, including: (i) any fees, costs and expenses of legal advisers, counsel, consultants, accountants, investment bankers or other advisors and service providers; (ii) any brokerage, fees, commissions, finders’ fees or financial advisory fees and, in each case, related costs and expenses; (iii) any fees, costs and expenses or payments related to any transaction bonus, discretionary bonus, any change of control payments, retention, severance or similar amounts, in each case payable, triggered or accelerated as a result of or in connection with the consummation of the transactions contemplated herein (including the employer portion of any payroll, social security, unemployment or similar Taxes in respect of any employees of any Group Company), but excluding (x) “double trigger” obligations that become due and payable following Completion due to actions taken by or at the direction of Purchaser (other than those required by law or where the “double trigger” obligation is due and payable as a result of a termination by a Group Company prior to Completion) and (y) the Success Sharing Plan Milestone Amount and the Transaction Bonus Amount. | |||||||

Transaction Documents | means this Agreement, the Disclosure Letter, the Call Option Agreement and any other agreement or document referred to in this Agreement as being in the agreed form; | |||||||

| Trapped Cash | means as at the Effective Time cash or cash equivalents held by on or behalf of a Group Company that may not be lawfully used by that Group Company to repay any Borrowings or lent or paid by that Group Company to the Purchaser; provided that Trapped Cash shall not include the €500,000 held as a lease deposit at Nordeus Serbia in connection with the lease held by Nordeus Serbia for the Group’s office space in Belgrade, Serbia; | |||||||

Certain identified information has been excluded from the exhibit because it is both (i) not material and (ii) would likely cause competitive harm to the Company, if publicly disclosed. Brackets with triple asterisks denote omissions.

Warranties | means: (i) as to the Seller, the Business Warranties, the Fundamental Warranties, the Tax Warranties and the warranties given by Seller in Clause 9, and (ii) as to a particular Guarantor, its Guarantor Warranties and the warranties given by such Guarantor in Clause 9, and Warranty shall mean any one of them; | |||||||

| Warranty Claim | means any claim by the Purchaser (or its permitted assigns) against (i) the Seller in respect of a breach of any of the Warranties (other than Guarantor Warranties) and (ii) a particular Guarantor in respect of a breach of any of its Guarantor Warranties; and | |||||||

| W&I Policy | means the policy of warranty and indemnity insurance issued to the Purchaser by the Insurer on or before the date of this Agreement in the agreed form; | |||||||

$ or US$ | means United States Dollars, the lawful currency of the United States of America. | |||||||

In this Agreement, unless otherwise specified, references to:

1.1.1any statute or statutory provision are to that statute or statutory provision as from time to time amended, modified, extended, consolidated or re-enacted whether before or after the date of this Agreement and any subordinate legislation made from time to time under that statute or statutory provision that is in force at the date of this Agreement;

1.1.2a person includes any individual, company, firm, corporation, undertaking, partnership, joint venture, association, institution or government (whether or not having a separate legal personality);

1.1.3a company include any company, corporation or body corporate, where incorporated;

1.1.4a party means a party to this Agreement and shall include its assignees and successors in title if and as permitted in accordance with this Agreement;

1.1.5Recitals, Clauses and Schedules are references to the recitals, clauses and schedules of this Agreement;

1.1.6one gender include all genders and references to the singular include the plural and vice versa;

1.1.7a document are references to that document as from time to time varied or supplemented;

1.1.8a document in the agreed form are references to such document in the terms agreed by the parties and for the purposes of identification initialled by or on behalf of each party on or before the date of this Agreement;

1.1.9a subsidiary or holding company shall be construed in accordance with sections 7 and 8 of the Companies Act;

1.1.10a person being connected with another person shall be construed in accordance with section 10 of the Taxes Consolidation ▇▇▇ ▇▇▇▇;

1.1.11written or in writing includes email; and

Certain identified information has been excluded from the exhibit because it is both (i) not material and (ii) would likely cause competitive harm to the Company, if publicly disclosed. Brackets with triple asterisks denote omissions.

1.1.12any Irish legal term for any action, remedy, method of judicial proceeding, legal document, legal status, court official or any legal concept or thing shall, in respect of any jurisdiction other than Ireland be deemed to include what most nearly approximates in that jurisdiction to the Irish legal term.

1.2The headings in this Agreement are for guidance only and shall not affect its interpretation.

1.3Any phrase in this Agreement introduced by the terms including, include, in particular or any similar expression shall be construed as illustrative and shall not limit the sense of the words preceding or following those terms.

1.4The Schedules form part of this Agreement and will be of full force and effect as though they were expressly set out in the body of this Agreement and any reference to “this Agreement” shall include reference to the Schedules.

1.5Where any provision is qualified or phrased by reference to the “ordinary course of business”, that reference shall be construed as meaning the ordinary and usual course of business of the Group as carried on in the 12 months prior to Completion.

1.6In this Agreement, to the extent that shall mean “to the extent that” and not solely “if”, and similar expressions shall be construed in the same way.

2.Agreement for Sale

2.1On and subject to the terms of this Agreement, the Seller shall sell to the Purchaser, free from all Encumbrances, and the Purchaser shall purchase from the Seller the Shares together with all rights attached or accruing to it (including the right to receive all distributions and dividends declared, paid or made in respect of such Share) with effect from Completion.

2.2The Seller hereby unconditionally and irrevocably approves and waives any right of pre-emption or other restriction on transfer in respect of the Shares conferred on it (whether pursuant to the constitution of the Company, the Shareholders’ Agreement or otherwise) and shall procure before Completion the irrevocable waiver of any such right or restriction conferred on any other person.

3.Consideration

3.1The total consideration payable by the Purchaser to the Seller in respect of the sale of the Shares (the Shares Consideration) shall be the aggregate of:

3.1.1the Cash Consideration as adjusted in accordance with Clause 5;

3.1.2the Consideration Shares;

3.1.3the Retention Payment (if and to the extent payable in accordance with the terms of this Agreement); and

3.1.4the Earn-Out Payments (if and to the extent payable in accordance with the terms of this Agreement), which shall be calculated and payable in accordance with Schedule 10.

3.2The Purchaser’s obligation to pay the Shares Consideration shall be satisfied by:

3.2.1the payment by the Purchaser to the Seller on Completion of the sum of $120,487,593 in cash in accordance with Clause 7.2.3(a) (the Cash Consideration); provided that Purchaser and the Seller may mutually agree in writing (including by email) that the Cash Consideration be paid in EUR based on the Designated Exchange Rate;

Certain identified information has been excluded from the exhibit because it is both (i) not material and (ii) would likely cause competitive harm to the Company, if publicly disclosed. Brackets with triple asterisks denote omissions.

3.2.2the issuance and delivery by the Purchaser to the Seller on Completion of an aggregate of 515,181 new Purchaser Common Stock in accordance with Clause 7.2.3(b) (the Consideration Shares);

3.2.3subject to Clause 4, the payment by the Purchaser of the Retention Payment to the Seller on the Retention Payment Date; and

3.2.4if applicable, the payment by the Purchaser of any amount payable by the Purchaser pursuant to Clause 5.3;

3.2.5as applicable, the payment by the Purchaser to the Seller of the part of any Earn-Out Payment that relates to the sale of the Shares in accordance with Schedule 10,

and any payments in cash shall be paid in accordance with Clause 21.1.

3.3The amount of the Cash Consideration shall be deemed adjusted following Completion in accordance with Clause 5 and, to the extent permitted by law, shall be reduced by the amount of any payment made by the Sellers to the Purchaser as a result of any Relevant Claim or any other claim under this Agreement; provided that any reduction as a result of a Relevant Claim shall not operate to reduce the Consideration for the purpose of the liability caps in paragraph 2 of Schedule 6.

3.4Within 5 Business Days following Completion, the Purchaser shall file with the SEC an automatic shelf registration statement (as defined in Rule 405 under the US Securities Act) on Form S-3 (a Shelf Registration Statement) relating to the offer and sale of the Consideration Shares by the Seller (but excluding any underwritten offering or underwritten block trade), and the Purchaser shall use its commercially reasonable efforts to (i) cause such Shelf Registration Statement to become effective under the Securities Act as soon as practicable and (ii) maintain the effectiveness of such Shelf Registration Statement at all times during which any such Consideration Shares are to be offered and sold by the Seller and at all times relevant to enable the resale of those Consideration Shares, in each case until all of the Consideration Shares covered by such Shelf Registration Statement have been disposed of in accordance with the intended methods of distribution by the Seller set forth in such Shelf Registration Statement or, if earlier, on such date on which the Consideration Shares may be transferred under Rule 144 as promulgated under the Securities Act without volume or manner of sale limitations. The Seller shall be given a reasonable opportunity to review and comment on the Shelf Registration Statement before it is filed with the SEC, and the Purchaser shall consider in good faith any comments from the Seller.

3.5The Seller hereby represents and warrants that the following statements are true, accurate and not misleading:

3.5.1it is receiving the Consideration Shares as provided under the terms of this Agreement for investment for its own account and not with a view to, or for resale in connection with, the distribution or other disposition thereof, other than transfers to the Guarantors and Seller Shareholders in each case in accordance with Clause 16;

3.5.2it has been given the opportunity to obtain any information or other documents which it deems necessary to evaluate the merits and risks related to its investment in the Consideration Shares and the Seller’s knowledge and experience in financial and business matters are such that the Seller is capable of evaluating the capital structure of the Purchaser and its subsidiaries, the business of the Purchaser and its subsidiaries (including the Purchaser) and the merits and risks of owning the Consideration Shares;

3.5.3its financial condition is such that the Seller can afford to bear the economic risk of holding the Consideration Shares for an indefinite period of time and has adequate means for providing for its current needs and contingencies and to suffer a complete loss of its investment in the Consideration Shares. The Seller’s overall commitment to investments

Certain identified information has been excluded from the exhibit because it is both (i) not material and (ii) would likely cause competitive harm to the Company, if publicly disclosed. Brackets with triple asterisks denote omissions.

which are not readily marketable is not disproportionate to its net worth. The Seller’s investment in the Consideration Shares will not cause such overall commitment to become excessive;

3.5.4it has had an opportunity to consult independent tax and legal advisors, and the Seller’s decision to consummate the transactions contemplated hereby has been based solely upon the Seller’s evaluation. The Seller is not relying on any statements made by the Purchaser or any of its Affiliates, members, directors, officers, managers, attorneys, employees, agents or other professional advisors in connection with its decision to consummate the transactions contemplated hereby, other than as set forth in this Agreement or as expressly provided in the other agreements delivered in connection with this Agreement; and

3.5.5it understands that, other than pursuant to an exemption from registration under the Securities Act or in connection with a registration thereunder, substantial restrictions exist on transferability of the Consideration Shares and any portion thereof and that the Seller may not be able to liquidate its investment in the Consideration Shares. Such Seller understands that any instruments representing the Consideration Shares may bear legends restricting the transfer thereof. The Seller has been advised that an investment in the Consideration Shares is speculative and is subject to a number of risks (including the risk that the Purchaser, the Company or any of their respective Affiliates will not generate any profits and the other risks set forth in the SEC Documents), and should be considered only by persons who are able to sustain a complete loss of their investment and to hold the Consideration Shares for a significant and indefinite period of time.

4.Set-Off against the Retention Payment

4.1Subject to Clause 11.2 and all applicable limitations of liability contained in this Agreement, if on the Retention Payment Date:

4.1.1some or all of a Due Amount or Amounts is or are outstanding and has or have not been paid to the Purchaser, such of the Due Amount or Amounts as is or are outstanding and does or do not exceed in aggregate the Retention Payment (and the Seller’s liability to pay the same) shall be set off against the Retention Payment, and the Purchaser’s obligation to make the Retention Payment shall be replaced by an obligation to make the Retention Payment as reduced pro tanto by the amount so set off; and/or

4.1.2there is an Outstanding Claim, the Purchaser shall:

(a)withhold from the Retention Payment an amount equal to the Estimated Liability or, if lower, the full amount of the Retention Payment as reduced pro tanto by the amount set off pursuant to clause 4.1.1 (Reserved Sum); and

(b)defer payment of the Reserved Sum until such time as the Outstanding Claim has become a Resolved Claim when the Reserved Sum shall be set off or paid pursuant to Clause 4.2.

4.2Where a Reserved Sum has been withheld by the Purchaser pursuant to Clause 4.1.2 in respect of an Outstanding Claim, upon such Outstanding Claim becoming a Resolved Claim after the Retention Payment Date:

4.2.1such of the Due Amount as does not exceed the Reserved Sum in respect of such Resolved Claim (and the Seller’s liability to pay the same in respect of the relevant Resolved Claim) shall be set off against such Reserved Sum, and the Purchaser’s obligation to pay the Reserved Sum shall be replaced by an obligation (subject to clause 4.2.2) to pay the Reserved Sum as reduced pro tanto by the amount so set off in respect of such Outstanding Claim and any other Resolved Claim; and

Certain identified information has been excluded from the exhibit because it is both (i) not material and (ii) would likely cause competitive harm to the Company, if publicly disclosed. Brackets with triple asterisks denote omissions.

4.2.2the Purchaser shall pay to the Seller the balance of the corresponding Reserved Sum (if any) as reduced a) pro tanto by the amount set off pursuant to Clause 4.2.1 in respect of such Outstanding Claim and any other Resolved Claim not satisfied by the Reserved Sum (or payment by the Seller) in respect of such Resolved Claim and b) by the amount of an Estimated Liability as exceeds the Reserved Sum in respect of any other Outstanding Claim which has not become a Resolved Claim (the amount of such Estimated Liability as so reduces the amount to be paid by the Purchaser in respect of a Resolved Claim pursuant to this clause 4.2.2 to be added to the Reserved Sum in respect of such other Outstanding Claim). Such payment shall be made by the Purchaser within 10 Business Days of the Outstanding Claim becoming a Resolved Claim.

4.3Subject to all applicable limitations of liability contained in this Agreement, nothing in this Clause 4 shall prejudice, limit or otherwise affect:

4.3.1any right or remedy the Purchaser may have against the Seller from time to time, whether arising under this Agreement or any Transaction Document or otherwise (other than in respect of such of a Due Amount which has been set off against a Reserved Sum pursuant to Clause 4.2.1); or

4.3.2the Purchaser’s right to recover against the Seller (other than in respect of such of a Due Amount which has been set off against a Reserved Sum pursuant to Clause 4.2.1), whether before or after the Retention Payment is made in accordance with this agreement.

4.4The amount of a Reserved Sum withheld by the Purchaser in accordance with this Clause 4 shall not be regarded as imposing any limit on the amount of any claims under this Agreement or any Transaction Document; subject in all cases to all applicable limitations of liability contained in this Agreement.

4.5If a Due Amount is not satisfied in full by way of set-off under Clause 4.1.1 or Clause 4.2.1, nothing in this Agreement shall prevent or otherwise restrict the Purchaser’s right to recover the balance from the Seller and the Due Amount (to the extent not so satisfied) shall remain fully enforceable against the Seller, but subject in all cases to all applicable limitations of liability contained in this Agreement.

5.Completion Accounts and Adjustment to the Cash Consideration

5.1 The Completion Accounts and Completion Accounts Pack shall:

5.5.1be prepared in accordance with Part A of Schedule 7;

5.5.2be agreed and determined in accordance with Part B of Schedule 7; and

5.5.3(in the case of the Completion Accounts) comprise in respect of the Group Companies:

(a)a consolidated profit and loss statement in respect of the period commencing on the Accounts Date and ending at the Effective Time;

(b)a consolidated balance sheet made up to the Effective Time based on the form and format of the Illustrative Pro-Forma Balance Sheet.

5.25.2 Following Completion, the amount of the Cash Consideration shall be adjusted as follows:

Net Working Capital

5.2.1there shall be deducted from the Cash Consideration a sum equal to the Percentage of the amount (if any) by which the Net Working Capital (as stated in the Completion Accounts) is less than the Target Net Working Capital; or

Certain identified information has been excluded from the exhibit because it is both (i) not material and (ii) would likely cause competitive harm to the Company, if publicly disclosed. Brackets with triple asterisks denote omissions.

5.2.2there shall be added to the Cash Consideration a sum equal to the Percentage of the amount (if any) by which the Net Working Capital (as stated in the Completion Accounts) is greater than the Target Net Working Capital; and

Completion Net Cash

5.2.3there shall be deducted from the Cash Consideration a sum equal to the Percentage of the amount (if any) by which the Completion Net Cash (as stated in the Completion Accounts) is less than the Estimated Net Cash; or

5.2.4there shall be added to the Cash Consideration a sum equal to the Percentage of the amount (if any) by which the Completion Net Cash (as stated in the Completion Accounts) is greater than the Estimated Net Cash.

5.3Within 10 Business Days of the later of a) the date on which the Completion Accounts is agreed or otherwise determined in accordance with this Agreement and b) the date the Purchaser has purchased the Call Option Shares pursuant to the Call Option Agreement or (if the Purchaser has not exercised the Call Option pursuant to the Call Option Agreement before the expiry of the Option Period (as defined in the Call Option Agreement)), the expiry of the Option Period:

5.3.1if Clause 5.2.1 applies, the Seller shall pay to the Purchaser an aggregate amount equal to the Percentage of the difference between the Target Net Working Capital and the Net Working Capital; or

5.3.2if Clause 5.2.2 applies, the Purchaser shall pay to the Seller an aggregate amount equal to the Percentage of the difference between the Target Net Working Capital and the Net Working Capital; and

5.3.3if Clause 5.2.3 applies, the Seller shall pay to the Purchaser an aggregate amount equal to the Percentage of the difference between the Estimated Net Cash and the Completion Net Cash; or

5.3.4if Clause 5.2.4 applies, the Purchaser shall pay to the Seller an aggregate amount equal to the Percentage of the difference between the Estimated Net Cash and the Completion Net Cash.

6.Borrowings, guarantees and release

6.1The Seller shall ensure that at Completion all monies, if any, owing by the Seller, any Guarantor or any Seller Affiliate or any Guarantor Affiliate to any Group Company are repaid in full.

6.2The Seller shall ensure that upon Completion, the Borrowings of the Group Companies that are then due for payment or repayment, as the case may be, are repaid, satisfied and extinguished in full and any Tax included in such Borrowings and required to be deducted or withheld is so deducted or withheld and accounted for to the relevant Tax Authority.

6.3The Purchaser and the Guarantors shall ensure that upon Completion the following Borrowings and other amounts, whether or not then due for payment or repayment are paid, repaid, satisfied and extinguished in full and any Tax included in such Borrowings and required to be deducted or withheld is so deducted or withheld and accounted for to the relevant Tax Authority:

6.3.1[***] payable to Founder Guarantors;

6.3.2the Success Sharing Plan Milestone Amount;

6.3.3the Transaction Bonus Amount;

Certain identified information has been excluded from the exhibit because it is both (i) not material and (ii) would likely cause competitive harm to the Company, if publicly disclosed. Brackets with triple asterisks denote omissions.

6.3.4[***] (less all Employee Tax Liability and Other Transaction Bonus Liabilities payable in connection with such amount) payable to the Prospective Equity Recipients.

(such Borrowings or other amounts being the Relevant Borrowings).

6.4If and to the extent that there are any Borrowings (other than the Relevant Borrowings) that have not reduced the Cash Consideration at Completion and/or Completion Net Cash pursuant to Schedule 7, then without prejudice to any other remedy available to the Purchaser, the Seller shall pay to the Purchaser on demand the amount of all such Borrowings and, if and to the extent applicable, the amount of all Loss incurred by the Purchaser and any Group Company arising directly or indirectly from or in connection with any failure by the Seller to pay, repay, satisfy or extinguish such Borrowings in accordance with clause 6.2.

6.5Each of the Seller and Guarantors undertake to the Purchaser that it or he has (or shall have upon Completion) procured the full and effectual release (without any provision or consideration for such release by any Group Company) of all guarantees, indemnities, mortgages, surety, security and similar commitments or arrangements given by or binding on any Group Company to any person in respect of any Liabilities of the Seller or any Seller Affiliate, Guarantor or Guarantor Affiliate (a Guarantee).

6.6Insofar as any Guarantee has not been so released, the Seller and each Guarantor shall, at the cost of the Seller or that Guarantor, execute and deliver all documents and take such actions as the Purchaser may reasonably request from time to time after Completion, in order to effect the release and discharge in full (on a non-recourse basis to the Purchaser and the Group Companies) of any such Guarantee. Pending each such release and discharge, the Seller shall pay to the Purchaser on demand the amount of all Losses incurred by the Purchaser and any Group Company arising directly or indirectly from or in connection with any such Guarantee.

6.7With effect from Completion, except in the case of the Relevant Borrowings (in which case this Clause 6.7 shall apply with effect from payment or repayment in full of the Relevant Borrowings), the Seller (and the Seller shall procure that any Seller Affiliate (other than a Guarantor or its Guarantor Affiliates)) shall release and, each of the Guarantors hereby release (and shall procure that its Guarantor Affiliates shall release) each Group Company from any and all Liabilities arising under or in connection with any Relevant Agreements or their termination. This release covers all Claims, Losses and Liabilities arising from such Liabilities whether or not such Liabilities are in existence at the date of this Agreement and whether or not in contemplation or otherwise known at the date of this Agreement by any of the parties.

6.8The Seller and, solely as to itself, each of the Guarantors hereby unconditionally and irrevocably warrants and undertakes that neither the Seller nor any Seller Affiliate (other than a Guarantor or its Guarantor Affiliates), or, in the case of the Guarantors, it or he or any of its Guarantor Affiliates has any Claim against any Group Company or against any of the officers, employees, servants or agents of any Group Company (collectively, the Released Parties) and on behalf of the Seller, any Seller Affiliate (other than a Guarantor or its Guarantor Affiliates) and, in the case of each of the Guarantors, its Guarantor Affiliates, hereby unconditionally and irrevocably releases and discharges each of the Released Parties (in the case of any Released Party (other than the Group Companies), in its or his capacity as an officer, employee, servant or agent of any Group Company) from any and all Claims where some or all of the Loss being claimed arises in the period on or prior to the Effective Time, which the Seller or any Seller Affiliate (other than a Guarantor or its Guarantor Affiliates), or each of the Guarantors and/or its Guarantor Affiliates, may have against such Released Parties (together with those Claims released pursuant to Clause 6.7, the Released Claims). Each of the Seller and the Guarantors acknowledges that it is its express intention when entering into the releases in Clause 6.7 and this Clause 6.8 that such releases cover all Released Claims whether or not the factual or legal basis for the Claim is known or could have been known by any person.

6.9Notwithstanding anything to the contrary herein, the foregoing Clauses 6.7 and 6.8 do not extend to, and the Released Claims shall not include: (a) any Claim to enforce the terms of, or any breach of, this

Certain identified information has been excluded from the exhibit because it is both (i) not material and (ii) would likely cause competitive harm to the Company, if publicly disclosed. Brackets with triple asterisks denote omissions.

Agreement or any Transaction Document, (b) any Claim with respect to claims for salary, wages, fees, expense reimbursement with respect to expenses, in each case incurred in the ordinary course of business and in accordance with the policies of any applicable Group Company, or benefits owed to such Person by any Group Company in such Person’s capacity as an employee or consultant of or service provider to any Group Company and in each case pursuant to their employment or consultancy agreement which has been Disclosed; (c) any Claim by such Person, if such Person is or was an officer or director of any Group Company, with respect to any rights available to such Person in their capacity as an officer or director of such entity under any indemnification agreement between such entity and such Person that has been Disclosed; (d) any Claim under any directors’ and officers’ or other fiduciary liability insurance policy maintained by any Group Company for the benefit of such Person to the extent such Claim is covered under such insurance policy without increase of the premium of such insurance policy or any other cost to any member of the Purchaser’s Group, (f) any Claim for Fraud by any member of the Purchaser’s Group (other than a Group Company), or (g) any Claim that cannot be released as a matter of law.

7.Completion

7.1Completion shall take place immediately following the execution of this Agreement by each of the parties when each of the matters set out in Clause 7.2 shall be effected.

7.2On Completion:

7.2.1the Seller and the Purchaser shall deliver to each other counterparts of the following documents duly executed by them:

(a)this Agreement;

(b)the Disclosure Letter;

(c)the Call Option Agreement.

7.2.2the Seller shall:

(a)cause to be delivered to the Purchaser or the Purchaser’s Solicitors (or, if so requested by the Purchaser, cause to be made available to the Purchaser or the Purchaser’s Solicitors):

(i)duly executed transfers of the Shares in favour of the Purchaser or its nominee together with the relevant share certificate relating to the Shares (or an indemnity in the agreed form in respect of any missing share certificate);

(ii)such waivers and consents, or other documents which the Purchaser may request prior to Completion and which may be required to give good title to the Share;

(iii)counterparts of any of the other Transaction Documents duly executed by all parties thereto other than the Purchaser and any member of the Purchaser’s Group;

(iv)copies of duly executed versions of any powers of attorney or other authorities under which any of the Transaction Documents may have been executed by any party thereto other than the Purchaser and any member of the Purchaser’s Group;

(v)in respect of the Seller, a tax reference number together with confirmation of the tax head to which it relates;

Certain identified information has been excluded from the exhibit because it is both (i) not material and (ii) would likely cause competitive harm to the Company, if publicly disclosed. Brackets with triple asterisks denote omissions.

(vi)the written resignations in the agreed form of:

(A)▇▇▇▇ ▇▇▇▇▇▇▇▇▇▇▇▇▇▇ and ▇▇▇▇▇ ▇▇▇▇▇▇▇ as directors of each of those Group Companies that they are directors of;

(B)▇▇▇▇▇▇ ▇▇▇▇▇▇▇▇▇▇▇ as a director of the Company; and

(C)▇▇▇▇ ▇▇▇▇▇▇▇▇▇▇ as a director of Nordeus Serbia;

(vii)copies of the Company Completion Board Minutes and Subsidiary Completion Board Minutes duly signed by the chairmen of such meetings and the Serbian Subsidiary Shareholder Resolutions duly executed along with the powers of attorney for registration of the changes contemplated by the Serbian Subsidiary Shareholder Resolutions;

(viii)evidence that the Seller and each of the Guarantors is authorised to enter into this Agreement and each of the Transaction Documents to which they are a party;

(ix)the amendment agreement to his employment agreement duly signed by ▇▇▇▇▇▇▇▇ ▇▇▇▇▇▇▇▇▇▇ and Nordeus Serbia; and

(x)a copy of the Deed of Termination duly executed by the parties thereto.

(b)procure that:

(i)a board meeting of the Company is duly convened and held at which the business referred to in the Company Completion Board Minutes shall be transacted (such business to include, without limitation, the appointment of such directors as may be indicated by the Purchaser, the passing of a valid resolution that the transfers referred to above be approved for registration, and that the Purchaser and/or its nominee be placed on the register of members of the Company as the holder of the Share);

(ii)a board meeting of each of the Subsidiaries is duly convened and held at which the business referred to in the Subsidiary Completion Board Minutes shall be transacted;

7.2.3subject to the Seller complying with its obligations under the preceding provisions of this Clause 7.2, the Purchaser shall:

(a)pay the Cash Consideration to the Seller;

(b)issue the Consideration Shares to the Seller in book entry form (subject to a restrictive legend provided by the Purchaser) and registered in the name of the Seller in an account for the Seller with the transfer agent of the Purchaser; and

(c)deliver to the Seller a copy of a secretary’s certificate of the Purchaser approving the Purchaser’s entry into this Agreement.

7.3Neither the Seller nor the Purchaser shall be obliged to complete this Agreement unless the Seller (in the case of the Purchaser) or the Purchaser (in the case of the Seller) shall have fulfilled all of its or their obligations under Clause 7.2. The Purchaser may in its absolute discretion waive any requirement contained in Clause 7.2.2.

Certain identified information has been excluded from the exhibit because it is both (i) not material and (ii) would likely cause competitive harm to the Company, if publicly disclosed. Brackets with triple asterisks denote omissions.

8.Period Following Completion