PURCHASE AGREEMENT dated as of the 9th day of November, 2010.

Exhibit 99.83

Execution Copy

PURCHASE AGREEMENT dated as of the 9th day of November, 2010.

AMONG:

BRIGUS GOLD CORP., a corporation incorporated and existing under the laws of Yukon

(“Brigus”)

- and -

SANDSTORM RESOURCES LTD., a corporation incorporated and existing under the laws of the Province of British Columbia

(“Sandstorm”)

WHEREAS Brigus owns 100% of an underground and open pit mine known as the Black Fox Mine (the “Project”), all as more particularly described in Schedule “A1” attached hereto and forming a part hereof as well as the Black Fox Extension as hereinafter defined (collectively, the “Property”);

AND WHEREAS Brigus has commenced open pit and initial underground production and Brigus intends to achieve steady state production from the underground portion of the Project in the second quarter of 2011 and to continue to develop the open pit portion of the Project;

AND WHEREAS Brigus has agreed to sell Sandstorm Payable Au and Sandstorm has agreed to purchase Sandstorm Payable Au and Brigus and Sandstorm have agreed to execute and deliver this Agreement;

AND WHEREAS the Parties are therefore desirous of executing and delivering this Agreement, all on and subject to the terms and conditions contained herein;

AND WHEREAS capitalized terms when used in these preambles shall have the respective meanings set forth in Article 1;

NOW THEREFORE in consideration of the premises and the mutual covenants and agreements herein contained and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged by each of the Parties, the Parties mutually agree as follows:

1. Definitions

“Annual Report” means a written report, in relation to any calendar year, detailing:

(i) the number of ounces of Au produced from the Property and delivered to an Offtaker in the applicable calendar year;

(ii) the names and addresses of each Offtaker to which the Au referred to in subsection (i) was delivered;

(iii) the number of ounces of Sandstorm Payable Au which have resulted or which are estimated to result from the Au referred to in subsection (i);

(iv) the number of ounces of Sandstorm Payable Au which have been delivered to Sandstorm with respect to the Au referred to in subsection (i), in accordance with the provisions of Article 8;

(v) a reconciliation between any provisional number of ounces of Sandstorm Payable Au specified in an Annual Report for a preceding calendar year and the final number of ounces of Sandstorm Payable Au for the applicable calendar year;

(vi) Au prices used by Brigus and its affiliates for short term and long term planning purposes with respect to the Property; and

(viii) the remaining Uncredited Balance and a calculation of how the Uncredited Balance was reduced during the applicable calendar year.

“Au” means gold;

“Audit Dispute Notice” has the meaning set forth in section 6(c)(i);

“Black Fox Extension” means the property that is described in Schedule “A2” attached hereto;

“Black Fox Property” means the Property exclusive of the Black Fox Extension;

“Brigus” means Brigus Gold Corp.;

“Brigus Event of Default” has the meaning set forth in section 9(a);

“Business Day” means any day other than a Saturday or Sunday or a day that is a statutory holiday in either Toronto, Ontario or Vancouver, British Columbia;

“Buy-Back Option” has the meaning set forth in Article 14;

“Buy-Back Purchase Price” means US$36,595,000 if the full Buy-Back Option is exercised by Brigus in accordance with Article 14 or such lesser amount if only part of the Buy-Back Option is exercised in accordance with Article 14;

“Cash Costs” means all costs per ounce of Au over the previous 24 months to mine and operate the Project, including processing and administrative costs, but excluding depreciation, interest and any financing costs, divided by the number of ounces of Payable Au produced over such period;

“Consumer Price Index” means the United States Consumer Price Index for All Urban Consumers (All Items) (time base 1982-84 = 100), as published by the Bureau of Labor Statistics, United States Department of Labor, or any successor or other body that may assume responsibility for the preparation and publishing of the said Index, as the case may be;

“Deductions” means any and all deductions, refining, reprocessing, processing, treatment and other charges, penalties, adjustments, shipping expenses and/or expenses pertaining to and/or in respect of Au and charged by an Offtaker and/or charged in respect of delivery costs to Sandstorm or to the final customer of Brigus and/or Sandstorm, as the case may be, or charged to Brigus as and by way of royalty payments;

“Demanding Party” has the meaning set forth in section 16(a);

“Dispute Notice” has the meaning set forth in section 16(a);

“Encumbrances” means any and all liens, charges, mortgages, encumbrances, pledges, security interests, royalties, taxes, proxies and third party rights or any other encumbrances of any nature whatsoever, whether registered or unregistered;

“Extended Term” has the meaning set forth in section 4(b);

“Execution Date” means the date of the execution and delivery of this Agreement by the Parties;

“Fixed Price” means US$500 per ounce of Au until December 31, 2012. The Fixed Price may be increased on December 31, 2012 and every December 31 thereafter during the Term and the Extended Term (each a “Review Date”) on the following basis. If on any Review Date: (i) the Cash Costs do not exceed the then applicable Fixed Price per ounce of Au, the then applicable Fixed Price per ounce of Au shall not be subject to an inflationary adjustment; or (ii) the Cash Costs exceed the then applicable Fixed Price per ounce of Au, the then applicable Fixed Price per ounce of Au shall be adjusted by the percentage increase in the Consumer Price Index for the 12 month period ended on the last day of the calendar month which precedes the calendar month in which the relevant Review Date falls, up to a maximum of a 2.0% adjustment for the applicable 12 month period;

“Hedging Arrangement” means any arrangement proposed to be entered into by Brigus or its affiliates pursuant to which the risk of the future price of Au is sold to a third Person, including without limitation, as and by way of netting and collateral arrangements under International Swaps and Derivatives Association, Inc. protocols and mandates;

“Insolvency Event” means, in relation to any person, any one or more of the following events or circumstances:

(i) proceedings are commenced for the winding-up, liquidation or dissolution of it, unless it in good faith actively and diligently contests such proceedings resulting in a dismissal or stay thereof within 60 days of the commencement of such proceedings;

(ii) a decree or order of a court of competent jurisdiction is entered adjudging it to be bankrupt or insolvent, or a petition seeking reorganization, arrangement or adjustment of or in respect of it is approved under applicable laws relating to bankruptcy, insolvency or relief of debtors;

(iii) it makes an assignment for the benefit of its creditors, or petitions or applies to any court or tribunal for the appointment of a receiver or trustee for itself or any substantial part of its property, or commences for itself or acquiesces in or approves or has filed or commenced against it any proceeding under any bankruptcy, insolvency, reorganization, arrangement or readjustment of debt law or statute or any proceeding for the appointment of a receiver or trustee for itself or any substantial part of its assets or property, or has a liquidator, administrator, receiver, trustee, conservator or similar person appointed with respect to it or any substantial portion of its property or assets; or

(iv) a resolution is passed for the winding-up or liquidation of it;

“Losses” means any and all damages, claims, losses, liabilities, fines, injuries, costs, penalties and expenses (including reasonable legal fees);

“Market Price” means for each ounce of Sandstorm Payable Au delivered and sold to Sandstorm, the London p.m. fix for Au as quoted in United States dollars by the London Bullion Market Association (or any successor metals exchange) on the Business Day prior to the date the Sandstorm Payable Au is “…[agreement redacted – proprietary structure]”;

“Material Adverse Change” in respect of Brigus, means any one or more changes, events or occurrences which, in either case, either individually or in the aggregate are material and adverse to Brigus, other than any change, effect, event or occurrence: (i) relating to the global economy or securities markets in general; (ii) affecting the worldwide Au mining industry in general and which does not have a materially disproportionate effect on Brigus; (iii) resulting from changes in the price of Au; or (iv)

relating to the rate at which Canadian dollars can be exchanged for the currency of any other nation, including the United States or vice versa, and references in this Agreement to dollar amounts are not intended to be, and shall not be deemed to be, interpretive of the amount used for the purpose of determining whether a “Material Adverse Change” has occurred and such defined terms and all other references to materiality in this Agreement shall be interpreted without reference to any such amounts;

“Minerals” means any and all economic, marketable metal bearing material, in whatever form or state, produced from the Property;

“Monthly Report” means a written report or reports, in relation to a calendar month, detailing:

(i) the number of ounces of Au produced from the Property and delivered to an Offtaker in the applicable calendar month;

(ii) the names and addresses of each Offtaker to which the Au referred to in subsection (i) was delivered;

(iii) the number of ounces of Sandstorm Payable Au which have resulted or which are estimated to result from the Au referred to in subsection (i);

(iv) the number of ounces of Sandstorm Payable Au which have been delivered to Sandstorm with respect to the Au referred to in subsection (i), in accordance with the provisions of Article 8;

(v) a reconciliation between any provisional number of ounces of Sandstorm Payable Au specified in a Monthly Report pursuant to subsection (iii) for a preceding calendar month and the final number of ounces of Sandstorm Payable Au for the applicable calendar month;

(vi) Au prices used by Brigus and its affiliates for short term and long term planning purposes with respect to the Property;

(vii) the reduction of the Uncredited Balance in such calendar month and the remaining Uncredited Balance; and

(viii) any material changes from the previous Monthly Report relating to anticipated quarterly production for the remainder of the current calendar year.

“National Instrument 43-101” means National Instrument 43-101 – Standards of Disclosure for Mineral Property of the Canadian Securities Administrators or any successor instrument, rule or policy;

“Offtaker” means the counterparty to an Offtake Agreement;

“Offtake Agreement” means any refining, marketing and/or processing agreement entered into by Brigus with respect to Au produced from the Property;

“Parties” means the parties to this Agreement and “Party” means any one of the Parties;

“Payable Au” means Au or other product containing Au produced from the Property, less the number of ounces of Au deducted on account of refining Au into Refined Au (for which net number of ounces Brigus receives either a cash payment or Refined Au from an Offtaker pursuant to and in accordance with any Offtake Agreement);

“Permitted Encumbrances” means an Encumbrance described in Schedule “B” attached hereto;

“Person” means and includes individuals, corporations, bodies corporate, limited or general partnerships, joint stock companies, limited liability corporations, joint ventures, associations, companies, trusts, banks, trust companies, governments or any other type of organization, whether or not a legal entity;

“Place of Delivery” has the meaning set forth in section 8(a);

“Prime” means the prime rate of interest quoted from time to time by the Royal Bank of Canada;

“Project” has the meaning ascribed thereto in the preambles to this Agreement;

“Project Charge” means a charge, mortgage and/or security interest in, to and over the Property as well as all hereafter acquired property rights pertaining to the Project and a charge, mortgage and/or security interest in, to and over all present and after acquired personal property used at or in connection with, or derived from the Project which shall be in form and substance satisfactory to Sandstorm acting as a prudent lender, as more particularly described in Article 19;

“Property” has the meaning ascribed thereto in the preambles to this Agreement;

“Purchase Price” per ounce of Payable Au means “…[agreement redacted – proprietary structure]”

“Refined Au” means marketable metal bearing material in the form of Au that is refined to standards meeting or exceeding commercial standards for the sale of refined Au;

“Responding Party” has the meaning set forth in section 16(a);

“Review Date” has the meaning set forth in the definition of Fixed Price;

“Sandstorm” means Sandstorm Resources Ltd.;

“Sandstorm Audit” has the meaning set forth in section 6(d);

“Sandstorm Payable Au” means:

(i) for the Black Fox Property, 12% of the Payable Au, provided that if Brigus exercises the Buy-Back Option in accordance with section 14, then Sandstorm Payable Au shall mean, as at and from the applicable payment date, 12% of the Payable Au minus the increments in respect of which the Buy-Back Option has been exercised (in multiples of 1%), to a maximum amount of increments aggregating 6%, such that if the full Buy-Back Option has been exercised, Sandstorm Payable Au for the Black Fox Property shall mean 6% of the Payable Au; and

(ii) for the Black Fox Extension, 10% of the Payable Au, provided that if Brigus exercises the Buy-Back Option in accordance with section 14, then Sandstorm Payable Au shall mean, as at and from the applicable payment date, 10% of the Payable Au minus the increments in respect of which the Buy-Back Option has been exercised as set forth in section 14, to a maximum amount of increments aggregating 5.5%, such that if the full Buy-Back Option has been exercised, Sandstorm Payable Au for the Black Fox Extension shall mean 4.5% of the Payable Au;

“Senior Lenders” has the meaning set forth in Article 19;

“Term” has the meaning set forth in section 4(a);

“Termination Notice” has the meaning set forth in section 4(b);

“Time of Delivery” has the meaning set forth in section 8(d);

“Transfer” when used as a verb, means to sell, grant, assign, encumber, pledge or otherwise dispose of or commit to dispose of, directly or indirectly, including through mergers, arrangements, amalgamations, consolidations, asset sales or spin-out transactions. When used as a noun, “Transfer” means a sale, grant, assignment, pledge or disposal or the commitment to do any of the foregoing, directly or indirectly, including through mergers, arrangements, amalgamations, consolidations, asset sale or spin-out transaction;

“TSX” means the Toronto Stock Exchange;

“TSXV” means the TSX Venture Exchange;

“Uncredited Balance” has the meaning ascribed thereto in the definition of Purchase Price;

“Uncredited Balance Refund Calculation” has the meaning set forth in section 3(d);

“Uncredited Balance Refund Notice” has the meaning set forth in section 3(c);

“Upfront Deposit” means the sum of US$56,300,000, subject to adjustment in accordance with Article 14; and

“Upfront Deposit Funding Date” means the Execution Date.

2. Agreement of Purchase and Sale

Subject to the terms and conditions of this Agreement and once Sandstorm has delivered the Upfront Deposit to Brigus, from and after January 1, 2011, Brigus shall sell to Sandstorm and Sandstorm shall purchase from Brigus the Sandstorm Payable Au free and clear of any and all Encumbrances, in consideration of those payments set forth in Article 3. “…[agreement redacted – proprietary structure]”

(a) In consideration of the obligation to deliver and sell the Sandstorm Payable Au as contemplated in this Agreement, subject to the provisions of Article 8, Sandstorm shall pay the Upfront Deposit to Brigus in cash by wire transfer on the Upfront Deposit Funding Date.

(b) Subject to the terms and conditions of this Agreement, from and after January 1, 2011, Brigus shall sell to Sandstorm and Sandstorm shall purchase from Brigus, the Sandstorm Payable Au; free and clear of any and all Encumbrances, in consideration of the payment of the Purchase Price. “…[agreement redacted – proprietary structure]”

(c) If, by the expiry or earlier termination of the Term or the Extended Term, if applicable, Brigus has not sold and delivered to Sandstorm, Sandstorm Payable Au having a value sufficient to reduce the Uncredited Balance to nil, then a refund of the Uncredited Balance shall be due and owing by Brigus to Sandstorm in an amount equal to the then remaining Uncredited Balance. If a refund of the Uncredited Balance shall be due and owing by Brigus to Sandstorm, Brigus shall notify Sandstorm (the “Uncredited Balance Refund Notice”) and the Uncredited Balance Refund Notice shall attach a copy of the applicable Uncredited Balance Refund Calculation.

(d) Within 60 days of the end of each fiscal year, Brigus shall prepare a detailed statement setting out the calculations of the Uncredited Balance on an annual basis (the “Uncredited Balance Refund Calculation”) and setting out the Uncredited Balance Refund Calculation. Brigus shall also prepare a final Uncredited Balance Refund Calculation within 60 days of the expiry or earlier termination of the Term or the Extended Term, if applicable. Each successive Uncredited Balance Refund Calculation shall include the aggregate information from previous Uncredited Balance Refund Calculations, including without limitation, matters settled by the dispute resolution procedures set forth in Article 16. Sandstorm shall have 90 days from the date of delivery of each Uncredited Balance Refund Calculation to dispute the accuracy of an

item therein. If Sandstorm and Brigus are unable to resolve any dispute with respect thereto, either Party shall have the right to elect to have the matter settled in accordance with the dispute resolution procedures set forth in Article 16. If Sandstorm has not disputed the accuracy of an item in an Uncredited Balance Refund Calculation within 90 days after the delivery thereof, then Sandstorm will be deemed to have agreed with the Uncredited Balance Refund Calculation.

4. Term

(a) The term of this Agreement shall commence on the Execution Date and subject to Article 9, shall continue until the date that is 80 years after the Execution Date (the “Term”).

(b) Sandstorm may terminate this Agreement at the end of the Term by providing to Brigus, not less than 90 days, prior to the expiry of the Term, written notice of its intention to terminate (a “Termination Notice”). If Sandstorm has not delivered a Termination Notice within 90 days prior to the expiry of the Term, then this Agreement shall continue in force for successive ten year periods (each, an “Extended Term”) until the date upon which the Extended Term is terminated in accordance with section 4(c).

(c) Sandstorm may terminate an Extended Term by providing to Brigus, prior to the end of such Extended Term, written notice of its intention to terminate the Extended Term, which termination shall be effective immediately upon receipt of such notice of termination.

Brigus covenants and agrees to and in favour of Sandstorm as follows and acknowledges and agrees that Sandstorm is relying on such covenants in executing and delivering this Agreement:

(a) During the Term and the Extended Term, as the case may be, Brigus and its affiliates and subsidiaries shall not enter into any future gold stream agreements, royalty agreements or other agreements (excluding Hedging Arrangements), in respect of the Property without the prior written consent of Sandstorm.

(b) Brigus shall at all times during the Term do and cause to be done all things necessary to maintain its corporate existence. Brigus shall at all times during the Term do all things necessary to maintain the Property in good standing, including paying all taxes owing in respect thereof. During the Term, Brigus shall not abandon any of the claims, leases, lands or tenements forming a part of the Property unless Brigus provides evidence satisfactory to Sandstorm, acting reasonably, that it is not economical, as at the date of determination, to produce Minerals from such claims, leases, lands or tenements.

(c) Until such time as the Project Charge has been duly registered, Brigus shall not

cause or allow to be registered any Encumbrance other than Permitted Encumbrances as against the Property without the prior written consent of Sandstorm.

6. Monthly Reports and Annual Reports

(a) During the Term and the Extended Term, as the case may be, Brigus shall deliver to Sandstorm a Monthly Report on or before the 15th Business Day after the last day of each calendar month.

(b) During the Term and the Extended Term, as the case may be, Brigus shall deliver to Sandstorm an Annual Report on or before 60 days after the last day of each fiscal year.

(c) Sandstorm shall have the right to dispute an Annual Report in accordance with the provisions of this Article 6. If Sandstorm disputes an Annual Report:

(i) Sandstorm shall notify Brigus in writing within 90 days from the date of delivery of the applicable Annual Report that it disputes the accuracy of that Annual Report (or any part thereof) (the “Audit Dispute Notice”);

(ii) Sandstorm and Brigus shall have 60 days from the date the Audit Dispute Notice is delivered by Sandstorm to resolve the dispute. If Sandstorm and Brigus have not resolved the dispute within the said 60 day period, a mutually agreed independent third party expert will be appointed to prepare a report with respect to the dispute in question (the “Expert’s Report”). If Sandstorm and Brigus have not agreed upon such expert within a further 10 days after the said 60 day period, then the dispute as to the expert shall be resolved by the dispute mechanism procedures set forth in Article 16;

(iii) if the Expert’s Report concludes that the actual number of ounces of Sandstorm Payable Au varies by two percent or less from the number of ounces of Sandstorm Payable Au set out in the Annual Report, then the cost of the Expert’s Report shall be borne by Sandstorm;

(iv) if the Expert’s Report concludes that the number of ounces of Sandstorm Payable Au varies by more than two percent from the number of ounces of Sandstorm Payable Au set out in the Annual Report, then the cost of the Expert’s Report shall be borne by Brigus; and

(v) if either Sandstorm or Brigus disputes the Expert’s Report and such dispute is not resolved between the Parties within ten days after the date of delivery of the Expert’s Report, then such dispute shall be resolved by the dispute mechanism procedures set forth in Article 16.

(d) If Brigus does not deliver a (draft or final) Monthly Report or an Annual Report as required pursuant to this Article 6, Sandstorm shall have the right to perform or to cause its representatives or agents to perform, at the cost and expense of Brigus, an audit of the books and records of Brigus relevant to the production and delivery of Sandstorm Payable Au produced during the calendar month or calendar year in question (the “Sandstorm Audit”) in conjunction with the provisions of Article 11. Brigus shall grant Sandstorm or its representatives or agents access to all such books and records on a timely basis. In order to exercise this right, Sandstorm must provide not less than 14 days’ written notice to Brigus of its intention to conduct the Sandstorm Audit. If within seven days of receipt of such notice, Brigus delivers the applicable (draft or final) Monthly Report or Annual Report, as the case may be, then Sandstorm shall have no right to perform the Sandstorm Audit. If Brigus delivers the applicable (draft or final) Monthly Report or Annual Report, as the case may be, before the delivery of the Sandstorm Audit, the applicable (draft or final) Monthly Report or Annual Report, as the case may be, shall be taken as final and conclusive, subject to the rights of Sandstorm as set forth in section 6(c). Otherwise, absent any manifest or gross error in the Sandstorm Audit, the Sandstorm Audit shall be final and conclusive, subject to the provision of Article 16.

7. Transfer Rights of Sandstorm

During the Term or the Extended Term, as the case may be, Sandstorm shall have the right to Transfer, in whole or in part, its rights and obligations under this Agreement, upon the provision of ten Business Days prior written notice to Brigus whereupon Sandstorm shall be released from its obligations under this Agreement.

8. Delivery of Minerals, Payments and Documentation in respect of Offtake

(a) Commencing as of January 1, 2011 and during the Term and the Extended Term, Brigus shall deliver and sell to Sandstorm all Sandstorm Payable Au to be delivered and sold under this Agreement to “…[agreement redacted – proprietary structure]” Sandstorm in writing from time to time (the “Place of Delivery”).

(b) Brigus shall notify Sandstorm in writing at least one Business Day before any delivery and credit to the account of Sandstorm of the number of ounces of Sandstorm Payable Au to be delivered “…[agreement redacted – proprietary structure]” and the estimated date and time of delivery and credit.

(c) Within 16 Business Days of the end of each calendar month, Brigus shall deliver and credit Sandstorm Payable Au to the metal account of Sandstorm in an amount equal to the number of ounces of Sandstorm Payable Au specified in the Monthly Report for the calendar month most recently ended.

(d) Delivery of Sandstorm Payable Au shall be deemed to have been made at the time Sandstorm Payable Au is credited to the Place of Delivery (the “Time of Delivery”).

(e) Title to and risk of loss of Sandstorm Payable Au shall pass from Brigus to Sandstorm at the Time of Delivery.

(f) All Deductions relating to each shipment of Minerals and/or Refined Au and all costs and expenses pertaining to the delivery and credit of Refined Au to the place of delivery shall be borne by Brigus.

(g) At the Time of Delivery, Brigus shall deliver to Sandstorm an invoice setting out the number of ounces of Sandstorm Payable Au so credited and the Purchase Price for such Refined Au.

(h) Sandstorm shall promptly pay for each shipment of Refined Au and in any event not later than five Business Days after the Time of Delivery and receipt of any invoice for such Refined Au.

(i) All payments for Refined Au by Sandstorm to Brigus shall be made in US Dollars and shall be made by wire transfer in immediately available funds to the bank account or accounts designated by Brigus in writing from time to time, without deduction or set-off.

(k) Subject to the dispute of any payment in accordance with section 16, any payment not made on or by the applicable payment date referred to in this Article 8 shall incur interest until such payment is made at a rate equal to Prime plus 2% per annum. In addition to the foregoing, if Sandstorm has not made any payment on or by the applicable payment date referred to in this Article 8 from and after the date that is 30 days following delivery by Brigus to Sandstorm of notice of such non-payment, then Brigus shall have the right to set off against any such non-payment (including interest) and withhold from future delivery to Sandstorm an amount of Refined Au equal in value to such non-payment (including interest). For the purposes of this section 8(k), any amount of Refined Au set off and withheld against any non-payment amount shall be valued at the per ounce price of Au in US dollars quoted by the London Bullion Market Association on the trading day immediately prior to the date that such amount of Refined Au would have been credited to the metal account of Sandstorm in accordance with this Article 8 but for such non-payment. In addition, Sandstorm shall be required to pay the Purchase Price on any amount of Refined Au set off and withheld by Brigus against any such non-payment by Sandstorm.

(a) The Parties may terminate this Agreement at any time by mutual written consent.

In addition, Sandstorm shall have the right to terminate this Agreement, effective upon ten days’ prior written notice to Brigus, if any of the following shall occur (each, a “Brigus Event of Default”):

|

(i) |

Brigus defaults in any material respect in the performance of any of its covenants or obligations contained in this Agreement or in the Project Charge and such default is not remedied to the reasonable satisfaction of Sandstorm within 60 days after receipt of written notice of such default by Brigus; |

|

|

|

|

(ii) |

upon the occurrence of any Insolvency Event affecting Brigus; and |

|

|

|

|

(iii) |

if the Project Charge has ceased to be valid, binding and enforceable in accordance with its terms and such invalidty is not rectified within 60 days of Sandstorm providing notice to Brigus. |

For greater certainty and without limitation, Sandstorm shall have the right to waive one or more Brigus Events of Default, all without prejudice to any and all rights of Sandstorm with respect to any and all Brigus Events of Default.

(b) If a Brigus Event of Default occurs and is continuing, in addition to and not in substitution for any other remedies available at law or in equity, Sandstorm shall have the right, upon written notice to Brigus, at its option, to: (i) demand repayment of the remaining Uncredited Balance, without interest, at the time of the occurrence of the applicable Brigus Event of Default; and (ii) Sandstorm shall have the right to seek damages in excess of the Uncredited Balance (the amounts in (i) and (ii), being collectively referred to as the “Brigus Default Fee”). Upon demand from Sandstorm, which demand shall include a calculation of the Brigus Default Fee, Brigus shall promptly pay the Brigus Default Fee in cash by wire transfer, in immediately available funds, to a bank account designated by Sandstorm. For greater certainty and without limitation, in the event Brigus is required to pay the Brigus Default Fee to Sandstorm, the provisions set forth in section 3(c) requiring the refund of the Uncredited Balance will no longer be applicable.

(c) The Parties hereby acknowledge that: (i) Sandstorm will be damaged by a Brigus Event of Default; and (ii) any sums payable or retainable pursuant to this Article 9 are in the nature of liquidated damages, not a penalty and are fair and reasonable.

(d) If Sandstorm elects to demand payment of the Brigus Default Fee, this Agreement shall be deemed terminated upon the payment by or on behalf of Brigus of the Brigus Default Fee.

(e) Termination of this Agreement under this Article shall not terminate any payment or delivery obligation hereunder that arose prior to the time of termination.

Each Offtake Agreement shall be on arm’s length commercial terms, consistent with normal industry standards and practice in Canada with respect to the payable adjustment factor. Brigus shall promptly disclose to Sandstorm the terms of any such

agreements and any amendments to the material terms and conditions of any Offtake Agreements that may affect Sandstorm and any refining, smelting or other purchase agreements in respect of Au from the Property.

11. Books; Records; Inspections

Brigus shall keep true, complete and accurate books and records of all material operations and activities with respect to the Property, including the processing of Minerals therefrom, where applicable. Subject to the confidentiality provisions of this Agreement and in addition to the provisions of section 6(d), Sandstorm and its authorized representatives shall be entitled to perform audits or other reviews and examinations of the books and records of Brigus relevant to the delivery of Sandstorm Payable Au pursuant to this Agreement during the Term or the Extended Term, as the case may be, to confirm compliance by Brigus with the terms of this Agreement. Sandstorm shall diligently complete any audit or other examination permitted hereunder. For greater certainty and without limitation, Sandstorm shall have access to all documents provided by Brigus to an Offtaker, as contemplated under the Offtake Agreements or which otherwise relate to the Au produced from the Property vis a vis the Offtaker and that are, in any manner, relevant to the calculation of Sandstorm Payable Au or the delivery and credit in respect thereof, in each instance. All costs and expenses of any audit or other examination permitted in this section shall be paid by Sandstorm, unless the results of such audit or other examination permitted in this section, disclose a discrepancy in calculations made by Brigus of equal to or greater than two percent, in which event the reasonable costs of such audit or other examination shall be paid by Brigus.

12. Conduct of Mining Operations, etc.

(a) All decisions concerning methods, the extent, times, procedures and techniques of any exploration, development and mining operations related to the Property shall be made by Brigus in its sole and absolute discretion.

(b) Sandstorm has no contractual rights relating to the development or operation of any of the operations of Brigus, including without limitation, the Property or any of its properties and Sandstorm shall not be required to contribute to any capital or expenditures in respect of operations at the Property. Except as provided in this Agreement and the Project Charge, Sandstorm has no right, title or interest in and to the Property.

(c) Sandstorm is not entitled to any form or type of compensation or payment from Brigus if Brigus discontinues or ceases operations from the Property save and except as provided in Article 3. This Agreement shall in no way be construed or considered a guarantee as to the delivery of any amount of Sandstorm Payable Au, on an annual basis or over the life of the Property.

(d) Brigus shall perform or cause to be performed all processing operations and activities in respect of the Property in a commercially prudent manner and in

accordance with good processing, engineering and environmental practices prevailing in the industry.

(e) At reasonable times and with the prior consent of Brigus (which shall not be unreasonably withheld or delayed), at the sole risk and expense of Sandstorm, Sandstorm shall have a right of access by its representatives to the Property and any mill, smelter, concentrator or other processing facility owned or operated by Brigus and/or its affiliates and that is to process Minerals produced from the Property, for the purpose of enabling Sandstorm to monitor compliance by Brigus with the terms of this Agreement and to prepare technical reports on the Property in compliance with National Instrument 43-101.

(f) Brigus will cooperate with and will allow Sandstorm access to technical information pertaining to the Property to permit Sandstorm to prepare technical reports on the Property in accordance with National Instrument 43-101 at the sole cost and expense of Sandstorm to comply with Sandstorm’s disclosure obligations under applicable Canadian and/or US securities laws and/or stock exchange rules and policies provided that: (i) to the extent permitted by law, Sandstorm will use the same report writer as Brigus to prepare all technical reports that Sandstorm is required to prepare and to use the same reports as Brigus (re-addressed to Sandstorm). For greater certainty and without limitation, so long as Brigus’ then current technical report is in compliance with National Instrument 43-101 from the perspective of Sandstorm in the opinion of counsel to Sandstorm, Sandstorm will use its commercially reasonable best efforts to use the same National Instrument 43-101 technical report, re-addressed to Sandstorm; and (ii) if Sandstorm is unable to use the same report writer as Brigus to prepare a required technical report, it will choose a Person to write the technical report that is acceptable to Brigus, acting reasonably, and Sandstorm will not finalize the technical report until Brigus has been provided with a reasonable opportunity to comment on the contents of the technical report and Sandstorm will act in good faith and will use its best efforts to incorporate Brigus’ comments into the technical report to the extent Brigus’ comments are made to conform the technical report with the existing disclosure of Brigus. Brigus will promptly deliver to Sandstorm any updated National Instrument 43-101 reports or mineral reserve and mineral resource estimates produced that pertain to the Property.

(g) Brigus shall ensure that all Au is produced from the Property in a prompt and timely manner consistent with sound mining processing, engineering and environmental practices. In addition, Brigus shall mine and process the ore from the Property in a manner consistent with industry standards and practices that would be expected by a person receiving/buying Payable Au. If Brigus wishes to commingle the Minerals produced from the Property with other Minerals, it may do so, as long as Sandstorm shall not be disadvantaged as a result of such commingling including ensuring that ore to which Sandstorm is entitled to a percentage of is neither displaced nor processed at a lower rate as a result of such co-mingling and further provided that a method is agreed upon by Sandstorm and Brigus to determine the quantum of Au produced from the Property. If Sandstorm and Brigus can not agree upon such a method, the matter

will be determined in accordance with the dispute resolution mechanism set forth in Article 16. Brigus may not cease to process ore from the Property in favour of ore from other sources.

13. Restricted Transfer Rights of Brigus

During the Term or the Extended Term, as the case may be, Brigus shall be permitted to Transfer, in whole or in part: (i) the Property; or (ii) its rights and obligations under this Agreement; so long as the following conditions are satisfied and upon such conditions being satisfied in respect of such Transfer, Brigus shall be released from its obligations under this Article:

(i) Brigus shall provide Sandstorm with at least 30 days prior written notice of its intent to Transfer;

(ii) any purchaser, merged company, transferee or assignee agrees in writing in favour of Sandstorm to be bound by the terms of this Agreement (in which event Brigus shall be released from its obligations under this Agreement so long as there is compliance with subsections 13(i) and (iii)), including without limitation, this section and any transferee that is a mortgagee, chargeholder or encumbrancer undertakes to obtain an agreement in writing in favour of Sandstorm from any subsequent purchaser or transferee of such mortgagee, chargeholder or encumbrancer that such subsequent mortgagee, chargeholder or encumbrancer will be bound by the terms of this Agreement and the Project Charge, as applicable and to the extent possible; and

(iii) Sandstorm does not suffer a Material Adverse Change in relation to the transactions set forth in this Agreement.

14. Buy-Back Option

For a period of time that commences on the Execution Date and that terminates on January 1, 2013 (the “Buy-Back Option Period”), Brigus shall have the sole and irrevocable option (the “Buy-Back Option”) to require that Sandstorm reduce the Sandstorm Payable Au with respect to the Black Fox Property from 12% by increments of 1% to an amount of not less than 6% in consideration of the payment by Brigus to Sandstorm of the Buy-Back Purchase Price, or part thereof. The Buy-Back Option may be exercised in whole or in part at any time during the Buy-Back Option Period, provided that any partial exercise must be in increments of not less than US$6,099,167 (which shall constitute reductions of the Upfront Deposit) for each 1% of the Buy-Back Option. To exercise the Buy-Back Option, Brigus shall provide five Business Days notice to such effect to Sandstorm and shall forward to Sandstorm within such five Business Days the Buy-Back Purchase Price or part thereof in case of a partial exercise, in cash by wire transfer. As and when the Buy-Back Option is exercised with respect to the Black Fox Property, there shall be a corresponding adjustment to the

Sandstorm Payable Au with respect to the Black Fox Extension on the following basis:

|

Reduction Black Fox Property |

|

Resulting Adjustment for Black Fox Extension |

|

|

|

|

|

11% |

|

9.1% |

|

10% |

|

8.2% |

|

9% |

|

7.3% |

|

8% |

|

6.3% |

|

7% |

|

5.4% |

|

6% |

|

4.5% |

15. Confidentiality

(a) Subject to section 15(b), neither Sandstorm nor Brigus shall, without the express written consent of the other Party, disclose any non-public information received under or in connection with this Agreement, other than to its respective directors, employees, agents, bankers, consultants, requisite regulatory authorities and/or prospective transferees and neither Party shall issue any press releases concerning the Property without the consent of the other Party, after the other Party has first reviewed the terms of such press release (to the extent practicable). Each Party agrees to reveal such information only to its respective directors, employees, agents, bankers, consultants and/or prospective transferees who need to know, who are informed of the confidential nature of the information and who agree to be bound by the terms of this Article 15. In addition, neither Party shall use any such information for its own use or benefit except for the purpose of enforcing its rights under this Agreement.

(b) Notwithstanding the foregoing: (i) Sandstorm and Brigus shall be entitled to publicly file a copy of this Agreement in such manner(s) as may be required by applicable securities laws (subject to such redactions as may be mutually agreed to by the Parties, such mutual agreement to be procured within five Business Days of the execution and delivery of this Agreement); (ii) each Party may disclose information obtained under this Agreement if required to do so for compliance with applicable laws, rules, regulations or orders of any governmental authority or stock exchange having jurisdiction over such Party or to allow a current or potential bona fide provider of finance to conduct due diligence provided that the other Party shall be given the right to review and object to the data or information to be disclosed prior to any public release subject to any reasonable changes proposed by such other Party; and (iii) each Party may disclose information for the purposes of any arbitration proceeding commenced under Article 16 of this Agreement.

16. Arbitration

In the event of a dispute in relation to this Agreement, including without limitation, the existence, validity, performance, breach or termination hereof or any matter arising hereunder, including whether any matter is subject to arbitration, the Parties agree to negotiate diligently and in good faith in an attempt to resolve such dispute. Failing

resolution satisfactory to either Party, within ten days of the time frame specified herein or if no time frame is specified within ten days of the delivery of notice by either Party of the said dispute, which shall be after the dispute remains open for a period of 90 days, either Party may request that the dispute be resolved by binding arbitration, conducted in English, in Xxxxxxx, Xxxxxxx, pursuant to the provisions of the Arbitration Act (Ontario). The case shall be administered in accordance with the following:

(a) To demand arbitration either Party (the “Demanding Party”) shall give written notice (the “Dispute Notice”) to the other Party (the “Responding Party”), which Dispute Notice shall toll the running of any applicable limitations of actions by law or under this Agreement. The Dispute Notice shall specify the nature of the allegation and the issues in dispute, the amount or value involved (if applicable) and the remedy requested. Within 15 Business Days of receipt of the Dispute Notice, the Responding Party shall answer the demand in writing, responding to the allegations and issues that are disputed.

(b) The Demanding Party and the Responding Party shall mutually agree upon one single qualified arbitrator within seven Business Days of the Responding Party’s answer, failing which each of the Demanding Party and the Responding Party shall select one qualified arbitrator within five Business Days of the Responding Party’s answer. Each arbitrator shall be a disinterested person qualified by experience to hear and determine the issues to be arbitrated. The arbitrator(s) so chosen shall select a neutral arbitrator within five Business Days of their selection.

(c) No later than 15 Business Days after hearing the representations and evidence of the Parties, the arbitrator(s) shall make their majority determination in writing and shall deliver one copy to each of the Parties. The written decision of the arbitrator(s) shall be final and binding upon the Parties in respect of all matters relating to the arbitration, the procedure, the conduct of the Parties during the proceedings and the final determination of the issues in the arbitration. There shall be no appeal from the determination of the arbitrator(s) to any court. The decision rendered by the arbitrator(s) may be entered into any court for enforcement purposes.

(d) The arbitrator(s) may determine all questions of law and jurisdiction (including questions as to whether or not a dispute is arbitratable) and all matters of procedure relating to the arbitration.

(e) The arbitrator(s) shall have the right to grant legal and equitable relief and to award costs (including legal fees and the costs of arbitration) and interest. The costs of any arbitration shall be borne by the Parties in the manner specified by the arbitrator(s) in their majority determination, if applicable. The arbitrator(s) may make an interim order, including injunctive relief and other provisional, protective or conservatory measures, as well as orders seeking assistance from a court in taking or compelling evidence or preserving and producing documents regarding the subject matter of the dispute.

(f) All papers, notices or process pertaining to an arbitration hereunder may be served on a Party as provided in this Agreement.

(g) The Parties agree to treat as confidential information, in accordance with the provisions of Article 15, the following: the existence of the arbitral proceedings; written notices, pleadings and correspondence in relation to the arbitration; reports, summaries, witness statements and other documents prepared in respect of the arbitration; documents exchanged for the purposes of the arbitration; and the contents of any award or ruling made in respect of the arbitration. Notwithstanding the foregoing part of this section, a Party may disclose such confidential information in judicial proceedings to enforce, nullify, modify or correct an award or ruling and as permitted under Article 15.

17. Representations and Warranties of Sandstorm

Sandstorm, acknowledging that Brigus is entering into this Agreement in reliance thereon, hereby represents and warrants to Brigus as follows:

(a) Sandstorm is a corporation duly and validly existing under the laws of its governing jurisdiction and Sandstorm is up to date in respect of all filings required by law or by any governmental authority.

(b) Sandstorm has the requisite corporate power and capacity to enter into this Agreement and to perform its obligations hereunder. Sandstorm has received all requisite board of director approvals with respect to the execution and delivery of this Agreement.

(c) This Agreement has been duly and validly executed and delivered by Sandstorm and constitutes a legal, valid and binding obligation of Sandstorm, enforceable against Sandstorm in accordance with its terms.

(d) Sandstorm has not made an assignment for the benefit of creditors, nor is Sandstorm the voluntary or involuntary subject of any proceedings under any bankruptcy or insolvency law, no receiver or receiver/manager has been appointed for all or any substantial part of the properties or business of Sandstorm and the corporate existence of Sandstorm has not been terminated by voluntary or involuntary dissolution or winding up (other than by way of amalgamation or reorganization) and Sandstorm is not aware of any circumstance which, with notice or the passage of time, or both, would give rise to any of the foregoing.

(e) Sandstorm is in compliance in all material respects with the rules, policies and regulations of the TSXV.

(f) Sandstorm has filed all documents required to be filed by it under all applicable securities laws in connection with its status as a public company and the policies of the TSXV, and such documents as of the date they were filed, comply in all material respects with requisite securities laws, do not contain any untrue statement of a material

fact or omit to state a material fact required to be stated therein or necessary to make the statements therein in light of the circumstances under which they were made, not misleading.

(g) This Agreement and the exercise of the rights and performance of the obligations of Sandstorm hereunder do not and will not: (i) conflict with any agreement, mortgage, bond or other instrument to which Sandstorm is a party or which is binding on its assets; (ii) conflict with its constating or constitutive documents; or (iii) conflict with or violate any applicable law.

(h) No regulatory or third party consents or approvals are required to be obtained by Sandstorm in connection with the execution and delivery or the performance by Sandstorm of this Agreement or the transactions contemplated hereby.

18. Representations and Warranties of Brigus

Brigus acknowledging that Sandstorm is entering into this Agreement in reliance thereon, hereby represents and warrants to Sandstorm as follows and agree that such representations and warranties shall remain true and correct during the Term and the Extended Term:

(a) Brigus is a corporation duly and validly existing under the laws of its governing jurisdiction and is up to date in respect of all filings required by law or by any governmental authority.

(b) Brigus has the requisite corporate power and capacity to enter into this Agreement and to perform its obligations hereunder. Brigus has received all requisite board of director approvals with respect to the execution and delivery of this Agreement.

(c) This Agreement has been duly and validly executed and delivered by Brigus and constitutes a legal, valid and binding obligation of Brigus enforceable against Brigus in accordance with its terms.

(d) This Agreement and the exercise of the rights and performance of the obligations of Brigus hereunder do not and will not; (i) conflict with any agreement, mortgage, bond or other instrument to which Brigus is a party or which is binding on its assets; (ii) conflict with its constating or constitutive documents; or (iii) conflict with or violate any applicable law.

(e) Other than as specified in this Agreement and approval by the Senior Lenders, no regulatory or third party consents or approvals are required to be obtained by Brigus in connection with execution and delivery or the performance by Brigus of this Agreement or the transaction contemplated hereby

(f) Brigus has not made an assignment for the benefit of creditors nor is Brigus the voluntary or involuntary subject of any proceedings under any bankruptcy or insolvency

law; no receiver or receiver/manager has been appointed for all or any substantial part of its properties or business and its corporate existence has not been terminated by voluntary or involuntary dissolution or winding up (other than by way of amalgamation or reorganization) and Brigus is not aware of any circumstance which, with notice or the passage of time, or both, would give rise to any of the foregoing.

(g) No person has any agreement, option, right of first refusal or right, title or interest or right capable of becoming an agreement, option, right of first refusal or right, title or interest, in or to the Property, or any of the Au therein, thereon or thereunder or derived therefrom.

(h) Brigus has all necessary corporate power to own the Property and to commence mining the Property. Brigus is in material compliance with all material applicable laws and licences, registrations, permits, consents and qualifications to which the Property is subject. Brigus will use commercially reasonable efforts to maintain all material permits necessary to continue mining the Property.

(i) At the Time of Delivery, Brigus will have and will deliver to Sandstorm during the Term and the Extended Term, as the case may be, an undivided 100% legal and beneficial good, valid, marketable and exclusive ownership of and title in and to, and actual and exclusive possession of Sandstorm Payable Au, free and clear of any and all Encumbrances other than Permitted Encumbrances.

(j) Brigus is not in default of any credit facility or material contract it has executed and delivered, to which its assets are subject or by which its assets are bound.

(k) Brigus has made available to Sandstorm all material information in its control or possession with respect to the Property and all corporate matters pertaining to Brigus, as requested by Sandstorm.

19. Project Charge

Brigus covenants to provide evidence, to the reasonable satisfaction of Sandstorm, of the due registration of the Project Charge in all applicable government offices within 90 days of the Execution Date. To the extent necessary, Brigus shall provide its written consent or signature to any documents or things necessary to accomplish the registration, recordation and notice with respect to the Project Charge. Brigus shall not amend, supplement, waive, restate, supersede, terminate, cancel or release or otherwise consent to a departure from the provisions of the Project Charge without the prior written consent of Sandstorm, such consent not to be unreasonably withheld. Sandstorm will agree to subordinate the Project Charge to creditors of Brigus (the “Senior Lenders”) so long as the Senior Lenders agree to ensure that, to the extent fully possible at law or in equity, this Agreement shall survive any legal or other process undertaken by the Senior Lenders as a result of their security enforcement proceedings, including without limitation, that this Agreement will be binding upon any transferee of

Sandstorm agrees to indemnify and save harmless Brigus, and its directors, officers, employees and agents from and against any and all actual Losses suffered or incurred by them that arise out of or relate to any failure of Sandstorm to timely and fully perform or cause to be performed all of the covenants and obligations to be observed or performed by it pursuant to this Agreement. This clause shall survive termination of this Agreement.

Brigus agrees to indemnify and save Sandstorm and its directors, officers, employees and agents harmless from and against any and all actual Losses suffered or incurred by Sandstorm, that arise out of or relate to any failure of Brigus to timely and fully perform or cause to be performed all of the covenants and obligations to be observed or performed by them pursuant to this Agreement. This clause shall survive termination of this Agreement.

22. Taxes

All deliveries of Sandstorm Payable Au or payments made by a Party shall be made without any deduction, withholding, charge or levy for or on account of any tax, duty or other charges of whatever nature imposed by any taxing or governmental authority, all of which shall be for the account of the Party making the delivery or payment.

(a) Each Party shall execute all such further instruments and documents and shall take all such further actions as may be necessary to effect the transaction contemplated herein, in each case at the cost and expense of the Party requesting such further instrument, document or action, unless expressly indicated otherwise.

(b) Nothing herein shall be construed to create, expressly or by implication, a joint venture, agency relationship, fiduciary relationship, mining partnership, commercial partnership or other partnership relationship between Brigus and Sandstorm.

(c) This Agreement shall be governed by and construed under the laws of the Province of Ontario and the federal laws of Canada applicable therein.

(d) Time is of the essence of this Agreement.

(e) All references in this Agreement to currency or to “$”, unless otherwise expressly indicated, shall be to United States dollars.

(f) If any provision of this Agreement is wholly or partially invalid, this Agreement shall be interpreted as if the invalid provision had not been a part hereof so that the invalidity shall not affect the validity of the remainder of this Agreement which shall be construed as if this Agreement had been executed without the invalid portion.

(g) Any notice or other communication required or permitted to be given hereunder shall be in writing and shall be delivered by hand or transmitted by facsimile transmission addressed to:

If to Brigus:

0000 Xxxxx Xxxxx Xxxxxx, Xxxxx 0000

Xxxxx’x Wharf Tower II

Xxxxxxx, XX X0X 0X0

Attention: President and Chief Executive Officer

Fax Number: (000) 000-0000

If to Sandstorm, to:

Xxxxx 0000, 000 Xxxx Xxxxxx

Xxxxxxxxx, XX X0X 0X0

Attention: President and Chief Executive Officer

Fax Number: (000) 000-0000

Any notice given in accordance with this section, if transmitted by facsimile transmission, shall be deemed to have been received on the next Business Day following transmission or, if delivered by hand, shall be deemed to have been received when delivered.

(h) This Agreement may not be changed, amended or modified in any manner, except pursuant to an instrument in writing signed on behalf of each of the Parties. The failure by any Party to enforce at any time any of the provisions of this Agreement shall in no way be construed to be a waiver of any such provision unless such waiver is acknowledged in writing, nor shall such failure affect the validity of this Agreement or any part thereof or the right of a Party to enforce each and every provision. No waiver or breach of this Agreement shall be held to be a waiver of any other or subsequent breach.

(i) Following the execution and delivery of this Agreement, each of Sandstorm, and Brigus will co-operate reasonably with the other Party in implementing any proposed adjustments to the structure of this Agreement to facilitate tax planning, provided that such adjustments have no material adverse impact on the non-proposing Party and that

such adjustments shall not result in the non-proposing Party incurring any significant costs.

(j) This Agreement may be executed in one or more counterparts and by the Parties in separate counterparts, each of which when executed shall be deemed to be an original, but all of which when taken together shall constitute one and the same agreement. Delivery of an executed counterpart of a signature page to this Agreement by telecopier shall be effective as delivery of a manually executed counterpart of this Agreement.

(k) This Agreement shall enure to the benefit of and shall be binding on and shall be enforceable by the Parties and their respective, successors and permitted assigns.

(l) The Parties have expressly required that this Agreement and all notices relating hereto be drafted in English.

(m) This Agreement constitutes the entire agreement among the Parties pertaining to the subject matter hereof and supersedes all prior agreements, negotiations, discussions and understandings, written or oral, among the Parties.

(n) The Parties may agree to enter into other financial instruments or agreements to supplement the pricing in this Agreement.

IN WITNESS WHEREOF the parties hereto have executed this Agreement as of the date and year first above written.

|

|

BRIGUS GOLD CORP. | |

|

|

Per: | |

|

|

|

s/s Xxxx Xxxx |

|

|

|

President & CEO |

|

|

| |

|

|

| |

|

|

| |

|

|

||

|

|

Per: | |

|

|

|

s/s Xxxxx Xxxxxx |

|

|

|

President & CEO |

SCHEDULE “A1”

DESCRIPTION OF THE BLACK FOX PROPERTY

Black Fox Mine Land Description

The Black Fox mine is located approximately seven miles xxxx xx Xxxxxxxx, Xxxxxxx, Xxxxxx.

The Black Fox mine consists of 3090 acres of which: 185 acres are leased mining claims, 2,081 acres where mineral and surface rights are owned by Brigus, 519 acres where Brigus has surface rights only and 304 acres where Brigus has mineral rights but no surface rights. The Black Fox mine land package is listed in Table 1.

Table 0.Xxxxx Fox Mine Property Land Package.

Brigus Gold (Apollo Gold) Black Fox Mine Land Package Summary

Surface and Mineral Rights Owned by Apollo

|

Township |

|

Pin # |

|

Concession # |

|

Lot # |

|

Parcel |

|

Hectares |

|

Acreage |

|

Status |

|

Property Package |

|

Effective date Date |

|

Xxxxxx |

|

65366-0127 |

|

1 |

|

6 |

|

14572 |

|

61.43 |

|

151.67 |

|

Surf and Mineral owned by Apollo |

|

Black Xxx |

|

- |

|

Xxxxxx |

|

65366-0143 |

|

1 |

|

8 |

|

4150 |

|

63.18 |

|

156 |

|

Surf and Mineral owned by Apollo |

|

Black Fox |

|

July 12/07 |

|

Xxxxxx |

|

65380-0531 |

|

6 |

|

4 |

|

10706 |

|

67.98 |

|

168 |

|

Surf and Mineral owned by Xxxxxx |

|

Xxxxx Xxx |

|

- |

|

Xxxxxx |

|

00000-0000 |

|

6 |

|

6 |

|

6413 |

|

32.60 |

|

80.5 |

|

Surf and Mineral owned by Apollo |

|

Black Fox |

|

Aug 31/02 |

|

Xxxxxx |

|

65380-0552 |

|

6 |

|

8 |

|

7745 |

|

66.52 |

|

164.24 |

|

Surf and Mineral owned by Apollo |

|

Black Fox |

|

Jan 31/03 |

|

Xxxxxx |

|

65380-0534 |

|

6 |

|

7 |

|

388 |

|

59.33 |

|

146.5 |

|

Surf and Mineral owned by Xxxxxx |

|

Xxxxx Xxx |

|

- |

|

Xxxxxx |

|

00000-0000 |

|

6 |

|

7 |

|

15466 |

|

39.28 |

|

96.98 |

|

Surf and Mineral owned by Xxxxxx |

|

Xxxxx Xxx |

|

- |

|

Xxxxxx |

|

00000-0000 |

|

6 |

|

6 |

|

23876 |

|

39.89 |

|

98.5 |

|

Surf and Mineral owned by Apollo |

|

Black Fox |

|

|

|

Xxxxxx |

|

65380-0557 |

|

6 |

|

6 |

|

2582 |

|

62.78 |

|

155 |

|

Surf and Mineral owned by Apollo |

|

Black Fox |

|

|

|

Xxxxxx |

|

65380-0558 |

|

6 |

|

5 |

|

11511 |

|

32.62 |

|

80.55 |

|

Surf and Mineral owned by Apollo |

|

Black Fox |

|

|

|

Xxxxxx |

|

65380-0559 |

|

6 |

|

4 |

|

3393 |

|

62.87 |

|

155.238 |

|

Surf and Mineral owned by Apollo |

|

Black Fox |

|

Dec 24/03 |

|

Xxxxxx |

|

65380-0553 |

|

6 |

|

7 |

|

4707 |

|

18.63 |

|

46 |

|

Surf and Mineral owned by Apollo |

|

Black Fox |

|

Feb 13/03 |

|

Xxxxxx |

|

65366-0126 |

|

1 |

|

5 |

|

24577 |

|

233.83 |

|

577.353 |

|

Surf and Mineral owned by Apollo |

|

Black Xxx |

|

- |

|

Xxxxxx |

|

65366-0186 |

|

1 |

|

6 |

|

13005 |

|

1.94 |

|

4.78 |

|

Surf and Mineral owned by Apollo |

|

Black Fox |

|

|

|

Total Apollo Owned Surface and Mineral Rights |

|

|

|

842.87 |

|

2081.31 |

|

|

|

|

|

- | ||||||

Surface Rights Only Owned by Apollo

|

Township |

|

Pin # |

|

Concession # |

|

Lot # |

|

Parcel |

|

Hectares |

|

Acreage |

|

Status |

|

Property Package |

|

Effective date Date |

|

Xxxxxx |

|

65366-0126 |

|

1 |

|

5 |

|

15639 |

|

15.92 |

|

39.3 |

|

Surf. Rights owned by Apollo |

|

Black Xxx |

|

- |

|

Xxxxxx |

|

65366-0126 |

|

1 |

|

5 |

|

15653 |

|

15.92 |

|

39.3 |

|

Surf. Rights owned by Apollo |

|

Black Xxx |

|

- |

|

Xxxxxx |

|

65366-0126 |

|

1 |

|

5 |

|

15636 |

|

15.92 |

|

39.3 |

|

Surf. Rights owned by Apollo |

|

Black Xxx |

|

- |

|

Xxxxxx |

|

65366-0126 |

|

1 |

|

5 |

|

15651 |

|

15.92 |

|

39.3 |

|

Surf. Rights owned by Apollo |

|

Black Xxx |

|

- |

|

Xxxxxx |

|

65366-0126 |

|

1 |

|

5 |

|

15652 |

|

15.92 |

|

39.3 |

|

Surf. Rights owned by Apollo |

|

Black Xxx |

|

- |

|

Xxxxxx |

|

65366-0126 |

|

1 |

|

5 |

|

15670 |

|

15.92 |

|

39.3 |

|

Surf. Rights owned by Apollo |

|

Black Xxx |

|

- |

|

Xxxxxx |

|

65366-0126 |

|

1 |

|

5 |

|

14576 |

|

15.92 |

|

39.3 |

|

Surf. Rights owned by Apollo |

|

Black Xxx |

|

- |

|

Xxxxxx |

|

65366-0126 |

|

1 |

|

5 |

|

14567 |

|

15.92 |

|

39.3 |

|

Surf. Rights owned by Apollo |

|

Black Xxx |

|

- |

|

Xxxxxx |

|

65366-0126 |

|

1 |

|

5 |

|

15669 |

|

15.92 |

|

39.3 |

|

Surf. Rights owned by Apollo |

|

Black Xxx |

|

- |

|

Xxxxxx |

|

65366-0126 |

|

1 |

|

5 |

|

15662 |

|

15.92 |

|

39.3 |

|

Surf. Rights owned by Apollo |

|

Black Xxx |

|

- |

|

Xxxxxx |

|

65366-0126 |

|

1 |

|

5 |

|

15660 |

|

15.92 |

|

39.3 |

|

Surf. Rights owned by Xxxxxx |

|

Xxxxx Xxx |

|

- |

|

Xxxxxx |

|

00000-0000 |

|

5 |

|

4 |

|

24023 |

|

3.15 |

|

7.78 |

|

Surf. Rights owned by Xxxxxx |

|

Xxxxx Xxx |

|

- |

|

Xxxxxx |

|

00000-0000 |

|

5 |

|

3 |

|

10255 |

|

32.10 |

|

79.25 |

|

Surf. Rights owned by Apollo |

|

Black Fox |

|

- |

|

Total Surface Rights Only Owned By Apollo |

|

|

|

210.33 |

|

519.33 |

|

|

|

|

|

- | ||||||

Mineral Rights Only Owned by Apollo

|

Township |

|

Pin # |

|

Concession # |

|

Lot # |

|

Parcel |

|

Hectares |

|

Acreage |

|

Status |

|

Property Package |

|

Effective date Date |

|

Xxxxxx |

|

65366-0129 |

|

1 |

|

7 |

|

23874 |

|

123.27 |

|

304.37 |

|

Mineral Rights owened by Apollo |

|

Black Fox |

|

- |

|

Total Mineral Rights Only Owned By Apollo |

|

|

|

123.27 |

|

304.37 |

|

|

|

|

|

- | ||||||

Leased Mining Claims by Apollo

|

Township |

|

Pin # |

|

Concession # |

|

Lot # |

|

Parcel |

|

Hectares |

|

Acreage |

|

Status |

|

Property Package |

|

Claim # |

|

Start Date |

|

Expiration Date |

|

Xxxxxx |

|

65366-0199 |

|

1 |

|

6 |

|

L-1115059 |

|

16.22 |

|

40.8 |

|

Leased MR/SR Claims |

|

Black Fox |

|

108180 |

|

May 1/2008 |

|

Apr 30/2029 |

|

Xxxxxx |

|

65380-0670 |

|

6 |

|

5 |

|

L-1048334 |

|

16.52 |

|

40.8 |

|

Leased MR/SR Claim |

|

Black Fox |

|

108179 |

|

May 1/2008 |

|

Apr 30/2029 |

|

Xxxxxx |

|

65380-0670 |

|

6 |

|

6 |

|

L-1048335 |

|

16.52 |

|

40.8 |

|

Leased MR/SR Claim |

|

Black Fox |

|

108179 |

|

May 1/2008 |

|

Apr 30/2029 |

|

Xxxxxx |

|

65380-0671 |

|

6 |

|

7 |

|

L-1113087 |

|

8.91 |

|

22 |

|

Leased MR Claim |

|

Black Fox |

|

108181 |

|

May 1/2008 |

|

Apr 30/2029 |

|

Xxxxxx |

|

65380-0676 |

|

6 |

|

5 |

|

L-1048333 |

|

16.52 |

|

40.8 |

|

Leased MR/SR Claim |

|

Black Fox |

|

108264 |

|

October 1/2008 |

|

Sept 30/2029 |

|

Total Mining Claims Leased By Apollo |

|

|

|

74.70 |

|

185.20 |

|

|

|

|

|

|

|

|

|

| ||||||

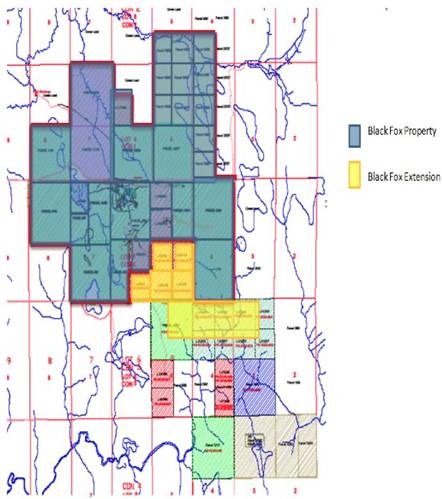

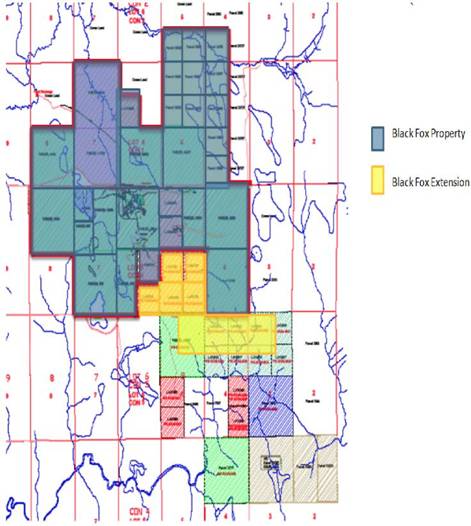

The Claims include those shaded in blue on the map attached.

SCHEDULE “A-2”

DESCRIPTION OF THE BLACK FOX EXTENSION

The Black Fox Extension shall include the part of the Pike River Project and concessions within a 500 metre radius of the Black Fox Property, which for greater certainty and without limitation, shall include L-531730, L-531731, L-547915, L-531729 and L-531728.

The Claims include those shaded in yellow on the map attached.

SCHEDULE “B”

PERMITTED ENCUMBRANCES

The following Encumbrances are deemed to be Permitted Encumbrances:

|

(i) |

any security interest, bond or deposit under workers’ compensation, social security, environmental or similar legislation or in connection with permitting, tenders, leases, contracts or expropriation proceedings or to secure public or statutory obligations, surety and appeal bonds or costs of litigation, all where required by law. |

|

|

|

|

(ii) |

any security interest or privilege imposed by law, such as builders’, mechanics’, material men’s, carriers’, warehousemen’s and landlords’ liens and privileges; or any security interest or privilege arising out of judgments or awards with respect to the Property, which ranks subordinate to the Project Charge which Brigus at the time is prosecuting an appeal or proceedings for review and with respect to which it has secured a stay of execution pending such appeal or proceedings for review; or any security interest for taxes, assessments or governmental charges or levies against the Property not at the time due and delinquent or the validity of which is being contested at the time by Brigus in good faith; or any undetermined or inchoate security interest or privilege incidental to current operations that has not been filed pursuant to law against Brigus or that relates to obligations not due or delinquent; or the deposit of cash or securities in connection with any security interest or privilege referred to in this paragraph. |

|

|

|

|

(iii) |

any right reserved to or vested in any municipality or governmental or other public authority by the terms of any lease, license, franchise, grant or permit held or acquired by Brigus in respect of the Property, or by any statutory provision, to terminate the lease, license, franchise, grant or permit or to purchase assets used in connection therewith or to require annual or other periodic payments as a condition of the continuance thereof. |

|

|

|

|

(iv) |

any security interest created or assumed by Brigus in favour of a public utility or any municipality or governmental or other public authority when required by the utility, municipality or other authority in connection with the operations of the Property. |

|

|

|

|

(v) |

any reservations, limitations, provisos and conditions expressed in original grants from the Crown including Crown Patents, the Province of Ontario or federal government or agencies thereof and any reservations and exceptions contained in, or implied by statute. |

|

(vi) |

any minor encumbrance, such as easements, rights-of-way, servitudes or other similar rights in land granted to or reserved by other Persons, rights-of-way for sewers, electric lines, telegraph and telephone lines, oil and natural gas pipelines and other similar purposes, or zoning or other restrictions applicable to the Property’s use of real property, that do not in the aggregate materially detract from the value of the property or materially impair its use in the operation of the Property. |

|

|

|

|

(vii) |

Encumbrances in favour of governmental authorities securing reclamation obligations of the Property. |

|

|

|

|

(viii) |

all exploration, development and operating permits and bonding requirements in respect of the Property imposed by federal, provincial and local government requirements, including the potential application of new environmental or other restrictions, limitations and requirements imposed by such authorities on mineral exploration, development, mining and processing operations. |

|

|

|

|

(ix) |

any existing or future security interest, mortgage or charge, whether fixed or floating, granted to any lender, commercial bank or other financial institution securing indebtedness; |

|

|

|

|

(x) |

any extension, renewal, alteration, substitution or replacement, in whole or in part, of a security interest referred to in the above paragraphs; |

|

|

|

|

(xi) |

Black Fox Properties, Parcel 8: PIN 65366-0127 (LT): |

|

|

|

|

|

(a) Instrument No. C341846 registered on April 14, 1986, being a Transfer of Easement in favour of Her Majesty The Queen, in Right of the Province of Ontario, Represented by the Minister of Transportation and Communication. |

|

|

|

|

|

(b) Instrument No. C485344 registered on August 21, 1998, being a Notice of a Royalty Agreement between Glimmer Resources Inc. and Joachim Xxxxxx XxXxxxxx. |

|

|

|

|

(xii) |

Black Fox Properties, Parcel 9: PIN 65380-0552 (LT): |

|

|

|

|

|

(a) Instrument No. C523970 registered on September 6, 2002, being a Notice of an Option to Purchase in favour of Exall Resources Limited together with an attached Royalty Agreement between Exall Resources Limited and Xxxxxx Xxxxxxx. |

|

|

|

|

|

(b) Instrument No. C523971 registered on September 6, 2002, being a Notice of Assignment of the aforesaid Option and Royalty Agreement in favour of Apollo Gold Corporation. |

|

(xiii) |

Black Fox Properties, Parcel 10: PIN 65380-0534 (LT): |

|

|

|

|

|

(a) Instrument No. C488166 registered on November 25, 1998, being a Notice of an Option Agreement granted by Xxxxxxx and Xxxxxxx Xxxxxx in favour of Exall Resources Limited. |

|

|

|

|

|