CEDING COMPANY AGREEMENT NOS. 297-6 and 697-1 REINSURER AGREEMENT NO. QARYR1-1711 AUTOMATIC/FACULTATIVE YRT REINSURANCE AGREEMENT (hereinafter referred to as the “Agreement”) Between

CEDING COMPANY AGREEMENT NOS. 297-6 and 697-1

REINSURER AGREEMENT NO. QARYR1-1711

AUTOMATIC/FACULTATIVE YRT

(hereinafter referred to as the “Agreement”)

Between

THE MINNESOTA LIFE INSURANCE COMPANY Agreement 297-6

And

SECURIAN LIFE INSURANCE COMPANY Agreement ▇▇▇-▇

▇▇ ▇▇▇▇, ▇▇▇▇▇▇▇▇▇

(collectively referred to as the “Ceding Company”)

and

THE CANADA LIFE ASSURANCE COMPANY

▇▇▇▇▇▇▇, ▇▇▇▇▇▇▇, ▇▇▇▇▇▇

(hereinafter referred to as the “Reinsurer”)

EFFECTIVE DATE OF AGREEMENT: November 1, 2017

TABLE OF CONTENTS

| ARTICLE 1 – PREAMBLE | 5 | |||||

| 1.1 |

PARTIES TO THIS AGREEMENT | 5 | ||||

| 1.2 | CHOICE OF LAW AND FORUM |

5 | ||||

| 1.3 | ENTIRE AGREEMENT |

5 | ||||

| 1.4 | ASSIGNMENT OR TRANSFER |

5 | ||||

| 1.5 | EXPENSE OF ORIGINAL POLICY |

5 | ||||

| 1.6 | RETAINED AMOUNTS |

5 | ||||

| ARTICLE 2 – AUTOMATIC REINSURANCE | 6 | |||||

| 2.1 |

GENERAL CONDITIONS | 6 | ||||

| 2.2 | UNDERWRITING EXCEPTIONS |

7 | ||||

| 2.3 | CHANGES TO UNDERWRITING GUIDELINES |

7 | ||||

| ARTICLE 3 – FACULTATIVE REINSURANCE | 8 | |||||

| ARTICLE 4 – COMMENCEMENT OF LIABILITY | 9 | |||||

| 4.1 |

AUTOMATIC REINSURANCE | 9 | ||||

| 4.2 | FACULTATIVE REINSURANCE |

9 | ||||

| 4.3 | BACKDATING TO SAVE AGE |

9 | ||||

| 4.4 | CONDITIONAL RECEIPT OR TEMPORARY INSURANCE AGREEMENT |

9 | ||||

| ARTICLE 5 – PREMIUM ACCOUNTING | 11 | |||||

| 5.1 |

PREMIUMS | 11 | ||||

| 5.2 | PAYMENT OF PREMIUMS |

11 | ||||

| 5.3 | DELAYED PAYMENT |

11 | ||||

| 5.4 | FAILURE TO PAY PREMIUMS |

11 | ||||

| 5.5 | FINANCIAL STATEMENT ACCOUNTING |

12 | ||||

| 5.6 | PREMIUM RATE GUARANTEE |

12 | ||||

| ARTICLE 6 – POLICY TERMINATIONS, CHANGES AND REINSTATEMENTS | 13 | |||||

| 6.1 |

REDUCTIONS | 13 | ||||

| 6.2 | TERMINATIONS |

13 | ||||

| 6.3 | INCREASES |

14 | ||||

| 6.4 | RISK CLASSIFICATION CHANGES |

14 | ||||

| 6.5 | REINSTATEMENT |

14 | ||||

| 6.6 | NONFORFEITURE BENEFITS |

15 | ||||

| ARTICLE 7 – CONVERSIONS, EXCHANGES AND REPLACEMENTS | 16 | |||||

| ARTICLE 8 – POLICY RESCISSION | 17 | |||||

2

| ARTICLE 9 – CLAIMS | 18 | |||||

| 9.1 |

NOTICE | 18 | ||||

| 9.2 | PROOFS |

18 | ||||

| 9.3 | AMOUNT AND PAYMENT OF REINSURANCE BENEFITS |

18 | ||||

| 9.4 | DISPUTED CLAIMS |

19 | ||||

| 9.5 | CLAIM EXPENSES |

19 | ||||

| 9.6 | MISREPRESENTATION OR SUICIDE |

19 | ||||

| 9.7 | MISSTATEMENT OF AGE OR GENDER |

19 | ||||

| 9.8 | EXTRA-CONTRACTUAL DAMAGES |

20 | ||||

| ARTICLE 10 – RETENTION LIMIT CHANGES | 21 | |||||

| ARTICLE 11 – RECAPTURE | 22 | |||||

| ARTICLE 12 – REINSURED NET AMOUNT AT RISK | 23 | |||||

| ARTICLE 13 – GENERAL PROVISIONS | 24 | |||||

| 13.1 | CURRENCY |

24 | ||||

| 13.2 | PREMIUM TAX |

24 | ||||

| 13.3 | INSPECTION OF RECORDS |

24 | ||||

| 13.4 | COMPLIANCE OF LAWS |

24 | ||||

| 13.5 | ANTI MONEY LAUNDERING |

25 | ||||

| 13.6 | THE FOREIGN ACCOUNT TAX COMPLIANCE ACT (FATCA) |

25 | ||||

| 13.7 | INTEREST RATE FOR BALANCES IN DEFAULT |

26 | ||||

| 13.8 | SEVERABILITY |

26 | ||||

| 13.9 | WAIVER |

26 | ||||

| ARTICLE 14 – DAC TAX | 27 | |||||

| ARTICLE 15 – RESERVES | 28 | |||||

| 15.1 | RESERVE BASIS |

28 | ||||

| 15.2 | RESERVE REPORTING |

28 | ||||

| 15.3 | RESERVE CREDIT |

28 | ||||

| ARTICLE 16 – OFFSET | 30 | |||||

| ARTICLE 17 – INSOLVENCY | 31 | |||||

| 17.1 | INSOLVENCY OF A PARTY TO THIS AGREEMENT |

31 | ||||

| 17.2 | INSOLVENCY OF THE CEDING COMPANY |

31 | ||||

| 17.3 | INSOLVENCY OF THE REINSURER |

32 | ||||

| ARTICLE 18 – ERRORS AND OMISSIONS | 33 | |||||

3

| ARTICLE 19 – ARBITRATION | 35 | |||||

| 19.1 | GENERAL |

35 | ||||

| 19.2 | ISSUE RESOLUTION |

35 | ||||

| 19.3 | NOTICE OF ARBITRATION |

35 | ||||

| 19.4 | PROCEDURE |

35 | ||||

| 19.5 | PLACE OF ARBITRATION |

36 | ||||

| 19.6 | ARBITRATION COSTS |

36 | ||||

| 19.7 | ARBITRATION SETTLEMENT |

36 | ||||

| 19.8 | INJUCTIVE RELIEF |

36 | ||||

| 19.9 | CONFIDENTALITY OF ARBITRATION |

37 | ||||

| ARTICLE 20 – DURATION OF AGREEMENT | 38 | |||||

| ARTICLE 21 – REPRESENTATIONS AND WARRANTIES | 39 | |||||

| ARTICLE 22 – CONFIDENTALITY | 41 | |||||

| 22.1 | DEFINITIONS |

41 | ||||

| 22.2 | NONDISCLOSURE SECURITY |

42 | ||||

| 22.3 | DATA SAFE GUARDS |

42 | ||||

| 22.4 | EXCEPTIONS |

43 | ||||

| 22.5 | RETURN, DESTRUCTION OF CONFIDENTIAL INFORMATION |

43 | ||||

| 22.6 | REPRESENTATIONS |

43 | ||||

| ARTICLE 23 – DEFINITIONS | 44 | |||||

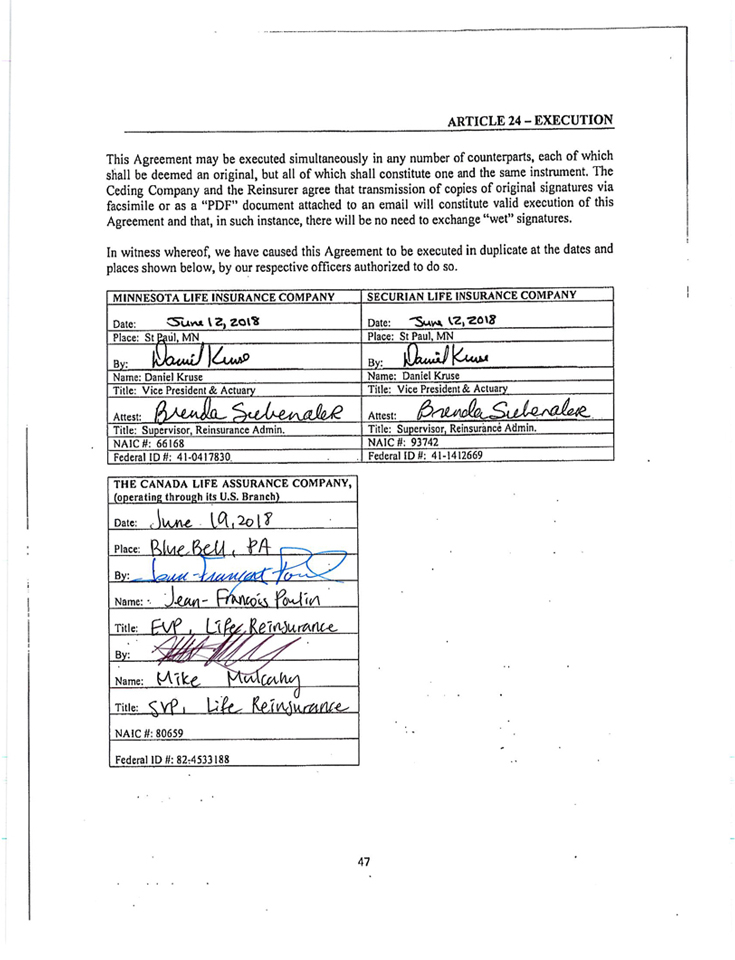

| ARTICLE 24 – EXECUTION | 47 | |||||

| EXHIBIT A – RETENTION SCHEDULE OF CEDING COMPANY | 48 | |||||

| EXHIBIT B – BUSINESS COVERED AND ISSUE AGE LIMITS | 49 | |||||

| EXHIBIT C – BINDING LIMITS | 51 | |||||

| EXHIBIT D – REINSURANCE PREMIUMS | 54 | |||||

| EXHIBIT E – RATE SCHEDULE FOR CONVERSIONS | 68 | |||||

| EXHIBIT F – DATA PROTECTION ADDENDUM | 72 | |||||

| EXHIBIT G – SELF ADMINISTERED REPORTING | 76 | |||||

4

ARTICLE 1 – PREAMBLE

| 1.1 | PARTIES TO THIS AGREEMENT |

This Agreement will be construed to constitute a separate and distinct Agreement between each Ceding Company and the Reinsurer. The duties and obligations of each Ceding Company and the Reinsurer under this Agreement are several and not joint.

This Agreement is an indemnity reinsurance agreement solely between the Ceding Company and the Reinsurer. The acceptance of risks under this Agreement by the Reinsurer will create no right or legal relation between the Reinsurer and the insured, owner, beneficiary, or assignee of any insurance policy of the Ceding Company.

This Agreement will be binding upon the parties hereto and their respective successors and assigns including any rehabilitator, conservator, liquidator or statutory successor of either party. Neither party may effect any novation of this Agreement without the other party’s prior written consent.

Day or days, when used in this Agreement, will mean calendar days.

| 1.2 | CHOICE OF LAW AND FORUM |

This Agreement, will in all respects be governed by, and construed in accordance with the law and exclusive jurisdiction of the Courts of Minnesota.

| 1.3 | ENTIRE AGREEMENT |

This Agreement constitutes the entire Agreement between the parties, with respect to the business being reinsured hereunder, and there are no understandings between the parties other than expressed in this Agreement. Any alterations to the provisions of this Agreement will be made by Amendment or Addenda and must be signed by both parties. These documents will be regarded as part of this Agreement and will be equally binding.

| 1.4 | ASSIGNMENT OR TRANSFER |

Neither this Agreement nor any new or inforce reinsurance under this Agreement, may be sold or assigned in whole or in part by either the Ceding Company or the Reinsurer without the prior written approval of the other party. Nothing herein shall prohibit the Reinsurer from retroceding or transferring Risk associated with the Agreement to other parties.

| 1.5 | EXPENSE OF THE ORIGINAL POLICY |

The ceding company will bear the expense of all medical examinations, inspection fees and other charges incurred in connection with the underwriting and issuance of the policy.

| 1.6 | RETAINED AMOUNTS |

The Ceding Company may not reinsure the amount it has retained on the Reinsured Business on any basis without the Reinsurer’s prior written consent.

5

ARTICLE 2 – AUTOMATIC REINSURANCE

| 2.1 | GENERAL CONDITIONS |

On and after the Effective Date of this Agreement, the Ceding Company will Automatically cede to the Reinsurer a portion of the life insurance policies, supplementary benefits, and riders listed in Exhibit B-Business Covered and Issue Age Limits.

The Reinsurer will Automatically accept its share of the above-referenced policies up to the limits shown in Exhibit C-Binding Limits, provided that:

| a. | the Ceding Company keeps its Quota Share Retention, as specified in Exhibit A-Retention Schedule of the Ceding Company. |

| b. | the Ceding Company applies the underwriting and reinstatement guidelines, practices, and procedures for risk selection conveyed to the Reinsurer prior to or at the time of pricing, or any Material Changes consented to in writing by the Reinsurer, which are still in use on the coverage commencement date; |

| c. | the sum of the Ultimate Face Amount of reinsurance required including contractual increases and any applicable riders, and the amount already reinsured on that life under this Agreement and all other agreements between the Reinsurer and the Ceding Company, does not exceed the Automatic Binding Limits set out in Exhibit C-Binding Limits; |

| d. | the amount of life insurance in force in all companies, including any coverage to be replaced, plus the Ultimate Face Amount currently applied for on that life in all companies, does not exceed the Jumbo Limits stated in Exhibit C-Binding Limits; |

| e. | the application is on a life that is not a Professional Athlete; |

| f. | the application is on a life that has not been submitted Facultatively to the Reinsurer or any other reinsurer within the last three (3) years, unless the reason for any prior Facultative submission was solely for capacity that may now be accommodated within the terms of this Agreement and |

| g. | policy is not issued using the WriteFit Accelerated Underwriting Program, or equivalent; |

| h. | The insureds, at the time of application, must be legal residents of the United States, Canada, Puerto Rico or Guam and issued in accordance with the Ceding Company’s underwriting guidelines. |

For purposes of this Agreement, “Ultimate Face Amount” will mean, to the best of the Ceding Company’s knowledge, the projected maximum face amount at the time of underwriting, including any contractual increases, that could be reached based on reasonable assumptions made about the policy.

6

| 2.2 | UNDERWRITING EXCEPTIONS |

It is understood and agreed that the Reinsurer will accept the Ceding Company’s underwriting decisions as long as the Ceding Company’s underwriters act in good faith, in a prudent manner and in accordance with the Ceding Company’s underwriting guidelines, manual, age and amount requirements and control procedures (collectively, “the Underwriting Requirements”).

Mistakes in mortality assessment will be accepted for Automatic reinsurance by the Reinsurer provided such mistakes are not systemic or part of a pattern that evidences disregard for the Underwriting Requirements.

Underwriter discretion, which may deviate from the Underwriting Requirements when deemed warranted and appropriate by the Ceding Company underwriter exercising his or her professional judgment, will also be accepted for Automatic reinsurance by the Reinsurer provided that the assessed mortality risk for the policy is consistent with the Ceding Company’s expected mortality level for the underwriting classification that is applied. Business Exceptions occur where the Underwriting Requirements are deviated from based on business considerations rather than underwriting judgment. Business Exceptions will be accepted for Automatic reinsurance only with the approval of the Reinsurer.

| 2.3 | CHANGES TO UNDERWRITING GUIDELINES |

The Ceding Company reserves the right to revise the underwriting guidelines from time to time. For any Material change to the underwriting guidelines, the Ceding Company agrees to provide 20 days advanced written notice to the Reinsurer, and the Reinsurer agrees to provide its decision in writing with regard to the proposed change within twenty (20) days. If there is no response from the Reinsurer, the Ceding Company will follow up with the Reinsurer before expiration of the review period. The Reinsurer’s failure to respond within twenty (20) days will constitute its acceptance of these changes.

7

ARTICLE 3 – FACULTATIVE REINSURANCE

The Ceding Company may submit any application on a Policy identified in Exhibit B – Business Covered and Issue Age Limits to the Reinsurer for its consideration on a facultative basis including, but not limited to, Policies with amounts in excess of the Automatic Binding Limits.

The Ceding Company shall apply for reinsurance on a facultative basis by sending to the reinsurer a mutually acceptable application for facultative reinsurance. In addition to the facultative application, the Ceding Company shall provide all underwriting evidence that is available for risk assessment including, but not limited to, copies of the application for insurance, medical examiners’ reports, attending physicians’ statements, inspection reports, and any other information bearing on the insurability of the risk. The Ceding Company also shall notify the Reinsurer of any outstanding underwriting requirements at the time of the facultative submission. Any subsequent information received by the Ceding Company that is pertinent to the risk assessment shall be immediately transmitted to the Reinsurer.

After consideration of the facultative application and related information, Reinsurer shall promptly inform the Ceding Company of its underwriting decision. If the Reinsurer makes an offer, the Ceding Company must accept Reinsurer’s offer during the lifetime of the insured and within the (i) time period specified in Reinsurer’s offer or (ii) one hundred and twenty (120) days after the Ceding Company’s receipt of such offer. The Ceding Company shall accept Reinsurer’s offer by (i) written notification or (ii) reporting such risk on the periodic reports it provides to Reinsurer pursuant to Exhibit G.

The Ceding Company will apply its “Facultative Placement Rules” defined a first in, best offer.

If the Ceding Company fails to accept the Reinsurer’s offer as set forth above, Reinsurer’s offer shall expire and no reinsurance coverage shall exist on the risk.

If both parties have good reason to believe the business should have been covered but its omission was an oversight, the Ceding Company may submit a written request to the Reinsurer on any such application it wishes to be ceded hereunder for approval. Subject to discussions between the Ceding Company and the Reinsurer, the Reinsurer will notify the Ceding Company within five (5) business days after the request whether it is able to accept such applications based on criteria such as capacity.

For Joint Second to Die products submitted on a facultative other basis, the Ceding Company will send the application and other underwriting information for the substandard life or lives. The Ceding Company will provide the name, date of birth, rating (standard or preferred), and smoking status of the unimpaired life on the reinsurance cover sheet. If the Joint Second to Die policy is facultative due to amount, then the Ceding Company will send the application and other underwriting information for both lives.

8

ARTICLE 4 – COMMENCEMENT OF LIABILITY

| 4.1 | AUTOMATIC REINSURANCE |

For Automatic reinsurance, the Reinsurer’s liability will commence at the same time as the Ceding Company’s liability.

| 4.2 | FACULTATIVE REINSURANCE |

For Facultative reinsurance, the Reinsurer’s liability will commence at the same time as the Ceding Company’s liability, provided that the Reinsurer has made a binding Facultative offer and that offer was accepted, during the lifetime of the insured, in accordance with the terms of this Agreement.

| 4.3 | BACKDATING TO SAVE AGE |

The Ceding Company will have the right to backdate policies up to six (6) months for the purpose of saving age. Such backdated policies will be covered by this Agreement even if the backdated issue date precedes the Effective Date of this Agreement.

| 4.4 | CONDITIONAL RECEIPT OR TEMPORARY INSURANCE AGREEMENT |

Reinsurance coverage under a Conditional Receipt or Temporary Insurance Agreement is limited to the Reinsurer’s share of amounts within the Conditional Receipt or Temporary Insurance Agreement specified in Exhibit C-Binding Limits. Reinsurance coverage is limited to one Conditional Receipt or Temporary Insurance Agreement per application on a life regardless of how many receipts are issued or initial premiums are accepted by the Ceding Company. The Reinsurer will accept liability provided that:

| a. | The Reinsurer has reviewed and approved the Conditional Receipt form or Temporary Insurance Agreement form; and |

| b. | The risk is eligible for Automatic reinsurance under this Agreement; or the Reinsurer has made a Facultative offer during the lifetime of the insured and the Ceding Company would have accepted that offer; and |

| c. | For facultative applications submitted to the Reinsurer, the Reinsurer’s liability under a Conditional Receipt or a Temporary Insurance Agreement will begin simultaneously with the Ceding Company’s contractual liability if the Reinsurer’s facultative offer has been accepted or would have been accepted. The Reinsurer’s liability is limited to its share, as shown in Exhibit C-Binding Limits, of amounts accepted within the Ceding Company’s usual cash-with-application procedures for temporary coverage. |

If the proposed insured dies prior to the completion of the underwriting process, the Reinsurer will continue underwriting the risk to determine if a facultative offer would have been made on the risk. If so, the Reinsurer will accept liability for the risk in accordance with the Ceding Company’s Facultative Placement Rules, subject to the limits specified in the paragraph above.

9

| d. | The Reinsurer has no liability for facultative applications that the Ceding Company has not submitted to the Reinsurer. |

| e. | The Ceding Company, its agents, or representatives have followed its normal cash-with-application procedures for such coverage. |

After a policy has been issued, no reinsurance benefits are payable under this pre-issue coverage provision.

10

ARTICLE 5 – PREMIUM ACCOUNTING

| 5.1 | PREMIUMS |

Reinsurance premium rates paid by the Ceding Company for life insurance and other benefits reinsured under this Agreement are shown in Exhibit D-Reinsurance Premiums. The rates will be applied to the Net Amount at Risk reinsured under this Agreement.

| 5.2 | PAYMENT OF PREMIUMS |

Reinsurance Premiums will be paid annually in advance. The Ceding Company will self-administer all reinsurance under this Agreement. Renewal Premium and any adjustments will be due within sixty (60) days of anniversary processing. New business Premium is due within one hundred twenty (120) days of the date the risk is issued and paid.

| 5.3 | DELAYED PAYMENT |

When balances are in default, each party reserves the right to charge interest at the prime rate plus 2% as stated in the Wall Street Journal on January 1, prior to the due date of the Premium when Premium is delinquent.

| 5.4 | FAILURE TO PAY PREMIUMS |

The payment of reinsurance premiums is a condition precedent to the liability of the Reinsurer for reinsurance covered by this Agreement. In the event that reinsurance premiums are not paid within sixty (60) days after they are due pursuant to Article 5.2 above, the Reinsurer will have the right to terminate the reinsurance for all policies having reinsurance premiums in arrears. If the Reinsurer elects to exercise its right of termination, it will give the Ceding Company ninety (90) days written notice of its intention. Such notice will be sent by certified mail or overnight courier service (e.g. Federal Express).

If all reinsurance premiums in arrears, including any that become in arrears during the ninety (90) day notice period, are not paid before the expiration of the notice period, the Reinsurer will be relieved of all liability under those policies as of the last date to which premiums have been paid for each policy. Reinsurance on policies on which reinsurance premiums subsequently fall due will automatically terminate as of the last date to which premiums have been paid for each policy, unless reinsurance premiums on those policies are paid on or before their due date pursuant to Article 5.2 above.

Terminated reinsurance may be reinstated, subject to approval by the Reinsurer, within thirty (30) days of the date of termination, and upon payment of all reinsurance premiums in arrears including any interest accrued thereon. The Reinsurer will have no liability for any claims incurred between the date of termination and the date of the reinstatement of the reinsurance. The right to terminate reinsurance will not prejudice the Reinsurer’s right to collect premiums for the period during which reinsurance was in force prior to the expiration of the ninety (90) day notice.

The Ceding Company may not force termination under the provisions of this Article to avoid the provisions regarding recapture in Article 11, nor to transfer the reinsured policies to another Reinsurer.

11

| 5.5 | FINANCIAL STATEMENT ACCOUNTING |

Each Party acknowledges to the other that it is responsible for ensuring that the accounting and tax treatment it has adopted for this Agreement and the transactions contemplated hereunder, complies with all relevant accounting, tax and regulatory standards applicable to it. Each Party must consult with its own accounting, tax and legal advisers to determine the proper accounting, tax and regulatory treatment for this Agreement and the transactions contemplated hereunder. A Party has no duty or responsibility to inquire, investigate or verify the accounting treatment which the other Party adopts.

| 5.6 | PREMIUM RATE GUARANTEE |

The Life Reinsurance Premium rates contained in this Agreement are guaranteed for one year, and the Reinsurer anticipates continuing to accept Premiums on the basis of these rates indefinitely. If the Reinsurer deems it necessary to increase rates, then it shall provide the Ceding Company with reasonable actuarial evidence for the justification of the rate increase.

For products that have not adopted the 2017 CSO Loaded Select & Ultimate mortality table:

In no event will the premium rates exceed the greater of:

| a. | YRT net premiums at the applicable statutory minimum valuation select and ultimate mortality table and statutory maximum interest rate for the reinsured business. |

| b. | The current standard annual reinsurance premiums as set out in Exhibit D-Reinsurance Premium. |

For products that have adopted the 2017 CSO Loaded Select & Ultimate mortality table:

In no event will the increased premium rates exceed the greater of:

| a. | YRT net premiums calculated using the statutory maximum interest rate for the reinsured business and a multiple of 125% of the 2017 CSO Loaded Sex & Smoker Distinct, Ultimate Only, Preferred Structure, Age Nearest Birthday mortality table. |

| b. | The current standard annual reinsurance premiums as set out in Exhibit D-Reinsurance Premium. . |

An additional mortality load consistent with pricing will be applied to non-standard risks including but not limited to conversions, post-level term, and substandard policies.

For inforce blocks of business,. if an increase in reinsurance rates occurs on a guaranteed product that is reinsured on non-guaranteed terms, the Ceding Company, with prior written notice to the Reinsurer, has the right to Recapture the business to which such increase applies, as of the effective date of the increase in reinsurance rates.

For inforce blocks of business, if an increase in reinsurance rates occurs on a non-guaranteed product that is reinsured on non-guaranteed terms, the Ceding Company should investigate the possibility of increasing its direct pricing or charges to restore the product to previous profitability. If the Ceding Company determines that it cannot reasonably implement such a pricing increase, then, with prior written notice to the Reinsurer, it has the right to Recapture the business to which such increase applies, as of the effective date of the increase in reinsurance rates.

12

ARTICLE 6 – POLICY TERMINATIONS , CHANGES AND REINSTATEMENTS

| 6.1 | REDUCTIONS |

Unless specified otherwise in this Agreement, if the amount of a Reinsured Policy issued by the Ceding Company is reduced , then the amount of reinsurance on that Reinsured Policy will be reduced effective the same date by the same proportion as the reduction under the original Reinsured Policy.

The reduction will be on a Last in First Out basis (LIFO). The reduction will first apply to any reinsurance on the Reinsured Policy being reduced and then, if applicable, in chronological order according to policy date (“Last in, first out”) to any reinsurance on other policies in force on the life. However, the Ceding Company will not be required to assume a risk for an amount in excess of its regular retention for the age at issue and the mortality rating of the policy under which reinsurance is being terminated.

If the reinsurance for a Reinsured Policy has been placed with more than one reinsurer, the reduction will be applied to all reinsurers pro rata to the amounts originally reinsured with each reinsurer.

A reduction to one of the Ceding Company’s policies not reinsured hereunder will require that the Ceding Company maintain its required retention as specified in Exhibit A-Retention Schedule of the Ceding Company of this Agreement.

In the event of the reduction of a policy or policies reinsured under this Agreement, the Reinsurer will refund any unearned reinsurance premiums. The reinsured portion of any policy fee will be deemed earned for the entire policy year if the policy was reinsured during any portion of that policy year.

| 6.2 | TERMINATIONS |

When a policy issued by the Ceding, Company terminates, the corresponding reinsurance on the Reinsured Policy will be terminated effective the same date. Unless specified otherwise in this Agreement, if a policy fully retained by the Ceding Company terminates, the terms of Article 6.1 will apply. Full retention shall be defined as specified in Exhibit A-Retention Schedule of the Ceding Company of this Agreement.

If a policy issued by the Ceding Company lapses and extended term insurance is elected under the terms of that policy, the corresponding reinsurance on the Reinsured Policy will continue on the same basis as the original Reinsured Policy until the expiry of the extended term period.

13

If a policy issued by the Ceding Company lapses and reduced paid-up insurance is elected under the terms of that policy, the amount of the corresponding reinsurance on the Reinsured Policy will be reduced according to the terms of Article 6.1.

If the Ceding Company allows the policy to remain in force under its automatic premium loan provision, the corresponding reinsurance on the Reinsured Policy will continue unchanged and in force as long as such provisions remain in effect, except as otherwise provided in this Agreement.

In the event of the termination of a policy or policies reinsured under this Agreement, the Reinsurer will refund any unearned reinsurance premiums subject to Article 18. Late Reporting.

| 6.3 | INCREASES |

Non-Contractual

If the amount of insurance is increased as a result of a non-contractual change, the increase will be underwritten and will be considered new risk under this Agreement in accordance with Exhibit A-Retention Schedule of Ceding Company. The Reinsurer’s approval is required if the new amount will cause the reinsured amount on the life to exceed the limits shown in Exhibit C, Automatic Pool Binding Limits, or Jumbo Limit. The Risk will not be automatically reinsured if the life was previously reviewed or underwritten on a facultative basis.

Contractual

Only reinsured riders that have contractual increases as shown in Exhibit B-Business Covered and Issue Age Limits will be reinsured. For policies reinsured on an automatic basis increases will be accepted up to the Pool Binding Limits as shown in Exhibit C-Retention Limits. For policies reinsured on a Facultative basis, reinsurance will follow the parameters outlined in the Reinsurer’s Facultative offer. Reinsurance premiums for the additional reinsurance shall be calculated using point in scale reinsurance premium rates from the original issue age of the Risk Reinsured.

| 6.4 | RISK CLASSIFICATION CHANGES |

For automatic Risks, the Ceding Company may reduce the rating classification or change the tobacco classification in accordance with the Ceding Company underwriting guidelines. The Ceding Company will notify the Reinsurer of this change. For Facultative Risks, the Ceding Company will submit the rating classified changes and tobacco class changes under the Facultative provisions in Article 3.

| 6.5 | REINSTATEMENT |

Any Risk originally reinsured on an automatic basis or on a facultative basis where no underwriting is required, in accordance with the terms and conditions of this Agreement, may be automatically reinstated with the Reinsurer. Any Risk originally reinsured with the Reinsurer on a Facultative basis that requires underwriting, will be submitted with the underwriting requirements and approved by the Reinsurer before the Risk is reinstated.

The Ceding Company will pay the Reinsurer all reinsurance Premiums in the same manner as the Ceding Company received the insurance Premiums under the particular Policy.

14

The Reinsurer will have no liability for any claims incurred on or after the date of termination for policies in which reinstatement was considered but not yet effective prior to date of death in accordance with the terms set out herein.

| 6.6 | NONFORFEITURE BENEFITS |

| a. | Extended Term: If the Policy changes to extended term insurance under the terms of the Policy, the Risk to be reinsured will continue until the expiry of the extended term. |

| b. | Reduced Paid-Up: If the Policy changes to reduced paid-up insurance under the terms of the Policy, the Risk will be reinsured in accordance with Article 6, Section 1 above. |

15

ARTICLE 7 – CONVERSIONS, EXCHANGES AND REPLACEMENTS

The Reinsurer does not accept conversions to permanent products under this Agreement.

The Reinsurer will continue to reinsure the Risks resulting from internal replacements or exchanges of any coverage reinsured under this Agreement, in an amount not to exceed the original amount reinsured.

Reinsurance Premiums and any allowances for internal replacements or exchanges will be on a point in scale basis from the original issue date of the Risk Reinsured.

16

ARTICLE 8 – POLICY RESCISSION

If it is determined that a Policy reinsured under this Agreement should be rescinded due to misrepresentation by the policy owner or the insured, the Reinsurer will pay its share of reasonable investigation and legal expenses connected with the rescission action. If it is determined that multiple similarly situated policies reinsured under this Agreement should all be rescinded for the same reason or reasons, the Ceding Company must consult with the Reinsurer in advance of incurring the investigation and legal expenses.

The Reinsurer will not reimburse the Ceding Company for routine expenses, including but not limited to the Ceding Company’s home office expenses, compensation of salaried officers and employees, and any legal expenses other than third party expenses incurred by the Ceding Company.

17

ARTICLE 9 – CLAIMS

| 9.1 | NOTICE |

When the Ceding Company is informed of a claim, it will promptly notify the Reinsurer of the claim. This notification will provide the Reinsurer with the following information: The Name, Policy Number, Issue Date, Date of Birth, Date of Death (if known), Face Amount and reinsured Net Amount At Risk.

| 9.2 | PROOFS |

The Ceding Company will examine and approve the claims and will send the Reinsurer notification of all paid claims. It is the sole decision of the Ceding Company to determine if the claim is payable. The Reinsurer agrees to accept the determination of the Ceding Company made based on the Ceding Company’s standard claims practices and subject to the terms of this Agreement.

When the Ceding Company is requesting its share of the claim, the following proofs will be submitted to the Reinsurer with each claim. A copy of the death certificate, proof of the amount paid with authenticated and essential information translated if not in English if previously prepared on such claim by the Ceding Company and a copy of the claimant’s statement. The Reinsurer will also pay its proportionate share of interest that the Ceding Company pays on the death benefit.

In every case of loss, copies of the proofs obtained by the Ceding Company will be taken by the Reinsurer as sufficient provided proofs are in accordance with the Ceding Company’s current claim practices.

The Reinsurer reserves the right to request, and the Ceding Company will send upon such request, documentation relating to any claim reinsured under this Agreement.

| 9.3 | AMOUNT AND PAYMENT OF REINSURANCE BENEFITS |

As soon as the Reinsurer receives proper claim notice, proof of the claim and the Death Claim Benefit Request Form, the Reinsurer shall within sixty (60) days pay the undisputed reinsurance benefits due the Ceding Company. The claim benefits paid will be in a single sum, regardless of the Ceding Company’s settlement options.

When death claim benefits due from the Reinsurer are in default, the Ceding Company reserves the right to charge interest at the Prime Rate plus 2% as stated in the Wall Street Journal on January 1, prior to the date of the death claim. Claims benefits in default are defined as claim benefits not reimbursed within ninety (90) days of the claim benefit request.

For policies where the Ceding Company decides not to pay the claim, the procedures stated below under Section 9.4, Disputed Claims will be followed.

18

| 9.4 | DISPUTED CLAIMS |

The Ceding Company will promptly notify the Reinsurer of its intent to deny, contest or compromise a claim reinsured under this Agreement. The Ceding Company will provide the Reinsurer with all papers for review. Within seven (7) days of receiving the papers, the Reinsurer must communicate its approval of the Ceding Company’s actions and agreement to be a party to the denial, contest, or compromise. Failure to respond to the Ceding Company within seven (7) days constitutes approval and agreement by the Reinsurer.

If the Reinsurer ▇▇▇▇▇▇▇▇.▇▇ be a party to such denial, contest or compromise, the Reinsurer will discharge all of its liability by paying its proportionate share of reinsurance due the Ceding Company as if there had been no denial, contest or compromise. The Reinsurer will also pay its proportionate share of covered expenses incurred to the date it notifies the Ceding Company it declines to be a party

| 9.5 | CLAIM EXPENSES |

The Reinsurer will pay its share of reasonable investigation and legal expenses connected with the litigation or settlement of contractual liability claims, unless the Reinsurer has discharged its liability as described in Section 9.4 above, the Reinsurer will not participate in any expenses after the date of discharge.

Claim expenses do not include routine home office claim and administration expenses, including the Ceding Company’s expenses incurred by the Ceding Company as a result of a dispute arising out of conflicting claims of entitlement to policy proceeds or benefits.

| 9.6 | MISREPRESENTATION OR SUICIDE |

If the Ceding Company returns Premium to the policy owner or beneficiary as a result of fraud or misrepresentation within the policy contestable period or as a result of the suicide of the insured, the Reinsurer will refund net reinsurance Premiums received on that policy without interest to the Ceding Company.

| 9.7 | MISSTATEMENT OF AGE OR GENDER |

If the amount of insurance changes because of a misstatement of age or sex classification, the Reinsurer’s share of liability will change proportionately. Reinsurance Premiums will be adjusted from the inception of the policy and any differences will be settled without interest.

19

| 9.8 | EXTRA-CONTRACTUAL DAMAGES |

Generally, the Reinsurer will not participate in and will not be liable to pay extra-contractual damages that are awarded against the Ceding Company as a result of an act, omission, or course of conduct committed solely by the Ceding Company, its agents, or representatives in connection with claims covered under this Agreement.

The parties recognize that circumstances may arise in which the Reinsurer would participate in extra-contractual damages. The Reinsurer will be liable for and reimburse the Ceding Company for the Reinsurer’s share of extra-contractual damages that result from actions approved in advance and in writing by the Reinsurer unless the Reinsurer had discharged all of its liability. In such situations, the Reinsurer and the Ceding Company will share such damages in proportion to the original amount reinsured.

For purposes of this Agreement, the term “extra-contractual damages” will include, by way of example and not limitation:

| 1. | Actual and consequential damages; |

| 2. | Damages for emotional distress or oppression; |

| 3. | Punitive, exemplary or compensatory damages; |

| 4. | Statutory damages, fines or penalties; |

| 5. | Amounts in excess of the reinsured hereunder that the Ceding Company pays to settle a dispute or claim; or |

| 6. | Third-party attorney fees, cost and expenses. |

20

ARTICLE 10 – RETENTION LIMIT CHANGES

The Ceding Company may change its Retention with respect to future new business at any time. The Ceding Company will notify the Reinsurer of such change at least thirty (30) days in advance of the effective date.

A change to the Ceding Company’s maximum retention limits will not affect the reinsured policies inforce except as specifically provided elsewhere in this Agreement. Furthermore, unless agreed in writing between the parties, an increase in the Ceding Company’s retention schedule will not cause an increase in the Automatic Pool Binding Limits.

21

ARTICLE 11 – RECAPTURE

If the Ceding Company increases its Retention, it shall have the right to Recapture ceded reinsurance in accordance with the following rules:

1. The Risk has been reinsured under this Agreement and in force for the minimum period shown in Exhibit C-Retention Schedule of the Ceding Company.

2. The Ceding Company retained its maximum limit of Retention for the plan, age and mortality rating at the time the policy was issued under this Agreement and in accordance with Exhibit A, Retention Schedule of the Ceding Company.

3. All reinsurance eligible for Recapture under the provisions of this Article, must be Recaptured.

4. The Risk will be Recaptured on the anniversary date of the policy following the Recapture notification letter unless agreed upon in writing by both parties.

5. For any death that occurred prior to Recapture, the Ceding Company’s retention limit at the time of death will apply.

6. After the effective date of Recapture, the Reinsurer will not be liable for any policies or portions of such policies eligible for Recapture that the Ceding Company has overlooked.

7. An increase in quota share will not entitle the Ceding Company to a Recapture.

To effect Recapture, the Ceding Company must notify the Reinsurer of its intent to do so within ninety (90) days of the effective date of the increase in its Retention limits. The Ceding Company may apply the new limits of Retention to existing ceded reinsurance and reduce and Recapture reinsurance inforce.

The amount eligible for Recapture will be the difference between the amount originally retained and the amount the Ceding Company would have retained on the same quota share basis had the new Retention schedule been in effect at the time of issue.

22

ARTICLE 12 – REINSURED NET AMOUNT AT RISK

The Cash Value will be applied to the reinsured amount proportionately. When multiple layers are reinsured, the Cash Value will be applied proportionately to each layer. If multiple companies exist on a layer, the Cash Value will be split proportionately among the Reinsurers.

The Reinsured Net Amount at Risk will be the difference between the reinsured face amount and the portion of the Cash Value corresponding to the reinsured face amount on the Policy.

Term Riders: the net amount at risk will equal the reinsured face amount.

23

ARTICLE 13 – GENERAL PROVISIONS

| 13.1 | CURRENCY |

All payments and reporting by all parties under this Agreement will be made in United States dollars.

| 13.2 | PREMIUM TAX |

The Reinsurer will not reimburse the Ceding Company for premium taxes.

| 13.3 | INSPECTION OF RECORDS |

The Reinsurer, will have the right to inspect original papers, records and all documents relating to the business reinsured under this Agreement. These documents will be made available during normal office hours at the office of the Ceding Company to the Reinsurer who will be named in advance; notification of such visits must be given two (2) weeks in advance.

All expenses of conducting the inspection will be the sole responsibility of the Reinsurer other than those expenses incidental to cooperating with the audit and producing the requested materials. The Ceding Company and the Reinsurer will work together to reduce the costs of inspections to the fullest extent practicable by making documents and other data available electronically and taking such other steps as may be required to enable the conduct of desk audits.

The Ceding Company, or its duly authorized representatives, will have the right to visit the office of the Reinsurer to inspect underwriting papers, claims or administration files relating to the reinsured business. Such access will be provided during regular business hours after giving reasonable prior notice. Any expenses incurred by the Ceding Company during such audit will be the responsibility of the Ceding Company.

| 13.4 | COMPLIANCE OF LAWS |

The policy is issued and maintained in accordance with all laws and the Ceding Company assures the policy does not involve individuals appearing on the OFAC Specifically Designated Nationals or Blocked Persons list or residing in a prohibited country. For the purposes of this Agreement, a “Prohibited Person” is a Specially Designated National and Blocked Person as defined by OFAC and a “Sanctioned Country” is collectively a department, agency, branch, instrumentality, government-owned entity or representative of the government of a sanctioned or an embargoed country as identified by OFAC. Neither the Ceding Company nor the Reinsurer shall be required to take any action under this Agreement that would result in it being in violation of said laws, including making any payments in violation of the law. Should either party discover a reinsurance payment has been made in violation of the law, or a Reinsured Policy was / is included within the reinsured business may be insured by, be owned by, or in any way be controlled by a Prohibited Person, or may be for a person residing in a Sanctioned Country, it shall notify the other party and the parties shall cooperate in order to take any necessary corrective actions.

The parties agree that such reinsurance cession will be null, void, and of no effect from its inception, to the same extent as if the policy had never been ceded. Each party will be restored to the position it would have occupied if the violation had not occurred, including the return of any payments received, unless prohibited by law.

24

| 13.5 | ANTI MONEY LAUNDERING |

Each party, for its part, undertakes that it will discharge its duties under all applicable anti-money laundering laws and relevant regulations or rules promulgated, and specifically under proceeds of crime (money laundering) and terrorist financing acts and regulations, as such law and regulations exist now and hereafter (“AML Laws”). Each party, for its part, agrees that it will be solely responsible for and will indemnify the other for any and all fines and/or penalties levied or assessed, whether on it or on the other party, by reason of its failure to discharge its said duties under all present and future AML Laws.

| 13.6 | THE FOREIGN ACCOUNT TAX COMPLIANCE ACT (FATCA) |

Both the Reinsurer and the Ceding Company agree to provide all information necessary to demonstrate compliance with the Foreign Account Tax Compliance Act (FATCA) consistent with Sections 1471 – 1474 of the U.S. Internal Revenue Code and any Treasury Regulations, or other guidance issued pursuant thereto, including, without limitation, as applicable, Forms ▇-▇, ▇▇▇▇▇ ▇-▇▇▇▇-▇, any information necessary for the parties to enter into an agreement described in Section 1471(b) of the U.S. Internal Revenue Code and to comply with the terms of that agreement or to comply with the terms of any inter-governmental agreements between the U.S. and any other jurisdictions relating to FATCA. This information will be provided promptly upon reasonable request by either party to this Agreement and promptly upon learning that any such information previously provided has become obsolete or incorrect.

The parties to this Agreement acknowledge that if they fail to supply such information on a timely basis, it may be subject to a 30% U.S. withholding tax imposed on payments of U.S. source income.

In the event that the Ceding Company believes that it is under a legal obligation to withhold a portion of any payment that is due to the Reinsurer as a result of the Reinsurer’s failure to provide such required FATCA documentation, the Ceding Company shall provide at least thirty (30) days prior written notice to the Reinsurer that it intends to withhold from such payment.

If the Reinsurer provides the required FATCA documentation within the. thirty (30) day notice period, then the Ceding Company shall not withhold any amount from the payment that is due. However, in the event that the Reinsurer does not provide the required FATCA documentation, then the Ceding Company shall withhold the amount legally required to be withheld (“FATCA Withholding Amount”) from the amount due and payable (“Settlement”). The Ceding Company shall remit such FATCA Withholding Amount to the IRS in accordance with FATCA, and pay the Settlement, net of the FATCA Withholding Amount, to the Reinsurer. The Ceding Company shall provide evidence of remittance to the Reinsurer within a commercially reasonable timeframe, not to exceed five (5) Business Days of remitting the FATCA Withholding Amount to the IRS.

The Ceding Company will provide reasonable assistance and cooperation to the Reinsurer in connection with the Reinsurer’s attempts to recover any portion of such withheld amount that may be recoverable from the IRS, including the timely provision of the relevant tax form reporting the FATCA withholding. Any amounts that are recovered by the Ceding Company under this paragraph shall be paid to the Reinsurer within five (5) business days of its receipt of such recovered amount.

25

| 13.7 | INTEREST RATE FOR BALANCES IN DEFAULT |

When balances are in default, each party reserves the right to charge interest at the Prime Rate plus 2% as stated in the Wall Street Journal as of the date the balances become overdue.

| 13.8 | SEVERABILITY |

If any provision of this Agreement is determined by a court of law to be invalid or unenforceable, such determination will not impair or affect the validity or the enforceability of the remaining provisions of this Agreement to the extent that enforcement of such remaining provisions, without the invalid or unenforceable provision, is consistent with the intent of the parties which is inferred from the provisions of the entire Agreement.

| 13.9 | WAIVER |

Either party may choose to waive any provision or right under this Agreement under which performance is owed to them by the other party. Any waiver of provisions or rights by a party to this Agreement must be in writing signed by a duly authorized representative of the party granting the waiver. If either party so elects, it will not be considered to be a permanent waiver of such provision nor in any way affect the validity of this Agreement. The applicable party will still have the right to insist upon the strict adherence to that provision or any other provision of this Agreement in the future.

26

ARTICLE 14– DAC TAX

The Ceding Company and the Reinsurer hereby agree to the following, pursuant to Section 1.848-2(g)(8) of the Income Tax Regulations issued December 29, 1992, under Section 848 of the Internal Revenue Code of 1986, as amended

1. The term “party” will refer to either the Ceding Company or the Reinsurer as appropriate.

2. The terms used in this Article are defined by reference to Treasury Regulation Section 1.848-2 in effect as of December 29,1992. The term “net consideration” refers to net consideration as defined in Treasury Regulation Section 1.848-2(f).

3. The party with the net positive consideration for this Agreement for each taxable year will capitalize specified policy acquisition expenses with respect to this Agreement without regard to the general deductions limitation of IRS Section 848(c)(1).

4. The parties agree to exchange information pertaining to the amount of net consideration under this Agreement each year by April 1 to ensure consistency, or as otherwise required by the Internal Revenue Service.

5. Each party may contest such calculation by providing an alternative calculation by May 1 of the year following the end of the taxable year to the other party and the parties will act in good faith to reach agreement as to the correct amount within thirty (30) days.

7. Each party agrees to report such amount of net consideration in their respective federal income tax returns for the previous tax year.

8. Each party will attach a schedule to its federal income tax return for the first taxable year ending on or after the Effective Date that identifies this Agreement as a reinsurance agreement for which the joint election under Regulation Section 1.848-2(g)(8) has been made.

9. Each party represents that it is subject to United States taxation under either Subchapter L or Subpart F of Part III of Subchapter N of the Internal Revenue Code of 1986, as amended.

27

ARTICLE 15 – RESERVES

15.1 Reserve Basis

The Reinsurer will hold mortality risk reserves for its share of liability on each policy calculated on an unearned premium basis.

15.2 Reserve Reporting

The Ceding Company shall provide a reserve summary for the Reinsured Policies to the Reinsurer within fifteen (15) days of the end of each quarter. Upon request, the Ceding Company will provide a detailed description of its statutory valuation basis as filed with the Ceding Company’s statutory annual statement.

The Ceding Company will calculate all reserves credits based on the unearned premium. The Ceding Company and the Reinsurer will mutually agree to amend this Agreement when the statutory reserve method changes or when the Ceding Company adopts a new reserve method, whichever comes first.

The Reinsurer will hold reinsurance reserves in accordance with all applicable laws and regulations that the Reinsurer deems controlling.

15.3 Reserve Credit

The parties intend that the Ceding Company will receive statutory reserve credit in its state of domicile for reinsurance provided under this Agreement. The parties agree to use reasonable efforts to ensure that such reserve credit will remain available to the Ceding Company.

If the Ceding Company loses statutory reserve credit in part or in total due to a change in law or regulation (or a change in the interpretation or application of existing law or regulation by a regulator) or due to a failure by the Reinsurer to maintain in effect a required license or accreditation in the Ceding Company’s state of domicile (hereinafter a “Reserve Credit Event”), then the parties will take the steps specified below. The parties will provide prompt notice of the occurrence of any Reserve Credit Event.

Upon the occurrence of any Reserve Credit Event, the Reinsurer shall establish on behalf of the Ceding Company such trust accounts, letters of credit, premiums withheld by the Ceding Company, or a combination thereof as may be required by applicable law in order to permit the Ceding Company to obtain credit for such reinsurance. The Reinsurer will have the option of determining the method of funding to be utilized so long as the Ceding Company is satisfied that such method will provide such statutory financial statement credit.

The Reinsurer also agrees to take any additional action as may be reasonably required so as to comply, with the requirements imposed by the insurance laws and regulations of the State of Minnesota in order to give the Ceding Company at all times full statutory financial statement credit for the reinsurance being provided under this Agreement, pursuant to Section 15.2 above, including by working in good faith to amend this Agreement to add reasonably required credit for reinsurance provisions.

28

If a Reserve Credit Event is not cured within ninety (90) days and the Reinsurer fails to establish or maintain collateral as set forth above, then the Ceding Company may recapture the business ceded under this Agreement. In that event, the Ceding Company and the Reinsurer will negotiate in good faith the terms of a mutually agreed recapture of the reinsurance provided hereunder, such recapture to include the payment by the Reinsurer to the Ceding Company of the unearned reinsurance premiums (if any) and the amount of any pending undisputed claims and claims incurred but not reported as of the effective date of the recapture that is reported to the Reinsurer within one hundred eighty (180) days of the effective date of the recapture.

29

ARTICLE 16 – OFFSET

Any undisputed amounts due, by either of the parties to this Agreement, may be offset and only the balance will be allowed or paid. This right will continue to exist after the termination of this Agreement, or of any business relationship between the parties. This right to offset is not diminished by the insolvency of either party.

30

ARTICLE 17 – INSOLVENCY

| 17.1 | INSOLVENCY OF A PARTY TO THIS AGREEMENT |

A Party to this Agreement will be deemed “insolvent” when it:

a) Applies for or consents to the appointment of a receiver, rehabilitator, conservator, liquidator or statutory successor (hereinafter referred to as the Authorized Representative) of its properties or assets; or

b) Is adjudicated as bankrupt or insolvent; or

c) Files or consents to the filing of a petition in bankruptcy, seeks reorganization or an arrangement with creditors to avoid bankruptcy or takes advantage of any bankruptcy, dissolution, liquidation, rehabilitation, conservation or similar law or statute; or

d) Becomes the subject of an order to rehabilitate or an order to liquidate as defined by the insurance code of the jurisdiction of the party’s domicile.

| 17.2 | INSOLVENCY OF THE CEDING COMPANY |

In the event that the Ceding Company is deemed insolvent, all reinsurance death claims payable hereunder will be payable by the Reinsurer directly to the Ceding Company, its liquidator, receiver or statutory successor on the basis of the liability of the Ceding Company for benefits under the Reinsured Policy, without diminution because of the insolvency of the Ceding Company.

It is understood, however, that in the event of such insolvency, the liquidator, receiver or statutory successor of the Ceding Company will give written notice to the Reinsurer of the pendency of a death claim against the Ceding Company on a Risk reinsured hereunder within a reasonable time after such death claim is filed in the insolvency proceeding.

Such notice will indicate the policy reinsured and whether the death claim could involve a possible liability on the part of the Reinsurer. The Reinsurer will be liable only for benefits reinsured as benefits become due under the terms of the Reinsured Policies and will not be or become liable for any amounts or reserves to be held by the Ceding Company as to the Reinsured Policies or for any damages or payments resulting from the termination or restructure of the Policies that are not otherwise expressly covered by this Agreement.

During the pendency of such claim, the Reinsurer may investigate such death claim and interpose, at its own expense, in the proceeding where such death claim is to be adjudicated, any defense or defenses it may deem available to the Ceding Company, its liquidator, receiver or statutory successor. It is further understood that the expense thus incurred by the Reinsurer will be chargeable, subject to court approval, against, the Ceding Company as part of the expense of liquidation to the extent of a proportionate share of the benefit that may accrue to the Ceding Company solely as a result of the defense undertaken by the Reinsurer.

31

| 17.3 | INSOLVENCY OF THE REINSURER |

In the event of the insolvency of the Reinsurer, the Ceding Company may cancel this Agreement for new business by promptly providing the Reinsurer or its Authorized Representative with written notice of cancellation, to be effective as of the date on which the Reinsurer’s insolvency is established by the authority responsible for such determination. Any requirement for a notification period prior to the cancellation of the Agreement would not apply under such circumstances.

In addition, in the event of the insolvency of the Reinsurer, the Ceding Company may provide the Reinsurer or its Authorized Representative with written notice of its intent to recapture all reinsurance in force under this Agreement regardless of the duration the reinsurance has been in force or the amount retained by the Ceding Company on the Reinsured Policies. The effective date of a recapture due to insolvency will be at the election of the Ceding Company but may not be earlier than the date on which the Reinsurer’s insolvency is established by the authority responsible for such determination. If the Ceding Company elects to recapture reinsurance under this Article, unearned premiums, net of outstanding balances, will be paid by the party with the positive balance.

In the event of the insolvency of either party, the rights or remedies of this Agreement will remain in full force and effect.

32

ARTICLE 18 – ERRORS AND OMISSIONS

ERRORS AND OMISSIONS

It is expressly understood and agreed that if failure to comply with any terms of this Agreement is hereby shown to be the result of an unintentional error, misunderstanding or omission, on the part of either the Ceding Company or the Reinsurer, both the Ceding Company and the Reinsurer, will be restored to the position they would have occupied, had no such error, misunderstanding or omission occurred, subject always to the correction of the error, misunderstanding or omission. In the event a payment is corrected, the party receiving the payment may charge interest. If such restorations are not possible, the Parties will endeavor in good faith to promptly remedy the situation in a manner that is mutually agreeable, and most closely approximates the intent of the Parties as evidenced by this Agreement. Any resolution made to correct such error will not constitute a waiver or set a precedent for any similar subsequent errors.

This provision applies only to oversights, misunderstanding or clerical errors relating to the administration of reinsurance covered by this Agreement.

This provision does not apply to the administration of the insurance provided by the Ceding Company to its insured, underwriting of the Risk or any other errors or omissions committed by the Ceding Company with regard to the policy reinsured hereunder, including applications for facultative reinsurance for which the Reinsurer has not received written notification that its offer of facultative reinsurance has been accepted by the Ceding Company in accordance with Article 3, Facultative Reinsurance.

If the Ceding Company has failed to cede as provided under this Agreement or has failed to comply with reporting requirements with respect to business ceded hereunder, the Ceding Company may be obligated to audit its records for similar errors and take all reasonable action necessary to correct errors and avoid similar errors if required by the Reinsurer.

Late Reporting

The Ceding Company is required to report Policies no later than three (3) years after the policy issue date. Risks reported after this time will be considered Late Reported Policies and will not be accepted on an automatic basis or as “Errors and Omissions” under the Agreement. Late Reported Policies may be submitted to the Reinsurer on a facultative-obligatory basis for individual consideration provided that the total net amount at risk on all such Late Reported Policies is less than or equal to five percent (5) % of the Reinsurer’s total net amount at risk at the time they are reported. If the total net amount at risk on such Policies is greater than five percent (5) % of the Reinsurer’s total net amount at risk, then the Reinsurer will consider such Policies on a facultative basis.

Upon notification by the Ceding Company of a Late Reported Policy, the Reinsurer will respond within five (5) business days from the date of the submission of any Late Reported Policy whether it will accept such Policy. If the Reinsurer does not accept such Late Reported Policy, such Policy will not be covered by this Agreement and the Reinsurer will have no liability on such Policy.

33

If the Reinsurer accepts such Late Reported Policy, the Ceding Company agrees to pay all reinsurance premiums plus delayed payment interest thereon since the issue date of the Policy up to the date of payment on the next remittance due date following the Reinsurer’s acceptance.

The Ceding Company is required to report Policy terminations of which we have knowledge of no later than three (3) years after the Policy termination date. Policy terminations reported after this time will be considered Late Reported Terminations. For Late Reported Terminations, the Reinsurer will only refund three (3) years’ premiums.

The Ceding Company will acknowledge that timely compliance with the reporting requirements of the Agreement are a material element of the Ceding Company’s responsibilities hereunder and an important basis of the Reinsurer’s ability to reinsure the risks hereunder. Consistent and material non-compliance with reporting requirements, including extended delays, will constitute a material breach of this Agreement.

34

ARTICLE 19 – ARBITRATION

| 19.1 | GENERAL |

The parties agree to act with the highest good faith. However, if the parties cannot mutually resolve a dispute or claim, which arises out of, or in connection with this Agreement, including its formation and validity, and whether arising during, or after the period of this Agreement and the dispute cannot be resolved through Issue Resolution as described below, the dispute will be decided through arbitration.

As a condition to the parties’ right to arbitration under this Agreement, either the Ceding Company or the Reinsurer will give written notification to the other party of any dispute relating to or arising from this Agreement, including, but not limited to, the formation or breach thereof.

| 19.2 | ISSUE RESOLUTION |

In the event of a dispute arising out of or relating to this Agreement, the parties agree to the following process of issue resolution. Within fifteen (15) days of notification, both parties must designate an officer of their respective companies to attempt to resolve the dispute. The officers will meet at a mutually agreeable location as soon as possible and as often as necessary to attempt to negotiate a resolution of the dispute. The format for discussions will be determined mutually by the officers. The issue resolution of the officers will, in the absence of manifest error, be final and binding on the parties.

If these officers are unable to resolve the dispute within thirty (30) days of their first meeting, the parties may agree in writing to extend the negotiation period for an additional thirty (30) days. If the matter is not resolved within thirty (30) days of the first meeting or the additional thirty (30) day period, if any, then either party may demand arbitration as documented below. The discussions and all information exchanged for the purposes of such discussions will be confidential and without prejudice.

If a resolution cannot be reached using the process described above, the dispute or claim shall be referred to arbitration.

| 19.3 | NOTICE OF ARBITRATION |

To initiate arbitration, either party will notify the other party by certified mail of its desire to arbitrate, stating the nature of the dispute and the remedy sought (the “Arbitration Notice”). The party, to which the Arbitration Notice is sent, shall respond to in writing, within twenty (20) days of its receipt. Failure to respond in a timely manner to the Arbitration Notice will be deemed a breach of this Agreement, enforceable within an applicable court of law.

| 19.4 | PROCEDURE |

Arbitration shall be conducted before a three-person arbitration panel (the “Arbitration Panel”) appointed as follows: Each party shall appoint one arbitrator, and the two arbitrators so appointed shall then appoint a neutral umpire before proceeding. If either party fails to appoint an arbitrator within thirty (30) days after it receives the Arbitration Notice, the Party who initially sent the Arbitration Notice may appoint both arbitrators.

35

Should the two arbitrators fail to choose an umpire within thirty (30) days of the appointment of the second arbitrator, the parties shall appoint the umpire pursuant to the ▇▇▇▇▇•U.S. Umpire Selection Procedure.

The arbitrators and umpire shall be either present or former disinterested executive officers of insurance or reinsurance companies, or arbitrators certified by ▇▇▇▇▇•U.S. The arbitrators and umpire shall not be under the control of either party, and shall have no financial interest in the outcome of the arbitration.

The parties shall be entitled to engage in reasonable discovery, including requests for production of relevant non-privileged documents. The umpire may order depositions and interrogatories upon a showing of need. It is the parties’ intent that the discovery proceedings be conducted in a cost-effective manner.

| 19.5 | PLACE OF ARBITRATION |

Unless the Parties agree otherwise, the arbitration hearing will take place in Minnesota.

| 19.6 | ARBITRATION COSTS |

Unless the arbitrators decide otherwise, each party will bear the expense of its own arbitration activities, including any outside attorney or witness fees Unless the Arbitration Panel orders otherwise, each party shall pay: (1) the fees and expenses of its own arbitrator; and (2) an equal share of the fees and expenses of the umpire and of the other expenses of the arbitration, such as hearing rooms, court reporters, etc.

| 19.7 | ARBITRATION SETTLEMENT |

The decision of a majority of the Arbitration Panel shall be final and binding, except to the extent otherwise provided in the Federal Arbitration Act. The Arbitration Panel shall render its award in writing. The Arbitration Panel shall have no power to award consequential, special, or punitive damages. Judgment upon the award may be entered in any court having jurisdiction, pursuant to the Federal Arbitration Act. The arbitrators will base their decision on the terms and conditions of this Agreement plus, as necessary, on the customs and practices of the insurance and reinsurance industry rather than solely on a strict interpretation of the applicable law or rules of evidence.

| 19.8 | INJUNCTIVE RELIEF |

Nothing in this Agreement shall prevent the parties, prior to appointment of the Arbitration Panel, from applying to a court of competent jurisdiction for provisional or interim measures or injunctive relief as may be necessary to safeguard the property or rights that are the subject matter of the arbitration. Once the Arbitration Panel has been selected, the Arbitration Panel shall have exclusive jurisdiction to hear applications for such relief, except that any interim measures or injunctive relief ordered by the Arbitration Panel may be immediately and specifically enforced by a court of competent jurisdiction. Notwithstanding the foregoing, in the event of any breach or threatened breach of the Confidentiality Section or any other privacy or confidentiality provisions of this Agreement, without limiting any other rights and remedies, the parties may seek an injunction either by applying to a court of competent jurisdiction or by applying to the Arbitration Panel, if such panel has been selected.

36

| 19.9 | CONFIDENTIALITY OF ARBITRATION |

Unless otherwise agreed by the parties or required by applicable law, the parties, the Arbitration Panel, and ▇▇▇▇▇•U.S shall maintain the confidentiality of all documents, communications, proceedings, and awards provided, produced, or exchanged pursuant to an arbitration conducted under this Article.

37

ARTICLE 20 – DURATION OF AGREEMENT

This Agreement will be in effect for an indefinite period and may be terminated as to the reinsurance of new business by the Reinsurer by giving ninety (90) days’ written notice of termination or by the Ceding Company by providing ninety (90) days written notice. The day the notice is mailed to the other party’s Home Office, or, if the mail is not used, the day it is delivered to the other party’s Home Office or to an Officer of the other party will be the first day of the notice period. During the notice period, this Agreement will continue to operate in accordance with its terms.

The Reinsurer remains liable for all Reinsured Policies in force as of the date of the termination, until their natural expiration, unless the parties mutually decide otherwise or as specified otherwise in this Agreement. All provisions of this Agreement will survive its termination to the extent necessary to carry out its purpose.

If the Reinsurer has made a Facultative offer prior to the termination date of this Agreement and the Ceding Company has accepted that Facultative offer before the termination of this Agreement or the termination of the Reinsurer’s offer whichever comes later, the Reinsurer will be liable even if the effective date of the policy falls beyond the termination date of this Agreement.

38

ARTICLE 21 – REPRESENTATIONS AND WARRANTIES

All matters with respect to this Agreement require the good faith of both parties.

The Reinsurer represents and warrants the following:

| 1. | That it is a corporation duly organized, validly existing and in good standing under the laws of Canada, using its U.S. domestic port of entry in the State of Michigan. |

| 2. | That it is subject to U.S. Federal income taxation as a domestic corporation. |

| 3. | That no United States federal excise tax is payable with respect to reinsurance premiums paid by the Ceding Company hereunder. |

| 4. | That it has obtained and will maintain, at all times during the effect of this Agreement, all consents, authorizations, licenses, approvals, and registrations required to perform its obligations under this Agreement. |

Each party represents and warrants to the other party that it is in compliance with all material legislation and regulations of state and federal laws, including without limitation, those relating to solvency, reserves and capitalization, applicable to the reinsured business.

The Reinsurer and the Ceding Company have entered into this Agreement in reliance upon each other’s representations and warranties. The Ceding Company and the Reinsurer each affirms that it has and will continue to disclose all matters material to this Agreement. Material for purposes of this Article will mean information that a prudent actuary would consider as reasonably likely to affect the Reinsurer’s experience under this Agreement. Examples of such matters are a Material Change in underwriting, claims or administration issue practices or philosophy, or a change in the Ceding Company’s ownership or control.

The Ceding Company acknowledges it has directly or indirectly provided the Reinsurer with information regarding the reinsured business prior to the execution of this Agreement, including the following written documents, which will not be interpreted as an exhaustive list:

| i. | mortality experience files; |

| ii. | appropriate policy forms, contractual provisions, options,; |

| iii. | application forms, conditional receipt or temporary insurance agreement; |

| iv. | age and amount requirements and preferred criteria; |

| v. | underwriting and exception guidelines and underwriting manual(s) of record, and reinstatement procedures; |

| vi. | distributions by risk categories |

39

The Ceding Company represents and warrants as of the effective date that any assumptions made in compiling these documents were based upon informed judgment and are consistent with sound actuarial and accounting principles. Further, the Ceding Company represents and warrants that, to the best of its knowledge, all factual information contained in these documents was, as of the date of their making, complete and accurate in all material respects. The Ceding Company is not consciously aware of any material omissions, errors, changes or discrepancies regarding the data or of any non-public changes in its executive management, administration, legal, regulatory, or financial conditions (collectively referred to as the “Discrepancies”) since the date such data was delivered to the Reinsurer which would materially affect the Reinsurer’s decision to participate in the reinsurance contemplated under this Agreement. In the event that the Ceding Company should become aware of any material Discrepancies, it will promptly inform the Reinsurer. The Ceding Company acknowledges that the Reinsurer has relied on these documents and the foregoing representations and warranties in entering into this Agreement.

All data and other information the Ceding Company provides to the Reinsurer throughout the term of this Agreement will be, to the Ceding Company’s knowledge as of the date such data and information is given, materially true, correct, complete and accurate.

40

ARTICLE 22 – CONFIDENTIALITY

| 22.1 | Confidentiality Definitions. |

“Confidential Information” means all information, regardless of when received, concerning Disclosing Party’s business, Customer Information, Personal Information, finances or operations, whether oral, written or otherwise; all analyses, compilations, studies, or documents relating to such information prepared by Receiving Party containing or based in whole or in part on such information; and all reproductions of such information. The term “Confidential Information” does not include information that: (a) is or becomes generally available to the public other than as a result of disclosure in breach of this Agreement by Receiving Party; (b) was available to Receiving Party on a non-confidential basis prior to its disclosure to Receiving Party; (c) becomes available to Receiving Party on a non-confidential basis from a source other than Disclosing Party, provided that such source is not known by Receiving Party to be prohibited from transmitting the information to Receiving Party by a contractual, legal, fiduciary or other obligation; or (d) was or is independently developed by Receiving Party.

“Customer Information” means non-public personal information as defined under the ▇▇▇▇▇-▇▇▇▇▇-▇▇▇▇▇▇ Act of 2001 and its corresponding regulations.

“Disclosing Party” means the party and its Affiliates that disclose Confidential Information under this Agreement.

“Person” means any corporation, company, entity, partnership, individual, or governmental entity or body.

“Personal Information” means an individual’s first name and last name or first initial and last name in combination with any one or more of his or her: (a) Social Security number; (b) driver’s license number or state-issued identification card number; or (c) financial account number, or credit or debit card number, with or without any required security code, access code, personal identification number or password, that would permit access to a resident’s financial account. Personal Information does not include information that is rightfully obtained from publicly available information, or from federal, state, or local government records rightfully made available to the general public.

“Receiving Party” means the party and its Affiliates and Representatives that receive Confidential Information under this Agreement.

“Representatives” means a party’s and its Affiliates’ directors, officers, employees, agents, representatives, consultants, retrocessionaires and advisors.

“Unauthorized Access” means any access to or disclosure or use of any of Disclosing Party’s Confidential Information in violation of this Agreement or applicable law.

41

| 22.2 | Nondisclosure; Security. |