SETTLEMENT AGREEMENT

Exhibit 10.1

This SETTLEMENT AGREEMENT (this “Agreement”) is entered into as of the 9th day of June, 2017 (the “Effective Date”), by and among Toshiba Corporation, a Japanese corporation (“Toshiba”), and Georgia Power Company, a Georgia corporation (“Georgia Power”), Oglethorpe Power Corporation (An Electric Membership Corporation), an electric membership corporation formed under the Laws of the State of Georgia (“OPC”), Municipal Electric Authority of Georgia, a public body corporation and politic and an instrumentality of the State of Georgia (“MEAG”), and The City of Dalton, Georgia, an incorporated municipality in the State of Georgia acting by and through its Board of Water, Light and Sinking Fund Commissioners (“Dalton”). Each of Toshiba, Georgia Power, OPC, MEAG and Xxxxxx may be referred to herein as a “Party” and collectively as the “Parties”.

WHEREAS, the Owners (as defined in the EPC Agreement (as defined below)) and Westinghouse (as defined below) are parties to the EPC Agreement;

WHEREAS, Toshiba has guaranteed certain obligations of Westinghouse under the EPC Agreement pursuant to the terms of the Toshiba Guaranty (as defined below);

WHEREAS, the Owners contend that they have been damaged by Westinghouse’s failure to perform its obligations under the EPC Agreement, and Westinghouse disputes the Owners’ contentions;

WHEREAS, Westinghouse has filed for protection under chapter 11 of the Bankruptcy Code (as defined below);

WHEREAS, the Owners contend that as a result of, among other things, Westinghouse’s chapter 11 filing and Westinghouse’s alleged failure to perform its obligations under the EPC Agreement, Toshiba’s obligations under the Toshiba Guaranty are due;

WHEREAS, Toshiba and the Owners have been engaged in discussions about Toshiba’s aforementioned guaranty obligations; and

WHEREAS, Toshiba and the Owners desire, through this Agreement, to resolve and set forth the amount and manner of payments to be made by Toshiba (directly or, as contemplated by Article III, indirectly) to Beneficiary (as defined below) in respect of Toshiba’s guaranty obligations and to set forth agreements with respect to certain other related matters.

NOW, THEREFORE, in consideration of the recitals, the mutual promises in this Agreement and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties to this Agreement, intending to be legally bound, hereby agree as follows:

ARTICLE I

DEFINED TERMS

DEFINED TERMS

Section 1.1 Defined Terms. For purposes of this Agreement, the following terms shall have the meanings hereby ascribed to them, except where the context clearly indicates a different meaning is intended.

“Affiliate” means, with respect to any Party, any other Person that (a) owns or controls, directly or indirectly, the Party, (b) is owned or controlled by the Party, or (c) is under common control with the Party, where “control” means the power to unilaterally direct the management or policies of, or unilaterally prevent any actions by, the Person, whether through the ownership of voting securities, by contract, or otherwise; provided, however, that in no event shall an Owner (or any of its subsidiaries) be deemed to be an Affiliate of another Owner (or any of its subsidiaries).

“Agreed Amount” means $3,680,000,000.

“Agreement” has the meaning set forth in the first paragraph of this Agreement.

“Bankruptcy Case” means Case No. 17-10751-MEW filed in the Bankruptcy Court, or any case that now is or in the future becomes jointly administered with such case.

“Bankruptcy Code” means the Bankruptcy Reform Act of 1978, as amended and codified in title 11 of the United States Code, 11 U.S.C. §§ 101-1532, as in effect on the date hereof.

“Bankruptcy Court” means the United States Bankruptcy Court for the Southern District of New York.

“Beneficiary” means Georgia Power, acting for itself and as agent for the other Owners, as set forth in the Toshiba Guaranty.

“CB&I Stone & Xxxxxxx” means CB&I Stone & Xxxxxxx, Inc., a Louisiana corporation, formerly named Stone & Xxxxxxx, Inc. and subsequently named WECTEC Global Project Services Inc.

“Covenant Release Date” means the earlier to occur of the date on which (a) Toshiba properly delivers a Payment Obligation Suspension Notice to Beneficiary in accordance with Section 2.4 and (b) Toshiba is rated by Standard & Poor’s or Xxxxx’x Investor Service at or above the Minimum Rating.

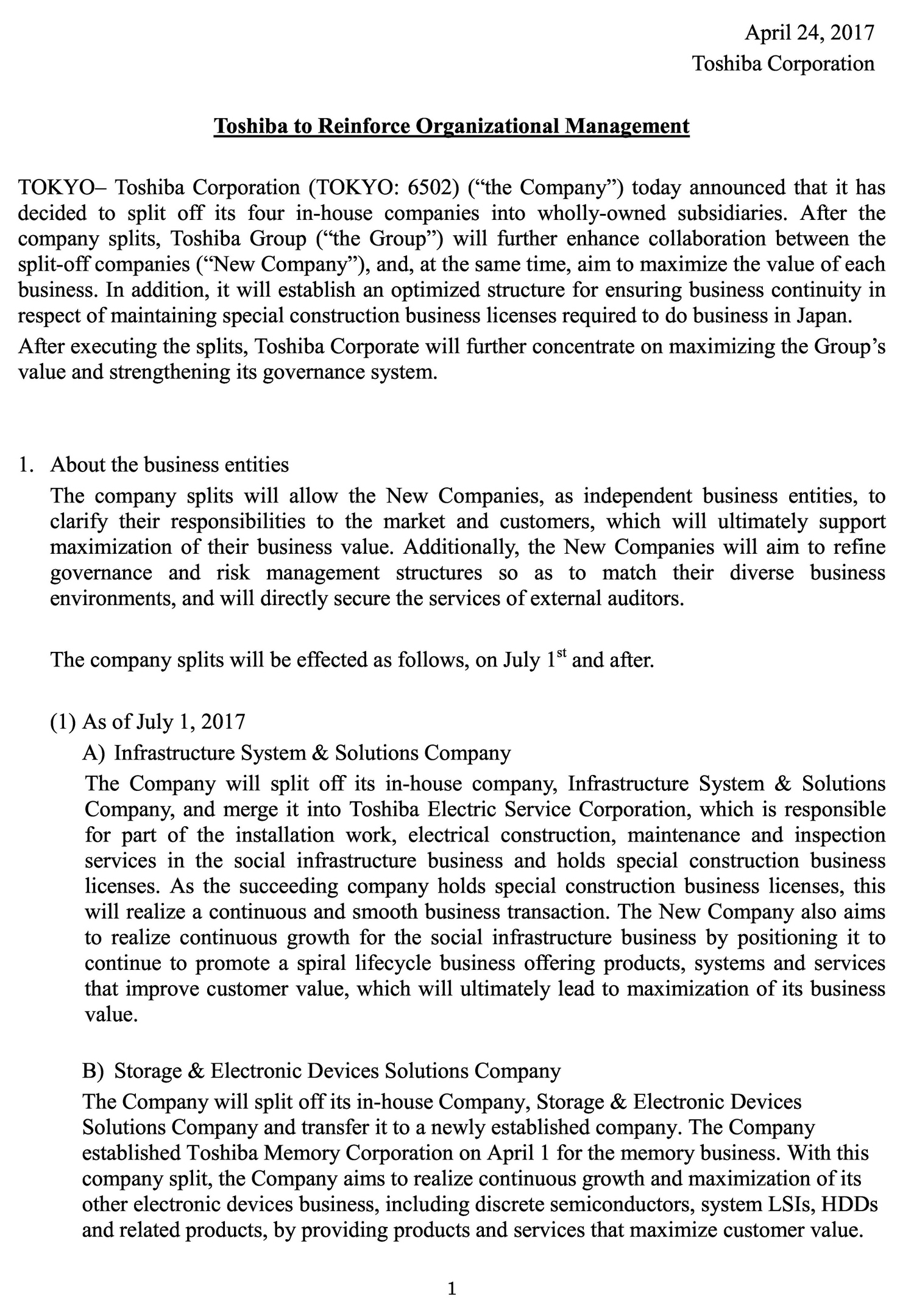

“Xxxxxx” has the meaning set forth in the first paragraph of this Agreement.

“Distribution Order” means an order, in the form of Exhibit D, entered in the Bankruptcy Case by the Bankruptcy Court, with only such changes thereto as are acceptable to each of the Parties in their respective sole discretion.

“Draw Demands” has the meaning set forth in Section 3.1.

2

“Draw Instruction Notice” has the meaning set forth in Section 3.1.

“Effective Date” has the meaning set forth in the first paragraph of this Agreement.

“EPC Agreement” means that certain Engineering, Procurement and Construction Agreement entered into as of April 8, 2008, by and among Georgia Power, acting for itself and as agent for OPC, MEAG and Dalton, and a consortium consisting of Westinghouse and Stone & Xxxxxxx, as amended by (a) Amendment No. 1 to Engineering, Procurement and Construction Agreement entered into as of December 11, 2009, by and among Georgia Power, acting for itself and as agent for OPC, MEAG and Dalton, and a consortium consisting of Westinghouse and Stone & Xxxxxxx, (b) Amendment No. 2 to Engineering, Procurement and Construction Agreement entered into as of January 15, 2010, by and among Georgia Power, acting for itself and as agent for OPC, MEAG and Dalton, and a consortium consisting of Westinghouse and Stone & Xxxxxxx, (c) Amendment No. 3 to Engineering, Procurement and Construction Agreement entered into as of February 22, 2010, by and among Georgia Power, acting for itself and as agent for OPC, MEAG and Dalton, and a consortium consisting of Westinghouse and Stone & Xxxxxxx, (d) Amendment No. 4 to Engineering, Procurement and Construction Agreement entered into as of May 2, 2011, by and among Georgia Power, acting for itself and as agent for OPC, MEAG and Dalton, and a consortium consisting of Westinghouse and Stone & Xxxxxxx, (e) Amendment No. 5 to Engineering, Procurement and Construction Agreement entered into as of February 7, 2012, by and among Georgia Power, acting for itself and as agent for OPC, MEAG and Dalton, and a consortium consisting of Westinghouse and Stone & Xxxxxxx, (f) Amendment No. 6 to Engineering, Procurement and Construction Agreement entered into as of January 23, 2014, by and among Georgia Power, acting for itself and as agent for OPC, MEAG and Dalton, and a consortium consisting of Westinghouse and Stone & Xxxxxxx, (g) Amendment No. 7 to Engineering, Procurement and Construction Agreement entered into as of December 31, 2015, by and among Georgia Power, acting for itself and as agent for OPC, MEAG, Dalton, MEAG Power SPVJ, MEAG Power SPVM, and MEAG Power SPVP, and a consortium consisting of Westinghouse and CB&I Stone & Xxxxxxx, and (h) Amendment No. 8 to Engineering, Procurement and Construction Agreement entered into as of April 20, 2016, by and among Georgia Power, acting for itself and as agent for OPC, MEAG, Dalton, MEAG Power SPVJ, MEAG Power SPVM and MEAG Power SPVP, and a consortium consisting of Westinghouse and WECTEC, in each case as amended from time to time.

“Excluded Affiliates” means the WEC Debtors and any other Affiliates of Toshiba that, taken as a whole, are not material to the consolidated financial position, results of operations, cash flows, or the ability to conduct business in the ordinary course, of Toshiba and its Affiliates (other than the WEC Debtors), taken as a whole.

“External Payments” means the payments received by Beneficiary described in Section 3.1, and Section 3.2, other than any of such payments that are rescinded or returned, in whole or in part, as contemplated by Section 2.5.

“Final Completion” means when:

3

(a) all systems, structures and components needed for the commencement of Start-Up Tests for both Units are operational in accordance with the terms of the AP1000 Facility Information;

(b) the U.S. Nuclear Regulatory Commission has made the findings required by 10 CFR 52.103(g) authorizing operation of each Unit;

(c) each Unit has produced a Net Unit Electrical Output acceptable to the Owners;

(d) each Unit has satisfied the Moisture Carryover Guarantee acceptable to the Owners; and

(e) all AP1000 intellectual property and all warranties and documentation required to be delivered to the Owners and all related equipment and components required to be made a part of the Facility have been delivered to the Owners.

“Forbearance Date” means June 30, 2020.

“Financial Institutions” has the meaning set forth in clause (s) of the definition of “Standard Permitted Lien.”

“Forbearance Termination Event” means the occurrence of any of the following:

(a) any payment contemplated in Section 2.2 has not been received by Beneficiary on or by the payment date therefor set forth on Schedule 2.2;

(b) a Toshiba Insolvency Proceeding;

(c) Toshiba has failed to perform, or has violated or breached, in any material respect, any covenant or obligation of Toshiba in Section 5.1;

(d) Toshiba has failed to perform, or has violated or breached, in any material respect, any other covenant or obligation of Toshiba in this Agreement, or any representation or warranty of Toshiba in this Agreement was inaccurate in material respect when made, and such failure, violation, breach or inaccuracy has not been cured by Toshiba within thirty (30) days of Beneficiary delivering to Toshiba a notice of such failure, violation, breach or inaccuracy (it being understood and agreed that there shall be no such cure period or cure opportunity for the items described in clauses (a), (b), (c), (e) and (f) of this definition of Forbearance Termination Event);

(e) counsel for each of the Parties has failed to deliver reasonably acceptable legal opinions regarding the authorization, execution, and delivery of this Agreement by such Party and the enforceability of this Agreement against such Party on or before June 14, 2017; or

(f) the Distribution Order has not been entered by the Bankruptcy Court in the Bankruptcy Case on or before June 26, 2017, or, following the entry thereof, the

4

Distribution Order has been reversed, withdrawn, reconsidered, vacated or otherwise amended in any manner not acceptable to any Owner in its sole discretion, or Toshiba or any Person bound thereby or subject thereto has breached or otherwise not complied with, in any material respect, any provision of the Distribution Order.

“Georgia Power” has the meaning set forth in the first paragraph of this Agreement.

“Governmental Unit” shall have the meaning set forth in section 101(27) of the Bankruptcy Code, including the U.S. Department of Energy and the Public Service Commission of the State of Georgia.

“Guaranteed Obligations” has the meaning set forth in the Toshiba Guaranty.

“Law” means any law (statutory or common), statute, regulation, rule, code or ordinance enacted, adopted, issued, or promulgated by any Governmental Unit.

“Letters of Credit” means the letters of credit described on Exhibit A to this Agreement, as such letters of credit may be renewed or replaced in a manner that is acceptable to the Owners in their sole discretion.

“Lien” means any mortgage, pledge, security interest, hypothecation, encumbrance, lien or charge of any kind (including any agreement to give any of the foregoing, any conditional sale or other title retention agreement or any lease in the nature thereof).

“MEAG” has the meaning set forth in the first paragraph of this Agreement.

“MEAG Power SPVJ” means MEAG Power SPVJ, LLC, a Georgia limited liability company.

“MEAG Power SPVM” means MEAG Power SPVM, LLC, a Georgia limited liability company.

“MEAG Power SPVP” means MEAG Power SPVP, LLC, a Georgia limited liability company.

“Minimum Rating” means an issuer rating of BB+ by Standard & Poor’s or a rating of Ba1 by Xxxxx’x Investor Service.

“NDA” means that certain Nondisclosure Agreement dated as of May 10, 2017 by and among Toshiba and the Owners.

“OPC” has the meaning set forth in the first paragraph of this Agreement.

“Owner Released Parties” has the meaning set forth in Section 6.7(b).

“Owner Releasing Parties” has the meaning set forth in Section 6.7(a).

“Party” has the meaning set forth in the first paragraph of this Agreement.

5

“Payment Obligation Suspension Notice” has the meaning set forth in Section 2.4.

“Person” means any individual, partnership, joint venture, firm, corporation, limited liability company, association, central bank, trust or other enterprise or any governmental or political subdivision or any agency, department or instrumentality thereof.

“Pro Rata Share” means, for each Owner, the percentage set forth next to such Owner’s name on Schedule 1.1(a) hereto.

“Promissory Note Substitution Notice” has the meaning set forth in Section 4.1.

“Released Parties” has the meaning set forth in Section 6.7(b).

“Releasing Parties” has the meaning set forth in Section 6.7(b).

“SCANA” means collectively South Carolina Electric & Gas Company, SCANA Corporation and any other owner or operator of the facility commonly referred to as Units 2 and 3 of the Xxxxxx X. Summer Nuclear Station near Columbia, South Carolina.

“Standard Permitted Lien” means any of the following:

(a) Liens for taxes not yet delinquent or Liens for taxes being contested in good faith and by appropriate proceedings for which adequate reserves in accordance with generally accepted accounting principles have been established;

(b) Liens in respect of property or assets imposed by Law that were incurred in the ordinary course of business, such as carriers’, suppliers’, warehousemen’s, materialmen’s and mechanics’ Liens and other similar Liens arising in the ordinary course of business, that do not in the aggregate materially detract from the value of such property or assets or materially impair the use thereof in the operation of the business of Toshiba or any of its Affiliates and do not secure any indebtedness;

(c) any modification, renewal or extension of any Lien in existence as of the date hereof, any Lien granted as a replacement or substitute therefor and any Lien granted to secure any refinancing of obligations secured by the foregoing; provided that any such refinancing, refunding, modification, renewal, extension, replacement or substitute Lien (i) does not secure any indebtedness other than the indebtedness secured on date hereof and permitted refinancings, refundings, renewals, exchanges or extensions thereof, and (ii) does not encumber any property other than the property subject thereto on the Effective Date other than (x) after-acquired property covered by the original grant and (y) improvements thereon, accessions thereto or proceeds from the disposition of such property;

(d) Liens incurred or deposits made in the ordinary course of business in connection with workers compensation, unemployment insurance and other types of social security, and other Liens to secure the performance of tenders, statutory obligations, contract bids, government contracts, surety, appeal, customs, performance and return-of-money bonds and other similar obligations, incurred in the ordinary course of business (exclusive of obligations in respect of the

6

payment for borrowed money), whether pursuant to statutory requirements, common law or consensual arrangements;

(e) Liens arising out of judgments, attachments or awards of not more than $200 million in the aggregate and not resulting in a Forbearance Termination Event;

(f) leases or subleases granted in the ordinary course of business to others not interfering in any material respect with the business of Toshiba or any of its Affiliates and any interest or title of a lessor under any lease;

(g) easements, rights-of-way, zoning or other restrictions, charges, encumbrances, defects in title, prior rights of other Persons, and obligations contained in similar instruments, in each case that do not secure indebtedness and do not involve, and are not likely to involve at any future time, either individually or in the aggregate, a substantial and prolonged interruption or disruption of the business activities of Toshiba or any of its Affiliates;

(h) Liens arising from the rights of lessors under leases (including financing statements regarding property subject to lease), provided that such Liens are only in respect of the property subject to, and secure only, the respective lease (and any other lease with the same or an affiliated lessor); and Liens arising out of conditional sale, title retention, consignment or similar arrangements for the sale of goods entered into by Toshiba or its Affiliates in the ordinary course of business;

(i) Liens securing indebtedness in respect of purchase money obligations and capital lease obligations (and refinancings thereof); provided that any such Liens attach only to the property being financed pursuant to, or subject to a sale and leaseback transaction relating to, such indebtedness and do not encumber any other property of Toshiba or any of its Affiliates (other than improvements on and accessions to the property being financed);

(j) bankers’ Liens, rights of setoff and other Liens existing solely with respect to cash and cash equivalents on deposit in one or more accounts maintained by Toshiba or its Affiliates, in each case granted in the ordinary course of business or arising by operation of Law in favor of the bank or banks with which such accounts are maintained, securing amounts owing to such bank with respect to cash management, credit card, overdraft and operating account arrangements, including those involving pooled accounts and netting arrangements;

(k) Liens on property of a Person existing at the time such Person is acquired or merged with or into or consolidated with Toshiba or its Affiliates to the extent such acquisition, merger or consolidation is permitted hereunder (and such Liens are not created in anticipation or contemplation thereof); provided that such Liens do not extend to property not subject to such Liens at the time of acquisition other than (x) after-acquired property covered by the original grant and (y) improvements thereon, accessions thereto or proceeds from the disposition of such property;

(l) Licenses or sublicenses of intellectual property granted by Toshiba or its Affiliates and not interfering in any material respect with the ordinary conduct of business of Toshiba or its Affiliates;

7

(m) Liens attached to xxxx xxxxxxx money deposits made by Toshiba or its Affiliates in connection with any letter of intent or purchase agreement entered into by Toshiba or its Affiliates;

(n) Liens on insurance policies and the proceeds thereof securing the financing of the premiums with respect thereto to the extent indebtedness in connection with such financing of the payment of insurance premiums;

(o) Liens in favor of customs and revenue authorities arising as a matter of Law to secure payment of customs duties in connection with the importation of goods;

(p) Liens upon specific items of inventory or other goods and proceeds of any Person securing such Person’s obligations in respect of bankers’ acceptances issued or created for the account of such Person to facilitate the purchase, shipment or storage of such inventory or other goods in the ordinary course of business;

(q) (i) contractual or statutory Liens of landlords to the extent relating to the property and assets relating to any lease agreements with such landlord, (ii) contractual Liens of suppliers (including sellers of goods) to the extent limited to property or assets relating to such contract, (iii) contractual or statutory Liens of governmental or other customers to the extent limited to the property or assets relating to such contract, and (iv) Liens in favor of governmental bodies to secure advance or progress payments pursuant to any contract or statute;

(r) any (i) customary restriction on the transfer of licensed intellectual property rights and (ii) customary provision in any agreement that restricts the assignment of such agreement or any intellectual property rights thereunder;

(s) Liens on cash, securities or other property in deposit or securities accounts in connection with the redemption, defeasance, repurchase or other discharge of debt issued by Toshiba or its Affiliates in favor of financial institutions, lenders, note holders, sureties and/or letter of credit issuers (and including any agents or trustees for any of the foregoing) that are not affiliated with, or Affiliates of, Toshiba (collectively "Financial Institutions"), in each case, in connection with debt financing arrangements or other financial accommodations provided to Toshiba or any of its Affiliates; and

(t) rights of consignors of goods.

“Stone & Xxxxxxx” means Stone & Xxxxxxx, Inc., a Louisiana corporation, subsequently named CB&I Stone & Xxxxxxx, Inc., and then subsequently named WECTEC Global Project Services Inc.

“Survival Action” has the meaning set forth in Section 8.3(a).

“Toshiba” has the meaning set forth in the first paragraph of this Agreement.

“Toshiba Financial Information” means such financial information relating to Toshiba as reasonably requested from time to time by Beneficiary or any Owner of the type and in the form provided by Toshiba to (a) any financial institutions, lenders, noteholders, sureties, and/or letter

8

of credit issuers (and including any agents or trustees for any of the foregoing), in each case in connection with debt financing arrangements or other financial accommodations, or (b) Standard & Poor’s or Xxxxx’x Investor Service.

“Toshiba Guaranty” means that certain Toshiba Corporation Guaranty dated and effective as of April 8, 2008, and made and entered into by Toshiba in favor of Georgia Power, acting for itself and as agent for OPC, MEAG and Dalton, as amended from time to time.

“Toshiba Insolvency Proceeding” means the occurrence of any of the following:

(a) (i) Toshiba or any of its Affiliates (other than the Excluded Affiliates) shall (A) admit in writing or demonstrate its inability to pay its debts generally as they become due, (B) make an assignment for the benefit of its creditors, (C) file a petition or application, or an answer, or otherwise commence a proceeding (including a bankruptcy proceeding (hasan tetsuzuki), civil rehabilitation proceeding (minji saisei tetsuzuki), corporate reorganization (kaisha kosei tetsuzuki) or special liquidation (tokubetsu seisan tetsuzuki) under Japanese Laws) under any applicable Law of any country or any political subdivision thereof or of any other Governmental Authority, seeking rehabilitation, reorganization, liquidation or arrangement or similar relief or otherwise to take advantage of any bankruptcy, insolvency or other similar Law, or for the appointment of a receiver, trustee, liquidator, custodian, sequestrator, conservator or other similar agent of Toshiba or any of its Affiliates (other than the Excluded Affiliates) of the whole or any material part of the property or assets of Toshiba or such Affiliate (other than the Excluded Affiliates), or (D) become subject to any kind of out-of-court procedures for rehabilitation, reorganization, liquidation or arrangement or similar relief (other than any restructure of debt financing arrangements existing on the Effective Date in a manner that has no material adverse effect on Beneficiary or on any Owner or on the ability of Toshiba to perform its obligations under this Agreement and the Toshiba Promissory Note); (ii) there is commenced against Toshiba or any of its Affiliates (other than the Excluded Affiliates) any proceeding for any of the relief described in clause (i)(C) or clause (i)(D) above and such proceeding shall remain undismissed for a sixty (60) day period; (iii) there is filed against Toshiba or any of its Affiliates (other than the Excluded Affiliates) any petition for commencement of proceeding for any of the relief described in clause (i)(C) or (i)(D) above and such petition for commencement of proceeding or proceeding shall remain undismissed for a sixty (60) day period; or (iv) Toshiba or any of its Affiliates (other than the Excluded Affiliates), by any act in any such proceeding, indicates its consent to or approval of or acquiescence in such relief;

(b) (i) a court of competent jurisdiction shall enter an order, judgment or decree appointing a receiver, trustee, (special) liquidator, custodian, sequestrator, conservator or other similar agent of Toshiba or any of its Affiliates (other than the Excluded Affiliates) for the whole or any substantial part of its property or assets, or (ii) under the provisions of any Law for the relief or aid of debtors, a court of competent jurisdiction shall assume custody or control of Toshiba or any of its Affiliates (other than the Excluded Affiliates) or of the whole or any substantial part of its property or assets; or

9

(c) Toshiba or any of its Affiliates (other than the Excluded Affiliates) shall file a certificate or other instrument of liquidation or dissolution or shall be liquidated, dissolved or wound-up or shall commence any action or proceeding for liquidation, dissolution, or winding-up, or shall take any corporate action in furtherance thereof; or Toshiba or any of its Affiliates (other than the Excluded Affiliates) shall have commenced against it any action or proceeding for liquidation, dissolution, or winding-up or shall have filed any petition for commencement of any action or proceeding for liquidation, dissolution, or winding-up.

“Toshiba Obligation Amount” means the Agreed Amount (a) minus any amounts paid to, and received by, Beneficiary under Section 2.2 or Section 2.3, (b) minus any External Payments properly paid to, and received by, Beneficiary, and (c) plus any amounts paid or returned by Beneficiary as contemplated by Section 2.5.

“Toshiba Promissory Note” has the meaning set forth in Section 4.1.

“Toshiba Released Parties” has the meaning set forth in Section 6.7(a).

“Toshiba Releasing Parties” has the meaning set forth in Section 6.7(b).

“Vogtle Cost Statement” has the meaning set forth in Section 6.5.

“Vogtle Costs” means the sum of all costs and expenses, as reflected in filings by one or more of the Owners (and any of their predecessors, successors and assigns) with Governmental Units, paid, accrued, or incurred by the Owners (and any of their predecessors, successors and assigns) before or after the date of this Agreement for engineering, procurement and construction costs, and for any other items that would have constituted Work if such items had been performed under the EPC Agreement, with respect to the Vogtle Facility through the date the Vogtle Facility achieves Final Completion.

“Vogtle Facility” means the two-unit, nuclear-fueled electricity generation facility that is defined as the “Facility” in the EPC Agreement and that is to be located at the Vogtle Electric Generating Plant in Waynesboro, Georgia.

“WEC Debtors” means, collectively, Westinghouse and any of the other entities listed on Schedule 1.1(b).

“WECTEC” means WECTEC Global Project Services Inc., a Louisiana corporation formerly named CB&I Stone & Xxxxxxx, Inc., and, prior thereto, named Stone & Xxxxxxx, Inc.

“Westinghouse” means Westinghouse Electric Company LLC, a Delaware limited liability company.

Section 1.2 Other Defined Terms. Unless otherwise defined or specified in this Agreement, capitalized terms shall have the meanings ascribed to them in the EPC Agreement.

10

ARTICLE II

SETTLEMENT AMOUNT AND TOSHIBA PAYMENTS

Section 2.1 Establishment of Amount of Toshiba Obligation Under the Toshiba Guaranty. The Parties agree that, notwithstanding (a) any term of or condition in the Toshiba Guaranty, the EPC Agreement, or any other agreement, (b) the performance, termination, breach, amendment, modification, assignment, rejection, assumption, unenforceability, or invalidity of the Toshiba Guaranty, the EPC Agreement, or any other agreement, or (c) the cessation or continuation of work on the Vogtle Facility or the completion or abandonment of the Vogtle Facility, the amount of Toshiba’s payment obligations under the Toshiba Guaranty is fully accrued and irrevocably deemed and agreed to be an amount equal to the Agreed Amount. In no event will Toshiba claim or assert that Toshiba’s payment obligations under the Toshiba Guaranty are for an amount less than the Agreed Amount, and each Owner agrees that in no event will it claim or assert Toshiba’s payment obligations under the Toshiba Guaranty or the EPC Agreement are for an amount in excess of the Agreed Amount.

Section 2.2 Toshiba Payment Obligations. Notwithstanding (a) any term of or condition in the Toshiba Guaranty, the EPC Agreement, or any other agreement, (b) the performance, termination, breach, amendment, modification, assignment, rejection, assumption, unenforceability or invalidity of the Toshiba Guaranty, the EPC Agreement, or any other Agreement, or (c) the cessation or continuation of work on the Vogtle Facility or the completion or abandonment of the Vogtle Facility, except to the extent paid by application of an External Payment pursuant to Article III, Toshiba shall pay the Agreed Amount to Beneficiary for the benefit of Georgia Power, OPC, MEAG, and Xxxxxx. Except to the extent paid by application of an External Payment pursuant to Article III, Toshiba shall make such payment to Beneficiary in the monthly payment amounts and on the payment dates set forth on Schedule 2.2. Toshiba shall make each such payment in United States dollars by wire transfer of immediately available funds to an account as may be designated from time to time by Beneficiary, provided that such designation shall have been delivered to Toshiba at least thirty (30) days prior to the applicable payment date.

Section 2.3 Optional Prepayments. Toshiba, without premium or penalty, may prepay any of the monthly payment amounts set forth on Schedule 2.2. Beneficiary will apply such prepayments pro rata (based on the respective unpaid amounts set forth on Schedule 2.2) against all remaining monthly payment amounts set forth on Schedule 2.2 that are not past due.

Section 2.4 Suspension of Payment Obligations Based on Letters of Credit. Notwithstanding anything to the contrary in Section 2.2, if the aggregate amount of Toshiba’s remaining payment obligations under Section 2.2 (determined disregarding any External Payments that have not already been applied pursuant to Article III against monthly payment amounts set forth on Schedule 2.2) is less than the remaining amount then available to be drawn under the Letters of Credit by Beneficiary prior to expiration of any of the Letters of Credit (after taking into account any required notice and cure periods, Draw Instruction Notices and any outstanding demands for payment under the Letters of Credit) without restriction, Toshiba may deliver a written notice (a “Payment Obligation Suspension Notice”) to the Owners stating that the aggregate amount of Toshiba’s remaining payment obligations under Section 2.2 (determined disregarding any External Payments that have not already been applied pursuant to Article III

11

against monthly payment amounts set forth on Schedule 2.2) is, and on the suspension date specified by Toshiba in the Payment Obligation Suspension Notice will be, less than the remaining amount then available to be drawn under the Letters of Credit by Beneficiary prior to expiration of any of the Letters of Credit (after taking into account any required notice and cure periods, Draw Instruction Notices and any outstanding demands for payment under the Letters of Credit) without restriction (provided, however, that Toshiba may not deliver a Payment Obligation Suspension Notice at any time (a) in which there exists a Forbearance Termination Event (disregarding, for the purpose of this Section 2.4, the cure period and cure opportunity provisions of clause (d) of the definition of Forbearance Termination Event), (b) Beneficiary or the Owners are not permitted to make demand for such payment under Section 17.4(b) of the EPC Agreement or under the Letters of Credit or (c) with a specified suspension date in the sixty (60) day period before the expiration date of any of the Letters of Credit or at any time thereafter). Following delivery of the Payment Obligation Suspension Notice to the Owners, upon the suspension date specified by Toshiba in the Payment Obligation Suspension Notice, which date shall be at least forty five (45) days after the date of such delivery, Toshiba’s direct payment obligations under Section 2.2 (but not under Section 2.5) will be suspended and Beneficiary shall be permitted to demand payments under the Letters of Credit in an aggregate amount equal to the amount of the Toshiba payment obligations that were so suspended; provided, however, that if Beneficiary makes any such demand for payment under the Letters of Credit and, for any reason, such payment is not received by Beneficiary within five (5) business days in the United States of America of the making of such demand, the suspension of Toshiba’s direct payment obligations under Section 2.2 shall be lifted, Toshiba’s payment obligations shall be reinstated effective as of the time of the original suspension (and any Covenant Release Date contemplated by clause (a) of the definition of “Covenant Release Date” shall be deemed voided and not to have occurred), and Toshiba shall make all payments as and when contemplated by Section 2.2. Beneficiary, in connection with making a demand, as contemplated by this Section 2.4, for payment under the Letters of Credit, shall provide Toshiba with a copy of such demand substantially contemporaneously with delivery of such demand to the applicable issuer.

Section 2.5 Reinstatement for Rescinded or Returned Payments. If, at any time, any payment or distribution or portion thereof contemplated by this Agreement (including any External Payments and any payments under this Article II) or by the Toshiba Promissory Note is rescinded or otherwise returned by Beneficiary or any other Person, whether upon or in connection with a Toshiba Insolvency Proceeding or the insolvency, bankruptcy, or reorganization of Toshiba, or otherwise, the original payment obligation of Toshiba under this Agreement shall be reinstated as of the date of such rescission or return and, to the extent such rescission or return relates to any payments as to which the payment dates therefor were prior to the date of such rescission or return, Toshiba shall make a payment to Beneficiary in the aggregate amount of such payments that were due on such payment dates within ten (10) Japanese business days following the delivery by Beneficiary to Toshiba of a written notice of such rescission or other return, accompanied by reasonable supporting documentation of such rescission or return.

12

ARTICLE III

EXTERNAL PAYMENTS

EXTERNAL PAYMENTS

Section 3.1 Payment through Draw on Letters of Credit. Notwithstanding anything to the contrary in Section 2.2, Toshiba may deliver up to two written notices (each, a “Draw Instruction Notice”) to Beneficiary directing Beneficiary to seek payment, in the aggregate, of all or a portion of up to two of the monthly payment amounts set forth on Schedule 2.2 (other than the monthly payment amount with the October 1, 2017 payment date and other than any monthly payment amount with a payment date occurring on or after the date of issuance of the Toshiba Promissory Note) by having the Owners make demands for payment (“Draw Demands”) under the Letters of Credit after all applicable notices have been delivered to Westinghouse and all notice, grace or cure periods have ended permitting the Owners to draw under such Letters of Credit; provided, however, that (a) the aggregate amount of the Draw Demands so directed by Toshiba in the Draw Instruction Notices shall not exceed $220,000,000, (b) the amount of any Draw Demand so directed by Toshiba in a Draw Instruction Notice shall not exceed the remaining amount then available to be drawn under the Letters of Credit by the Owners prior to expiration of any of the Letters of Credit (after taking into account any required notice and cure periods, other Draw Instruction Notices and any other demands for payment under the Letters of Credit) without restriction, (c) Toshiba may not deliver the Draw Instruction Notice at any time (i) in which there exists a Forbearance Termination Event (disregarding, for the purpose of this Section 3.1, the cure period and cure opportunity provisions of clause (d) of the definition of Forbearance Termination Event), (ii) the Owners are not permitted to make demand for such payment under Section 17.4(b) of the EPC Agreement or under the Letters of Credit or (iii) in the sixty (60) day period before the expiration date of any of the Letters of Credit or at any time thereafter; and (d) any Draw Instruction Notice must be delivered to Beneficiary at least forty five (45) days prior to the earliest payment date to which it applies. Toshiba shall specify in the Draw Instruction Notice (a) the amounts to be demanded in the Draw Demands and (b) instructions as to which monthly payment amounts (not to exceed, in the aggregate for all Draw Instruction Notices, two of the monthly payment amounts) shall be reduced by Beneficiary by application of the proceeds of the Draw Demands. If the Draw Instruction Notice is delivered by Toshiba to Beneficiary in accordance with the terms hereof, then no later than seven (7) days after all applicable notices have been delivered to Westinghouse and all notice, grace or cure periods have ended permitting the Owners to draw under the Letters of Credit, Beneficiary will present to the issuer(s) of the Letters of Credit a Draw Demand under the Letters of Credit in the amounts set forth in the Draw Instruction Notice. If Beneficiary receives the proceeds of the Draw Demand from the issuer(s) of the Letters of Credit within ten (10) business days in the United States of America of the Owners’ presentation of the Draw Demand, Beneficiary will apply such proceeds to reduce monthly payment amounts as specified in the Draw Instruction Notice. If Beneficiary does not receive the proceeds of the Draw Demand from the issuer(s) of the Letters of Credit within ten (10) business days in the United States of America of the Owners’ presentation of the Draw Demand, (a) Toshiba shall be obligated to pay to Beneficiary as and when contemplated by Section 2.2 the monthly payment amounts that were to be reduced by Beneficiary by application of the proceeds of such Draw Demand and (b) Beneficiary will apply such proceeds of the Draw Demand, if and when received from the issuer(s) of the Letters of Credit, to reduce monthly payment amounts on Schedule 2.2 in inverse order of their specified payment dates (i.e., starting with payment dates that are the farthest in the future).

13

Section 3.2 Westinghouse Proceeds.

(a) Beneficiary will apply the first $1,000,000,000 of all cash distributions received by it (i) pursuant to the Distribution Order or as contemplated by Section 5.6, or (ii) in respect of claims of the Owners for a breach by Westinghouse of the EPC Agreement (including any rejection thereof under section 365 of the Bankruptcy Code), including any distributions from Westinghouse in exchange for, on account of, or in connection with such claims, against the monthly payment obligations of Toshiba under Section 2.2. Beneficiary will apply such cash distributions received by it to the monthly payment amounts on Schedule 2.2 in inverse order of their specified payment dates (i.e., starting with payment dates that are the farthest in the future).

(b) Beneficiary will apply all cash distributions in excess of $1,000,000,000 received by it (i) pursuant to the Distribution Order or as contemplated by Section 5.6, or (ii) in respect of claims of the Owners for a breach by Westinghouse of the EPC Agreement (including any rejection thereof under section 365 of the Bankruptcy Code), including any distributions from Westinghouse in exchange for, on account of, or in connection with such claims, against the monthly payment obligations of Toshiba under Section 2.2 Beneficiary will apply such distributions pro rata (based on the respective unpaid amounts set forth on Schedule 2.2) (a) first against all remaining monthly payment amounts set forth on Schedule 2.2 that have payment dates on or after March 1, 2019 and that are not past due, (b) second against all remaining monthly payment amounts set forth on Schedule 2.2 that have payment dates before March 1, 2019 and that are not past due and (c) third, if there are monthly payment amounts that are past due, against any such payment amounts.

(c) For the avoidance of doubt, no non-cash distribution received by Beneficiary or any Owner shall be applied to reduce the monthly payment obligations of Toshiba under Section 2.2, unless and until such distribution is reduced to cash. In the event that, as of the time (i) Toshiba is entitled to exercise subrogation rights as contemplated by Section 9.3 and (ii) the proviso in Section 9.3 is no longer applicable, any Owner continues to own or have any interest in any non-cash distributions received by such Owner in exchange for, on account of, or in connection with any claims of such Owner for a breach by Westinghouse of the EPC Agreement (including any rejection thereof under section 365 of the Bankruptcy Code), Toshiba shall have the right, at any time thereafter, to demand in writing that such Owner, if and when any such non-cash distribution or interest therein is thereafter reduced to cash, transfer to Toshiba such cash. Following its receipt of such written demand such Owner shall so transfer to Toshiba any such cash received by it on account of such non-cash distribution or interest therein that has not, pursuant to this Agreement, been applied to monthly payment amounts on Schedule 2.2, but only to the extent the aggregate amount of all cash transferred to Toshiba pursuant to this Section 3.2(c) does not exceed such Owner’s Pro Rata Share of the Agreed Amount. Any such transfer of cash to Toshiba will be accompanied by a reasonably detailed accounting of (a) the non-cash distributions received by such Owner in exchange for, on account of, or in connection with any claims of such Owner for a breach by Westinghouse of the EPC Agreement (including any rejection thereof under section 365 of the Bankruptcy Code) and (b) any cash received in respect thereof.

14

ARTICLE IV

SUBSTITUTION OF PROMISSORY NOTE

SUBSTITUTION OF PROMISSORY NOTE

Section 4.1 Substitution of Toshiba Promissory Note. At any time when Toshiba is rated by Standard & Poor’s or Xxxxx’x Investor Service at or above the Minimum Rating, and upon consent of each Owner in its sole discretion, Beneficiary may deliver to Toshiba a notice (a “Promissory Note Substitution Notice”) directing Toshiba to issue and deliver to Beneficiary a promissory note (the “Toshiba Promissory Note”), in substantially the form of Exhibit B, with (A) a principal amount equal to the Toshiba Obligation Amount and (B) a maturity date on the ten year anniversary of the issuance date. Upon Beneficiary’s receipt of the Toshiba Promissory Note, Toshiba’s obligation under the Toshiba Promissory Note shall be deemed to replace Toshiba’s payment obligations under Section 2.2 (but not under Section 2.5). Contemporaneously with or promptly following Beneficiary’s receipt of the Toshiba Promissory Note, the Owners will surrender the Letters of Credit to Toshiba or the issuer of such Letter of Credit.

ARTICLE V

COVENANTS OF TOSHIBA

COVENANTS OF TOSHIBA

Section 5.1 Restrictive Covenants. At all times prior to the Covenant Release Date (and thereafter if the Covenant Release Date is voided pursuant to Section 2.4), Toshiba shall not, and shall cause each of its Affiliates (other than (i) the WEC Debtors and (ii) Affiliates of Toshiba that have their common equity securities listed on the New York Stock Exchange, The NASDAQ Stock Market, the Japan Stock Exchange, the London Stock Exchange, the Shanghai Stock Exchange, the Hong Kong Stock Exchange, Euronext or any other stock exchange acceptable to the Owners) not to, (a) create, incur, assume or suffer to exist any Lien upon or with respect to any assets of Toshiba or any of its Affiliates (other than (i) the WEC Debtors and (ii) Affiliates that have their common equity securities listed on the New York Stock Exchange, The NASDAQ Stock Market, the Japan Stock Exchange, the London Stock Exchange, the Shanghai Stock Exchange, the Hong Kong Stock Exchange, Euronext or any other stock exchange acceptable to the Owners), whether now owned or hereafter acquired, or (b) take any other action (including in connection with any merger, spin or consolidation, deconsolidation or amalgamation) that, in each case, would have the effect of subordinating the claims of Beneficiary under the Toshiba Guaranty or the claims of Beneficiary or any Owner under this Agreement to any other claims. The foregoing provisions of this Section 5.1 shall not apply to:

(i) the transactions described in the press release issued by Toshiba on April 24, 2017, a copy of which is attached as Schedule 5.1(b), as well as the other ancillary transactions described in Schedule 5.1(b);

(ii) Liens in favor of Financial Institutions, in each case, in connection with debt financing arrangements or other financial accommodations provided to Toshiba or any of its Affiliates;

(iii) any Standard Permitted Lien arising in the ordinary course of business of Toshiba and its Affiliates; and

15

(iv) guaranties by Toshiba for existing and new ordinary course projects of Toshiba or its Affiliates so long as such guaranties are subordinate to or pari passu with Toshiba’s obligations under the Toshiba Guaranty and under this Agreement.

Section 5.2 SCANA. Toshiba will negotiate in good faith with the Owners regarding, and to minimize any adverse effects on the Owners or the construction, maintenance or operation of the Vogtle Facility (whether such facility is completed under the EPC Agreement or otherwise) of, any agreements or arrangements Toshiba or any of its Affiliates may enter into or contemplate entering into with SCANA or any successors or assigns thereof; provided, however, that in no event will Toshiba or its Affiliates be required, by reason of this Section 5.2, to release, amend, waive, or otherwise modify any of their rights under this Agreement or any other agreement.

Section 5.3 Services Agreement. Toshiba will negotiate in good faith with the Owners regarding a potential services agreement under which Toshiba would provide parts and services relating to the Vogtle Facility; provided, however, that in no event will Toshiba, by reason of this Section 5.3, have any obligation to enter into such services agreement; and provided further, however, that this Section 5.3 shall not require Toshiba to offer any extension of defect liability periods for the equipment and services it has supplied pursuant to previous agreements.

Section 5.4 Financial Information. Until the earlier of (a) the issuance of the Toshiba Promissory Note or (b) the full and irrevocable payment by Toshiba of all amounts contemplated by Section 2.2 (determined disregarding any External Payments that have not already been applied pursuant to Article III against monthly payment amounts set forth on Schedule 2.2), and provided that the NDA remains effective (or, if the NDA is not effective, provided that each of the requesting Owners is willing to enter into a new agreement with Toshiba with confidentiality terms substantially comparable to those in the NDA), Toshiba will provide to Beneficiary the Toshiba Financial Information promptly following the request therefor by any Owner. Notwithstanding the foregoing, Toshiba shall be under no obligation to provide information to the Beneficiary relating to asset sales that have not been completed.

Section 5.5 Amendment, Modification and Waiver of the Distribution Order. Without the prior written consent of each Owner, which consent may be granted or withheld in its sole discretion, Toshiba will not seek to reverse, withdraw, have reconsidered, vacate or otherwise amend the Distribution Order. Toshiba shall comply with all of its obligations under the Distribution Order.

Section 5.6 Pay Over. Until the full and irrevocable payment to Beneficiary of the Toshiba Obligation Amount pursuant to this Agreement, after taking into account the effect of any amounts that have been or in the future may be required to be paid or returned by Beneficiary or any other Person as contemplated by Section 2.5, any of the following that are received by Toshiba or any of its Affiliates (other than the WEC Debtors) shall be segregated and held in trust by Toshiba for Beneficiary and promptly paid over by Toshiba to Beneficiary for the benefit of Georgia Power, OPC, MEAG and Xxxxxx to be applied by Beneficiary as provided in Section 3.2(a) and Section 3.2(b): (i) any payment or distribution from Westinghouse (or any of its subsidiaries) or Toshiba Nuclear Energy Holdings (UK) Limited (or any of its subsidiaries); (ii) any proceeds from the sale, by asset sale, stock sale, merger or otherwise, of

16

Westinghouse (or any of its subsidiaries) or Toshiba Nuclear Energy Holdings (UK) Limited (or any of its subsidiaries; or (iii) any proceeds from the sale of any claim against Westinghouse (or any of its subsidiaries) or Toshiba Nuclear Energy Holdings (UK) Limited (or any of its subsidiaries) (any of the items described in the foregoing clauses (i), (ii) and (iii), the “Pay Over Property”); provided, however, that, with respect to any Pay Over Property in respect of the equity securities of Toshiba Nuclear Energy Holdings (UK) Limited, this Section 5.6 shall not apply to the portion of such Pay Over Property allocable to any minority owner of Toshiba Nuclear Energy Holdings (UK) Limited that is not an Affiliate of Toshiba under the governing documents of Toshiba Nuclear Energy Holdings (UK) Limited, so long as such allocated portion does not exceed 10% of such Pay Over Property. Notwithstanding any provision of this Section 5.6, in lieu of complying with the foregoing provisions of this Section 5.6 Toshiba shall be entitled to return to Westinghouse (or any of its subsidiaries) or Toshiba Nuclear Energy Holdings (UK) Limited (or any of its subsidiaries) any Pay Over Property paid or distributed by such Person or such Person's agent or designee to Toshiba or any of its Affiliates. Toshiba further agrees that it (i) will not sell or transfer, or permit any of its Affiliates (other than the WEC Debtors) to sell or transfer (other than any sale or transfer to any Affiliate other than the WEC Debtors), any rights in respect of intercompany loans to Westinghouse (or any of its subsidiaries) or Toshiba Nuclear Energy Holdings (UK) Limited (or any of its subsidiaries) or any claims Toshiba or any of its Affiliates (other than the WEC Debtors) may have against Westinghouse (or any of its subsidiaries) or Toshiba Nuclear Energy Holdings (UK) Limited (or any of its subsidiaries) (and that Toshiba has sole authority to control) arising from Beneficiary or Owners’ draws under the Letters of Credit until the full and irrevocable payment to Beneficiary of the Toshiba Obligation Amount pursuant to this Agreement, after taking into account the effect of any amounts that have been or in the future may be required to be paid or returned by Beneficiary or any other Person as contemplated by Section 2.5 and (ii) will not sell or transfer any of its equity interest in Toshiba Nuclear Energy Holdings (UK) Limited until after a sale of all or substantially all of the assets of the WEC Debtors, including all or substantially all of the assets of Toshiba Nuclear Energy Holdings (UK) Limited.

Section 5.7 Payments Free and Clear.

(a)All payments under this Agreement shall be made in U.S. Dollars and without any deductions or withholding for or on account of any tax imposed upon any Owner, Beneficiary or Toshiba unless such deduction or withholding is required by any applicable Law, as modified by the practice of any relevant governmental revenue authority, then in effect. If Toshiba is so required to deduct or withhold, then Toshiba will (i) pay to the relevant authorities the full amount required to be deducted or withheld (including the full amount of tax required to be deducted or withheld from any additional amount paid by Toshiba to any Owner or Beneficiary under this Section 5.7) promptly upon the earlier of determining that such deduction or withholding is required or receiving notice that such an amount has been assessed against any Owner or Beneficiary, and in any event before penalties attach thereto or interest accrues thereon, (ii) promptly forward to the Owners an official receipt (or certified copy), or other documentation reasonably acceptable to the Owners, evidencing such payment to such authorities and (iii) in addition to the payment which any Owner or Beneficiary is otherwise entitled under this Agreement, if such deduction or withholding is on account of any tax imposed upon Toshiba, pay to the Owners and Beneficiary such additional amount as is necessary to ensure that the net amount actually received by the Owners and Beneficiary (free and clear of

17

taxes assessed against Toshiba) will equal the full amount the Owners and Beneficiary would have received had no such deduction or withholding been required.

(b)If (i) Toshiba is required to make any deduction or withholding on account of any tax from any payment made by it under this Agreement, (ii) Toshiba does not make the deduction or withholding, and (iii) a liability for or on account of the tax is therefore assessed directly against any Owner or Beneficiary, Toshiba shall pay to the Owners and Beneficiary, promptly after deemed, the amount of the liability (including any related liability for interest or penalties).

ARTICLE VI

COVENANTS OF BENEFICIARY AND OWNERS

COVENANTS OF BENEFICIARY AND OWNERS

Section 6.1 Forbearance. Beneficiary will not, prior to the Forbearance Date, enforce any rights under the Toshiba Guaranty unless a Forbearance Termination Event has occurred (inclusive of the expiration without cure of any applicable cure period set forth in clause (d) of the definition of Forbearance Termination Event). Unless a Forbearance Termination Event has occurred, Beneficiary will not, prior to the Forbearance Date, make any demand for payment under any of the Letters of Credit except (a) as contemplated by Section 2.4 or Section 3.1, (b) from and after the delivery by Toshiba of a Payment Obligation Suspension Notice, and (c) in the sixty (60) day period before the expiration thereof.

Section 6.2 SCANA. Each of the Owners agrees that it will negotiate in good faith with Toshiba regarding, and to minimize any adverse effects on the Owners or the construction, maintenance or operation of the Vogtle Facility (whether such facility is completed under the EPC Agreement or otherwise) of, any agreement or arrangements Toshiba or any of its Affiliates may enter into or contemplate entering into with SCANA or any successors or assigns thereof; provided, however, that in no event will any of the Owners be required, by reason of this Section 6.2, to release, amend, waive, or otherwise modify any of their rights under this Agreement or any other agreement.

Section 6.3 Services Agreement. Beneficiary will negotiate in good faith with Toshiba regarding a potential services agreement under which Toshiba may provide parts and services relating to the Vogtle Facility; provided, however, that in no event will any of the Owners be required, by reason of this Section 6.3, to release, amend, waive, or otherwise modify any of their rights under this Agreement or any other agreement; and provided further, however, that in no event will any of the Owners, by reason of this Section 6.3, have any obligation to enter into such services agreement or to consider, or to undertake, any work or obligation with respect to the Vogtle Facility or the completion thereof.

Section 6.4 Consideration of Cost Reduction Proposals. Beneficiary will consider any good faith proposals it may receive from Toshiba for arrangements for incentives benefitting both Toshiba and the Owners that are intended to reduce costs to achieve Final Completion; provided, however, that in no event will any of the Owners be required, by reason of this Section 6.4, to release, amend, waive, or otherwise modify any of their rights under this Agreement or any other agreement; and provided, further, however, that in no event will any of the Owners, by reason of this Section 6.4, have any obligation to enter into any arrangements with respect to any

18

such incentives or to consider, or to undertake, any work or obligation with respect to the Vogtle Facility or Final Completion. Each Owner acknowledges and agrees that Toshiba is not required to provide any proposals pursuant to this Section 6.4. Toshiba makes no representations or warranties in respect of any such proposal. Except to the extent it otherwise agrees in writing, Toshiba will have no responsibility for the implementation and operation of any such proposal.

Section 6.5 Refund of Toshiba Payments. If, and only if, the Vogtle Facility achieves Final Completion, Beneficiary and each of the Owners agrees that it will promptly provide Toshiba with a statement (the “Vogtle Cost Statement”), in a form reasonably acceptable to Toshiba, of all Vogtle Costs. If (a) the amount of (i) Vogtle Costs as shown on the Vogtle Cost Statement minus (ii) the Contract Price (as adjusted as provided by the EPC Agreement) is less than (b) the Agreed Amount, then, if all payment obligations of Toshiba in this Agreement and in the Toshiba Promissory Note have been fully and irrevocably paid (whether or not then due), each Owner shall pay Toshiba its Pro Rata Share of 50% of the resulting difference. For the avoidance of doubt, the Parties acknowledge that the Owners shall have no obligation to minimize or reduce the Vogtle Costs, and Toshiba shall have no right to assert any right to payment under this Section 6.5 based on an assertion that the Vogtle Costs should have been lower.

Section 6.6 Support of Sale of Westinghouse’s Assets and Plan Support Agreement. Toshiba and each of the Owners agrees that it will support a prompt sale of the assets of Westinghouse and the other WEC Debtors pursuant to a plan of reorganization or a motion under section 363 of the Bankruptcy Code that is, in each case, acceptable to Toshiba and the Owners in their respective sole discretion. Toshiba and each of the Owners agrees that it will negotiate in good faith regarding the terms of an acceptable, in their respective sole discretion, plan support agreement that will set forth terms of an acceptable, in their respective sole discretion, chapter 11 plan for Westinghouse and the other WEC Debtors. Such plan support agreement shall include plan provisions which (i) provide for a third party release, exculpation and plan injunction substantially in the form of Exhibit C, and (ii) set forth an allocation, acceptable to each of the Owners in their respective sole discretion, of distributions to the Owners on account of their respective claims.

Section 6.7 Release.

(a) Effective immediately upon (i) the full payment to Beneficiary, and receipt by the Owners, of the Toshiba Obligation Amount, or (ii) the issuance of the Toshiba Promissory Note (as applicable), each of the Owners on behalf of itself and its present and former agents, Affiliates, principals, shareholders, stakeholders, predecessors, subsidiaries, successors and assigns (collectively, the “Owner Releasing Parties”) hereby fully, finally and forever releases, acquits and discharges Toshiba, and each of its respective agents, Affiliates, members, shareholders, executives, employees, attorneys, advisors, accountants, auditors, representatives, associates, directors, officers, partners, principals, insurers, predecessors, subsidiaries, successors, estates, heirs, executors, trusts, trustees, administrators, licensees and assigns, excluding the WEC Debtors and any subsidiaries thereof (such parties collectively, the “Toshiba Released Parties”) from any and all manner of action, causes of action, claims, demands, lawsuits, attorneys’ fees and costs, losses, expenses, damages, right to equitable remedy if such breach gives rise to a right of payment, or liabilities of whatever kind and nature

19

whatsoever, whether now known or unknown, asserted or unasserted, suspected or unsuspected, whether arising under federal, state, local, statutory, common, foreign or administrative Law, or any other Law, rule or regulation, whether fixed or contingent, accrued or unaccrued, liquidated or unliquidated, matured or unmatured, disputed or undisputed, at law or in equity, secured or unsecured that any of the Owner Releasing Parties heretofore had, or now or hereafter have, own or hold, or could assert directly or indirectly, against Toshiba in any forum, arising out of or related to (a) the EPC Agreement and any and all related documents, and (b) the Toshiba Guaranty; provided, however, that nothing in this Section 6.7(a) shall release Toshiba or any of the other Toshiba Released Parties from any obligation under any contract or agreement to which it is a party (other than the Toshiba Guaranty), including this Agreement (including under Section 2.5), the Toshiba Promissory Note, any other contract in connection with Toshiba’s or any other Toshiba Released Party’s role as supplier to the Vogtle Facility, and any services agreements entered into by Toshiba and the Owners.

(b) Effective immediately upon the effectiveness of the release contemplated by Section 6.7(a), Toshiba, on behalf of itself and its present and former agents, Affiliates, principals, shareholders, stakeholders, predecessors, subsidiaries, successors and assigns, excluding the WEC Debtors and any subsidiaries thereof (collectively, the “Toshiba Releasing Parties”, together with the Owner Releasing Parties, the “Releasing Parties”) hereby fully, finally and forever releases, acquits and discharges each of the Owners and each of their respective agents, Affiliates, executives, employees, attorneys, advisors, accountants, auditors, representatives, associates, directors, officers, partners, principals, insurers, predecessors, subsidiaries, successors, estates, heirs, executors, trusts, trustees, administrators, licensees and assigns (collectively, the “Owner Released Parties”, together with the Toshiba Released Parties, the “Released Parties”) from any and all manner of action, causes of action, claims, demands, lawsuits, attorneys’ fees and costs, losses, expenses, damages, right to equitable remedy if such breach gives rise to a right of payment, or liabilities of whatever kind and nature whatsoever, whether now known or unknown, asserted or unasserted, suspected or unsuspected, whether arising under federal, state, local, statutory, common, foreign or administrative Law, or any other Law, rule or regulation, whether fixed or contingent, accrued or unaccrued, liquidated or unliquidated, matured or unmatured, disputed or undisputed, at law or in equity, secured or unsecured that any of the Toshiba Releasing Parties heretofore had, or now or hereafter have, own or hold, or could assert directly or indirectly, against Toshiba in any forum, arising out of or related to (a) the EPC Agreement and any and all related documents, and (b) the Toshiba Guaranty; provided however, that nothing in this Section 6.7(b) shall release any of the Owner Released Parties from any obligation under any other contract or agreement to which it is a party (other than the Toshiba Guaranty), including this Agreement, any other contract in connection with Toshiba’s or any other Toshiba Released Party’s role as supplier to the Vogtle Facility, and any services agreements entered into by Toshiba and the Owners.

(c) The Releasing Parties are fully aware of the provisions of California Civil Code Section 1542, which provides as follows:

A general release does not extend to claims which the creditor does not know or suspect to exist in his or her favor at the time of executing the release, which if known by him or her must have materially affected his or her settlement with the debtor.

20

Each of the Releasing Parties agrees to voluntarily waive the provisions of California Civil Code Section 1542 (or under any Law of any state or territory of the United States, or principle of common law, or under the Law of any foreign country, that is similar, comparable or equivalent to section 1542 of the California Civil Code) with respect to the claims released in Section 6.7(a) and Section 6.7(b). The Releasing Parties acknowledge and agree that the foregoing waiver was separately bargained for and a key element of the Agreement of which this release is a part.

(d) Covenants Not To Xxx

(i) The Releasing Parties promise not to xxx or proceed in any manner, in court, agency or any other proceedings, whether at law, in equity, by way of administrative hearing, or otherwise, or to solicit others to institute any such actions or proceedings, against the Released Parties concerning any of the claims released in this Section 6.7.

(ii) The releases and covenants not to xxx contained in this Section 6.7 may be pleaded as a full and complete defense to, and may be used as the basis for an injunction against, any action, suit or other proceeding which may be instituted in breach of the releases or covenants not to xxx.

ARTICLE VII

REPRESENTATIONS AND WARRANTIES

REPRESENTATIONS AND WARRANTIES

Section 7.1 Representations and Warranties of Toshiba. Toshiba represents and warrants to the Owners as of the date of this Agreement that:

(a) Due Organization. Toshiba is a corporation duly organized and validly existing under the Laws of Japan. Toshiba has the requisite power and authority to own and operate its business and properties and to carry on its business as such business is now being conducted and is duly qualified to do business in any other jurisdiction in which the transaction of its business makes such qualification necessary.

(b) Due Authorization; Binding Obligation. Toshiba has full power and authority to execute and deliver this Agreement and to perform its obligations hereunder, and the execution, delivery and performance of this Agreement by Toshiba, and the consummation by Toshiba of the transactions contemplated hereby, have been duly authorized by the necessary action on the part of Toshiba; this Agreement has been duly executed and delivered by Toshiba and is the valid and binding obligation of Toshiba enforceable in accordance with its terms, subject to applicable bankruptcy, insolvency, reorganization, moratorium, liquidation, and other similar Laws and principles of equity affecting creditors’ rights and remedies generally.

(c) Non-Contravention. The execution, delivery and performance of this Agreement by Toshiba and the consummation of the transactions contemplated hereby do not and will not (i) violate or conflict with (A) the organizational documents of Toshiba or (B) any Law or any order of any Governmental Unit, (ii) violate, conflict with or result in a breach or termination of, or otherwise give any Person additional rights or compensation under, or the right to terminate or accelerate, or the loss of a material benefit under, or constitute (with notice or lapse of time, or both) a default under the terms of any indenture, mortgage, lease, agreement,

21

instrument, judgment, decree, order or ruling to which Toshiba is a party or by which it or any of its properties is bound or affected or (iii) result in the creation or imposition of any Lien with respect to, or otherwise have an adverse effect upon, the properties or assets of Toshiba or any of its Affiliates.

(d) Approvals. There are no approvals or consents of Governmental Units or other Persons not yet obtained, the absence of which would materially impair Toshiba’s ability to execute, deliver and perform its obligations under this Agreement.

(e) Litigation. There are no proceedings, claims or lawsuits pending or, to the knowledge of Toshiba, threatened against Toshiba that question the legality, validity or enforceability of this Agreement or any of the transactions contemplated hereby.

Section 7.2 Representation and Warranties of Owners. Each Owner hereby severally represents and warrants to Toshiba as of the date of this Agreement that:

(a) Validity and Enforceability. Such Owner has the corporate power and authority to execute and deliver this Agreement and to perform its obligations under this Agreement. The execution, delivery and performance of this Agreement by such Owner, and the consummation by such Owner of the transactions contemplated hereby, have been duly authorized and approved by all required action on the part of such Owner. This Agreement has been duly executed and delivered by such Owner and, assuming due authorization, execution and delivery by Toshiba, represents the legal, valid and binding obligation of such Owner enforceable against such Owner in accordance with its terms, subject to applicable bankruptcy, insolvency, reorganization, moratorium, liquidation, and other similar Laws and principles of equity affecting creditors’ rights and remedies generally.

(b) Existence and Good Standing. Such Owner is duly organized, validly existing and in good standing under the Laws of the State of Georgia.

(c) No Conflict; Required Filings and Consents. Neither the execution of this Agreement by such Owner nor the performance by such Owner of its obligations hereunder will violate or conflict with the charter or any other organizational document of such Owner and, assuming the approval of the Department of Energy, such execution and performance do not and will not conflict with or result in a breach of or default under any indenture, mortgage, lease, agreement, instrument, judgment, decree, order or ruling to which such Owner is a party or by which it or any of its properties is bound or affected.

(d) Approvals. Except for the approval of the Department of Energy, there are no approvals or consents of Governmental Units or other Persons not yet obtained, the absence of which would materially impair such Owner’s ability to execute, deliver and perform its obligations under this Agreement.

(e) Litigation. There are no proceedings, claims or lawsuits pending or, to the knowledge of such Owner, threatened against such Owner that question the legality, validity or enforceability of this Agreement or any of the transactions contemplated hereby.

22

ARTICLE VIII

REMEDIES, NUCLEAR INDEMNITY AND INSURANCE

REMEDIES, NUCLEAR INDEMNITY AND INSURANCE

Section 8.1 Beneficiary Remedies. From and after the earlier of (a) any Forbearance Termination Event (including the expiration without cure of any applicable cure period set forth in clause (d) of the definition of Forbearance Termination Event) and (b) the Forbearance Date, Beneficiary may pursue all of its legal and equitable rights and remedies under the Toshiba Guaranty and Toshiba shall not argue that the terms or existence of this Agreement constitute a defense thereunder; provided, however, that each of the Owners agrees that it shall not, in any event, pursue, assert, or claim any amounts under the Toshiba Guaranty in excess of the Toshiba Obligation Amount and Toshiba agrees that it shall not, in any event, assert or claim that under the Toshiba Guaranty it owes Beneficiary an amount less than the Toshiba Obligation Amount.

Section 8.2 Owner Remedies. From and after a Forbearance Termination Event, in addition to Beneficiary’s rights under Section 8.1, each Owner may (a) by notice to Toshiba, declare all payment obligations of Toshiba under this Agreement to be immediately due and payable, whereupon all such obligations shall accelerate and be immediately due and payable; provided, however, that if a Toshiba Insolvency Proceeding has occurred, no such declaration shall be required and, upon the occurrence of such Toshiba Insolvency Proceeding, all of such obligations shall automatically accelerate and be immediately due and payable, (b) make draws under the Letters of Credit and apply the proceeds thereof to reduce amounts due under this Agreement (including amounts due as a result of the acceleration described in the foregoing clause (a)) or under the Toshiba Guaranty and (c) pursue all of legal and equitable rights and remedies available to it.

Section 8.3 Specific Performance; Remedies Not Exclusive.

(a) Toshiba agrees that irreparable damage will result if this Agreement is not performed by Toshiba in accordance with its terms, and any damages available at law for a breach of this Agreement would not be an adequate remedy. Therefore, this Agreement and the obligations of Toshiba hereunder shall be enforceable in a court of equity, or other tribunal with jurisdiction, by a decree of specific performance, and appropriate preliminary or permanent injunctive relief may be applied for and granted in connection therewith (and any requirement to post any bond in connection therewith is hereby waived). Notwithstanding the foregoing, neither the Beneficiary nor any of the Owners may seek a decree of specific performance, or any related preliminary or permanent injunctive relief, with respect to any action (a “Survival Action”) taken by Toshiba that violates Section 5.1 if (i) such action has been approved in advance by Toshiba’s board of directors and (ii) in connection with such approval, Toshiba’s board of directors has determined, in good faith, after consultation with, and receiving the advice of, outside legal counsel, that (A) the failure to take the Survival Action will (x) violate the directors’ fiduciary duties under applicable Law and (y) result in the failure of Toshiba to continue as a going concern and (B) such Survival Action will have the minimum adverse consequence to Beneficiary and the Owners that can be reasonably achieved while also allowing Toshiba to continue as a going concern (it being understood, for the avoidance of doubt, that notwithstanding anything to the contrary herein, Beneficiary and Owners reserve all rights to pursue all of its legal and equitable rights and remedies under the Toshiba Guaranty; provided, however, that each of the Owners agrees that it shall not, in any event, pursue, assert, or claim

23

any amounts under the Toshiba Guaranty in excess of the Toshiba Obligation Amount). Subject to the limitations set forth in this Section 8.3(a), if an action is brought by either the Beneficiary or the Owners to enforce this Agreement, Toshiba shall waive the defense that there is adequate remedy at Law. The limitations set forth in this Section 8.3(a) on seeking a decree of specific performance, or any related preliminary or permanent injunctive relief, shall not mean, and shall not imply, that a violation of Section 5.1 is not a breach of this Agreement and a Forbearance Termination Event triggering the rights and remedies arising therefrom as set forth in this Agreement and at law, which rights and remedies shall be available.

(b) Each of Beneficiary and the Owners agree that irreparable damage will result if this Agreement is not performed in accordance with its terms, and any damages available at law for a breach of this Agreement would not be an adequate remedy. Therefore, this Agreement and the obligations of each of the Beneficiary and the Owners hereunder shall be enforceable in a court of equity, or other tribunal with jurisdiction, by a decree of specific performance, and appropriate preliminary or permanent injunctive relief may be applied for and granted in connection therewith (and any requirement to post any bond in connection therewith is hereby waived). If an action is brought by Toshiba to enforce this Agreement, Beneficiary and each of the Owners shall waive the defense that there is adequate remedy at Law.

(c) All remedies provided for in this Agreement or otherwise available at law or in equity shall be cumulative and not exclusive and shall be in addition to any other remedies that a Party may have under this Agreement.

Section 8.4 Attorneys’ Fees. The prevailing Party in any action to enforce this Agreement against any other Party or to recover damages or obtain other remedies for a breach of this Agreement by any other Party shall be entitled to receive from the losing Party any and all costs (including reasonable attorneys’ fees and related expenses) incurred in connection with such action.

Section 8.5 Nuclear Indemnity and Insurance. Subject to Section 8.5(f), while they are owners of the Vogtle Facility and all required authorizations from the U.S. Nuclear Regulatory Commission authorizing operation of the Vogtle Facility have been issued and are in effect:

(a) Owners shall maintain insurance to cover Public Liability Claims as defined in 42 U.S.C. § 2014(w) in such form and in such amount to meet the financial protection requirements of the Atomic Energy Act of 1954, as amended, and regulations promulgated pursuant thereto.

(b) Owners shall maintain a governmental indemnity agreement pursuant to the Atomic Energy Act of 1954, as amended, and regulations promulgated pursuant thereto.

(c) In the event that the financial protection system contemplated by Section 170 of the Atomic Energy Act of 1954, as amended, is repealed or changed, Owners will maintain in effect liability protection through governmental indemnity, limitation of liability to third parties and/or insurance of comparable coverage which will not result in a material impairment of the protection afforded Toshiba and its Affiliates set forth on Schedule 8.5 hereto

24