MERGER AGREEMENT BETWEEN NIKA PHARMACEUTICALS, INC. AND NIKA BIOTECHNOLOGY, INC.

MERGER AGREEMENT BETWEEN NIKA PHARMACEUTICALS, INC. AND NIKA BIOTECHNOLOGY, INC.

THIS AGREEMENT AND PLAN OF MERGER (the "Agreement") is made and entered into as of February 12, 2024, by and between Nika BioTechnology, Inc. (OTCMKTS: NIKA), a Nevada corporation (hereafter referred to as the "Target''), and Nika Pharmaceuticals, Inc. (OTCMKTS: "NKPH"), a Colorado corporation (hereafter referred to as the "Survivor").

RECIT ALS

A. The Board of Directors of both the Target and the Survivor believe it is advisable and in the best interests of each company and its respective stockholders that the Survivor acquire the Target through the statutory merger of the Target into the Survivor. Upon the terms and conditions set forth herein, and, in furtherance thereof, the Target and the Survivor have approved this Agreement and the transactions contemplated hereby.

B. Pursuant to the Merger, among other things, and subject to the terms and conditions of this Agreement, the issued and outstanding Common Sharesand Preferred Shares of the Target shall be converted into the right to receive the consideration set forth herein.

C. The Target and the Survivor each desire to make certain representations, warranties, covenants and other agreements in connection with the transactions contemplated hereby.

D. In a timely manner, the Survivor and the Target will each announce this Agreement to the public in order to identify the Merger between NKPH and NIKA.

NOW, THEREFORE, in consideration of the mutual agreements, covenants and other premises set forth herein, the mutual benefits to be gained by the performance thereof, and for other good and valuable considerations, the receipt and sufficiency of which are hereby acknowledge and accepted, the parties hereby agree as follows:

1

Table of Contents

2

3

ARTICLE I - THE MERGER

1. 1 The Merger

At the Effective Time and subject to and upon the terms and conditions of this Agreement and the applicable provisions of the Nevada Revised Statutes ("Nevada Law") and the applicable provisions of Colorado RevisedStatutes ("Colorado Law"), the Target shall be merged with and into the Survivor (the "Merger"), the separate corporate existence of the Target shall cease, and the Survivor shall continue as the surviving consolidated entity. The Survivor as the surviving consolidated entity after the Merger is sometimes referred to hereinafter as the "Surviving Entity".

1.2 EffectiveTime

Unless this Agreement is earlier terminated pursuant to Section 5.1 hereof, the closing of the Merger (the "Closing") will take place as promptly as practicable. The date upon which the Merger shall become effective shall be provided in an Articles of Merger referencing this Plan of Merger. The filing of the Articles of Merger shall be caused in accordance with the applicable provisions of Nevada law and Col.orado Law, and the time provided in the Articles of Merger shall be referred to herein as the ''Effective Time". The actual market Effective Time may be subject to regulatory decision and may differ from the Effective Time provided in the Articles of Merger.

1.3 Effectof the Merger

The effect of the Merger shall be as set forth in this Agreement and as provided in the applicable provisions of Nevada law and Colorado law. Without limiting the generality of the foregoing, and subject thereto, upon the filing of the Nevada Certificate of Merger with the Secretary of State of the State of Nevada and the Colorado Statement of Merger with the Secretary of State of the State of Colorado, except as otherwise agreed to pursuant to the terms of this Agreement or Articles of Merger, all of the property, rights, privileges, powers and franchises of the Target shall vest in the Surviving Entity, and all debts, liabilities and dutie s of the Target, and Xxxxxx shall become the debts, liabilities and duties of the Surviving Entity.

1.4 Organizational Documents

Unless otherwise determined by the Survivor prior to the Effective Time, the Articles of Incorporation of the Survivor shall be the Articles of Incorporation of the Surviving Entity.

Unless otherwise determined by the Survivor prior to the Effective Time, to the maximum extent possible, the Bylaws of the Survivor shall be the Bylawsof the Surviving Entity.

1. 5 Directors and Officers

As the current Directors and Officers of the Company and the Survivor are the same, the Directors and Officers of the Surviving Entity will also remain the same. In other words, Xxxxxxx Xxxxxxxx Xxxxx will remain as CEO, CFO, President, Treasurer and Chairman of the Board of Directors, Xxxxxxxx X. Xxxxxxx will remain as the Secretary and Director, and Xx. Xxxxxx Xxxxxxxx Xxxxxxx will remain as Chief Scientific Officer of the Surviving Entity.

4

1.6 Definitions

For all purposes of this Agreement, the following terms shall have the following respective meanings:

"Common Shares" shall mean the common stock of the Target.

"Preferred Shares" shall mean the Preferred A stock of the Target.

"Court" shall mean any court or arbitration tribunal of the United States, any domestic state, or any foreign country, and any political subdivision or agency thereof.

"Exchange Act" shall mean the Securities ExchangeAct of 1934, as amended.

"GAAP" shall mean United States generally accepted accounting principles consistently applied.

"Law" shall mean any law {statutory, common or otherwise), constitution, treaty, convention, ordinance, equitable principle, code, rule, regulation, executive order, or other similar authority enacted, adopted, promulgated, or applied by any Governmental Entity, each as amended and now in effect.

"Person" shall mean an individual or entity, including a partnership, a limited liability company, a corporation, an association, a joint stock company, a trust, a joint venture, an unincorporated organization, or a Governmental Entity (or any department, agency, or political subdivision).

"Related Agreements" shall mean the Articles of Merger and all other agreements and certificates entered into by the Survivor or the Target in connection with the merger transactions.

"SEC" shall mean the United States Securities and Exchange Commission.

"Securit ies Act" shall mean the Securities Act of 1933, as amended.

"Stockholde" r shall mean any holder of any Shares of the Target immediately prior to the Effective Time and as listed on the most recent shareholder list provided by the Target's transfer agent to the Surviving Entity's transfer agent.

"Survivor Common Stock1' shall mean the issued and outstanding shares of the common stock, par value $0.0001 per share, of the Survivor.

"Survivor Preferred Stock" shall mean the issued and outstanding shares of the Preferred A stock, par value $0.0001 per share, of the Survivor.

"Total Outstand ing Shares" shall mean the aggregate number of Shares issued and outstanding immediately prior to the Effective Time.

5

1. 7 Effect of the Merger on the Capital Stock and Shares of the Constituent Entitles.

1. 7. 1 Effect on the Gapital Stock

There will be no changesas to the rights that each Capital Stock grants its stockholder.

1. 7. 2 Necessary Actions

Each shareholder shall have the duty to follow the instructions provided by the Exchange Agent and enact the conversion of Target Owned Shares into Survivor Common Stock.

1. 7.3 Cancellation of Target Owned Common Shares

On the Effective Date, each issued and outstanding Target Owned Common Shares shall be cancelled and converted into Survivor Common Stock on a one-to-one basis.

1. 7.4 Adjustments to the Survivor Common Stock

No adjustments to the Survivor Authorized Common Stock shall be made. The Survivor issued and outstanding Common Stock shall increase to satisfy the conversion in article 1.7.3.

1. 7.5 Cancellation of Target Owned Preferred Shares

On the Effective Date, each issued and outstanding Target Owned Preferred Shares shall be cancelled and converted Into Survivor Preferred Stock on a two-to-one basis.

1. 7. 6 Adjustments to the Survivor Preferred Stock

The Survivor Authorized Preferred Stock shall be increased to 15,000,000 prior to the Effective Time. The Survivor Issued and outstanding Preferred Stock shall increase to satisfy the conversion in article 1.7.5.

1.8 Surrenderof Certificates

1. 8. 1 Exchange Agent

The Survivor, and its transfer agent immediately prior to the signing of this merger agreement, shall serve as the Exchange Agent for the Merger.

6

1. 8. 2 Exchange Procedure

The ExchangeProcedure shall be specified in a Letter of Transmittal provided by the Exchange Agent to each shareholder of the Target at the Effective Time of the merger.

1.8.3 No Liability

Neither the Surviving and Target entity, nor their officers and directors shall be held liable for any and all claims, losses, liabilities, damages, deficiencies, costs, interest, awards, judgments, penalties, and expenses, including attorneys' and consultants' fees and expenses in connection to the exchangeof shares.

1.9 No FurtherOwners hipRights in Company Shares

The shares of the Survivor Common and Preferred Stock issued in respect of the surrender for exchange of Common Shares and Preferred Shares respectively, in accordance with the terms hereof shall be deemed to be in full satisfaction of all rights pertaining to such Common Shares and Preferred Shares,which were outstanding immediately prior to the Effective Time. If, after the Effective Time, Target Certificates are presented to the Surviving Entity for any reason, they shall be cancelled and exchanged as provided in this Article I.

1.10 Lost, Stolen or DestroyedCertificates

In the event any Target Certificates shall have been lost, stolen or destroyed, the Survivor shall issue in exchangefor such lost, stolen or destroyed certificates, upon the making of an affidavit of that fact by the holder thereof, such amount, if any, as may be required pursuant to Section 1.7 hereof; provided, however, that the Survivor may, in its discretion and as a condition precedent to the issuance thereof, require the Stockholder who is the owner of such lost, stolen or destroyed certificates to either (i) deliver a bond in such amount as it may direct or (ii) provide an indemnification agreement in form and substance acceptable to the Survivor, against any claim that may be made against the Survivor with respect to the certificates alleged to have been lost, stolen or destroyed.

1. 11 Tax Consequen ces

The Survivor and the Target (i) intend that the Merger shall constitute a reorganization within the meaning of Section 368(a)(l)(A) of the Code, (ii) shall report the Merger as a single statutory merger of the Target with and into the Survivor qualifying as a reorganization within the meaning of Section 368(a)(1)(A) of the Code for federal income tax purposes, and (iii) by executing this Agreement, adopt a plan of tax-free reorganization within the meaning of Treasury Regulations Sections 1.368 2(g) and 1.368 3. However, no party hereto makes any representations or warranties regarding the tax treatment of the Merger, or any of the tax consequences relating to the Merger, this Agreement, or any of the other transactions or agreements contemplated hereby. Each party hereto acknowledges that it is relying solely on its own tax advisors in connection with the Merger, this Agreement and the other transactions contemplated hereby.

1.12 Taking of Necessary Action;Further Action

If at any time after the Effective Time, any further action is necessaryor desirable to carry out the purposes of this Agreement and to vest the Surviving Entity with full right, title and possession to all assets, property, rights, privileges, powers and franchises of the Target, the Survivor and the Surviving Entity and the officers and directors of the Survivor and the Surviving Entity are fully authorized in the name of their respective corporations or otherwise to take, and will take, all such lawful and necessaryaction.

7

ARTICLE II - REPRESENTATIONS AND WARRANTIES OF THE TARGET

The Target hereby represents and warrants to the Survivor that on the date hereof and as of the EffectiveTime, as though made at the Effective Time, as follows:

2.1 Organizationof the Target

The Target ls a corporation duly organized, validly existing, and in good standing under the laws of the State of Nevada, with corporate power to own property and carry on its business as it is now being conducted. NIKA is domiciled in Nevada under the Nevada Secretary of State as Entity Number C7195-1999 and Nevada BusinessID NV19991213301. NIKA is a public company with CIK #0001619147 and its common stock trades on OTC Markets PINK. All filings with OTC Markets are current.

2.2 Target Capital Structure

The Target has 500,000,000 Authorized Common Stock, 204,205,027 of which are issued and outstanding. All Common Shares are duly authorized, validly issued, fully paid and non‒ assessable.There are no declared or accrued but unpaid dividends with respect to any Common Shares and no Common Shares are unvested. The Common Shares are publicly traded on OTC Markets PINK with a current price of $ per share as of the date of the signing of this agreement.

The Company has 10,000,000 Authorized Preferred A Stock, 10,000,000 of which are issued and outstanding. All Preferred Shares are duly authorized, validly issued, fully paid and non‒ assessable. The holders of Preferred Shares are entitled to notice of any meeting of the Corporation's shareholders and to vote on any matter subject to a vote, including but not limited, to vote as a single class with the Common Shares upon any matter submitted for approval by the holders of Common Shares, and have five hundred (500) votes for every share of Preferred Shares standing in his or her name on the stock transfer records of the Corporation. Each outstanding share of the series of Preferred Share of the Corporation is entitled to five hundred (500) votes on each matter submitted to a vote. There are no other preferences for the Preferred Shares.

8

2.3 Subsidiaries

The Company owns a 40% stake in the Bulgarian limited liability entity Nika Europe, Ltd, UIC: 206925008, which was acquired on October 11, 2022.

The Companydoes not have any other subsidiaries.

2.4 Authority

The Target has all requisite power and authority to enter into this Agreement and any Related Agreements to which it is a party and to consummate the transactions contemplated hereby and thereby. The execution and delivery by the Target of this Agreement and any Related Agreements to which the Target is a party and the consummation by the Target of the transactions contemplated hereby and thereby have been duly authorized by all necessary corporate action on the part of the Target and no further action is required on the part of the Target to authorize the Agreement and any Related Agreements to which it is a party and the transactions contemplated hereby and thereby, subject only to the approval of this Agreement and the transactions contemplated hereby by the Stockholders. This Agreement and the transactions contemplated hereby have been unanimously approved by the Board of Directors of the Target.

2.5 Company Financial Statements

The Target provides the Survivor with its unaudited financial statements for the fiscal years ended December 31, 2021 and December 31, 2022, as well as the unaudited quarterly financial statements for the periods ending on March 31, 2023, June 30, 2023, and September 30, 2023. Such financial statements fairly present the consolidated financial position of the Company as of the respective dates thereof and the consolidated results of the Target's operations and cash flows for the periods indicated (subject to, in the case of unaudited statements, normal and recurring year-end audit adjustments).

2.6 No Undisclosed Liablllties

Neither the Target, nor any of its Subsidiaries have any liability, indebtedness, obligation, expense, claim, deficiency, guaranty or endorsements of any type, whether accrued, absolute, contingent, matured, unmatured or other (whether or not required to be reflected in financial statements in accordance with GAAP) in excess of $10,000 individually or $50,000 in the aggregate, except for those which (i} have been reflected in the Financials or (ii) are liabilities or obligations incurred in connection with transactions contemplated hereby.

9

2. 7 Litigation

There is no proceeding pending against or, to the knowledge of the Target, threatened against or affecting, the Target or any of its Subsidiaries that has had or would reasonably be expected to have, individually or in the aggregate, a material adverse effect on the financial condition or results of operations of the Company. Neither the Target, nor any of its Subsidiaries is subject to any order against the Target or any of its Subsidiaries or naming the Target or any of its Subsidiaries as a party that would, individually or in the aggregate, reasonably be expected to prevent, materially delay or materially impair the Target's ability to consumma te the transactions contemplated by this Agreement.

2.8 Brokers' and Finders' Fees

The Target has not incurred, nor will it incur, directly or indirectly, any liabilities for brokerage or finders' fees or agents' commissions, fees related to investment banking or similar advisory services or any similar charges and fees in connection with the Agreement or any transaction contemplated hereby, nor will the Survivor incur, directly or indirectly, any such liability based on arrangements made by or on behalf of the Target.

2.9 RepresenationsComplete

None of the representations or warranties made by the Target in this Agreement, and none of the statements made in any schedule or certificate furnished by the Target pursuant to this Agreement, contains any untrue statement of a material fact or omits to state any material fact necessary in order to make the statements contained herein or therein, in the light of the circumstances under which made, not misleading.

ARTICLE 111- REPRESENTATIONS AND WARRANTIES OF THE SURVIVOR

3.1 OrganizationsandStandingof the Surviv or

The Survivor is a corporation duly organized, validly existing and in good standing under the laws of the State of Colorado, with the corporate power to own its properties and to carry on its business as is now being conducted. The Survivor is a SEC reporting company with CIK # 1145604 and EIN # 00-0000000, whose common stock trade on OTC Markets PINK.

3.2 SurvivorCapital Structure

The Survivor has 2, 700,000,000 Authorized Common Stock, 876,090,000 of which are issued and outstanding. All Common Shares are duly authorized, validly issued, fully paid and non-assessable.There are no declared or accrued but unpaid dividends with respect to any Common Shares and no Common Sharesare unvested.

The Survivor has 10,000,000 Authorized Preferred A Stock, 10,000,000 of which are issued and outstanding. All Preferred Shares are duly authorized, validly issued, fully paid and non• assessable. The holders of Preferred Shares are entitled to notice of any meeting of the Corporation's shareholders and to vote on any matter subject to a vote, including but not limited, to vote as a single class with the Common Shares upon any matter submitted for approval by the holders of Common Shares, and have one thousand {1000) votes for every share of Preferred Shares standing in his or her name on the stock transfer records of the Corporation. Each outstanding share of the series of Preferred Share of the Corporation is entitled to one thousand (1000) votes on each matter submitted to a vote. There are no other preferences for the Preferred Shares.

10

3.3 Subsidiaries

The Survivor owns a 40% stake in the Bulgarian limited liability entity Nika Europe, Ltd, UIC: 206925008, which was acquired on October 11, 2022.

The Survivor has a wholly owned subsidiary named Centennial Ventures, Inc., which is a Colorado corporation with no activity.

The Survivor does not have any other subsidiaries.

3.4 Autho rity

The Survivor has all requisite power and authority to enter into this Agreement and any Related Agreements to which it is a party and to consummate the transactions contemplated hereby and thereby. The execution and delivery by the Survivor of this Agreement and any Related Agreements to which the Survivor is a party and the consummation by the Survivor of the transactions contemplated hereby and thereby have been duly authorized by all necessary corporate action on the part of the Survivor and no further action is required on the part of the Survivor to authorize the Agreement and any Related Agreements to which it is a party and the transactions contemplated hereby and thereby, subject only to the approval of this Agreement and the transactions contemplated hereby by the Stockholders. This Agreement and the transactions contemplated hereby have been unanimously approved by the Board of Directors of the Survivor.

3.5 Survivor Financial Statements

The Survivor is a fully reporting company, which files its financial statements and reports with the SEC. The Survivor has audited financial statements in Form 10-K for the years ending on December 31, 2021 and December 31, 2022, as well as unaudited quarterly financial statements in Form 10-Q for the periods ending on March 31, 2023, June 30, 2023, and September 30, 2023.

The Survivor has engaged the firm of XX Xxxxxxx CPA, PC to serve as the independent accountant to audit the company's financial statements.

11

3.6 No UndisclosedLiabilities

Neither the Survivor, nor any of its Subsidiaries have any liability, indebtedness, obligation, expense, claim, deficiency, guaranty or endorsements of any type, whether accrued, absolute, contingent, matured, unmatured or other (whether or not required to be reflected in financial statements in accordance with GAAP) in excess of $10,000 individually or $50,000 in the aggregate, except for those which (i) have been reflected in the Financials or (ii) are liabilities or obligations incurred in connection with transactions contemplated hereby.

3. 7 Litigation

There is no proceeding pending against or, to the knowledge of the Survivor, threatened against or affecting, the Survivor or any of its Subsidiaries that has had or would reasonably be expected to have, individually or in the aggregate, a material adverse effect on the financial condition or results of operations of the Survivor. Neither the Survivor, nor any of its Subsidiaries is subject to any order against the Survivor or any of its Subsidiaries or naming the Survivor or any of its Subsidiaries as a party that would, individually or in the aggregate, reasonably be expected to prevent, materially delay or materially impair the Company's ability to consummate the transactions contemplated by this Agreement.

3.8 Brokers'and Finders' Fees

The Survivor has not incurred, nor will it incur, directly or indirectly, any liabilities for brokerage or finders' fees or agents' commissions, fees related to investment banking or simllar advisory services or any similar charges and fees in connection with the Agreement or any transaction contemplated hereby, nor will the Company incur, directly or indirectly, any such liability based on arrangements made by or on behalf of the Survivor.

3.9 RepresentationsComplete

None of the representations or warranties made by the Survivor in this Agreement, and none of the statements made in any schedule or certificate furnished by the Company pursuant to this Agreement, contains any untrue statement of a material fact or omits to state any material fact necessary in order to make the statements contained herein or therein, in the light of the circumstances under which made, not misleading.

12

ARTICLE IV - ADDITIONAL AGREEMENTS

4.1 Benefits of Merger

Both the Target and the Survivor agree to the following reasons and justifications for pursuing a Merger (the "Benefits" :)

The Target has its common shares publicly traded on OTC Markets PINK, whilst the Survivor is a fully-reporting company with audited financials whose common stock also recently became listed on OTC Markets PINK. Both companies are specialized in the field of pharmaceuticals and at this point of time on the basis of a Cooperation Agreement are developing a joint business while splitting the funding and the net profit in equal 50% parts. To put in concrete terms, both of these companies will profit from the production and distribution of ITV-1, ITV-2, ITV-3, ITV-4, ITV-5 and TNG, which are drugs in injection form dedicated for the treatment of AIDS, chronic hepatitis S and C, rheumatoid arthritis, and other viral and infectious diseases, in which a strong cell immunity is of utmost importance. Both companies will also share the profits from 8 dietary supplements - Physiolong, Carotilen, Fructin, Dry Xxxx, Biodetoxin, Silymaron, Hypocholestin, and Anthocylen C. Exactly because of the joint structure of the business of both companies, a market extension merger between them would have a positive effect, which makes it the recommended and necessary choice of action. This is supported by the following additional circumstances:

| • | Both companies have the same majority control shareholder, Xxxxxxx Xxxxxxxx Savov who is providing both with the necessary financing to cover their administrative and | |

| • | development cost during the early stages of the companies; | |

| • | The board of directors and the officers of both companies is comprised by the same individuals - specialists; | |

| • | The merger will ease potential investors, as the Surviving Entity will own the entire business and there will be no confusion in which company to invest in; | |

| • | The Merger will ease the marketing strategy of the Target and the Survivor and will help the dissemination to all useful information to investors and the public; | |

| • | The Merger will ease the preparation of financial statements, the auditing, as well as any other mandatory disclosures to the regulatory bodies and the public; | |

| • | The Merger will make it easier for investing in both the main properties - factory, laboratories for scientific research, etc. - as well as in the acquirement of new patents for medicines and dietary supplements, and their development and release on the market. | |

| • | The Merger will decrease the operational costs in half, which will free up funds for additional capital reserves and investments; | |

| • | All rights and ownership in joint subsidiaries and other assets will be consolidated in the Surviving Entity, which will ease the control of the subsidiaries. |

13

4.2 Reasonable Efforts

Subject to the terms and conditions provided in this Agreement, each of the parties hereto shall use its reasonable efforts to take promptly, or causeto be taken promptly, all actions, and to do promptly, or cause to be done promptly, all things necessary, proper or advisable under applicable laws and regulations to consummate and make effective the transactions contemplated hereby, to cause all conditions to the obligations of the other parties hereto to effect the Merger to occur, to obtain all necessary waivers, consents, approvals and other documents required to be delivered hereunder and to effect all necessary registrations and filings and to remove any injunctions or other impediments or delays, legal or otherwise, in order to consummate and make effective the transactions contemplated by this Agreement.

4.3 Restrictionson Transfer

The shares of the Survivor Common Stock to be issued to the Stockholders with restricted common stock as the Merger Consideration will be restricted securities under Rule 144 of the Securities Act and will be subject to applicable holding periods and restriction on transfer thereunder. The shares of the Survivor Common Stock to be issued to the Stockholders with unrestricted common stock as the Merger Consideration will be unrestricted securities.

4.4 BoardApprov al

The Board of Directors of the Survivor shall have approved this Agreement, the Merger and the transaction contemplated hereby and thereby, which approval shall not have been altered, modified, changed or revoked.

4.5 lndemniflca tion

The Stockholders agree to severally and not jointly indemnify and hold harmless the Survivor and its officers, directors, affiliates, employees, agents and representatives, including the Surviving Entity (the "Indemnified Parties"), against all claims, losses, liabilities, damages, deficiencies, costs, interest, awards, judgments, penalties, and expenses, including attorneys' and consultants' fees and expenses.

ARTICLE V-TERMINATION, AMENDMENT, WAIVER

5.1 Termination

Subject to Section 5.2 hereof, this Agreement may be terminated and the Merger abandoned at any time prior to the Closing by mutual written consent of the Target and the Survivor.

5.2 Effectof Termination

In the event of termination of this Agreement as provided in Section S.1 hereof, this Agreement shall forthwith become void and there shall be no liability or obligation on the part of the Survivor, the Target, or its respective officers, directors or Stockholders, if applicable; provided,however, that each party hereto and each Person shall remain liable for any breaches of this Agreement prior to its termination.

14

5.3 Amendment

This Agreement may be amended by the parties hereto at any time by execution of an instrument in writing signed by both parties.

5.4 Extension; Waiver

At any time prior to the Closing, the Survivor, on the one hand, and the Target, on the other hand, may, to the extent legally allowed, (i) extend the time for the performance of any of the obligation of the other party hereto, (ii} waive any inaccuracies in the representations and warranties made to such party contained herein or in any document delivered pursuant hereto, and (iii) waive compliance with any of the covenants, agreements or conditions for the benefit of such party contained herein. Any agreement on the part of a party hereto to any such extension or waiver shall be valid only if set forth in an instrument in writing signed on behalf of such party.

ARTICLE VI - GENERAL PROVISIONS

6.1 Notices

All notices and other communication hereunder shall be in writing and shall be deemed given if delivered personally or by commercial messenger or courier service, or mailed by certified mail (return receipt requested) or sent via electronic mail to the parties.

6.2 Counterpart

This Agreement may be executed in one or more counterparts, all of which shall be considered one and the same agreement and shall become effective when one or more counterparts have been signed by each of the parties and delivered to the other party, it being understood that all parties need not sign the same counterpart.

6.3 Entire Agreement

This Agreement, the Exhibits hereto, and the documents and instruments and other related agreements among the parties hereto referenced herein: (i) constitute the entire agreement among the parties, with respect to the subject matter hereof and supersede all prior agreements and understandings both written and oral, among the parties with respect to the subject matter hereof; (ii) are not intended to confer upon any other person any rights or remedies hereunder.

15

6.4 Severability

In the event that any provision of this Agreement or application thereof becomes or is declared by a court of competent jurisdiction to be lllegal, void or unenforceable, the remainder of this Agreement will continue in full force and effect and the application of such provision to other persons or circumstances will be interpreted so as reasonably to effect the intent of the parties hereto. The parties further agree to replace such void or unenforceable provision of this Agreement with a valid and enforceable provision that will achieve, to the extent possible, the economic, businessand other purposes of such void or unenforceable provision.

6.5 Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of Nevada and the State of Colorado.

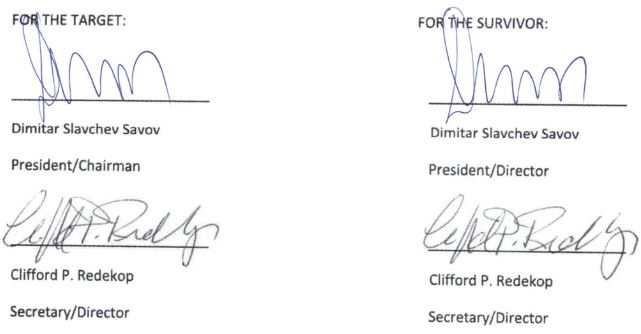

IN WITNESS WHEREOF, the Survivor and the Target have caused this Agreement to be signed, all as of the date first written above.

16