China Water and Drinks Inc. ) And Mr. Li Sui Poon In respect of 100% issued and outstanding shares of FAVOR START INVESTMENT LIMITED Amended and Restated Share Purchase Agreement

EXHIBIT 2.5

( China Water and Drinks Inc. )

And

Xx. Xx Xxx Xxxx

100%

In respect of 100% issued and outstanding shares of

FAVOR START INVESTMENT LIMITED

Amended and Restated

2008 6 12

Execution Date: Effective as of June 12, 2008

Effective Date of Amendment: June 12, 2008

Private & Confidential Prosper Focus Enterprise

Table of Content

4

Preamble 4

6

Article 1 Definitions And Interpretation 6

7

Article 2 Sale and Purchase of the Sale Shares 7

8

Article 3 Consideration and Payment 8

9

Article 4 Conditions Precedent 9

12

Article 5 Closing 12

13

Article 6 Representation and Warranties 13

28

Article 7 Breach of Agreement and Remedies 28

30

Article 8 Force Majeure 420

31

Article 9 Governing Law and Dispute Settlement 31

453

Article 10 Notice 453

463

Article 11 Miscellaneous 463

39

Schedule 1 The Seller, the Purchaser and the Sale Shares 540

550

Schedule 2 The Company 550

550

Schedule 3 Deliveries at Closing 550

Confidential Page 2 of 61 NY#1727228 v6

Private & Confidential Prosper Focus Enterprise

AMENDED AND RESTATED

2008 6 12

This Amended and Restated Share Purchase Agreement (this “Agreement”) is dated effective as of June 12, 2008 and between:

1

6 607

(OTCBB) OTCBB CWDK, 1.

CHINA WATER & DRINKS INC., a Nevada corporation, located at Xxxx 000, 0/X, Xxxxxxxxx Xxxxx, 0 Science Museum Road, Tsim Sha Shui East, Kowloon, Hong Kong (collectively with its predecessors, the “Purchaser”) and listed and traded on the Over The Counter Bulletin Board (OTCBB) under the symbol of CWDK, particulars of which set our in Schedule 1 hereto:

and

Xx. Xx Xxx Xxxx, a Hong Kong resident (the “Seller”).

The Seller and the Purchaser maybe hereinafter referred to individually as a “Party” and collectively as the “Parties”.

Confidential Page 3 of 61 NY#1727228 v6

Private & Confidential Prosper Focus Enterprise

Preamble

2008 6 12

This Agreement is intended to amend and restate the Share Purchase Agreement (“Share Purchase Agreement”) dated June 12, 2008. This Agreement upon execution and delivery constitutes the legal, valid and binding obligation of the Parties.

Whereas, the Purchaser and the Seller are parties to the Share Purchase Agreement dated as of June 12, 2008.

Whereas, Favor Start Investments Limited (“Favor Start” or the “Company”) is a company duly incorporated and validly existing under the laws of the British Virgin Islands (“BVI”), the particulars of which are set out in Schedule 2 hereto:

Whereas, Prosper Focus Enterprise Limited (“Prosper Focus”) is a company duly incorporated and validly existing under the laws of Hong Kong.

Confidential Page 4 of 61 NY#1727228 v6

Private & Confidential Prosper Focus Enterprise

100%

100%

Confidential Page 5 of 61 NY#1727228 v6

Private & Confidential Prosper Focus Enterprise

67%

Whereas, Prosper Focus is the registered holder of 67% equity interest in Guangzhou Canyon.

100%

100%

100%

100%

Article 1 Definitions And Interpretation

1.1

Confidential Page 6 of 61 NY#1727228 v6

Private & Confidential Prosper Focus Enterprise

For the purpose of this Agreement, unless otherwise expressed or required by context, the following terms as used herein shall have the following meanings:

(a)

“Affiliate” means any corporation, partnership, trust or other entity directly or indirectly controlling or controlled by or under direct or indirect common control with a party; “control” for the purpose of this definition being taken to mean direct or indirect ownership of any equity holders of a Party of any part of the equity interest in said entity.

(b)

“Agreement” means this Share Purchase Agreement, as amended and restated.

(c)

“Audit Report” means the US GAAP audited financial reports of Guangzhou Canyon for the fiscal year ended December 31, 2007.

(d)

“Business” means the business activities legally carried out or to be developed by the Company or Guangzhou Canyon in accordance with their respective applicable laws, governmental requirements and provision of their valid business licenses. The business of Guangzhou Canyon shall consist of manufacturing and sales of drinking water products (bottled distilled water, bottled purified water).

(e)

Confidential Page 7 of 61 NY#1727228 v6

Private & Confidential Prosper Focus Enterprise

“Business Day” means any day on which commercial banks in Hong Kong are open for business except Saturdays, Sundays or statutory holidays.

(f)

“Closing” means the completion of the sale and purchase of the Sale Shares in accordance with Article 5 hereof.

(g)

“Closing Date” means the date on which Closing takes place in accordance with Article 5.1.

(h)

“consideration” means the full consideration for the sale and purchase of the Sale Shares as set out in Article 3.1 hereof.

(i)

“Encumbrance” means any restriction of any kind, including any restriction on use, voting, receipt of income, or exercising of any other attribute of ownership, including any Security Interests and any third party rights.

(j)

“HKD” mean Hong Kong dollars, the lawful currency of Hong Kong.

(k)

“Hong Kong” means Hong Kong Special Administrative Region of PRC.

(l)

Confidential Page 8 of 61 NY#1727228 v6

Private & Confidential Prosper Focus Enterprise

“Intellectual Property Rights” means all inventions, patents, registered designs, design rights, database rights, copyrights, neighboring rights, know-how, trademarks, commercial software, commercial computer program goodwill and the pending applications with respect to the above (if applicable).

(m)

“Management Accounts” means the un-audited balance sheet and the unaudited profit and loss account(s) of Guangzhou Canyon.

(n)

“Management Accounts Date” means the last day of the month prior to Closing Date.

(o)

“Material Adverse Change” means any change, event or effect that individually or in the aggregate might have a material adverse effect on the value of Sale Shares, the Company’s, Prosper Focus’ or Guangzhou Canyon’s business, results of operations, assets, financial condition or the transactions contemplated by this Agreement (including without limitation any change of governing laws or the change or deterioration of local or international water drinks markets).

(p)

“PRC” means the People’s Republic of China, and for purpose of this Agreement only, excluding Hong Kong Special Administrative Region, Macau Special Administrative Region and Taiwan Region.

(q)

Confidential Page 9 of 61 NY#1727228 v6

Private & Confidential Prosper Focus Enterprise

“Sale Shares” means the shares as defined in Article 2.1 of this Agreement.

(r)

“Subsidiary” means any subsidiary of the Company (as defined in the Companies Ordinance, Chapter 32 of the Laws of Hong Kong).

(s)

“Taxation” means all forms of tax, duty, rate, levy or other imposition imposed by any governmental authority or any regulatory body in BVI, Hong Kong, PRC, or elsewhere, including without limitation, capital gain tax, provisional capital gain tax, interest tax, property tax, real estate tax, land use fees, increment tax on land value, income tax, value added tax, withholding tax, individual income tax, stamp duty, capital duty, estate tax, contribution and any interest, fine, penalty or surcharge in connection with any such Taxation.

(t)

“USD” means United States dollars, the lawful currency of the United States of America.

1.2

Interpretation

(a)

Confidential Page 10 of 61 NY#1727228 v6

Private & Confidential Prosper Focus Enterprise

The headings to the Articles of this Agreement are for ease of reference only and shall be ignored in interpreting this Agreement. Words and expressions in the singular include the plural and vice versa.

(b)

The Schedules herein shall be deemed to form part of this Agreement with equal legal effect.

(c)

Reference to persons includes any public body and any body of persons, corporate or unincorporated.

Article 2 Purchase of the Sale Shares

2.1

Subject to the terms and conditions contained in this Agreement, the Seller hereby agrees to sell and the Purchaser, in reliance on the Seller’s representations and warranties, agrees to purchase from the Seller the Company Share, free from any mortgages, pledges, liens, Encumbrances, claims, and other third party rights whatsoever and together with all rights attached to the Company Share after the date of this Agreement including any shares to be allotted, dividend and bonus or other interests to be distributed attached to the Company Share after the date of this Agreement (“Sale Shares”).

Confidential Page 11 of 61 NY#1727228 v6

Private & Confidential Prosper Focus Enterprise

Article 3 Consideration and Payment

3.1 2007 12 31

(USD$19,100,000.00)

Subject to the terms and conditions hereof, based on the value of Guangzhou Canyon recorded in the audited reports dated 31, December 2007, the consideration for the Sale Shares shall be USD$19,100,000.00 (the “Consideration”),

3.2 3

The Parties agree that payments shall be made by the Purchaser in three installments in accordance with the following methods:

(a) (USD$10,208,128.20)

The Purchaser has previously paid to the Seller USD$10,205,128.20 as a deposit and in connection with the potential acquisition of the Sale Shares.

(b)

If the preconditions set forth in article 4.1 are not met to the satisfaction of the Purchaser, the two parties agree to renegotiate the terms of this Agreement. Additionally, the Purchaser has the right to adjust the Consideration based on the results of the Audit report to unilaterally and unconditionally terminate this Agreement. If the Purchaser terminates this Agreement, within 10 Business Days the Seller shall unconditionally refund to the Purchaser, at the Purchaser’s designated account, the full Consideration previously paid by the Purchaser to the Seller.

Confidential Page 12 of 61 NY#1727228 v6

Private & Confidential Prosper Focus Enterprise

(c) 4.1 (USD$6,984,871.80) 3.2(a) 90%

If the preconditions set forth in Article 4.1 are met to the satisfaction of the Purchaser, the Purchaser will pay to the Seller USD$6,984,871.80 at Closing. Together with the amounts paid under Article 3.2(a) of $10,205,128.20, the Seller will have received USD$17,190,000.00, representing 90% of the Consideration.

(d) 2009 2010 3 31

(i) 2008 2007 20%

(ii) 2009 2008 20%

(iii) 2007

The remaining 10 percent of the Consideration, representing USD$1,910,000.00, shall be paid in cash to the Seller, at Seller’s designated account, within 10 Business Days of the completion of the Purchaser’s 2009 annual report (estimated to be completed by March 31, 2010) subject to satisfaction of all of the following conditions:

Confidential Page 13 of 61 NY#1727228 v6

Private & Confidential Prosper Focus Enterprise

(i) an increase in the 2008 after tax net income of Guangzhou Canyon of 20% over the 2007 after tax net income (both based on audits prepared in accordance with U.S. GAAP),

(ii) an increase in the 2009 after tax net income of Guangzhou Canyon of 20% over the 2008 after tax net income (both based on audits prepared in accordance with U.S. GAAP), and

(iii) no material restatement to the 2007 financial statements of Guangzhou Canyon as audited in accordance with U.S. GAAP).

If any of the preceding conditions is not met, the USD$1,910,000.00 will be forfeited and no further payments shall be made by the Purchaser to the Seller.

Article 4 Conditions Precedent

4.1 The Parties agree that the Closing contemplated hereunder shall be conditional upon the following conditions being fulfilled to the satisfaction of the Purchaser:

(a) The Parties hereto have obtained all necessary consents, authorization or other approvals in connection with the entering into and performance of this Agreement and transfer of the Sale Shares, and the equity of Prosper Focus and Grand Canyon under the laws of the BVI, PRC and Hong Kong.

(b) All the representations, covenants and warranties provided by the Seller hereunder are true, accurate and complete in all respects. The Seller is not in

Confidential Page 14 of 61 NY#1727228 v6

Private & Confidential Prosper Focus Enterprise

breach of any stipulations or terms and conditions hereunder commencing from the date of this Agreement to the Closing Date (including the Closing Date).

(c) 67% USD$10,205,128.20.

The Seller has provided the latest corporate documents of the Company and Prosper Focus to the Purchaser, and Seller has verified at BVI corporate registration institute and confirmed that the Seller is the sole shareholder of the Company. The Seller has taken all such actions, approvals and consents necessary to effect a proper transfer of the Shares of Prosper Focus to the Company. In the event that no such actions, approvals or consents are taken or if Seller cannot transfer the Sale Shares or 100% of the Shares of Prosper Focus to Purchaser, the Purchaser shall be entitled to obtain a pledge of the Guangzhou Canyon 67% shares from Prosper Focus and obtain a full refund of the deposit in the amount of USD$10,205,128.20.

(d)

The Company has been duly incorporated and validly existing and the Seller have fully contributed to the Company in accordance with the applicable laws and thus duly holding all shares of the Company.

(e)

The Purchaser has completed satisfactory due diligence investigation on the Company. Prosper Focus and Guangzhou Canyon (including but not limited to, finance, technique, business, environment, legal, etc.).

(f)

Confidential Page 15 of 61 NY#1727228 v6

Private & Confidential Prosper Focus Enterprise

Legally qualified institutions have issued assets appraisal reports and audit reports on the Company, Prosper Focus and Guangzhou Canyon which are satisfactory to the Purchaser.

(g)

In the event of any Material Adverse Change discovered in the due diligence investigation on the Company, Prosper Focus and Guangzhou Canyon, the Purchaser has the right to adjust the Consideration as per the appraisal result and audit results. If the Purchaser does not accept the adjusted Consideration, then the Purchaser through written notice to the Seller has the right to unilaterally unconditionally withdraw from the proposed transaction hereunder and terminate this Agreement, and the Purchaser’s such activities shall not constitute breach of this Agreement.

(h) 4.1 (a)

A certified true copy of the board resolutions of the Company in the agreed terms has been made and issued by the Company, the contents of which shall be agreed by the Parties and shall include, inter alias, the terms and conditions set out in Article 4.1(a) below.

(i)

The Seller has assisted the Purchaser to complete the restructuring of the Board of Directors of the Company in accordance with relevant procedures as required by relevant laws and regulations of BVI, the Articles of Association of the Company and the Shareholder Agreement. After the restructuring, the Board of

Confidential Page 16 of 61 NY#1727228 v6

Private & Confidential Prosper Focus Enterprise

Directors of the Company shall be composed of one member, all of which shall be nominated by the Purchaser in accordance with relevant procedures as required by relevant laws and regulations of BVI and the Articles of Association of the Company.

(j) 1

The Seller has assisted the Purchaser to complete the restructuring of the Board of Directors of the Prosper Focus in accordance with relevant procedures as required by relevant laws and regulations of Hong Kong, the Articles of Association of the Prosper Focus and the Shareholder Agreement. After the restructuring, the Board of Directors of Prosper Focus shall be composed of one member, all of which shall be nominated by the Purchaser in accordance with relevant procedures as required by relevant laws and regulations of Hong Kong and the Articles of Association of Prosper Focus.

(k) 3 2

The Seller has completed the restructuring of the Board of Directors of Guangzhou Canyon in accordance with relevant procedures as required by relevant laws and regulations of PRC, and the Articles of Association of Guangzhou Canyon. After restructuring, the Board of Directors of Guangzhou Canyon shall be composed of three members, two of which shall be nominated by the Purchaser and shall be appointed as the board members of Guangzhou Canyon in accordance with relevant procedures as required by relevant laws and regulations of PRC and the Articles of Association of Guangzhou Canyon.

(l)

The Seller has committed to unconditionally and irrevocably renounce the use of any trademark and brand of Guangzhou Canyon.

Confidential Page 17 of 61 NY#1727228 v6

Private & Confidential Prosper Focus Enterprise

(m)

The Seller has committed to unconditionally and irrevocably renounce the use of any franchises and patent applications under the Intellectual Property Rights of Guangzhou Canyon.

(n) 2007 1 1

No Material Adverse Change has occurred or exists in the Company, Prosper Focus and Guangzhou Canyon as of 2007-1-1.

4.2 4.1 2008 6 30

9, 10, 11.4, 11.6, 11.7

The Parties shall use their respective best efforts to satisfy the conditions precedent in Article 4.1 above by no later than June 30, 2008 or the date otherwise agreed by the Parties. If the above conditions precedent have not been fully fulfilled by then, the Purchaser shall have the right to terminate this Agreement by written notice (except Articles 9, 10, 11.4, 11.6 and 11.7 which shall remain to be effective) and the Seller shall be liable for breach.

5.1

Confidential Page 18 of 61 NY#1727228 v6

Private & Confidential Prosper Focus Enterprise

Subject to Article 7 hereof, Closing shall take place at the domicile of the Company on the fifth business day after the fulfillment of the conditions precedent described in Article 4 above or at such other place and/or at such other time as the Parties hereto may agree in writing from time to time (“Closing Date”).

5.2

On the Closing Date, the Seller shall deliver to the Purchaser, inter alias, the documents set forth in Schedule 6 hereto.

5.3 4.1(i) 4.1(j)

The Seller shall guarantee that the Company, Prosper Focus and Guangzhou Canyon shall convene board meetings respectively to appoint directors as stipulated in Article 4.1(i) and Article 4.1(j) in accordance with the requirements of the Purchaser.

5.4 3.2(c)

The Purchaser shall guarantee to pay the remaining consideration on the Closing Date in accordance with Article 3.2(c) above.

5.5

The Parties shall use respective best efforts to assist and procure that the Company, Prosper Focus and Guangzhou Canyon updates their register of members and conducts relevant registration procedure at corporate registration institute’s in each of their respective registered domiciles.

Article 6 Representations, Warranties and Covenants

Confidential Page 19 of 61 NY#1727228 v6

Private & Confidential Prosper Focus Enterprise

6.1

The Seller makes the following statements and guarantees to the Purchaser as below:

6.1.1

Information

(a)

All information which has been given by the directors, officers, auditors, financial advisers, legal representatives or officials of the Company, Guangzhou Canyon, and Prosper Focus to the Purchasers or to the legal representatives, accountants or agents of the Purchaser in the course of the negotiation leading to this Agreement is true and accurate in all respects and not misleading in any respect.

(b)

The facts set out in the Preamble are true and accurate in all respects.

(c)

All facts concerning the Sale Shares and the business and affairs of the Company, Guangzhou Canyon and Prosper Focus material for disclosure to an intending purchaser of the Sale Shares have been disclosed to the Purchaser and the Seller is not aware of any facts or circumstances, in reference to Guangzhou Canyon, and Prosper Focus, which might reasonably affect the willingness of a willing purchaser to purchase the Sale Shares on the terms of this Agreement.

6.1.2

Shares Transfer

Confidential Page 20 of 61 NY#1727228 v6

Private & Confidential Prosper Focus Enterprise

The Seller shall have the proprietary right over the Sale Shares to be transferred. No other third party has any kind of rights over the Sale Shares to be transferred, nor any un-issued shares or loan capital (if any); there is also no pledge, other beneficial interests or Encumbrance over the Sale Shares to be transferred.

6.1.3

Accounts Statement

(a) GAAP GAAP

The Audit Report and Management Accounts have been prepared in accordance with the laws of the country where the company was legally registered and established at (“Resident Country”), and U.S. GAAP, and on a consistent basis in accordance with generally accepted accounting principles and practices in the Resident Country; and audited in accordance with all applicable Statements of standard Accounting Practice of the Society of Accountants in the Resident Country and U.S. GAAP.

(b)

Except as set forth in the Audit Report, there have been no major changes in the financial and accounting policies underlying the financial statements of the Company, Guangzhou Canyon or Prosper Focus.

(c) (i) (ii)

Confidential Page 21 of 61 NY#1727228 v6

Private & Confidential Prosper Focus Enterprise

(iii)

The Audit Report and the Management Accounts (i) show a true and fair view of the assets, liabilities, capital commitments and the state of affairs of the Company, Guangzhou Canyon and Prosper Focus, (ii) reserve or provide in full for depreciation and all bad and doubtful debts and all other liabilities, actual, contingent or otherwise and for all financial commitments in existence at the Audit Report date or the Management Accounts Date; (iii) reserve or provide in full for Taxation including any contingent or deferred liability for which the Company, Guangzhou Canyon and Prosper Focus were liable at the Audit Report date or the Management Accounts Date and whether or not the Company Guangzhou Canyon and Prosper Focus have or may have any right of reimbursement against any other person.

(d)

All the accounts, books, registers, ledgers and financial and other material records of whatsoever kind of the Company, Guangzhou Canyon and Prosper Focus have been fully properly and accurately kept and completed.

6.1.4

Changes Since the Audited Accounting Date Since the Audited Accounting Date:

(a)

The business of the Company, Guangzhou Canyon and Prosper Focus has been carried on in the ordinary course and so as to maintain the same as a going concern.

Confidential Page 22 of 61 NY#1727228 v6

Private & Confidential Prosper Focus Enterprise

(b)

No material changes have occurred in the assets and liabilities (whether actual or contingent) shown in the Audit Report or Management Accounts and there has been no reduction in the value of the net tangible assets of the Company, Guangzhou Canyon or Prosper Focus on the basis of valuation adopted in the Audit Report and Management Accounts and there has been no adverse change in the financial position or trading prospects of the Company.

(c)

The business of the Company, Guangzhou Canyon and Prosper Focus have not been adversely affected by the loss of any important contract or customer or source of supply or by any abnormal factor and the Seller are not aware of any facts which are likely to give rise to any such effects.

(d)

No dividends, bonuses or distributions have been declared, paid or made except as provided for in the Audit Report and Management Accounts and no shareholders’ resolutions have been passed for the Company, Guangzhou Canyon or Prosper Focus.

6.1.5

Taxation

(a)

Confidential Page 23 of 61 NY#1727228 v6

Private & Confidential Prosper Focus Enterprise

The Company, Guangzhou Canyon and Prosper Focus has duly and timely submitted all of the genuine, complete Taxation returns and other relevant documents to relevant competent Taxation authorities in accordance with applicable laws and requirements of such Taxation authorities. And except the information disclosed to the Purchaser during the due diligence on Guangzhou Canyon before the execution of this Agreement, the Company has duly paid all of the Taxation payable by it.

(b)

Neither the Company, Guangzhou Canyon nor Prosper Focus have any current, or contingent, or delayed payment of Taxation liability except those which occurred in the ordinary course of business for each of the Company, Guangzhou Canyon or Prosper Focus respectively.

(c)

Except as disclosed to the Purchaser through the due diligence on the Company, Proper Focus and Guangzhou Canyon before the execution of this Agreement, neither the Company Guangzhou Canyon nor Prosper Focus have any violation of any relevant tax laws and regulations, nor have the Company, Guangzhou Canyon or Prosper Focus received any notice of or have in existence any risks of any inquiry, or investigation, or penalty by any relevant governmental authorities in relation to the Taxation issues.

(d)

Confidential Page 24 of 61 NY#1727228 v6

Private & Confidential Prosper Focus Enterprise

Any Taxation liability incurred by the Company, Guangzhou Canyon and Prosper Focus after the Closing due directly or indirectly to the business conducts on behalf of the Seller before the Closing (including but not limited to any other transaction, conduct, omission, situation and circumstances no matter whether these matters have been disclosed to the Purchaser or acknowledged by the Purchaser) shall be borne by the Seller.

(e)

Upon the occurrence of the above-mentioned situations, the Seller shall use its dividends payable by the Company, Guangzhou Canyon or Prosper Focus or its shares of the Company, Guangzhou Canyon or Prosper Focus with the value equivalent to the Taxation liability (the value of the share shall be calculated in accordance with the pricing standard of the Sale Shares under this Agreement so as to determine the ratio of the shares to be transferred) to repay the Purchaser or any other third party designated by the Purchaser to perform the Taxation Indemnity under Article 5.4 of this Agreement.

6.1.6

Assets

Confidential Page 25 of 61 NY#1727228 v6

Private & Confidential Prosper Focus Enterprise

The assets included in the Management Accounts or acquired since the Audit Report and all assets used by the Company, Guangzhou Canyon or Prosper Focus are legally and beneficially owned by the Company, Guangzhou Canyon and Prosper Focus, free from any mortgage, charge, lien or similar encumbrance except those which had been fully disclosed to the Purchaser during the due diligence course on the Company and Guangzhou Canyon conducted by the Purchaser before the execution of this Agreement; are not the subject of any agreement of lease, hire purchase or sale on deferred terms; are in the possession or under the control of the Company, Guangzhou Canyon or Prosper Focus; are in good condition; and comprise all the assets required to enable the Company, Guangzhou Canyon and Prosper Focus to carry on its business fully and effectively in the ordinary course.

6.1.7

Intellectual Property

The Company, Guangzhou Canyon and Prosper Focus have complete title (including but not limited to the right of use, obtaining benefit, disposal, transfer and mortgage) or lawful right of use its trade marks (either registered or un-

Confidential Page 26 of 61 NY#1727228 v6

Private & Confidential Prosper Focus Enterprise

registered), trade names, patents, know-how, copyrights, neighboring rights, names, website domain names, commercial software, commercial computerized program and other intellectual properties. The Company, Guangzhou Canyon and Prosper Focus have not in carrying on its business in the past used or required to use, and does not own, any intellectual property rights or similar rights. Neither the Company, Guangzhou Canyon or Prosper Focus nor any of its staff or employees, have infringed any third party’s Intellectual Property Rights or is subject to any claims for infringement of Intellectual Property Right, and no claims have been made and no applications or proceedings are pending. The Company, Guangzhou Canyon and Prosper Focus did not use or were required to use any illegally owned or not owned intellectual properties or other similar rights. The Company, Guangzhou Canyon and Prosper Focus and its employees and staff did not infringe any other third party’s intellectual property rights or forced to compensate to any other third party for such infringement. The Company, Guangzhou Canyon and Prosper Focus are not involved in any pending litigation or proceeding.

6.1.8

Insurance

Details of all current insurance policies in respect of which the Company, Guangzhou Canyon and Prosper Focus have an interest has been disclosed in writing to the Purchaser; all such policies are in full force and effect and are not void or avoidable; no claim is outstanding or may be made under any of such policies and no event has occurred or circumstances exist which are likely to give rise to any claim; nothing has been done or omitted to be done which is likely to result in an increase in premium; and nothing has been done or omitted to be done which would make any such policy of insurance void or avoidable.

Confidential Page 27 of 61 NY#1727228 v6

Private & Confidential Prosper Focus Enterprise

6.1.9

(a)

Real Estate

Guangzhou Canyon has leased, and used the land and premises.

Except those which have been disclosed to the Purchaser during the due diligence course conducted by the Purchaser on Guangzhou Canyon before the execution of this Agreement, full and accurate particulars of all title deeds and documents, tenancy, lease or license agreement or other rights of occupation relating to the Property or any agreements (whether written or oral) to grant the same have been disclosed to the Purchaser and Guangzhou Canyon has in all respects observed and complied with the provisions of all such deeds, documents, tenancies, leases and agreements.

Guangzhou Canyon has fully paid in the price payable according to the Lease

Agreement or any other relevant Agreement respectively.

6.1.10

Contracts

Confidential Page 28 of 61 NY#1727228 v6

Private & Confidential Prosper Focus Enterprise

(a) (i) (ii) (iii)

The Company, Guangzhou Canyon or Prosper Focus are not a party to any of the following contracts: (i) under which any party is in default; (ii) which may be affected by reason of the sale of the Sale Shares; (iii) which may be rescinded, avoided or terminated by any party thereto.

(b)

The Company, Guangzhou Canyon or Prosper Focus have no material, long term, onerous or unusual contracts or commitments binding upon it nor any contract entered into otherwise than on an arms length basis or otherwise than in the ordinary course of business.

(c)

The Company, Guangzhou Canyon and Prosper Focus have given no guarantee, condition or warranty or made any representation in respect of goods or services supplied by it or accepted any obligations that could give rise to any liabilities after any such goods or services have been supplied by it.

6.1.11

Business

(a)

Confidential Page 29 of 61 NY#1727228 v6

Private & Confidential Prosper Focus Enterprise

The Company, Guangzhou Canyon and Prosper Focus have obtained, maintained in force and complied will all necessary licenses and consents required for the proper carrying on of its business and to the best of its knowledge, information and belief of the Seller there are no circumstances which indicate that any such licenses or consents will be revoked or not renewed. Especially those governmental approvals, certificates, permits and authentications required to conduct ordinary business of Guangzhou Canyon within its legal business scope, including but not limited to Production Permit, Hygiene Permit, and relevant environmental impact assessment report and the approval thereof, official project assessment and acceptance for the construction in process in accordance with relevant laws and regulations which will not be revoked, renewed or adversely affected.

(b)

The Company, Guangzhou Canyon and Prosper Focus have complied with all applicable legislation and regulations and is not in breach of any requirement of laws and regulations in Hong Kong, BVI, China or the United States or any other country. The marketing network, marketing mode, distribution conduct and any other relevant commercial conducts in relation to the Company, Guangzhou Canyon and Prosper Focus or its products have not been punished or claimed by any relevant competent governmental authorities as of the date of

Confidential Page 30 of 61 NY#1727228 v6

Private & Confidential Prosper Focus Enterprise

this Agreement. After execution of this Agreement, there will not be any claim or penalty against the Company, Guangzhou Canyon and Prosper Focus by any relevant governmental authorities due to the marketing network, marketing mode, distribution conduct and any other relevant commercial conducts of Company, Guangzhou Canyon or Prosper Focus’s products which occurred before the Closing of this Agreement.

(c)

All Company’s, Guangzhou Canyon’s and Prosper Focus’s records, systems, controls date and information are under the exclusive ownership and direct control of each of Company, Guangzhou Canyon and Prosper Focus respectively.

6.1.12

Affiliated Transaction

All transactions or transfer of any resources or responsibility by the Company, Guangzhou Canyon or Prosper Focus, or any other commercial conducts with its affiliates have been fully disclosed to the Purchaser and the above-mentioned conducts are on a fair and reasonable basis without any violation of applicable laws and regulations, nor any warning, recourse or penalties from competent governmental authorities.

6.1.13

Debt

(a)

Confidential Page 31 of 61 NY#1727228 v6

Private & Confidential Prosper Focus Enterprise

Except the debts recorded in the Audit Report or the Management Accounts, neither the Company, Guangzhou Canyon nor Prosper Focus has any other outstanding borrowing or indebtedness in the nature of borrowing.

(b)

Except those disclosed to the Purchaser during the due diligence course on the Company, Guangzhou Canyon and Prosper Focus conducted by the Purchaser before execution of this Agreement, the Company, Guangzhou Canyon and Prosper Focus has not entered into and is not bound by any guarantee, indemnity or other agreement to secure and obligation of a third party under which any liability or contingent liability is outstanding.

6.1.14

Environment Protection

(a)

The site, facilities, assembly lines, the buildings and the designs thereof of the Company, Guangzhou Canyon and Prosper Focus are in full compliance with the applicable laws in force for the time being, and with laws, regulations, rules, and permits related to land administration, environmental protection, water and soil conservation, construction standards, fire prevention and worker safety in effect as of the date hereof.

(b)

Confidential Page 32 of 61 NY#1727228 v6

Private & Confidential Prosper Focus Enterprise

There is no pre-existing environmental contamination under, above or around the site, facilities, assembly lines and the buildings, whether due to the operation of the machinery and facilities or otherwise.

(c)

There are no impediments or difficulties to the Company, Guangzhou Canyon and Prosper Focus being able to obtain and maintain for the site, facilities, assembly lines and the buildings all necessary waste disposal, waste water treatment services and the like in full compliance with all relevant laws, regulations and rules related to land administration, environmental protection, water and soil conservation, construction standards, fire prevention and worker safety.

(d)

The site, facilities, assembly lines and the buildings are free from any environmental liabilities to and claims, investigation, penalty and other proceedings from both government and non-government Parties.

6.1.15

Labor Dispute and Labor Contract

(a)

The Company, Guangzhou Canyon and Prosper Focus have entered into lawful, effective and enforceable employment contracts with its employees. Neither

Confidential Page 33 of 61 NY#1727228 v6

Private & Confidential Prosper Focus Enterprise

Company, Guangzhou Canyon nor Prosper Focus are involved in any dispute, arbitration or lawsuit proceedings pending with any of its employees. There are no material adjustments in respect of the contents of the employment contracts and the execution and performance thereof within two years before the date of the Closing.

(b)

The Company, Guangzhou Canyon and Prosper Focus has made proper social or other insurances for its employees in accordance with the applicable laws and the payment of all the relevant insurance fees has been timely made. And the Company, Guangzhou Canyon and Prosper Focus has made any contributions (including without limitation the housing fund) or arrangement required for its employees in accordance with the applicable laws.

(c)

As of the date of this Agreement, the Company, Guangzhou Canyon and Prosper Focus has not introduced any share incentive scheme, share option scheme or profit sharing bonus or other such incentive scheme for all or any of its directors, key management or employees.

6.1.16

Litigation and Violation

(a)

Confidential Page 34 of 61 NY#1727228 v6

Private & Confidential Prosper Focus Enterprise

Neither the Company, Guangzhou Canyon and Prosper Focus nor any person for whose acts or defaults the Company, Guangzhou Canyon or Prosper Focus may be vicariously liable is involved in any civil, criminal or arbitration proceedings, and no such proceedings are pending or threatened against the Company, Guangzhou Canyon or Prosper Focus or any such person and to the best knowledge, information and belief of the Seller there are no facts likely to give rise to any such proceedings.

(b)

There are no governmental or other investigations or inquiries or disciplinary proceedings concerning the Company, Guangzhou Canyon or Prosper Focus, none is pending or threatened and, to the best knowledge, information and belief of the Seller there are no facts likely to give rise to such investigations, inquiries or proceedings.

6.1.17 A

Single Investment

Save as disclosed to the Purchaser by the Seller during the due diligence conducted by the Purchaser on Guangzhou Canyon, the Company has neither conducted or engaged in any business of or entered into any agreements or contracts with or contributed or invested in any third party, nor has the

Confidential Page 35 of 61 NY#1727228 v6

Private & Confidential Prosper Focus Enterprise

Company held any shares, equity, property or interests (whether holding any such shares, equity, property or interests in the capacity of the Company or through empowering any other party or being authorized by any other party) in any companies, institutions or firms except in Guangzhou Canyon.

6.1.18

Registered Capital of Guangzhou Canyon

Guangzhou Canyon has duly and timely paid in full the registered capital and relevant contribution has been duly completed.

6.1.19

Compliance

The Company, Guangzhou Canyon and Prosper Focus have carried out its business in accordance with the applicable laws and regulations and its articles of association at any time and in all respects. The Company, Guangzhou Canyon and Prosper Focus have no conduct in contravention of any laws or regulations or its articles of association.

6.1.20

Miscellaneous

(a)

i. The Company is a legal entity, which is duly established, and validly existing in accordance with the applicable laws of BVI and could bear legal liabilities independently;

Confidential Page 36 of 61 NY#1727228 v6

Private & Confidential Prosper Focus Enterprise

ii.

Guangzhou Canyon is a legal entity, which is duly established, and validly existing in accordance with the applicable laws of PRC and could bear legal liabilities independently;

iii.

Prosper Focus is a legal entity, which is duly established, and validly existing in accordance with the applicable laws of Hong Kong and could bear legal liabilities independently;

(b)

The execution or performance of this Agreement shall not be in violation of any applicable laws, regulations, its articles of association or any terms of its by-laws or any agreements to which it is a party.

(c) The Purchaser has obtained all necessary approvals, permits, consents or authorization in connection with the entering into and performance of this Agreement and has obtained all necessary rights, powers and capacity to execute and perform all of the obligations and liabilities under this Agreement.

(d)

The Seller shall be liable for any possible debt, civil liabilities and criminal liabilities related to the shares of the Company, Guangzhou Canyon and Prosper Focus that occurred before the transfer date.

Confidential Page 37 of 61 NY#1727228 v6

Private & Confidential Prosper Focus Enterprise

(e)

After the execution of this Agreement, the Seller will not change the operation strategy or management structure of the Company, Guangzhou Canyon and Prosper Focus. In the event of any major change to the Company’s operation, Proper Focus or Guangzhou Canyon’s the Seller shall notify the Purchaser immediately.

(f)

Unless there was any other special stipulation otherwise, in this Article the Company shall mean itself and its Affiliate, including but not limited to Guangzhou Canyon and its subsidiaries and branches. The representation, warranties, and undertaking made by the Seller to the Purchaser in this Agreement shall also be applicable to the Company, Guangzhou Canyon and Prosper Focus and their Affiliates; the Seller shall procure and ensure that the Company and its Affiliates, including but not limited to Guangzhou Canyon and its subsidiaries and branches and Prosper Focus, will perform their obligations and responsibilities in accordance with these warranties, representatives and promises hereunder.

(g)

All of the representations and warranties herein are as at the date hereof and will be for all times up to and including the Closing Date, true and correct in all respects and not misleading in any respect.

Confidential Page 38 of 61 NY#1727228 v6

Private & Confidential Prosper Focus Enterprise

(h)

The Purchaser’s rights in respect of each of the said representations, warranties, undertakings and indemnities contained herein will survive the Closing Date and continue in full force and effect notwithstanding the Closing Date and shall not be affected by any information relating to the Company, Prosper Focus and Guangzhou Canyon of which the Purchaser has knowledge.

(i)

The Seller acknowledges that the Purchaser is entering into this Agreement in reliance upon representations in the terms of the representations, warranties, undertakings made by the Seller in reference to the Company, Guangzhou Canyon and Prosper Focus.

(j)

The rights and remedies of the Purchaser in respect of the representations, warranties, and undertakings shall not be affected by any due diligence investigation made by or on behalf of the Purchaser into the affairs of the Company, Guangzhou Canyon and Prosper Focus.

(k)

Any of the representations, warranties and undertakings set out in this Article shall be construed as separate and independent and (save where expressly provided to the contrary) shall not be limited or restricted by reference to or inference from the terms of any other term of this Agreement or any other Warranty.

Confidential Page 39 of 61 NY#1727228 v6

Private & Confidential Prosper Focus Enterprise

(1) 9, 10, 11.4, 11.6, 11.7

Prior to the Closing Date, if any of the representations, warranties or undertakings set out in this Article is found to be untrue, inaccurate or misleading or has not been fully and/or punctually carried out in any respect, or in the event of the Seller becoming unable or failing to do anything required under this Agreement to be done by it at or before the Closing Date, and if any of the aforesaid comes to the knowledge of the Seller, the Seller shall forthwith notify the Purchaser thereof, and in all these events, the Purchaser shall not be bound to procure the completion of the sale and purchase of the Sale Shares and may by notice in writing rescind this Agreement in which event the Seller shall perform all the duties under Article 7 and the Parties hereto shall be discharged from their respective further obligations hereunder except for their obligations under Article 9, 10, 11.4, 11.6 and 11.7 and without prejudice to the rights of either party in respect of antecedent breaches.

6.2

The Purchaser hereby represents and warrants to the Seller:

(a)

The Purchaser is a company which is duly established and validly existing in accordance with the laws of the State of Nevada of USA.

(b)

Confidential Page 40 of 61 NY#1727228 v6

Private & Confidential Prosper Focus Enterprise

The execution or performance of this Agreement shall not be in violation of any applicable laws, regulations, ordinances, its Articles of Association or any terms of its by-laws or any material contracts or agreements to which it is a party or binding on itself or its assets.

(c)

The Purchaser has obtained all necessary approvals, permits, consents or authorization in connection with the entering into and performance of this Agreement and has obtained all necessary rights, powers and capacity to execute and perform all of the obligations and liabilities under this Agreement.

(d)

The Purchaser undertakes that after Closing of the transaction contemplated hereunder, it will keep the Company’s current organization structure, support the Company’s business development in full, and provide capital support to the Company as per the need of business.

(e)

The representative signing on this Agreement has been duly authorized, having the right to execute this Agreement on behalf of the Purchaser.

(f)

The Purchaser shall pay the Consideration in full to the Seller according to this Agreement.

(g)

The representations, warranties, and undertakings made by the Purchaser in this Agreement are, as at the date hereof and afterwards, true and correct and complete in all respects and not misleading in any respect.

Confidential Page 41 of 61 NY#1727228 v6

Private & Confidential Prosper Focus Enterprise

Article 7 Breach of Agreement and Remedies

7.1

If prior to the Closing Date, it becomes apparent that the Seller is in breach of any of the representations, warranties or covenants hereunder, the Purchaser shall be entitled, in addition to and without prejudice to all other rights and remedies available to the Purchaser in respect thereof, to rescind this Agreement by notice in writing to the Seller to that effect whereupon:

(a)

the Seller shall forthwith indemnify the Purchaser in full for and against all costs, charges and expenses (including, but not limited to, all legal and other professional fees and expenses) incurred by the Purchaser in connection with the negotiation, preparation and rescission of this Agreement; and the Seller shall forthwith refund the Purchaser in full for any part of the Consideration that has been paid by the Purchaser.

(b) 9, 10, 11.4, 11.6, 11.7

All other provisions of this Agreement shall cease and terminate except for Article 9, 10, 11.4, 11.6 and 11.7 hereof.

7.2

Confidential Page 42 of 61 NY# 1727228 v6

Private & Confidential Prosper Focus Enterprise

After the Closing Date, the Seller hereby agrees to indemnify the Purchaser in respect of all its costs (including all its legal costs) or expenses which the Purchaser may incur either before or after the commencement of any action in connection with:

(a)

The settlement of any claim that any of the representations, warranties or covenants are untrue or misleading or have been breached;

(b)

Any legal proceedings in which the Purchaser claims that any of the representations, warranties or covenants are untrue or misleading or have been breached and in which judgment is given in favor of the Purchaser; or

(c)

The enforcement of any such settlement or judgment.

7.3 4.1 4.2 5 5.1

In the event that, due to any reasons other than any of the Parties hereof, all of the Conditions Precedent as set out in the Article 4.1 have not been fulfilled on or prior to the Satisfaction Date of Conditions as specified in Article 4.2, or the Closing as set out in Article 5 has not been completed on or prior to the Closing Date, any of the Parties hereof has no right to claim against the other Party in respect of the cost, fees, expenses or any other relevant losses arising out of the execution and performance of this Agreement, unless otherwise agreed.

7.4 4.1 4.2 5.1 4.2

Confidential Page 43 of 61 NY#1727228 v6

Private & Confidential Prosper Focus Enterprise

In the event that, due to the reasons of the Seller hereof, all of the Conditions Precedent as set out in the Article 4.1 have not been fulfilled on or prior to the Satisfaction Date of Conditions as specified in Article 4.2, or the Closing as set out in Article 5 has not been completed on or prior to the Closing Date, the Seller shall be deemed to have breached this Agreement. Under such circumstances, the Purchaser has the right to choose to rescind this Agreement according to Article 4.2 and to require the Seller to bear the liabilities of compensating the Purchaser for damages pursuant to any applicable laws and this Agreement and the Seller shall fully refund to the Purchaser all of the Consideration the Purchaser has paid within five Business Days after the requirement of refunding of the Consideration is made in writing by the Purchaser; or the Purchaser shall have the right not to choose to rescind this Agreement nonetheless the Seller shall bear the liabilities of compensating the Purchaser for damages in accordance with the applicable laws and this Agreement.

7.5 4.1 4.2 5 5.1

In the event that, due to the reasons of the Purchaser hereof, all of the Conditions Precedent as set out in the Article 4.1 have not been fulfilled on or prior to the Satisfaction Date of Conditions as specified in Article 4.2, or the Closing as set out in Article 5 has not been completed on or prior to the Closing Date, the Purchaser shall be deemed to have breached this Agreement.

7.6

The rights of the Purchaser pursuant to this Article 7 shall not restrict any of its rights or its ability to claim damages on any basis available to it in the event of a breach of any of the Representations, Warranties or any of them proving to be untrue or misleading.

Confidential Page 44 of 61 NY#1727228 v6

Private & Confidential Prosper Focus Enterprise

7.7 7.1

If the Purchaser could not acquire the Sale Shares or lose the Sale Shares after obtains due to the Seller’s breach of this Agreement, the Purchaser has the right to terminate this Agreement. In such situation, the Seller shall repay the USD$10,205,128.20 down payment plus USD$5,000,000.00 penalty and bear the liabilities stipulated in Article 7.1 hereof.

8.1

“Force Majeure” shall mean all events which are beyond the control of the Parties hereto, and which are unforeseen, unavoidable and insurmountable, and which prevent full or partial performance by either of the Parties. Such events shall include earthquakes, typhoons, epidemic, food, fire, war, strikes, riots, acts of governments, changes in law or the application thereof of any other instances which cannot be foreseen, prevented or controlled, including instances which are accepted as Force Majeure in general international commercial practice.

8.2

Consequences of Force Majeure

Confidential Page 45 of 61 NY#1727228 v6

Private & Confidential Prosper Focus Enterprise

(a)

If an event of Force Majeure occurs, a Party’s contractual obligations affected by such an event hereunder shall be suspended during the period of delay caused by the Force Majeure and shall be automatically extended, without penalty or liability, for a period equal to such suspension.

(b) (10)

The Party claiming Force Majeure shall promptly inform the other Parties in writing and shall furnish within ten (10) days thereafter sufficient proof of the occurrence of Force Majeure and shall be automatically extended, without penalty or liability, for a period equal to such suspension.

(c)

If the event of Force Majeure, the Parties shall immediately consult with each other in order to find an equitable solution (such as, to postpone the performance of this Agreement to a date agreed by the Parties, or terminate this Agreement) and shall use all reasonable endeavors to minimize the consequences of such Force Majeure.

Confidential Page 46 of 61 NY#1727228 v6

Private & Confidential Prosper Focus Enterprise

Article 9 Governing Law and Dispute Settlement

9.1

The validity, interpretation, implementation and resolution of dispute arising therefrom shall be governed by the laws of Hong Kong.

9.2 (60)

If any dispute, controversy or claim (“Dispute”) arises out of or in connection with this Agreement, the Parties shall use all reasonable endeavors to resolve through friendly consultations. In the event such dispute is not resolved through consultations within sixty (60) days after the date such consultations were firstly requested in writing by a Party, then any Party may submit the dispute for arbitration in Hong Kong before Hong Kong International Arbitration Center (“HKIAC”) in accordance with the HKIAC Arbitration Rules then in force.

(a) (3)

The arbitration tribunal shall consist of three arbitrators, one appointed by the Purchaser, one appointed by the Seller, and the one, the President Arbitrator, shall be appointed by HKIAC.

(b)

The arbitration proceedings shall be conducted in the English language and Chinese language.

(c)

The arbitration award shall be final and binding on the Parties.

Confidential Page 47 of 61 NY#1727228 v6

Private & Confidential Prosper Focus Enterprise

(d)

The arbitral award may be enforced by any court having competent jurisdiction over the party or its assets against whom the arbitral award is to be enforced, or be applied to such court for assistant in enforcement, as the case may be. Any cost of arbitration shall be borne by the losing party. The Parties agree that if a Party needs to bring a lawsuit to enforce the arbitration award, the party sued shall bear all reasonable cost, disbursement and legal fee, including but not limited to any extra litigation or arbitration fee incurred by the party requesting enforcement of the award.

9.3

When any dispute occurs and is the subject of friendly consultations or arbitration, the Parties shall continue to exercise their remaining respective rights and fulfill their remaining obligations hereunder.

10.1 (a) (b) (c)

An notice or written communication provided for herein by either Party to the other (the “Notice”), shall be made in Chinese and English to the address described in Article 10.3 below either (a) by hand; or (b) by courier service delivered letter; or (c) by facsimile.

Confidential Page 48 of 61 NY#1727228 v6

Private & Confidential Prosper Focus Enterprise

10.2

Notices shall be deemed to have been delivered at the following times: (a) if by hand, on reaching the designated address and subject to return receipt or other proof of delivery; (b) if by courier, the fifth Business Day after the date of dispatch; and (c) if by fax, upon the next Business Day following the date marked on the Confirmation of transmission report by the sender’s fax machine, indication completed uninterrupted transmission to the relevant facsimile number.

10.3 10.1 10.1

As to Section 10.1, both parties’ address can be separately notified (both parties can notify each other anytime about the address change according to Section 10.1.)

Confidential Page 49 of 61 NY#1727228 v6

Private & Confidential Prosper Focus Enterprise

11.1

Non-compete

(a)

After the execution of this Agreement, the purchaser shall take the post of General Manager / President / Chief Executive Officer in accordance with the appointment of the Board of Directors of the Company and / or Guangzhou Canyon and conduct its duties according to the employment contract entered into between him and the Company and/or Guangzhou Canyon and the authorization thereof. The term of the first General Manager is five years.

(b)

After the execution of this Agreement, the Parties hereof shall avoid any occurrence of competition between themselves in products and sale territories etc. on the principles of mutual co-ordination, mutual benefits and interests and common development. In the event that a competition situation occurs among the Shareholders of the Company and Guangzhou Canyon in products or sale territories, the Shareholders or Guangzhou Canyon shall actively co-ordinate with each other and settle it through consultation.

11.2

Access

Confidential Page 50 of 61 NY#1727228 v6

Private & Confidential Prosper Focus Enterprise

The Seller shall procure that as from the date of this Agreement the Purchaser and any persons authorized by it shall be given full access to the employees, premises, plant, machinery, books of account, records and documents of the Company, Prosper Focus and Guangzhou Canyon and the directors and employees of the Company, Prosper Focus and Guangzhou Canyon shall be instructed to give promptly to the Purchaser and any persons authorized by it all information in relation to the Company, Prosper Focus and Guangzhou Canyon that the Purchaser may request. And the Purchaser shall have the right to appoint auditing firms and law firms at its discretion to carry out auditing and legal due diligence upon the Company, Prosper Focus and Guangzhou Canyon.

11.3

Post-execution Obligations

Except for the need of the daily operation and management and being agreed in writing by the Purchaser in advance, the Seller shall, before the Closing hereof or termination of this Agreement (whichever is earlier), procure and ensure that the Company, Prosper Focus and Guangzhou Canyon and their Affiliates shall not:

(a)

Carry out any conducts not in the ordinary business; or

Confidential Page 51 of 61 NY#1727228 v6

Private & Confidential Prosper Focus Enterprise

(b)

make any disposal of any assets of the Company, Guangzhou Canyon and Prosper Focus with book value in excess of USD$50,0000, inter alias in the form of acquisition, loan, cost, creation or renewal of security (including without limitation guarantee, mortgage, pledge, lien, encumbrance or any other third party right), dividend, investment, capital contribution, joint ventures, partnership, profit sharing; or decrease the share capital or registered capital of the Company, Prosper Focus or Guangzhou Canyon.

11.4

Announcement and Confidentiality

(a)

Save as required by any applicable law, court order, or any governmental or regulatory authorities (including without limitation the stock exchange on which the Purchaser listed), neither the Company, Prosper Focus nor Guangzhou Canyon shall make any announcement of or release or disclose any information concerning this Agreement or the transaction contemplated hereof to any newspapers, or any persons or institutions (save as disclosed to their respective professional advisers under a duty of confidentiality) without the prior written consent of the Purchaser.

(b)

This Article shall remain effective notwithstanding Closing or termination of this Agreement.

Confidential Page 52 of 61 NY#1727228v6

Private & Confidential Prosper Focus Enterprise

11.5

Assignment

This Agreement shall be binding on and shall ensure for the benefit of the successors and assigns of the Parties hereto but shall not be assigned by any party without the prior written consent of the other Parties hereto.

11.6

Cost and Expenses

Each of the Parties hereto shall bear their own legal and professional fees, costs and expenses incurred by the Parties hereto in the negotiation, preparation, execution and completion of this Agreement. The stamp duty incurred in connection with this Agreement shall be borne by the Seller and the Purchaser in equal shares. The Seller shall be solely liable and responsible for any and all taxes in connection with the sale and transfer of the Sale Shares, or on the profit derived by the Seller from such sale and transfer of the Sale Shares hereof.

11.7

Process Agent

(a)

Confidential Page 53 of 61 NY#1727228 v6

Private & Confidential Prosper Focus Enterprise

The process agent of the Purchaser, namely with his address at XXXX 000, 0/X., XXXXXXXXX XXXXX, XXXXXXX MUSEUM ROAD, TSIM SHATSUI EAST, KOWLOON, HONGKONG, shall receive on behalf of it in Hong Kong any of the summons, writs, arbitral or other legal documents of the arbitration or other legal or claim procedures in relation to this Agreement (hereinafter referred to as “Summon Documents”).

(b)

Any such Summon Documents will be deemed to have been duly served on a Party if they are served on the process agent(s).

11.8

Severability

If at any time any one or more provisions hereof is or becomes invalid, illegal, unenforceable or incapable of performance in any respect, the validity, legality, enforceability or performance of the remaining provisions hereof shall not thereby in any way be affected or impaired.

11.9

Entire Agreement

This Agreement as amended and restated together with its Schedule constitutes the entire agreement and understanding between the Parties in connection with the subject-matter of this Agreement and supersedes all previous proposals,

Confidential Page 54 of 61 NY#1727228 v6

Private & Confidential Prosper Focus Enterprise

representations, warranties, agreements or undertakings relating thereto whether oral, written or otherwise and (save as expressly provided or reserved herein) neither party has relied on any such proposals, representations, warranties, agreements or undertakings.

11.10

Time

(a)

Time shall be of the essence of this Agreement. The Parties hereto shall perform their respective obligations within the performance period as agreed in this Agreement.

(b)

No time or indulgence given by any party to the other shall be deemed or in any way be construed as a waiver of any of its rights and remedies hereunder.

11.11

Effectiveness and Counterpart

(a)

This Agreement shall come into effect after signature.

(b)

This Agreement is executed in English and Chinese in six counterparts. Each Party shall hold three copies, and all of the copies shall have the same effect.

Where there is a difference in translation, the English version shall control.

(the remaining left blank)

Confidential Page 55 of 61 NY#1727228 v6

Private & Confidential Prosper Focus Enterprise

Seller”

Purchaser:

By:

By:

Name

Name:

ID No.”

Title:

Nationality:

Nationality:

Confidential Page 42 of 46 NY#1727228 v6

Private & Confidential Prosper Focus Enterprise

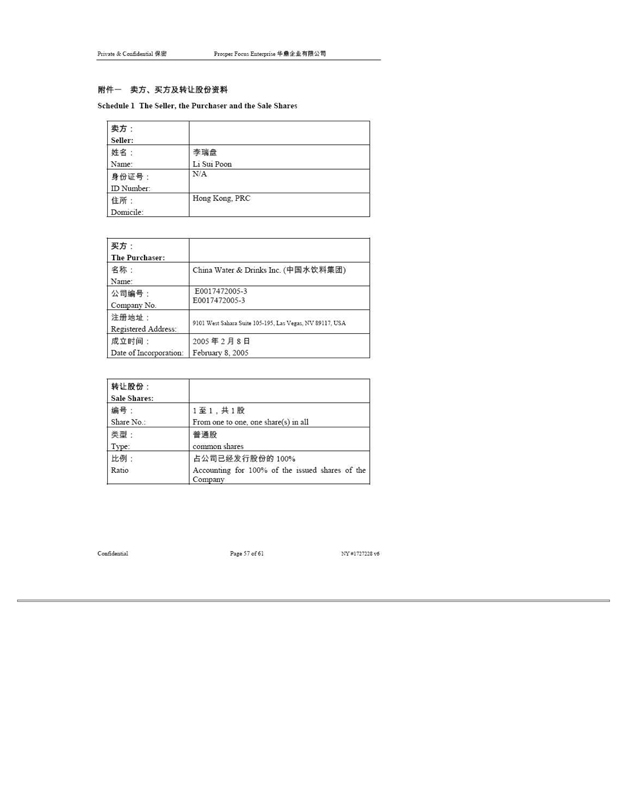

Schedule 1 The Seller, the Purchaser and the Sale Shares

Seller:

Name: Li Xxx Xxxx

ID Number: N/A

Domicile: Hong Kong, PRC

The Purchaser:

Name: China Water & Drinks Inc.

Company No. E0017472005-3

E0017472005-3

Registered Address: 0000 Xxxx Xxxxxx Xxxxx 000-000, Xxx Xxxxx, XX 00000, XXX

Date of Incorporation: February 8, 2005

Sale Shares:

Share No.: From one to one, one share(s) in all

Type: common shares

Ratio Accounting for 100% of the issued shares of the Company

Confidential Page 57 of 61 NY#1727228 v6

Private & Confidential Prosper Focus Enterprise

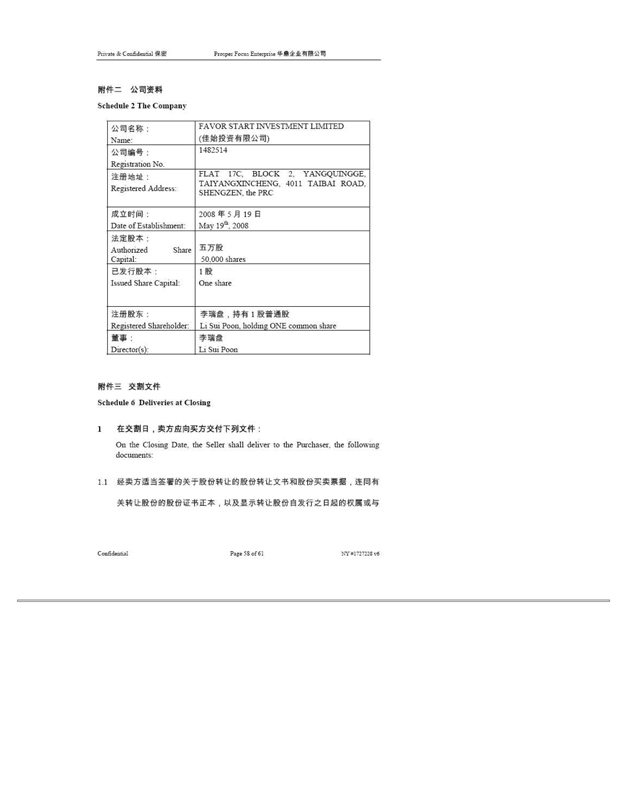

Schedule 2 The Company

Name: FAVOR START INVESTMENT LIMITED

Registration No. 1482514

Registered Address: XXXX 00X, XXXXX 0, XXXXXXXXXXX, XXXXXXXXXXXXXXX, 0000 XXXXXX XXXX, XXXXXXXX, the PRC

2008 5 19

Date of Establishment:

May 19th , 2008

Authorized Share Capital: 50,000 shares

1

Issued Share Capital:

One share

Registered Shareholder: Li Xxx Xxxx, holding ONE common share

Director(s): Li Xxx Xxxx

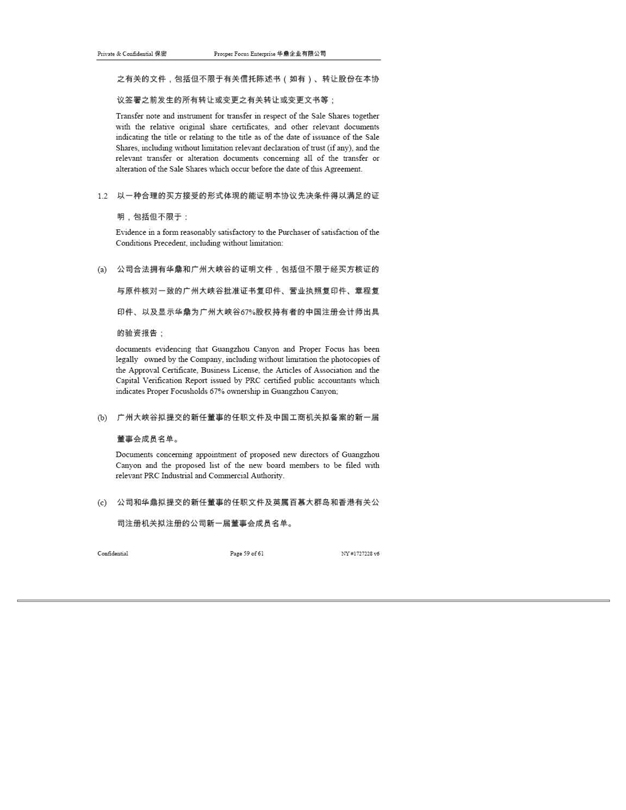

Schedule 6 Deliveries at Closing

1

On the Closing Date, the Seller shall deliver to the Purchaser, the following documents:

1.1

Confidential Page 58 of 61 NY#1727228 v6

Private & Confidential Prosper Focus Enterprise

Transfer note and instrument for transfer in respect of the Sale Shares together with the relative original share certificates, and other relevant documents indicating the title or relating to the title as of the date of issuance of the Sale Shares, including without limitation relevant declaration of trust (if any), and the relevant transfer or alteration documents concerning all of the transfer or alteration of the Sale Shares which occur before the date of this Agreement.

1.2

Evidence in a form reasonably satisfactory to the Purchaser of satisfaction of the Condition Precedent, including without limitation.

(a) 67%

documents evidencing that Guangzhou Canyon and Proper Focus has been legally owned by the Company, including without limitation the photocopies of the Approval Certificate. Business License, the Articles of Association and the Capital Verification Report issued by PRC certified public accountants which indicates Proper Focusholds 67% ownership in Guangzhou Canyon.

(b)

Documents concerning appointment of proposed new directors of Guangzhou Canyon and the proposed list of the new board members to be filed with relevant PRC Industrial and Commercial Authority.

(c)

Confidential Page 59 of 61 NY#1727228 v6

Private & Confidential Prosper Focus Enterprise

Documents concerning appointment of proposed new directors of the Company and Proper Focus and the list of the new board members to be registered with relevant companies registry in BVI and Hong Kong.

(d)

Monthly Management Accounts for that current month of the Management Accounts Date;

(e) (1) (2) (3)

A certified true copy of the minutes of a meeting of the board of directors of the Company (the contents thereof having been accepted by the Purchaser) at which the directors have approved: (i) the execution of this Agreement by the Seller and the Purchaser whereby the Seller proposes to transfer the Sale Shares to the Purchaser pursuant to this Agreement; (ii) the registration of the relevant shares transfer into the books of the Company and issuance of share certificates to the Purchaser in respect of the Sale Shares under the condition that all relevant stamp tax have been duly paid in; and (iii) the appointment of such persons as the Purchaser may nominate as proposed directors of the Company taking effect from the Closing Date within one month.

(f)

any other document required by the Seller

2

On the Closing Date, the Purchaser shall deliver to the Seller, the following documents:

2.1

The copy of board resolution of the Purchaser approving the contemplated transaction hereunder.

Confidential Page 60 of 61 NY#1727228 v6

Private & Confidential Prosper Focus Enterprise

2.2

Any other document required by the Purchaser

Confidential Page 61 of 61 NY#1727228 v6