EXECUTION VERSION LIMITED WAIVER AND SIXTH AMENDMENT TO CREDIT AGREEMENT This LIMITED WAIVER AND SIXTH AMENDMENT TO CREDIT AGREEMENT, dated as of December 31, 2023 (this “Amendment”), is entered into by and among LIFECORE BIOMEDICAL, INC., a Delaware...

EXECUTION VERSION LIMITED WAIVER AND SIXTH AMENDMENT TO CREDIT AGREEMENT This LIMITED WAIVER AND SIXTH AMENDMENT TO CREDIT AGREEMENT, dated as of December 31, 2023 (this “Amendment”), is entered into by and among LIFECORE BIOMEDICAL, INC., a Delaware corporation (“Holdings”), CURATION FOODS, INC., a Delaware corporation (“Curation”), LIFECORE BIOMEDICAL OPERATING COMPANY, INC., a Delaware corporation (collectively with Holdings and Curation, the “Borrowers” and each a “Borrower”), each Guarantor party hereto, BMO BANK N.A. (F/K/A BMO XXXXXX BANK N.A.), as Administrative Agent, and the Lenders party hereto. RECITALS: WHEREAS, reference is hereby made to that certain Credit Agreement, dated as of December 31, 2020 (as amended, restated, supplemented or otherwise modified prior to the date hereof, the “Existing Credit Agreement”, and as further amended by this Amendment, the “Credit Agreement”; capitalized terms used herein (including the preamble and recitals hereto) and not otherwise defined herein shall have the meanings ascribed thereto in the Credit Agreement, as amended herein), by and among the Borrowers, the other Loan Parties party thereto from time to time, the Lenders party thereto from time to time, BMO Bank N.A., as Administrative Agent and the other parties party thereto from time to time; WHEREAS, the Borrower Agent has informed the Administrative Agent that the Events of Default identified on Exhibit A hereto have occurred and are continuing (collectively, the “Specified Events”); and WHEREAS, the Loan Parties have requested that the Administrative Agent and the Lenders waive the Specified Events and make certain amendments to the Credit Agreement, and the Administrative Agent and the Lenders have agreed to do so, but solely on the terms and conditions set forth herein. NOW, THEREFORE, in consideration of the premises and the agreements, provisions and covenants herein contained, the parties hereto hereby agree as follows: 1. Acknowledgements. (a) Acknowledgement of Obligations. The Loan Parties hereby acknowledge, confirm and agree that all Loans under the Credit Agreement, together with interest accrued and accruing thereon, and all fees, costs, expenses and other charges now or hereafter payable by Borrowers to Administrative Agent or any Lender, are unconditionally owing by Borrowers to Administrative Agent or such Lender, without offset, defense or counterclaim of any kind, nature or description whatsoever. (b) Acknowledgement of Loan Documents. The Loan Parties hereby acknowledge, confirm and agree that Administrative Agent has and shall continue to have a valid, enforceable and perfected first priority lien upon and security interest in the Collateral heretofore granted to Administrative Agent pursuant to the Loan Documents or otherwise granted to or held by Administrative Agent. (c) Acknowledgment of Defaults. The Loan Parties hereby acknowledge and agree that the each of Specified Events have occurred and are continuing, constitutes an Event of Default, and entitles Administrative Agent and each Lender to exercise its rights and remedies under the Loan Documents, applicable law or otherwise, including, without limitation, by exercising the right to declare the Obligations to be immediately due and payable under the terms of the Loan Documents. The Loan Parties represent and warrant that as of the date hereof, no other Events of Default exist other than the Specified Events.

2 2. Limited Waiver of Specified Events; Default Rate Interest. (a) Subject to satisfaction of the conditions precedent set forth in Section 5 below, the Administrative Agent and the Lenders party hereto (constituting Required Lenders) hereby waive, as of the date hereof, the Specified Events (collectively, the “Limited Waiver”). (b) Except as expressly set forth herein, the Limited Waiver shall not be deemed to constitute a consent to, or waiver or approval of, any other act, any other omission or any other failure by the Loan Parties to comply with the terms and provisions of the Existing Credit Agreement or any of the other Loan Documents. (c) The Limited Waiver is a limited, one time waiver and, except as expressly set forth herein, shall not be deemed to: (i) constitute a waiver of any Default, Event of Default or any other breach by the Loan Parties of, or non-compliance by the Loan Parties with, the Existing Credit Agreement or any of the other Loan Documents, whether now existing or hereafter arising, (ii) constitute a waiver of any right or remedy of any Secured Party under the Existing Credit Agreement or any other Loan Documents which does not arise as a result of the Specified Events (in each case prior to giving effect to this Limited Waiver) or (iii) establish a custom or course of dealing or conduct between any Secured Party, on the one hand, and the Loan Parties, on the other hand. (d) Each Secured Party expressly reserves the right to exercise all rights and remedies under the Existing Credit Agreement and all other Loan Documents and under applicable law with respect to the occurrence of any Event of Default other than the Specified Events. (e) Each of the parties hereto acknowledges and agrees that as of June 30, 2023, all outstanding Loan Obligations began to bear interest at the Default Rate, and shall continue to bear interest at the Default Rate until the end of the Interest Period of the SOFR Loans outstanding on the date hereof. 3. Amendments. Subject to the terms and conditions set forth herein, including satisfaction of each condition set forth in Section 4 below, and in reliance on the representations, warranties, covenants and agreements of the Loan Parties set forth herein, as of the date hereof, the Existing Credit Agreement is hereby amended as follows as of the date hereof: (a) Section 1.01 of the Existing Credit Agreement is hereby further amended by inserting the following new defined term in alphabetical order: “Sixth Amendment Effective Date” means December 31, 2023. “Specified Account Debtor (35%)” means the second Account Debtor listed in the definition of “Specified Account Debtor” as defined in the Fee Letter described in clause (ii) of the definition thereof, and (b) each other Account Debtor approved by the Administrative Agent in its sole discretion and in writing (including via email). “Specified Account Debtor (45%)” means the first Account Debtor listed in the definition of “Specified Account Debtor” as defined in the Fee Letter described in clause (ii) of the definition thereof, and (b) each other Account Debtor approved by the Administrative Agent in its sole discretion and in writing (including via email). “Specified Adjustment Date” has the meaning set forth in the definition of “Applicable Margin”.

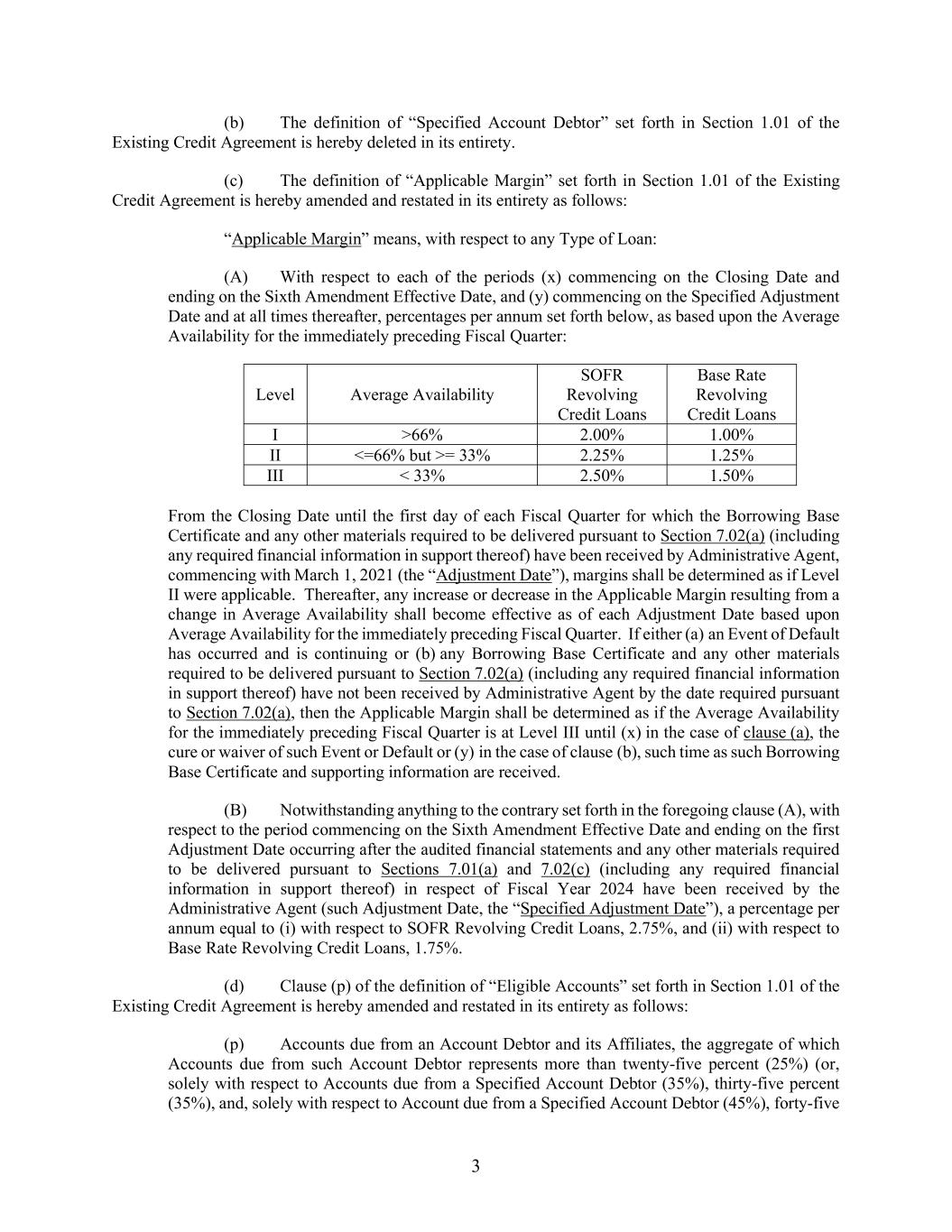

3 (b) The definition of “Specified Account Debtor” set forth in Section 1.01 of the Existing Credit Agreement is hereby deleted in its entirety. (c) The definition of “Applicable Margin” set forth in Section 1.01 of the Existing Credit Agreement is hereby amended and restated in its entirety as follows: “Applicable Margin” means, with respect to any Type of Loan: (A) With respect to each of the periods (x) commencing on the Closing Date and ending on the Sixth Amendment Effective Date, and (y) commencing on the Specified Adjustment Date and at all times thereafter, percentages per annum set forth below, as based upon the Average Availability for the immediately preceding Fiscal Quarter: Level Average Availability SOFR Revolving Credit Loans Base Rate Revolving Credit Loans I >66% 2.00% 1.00% II <=66% but >= 33% 2.25% 1.25% III < 33% 2.50% 1.50% From the Closing Date until the first day of each Fiscal Quarter for which the Borrowing Base Certificate and any other materials required to be delivered pursuant to Section 7.02(a) (including any required financial information in support thereof) have been received by Administrative Agent, commencing with March 1, 2021 (the “Adjustment Date”), margins shall be determined as if Level II were applicable. Thereafter, any increase or decrease in the Applicable Margin resulting from a change in Average Availability shall become effective as of each Adjustment Date based upon Average Availability for the immediately preceding Fiscal Quarter. If either (a) an Event of Default has occurred and is continuing or (b) any Borrowing Base Certificate and any other materials required to be delivered pursuant to Section 7.02(a) (including any required financial information in support thereof) have not been received by Administrative Agent by the date required pursuant to Section 7.02(a), then the Applicable Margin shall be determined as if the Average Availability for the immediately preceding Fiscal Quarter is at Level III until (x) in the case of clause (a), the cure or waiver of such Event or Default or (y) in the case of clause (b), such time as such Borrowing Base Certificate and supporting information are received. (B) Notwithstanding anything to the contrary set forth in the foregoing clause (A), with respect to the period commencing on the Sixth Amendment Effective Date and ending on the first Adjustment Date occurring after the audited financial statements and any other materials required to be delivered pursuant to Sections 7.01(a) and 7.02(c) (including any required financial information in support thereof) in respect of Fiscal Year 2024 have been received by the Administrative Agent (such Adjustment Date, the “Specified Adjustment Date”), a percentage per annum equal to (i) with respect to SOFR Revolving Credit Loans, 2.75%, and (ii) with respect to Base Rate Revolving Credit Loans, 1.75%. (d) Clause (p) of the definition of “Eligible Accounts” set forth in Section 1.01 of the Existing Credit Agreement is hereby amended and restated in its entirety as follows: (p) Accounts due from an Account Debtor and its Affiliates, the aggregate of which Accounts due from such Account Debtor represents more than twenty-five percent (25%) (or, solely with respect to Accounts due from a Specified Account Debtor (35%), thirty-five percent (35%), and, solely with respect to Account due from a Specified Account Debtor (45%), forty-five

4 percent (45%)) of all then outstanding Accounts owed to the Borrowers, but only to the extent of such excess; (e) Section 7.01(b) of the Existing Credit Agreement is hereby amended and restated in its entirety as follows: (b) monthly, as soon as available, but in any event within 30 days after the end of each calendar month (other than each of the calendar months of June, July, August, September and October of 2023), unaudited Consolidated and consolidating balance sheets of the Consolidated Group as of the end of such month and the related statements of income and cash flow for such month and for the portion of the Fiscal Year then elapsed, on a Consolidated basis for the Consolidated Group, setting forth in comparative form corresponding figures for the preceding Fiscal Year and certified by a Responsible Officer of Borrower Agent as prepared in accordance with GAAP and fairly presenting the financial condition, results of operations, shareholders equity and cash flows for such month and period, subject to normal year-end adjustments and the absence of footnotes; and 4. Representations and Warranties. To induce the Administrative Agent and the Lenders to enter into this Amendment, each Loan Party represents and warrants that: (a) as of the date hereof, the representations and warranties of the Loan Parties contained in Article VI of the Credit Agreement or any other Loan Document, or which are contained in any document furnished at any time under or in connection herewith or therewith, are true and correct in all material respects, except to the extent that such representations and warranties specifically refer to an earlier date, in which case they shall be true and correct in all material respects as of such earlier date; (b) as of the date hereof, no Default has occurred and is continuing under the Existing Credit Agreement or any other Loan Document or would result from the execution and delivery of this Amendment (other than the Specified Events); (c) the execution and delivery of this Amendment and the performance by each Loan Party of this Amendment and the Credit Agreement have been duly authorized by all necessary corporate or other organizational action, and do not and will not (i) contravene the terms of the Organization Documents of any such Person; (ii) conflict with or result in any breach or contravention of, or the creation of any Lien under (A) any Contractual Obligation to which such Person is a party (other than the creation of Liens in favor of the Administrative Agent pursuant to any Loan Document and the creation of the Term Loan Liens) or (B) any order, injunction, writ or decree of any Governmental Authority or any arbitral award to which such Person or its property is subject; or (iii) violate any Law applicable to such Person; (d) no approval, consent, exemption, authorization, or other action by, or notice to, or filing with, any Governmental Authority or any other Person is necessary or required in connection with (i) the execution and delivery of this Amendment or the performance by, or enforcement against, any Loan Party of this Amendment of the Credit Agreement, or (ii) the exercise by the Administrative Agent or any Lender of its rights under the Amendment or the Credit Agreement or the remedies in respect of the Collateral pursuant to the Loan Documents; (e) this Amendment has been duly executed and delivered by each Loan Party that is party thereto; and (f) this Amendment and the Credit Agreement constitute legal, valid and binding obligations of such Loan Party, enforceable against each Loan Party in accordance with its terms, except

5 (a) as rights to indemnification hereunder may be limited by applicable Law and (b) as the enforcement hereof may be limited by any applicable Debtor Relief Laws or by general equitable principles. 5. Conditions to Effectiveness. The effectiveness of this Amendment is subject to the following conditions: (a) Delivery of Documents. On or before the date hereof, the Administrative Agent shall have received sufficient copies of (i) this Amendment, (ii) a waiver and amendment under the Term Loan Agreement in form and substance satisfactory to the Administrative Agent, (iii) a closing certificate signed by the an Authorized Officer of Borrower Agent dated as of the date hereof, stating that (A) all representations and warranties set forth in this Amendment and the other Loan Documents are true and correct on and as of such date (other than representations and warranties relating to a specific earlier date and in such case such representations and warranties are true and correct in all material respects as of such earlier date) and (B) on such date no Default or Event of Default has occurred or is continuing immediately after giving effect to the execution and delivery of this Amendment and the consummation of the transactions contemplated hereby, (iv) a Borrowing Base Certificate as of the Sixth Amendment Effective Date, and (v) any other documents or agreements reasonably requested by the Administrative Agent in connection herewith, in each case, duly executed and delivered by each applicable Loan Party and each other Person party thereto. (b) Accuracy of Representations and Warranties. Other than in respect of the Specified Defaults, all of the representations and warranties of the Loan Parties contained in Article VI of the Credit Agreement or any other Loan Document, or which are contained in any document furnished at any time under or in connection herewith or therewith, are true and correct in all material respects, except to the extent that such representations and warranties specifically refer to an earlier date, in which case they shall be true and correct in all material respects as of such earlier date. (c) Accrued Interest. The Administrative Agent shall have received payment from the Borrowers of all unpaid interest on the Loan Obligations (including, without limitation, interest accrued at the Default Rate pursuant to Section 2(e) above) that has accrued through and including December 31, 2023. (d) Expenses. The Loan Parties shall have paid, to the extent invoiced on or before the date hereof, to the Administrative Agent (or its advisors) all reasonable and documented costs and expenses of the Administrative Agent in connection with preparation, execution and delivery of this Amendment and all other related documents together with any other amounts, if any, in any case required to be paid under Section 11.04 of the Credit Agreement and unpaid on the date hereof, including, without limitation, legal fees and expenses due and owing to Xxxxxx Xxxxxx LLP, counsel to the Administrative Agent. 6. Post-Closing Covenant. Not later than January 15, 2024, the Borrowers shall deliver to the Administrative Agent and the Lenders, unaudited Consolidated and consolidating balance sheets of the Consolidated Group as of the end of the November 2023 fiscal month, and the related statements of income and cash flow for such fiscal month and for the portion of the Fiscal Year then elapsed, on a Consolidated basis for the Consolidated Group, setting forth in comparative form corresponding figures for the preceding Fiscal Year and certified by a Responsible Officer of Borrower Agent as prepared in accordance with GAAP and fairly presenting the financial condition, results of operations, shareholders equity and cash flows for such month and period, subject to normal year-end adjustments and the absence of footnotes. 7. Ratification; Reference to and Effect Upon the Existing Credit Agreement; No Impairment.

6 (a) Each Loan Party party hereto hereby consents to this Amendment and each of the transactions referenced herein, and hereby reaffirms its obligations under the Credit Agreement and each other Loan Document to which it is a party, as applicable, including, without limitation, the Loan Parties’ obligations under Section 7.02(c) of the Credit Agreement to, concurrently with the delivery of financial statements under Section 7.01(a) or 7.01(b) of the Credit Agreement, deliver to the Administrative Agent, a Compliance Certificate executed by the chief financial officer of the Borrower Agent which calculates the Applicable Margin and the financial covenant set forth in Section 8.12 of the Credit Agreement (whether or not a Financial Covenant Trigger Period is then in effect) (and, if in effect, certifies compliance therewith). (b) Nothing herein contained shall be construed as a substitution or novation of the Obligations outstanding under the Existing Credit Agreement or instruments securing the same. Except as specifically amended above, the Existing Credit Agreement and the other Loan Documents shall remain in full force and effect and are hereby ratified and confirmed. (c) The execution, delivery and effectiveness of this Amendment shall not operate as a waiver of any right, power or remedy of the Administrative Agent or any Lender under the Existing Credit Agreement or any other Loan Document, nor constitute a waiver of any provision of the Existing Credit Agreement or any other Loan Document. Upon the effectiveness of this Amendment, each reference in the Credit Agreement to “this Agreement”, “hereunder”, “hereof”, “herein” or words of similar import shall mean and be a reference to the Credit Agreement. (d) Each Loan Party acknowledges that its Obligations and other liabilities and obligations under the Credit Agreement and the other Loan Documents are not impaired in any respect by this Agreement. 8. Release; Indemnification. (a) In further consideration of the execution of this Amendment by the Administrative Agent and the Lenders, each Loan Party, individually and on behalf of its successors (including any trustees acting on behalf of such Loan Party and any debtor in possession with respect to such Loan Party), assigns, Subsidiaries and Affiliates (collectively, the “Releasors”), hereby forever releases each Agent and Xxxxxx and their respective successors, assigns, parents, Subsidiaries, Affiliates, officers, employees, directors, agents and attorneys (collectively, the “Releasees”) from any and all debts, claims, demands, liabilities, responsibilities, disputes, causes, damages, actions and causes of actions (whether at law or in equity) and obligations of every nature whatsoever, whether liquidated or unliquidated, whether known or unknown, whether matured or unmatured, whether fixed or contingent that such Releasor has, had or may have against the Releasees, or any of them, which arise from or relate to any actions which the Releasees, or any of them, have or may have taken or omitted to take in connection with the Credit Agreement or the other Loan Documents prior to the date hereof, including with respect to the Obligations, any Collateral, the Credit Agreement, any other Loan Document and any third party liable in whole or in part for the Obligations. This provision shall survive and continue in full force and effect whether or not each Loan Party shall satisfy all other provisions of this Amendment or the other Loan Documents, including payment in full of all Obligations. Each Releasor understands, acknowledges and agrees that the foregoing release set forth above may be pleaded as a full and complete defense and may be used as a basis for an injunction against any action, suit or other proceeding which may be instituted, prosecuted or attempted in breach of the provisions of such release. (b) Each Loan Party hereby acknowledges and agrees that such Loan Party’s obligations under this Amendment shall include an obligation to indemnify and hold the Releasees harmless with respect to any indemnified liabilities in any manner relating to or arising out of the negotiation,

7 preparation, execution, delivery, performance, administration and enforcement of this Amendment to the extent required by Section 11.04(b) of the Credit Agreement. 9. Relationship of Parties. The relationship of the Administrative Agent and the Lenders, on the one hand, and the Loan Parties, on the other hand, has been and shall continue to be, at all times, that of creditor and debtor and not as joint venturers or partners. Nothing contained in this Amendment, any instrument, document or agreement delivered in connection herewith, the Credit Agreement or any of the other Loan Documents shall be deemed or construed to create a fiduciary relationship between or among the parties hereto or thereto. 10. GOVERNING LAW. THIS AMENDMENT SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAW OF THE STATE OF NEW YORK. 11. Headings. Section headings herein are included herein for convenience of reference only and shall not constitute a part hereof for any other purpose or be given any substantive effect. 12. Counterparts; Electronic Execution. This Amendment may be executed in counterparts (and by different parties hereto in different counterparts), each of which shall constitute an original, but all of which when taken together shall constitute a single agreement. Receipt of an executed signature page to this Amendment by facsimile or other electronic transmission shall constitute effective delivery thereof. The words “execution,” “signed,” “signature,” and words of like import in this Amendment shall be deemed to include electronic signatures or the keeping of records in electronic form, each of which shall be of the same legal effect, validity or enforceability as a manually executed signature or the use of a paper-based recordkeeping system, as the case may be, to the extent and as provided for in any applicable law, including the Federal Electronic Signatures in Global and National Commerce Act, the New York State Electronic Signatures and Records Act, or any other similar state laws based on the Uniform Electronic Transactions Act. [Remainder of Page Intentionally Blank]

Signature Page to Limited Waiver and Sixth Amendment to Credit Agreement IN WITNESS WHEREOF, the parties hereto have caused this Amendment to be duly executed and delivered by their respective officers thereunto duly authorized as of the date first written above. LIFECORE BIOMEDICAL, INC. (f/k/a Landec Corporation) By: Name: Xxxx Xxxxxxx Title: Vice President and Secretary CURATION FOODS, INC. By: Name: Xxxx Xxxxxxx Title: Vice President and Secretary LIFECORE BIOMEDICAL OPERATING COMPANY, INC. (f/k/a Lifecore Biomedical, Inc.) By: Name: Xxxx Xxxxxxx Title: Vice President and Secretary GREENLINE LOGISTICS, INC. By: Name: Xxxx Xxxxxxx Title: Vice President and Secretary LIFECORE BIOMEDICAL, LLC By: Name: Xxxx Xxxxxxx Title: Vice President and Secretary CAMDEN FRUIT CORP. By: Name: Xxxx Xxxxxxx Title: Vice President and Secretary

Signature Page to Limited Waiver and Sixth Amendment to Credit Agreement ADMINISTRATIVE AGENT: BMO BANK N.A., as Administrative Agent By: Name: Xxxxxxxxx Xxxx Title: Director LENDER: BMO BANK N.A., as the Lender By: Name: Xxxxxxxxx Xxxx Title: Director

EXHIBIT A Specified Events 1. The Events of Default under Section 9.01(b) of the Existing Credit Agreement as a result of the Loan Parties’ failure to comply with the requirements set forth in (i) Section 7.01(a) of the Existing Credit Agreement with respect to the delivery of certain annual financial statements for the Fiscal Year 2023, (ii) Section 7.01(b) of the Existing Credit Agreement with respect to the delivery of certain monthly financial statements (and corresponding figures for the portion of the fiscal year then elapsed) for each of the months of June, July, August, September, October and November of 2023, (iii) Section 7.03(c) of the Existing Credit Agreement with respect to delivery of annual financial projections of the Consolidated Group for the Fiscal Year 2024, and (iv) Section 7.03(a) with respect to providing notice of the occurrence of the Defaults and Events of Default described in the foregoing clauses (i), (ii) and (iii), and in #2 and #3 below. 2. The Events of Default under Section 9.01(c) of the Existing Credit Agreement as a result of the Loan Parties’ failure to comply with the requirements set forth in Section 7.01(c) of the Existing Credit Agreement with respect to the delivery of a Compliance Certificate in connection with the delivery of the financial statements described in clauses (i) and (ii) in #1 above, as well as in connection with the monthly financial statements for May of 2023, in each case within the time period set forth in the Existing Credit Agreement. 3. The Defaults and/or Events of Default under Section 9.01(e) of the Existing Credit Agreement as a result of the Credit Party Representative’s (as defined in the Term Loan Agreement (as defined in the Existing Credit Agreement)) failure to timely deliver (i) the monthly reports required to be delivered pursuant to Section 5.1(a) of the Term Loan Agreement in respect of each of the months of June, July, August, September October and November of 2023, (ii) the quarterly report required to be delivered pursuant to Section 5.1(b) of the Term Loan Agreement in respect of the fiscal quarter ending in August of 2023, (iii) the Compliance Certificates required to be delivered pursuant to Section 5.1(d) of the Term Loan Agreement in respect of the monthly reports and the quarterly report described in the foregoing clauses (i) and (ii), (iv) the annual financial reports required to be delivered pursuant to Section 5.1(c) of the Term Loan Agreement in respect of the Fiscal Year ending in May of 2023, (v) the consolidated plan and financial forecast required to be delivered pursuant to Section 5.1(i) of the Term Loan Agreement, (vi) the certificate of an Authorized Officer required to be delivered pursuant to Section 5.1(n) of the Term Loan Agreement, (vii) notice of the events of default described in the foregoing clauses (i) through (vi) required to be delivered pursuant to Section 5.1(f) of the Term Loan Agreement.