66444216;16 DM_US 190520716-12.102113.0045 ASSET PURCHASE AGREEMENT DATED AS OF December 9, 2022 AMONG CANO HEALTH, LLC CANO HEALTH, INC., THE SELLERS PARTY HERETO AND DEMARQUETTE KENT

66444216;16 DM_US 190520716-12.102113.0045 ASSET PURCHASE AGREEMENT DATED AS OF December 9, 2022 AMONG XXXX HEALTH, LLC XXXX HEALTH, INC., THE SELLERS PARTY HERETO AND XXXXXXXXXXX XXXX

-ii- 66444216;16 DM_US 190520716-12.102113.0045 TABLE OF EXHIBITS EXHIBIT A DEFINITIONS EXHIBIT B SPECIFICALLY EXCLUDED ASSETS EXHIBIT C PURCHASE CONSIDERATION ALLOCATION EXHIBIT D GENERAL COMPLIANCE ATTESTATION EXHIBIT E RESTRICTIVE COVENANT AGREEMENT EXHIBIT F FORMS OF EMPLOYMENT AGREEMENTS EXHIBIT G BILL OF SALE EXHIBIT H FORM OF RELEASE EXHIBIT I FORM OF MANAGEMENT SERVICES AGREEMENT EXHIBIT J SIDE LETTER EXHIBIT K DISCLOSURE SCHEDULES

66444216;16 DM_US 190520716-12.102113.0045 ASSET PURCHASE AGREEMENT This Asset Purchase Agreement (this “Agreement”) dated December 9, 2022 is among Xxxx Health, LLC (the “Purchaser”), Xxxx Health, Inc., a Delaware corporation (“Holdings”), Total Health Medical Centers, LLC, a Florida limited liability company (“Total Health”), Your Partners in Health, LLC, a Florida limited liability company (“Your Partners in Health”), Your Partners In Health I, LLC, a Florida limited liability company (“YPH I”), ProCare Medical Management LLC, a Florida limited liability company (“ProCare Medical Management”), Care Management Resources, LLC, a Florida limited liability company (“Care Management”), Care Management Resources I, LLC, a Florida limited liability company (“Care Management I” and together with Total Health, Your Partners in Health, YPH I, ProCare Medical Management and Care Management, each a “Seller” and collectively, the “Sellers”), and xxXxxxxxxxx Xxxx (the “Owner” and together with the Seller, the “Seller Parties”). The Purchaser and the Seller Parties are collectively referred to herein as the “Parties”. Capitalized terms used herein are defined in Exhibit A. RECITALS A. WHEREAS, the Owner owns all of the issued and outstanding equity interests of the Sellers, other than (i) ProCare Medical Management, which is wholly owned by Care Management, (ii) YPH I, which is wholly owned by Your Partners in Health, and (iii) Care Management I, which is wholly owned by Care Management. B. WHEREAS, the Sellers desire to sell all or substantially all of the Acquired Assets to the Purchaser in compliance with all applicable laws, on the terms and conditions set forth herein. AGREEMENT NOW, THEREFORE, in consideration of the foregoing and the respective representations, warranties, covenants and agreements hereinafter set forth and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto, intending to be legally bound, hereby agree as follows: ARTICLE I PURCHASE OF THE ACQUIRED ASSETS; ASSUMPTION OF ASSUMED LIABILITIES 1.1 Purchase of the Acquired Assets. On the terms of this Agreement, the Purchaser hereby purchases from each Seller, and each Seller hereby sells to the Purchaser, all of such Seller’s rights and assets used in or related to such Seller’s Business other than the Excluded Assets identified in Section 1.2, free and clear of all Encumbrances other than Permitted Encumbrances, for the consideration specified in Section 1.5 (the “Acquired Assets”). The Acquired Assets specifically include all of each Seller’s rights, title and interests in and to all: (a) tangible personal property owned by or leased to such Seller, including (i) all Equipment owned by or leased to such Seller and (ii) all inventory, supplies, consumables and disposables owned by such Seller, (b) lease and subleases for the Leased Real Estate, (c) intellectual property assets, (d) the Acquired Contracts, (e) the right to all payments received post-Closing in respect of the Receivables, (f) patient lists, records and information, to the extent legally transferrable,

-2- DM_US 190520716-12.102113.0045 (g) rights in connection with deposits, escrows and prepaid expenses, (h) claims and rights (and benefits arising therefrom) with or against all commercial vendors and suppliers, including all rights under warranties covering any Equipment or services rendered to such Seller, (i) Permits (excluding Medicare and Medicaid provider numbers and all associated PINs related to physician employees and independent contractors) and all rights thereunder, to the extent legally transferrable, (j) books and records relating to the Acquired Assets and Assumed Liabilities, including accounts receivable, inventory, maintenance and asset history records, but excluding employee medical files and attorney-client privileged information (the “Books and Records”), (k) insurance benefits, including rights, claims and proceeds related to or arising from the Acquired Assets or the Assumed Liabilities, and (l) goodwill associated with the operation of such Seller’s Business and the Acquired Assets. 1.2 Excluded Assets. Any contrary provision in this Agreement notwithstanding, the Acquired Assets will not include, and each Seller will retain, the following assets (the “Excluded Assets”): (a) such Seller’s general ledgers, corporate charters, minute and stock record books, income Tax Returns and corporate seals, (b) such Seller’s Medicare and Medicaid provider numbers, NPIs and all associated PINs related to physician employees and independent contractors, (c) legal title to all Receivables (subject to the economic rights transferred pursuant to Section 1.1(e)), (d) all cash and cash equivalents and securities, (e) all Contracts other than the Acquired Contracts, (f) all Employee Benefit Plans, (g) the assets specifically listed on Exhibit B, (h) all Tax assets (including duty and Tax refunds and prepayments) of Seller or any of its Affiliates, and (i) all of such Seller’s rights under this Agreement. 1.3 Liabilities. On the terms in this Agreement, the Purchaser hereby assumes and agrees to discharge and perform when due all Assumed Liabilities. Other than the Assumed Liabilities, the Purchaser does not assume, and will not otherwise be responsible for or bear the economic burden of, any liabilities of each Seller (including liabilities for each Seller’s Employee Benefit Plans, Taxes, Indebtedness, violations of or obligations under Law and overpayments by Third-Party Payors) (the “Excluded Liabilities”). The Seller Parties will remain responsible for all of the Excluded Liabilities. 1.4 Assignment of Contracts and Rights. Notwithstanding anything to the contrary contained in this Agreement, this Agreement shall not constitute an agreement to assign any Acquired Contract if an attempted assignment thereof, without consent of a third party thereto, would constitute a breach or other

-3- DM_US 190520716-12.102113.0045 contravention thereof or in any way adversely affect the rights of the Purchaser or each Seller thereunder. Each Seller shall use its reasonable best efforts to obtain the consent of the other parties to any such Acquired Contract for the assignment thereof to the Purchaser or any Affiliates of the Purchaser, as the Purchaser may request. Unless and until such consent is obtained, or if an attempted assignment thereof would be ineffective or would adversely affect the rights of the Purchaser or each Seller thereunder so that the Purchaser would not in fact receive all rights under such Acquired Contract, the Parties shall cooperate in an arrangement under which the Purchaser would obtain the benefits and assume the obligations thereunder in accordance with this Agreement at the Purchaser’s sole cost and expense, including subcontracting, sub- licensing, or subleasing to the Purchaser or under which each Seller would enforce, at the Purchaser expense, for the benefit of the Purchaser, any and all rights of each Seller against a third party thereto; provided, however, that no Seller nor the Purchaser or any Affiliates of the Purchaser shall be required to pay any consideration therefor. Each Seller shall promptly pay to the Purchaser when received all monies received by each Seller under any such Acquired Contracts. 1.5 Purchase Consideration. The aggregate consideration for the Acquired Assets (the “Purchase Consideration”) is: (a) an amount of cash (the “Cash Consideration”) equal to: (i) thirty two million five hundred thousand and 00/100 U.S. Dollars ($32,500,000) (the “Initial Cash Consideration”), minus (ii) the amount, if any, by which (A) each Seller’s current assets (excluding current or deferred Tax assets) as historically calculated in accordance with the Sellers’ past practices as of 12:01 A.M. Eastern time on the Closing Date that are included in the Acquired Assets, minus each Seller’s current liabilities (excluding Indebtedness, Transaction Expenses and deferred Tax Liabilities) as historically calculated in accordance with the Sellers’ past practices as of 12:01 A.M. Eastern time on the Closing Date that are included in the Assumed Liabilities (“Net Working Capital”), is less than (B) the Net Working Capital Target; plus (iii) the amount, if any, by which the Net Working Capital is more than the Net Working Capital Target. (b) the assumption of the Assumed Liabilities, to be assumed on the Closing Date. (c) Notwithstanding anything in this Agreement to the contrary, the Purchaser and Holdings shall be permitted to round down the number of any Equity Consideration Shares to be issued to the Owner pursuant to this Agreement to the nearest whole number in order to avoid issuing any fractional shares, provided that to the extent that the number of such Equity Consideration Shares is “rounded down”, the Purchaser shall also pay or cause to be paid to the Sellers an amount of cash equal to the product obtained by multiplying (i) such fraction of an Equity Consideration Share that has been rounded down by (ii) the applicable per share issuance price with respect to such Equity Consideration Shares. (d) On the Payment Date, the Purchaser and Holdings may elect to pay some or all of the Cash Consideration through Equity Consideration Shares in lieu of cash, subject to the terms set forth below; provided that at least One Million Three Hundred Thirty Five Thousand U.S. Dollars ($1,335,000) of the Cash Consideration shall be paid in cash. (e) If the Purchaser and Holdings elect to pay ten percent (10%) or less of the Cash Consideration in Equity Consideration Shares, such Equity Consideration Shares will be issued on the Payment Date by dividing the amount of Cash Consideration to be paid through Equity Consideration Shares by the Issuance Per Share Price. If the Purchaser and Holdings elect to pay more than 10% of the Cash Consideration through Equity Consideration Shares in lieu of cash, then:

-4- DM_US 190520716-12.102113.0045 (i) Twenty percent (20%) of the Equity Consideration Shares issued to the Seller Parties (the “Uncollared Equity Consideration Shares”) shall be issued on the Payment Date to the Seller Parties at the Issuance Per Share Price, as calculated by dividing twenty percent (20%) of the Cash Consideration to be paid in Equity Consideration Shares by the Issuance Per Share Price. (ii) Of the remaining eighty percent (80%) of the Equity Consideration Shares to be issued to the Seller Parties (the “Collared Equity Consideration Shares”), thirty percent (30%) of the Collared Equity Consideration Shares shall be issued on the Payment Date at the Issuance Per Share Price to the Seller Parties, as calculated by dividing twenty four percent (24%) of the Cash Consideration to be paid in Equity Consideration Shares by the Issuance Per Share Price (the “Payment Date Collared Share Value”), provided, however, that if, on the first anniversary of the Payment Date, the First Anniversary Issuance Per Share Price is less than the Issuance Per Share Price, then, for each of the Collared Equity Consideration Shares issued pursuant to this Section 1.5(e)(ii) that the Seller Parties have retained as of the first anniversary of the Payment Date (the “Retained Collared Equity Shares”), Holdings shall issue additional Collared Equity Consideration Shares (the “True-Up Equity Consideration Shares”) to the Seller Parties equal to: (1) the Retained Collared Equity Shares multiplied by the Issuance Per Share Price, divided by (2) the First Anniversary Issuance Per Share Price, minus (3) the Retained Collared Equity Shares. (iii) The remainder of the Collared Equity Consideration Shares shall be issued on the first anniversary of the Payment Date (the “First Anniversary Issuance Date”) as follows: (1) If the First Anniversary Issuance Per Share Price is less than the Issuance Per Share Price, then an amount of Collared Equity Consideration Shares issued at the Issuance Per Share Price as needed to pay the remainder of the Cash Consideration owed to the Seller Parties. (2) If the First Anniversary Issuance Per Share Price is more than the Issuance Per Share Price but less than the Issuance Per Share Price Collar, then an amount of Collared Equity Consideration Shares that would have been issued at the Issuance Per Share Price as needed to pay the remainder of the Cash Consideration owed to the Seller Parties. (3) If the First Anniversary Issuance Per Share Price is more than the Issuance Per Share Price Collar, then an amount of Collared Equity Consideration Shares issued at the First Anniversary Issuance Per Share Price as needed to pay the remainder of the Cash Consideration owed to the Seller Parties. (4) In the event that the value of the Collared Equity Consideration Shares issued pursuant to Section 1.5(e)(ii), measured at the First Anniversary Issuance Per Share Price, exceeds 90% of the amount of the Purchase Consideration paid in Equity Consideration Shares, the Purchaser shall not issue any additional Collared Equity Consideration Shares to the Seller Parties, and the Seller Parties shall repay, in either cash or Collared Equity Consideration Shares, the amount by which the value of the Collared Equity Consideration Shares issued pursuant to Section 1.5(e)(ii), measured at the First Anniversary Issuance Per Share Price, exceeds 90% of the amount of the Purchase Consideration which was designated on the Payment Date to be paid in Equity Consideration Shares. (iv) The Seller Parties shall keep the Uncollared Equity Consideration Shares in a separate and distinct brokerage account from the Collared Equity Consideration Shares until all of the Equity Consideration Shares have been sold by the Seller Parties. provided, however, that if the Class A Common Stock of Holdings is not listed on the NYSE at the First Anniversary Issuance Date, Holdings shall pay to the Sellers on the First Anniversary Issuance Date an amount in cash equal to the value of the (i) remainder of the Cash Consideration not paid on the Payment Date plus (ii) (1) if the stock remains listed on any public stock exchange, the value of the True-Up Equity Consideration Shares or (2) if the stock is no longer listed on any public stock exchange, then the cash value

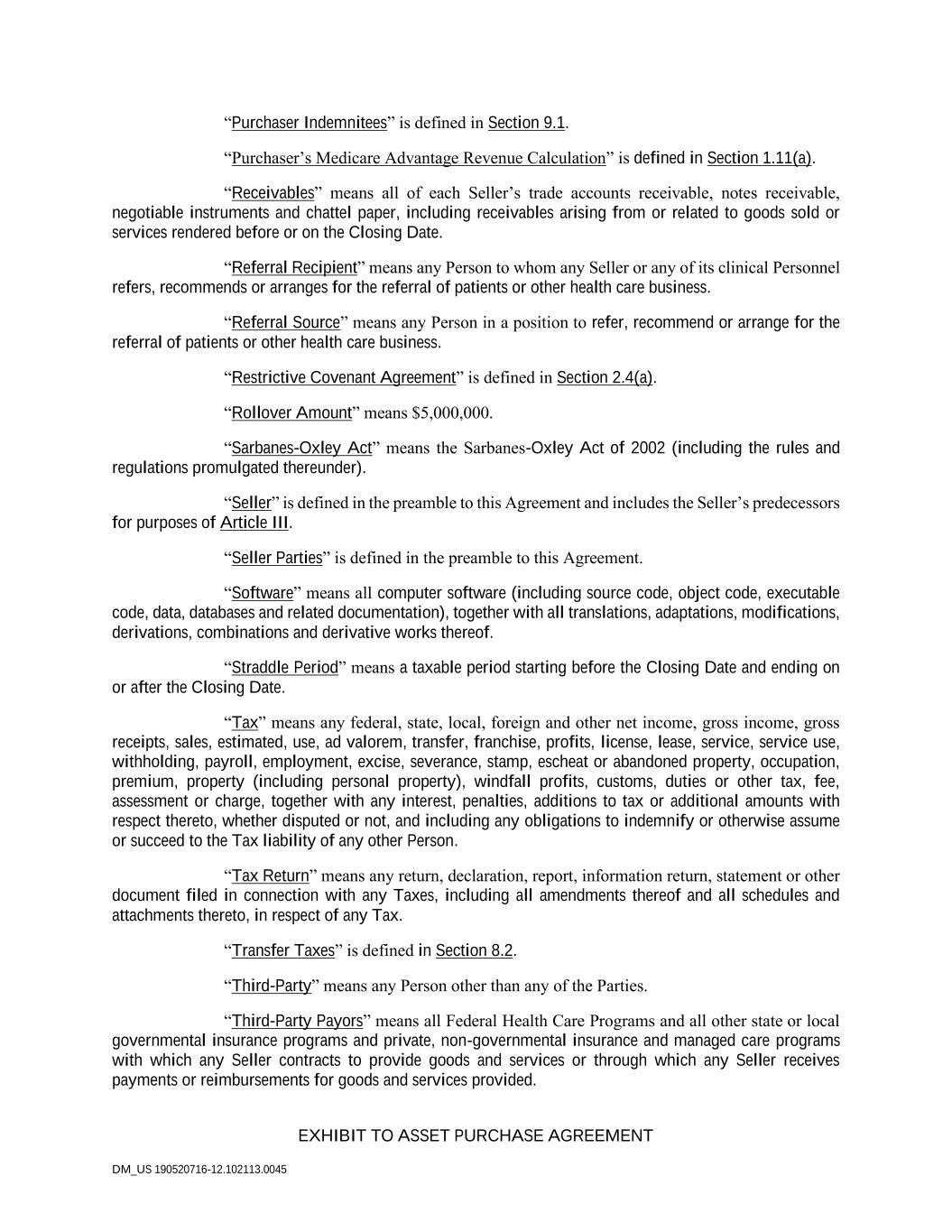

-5- DM_US 190520716-12.102113.0045 of the amount of shares that the Sellers would have received in item (1) above if the First Anniversary Issuance Per Share Price equaled the purchase price of the Class A common stock in the transaction which caused the Class A common stock to become de-listed. 1.6 Allocation of the Purchase Consideration. Within one hundred twenty (120) calendar days after the final determination of the Closing Net Working Capital in accordance with Section 1.10, the Purchaser will deliver to the Owner an allocation of the Purchase Consideration (and other amounts treated as purchase price for federal income Tax purposes) among the Acquired Assets, which shall include, for the avoidance of doubt, the Receivables (the “Purchase Consideration Allocation”). The Purchase Consideration Allocation shall be prepared in accordance with the methodology set forth in Exhibit C (the “Allocation Methodology”) for purposes of Section 1060 of the Code, the applicable Treasury regulations promulgated thereunder, and any similar provision of applicable state, local, or non-U.S. applicable law. The Purchase Consideration Allocation shall be deemed final unless the Owner notifies the Purchaser in writing that the Owner objects to one or more items reflected in the Purchase Consideration Allocation within thirty (30) days after delivery to the Owner. In the event of any objection, the Owner and the Purchaser shall negotiate in good faith to resolve such dispute in a manner consistent with the Allocation Methodology. If the Owner and the Purchaser resolve all such objections or if the Purchase Consideration Allocation is otherwise final, each Party agrees that it will (i) be bound by the Purchase Consideration Allocation for purposes of determining any Taxes, (ii) report for Tax purposes the transactions consummated pursuant to this Agreement in a manner consistent with the Purchase Consideration Allocation (including without limitation the filing of Internal Revenue Service Form 8594), and (iii) not take a position for Tax purposes that is inconsistent with the Purchase Consideration Allocation on any Tax Return or in any proceeding before any Tax authority except with the prior written consent of the other Party. The Purchaser shall timely and properly prepare, execute, file and deliver all such documents, forms and other information as the Owner may reasonably request to prepare the Purchase Consideration Allocation. In the event that the Purchase Consideration Allocation is disputed by any Tax authority in writing, the Party receiving notice of such dispute will promptly notify the other Party, provided that the failure of the Party receiving such notice of dispute to promptly notify the other Party shall not constitute a breach of this provision unless such other Party is actually prejudiced by such failure. 1.7 Estimated Closing Certificate. Prior to the Closing Date, the Seller Parties will prepare and deliver to the Purchaser a certificate (the “Estimated Closing Certificate”) signed by the Owner that contains the Seller Parties’ reasonable good faith estimate of (i) the outstanding amount of all Indebtedness as of immediately prior to the Closing (the “Closing Indebtedness”), (ii) the Transaction Expenses as of immediately prior to the Closing (the “Closing Transaction Expenses”), (iii) the Net Working Capital as of the Closing Date (the “Estimated Net Working Capital”) and, (iv) based thereon, Seller Parties’ calculation of the Closing Cash Payment. The Estimated Closing Certificate will also include wire instructions necessary to make the payments and deliveries contemplated by Section 1.9. 1.8 Payments of Purchase Price. (a) At the Closing, the Purchaser shall make or cause to be made the following payments as set forth in the Estimated Closing Certificate: (i) the Purchaser will pay the amount required to discharge in full at the Closing the Estimated Indebtedness by wire transfer of immediately available funds in accordance with the payoff letters and instructions provided pursuant to Section 2.4(j), and (ii) the Purchaser will pay the amount required to discharge in full at the Closing the Estimated Transaction Expenses by wire transfer of immediately available funds in accordance with the payment letters and instructions provided by the Seller Parties before the Closing.

-6- DM_US 190520716-12.102113.0045 (b) On the Payment Date, the Purchaser will pay the Closing Cash Payment to the Sellers, by wire transfer of immediately available funds to the bank accounts specified in the Estimated Closing Certificate, or, if paid in Equity Consideration Shares, then subject to the terms of Section 1.5, Holdings shall issue the Equity Consideration Shares to the Owner. 1.9 Net Working Capital Adjustment. (a) Purchaser’s Net Working Capital Calculation. Within ninety (90) calendar days after the Closing Date, the Purchaser will prepare and deliver to the Owner (i) a statement (the “Purchaser’s Net Working Capital Statement”) setting forth the Purchaser’s good faith calculation of the Net Working Capital as of 12:01 A.M. Eastern time on the Closing Date (the “Closing Net Working Capital”) and (ii) copies of all material working papers used by the Purchaser to calculate the Net Working Capital. For the avoidance of doubt, any amounts withheld from the Closing Cash Payment as Indebtedness shall not be double-counted as a liability for the purposes of calculating the Closing Net Working Capital. (b) Disputes Regarding the Net Working Capital Calculation. (i) Notice of Dispute. The Owner will have from the date on which the Purchaser delivers the Purchaser’s Net Working Capital Statement (the “Net Working Capital Statement Delivery Date”) until 5:00 P.M. Eastern time on the date that is thirty (30) calendar days after the Net Working Capital Statement Delivery Date (the “Net Working Capital Dispute Period”) to dispute any elements of or amounts reflected in the Purchaser’s calculation of the Closing Net Working Capital (a “Net Working Capital Dispute”) or to accept the Purchaser’s Net Working Capital Statement as final and binding on the Parties. If the Owner does not give written notice of a Net Working Capital Dispute, setting forth in reasonable detail the elements and amounts with which the Owner disagrees, (a “Net Working Capital Dispute Notice”) to the Purchaser within the Net Working Capital Dispute Period, then the Owner will be deemed to have accepted and agreed to the Purchaser’s calculation of the Closing Net Working Capital as stated in the Purchaser’s Net Working Capital Statement, and such calculation of the Closing Net Working Capital will be final and bind the Parties. If the Owner delivers a Net Working Capital Dispute Notice to the Purchaser within the Net Working Capital Dispute Period, then the Purchaser and the Owner will attempt to resolve the Net Working Capital Dispute and agree in writing upon the final amount of the Closing Net Working Capital within thirty (30) calendar days after the Purchaser’s receipt of a Net Working Capital Dispute Notice. (ii) Arbitrating Accountant. If the Purchaser and the Owner are unable to resolve the Net Working Capital Dispute within thirty (30) calendar days after the Purchaser’s receipt of a Net Working Capital Dispute Notice, then the Purchaser and the Owner will jointly engage the Arbitrating Accountant to arbitrate the Net Working Capital Dispute. The Arbitrating Accountant may only review the Net Working Capital items and calculations that are in dispute and resolve the Net Working Capital Dispute in accordance with the requirements of this Section 1.10. (iii) Dispute Resolution Mechanics. In connection with the resolution of a Net Working Capital Dispute, the Arbitrating Accountant will allow the Purchaser and the Owner to present their respective positions regarding each Net Working Capital item and calculation that is in dispute. The Arbitrating Accountant may, in its discretion, conduct a conference concerning the Net Working Capital Dispute, at which conference the Purchaser and the Owner may present additional documents, materials and other information and have present their respective advisors, counsel and accountants. In connection with the resolution of a Net Working Capital Dispute, there may be no other hearings or oral examinations, testimony, depositions, discovery or other similar proceedings. The Parties will make available to each other and the Arbitrating Accountant all relevant documents, books, records, work papers, facilities, personnel and other information that the Arbitrating Accountant reasonably requests to review the calculations of Net Working Capital presented by the Purchaser and the Owner and resolve the Net Working Capital Dispute.

-7- DM_US 190520716-12.102113.0045 (c) Resolution of Dispute. As promptly as possible, and in any event within thirty (30) calendar days after the date of its appointment, the Arbitrating Accountant will render its decision on the Net Working Capital Dispute in writing to the Purchaser and the Owner, reflecting its decision with respect to each disputed Net Working Capital item and calculation. In rendering its decision, the Arbitrating Accountant may not assign a value to any item that exceeds the greater of the value asserted in good faith by the Purchaser and the value asserted in good faith by the Owner or that is less than the lesser of the value asserted in good faith by the Purchaser and the value asserted in good faith by the Owner. The Arbitrating Accountant’s determination may not be based on its independent review, but solely on presentations by the Purchaser and the Owner or their respective representatives. The Arbitrating Accountant’s calculation of the Net Working Capital will, except in the event of fraud or to the extent of any mathematical error, be final and bind the Parties and judgment may be entered on the award. The costs and fees related to such determination by the Arbitrating Accountant, including the costs relating to any negotiations with the Arbitrating Accountant with respect to the terms and conditions of such Arbitrating Accountant’s engagement, will be paid by the Purchaser and the Sellers on an inversely proportional basis, based upon the relative portions of the Net Working Capital Dispute that have been submitted to the Arbitrating Accountant for resolution that ultimately are awarded in favor of the Purchaser and the Seller Parties (e.g., if $100,000 is in dispute, and of that amount the Arbitrating Accountant awards $75,000 in favor of the Purchaser and $25,000 in favor of the Seller Parties, then the Purchaser will be responsible for 25%, and the Seller Parties, 75%, of the costs and fees). The Parties will otherwise pay their own respective expenses. (d) Adjustments to the Cash Consideration. Within five (5) Business Days after final determination of the Closing Net Working Capital in accordance with this Agreement, the Cash Consideration will be adjusted as follows: (i) if the Estimated Net Working Capital, as finally determined, is less than the Closing Net Working Capital (the amount of such deficit, a “Net Working Capital Shortfall”), Seller Parties will be jointly and severally liable to the Purchaser for the amount of the Net Working Capital Shortfall in excess of any set off amounts, to be paid to the Purchaser within three (3) Business Days of the final determination of the Closing Net Working Capital by a wire transfer of immediately available funds; provided, that if the Purchaser elects to pay the Cash Consideration in Equity Consideration Shares pursuant to Section 1.5(d), then payment of the Net Working Capital Shortfall to Purchaser shall first be satisfied by reducing (not below zero) any Retained Collared Equity Shares owed to Seller Parties by the dollar amount equal to the Net Working Capital Shortfall, with any remaining shortfall amount due to be paid in cash, provided that the Seller Parties shall not be required to pay any such remaining Net Working Capital Shortfall until the Seller Parties have had a reasonable opportunity to sell a portion of the Equity Consideration Shares pursuant to an effective registration statement registering for resale the Registrable Securities or Rule 144 in an amount equal to the lesser of (i) an amount sufficient to cover such remainder and (ii) all remaining Equity Consideration Shares then held by Seller Parties at the time the Net Working Capital Shortfall is determined. Purchaser acknowledges that a “reasonably opportunity”, as used in the immediately preceding sentence, will not be less than ten (10) Business Days after the final determination of the Closing Net Working Capital. Any Net Working Capital Shortfall shall be reduced by any amounts owed to Sellers but unpaid pursuant to Section 1.5(c). (ii) If the Estimated Net Working Capital, as finally determined, is more than the Closing Net Working Capital (the amount of such excess, a “Net Working Capital Excess”), then the Purchaser will be liable to the Owner for the amount of the Net Working Capital Excess. Such Net Working Capital Excess shall be paid to the Owner within three (3) Business Days of the final determination of the Closing Net Working Capital by a wire transfer of immediately available funds. 1.10 Deferred Consideration. (a) Within ninety (90) days after the first anniversary of the Closing, the Purchaser shall prepare and delivery to the Owner the Purchaser’s calculation of the First Anniversary Medicare

-8- DM_US 190520716-12.102113.0045 Advantage Revenue together with copies of all material working papers used by the Purchaser to calculate such Medicare Advantage Revenue (each such calculation a “Purchaser’s Medicare Advantage Revenue Calculation”). The Owner will have from the date on which the Purchaser delivers a Purchaser’s Medicare Advantage Revenue Calculation (the “Medicare Advantage Revenue Calculation Delivery Date”) until 5:00 P.M. Eastern time on the date that is fifteen (15) calendar days after the Medicare Advantage Revenue Calculation Delivery Date (the “Medicare Advantage Revenue Dispute Period”) to dispute any elements of or amounts reflected in the Purchaser’s calculation of Medicare Advantage Revenue for such period with reasonable explanation and evidence supporting such dispute (a “Medicare Advantage Revenue Dispute”) or to accept the Purchaser’s Medicare Advantage Revenue Calculation as final and binding on the Parties. If the Owner does not give written notice of a Medicare Advantage Revenue Dispute, setting forth in reasonable detail the elements and amounts with which the Owner disagrees, (a “Medicare Advantage Revenue Dispute Notice”) to the Purchaser within the Medicare Advantage Revenue Dispute Period, then the Owner will be deemed to have accepted and agreed to the Purchaser’s calculation of the Medicare Advantage Revenue as stated in the Purchaser’s Medicare Advantage Revenue Calculation for such period, and such calculation of the applicable Medicare Advantage Revenue will be final and bind the Parties. If the Owner delivers a Medicare Advantage Revenue Dispute Notice to the Purchaser within the Medicare Advantage Revenue Dispute Period, then the Purchaser and the Owner will attempt to resolve the Medicare Advantage Revenue Dispute and agree in writing upon the final amount of the applicable Medicare Advantage Revenue within fifteen (15) calendar days after the Purchaser’s receipt of a Medicare Advantage Revenue Dispute Notice. If the Purchaser and the Owner are unable to resolve the Medicare Advantage Revenue Dispute within fifteen (15) calendar days after the Purchaser’s receipt of a Medicare Advantage Revenue Dispute Notice, then the Purchaser and the Owner will jointly engage the Arbitrating Accountant to arbitrate the Medicare Advantage Revenue Dispute. The Arbitrating Accountant shall resolve the Medicare Advantage Revenue Dispute in accordance with the provisions of Sections 1.10(b)(ii) and (iii) and 1.10(c), substituting the words “Medicare Advantage Revenue” for “Net Working Capital” in each place such words appear in such Sections. (b) Within thirty (30) calendar days of the final determination of the First Anniversary Medicare Advantage Revenue pursuant to Section 1.10(a), in the event that the First Anniversary Medicare Advantage Revenue equals or exceeds the Baseline Medicare Advantage Revenue the Purchaser or Holdings shall pay fourteen million U.S. Dollars ($14,000,000) in cash (the “Deferred Consideration”) to the Sellers (in the same proportions as the Closing Cash Payment was paid). (c) The payment of the Deferred Consideration is subject to (i) the Owner’s continued employment in good standing at the Purchaser on the first anniversary of the Closing Date, (ii) each Seller Parties’ continued compliance with all restrictive covenants contained in each of the Transaction Documents, and (iii) the Owner’s execution and continued compliance with that certain Compliance Attestation, attached hereto as Exhibit D. The foregoing notwithstanding, if the Owner’s employment is terminated by the Purchaser without Cause (as defined in the Owner’s Employment Agreement) or with Good Reason by the Owner (as defined in the Owner’s Employment Agreement), the Owner shall have been deemed to satisfy the requirements of Section 1.10(d). (d) Notwithstanding anything in this Agreement to the contrary, the Purchaser shall not make any payments in respect of the Deferred Consideration that the Purchaser is otherwise required to make, and the Purchaser may defer such payments if there exists and is continuing a default or an event of default under any credit agreement, guarantee or other agreement existing as of the Closing Date under which Purchaser or any of its subsidiaries has borrowed money as of the Closing Date (each, a “Debt Agreement”) or if such payment would constitute a breach of, or result in a default or an event of default (with or without the giving of notice or passage of time or both) on the part of the Purchaser or any of its subsidiaries under any such Debt Agreement or would not be permitted under any applicable laws. If Purchaser is unable to make any payments in accordance with the preceding sentence, Purchaser shall make

-9- DM_US 190520716-12.102113.0045 such payments as soon as such payments are no longer a breach or default under a Debt Agreement or are permitted under applicable laws. (e) During the period commencing on the date hereof and ending on the first anniversary of the Closing Date, the Purchaser (i) shall not change the methods of accounting for the Medicare Advantage Revenue in a manner that would adversely affect the calculation of Medicare Advantage Revenue, (ii) shall maintain segregated financial records of the Medicare Advantage Revenue, and (iii) shall not take any action or omission that affects Medicare Advantage Revenue with the sole purpose of avoiding the payment of the Deferred Consideration. 1.11 Withholding. Notwithstanding any other provision in this Agreement, Purchaser and its Affiliates shall have the right to deduct and withhold any required Taxes from any payments to be made hereunder. To the extent that amounts are so withheld and paid to the appropriate taxing authority, such withheld amounts shall be treated for all purposes of this Agreement as having been delivered and paid to the applicable Seller Party or any other recipient of payment in respect of which such deduction and withholding was made. ARTICLE II CLOSING; CLOSING DELIVERIES 2.1 Time and Place of Closing. Consummation of the Contemplated Transactions (the “Closing”) will occur remotely on the date hereof (the “Closing Date”) through the exchange of electronic copies. The Closing will be effective as of 12:01 A.M. Eastern time on the Closing Date. 2.2 Closing Deliveries of the Seller Parties. At the Closing, the Seller Parties are delivering to the Purchaser: (a) a restrictive covenant agreement in the form of Exhibit E (the “Restrictive Covenant Agreement”), signed by the Seller Parties, (b) employment agreement in the form attached as Exhibit F (the “Employment Agreement”), signed by the Owner, (c) a bill of sale for the assets of the Seller in the form attached as Exhibit G (the “Bill of Sale”), signed by the Seller Parties, (d) a release, in the form attached as Exhibit H (the “Release”), signed by the Seller Parties, (e) a Management Services Agreement, in the form attached as Exhibit I (the “Management Services Agreement”), signed by the Seller Parties, (f) a side letter, in the form attached as Exhibit J (the “Side Letter”), signed by the Seller Parties, (g) copies of all consents, authorizations, Orders, approvals, filings, registrations and pre-Closing notices set forth on Schedule 2.2(k), (h) payoff letters, issued by the holders of Indebtedness to be paid off at the Closing pursuant to Section 1.9(a), issued not earlier than fifteen (15) calendar days before the Closing Date, together with wire transfer instructions and the agreement of such Indebtedness holders to release all Encumbrances held by such Persons in the Acquired Assets, and authorizing the filing of UCC-3 termination statements and equivalent Encumbrance termination filings in all applicable non-UCC jurisdictions, upon receipt of the payoff amounts; provided that, for the avoidance of doubt, Sellers shall

-10- DM_US 190520716-12.102113.0045 not be required to obtain payoff letters from Anchor Bank or Seaside Bank in connection with Sellers’ lines of credit with such banks until the Payment Date, (i) certificates of existence for each Seller issued not earlier than ten (10) days before the Closing Date by the Secretary of State of the State of such Seller’s formation, (j) (i) a non-disturbance agreement from each landlord of the Leased Real Estate, as Purchaser may reasonably request, and (ii) an estoppel certificate from each landlord of the Leased Real Estate, as Purchaser may reasonably request. (k) either (i) a properly completed Internal Revenue Service Form W-9 by each Seller or (ii) a certificate of non-foreign status pursuant to Treas. Reg. § 1.1445-2(b)(2) for such Seller in a form reasonably acceptable to the Purchaser, and (l) without limitation by specific enumeration of the foregoing, all other documents reasonably required by the Purchaser from the Seller Parties to consummate the Contemplated Transactions. 2.3 Closing Deliveries of the Purchaser. At the Closing, the Purchaser is delivering to the Seller Parties: (a) the Restrictive Covenant Agreements, signed by the Purchaser, (b) the Employment Agreement, signed by the Purchaser, and (c) the Side Letter, signed by the Purchaser Parties. 2.4 Payment Date Deliveries of the Purchaser. On the Payment Date, the Purchaser is delivering to the Seller Parties: (a) that portion of the Cash Consideration deliverable to the Seller Parties pursuant to Section 1.9(d), and (b) a book entry statement by the Holdings’ transfer agent reflecting the issuance of the Equity Consideration Shares to the Owner. ARTICLE III REPRESENTATIONS AND WARRANTIES REGARDING THE SELLERS The Seller Parties represent and warrant to the Purchaser that, except as disclosed in the Schedules attached as Exhibit K (the “Disclosure Schedule”). 3.1 Organization. Each Seller is a limited liability company duly formed, validly existing and in good standing under the Laws of the jurisdiction of its formation. 3.2 Power and Authority. Each Seller has all necessary limited liability company power and authority to conduct its business as currently conducted. Each Seller has full corporate or limited liability company power and authority to enter into and perform all Transaction Documents to be executed by it pursuant to this Agreement (the “Seller Documents”) and to consummate the Contemplated Transactions. 3.3 Enforceability. The Seller Documents have been duly executed and delivered by each Seller and constitute valid and legally binding obligations of each Seller, enforceable against such Seller in accordance with their terms, except as may be limited by applicable bankruptcy, insolvency, moratorium and similar generally applicable Laws regarding creditors’ rights or by general equity principles.

-11- DM_US 190520716-12.102113.0045 3.4 Consents. Except as set forth on Schedule 3.4, no consent, authorization, Order or approval of, filing or registration with or notice to, any government authority, Third-Party Payor or other Person is required for (a) each Seller’s execution, delivery and performance of the Seller Documents or consummation of the Contemplated Transactions or (b) the Purchaser’s use of the Acquired Assets and operation of such Seller’s business immediately after the Closing as conducted by such Seller immediately before the Closing. 3.5 No Conflicts. Except as set forth on Schedule 3.5, neither the execution and delivery of the Seller Documents by the Seller Parties nor the consummation of the Contemplated Transactions by the Seller Parties will conflict with or result in a breach of any provision of each Seller’s corporate governing documents or any Law or Order to which each Seller is party or by which such Seller is bound. No Seller is a party to or bound by any Contract under which (a) the execution, delivery or performance of the Transaction Documents by the Seller Parties or consummation of the Contemplated Transactions will (i) constitute a default, breach or event of acceleration or (ii) amend, or give the counterparty thereto any right to amend, any material right or obligation of each Seller thereunder or (b) performance by the Seller Parties according to the terms of the Transaction Documents may be prohibited, prevented or delayed. 3.6 Capitalization. (i) The Owners are collectively the record and beneficial owners of all of the issued and outstanding equity securities of each Seller (other than other than ProCare Medical Management, YPH I and Care Management I), free and clear of all Encumbrances, (ii) Care Management is the record and beneficial owner of all of the issued and outstanding equity securities of ProCare Medical Management and Care Management I, and (iii) Your Partners in Health is the record and beneficial owner of all of the issued and outstanding equity securities of YPH I, each as reflected on Schedule 3.6. There are no outstanding subscriptions, options, warrants, rights (including preemptive rights), calls, convertible securities or other agreements or commitments relating to each Seller’s issued or unissued securities. No Seller is party to and or has granted any equity appreciation, participation, phantom equity or similar rights. The rights, preferences, privileges and restrictions of each Seller’s equity securities are as stated in their respective Governing Documents. Except for the Governing Documents of each Seller, there are no voting trusts, voting agreements, proxies, equityholder agreements or other agreements that may affect the voting or Transfer of the equity securities of such Seller. 3.7 Subsidiaries. Other than as set forth on Schedule 3.6, no Seller holds or beneficially owns any direct or indirect equity securities or other interest or any subscriptions, options, warrants, rights, calls, convertible securities or other agreements or commitments for any equity securities or other interest in any Person. 3.8 Financial Statements. (a) Schedule 3.8(a) contains complete and accurate copies of the Sellers’ unaudited consolidated balance sheets, statements of income and retained earnings, statements of cash flows and notes to financial statements (together with any supplementary information thereto) as of and for the years ended December 31, 2020 and December 31, 2021 (the “Financial Statements”) and the Sellers’ unaudited consolidated balance sheet and statements of income and cash flows as of and for the 9-month period ended on September 30, 2022 (other than for Total Health and Your Partners in Health, which are as of and for the 8-month period ended on August 31, 2022) (the “Interim Financial Statements”). The Financial Statements and Interim Financial Statements fairly present in all material respects the Sellers’ consolidated financial position as of such dates and the consolidated results of the Sellers’ operations and cash flows for such periods. The Sellers’ books, accounts and records are, and have been, maintained in a manner consistent with the Sellers’ historical practice and properly reflect all transactions entered into by the Sellers. (b) No Seller has any material liabilities or Indebtedness except (i) liabilities and Indebtedness reflected in the Interim Financial Statements (ii) liabilities under existing contracts that are

-12- DM_US 190520716-12.102113.0045 not yet due and payable or liabilities incurred by the Sellers after the date of the Interim Financial Statements (none of which results from or relates to any breach of contract, breach of warranty, tort, infringement or violation of Law) or incurred as Transaction Expenses; (iii) in the ordinary course of business consistent with historical practice since the date of the Interim Financial Statements or (iv) Schedule 3.8(b). (c) Each Seller maintains a system of internal accounting controls sufficient to provide reasonable assurance that (i) transactions are executed in accordance with management’s general or specific authorizations and (ii) transactions are recorded as necessary to permit preparation of Financial Statements as historically calculated in accordance with the Sellers’ past practices. 3.9 Assets; Bank Accounts. (a) Each Seller has good and valid title to, or valid leasehold interests in, the Acquired Assets, free and clear of all Encumbrances other than Permitted Encumbrances. The Acquired Assets, taken as a whole, (i) include all of the assets used in the operation of such Seller’s businesses as currently conducted, (ii) are in good operating condition and repair (normal wear and tear excepted), suitable for the uses intended therefor, free from latent defects and (iii) have been maintained in accordance with normal industry practice. Schedule 3.9(a) lists all Equipment owned by such Seller or used in such Seller’s business. (b) All Receivables (i) are reflected in the Interim Financial Statements or arose after the date of the Interim Financial Statements, (ii) arose from bona fide arms-length transactions for the performance of services or sale of goods, and (iii) are good and collectible (or have been collected) in the ordinary course of business in accordance with their terms and at the aggregate recorded amounts thereof, using commercially reasonable collection practices (less the amount of applicable reserves for doubtful accounts and for allowances and discounts). All reserves, allowances and discounts were and are consistent with the reserves, allowances and discounts historically maintained or recorded by each Seller in the ordinary course of business. (c) Schedule 3.9(c) lists every bank account utilized by the Sellers and indicates (i) the applicable depositary institution, (ii) all authorized persons on such account, (iii) the account numbers, and (iv) whether such account serves as a lockbox for payments from patients of each Seller or its Third Party Payors (the “Bank Accounts”). 3.10 Insurance. (a) Schedule 3.10 lists all insurance policies maintained by the Seller Parties in respect of the Sellers’ business. No Seller has received written or, to any Seller’s Knowledge, other notice of termination or non-renewal of any such insurance policies. No Seller has received written or, to the Seller’s Knowledge, other notice from any insurance carrier denying or disputing any claim, the amount of any claim or the coverage of any claim made on any such insurance policy or similarly reserving rights in connection therewith. Each Seller is current in all premiums and other payments due under such insurance policies. There are no Third-Party claims or actions pending or, to Seller’s Knowledge, threatened against each Seller for which claims have been or are reasonably likely to be made against any such insurance policy. No Seller has received written or, to Seller’s Knowledge, other notice from any insurance carrier denying or disputing any claim, the amount of any claim or the coverage of any claim made on any such insurance policy or similarly reserving rights in connection therewith. (b) Each Provider currently maintains and historically has maintained (during all periods that such Provider provided services to or on behalf of each Seller) valid and collectible professional liability insurance policies, with liability limits of at least $250,000 per occurrence and $750,000 in the aggregate. There are no Third-Party claims or actions pending or, to the Seller’s Knowledge, threatened against any Provider for which coverage claims have been or are reasonably likely to be made against any

-13- DM_US 190520716-12.102113.0045 such insurance policy. To Seller’s Knowledge, no Provider has received written or, to Seller’s Knowledge, other notice from any insurance carrier denying or disputing any claim, the amount of any claim or the coverage of any claim made on any such insurance policy or similarly reserving rights in connection therewith. 3.11 Permits. (a) Each Seller has all material Permits required to conduct such Seller’s businesses as currently conducted. Schedule 3.11 lists all material Permits required to conduct such Seller’s businesses as currently conducted. All such Permits (a) have been issued or given to each Seller and no other Person and are in good standing and full force and effect and (b) constitute all material licenses, permits, registrations, accreditations, certifications, approvals and agreements and consents that are required for each Seller to conduct its business as currently conducted (including the receipt of payment or reimbursement from patients, Third-Party Payors and related fiscal intermediaries). Each Seller is operating and, since January 1, 2019, has operated in material compliance with each such issued Permit, and, to the Seller’s Knowledge, there is no basis for any government authority or other Person to allege that each Seller has not operated in material compliance with any required Permit or that any Permit held by any Seller is not in good standing. (b) Each Provider has in good standing all material Permits required for such Provider to perform such Provider’s services for each Seller and for each Seller to obtain payment or reimbursement from patients, Third-Party Payors and related fiscal intermediaries with respect to such services. 3.12 Conduct of Business. Since the date of the Interim Financial Statements, no event has occurred and no fact, circumstance or condition exists that, individually or in combination with any other event, fact, circumstance or condition, has or would reasonably be expected to have a material adverse effect on each Seller’s Business, operations, assets, liabilities or financial condition. Except as set forth on Schedule 3.12, since the date of the Interim Financial Statements, no Seller has: (a) disposed of any assets, except for (i) the sale and consumption of inventory, supplies and consumables in the ordinary course of business and (ii) the application of cash in payment of bona fide liabilities incurred in the ordinary course of business consistent with historical practice, (b) purchased any assets (i) for a cost of more than $25,000 individually or $100,000 in the aggregate or (ii) other than in the ordinary course of business consistent with historical practice, (c) entered into or terminated any Contract (i) involving more than $25,000 individually or $100,000 in the aggregate or (ii) other than in the ordinary course of business consistent with historical practice, (d) waived any right or canceled or compromised any debt or claim other than in the ordinary course of business consistent with historical practice, (e) taken any act or omitted to take any act, or permitted any act or omission to occur, that would cause a breach by such Seller of any of its Material Contracts, (f) suffered any casualty, damage, destruction, loss or interruption in use (whether or not covered by insurance) with respect to any asset or property that has or would reasonably be expected to result in a loss or liability in excess of $25,000, (g) entered into, terminated or modified any employment Contract that involves annual total compensation in excess of $50,000,

-14- DM_US 190520716-12.102113.0045 (h) increased the compensation payable to any of such Seller’s directors, limited liability company managers or equivalent governing authorities, officers or Personnel, other than ordinary course compensation increases in the ordinary course of business consistent with past practice, (i) hired or terminated any Personnel who individually have annual total compensation in excess of $50,000 or who collectively have annual total compensation in excess of $100,000, (j) made any change in accounting methods or principles or any collection or payment policy or practice, (k) (i) made or revoked any material Tax election, (ii) filed an amended Tax Return, (iii) settled or compromised any Tax claim, (iv) made or changed any material Tax accounting method, (v) initiated any voluntary Tax disclosure or Tax amnesty or similar filings with any Taxing authority, or (vii) consented to extend or waive the limitation period applicable to any claim or assessment in respect of Taxes, (l) effected any restructuring, reorganization or liquidation, or (m) entered into any Material Contract or other commitment to do any of the foregoing. 3.13 Contracts. Schedule 3.13 lists the following Contracts to which each Seller is party, specifying the name and date of, and parties to, each such Contract (collectively, the “Material Contracts”): (a) Contracts with the Third-Party Payors who, in the aggregate, accounted for more than 75% of such Seller’s billings (defined by dollar value of gross billings) during the 12-month period ending September 30, 2022, (b) Contracts with Providers, (c) Contracts for sales and marketing services, (d) Contracts with medical product, device or drug manufacturers, wholesalers, distributors and pharmacies, (e) Contracts pursuant to which any Person provides management, billing and collections or other administrative services to such Seller, (f) partnership agreements, joint venture agreements and other Contracts (however named) involving a sharing of profits, losses, costs or liabilities by such Seller and another Person, (g) Contracts providing for capital expenditures in excess of $50,000 by such Seller with unpaid expenditure commitments, (h) Contracts regarding the employment and engagement of the Personnel, including (i) employment, independent contractor, consulting and similar Contracts (excluding at-will employment agreements that are terminable without severance) and (ii) Contracts providing for bonus, severance or similar compensation awards to Personnel or agents, in each case involving compensation awards in excess of $50,000 annually, (i) Contracts with any of such Seller’s directors, limited liability company managers or equivalent governing authorities (other than such Seller’s corporate governing documents), (j) Contracts for the purchase or sale of any assets (i) other than in the ordinary course of business consistent with historical practice, (ii) containing contingent payment obligations or (iii) involving the payment of more than $100,000 in any 12-month period,

-15- DM_US 190520716-12.102113.0045 (k) Contracts affecting the ownership of, title to or use or occupancy of or any interest in real estate, including leases and subleases for the Leased Real Estate, (l) Contracts for the leasing or subleasing (as lessee, sublessee, lessor or sublessor) of personal property or intangibles involving the payment of more than $100,000 in any 12-month period, (m) Contracts restricting in any manner (i) such Seller’s right to compete with any other Person, (ii) such Seller’s right to sell to or purchase from any other Person, (iii) the right of any other Person to compete with such Seller or (iv) the ability of such other Person to employ or retain any Personnel, (n) Contracts relating to Indebtedness in excess of $100,000 in any 12-month period, (o) surety or indemnification agreements (other than ordinary course Contracts the primary purpose of which is not indemnification but may contain indemnification terms customary for such Contracts generally), (p) Contracts with Governmental Authorities, and (q) Contracts not otherwise identified above that either (i) involve consideration in excess of $100,000 in any 12-month period or (ii) have terms of more than one year and are not terminable by such Seller upon less than 30 calendar days’ notice without penalty. All Material Contracts are in full force and effect and bind the applicable Seller and, to the Seller’s Knowledge, the other parties thereto. No event has occurred or fact, circumstance or condition exists that, to the Seller’s Knowledge, with or without notice or the lapse of time, or the happening of any further event or existence of any future fact, circumstance or condition, would constitute a material breach by the applicable Seller under any Material Contract. No party to any Material Contract has repudiated or terminated such Material Contract or notified the applicable Seller in writing of its intent not to renew such Material Contract. There are no renegotiations or attempts to renegotiate (to the Seller’s Knowledge) any amount to be paid or payable to or by the applicable Seller under any Material Contract, and no Person has made a written demand for such renegotiation. No Seller has released or waived any of its rights under any Material Contract. 3.14 Employees and Independent Contractors. (a) Schedule 3.14(a)(i) lists all of the Personnel as of the date of this Agreement (including employees on temporary leave of absence), together with their respective base compensation and maximum bonus potential for the 2022 calendar year, dates of hire/engagement, positions or services (for independent contractors), full or part time status (for employees), and specific designation of those Personnel who are engaged as independent contractors. Schedule 3.14(a)(ii) identifies all Personnel who are receiving, directly or indirectly, any portion of the Purchase Consideration or are otherwise receiving any contractual or discretionary bonus, phantom equity payment or similar compensation in conjunction with the closing of the Contemplated Transactions, together with the amount of Purchase Consideration or other compensation such Persons are receiving. None of the Personnel is an undocumented alien who is not authorized for employment in the United States, and each Seller has maintained I-9 Forms for all Personnel in accordance with applicable Law. (b) Other than the Persons identified as employees on Schedule 3.14(a)(ii), there is no Person who is or should be classified as an employee of each Seller (under appliable Law, any Contract, or otherwise), and all other Persons providing services for or on behalf of each Seller are independent contractors under applicable Tax, employment, and other Laws and under applicable Contracts. No such Person or any Government Authority has made or, to each Seller’s Knowledge, threatened any claim that such Person is or should be classified as an employee of each Seller (whether under applicable Law, any Contract, or otherwise).

-16- DM_US 190520716-12.102113.0045 (c) None of the Personnel is party to, or otherwise bound by, any Contract (including any confidentiality, non-competition or proprietary rights agreement) between such Personnel and each Seller or, to each Seller’s Knowledge, any other Person that would materially and adversely affect the ability of the Purchaser and its Affiliates to conduct each Seller’s business after the Closing as currently conducted. (d) No Seller is party to or bound by a collective bargaining agreement or other Contract with any labor union or labor organization, and no such Contract is currently being negotiated or contemplated. There is no pending or, to each Seller’s Knowledge, threatened, with respect to any Personnel, (i) strike, slowdown, picketing, work stoppage or other material labor dispute, (ii) Proceeding, mediation, charge, grievance proceeding, or other claim against or affecting each Seller relating to the alleged violation of any Law pertaining to labor relations or employment matters, including any charge or complaint filed by any Personnel or union with the National Labor Relations Board, the Equal Employment Opportunity Commission, or any comparable Government Authority, (iii) union organizational activity or (iv) application for certification of a collective bargaining agent. There is no lockout of any Personnel, and no Seller is contemplating such action. (e) Each Seller has materially satisfied all legal obligations (under law, contract or otherwise) with respect to (i) overtime pay other than overtime pay for the current payroll period, (ii) wages or salaries other than wages or salaries for the current payroll period, (iii) vacation, sick leave or time off (or pay in lieu of vacation, sick leave or time off), other than vacation, sick leave or time off (or pay in lieu thereof) earned during the 12-month period immediately before the date of this Agreement and reflected in the Financial Statements or the Interim Financial Statements or arising in the ordinary course of business thereafter and included in the Net Working Capital, (iv) employment discrimination, harassment or retaliation and (v) occupational health and safety. Each Seller has made all required payments in all material respects for unemployment compensation with the appropriate Government Authorities with respect to its employees. (f) The employment of each Seller's employees is terminable at will without cost to such Seller other than reimbursements for business expenses in the ordinary course of business consistent with historical practice, payments for continuing benefits that are legally required, and payments of accrued salaries, wages, and vacation pay, sick pay, or any other paid time off that are legally required. None of each Seller’s current or former employees has a right to be rehired by such Seller before the hiring of a Person not previously employed by such Seller. (g) There has been no “mass layoff” or “plant closing” (as defined under the WARN Act) with respect to each Seller within six months before the Closing Date. Other than as set forth on Schedule 3.14(g), none of each Seller’ employees has experienced an “employment loss” (as defined under the WARN Act) with respect to each Seller within ninety (90) calendar days before the Closing Date. (h) To Seller’s Knowledge, no Seller Party has taken any action that was calculated to dissuade any Personnel from continuing to be associated with the Purchaser and its Affiliates (including each Seller) after the Closing. To Seller’s Knowledge, none of the Personnel intends to refuse an offer of employment or engagement with the Purchaser or any of its Affiliates (including each Seller) at or after the Closing if such an offer is made. 3.15 Employee Benefits. (a) Schedule 3.15(a) lists each Employee Benefit Plan. With respect to each Employee Benefit Plan, each Seller has provided to the Purchaser complete and accurate copies of (i) all documents comprising such Employee Benefit Plan (including a detailed written description for any unwritten Employee Benefit Plan), (ii) all related trust agreements, insurance contracts and other funding instruments, (iii) all related rulings, determination letters or advisory opinions of any Government

-17- DM_US 190520716-12.102113.0045 Authority, (iv) all related summary plan descriptions, summaries of material modifications, employee handbooks and other written communications, (v) the most recent related actuarial and financial reports, (vi) all Form 5500 annual reports and other reports (including any Forms PBGC-1) filed with any Government Authority within the last three years, (vii) all Voluntary Correction Program applications submitted to the IRS in the last three years under its Employee Plans Compliance Resolution System and any applications submitted to the Department of Labor within the last three years under its Voluntary Fiduciary Correction Program, (viii) copies of all coverage, non-discrimination, top-heavy and 415 testing performed for the last three years, and (ix) all related Contracts with third-party administrators, actuaries, investment managers and other service providers. (b) Each Employee Benefit Plan (and each related trust, insurance contract and fund) (i) has been maintained, funded and administered in material compliance with its terms and any applicable collective bargaining agreements and (ii) materially complies in form and operation with all applicable requirements of ERISA, the Code and other applicable Laws (including state insurance Laws). Each Seller and their ERISA Affiliates are operating and always have operated in material compliance with all requirements of COBRA. (c) All required reports and descriptions (including Form 5500 annual reports, summary annual reports and summary plan descriptions) have been timely filed and distributed with respect to each Employee Benefit Plan in accordance with the applicable requirements of ERISA and the Code. Each Employee Benefit Plan that is subject to COBRA meets the requirements of COBRA. (d) Full payment has been made of all amounts that each Seller are obligated to pay under all Employee Benefit Plans attributable to any period before the Closing. (e) With respect to each Employee Benefit Plan that is intended to meet the requirements of a “qualified plan” under Code § 401(a), (i) such Employee Benefit Plan complies with all requirements for qualification under Code § 401(a), (ii) such Employee Benefit Plan has received a favorable determination or opinion from the IRS as to such Plan’s qualification under the Code (or is entitled to rely on an opinion or advisory letter issued to a prototype sponsor to the effect that such Employee Benefit Plan is qualified as to form under the applicable requirements of the Code), and nothing has occurred since the date of such determination that could adversely affect the qualified status of such Employee Benefit Plan or any related trust and (iii) such Employee Benefit Plan has been timely amended for the requirements of all applicable Tax legislation and discretionary amendments. (f) Each Seller and their ERISA Affiliates do not sponsor, maintain, contribute to, or otherwise have any liability with respect to, any “defined benefit plan” as defined in ERISA § 3(35) or any plan that is subject to ERISA Title IV or Code § 412. (g) Each Seller and their ERISA Affiliates do not sponsor, maintain, contribute to or otherwise have any liability (including withdrawal liability as defined in ERISA § 4201) with respect to any “multi-employer plan” as defined in ERISA § 3(37). (h) Each Seller and their ERISA Affiliates do not sponsor, maintain, contribute to or otherwise have any liability with respect to any “welfare plan” as defined in ERISA § 3(1) providing continuing benefits or coverage for any participant or any beneficiary of a participant after such participant’s termination of employment, except in accordance with COBRA and at the expense of the participant or the beneficiary of the participant. (i) Other than routine benefit claims by participating employees and beneficiaries, there are no pending or, to SBC’s Knowledge, threatened claims, lawsuits, audits or other actions against any Employee Benefit Plan by any employee or beneficiary covered under any Employee Benefit Plan or otherwise involving any Employee Benefit Plan (other than routine claims for benefits).

-18- DM_US 190520716-12.102113.0045 (j) With respect to each Employee Benefit Plan, there has not occurred, and no Person is contractually bound to enter into, any “prohibited transaction” under Code § 4975(c) or ERISA § 406 that is not exempt under Code § 4975(d) or ERISA § 408. No fiduciary has any liability for breach of fiduciary duty with respect to the administration or investment of the assets of any Employee Benefit Plan. (k) No assets owned or managed by the Acquired Companies constitute “plan assets” as defined in 29 C.F.R. § 2510.3-101, and the Contemplated Transactions (including those transactions occurring after the Closing) will not constitute a “prohibited transaction” under Code § 4975(c) or ERISA § 406 that is not exempt under Code § 4975(d) or ERISA § 408. (l) Each Seller has no material liabilities by reason of any Personnel being (i) improperly permitted to participate in any Employee Benefit Plan or (ii) improperly excluded from participating in any Employee Benefit Plan. (m) Consummation of the Contemplated Transactions will not result in or satisfy a condition to the payment of compensation that would, in combination with any other payment, result in an “excess parachute payment” under Code § 280G. No Seller has any obligation to gross up any Person for taxes under Code § 4999. (n) Each Employee Benefit Plan permits the plan sponsor to amend or terminate the plan at any time, subject to the applicable filing and notice requirements under ERISA and the Code for amendment or plan termination. (o) Schedule 3.15(o) lists each Seller Contract, plan or other arrangement (whether or not written or an Employee Benefit Plan) that is a “non-qualified deferred compensation plan” subject to Code § 409A. Each such Contract, plan or other arrangement materially complies with the requirements of Code §§ 409A(a)(2)-(4) and all IRS regulations and other guidance promulgated thereunder. No non- qualified deferred compensation plan has been administered in a manner that would violate Code § 409A or the regulations or guidance thereunder or cause an excise tax to apply to payments to plan participants. No Seller has any obligation to gross up any Person for taxes under Code § 409A. 3.16 Real Estate. (a) No Seller owns any real property. (b) Schedule 3.16(b) lists all real property that is leased or subleased to each Seller as lessee or sublessee and used in the Business (the “Leased Real Estate”). All Leased Real Estate is leased or subleased to each Seller pursuant to written leases or subleases. All Leased Real Estate leases and subleases are in full force and effect, subject to proper authorization and execution by the other party thereto and the application of any bankruptcy or other creditor’s rights laws, and are listed on Schedule 3.16(b). Each Seller has provided to the Purchaser complete and accurate copies of all such leases and subleases (including all related amendments, modifications, addenda and side letters), which copies are correct and complete in all material respects. All rental and other payments under each Leased Real Estate lease or sublease that are due and payable by each Seller are current. No material default by each Seller has occurred under any Leased Real Estate lease or sublease which remains uncured and, to the Seller’s Knowledge, no material default by any other party has occurred under any Leased Real Estate lease or sublease. No event has occurred or fact, circumstance or condition exists that, with or without notice or the lapse of time, or the happening of any future event or existence of any future fact, circumstance or condition would become a default by each Seller under any Leased Real Estate lease or sublease. No security deposit or portion thereof deposited with respect to any Leased Real Estate has been applied in respect of a breach or default under the applicable lease or sublease without redeposit in full. After the Closing, each Seller will owe no brokerage commissions or finder’s fees with respect to any Leased Real Estate. Except as otherwise set forth on Schedule 3.16(b), each Seller is the sole tenant of the Leased Real Estate, does not share the Leased

-19- DM_US 190520716-12.102113.0045 Real Estate with or sublease any portion of the Leased Real Estate to any other Person and enjoys peaceful and quiet possession of the Leased Real Estate. (c) The improvements on the Leased Real Estate are in good operating condition and repair (ordinary wear and tear excepted) in all material respects. To Seller’s Knowledge, no material capital expenditures for the maintenance and/or repair of the Leased Real Estate are required or are reasonably likely to be required within one (1) year after the Closing in order to enable each Seller to continue using such Leased Real Estate in the ordinary course of business as currently conducted. (d) To Seller’s Knowledge, the Leased Real Estate and all improvements and parking located and operations conducted thereon have received all approvals of applicable Government Authorities (including Permits, all of which have been fully paid for and are in full force and effect) required in connection with the ownership, use, occupancy or operation thereof. To Seller’s Knowledge, the improvements comprising part of the Leased Real Estate and the Business conducted by each Seller thereon are not in violation of any applicable zoning or building Law, and there are no violations of any applicable zoning or building Law, including the Americans with Disabilities Act of 1990, 42 U.S.C. § 12101, relating to the Leased Real Estate that remain unresolved. To Seller’s Knowledge, the improvements comprising part of the Leased Real Estate and the Business conducted by each Seller thereon are not in violation of any use or occupancy restriction, limitation, condition or covenant of record or public utility or other easement. (e) To the Seller’s Knowledge, there are no (i) challenges or appeals pending, or, to the Seller’s Knowledge, threatened in writing regarding the amount of the Taxes on, or the assessed valuation of, the Leased Real Estate, and no Seller has entered into any special arrangements or agreements with any government authority with respect thereto, (ii) condemnation Proceedings pending or, to the Seller’s Knowledge, threatened with respect to the Leased Real Estate or (iii) outstanding options, rights of first offer, rights of first refusal or contracts to purchase any Leased Real Estate or any portion thereof. 3.17 Environmental. (a) Each Seller and its assets and businesses are and, since January 1, 2018, have been owned and operated in material compliance with all Environmental Laws and Environmental Permits. No written notice, citation, inquiry or complaint has been issued to or to Seller’s Knowledge threatened in writing against the Owner (with respect to each Seller’s Business) or any Seller in the past three (3) years alleging any violation of or liability under any Environmental Law or Environmental Permit. (b) Schedule 3.17 lists all material Environmental Permits required for the operation of each Seller’s businesses as currently conducted. Each Seller possess, and such Seller has provided the Purchaser with complete and accurate copies of, all Environmental Permits required to be listed on Schedule 3.17. (c) At the Leased Real Estate, to Seller’s Knowledge, the there are no underground storage tanks, mold contaminations or materials or equipment containing friable asbestos or polychlorinated biphenyls. There has been no generation, treatment, storage, transportation, disposal (whether on-site or off-site) or release of any hazardous materials by any Seller or, to the Seller’s Knowledge, any other Person for which the tenant of the Leased Real Estate is or may be responsible or that otherwise would reasonably be expected to give rise to any liability under applicable environmental Laws. (d) There has been no generation, treatment, storage, transportation, disposal (whether on-site or offsite) or Release of any Hazardous Materials by any Seller or its Affiliates or, to Seller’s Knowledge, any other Person for which each Seller is or may be responsible under any Environmental Law. (e) No Seller has assumed, provided an indemnity with respect to, or otherwise become subject to any liability (including any obligation for corrective or remedial action) of any other Person relating to any Environmental Law or Environmental Permit.