SUBLEASE AGREEMENT

Exhibit 10.11

THIS SUBLEASE AGREEMENT (“Sublease”) is entered into as of the 7th day of July, 2015 by and between CARDCONNECT, LLC, a Delaware limited liability company (“CardConnect”), formerly known as FINANCIAL TRANSACTION SERVICES, LLC, having an address of 0000 Xxxxxxxxxxx Xxxxx, 0xx Xxxxx, Xxxx xx Xxxxxxx, XX 00000, as sublandlord, and NABRIVA THERAPEUTICS US, INC., a Delaware corporation, having an address of 0000 Xxxxxxxxxxx Xxxxx, Xxxxx 000, Xxxx xx Xxxxxxx, XX 00000 (“Subtenant” or “Sublessee”).

RECITALS

WHEREAS, EOS at 1000 Continental, LLC, a Delaware limited liability company (“Prime Landlord”), and CardConnect (as successor-in-interest to Financial Transaction Services, LLC by virtue of the Delaware as-filed certificate of name change dated January 14, 2015, and filed on January 26, 2015 with the State of Delaware, Secretary of State, Division of Corporations) are parties to that certain Office Space Lease, dated April 6, 2012 (“Original Lease”), in which CardConnect leased certain space in the Prime Landlord’s building located at 0000 Xxxxxxxxxxx Xxxxx, Xxxx of Prussia (“Building”), as subsequently amended by First Amendment to Office Space Lease, dated June 12, 2012, as further amended by Second Amendment to Office Space Lease, dated May 1, 2013, as further amended by Third Amendment to Office Space Lease, dated June 17, 2013, and as further amended by Fourth Amendment to Office Space Lease, dated October 11, 2013 (the Original Lease, as amended by the First, Second, Third, and Fourth Amendments to Office Space Lease as aforesaid, are hereinafter collectively referred to as the “Prime Lease”).

WHEREAS, a true and correct copy of the Prime Lease, redacted only to remove reference to the precise Fixed Rent payable thereunder and certain other economic terms, is attached hereto as Exhibit A and made a part hereof and;

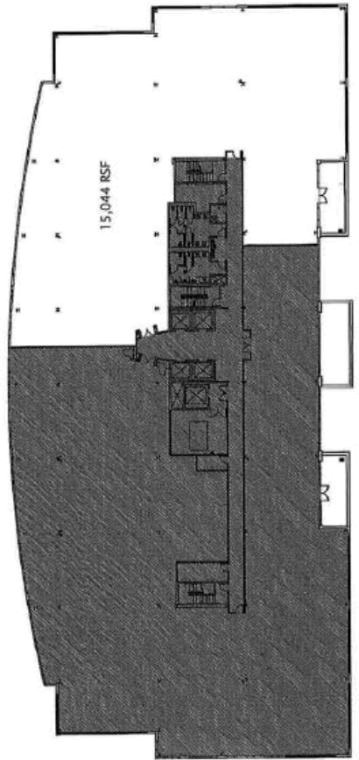

WHEREAS, pursuant to the Prime Lease, CardConnect leases, among other premises within the Building, approximately 15,044 rentable square feet located on the sixth (6th) floor of the Building and known as Suite 600 (“Subleased Premises”); and

WHEREAS, CardConnect desires to sublease to Subtenant and Subtenant desires to sublease from CardConnect, the Subleased Premises, together with the right to use all of CardConnect’s existing furniture and equipment located in the Subleased Premises (the “Office F&E”), and Subtenant desires to sublease the Subleased Premises and to use the Office F&E, all in accordance with the terms and conditions hereinafter set forth.

NOW THEREFORE, in consideration of the foregoing recitals, and for good and valuable consideration, the receipt and sufficiency of which are acknowledged, the parties hereto, intending to be legally bound, agree as follows:

1. Recitals; Defined Terms. The foregoing recitals are incorporated herein by reference. Each capitalized term used as a defined term in this Sublease but not otherwise defined in this Sublease shall have the same meaning ascribed to such term in the Prime Lease.

2. Sublease; Office F&E. CardConnect hereby subleases to Subtenant and Subtenant hereby subleases from CardConnect, the Subleased Premises in accordance with the terms and conditions herein set forth. Subtenant shall also have access to all Common Areas (as defined in the Prime Lease) made available to CardConnect by Prime Landlord for use in common under the Prime Lease, which shall include but not be limited to any parking areas, sidewalks, public hallways, bathrooms, lobby areas, elevators, stairs and other areas used in common by CardConnect and other tenants in the Building. Subtenant shall also have the non-exclusive right, at no additional cost, to utilize up to 3.35 unreserved parking spaces within the parking areas at the Property for each 1,000 rentable square feet within the Subleased Premises. In addition, Subtenant has the right to use CardConnect’s Office F&E located at the Subleased Premises on an as-is basis, an inventory of which is attached hereto as Exhibit B and made a part hereof. Should Subtenant complete the Term of this Sublease through December 15, 2023, without having exercised its option to terminate pursuant to Section 3(a) below and without any default having occurred, then upon the expiration of this Sublease, the Office F&E shall become the sole and exclusive property of Subtenant and, upon Subtenant’s request, CardConnect shall provide Subtenant with an executed Xxxx of Sale for such Office F&E. Subtenant is taking the Subleased Premises in its “As-Is, Where-Is” condition. The Subleased Premises shall be delivered to Subtenant in

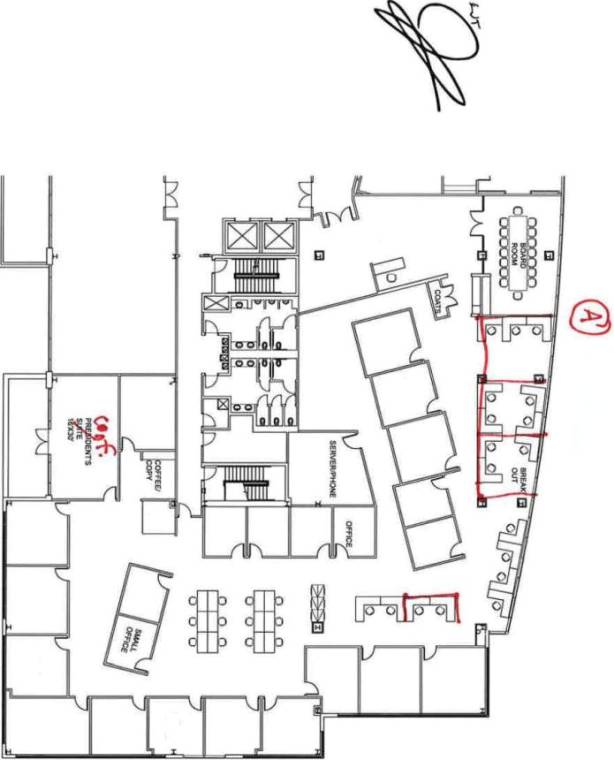

broom clean condition and vacant, except for the Office F&E. Subject to obtaining the Prime Landlord’s written consent (which Sublandlord shall make commercially reasonable efforts to obtain) Subtenant, and subject to complying with the terms and conditions of the Prime Lease, at Subtenant’s sole cost and expense, shall have the right to install the three (3) office partitions in the Subleased Premises as shown on Exhibit C attached hereto and made a part hereof (collectively, “Subtenant Improvements”).

3. Term. The term of this Sublease shall commence on the earlier of (i) Subtenant’s occupancy of the Subleased Premises for the conduct its business or (ii) fourteen (14) days after CardConnect vacates the Subleased Premises and delivers possession of the Subleased Premises to Subtenant (the “Sublease Commencement Date”) but in no event later than November 1, 2015, subject to the satisfaction of the conditions prior to such date that CardConnect and Subtenant shall have executed this Sublease and CardConnect shall have received the written consent of Prime Landlord to this Sublease (“Prime Landlord’s Consent”) and, unless sooner terminated as a result of a default by Subtenant, this Sublease shall continue until December 15, 2023 (the “Term”), provided, in no event shall the Term extend beyond December 30, 2023, with the parties acknowledging that the expiration date of the Prime Lease is December 31, 2023 with respect to the Subleased Premises. Subtenant shall have no right to renew this Sublease and CardConnect shall not be obligated to exercise any renewal rights it may now have or hereafter be entitled to under the Prime Lease. In the event that CardConnect shall, for any reason, fail to deliver possession of the Premises in the condition required by this Sublease on or before November 30, 2015, Subtenant shall have the right to terminate this Sublease upon five (5) days written notice to CardConnect at any time thereafter until the Sublease Commencement Date occurs, and in the event of such termination, neither party hereto shall have any further rights, liabilities or obligations hereunder except that CardConnect shall forthwith return to Subtenant any Rent (hereinafter defined) previously paid under this Sublease, including any Security Deposit.

| a. | Surrender |

(i) Upon the expiration or termination of the Term, Subtenant shall quit and surrender the Subleased Premises broom clean and in the same condition, order and repair as they were in at the Sublease Commencement Date, reasonable wear and tear, damage by casualty or condemnation and repairs that are the obligation of Prime Landlord and CardConnect excepted.

(ii) Without limiting the foregoing, and in addition to the foregoing, if the Prime Landlord requires any alterations or improvements performed by Subtenant during the Sublease Term other than the Subtenant Improvements (which shall not be required to be removed) to be removed, such requirement to be disclosed no less than thirty (30) days prior to end of the Sublease Term, then Subtenant shall remove the same, at Subtenant’s sole cost and expense, prior to the expiration or termination of this Sublease. Notwithstanding anything herein to the contrary, Subtenant shall not be responsible for any removal or restoration of any improvements or changes made by or on behalf of CardConnect prior to the Sublease Commencement Date.

(iii) Section 28 of the Prime Lease regarding holdover is incorporated by reference herein and made a part hereof and shall apply to this Sublease such that references to “Landlord” in such Section 28 for purposes of this Sublease shall mean “CardConnect” and references to “Tenant” in such Section 28 for purposes of this Sublease shall mean “Subtenant.”

| b. | Termination Option. |

(i) So long as no sums due hereunder remain outstanding and provided there shall not have occurred an Event of Default (as hereinafter defined) which remains uncured under this Sublease, Subtenant shall have the right to terminate this Sublease at the expiration of the forty-eighth (48th) month of the Term upon six (6) months’ prior written notice to CardConnect (i.e., such written notice must be received by CardConnect at least six months prior to the expiration of the 48th month of the Term), in which case Subtenant shall owe to CardConnect (in addition to all Rent (as hereinafter defined) through the last day of the term as so earlier ended) an early termination fee of One Hundred and Thirty Thousand and 00/100 Dollars ($130,000.00), which shall be due and payable at the time of giving of Subtenant’s written notice to terminate.

2

(ii) So long as no sums due hereunder remain outstanding and provided there shall not have occurred an Event of Default (as hereinafter defined) which remains uncured under this Sublease, Subtenant shall have the right to terminate this Sublease at the expiration of the sixty-sixth (66th) month of the Term upon six (6) months’ prior written notice to CardConnect (i.e., such written notice must be received by Card Connect at least six months prior to the expiration of the 66th month of the Term), in which case Subtenant shall owe to CardConnect (in addition to all Rent through the last day of the term as so earlier ended) an early termination fee of Eighty-Eight Thousand and 00/100 Dollars ($88,000.00), which shall be due and payable at the time of Subtenant’s written notice to terminate.

(iii) In the event Subtenant exercises its early termination right set forth in either Sections 3(a)(i) or 3(a)(ii) above, this Sublease shall terminate on the respective termination date as though such date were the date originally set forth in this Sublease as its expiration date and the Office F&E shall remain the sole and exclusive property of CardConnect and such Office F&E, in its “As-Is, Where-Is” condition, shall remain at the Subleased Premises after Subtenant vacates same.

4. Rent.

a. Base Rent. Commencing on the Sublease Commencement Date, Subtenant shall pay to CardConnect as annual rent for use of the Subleased Premises the sum set forth below for the period covered payable in equal monthly installments as set forth below on the 1st day of each month throughout the Term (the “Base Rent”).

| Sublease Period |

Square Footage | Rent per Square Foot |

Annual Rent | Monthly Rent | ||||||||||||

| Sublease Commencement Date to 7/31/16 | 15,044 | $ | 31.50 | $ | 39,490.50 | |||||||||||

| 8/1/16 - 7/31/17 |

15,044 | $ | 32.00 | $ | 481,407.96 | $ | 40,117.33 | |||||||||

| 8/1/17 - 7/31/18 |

15,044 | $ | 32.50 | $ | 488,930.04 | $ | 40,744.17 | |||||||||

| 8/1/18 - 7/31/19 |

15,044 | $ | 33.00 | $ | 496,452.00 | $ | 41,371.00 | |||||||||

| 8/1/19 - 7/31/20 |

15,044 | $ | 33.50 | $ | 503,973.96 | $ | 41,997.83 | |||||||||

| 8/1/20 - 7/31/21 |

15,044 | $ | 34.00 | $ | 511,496.04 | $ | 42,624.67 | |||||||||

| 8/1/21 - 7/31/22 |

15,044 | $ | 34.50 | $ | 519,018.00 | $ | 43,251.50 | |||||||||

| 8/1/22 - 7/31/23 |

15,044 | $ | 35.00 | $ | 526,539.96 | $ | 43,878.33 | |||||||||

| 8/1/23 - 12/15/23 |

15,044 | $ | 35.50 | $ | 44,505.17 | |||||||||||

b. Additional Rent. Throughout the Term, Subtenant shall be responsible for Subtenant’s pro rata share of the total excess, if any, in Operating Expenses and Real Estate Taxes (as those terms are defined in the Prime Lease) (collectively, “Additional Rent”) over the Operating Expenses and Real Estate Taxes for the base year (2013), prorated for any partial tax year within the Term. Subtenant’s pro rata share of Operating Expenses and Real Estate Taxes shall be 7.42% which is based upon the fraction, the numerator of which is the number of rentable square feet contained in the Subleased Premises and the denominator of which is 202,677, being the number of rentable square feet contained in the entire Building. Subtenant will pay Additional Rent in monthly installments on the first day of each month to be determined by reference to Prime Landlord’s billing of Tenant’s Expense Payment and Monthly Tax Payment Estimate (as defined by the Prime Lease) to CardConnect. Subtenant shall not be liable for any amounts payable to Prime Landlord arising out of CardConnect’s negligence or breach of the Prime Lease. CardConnect shall provide Subtenant with full and complete copies of Prime Landlord’s Monthly Operating Expense Estimate, annual Operating Expense Statement as well as any Tax Statements and any other real estate tax related information promptly following CardConnect’s receipt of same from Prime Landlord. Base Rent and Additional Rent are sometimes collectively referred to herein as “Rent”.

c. Partial Months. Notwithstanding the foregoing, in the event that the Sublease Commencement Date falls on any day other than the first (1st) day of a calendar month or the Term expires or terminates on a day

3

other than the last day of a calendar month, any installment of Base Rent payable pursuant to Section 4(a) above, or amount of Additional Rent due pursuant to Section 4(b) above, shall be prorated based upon the number of days that Subtenant possesses the Subleased Premises during the applicable calendar month.

d. Payment. Subtenant, without notice (except for Additional Rent), demand, deduction or set-off whatsoever, shall make payments of Rent to CardConnect at such place as CardConnect may direct in writing. Initially, Rent payments shall be sent to CardConnect at the address set forth above at the beginning of this Sublease. If any installment of Rent is not paid with five (5) days of the date due thereof, CardConnect may charge interest in the same amount, manner and terms as is set forth in Section 9 of the Prime Lease.

e. Security Deposit. Upon the execution and delivery of this Sublease, Subtenant shall deposit with CardConnect the sum of Seventy-Eight Thousand Nine Hundred Eighty-One and 00/100 Dollars ($78,981.00) equal to two (2) months’ Base Rent (the “Security Deposit”), as security for the full and faithful performance of every provision of this Sublease to be performed by Subtenant. The Security Deposit shall in no way be construed to represent prepayment of Base Rent for the last month or months of the Term. If Subtenant defaults with respect to any provision of this Sublease, CardConnect may use, apply or retain all or any part of the Security Deposit for payment of the Base Rent or any other sum in default or for the payment of any other amount which CardConnect may spend or become obligated to spend by reason of Subtenant’s default. If any portion of the Security Deposit is so used or applied, Subtenant shall, within ten (10) days after notice of the amount thereof given by CardConnect to Subtenant, deposit cash with CardConnect in an amount sufficient to restore the Security Deposit to its original amount. CardConnect shall not be required to keep the Security Deposit separate from its general funds and Subtenant shall not be entitled to interest on the Security Deposit. The Security Deposit or any balance thereof shall be returned to Subtenant within thirty (30) days of (i) the expiration of the Term, or (ii) the earlier termination of this Sublease and Subtenant’s vacation of the Sublet Premises.

5. Use of Subleased Premises; Utilities.

a. Subtenant shall use the Subleased Premises solely for general office use only and subject to all of the provisions set forth in the Prime Lease. Subtenant shall, at Subtenant’s sole cost and expense, comply with all applicable federal, state and local laws, ordinances or other regulations and shall obtain, and maintain and comply with during the Term all necessary permits or licenses applicable to Subtenant’s operations at the Subleased Premises. Subtenant shall not use or permit the use of the Subleased Premises for any purpose which would jeopardize or invalidate any insurance on the Subleased Premises or which would cause a lien to be placed on the Subleased Premises. Subtenant shall maintain the Subleased Premises in a clean and safe manner.

b. Subtenant shall not pay for utilities consumed at the Subleased Premises except (i) to the extent the same are the obligation of CardConnect under the Prime Lease in which case Subtenant shall pay the same in the manner provided in the Prime Lease, and (ii) Subtenant shall be responsible for all electricity costs of the Subleased Premises. If separately metered or sub-metered, Subtenant shall contract directly with the electricity service provider and pay all bills related thereto when due. If electricity is not so metered or sub-metered, then CardConnect shall reasonably and equitably determine the portion of Subtenant’s electricity xxxx each month and Subtenant shall pay such amount as Additional Rent within the ten (10) days after CardConnect renders a xxxx therefor and such xxxx shall include the calculation used to determine the amount due by Subtenant. Subtenant shall not be responsible for any fees or penalties resulting from CardConnect’s late payment.

6. Insurance. At Subtenant’s expense, Subtenant shall provide and keep in force during the Term the same insurance required to be kept by CardConnect under Section 10 of the Prime Lease except that each of CardConnect and Prime Landlord shall be named as an additional insured on such policies. Without limiting the foregoing, Section 10(a) of the Prime Lease is incorporated by reference herein and made a part hereof and shall apply to this Sublease such that references to “Landlord” in such Section 10(a) for purposes of this Sublease shall mean “CardConnect” and “Prime Landlord” and references to “Tenant” in such Section 10(a) for purposes of this Sublease shall mean “Subtenant.

7. Default. The provisions on Section 29 of the Prime Lease are incorporated by reference herein and made a part hereof such that references to “Tenant” in such Section 29 for purposes of this Sublease shall mean “Subtenant” and references to “Landlord” therein shall mean “CardConnect.” In furtherance of the foregoing, Subtenant shall have

4

the same cure periods as are provided to the “Tenant” in the event of a default as are set forth in Section 29 of the Prime Lease and CardConnect shall have the same rights and remedies as are provided to the “Landlord” as are set forth in Section 29 of the Prime Lease. WITHOUT LIMITING THE FOREGOING, SUBTENANT KNOWINGLY, VOLUNTARILY AND INTELLIGENTLY AGREES THAT CARDCONNECT SHALL, IN ADDITION TO ALL REMEDIES AT LAW, EQUITY AND PER THIS SECTION 7, SHALL HAVE THE REMEDY OF CONFESSION OF JUDGMENT FOR POSSESSION AS SET FORTH IN SECTION 29(b)(v) OF THE PRIME LEASE WHICH IS INCORPORATED BY REFERENCE HEREIN AND MADE A PART OF THIS SUBLEASE. Notwithstanding the foregoing, neither Subtenant nor CardConnect shall be entitled to consequential, punitive or special damages from the other party for any reason under this Sublease.

8. Indemnification. Subtenant shall indemnify, hold harmless and defend, at Subtenant’s expense, Prime Landlord and CardConnect, and each of such parties’ members, managers, officers, employees, agents, contractors and guests from and against any and all actions, claims, demands and expenses (including without limitation reasonable attorneys’ fees and costs) relating, directly or indirectly, to the use or occupancy of the Subleased Premises, the Building, or the Property by Subtenant or Subtenant’s employees, agents or invitees. CardConnect shall indemnify, hold harmless and defend, at CardConnect’s expense, Subtenant, its members, managers, officers, employees, agents, contractors and guests from and against any and all actions, claims, demands and expenses (including without limitation reasonable attorneys’ fees and costs) relating, directly or indirectly, the acts of omissions, at the Subleased Premises, the Building, or the Property of CardConnect or CardConnect’s employees, agents or invitees. This Section 8 shall survive the expiration or termination of this Sublease.

9. Recourse. Subtenant’s recovery of any judgment against CardConnect shall not exceed three (3) month’s rent.

10. Compliance with Prime Lease.

a. This Sublease (including the length of the term hereof) is subject and subordinate to all terms, covenants and conditions of the Prime Lease, except to the extent they are inapplicable or modified by the provisions of this Sublease. Except to the extent inapplicable or modified, each and every term, covenant and condition of the Prime Lease which is binding or inuring to the benefit of the landlord thereunder shall, in respect of this Sublease, bind or inure to the benefit of CardConnect, and each and every term, covenant and condition of the Prime Lease binding or inuring to the benefit of the tenant thereunder shall, in respect of this Sublease, bind or inure to the benefit of Subtenant, with the same force and effect as if such terms, covenants and conditions were completely set forth in this Sublease, and as if the words “Landlord” and “Tenant”, or words of similar import, wherever the same appear in the Prime Lease, were construed to mean, respectively, “CardConnect” and “Subtenant” as such terms are used in this Sublease, and as if the words “demised premises” or “Demised Premises” or “Premises” or words of similar import, wherever the same appear in the Prime Lease, were construed to mean “Subleased Premises” as defined in this Sublease, and as if the word “Lease”, or words of similar import, wherever the same appear in the Prime Lease were construed to mean this Sublease. Subtenant shall perform and observe and be bound by all of the terms, covenants and conditions of the Prime Lease with respect to the Subleased Premises; provided, however, that Subtenant shall have no obligation to make any payments directly to the Prime Landlord of rent, taxes, operating expenses or other amounts due by CardConnect under the Prime Lease except for utilities to the extent the same are payable by Subtenant as set forth above in Section 5. Without limiting the foregoing, the following provisions of the Prime Lease are expressly excluded from and are not incorporated into this Sublease: Basic Lease Provisions and Definition sections (H) and (J); Section 8(d), Section 12(g); Section 36; Section 42; Section 43; Section 45 and Section 46.

b. CardConnect shall not terminate the Prime Lease during the Term except in the exercise of a contractual right of termination in the instance of damage by fire or other casualty or partial or total taking, unless arrangements are made for Subtenant to occupy the Subleased Premises on economic terms comparable to those provided in this Sublease. CardConnect shall comply with all of the terms and provisions of the Prime Lease as are in full force and effect during the Term.

c. CardConnect shall not modify, amend or alter in any way any provision of the Prime Lease without the prior written consent of Subtenant, which consent shall not be unreasonably withheld, conditioned or delayed unless the modification, amendment or alteration will increase Subtenant’s obligations under this Sublease

5

or decrease Subtenant’s rights under this Sublease, in which case such consent shall be given or withheld in Subtenant’s sole discretion. Notwithstanding the foregoing, CardConnect may modify, amend or alter any provision of the Prime Lease that relates to a leased premises other than the Subleased Premises, or which relates to the Subleased Premises provided it does not reduce Subtenant’s rights or increase its obligations under the Sublease, without the prior written consent of Subtenant.

d. CardConnect and Subtenant hereby acknowledge and agree that Subtenant’s rights in and to the Subleased Premises shall be no greater than those of Tenant under the Prime Lease.

11. No Representation; Repairs. CardConnect has made no representation, either express or implied with respect to the condition of the Subleased Premises or any of the Office F&E. Notwithstanding anything to the contrary in Section 14 of the Prime Lease, it is understood and agreed that CardConnect is not under any duty to make repairs or alterations to the Subleased Premises during the Term of this Sublease and that Subtenant is taking possession of the Subleased Premises and all of the Office F&E in its “AS IS” “WITH ALL FAULTS” condition. With respect to services and repairs or the performance of other similar obligations required under the Prime Lease, CardConnect shall have no obligation with respect to the same. Subtenant shall have the right to request the same directly from Prime Landlord, and, at its sole cost and expense, to conduct such proceedings (in court or elsewhere), as may be required, to obtain from Prime Landlord any such work, services, repairs, repainting and restoration or the performance of such obligations; such proceedings may be, at Subtenant’s option, in its own name or in CardConnect name, and CardConnect agrees to cooperate and assist Subtenant in connection therewith, including if necessary requesting any consents required from Prime Landlord on Subtenant’s behalf and to execute such documents as may be reasonably required in connection therewith. CardConnect shall have no liability to Subtenant whatsoever for a failure of services, including, without limitation, any default by Prime Landlord.

12. Signage. Subtenant shall have the right to be listed in the directory for the Building and to have a sign indicating Subtenant’s name placed on the door to the Subleased Premises, subject to the terms of Section 16(d) of the Prime Lease and the review and approval of the Prime Landlord.

13. General.

a. Assignment. This Sublease shall bind and inure to the benefit of the parties hereto and to their respective heirs, personal representatives, successors and permitted assigns; provided, however, Subtenant shall not, by operation of law or otherwise, assign this Sublease or sublet all or any part of the Subleased Premises without the prior written consent of Prime Landlord in accordance with the Prime Lease, and as to CardConnect, without CardConnect’s prior written consent (not be unreasonably withheld, conditioned or delayed).

b. Severability. The invalidity of any portion hereof shall not affect the force and effect of the remaining valid provisions of this Sublease.

c. Governing Law. This Sublease shall be construed and the legal relations hereunder of the parties bound hereby will be determined, according to the internal laws of the Commonwealth of Pennsylvania.

d. Counterparts. This Sublease may be executed in several counterparts, each of which will be deemed to be an original. For purposes of the foregoing, facsimile signatures or signatures transmitted by e-mail or PDF shall have the same force and effect as original signatures.

e. Contingency. This Sublease is contingent upon CardConnect obtaining the Prime Landlord’s Consent. If CardConnect is unable to obtain the Prime Landlord’s Consent by September 30, 2015, then at any time thereafter for so long as Prime Landlord’s Consent is not obtained, either party may terminate this Sublease in which event neither party shall have any further rights or obligations one to the other neither party hereto shall have any further rights, liabilities or obligations and CardConnect shall forthwith return to Subtenant any Rent previously paid under this Sublease, including any Security Deposit.

f. Brokers. CardConnect represents to Subtenant that it has not entered into any agreement with any broker with respect to the making of this Sublease, other than its broker, Xxxxx Xxxxxx of CBRE, Inc., which shall be

6

paid a commission pursuant to a separate commission agreement between CardConnect and such broker. Subtenant represents to CardConnect that it has not entered into any agreement with any broker relative to the making of this Sublease. Each party agrees that should any claim be made against another party for any broker’s commission by reason of the acts of such party, the party upon whose acts such claim is predicated shall indemnify and hold the other party free and harmless from and against any and all liability and expenses in connection therewith.

g. Consent. Prime Landlord’s consent hereto shall not be deemed a consent to any future subletting or assignment of the Subleased Premises.

7

IN WITNESS WHEREOF, the parties hereto have set their hands as of the day and year first above written.

| CARDCONNECT, LLC | ||

| By: | /s/ Xxxx Xxxxxxxx | |

| Name: | Xxxx Xxxxxxxx | |

| Title: | CEO | |

| NABRIVA THERAPEUTICS US, INC. | ||

| By: | /s/ Xxxxx Xxxxx | |

| Name: | Xxxxx Xxxxx | |

| Title: | CEO | |

8

EXHIBIT A

OFFICE SPACE LEASE

0000 XXXXXXXXXXX XXXXX

OFFICE SPACE LEASE

for

Suite 600 at 0000 XXXXXXXXXXX XXXXX

by and between

CONTINENTAL SQUARE ASSOCIATES, L.P.

(as Landlord)

And

FINANCIAL TRANSACTION SERVICES, LLC

(as Tenant)

Date: April , 2012

TABLE OF CONTENTS

| Page | ||||||

| 1. |

Definitions |

1 | ||||

| 2. |

Premises |

1 | ||||

| 3. |

Completion of Premises |

1 | ||||

| 4. |

Commencement Date |

1 | ||||

| 5. |

Use of Premises |

1 | ||||

| 6. |

Fixed Basic Rent |

2 | ||||

| 7. |

Real Estate Taxes |

2 | ||||

| 8. |

Operating Expenses |

5 | ||||

| 9. |

Late Charge |

11 | ||||

| 10. |

Insurance |

12 | ||||

| 11. |

Repairs and Xxxxxxxxxxx |

00 | ||||

| 00. |

Utilities and Services |

15 | ||||

| 13. |

Governmental Regulations |

18 | ||||

| 14. |

Alterations, Additions and Fixtures |

18 | ||||

| 15. |

Mechanic’s Liens |

19 | ||||

| 16. |

Negative Covenants of Tenant |

20 | ||||

| 17. |

Landlord’s Right of Entry |

24 | ||||

| 18. |

Damage by Fire or Other Casualty |

24 | ||||

| 19. |

Non-Abatement of Rent |

25 | ||||

| 20. |

Indemnification |

26 | ||||

| 21. |

Eminent Domain |

26 | ||||

| 22. |

Quiet Enjoyment; Landlord Xxxxxxx |

00 | ||||

| 00. |

Rules and Regulations |

27 | ||||

| 24. |

Assignment and Sublease |

27 | ||||

| 25. |

Intentionally Omitted |

30 | ||||

| 26. |

Xxxxxxxxxxxxx |

00 | ||||

| 00. |

Curing Tenant’s Defaults |

31 | ||||

| 28. |

Surrender |

31 | ||||

| 29. |

Defaults-Remedies |

32 | ||||

| 30. |

Brokers’ Commission |

35 | ||||

| 31. |

Notices |

35 | ||||

| 32. |

Inability to Perform |

36 | ||||

| 33. |

Survival |

36 | ||||

| 34. |

Corporate Tenants |

37 | ||||

| 35. |

Waiver of Invalidity of Lease |

37 | ||||

| 36. |

Letter of Credit |

37 | ||||

| 37. |

Estoppel Certificate |

38 | ||||

| 38. |

Rights Reserved by Landlord |

38 | ||||

| 39. |

Miscellaneous |

39 | ||||

| 40. |

OFAC |

41 | ||||

| 41. |

Additional Definitions |

42 | ||||

| 42. |

Right of First Offer |

42 | ||||

| 43. |

Renewal Option |

43 | ||||

| 44. |

TENANT WAIVER |

44 | ||||

THIS LEASE is made as of the day of April, 2012 between CONTINENTAL SQUARE ASSOCIATES, L.P. (herein referred to as “Landlord”), a Pennsylvania limited partnership, and FINANCIAL TRANSACTION SERVICES, LLC (herein referred to as “Tenant”), a Delaware limited liability company.

PREAMBLE

BASIC LEASE PROVISIONS AND DEFINITIONS

In addition to other terms elsewhere defined in this Lease, the following terms whenever used in this Lease shall have only the meanings set forth in this Section, unless such meanings are expressly modified, limited or expanded elsewhere in this Lease.

| A. | ADDITIONAL RENT shall mean all sums in addition to Fixed Basic Rent payable by Tenant to Landlord or to third parties pursuant to the provisions of the Lease. |

| B. | BASE YEAR shall mean calendar year 2012. |

| C. | BROKER(S) shall mean XxXxxxx Partners, LLC and Newmark Knight Xxxxx Xxxxx Xxxx. |

| D. | BUILDING shall mean the building known as 0000 Xxxxxxxxxxx Xxxxx located on the Property. |

| E. | BUILDING HOLIDAYS shall be those holidays listed on Exhibit D. |

| F. | EXHIBITS shall be the following, attached to this Lease and incorporated in this Lease and made a part of this Lease: |

| Exhibit A |

Premises | |

| Exhibit B |

Legal Description of Property | |

| Exhibit C |

Work Letter | |

| Exhibit D |

Building Holidays | |

| Exhibit E |

Janitorial Specifications | |

| Exhibit F |

Rules and Regulations | |

| Exhibit G |

Tenant Estoppel Certificate | |

| Exhibit H |

Confirmation of Lease Term | |

| Exhibit I |

Subordination, Non-Disturbance and Attornment Agreement | |

| Exhibit J |

Sustainability Rules and Regulations | |

| Exhibit K |

Letter of Credit | |

| G. | FIXED BASIC RENT shall be calculated and payable as follows, subject to Landlord’s determination of the number of rentable square feet contained within the Premises (as provided below): |

| Months | Rentable Sq. Ft. | Rate Per Rentable Sq. Foot |

Yearly Rate |

Monthly Installment |

||||||||||||

| 1-12* |

15,044 | $ | 30.00 | $ | 451,320.00 | $ | 37,610.00 | |||||||||

| 13-24 |

15,044 | $ | 30.50 | $ | 458,842.00 | $ | 38,236.83 | |||||||||

| 25-36 |

15,044 | $ | 31.00 | $ | 466,364.00 | $ | 38,863.67 | |||||||||

| 37-48 |

15,044 | $ | 31.50 | $ | 473,886.00 | $ | 39,490.50 | |||||||||

| 49-60 |

15,044 | $ | 32.00 | $ | 481,408.00 | $ | 40,117.33 | |||||||||

| 61-72 |

15,044 | $ | 32.50 | $ | 488,930.00 | $ | 40,744.17 | |||||||||

| 73-84 |

15,044 | $ | 33.00 | $ | 496,452.00 | $ | 41,371.00 | |||||||||

| 85-96 |

15,044 | $ | 33.50 | $ | 503,974.00 | $ | 41,997.83 | |||||||||

| 97-108 |

15,044 | $ | 34.00 | $ | 511,496.00 | $ | 42,624.67 | |||||||||

| 109-120 |

15,044 | $ | 34.50 | $ | 519,018.00 | $ | 43,251.50 | |||||||||

| * | So long as Tenant is not in default hereunder, Fixed Basic Rent and Operating Expenses shall xxxxx for the first two (2) months of the Term, provided, that during such period Tenant shall be liable for the cost of utilities as provided in Section 12 of this Lease as well as the cost of janitorial services as provided in Section 8(a)(iii)(q) of this Lease incurred by Landlord with respect to the Premises, which, in the case of the janitorial costs, shall be calculated as if the costs for same for the Base Year were Zero Dollars ($0.00). |

| H. | IMPROVEMENT ALLOWANCE shall mean the sum of Forty Seven and 50/100 Dollars ($47.50) per rentable square foot of the Premises. |

| I. | LEASE YEAR shall mean, with respect to the first Lease Year, the period commencing on the Commencement Date and ending on the last day of the month which is twelve (12) consecutive full calendar months following the Commencement Date and, with respect to each Lease Year thereafter, each consecutive twelve (12) calendar month period thereafter. |

| J. | LETTER OF CREDIT shall be in the amount of Three Hundred Thousand Dollars ($300,000.00) in the form required by the Lease. The Letter of Credit shall be issued by a United States banking institution with retail banking offices in Philadelphia or Xxxxxxxxxx County in the form of Exhibit K and shall be held in accordance with Section 36 of the Lease. |

| K. | PERMITTED USE shall be general office use and for no other purpose. |

| L. | PREMISES shall be approximately 15,044 rentable square feet on the sixth floor of the Building as set forth on Exhibit A, such measurement to be subject to final determination by Landlord’s architect, using a floor factor of 18.8%, within thirty (30) days after receipt |

| and approval of final plans for the Premises; provided, that in any event, the Premises shall include such amount of space such that the Premises shall include the first patio via the space located on the eastern side of the Building that wraps around to the western side of the Building. In the event that the final plans for the Premises indicate that the square footage measurement previously used by Landlord and Tenant for such space (15,044 rentable square feet for the Premises) is in excess of or lower than the actual rentable square footage number, any payments due to Landlord from Tenant based upon the amount of rentable square feet contained in the Premises (including, without limitation, Tenant’s Proportionate Share) shall be proportionally, retroactively and prospectively reduced or increased, as appropriate, to reflect the actual number of rentable square feet. The Premises will be measured in accordance with the Standard Method for Measuring Floor Area in Office Buildings (ANSI/BOMA Z65.1-1996). |

| M. | PROPERTY shall mean the Building and the lot, tract or parcel of land on which the Building is situated and all improvements thereto as more particularly described on Exhibit B attached hereto. |

| N. | SECURITY DEPOSIT shall be the sum of $300,000 in the form of a letter of credit as same may be reduced as set forth in Section 36 of this Lease. |

| O. | TENANT’S PROPORTIONATE SHARE shall mean 7.42 percent based upon the fraction, the numerator of which is the number of rentable square feet contained within the Premises (as same may be adjusted as set forth in Paragraph K above) and the denominator of which is 202,677, being the number of rentable square feet contained in the Building. |

| P. | TERM shall mean the period of time commencing on the Commencement Date (as defined in Section 4 of the Lease) and ending on the last day of the month which is ten (10) years following the Commencement Date, unless otherwise terminated or extended pursuant to the terms of this Lease. |

For and in consideration of the covenants contained in this Lease, and upon the terms and conditions set forth in this Lease, Landlord and Tenant, intending to be legally bound, agree as follows:

1. Definitions. The definitions set forth in the preceding Preamble shall apply to the same capitalized terms appearing in this Lease. Additional definitions are contained in Section 41 and throughout this Lease.

2. Premises. Landlord hereby demises and leases the Premises to Tenant and Tenant hereby leases and takes the Premises from Landlord for the Term and upon the terms, covenants, conditions, and provisions set forth in this Lease, including the Preamble (this “Lease”). Tenant’s interest in the Premises as tenant shall include the right, in common with Landlord and other occupants of the Building, to use driveways, sidewalks, loading and parking areas, lobbies, hallways and other facilities which are located within the Property and which are designated by Landlord from time to time for the use of all of the tenants of the Building (the “Common Facilities”). Tenant, at no additional cost, shall have the non-exclusive right to utilize up to 3.35 unreserved parking spaces within the parking areas at the Property for each 1,000 rentable square feet within the Premises.

3. Completion of Premises. The Premises Work to be done to the Premises shall be completed in accordance with the Work Letter attached hereto as Exhibit C (“Premises Work” being defined in such Work Letter). Landlord shall use its commercially reasonable efforts to Substantially Complete (as defined in the Work Letter) the Premises Work on or before August 1, 2012 provided this Lease is fully executed by the parties and the Premises Plans (as defined in the Work Letter) are final on or before the dates set forth in the Work Letter (the “Target Commencement Date”). The Target Commencement Date shall be delayed for Tenant Delays (as that term is defined in the Work Letter), If the Premises Work is not Substantially Complete on or before the Target Commencement Date (as such date may be delayed as provided in the Work Letter) whether or not within Landlord’s control, Landlord shall not be subject to any liability to Tenant and no such failure to deliver the Premises by such date shall in any respect affect the validity or continuance of this Lease or any obligation of Tenant hereunder; provided, however, following the Commencement Date Tenant shall be entitled to one (1) day of abated Fixed Basic Rent for each one (1) day of delay in achieving Substantial Completion following the Target Commencement Date (as same may be delayed as provided in the Work Letter).

4. Commencement Date. The Term shall commence on the date (the “Commencement Date”) which is the first to occur of (a) the date the Premises are Substantially Completed or would have been Substantially Completed but for Tenant Delay or (b) the date on which the Premises are actually occupied by Tenant for the normal conduct of Tenant’s business with Landlord’s permission. Upon Landlord’s request, Tenant shall execute the Confirmation of Lease Term attached hereto as Exhibit H.

5. Use of Premises. Tenant shall occupy the Premises throughout the Term and shall use the same for, and only for, the Permitted Use. Tenant acknowledges that Landlord intends to operate the Building under certain LEED™ for Existing Buildings standards and may pursue LEED™ for Existing Buildings certification for the Building (“Building Certification”). Any material cost to modify or otherwise improve alter the Building’s structure or systems in order to achieve

Building Certification will be borne solely by Landlord and shall not be charged back to Tenant in any way as a Lease expense. Tenant shall comply at all times with the Sustainability Rules and Regulations established by Landlord attached hereto as Exhibit J, as same may be modified or additional sustainability rules and regulations implemented to obtain or maintain Building Certification or to reduce energy consumption or protect the environment (the “Sustainability Standards”) and shall take commercially reasonable efforts to cause its invitees, visitors, and guests to do so.

6. Fixed Basic Rent. Commencing on the Commencement Date, Tenant shall pay, throughout the Term, the annual Fixed Basic Rent in the amount specified in the Preamble, without notice or demand and without setoff or deduction (except as otherwise set forth herein), in monthly installments equal to one-twelfth of the annual Fixed Basic Rent (specified as Monthly Installments in the Preamble), in advance, on the first day of each calendar month during the Term. If the Commencement Date falls on a day other than the first day of a calendar month, the Fixed Basic Rent shall be due and payable for such month, apportioned on a per diem basis for the period between the Commencement Date and the first day of the next first full calendar month in the Term and such apportioned sum shall be paid on or before the Commencement Date.

7. Real Estate Taxes.

a. Definitions. The following terms shall be defined as hereinafter provided:

i. “Real Estate Taxes” shall mean all taxes, liens, charges, imposts and assessments of every kind and nature, ordinary or extraordinary, foreseen or unforeseen, general or special, levied, assessed or imposed by any governmental authority with respect to the Property, as well as all fees or assessments payable on account of the Property being located in any special services district. Notwithstanding the foregoing:

(1) if at any time during the Term the present system of ad valorem taxation of real property shall be changed or supplemented so that in lieu of or in addition to the ad valorem tax on real property there shall be assessed on Landlord or the Property any tax of any nature which is imposed in whole or in part, in substitution for, addition to, or in lieu of any tax which would otherwise constitute a Real Estate Tax, such tax shall be included within the term “Real Estate Taxes,” but only to the extent that the same would be payable if the Property were the only property of Landlord. Such tax may include, but shall not be limited to, a capital levy or other tax on the gross rents or gross receipts with respect to the Property, or a federal, state, county, municipal or other local income, franchise, profit, excise or similar tax, assessment, levy or charge measured by or based, in whole or in part, upon any such gross rents or gross receipts;

(2) Real Estate Taxes shall also encompass all of Landlord’s reasonable expenses, including but not limited to attorney’s fees and expenses, incurred by Landlord in any effort to minimize Real Estate Taxes whether by contesting proposed increases in assessments, applying for the benefit of any tax abatement program available for the Property, appealing the denial of any such tax abatement, or contesting any challenge to the validity of any tax abatement program or its applicability to the Property or by any other means or procedures appropriate in the circumstances; provided, however, that under no circumstances shall Landlord have any obligation to undertake any contest, appeal or other procedure to minimize Real Estate Taxes or to obtain or maintain the benefits of any tax abatement program for the Property;

(3) except as otherwise provided in Section 7(a)(i)(1) above, there shall be excluded from Real Estate Taxes (i) all of Landlord’s federal or state income, excess profit, excise, business privilege, payroll, franchise, estate, succession and inheritance taxes or capital stock tax (ii) penalties due to Landlord’s lateness or failure to pay taxes when due and (iii) transfer taxes imposed on Landlord in connection with Landlord’s sale, assignment or other transfer of ownership in the Property, including, without limitation, any realty transfer tax due in connection with any such assignment or transfer;

(4) following the Commencement Date, Real Estate Taxes should not be reduced by any rebates, credits or reductions obtained by or granted to Landlord on account of Landlord’s installation of capital improvements or processes implemented in connection with the Sustainability Standards or Building Certification unless and until Landlord has recovered all of the costs and expenses pursuant to Section 8(a)(iii)(1)(o) incurred by it in order to make such improvement or to undertake such process.

ii. “Tax Year” shall mean each calendar year, or such other period of twelve (12) months as now or hereafter may be duly adopted as the fiscal year for real estate tax purposes of the governmental unit in which the Property is located, occurring during the Term.

iii. “Tax Statement” shall mean a statement provided by Landlord, setting forth in reasonable detail: (a) the Real Estate Taxes for the Tax Year(s) (or portion thereof if less than full Tax Year(s) immediately preceding the Tax Year in which such statement is issued, (b) Tenant’s Tax Payment (defined in Section 7(b)) for such preceding Tax Year(s), prorated if only a part of a Tax Year falls within the Term; (c) the amount of payments made by Tenant on account of Tenant’s Tax Payment during such preceding Tax Year(s); (d) the amount of payments of the Monthly Tax Payment Estimate (defined in Section 7(b)(i)(1)) made to date by Tenant in the Tax Year in which the Tax Statement is issued; and (e) the Monthly Tax Payment Estimate for the Tax Year in which the Tax Statement is issued.

b. Payment of Tenant’s Tax Payment. Commencing on January 1, 2013, Tenant shall pay to Landlord, as Additional Rent hereunder, an amount equal to Tenant’s Proportionate Share of the total excess, if any, in Real Estate Taxes for such Tax Year over the Real Estate Taxes for the Base Year, prorated for any partial Tax Year within the Term (“Tenant’s Tax Payment”). Tenant shall only be responsible for Real Estate Taxes imposed for Tax Years during the Term of this Lease and any extensions, renewals, and hold-over periods hereof. For any portion of a Tax Year during the Term, Tenant’s Tax Payment shall be prorated on a per diem basis.

i. Such Tenant’s Tax Payment shall be paid in the following manner:

(1) Beginning on January 1, 2013, and continuing thereafter during each Tax Year during the Term on the first day of each month until receipt of the next Tax Statement, Tenant will pay Landlord an amount set by Landlord sufficient to pay Landlord’s estimate (reasonably based on the actual Real Estate Taxes for the preceding Tax Years (but subject to the provision of Section 7(b)(ii) below) and Landlord’s projections of any anticipated increases or decreases thereof) of

Tenant’s Tax Payment for the current Tax Year (or remaining portion thereof) (the “Monthly Tax Payment Estimate”). The Monthly Tax Payment Estimate for a period less than a full calendar month shall be duly prorated.

(2) Following the end of each Tax Year, Landlord shall furnish Tenant a Tax Statement setting forth the information described in Section 7(a)(iii) above. Within thirty (30) days following the receipt of such Tax Statement (the “Tax Expense Share Date”) Tenant shall pay to Landlord: (i) the amount by which the Tenant’s Tax Payment for the Tax Year (or portion thereof) covered by the Tax Statement exceeds the aggregate of Monthly Tax Payment Estimates paid by Tenant with respect to such Tax Year (or portion thereof); and (ii) the amount by which the Monthly Tax Payment Estimate for the current Tax Year as shown on the Tax Statement multiplied by the number of months elapsed to date in the current Tax Year (including the month in which payment is made) exceeds the aggregate amount of payments of the Monthly Tax Payment Estimate theretofore made in the Tax Year in which the Tax Statement is issued. Landlord shall diligently endeavor to furnish Tenant a Tax Statement not later than one hundred and twenty (120) days following the end of each Tax Year.

(3) On the first day of the first month following receipt by Tenant of any annual Tax Statement and continuing thereafter on the first day of each succeeding month until the issuance of the next ensuing Tax Statement, Tenant shall pay Landlord the amount of the Monthly Tax Payment Estimate shown on the Tax Statement.

(4) If on any Tax Expense Share Date Tenant’s payments of the installments of the Monthly Tax Payment Estimate for the preceding year’s Real Estate Taxes are greater than Tenant’s Tax Payment for such preceding Tax Year, Landlord shall credit Tenant with any excess, which credit may be offset by Tenant against next due installments of Rent. If the Term expires prior to the Tax Expense Share Date for the applicable Tax Year and if Tenant’s payments of Monthly Tax Payment Estimate either exceed or are less than Tenant’s Tax Payment, Landlord shall send the Tax Statement to Tenant, and an appropriate payment from Tenant to Landlord or refund from Landlord to Tenant shall be made on the Tax Expense Share Date. The provisions of this Section 7(b)(i)(4) shall remain in effect notwithstanding any termination of this Lease; provided however, that if upon termination of this Lease Tenant owes Landlord any sums under this Lease (for Rent or otherwise), Landlord shall have the right to reduce the amount of any refund due Tenant under this Section 7(b)(i)(4) against such sums owed by Tenant to Landlord.

ii. Real Estate Taxes with respect to a Tax Year which is the subject of an appeal filed by or on behalf of Landlord shall be paid on the basis of the amount reflected in the tax xxxx and shall not be adjusted until the final determination of the appeal. Upon such determination of any appeal, Landlord will notify Tenant in writing of the actual amount of Tenant’s Tax Share of the Real Estate Taxes for the year or years which were the subject of the appeal and the amount, if any, remaining due by Tenant in excess of Tenant’s estimated payments. Tenant shall pay such entire amount so due within thirty (30) days after receipt of Landlord’s notice. If the final determination of the appeal results in a reduction of the Real Estate Taxes at issue and Landlord receives a cash refund from the taxing authority on account of overpayment of Real Estate Taxes for such year, Tenant shall receive a credit against the installment of Fixed Basic Rent next coming due in the amount by which Tenant’s payments on account of Tenant’s Tax Share of such Real Estate Taxes exceeded the payments actually due for the applicable year, or if this Lease is terminated or expired, Landlord shall pay the excess payment made by Tenant within thirty (30) days of Landlord’s actual receipt of such cash refund.

iii. Any Tax Statement or other notice from Landlord pursuant to this Section 7(b) shall be deemed approved by Tenant as correct unless within sixty (60) days after the furnishing thereof, Tenant shall notify Landlord in writing that it disputes the correctness of the Tax Statement or other notice, specifying in detail the basis for such assertion. Pending the resolution of such dispute, however, Tenant shall make payments in accordance with said Tax Statement or other notice. Within the foregoing sixty (60) day period, Landlord shall make its records relating to the Real Estate Taxes and to the calculation of Tenant’s Proportionate Share thereof for the applicable Tax Year available for Tenant’s inspection at Landlord’s principal place of business or at another place reasonably designated by Landlord during normal business hours upon at least three (3) business days prior written request from Tenant to Landlord or its manager.

c. Tenant’s Personality. Tenant shall pay all taxes imposed upon Tenant’s furnishings, trade fixtures, equipment or other personal property.

8. Operating Expenses.

a. Definitions. As used in this Section 8 the following terms shall be defined as hereinafter provided:

i. “Operating Year” shall mean each calendar year, or such other period of twelve (12) months as hereafter may be adopted by Landlord as its fiscal year, occurring either in whole or in part during the Term.

ii. “Operating Expense Statement” shall mean a statement provided by Landlord, setting forth in reasonable detail: (a) the Operating Expenses for the Operating Year (or portion thereof if less than a full Operating Year) immediately preceding the Operating Year in which the statement is issued, reasonably detailed by major categories, (b) the Tenant’s Expense Payment (defined in Section 8(b)) for such preceding Operating Year, prorated if only a part of the Operating Year falls within the Term, (c) the amount of payments made by Tenant on account of the Tenant’s Expense Payment during such preceding Operating Year, (d) the amount of payments of the Monthly Operating Expense Estimate (defined in Section 8(b)(i)(1)) made to date by Tenant in the Operating Year in which the Expense Statement is issued, and (e) the Monthly Operating Expense Estimate for the Operating Year in which the Operating Expense Statement is issued.

iii. “Operating Expenses” shall mean

(1) the expenses incurred by Landlord in connection with the operation, repair, maintenance, protection and management of the Property, including by way of example rather than of limitation, the following:

(a) Wages, salaries, fees and other compensation and payments, payroll taxes, contributions to any social security, unemployment insurance, welfare, pension or similar fund and payments for other fringe benefits made to or on behalf of any and all employees of Landlord performing services rendered in connection with the operation, repair, maintenance, protection and management of the Property, including, without limitation: elevator operators; elevator starters;

window cleaners; porters; janitors; maids; miscellaneous handymen; watchmen; persons engaged in patrolling and protecting the Property; carpenters; engineers; firemen; mechanics; electricians; plumbers; landscapers; insurance risk managers; building superintendent and assistants; property manager; and clerical and administrative personnel all of which expenses shall not exceed the market rate for such services for other comparable office buildings in the area of the Building. Landlord may contract for any of the foregoing to be performed by independent contractors, in which event all sums paid to such independent contractors shall be included within Operating Expenses pursuant to Section 8(a)(iii)(1)(q) below.

(b) The cost of employee uniforms, and the cleaning, pressing and repair thereof.

(c) Cleaning costs for the Property, including the facade, windows and sidewalks, all costs for snow and rubbish removal and the costs of all labor, supplies, equipment and materials incidental to such cleaning.

(d) Premiums and other charges incurred by Landlord with respect to all insurance relating to the Property and the operation and maintenance thereof, including without limitation: all risk of physical damage or fire and extended coverage insurance; public liability insurance; elevator insurance; workmen’s compensation insurance; boiler and machinery insurance; sprinkler leakage insurance; rent insurance; and health, accident and group life insurance for employees.

(e) The cost of heat, electricity, gas, water, sewer and all other utility services, servicing the Building generally to the extent not billed directly to Tenant in accordance with Section 12(a) below.

(f) Costs incurred for operation, service, maintenance, inspection and repairs of the Property, including the heating, air-conditioning, ventilating, plumbing, electrical and elevator systems of the Building and the costs of labor, materials, supplies and equipment used in connection with all of the aforesaid items.

(g) Sales and excise taxes and the like upon any of the expenses enumerated herein.

(h) The reasonable management fees of the managing agent for the Building, which shall not be exceed 4% of the gross revenues from the Property.

(i) The cost of tools, equipment, and supplies and any replacement thereof.

(j) The cost of repainting or otherwise redecorating any part of the Building other than premises demised to tenants in the Building, and the reasonable cost of displays or decorations for the lobby, balconies and other public portions of the Property.

(k) The cost of telephone, telecopier and courier services, postage and delivery charges, office supplies, maintenance and repair of office equipment, and similar costs.

(l) The cost of licenses, permits and similar fees and charges.

(m) Auditing and accounting fees including accounting fees incurred in connection with the preparation and certification of the Tax Statements and the Operating Expense Statements.

(n) All costs incurred by Landlord to comply with governmental requirements enacted after the Commencement Date, whether federal, state or municipal, and all repairs, replacements and improvements which are appropriate for the continued operation of the Building as a first class building, including capital expenditures which under generally applied real estate accounting practice are expensed or are regarded as deferred expenses.

(o) All costs and expenses associated with the acquisition and installation of any energy or cost saving devices or alternative renewable energy devices or sources, but only to the extent of savings realized by Landlord and/or Tenant as a result of the installation and/or use of such improvements, devices or sources.

(p) Fair market rental or other reasonable costs with respect to the management office for the Building.

(q) Cost of independent contractors performing services, including, but not limited to, cleaning, janitorial, window-washing, rubbish removal, comprehensive recycling for cardboard, glass, paper, plastic and metal or such other materials as may be required from time to time by the Sustainability Standards, security, landscaping, snow and ice removal services, electrical, painting, plumbing, elevator, heating, ventilation and air conditioning maintenance and repair and all fees due such independent contractors.

(r) Legal fees with respect to the Property other than those incurred in the negotiation or enforcement of tenant leases.

(s) Capital expenditures necessitated by casualties but only to the extent of deductibles paid in connection therewith.

(t) Any and all other expenditures of Landlord which are properly expensed in accordance with generally applied real estate accounting practices consistently applied with respect to the operation, repair, maintenance, protection and management of first-class office buildings in the locality of the Building.

(u) If Landlord shall purchase any item of capital equipment or make any capital expenditure as described in Sections 8(a)(iii)(1)(n), or 8(a)(iii)(1)(o) or 8(a)(iii)(1)(s) or 8(a)(iii)(1)(t) above (jointly the “Capital Expenditures”) then the costs for same shall be amortized on a straight line basis beginning in the year of installation and continuing for the useful life thereof, but not more than ten (10) years, or such shorter time as may be hereinafter provided, with a per annum interest factor equal to the rate of Interest on the date of purchase of any Capital Expenditure. The amount of amortization for such costs shall be included in Operating Expenses for each Operating Year to which the amortization relates. Tenant agrees that the determination by Landlord’s accountants of the useful life of the subject of such Capital Expenditures shall be binding on Tenant. If Landlord shall lease such items of capital equipment, then the lease shall be included in Operating Expenses for each Operating Year in which they are incurred. Notwithstanding the foregoing, if Landlord shall effectuate savings in labor or energy related costs as a result of the installation of new devices or equipment (provided such savings do not contribute primarily to the benefit of any particular tenant), then Landlord may, in lieu of the above, elect to include up to the full amount of any such savings in each Operating Year

(beginning with the Operating Year in which the equipment is placed in service) as an Operating Expense until Landlord has recovered thereby the cost of installation of said devices or equipment and interest thereon as above provided, even if the result of such application will result in the amortization of such costs over a period shorter than the useful life of such installation; provided, the annual amortized costs do not exceed the actual cost savings realized. Landlord shall notify Tenant in writing if Landlord elects to apply such savings to the cost of such equipment and shall include a statement of the amount of such savings in the Operating Expense Statement for each applicable Operating Year. Operating Expenses shall thereafter be reduced by the amount of any previous capital expenditures included therein expensed pursuant to this Section 8(a)(iii)(1)(u) when such amortization has been completed.

(2) Operating Expenses shall be “net” and, for that purpose, shall be reduced by the amounts of any reimbursement or credit received by Landlord with respect to an item of cost that is included within Operating Expenses (other than reimbursements to Landlord by tenants of the Building pursuant to operating expense provisions of such tenants’ leases).

(3) In determining Operating Expenses for any Operating Year, including, without limitation, the Base Year, during which less than ninety five percent (95%) of the rentable area of the Building shall have been occupied by tenants receiving services which form the basis for Operating Expenses for more than thirty (30) days during such year, the variable components of the actual Operating Expenses for such year shall be increased to the amount which normally would have been incurred for such Operating Year had all such services been provided to tenants occupying ninety five percent (95%) of the Building throughout such Operating Year, including, without limitation, the Base Year, as reasonably determined by Landlord, and shall include during any year in which construction warranties or guaranties eliminate or reduce the need for service contracts on Building systems or components, the reasonable cost of such service contracts that would otherwise be required notwithstanding such construction warranties or guaranties. Notwithstanding the foregoing, in no event shall Landlord receive more than one hundred percent (100%) of the Building’s actual Operating Expenses for any Operating Year as a result of the operation of this Section 8(a)(iii)(3).

(4) Notwithstanding the provisions of Section 8(a)(iii)(1), “Operating Expenses” shall not include expenditures for any of the following:

(a) Any capital addition made to the Building except a Capital Expenditure.

(b) Repairs or other work occasioned by fire, windstorm or other insured casualty or hazard, to the extent that Landlord shall receive proceeds of such insurance.

(c) All costs incurred in procuring new tenants or negotiating or enforcing the terms of a lease with a tenant, including, without limitation leasing commissions and advertising expenses.

(d) Repairs or rebuilding necessitated by condemnation or conveyance of title in lieu thereof to the extent that Landlord receives proceeds for such repairs or rebuilding.

(e) Depreciation and amortization of the Building, other than as permitted pursuant to Section 8(a)(iii)(1)(u).

(f) Real Estate Taxes and the items excluded from Real Estate Taxes as set forth in Section 7(a)(i)(3).

(g) The salaries and benefits of executive officers of Landlord, if any.

(h) Debt service payments on any indebtedness applicable to the Property, including any mortgage debt, and any other costs associated with financing a mortgage.

(i) All costs incurred in connection with or related to Landlord’s Work in the Premises or the original construction (as distinguished from operation, repair and maintenance).

(j) All costs and expenses incurred as a result of any negligence or willful misconduct of the Landlord, its agents, servants or employees.

(k) Any items for which Landlord is reimbursed by insurance or otherwise compensated, including direct reimbursement by any other tenant or occupant (other than reimbursements to Landlord by tenants of the Building pursuant to operating expense provisions of such tenants’ leases)

(l) All costs, expenses, liabilities, fines, penalties and losses in connection with or related to Hazardous Substances (as defined herein) testing, abatement, remediation, clean-up or removal programs in the Common Facilities where such costs, expenses, liabilities, fines, penalties and/or losses are caused by the negligence or willful misconduct of Landlord or a tenant of the Property or any of their agents or employees or a third party under contract with or control of Landlord or such tenant.

iv. “Monthly Operating Expense Estimate” shall have the meaning specified in Section 8(b)(i)(1) hereof.

v. “Controllable Operating Expenses” shall mean all Operating Expenses other than Non-Controllable Operating Expenses.

vi. “Non-Controllable Operating Expenses” shall mean utility costs, snow and ice removal expenses, insurance premiums, trash removal expenses, other items the unit cost and quantity requirements of which are not susceptible to pre-negotiation by Landlord, or which are otherwise not reasonably controllable by Landlord (such as, but not limited to, increases in the minimum wage which may affect the cost of service contracts), and contracts or services which are the subject of collective bargaining agreements or which are performed by persons subject to collective bargaining agreements and the amortized costs of Capital Expenditures.

b. Tenant’s Expense Payment. Commencing on the Commencement Date, Tenant shall pay to Landlord as Additional Rent hereunder an amount equal to Tenant’s Proportionate Share of the total excess, if any, in Operating Expenses for such Operating Year over the Operating Expenses for the Base Year (“Tenant’s Expense Payment”). Tenant shall only be responsible for Operating Expenses imposed for Operating Years during the Term of this Lease and any extensions, renewals, and hold-over periods hereof. For any portion of an Operating Year less than a full twelve (12) month period occurring within the Term, Tenant’s Expense Payment shall be prorated on a per diem basis.

i. Such Tenant’s Expense Payment shall be paid in the following manner:

(1) Beginning on the Commencement Date and continuing thereafter during each Operating Year during the Term on the first day of each month until receipt of the next Operating Expense Statement, Tenant will pay Landlord an amount set by Landlord sufficient to pay Landlord’s estimate (reasonably based on the actual Operating Expenses for the preceding Operating Year and Landlord’s projections of any anticipated increases or decreases thereof) of Tenant’s Expense Payment for the current Operating Year (or remaining portion thereof) (the “Monthly Operating Expense Estimate”). The Monthly Operating Expense Estimate for a period less than a full calendar month shall be duly prorated.

(2) Following the end of each Operating Year, Landlord shall furnish Tenant an Operating Expense Statement setting forth the information described in Section 8(a)(ii) above. Within thirty (30) days following the receipt of such Operating Expense Statement (the “Expense Share Date”) Tenant shall pay to Landlord: (i) the amount by which the Tenant’s Expense Payment for the Operating Year (or portion thereof) covered by the Operating Expense Statement exceeds the aggregate of Monthly Operating Expense Estimates paid by Tenant with respect to such Operating Year (or portion thereof); and (ii) the amount by which the Monthly Operating Expense Estimate for the current Operating Year as shown on the Operating Expense Statement multiplied by the number of months elapsed to date in the current Operating Year (including the month in which payment is made) exceeds the aggregate amount of payments of the Monthly Operating Expense Estimate theretofore made in the Operating Year in which the Operating Expense Statement is issued. Landlord shall diligently endeavor to furnish Tenant an Operating Expense Statement not later than one hundred and twenty (120) days following the end of each Operating Year.

(3) On the first day of the first month following receipt by Tenant of any annual Operating Expense Statement and continuing thereafter on the first day of each succeeding month until the issuance of the next ensuing Operating Expense Statement, Tenant shall pay Landlord the amount of the Monthly Operating Expense Estimate shown on the Operating Expense Statement.

(4) If on any Expense Share Date Tenant’s payments of the installments of the Monthly Operating Expense Estimate for the preceding year’s Operating Expenses are greater than Tenant’s Expense Payment for such preceding Operating Year, Landlord shall credit Tenant with any excess, which credit may be offset by Tenant against next due installments of Rent. If the Term expires prior to the Expense Share Date for the applicable Operating Year and if Tenant’s payments of Monthly Operating Expense Estimate either exceed or are less than Tenant’s Expense Payment, Landlord shall send the Operating Expense Statement to Tenant no later than one hundred eighty (180) days following the end of an Operating Year, and an appropriate payment from Tenant to Landlord or refund from Landlord to Tenant shall be made on the Expense Share Date. The provisions of this Section 8(b)(i)(4) shall remain in effect notwithstanding any termination of this Lease; provided however, that if upon termination of this Lease Tenant owes Landlord any sums under this Lease (for Rent or otherwise), Landlord shall have the right to reduce the amount of any refund due to Tenant under this Section 8(b)(i)(4) against such sums owed by Tenant to Landlord.

c. Cam Cap. Notwithstanding any provision of this Lease to the contrary, for the calendar year commencing on January 1, 2013 and each year thereafter during the Term, Controllable Operating Expenses charged as part of Operating Expenses for any calendar year shall be subject to and limited by a cap (the “Cam Cap”), which cap shall equal the aggregate amount of all Controllable Operating Expenses that were charged as part of Operating Expenses for the prior calendar year or with respect to the Base Year were included in the determination of Operating Expenses for the Base Year, as increased by four percent (4%).

d. Tenant’s Audit Rights. Tenant shall have the right, at its expense (except as expressly set forth below), to have its “Representatives” (hereinafter defined) during normal business hours at any time within ninety (90) days following the furnishing to Tenant of the annual Operating Expense Statement, to audit Landlord’s accounting records relative to such Operating Expense Statement and applicable to the Operating Yea set forth in such Operating Expense Statement, but not with respect to prior Operating Years. If Tenant elects to so audit Landlord’s accounting records, then, unless Tenant shall take written exception to any item of Operating Expenses specifying in detail the reasons for such exception as to a particular item within ninety (90) days after Tenant’s receipt of such annual Operating Expense Statement, the Operating Expense Statement shall be considered as final and accepted by Tenant. For purposes hereof, the term “Representatives” shall mean either a nationally recognized independent certified public accounting firm licensed to do business in the Commonwealth of Pennsylvania, or another public accounting firm (or a firm who appoints a certified public accountant to handle the matter) reasonably acceptable to Landlord. Tenant shall not retain its Representatives on a contingent fee basis. Tenant and its Representative shall, at Landlord’s request, execute a reasonable confidentiality agreement in favor of Landlord prior to any such examination or audit hereunder. In the event any such audit determines that the Operating Expense Statement overstated the amount(s) payable by Tenant attributable to Operating Expenses from the actual amount so required hereunder for any calendar year by an amount in excess of five percent (5%), Landlord shall be responsible for the payment of reasonable and actual audit fees incurred by Tenant under this provision within thirty (30) days following receipt of invoice and reasonable backup documentation therefor; otherwise, Tenant shall be responsible for all such fees. Notwithstanding any exception made by Tenant, Tenant shall pay Landlord the full amount of the Operating Expenses set forth in the applicable Operating Expense Statement, subject to readjustment at such time as any such exception may be resolved (i.e., either by agreement of Landlord or by final determination of a court of competent jurisdiction) in favor of Tenant. Landlord’s books and records related to Operating Expenses and the calculation thereof shall be available for review by Tenant and/or Tenant’s Representatives at all reasonable times during normal business hours within the foregoing 90-day period, upon Tenant’s reasonable prior request therefor to Landlord.

9. Late Charge. Landlord may charge a late payment charge of three percent (3%) of any installment of Fixed Basic Rent or Additional Rent that is not paid within five (5) days of the due date thereof. Any amount due from Tenant to Landlord which is not paid when due shall bear interest (“Interest”) at an interest rate equal to the Prime Rate published from time to time in the Money Rates column of the Wall Street Journal plus 2% (or, if lower, the highest rate then allowed under the usury laws of the Commonwealth of Pennsylvania) from the date due until the date paid. The right of Landlord to charge a late charge with respect to past due installments of Fixed Basic Rent and Additional Rent is in addition to Landlord’s rights and remedies upon an Event of Default.

10. Insurance.

a. Tenant’s Insurance.

i. Tenant covenants and represents, such covenants and representations being specifically designed to induce Landlord to execute this Lease, that during the entire Term, at its sole cost and expense, Tenant shall obtain, maintain and keep in full force and effect the following insurance:

(1) “Special Form” property insurance against fire, theft, vandalism, malicious mischief, sprinkler leakage and such additional perils as are now, or hereafter may be, included in a standard extended coverage endorsement from time to time in general use in the Commonwealth of Pennsylvania upon property of every description and kind owned by Tenant and or under Tenant’s care, custody or control located within the Premises or for which Tenant is legally liable, including by way of example and not by way of limitation, furniture, fixtures, fittings, installations and any other personal property (but excluding the work done by Landlord in connection with Exhibit C which is owned by Landlord) in an amount equal to the full replacement cost thereof.

(2) Commercial General Liability Insurance coverage to include personal injury, bodily injury, broad form property damage, operations hazard, contractual liability, products and completed operations liability naming Landlord and Landlord’s mortgagee or trust deed holder and ground lessors (if any) as additional named insureds in limits of not less than [Five Million Dollars ($5,000,000.00)].

(3) Business interruption insurance in such amounts as will reimburse Tenant for direct or indirect loss of earnings attributable to all perils commonly insured against by prudent tenants or assumed by Tenant pursuant to this Lease or attributable to prevention or denial of access to the Premises or Building as a result of such perils.

(4) Workers’ Compensation insurance in form and amount as required by applicable law.