LEASE between

Exhibit 10.20

EXECUTION COPY

between

BURLINGTON CENTRE OWNER LLC, as Landlord

and

EVERBRIDGE, Inc., as Tenant

00 Xxxxxxxxx Xxxxx

Xxxxxxxxxx, Xxxxxxxxxxxxx

As of December 16, 2016

EAST\126610515.10

|

ARTICLE 1 |

GRANT |

1 |

|

|

|

|

|

ARTICLE 2 |

TERM |

2 |

|

|

|

|

|

ARTICLE 3 |

COMPLETION AND OCCUPANCY OF THE PREMISES |

3 |

|

|

|

|

|

ARTICLE 4 |

RENT AND SECURITY |

4 |

|

|

|

|

|

ARTICLE 5 |

ADDITIONAL RENT FOR ESCALATIONS IN REAL ESTATE TAXES AND OPERATING EXPENSES |

7 |

|

|

|

|

|

ARTICLE 6 |

SERVICES AND UTILITIES |

15 |

|

|

|

|

|

ARTICLE 7 |

CONDUCT OF BUSINESS BY TENANT |

18 |

|

|

|

|

|

ARTICLE 8 |

ALTERATIONS, IMPROVEMENTS AND SIGNAGE |

20 |

|

|

|

|

|

ARTICLE 9 |

INSURANCE |

24 |

|

|

|

|

|

ARTICLE 10 |

CASUALTY |

27 |

|

|

|

|

|

ARTICLE 11 |

CONDEMNATION |

28 |

|

|

|

|

|

ARTICLE 12 |

ASSIGNMENT AND SUBLETTING |

30 |

|

|

|

|

|

ARTICLE 13 |

DEFAULTS AND REMEDIES |

32 |

|

|

|

|

|

ARTICLE 14 |

SUBORDINATION; ATTORNMENT AND RIGHTS OF MORTGAGE HOLDERS |

36 |

|

|

|

|

|

ARTICLE 15 |

NOTICES |

37 |

|

|

|

|

|

ARTICLE 16 |

MISCELLANEOUS |

38 |

|

|

|

|

|

ARTICLE 17 |

EXTENSION RIGHT |

44 |

|

|

|

|

|

ARTICLE 18 |

ROOFTOP RIGHTS |

46 |

|

|

|

|

|

ARTICLE 19 |

RIGHT OF FIRST OFFER |

48 |

|

|

|

|

|

ARTICLE 20 |

EXPANSION RIGHTS |

50 |

List of Exhibits

|

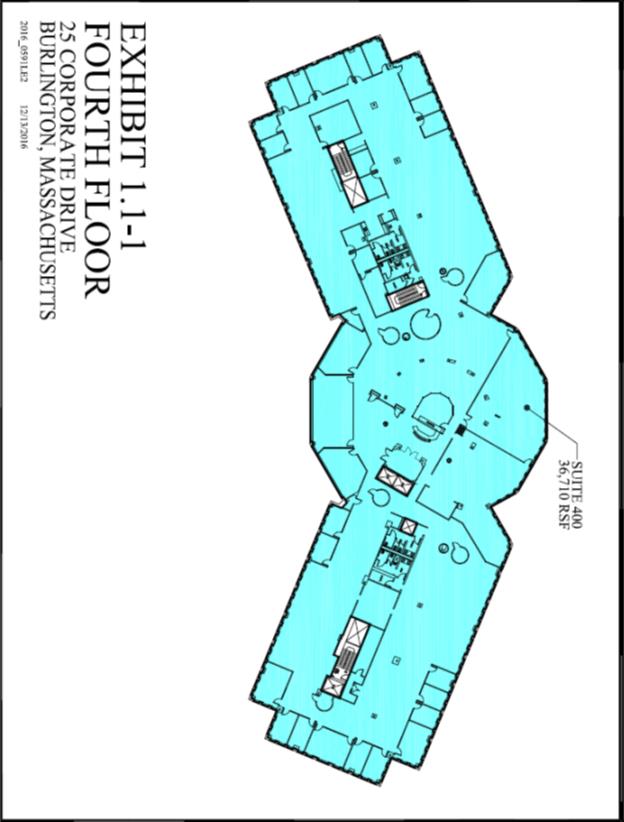

Exhibit 1.1-1 |

Plan of Premises |

|

Exhibit 1.1-2 |

Legal Description |

|

Exhibit 1.1-3 |

Commencement Date Certificate |

|

Exhibit 1.3 |

Building Parking |

|

Exhibit 3.1.1 |

Work Letter |

|

Exhibit 4.6 |

Form of Letter of Credit |

|

Exhibit 6.1 |

Cleaning Specifications |

|

Exhibit 7.4 |

Rules and Regulations |

|

Exhibit 8.9 |

Exterior Signage Location Area |

|

Exhibit 14.1 |

Form of SNDA |

|

Exhibit 14.6 |

Title Encumbrances |

|

Exhibit 16.24 |

Form of Notice of Lease |

|

Exhibit 19.7 |

Parties with Leases Containing Superior Rights to Tenant’s ROFO Right |

|

Exhibit 20.1(a) |

Expansion Premises |

This Lease is made and entered into as of December 16, 2016 (the “Effective Date”), by and between BURLINGTON CENTRE OWNER LLC, a Delaware limited liability company with its principal place of business at c/o The Xxxxx Companies, 000 Xxxx Xxxxxx, 00xx Xxxxx, Xxxxxx, Xxxxxxxxxxxxx 00000 (the “Landlord”) and everbridge, Inc., a Delaware corporation, with its principal place of business at 00 Xxxxxxxxx Xxxxx, Xxxxxxxxxx, XX 00000 (the “Tenant”).

1.1Premises. Landlord, for and in consideration of the rents herein reserved and of the covenants and agreements herein contained on the part of Tenant to be performed, hereby leases to Tenant and Tenant hereby leases from Landlord on the terms and provisions contained in the Lease, those certain two office spaces shown on Exhibit 1.1-1 attached hereto and made a part hereof (collectively, the “Premises”) containing collectively 46,132 square feet of rentable area, in the office building located at 00 Xxxxxxxxx Xxxxx, Xxxxxxxxxx, Xxxxxxxxxxxxx (the “Building”), which Building currently contains 117,879 square feet of rentable area. The Premises consists of:

(A) The premises currently occupied by Tenant on the fourth floor of the Building pursuant to a certain Sublease between Tenant and Acquia, Inc., containing 36,710 rentable square feet (the “Fourth Floor Premises“).

(B) A portion of the third floor of the Building, containing 9,422 rentable square feet of space (the “Third Floor Premises”).

The Premises, Building, the “Common Areas” (defined below) and the land upon which the same are located, which is legally described in Exhibit 1.1-2 (the “Land”), together with all other improvements thereon and thereunder are collectively referred to as the “Property.” The Property is located within the office park known as Burlington Centre Office Park (the “Park”).

1.2Common Areas. Landlord hereby grants to Tenant during the Term (as defined in Section 2.1.1) of this Lease, an appurtenant right to use, in common with the others entitled to such use, the Common Areas as they from time to time exist, subject to the rights, powers and privileges herein reserved to Landlord. The term “Common Areas” as used herein will include all areas and facilities outside the Premises that are provided and designated by Landlord for the general non-exclusive use and convenience of Tenant and other tenants. Common Areas include but are not limited to the fitness center, if any, cafeteria, if any, hallways, lobbies, stairways, elevators, pedestrian sidewalks, landscaped areas, loading areas, roadways, parking areas, rights of way, walking and jogging paths, if any. For so long as the Landlord named herein owns the Building and the office buildings located at 10, 30 and 00 Xxxxxxxxx Xxxxx, Xxxxxxxxxx, Xxxxxxxxxxxxx (together with the Building and the land upon which the same are located, “Burlington Centre”), the “Common Areas” may include areas, facilities and amenities located within Burlington Centre specifically designated by Landlord for the general non-exclusive use and convenience of Tenant and other tenants of the Building and the other buildings comprising Burlington Centre.

1.3Parking. During the Term of this Lease, at no additional cost to Tenant (other than to the extent the costs and expenses therefor are included in Operating Expenses), Tenant shall be entitled to use the parking facilities at the Property in common with other Building tenants on a “first come, first serve” basis, but such right shall be limited to 3.1 parking spaces per 1,000 rentable square feet of the Premises, as such square footage may adjust from time to time pursuant to Tenant’s rights under this Lease to expand the Premises or the Premises are otherwise expanded by amendment to this Lease. Upon the Commencement Date, Tenant shall be entitled to 143 parking spaces pursuant to such ratio. Tenant agrees not to overburden the parking facilities and agrees to cooperate with Landlord and other tenants in the use of parking facilities. Landlord may reasonably designate and allocate parking facilities at the Property for the handicapped, and visitors to the Building and may reasonably designate parking facilities at the Park for the different buildings in the Park so long as no other buildings in the Park are granted exclusive parking rights in the highlighted area shown on Exhibit 1.3, attached. Provided Tenant’s rights under this Section 1.3, and/or elsewhere in this Lease, are not materially diminished and/or adversely affected, Landlord reserves the right to relocate parking spaces and to recapture

1

EAST\126610515.10

portions of the parking facilities at any time and from time to time for necessary temporary maintenance and repairs and as may be required by mechanical, structural or code-related matters. Landlord may, at no cost to Tenant (other than to the extent the costs and expenses therefor are included in Operating Expenses), (i) install parking signage, (ii) implement a pass, sticker or other access control system to control parking use, and (iii) employ valet parking on a temporary basis to meet the requirements of this Section. To the extent applicable to Tenant’s use of the parking spaces, the provisions of this Lease shall apply, including rules and regulations of general applicability from time to time promulgated in writing by Landlord. and delivered to Tenant and other tenants of the Building. Landlord shall not be responsible for money, jewelry, automobiles or other personal property lost in or stolen from the parking facilities, or for any loss, injury or damage to persons using the parking lot or automobiles or other property thereon, it being agreed that, to the fullest extent permitted by law, the use of the parking facilities and the parking spaces shall be at the sole risk of Tenant and its employees.

1.4Condition of Third Floor Premises Upon Delivery by Landlord. Notwithstanding anything to the contrary contained in this Lease either expressed or implied, Landlord covenants to Tenant that the Third Floor Premises shall be delivered to Tenant in its then “as is” condition, and (1) in a structurally sound condition; (2) with existing heating, ventilating and/or air-conditioning systems in good working condition; (3) free of any and all leaks and broken glass; (4) free of personal property of Landlord or Landlord's agent and/or other tenants or occupants; (5) free of all occupants and/or tenants; (6) free of all signs other than Tenant's signs; and (7) free of all Hazardous Substances (as defined below) in violation of Applicable Laws, including but not limited to, asbestos and PCBs (Landlord warranting to remove all such Hazardous Substances (as defined below) from the Third Floor Premises, at Landlord's sole cost and expense and in compliance with all applicable Laws, prior to the date of delivery of possession of the Third Floor Premises); and (8) in compliance with all building, municipal, county, state, environmental and federal laws, ordinances, codes and regulations governing and regulating the existing construction in the Third Floor Premises prior to the acceptance of the Third Floor Premises by Tenant on the earlier to occur of: (a) the Third Floor Premises Commencement Date (as defined below) or (b) the Early Access Date (as defined in Exhibit 3.1.1).

2.1Lease Term.

2.1.1Commencement Date; Term. The Fourth Floor Premises are leased for the period (the “Initial Term”) commencing on June 1, 2017 (the “Commencement Date”) and ending on May 31, 2022 (the “Expiration Date”), unless sooner terminated or extended as herein provided. The Third Floor Premises shall be leased for the period commencing on the earlier of (i) June 1, 2017 and (ii) the date that Tenant occupies the Third Floor Premises for the conduct of its business (the “Third Floor Premises Commencement Date”), and ending on the Expiration Date. The Initial Term hereof, as it may be extended, is referred to herein as the “Term”. Tenant acknowledges that it currently occupies the Fourth Floor Premises pursuant to a sublease agreement ending on May 31, 2017.

2.1.3Confirmatory Amendment. When the Third Floor Premises Commencement Date has been determined in accordance with the provisions set forth in this Lease, the parties hereto shall execute a document setting forth said date and said document shall be deemed a supplement to and part of this Lease. The parties hereto agree to execute such confirmatory document not later than forty five (45) days following the determination of such date (i.e., meaning the Third Floor Premises Commencement Date).

2.2Holding Over.

2.2.1Tenant shall have the one-time right to retain occupancy of the Premises for a period designated by Tenant in its Holdover Notice (as defined below) following the expiration of the Term, but in any event not to exceed thirty (30) days; provided that (i) no monetary or material non-monetary Event of Default has occurred and is continuing, and (ii) Tenant shall have delivered written notice (a “Holdover Notice”) to Landlord of Tenant’s intention to hold over at least six (6) months prior to the expiration of the Term (a “Permitted Holdover”). In the event that Tenant retains occupancy of the Premises, or any part thereof, after the end of the Term, and

-2-

EAST\126610515.10

the conditions in clauses (i) and (ii) above have not been satisfied, or if Tenant retains occupancy of the Premises beyond the period of a Permitted Holdover (in either case, an “Unpermitted Holdover”), Tenant's occupancy of the Premises shall be as a tenant at sufferance terminable at any time by Landlord. Tenant’s occupancy during any holdover period shall otherwise be subject to the provisions of this Lease (unless clearly inapplicable), except that Tenant shall pay Landlord Base Rent for such time as Tenant remains in possession of the Premises (A) in the case of a Permitted Holdover, at a monthly rate equal to one hundred twenty-five percent (125%) of the Base Rent payable during the last month of the Lease Term for the first thirty (30) days of such holding over, and (B) following such initial thirty (30) day period of said Permitted Holdover, or in the case of an Unpermitted Holdover, at a monthly rate equal to one hundred fifty percent (150%) of the Base Rent payable during the last month of the Lease Term, in each case together with all Additional Rent at the same rates as otherwise due and payable under this Lease. In addition, in the event of an Unpermitted Holdover, or in the event that Tenant holds over beyond the period of a Permitted Holdover, Tenant shall be liable to Landlord for all damages sustained by reason of Tenant’s retention of possession of the Premises after the end of the Term, including without limitation consequential damages or indirect damages; it being expressly understood and agreed that Tenant shall not be liable for any damages on account of such holdover by Tenant during the Permitted Holdover, whether they be direct, indirect or consequential, except for such direct damages as provided for in Section 2.2.2 below, Tenant hereby acknowledging that Landlord may need the Premises after the end of the Term for other tenants and that the damages which Landlord may suffer as the result of Tenant’s holding over cannot be determined as of the Execution Date. The provisions hereof do not limit or restrict Landlord’s rights or remedies under this Lease in the event of any holding over by Tenant (but subject to Tenant’s right to a Permitted Holdover, as set forth above).

2.2.2Upon receipt of a written request from Tenant delivered not earlier than six (6) months prior to the scheduled Expiration Date of the Term, Landlord shall inform Tenant within thirty (30) days following Landlord’s receipt of such written request, whether the Premises has been re-leased for the period following the Expiration Date (to the extent the disclosure of such information will not cause Landlord to be in breach of any third party confidentiality agreement), including the target commencement date for delivery of the leased space.

ARTICLE 3COMPLETION AND OCCUPANCY OF THE PREMISES

Tenant, at Tenant’s cost (subject to Tenant’s use of the Allowance as further described in the Work Letter, as defined below), shall perform the construction of any improvements necessary for Tenant’s initial occupancy of the Third Floor Premises (and may construct additional improvements to the Fourth Floor Premises) in accordance with Exhibit 3.1.1 (the “Work Letter”) attached hereto and incorporated herein. Tenant acknowledges that it is in possession of the Fourth Floor Premises. Landlord represents to Tenant that the Fourth Floor Premises are free of all Hazardous Substances (as defined below) in violation of Applicable Laws.

Except as specifically provided in this Lease, including but not limited to Section 1.4 and the preceding paragraph, Landlord has made no representations, warranties or undertakings as to the present condition of the Premises or the fitness of the Premises for any particular use, and Tenant accepts delivery of the Premises in its “AS IS” condition (nothing in this sentence being deemed to diminish Landlord’s obligations to repair and maintain the Building in accordance with the terms of this Lease).

-3-

EAST\126610515.10

4.1Annual Base Rent.

4.1.1Schedule of Monthly Rent Payments. Beginning with the Commencement Date and continuing throughout the Term, Tenant shall pay to or upon the order of Landlord an annual rental (the “Base Rent”) as set forth below which shall be payable in consecutive monthly installments on or before the first day of each calendar month in advance in the monthly amount set forth below:

|

Period |

Annual Base Rent |

Monthly Base Rent |

Annual Base Rent per Rentable Square Foot |

|

6/1/17-5/31/18* |

$1,508,516.40 |

$125,709.70 |

$32.70 |

|

6/1/18-5/31/19 |

$1,554,648.40 |

$129,554.03 |

$33.70 |

|

6/1/19-5/31/20 |

$1,600,780.40 |

$133,398.37 |

$34.70 |

|

6/1/20-5/31/21 |

$1,646,912.40 |

$137,242.70 |

$35.70 |

|

6/1/21-5/31/22 |

$1,693,044.40 |

$141,087.03 |

$36.70 |

*In the event that the Third Floor Premises Commencement Date occurs prior to June 1, 2017, Tenant shall pay Base Rent with respect to the Third Floor Premises at the Annual Base Rent per Rentable Square Foot applicable on June 1, 2017 (i.e., $32.70 per square foot per annum for 9,422 rentable square feet) until June 1, 2017 and thereafter shall pay Base Rent as set forth above.

4.1.2Rent Credit. Provided no Event of Default, as described in Article 13 hereof, shall have occurred and be continuing hereunder, Tenant shall have a credit in the amount of two hundred forty-one thousand seventy-two dollars and fifty-eight cents ($241,072.58) to be applied toward the first payments of Base Rent and Additional Rents due hereunder.

4.1.3Manner of Payment. All payments of Rent shall be made without demand, deduction, counterclaim, set‑off, discount or abatement, except as expressly provided in this Lease, in lawful money of the United States of America. If the Commencement Date for any portion of the Premises should occur on a day other than the first day of a calendar month, or the Expiration Date should occur on a day other than the last day of a calendar month, then the monthly installment of Base Rent for such fractional month shall be prorated upon a daily basis based upon a thirty (30)-day month.

4.2Additional Rent. Tenant shall pay to Landlord all charges and other amounts required under this Lease and the same shall constitute additional rent hereunder (herein called “Additional Rent”), including, without limitation, any sums due resulting from the provisions of Article 5 hereof. All such amounts and charges shall be payable to Landlord in accordance with Section 4.3 hereof. Landlord shall have the same remedies for a default in the payment of Additional Rent as for a default in the payment of Base Rent. The term “Rent” as used in this Lease shall mean the Base Rent and the Additional Rent.

4.3Place of Payment. The Base Rent and all other sums payable to Landlord under this Lease shall be paid to Landlord at P.O. Box 310300, Property 434810, Xxx Xxxxxx, Xxxx 00000-0000 or at such other place as Landlord shall designate in writing to Tenant from time to time on thirty (30) days’ advance written notice to Tenant (or on five (5) days’ advance written notice to Tenant if such change is in connection with a sale of the Building).

-4-

EAST\126610515.10

4.4Terms of Payment. Tenant shall pay to Landlord the Base Rent as provided in Section 4.1 above and Tenant shall pay the Additional Rent payable under Article 5 and Article 6, each payment to be on the terms provided in this Lease, and at the times and in the manner provided in this Lease. Except as provided in the immediately preceding sentence and as may otherwise be expressly provided by the terms of this Lease, Tenant shall pay to Landlord, within thirty (30) days (unless another period is specified in this Lease) after delivery by Landlord to Tenant of bills or statements therefor: (a) sums equal to all expenditures made and monetary obligations incurred by Landlord in accordance with the terms of this Lease for Tenant’s account; and (b) all other sums of money accruing from Tenant to Landlord in accordance with the terms of this Lease.

4.5Late Charges. If Tenant shall fail to pay any Rent within five (5) days after the date same is due and payable or if any check received by Landlord from Tenant shall be dishonored, Tenant agrees that Landlord’s actual damages resulting therefrom are difficult to fix or ascertain. As a result, Tenant shall pay to Landlord (a) an administrative fee equal to five percent (5%) per month on the amount due (provided that such administrative fee shall be waived for the first late payment in any 12-month period if such payment is made within five (5) business days following notice from Landlord that such amount is past due), and (b) interest on the amount due from its due date until paid at the lesser of the prime rate of interest as reported by the Bank of America or its successor plus nine (9%) percent per annum or the maximum legal rate that Landlord may charge Tenant (provided that such interest shall not begin to accrue with respect to non-recurring payments of Additional Rent (but expressly excluding amounts payable on account of Operating Expenses and Taxes) if such payment is made within five (5) business days following notice from Landlord that such amount is past due). Such charges shall be paid to Landlord together with such unpaid amounts as an administrative fee to compensate Landlord for administrative expenses and its cost of funds.

4.6Security Deposit.

4.6.1Letter of Credit Amount. Upon execution and delivery of this Lease by and between Landlord and Tenant, Tenant shall deliver to Landlord a security deposit (the "Security Deposit") in the form of a "Letter of Credit" (as defined below) in the amount of $133,106.00 for the faithful performance of all terms, covenants and conditions of this Lease.

4.6.2.Letter of Credit Requirements. Each letter of credit provided to Landlord hereunder as the Security Deposit shall be in the form of an unconditional, irrevocable, standby letter of credit which shall be in full force and effect for the periods required hereby, and shall meet all of the following conditions (a "Letter of Credit"):

(a)it shall be issued for the benefit of Landlord by an "Eligible Bank" (defined below) approved by Landlord;

(b)it shall be effective on the date of this Lease and have a term of not less than one (1) year following its date of issuance and contain automatic year-to-year renewal provisions subject to the Letter of Credit issuer's obligation to notify Landlord in writing by certified or registered mail of non-renewal at least sixty (60) days prior to the expiration of the Letter of Credit;

(c)the expiry date of the Letter of Credit for the last year of the Term shall be at least sixty (60) days following the Expiration Date of the Lease;

(d)it shall provide for the amount thereof as set forth in Section 4.6.1 to be available to the Landlord in multiple drawings conditioned only upon presentation of a sight draft;

(e)it shall be assignable by Landlord to its successors, assigns and mortgagees and by any successive beneficiaries thereof at no cost to transferor or transferee (Tenant agreeing to pay such charges in connection with any transfer of the Letter of Credit), and shall expressly permit multiple assignments; and

-5-

EAST\126610515.10

(f)it shall be in such form as shall be reasonably acceptable to Landlord, Landlord acknowledging that the form attached hereto as Exhibit 4.6 is acceptable.

An "Eligible Bank" shall mean, as of the Effective Date, the institutional bank set forth in Exhibit 4.6 or, in the alternative, a commercial or savings bank organized under the laws of the United States or any state thereof or the District of Columbia and having total assets in excess of $1,000,000,000.00 which shall be a financial institution having a rating of not less than BBB or its equivalent by Standard and Poors Corporation and subject to a Xxxxxxxx Watch Rating of C or better. Tenant, at its expense, shall cause the issuing bank to provide Landlord's mortgage lender with a written acknowledgment which evidences its consent to Landlord's collateral assignment of the proceeds of the Letter of Credit and acknowledgment of the security interest of such mortgage lender therein within seven (7) days following the request of Landlord or Landlord's mortgagee therefor.

4.6.3Substitute Letter of Credit. Tenant shall deliver to Landlord a substitute Letter of Credit that satisfies the requirements for a Letter of Credit stated in Section 4.6.2 for the applicable period not later than ten (10) days following delivery of a non-renewal notice by the Letter of Credit issuer with respect to the Letter of Credit issued to Landlord or thirty (30) days prior to the scheduled expiration of the Letter of Credit, whichever first occurs (such date, the "Re-Delivery Deadline"). If Tenant fails to deliver the substitute Letter of Credit within such 10-day period, Landlord shall have the right to draw the Letter of Credit and receive the proceeds as a cash Security Deposit.

4.6.4Landlord's Rights Upon Default. Upon the occurrence of any of the Events of Default described in Article 13 hereof, in addition to any other rights or remedies available to Landlord under this Lease, Landlord shall have the right to present the Letter of Credit for payment by the issuing bank and the proceeds thereof shall be due and payable to Landlord in accordance with the terms hereof and the Letter of Credit. Tenant agrees that Landlord may, without waiving any of Landlord's other rights and remedies under this Lease upon the occurrence of any of the Events of Default, apply the Security Deposit to remedy any failure by Tenant to perform any of the terms, covenants or conditions to be performed by Tenant under this Lease which remain uncured beyond applicable notice and cure periods and to compensate Landlord for any damages incurred as a result of any such Event of Default. If Landlord uses any portion of the Security Deposit to cure any Event of Default by Tenant hereunder, Tenant shall forthwith replenish the Security Deposit to the original amount within ten (10) days following written notice from Landlord in the manner directed by Landlord in such notice (which may be in the form of a new or amended Letter of Credit, or in the form of a cash payment). If Tenant fails to restore the full amount of the Security Deposit within such 10-day period, then the amount of such deficiency shall be subject to the charges described in Section 4.5. During any period that Landlord is holding the Security Deposit in the form of cash, Landlord shall not be required to keep the Security Deposit separate from its general funds, and Tenant shall not be entitled to interest on any such deposit.

4.6.5Sale of Building. In the event of a sale or other transfer of the Building (or Landlord's interest therein), Landlord shall have the right to transfer the Security Deposit to the new owner or to transferee. Upon any such transfer and the assumption by such successor of all of Landlord's obligations under this Lease from and after the date of such transfer (notice of such transfer to be promptly provided by Landlord or such successor), Landlord shall thereupon be released by Tenant from all liability for the return of the Security Deposit; and Tenant agrees to look to the new landlord for the return of such Security Deposit. If an Event of Default is not then continuing, Landlord will, within sixty (60) days after the expiration or earlier termination of the Lease, return the Security Deposit, or so much as has not been applied by Landlord, to Tenant or the last permitted assignee of Tenant's interest hereunder at the expiration of the Term.

-6-

EAST\126610515.10

ARTICLE 5ADDITIONAL RENT FOR ESCALATIONS IN REAL ESTATE TAXES AND OPERATING EXPENSES

5.1Definitions. Base Rent does not anticipate any increase in the amount of taxes on the Property, or in the cost of the operation and maintenance thereof. In order that the Rent payable hereunder shall reflect any such increases, Tenant agrees to pay as Additional Rent, an amount calculated as hereinafter set forth. For purposes of this Article 5, the following definitions shall apply:

“Tax Year”: The fiscal year of the Town of Burlington (July 1 – June 30) or other applicable governmental authority for real estate tax purposes or such other twelve (12)-month period as may be duly adopted in place thereof.

“Base Tax Year”: The Town of Burlington’s tax fiscal year of July 1, 2017 through June 30, 2018.

“Base Taxes”: The amount of Taxes assessed with respect to the Property for each Tax Year (or portion thereof) which occurs during the Base Tax Year, giving full effect to any revaluation and deducting any reasonable out-of-pocket expenses incurred by Landlord in connection with a

Tax Protest (as defined below).

“Tax Increases”: Attributable to a Tax Year, shall mean the excess, if any, of the Taxes paid or incurred during such Tax Year over the Base Taxes.

“Taxes”: All taxes, assessments and charges of every kind and nature levied, assessed or imposed at any time by any governmental authority upon or against the Property or any improvements, fixtures and equipment of Landlord used in the operation thereof whether such taxes and assessments are general or special, ordinary or extraordinary, foreseen or unforeseen in respect of each Tax Year falling wholly or partially within the Term. Taxes shall include, without limitation, all general real property taxes and general and special assessments, charges, fees or assessments for all governmental services or purported benefits to the Property, service payments in lieu of taxes, all business privilege taxes, and any tax, fee or excise on the act of entering into this Lease or any other lease of space in the Building, or on the use or occupancy of the Building or any part thereof, or on the rent payable under any lease of space in the Building, or in connection with the business of renting space under any lease in the Building, or in connection with the business of renting space in the Building, that are now or hereafter levied or assessed against Landlord by the United States of America, the Commonwealth of Massachusetts, or any political subdivision, public corporation, district or other political or public entity (herein “governmental authority”), including reasonable legal fees, experts’ and other witnesses’ fees, costs and disbursements incurred in connection with proceedings to contest, determine or reduce Taxes. Taxes shall also include any other tax, fee or other excise, however described, that may be levied or assessed by any governmental authority as a substitute for, or as an addition to, in whole or in part, any other Taxes (including, without limitation, any municipal income tax) and any governmental authority’s license fees, tax measured or imposed upon rents, or other tax or charge upon Landlord’s business of leasing the Building, whether or not now customary or in the contemplation of the parties on the date of this Lease. Taxes shall not include: (a) franchise, transfer, gift, excise, capital stock, estate, succession and inheritance taxes, and federal and state income taxes measured by the net income of Landlord from all sources, unless due to a change in the method of taxation such tax is levied or assessed against Landlord as a substitute for, or as an addition to, in whole or in part, any other Tax that would constitute a Tax; (b) penalties or interest for late payment of Taxes, except to the extent resulting from Tenant’s failure to pay Tax Increases in accordance with this Lease, or (c) Taxes attributable to an expansion of the Building to include new leasable premises following the Commencement Date or (d) Taxes separately assessed or levied upon any improvements or alterations made by other tenants at the Building or the Property. In no event shall Taxes hereunder be duplicative of any Taxes otherwise paid by Tenant, or payable by Tenant, under this Lease. Tenant shall not be required to share in any penalties, interest, late payments or the like resulting from Landlord's late payment of Taxes, except to the extent Landlord’s late payment of Taxes is a result of Tenant’s failure to pay Taxes as required by the provisions of this Article 5.

-7-

EAST\126610515.10

“Base Expense Year”: The calendar year 2017.

“Expense Year”: The first and full calendar year following the Base Expense Year and each calendar year thereafter.

“Base Expenses”: The Operating Expenses for the Base Expense Year equitably adjusted to the amount such Operating Expenses would have been if one hundred percent (100%) of the rentable area in the Building had been occupied during the Base Expense Year if there is less than one hundred percent (100%) occupancy in the Base Expense Year. Only those component expenses that are affected by variation in occupancy levels shall be “grossed-up.” For purposes of determining Tenant's Share of Expense Increases, the Base Expenses shall be deemed to have been incurred by Landlord during the Base Expense Year. Base Expenses shall not include market-wide cost increases due to extraordinary circumstances, including but not limited to Force Majeure (as defined in Section 16.25, below), security concerns, boycotts, strikes, embargoes or shortages. For purposes of this paragraph, “market-wide cost increases due to extraordinary circumstances” shall mean an actual, material increase in a category of Operating Expenses under this Lease in excess of the amount reasonably budgeted by Landlord for such expense category in the Operating Expenses that is attributable to some unanticipated event or circumstance occurring during the Base Expense Year and that affects the Property for a temporary period of time.

“Expense Increases”: Attributable to an Expense Year, shall mean the excess, if any, of the Operating Expenses paid or incurred during such Expense Year equitably adjusted, if less than one hundred percent (100%) occupancy, to the amount such Operating Expenses would have been if one hundred percent (100%) of the rentable area in the Building had been occupied during the Expense Year over the Base Expenses. Only those component expenses that are affected by variation in occupancy levels shall be “grossed-up”.

“Operating Expenses”: All commercially reasonable costs and expenses (and taxes, if any, thereon) paid or incurred on behalf of Landlord (whether directly or through independent contractors) in connection with the management, operation, maintenance and repair of the Building and Common Areas (including any sales or other taxes thereon) during the Term as a first‑class office building, including, without limitation:

(a)supplies, materials and equipment purchased or rented, total wage and salary costs paid to, and all contract payments made on account of, all persons to the extent engaged in the operation, maintenance, security, cleaning and repair of the Property at or below the level of building manager (including the amount of any taxes, social security taxes, unemployment insurance contributions, union benefits) and any on-site employees of Landlord’s property management agent;

(b)the maintenance, repair and replacement (subject to the limitations on capital expenditures set forth below) of building systems, including heating, ventilating, air conditioning, plumbing, electrical, mechanical, sewer, fire detection, sprinkler, life safety and security systems, telecommunications facilities, elevators and escalators, exterior windows and doors, tenant directories, emergency generator, and other equipment used in common by, or for the benefit of, occupants of the Building including such repairs and replacements as may be necessary to maintain the same in proper working order and in compliance with all applicable laws and industry performance standards;

(c)charges of contractors for services and facilities otherwise includable in Operating Expenses, including security, trash removal, cleaning, janitorial, window washing, snow and ice removal, exterior and interior landscaping, the maintenance and repair of the parking facilities, roadways and light poles;

(d)the cost of utility services for the Property, including, without limitation, water, sanitary sewer, electricity, gas, fuel oil, steam, chilled water; but excluding electricity supplied to the Premises and billed to Tenant pursuant to Section 5.4 and electricity used by other tenants of the Building within their leased space and billed directly to such tenants;

-8-

EAST\126610515.10

(e)the premiums for fire, extended coverage, loss of rents, boiler, machinery, sprinkler, public liability, property damage, earthquake, flood, and other insurance relative to the Property and the operation and maintenance thereof (including the fitness center described below) and unreimbursed costs incurred by Landlord that are subject to an insurance deductible;

(f)the operation and maintenance of any areas, facilities and amenities located in Burlington Centre (for so long as such areas, facilities and amenities in Burlington Centre comprise a portion of the Common Areas) and in the Building, including, without limitation, the cost of utilities, repairs and insurance associated with such areas, facilities and amenities; provided, however, any income and/or revenue from charges, fees, park association assessments, or the like for any usage and/or consumption or the like, with respect to, in connection with and/or arising out of, any such areas, facilities and/or amenities, shall first be applied to reduce such costs and expenses;

(g)the cost of capital items incurred with respect to the operation, maintenance and repair of the Property for repairs, alterations, installations, improvements and additions amortized over the useful life of the capital items as determined in the reasonable judgment of Landlord’s accountant in accordance with generally accepted accounting principles (“GAAP”) consistently applied, together with interest at or Landlord’s borrowing rate for such capital items or, to the extent that no such sums are borrowed, nine percent (9%) per annum on the unamortized balance of the cost of the capital item and the installation thereof that are made to the Property by Landlord, but only in order to: (i) intentionally deleted, (ii) reduce (or avoid an increase in) operation or maintenance expenses with respect to the Property (but such costs and charges shall be only to the extent of Landlord’s reasonable estimate of such cost savings), (iii) comply with the requirements of laws, regulations or orders of any governmental or quasi-governmental authority, agency or department which were enacted, became effective or first enforced after the Commencement Date, or (iv) comply with the requirements of Landlord’s insurers that became effective or first enforced after the Commencement Date;

(h)office costs of administration; legal and accounting fees and other expenses of maintaining and auditing Property accounting records and preparing Landlord’s Statements; and

(i)a single per annum fee for management services whether rendered by Landlord (or affiliate) or a third‑party property manager in an amount not to exceed the rate of four percent (4%) of gross revenues from the Property, determined in a consistent manner, net of such management fee, plus reimbursable expenses.

Operating Expenses shall be determined in accordance with GAAP, consistently applied.

“Controllable Operating Expenses” means all Operating Expenses as defined above other than those Operating Expenses defined in (i) items (d) above, item (e) above, and item (g) above (with respect to subparts (iii) or (iv) above only), and (i) set forth in the definition of Operating Expenses above, (ii) snow and ice removal, (iii) premium labor costs for union contracts and premium wages/benefits for union engineering, security and janitorial personnel applicable to the general area in which the Property is located, (iv) costs payable under any cross-easement or similar agreement, (iv) any costs incurred by Landlord in order to comply with laws, regulations or orders of any governmental or quasi-governmental authority, agency or department which were enacted, became effective or first enforced after the Commencement Date hereof, and (v) any other matters not expressly listed in the definition of Operating Expenses that, by their nature, are not within Landlord’s reasonable control such as extraordinary maintenance and extraordinary grounds keeping expenses incurred by Landlord as a result of unusual natural causes.

Operating Expenses shall not include: (1) utility expenses that are separately metered for any individual tenant in the Building; (2) any expense for which Landlord is reimbursed by a specific tenant by reason of a special agreement or requirement of the occupancy of the Building by such tenant; (3) expenses for services provided by Landlord for the exclusive benefit of a given tenant or tenants for which Landlord is directly reimbursed by such tenant or tenants; (4) all costs, fees and disbursements relating to activities for the solicitation, negotiation and execution of leases for space in the Building (including but not limited to advertising costs, leasing commissions and attorneys’ fees therefor); (5) the costs of

-9-

EAST\126610515.10

alterations to, or the decorating or the redecorating of, space in the Building leased to other tenants; (6) except as stated in subparagraph (h) of the definition of Operating Expenses, the costs associated with the operation of the business of the ownership or entity which constitutes “Landlord”, including costs of selling, syndicating, financing or mortgaging any of Landlord’s interest in the Property; (7) rentals payable under any ground or underlying lease, if any; (8) depreciation, interest and principal payments on mortgages and other debt costs, if any; (9) repairs or other work required due to fire or other casualty to the extent of insurance proceeds actually received by Landlord; (10) costs to correct any defects in the original construction of the Building; (11) capital expenses for items that are not included in the definition of “Operating Expenses”; (12) payments to affiliates of Landlord (excluding property management fees but only to the extent not in excess of the amount set forth above) to the extent that they exceed market charges; (13) Taxes; (14) costs incurred for any items to the extent covered by a manufacturer’s, materialman’s, vendor’s or contractor’s warranty that are paid or reimbursed by such manufacturer, materialman, vendor or contractor; (15) legal fees or other expenses incurred in connection with enforcing leases with tenants in the Building; (16) wages, bonuses and other compensation of employees (and fringe benefits other than insurance plans and tax qualified benefit plans) above the grade of Building Manager; (17) any liabilities, costs or expenses associated with or incurred in connection with the removal, enclosure, encapsulation or other handling of Hazardous Substances (as defined in Section 7.6.1 below), other than the ordinary and customary handling of Hazardous Substances consistent with first class office use (such as disposal of computer monitors and toner cartridges), and the cost of defending against claims in regard to the existence or release of Hazardous Substances at the Building, the Property or the Park (except with respect to those costs for which Tenant is otherwise responsible pursuant to the express terms of this Lease); (18) increased insurance or Real Estate Taxes assessed specifically to any tenant of the Building or the Property for which Landlord is entitled to reimbursement from any other tenant; (19) cost of any HVAC, janitorial or other services provided to tenants on an extra cost basis after regular business hours; (20) the cost of installing, operating and maintaining any specialty service amenity, such as, but not limited to, an observatory, broadcasting facilities, cafeteria amenity, exercise facility amenity, and/or child or daycare amenity, except to the extent the revenues from such specialty service amenity are respectively first applied to reduce such costs; (21) cost of any work or service performed on an extra cost basis for any tenant in the Building, the Property or the Park to a materially greater extent or in a materially more favorable manner than furnished generally to the tenants and other occupants; (22) cost of any work or services performed for any facility other than the Building or Property or appurtenances thereto and expressly permitting Operating Expenses (subject to the provisions hereof) payable on account of the Park for landscaping, plowing, road maintenance, storm water drainage, and other shared costs; (23) lease payments for rental equipment (other than equipment for which depreciation is properly charged as an expense) that would constitute a capital expenditure if the equipment were purchased; (24) late fees or charges incurred by Landlord due to late payment of expenses, except to the extent attributable to Tenant’s actions or inactions; (25) cost of acquiring or securing sculptures, paintings and other works of art or the like (other than ordinary and customary cleaning and maintenance in de minimis amounts); (26) costs of parking operations to the extent Landlord receives a separate parking fee therefor (as distinguished from Operating Expenses and Taxes); (27) charitable or political contributions; (28) reserve funds; (29) all other items for which another party compensates or pays so that Landlord shall not recover any item of cost more than once; (30) any cost associated with operating an on or off-site management office for the Building, the Property or the Park, except to the extent included in the one management fee permitted hereby; (31) Landlord’s general overhead and any other expenses not attributable to the operation and management of the Building and the Property (e.g. the activities of Landlord’s officers and executives or professional development expenditures), except to the extent included in the management fee permitted hereby; (32) costs and expenses incurred in connection with compliance with or contesting or settlement of any claimed violation of law or requirements of law, except to the extent attributable to Tenant’s actions or inactions; (33) costs of mitigation or impact fees or subsidies (however characterized), imposed or incurred prior to the date of the Lease on account of the initial development of the Property, or imposed or incurred solely as a result of another tenant’s or tenants’ use of the Site or their respective premises; (34) costs related to public transportation, transit or vanpools, except to the extent such costs would otherwise not be excluded above or that Tenant shall elect to participate in the service to which such costs relate; and (35) not more than one management, administrative, supervisory or the like fee to Landlord, Landlord’s affiliates, or the property manager, other than the one (1) annual management fee set forth in subpart (i) of the definition of Operating Expenses in Section 5.1.

-10-

EAST\126610515.10

In addition to the foregoing, if in any calendar year after 2017, Landlord shall provide a material service to Building tenants that was not provided in 2017, Landlord may not include the cost of such services in Operating Expenses unless the services in question are consistent with those offered at comparable first class office buildings in the greater Burlington area as reasonably determined by Landlord.

“Tenant’s Share”: Tenant’s Share shall be a fraction, the numerator of which shall be the rentable area of the Premises and the denominator of which shall be the rentable area of the Building. On the Commencement Date for the entire Premises the Tenant’s Share is 39.13%, consisting of 7.99% with respect to the Third Floor Premises and 31.14% with respect to the Fourth Floor Premises (and if the Commencement Date for the Third Floor Premises occurs earlier, then Tenant’s Share shall be 7.99% until such time as the Commencement Date for the Fourth Floor Premises occurs). The Tenant’s Share shall be recalculated from time to time in the event that there shall be a change in the rentable area of the Premises due to the physical expansion or contraction thereof or a change in the rentable area of the Building due to the physical expansion thereof, as the case may be. The parties acknowledge that on the Commencement Date of this Lease the Building contains 117,879 square feet of rentable area.

“Landlord’s Statement”: An instrument containing a computation of any Additional Rent due pursuant to the provisions of this Article 5, together with a reasonable summary of such costs on a line item basis.

5.2Payment of Taxes. Tenant shall pay, as Additional Rent, Tenant’s Share of all Taxes actually payable by Landlord (meaning as adjusted for any available early payment discounts) in respect of any Tax Year falling wholly or partially within the Term, to the extent that Taxes for any such period shall exceed the Base Taxes (which payment shall be adjusted by proration with respect to any partial Tax Year). Within thirty (30) days after the issuance by the Town of Burlington or other applicable governmental authority of the xxxx for Taxes, Landlord shall submit to Tenant a copy of such xxxx, together with Landlord’s Statement and Tenant shall pay the Additional Rent set forth on such Landlord’s Statement (less the amount of estimated payments paid by Tenant on account thereof) as set forth herein. Landlord, at its option, may require Tenant to make equal monthly payments on account of Tenant’s Share of Tax Increases annually for Tax Years following the Base Tax Year. The monthly payments shall be one‑twelfth (1/12th) of the amount of Tenant’s Share of Tax Increases annually, as estimated by Landlord in good faith, and shall be payable on or before the first day of each month during the Term, in advance, in an amount estimated by Landlord in good faith and billed by Landlord to Tenant; provided, that, Landlord shall have the right initially to determine such monthly estimates in good faith and to revise such estimates in good faith not more than twice in any calendar year.

Landlord may petition for reduction of the assessed valuation of the Building, claim a refund of Taxes or otherwise challenge the validity, amount or applicability of any tax, assessment or other similar governmental charge deemed unreasonable by Landlord (“Tax Protest”). Any reasonable out-of-pocket costs and expenses incurred by Landlord in connection with a Tax Protest for the Building shall be includable in Taxes and Tenant’s Share of any refund of any tax, assessment or governmental charge received by Landlord pursuant to any Tax Protest (after any reimbursement of Landlord’s reasonable costs) shall, to the extent paid by Tenant on account of Tenant’s Share of Tax Increases during the period subject to the Tax Protest, be refunded or credited against the next monthly payments on account of Tenant’s Share of Tax Increases due hereunder, or in the event there is any remaining unapplied refund upon expiration or termination of this Lease, Landlord shall remit such amount to Tenant within thirty (30) days after expiration or termination of this Lease. Tenant shall share in any refund or abatement, net of such reasonable costs and expenses (to the extent not previously paid as Operating Expenses) that may be made of any tax, levy, charge or assessment in the same proportion that the same was paid by Tenant or with Tenant’s funds, but in any event not to exceed the amount paid by Tenant for Taxes during the applicable period. The obligation of Landlord to so reimburse Tenant for its share of a refund or an abatement shall survive the Expiration Date, or earlier termination of this Lease.

With respect to any special or extraordinary assessment, levy, charge, special tax or the like which may be levied against or upon the Premises, the Property or the Building for which assessment, levy, charge, special tax or the like Tenant is obligated to pay its Tenant’s Share, Landlord shall use commercially reasonable efforts to arrange for such assessment, levy, charge, special tax or the like to be paid in installments, if permitted by law, over the longest period of time permissible. Only those installments that are due and payable during the Term of this Lease, or any extension thereof, shall be included in Taxes.

-11-

EAST\126610515.10

Subject to the rights of any Mortgagees (as defined below), Landlord shall, at the request of Tenant and other tenants of the Building leasing, in the aggregate, at least fifty percent (50%) of the rentable area of the Building, made at least sixty (60) days prior to the deadline for filing a tax abatement in any fiscal year, use commercially reasonable efforts to pursue an abatement of or to contest or review by legal proceedings or otherwise any Taxes, provided that in Landlord’s reasonable judgment, Landlord’s petition for reduction of the assessed valuation of the Building or claim for a refund of Taxes is reasonably likely to succeed. Tenant shall pay as Additional Rent the Tenant's Share of any and all reasonable costs or expenses (including reasonable attorneys’ fees) the Landlord may incur in connection with any tax refund or abatement proceedings. Tenant shall share in any refund or abatement, net of such costs and expenses (except to the extent of Tenant’s payments to Landlord for the same, which payments by Tenant will be proportionally and equitably reimbursed to Tenant), which may be made of any Taxes in the same proportion that such Taxes were paid by Tenant or with Tenant’s funds, but in any event not to exceed the Taxes actually paid by Tenant with respect to the period in question. The obligation of Landlord to so reimburse Tenant for its share of a refund or an abatement shall survive the Expiration Date, or earlier termination of this Lease.

5.3Payment of Operating Expenses. Tenant shall pay to Landlord, as Additional Rent, Tenant’s Share of all Operating Expenses in respect of each Expense Year to the extent Operating Expenses for each such Expense Year shall exceed Base Expenses. Tenant shall pay a sum equal to one-twelfth (1/12) of the annual amount of Tenant’s Share of Expense Increases for each Expense Year on or before the first day of each month of such Expense Year, in advance, in an equal monthly amount estimated by Landlord in good faith and billed by Landlord to Tenant; provided, that, Landlord shall have the right initially to determine such monthly estimates in good faith and to revise such estimates in good faith but not more than twice in any calendar year. After the expiration of the Base Expense Year and each Expense Year, Landlord shall prepare and furnish Tenant with Landlord’s Statement showing the Base Expenses or the Operating Expenses incurred during such Expense Year. Within thirty (30) days after receipt of Landlord’s Statement for any Expense Year setting forth Tenant’s Share of any Expense Increase attributable to such Expense Year together with reasonable backup information to account for such Expense Increases, Tenant shall pay Tenant’s Share of such annual Expense Increase (less the amount of estimated payments paid by Tenant on account thereof) to Landlord as Additional Rent.

Notwithstanding the provisions of this Section 5.3 or elsewhere in this Lease, Tenant’s Share of Controllable Operating Expenses for any Expense Year during each Expense Year of the Term shall not exceed an amount equal to (A) Tenant’s Share of Controllable Expenses in the Base Expenses multiplied by one hundred five percent (105%) per annum for each such Expense Year (cumulative and compounding), less (B) Controllable Expenses in the Base Expenses. By way of example, if Tenant’s Share of Controllable Expenses in the Base Expenses is equal to $5,000, Tenant’s Share of Controllable Expenses for the 2018 Expense Year shall not exceed $5,250.00 ($5,000 x 1.05).

5.4Payment of Electric Expense. Tenant shall pay for the full cost (the “Electric Expense”) of the electric energy consumed within the Premises and any special facilities and equipment serving the Premises as reasonably determined by Landlord from time to time based upon the survey report of a third party engineering consultant. The determination of the Electric Expense shall include consideration of Tenant’s electricity consumption, actual hours of operation, the equipment and machinery in the Premises and the rentable area of the Premises, the actual rate of payment established by the utility company for such service and the actual tenant electrical expense for the Building. Beginning on the Commencement Date, Tenant shall pay Landlord at the rate of $1.75 per rentable square foot of the Premises per annum (subject to change as described below) with respect to the expense of Tenant’s lights and general office equipment (exclusive of any special facilities and equipment) (herein the “Estimated Electric Charge”). Landlord represents and covenants to Tenant that said Estimated Electric Charge of $1.75 per rentable square foot is applicable to each of the tenants in the Building as of the Effective Date. During the Term, Tenant’s rate of payment shall increase or decrease from time to time based upon the increases or decreases in rate charged by the utility company to the Landlord or Tenant’s Share of the actual tenant electrical expense for the Building; and Landlord shall have the right to issue supplemental billing to Tenant from time to time for its Electric Expense to account for such increases or such decreases. Tenant’s Electric Expense shall also be subject to increase and decrease based upon a change in Tenant’s electric consumption as determined in good faith, absent manifest error, by Landlord’s independent consultant. The Electric Expense payable in respect of the Premises shall constitute Additional Rent under this Lease (but shall not be included as an

-12-

EAST\126610515.10

Operating Expense), and shall be due and payable monthly in advance beginning on the Commencement Date, and continuing on the first day of each calendar month during the Term. Landlord shall have the right to separately meter or check-meter the Premises for electricity, at Landlord’s expense, and, in any event, with respect to electricity utilized by Tenant with respect to any specialized supplemental cooling systems for any server room of Tenant, such electricity shall be separately or check metered by Tenant, at Tenant’s expense. If the Premises or any specialized cooling systems are separately metered, Tenant shall pay for electricity directly to the service provider therefor based on such actual consumption, rather than the aforesaid Estimated Electric Charge. If the Premises or any specialized cooling systems are check metered, Tenant shall pay, as Additional Rent, 1/12ths of Landlord’s reasonable estimate of the costs of such electricity together with Tenant’s payment of Base Rent and Landlord shall annually reconcile such payments against the actual electricity usage based on Landlord’s reading of the check meters, absent manifest error, from time to time (but in any event no less often than once per year); in connection therewith, Landlord shall provide Tenant with reasonable back-up evidencing the costs that are subject to such reconciliation.

5.5Landlord’s Statements.

5.5.1Landlord’s Statements. Landlord will deliver Landlord’s Statements to Tenant during the Term. Landlord’s delay or failure to render Landlord’s Statement with respect to the Base Expense Year, any Expense Year or any Tax Year beyond a date specified herein shall not prejudice Landlord’s right to render a Landlord’s Statement with respect to that or any subsequent Expense Year or subsequent Tax Year (except to the extent provided in Section 5.7 below), provided that Landlord shall endeavor to issue Landlord’s Statements within one hundred twenty (120) days after the close of the Expense Year (including also the Base Expense Year) or Tax Year in question and in any event shall issue such Statements not later than the date that is twelve (12) months after the close of the Expense Year or Tax Year in question. The obligations of Landlord and Tenant under the provisions of this Article with respect to any Additional Rent incurred during the Term shall survive the expiration or any sooner termination of the Term. If Landlord fails to give Tenant a statement of projected Operating Expenses or Taxes prior to the commencement of any Expense Year, Tenant shall continue to pay Operating Expenses and Taxes in accordance with the previous statement, until Tenant receives a new statement from Landlord. All statements of projected Operating Expenses and Taxes, and Landlord’s Statements issued to Tenant after the close of the Expense Year (including also the Base Expense Year) shall include reasonable detail with respect to the various expense components included in the projected Operating Expenses and Taxes.

5.5.2Tenant Inspection Rights. During the one hundred twenty (120) day period after receipt of any Landlord’s Statement (the “Review Period”), Tenant may obtain copies of tax bills and inspect and audit Landlord’s records relevant to the Taxes and Operating Expenses reflected in such Landlord’s Statement (a “Tenant Audit”) at a reasonable time mutually agreeable to Landlord and Tenant during Landlord’s usual business hours, at Landlord’s or Landlord’s property manager’s offices in the continental United States. Each Landlord’s Statement shall be conclusive and binding upon Tenant unless within one hundred twenty (120) days after receipt of such Landlord’s Statement Tenant shall notify Landlord that it disputes the correctness of Landlord’s Statement, specifying the respects in which Landlord’s Statement is claimed to be incorrect. Tenant’s right to conduct any Tenant Audit shall be conditioned upon the following: (a) no monetary or material non-monetary Event of Default shall be ongoing at the time that Tenant seeks to conduct the Tenant Audit; (b) in no event shall any Tenant Audit be performed by a firm retained on a “contingency fee” basis; (c) the Tenant Audit shall be concluded no later than sixty (60) days after the end of the Review Period; (d) any Tenant Audit shall not unreasonably interfere with the conduct of Landlord’s business; (e) Tenant and its auditor, who shall be a qualified certified public accountant, shall treat any information gained in the course of any Tenant Audit in a confidential manner and shall each execute a commercially reasonable confidentiality agreement for Landlord’s benefit prior to commencing any Tenant Audit; (f) Tenant’s accounting firm’s audit report shall, at no charge to Landlord, be submitted in draft form for Landlord’s review and comment before the final approved audit report is delivered to Landlord, and Landlord shall have the right to point out errors or make suggestions with respect to such audit report, and any appropriate comments or clarifications by Landlord which are accepted by Tenant’s auditor shall be incorporated into the final audit report, it being the intention of the parties that Landlord’s right to review is intended to prevent errors and avoid the dispute

-13-

EAST\126610515.10

resolution mechanism set forth below and not to unduly influence Tenant’s auditor in the preparation of the final audit report; (g) Tenant shall only be able to conduct one (1) Tenant Audit during any calendar year, unless a Tenant Audit discloses an overcharge of five percent (5%) or more in any line item of Operating Expenses for that Expense Year, in which case Tenant shall have the right to review that same line item for the immediately two (2) prior Expense Years to see if the same error was made in such years, and if so an appropriate adjustment shall be made with respect to such prior years; and (h) the Tenant Audit shall be conducted by Tenant at its sole cost and expense unless the results of such Tenant Audit show that Landlord’s Statement overstated the amount of Operating Expenses owed by Tenant for the relevant billing period by more than five percent (5%) in which case Landlord shall be responsible for payment of such reasonable costs and expenses. If Tenant makes a timely exception within the Review Period, Tenant shall nonetheless pay the amount shown on the Landlord’s Statement in the manner prescribed in this Lease, without any prejudice to such exception, and any overpayments identified during any Tenant Audit, if any, shall be applied as a credit by Tenant in full against the amount of Additional Rent owed by Tenant immediately following the Tenant Audit, such that Tenant is reimbursed as quickly as possible, or refunded to Tenant within thirty (30) days if the Lease has expired or terminated, with such Landlord obligation to so refund to Tenant to survive the earlier termination of this Lease, or the Expiration Date of this Lease.

5.6Adjustments. If the actual amount of Tenant’s Share of the Expense Increases for any Expense Year or Tenant’s Share of Tax Increases for any Tax Year exceeds the estimated amount thereof paid by Tenant for such Expense Year or Tax Year, then Tenant shall pay to Landlord the difference between the estimated amount paid by Tenant and the actual amount of such Additional Rent payable by Tenant. This Additional Rent payment shall be due and payable within thirty (30) days following delivery of Landlord’s Statement. If the total amount of estimated payments made by Tenant in respect of Tenant’s Share of Expense Increases for such Expense Year or Tenant’s Share of Tax Increases for any Tax Year shall exceed the actual amount of such Additional Rent payable by Tenant, then such excess amount shall be credited in full against the monthly installments of Additional Rent due and payable from Tenant to Landlord hereunder until such amount shall have been refunded in full to Tenant, such that Tenant is reimbursed as quickly as possible (and said amount shall be promptly reimbursed in full to Tenant, within thirty (30) days, if there is insufficient time remaining in the Term for Tenant to recover the entire amount). Landlord’s obligation to so refund Tenant shall survive the earlier termination of this Lease, or the Expiration Date of this Lease Any excess payments made by Tenant during the Term that have not been so applied and are outstanding at the end of the Term shall be paid to Tenant promptly following delivery of Landlord’s Statement for the final Expense Year and final Tax Year, as applicable. Even though the Term has expired and Tenant has vacated the Premises, when final determination is made of Tenant’s Share of Expense Increases or Tax Increases for the year in which this Lease terminates, Tenant shall pay any increase due over the estimated Expense Increases or Tax Increases paid within thirty (30) days after Landlord’s delivery of Landlord’s Statement therefor.

5.7Landlord’s Failure to Include. (a) If Landlord fails to include any item of Operating Expenses payable, paid, to be paid or incurred by Landlord in any Landlord’s Statement with respect to Operating Expenses (or in any subsequent corrected or supplemented Landlord’s Statement with respect to Operating Expenses) furnished to Tenant with respect to the applicable calendar year or expense year, which failure continues for more than three (3) years after the initial delivery of such Landlord’s Statement with respect to Operating Expenses furnished to Tenant, then from and after the expiration of such three (3) year period, Landlord shall forfeit the right to include any such item(s) in a corrected or supplemental statement of Operating Expenses, and such Operating Expenses shall not be due and/or payable by Tenant as Additional Rent hereunder, or otherwise payable.

(b)If Landlord fails to include any Tax payable, paid, to be paid, or incurred by Landlord in any Landlord’s Statement with respect to Taxes (or in any subsequent corrected or supplemented Landlord’s Statement with respect to Taxes) furnished to Tenant with respect to any tax fiscal year, which failure continues for more than three (3) years after the initial delivery of such Landlord’s Statement with respect to Taxes furnished to Tenant which reflects the Taxes payable, paid or incurred for such fiscal year, then from and after the expiration of such three (3) year period, Landlord shall forfeit the right to include any such Taxes in a corrected or supplemental Landlord’s Statement with respect to Taxes, and such Taxes shall not be due and/or payable by Tenant as Additional Rent hereunder or otherwise payable.

-14-

EAST\126610515.10

(c)If Landlord fails to include any other Additional Rents payable, paid, to be paid, or incurred by Landlord in a Landlord Statement, or other monthly or periodic statement, with respect to any Additional Rent (or in any subsequent corrected or supplemental Landlord Statement, or other monthly or periodic statement, with respect to such Additional Rents) furnished to Tenant, which failure continues for more than three (3) years after the initial delivery of such Landlord Statement, or other monthly or periodic statement, which reflects the Additional Rent paid or incurred with respect to such applicable period, then from and after the expiration of such three (3) year period, Landlord shall forfeit the right to include any such Additional Rent in a corrected or supplemental Landlord Statement, or other monthly or periodic statement, with respect to such Additional Rent, and such Additional Rent shall not be due or payable by Tenant as Additional Rent hereunder or otherwise payable.

ARTICLE 6SERVICES AND UTILITIES

6.1Services. Landlord shall provide the following services to the Building and Premises:

(a)Janitor services in and about the Premises in accordance with the cleaning specifications set forth in Exhibit 6.1, Saturdays, Sundays and union and state and federal government holidays (the “Holidays”) excepted. Tenant shall not provide any janitor service without Landlord’s written consent. If Landlord’s consent is given, such janitor services shall be subject to Landlord’s supervision and control, but shall be performed at Tenant’s sole cost and responsibility.

(b)Heat and air‑conditioning as required to maintain comfortable temperature consistently throughout the Premises (excluding specialized temperature and humidity control for computers, printers and other equipment) daily from 8:00 a.m. to 6:00 p.m. Monday through Friday, Saturdays from 8:00 a.m. to 12:00 p.m. (“Normal Business Hours”), the remainder of Saturdays, Sundays and Holidays excepted, consistent with such service typical of comparable first class buildings in the greater Burlington area.

(c)Hot and cold running water for cleaning, landscaping, grounds maintenance, fire protection, drinking, lavatory and toilet purposes drawn through fixtures installed by Landlord or by Tenant with Landlord’s written consent. If Tenant’s water use increases beyond customary office user levels, Landlord shall have the right to install a water meter at Tenant’s expense and to charge Tenant as Additional Rent for its water consumption in the Premises in accordance with readings from such meter.

(d)Electric current from providers selected by Landlord, in amounts required for normal lighting by building standard lighting overhead fixtures and for Tenant’s normal business operations, including without limitation, personal computers, copiers, facsimiles and other ordinary business equipment, subject, however, to Landlord’s approval of Tenant’s final electrical plan for the Premises (but specifically excluding electric current surge protection).

(e)Maintenance of the Common Areas so that they are clean and free from accumulations of snow, debris, rubbish and garbage consistent with similar first-class office parks in the Burlington area.

(f)Security services; access by Tenant to the Premises and use of designated elevator service twenty-four (24) hours per day, seven (7) days per week, fifty-two (52) weeks per year, subject to Landlord’s Rules and Regulations and to Landlord’s reasonable security measures (including the operation of Landlord’s computerized access system at the Building’s entrances, if any). Landlord makes no representation or warranty regarding the efficacy of such security measures and shall not be held to a higher standard of care in the presence of such security measures as it would be in the absence of same. Overtime HVAC and other services shall be available as provided in Section 6.2 hereof.

-15-

EAST\126610515.10

Landlord shall have the right to select the utility providers and Tenant shall pay all actual costs associated with obtaining the utility service as provided in Article 5 hereof. Landlord agrees to furnish or cause to be furnished to the Premises the utilities and services described herein, subject to the conditions and in accordance with the standards set forth herein. To the maximum extent permitted pursuant to Applicable Laws (as hereinafter defined) Landlord’s failure to furnish any of such services when such failure is caused by accidents, the making of repairs, alterations or improvements, labor difficulties, difficulty in obtaining adequate supply of fuel, electricity, steam, water or other service or supplies from the sources from which they are usually obtained for the Building, or governmental constraints or any other cause beyond Landlord’s reasonable control, shall not result in any liability to Landlord. Tenant shall not be entitled to any abatement or reduction of rent by reason of such failure, no eviction of Tenant shall result from such failure and Tenant shall not be relieved from the performance of any covenant or agreement in this Lease. In the event of any failure, stoppage or interruption thereof, Landlord shall diligently attempt to resume service promptly. Landlord shall provide Tenant with at least 48 hours prior notice (unless the same shall be impracticable due to the nature of the reason for the shutdown or if the shutdown is required due to an emergency) of any planned shutdown of electricity, heat, air conditioning or water in the Building.

Notwithstanding anything to the contrary in this Lease including the provisions of Section 16.27 below, or the foregoing, either expressed or implied, if there shall be an interruption, curtailment or suspension of any service and/or utility necessary for the occupancy of the Premises and required to be provided by Landlord pursuant to this Section 6.1 or elsewhere in this Lease (and no reasonably equivalent alternative service or supply, or repair or replacement, is provided by Landlord) that shall materially interfere with Tenant’s use and enjoyment of all or a material portion of the Premises (a “Service Interruption”), and if (i) such Service Interruption shall continue for five (5) consecutive business days (“Service Interruption Period”) following receipt by Landlord of written notice from Tenant describing such Service Interruption (the “Service Interruption Notice”), (ii) such Service Interruption is not the result of Force Majeure or primarily and proximately from any of Tenant’s acts or omissions, and (iii) the restoration of such Service Interruption is in the reasonable control of Landlord, then Tenant shall be entitled to an equitable abatement of Base Rent and Tenant’s Share of Expense Increases and Tax Increases, based on the nature and duration of the Service Interruption, the area of the Premises affected, and the then current Base Rent and Tenant’s Share of Expense Increases and Tax Increases amounts, for the period that shall begin on the first (1st) business day of such applicable Service Interruption Period, and that shall end on the day such Service Interruption ceases. Notwithstanding anything in this Lease to the contrary, but subject to Article 10 and Article 11 (which shall govern in the event of a casualty or condemnation), the remedies expressly provided in this paragraph shall be Tenant’s sole recourse and remedy in the event of an interruption of Landlord services to the Premises.

6.2Additional Services. Landlord shall impose reasonable charges and may establish reasonable rules and regulations for the following: (a) the use of any heating, air‑conditioning, ventilation, electric current or other utility services or equipment by Tenant after Normal Business Hours (“Overtime HVAC”); (b) the use or consumption of any other building services, supplies or utilities after Normal Business Hours and any unanticipated, additional costs incurred by Landlord to operate the Building after Normal Business Hours as a result thereof; (c) additional or unusual janitorial services required because of any non‑building standard improvements in the Premises, the carelessness of Tenant, the nature of Tenant’s business (including the operation of Tenant’s business after Normal Business Hours); and (d) the removal of any refuse and rubbish from the Premises except for discarded material placed in wastepaper baskets and left for emptying as an incident to Landlord’s normal cleaning of the Premises in accordance with Exhibit 6.1. The expense charged by Landlord to Tenant for any Overtime HVAC shall be based on Landlord’s actual cost for such utility services as charged to Landlord by the utility companies providing such services. The expense charged for Overtime HVAC is currently $50 per hour per HVAC unit; provided, however, such Overtime HVAC expense may be reasonably increased from time to time by Landlord subject to the increases in the actual rate charged by the utility company to Landlord. This amount shall constitute Additional Rent and shall be payable in accordance with Section 4.4 of this Lease.

-16-

EAST\126610515.10