RETIREMENT AGREEMENT

EXECUTION VERSION

Exhibit 10.1

This RETIREMENT AGREEMENT (the “Agreement”) is entered into this 23rd day of August, 2017 by and between BioDelivery Sciences International, Inc., (the “Company”), and ▇▇▇▇ ▇. ▇▇▇▇▇ (“▇▇▇▇▇”). ▇▇▇▇▇ and the Company may be collectively referred to as the “parties” or individually referred to as a “party.”

WHEREAS, ▇▇▇▇▇ has heretofore served in various senior executive positions with the Company since August 24, 2004 and presently serves as the Company’s President and Chief Executive Officer;

WHEREAS, ▇▇▇▇▇ has elected to voluntarily retire from the position of President and Chief Executive Officer of the Company to allow for a period of transition during which the Company will search for a new President and/or Chief Executive Officer;

WHEREAS, in connection with ▇▇▇▇▇’▇ retirement, the Company desires to provide ▇▇▇▇▇ with certain benefits; and

WHEREAS, the parties intend that this Agreement will set out the terms of ▇▇▇▇▇’▇ retirement from the Company.

NOW, THEREFORE, in consideration of the promises and the mutual covenants herein contained, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereby agree as follows.

1. Retirement from the Company; Mutual Termination of Employment Agreement.

(a) ▇▇▇▇▇ will remain employed by the Company as President and Chief Executive Officer during a period of time (the “Transition Period”) in order to provide for an orderly transition of his duties. The Transition Period will commence as of the date ▇▇▇▇▇ signs this Agreement (the “Signature Date”) and will continue until January 2, 2018 (the “Retirement Date”). ▇▇▇▇▇’▇ employment with the Company and each of its subsidiaries will terminate as of the Retirement Date. ▇▇▇▇▇ shall be paid his full compensation and participate in full benefits through the Retirement Date at the same levels he receives such compensation and participates in such benefits at the Signature Date; provided, however, that such compensation shall include the increase in base salary that was approved by the Board in January 2017, but temporarily deferred for the senior management team at the request of ▇▇▇▇▇, retroactive to January 1, 2017; provided further that any catch-up in payments of base salary to implement the increase shall be made on or before December 31, 2017. ▇▇▇▇▇ hereby resigns from the positions of President and Chief Executive Officer of the Company and each of its subsidiaries by reason of his voluntary retirement effective as of the Retirement Date. ▇▇▇▇▇ acknowledges that, as of the Signature Date, he is entering into this Agreement of his own choosing and is not the result of any disagreement with the Company on any matter relating to the Company’s operations, policies (including accounting or financial policies) or practices. Notwithstanding anything else in this Agreement to the contrary, the Board may remove ▇▇▇▇▇ from the position of Chief Executive Officer and President prior to the January 2, 2018 only for “Good Cause” (as defined herein), but in such case, ▇▇▇▇▇ shall remain an employee through the Retirement Date (and put on paid administrative leave, at the Board’s discretion), shall be entitled to full pay and benefits through the Retirement Date, and shall be entitled to the payments and benefits set forth in this Agreement, including but not limited to those specified in Section 2. As used in this Agreement, the term “Good Cause” shall mean: (i) an act or omission constituting gross misconduct or willful misfeasance by ▇▇▇▇▇; (ii) the commission by ▇▇▇▇▇ of an act of fraud,

EXECUTION VERSION

embezzlement or any felony or crime of dishonesty in connection with his Company duties; or (iii) conviction of ▇▇▇▇▇ of a felony or any other crime that would materially and adversely affect (A) the business reputation of the Company or (B) the performance of ▇▇▇▇▇’▇ Company duties.

(b) It is expressly agreed that ▇▇▇▇▇ also presently serves as a director on, and as Vice Chairman of, the Company’s Board of Directors (the “Board”), and that this Agreement does not represent a retirement or resignation by ▇▇▇▇▇ from his position as a director or as Vice Chairman. It is further agreed that, up until and following the Retirement Date, ▇▇▇▇▇ shall continue to serve as Vice Chairman of the Board, subject to the provisions of applicable law, the Company’s Certificate of Incorporation, as amended, and the Company’s Amended and Restated Bylaws. ▇▇▇▇▇ shall serve as Vice Chairman of the Board and a director of the Company until the earlier of his death, resignation, removal by the Company’s stockholders, voluntary refusal to stand for reelection as a director or the decision of the Board to not nominate him for reelection as a director when his current term is concluded in 2019. For his service on the Board, ▇▇▇▇▇ shall be entitled to receive annual cash and equity award payments as determined by the Compensation Committee of the Board.

(c) Following the Retirement Date, ▇▇▇▇▇ shall be permitted to consult with, be employed by, act as a director for, or otherwise be associated with, any other business, subject in all instances to the terms of this Agreement, the surviving terms of the Employment Agreement (as defined below) (including the non-competition provisions thereof) and the Confidentiality Agreement (as defined below), as modified in Section 1(f) of this Agreement..

(d) Except as set forth in this Agreement, as provided by the specific terms of a Company benefit plan or as required by law, as of the Retirement Date, all of ▇▇▇▇▇’▇ benefits as an officer and employee of the Company will be terminated; provided, however, that ▇▇▇▇▇ will be entitled to any and all vested rights as of the Retirement Date in any benefits, and to payment of his accrued but unused vacation in his last paycheck.

(e) By its execution of this Agreement, the Company acknowledges and agrees that ▇▇▇▇▇’▇ retirement shall be a “Retirement” (including a retirement “in good standing”) as defined in and for purposes of the Company’s 2011 Equity Incentive Plan, as amended (the “Plan”).

(f) By their mutual execution of this Agreement, the Company and ▇▇▇▇▇ hereby voluntarily agree to terminate ▇▇▇▇▇’▇ employment agreement with the Company, dated August 24, 2004, as amended by that First Amendment thereto (collectively the “Employment Agreement”) as of the Retirement Date; provided, however, that: (i) the terms and conditions of the Employment Agreement relating to termination, including but not limited to the provisions of Section 4 in the Employment Agreement, are terminated as of the Signature Date and will be of no force or effect and replaced by the terms of this Agreement; and (ii) the terms and conditions of the Employment Agreement relating to confidentiality, non-competition, and other terms of the Employment Agreement which expressly survive termination, shall so survive and are incorporated herein by reference; provided further that the Company and ▇▇▇▇▇ agree to and hereby do amend the Employment Agreement as follows: (aa) the post-termination restrictive period set forth in Section 11 of the Employment Agreement shall not extend beyond one (1) year following the Retirement Date; (bb) Section 11(a)(i)(A) shall be deleted; (ccc) Section 11(a)(i)(B) shall be deleted and replaced with the following: “use of buccal delivery or injectable micropartical technology for the delivery of drugs that directly compete with the drugs or products offered by the Company at the time of Employee’s termination of employment”; and (ddd) the last sentence of the last paragraph of Section 11 (following 11(d)) shall be deleted and replaced with the following: “Nothing in this Agreement shall preclude Employee from employment at a non-for-profit or governmental institution, provided that no for-profit business involved in a Competitive Activity as defined in Section 11(a) shall derive a benefit from Employee’s employment.”

2

EXECUTION VERSION

(g) In addition, by their mutual execution of this Agreement, the Company and ▇▇▇▇▇ agree that the terms and conditions of that certain Confidentiality and Intellectual Property Agreement, dated August 24, 2004 by ▇▇▇▇▇ in favor of the Company (the “Confidentiality Agreement”) shall not terminate and shall remain in full force and effect following the Retirement Date and are incorporated herein by reference; provided, however, that the Company and ▇▇▇▇▇ agree to and hereby do amend the Confidentiality Agreement as follows: (i) the post-termination restrictive period set forth in Section 10 of the Confidentiality Agreement shall not extend beyond two (2) years following the Retirement Date; and (ii) the last sentence of Section 10 shall be deleted in its entirety and replaced with the following: “Employee further agrees that, for a period of two (2) years following the expiration or termination of the Employment Agreement, should Employee be approached by a person who Employee has actual knowledge is, or was within the previous three (3) months, an employee of the Company or any subsidiary or joint venture thereof, Employee will not (directly or indirectly) offer to nor employ or retain any such person as an employee, independent contractor or agent; provided, however, this provision shall not apply to any person whose employment was terminated by the Company.”

(h) ▇▇▇▇▇ further agrees that if, at any time during his membership on the Board, regardless of the foregoing Confidentiality Agreement has terminated or expired, he engages in conduct that Section 11 of the Confidentiality Agreement prohibits, ▇▇▇▇▇ will immediately resign from his position as a Director of the Board and as Vice Chairman of the Board.

2. Retirement Benefits. In consideration for entering into and not revoking the Supplemental Release Agreement referred to in Section 5(c) below, the Company will provide ▇▇▇▇▇ with the following retirement payments and benefits:

(a) Retirement Payment. Subject to the occurrence of the Effective Date (as defined in the Supplemental Release Agreement) (the “Effective Date”) and to ▇▇▇▇▇’▇ compliance with the terms of this Agreement and the Supplemental Release Agreement (with respect to payments under Section 2(a)(ii), (iii) and (iv)), the Company will pay ▇▇▇▇▇ the following amounts: (i) a cash payment equal to $787,000.00 (less applicable withholdings) (the “Signing Payment”) to be paid in lump sum within ten (10) days of the Signature Date, (ii) a cash payment equal to $787,000.00 (less applicable withholdings) (the “Retirement Payment”) to be paid in lump sum on January 15, 2018; (iii) if the Retirement Date occurs after there has been a Change in Control (as defined in Section 4(e) of the Employment Agreement, as amended), an additional cash payment equal to $236,000 (less applicable withholdings) (the “CIC Retirement Payment”) to be paid in lump sum within ten (10) days of the Retirement Date, and (iv) if a Change in Control occurs on or after the Retirement Date and within twelve (12) months following the Retirement Date, with a company with whom ▇▇▇▇▇ had contact about a potential transaction in his capacity as an employee of the Company (“Contact About a Potential Transaction” as defined below) prior to the Retirement Date, then the Company shall pay to ▇▇▇▇▇ an additional amount equal to $236,000 (less applicable withholdings) (the “Additional Retirement Payment”) in lump sum on the closing of the Change in Control. For purposes of this Section 2(a), “Contact About a Potential Transaction” shall include, among other things, ▇▇▇▇▇, or employees for whom ▇▇▇▇▇ supervised or had responsibility, having discussed with, contacted to discuss, in both cases whether informal or formal, or having identified a company, entity or person as a potential party to a transaction that contemplated a potential Change in Control.

(b) Reimbursement for Costs of Continued Health Benefits. The Company shall reimburse ▇▇▇▇▇ for the actual additional costs of continuation of ▇▇▇▇▇’▇ group health and dental insurance under the Consolidated Omnibus Reconciliation Act of 1985 (“COBRA”), at the same level in which he participated as of the Retirement Date, for the eighteen (18) month period following the Retirement Date, provided that ▇▇▇▇▇ shall bear full responsibility for applying for COBRA coverage, and

3

EXECUTION VERSION

nothing herein shall constitute a guarantee of COBRA continuation coverage or benefits or a guarantee of eligibility for health benefits. Notice of COBRA continuation benefits shall be provided under separate cover. Reimbursements under this Section 2(b) shall be made on a monthly basis beginning in the month after the Supplemental General Release Agreement, required under Section 9(b), becomes effective and non-revocable. ▇▇▇▇▇ shall not be entitled to a cash payment or other benefit in lieu of the reimbursements provided for herein or for amounts in excess of the actual costs of premiums for the coverages hereunder.

(c) Equity Awards. Subject in each case to the occurrence of the Effective Date and to ▇▇▇▇▇’▇ compliance with the terms of this Agreement and the Supplemental Release Agreement:

| (i) | Existing Options. The Company acknowledges and agrees that all options (the “Options”) to purchase shares of Company common stock, par value $.001 per share (the “Common Stock”) previously issued to ▇▇▇▇▇ under the Plan or under any other Company plan or arrangement (including, without limitation, the Company’s Amended and Restated 2001 Incentive Plan, as amended) have vested. The Company further agrees that all such vested Options shall not terminate on the 90th day following the Retirement Date, but shall, instead, remain outstanding for the remaining life of such Options; provided, however, that ▇▇▇▇▇ acknowledges and agrees that (A) any unexercised Options held following the 90th day following the Retirement Date shall lose their status as incentive stock options (“ISOs”) within the meaning of Section 422 of the Internal Revenue Code of 1986, as amended, (the “Code”) and shall revert to nonqualified stock options; and (B) he has been made aware of and understands the ramifications to him of the change of status of his Options from ISOs to non-qualified options. |

| (ii) | 2017 Equity Award. ▇▇▇▇▇ will be entitled to receive his 2017 equity award bonus under and in accordance with the terms of the Employment Agreement and the Plan (the “2017 Equity Award”), with the type and amount thereof to be determined in accordance with the Company’s prevailing compensation policies and procedures for ▇▇▇▇▇ in his role as President and Chief Executive Officer of the Company relative to the 2017 equity awards made to the Company’s other officers. The Company and ▇▇▇▇▇ acknowledge and agree that such annual equity awards have in the past periods been awarded as vesting restricted stock units (“RSUs”) under the Plan, but in light of ▇▇▇▇▇’▇ Retirement, the 2017 Equity Bonus will be awarded in the form of a one-time issuance of fully vested shares of Common Stock under the Plan, the number of which will be determined: |

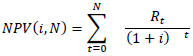

(A) with respect to RSUs which by their terms would vest with the passage of time (“Time Vesting RSUs”), a number of shares of Common Stock equal to (1) the Net Present Value (as defined below) of the Time Vesting RSUs that would have been issued to ▇▇▇▇▇ for the 2017 Equity Award had he not retired divided by (2) the 30-day volume weighted average price of the Common Stock (the “30-day VWAP”) as of the date of issuance of the 2017 Equity Bonus; and

4

EXECUTION VERSION

(B) with respect to RSUs which by their terms would vest based on future performance (“Performance Vesting RSUs”), a number of shares of Common Stock determined by multiplying the number of Performance Vesting RSUs that would have been issued to ▇▇▇▇▇ for the 2017 Equity Award had he not retired by 0.66.

| (iii) | LTIP Awards. ▇▇▇▇▇ will continue to be entitled to receive (if applicable) one hundred percent (100%) of his regular award of vested Common Stock (the “LTIP Stock”) under the Company’s Performance Long Term Incentive Plan (the “LTIP”), with the amount of such LTIP Stock to be determined and issued in accordance with the terms and provisions of the LTIP. The issuance of the LTIP Stock to ▇▇▇▇▇ as provided for above shall occur, if applicable, concurrently with the issuance of LTIP Stock to the Company’s officers, but no later than March 15, 2018. Should ▇▇▇▇▇ (i) voluntarily resign from his officer positions with the Company prior to the Retirement Date or (ii) voluntarily resign from the Board, in each case prior to payment of any amount of LTIP Stock as provided for herein, ▇▇▇▇▇’▇ right to receive LTIP Stock from and after that time shall terminate. Notwithstanding any provisions of this Agreement, the Plan, or the LTIP to the contrary, in the event a Change in Control occurs on or within twelve (12) months following the Retirement Date with a company with whom ▇▇▇▇▇ had Contact About a Potential Transaction (as defined in Section 2(a) of this Agreement) prior to his Retirement Date, then the Company shall issue to ▇▇▇▇▇, as an additional retirement benefit, fully vested shares of the Company’s Common Stock in an amount equal to the number of shares ▇▇▇▇▇ would have received pursuant to the LTIP had he remained employed with the Company through the Change in Control. |

| (iv) | Previously Awarded RSUs. As of the Retirement Date, all previously granted Time Vesting RSUs issued to ▇▇▇▇▇ pursuant to the Plan that are unvested as of the Retirement Date shall terminate and, in lieu thereof, ▇▇▇▇▇ shall receive a one-time issuance of fully vested shares of Common Stock under the Plan, the number of which will be determined with reference to the Time Vesting RSUs being terminated by dividing (A) the Net Present Value of such Time Vesting RSUs by (B) the 30-day VWAP as of the Retirement Date. For the avoidance of doubt, such termination shall not apply to any Time Vesting RSUs which, by their terms, vest prior to the Retirement Date. In addition, as of the Retirement Date, all previously granted RSUs issued to ▇▇▇▇▇ pursuant to the Plan which vest due to achievement of future performance milestones that are unvested as of the Retirement Date shall terminate and, in lieu thereof, ▇▇▇▇▇ shall receive a one-time issuance of 250,000 fully vested shares of Common Stock under the Plan. |

| (v) | Net Issuance. ▇▇▇▇▇ shall be entitled to the customary Company benefit allowing for the “net issuance” by the Company of Common Stock underlying the Options or RSUs or Common Stock comprising the LTIP Stock in order to provide ▇▇▇▇▇ the opportunity (on his own or through the Company) to sell shares of Common Stock, the proceeds of which will be utilized to pay ▇▇▇▇▇’▇ federal, state or local income or withholding tax liability. |

5

EXECUTION VERSION

| (vi) | Definition of Net Present Value. As used in this Agreement, the term “Net Present Value” means the net present value of a subject RSU, calculated pursuant to the following formula: |

Where:

NPV = Net Present Value of a subject RSU.

i = 4.0%, the agreed upon annual interest rate for one compounding (i.e., vesting) period.

N = the total number of vesting periods for the subject RSU.

t = the compounding period (expressed in years) between the Retirement Date and the applicable vesting date(s) specified in the subject RSU (i.e., either one, two or three vesting years or partial years, as the case may be).

R = (a) the number of shares of common stock underlying the applicable RSU that would vest on the applicable vesting date(s) specified in the subject RSU (assuming full vesting on each such vesting date) multiplied by (b) the 30-day VWAP on the Retirement Date.

| (c) | Health Benefits. ▇▇▇▇▇ will continue to receive coverage under the Company’s medical, dental and FSA plans at his current elections and premium rates through the Retirement Date. After the Retirement Date, the provisions of Section 2(b) shall apply with respect to reimbursement for continuation of ▇▇▇▇▇’▇ health benefits. All other benefits not expressly mentioned herein, including, but not limited to, disability and life insurance benefits, will end on the Retirement Date. |

| (d) | Expense Reimbursement. ▇▇▇▇▇ will receive payment for all approved and outstanding expense reports owed in connection with appropriate business expenses through the Retirement Date. All requests for reimbursements shall be submitted no later than January 2, 2018, and reimbursements shall be provided within thirty (30) days, but in no event after February 1, 2018. |

| (e) | 401(k). ▇▇▇▇▇ will be entitled to any Company 401(k) benefits in accordance with the terms and conditions of the applicable Company plans (noting that any 401(k) deferrals and matching contributions will terminate as of the Retirement Date in accordance with the terms and conditions of those plans). |

| (f) | D&O Coverage. For a period of six (6) years after the Retirement Date, the Company or any successor to the Company shall purchase and maintain, at its own expense, directors’ and officers’ liability insurance providing coverage to ▇▇▇▇▇ on terms that are no less favorable than the coverage provided to other |

6

EXECUTION VERSION

| directors and similarly situated executives of the Company. In addition, ▇▇▇▇▇ shall be entitled to indemnification from the Company, including advancement, to the fullest extent allowed by, and subject to the provisions of, the Company’s Certificate of Incorporation, as amended, and Amended and Restated Bylaws. |

| (g) | Reimbursement of Attorneys’ Fees. The Company will reimburse ▇▇▇▇▇ for his reasonable attorneys’ fees incurred in connection with the preparation and negotiation of this Agreement, up to a maximum of $40,000. Such amount will be paid within thirty (30) days of ▇▇▇▇▇’▇ submission of acceptable documentation of such fees following the Signing Date, but in no event later than August 31, 2017. |

| (h) | Acknowledgement and Waiver. ▇▇▇▇▇ acknowledges that the compensation and benefits available to him under this Agreement are in lieu of any compensation and benefits he would be eligible to receive under the Employment Agreement upon the termination of his employment. Accordingly, except for the compensation and benefits provided for under this Agreement upon the termination of ▇▇▇▇▇’▇ employment, ▇▇▇▇▇ hereby waives any severance, separation or post-termination compensation available to him upon the termination of his employment as provided under the Employment Agreement. For the avoidance of doubt, however, this waiver does not include any right to the acceleration of vesting or other benefits that may be available to ▇▇▇▇▇ under any of the Company’s equity plans. For the further avoidance of doubt, the Company acknowledges and agrees that ▇▇▇▇▇ is entitled to the compensation and benefits set forth in this Agreement, including without limitation Section 2, upon the termination of his employment for any reason at any time. |

3. Press Releases. ▇▇▇▇▇ and the Company shall cooperate in preparing and shall mutually agree upon a press release and all other public announcements concerning ▇▇▇▇▇’▇ retirement under this Agreement.

4. Release of Claims.

(a) ▇▇▇▇▇ Release. In consideration of the mutual agreements and covenants herein contained, by signing this Agreement, ▇▇▇▇▇ knowingly and voluntarily releases and forever discharges the Company and its affiliates, subsidiaries, divisions, insurers, predecessors, successors and assigns, and their current and former employees, attorneys, officers, directors and agents thereof, both individually and in their business capacities, and their employee benefit plans and programs and their administrators and fiduciaries (collectively referred to throughout the remainder of this Agreement as “Company Released Parties”), of and from any and all claims, known and unknown, asserted or unasserted, which ▇▇▇▇▇ has or may have against the Company or any Company Released Parties as of the date of execution of this Agreement, including, but not limited to: (i) any claims, whether statutory, common law, or otherwise, arising out of the terms or conditions of his employment at the Company; (ii) any claims, whether statutory, common law, or otherwise, arising out of the facts and circumstances of his employment and the termination of his employment at the Company; (iii) any claims for breach of contract, quantum meruit, unjust enrichment, breach of oral promise, tortuous interference with business relations, injurious falsehood, defamation, negligent or intentional infliction of emotional distress, invasion of privacy, and any other common law contract and tort claims; (iv) any claims for unpaid or lost benefits or salary, bonus, vacation pay, severance pay, or other compensation; (v) any claims for attorneys’ fees, costs, disbursements, or other expenses; (vi) any claims for damages or personal injury; (vii) any claims of employment discrimination, harassment or retaliation, whether based on federal, state, or local law or

7

EXECUTION VERSION

judicial or administrative decision; and (viii) any claims arising under the Fair Labor Standards Act, 29 U.S.C.§ 201, et seq.; Title VII of the Civil Rights Act of 1964, 42 U.S.C. § 2000e, et seq. (as amended); the Civil Rights Act of 1866, 42 U.S.C. § 1981; the Civil Rights Act of 1991, Pub. Law No. 102-166; the National Labor Relations Act, 29 U.S.C. § 151, et seq.; the Family and Medical Leave Act, 29 U.S.C. § 2601 et seq.; the Rehabilitation Act of 1973, 29 U.S.C. § 701, et seq.; the Age Discrimination in Employment Act; the Older Workers Benefit Protection Act; the Worker Adjustment and Retraining Notification Act; the Americans With Disabilities Act, 42 U.S.C. § 12101, et seq.; the Employee Retirement Income Security Act of 1974, 29 U.S.C. §1001, et seq., the ▇▇▇▇▇▇▇▇-▇▇▇▇▇ Act of 2002, 18 U.S.C. §1514A, et seq., the ▇▇▇▇-▇▇▇▇▇ ▇▇▇▇ Street Reform and Consumer Protection Act, claims under North Carolina or other state laws, including, but not limited to, the North Carolina Retaliatory Employment Discrimination Act, the North Carolina Persons with Disabilities Protection Act, the North Carolina Equal Employment Practices Act, and/or any other federal, state or local statute, law, ordinance, regulation or order, or the common law, or any self-regulatory organization rule or regulation. The enumeration of specific rights, claims, and causes of action being released should not be construed to limit the general scope of the foregoing release. It is the intent of ▇▇▇▇▇ and the Company that by the foregoing release, ▇▇▇▇▇ is giving up all rights, claims, and causes of actions against the Company Released Parties which accrued prior to the effective date hereof, whether or not he is aware of them and whether or not any damage or injury has yet occurred. This release does not include either Party’s right to enforce the terms of this Agreement. In connection with this release provision, ▇▇▇▇▇ does not waive his right to file a charge or participate in any proceeding of any federal, state or local governmental agency, including the Equal Employment Opportunity Commission, the National Labor Relations Board, and the Securities and Exchange Commission. To the extent permitted by law, ▇▇▇▇▇ agrees that if such a claim is made, ▇▇▇▇▇ shall not be entitled to recover any individual monetary relief or other individual remedies should any administrative agency pursue any claim on his behalf. Nothing in this Agreement extinguishes any claims ▇▇▇▇▇ may have: (i) against the Company for breach of this Agreement; (ii) against any of the Company Released Parties for any claims arising from events that occur following the Effective Date; or (iii) related to the Company’s obligation, if any, to indemnify ▇▇▇▇▇ as an officer of the Company, including under any directors’ and officers’ liability policy maintained by the Company.

(b) Company Release. In consideration of the mutual agreements and covenants herein contained, by signing this Agreement, the Company knowingly and voluntarily releases and forever discharges ▇▇▇▇▇, his affiliates, and his attorneys and representatives (collectively referred to throughout the remainder of this Agreement as “▇▇▇▇▇ Released Parties”), of and from any and all claims, known and unknown, asserted or unasserted, which the Company has or may have against ▇▇▇▇▇ or any ▇▇▇▇▇ Released Parties as of the date of execution of this Agreement, including, but not limited to, (i) any claims, whether statutory, common law, or otherwise; (ii) any claims for breach of contract, breach of fiduciary duty, conversion, quantum meruit, unjust enrichment, breach of oral promise, tortuous interference with business relations, injurious falsehood, defamation, and any other common law contract and tort claims; (iii) any claims for attorneys’ fees, costs, disbursements, or other expenses; and (vi) any claims for damages; provided, however, that expressly excluded from such released claims are (A) claims arising out of ▇▇▇▇▇’▇ capacity as an officer or employee of the Company for fraud, criminal acts, intentional misconduct or actively concealed grossly negligent acts, and (B) any claims relating specifically to ▇▇▇▇▇’▇ actions or omissions as a director of the Company. The enumeration of specific rights, claims, and causes of action being released should not be construed to limit the general scope of the foregoing release. It is the intent of ▇▇▇▇▇ and the Company that by the foregoing release, the Company is giving up all rights, claims, and causes of actions against the ▇▇▇▇▇ Released Parties which accrued prior to the effective date hereof, whether or not he is aware of them and whether or not any damage or injury has yet occurred. This release does not include either Party’s right to enforce the terms of this Agreement. Nothing in this Agreement extinguishes any claims the Company may have: (i) against ▇▇▇▇▇ for breach of this Agreement or the Supplemental Release Agreement; or (ii) against any of the ▇▇▇▇▇ Released Parties for any claims arising from events that occur following the Effective Date.

8

EXECUTION VERSION

(c) Supplemental Release. Additionally, on the Retirement Date, or within there (3) days thereafter, ▇▇▇▇▇ and the Company agree to execute and deliver to the other party a Supplemental Release Agreement in the form attached as hereto as Exhibit “A” containing a general release of claims co-extensive and substantially similar with the release set forth above to include a release of all claims through and including the Retirement Date (the “Supplemental Release Agreement”); provided, however, that the Company’s failure to execute the Supplemental Release Agreement shall not relieve the Company of its full obligations under this Agreement, including but not limited to its obligations under Section 2.

6. Affirmations. ▇▇▇▇▇ hereby affirms, represents and warrants that:

(a) he has not filed, caused to be filed, or presently is a party to any claim against any Released Party;

(b) except for the payments and benefits provided for in this Agreement, he has been paid and/or has received all compensation, wages, bonuses, commissions, and/or benefits to which ▇▇▇▇▇ may be entitled;

(c) he has been granted and received any and all leaves (paid or unpaid) to which he may have been entitled during his employment, including any leave to which he was entitled under the Family and Medical Leave Act or local leave or disability accommodation laws;

(d) he has no known workplace injuries or occupational diseases;

(e) he has not been retaliated against for reporting any allegations of wrongdoing by any Released Party, including any allegations of corporate fraud;

(f) this Agreement states fully all agreements, understandings, promises, and commitments as between himself and the Company relating to the termination of ▇▇▇▇▇’▇ employment;

(g) in deciding to sign this Agreement, he has not relied on any representations, statements, agreements, understandings, promises, or commitments that are not expressly set forth in this Agreement;

(h) he has reviewed this Agreement in its entirety;

(i) he has been afforded at least twenty-one (21) calendar days within which to consider this Agreement and that he has, by this Agreement, been advised in writing to consult with legal counsel before signing this Agreement;

(j) should he choose to sign this Agreement before the expiration of twenty-one (21) days, or choose not to consult legal counsel, he does so freely and knowingly, and waives any and all claims that such action or inaction would affect the validity of this Agreement; and

(k) any changes to this Agreement, whether material or immaterial, do not restart the twenty-one (21) day period.

7. Confidentiality. ▇▇▇▇▇ hereby ratifies and confirms the terms of the Confidentiality Agreement and further represents and agrees that he will not (except as required by law) disclose information regarding the specific terms of this Agreement to anyone outside of the Company except his

9

EXECUTION VERSION

immediate family, or his attorneys, accountants, or financial advisors as reasonably necessary. Notwithstanding the foregoing, nothing in this Agreement shall be construed to prohibit ▇▇▇▇▇ from reporting conduct to, providing truthful information to or participating in any investigation or proceeding conducted by any federal or state government agency or self-regulatory agency.

8. Cooperation. By signing this Agreement, ▇▇▇▇▇ agrees that, for a period of equal to the period of time under which ▇▇▇▇▇ is covered by the director and officer liability insurance (including tail coverage) of the Company or its successors (the “Cooperation Period”), he will, at the Company’s expense, cooperate fully with the Company and its officers, directors, employees, agents, successors, assigns and legal counsel in connection with any claim, complaint, charge, suit or action previously or hereafter asserted or filed by or against the Company or any of the Released Parties of the Company which relates to, arises out of or is connected directly or indirectly with (i) ▇▇▇▇▇’▇ service as an officer or director of the Company, or (ii) any other relationship or dealings between ▇▇▇▇▇ and the Company or any of the Company’s Released Parties. Further, during the Cooperation Period, ▇▇▇▇▇ agrees that, in the event that he is subject to a valid and enforceable subpoena or court order that compels his testimony at a trial, hearing or deposition concerning his relationship with the Company or any other matter relating to the Company or any of the Company’s Released Parties, he will inform the Chairman of the Board of the Company in writing within seventy two (72) hours of his becoming aware that he is required to testify and will reasonably cooperate with the Company in minimizing any disclosure by ▇▇▇▇▇ of any confidential or proprietary information of the Company. ▇▇▇▇▇ expressly agrees that, to the extent permitted by applicable law or court order, he will continue to cooperate with the Company in accordance with this Section after receiving said subpoena or court order. No part of this Agreement will abrogate ▇▇▇▇▇’▇ obligation to provide truthful testimony under oath. The Company shall compensate ▇▇▇▇▇ (following his provision of appropriate documentation) at an hourly rate of $350 for any time he is required to devote to his obligations under this Section 8, and shall reimburse ▇▇▇▇▇ for all of his reasonable out of pocket expenses; provided, however, that if ▇▇▇▇▇ is still serving as a director, ▇▇▇▇▇ shall not be entitled to such compensation in connection with cooperation under this Section 8 with claims or litigation arising from ▇▇▇▇▇’▇ duties as a director or former officer of the Company; and provided, further, ▇▇▇▇▇ shall not be not be entitled to reimbursement for his expenses to the extent that he has been compensated for such expenses under the Company’s director and officer insurance policy.

9. No Disparagement. Neither the Company or the Company Released Parties, on the one hand, nor ▇▇▇▇▇ (either directly or indirectly), on the other hand, shall make any communications, whether written, electronic, oral, or otherwise, to any other person or entity, including, but not limited to any publications and any website postings or blogs, which denigrate, defame, damage the reputation of, or otherwise cast aspersions upon each other, or their respective products, services, reputation, business and manner of doing business.

10. No Modifications; Entire Agreement. This Agreement cannot be changed or terminated orally, and no modification or waiver of any of the provisions of this Agreement will be effective unless it is in writing and signed by both parties. This Agreement sets forth the entire and fully integrated understanding between the parties, and there are no representations, warranties, covenants or understandings, oral or otherwise, that are not expressly set out herein. The parties acknowledge that, in deciding to enter into this Agreement, they have not relied upon any statements not written in this Agreement.

11. Governing Law. This Agreement shall be construed, interpreted, and governed in accordance with and by North Carolina law. Any and all claims, controversies, and causes of action arising out of this Agreement, whether sounding in contract, tort, or statute, shall be governed by the laws of the State of North Carolina, including its statutes of limitations, without giving effect to any North Carolina conflict-of-laws rule that would result in the application of the laws of a different jurisdiction provided, however, that claims related specifically to ▇▇▇▇▇’▇ conduct as a director of the Company and all related corporate matters arising from his service as a director of the Company shall be construed, interpreted, and governed in accordance with and by Delaware law.

10

EXECUTION VERSION

12. Revocation. ▇▇▇▇▇ may revoke this Agreement for a period of seven (7) calendar days following the day he executes this Agreement. In order to revoke this Agreement, ▇▇▇▇▇ must state his desire to revoke in writing and e-mail said writing to the Company’s attorney, ▇▇▇▇▇▇▇▇ ▇. ▇▇▇▇▇▇▇▇▇▇, Esq., Ellenoff ▇▇▇▇▇▇▇▇ & Schole LLP, at ▇▇▇▇▇▇▇▇▇▇▇@▇▇▇▇▇▇.▇▇▇, on or before the seventh (7th) day after execution. Additionally, a confirmation of said revocation must be mailed, post-marked on or before the seventh day after execution, to the Company’s attorney, ▇▇▇▇▇▇▇▇ ▇. ▇▇▇▇▇▇▇▇▇▇, Esq., Ellenoff ▇▇▇▇▇▇▇▇ & Schole LLP, ▇▇▇▇ ▇▇▇▇▇▇ ▇▇ ▇▇▇ ▇▇▇▇▇▇▇▇, ▇▇▇▇ ▇▇▇▇▇, ▇▇▇ ▇▇▇▇, ▇▇ ▇▇▇▇▇. If the last day of the revocation period is a Saturday, Sunday, or legal holiday, then the revocation period shall not expire until the next following day which is not a Saturday, Sunday, or legal holiday.

13. Section 409A of the Internal Revenue Code.

(a) Parties’ Intent. The parties intend that all payments or benefits hereunder shall either qualify for an exemption from or comply with the applicable rules governing non-qualified deferred compensation under Section 409A of the Internal Revenue Code of 1986, as amended (the “Code”), and the regulations thereunder (collectively, “Section 409A”) and all provisions of this Agreement shall be construed in a manner consistent with such intention. If any provision of this Agreement (or of any award of compensation, including equity compensation or benefits) would cause ▇▇▇▇▇ to incur any additional tax or interest under Section 409A, the Company shall, upon the specific request of ▇▇▇▇▇, use its reasonable business efforts to in good faith reform such provision to be exempt from, or comply with, Code Section 409A; provided, that to the maximum extent practicable, the original intent and economic benefit to ▇▇▇▇▇ and the Company of the applicable provision shall be maintained, and the Company shall have no obligation to make any changes that could create any material additional economic cost or loss of material benefit to the Company. Should any provision of this Agreement or of the Employment Agreement be determined to not be in compliance with Section 409A, or should ▇▇▇▇▇ become liable for any excise tax, penalty or interest under Section 409A, the Company shall pay all such taxes, penalties and interest, including an additional amount to cover any additional taxes on such payments.

(b) Release Requirement. If a payment that is deferred compensation subject to Section 409A is subject to satisfaction of a release requirement and the period for satisfying the release requirement begins in one calendar year and ends in the following calendar year (the “Release Satisfaction Period”), then any amount becoming payable during the Release Satisfaction Period shall not be paid until the later calendar year.

(c) Separation from Service. A termination of employment or separation from service shall not be deemed to have occurred for purposes of any provision of this Agreement providing for the payment of any amounts or benefits that constitute nonqualified deferred compensation within the meaning of Section 409A upon or following a termination of employment or separation from service unless such termination also constitutes a “Separation from Service” within the meaning of Section 409A and, for purposes of any such provision of this Agreement, references to a “termination,” “termination of employment,” “separation from service” or like terms shall mean Separation from Service.

(d) Delayed Distribution to Specified Employees. If the Company determines in accordance with Sections 409A and 416(i) of the Code and the regulations promulgated thereunder, in the Company’s sole discretion, that a delay in benefits provided under this Agreement is necessary to comply with Code Section 409A(A)(2)(B)(i) since ▇▇▇▇▇ is a Specified Employee thereunder, then any post

11

EXECUTION VERSION

separation payments and any continuation of benefits or reimbursement of benefit costs provided by this Agreement, and not otherwise exempt from Section 409A, shall be delayed for a period of six (6) months following the date of ▇▇▇▇▇’▇ separation from service (the “409A Delay Period”). In such event, any post separation payments and the cost of any continuation of benefits provided under this Agreement that would otherwise be due and payable to ▇▇▇▇▇ during the 409A Delay Period shall not commence until, and shall be made to ▇▇▇▇▇ in a lump sum cash amount on the first business day after the date that is six (6) months following ▇▇▇▇▇’▇ Separation from Service and in such event the initial payment shall include a catch-up amount covering amounts that would otherwise have been paid during the six-month period following ▇▇▇▇▇’▇ Separation from Service.

14. Section 280G of the Internal Revenue Code.

(a) Notwithstanding any other provision of this Agreement or any other plan, arrangement or agreement to the contrary, if any of the payments or benefits provided or to be provided by the Company or its affiliates to ▇▇▇▇▇ or for ▇▇▇▇▇’▇ benefit pursuant to the terms of this Agreement or otherwise (“Covered Payments”) constitute parachute payments (“Parachute Payments”) within the meaning of Section 280G of the Internal Revenue Code of 1986, as amended (the “Code”) and would, but for this Section 14, be subject to the excise tax imposed under Section 4999 of the Code (or any successor provision thereto) or any similar tax imposed by state or local law or any interest or penalties with respect to such taxes (collectively, the “Excise Tax”), then prior to making the Covered Payments, a calculation shall be made comparing (i) the Net Benefit (as defined below) to ▇▇▇▇▇ of the Covered Payments after payment of the Excise Tax to (ii) the Net Benefit to ▇▇▇▇▇ if the Covered Payments are limited to the extent necessary to avoid being subject to the Excise Tax. Only if the amount calculated under (i) above is less than the amount under (ii) above will the Covered Payments be reduced to the minimum extent necessary to ensure that no portion of the Covered Payments is subject to the Excise Tax (that amount, the “Reduced Amount”). “Net Benefit” shall mean the present value of the Covered Payments net of all federal, state, local, foreign income, employment and excise taxes.

(b) The Covered Payments shall be reduced in a manner that maximizes ▇▇▇▇▇’▇ economic position. In applying this principle, the reduction shall be made in a manner consistent with the requirements of Section 409A of the Code, and where two economically equivalent amounts are subject to reduction but payable at different times, such amounts shall be reduced on a pro rata basis but not below zero.

(c) Any determination required under this Section 14 shall be made in writing in good faith by an independent accounting firm selected by the Company that is reasonably acceptable to ▇▇▇▇▇ (the “Accountants”), which shall provide detailed supporting calculations to the Company and ▇▇▇▇▇ as requested by the Company or ▇▇▇▇▇. The Company and ▇▇▇▇▇ shall provide the Accountants with such information and documents as the Accountants may reasonably request in order to make a determination under this Section 14. For purposes of making the calculations and determinations required by this Section 14, the Accountants may rely on reasonable, good faith assumptions and approximations concerning the application of Section 280G and Section 4999 of the Code. The Accountants’ determinations shall be final and binding on the Company and ▇▇▇▇▇. The Company shall be responsible for all fees and expenses incurred by the Accountants in connection with the calculations required by this Section 14.

(d) It is possible that after the determinations and selections made pursuant to this Section 14, ▇▇▇▇▇ will receive Covered Payments that are in the aggregate more than the amount provided under this Section 14 (“Overpayment”) or less than the amount provided under this Section 14 (“Underpayment”). In the event that: (A) the Accountants determine, based upon the assertion of a deficiency by the Internal Revenue Service against either the Company or ▇▇▇▇▇ which the Accountants

12

EXECUTION VERSION

believe has a high probability of success, that an Overpayment has been made or (B) it is established pursuant to a final determination of a court or an Internal Revenue Service proceeding that has been finally and conclusively resolved that an Overpayment has been made, then ▇▇▇▇▇ shall pay any such Overpayment to the Company. In the event that: (A) the Accountants, based upon controlling precedent or substantial authority, determine that an Underpayment has occurred or (B) a court of competent jurisdiction determines that an Underpayment has occurred, any such Underpayment will be paid promptly by the Company to or for the benefit of ▇▇▇▇▇ together with interest at the applicable federal rate (as defined in Section 7872(f)(2)(A) of the Code) from the date the amount would have otherwise been paid to ▇▇▇▇▇ until the payment is made.

15. Miscellaneous.

(a) Should any portion, term or provision of this Agreement be declared or determined by any court to be illegal, invalid or unenforceable, the validity or the remaining portions, terms and provisions shall not be affected thereby, and the illegal, invalid or unenforceable portion, term or provision shall be deemed not to be part of this Agreement, except that should the general release language be found to be illegal or unenforceable, ▇▇▇▇▇ agrees to execute a binding replacement release

(b) The parties agree that the failure of a party at any time to require performance of any provision of this Agreement shall not affect, diminish, obviate or void in any way the party’s full right or ability to require performance of the same or any other provision of this Agreement at any time thereafter.

(c) This Agreement shall inure to the benefit of and shall be binding upon ▇▇▇▇▇, his heirs, administrators, representatives, and executors, and upon the successors and assigns of the Company. ▇▇▇▇▇ may not (except by operation of law upon his death) assign or delegate his rights or obligations under this Agreement without the written consent of the Company. The Company’s payment obligations to ▇▇▇▇▇ set forth in Section 2 shall survive his death or disability prior to the Retirement Date and, in the event of his death, will be paid to his heirs and assigns as applicable.

(d) The headings of the paragraphs of this Agreement are for convenience only and are not binding on any interpretation of this Agreement.

(e) This Agreement may be executed in one or more counterparts, each of which will be deemed an original but all of which together will constitute one and the same agreement. Facsimile or PDF reproductions of original signatures shall be deemed binding for the purpose of the execution of this Agreement.

[remainder of page intentionally left blank]

13

EXECUTION VERSION

▇▇▇▇▇ ACKNOWLEDGES THAT HE HAS HAD OVER TWENTY-ONE (21) CALENDAR DAYS TO CONSIDER THIS AGREEMENT WHICH CONTAINS A GENERAL RELEASE AND HAS BEEN ADVISED TO CONSULT WITH AN ATTORNEY PRIOR TO HIS SIGNING OF THIS AGREEMENT AND GENERAL RELEASE.

HAVING ELECTED TO EXECUTE THIS AGREEMENT, TO FULFILL THE PROMISES AND TO RECEIVE THE SUMS AND BENEFITS CONTAINED HEREIN, ▇▇▇▇▇ FREELY AND KNOWINGLY, AND AFTER DUE CONSIDERATION, ENTERS INTO THIS AGREEMENT INTENDING TO WAIVE, SETTLE AND RELEASE ALL CLAIMS HE HAS OR MIGHT HAVE AGAINST THE COMPANY. SIMILARLY, HAVING ELECTED TO EXECUTE THIS AGREEMENT, TO FULFILL THE PROMISES AND TO RECEIVE THE BENEFITS CONTAINED HEREIN, THE COMPANY FREELY AND KNOWINGLY, AND AFTER DUE CONSIDERATION, ENTERS INTO THIS AGREEMENT INTENDING TO WAIVE, SETTLE AND RELEASE ALL CLAIMS IT AND ITS AFFILIATES HAVE OR MIGHT HAVE AGAINST THE ▇▇▇▇▇ RELEASED PARTIES.

[Signature Page Follows]

14

IN WITNESS WHEREOF, the parties have executed this Retirement Agreement as of the dates set forth below.

| BIODELIVERY SCIENCES INTERNATIONAL, INC. | ||

| By: | /s/ ▇▇▇▇▇ ▇. ▇’▇▇▇▇▇▇▇, ▇▇. | |

| Name: ▇▇▇▇▇ ▇. ▇’▇▇▇▇▇▇▇, ▇▇. | ||

| Title: Chairman | ||

| Date: August 23, 2017 | ||

| /s/ ▇▇▇▇ ▇. ▇▇▇▇▇ | ||

| ▇▇▇▇ ▇. ▇▇▇▇▇ | ||

| Date: August 23, 2017 | ||

EXHIBIT A

SUPPLEMENTAL RELEASE AGREEMENT

This SUPPLEMENTAL RELEASE AGREEMENT (the “Supplemental Release Agreement”) is entered into this day of , 2018 by and between BioDelivery Sciences International, Inc., (the “Company”), and ▇▇▇▇ ▇. ▇▇▇▇▇, his heirs, executors, administrators, successors, and assigns (collectively referred to throughout this Agreement as “▇▇▇▇▇”). The Company and ▇▇▇▇▇ are hereinafter collectively referred to as the “Parties.”

WHEREAS, the Parties previously entered into a Retirement Agreement, dated August , 2017 (the “Retirement Agreement”), detailing the terms of ▇▇▇▇▇’▇ retirement as an officer and employee of the Company (capitalized terms used herein and not defined herein shall have the respective meanings set forth in the Retirement Agreement);

WHEREAS, this Supplemental Release Agreement formed part of the Retirement Agreement, was expressly incorporated therein, and was attached as Exhibit B to the Retirement Agreement; and

WHEREAS, pursuant to the Retirement Agreement, ▇▇▇▇▇ and the Company agreed to execute and deliver to the other party this Supplemental Release Agreement containing a release of claims co-extensive and substantially similar with the release set forth in Retirement Agreement, to include the period between the execution of the Retirement Agreement and the Retirement Date.

NOW THEREFORE, for good and valuable consideration, including but not limited to the payments and benefits detailed under Section 2 of the Retirement Agreement, the provision of which is conditioned on ▇▇▇▇▇’▇ signing, returning and not revoking this Supplemental Release Agreement, the Parties hereby agree to the following:

1. ▇▇▇▇▇ and the Company will maintain the terms of this Supplemental Release Agreement confidential to the extent practicable and as permitted by law; provided, however, that (a) ▇▇▇▇▇ may disclose the terms of this Agreement to ▇▇▇▇▇’▇ immediate family members and to ▇▇▇▇▇’▇ attorneys, accountants, financial or tax advisors, and (b) nothing in this Section 1 is intended to prohibit ▇▇▇▇▇ or the Company from providing truthful information to any governmental agency, arbitrator, or court, or to otherwise testify truthfully under oath, as required by law or to the extent necessary to enforce the terms of this Agreement.

2. ▇▇▇▇▇’▇ Release. In consideration of the terms hereof, ▇▇▇▇▇, agrees to and does waive any and all claims ▇▇▇▇▇ may have for employment by the Company. ▇▇▇▇▇ knowingly and voluntarily releases and forever discharges the Company and its affiliates, divisions, predecessors, insurers, successors and assigns, and their current and former partners, employees, attorneys, officers, directors and agents thereof, both individually and in their business capacities, and their employee benefit plans and programs and their administrators and fiduciaries (collectively referred to throughout the remainder of this Agreement as the “Company Released Parties”), of and from any and all claims, known and unknown, asserted or unasserted, which ▇▇▇▇▇ has or may have against the Company Released Parties as of the date of execution of this Agreement, including, but not limited to, (i) any claims, whether statutory, common law, or otherwise, arising out of the terms or conditions of his employment or partnership at the Company; (ii) any claims, whether statutory, common law, or otherwise, arising out of the facts and circumstances of his employment and the termination of his employment at the Company; (iii) any claims for breach of contract, quantum meruit, unjust enrichment, breach of oral promise, tortious interference with business relations, injurious falsehood, defamation, negligent or intentional infliction of emotional distress, invasion of privacy, and any other common law contract and tort claims; (iv) any claims for

1

unpaid or lost benefits or salary, bonus, vacation pay, severance pay, or other compensation; (v) any claims for attorneys’ fees, costs, disbursements, or other expenses; (vi) any claims for damages or personal injury; (vii) any claims of employment discrimination, harassment or retaliation, whether based on federal, state, or local law or judicial or administrative decision; and (viii) any claims arising under the Fair Labor Standards Act, 29 U.S.C.§ 201, et seq.; Title VII of the Civil Rights Act of 1964, 42 U.S.C. § 2000e, et seq. (as amended); the Civil Rights Act of 1866, 42 U.S.C. § 1981; the Civil Rights Act of 1991, Pub. Law No. 102-166; the National Labor Relations Act, 29 U.S.C. § 151, et seq.; the Family and Medical Leave Act, 29 U.S.C. § 2601 et seq.; the Rehabilitation Act of 1973, 29 U.S.C. § 701, et seq.; the Age Discrimination in Employment Act; the Older Workers Benefit Protection Act; the Worker Adjustment and Retraining Notification Act; the Americans With Disabilities Act, 42 U.S.C. § 12101, et seq.; the Employee Retirement Income Security Act of 1974, 29 U.S.C. §1001, et seq., the ▇▇▇▇▇▇▇▇-▇▇▇▇▇ Act of 2002, 18 U.S.C. §1514A, et seq., the ▇▇▇▇-▇▇▇▇▇ ▇▇▇▇ Street Reform and Consumer Protection Act, claims under North Carolina or other state laws, including but not limited to the North Carolina Retaliatory Employment Discrimination Act, the North Carolina Persons with Disabilities Protection Act, the North Carolina Equal Employment Practices Act, and/or any other federal, state or local statute, law, ordinance, regulation or order, or the common law, or any self-regulatory organization rule or regulation. ▇▇▇▇▇ acknowledges that he has received any and all leaves (paid or unpaid) to which he may have been entitled during his employment. The enumeration of specific rights, claims, and causes of action being released should not be construed to limit the general scope of this Release. It is the intent of ▇▇▇▇▇ and the Company that by this Release, ▇▇▇▇▇ is giving up all rights, claims, and causes of actions against the Company Released Parties which accrued prior to the effective date hereof, whether or not he is aware of them and whether or not any damage or injury has yet occurred. This release does not include either Party’s right to enforce the terms of this Agreement. In connection with this release provision, ▇▇▇▇▇ does not waive his right to file a charge or participate in any proceeding of any federal, state or local governmental agency, including the Equal Employment Opportunity Commission, the National Labor Relations Board, and the Securities and Exchange Commission. To the extent permitted by law, ▇▇▇▇▇ agrees that if such a claim is made, ▇▇▇▇▇ shall not be entitled to recover any individual monetary relief or other individual remedies should any administrative agency pursue any claim on his behalf. Nothing in this Supplemental Release Agreement extinguishes any claims ▇▇▇▇▇ may have: (i) against the Company for breach of the Retirement Agreement; (ii) against any of the Company Released Parties for any claims arising from events that occur following the Effective Date; or (iii) related to the Company’s obligation, if any, to indemnify ▇▇▇▇▇ as an officer of the Company, including under any directors’ and officers’ liability policy maintained by the Company.

3. The Company’s Release. In consideration of the mutual agreements and covenants herein contained, by signing this Agreement, the Company knowingly and voluntarily releases and forever discharges ▇▇▇▇▇, his affiliates, and his attorneys and representatives (collectively referred to throughout the remainder of this Agreement as “▇▇▇▇▇ Released Parties”), of and from any and all claims, known and unknown, asserted or unasserted, which the Company has or may have against ▇▇▇▇▇ or any ▇▇▇▇▇ Released Parties as of the date of execution of this Agreement, including, but not limited to: (i) any claims, whether statutory, common law, or otherwise; (ii) any claims for breach of contract, breach of fiduciary duty, conversion, quantum meruit, unjust enrichment, breach of oral promise, tortuous interference with business relations, injurious falsehood, defamation, and any other common law contract and tort claims; (iii) any claims for attorneys’ fees, costs, disbursements, or other expenses; and (vi) any claims for damages; provided, however, that expressly excluded from such released claims are (A) claims arising out of ▇▇▇▇▇’▇ capacity as an officer or employee of the Company for fraud, criminal acts, intentional misconduct, or actively concealed grossly negligent acts, and (B) any claims relating specifically to ▇▇▇▇▇’▇ actions or omissions as a director of the Company. The enumeration of specific rights, claims, and causes of action being released should not be construed to limit the general scope of the foregoing release. It is the intent of ▇▇▇▇▇ and the Company that by the foregoing release, the Company is giving up all rights, claims, and causes of actions against the ▇▇▇▇▇ Released Parties which

2

accrued prior to the effective date hereof, whether or not he is aware of them and whether or not any damage or injury has yet occurred. This release does not include either Party’s right to enforce the terms of this Agreement. Nothing in this Agreement extinguishes any claims the Company may have: (i) against ▇▇▇▇▇ for breach of the Retirement Agreement or this Agreement; or (ii) against any of the ▇▇▇▇▇ Released Parties for any claims arising from events that occur following the Effective Date (as defined in the Supplemental Release Agreement).

4. ▇▇▇▇▇ and the Company acknowledge that before entering into this Agreement, each party has had the opportunity to consult with an attorney. ▇▇▇▇▇ further acknowledges that he has entered into this Agreement of his own free will, and that no promises or representations have been made to him by any person to induce him to enter into this Agreement other than the express terms set forth herein. ▇▇▇▇▇ further acknowledges that he has read this Agreement and understands all of its terms, including the waiver and release of claims set forth in Section 2 above. ▇▇▇▇▇ further acknowledges that he has been afforded 21 days or more to consider this Agreement before signing and returning it.

5. ▇▇▇▇▇ and the Company must sign this Supplemental Release Agreement on the Retirement Date or within three (3) business days thereafter. Under no circumstances is ▇▇▇▇▇ or the Company to return the Supplemental Release Agreement to the Company’s President or sign the Supplemental Release Agreement prior to the Retirement Date.

6. ▇▇▇▇▇ may revoke his acceptance of this Supplemental Release Agreement for a period of seven (7) calendar days following the day he executes this Supplemental Release Agreement. In order to revoke this Supplemental Release Agreement, ▇▇▇▇▇ must state his desire to revoke in writing and, on or before the seventh day after execution, e-mail said writing to the Company’s Attorney, ▇▇▇▇▇▇▇▇ ▇. ▇▇▇▇▇▇▇▇▇▇, Esq., at ▇▇▇▇▇▇▇▇▇▇▇@▇▇▇▇▇▇.▇▇▇. Additionally, a confirmation of said revocation must be mailed, post-marked on or before the seventh day after execution, to ▇▇▇▇▇▇▇▇ ▇. ▇▇▇▇▇▇▇▇▇▇, Esq., Ellenoff ▇▇▇▇▇▇▇▇ & Schole LLP, ▇▇▇▇ ▇▇▇▇▇▇ ▇▇ ▇▇▇ ▇▇▇▇▇▇▇▇, ▇▇▇▇ ▇▇▇▇▇, ▇▇▇ ▇▇▇▇, ▇▇ ▇▇▇▇▇. If the last day of the revocation period is a Saturday, Sunday, or legal holiday, then the revocation period shall not expire until the next following day which is not a Saturday, Sunday, or legal holiday.

7. The “Effective Date” of this Supplemental Release Agreement shall be the eighth (8th) business day after ▇▇▇▇▇’▇ execution hereof. The Company’s failure to execute this Supplemental Release Agreement shall not relieve the Company of its full obligations under the Retirement Agreement, including its obligations under Section 2.

▇▇▇▇▇ ACKNOWLEDGES THAT HE HAS HAD OVER TWENTY-ONE (21) CALENDAR DAYS TO CONSIDER THIS AGREEMENT WHICH CONTAINS A GENERAL RELEASE AND HAS BEEN ADVISED TO CONSULT WITH AN ATTORNEY PRIOR TO HIS SIGNING OF THIS AGREEMENT AND GENERAL RELEASE.

HAVING ELECTED TO EXECUTE THIS AGREEMENT, TO FULFILL THE PROMISES AND TO RECEIVE THE SUMS AND BENEFITS CONTAINED HEREIN, ▇▇▇▇▇ FREELY AND KNOWINGLY, AND AFTER DUE CONSIDERATION, ENTERS INTO THIS AGREEMENT INTENDING TO WAIVE, SETTLE AND RELEASE ALL CLAIMS HE HAS OR MIGHT HAVE AGAINST THE COMPANY. SIMILARLY, HAVING ELECTED TO EXECUTE THIS AGREEMENT, TO FULFILL THE PROMISES AND TO RECEIVE THE BENEFITS CONTAINED HEREIN, THE COMPANY FREELY AND KNOWINGLY, AND AFTER DUE CONSIDERATION, ENTERS INTO THIS AGREEMENT INTENDING TO WAIVE, SETTLE AND RELEASE ALL CLAIMS IT AND ITS AFFILIATES HAVE OR MIGHT HAVE AGAINST THE ▇▇▇▇▇ RELEASED PARTIES.

3

IN WITNESS WHEREOF, the parties have executed this Supplemental Release Agreement as of the dates set forth below.

| BIODELIVERY SCIENCES INTERNATIONAL, INC. | ||

| By: | ||

| Name: | ||

| Title: | ||

| Date: | ||

| ▇▇▇▇ ▇. ▇▇▇▇▇ | ||

| Date: | ||

4