SECOND AMENDED AND RESTATED LIMITED PARTNERSHIP AGREEMENT OF WESTERN REFINING COMPANY, L.P.

Exhibit 3.20

SECOND AMENDED AND RESTATED LIMITED

PARTNERSHIP AGREEMENT OF

WESTERN REFINING COMPANY, L.P.

August 29, 2003

SECOND AMENDED AND RESTATED

LIMITED PARTNERSHIP AGREEMENT OF

WESTERN REFINING COMPANY, L.P.

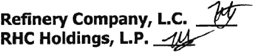

THIS SECOND AMENDED AND RESTATED LIMITED PARTNERSHIP AGREEMENT OF WESTERN REFINING COMPANY, L.P. (this “Agreement” effective the 29th day of August, 2003 (the “Effective Date”), is made by and between: (i) Refinery Company, L.C., a Texas limited liability company, as general partner (as indicated and as additionally herein provided, the “General Partner”; and (ii) RHC Holdings, L.P., a Texas limited partnership, as limited partner (the “Limited Partner” (the General Partner and Limited Partner shall be collectively referred to herein as the “Partners”)

ARTICLE I

FORMATION AND ORGANIZATION-

1.1 Certain Definitions. Capitalized terms used in this Agreement have the following meanings:

“Act” means the Delaware Revised Uniform Limited Partnership Act, as from time to time amended.

“Adjusted Capital Account Deficit” means, with respect to any Interest Holder, the deficit balance, if any, in such Interest Holder’s capital Account as of the end of the relevant Allocation Year, after giving effect to the following adjustments:

(i) Credit to the Interest Holder’s capital Account any amounts which such Interest Holder is obligated to restore pursuant to any provision of this Agreement or is deemed to be obligated to restore pursuant to the penultimate sentences of Regulations Sections 1.704-2(g)(1) and 1.704-2(i)(5); and

(ii) Debit to the Interest Holder’s Capital Account the items described in Sections 1.704-1(b)(2)(ii)(d)(4), 1.704-1(b)(2)(ii)(d)(5), and 1.704-1(b)(2)(ii)(d)(6) of the Regulations.

The foregoing definition of Adjusted Capital Account Deficit is intended to comply with the provisions of Section 1.704-l(b)(2)(ii)(d) of the Regulations and shall be interpreted consistently therewith.

Second Amended and Restated Limited Partnership Agreement-Page 2 of 44

“Adjusted Capital Contributions” means, as of any day, an Interest Holder’s Capital Contributions adjusted as follows:

(i) Increased by the amount of any Partnership liabilities which, in connection with Distributions pursuant to this Agreement, are assumed by the Interest Holder or are secured by any property of the Partnership distributed to such Interest Holder;

(ii) Increased by any amounts actually paid by such Interest Holder to any Partnership lender pursuant to the terms of any Assumption Agreement; and

(iii) Reduced by the amount of cash and the Gross Asset Value of any Partnership Property distributed to the Interest Holder pursuant to this Agreement, and the amount of any liabilities of such Interest Holder assumed by the Partnership or which are secured by any property contributed by such Interest Holder to the Partnership.

In the event any Interest Holder transfers all or any portion of his Interest in accordance with the terms of this Agreement, his/her/its transferee shall succeed to the Adjusted Capital Contribution of the transferor to the extent it relates to the transferred Interest.

“Affiliate” means, when used with reference to a specified Person, any Person that directly or indirectly controls or is controlled by or is under common control with the specified Person. In the case of a Person who is an individual, Affiliate shall include (x) any member of the immediate family of such Person, including the spouse, siblings and lineal descendants and their spouses, of such immediate family member, (y) any trust whose principal beneficiary is such Person or one or more members of such Person’s immediate family, and (z) any Person or entity controlled by such individual’s immediate family or any such trust. For purposes of this definition “control” when used with respect to any specified Person or entity means the power to direct the management and policies of such Person or entity, directly or indirectly, whether through the ownership of voting securities, by contract or otherwise.

“Agreement” means this Second Amended and Restated Limited Partnership Agreement of Western Refining Company, L.P.

“Allocation Year” means (i) any period commencing on January 1 and ending on the following December 31, or (ii) any portion of the period described in clause (i) for which the Partnership is required to allocate Profits, Losses, and other items of Partnership income, gain, loss or deduction pursuant to Article III.

“Assumption Agreement” means any agreement among the Partnership, any of the Partners, and any Person to whom the Partnership is indebted pursuant to a loan agreement, any seller financing with respect to an installment sale, a reimbursement agreement, or any other arrangement (collectively, a “Loan” pursuant to which any Interest Holder expressly assumes any personal liability with respect to such Loan. The

Second Amended and Restated Limited Partnership Agreement-Page 3 of 44

amount of any such Loan shall be treated as assumed by the assuming Interest Holder for all purposes under this Agreement in the proportions set forth in such Assumption Agreement and the respective amounts so assumed shall be credited to the assuming Interest Holders’ respective Capital Accounts under Section 2.4(a)(i). To the extent such Loan is repaid by the Partnership, and not the assuming Interest Holder, the assuming Interest Holder’s capital Account shall be debited with his/her/its respective share of the repayments under 2.4(a)(ii). To the extent such Loan is actually repaid by the assuming Interest Holder from his/her/its own funds, there shall be no adjustments to the Capital Accounts of the assuming Interest Holders to the extent that those Interest Holders actually repay his/her/its allocation of such Loan.

“Assignee” means a person who has acquired a Limited Partner’s beneficial Interest or a portion thereof and has not become a substituted Limited Partner.

“Attempted Disposition” means any act or occurrence which would constitute a Disposition hereunder but for the fact that such act or occurrence was in breach of, or not in accordance with, the terms and provisions of this Agreement.

“Base Rate” means the rate of interest as officially designated from time to time by Bank of America, N.A. or by any successors to it, as being its “base rate” or “prime rate”, such interest being adjusted hereunder on an annual basis; in the event said bank ceases to designate a “Prime Rate” or a “Base Rate”, the “Base Rate”, as used herein, shall be established as the lowest base rate or prime rate published in the Wall Street Journal, or (if not so then published) by using the comparable rate published in some other comparable national publication.

“Capital Account” has the meaning set forth in Section 2.4.

“Capital Contribution” means, with respect to any Interest Holder, the amount of money and the initial Gross Asset Value of any property (other than money) contributed to the Partnership by such Person (or its predecessors in interest) with respect to the Interest held by such Person.

“Code” means the Internal Revenue Code of 1986, as amended.

“Depreciation” means, for each Allocation Year, an amount equal to the depreciation, amortization, or other cost recovery deduction allowable for federal income tax purposes with respect to an asset for such Allocation Year, except that if the Gross Asset Value of an asset differs from its adjusted basis for federal income tax purposes at the beginning of such Allocation Year, Depreciation shall be an amount which bears the same ratio to such beginning Gross Asset Value as the federal income tax depreciation, amortization, or other cost recovery deduction for such Allocation Year bears to such beginning adjusted tax basis; provided, however, that if the adjusted basis for federal income tax purposes of an asset at the beginning of such Allocation Year is zero, Depreciation shall be determined with reference to such beginning Gross Asset Value using any reasonable method selected by the General Partner, in its sole and absolute discretion.

Second Amended and Restated Limited Partnership Agreement-Page 4 of 44

“Determination Date” means (i) the date of the Offer, in the case of a purchase of an Interest pursuant to Section 9.2 hereof; or (ii) in the case of a purchase of an Interest upon an Involuntary Disposition pursuant to Section 9.3 hereof, the date of such Involuntary Disposition; or (iii) in the case of a purchase of an Interest upon termination of marital relationship pursuant to Section 9.4 hereof, the date of such termination of such marital relationship; or (iv) in the case of a purchase of an Interest upon death pursuant to Section 9.5(a) hereof, the date of such death; or (v) in the case of a purchase of an Interest upon Permanent Disability pursuant Section 9.5(b) hereof, the date of determination of such Permanent Disability.

“Dispute” has the meaning set forth in Article XI.

“Disposition” has the meaning set forth in Section 9.2.

“Distributable Funds” has the meaning set forth in Section 3.6.

“Distribution” means the transfer of money or property by the Partnership to the Interest Holders without consideration.

“Fiscal Year” or “Year” means a calendar year (or portion thereof) ending on December 31 of such year.

“General Partner” means (i) Refinery Company, L.C., (ii) any other Person or Persons that succeed Refinery Company, L.C. in that capacity or (iii) any other Person not otherwise identified or defined herein who shall be admitted as a General Partner in accordance with the provisions hereof.

“Gross Asset Value” means, with respect to any asset, the asset’s adjusted basis for federal income tax purposes, except as follows:

(i) The initial Gross Asset Value of any asset contributed by a Partner to the Partnership shall be the gross fair market value of such asset, as determined by the contributing Partner and the General Partner;

(ii) The Gross Asset Values of all Partnership Property shall be adjusted to equal their respective gross fair market values, as determined by the General Partner in its sole and absolute discretion, as of the following times: (A) the acquisition of an additional Interest by any new or existing Partner in exchange for more than a de minimis Capital Contribution; (B) a Capital Contribution by a Partner or Interest Holder of more than that Person’s pro rata contribution; (C) the Distribution by the Partnership to

Second Amended and Restated Limited Partnership Agreement-Page 5 of 44

an Interest Holder of more than a de minimis amount of Partnership Property as consideration for an Interest; and (D) the liquidation of the Partnership within the meaning of Regulations Section 1.704-l(b)(2)(ii)(g); provided, however, that adjustments pursuant to clauses (A), (B), and (C) above shall be made only if the General Partner reasonably determines that such adjustments are necessary or appropriate to reflect the relative economic interests of the General Partner and Interest Holders in the Partnership;

(iii) The Gross Asset Value of any Partnership Property distributed to any Interest Holder shall be adjusted to equal the gross fair market value of that Partnership Property on the date of Distribution as determined by the distributee and the General Partner; and

(iv) The Gross Asset Value of Partnership Property shall be increased (or decreased) to reflect any adjustments to the adjusted basis of such assets pursuant to Code Section 734(b) or Code Section 743(b), but only to the extent that such adjustments are taken into account in determining Capital Accounts pursuant to Regulation Section 1.704-l(b)(2)(iv)(m) and subparagraph (vi) of the definition of Profits and Losses in Section 1.1 or Section 3.2(g); provided, however, that Gross Asset Values shall not be adjusted pursuant to this subparagraph (iv) to the extent the General Partner determines that an adjustment pursuant to subparagraph (ii) is necessary or appropriate in connection with a transaction that would otherwise result in an adjustment pursuant to this subparagraph (iv).

If the Gross Asset Value of an asset has been determined or adjusted pursuant to subparagraphs (i), (ii), or (iv), such Gross Asset Value shall thereafter be adjusted by the Depreciation taken into account with respect to such asset for purposes of computing Profits and Losses. For purposes of this definition of Gross Asset Value, a Capital Contribution or Distribution shall be considered de minimis if its value is less than $1,000.00.

“Guaranteed Indebtedness” has the meaning set forth in Section 9.7.

“Interest” means a Person’s entire right, title and interest in the Partnership and all rights and benefits there from (including such Person’s capital Account, Ownership Percentage, and share of Profits, Losses and Distributions), together with all obligations of such Person to comply with the terms and provisions of this Agreement.

“Interest Holder” or “Interest Holders” means any and all Persons who hold an Interest, regardless of whether such Person has been admitted to the Partnership as a General Partner or Limited Partner, or is an Assignee of a Partner.

“Issuance Items” has the meaning set forth in Section 3.2(h).

Second Amended and Restated Limited Partnership Agreement-Page 6 of 44

“Involuntary Disposition” means: (i) committing an act of bankruptcy or making a general assignment for the benefit of creditors; or (ii) if there is filed by or against an Interest Holder other than the General Partner a petition in bankruptcy or a petition for the appointment of a receiver, or the commencement under any bankruptcy or insolvency laws of any proceeding for relief, composition, extension, arrangement or adjustment of any obligations of such an Interest Holder; or (iii) the issuance of any writ, attachment or similar process against the property of an Interest Holder other than the General Partner; or (iv) the taking of possession of or assumption of control of all or any substantial part of the property of an Interest Holder other than the General Partner by any government or agency thereof.

PROVIDED, HOWEVER, NOTWITHSTANDING THE FOREGOING, there shall be no Involuntary Disposition pursuant to (ii), (iii), or (iv) above if, within sixty (60) days after: [a] any matter described in (ii), such filing, petition, or commencement is withdrawn, released, vacated or stayed; or [b] any matter described in (iii) above, such writ, attachment, or similar process is vacated, released, or bonded; or [c] any matter described in (iv) above, such taking of possession of or assumption of control shall have been rescinded or otherwise relinquished or abandoned.

The date of such Involuntary Disposition shall be: [i] with respect to any matter described in (i) upon the committing of such acts of bankruptcy or making of such general assignment; or [ii] with respect to any matter described in (ii), (iii), or (iv) above, upon the expiration of such sixty (60) day period without any of the applicable curative events described above.

“Limited Partner” or “Limited Partners” shall refer to, (i) RHC Holdings, L.P.; and (ii) to any other Person not otherwise identified and defined herein who shall be admitted as a Limited Partner in accordance with the provisions hereof.

“Loans” has the meaning set forth in the definition of “Assumption Agreement”.

“Losses” has the meaning set forth in the definition of “Profits” and “Losses” below.

“Majority Vote” means the affirmative vote or written consent of Partners then owning of record more than fifty percent (50%) of the total Ownership Percentages of the Partnership.

“Net Cash From Operations” means the gross cash proceeds from Partnership operations (including, without limitation, Capital Contributions, sales and dispositions of Partnership Property in the ordinary course of business) less the portion thereof used to pay or establish reserves for all Partnership Expenses, working capital, debt payments, capital improvements, replacements, and contingencies(“Reserves”), all as

Second Amended and Restated Limited Partnership Agreement-Page 7 of 44

determined by the General Partner in its sole discretion, whose determination shall be final and binding on all Interest Holders. Net cash From Operations shall not be reduced by depreciation, amortization, cost recovery deductions, or similar allowances, but shall be increased by any reductions of Reserves previously established pursuant to the first sentence of this definition and the definition of Net Cash from Sales or Refinancings.

“Net Cash From Sales or Refinancings” means the net cash proceeds from all sales and other dispositions (other than in the ordinary course of business) and all refinancings of Partnership Property, whether in whole or in part, less any portion thereof used to establish Reserves, all as determined by the General Partner in its sole discretion, whose determination shall be final and binding on all Interest Holders. Net Cash From Sales or Refinancings shall include, without limitation, all principal and interest payments with respect to any note or other obligation received by the Partnership in connection with sales and other dispositions (other than in the ordinary course of business) of Partnership Property; and the proceeds of casualty insurance or condemnation awards not currently required for Reserves, rebuilding, restoration, repair, maintenance, or operation of the Partnership or Partnership Property.

“Nonrecourse Deductions” has the meaning set forth in Section 704-2(b)(l) and 1.704-2(c) of the Regulations.

“Nonrecourse Liability” has the meaning set forth in Section 1.704-2(b)(3) of the Regulations.

“Offer” has the meaning set forth in Section 9.2(a).

“Ownership Percentage” has the meaning set forth in Section 2.5.

“Partner” or “Partners” shall refer to the General Partner and the Limited Partners, or any of them.

“Partner Nonrecourse Debt” the same meaning as the term “partner nonrecourse debt” set forth in Section 1.704-2(b)(4) of the Regulations.

“Partner Nonrecourse Debt Minimum Gain” means an amount, with respect to each Partner Nonrecourse Debt, equal to the Partnership Minimum Gain that would result if such Partner Nonrecourse Debt were treated as a Nonrecourse Liability, determined in accordance with Section 1.704-2(i)(3) of the Regulations.

“Partner Nonrecourse Deductions” has the same meaning as the term “partner nonrecourse deductions” set forth in Sections 1.704-2(i)(l) and 1.704-2(i)(2) of the Regulations.

Second Amended and Restated Limited Partnership Agreement-Page 8 of 44

“Partnership” means Western Refining Company, L.P.

“Partnership Expenses” means (i) all cash expenditures and accruals therefor of the Partnership incurred in the operation of the Partnership’s business, (ii) all principal and interest payments relating to any indebtedness incurred by the Partnership, and (iii) all capital costs incurred by the Partnership.

“Partnership Minimum Gain” has the meaning set forth in Sections 1.704-2(b)(2) and 1.704-2(d) of the Regulations.

“Partnership Property” means all real and personal property owned by the Partnership and any improvements thereto, and shall include both tangible and intangible property.

“Permanent Disability” means, with respect to an Interest Holder who is an employee of the Partnership or an Affiliate of the Partnership, the failure or inability of such Interest Holder and/or the medical diagnosis that such Interest Holder will be unable, due to physical condition or mental illness of any kind, to perform his/her full time duties as an employee of the Partnership or an Affiliate of the Partnership for a period of one hundred eighty (180) consecutive days. In the event that the Partnership and such affected Interest Holder disagree as to whether such affected Interest Holder is permanently disabled, then such determination shall be made in writing by a physician mutually selected by the Partnership and such affected Interest Holder. The written determination by the physician so selected as to the permanent disability of such Interest Holder shall be conclusive and binding upon the parties hereto for the purposes of this Agreement. The expenses of the medical examination to determine such matters shall be borne solely by the Partnership.

“Person”, whether or not capitalized, means an individual, a corporation, a partnership, a limited liability company, an association, a trust or any other entity or organization, including (by way of example and without limitation) a government or political subdivision or an agency or instrumentality thereof.

“Profits” and “Losses” means, for each Allocation Year, an amount equal to the Partnership’s taxable income or loss for such Allocation Year, determined in accordance with Code Section 703(a) (for this purpose, all items of income, gain, loss, or deduction required to be stated separately pursuant to Code Section 703(a)(l) shall be included in taxable income or loss), with the following adjustments:

(i) Any income of the Partnership that is exempt from federal income tax and not otherwise taken into account in computing Profits or Losses pursuant to this definition of Profits and Losses shall be added to such taxable income or loss;

Second Amended and Restated Limited Partnership Agreement-Page 9 of 44

(ii) Any expenditures of the Partnership described in Code Section 705(a)(2)(B) or treated as Code Section 705(a)(2)(B) expenditures pursuant to Regulations Section 1.704-l(b)(2)(iv)(i), and not otherwise taken into account in computing Profits or Losses pursuant to this definition of Profits and Losses shall be subtracted from such taxable income or loss;

(iii) In the event the Gross Asset Value of any Partnership asset is adjusted pursuant to subparagraphs (ii) or (iii) of the definition of Gross Asset Value, the amount of such adjustment shall be taken into account as gain or loss from the disposition of such asset for purposes of computing Profits or Losses;

(iv) Gain or loss resulting from any disposition of Partnership Property with respect to which gain or loss is recognized for federal income tax purposes shall be computed by reference to the Gross Asset Value of the Partnership Property disposed of, notwithstanding that the adjusted tax basis of such property differs from its Gross Asset Value;

(v) In lieu of the depreciation, amortization, and other cost recovery deductions taken into account in computing such taxable income or loss, there shall be taken into account Depreciation for such Allocation Year, computed in accordance with the definition of Depreciation;

(vi) To the extent an adjustment to the adjusted tax basis of any Partnership Property pursuant to Code Section 734(b) or Code Section 743(b) is required pursuant to Regulations Section 1.704-1(b)(2)(iv)(m)(4) to be taken into account in determining Capital Accounts as a result of a Distribution other than in complete liquidation of an Interest Holder’s Interest, the amount of such adjustment shall be treated as an item of gain (if the adjustment increases the basis of the asset) or loss (if the adjustment decreases the basis of the asset) from the disposition of the asset and shall be taken into account for purposes of computing Profits or Losses; and

(vii) Any items which are specially allocated pursuant to Section 3.2 and/or Section 3.3 shall not be taken into account in computing Profits or Losses.

The amounts of the items of Partnership income, gain, loss, or deduction available to be specially allocated pursuant to Sections 3.2 and/or 3.3 shall be determined by applying rules analogous to those set forth in subparagraphs (i) through (vi) above.

“Regulations” means the Federal Income Tax Regulations, including, without limitation, the Temporary Regulations and proposed Regulations, promulgated and/or proposed under the Code, as such regulations may be amended from time to time (including corresponding provisions of succeeding regulations).

Second Amended and Restated Limited Partnership Agreement-Page 10 of 44

“Regulatory Allocations” has the meaning set forth in Section 3.3.

“Reserves” has the meaning set forth in the definition of Net Cash From Operations.

“Rules” has the meaning set forth in Section 11.3.

“Section” shall refer to the numbered sections of this Agreement, unless otherwise specified herein.

“Super-Majority Vote” means the affirmative vote or written consent of Partners then owning of record more than sixty-seven percent (67%) of the total Ownership Percentages of the Partnership.

“Tax Distribution” has the meaning set forth in Section 3.7(d) hereof.

1.2 Formation and Name of Partnership. The Partnership has been formed as a limited partnership pursuant to the Act. The Partnership shall conduct its business under the name “Western Refining Company, L.P.”, and such name shall be used at all times in connection with the Partnership’s business and affairs; provided, however, the Partnership may conduct its business under one (1) or more assumed names, as determined by the General Partner.

1.3 Term. The Partnership shall continue until dissolved pursuant to Article X hereof, and this Agreement shall be effective, from and after the Effective Date hereof.

1.4 Principal Place of Business; Assumed Name Certificate.

(a) The principal place of business of the Partnership, where the books and records of the Partnership shall be kept, shall be 0000 Xxxxxxxxxx Xxxxx, Xx Xxxx, Xxxxx 00000, and thereafter such other place or places as the General Partner may from time to time determine. The General Partner shall promptly notify the Limited Partners of any change in the Partnership’s principal place of business.

(b) The Partners shall execute any assumed or fictitious name certificate or certificates required by law to be filed in connection with the formation of the Partnership and shall cause such certificate or certificates to be filed in the appropriate records.

1.5 Purposes of the Partnership. The Partnership shall have the power and authority to engage in any activity and exercise any powers permitted to limited partnerships under the laws of the State of Delaware.

Second Amended and Restated Limited Partnership Agreement-Page 11 of 44

1.6 General Partner. Refinery Company, L.C., a Texas limited liability company, shall be and is hereby constituted the General Partner of the Partnership. The address of the General Partner shall be at such place or places as the member of Refinery Company, L.C. may from time to time deem advisable.

1.7 Limited Partners. The sole Limited Partner is RHC Holding, L.P., a Texas limited partnership.

ARTICLE II

CAPITAL CONTRIBUTIONS AND FINANCING

2.1 Agreed Capital Contributions; Optional Additional Capital Contributions; Capital Deficit Restoration Requirements.

(a) The initial Capital Accounts of the Partnership were set forth in the Partnership Agreement dated May 4, 1993, and such Capital Accounts were transferred pursuant to that certain Purchase Agreement dated August 29, 2000 by and among The CIT Group/EI Paso Refinery, Inc., NYUFE Refinery Inc., Mellon Bank, N.A., as Trustee for the Long Term Investment Trust, Xxxx Xxxxxxx Life Insurance Company and Xxxx Xxxxxxx Variable Life Insurance, as Sellers, and Western Refining Company, a Texas corporation and the Limited Partner, as purchasers. The Partner’s Capital Contributions and Capital Accounts are set forth on Exhibit A attached hereto.

(b) In addition to the Capital Contributions set forth above, the General Partner may permit Interest Holders to make optional additional Capital Contributions. Following the making of an additional Capital Contribution, the Ownership Percentages of the Partners may be adjusted, at the sole and absolute discretion of the General Partner, as set forth in Section 2.5 below.

2.2 Financing. The funds to finance the business of the Partnership shall be derived from the following sources to the extent that the Partnership's operating revenues are not sufficient: (i) the agreed Capital Contributions of the Partners, as provided in Section 2.1(a) above; (ii) additional Capital Contributions of the Partners as provided in Section 2.1(b) above; and (iii) loans to the Partnership from Partners, Affiliates of Partners, or third party lenders (including, by way of example only and without limitation, banks or mortgage companies). The terms of financing in the form of loans from Partners and Affiliates of Partners shall be reasonably consistent with the terms that can be obtained for similar projects from unrelated third party lenders. If financing in the form of loans is approved by the General Partner, all other Interest Holders shall cooperate with the General Partner in connection therewith.

Second Amended and Restated Limited Partnership Agreement-Page 12 of 44

2.3 Withdrawal of Capital Interest. No Interest Holder shall be entitled to withdraw any part of such Interest Holder’s Capital Contribution or to receive any Distribution from the Partnership except as provided in this Agreement. No Interest Holder shall be entitled to demand or receive from the Partnership (i) interest on such Interest Holder's capital Contribution or (ii) property other than cash in return of such Interest Holder’s Capital Contribution.

2.4 Capital Accounts. One individual capital account (“Capital Account” shall be maintained for each Interest Holder. The Capital Account balance for each Interest Holder as of the Effective Date shall be as set forth on Exhibit A hereto. Thereafter, the Capital Account for that Interest Holder shall be maintained in accordance with the following provisions:

(a) Adjustments Required by Partnership Operations. The Capital Accounts shall be adjusted to reflect the impact of the Partnership's operations as follows:

(i) Increased by:

(1) that Interest Holder’s additional pro-rata Capital Contributions (any contribution of property, other than money, by an Interest Holder to the Partnership will result in an increase of such Interest Holder’s Capital Account equal to the agreed fair market value of the property contributed, as mutually agreed by the General Partner and the contributing Interest Holder) net of liabilities secured by such contributed property that the Partnership is considered to assume or take subject to under Section 752 of the Code;

(2) that Interest Holder’s distributive share of Profits, as allocated to it under Article III;

(3) any items in the nature of income or gain which are specially allocated to that Interest Holder pursuant to Section 3.2 and/or Section 3.3 hereof; and

(4) the amount of any Partnership liabilities assumed by that Interest Holder or which are secured by any Partnership Property distributed to that Interest Holder.

(ii) Decreased by:

(1) the amount of cash and the Gross Asset Value of any Partnership Property distributed to that Interest Holder under any provision of this Agreement (any Distribution of Partnership Property, other than money, to an Interest Holder will result in a reduction in such Interest Holder’s Capital Account in an amount equal to the agreed fair market value of the property distributed to such Interest Holder, as mutually agreed by the General Partner and the Interest Holder receiving such distributed property) net of liabilities secured by such distributed property that such Interest Holder is considered to assume or take subject to under Section 752 of the Code;

Second Amended and Restated Limited Partnership Agreement-Page 13 of 44

(2) that Interest Holder’s distributive share of Losses or deductions allocated to that Interest Holder under Article III;

(3) any items in the nature of expenses or losses which are specially allocated to that Interest Holder under Section 3.2 and/or Section 3.3; and

(4) that Interest Holder’s share of Partnership expenditures described in Code Section 705(a)(2)(B).

In determining the amount of any liability for purposes of subparagraphs (a)(i) and (a)(ii), and the definition of Adjusted Capital Contributions, there shall be taken into account Code Section 752(c) and any other applicable provisions of the Code and Regulations.

(iii) Otherwise adjusted in accordance with the Capital Account maintenance rules of Regulations Section 1.704-l(b)(2)(iv).

(b) Admission of Additional Limited Partners. If the General Partner determines, in its sole and absolute discretion, that additional capital would be beneficial to the Partnership, the General Partner may raise the additional capital by admitting additional Limited Partners to the Partnership on such terms and conditions as determined by the General Partner, subject to the remaining provisions of this Section 2.4(b) but otherwise in the General Partner’s sole and absolute discretion.

(1) Immediately before the admission of an additional Limited Partner, each Interest Holder’s Capital Account shall be adjusted to reflect the Gross Asset Value of the Partnership Property. Then, the additional Limited Partner’s Capital Account shall be created by the Partnership, and the Ownership Percentages of the Interest Holders shall be adjusted as provided in Section 2.5. The purpose of adjusting the Capital Accounts in this manner is to properly reflect the economic relationship among all Interest Holders on the Partnership's books and records.

(2) As conditions precedent to any Person’s becoming an additional Limited Partner, any such Person and his/her spouse shall become (by written joinder agreement or otherwise) parties to this Agreement, which shall bind them to, and grant them the benefits of, this Agreement.

(c) Non-Pro Rata Capital Contributions. If additional non-pro rata Capital Contributions are made by any Partner, at the General Partner’s sole and absolute discretion, each Interest Holder’s capital Account may be adjusted to reflect the Gross Asset Value of the Partnership Property immediately before the non-pro rata

Second Amended and Restated Limited Partnership Agreement-Page 14 of 44

Capital Contribution. Then, the non-pro rata Capital Contribution of the contributing Partner will be added to that Partner’s Capital Account and the Ownership Percentages of the Interest Holders shall be adjusted as provided in Section 2.5. The purpose of adjusting the Capital Accounts in this manner is to properly reflect the economic relationship among all Interest Holders on the Partnership's books and records.

The foregoing provisions of this Section 2.4 and the other provisions of this Agreement relating to the maintenance of Capital Accounts are intended to comply with Regulations Section 1.704-l(b), and shall be interpreted and applied in a manner consistent with such Regulations. In the event all or a portion of an Interest is transferred in accordance with the terms of this Agreement, the transferee shall succeed to the Capital Account of the transferor to the extent it relates to the transferred Interest. In the event the General Partner determines, in its sole and absolute discretion, that it is prudent to modify the manner in which the Capital Accounts, or any debits or credits thereto (including, without limitation, debits or credits relating to liabilities which are secured by contributions or distributed property or which are assumed by the Partnership or Interest Holders), are computed in order to comply with such Regulations, the General Partner may make such modification, provided that it is not likely to have a material adverse effect on the amounts distributed to any Person pursuant to Article X upon the dissolution of the Partnership. The General Partner also shall (i) make any adjustments that are necessary or appropriate to maintain equality between the Capital Accounts of the General Partner and other Interest Holders and the amount of Partnership capital reflected on the Partnership's balance sheet, as computed for book purposes, in accordance with Regulations Section 1.704-1(b)(2)(iv)(q), and (ii) make any appropriate modifications in the event unanticipated events might otherwise cause this Agreement not to comply with Regulations Section 1.704-l(b), provided that, to the extent that any such adjustment is inconsistent with other provisions of this Agreement and would have a material adverse effect on any Limited Partner, such adjustment shall require the consent of the affected Limited Partner.

2.5 Ownership Percentages. The beneficial ownership interest of each Interest Holder in the Partnership (“Ownership Percentage”) shall initially be as set forth in Exhibit A attached hereto, which is the percentage determined by dividing each Interest Holder’s initial Capital Account by the aggregate initial Capital Accounts of all Interest Holders. In the event that the General Partner deems it appropriate to adjust the Capital Accounts of the Interest Holders to reflect the economic relationship of the Interest Holders, each Interest Holder’s Capital Account shall be increased or decreased, as the case may be, to reflect that Interest Holder’s portion of the change in the Gross Asset Value of each item of Partnership Property. After the Gross Asset Value of the Partnership Property is so adjusted and all existing Interest Holders’ Capital Accounts are adjusted to reflect their then respective Ownership Percentages, the additional Capital Contributions, whether from the addition of a new Partner or a non pro rata contribution, shall be added to the Capital Account of the contributing Interest Holder. After all such increases are reflected on the Partnership's books and records, each Interest Holder's Ownership Percentage shall be recalculated by dividing the Interest Holder's Capital Account by the aggregate of the Capital Accounts of all Interest Holders.

Second Amended and Restated Limited Partnership Agreement-Page 15 of 44

ARTICLE III

ALLOCATIONS AND DISTRIBUTIONS

3.1 Allocation of Profits and Losses. After giving effect to the special allocations set forth in Sections 3.2 and/or 3.3, Profits and Losses for any Allocation Year shall be allocated to the Interest Holders as follows:

(a) Subject to Sections 3.1(c) and (d), Losses shall be allocated as follows:

(i) To those Interest Holders with positive Capital Accounts, in the ratio of their positive Capital Accounts, until such Capital Accounts have been reduced to zero; and

(ii) Thereafter, to the Interest Holders in proportion to their Ownership Percentages.

(b) Subject to Sections 3.1(c) and 3.1(d), Profits shall be allocated as follows:

(i) First, in the ratio of the negative capital Accounts of the Interest Holders with negative Capital Accounts until all Interest Holders with negative Capital Accounts have such Capital Accounts increased to zero;

(ii) Second, to the Interest Holders in proportion and up to the amount of Losses previously allocated to each of them under Section 3.1(a)(i); and

(iii) Third, to the Interest Holders in proportion to their Ownership Percentages.

(c) Losses allocated pursuant to Section 3.1(a) hereof shall not exceed the maximum amount of Losses that can be so allocated without causing any Interest Holder to have an Adjusted Capital Account Deficit at the end of any Allocation Year. In the event some, but not all, of the Interest Holders would have Adjusted capital Account Deficits as a consequence of an allocation of Losses pursuant to Sections 3.1(a) the limitation set forth in this Section 3.1(c) shall be applied on an Interest Holder-by-Interest Holder basis so as to allocate the maximum permissible Loss to each Interest Holder under Regulations Section 1.704-1(b)(2)(ii)(d).

(d) All allocations of Profits and Losses to the Interest Holders shall be made pro rata in accordance with their respective Ownership Percentages, unless otherwise specifically provided herein.

Second Amended and Restated Limited Partnership Agreement-Page 16 of 44

3.2 Special Allocations. The following special allocations shall be made in the following order:

(a) Minimum Gain Charqeback. Except as otherwise provided in Section 1.704-2(f) of the Regulations, notwithstanding any other provision of this Article III, if there is a net decrease in Partnership Minimum Gain during any Allocation Year, each Interest Holder shall be specially allocated items of Partnership income and gain for such Allocation Year (and, if necessary, subsequent Allocation Years) in an amount equal to such Interest Holder’s share of the net decrease in Partnership Minimum Gain, determined in accordance with Regulations Section 1.704-2(g). Allocations pursuant to the previous sentence shall be made in proportion to the respective amounts required to be allocated to each Interest Holder pursuant thereto. The items to be so allocated shall be determined in accordance with Sections 1.704-2(f)(6) and 1.704-2(j)(2) of the Regulations. This Section 3.2(a) is intended to comply with the minimum gain chargeback requirement in Section 1.704-2(f) of the Regulations and shall be interpreted consistently therewith.

(b) Interest Holder Minimum Gain Charqeback. Except as otherwise provided in Section 1.704-2(i)(4) of the Regulations, notwithstanding any other provision of this Article III, if there is a net decrease in Partner Nonrecourse Debt Minimum Gain attributable to a Partner Nonrecourse Debt during any Allocation Year, each Interest Holder who has a share of the Partner Nonrecourse Debt Minimum Gain attributable to such Partner Nonrecourse Debt, determined in accordance with Section 1.704-2(i)(S) of the Regulations, shall be specially allocated items of Partnership income and gain for such Allocation Year (and, if necessary, subsequent Allocation Years) in an amount equal to such Interest Holder’s share of the net decrease in Partner Nonrecourse Debt Minimum Gain attributable to such Partner Nonrecourse Debt, determined in accordance with Regulations Section 1.704-2(i)(4). Allocations pursuant to the previous sentence shall be made in proportion to the respective amounts required to be allocated to each Interest Holder pursuant thereto. The items to be so allocated shall be determined in accordance with Sections 1.704-2(i)(4) and 1.704-2(j)(2) of the Regulations. This Section 3.2(b) is intended to comply with the minimum gain chargeback requirement in Section 1.704-2(i)(4) of the Regulations and shall be interpreted consistently therewith.

(c) Qualified Income Offset. In the event any Interest Holder unexpectedly receives any adjustments, allocations, or distributions described in Section 1.704-1(b)(2)(ii)(d)(4), Section 1.704-1(b)(2)(ii)(d)(S) or Section 1.704-1(b)(2)(ii)(d)(6) of the Regulations, items of Partnership income and gain shall be specially allocated to each such Interest Holder in an amount and manner sufficient to eliminate, to the extent required by the Regulations, the Adjusted Capital Account Deficit of such Interest Holder as quickly as possible, provided that an allocation pursuant to this Section 3.2(c) shall be made only if and to the extent that such Interest Holder would have an Adjusted Capital Account Deficit after all other allocations provided for in this Article III have been tentatively made as if this Section 3.2(c) were not in this Agreement.

Second Amended and Restated Limited Partnership Agreement-Page 17 of 44

(d) Gross Income Allocation. In the event any Interest Holder has a deficit Capital Account at the end of any Allocation Year which is in excess of the sum of (i) the amount such Interest Holder is obligated to restore pursuant to any provision of this Agreement, and (ii) the amount such Interest Holder is deemed to be obligated to restore pursuant to the penultimate sentences of Regulations Sections 1.704-2(g)(1) and 1.704-2(i)(S), each such Interest Holder shall be specially allocated items of Partnership income and gain in the amount of such excess as quickly as possible, provided that an allocation pursuant to this Section 3.2(d) shall be made only if and to the extent that such Interest Holder would have a deficit Capital Account in excess of such sum after all other allocations provided for in this Article III have been made as if Section 3.2(c) and this Section 3.2(d) were not in this Agreement.

(e) Partner Nonrecourse Deductions. Any Partner Nonrecourse Deductions for any Allocation Year shall be specially allocated to the General Partner or Interest Holder who bears the economic risk of loss with respect to the Partner Nonrecourse Debt to which such Partner Nonrecourse Deductions are attributable in accordance with Regulations Section 1.704-2(i)(1).

(f) Nonrecourse Deductions. Nonrecourse Deductions of the Partnership (other than Partner Nonrecourse Deductions) for any Allocation Year shall be aggregated with all other items of Partnership income, gain, loss, and deduction in determining the Profit and Losses of the Partnership.

(g) Section 754 Adjustments. To the extent an adjustment to the adjusted tax basis of any Partnership asset pursuant to Code Section 734(b) or Code Section 743(b) is required, pursuant to Regulations Section 1.704-1(b)(2)(iv)(m)(2) or Regulations Section 1.704-1(b)(2)(iv)(m)(4), to be taken into account in determining Capital Accounts as the result of a Distribution to an Interest Holder in complete liquidation of the distributee’s Interest, the amount of such adjustment to Capital Accounts shall be treated as an item of gain (if the adjustment increases the basis of the asset) or loss (if the adjustment decreases such basis) and such gain or loss shall be specially allocated to the Interest Holders in accordance with their Ownership Percentages in the event that Regulations Section 1.704-1(b)(2)(iv)(m)(2) applies, or to the Interest Holder to whom such Distribution was made in the event that Regulations Section 1.704-1(b)(2)(iv)(m)(4) applies.

(h) Allocations Relating to Taxable Issuance of Interests. Any income, gain, loss or deduction realized as a direct or indirect result of the issuance of an Interest by the Partnership to a Partner (the “Issuance Items”) shall be allocated among the General Partner and other Interest Holders so that, to the extent possible, the net amount of such Issuance Items, together with all other allocations under this Agreement to each Interest Holder, shall be equal to the net amount that would have been allocated to each such Interest Holder if the Issuance Items had not been realized.

Second Amended and Restated Limited Partnership Agreement-Page 18 of 44

3.3 Curative Allocations.

The allocations set forth in Sections 3.1(c), 3.2(a), 3.2(b), 3.2(c), 3.2(d), 3.2(e), 3.2(f), and 3.2(g) (the “Regulatory Allocations”) are intended to comply with certain requirements of the Regulations. It is the intent of the Interest Holders that, to the extent possible, all Regulatory Allocations shall be offset either with other Regulatory Allocations or with special allocations of other items of Partnership income, gain, loss or deduction pursuant to this Section 3.3. Therefore, notwithstanding any other provision of this Article III(other than the Regulatory Allocations), the General Partner shall make such offsetting special allocations of Partnership income, gain, loss or deduction in whatever manner it determines appropriate so that, after such offsetting allocations are made, each Interest Holder’s capital Account balance is, to the extent possible, equal to the Capital Account balance such Interest Holder would have had if the Regulatory Allocations were not part of this Agreement and all Partnership items were allocated pursuant to Section 3.1. In exercising its discretion under this Section 3.3, the General Partner shall take into account future Regulatory Allocations under Sections 3.2(a) and 3.2(b) that, although not yet made, are likely to offset other Regulatory Allocations previously made under Sections 3.2(e) and 3.2(f).

3.4 Other Allocation Rules.

(a) Profits, Losses and any other items of income, gain, loss or deduction shall be allocated to the Interest Holders pursuant to this Article III as of the last day of each Allocation Year; provided that Profits, Losses and such other items shall also be allocated at such times as the Gross Asset Values of Partnership Property are adjusted pursuant to subparagraph (ii) of the definition of Gross Asset Value in Section 1.1.

(b) For purposes of determining the Profits, Losses, or any other items allocable to any period, Profits, Losses, and any such other items shall be determined on a daily, monthly, or other basis, as determined by the General Partner using any permissible method under Code Section 706 and the Regulations thereunder.

(c) All allocations to the Interest Holders pursuant to this Section 3.4 shall, except as otherwise provided, be divided among them in proportion to their respective Ownership Percentages. In the event there is more than one General Partner, all such allocations to the General Partners shall be divided among them as they may agree.

(d) The Interest Holders are aware of the income tax consequences of the allocations made by this Article III and hereby agree to be bound by the provisions of this Article III in reporting their shares of Partnership income and loss for income tax purposes, except to the extent otherwise required by law.

Second Amended and Restated Limited Partnership Agreement-Page 19 of 44

(e) Solely for purposes of determining an Interest Holder’s proportionate share of the “excess nonrecourse liabilities” of the Partnership within the meaning of Regulations Section 1.752-3(a)(3), the Interest Holders’ Interests in Partnership profits are as follows: General Partner one percent (1%), and other Interest Holders’ ninety-nine percent (99%) (i.e., in proportion to their Ownership Percentages).

(f) To the extent permitted by Section 1.704-2(h)(3) of the Regulations, the General Partner shall endeavor to treat Distributions of Net Cash From Operations or Net Cash From Sales or Refinancings as having been made from the proceeds of a Nonrecourse Liability or a Partner Nonrecourse Debt only to the extent that such Distributions would cause or increase an Adjusted capital Account Deficit for any Interest Holder.

(g) All tax credits shall, subject to the applicable provisions of the Code and Regulations Section 1.704-1(b), be allocated to the Interest Holders in accordance with their respective Ownership Percentage as of the time the tax credit arises. Each Partner’s allocable share of any tax credit recapture shall bear the same ratio to the total credit recapture as such Partner’s share of the original tax credit subject to recapture.

(h) To the extent possible, each Interest Holder’s allocable share of Partnership Profits which is characterized as ordinary income pursuant to Sections 1245 or 1250 of the Code, with respect to the disposition of an item of Partnership Property shall bear the same ratio to the total Profits of the Partnership so characterized as such Interest Holder’s share of the past depreciation and/or cost recovery deductions taken with respect to the specific item of Partnership Property bears to all the Interest Holders’ past depreciation and/or cost recovery deductions with respect to that specific item of Partnership Property.

3.5 Tax Allocations: Code Section 704C(c). In accordance with Code Section 704(c) and the Regulations thereunder, income, gain, loss, and deduction with respect to any property contributed to the capital of the Partnership shall, solely for tax purposes, be allocated among the Interest Holders so as to take account of any variation between the adjusted basis of such property to the Partnership for federal income tax purposes and its initial Gross Asset Value (computed in accordance with subparagraph (i) of the definition of Gross Asset Value in Section 1.1).

In the event the Gross Asset Value of any Partnership asset is adjusted pursuant to subparagraph (ii) of the definition of Gross Asset Value in Section 1.1, subsequent allocations of income, gain, loss, and deduction with respect to such asset shall take account of any variation between the adjusted basis of such asset for federal income tax purposes and its Gross Asset Value in the same manner as under Code Section 704(c) and the Regulations thereunder.

Second Amended and Restated Limited Partnership Agreement-Page 20 of 44

Any elections or other decisions relating to such allocations shall be made by the General Partner in any manner that reasonably reflects the purpose and intention of this Agreement, provided that the Partnership shall elect to apply the “Traditional Method” allocation method permitted by the Regulations under Code Section 704(c). Allocations pursuant to this Section 3.5 are solely for purposes of federal, state, and local taxes and shall not affect or in any way be taken into account in computing any Interest Holder’s Capital Account or share of Profits, Losses, other items, or Distributions pursuant to any provision of this Agreement.

Except as otherwise provided in this Agreement, all items of Partnership income, gain, loss, deduction, credit and any other allocations not otherwise provided for shall be divided among the Interest Holders according to their respective Ownership Percentages.

3.6 Distributable Funds. The term “Distributable Funds” of the Partnership shall mean the excess from time to time of (A) the Net Cash From Operations plus the Net Cash From Sales or Refinancings, over (B) the working capital requirements to pay Partnership Expenses and reasonable Reserves of the Partnership. Nothing herein shall be construed to require that the General Partner obtain financing for the purpose of creating Distributable Funds.

3.7 Distributions.

(a) Subject to Section 3.7(d) (governing Tax Distributions) and Article X hereof (governing the Distribution of assets of the Partnership upon dissolution and liquidation of the Partnership), the General Partner shall distribute Distributable Funds as determined by the General Partner in its sole discretion. Unless otherwise agreed by the General Partner and all Limited Partners, Distributable Funds shall be distributed to the Interest Holders in proportion to their respective Ownership Percentages.

(b) Unless otherwise required by this Agreement or by law, no Interest Holder shall be required to restore to the Partnership any funds distributed to such Interest Holder pursuant to the provisions of this Agreement.

(c) The working capital requirements and Reserves of the Partnership shall be determined by the General Partner, whose determination shall be final and binding.

(d) Subject to there being Distributable Funds available to make Distributions and there being no other agreements of the Partnership (including,by way of example and without limitation, any agreements between the Partnership and any lenders to the Partnership) which would limit or prohibit such Distributions, the General Partner shall, before the expiration of ninety (90) days following the end of a Fiscal Year, promptly declare and pay a Tax Distribution, as hereinafter defined, to each Interest Holder in proportion to that Interest Holder’s Ownership Percentage. The amount of

Second Amended and Restated Limited Partnership Agreement-Page 21 of 44

the “Tax Distribution” shall be calculated on a one percent (1%) Interest basis by determining (A) that portion of the Partnership’s taxable income attributable to a one percent (1%) Interest during the prior Fiscal Year multiplied by (B) the highest federal and state tax rate then applicable, as determined by the General Partner. The amount of the Tax Distribution shall then be multiplied by the respective Interest Holder’s actual Interest during such Fiscal Year (or portion thereof) in accordance with the reasonable determination of the General Partner, to determine the total Tax Distribution to that Interest Holder. The General Partner and Partnership’s obligation to declare and pay the foregoing Tax Distribution to the Interest Holders is subject to the restrictions governing Distributions under the Act and such other pertinent governmental or contractual restrictions as are now, or may hereafter become effective.

(e) Partnership assets may, pursuant to either liquidating or non-liquidating Distributions, be distributed by the General Partner in kind.

(f) All amounts withheld or required to be withheld pursuant to the Code or any provision of any state, local or foreign tax law with respect to any payment, Distribution or allocation to the Partnership or the Interest Holders and treated by the Code (whether or not withheld pursuant to the Code) or any such tax law as amounts payable by or in respect of any Interest shall be treated as amounts distributed to the Interest Holder with respect to which such amount was withheld pursuant to this Article III for all purposes under this Agreement. The General Partner is authorized to withhold from Distributions to the Interest Holders and to pay over to any federal, state, local or foreign government any amounts required to be so withheld pursuant to the Code or any provisions of any other federal, state, local or foreign law and shall allocate any such amounts to the Interest Holders with respect to which such amount was withheld.

ARTICLE IV

MANAGEMENT OF PARTNERSHIP BY THE GENERAL PARTNER

4.1 Management. The management of the Partnership shall be the responsibility of the General Partner. The officers and managers of the General Partner shall devote to the management of the Partnership so much time as they determine in their sole discretion to be reasonably necessary. The officers and managers of the General Partner shall not be required to devote their time exclusively to the operation of the business of the Partnership. All decisions made for and on behalf of the Partnership by the General Partner shall be binding upon the Partnership. Except as expressly limited herein, the General Partner, acting for and on behalf of the Partnership, by way of extension and not in limitation of the rights and powers given by law or by the other provisions of this Agreement, shall have the full and entire right, power and authority in the management of the Partnership business to do any and all acts and things necessary, proper or advisable in its discretion to effectuate or further the business of the Partnership.

Second Amended and Restated Limited Partnership Agreement-Page 22 of 44

4.2 Powers of the General Partner. Subject to any other limitations contained in this Agreement, the General Partner shall have full charge of the overall management, conduct and operation of the Partnership in all respects and in all matters, and shall have the authority to act on behalf of and bind the Partnership in all matters respecting the Partnership, its business and its property. The powers of the General Partner shall include, without limitation, the following:

(a) To deal in any Partnership assets, whether real estate or personalty, including but not limited to the right to sell, exchange, or convey title to, and grant options for the sale of all or any portion of such assets including any mortgage or leasehold interest or other realty or personalty which may be acquired by the Partnership; to lease all or any portion of the assets of the Partnership without limit as to the term thereof, whether or not such term (including renewals and extensions thereof) shall extend beyond the date of termination of the Partnership; subject to the provisions of Section 2.2 hereof, to borrow money and as security thereof to encumber all or any part of any Partnership asset; to obtain refinancing of any deed of trust or deeds of trust placed on any Partnership asset; to prepay same in whole or in any part; and to increase, modify, consolidate or extend any deed of trust or deeds of trust placed on any Partnership asset, except as limitations on those powers are elsewhere noted in this Agreement.

(b) To acquire, own, hold, improve, develop, manage, sell and lease any Partnership asset.

(c) To enter into, amend, or terminate operating agreements with others with respect to any Partnership asset containing such terms, provisions and conditions as the General Partner shall approve.

(d) Subject to the provisions of Section 2.2 hereof, to borrow money from lenders (which may include the General Partner and its Affiliates) for any Partnership notes, debentures and other debt securities, and hypothecate the assets of the Partnership to secure repayment of the borrowed sums, and no lender to which application is made for a loan by the Partnership shall be required to inquire as to the purpose for which such loan is sought, and, as between the Partnership and such lender, it shall be conclusively presumed that the proceeds of such loan are to be and will be used for the purposes authorized under this Agreement.

(e) To employ, retain, or otherwise secure, or enter into other contracts with personnel or firms to assist in the acquisition, development, improvement, management and general operation of all Partnership assets, including, but not limited to, attorneys, accountants and engineers, all on such terms and for such consideration as the General Partner deems advisable.

Second Amended and Restated Limited Partnership Agreement-Page 23 of 44

(f) To deposit Partnership funds in an account or accounts to be established at such time or times in such financial institutions (including any state or federally chartered bank or savings and loan association), and authorize withdrawals of such funds by such persons, at such times, and in such amounts, as the General Partner may designate.

(g) To be reimbursed for all expenses incurred in conducting the Partnership business, all taxes paid by the General Partner in connection with the Partnership business, and all costs associated with the organization and operation of the Partnership.

(h) To purchase at the expense of the Partnership, liability and other insurance to protect the Partnership's assets and business.

(i) To bring, prosecute, defend, settle and compromise claims by and against the Partnership and confess judgments against the Partnership when, in the judgment of the General Partner, any such act shall be in the best interest of the Partnership.

(j) To make such elections under the tax laws of the United States, the several states and other relevant jurisdictions as to the treatment of items of Partnership income, gain, loss, deduction and credit, and as to all other relevant matters as the General Partner may deem necessary or desirable.

(k) To take any and all action which is permitted under the Act and which is customary or reasonably related to the acquisition, ownership, development, improvement, management, leasing and disposition of real, personal and mixed property.

(l) To possess and exercise, as may be required, all of the rights and powers of a General Partner as more particularly provided by the Act except to the extent that any of such rights may be limited or restricted by the express provisions of this Agreement.

(m) To execute, acknowledge and deliver any and all instruments and take such other steps as are necessary to effectuate the foregoing.

No Person dealing with the Partnership shall be required to inquire into, or obtain any consents or other documentation as to the authority of the General Partner to take any of the actions specified above or to exercise any such rights or powers.

Second Amended and Restated Limited Partnership Agreement-Page 24 of 44

4.3 Duties of the General Partner. The General Partner shall perform or cause to be performed the following services, any or all of which the General Partner may elect to delegate to a third party:

(a) Establish books of account, record and payment procedures including, without limitation, individual Capital Accounts of the Interest Holders.

(b) Provide book keeping and other related services for the Partnership including, without limitation, the annual preparation of the Partnership’s federal income tax return and the preparation of the reports required pursuant to Section 7.2 hereof; provided, however, the Partnership shall pay for services provided by third party accounting firms or other professionals with respect to preparation of the Partnership federal income tax return and other reports and services required hereby.

(c) Provide overall management, financial and business planning services to the Partnership.

(d) Disburse all receipts and make all necessary payments and expenditures in accordance with the terms of this Agreement.

(e) Make all reports to the Limited Partners required by this Agreement or by law.

4.4 Liability and Indemnification of the General Partner.

(a) Liability. Neither the General Partner nor any Person owning an interest in the General Partner, directly or indirectly, or any of their respective officers, managers, directors, employees or partners shall be liable, responsible or accountable in damages or otherwise to the Partnership or any of the Interest Holders for any act or omission performed or omitted by any of them pursuant to the authority granted to the General Partner by this Agreement if it is determined that the Person (i) acted in good faith, (ii) reasonably believed (a) in the case of conduct in the Person’s official capacity as a General Partner of the Partnership, that the Person’s conduct was in the Partnership’s best interest, and (b) in all other cases, that the Person’s conduct was at least not opposed to the Partnership’s best interest, and (iii) in the case of a criminal proceeding, had no reasonable cause to believe that the Person’s conduct was unlawful, provided, however, that none of said Persons shall be relieved of liability in respect of any claim, issue or matter as to which it or any Affiliate of said Persons shall have been adjudged to be liable for gross negligence or willful misconduct in the performance of a fiduciary duty to the Partnership or to the Interest Holders.

Second Amended and Restated Limited Partnership Agreement-Page 25 of 44

(b) Indemnification. The Partnership shall indemnify the General Partner to the fullest extent permitted by applicable law. The satisfaction of any indemnification and any saving harmless shall be from and limited to Partnership assets, and no Interest Holder shall have any personal liability on account thereof.

4.5 Prohibited Transactions. The following transactions shall be prohibited:

(a) The Partnership shall not use Partnership funds other than to (i) pay Partnership Expenses, (ii) make Distributions to the Partners in accordance with the terms hereof or (iii) maintain Reserves, as permitted by Section 3.6 hereof.

(b) Neither the General Partner nor any of its Affiliates shall do any act in contravention of this Agreement.

4.6 Actions of General Partner Requiring Super-Majority Vote. Notwithstanding anything to the contrary contained in this Agreement or the Act, the General Partner shall have the authority to do the following acts (each of which is considered outside the ordinary course of the Partnership’s business) only with the approval by a Super-Majority Vote of the Partners of the specific act in question:

(a) Make an assignment of the property of the Partnership for the benefit of creditors of the Partnership or file a voluntary petition under the Federal Bankruptcy Act or any state insolvency law on behalf of the Partnership.

(b) Do any act which would make it impossible to carry on the normal and ordinary business of the Partnership.

(c) Sell all or substantially all of the assets of the Partnership. (d) Any decision to dissolve the Partnership.

4.7 Actions of General Partner Requiring Majority Vote. Notwithstanding anything to the contrary contained in this Agreement or the Act, the General Partner shall have the authority to do the following acts (each of which is considered outside the ordinary course of the Partnership’s business) only with the approval by a Majority Vote of the Partners of the specific act in question:

(a) Amend the Agreement, pursuant to Section 4.8.

(b) Designate any successor or additional General Partners, pursuant to Section 9.1(a).

Second Amended and Restated Limited Partnership Agreement-Page 26 of 44

(c) Effect a consent by the Partnership to any Disposition of an Interest Holder’s Interest, pursuant to Section 9.2, admit a new Limited Partner, or consent to a substituted Limited Partner.

(d) Effect an election by the Partnership to purchase an Interest Holder’s Interest which was the subject of an Offer, pursuant to Section 9.2(b).

4.8 Amendment of Agreement. Except as provided for in Section 2.4(b) above, this Agreement may be amended only with consent of the General Partner and a Majority Vote of the Partners approving the specific amendment in question; provided, however, that this Agreement shall not be amended without the consent of the Partner affected if the effect of any such amendment would be to (i) increase such Partner’s personal liability, (ii) change the contributions required of such Partner, (iii) adversely change such Partner’s rights and/or Interest Holders’ interests in Profits and Losses of the Partnership, or (iv) change Interest Holders’ rights upon liquidation of the Partnership.

4.9 Safekeeping of Partnership Assets. The General Partner shall have fiduciary responsibility for the safekeeping and use of the funds and assets of the Partnership, whether or not in the General Partner’s immediate possession and control. The General Partner shall not employ or permit another to employ such funds or assets in any manner except for the exclusive benefit of the Partnership.

4.10 Conflict with Other Agreements. Notwithstanding anything in this Agreement to the contrary, if any provision of any loan agreement, promissory note, security agreement or other agreement relating to Partnership indebtedness or any extension or renewal thereof requires the General Partner or the Partnership to take any action or forebear from taking any action (such as making Distributions to Partners), the terms of said loan agreement, promissory note, security agreement or related agreement shall be controlling over the terms of this Agreement.

ARTICLE V

REIMBURSEMENT OF EXPENSES TO GENERAL PARTNER

The Partnership shall reimburse the General Partner for any Partnership Expenses paid by the General Partner. The Partnership may compensate the General Partner and/or the members, managers, officers and employees of the General Partner for the salaries, benefits and expenses of such Persons engaged in the management and operation of the Partnership.

Second Amended and Restated Limited Partnership Agreement-Page 27 of 44

ARTICLE VI

INTEREST HOLDER'S AGREEMENT TO NOT COMPETE WITH PARTNERSHIP

6.1 Generally. The provisions of this Article VI shall apply to each Person who is, or shall have been, both an Interest Holder and an employee of the Partnership and/or an Affiliate of the Partnership: (i) for so long as such Person shall be both an Interest Holder and an employee of the Partnership and/or any Affiliate of the Partnership; and (ii) for a period of one (1) year following the termination (for any reason) of such Person’s employment with the Partnership and/or any Affiliate of the Partnership. Subject to the foregoing time limitation and notwithstanding any other provision in this Agreement to the contrary, it is understood and agreed that this Article VI shall survive any such Person’s ceasing to be an Interest Holder or ceasing employment with the Partnership and/or any Affiliate of the Partnership. With respect to any such Person to whom this Article VI shall apply, each such Person agrees to not, directly or indirectly, compete with, or own, manage, operate, or control or participate in the ownership, management, operation, or control of, or provide services (as an employee, independent contractor, or otherwise) to, any business, firm, corporation, partnership, person, proprietorship, or other entity which refines or markets, either wholesale or retail, petroleum products in:

(a) That portion of Texas which is West of U.S. Interstate Highway 35 (as it may be renamed or re-designated in the future); or

(b) New Mexico, Arizona, Nevada, Utah; or

(c) Any other state in the United States in which the Partnership and/or any Affiliate of the Partnership has refined or sold petroleum products within the period of: (i) with respect to any Interest Holder who is still such an employee, the previous twelve (12) months; or (ii) with respect to an Interest Holder whose employment shall have terminated, the twelve (12) months prior to such termination of such employment.

6.2 Reformation. If, at the time of enforcement of this Article VI, a court shall hold that the duration, scope, area, or other restrictions stated herein are unreasonable under the circumstances then existing, the parties agree that the maximum duration, scope, area, or other restrictions reasonable under such circumstances shall be substituted for the stated duration, scope, area, or other restriction.

6.3 Remedies. The Partnership and each Person to whom this Article VI applies expressly agree that upon the occurrence of a breach of the provisions of this Article VI, the Partnership might not have an adequate remedy at law. Accordingly, each such Person agrees that the Partnership shall have the right, in addition to any other rights and remedies existing in its favor, to enforce its rights hereunder, not only by an action or actions for damages, but also by an action or actions for specific performance, injunction and/or equitable relief in order to enforce or prevent any violations (whether anticipatory, continuing or future) of this Article VI.

Second Amended and Restated Limited Partnership Agreement-Page 28 of 44

ARTICLE VII

BOOKS, REPORTS, AND FISCAL MATTERS

7.1 Books. The General Partner shall maintain full and complete books of account and records, as specified in Section 7.3, for the Partnership at the Partnership office; provided, however, that if the books and records are not kept and maintained at the Partnership office, the Partnership shall make them available in the Partnership office within two (2) days after the date of receipt of a written request of a Partner. The books of account shall be kept on the income tax basis of accounting. Each Limited Partner may inspect and copy the books at any time during normal business hours.

7.2 Reports. The General Partner shall cause to be prepared, at the expense of the Partnership, the reports described in this Section 7.2.

(a) Annual Report. Within one hundred twenty (120) days after the end of each Fiscal Year, or as soon thereafter as practicable, an annual report shall be sent to all Limited Partners which shall include: (1) a balance sheet as of the end of such Fiscal Year, together with a profit and loss statement, a statement of the source and application of funds and a statement of changes in Partners’ capital for such year; (2) a report on Distributions to the Partners for the prior period separately identifying Distributions from: (i) Net cash From Operations during the prior period, (ii) Net cash From Sales or Refinancings, (iii) Reserves established by the General Partner, and (3) a report on Distributions made, costs reimbursed and compensation paid to any Partner and such Partner's Affiliates.

(b) Tax Information. Within the time permitted by applicable law and regulations, including (by way of example only and without

limitations) any permitted extensions, there will be distributed to the Limited Partners all information having to do with the Partnership necessary for the preparation of each such Partner’s federal income tax return including, without

limitation, a Schedule

K-1.

7.3 Record Keeping. The General Partner shall maintain the following records for the Partnership at the Partnership’s principal place of business, or at such other place as the General Partner may select in accordance with Section 7.1:

(a) A current list of the full names and mailing address of each Partner, together with the Ownership Percentage of each Partner. Such list shall separately identify, in alphabetical order, the General Partner and the Limited Partners and shall contain the last known street address of the business or residence of the General Partner.

Second Amended and Restated Limited Partnership Agreement-Page 29 of 44

(b) Copies of the Partnership’s federal, state and any local income tax or information returns and reports for the six (6) most recent taxable years or since the Fiscal Year ended in 2000, whichever is the lesser.

(c) Copies of this Agreement and all amendments or restatements to this Agreement, if any, and executed copies of any power of attorney pursuant to which this Agreement or any amendment or restatement has been executed.

(d) A copy of the Certificate of Limited Partnership and all Certificates of Amendment, if any, and executed copies of any power of attorney pursuant to which any certificate has been executed.

(e) Financial statements of the Partnership for the six (6) most recent Fiscal Years, or since the fiscal year ended in 2000, whichever is the lesser.

(f) The Partnership’s books and records for at least the current and the past three (3) Fiscal Years, or since the fiscal year ended in 2000, whichever is the lesser.

(g) Such other records and information as may be required by the Act.

7.4 Delivery to Limited Partners and Inspections. Upon the request of any Partner, the General Partner shall promptly deliver to the requesting Partner, at the Partnership’s expense, a copy of the information required to be maintained by the Partnership pursuant to Section 7.3. In addition, each Partner has the right to examine and to copy for any proper purpose, in person or by representative, at such Partner’s expense and during normal business hours, any of the Partnership’s records required to be maintained by Section 7.3 (provided that such Partner first agrees in writing to respect the confidentiality of such information).