AMENDED AND RESTATED SECURED MASTER LOAN AGREEMENT DATED AS OF DECEMBER 11, 2009 among RAMCO-GERSHENSON PROPERTIES, L.P., as Borrower, RAMCO-GERSHENSON PROPERTIES TRUST, as a Guarantor, KEYBANK NATIONAL ASSOCIATION, as a Bank, THE OTHER BANKS WHICH...

Exhibit 10.1

AMENDED AND RESTATED

DATED AS OF DECEMBER 11, 2009

among

RAMCO-XXXXXXXXXX PROPERTIES, L.P.,

as Borrower,

RAMCO-XXXXXXXXXX PROPERTIES TRUST,

as a Guarantor,

KEYBANK NATIONAL ASSOCIATION,

as a Bank,

THE OTHER BANKS WHICH ARE A PARTY TO THIS AGREEMENT,

THE OTHER BANKS WHICH MAY BECOME PARTIES TO THIS AGREEMENT,

KEYBANK NATIONAL ASSOCIATION,

as Agent,

KEYBANC CAPITAL MARKETS,

as Sole Lead Manager and Arranger,

JPMORGAN CHASE BANK, N.A.

and

BANK OF AMERICA, N.A.

as Co-Syndication Agents,

and

DEUTSCHE BANK TRUST COMPANY AMERICAS,

as Documentation Agent

TABLE OF CONTENTS

|

Page

|

|||

|

§1.

|

DEFINITIONS AND RULES OF INTERPRETATION

|

1

|

|

|

§1.1.

|

Definitions

|

1

|

|

|

§1.2.

|

Rules of Interpretation

|

25

|

|

|

§2.

|

THE CREDIT FACILITY

|

26

|

|

|

§2.1.

|

Commitment to Lend Revolving Credit Loans

|

26

|

|

|

§2.2.

|

Commitment to Lend Term Loan

|

27

|

|

|

§2.3.

|

Unused Facility Fee

|

27

|

|

|

§2.4.

|

Interest on Loans

|

27

|

|

|

§2.5.

|

Requests for Revolving Credit Loans

|

28

|

|

|

§2.6.

|

Funds for Loans

|

29

|

|

|

§2.7.

|

Optional Reduction of Revolving Credit Commitments

|

29

|

|

|

§2.8.

|

Increase of Revolving Credit Commitment

|

30

|

|

|

§2.9.

|

Letters of Credit

|

32

|

|

|

§2.10.

|

Swing Line Loans

|

37

|

|

|

§2.11.

|

Evidence of Debt

|

40

|

|

|

§3.

|

REPAYMENT OF THE LOANS

|

41

|

|

|

§3.1.

|

Stated Maturity

|

41

|

|

|

§3.2.

|

Mandatory Prepayments

|

41

|

|

|

§3.3.

|

Optional Prepayments

|

42

|

|

|

§3.4.

|

Partial Prepayments

|

42

|

|

|

§3.5.

|

Effect of Prepayments

|

42

|

|

|

§4.

|

CERTAIN GENERAL PROVISIONS

|

43

|

|

|

§4.1.

|

Conversion Options

|

43

|

|

|

§4.2.

|

Commitment and Syndication Fee

|

43

|

|

|

§4.3.

|

Agent’s Fee

|

44

|

|

|

§4.4.

|

Funds for Payments

|

44

|

|

|

§4.5.

|

Computations

|

45

|

|

|

§4.6.

|

Suspension of LIBOR Rate Loans

|

45

|

|

|

§4.7.

|

Illegality

|

45

|

|

|

§4.8.

|

Additional Interest

|

45

|

|

|

§4.9.

|

Additional Costs, Etc

|

46

|

|

i

TABLE OF CONTENTS

|

Page

|

|||

|

§4.10.

|

Capital Adequacy

|

47

|

|

|

§4.11.

|

Indemnity of Borrower

|

47

|

|

|

§4.12.

|

Interest on Overdue Amounts; Late Charge

|

47

|

|

|

§4.13.

|

Certificate

|

48

|

|

|

§4.14.

|

Limitation on Interest

|

48

|

|

|

§5.

|

COLLATERAL SECURITY; GUARANTY

|

48

|

|

|

§5.1.

|

Collateral

|

48

|

|

|

§5.2.

|

Appraisals

|

48

|

|

|

§5.3.

|

Replacement or Addition of Mortgaged Properties

|

49

|

|

|

§5.4.

|

Release of Mortgaged Property

|

51

|

|

|

§5.5.

|

Additional Guarantors

|

54

|

|

|

§5.6.

|

Release of Certain Subsidiary Guarantors

|

54

|

|

|

§6.

|

REPRESENTATIONS AND WARRANTIES OF THE TRUST AND THE BORROWER

|

54

|

|

|

§6.1.

|

Corporate Authority, Etc

|

54

|

|

|

§6.2.

|

Governmental Approvals

|

55

|

|

|

§6.3.

|

Title to Properties; Lease

|

55

|

|

|

§6.4.

|

Financial Statements

|

56

|

|

|

§6.5.

|

No Material Changes

|

56

|

|

|

§6.6.

|

Franchises, Patents, Copyrights, Etc

|

56

|

|

|

§6.7.

|

Litigation

|

56

|

|

|

§6.8.

|

No Materially Adverse Contracts, Etc

|

57

|

|

|

§6.9.

|

Compliance with Other Instruments, Laws, Etc

|

57

|

|

|

§6.10.

|

Tax Status

|

57

|

|

|

§6.11.

|

No Event of Default

|

57

|

|

|

§6.12.

|

Investment Company Acts

|

57

|

|

|

§6.13.

|

Absence of UCC Financing Statements, Etc

|

57

|

|

|

§6.14.

|

Setoff, Etc

|

57

|

|

|

§6.15.

|

Certain Transactions

|

58

|

|

|

§6.16.

|

Employee Benefit Plans

|

58

|

|

|

§6.17.

|

Regulations T, U and X

|

58

|

|

|

§6.18.

|

Environmental Compliance

|

58

|

|

-ii-

TABLE OF CONTENTS

|

Page

|

|||

|

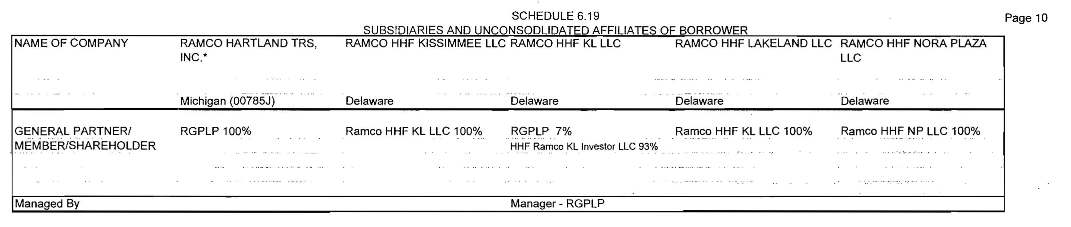

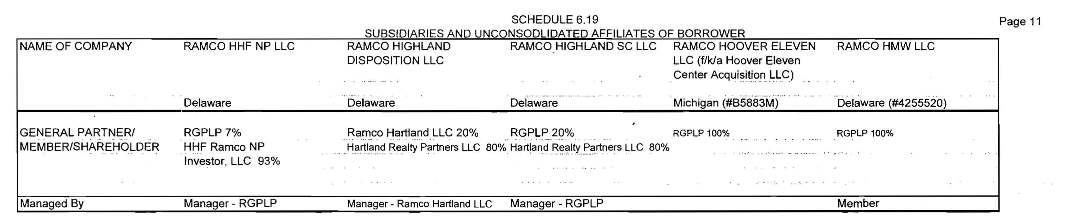

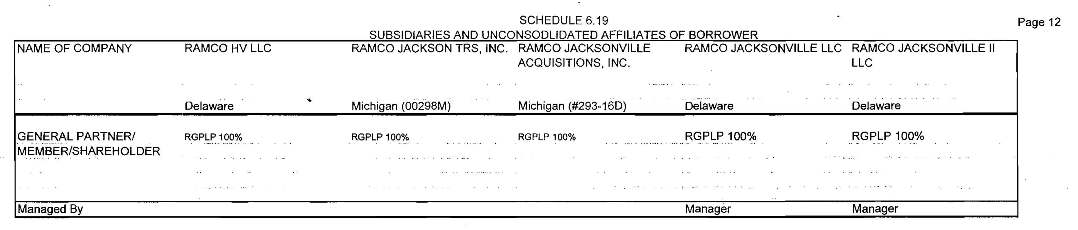

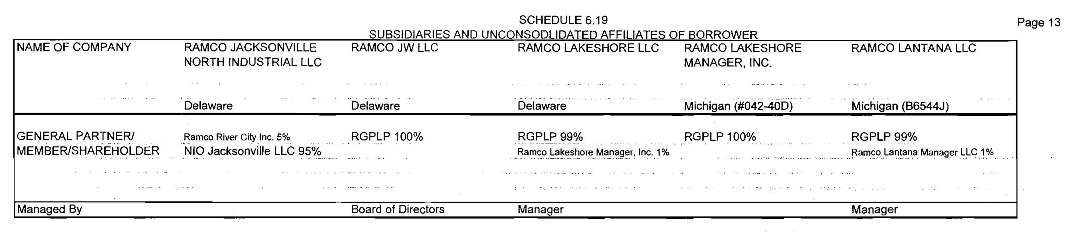

§6.19.

|

Subsidiaries and Unconsolidated Affiliates

|

60

|

|

|

§6.20.

|

Loan Documents

|

60

|

|

|

§6.21.

|

Mortgaged Property

|

60

|

|

|

§6.22.

|

Brokers

|

64

|

|

|

§6.23.

|

Other Debt

|

64

|

|

|

§6.24.

|

Solvency

|

64

|

|

|

§6.25.

|

Contribution Agreement

|

64

|

|

|

§6.26.

|

No Fraudulent Intent

|

64

|

|

|

§6.27.

|

Transaction in Best Interests of Borrower; Consideration

|

64

|

|

|

§6.28.

|

Partners and the Trust

|

65

|

|

|

§6.29.

|

Tax Indemnity Agreement

|

65

|

|

|

§6.30.

|

Embargoed Persons

|

65

|

|

|

§6.31.

|

Mortgaged Properties

|

65

|

|

|

§7.

|

AFFIRMATIVE COVENANTS OF THE TRUST AND THE BORROWER

|

65

|

|

|

§7.1.

|

Punctual Payment

|

65

|

|

|

§7.2.

|

Maintenance of Office

|

65

|

|

|

§7.3.

|

Records and Accounts

|

66

|

|

|

§7.4.

|

Financial Statements, Certificates and Information

|

66

|

|

|

§7.5.

|

Notices

|

69

|

|

|

§7.6.

|

Existence; Maintenance of Properties

|

70

|

|

|

§7.7.

|

Insurance

|

70

|

|

|

§7.8.

|

Taxes

|

76

|

|

|

§7.9.

|

Inspection of Properties and Books

|

76

|

|

|

§7.10.

|

Compliance with Laws, Contracts, Licenses, and Permits

|

76

|

|

|

§7.11.

|

Use of Proceeds

|

77

|

|

|

§7.12.

|

Further Assurances

|

77

|

|

|

§7.13.

|

Compliance

|

77

|

|

|

§7.14.

|

[Intentionally Omitted.]

|

77

|

|

|

§7.15.

|

Ownership of Real Estate

|

77

|

|

|

§7.16.

|

More Restrictive Agreements

|

77

|

|

|

§7.17.

|

Trust Restrictions

|

78

|

|

|

§7.18.

|

Interest Rate Contract(s)

|

78

|

|

-iii-

TABLE OF CONTENTS

|

Page

|

|||

|

§7.19.

|

Mortgaged Properties

|

78

|

|

|

§7.20.

|

Registered Servicemark

|

81

|

|

|

§7.21.

|

Leases of the Property

|

81

|

|

|

§7.22.

|

Management

|

82

|

|

|

§7.23.

|

Remediation Reserve

|

82

|

|

|

§7.24.

|

Compliance with Recommendations; Environmental Insurance

|

83

|

|

|

§8.

|

CERTAIN NEGATIVE COVENANTS OF THE TRUST AND THE BORROWER

|

83

|

|

|

§8.1.

|

Restrictions on Indebtedness

|

83

|

|

|

§8.2.

|

Restrictions on Liens Etc

|

84

|

|

|

§8.3.

|

Restrictions on Investments

|

86

|

|

|

§8.4.

|

Merger, Consolidation

|

87

|

|

|

§8.5.

|

Conduct of Business

|

87

|

|

|

§8.6.

|

Compliance with Environmental Laws

|

87

|

|

|

§8.7.

|

Distributions

|

89

|

|

|

§8.8.

|

Asset Sales

|

89

|

|

|

§8.9.

|

Development Activity

|

90

|

|

|

§8.10.

|

Restrictions on New Development Activity and New Redevelopment Activity

|

91

|

|

|

§8.11.

|

Trust Preferred Equity and Subordinated Debt

|

92

|

|

|

§9.

|

FINANCIAL COVENANTS OF THE TRUST AND THE BORROWER

|

92

|

|

|

§9.1.

|

Liabilities to Assets Ratio

|

92

|

|

|

§9.2.

|

Fixed Charges Coverage

|

92

|

|

|

§9.3.

|

Consolidated Tangible Net Worth

|

92

|

|

|

§9.4.

|

[Intentionally Omitted]

|

93

|

|

|

§9.5.

|

Borrowing Base Test

|

93

|

|

|

§10.

|

CLOSING CONDITIONS

|

93

|

|

|

§10.1.

|

Loan Documents

|

93

|

|

|

§10.2.

|

Certified Copies of Organizational Documents

|

93

|

|

|

§10.3.

|

Resolutions

|

93

|

|

|

§10.4.

|

Incumbency Certificate; Authorized Signers

|

93

|

|

|

§10.5.

|

Opinion of Counsel

|

94

|

|

-iv-

TABLE OF CONTENTS

|

Page

|

|||

|

§10.6.

|

Payment of Fees

|

94

|

|

|

§10.7.

|

Performance; No Default

|

94

|

|

|

§10.8.

|

Representations and Warranties

|

94

|

|

|

§10.9.

|

Proceedings and Documents

|

94

|

|

|

§10.10.

|

Stockholder and Partner Consents

|

94

|

|

|

§10.11.

|

Compliance Certificate

|

94

|

|

|

§10.12.

|

Contribution Agreement

|

94

|

|

|

§10.13.

|

No Legal Impediment

|

94

|

|

|

§10.14.

|

Governmental Regulation

|

95

|

|

|

§10.15.

|

Appraisals

|

95

|

|

|

§10.16.

|

Eligible Real Estate Qualification Documents

|

95

|

|

|

§10.17.

|

Other

|

95

|

|

|

§11.

|

CONDITIONS TO ALL BORROWINGS

|

95

|

|

|

§11.1.

|

Prior Conditions Satisfied

|

95

|

|

|

§11.2.

|

Representations True; No Default

|

95

|

|

|

§11.3.

|

Borrowing Documents

|

95

|

|

|

§11.4.

|

Endorsement to Title Policy

|

95

|

|

|

§11.5.

|

Future Advances Tax Payment

|

96

|

|

|

§12.

|

EVENTS OF DEFAULT; ACCELERATION; ETC

|

96

|

|

|

§12.1.

|

Events of Default and Acceleration

|

96

|

|

|

§12.2.

|

Limitation of Cure Periods

|

100

|

|

|

§12.3.

|

Termination of Commitments

|

100

|

|

|

§12.4.

|

Remedies

|

100

|

|

|

§12.5.

|

Distribution of Proceeds

|

101

|

|

|

§13.

|

SETOFF

|

000

|

|

|

§00.

|

THE AGENT

|

102

|

|

|

§14.1.

|

Authorization

|

102

|

|

|

§14.2.

|

Employees and Agents

|

102

|

|

|

§14.3.

|

No Liability

|

102

|

|

|

§14.4.

|

No Representations

|

103

|

|

|

§14.5.

|

Payments

|

103

|

|

|

§14.6.

|

Holders of Notes

|

105

|

|

-v-

TABLE OF CONTENTS

|

Page

|

|||

|

§14.7.

|

Indemnity

|

105

|

|

|

§14.8.

|

Agent as Bank

|

105

|

|

|

§14.9.

|

Resignation

|

105

|

|

|

§14.10.

|

Duties in the Case of Enforcement

|

106

|

|

|

§14.11.

|

Bankruptcy

|

106

|

|

|

§14.12.

|

Approvals

|

106

|

|

|

§14.13.

|

Borrower not Beneficiary

|

107

|

|

|

§14.14.

|

Request for Agent Action

|

107

|

|

|

§14.15.

|

Reliance on Hedge Provider

|

000

|

|

|

§00.

|

EXPENSES

|

107

|

|

|

§16.

|

INDEMNIFICATION

|

108

|

|

|

§17.

|

XXXXXXXX XX XXXXXXXXX, XXX

|

000

|

|

|

§00.

|

ASSIGNMENT AND PARTICIPATION

|

110

|

|

|

§18.1.

|

Conditions to Assignment by Banks

|

110

|

|

|

§18.2.

|

Register

|

110

|

|

|

§18.3.

|

New Notes

|

111

|

|

|

§18.4.

|

Participations

|

111

|

|

|

§18.5.

|

Pledge by Bank

|

111

|

|

|

§18.6.

|

No Assignment by Borrower or the Trust

|

112

|

|

|

§18.7.

|

Disclosure

|

112

|

|

|

§18.8.

|

Amendments to Loan Documents

|

112

|

|

|

§18.9.

|

Mandatory Assignment

|

112

|

|

|

§18.10.

|

Titled Agents

|

113

|

|

|

§19.

|

NOTICES

|

113

|

|

|

§20.

|

RELATIONSHIP

|

000

|

|

|

§00.

|

GOVERNING LAW: CONSENT TO JURISDICTION AND SERVICE

|

114

|

|

|

§22.

|

HEADINGS

|

000

|

|

|

§00.

|

COUNTERPARTS

|

000

|

|

|

§00.

|

ENTIRE AGREEMENT, ETC

|

000

|

|

|

§00.

|

WAIVER OF JURY TRIAL AND CERTAIN DAMAGE CLAIMS

|

000

|

|

|

§00.

|

DEALINGS WITH THE BORROWER OR THE GUARANTORS

|

116

|

|

|

§27.

|

CONSENTS, AMENDMENTS, WAIVERS, ETC

|

116

|

|

-vi-

TABLE OF CONTENTS

|

Page

|

||

|

§28.

|

SEVERABILITY

|

117

|

|

§29.

|

TIME OF THE ESSENCE

|

117

|

|

§30.

|

NO UNWRITTEN AGREEMENTS

|

000

|

|

§00.

|

REPLACEMENT OF NOTES

|

000

|

|

§00.

|

TRUST EXCULPATION

|

117

|

|

§33.

|

PATRIOT ACT

|

118

|

-vii-

EXHIBITS AND SCHEDULES

|

EXHIBIT A

|

FORM OF REVOLVING CREDIT NOTE

|

|

EXHIBIT B

|

FORM OF TERM LOAN NOTE

|

|

EXHIBIT C

|

FORM OF SWING LINE NOTE

|

|

EXHIBIT D

|

FORM OF JOINDER AGREEMENT

|

|

EXHIBIT E

|

FORM OF LOAN REQUEST

|

|

EXHIBIT F

|

FORM OF SWING LINE LOAN NOTICE

|

|

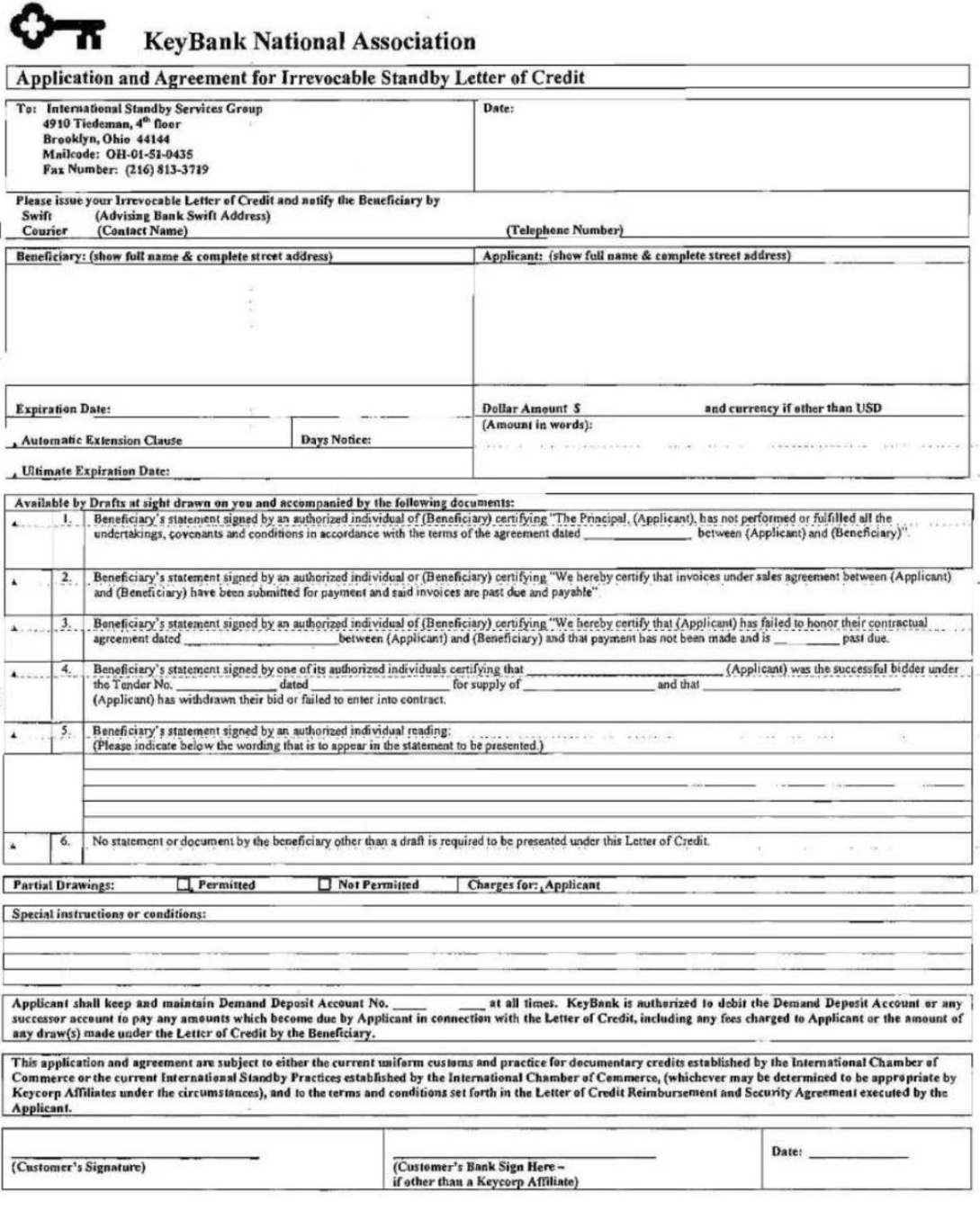

EXHIBIT G

|

LETTER OF CREDIT APPLICATION

|

|

EXHIBIT H

|

[RESERVED]

|

|

EXHIBIT I

|

FORM OF COMPLIANCE CERTIFICATE

|

|

EXHIBIT J

|

FORM OF ASSIGNMENT AND ACCEPTANCE AGREEMENT

|

|

SCHEDULE 1.1

|

BANKS AND COMMITMENTS

|

|

SCHEDULE 1.2

|

EXISTING HEDGE AGREEMENTS

|

|

SCHEDULE 2.9

|

EXISTING LETTERS OF CREDIT

|

|

SCHEDULE 5.3

|

ELIGIBLE REAL ESTATE QUALIFICATION DOCUMENTS

|

|

SCHEDULE 6.5

|

MARKETED PROPERTIES

|

|

SCHEDULE 6.7

|

LITIGATION

|

|

SCHEDULE 6.10

|

TAX MATTERS

|

|

SCHEDULE 6.15

|

AFFILIATE TRANSACTIONS

|

|

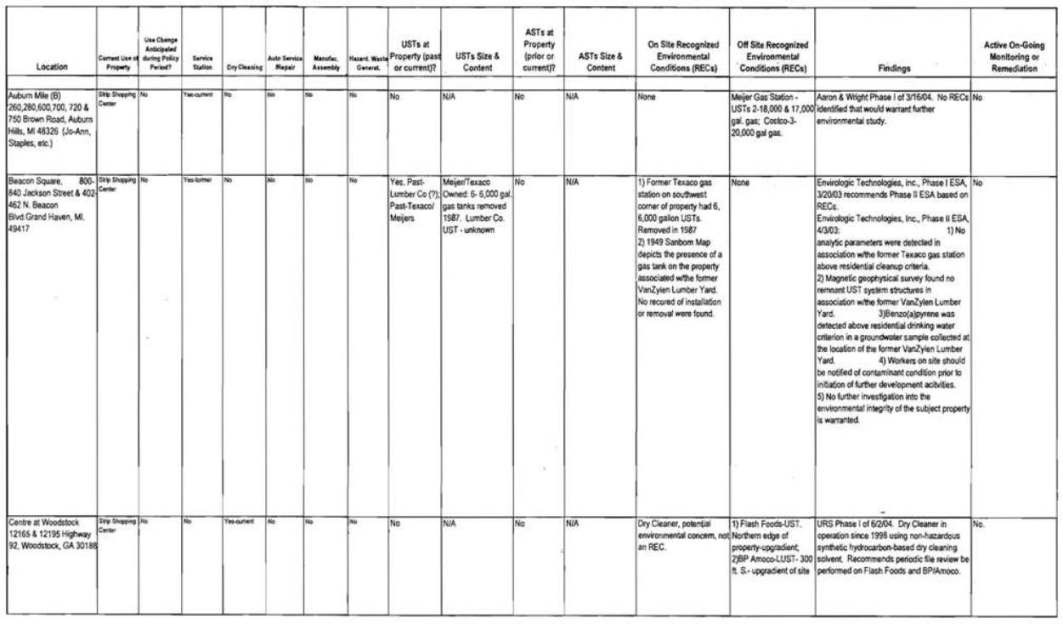

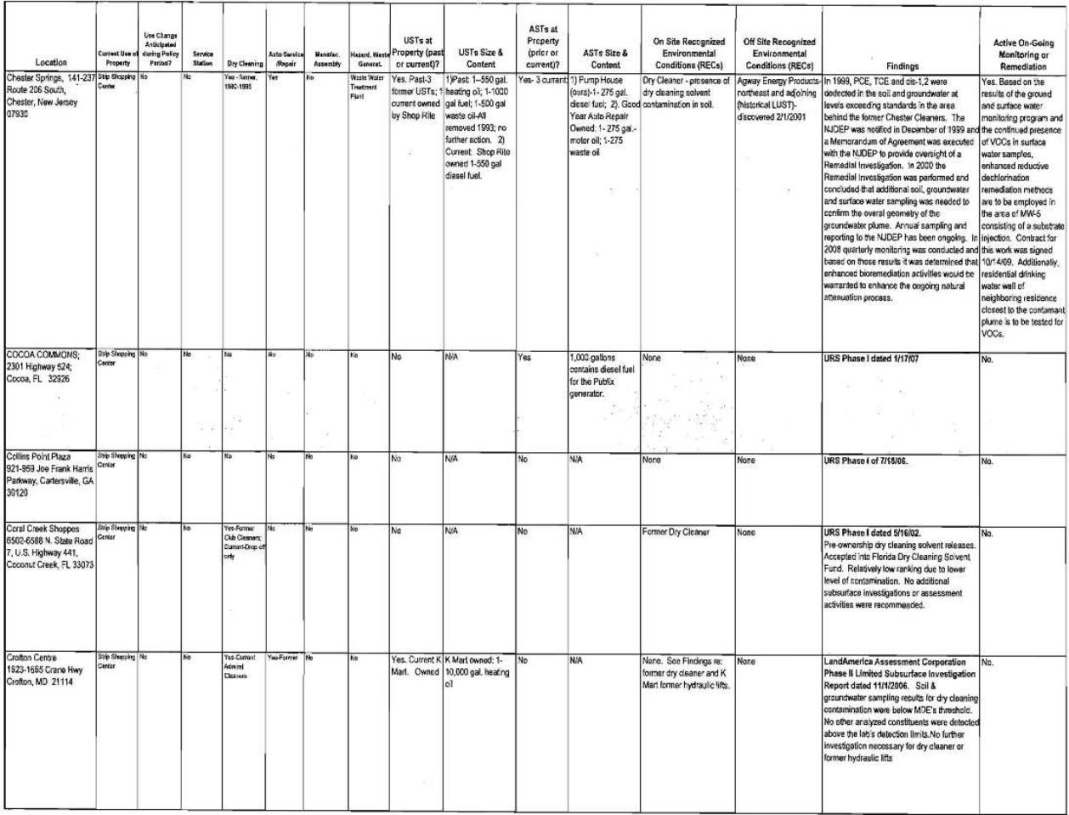

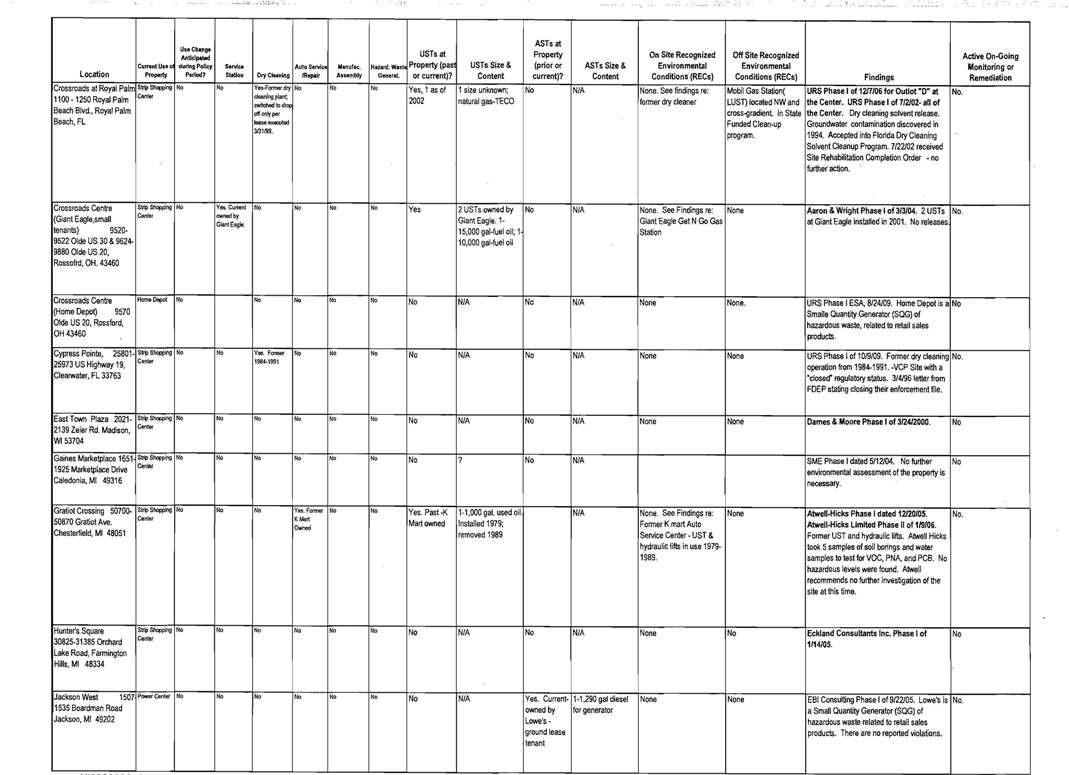

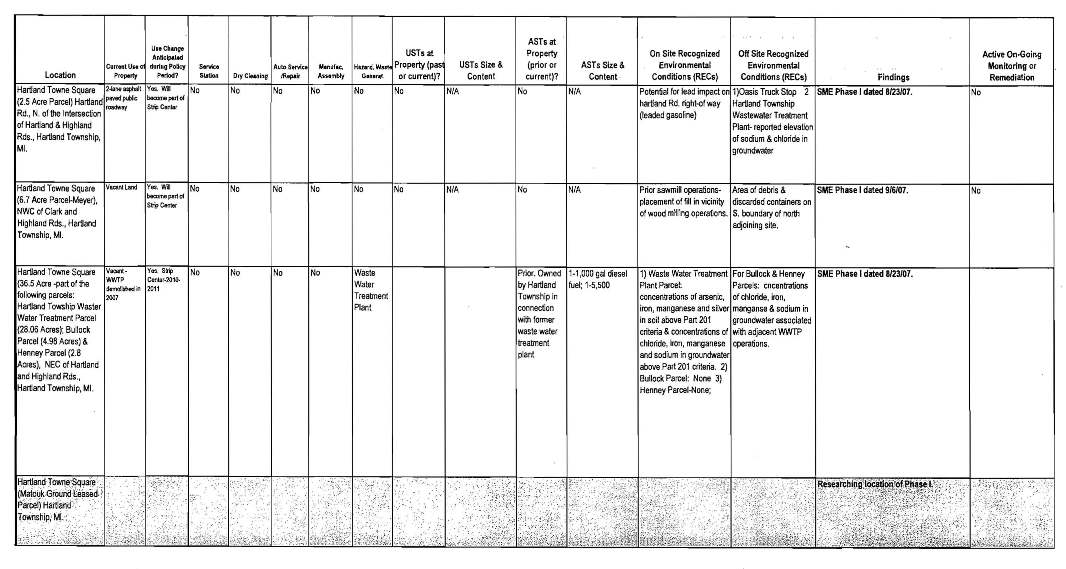

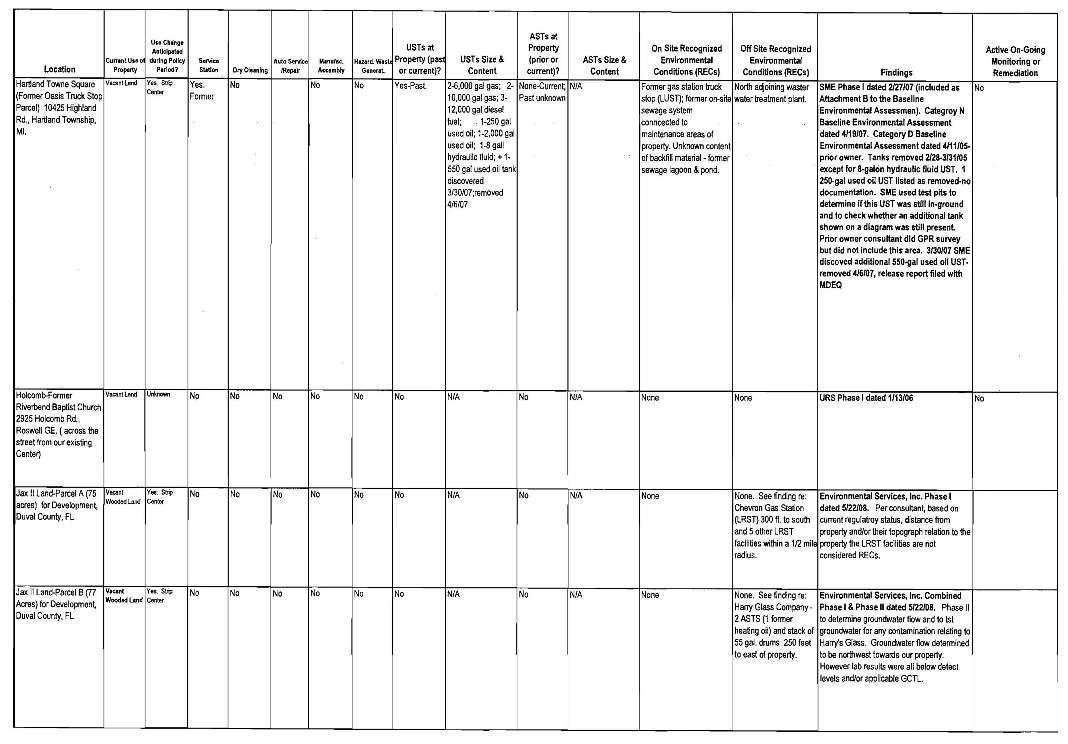

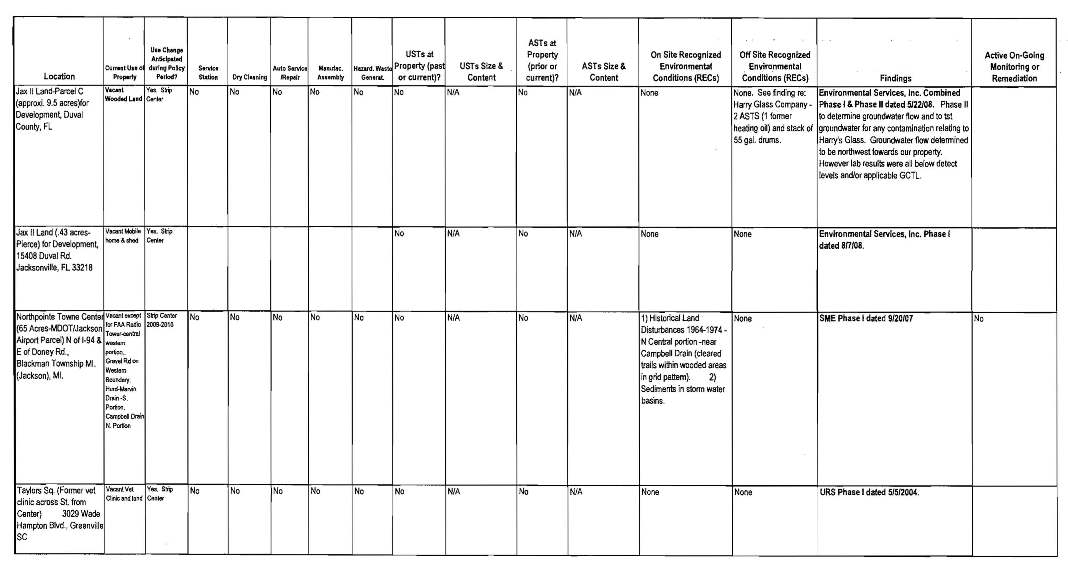

SCHEDULE 6.18

|

ENVIRONMENTAL MATTERS

|

|

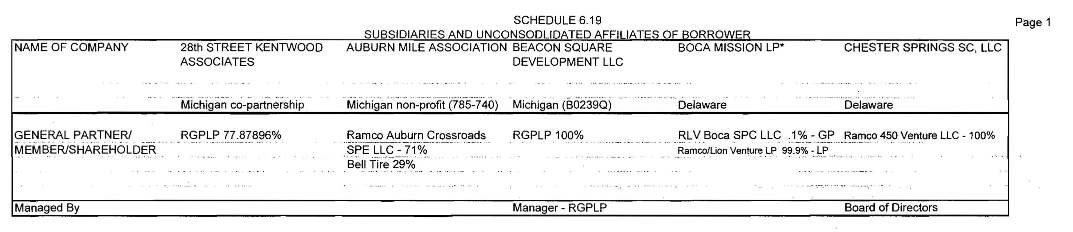

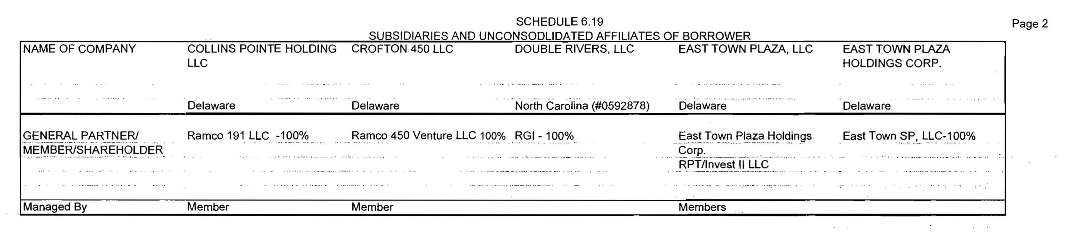

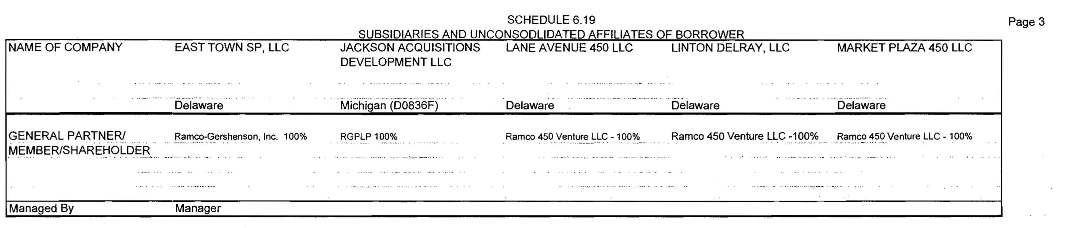

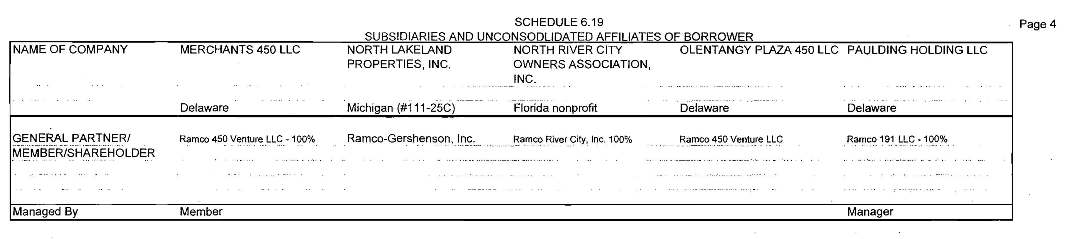

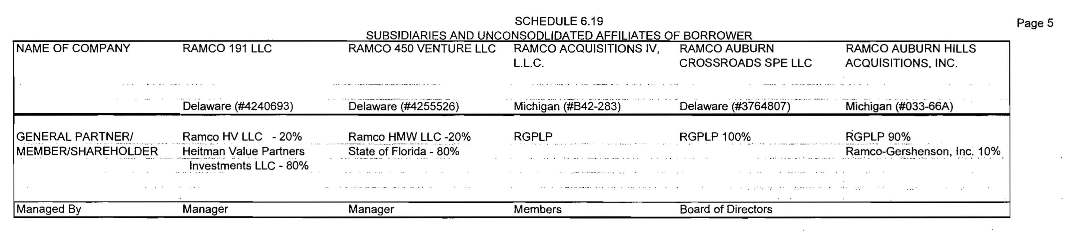

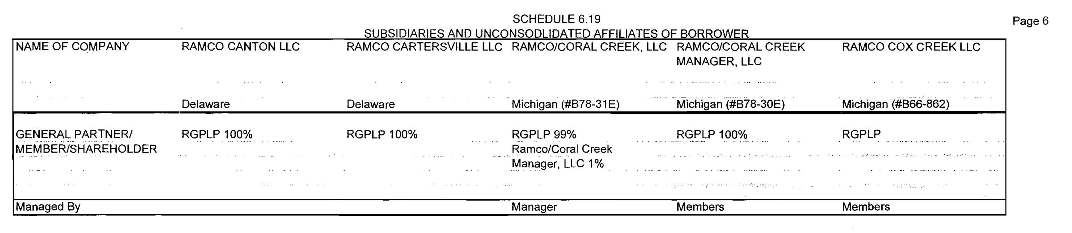

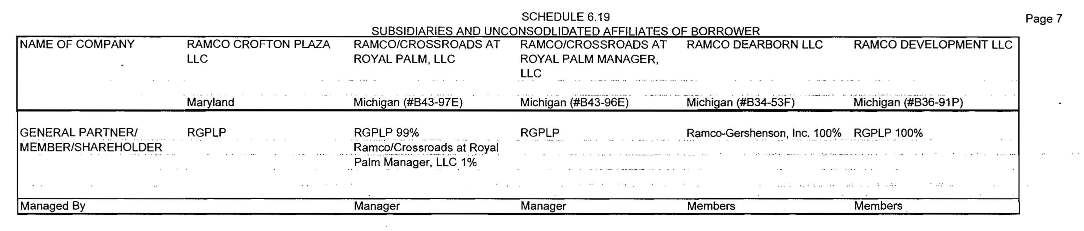

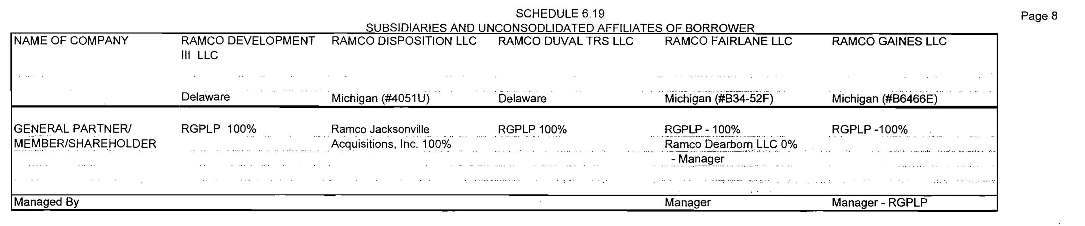

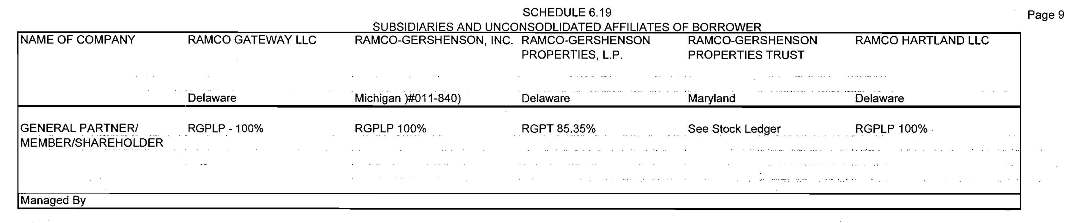

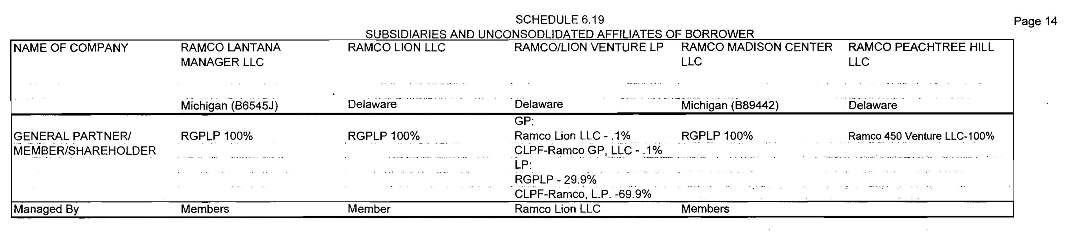

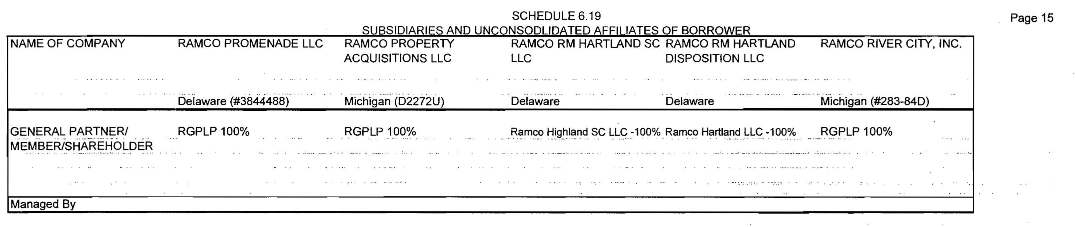

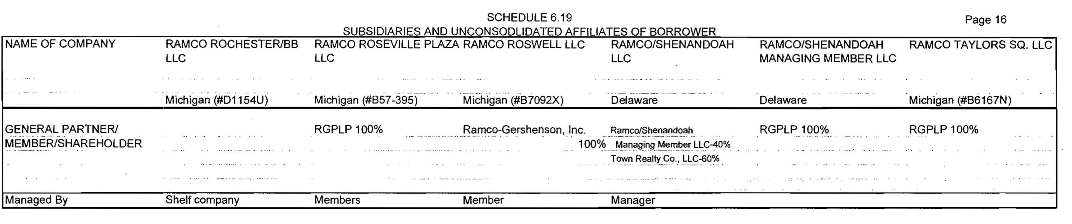

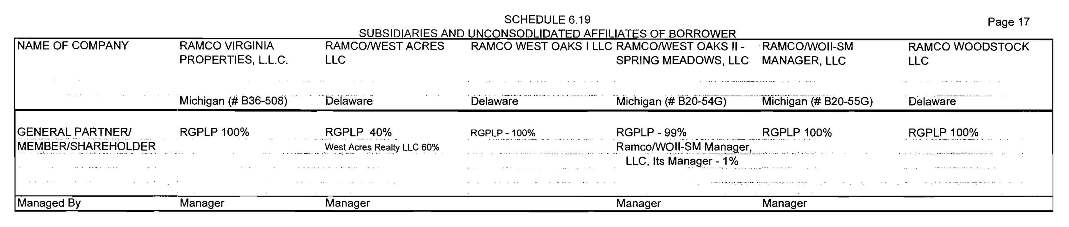

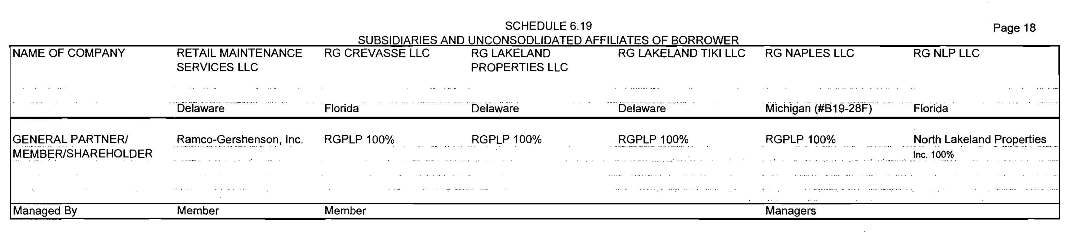

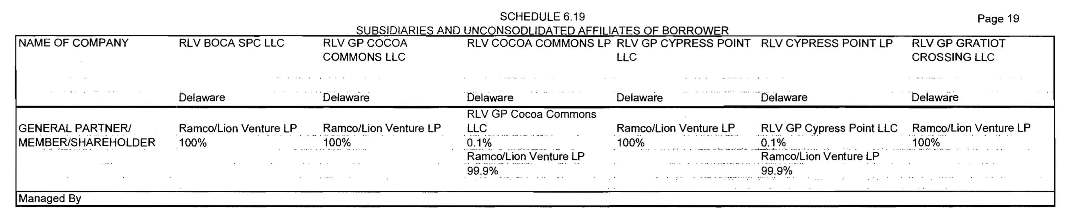

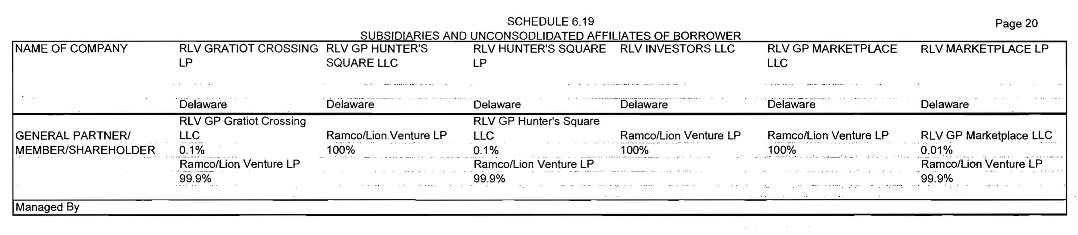

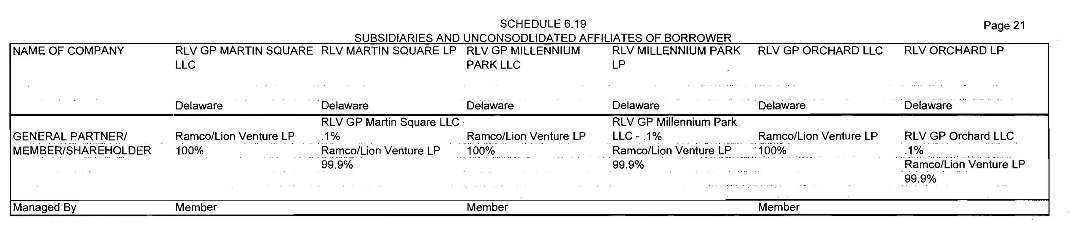

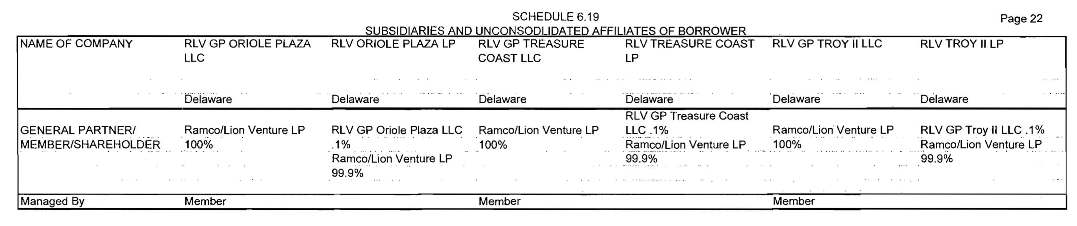

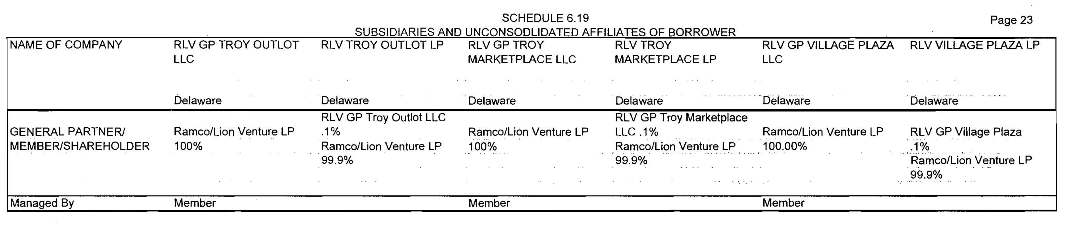

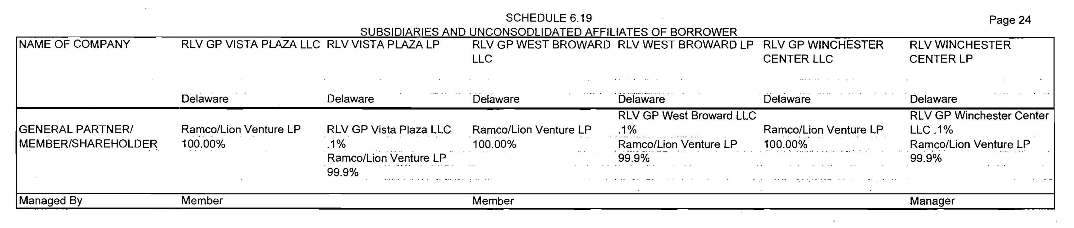

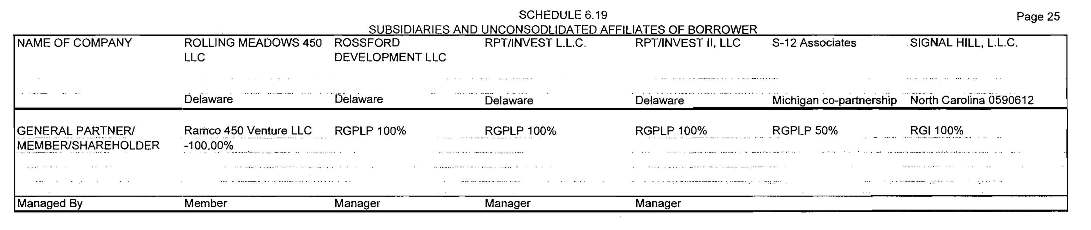

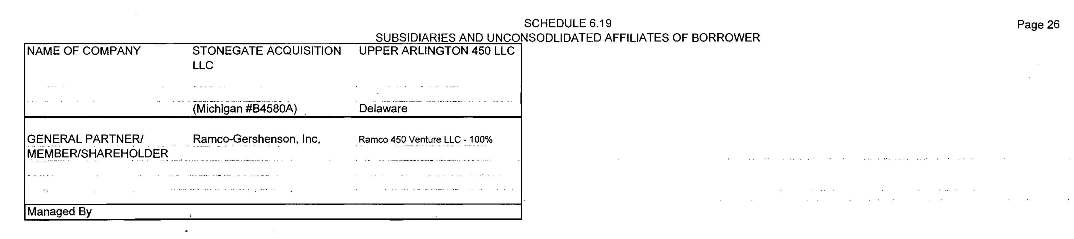

SCHEDULE 6.19

|

SUBSIDIARIES OF THE BORROWER AND GUARANTOR

|

|

SCHEDULE 6.21

|

MANAGEMENT AGREEMENTS; OPTIONS

|

|

SCHEDULE 6.29

|

PROPERTY OF GUARANTOR

|

|

SCHEDULE 6.31

|

INITIAL MORTGAGED PROPERTIES

|

|

SCHEDULE 7.23

|

REMEDIATION

|

|

SCHEDULE 8.10

|

EXISTING DEVELOPMENT PROJECTS

|

AMENDED AND RESTATED

This AMENDED AND RESTATED SECURED MASTER LOAN AGREEMENT is made as of the 11th day of December, 2009 by and among RAMCO-XXXXXXXXXX PROPERTIES, L.P. (the “Borrower”), a Delaware limited partnership, RAMCO-XXXXXXXXXX PROPERTIES TRUST (the “Trust”), a Maryland real estate investment trust, KEYBANK NATIONAL ASSOCIATION, a national banking association (“KeyBank”), and the other lending institutions that are a party hereto, and the other lending institutions which may become parties hereto pursuant to §18 (the “Banks”), and KEYBANK NATIONAL ASSOCIATION, a national banking association, as Administrative Agent for the Banks (the “Agent”).

RECITALS

WHEREAS, the Borrower, the Trust, Agent and the Banks are parties to that certain Unsecured Master Credit Agreement dated as of December 13, 2005, as amended by a First Amendment to Unsecured Master Credit Agreement dated as of December 27, 2006, a Second Amendment to Unsecured Master Credit Agreement dated as of April 30, 2007, and a Third Amendment to Unsecured Master Credit Agreement dated as of November 13, 2007 (the “Prior Credit Agreement”); and

WHEREAS, the Borrower has requested that the Banks extend the maturity date under the Prior Credit Agreement and make certain other modifications; and

WHEREAS, the Borrower, the Guarantor, the Agent and the Banks desire to amend and restate the Prior Credit Agreement in its entirety;

NOW, THEREFORE, in consideration of the terms and conditions herein, and of any loans, advances, or extensions of credit heretofore, now or hereafter made to or for the benefit of the Borrower by the Banks, the parties hereto amend and restate the Prior Credit Agreement in its entirety and covenant and agree as follows:

§1. DEFINITIONS AND RULES OF INTERPRETATION.

§1.1. Definitions. The following terms shall have the meanings set forth in this §1 or elsewhere in the provisions of this Agreement referred to below:

Affiliate. An Affiliate, as applied to any Person, shall mean any other Person directly or indirectly controlling, controlled by, or under common control with, that Person. For purposes of this definition, “control” (including, with correlative meanings, the terms “controlling”, “controlled by” and “under common control with”), as applied to any Person, means (a) the possession, directly or indirectly, of the power to vote ten percent (10%) or more of the stock, shares, voting trust certificates, beneficial interest, partnership interests, member interests or other interests having voting power for the election of directors of such Person or otherwise to direct or cause the direction of the management and policies of that Person, whether through the ownership of voting securities or by contract or otherwise, or (b) the ownership of (i) a general partnership interest, (ii) a managing member’s interest in a limited liability company or (iii) a limited partnership interest or preferred stock (or other ownership interest) representing ten percent (10%) or more of the outstanding limited partnership interests, preferred stock or other ownership interests of such Person.

1

Agent. KeyBank National Association, acting as Administrative Agent for the Banks, its successors and assigns.

Agent’s Head Office. The Agent’s head office located at 000 Xxxxxx Xxxxxx, Xxxxxxxxx, Xxxx 00000-0000, or at such other location as the Agent may designate from time to time by notice to the Borrower and the Banks.

Agent’s Special Counsel. XxXxxxx Long & Xxxxxxxx LLP or such other counsel as may be approved by the Agent.

Agreement. This Amended and Restated Secured Master Loan Agreement, including the Schedules and Exhibits hereto.

Appraisal. An as is MAI appraisal of the value of a parcel of Real Estate, determined on an as is fair value basis, performed by an independent appraiser selected by the Agent who is not an employee of the Borrower, the Guarantors or any of their Subsidiaries, the Agent or a Bank, the form and substance of such appraisal and the identity of the appraiser to be in compliance with the Financial Institutions Reform, Recovery and Enforcement Act of 1989, as amended, the rules and regulations adopted pursuant thereto and all other regulatory laws applicable to the Banks and otherwise acceptable to the Agent.

Appraised Value. The as-is value of a Mortgaged Property determined by the Appraisal of such property obtained pursuant to §5.2, §5.3, §7.19 or §10.15, subject, however, to such changes or adjustments to the value determined thereby as may be required by the appraisal department of the Agent.

Aquia Loan Agreement. That certain First Amended and Restated Revolving Credit Agreement dated of even date herewith among KeyBank, Borrower, Trust, Ramco Virginia Properties, L.L.C. and the other parties thereto, as the same may be modified and amended.

Arranger. KeyBanc Capital Markets.

Assignment and Acceptance Agreement. See §18.1.

Assignment of Leases and Rents. Each of the collateral assignments of leases and rents from the Borrower or any Subsidiary Guarantor to the Agent, as the same may be modified or amended, pursuant to which there shall be assigned to the Agent for the benefit of the Banks, among other things, the interest of the Borrower or such Subsidiary Guarantor as lessor with respect to all Leases of all or any part of a Mortgaged Property and any and all rents thereunder, each such collateral assignment to be in form and substance satisfactory to the Agent.

Balance Sheet Date. September 30, 2009.

2

Banks. KeyBank, the other Banks a party hereto, and any other Person who becomes an assignee of any rights of a Bank pursuant to §18; and collectively, the Revolving Credit Banks, the Term Loan Banks and the Swing Line Lender. The Issuing Bank shall be a Bank, as applicable.

Base Rate. The greater of (a) the variable annual rate of interest announced from time to time by Agent at Agent’s Head Office as its “prime rate”, (b) one-half of one percent (0.5%) above the Federal Funds Effective Rate, or (c) the LIBOR Rate determined as of any date of determination for an Interest Period of one month plus one percent (1%) (rounded upwards, if necessary, to the next one-eighth of one percent). The Base Rate is a reference rate and does not necessarily represent the lowest or best rate being charged to any customer. Any change in the rate oSchf interest payable hereunder resulting from a change in the Base Rate shall become effective as of the opening of business on the day on which such change in the Base Rate becomes effective, without notice or demand of any kind.

Base Rate Loans. Collectively, the Revolving Credit Base Rate Loans and the Term Base Rate Loans.

Board. See the definition of Change of Control.

Borrower. As defined in the preamble hereto.

Borrowing Base Availability. At any date of determination, the Borrowing Base Availability shall be the Borrowing Base Availability for Eligible Real Estate included in the Mortgaged Property owned by the Borrower or any Subsidiary Guarantor. The Borrowing Base Availability for Eligible Real Estate included in the Mortgaged Property shall be the amount which is the lesser of (a) sixty-five percent (65%) of the Collateral Pool Value through March 31, 2010, sixty percent (60%) of the Collateral Pool Value thereafter through and including March 31, 2011, and fifty-five percent (55%) of the Collateral Pool Value thereafter; and (b) the Debt Service Coverage Amount for the Mortgaged Properties, and the amount which is the lesser of (a) and (b) shall be the Borrowing Base Availability for Eligible Real Estate included in the Mortgaged Property. Notwithstanding the foregoing, the Borrowing Base Availability attributable to a Mortgaged Property shall not exceed the principal amount to which recovery under the applicable Security Deed is limited, unless such Security Deed is amended to increase any such limit. Furthermore, the Borrowing Base Availability shall be adjusted and reduced as described in clause (c) of the definition of “Insurance Availability Condition”.

Borrowing Base Property Certificate. See §7.4(e).

Building. With respect to each parcel of Real Estate, all of the buildings, structures and improvements now or hereafter located thereon.

Business Day. Any day on which banking institutions located in the same city and state as the Agent’s Head Office and in New York are open for the transaction of banking business and, in the case of LIBOR Rate Loans, which also is a LIBOR Business Day.

Capital Expenditure Reserve Amount. With respect to any Person or property, a reserve for replacements and capital expenditures equal to $.10 per square foot of building space located on all Real Estate owned by such Person, other than Real Estate subject to leases which provide that the tenant is responsible for all building maintenance.

3

Capital Improvement Project. With respect to any Real Estate now or hereafter owned by the Borrower or any of its Subsidiaries which is utilized principally for shopping centers, capital improvements consisting of rehabilitation, refurbishment, replacement, expansions and improvements (including related amenities) to the existing Buildings on such Real Estate and capital additions, repairs, resurfacing and replacements in the common areas of such Real Estate all of which may be properly capitalized under GAAP.

Capitalized Lease. A lease under which a Person is the lessee or obligor, the discounted future rental payment obligations under which are required to be capitalized on the balance sheet of the lessee or obligor in accordance with GAAP.

Cash Equivalents. As of any date, (i) securities issued or directly and fully guaranteed or insured by the United States government or any agency or instrumentality thereof having maturities of not more than one year from such date, (ii) time deposits and certificates of deposits having maturities of not more than one year from such date and issued by any domestic commercial bank having, (A) senior long term unsecured debt rated at least A or the equivalent thereof by S&P or A2 or the equivalent thereof by Xxxxx’x and (B) capital and surplus in excess of $100,000,000.00; (iii) commercial paper rated at least A-1 or the equivalent thereof by S&P or P-1 or the equivalent thereof by Xxxxx’x and in either case maturing within one hundred twenty (120) days from such date, and (iv) shares of any money market mutual fund rated at least AAA or the equivalent thereof by S&P or at least Aaa or the equivalent thereof by Xxxxx’x.

CERCLA. See §6.18.

Change of Control. The occurrence of any one of the following events:

(a) during any twelve month period on or after the date of this Agreement, individuals who at the beginning of such period constituted the Board of Directors or Trustees of the Trust (the “Board”) (together with any new directors whose election by the Board or whose nomination for election by the shareholders of the Trust was approved by a vote of at least a majority of the members of the Board then in office who either were members of the Board at the beginning of such period or whose election or nomination for election was previously so approved) cease for any reason to constitute a majority of the members of the Board then in office;

(b) any Person or group (as that term is understood under Section 13(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and the rules and regulations thereunder) shall have acquired beneficial ownership (within the meaning of Rule 13d-3 under the Exchange Act) of a percentage (based on voting power, in the event different classes of stock shall have different voting powers) of the voting stock of the Trust equal to at least thirty percent (30%);

(c) the Borrower or Trust consolidates with, is acquired by, or merges into or with any Person (other than a merger permitted by Section 8.4); or

4

(d) the Borrower fails to own, free of any lien, encumbrance or other adverse claim, at least one hundred percent (100%) of the economic interest in the Voting Interest of each Subsidiary Guarantor.

Closing Date. The first date on which all of the conditions set forth in §10 and §11 have been satisfied.

Code. The Internal Revenue Code of 1986, as amended.

Collateral. All of the property, rights and interests of the Borrower, the Guarantors or any of their Subsidiaries which are or are intended to be subject to the security interests, liens and mortgages created by the Security Documents, including, without limitation, the Mortgaged Property.

Collateral Pool Value. The Collateral Pool Value shall be determined as follows:

(a) For the period through and including September 30, 2010, the Collateral Pool Value shall be the sum of the Appraised Values of each Eligible Real Estate included in the Mortgaged Property owned by the Borrower or any Subsidiary Guarantor; and

(b) Thereafter, the Collateral Pool Value shall be an amount equal to the sum of:

(i) with respect to any Eligible Real Estate included in the Mortgaged Property as to which an Appraisal is obtained pursuant to §5.2(a) on or after September 30, 2010 or pursuant to §5.4(b)(ix), the sum of the Appraised Values of such Mortgaged Properties as most recently determined; provided, however, that with respect to each such Mortgaged Property, from and after the date that is twelve (12) months after the date of the written determination by Agent to Borrower and the Banks of the Appraised Value of such Mortgaged Property, then unless and until another Appraisal is obtained pursuant to §5.2(a) with respect to such Mortgaged Property, the Collateral Pool Value with respect to such Mortgaged Property shall be determined pursuant to the terms of clause (b)(ii) of this definition; and

(ii) with respect to each other Mortgaged Property, the aggregate Operating Cash Flow from Eligible Real Estate included in the Mortgaged Property (excluding the Operating Cash Flow of any Mortgaged Property valued pursuant to clause (b)(i) above) divided by 0.0850 (the “Capitalization Rate”).

Notwithstanding the foregoing, the Collateral Pool Value for a Mortgaged Property that is a Redevelopment Property shall be the cost incurred for such Mortgaged Property as determined in accordance with GAAP for a period of up to eighteen (18) months, which period shall commence upon the date which Agent approves such Mortgaged Property as a Redevelopment Property.

Commitment. With respect to each Bank, the aggregate of (a) the Revolving Credit Commitment of such Bank and (b) the Term Loan Commitment of such Bank.

5

Commitment Percentage. With respect to each Bank, the percentage set forth on Schedule 1.1 hereto as such Bank’s percentage of the aggregate Commitments of all of the Banks, as the same may be changed from time to time in accordance with the terms of this Agreement.

Compliance Certificate. See §7.4(e).

Condemnation Proceeds. All compensation, awards, damages, judgments and proceeds awarded to the Borrower or a Subsidiary Guarantor by reason of any Taking, net of all reasonable and customary amounts actually expended to collect the same, including, without limitation, reasonable and customary amounts expended in negotiating, litigating, if appropriate, or investigating the amount of such compensation, awards, damages, judgments and proceeds.

Consolidated or combined. With reference to any term defined herein, that term as applied to the accounts of a Person and its Subsidiaries, consolidated or combined in accordance with GAAP.

Consolidated Operating Cash Flow. With respect to any period of a Person, an amount equal to the Operating Cash Flow of such Person and its Subsidiaries for such period consolidated in accordance with GAAP.

Consolidated Tangible Net Worth. The amount by which Consolidated Total Adjusted Asset Value exceeds Consolidated Total Liabilities, and less the sum of:

(a) the total book value of all assets of a Person and its Subsidiaries properly classified as intangible assets under GAAP, including such items as good will, the purchase price of acquired assets in excess of the fair market value thereof, trademarks, trade names, service marks, brand names, copyrights, patents and licenses, and rights with respect to the foregoing; and

(b) all amounts representing any write-up in the book value of any assets of such Person or its Subsidiaries resulting from a revaluation thereof subsequent to the Balance Sheet Date; and

(c) all amounts representing minority interests as of such date which are applicable to third parties in Investments of the Borrower.

Consolidated Total Adjusted Asset Value. With respect to any Person, the sum of all assets of such Person and its Subsidiaries determined on a Consolidated basis in accordance with GAAP, provided that all Real Estate that is improved and not Under Development shall be valued at an amount equal to (A) the Operating Cash Flow of such Person and its Subsidiaries and Unconsolidated Affiliates described in §8.3(i) from such Real Estate for the period covered by the four previous consecutive fiscal quarters (treated as a single accounting period) divided by (B) 0.0850 (an 8.50% capitalization rate), provided that (i) prior to such time as the Borrower or any of its Subsidiaries or such Unconsolidated Affiliates has owned and operated any parcel of Real Estate for four full fiscal quarters (or with respect to any Redevelopment Property that has been valued at cost as permitted below and has recommenced operations for less than four full fiscal quarters), the Operating Cash Flow with respect to such parcel of Real Estate for the number of full fiscal quarters which the Borrower or any of its Subsidiaries or such Unconsolidated Affiliates has owned and operated such parcel of Real Estate (or, with respect to a Redevelopment Property that has recommenced operations, the Operating Cash Flow for such Redevelopment Property for the number of full fiscal quarters which the Borrower or its Subsidiary or such Unconsolidated Affiliate has recommenced operations) as annualized shall be utilized, (ii) the Operating Cash Flow for any parcel of Real Estate (or Redevelopment Property that has recommenced operations) without a full quarter of performance shall be annualized in such manner as the Agent shall approve, such approval not to be unreasonably withheld, (iii) prior to being capitalized, the Operating Cash Flow with respect to any parcel of Real Estate owned by an Unconsolidated Affiliate of such Person shall be reduced by the amount of all Debt Service of such Unconsolidated Affiliate, and (iv) to the extent that the capitalized Operating Cash Flow with respect to any parcel of Real Estate owned by an Unconsolidated Affiliate of such Person is included in the calculation of Consolidated Total Adjusted Asset Value for such Person, such Person’s interest in the Unconsolidated Affiliate shall not be included in the calculation of Consolidated Total Adjusted Asset Value for such Person. Real Estate that is Under Development and undeveloped Land shall be valued at its capitalized cost in accordance with GAAP. Notwithstanding the foregoing, Borrower may elect to value a Redevelopment Property at cost as determined in accordance with GAAP, as set forth in the first sentence of this definition, for a period of up to eighteen (18) months which eighteen (18) month period shall commence upon the date which Agent receives written notice from Borrower of such election (including any notice provided under the Prior Credit Agreement). The assets of the Borrower and its Subsidiaries on the consolidated financial statements of the Borrower and its Subsidiaries shall be adjusted to reflect the Borrower’s allocable share of such asset (including Borrower’s interest in any Unconsolidated Affiliate whose asset value is determined by application of the capitalization rate above), for the relevant period or as of the date of determination, taking into account (a) the relative proportion of each such item derived from assets directly owned by the Borrower and from assets owned by its respective Subsidiaries and Unconsolidated Affiliates, and (b) the Borrower’s respective ownership interest in its Subsidiaries and Unconsolidated Affiliates.

6

Consolidated Total Liabilities. All liabilities of a Person and its Subsidiaries determined on a Consolidated basis in accordance with GAAP and all Indebtedness of such Person and its Subsidiaries, whether or not so classified, including any liabilities arising in connection with sale and leaseback transactions. Consolidated Total Liabilities shall not include Trust Preferred Equity or Subordinated Debt. Amounts undrawn under this Agreement shall not be included in Indebtedness for purposes of this definition. Notwithstanding anything to the contrary contained herein, (a) Indebtedness (i) of Borrower and its Subsidiaries consisting of environmental indemnities and guarantees with respect to customary exceptions to exculpatory language with respect to Non-recourse Indebtedness and (ii) of Borrower with respect to the TIF Guaranty shall not be included in the calculation of Consolidated Total Liabilities of Borrower and its Subsidiaries unless a claim shall have been made against Borrower or a Subsidiary of Borrower on account of any such guaranty or indemnity, and (b) Indebtedness of Borrower, the Trust and their Subsidiaries under completion guarantees shall equal the remaining costs to complete the applicable construction project in excess of construction loan or mezzanine loan proceeds available therefor and any equity deposited or invested for the payment of such costs.

7

Contribution Agreement. That certain Contribution Agreement dated of even date herewith among the Borrower, the Trust and the Subsidiary Guarantors.

Conversion Request. A notice given by the Borrower to the Agent of its election to convert or continue a Loan in accordance with §4.1.

Co-Syndication Agents. JPMorgan Chase Bank, N.A. and Bank of America, N.A.

Debt Offering. The issuance and sale by the Borrower or any Guarantor of any debt securities of the Borrower or such Guarantor.

Debt Service. For any period, the sum of all interest, including capitalized interest not paid in cash, bond related expenses, and mandatory principal/sinking fund payments due and payable during such period excluding any balloon payments due upon maturity of any Indebtedness. Any of the foregoing payable with respect to Subordinated Debt shall be included in the calculation of Debt Service.

Debt Service Coverage Amount. At any time determined by the Agent, an amount equal to the maximum principal loan amount which, when bearing interest at a rate per annum equal to the greater of (a) the then-current annual yield on seven (7) year obligations issued by the United States Treasury most recently prior to the date of determination plus 2.50% payable based on a 25 year mortgage style amortization schedule (expressed as a mortgage constant percentage) and (b) 8.5%, would be payable by the monthly principal and interest payment amount resulting from dividing (a) the Operating Cash Flow from the Mortgaged Properties for the preceding four fiscal quarters divided by 1.5 by (b) 12. The determination of the Debt Service Coverage Amount and the components thereof by the Agent shall, so long as the same shall be determined in good faith, be conclusive and binding absent manifest error.

Default. See §12.1.

Defaulting Bank. See §14.5(c).

Derivatives Contract. Any and all rate swap transactions, basis swaps, credit derivative transactions, forward rate transactions, commodity swaps, commodity options, forward commodity contracts, equity or equity index swaps or options, bond or bond price or bond index swaps or options or forward bond or forward bond price or forward bond index transactions, interest rate options, forward foreign exchange transactions, cap transactions, floor transactions, collar transactions, currency swap transactions, cross-currency rate swap transactions, currency options, spot contracts, or any other similar transactions or any combination of any of the foregoing (including any options to enter into any of the foregoing), whether or not any such transaction is governed by or subject to any master agreement. Not in limitation of the foregoing, the term “Derivatives Contract” includes any and all transactions of any kind, and the related confirmations, which are subject to the terms and conditions of, or governed by, any form of master agreement published by the International Swaps and Derivatives Association, Inc., any International Foreign Exchange Master Agreement, or any other master agreement of similar type, including any such obligations or liabilities under any such master agreement.

Directions. See §14.12.

8

Distribution. With respect to any Person, the declaration or payment of any cash, cash flow, dividend or distribution on or in respect of any shares of any class of capital stock, partnership interest, membership interest or other beneficial interest of such Person other than that portion of any dividends or distributions payable in equity securities of such Person; the purchase, redemption, exchange or other retirement of any shares of any class of capital stock, partnership interest, membership interest or other beneficial interest of such Person, directly or indirectly through a Subsidiary of such Person or otherwise; the return of capital by such Person to its shareholders, partners, members or other owners as such; or any other distribution on or in respect of any shares of any class of capital stock or other beneficial interest of such Person.

Documentation Agent. Deutsche Bank Trust Company Americas.

Dollars or $. Dollars in lawful currency of the United States of America.

Domestic Lending Office. Initially, the office of each Bank designated as such in Schedule 1.1 hereto; thereafter, such other office of such Bank, if any, located within the United States that will be making or maintaining Base Rate Loans.

Drawdown Date. The date on which any Loan is made or is to be made, and the date on which any Loan which is made prior to the Revolving Credit Maturity Date or Term Loan Maturity Date, as applicable, is converted or combined in accordance with §4.1.

Eligible Real Estate. Real Estate which meets the conditions set forth in § 7.19(a).

Eligible Real Estate Qualification Documents. See Schedule 5.3.

Employee Benefit Plan. Any employee benefit plan within the meaning of §3(3) of ERISA maintained or contributed to by the Borrower, a Guarantor or any ERISA Affiliate, other than a Multiemployer Plan.

Environmental Insurance Policy. That certain Pollution and Legal Liability Real Estate Policy issued by Environmental Insurer, Policy No. CRE 2675936, in favor of Ramco-Xxxxxxxxxx Properties, as named Insured.

Environmental Insurer. American International Specialty Lines Insurance Company.

Environmental Laws. See §6.18(a).

Equity Offering. The issuance and sale by the Borrower or any Guarantor of any equity securities of the Borrower or such Guarantor.

ERISA. The Employee Retirement Income Security Act of 1974, as amended and in effect from time to time.

ERISA Affiliate. Any Person which is treated as a single employer with the Borrower or any Guarantor under §414 of the Code.

9

ERISA Reportable Event. A reportable event with respect to a Guaranteed Pension Plan within the meaning of §4043 of ERISA and the regulations promulgated thereunder as to which the requirement of notice has not been waived.

Event of Default. See §12.1.

Existing Hedge Agreements. The existing hedge agreements of the Trust and its Subsidiaries described on Schedule 1.2 hereto.

Existing Letters of Credit. The Letters of Credit issued by Issuing Bank and described on Schedule 2.9 hereto.

Federal Funds Effective Rate. For any day, the rate per annum (rounded to the nearest one hundredth of one percent (1/100 of 1%)) announced by the Federal Reserve Bank of Cleveland on such day as being the weighted average of the rates on overnight federal funds transactions arranged by federal funds brokers on the previous trading day, as computed and announced by such Federal Reserve Bank in substantially the same manner as such Federal Reserve Bank computes and announces the weighted average it refers to as the “Federal Funds Effective Rate”, or, if such rate is not so published for any day that is a Business Day, the average of the quotations for such day on such transactions received by the Agent from three (3) Federal funds brokers of recognized standing selected by the Agent.

Fixed Charges. With respect to the Trust and its Subsidiaries for any fiscal period, an amount equal to the sum of (a) the Debt Service of the Trust and its Subsidiaries, plus (b) the Preferred Distributions of the Trust and its Subsidiaries, all determined on a consolidated basis in accordance with GAAP.

Funds from Operations. With respect to any Person for any fiscal period, the Net Income (or Deficit) of such Person computed in accordance with GAAP, excluding losses from sales of property, plus depreciation and amortization, and after adjustments for unconsolidated partnerships and joint ventures. Adjustments for unconsolidated partnerships and joint ventures will be calculated to reflect funds from operations on the same basis.

GAAP. Principles that are (a) consistent with the principles promulgated or adopted by the Financial Accounting Standards Board and its predecessors, as in effect from time to time and (b) consistently applied with past financial statements of the Person adopting the same principles; provided that a certified public accountant would, insofar as the use of such accounting principles is pertinent, be in a position to deliver an unqualified opinion (other than a qualification regarding changes in GAAP) as to financial statements in which such principles have been properly applied. Notwithstanding the foregoing, for the purposes of the financial calculations hereunder, any amount otherwise included therein from a xxxx-up or xxxx-down of a derivative product of a Person shall be excluded.

Government Acts. See §2.9(j).

Guaranteed Pension Plan. Any employee pension benefit plan within the meaning of §3(2) of ERISA maintained or contributed to by the Borrower, any Guarantor or any ERISA Affiliate the benefits of which are guaranteed on termination in full or in part by the PBGC pursuant to Title IV of ERISA, other than a Multiemployer Plan.

10

Guarantors. Collectively, the Trust and each Subsidiary Guarantor, and individually, any one such Guarantor.

Guaranty. The Amended and Restated Unconditional Guaranty of Payment and Performance dated of even date herewith made by the Guarantors in favor of the Agent and the Banks, as the same may be modified or amended, such Guaranty to be in form and substance satisfactory to the Agent.

Hazardous Substances. See §6.18(b).

Hedge Obligations. All obligations of Borrower to any Lender Hedge Provider under any agreement with respect to an interest rate swap, collar, cap or floor or a forward rate agreement or other agreement regarding the hedging of interest rate risk exposure relating to the Obligations, and any confirming letter executed pursuant to such hedging agreement, all as amended, restated or otherwise modified.

High Leverage Condition. Any period of time in which a Target Leverage Condition does not exist.

Indebtedness. All obligations, contingent and otherwise, that in accordance with GAAP should be classified upon the obligor’s balance sheet as liabilities, or to which reference should be made by footnotes thereto, but without any double counting, including in any event and whether or not so classified: (a) all debt and similar monetary obligations, whether direct or indirect (including, without limitation, any obligations evidenced by bonds, debentures, notes or similar debt instruments); (b) all liabilities secured by any mortgage, pledge, security interest, lien, charge or other encumbrance existing on property owned or acquired subject thereto, whether or not the liability secured thereby shall have been assumed; (c) all guarantees, endorsements and other contingent obligations whether direct or indirect in respect of indebtedness of others, including any obligation to supply funds to or in any manner to invest directly or indirectly in a Person, to purchase indebtedness, or to assure the owner of indebtedness against loss through an agreement to purchase goods, supplies or services for the purpose of enabling the debtor to make payment of the indebtedness held by such owner or otherwise; (d) any obligation as a lessee or obligor under a Capitalized Lease; (e) all subordinated debt, including, without limitation, Subordinated Debt (but excluding Trust Preferred Equity); (f) all obligations to purchase under agreements to acquire (but excluding agreements which provide that the seller’s remedies thereunder are limited to market liquidated damages in the event the purchaser defaults thereunder), or otherwise to contribute money with respect to, properties under “development” within the meaning of §8.9; and (g) all obligations, contingent or deferred or otherwise, of any Person, including, without limitation, any such obligations as an account party under acceptance, letter of credit or similar facilities including, without limitation, obligations to reimburse the issuer in respect of a letter of credit except for contingent obligations (but excluding any guarantees or similar obligations) that are not material and are incurred in the ordinary course of business in connection with the acquisition or obtaining commitments for financing of Real Estate.

11

Indemnity Agreement. The Indemnity Agreement Regarding Hazardous Materials made by the Borrower and the Guarantors in favor of the Agent and the Banks, as the same may be modified or amended, pursuant to which the Borrower and the Guarantors agree to indemnify the Agent and the Banks with respect to Hazardous Substances and Environmental Laws, such Indemnity Agreement to be in form and substance satisfactory to the Agent.

Insurance Availability Condition. An Insurance Availability Condition shall exist in the event that (a) any loss or damage has occurred to any Mortgaged Property which is covered by a casualty insurance policy, (b) the Agent shall reasonably determine that the repair or reconstruction of such loss or damage can be completed prior to the Maturity Date, and (c) after application of §7.19(c), and after deducting from the Borrowing Base Availability an amount equal to the cost, as reasonably estimated by Agent after consultation with Borrower, to repair and restore such Mortgaged Property to its condition prior to such casualty, Borrower would be in compliance with the covenants set forth in §9.5.

Insurance Proceeds. All insurance proceeds, damages and claims and the right thereto under any insurance policies relating to any portion of any Collateral, net of all reasonable and customary amounts actually expended to collect the same, including, without limitation, reasonable and customary amounts expended in negotiating, litigating, if appropriate, or investigating the amount of such insurance, proceeds, damages and claims.

Interest Payment Date. As to each Base Rate Loan, the first day of each calendar month during the term of such Base Rate Loan and as to each LIBOR Rate Loan, the first day of each calendar month during the term of such LIBOR Rate Loan and the last day of the Interest Period relating thereto.

Interest Period. With respect to each LIBOR Rate Loan (a) initially, the period commencing on the Drawdown Date of such Loan and ending one, two, three or six months (or, with the consent of the Banks, a period of less than one (1) month) thereafter and (b) thereafter, each period commencing on the day following the last day of the next preceding Interest Period applicable to such Loan and ending on the last day of one of the periods set forth above, as selected by the Borrower in a Conversion Request; provided that all of the foregoing provisions relating to Interest Periods are subject to the following:

(i) if any Interest Period with respect to a LIBOR Rate Loan would otherwise end on a day that is not a LIBOR Business Day, that Interest Period shall end and the next Interest Period shall commence on the next preceding or succeeding LIBOR Business Day as determined conclusively by the Agent in accordance with the then current bank practice in the London Interbank Market;

(ii) if the Borrower shall fail to give notice as provided in §4.1, the Borrower shall be deemed to have requested a conversion of the affected LIBOR Rate Loan to a Base Rate Loan on the last day of the then current Interest Period with respect thereto; and

(iii) no Interest Period relating to any LIBOR Rate Loan shall extend beyond the Revolving Credit Maturity Date or Term Loan Maturity Date, as applicable.

12

Interest Rate Contracts. Interest rate swap, collar, cap or similar agreements providing interest rate protection.

Investments. With respect to any Person, all shares of capital stock, evidences of Indebtedness and other securities issued by any other Person, all loans, advances, or extensions of credit to, or contributions to the capital of, any other Person, all purchases of the securities or business or integral part of the business of any other Person and commitments and options to make such purchases, all interests in real property, and all other investments; provided, however, that the term “Investment” shall not include (i) equipment, inventory and other tangible personal property acquired in the ordinary course of business, or (ii) current trade and customer accounts receivable for services rendered in the ordinary course of business and payable in accordance with customary trade terms. In determining the aggregate amount of Investments outstanding at any particular time: (a) the amount of any Investment represented as a guaranty shall be taken at not less than the principal amount of the obligations guaranteed and still outstanding; (b) there shall be included as an Investment all interest accrued with respect to Indebtedness constituting an Investment unless and until such interest is paid; (c) there shall be deducted in respect of each such Investment any amount received as a return of capital (but only by repurchase, redemption, retirement, repayment, liquidating dividend or liquidating distribution); (d) there shall not be deducted in respect of any Investment any amounts received as earnings on such Investment, whether as dividends, interest or otherwise, except that accrued interest included as provided in the foregoing clause (b) may be deducted when paid; and (e) there shall not be deducted from the aggregate amount of Investments any decrease in the value thereof.

Issuing Bank. KeyBank in its capacity as the Bank issuing Letters of Credit, or any successor issuing bank hereunder.

Joinder Agreement. The joinder agreement with respect to the Guaranty, the Contribution Agreement and the Indemnity Agreement to be executed and delivered pursuant to §5.5 by any additional Guarantor, substantially in the form of Exhibit D hereto.

KeyBank. As defined in the preamble hereto.

Leases. Leases, licenses and agreements whether written or oral, relating to the use or occupation of space in or on any Building or on any Real Estate by persons other than the Borrower.

Lender Hedge Provider. With respect to any Hedge Obligations, any counterparty thereto that, at the time the applicable hedge agreement was entered into, was a Bank or an Affiliate of a Bank. For the avoidance of doubt, Bank of America, N.A. is a Lender Hedge Provider with respect to the Existing Hedge Agreements.

Letter of Credit. Any standby letter of credit issued at the request of the Borrower and for the account of the Borrower in accordance with §2.9.

Letter of Credit Application. See §2.9(b).

Letter of Credit Liabilities. At any time and in respect of any Letter of Credit, the sum of (a) the maximum undrawn face amount of such Letter of Credit plus (b) the aggregate unpaid principal amount of all drawings made under such Letter of Credit which have not been repaid (including repayment by a Revolving Credit Loan). For purposes of this Agreement, a Revolving Credit Bank (other than the Bank acting as the Issuing Bank) shall be deemed to hold a Letter of Credit Liability in an amount equal to its participation interest in the related Letter of Credit under §2.9, and the Bank acting as the Issuing Bank shall be deemed to hold a Letter of Credit Liability in an amount equal to its retained interest in the related Letter of Credit after giving effect to the acquisition by the Revolving Credit Banks other than the Bank acting as the Issuing Bank of their participation interests under such Section.

13

Letter of Credit Sublimit. An amount equal to $25,000,000.00, as such amount may increase as provided in §2.9 or may reduce as provided in §2.7.

LIBOR Business Day. Any day on which commercial banks are open for international business (including dealings in Dollar deposits) in London.

LIBOR Lending Office. Initially, the office of each Bank designated as such in Schedule 1.1 hereto; thereafter, such other office of such Bank, if any, that shall be making or maintaining LIBOR Rate Loans.

LIBOR Rate. For any LIBOR Rate Loan for any Interest Period, the average rate (rounded to the nearest 1/100th) as shown in Reuters Screen LIBOR 01 Page at which deposits in U.S. dollars are offered by first class banks in the London Interbank Market at approximately 11:00 a.m. (London time) on the day that is two (2) LIBOR Business Days prior to the first day of such Interest Period with a maturity approximately equal to such Interest Period and in an amount approximately equal to the amount to which such Interest Period relates, adjusted for reserves and taxes if required by future regulations. If such service no longer reports such rate or Agent determines in good faith that the rate so reported no longer accurately reflects the rate available to Agent in the London Interbank Market, Agent may select a replacement index. For any period during which a Reserve Percentage shall apply, the LIBOR Rate with respect to LIBOR Rate Loans shall be equal to the amount determined above divided by an amount equal to 1 minus the Reserve Percentage. Notwithstanding the foregoing, the LIBOR Rate shall not be less than two percent (2%) for any Revolving Credit Loans or Term Loans (including for the purpose of calculating the Base Rate for any Revolving Credit Loans or Term Loans bearing interest by reference thereto) in excess of the notional amount hedged pursuant to the Existing Hedge Agreements, provided that (i) as the Existing Hedge Agreements expire in accordance with their current terms, the principal amount of the Revolving Credit Loans and Term Loans subject to the floor of two percent (2%) shall increase by the notional amount of the applicable Existing Hedge Agreement that has expired or terminated, and (ii) the floor of two percent (2%) shall first be applied to Revolving Credit Loans and then to Term Loans.

LIBOR Rate Loans. Collectively, the Revolving Credit LIBOR Rate Loans and the Term LIBOR Rate Loans.

Lien. See §8.2.

Liquidity. As of any date of determination, the sum of (x) Unrestricted Cash and Cash Equivalents of the Borrower, plus (y) the maximum amount of Revolving Credit Loans that Borrower may borrow pursuant to §2.1 (after deducting the amount of all other Outstanding Loans and Letter of Credit Liabilities), plus (z) any amounts that can be drawn under the Aquia Loan Agreement.

14

Loan Documents. This Agreement, the Notes (if any), the Letters of Credit, the Letter of Credit Applications, the Guaranty, the Security Documents and all other documents, instruments or agreements now or hereafter executed or delivered by or on behalf of the Borrower or the Guarantors in connection with the Loans.

Loan Request. See §2.5.

Loans. The Revolving Credit Loans and the Term Loans. Swing Line Loans shall constitute “Revolving Credit Loans” for all purposes under this Agreement (provided that only the Swing Line Lender shall be obligated to make a Swing Line Loan), but shall not be considered the utilization of a Revolving Credit Bank’s Revolving Credit Commitment (except to the extent of such Revolving Credit Bank’s participation in Swing Line Loans).

Majority Banks. As of any date, any Bank or collection of Banks whose aggregate Commitment Percentage is more than fifty percent (50%); provided, that, in determining said percentage at any given time, all then existing Defaulting Banks will be disregarded and excluded and the Commitment Percentages of the Banks shall be redetermined for voting purposes only, to exclude the Commitment Percentages of such Defaulting Banks.

Majority Revolving Credit Banks. As of any date, any Revolving Credit Bank or collection of Revolving Credit Banks whose aggregate Revolving Credit Commitment Percentage is greater than fifty percent (50%); provided that in determining said percentage at any given time, all the existing Revolving Credit Banks that are Defaulting Banks will be disregarded and excluded and the Revolving Credit Commitment Percentages of the Revolving Credit Banks shall be redetermined for voting purposes only to exclude the Revolving Credit Commitment Percentages of such Defaulting Banks.

Management Agreements. Agreements, whether written or oral, providing for the management of the Mortgaged Properties or any of them.

Mortgaged Property or Mortgaged Properties. The Eligible Real Estate owned or leased by the Borrower or any Subsidiary Guarantor which is conveyed to and accepted by the Agent as security for the Obligations of the Borrower pursuant to the Security Deeds.

Multiemployer Plan. Any multiemployer plan within the meaning of §3(37) of ERISA maintained or contributed to by the Borrower, a Guarantor or any ERISA Affiliate.

Net Income (or Deficit). With respect to any Person (or any asset of any Person) for any fiscal period, the net income (or deficit) of such Person (or attributable to such asset), after deduction of all expenses, taxes and other proper charges, determined in accordance with GAAP.

Net Offering Proceeds. The gross cash proceeds received by the Borrower or any Guarantor as a result of a Debt Offering or an Equity Offering less the customary and reasonable costs, fees, expenses, underwriting commissions and discounts incurred by the Borrower or such Guarantor in connection therewith.

15

Net Proceeds. With respect to the sale or refinance of any portion of the Mortgaged Property in accordance with the provisions of §5.4, all gross proceeds of such sale or refinance plus all other consideration received in conjunction with such sale or refinance less all reasonable, ordinary and customary costs, expenses and commissions incurred as a direct result of such sale or refinance and paid to any Person; provided that no such costs, expenses or commissions shall be paid to the Borrower, a Guarantor or any of their respective partners, members, managers, officers, directors or Affiliates unless such costs, expenses or commissions do not exceed those payable in an arms-length transaction in the applicable market as reasonably determined by Agent.

Net Rentable Area. With respect to any Real Estate, the floor area of any buildings, structures or improvements available (or to be available upon completion) for leasing to tenants determined in accordance with the Rent Roll for such Real Estate, the manner of such determination to be consistent for all Real Estate unless otherwise approved by the Agent.

New Development Activity. Either of the following commencing after the date of this Agreement: (i) any new vertical construction of a shopping center, office complex or other development type, or (ii) the commencement of a new phase of vertical construction on any Real Estate (addition of a building for a tenant within an existing phase of a development or renovation of an existing center shall not be considered a new phase).

New Redevelopment Activity. Any of the following commencing after the date of this Agreement: (i) the substantial renovation of improvements to Real Estate which materially changes the character or size thereof, (ii) the addition of buildings, structures, improvements, amenities or other related facilities to existing Real Estate which is already used principally for shopping centers, office complexes or other development types operated by the Borrower and its Subsidiaries, and the costs of which will not be recoverable under reimbursement provisions (other than through rent or a gross up of rent), (iii) the demolition of existing structures or improvements to Real Estate, or (iv) the construction of any structures or improvements to Real Estate performed by an existing or potential tenant, and the Borrower (or any Subsidiary or Affiliate thereof), the Trust or its respective Subsidiary, as applicable, is obligated to reimburse such tenant for the cost of such construction upon completion of such construction by such tenant. The term New Redevelopment Activity shall not include any maintenance, repairs and replacement to any Real Estate, or improvements thereon, completed in the ordinary course of business or any tenant work that is paid for by a tenant (other than through rent or a gross up of rent), even if performed by the Borrower, the Trust or a Subsidiary as landlord.

Non-recourse Indebtedness. Indebtedness of a Person which is secured solely by one or more parcels of Real Estate (other than a Mortgaged Property) and related personal property and is not a general obligation of such Person, the holder of such Indebtedness having recourse solely to the parcels of Real Estate securing such Indebtedness, the Building and any leases thereon and the rents and profits thereof.

Non-Consenting Bank. See §18.9.

16

Notes. Collectively, the Revolving Credit Notes, Term Loan Notes, and the Swing Line Note, if any.

Notice. See §19.

Obligations. All indebtedness, obligations and liabilities of the Borrower and the Guarantors to any of the Banks and the Agent, individually or collectively, under this Agreement or any of the other Loan Documents or in respect of any of the Loans, the Letters of Credit or the Notes, or other instruments at any time evidencing any of the foregoing, whether existing on the date of this Agreement or arising or incurred hereafter, direct or indirect, joint or several, absolute or contingent, matured or unmatured, liquidated or unliquidated, secured or unsecured, arising by contract, operation of law or otherwise.

OFAC. Office of Foreign Asset Control of the Department of the Treasury of the United States of America.

Operating Cash Flow. With respect to any Person (or any asset of any Person) for any period, for the four (4) most recently completed consecutive fiscal quarters of such Person an amount equal to the sum of (a) the Net Income of such Person (or attributable to such asset) for such period (excluding from Net Income any base rents from tenants leasing 5,000 square feet or more (1) that are subject to any bankruptcy proceeding and that have not affirmed or assumed their respective lease or other occupancy agreement or (2) as to which a payment default has occurred under the applicable Lease for sixty (60) days or more beyond any applicable grace and cure period) plus (b) depreciation and amortization, interest expense, and any extraordinary or nonrecurring losses deducted in calculating such Net Income, minus (c) any extraordinary or nonrecurring gains included in calculating such Net Income, minus (d) the Capital Expenditure Reserve Amount, minus (e) to the extent not already deducted in calculating Net Income, a management fee of 3% of minimum rents attributable to any Real Estate of such Person, all as determined in accordance with GAAP, minus (f) any lease termination payments not received in the ordinary course of business. Payments from Borrower or its Affiliates under leases shall be excluded from Operating Cash Flow.

Outstanding. With respect to the Loans, the aggregate unpaid principal thereof as of any date of determination. With respect to Letters of Credit, the aggregate undrawn face amount of issued Letters of Credit

Patriot Act. The Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001, as the same may be amended from time to time, and corresponding provisions of future laws.

PBGC. The Pension Benefit Guaranty Corporation created by §4002 of ERISA and any successor entity or entities having similar responsibilities.

Permitted Liens. Liens, security interests and other encumbrances permitted by §8.2.

Person. Any individual, corporation, partnership, limited liability company, trust, unincorporated association, business, or other legal entity, and any government or any governmental agency or political subdivision thereof.

17

Potential Collateral. Any property of the Borrower or a Wholly Owned Subsidiary of Borrower which is not at the time included in the Collateral and which consists of (i) Eligible Real Estate and (ii) Real Estate which is capable of becoming Eligible Real Estate through the satisfaction of the conditions in §7.19 and the completion and delivery of Eligible Real Estate Qualification Documents.

Preferred Distributions. For any period, the amount of any and all Distributions (but excluding any repurchase of Preferred Equity) paid, declared but not yet paid or otherwise due and payable to the holders of Preferred Equity.

Preferred Equity. Any form of preferred stock or partnership interest (whether perpetual, convertible or otherwise) or other ownership or beneficial interest in the Trust or any Subsidiary of the Trust (including any Trust Preferred Equity) that entitles the holders thereof to preferential payment or distribution priority with respect to dividends, distributions, assets or other payments over the holders of any other stock, partnership interest or other ownership or beneficial interest in such Person.

Prior Credit Agreement. As defined in the recitals.

Real Estate. All real property at any time owned or leased (as lessee or sublessee) by the Borrower or any of its Subsidiaries.

Record. The grid attached to any Note, or the continuation of such grid, or any other similar record, including computer records, maintained by Agent with respect to any Loan referred to in such Note.

Recourse Indebtedness. Any Indebtedness (whether secured or unsecured) that is recourse to the Borrower or the Trust. Guaranties with respect to customary exceptions to Non-recourse Indebtedness of Borrower’s Subsidiaries or Unconsolidated Affiliates shall not be deemed to be Recourse Indebtedness; provided that if a claim is made against Borrower or the Trust with respect thereto, the amount so claimed shall be considered Recourse Indebtedness.

Redevelopment Property. Any Real Estate which is not Under Development and (1) is undergoing a significant Capital Improvement Project and (2) is designated as a Redevelopment Property by Borrower and approved by Agent, such approval not to be unreasonably withheld.

Register. See §18.2.

REIT Status. With respect to the Trust, its status as a real estate investment trust as defined in §856(a) of the Code.

Related Fund. With respect to any Bank which is a fund that invests in loans, any Affiliate of such Bank or any other fund that invests in loans that is managed by the same investment advisor as such Bank or by an Affiliate of such Bank or such investment advisor.

Release. See §6.18(c)(iii).

18

Remediation Reserve. An amount equal to $250,000.00, as adjusted by Agent pursuant to §7.23.

Rent Roll. A rent roll report prepared by the Borrower in the form customarily used by the Borrower and approved by the Agent, such approval not to be unreasonably withheld.

Required Banks. As of any date, any Bank or collection of Banks whose aggregate Commitment Percentage is equal to or greater than sixty-six and two-thirds percent (66.66%); provided that in determining said percentage at any given time, all then existing Defaulting Banks will be disregarded and excluded and the Commitment Percentages of the Banks shall be redetermined for voting purposes only to exclude the Commitment Percentages of such Defaulting Banks.