Washington Real Estate Investment Trust SHOPPING CENTER LEASE BY AND BETWEEN Washington Real Estate Investment Trust as Landlord and Sykesville Federal Savings Association as Tenant

Exhibit 10.6

Washington Real Estate Investment Trust

BY AND BETWEEN

Washington Real Estate Investment Trust

as Landlord

and

Sykesville Federal Savings Association

as Tenant

TABLE OF CONTENTS

| ARTICLE I. PREMISES |

1 | |||

| ARTICLE II. TERM |

1 | |||

| ARTICLE III. RENT |

2 | |||

| ARTICLE IV. SECURITY DEPOSIT |

5 | |||

| ARTICLE V. USE OF THE PREMISES AND OPERATION OF BUSINESS |

5 | |||

| ARTICLE VI. ENVIRONMENTAL COVENANTS |

6 | |||

| ARTICLE VII. LATE CHARGE |

8 | |||

| ARTICLE VIII. COMMON AREAS |

8 | |||

| ARTICLE IX. ASSIGNMENT & SUBLETTING |

9 | |||

| ARTICLE X. REPAIRS |

10 | |||

| ARTICLE XI. REMOVAL OF DATA AND TELECOMMUNICATIONS WIRES |

11 | |||

| ARTICLE XII. UTILITIES |

12 | |||

| ARTICLE XIII. TENANTS TAXES |

12 | |||

| ARTICLE XIV. COMPLIANCE WITH LAWS |

13 | |||

| ARTICLE XV. NUISANCES |

13 | |||

| ARTICLE XVI. REMODELING AND ALTERATIONS |

13 | |||

| ARTICLE XVII. MECHANICS LIENS |

14 | |||

| ARTICLE XVIII. ROOF AND WALLS |

14 | |||

| ARTICLE XIX. INDEMNITY |

14 | |||

| ARTICLE XX. INSURANCE |

15 | |||

| ARTICLE XXI. TRASH |

16 | |||

| ARTICLE XXII. SIGNS |

16 | |||

| ARTICLE XXIII. PROMOTION FUND |

17 | |||

| ARTICLE XXIV. SUBORDINATION |

17 | |||

| ARTICLE XXV. DESTRUCTION |

18 | |||

| ARTICLE XXVI. CONDEMNATION |

18 | |||

| ARTICLE XXVII. BANKRUPTCY |

19 | |||

| ARTICLE XXVIII. DEFAULT |

19 | |||

| ARTICLE XXIX. WAIVER OF JURY TRIAL |

21 | |||

| ARTICLE XXX. LEGAL FEES |

21 | |||

| ARTICLE XXXI. LANDLORD’S LIEN |

21 | |||

| ARTICLE XXXII. ACCESS TO PREMISES |

21 | |||

| ARTICLE XXXIII. EXCAVATION |

22 | |||

| ARTICLE XXXIV. QUIET ENJOYMENT |

22 | |||

| ARTICLE XXXV. SURRENDER OF PREMISES |

22 | |||

| ARTICLE XXXVI. HOLDING OVER |

22 | |||

| ARTICLE XXXVII. NO WAIVER |

23 | |||

| ARTICLE XXXVIII. BROKER |

23 | |||

| ARTICLE XXXIX. ESTOPPEL CERTIFICATE |

23 | |||

| ARTICLE XL. RULES & REGULATIONS |

23 | |||

1

| ARTICLE XLI. LIMITATION OF LIABILITY OF LANDLORD |

24 | |||

| ARTICLE XLII. NOTICES |

25 | |||

| ARTICLE XLIII. FINANCIAL STATEMENTS |

25 | |||

| ARTICLE XLIV. RADIUS RESTRICTION |

25 | |||

| ARTICLE XLV. MEDICAL WASTE |

25 | |||

| ARTICLE XLVI. RENEWAL OPTION |

25 | |||

| ARTICLE XLVII. MISCELLANEOUS |

26 | |||

ATTACHMENTS:

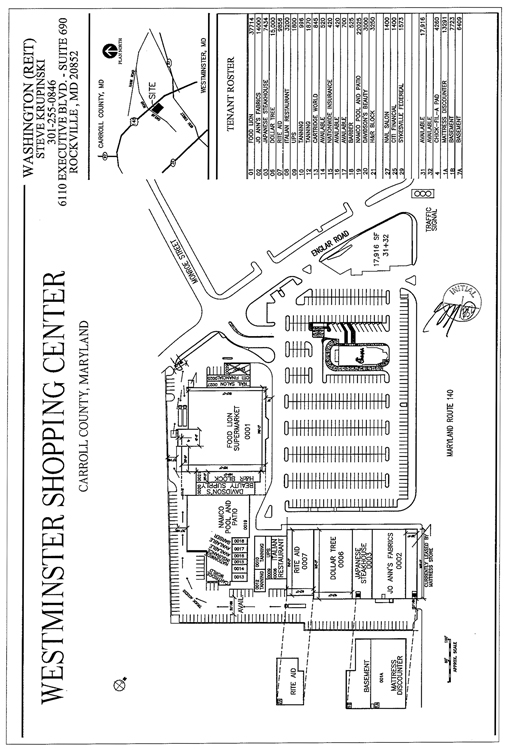

EXHIBIT A. SITE PLAN

EXHIBIT B. LANDLORD’S WORK-AS IS

EXHIBIT C. MEMORANDUM OF LEASE COMMENCEMENT DATE

2

WASHINGTON REAL ESTATE INVESTMENT TRUST

THIS AGREEMENT OF LEASE is made this 6 day of April, 2010 by and between Washington Real Estate Investment Trust, (“Landlord”), and Sykesville Federal Savings Association (“Tenant”).

WITNESSETH:

ARTICLE I. PREMISES

1.1. Landlord, for and in consideration of the rents, covenants and agreements hereinafter reserved, mentioned and contained on the part of Tenant, its successors and assigns, to be paid, kept, observed and performed, by these presents does hereby lease, rent, let and demise unto Tenant, and Tenant does hereby take and hire, upon and subject to the terms, provisions, covenants, conditions and limitations hereof, the premises known as # 29, Route 140 and ▇▇▇▇▇▇ Road, Westminster, Maryland 21157, County of ▇▇▇▇▇▇▇, State of Maryland, and shown outlined in red on the plan attached hereto as Exhibit A and made a part hereof, being a retail store hereby deemed to contain approximately 1,537 square feet of gross leasable area (“Premises”), and being a part of the Westminster Shopping Center (“Shopping Center”). If Tenant fails to notify Landlord, by September 1, 2010, of Tenant’s architect’s certification of the total number of leasable square feet in the Premises, then the leasable square feet shall be as stated above. In the event Tenant’s architect and Landlord’s architect disagree on the total number of leasable square feet in the Premises, Landlord and Tenant shall designate a third architect, acceptable to both Landlord and Tenant, to determine the total number of leasable square feet in the Premises and the determination of the third architect shall be binding on both Landlord and Tenant. The cost of such third architect’s services shall be borne equally by both Landlord and Tenant. Should a variance be determined to exist between Landlord’s square footage calculation for the Premises and the square footage calculation determined by Tenant (or the third architect, as applicable), then the Fixed Minimum Rent and Tenant’s Common Area Costs Percentage and Tenant’s percentage share of real estate taxes shall be adjusted to reflect such revised square footage calculation, and Landlord and Tenant shall execute an amendment to Lease to reflect all such revised calculations.

1.2. Tenant’s use and occupancy of the Premises shall include the non-exclusive right, in common with Landlord and all others to whom Landlord has or may hereafter grant rights, to use and permit its customers to use such Common Areas (as defined in Section 8.1 hereof) within the Shopping Center (including, but not limited to the parking areas, driveways, truckways, delivery passages, truck loading areas, access and egress roads, walkways, sidewalks and landscaped and planted areas), as Landlord shall from time to time deem appropriate, but such rights shall always be subject to the terms and conditions of this Lease, to the rules and regulations for the use thereof from time to time promulgated by Landlord pursuant to ARTICLE XL hereof, and the rights of Landlord to designate and change, modify or eliminate, from time to time, the Common Areas and facilities so to be used pursuant to ARTICLE VIII hereof. The Common Areas shall not be used for solicitation purposes, distribution of handbills or other advertising material, demonstrations, or any other activities that would, in Landlord’s judgment, interfere with the use of such Common Areas or with the conduct of business within the Shopping Center or with the rights of any tenants of the Shopping Center. Landlord may, from time to time, designate portions of the parking areas for use by Tenant, its employees, agents, customers and guests so as to effectively and efficiently allocate the parking spaces among all users of the Shopping Center. Tenant, its employees, agents, customers and guests shall use only those portions of the parking areas so designated by Landlord and in accordance with the terms of Section 40.1(e) hereof.

ARTICLE II. TERM

2.1. The lease term (“Term”) shall commence on the date Landlord delivers possession of the Premises to Tenant (“Lease Commencement Date”). The (“Term”) shall be for approximately five (5) years and zero (0) months from the Rent Commencement Date, as hereinafter defined. The date the Term expires shall be August 31, 2015 (“Lease Expiration Date”). It is presently anticipated the Premises will be delivered to Tenant on or about March 15, 2010 (“Anticipated Possession Date”).

2.2. Regulatory Approval. Notwithstanding anything to the contrary contained in this Lease, this Lease is subject to receipt by Tenant of all required regulatory approvals to establish a full service branch banking office in the Premises; provided, however, that if such approval is not obtained within six (6) months from the Lease Commencement Date, and Tenant shall provide written notice to Landlord of its inability to obtain such approval, the Term of this Lease shall cease and determine and Landlord shall return all advanced rent or security deposits required paid to Landlord by Tenant as required

-1-

by this Lease, unless Tenant shall pay to Landlord an amount equivalent to the Fixed Minimum Rent hereinafter specified for the further period of six (6) months; and provided, further, that if such approvals are not obtained within said additional period of six (6) months, and Tenant shall provide written notice to Landlord of its inability to obtain such approvals, then and in such event this Lease shall absolutely cease and determine and both Landlord and Tenant shall be released and discharged of any and all liability to each other, except that Tenant shall reimburse Landlord for all unamortized transaction costs including, but not limited to, brokers’ commissions and rental abatement. Tenant agrees to use all commercially reasonable efforts to obtain such approval. This provision shall in no way affect the Rent Commencement Date as defined hereinabove. Tenant agrees to file application with the appropriate regulatory agencies on or before April 1, 2010.

2.3. If Landlord is unable to give possession of the Premises on or about the Anticipated Possession Date by reason of the holding over or retention of possession of any tenant or occupant, or if repairs, improvements or decorations to the Premises, or to the building of which the Premises form a part (“Building”) are not completed, or for any other reason, Landlord shall not be subject to any liability for the failure to give possession on the Anticipated Possession Date and no such failure to give possession on the Anticipated Occupancy Date shall in any other respect affect the validity of this Lease or the obligations of Tenant hereunder, nor shall the same be construed in any way to extend the Term of this Lease. If permission is given to Tenant to possess the Premises prior to the Lease Commencement Date, Tenant covenants and agrees mat such occupancy shall be deemed to be under all the terms, covenants, conditions and provisions of this Lease.

2.4. Promptly after the Lease Commencement Date and the Rent Commencement Date are ascertained, Landlord and Tenant shall execute a certificate substantially in the form of Exhibit C attached hereto and incorporated herein for all purposes affirming the Lease Commencement Date, the Rent Commencement Date and the Lease Expiration Date.

ARTICLE III. RENT

3.1. Tenant covenants and agrees to pay to Landlord, or its designee, at Washington Real Estate Investment Trust. ▇.▇. ▇▇▇ ▇▇▇▇▇, ▇▇▇▇▇▇▇▇▇, ▇▇▇▇▇▇▇▇, ▇▇▇▇▇-▇▇▇▇ without notice or demand and without abatement, deduction or setoff, in funds drawn on a member bank of the Federal Reserve System, Fifth District. In the event any check is returned by Tenant’s bank, or in the event Tenant fails to make any payment of rent on such payment’s due date, Landlord shall have the right, at Landlord’s option, to require any or all subsequent payments be made by certified funds or cashier’s check.

3.2. Fixed Minimum Rent: Tenant shall pay in advance, on the first day of each calendar month, annual fixed minimum rent of Forty-Two Thousand Two Hundred Sixty-Seven and 50/100 Dollars ($42,267.50) (“Fixed Minimum Rent”) for the first Lease Year in equal monthly installments in the amount of Three Thousand Five Hundred Twenty-Two and 29/100 Dollars ($3,522.29). Such Fixed Minimum Rent (and the monthly installments thereof) shall be adjusted annually pursuant to Section 3.3 hereof. The first payment shall be made upon the execution of this Lease by Tenant, and the second and subsequent monthly payments shall be made on the first day of each and every calendar month (beginning with the second month) from and after the Rent Commencement Date. The date (“Rent Commencement Date”) upon which Tenant shall commence the payment of Fixed Minimum Rent shall be the earlier of: (1) September 1, 2010 or (2) upon substantial completion of the Premises. If the Rent Commencement Date begins on a day other than the first day of a month, the Fixed Minimum Rent from such date until the first day of the next month shall be prorated on the basis of the actual number of days in such month and shall be payable in advance.

3.3. Rent Escalation: On the first day of the second Lease Year and on the first day of every Lease Year thereafter during the Term, the Fixed Minimum Rent shall be increased by two and 00/100 percent (2 %) of the preceding Lease Year’s Fixed Minimum Rent.

3.4. The term “Lease Year” shall mean each period of twelve (12) consecutive calendar months commencing on the Lease Commencement Date, except that if the Lease Commencement Date is not the first day of a month, then the first Lease Year shall commence on the Lease Commencement Date and shall continue for the balance of the month in which the Lease Commencement Date occurs, and for a period of twelve (12) calendar months thereafter and subsequent Lease Years shall commence on the day following the last day of the preceding Lease Year. The term “Partial Lease Year” shall mean any period of less than twelve (12) calendar months during the last Lease Year of the Lease if the Lease Expiration Date occurs prior to the end of a full Lease Year.

3.5. Common Area Costs:

(a) During each calendar year or portion thereof included in the Term and any renewal thereof, commencing on the Rent Commencement Date, Tenant shall pay to Landlord, as additional rent, Tenant’s Proportionate Share of Common Area Costs. Tenant’s Proportionate Share of Common Area Costs (“Tenant’s Proportionate Share”) shall equal Tenant’s Common Area Costs Percentage times the annual Common Area Costs of the Shopping Center. Tenant’s Common Area Costs Percentage is one and

-2-

07/100 percent (1.07%) which percentage represents the ratio of the approximate gross leasable area of the Premises to the total approximate gross leasable area of the Shopping Center. In the event that the gross leasable area of the Shopping Center or the Premises is increased or decreased, the Tenant’s Common Area Costs Percentage shall be recalculated and adjusted. Tenant’s percentage share of Common Area Costs shall be the percentage set forth above, except as follows: If any space in the Shopping Center is leased to a tenant who is separately responsible for paying the cost of a service that would otherwise be included in Common Area Costs, the leasable area of such tenant’s space shall be excluded from the leasable area of the Shopping Center for the purpose of determining Tenant’s percentage share of the balance of the cost of such services. Additionally, if any space in the Shopping Center is leased to a tenant who creates an exemption from any category of Common Area Costs so as to reduce the Shopping Center’s total cost of the same proportion to that tenant’s leasable area, then the leasable area of such tenant’s space shall be excluded from the leasable area of the Shopping Center for the purpose of determining Tenant’s percentage share of such category of Common Area Costs.

(b) As used in Section 3.5(a) above, the term “Common Area Costs” shall mean all the costs and expenses of every kind and nature paid or incurred by Landlord in each calendar year in operating, managing, cleaning, protecting, equipping, lighting, repairing, replacing and maintaining all Common Areas in the Shopping Center. Such costs and expenses shall include, without limitation (including appropriate reserves), (1) the cost of maintaining, repairing or replacing all service pipes, electric, gas, and water lines and sewer mains leading to and from the Premises and other premises in the Shopping Center; (2) gas, electricity, water, sanitary sewer, storm sewer and other utility charges (including surcharges of every type and nature for services provided to the Common Areas incurred in operating the Shopping Center); (3) all costs incurred in painting (including painting of exterior walls), gardening, landscaping, and for traffic control; (4) the cost of public liability insurance, property damage insurance, and all other insurance coverage carried by Landlord for all land and improvements comprising the Shopping Center (including worker’s compensation and fidelity bonds); (5) all costs for repairs, maintenance and improvements including but not limited to, roof repairs, maintenance and replacement; sidewalk and street repair, maintenance and replacement; sign repair and maintenance; line painting and striping; lighting; decorations; sanitary and drainage control; public address system; security systems; cleaning; removal of snow, trash and rubbish; and depreciation on machinery and equipment used in such improvements, maintenance or repair; (6) costs of personnel, if any, to direct parking and to provide security for the Common Areas and facilities, management fees and personnel costs, including, but not limited to salaries, wages, fringe benefits and other direct or indirect costs of engineers, superintendents, watchmen, security, porters and other Shopping Center personnel, costs of service and maintenance contracts; (7) depreciation (on a straight line basis) of all capital expenditures made by Landlord to the extent such capital expenditures are made with the intention to reduce Common Area Costs or comply with any governmental law, order, requirement or regulation; and (8) Landlord’s administrative costs and overhead costs in an amount, in the aggregate, equal to five percent (5 %) of the total of all other Common Area Costs. For purposes of this Section 3.5, the term “Shopping Center” shall include the Land (as defined in Section 3.6).

(c) Upon the Lease Commencement Date and thereafter at the beginning of each calendar year, Landlord shall submit to Tenant a statement of Landlord’s estimate on an annual basis of the Common Area Costs. Within thirty (30) days after delivery of such statement, Tenant shall pay to Landlord, as additional rent, an amount equal to one-twelfth (l/12th) of the amount determined to be Tenant’s Proportionate Share. In case such estimate is submitted during the calendar year, Tenant shall (i) include with the next monthly installment of Fixed Minimum Rent a lump sum payment to Landlord equal to one-twelfth (l/12th) of Tenant’s Proportionate Share multiplied by the number of months in such calendar year that will have elapsed prior to the first month the payment required by clause (ii) hereof is due and (ii) begin paying to Landlord monthly, as additional rent, due and payable on the first day of each month, an amount equal to one-twelfth (1/12th) of Tenant’s Proportionate Share. As soon as practicable after the expiration of each calendar year, Landlord shall submit to Tenant a statement showing the determination of the total Common Area Costs and Tenant’s Proportionate Share. However, Landlord’s failure to provide any statement within the time specified shall in no way excuse Tenant from its obligation to pay its proportionate share or constitute a waiver of Landlord’s right to ▇▇▇▇ and collect such proportionate share. If such statement shows that Tenant’s monthly payments pursuant to this Section exceeded Tenant’s Proportionate Share of the actual expenses incurred for the preceding calendar year, then the excess shall be credited towards any amounts then due Landlord or accruing thereafter and if no amounts are due Landlord or will accrue thereafter, then such excess shall be refunded to Tenant. If such statement shows that Tenant’s Proportionate Share of Landlord’s actual Common Area Costs exceeded Tenant’s monthly payments for the preceding calendar year, the deficiency shall be paid by Tenant within fifteen (15) days after the submission of such statement.

(d) If the Lease Commencement Date or the Lease Expiration Date is a day other than the first day or last day of a calendar year, respectively, then Tenant’s liability for its Proportionate Share of Common Area Costs incurred during such calendar year shall be apportioned by multiplying the amount of Tenant’s liability therefor for the full calendar year by a fraction, the numerator of which is the number of days during such calendar year falling within the Term, and the denominator of which is 365. Tenant’s liability for payment of its Proportionate Share of Common Area Costs as aforesaid shall survive expiration or termination of this Lease.

-3-

3.6. Real Estate Taxes

(a) Commencing on the Rent Commencement Date, Tenant shall reimburse Landlord, as additional rent, and in the manner hereinafter provided, that portion of all real estate taxes equal to the product obtained by multiplying such real estate taxes by the Tenant’s Common Area Costs Percentage. Tenant’s percentage share of real estate taxes shall be deemed to be one and 07/100 percent (1.07%), being the ratio of the approximate gross leasable area of the Premises to the approximate gross leasable area of the Shopping Center, except as follows: In the event the leasable area of the Shopping Center is increased or decreased, the Tenant’s percentage share of real estate taxes should be recalculated and adjusted. If any space in the Shopping Center is leased to a tenant who creates an exemption from real estate taxes so as to reduce the Shopping Center’s total cost of the same in proportion to that tenant’s leasable area, then the leasable area of such tenant’s space shall be excluded from the leasable area of the Shopping Center for the purpose of determining Tenant’s percentage share of real property taxes. Tenant shall pay to Landlord monthly, in advance, on the first day of each calendar month, one-twelfth (1/12th) of the estimated charge for its proportionate share of real estate taxes. Such monthly estimated charge may be adjusted and revised by Landlord as of the end of each calendar year or partial calendar year included in the Term. The term “real estate taxes” shall mean (i) all real estate taxes, including general and special assessments, if any, which are imposed upon Landlord or assessed against the Shopping Center and/or the land on which the Shopping Center is located (“Land”) during any calendar year, and (ii) any other present or future taxes or governmental charges that are imposed upon Landlord or assessed against the Shopping Center and/or the Land during any calendar year which are in the nature of, in addition to or in substitution for real estate taxes, including, without limitation, any license fees, tax measured by or imposed upon rents, or other tax or charge upon Landlord’s business of leasing the Shopping Center, but shall not include any federal, state or local income tax. Any reasonable expense incurred by Landlord (including attorneys’ fees) in contesting any real estate tax increase shall be included as an item of real estate taxes for the purpose of computing additional rent due Landlord. Landlord, however, shall have no obligation to contest any real estate tax increase. If Landlord takes advantage of any provisions allowing any assessment to be paid in installments, Tenant shall be obligated to pay only its proportionate share of each such installment.

(b) Following the end of each calendar year or partial calendar year included in the Term, Landlord shall submit to Tenant a statement in reasonable detail of the actual real estate taxes for the immediately preceding fiscal tax year or partial calendar year on an accrual basis and the figures used for computing Tenant’s proportionate share of real estate taxes. However, Landlord’s failure to provide any statement within the time specified shall in no way excuse Tenant from its obligation to pay its proportionate share or constitute a waiver of Landlord’s right to ▇▇▇▇ and collect such proportionate share. If Tenant’s proportionate share of real estate taxes is less than the amount paid by Tenant for such period, the excess deficiency shall be credited towards any amounts then due Landlord or accruing thereafter and if no amounts are due Landlord or will accrue thereafter, then such balance owed shall be refunded to Tenant. If Tenant’s proportionate share of real estate taxes is more than the amount paid by Tenant for such period, then Tenant shall pay the balance due within fifteen (15) days after the submission of such statement. Any real estate taxes for a real estate calendar year, a part of which is included within the period in question for the above computation and a part of which is not so included, shall be apportioned on the basis of the number of days in the real estate calendar year included in the period in question for the purpose of making the above computation, and the real estate calendar year for any improvement assessment will be deemed to be the one-year period commencing on the date when such assessment is due, except that if any improvement assessment is payable in installments, the real estate calendar year for each installment will be deemed to be the one-year period commencing on the date when such installment is due.

(c) If the Term commences or expires on a day other than the first day or last day of a calendar year, respectively, then Tenant’s liability for its proportionate share of real estate taxes incurred during such calendar year shall be apportioned by multiplying the amount of Tenant’s liability therefor for the full calendar year by a fraction, the numerator of which is the number of days during such calendar year falling within the Term, and the denominator of which is 365. Tenant’s liability for payment of its proportionate share of real estate taxes shall survive expiration or termination of this Lease.

(d) If some method or type of taxation shall replace the current method of assessment of real estate taxes, or the type thereof. Tenant agrees that Tenant shall pay an equitable share of the same computed in the fashion consistent with the method of computation provided in this ARTICLE III to the end that Tenant’s cost on account thereof shall be, to the maximum extent possible, the same as Tenant would bear under the foregoing Sections of this ARTICLE III.

3.7. All costs and expenses other than Fixed Minimum Rent which Tenant assumes or agrees to pay to Landlord pursuant to this Lease shall be deemed to be “additional rent” and, in the event of nonpayment thereof. Landlord shall have all the rights and remedies provided for in the case of nonpayment of rent, including assessment of interest and late fees. Fixed Minimum Rent and additional rent are sometimes referred to collectively herein as “rent”.

-4-

| ARTICLE IV. SECURITY DEPOSIT | ||||

| 4.1. Tenant agrees to pay Landlord at the signing of this Lease Three Thousand Five Hundred Twenty-Two and 29/100 Dollars ($3,522.29) (“Security Deposit”) as security for compliance with the terms of this Lease. Upon the occurrence of any Event of Default by Tenant, Landlord may, from time to time in its sole discretion, without prejudice to any other remedy, use and apply the Security Deposit to the extent necessary to make good, any arrearages of rent and any other damage, injury, expense or liability suffered by Landlord by such Event of Default Following any such application of the Security Deposit, Tenant shall pay to Landlord on demand as additional rent the amount so applied in order to restore the Security Deposit to its original amount. Within approximately forty-five (45) days after the Lease Expiration Date and after the Premises have been properly vacated and inspected and the keys returned to Landlord, then Landlord shall return said Security Deposit to Tenant, without interest, less such portion of the Security Deposit as Landlord shall have used to satisfy Tenant’s obligations under this Lease. If Landlord transfers the Security Deposit to any transferee of the Shopping Center or Landlord’s interest therein, then said transferee shall be liable to Tenant for the return of the Security Deposit, and Landlord shall be released from all liability for the return of the Security Deposit. The holder of any mortgage shall not be liable for the return of the Security Deposit unless such holder actually receives the Security Deposit If an Event of Default under this Lease shall occur more than two (2) times within any twelve month period, irrespective of whether or not such Event of Default is cured, then, without limiting Landlord’s other rights and remedies provided for in this Lease or at law or equity, the Security Deposit shall automatically be increased by an amount equal to the greater of: (a) three (3) times the original Security Deposit, or (b) three (3) months’ Fixed Minimum Rent, at the then current amount, which shall be paid by Tenant to Landlord within ten (10) days of Landlord’s demand therefor. |

||||

| ARTICLE V. USE OF THE PREMISES AND OPERATION OF BUSINESS |

| |||

|

5.1. Permitted Use: Tenant will use and occupy the Premises solely for the following express use(s) and purpose(s) and for no other use or purpose: the operation of a retail branch banking office consistent with the majority of Tenant’s other offices in the Baltimore Metropolitan Region (“Permitted Use”). Tenant shall not change or modify such Permitted Use in any manner whatsoever and shall not make any substantial change or modification in the method by, or in the manner in which Tenant conducts his business in the Premises without the prior written approval of Landlord which shall not be unreasonably withheld, conditioned or delayed. Tenant acknowledges and agrees that the Permitted Use of the Premises has been precisely defined to achieve a balanced and diversified group of tenants, merchandise and services at the Shopping Center. Accordingly, it is understood and agreed that without Landlord’s prior written consent, which shall not be unreasonably withheld, conditioned or delayed. Tenant shall not sell any products, offer any services or undertake any line of business that in each case is not in conformity with the Permitted Use of the Premises. Tenant shall pay to Landlord, as additional rent any additional costs incurred by Landlord as a result of Tenant’s Permitted Use or any other use or purpose of the Premises. Landlord acknowledges that operation of a retail bank branch by Tenant will not directly or materially compete with the use of any other tenant in the Shopping Center. Tenant will not use or occupy the Premises for any unlawful purpose or that would violate Tenant’s certificate of occupancy, or for any purpose that would constitute a nuisance or unreasonable annoyance to Landlord or any other tenants of the Shopping Center, and Tenant will comply with all present and future laws, ordinances, regulations, and orders of the United States of America, the state the Shopping Center is located, and any other public or quasi-public authority having jurisdiction over the Shopping Center. If required, and Landlord performs Alterations pursuant to Exhibit B of the Lease, Landlord shall obtain, at Tenant’s sole expense, any initial certificate of occupancy and/or any other permits, approvals, and licenses required at the time of the commencement of the Term. Otherwise, Tenant shall obtain, at Tenant’s sole expense, any initial certificate of occupancy and/or any other permits, approvals, and licenses required at the time of the commencement of the Term. Any amended or substitute certificate of occupancy necessitated by Tenant’s particular use of the Premises or any alterations made by Tenant in the Premises shall be obtained by Tenant at Tenant’s sole expense. Tenant shall keep current such certificates, permits, approvals, and licenses at Tenant’s own expense and shall promptly deliver a copy thereof to Landlord. |

|||

| 5.2. Provided this Lease is in full force and effect, there exists no Event of Default hereunder and Tenant is using and occupying the Premises for the Permitted Use under Tenant’s Trade Name, Landlord shall not permit any portion of the Shopping Center, other than the Premises, to be used by a bank or credit union (other than (i) pursuant to Landlord’s lease dated May 15, 2007 with Susquehanna Bank or any subsequent lease for such parcel or (ii) automatic teller machines located at a grocery store in the Shopping Center) Should Landlord permit any portion of the Shopping Center, other than the Premises, to be used by a bank or credit union in breach of the foregoing sentence. Tenant as its sole and exclusive remedy shall have the one-time right to terminate this Lease provided that Tenant first shall have sent Landlord written notice of the violation and Landlord shall have failed to cure such violation within sixty (60) days (“Cure Deadline”). If Landlord fails to cure such violation within the Cure Deadline, Tenant must elect to either (i) terminate this Lease, which shall be effective sixty (60) days from the date of Landlord’s receipt of the Election Notice (as defined below) or (ii) waive any claim of default against Landlord on account of this violation. Such election by Tenant must be made in writing (“Election Notice”) so long as the violation exists, and shall be delivered to Landlord within thirty (30) days after the Cure Deadline. If Tenant fails to timely make such election. Tenant shall be deemed to have elected to waive any claim of default against Landlord on account of this violation. Anything to the contrary notwithstanding, Tenant shall have no remedy for a violation of if (a) another |

| |||

-5-

tenant or occupant in the Shopping Center violates a provision of its lease or license agreement regarding its premises, which either does not permit or specifically prohibits a use that violates this provision; (b) Landlord provides notice of the lease or license agreement violation to such other tenant or occupant; and (c) Landlord commences an action (or arbitration, if required by such lease or license agreement) against such other tenant or occupant, and thereafter uses commercially reasonable efforts to enforce its rights under such lease or license agreement. Nothing contained herein shall require Landlord to appeal any adverse decision denying relief to Landlord.

5.3. Trade Name: Tenant will conduct business in the Premises in the trade name of Sykesville Federal Savings Association and has the right to change its trade or corporate name with notice to Landlord. Tenant has the right to convert to a state bank and/or convert to a capital stock organization with prior written notice to Landlord and such action shall not constitute an event of default hereunder.

5.4. Operation of Business: Tenant agrees (1) except as herein otherwise provided, to continuously and uninterruptedly occupy and use the entire Premises during the entire Term and any Renewal Term(s) for the uses herein specified (without consideration of the profitability of the business) and to conduct Tenant’s business therein in a reputable manner; (2) to remain open for business during all business days permissible for a bank to be open under applicable laws and regulations and during normal business hours, which will be determined by Tenant and may be modified from time to time by Tenant, however, Tenant hereby acknowledges, consents and agrees that any and/or all services, facilities and access by the public to the Premises and/or to the Shopping Center may be suspended in whole or in part during such times as such businesses are not customarily open for business, on legal holidays, on such other days as may be declared by local, state or federal authorities as days of observance, or during any periods of actual or threatened civil commotion, insurrection or other circumstances beyond Landlord’s control, when Landlord, in Landlord’s reasonable judgment, shall deem the suspension of such services, facilities and access necessary for the protection and/or preservation of persons and/or property; (3) to keep the display windows and signs, if any, well lighted during such hours and days as the Shopping Center is lighted by Landlord, including periods in addition to the business hours of Tenant, if in Landlord’s judgment such lighting is necessary or desirable; (4) to keep and maintain the Premises and Tenant’s personal property and signs therein or thereon and the exterior and interior portions of all windows, doors and all other glass or plate glass in a neat, clean, sanitary and safe condition and good repair, promptly replacing any glass that is broken or cracked; (5) to warehouse, store or stock in the Premises only such goods, wares and merchandise as Tenant intends to offer for sale at retail; (6) to apply for, secure, maintain and comply with all licenses or permits which may be required for the conduct by Tenant of the business herein permitted to be conducted in the Premises and to pay, if, as and when due, all license and permit fees and charges of a similar nature in connection therewith; (7) to use for office or other non-selling purposes only such space as is reasonably required for the conduct of Tenant’s business in the Premises and such office or other non-selling space shall not be used to perform any functions for any other store or business conducted by Tenant or by any other person or firm; (8) neither to solicit business nor to distribute advertising matter in the parking or other Common Areas or facilities of the Shopping Center except as permitted in writing by Landlord; (9) not to conduct any auction, distress, fire or bankruptcy sale or any going-out-of-business sale (whether real or fictitious); (10) not to represent or advertise that it regularly or customarily sells merchandise at manufacturer’s, distributor’s, wholesale, warehouse, discount, fire sale, bankruptcy sale or similar prices other than at retail, but nothing contained herein shall restrict Tenant from determining the selling price of its own merchandise or preclude the conducting of periodic seasonal, promotional or clearance sales; (11) not to conduct any catalogue, telephone or mail-order sales in or from the Premises except of merchandise permitted pursuant to Article V of this Lease; and (12) not to park or permit to be parked any of Tenant’s trucks, employee vehicles or any of Tenant’s delivery vehicles in the parking areas and not to load or unload, or permit to be loaded or unloaded, any trucks or delivery vehicles in any portion of the Shopping Center other than in places designated for such purposes by Landlord.

ARTICLE VI. ENVIRONMENTAL COVENANTS

6.1. The following environmental covenants shall apply:

(a) Tenant, its employees, agents, contractors and invitees shall, at Tenant’s own expense, comply with all Environmental Laws, as herein defined, in connection with its use and occupancy of the Premises or the Shopping Center and shall obtain, maintain and comply with all necessary environmental permits, approvals, registrations and licenses.

(b) Tenant, its employees, agents, contractors and invitees shall not use, generate, release, manufacture, treat, refine, produce, process, store, dump or dispose of any Hazardous Substance, as herein defined, on, under, or about the Premises, or any other portion of the Shopping Center, or transport to or from the Premises or any other portion of the Shopping Center any Hazardous Substances. Notwithstanding anything to the contrary contained in this ARTICLE VI, Tenant may use and store within the Premises such reasonable quantities of normal office products as are used by Tenant in the ordinary course of its business operations and which are customarily found in first-class offices; provided such reasonable quantities and use do not constitute a danger to the health of individuals or a danger to the environment and which are used, stored and disposed of in accordance with all applicable Environmental Laws.

-6-

(c) Tenant shall, at Tenant’s own expense, make all submissions to, provide all information required by and comply with all requirements of all governmental authorities (the “Authorities or Authority”) under the Environmental Laws. Tenant shall provide Landlord with copies of any environmental audit prepared by or for Tenant with respect to the Premises and any report(s) or filing(s) made by Tenant with any Authority.

(d) Should Landlord, any Authority or any third party demand that a clean-up plan be prepared or that a clean-up be undertaken because of any deposit, spill, discharge, or other release of Hazardous Substances that occurs as a result of Tenant’s use or occupancy of the Premises or the Shopping Center, then Tenant shall, at Tenant’s own expense, prepare and submit to Landlord and any applicable Authority the required plans and all related bonds and other financial assurances, and Tenant shall carry out all such clean-up plans following their approval by Landlord and all applicable Authorities.

(e) Tenant shall promptly provide all information regarding the use, generation, storage, transportation, or disposal of Hazardous Substances that is requested by Landlord. If Tenant fails to fulfill any duty imposed under this ARTICLE VI within ten (10) days, Landlord may fulfill such duty on behalf of Tenant, at Tenant’s cost and expense; and in such case, Tenant shall cooperate with Landlord in order to prepare all documents Landlord deems necessary or appropriate to determine the applicability of the Environmental Laws to the Premises and Tenant’s use thereof, and for compliance therewith, and Tenant shall execute all documents promptly upon Landlord’s request. No such action by Landlord and no attempt made by Landlord to mitigate damages under any Environmental Law shall constitute a waiver of any of Tenant’s obligations under this ARTICLE VI.

(f) Tenant shall immediately notify Landlord in writing of any release or discharge of any Hazardous Substance, whether or not the release is in quantities that would require under law the reporting of such release to a governmental or regulatory agency.

(g) Tenant shall also immediately notify Landlord in writing of, and shall contemporaneously provide Landlord with a copy of:

(i) Any written notice of release of Hazardous Substances in the Premises that is provided by Tenant or any subtenant or other occupant of the Premises to a governmental or regulatory agency;

(ii) Any notice of a violation, or a potential or alleged violation, of any Environmental Law that is received by Tenant or any subtenant or other occupant of the Premises from any governmental or regulatory agency;

(iii) Any inquiry, investigation, enforcement, cleanup, removal, or other action that is instituted or threatened by a governmental or regulatory agency against Tenant or any subtenant or other occupant of the Premises and that relates to the release or discharge of Hazardous Substances on or from the Premises;

(iv) Any claim that is instituted or threatened by any third party against Tenant or any subtenant or other occupant of the Premises and that relates to any release or discharge of Hazardous Substance on or from the Premises; and

(v) Any notice of the loss of any environmental operating permit by Tenant or any subtenant or other occupant of the Premises.

(h) Landlord shall have the right, but not the obligation, with forty-eight (48) hours prior written notice, except in an emergency when no notice shall be required, at all reasonable times during the Term to (1) inspect the Premises, (2) enter upon the Premises to conduct tests and investigations and take samples to determine whether Tenant is in compliance with the provisions of this ARTICLE VI, or as otherwise necessary and (3) request lists of all Hazardous Substances used, stored or located on the Premises. The cost of all such inspections, tests and investigations shall be borne by Tenant.

(i) Tenant’s obligations and liabilities under this ARTICLE VI shall survive the expiration or early termination of the Lease. For purposes of this ARTICLE VI, the term “Shopping Center” shall include the Land.

6.2. Tenant shall indemnify, defend, protect and hold harmless Landlord, the manager of the Shopping Center, and their respective officers, directors, trustees, beneficiaries, shareholders, partners, agents and employees from all fines, suits, procedures, claims, and actions of every kind, and all costs associated therewith (including, without limitation, attorneys’ and consultants’ fees and the costs of investigation and settlement of any claims) arising out of or in any way connected with (1) any deposit, spill, discharge, or other release of Hazardous Substances which arises at any time from Tenant’s, its employees’, agents’, contractors’, or invitees’ use or occupancy of the Premises or any other portion of the Shopping Center, or (2) from its failure to provide all information, make all submissions and take all steps required by all Authorities under the Environmental Laws and (3) Tenant’s, its employees’, agents’, contractors’ or invitees’ breach of this ARTICLE VI, whether or not Tenant has acted negligently with respect to such Hazardous Substances.

6.3. As used in this ARTICLE VI, the term “Hazardous Substances” means:

(a) any substance designated pursuant to Section 311 (b)(2)(A) of the Federal Water Pollution Control Act;

-7-

(b) any element, compound, mixture solution or substance designated pursuant to Section 102 of the Comprehensive Environmental Response, Compensation and Liability Act;

(c) any hazardous waste having the characteristics identified under or listed pursuant to Section 3001 of the Solid Waste Disposal Act;

(d) any toxic pollutant listed under Section 307(a) of the Federal Water Pollution Control Act;

(e) any hazardous air pollutant listed under Section 112 of the Clean Air Act;

(f) any imminently hazardous chemical substance or mixture with respect of which the Administrator of the United States Environmental Protection Agency has taken action pursuant to Section 7 of the Toxic Substances Control Act; and

(g) any substance, waste or other material considered hazardous, dangerous or toxic under any state, local or federal law, code, ordinance or regulation.

(h) petroleum and petroleum products, including crude oil or any fraction thereof, which is not specifically listed or designated as a Hazardous Substance under Section 6.3(a) through (g) of this ARTICLE VI, as well as natural gas, natural gas liquids, liquefied natural gas and synthetic gas usable for fuel and mixtures of natural gas and such synthetic gas.

6.4. As used in this ARTICLE VI, the term “Environmental Laws” shall mean and refer to the entirety of the federal acts, portions of which are referenced in Section 6.3, and all other federal and all state and local laws, codes, ordinances, rules regulations, and directives governing the discharge, emission or disposal of any pollutant in, to or from the Premises or any other portion of the Shopping Center or other premises or the environment and prescribing methods for storing, handling or otherwise managing Hazardous Substances and wastes including, but not limited to, the then current versions of the following federal statutes, their state analogs, and the regulations implementing them: The Resource Conservation and Recovery Act (42 U.S.C. 6901 et seq.), the Comprehensive Environmental Response, Compensation and Liability Act (42 U.S.C. 9601 et seq.), the Clean Water Act (33 U.S.C. 1251 et seq.), the Clean Air Act (42 ▇.▇.▇, ▇▇▇▇ et seq.), and the Toxic Substances Control Act (15 U.S.C. 2601 et seq.).

ARTICLE VII. LATE CHARGE

7.1. Tenant agrees to pay to Landlord, as additional rent, a late fee equal to five percent (5%) of any amount due for monthly Fixed Minimum Rent or other payments due hereunder if said payments have not been received by Landlord within five (5) days of the due date. In addition, if Landlord does not receive such payment within thirty (30) days of such payment’s due date, then such payment and late charge shall bear interest at the rate per annum equal to the greater of (i) eighteen percent (18%) per annum; provided, however, such rate is not usurious or (ii) the highest non-usurious rate permitted under the laws of the jurisdiction where the Shopping Center is located from the date such payment was due to the date of payment thereof. Such late charge and interest shall constitute additional rent due hereunder, shall be paid with the next monthly installment of Fixed Minimum Rent coming due hereunder, and shall be in addition to, and not in lieu of, all other rights and remedies provided to Landlord in this Lease, at law, or in equity.

ARTICLE VIII. COMMON AREAS

8.1. Subject to Landlord’s rights in this Section VIII during the Term, Landlord shall make available from time to time in the Shopping Center such Common Areas as Landlord shall deem appropriate. “Common Areas” shall mean all areas and improvements now or hereafter existing, made available by Landlord for the common and joint use of Landlord, Tenant and other tenants and occupants of the Shopping Center, and their respective employees, agents, customers and invitees, which may include if provided, but shall not be limited to driveways, footways, parking areas, walkways and all other areas in the Shopping Center now or hereafter constructed to be used in common by the tenants and/or customers of the Shopping Center. All Common Areas shall at all times be subject to such rules and regulations as Landlord may from time to time prescribe and Landlord shall at all times have full and exclusive control, management and direction of said Common Areas. Landlord further shall have the right (but shall not be obligated) (a) to police the Common Areas; (b) to restrict parking by tenants, their officers, agents and employees; (c) to designate employee parking areas; (d) to establish and enforce parking charges, with appropriate provisions for free-parking ticket validation by tenants; (e) to close temporarily all or any portion of the Common Areas or any parts thereof, including the parking areas or facilities for the purpose of maintenance, repairs, and/or construction; (f) to discourage non-customer parking; and (g) to do and perform such other acts in and to such areas as Landlord, in the use of its business judgment, shall determine to be advisable. Landlord further shall have the right, without materially, adversely affecting access to or the use or accessibility of the Premises or without materially, adversely affecting the character of the Shopping Center as such exists on the Lease Commencement Date, in its sole discretion, at all times, and from time to time throughout the Term, without incurring any liability to Tenant, including but not limited to loss of sales, and without it constituting an eviction to: (i) change the area, appearance, size, level, layout, location, and/or arrangement of the Shopping Center or any part thereof (including, without limitation, the Common Areas and the entrances to and exits from the Common Areas); (ii) construct other

-8-

buildings, structures or improvements in the Common Areas and elsewhere in the Shopping Center (including, without limitation, construction of kiosks in the Common Areas), and make alterations and additions thereto, or rearrangements thereof, demolish parts thereof, build additional stories on any building in the Shopping Center (and for such purposes to construct and erect columns and support facilities in any building), and construct additional buildings or facilities adjoining or proximate to the Shopping Center; (iii) expand, reduce, or alter the parking areas in any manner whatsoever including, without limitation, the construction of multiple-deck, elevated, or underground parking facilities; (iv) relocate or rearrange the various buildings, parking areas, and other parts of the Shopping Center; (v) make changes and additions to the pipes, conduits, and ducts or other structural and nonstructural installations in the Premises where desirable to serve the Common Areas and other premises in the Shopping Center or to facilitate the expansion or alteration of the Shopping Center (including, without limitation, the construction and erection of columns and support facilities); and (vi) add additional real property to the Shopping Center.

ARTICLE IX. ASSIGNMENT & SUBLETTING

9.1. Tenant shall not assign this Lease or any of Tenant’s rights or obligations hereunder, or sublet or permit anyone to occupy the Premises or any part thereof, without the prior written consent of Landlord which may be withheld in Landlord’s absolute sole discretion. No assignment or transfer of this Lease may be effected by operation of law or otherwise without Landlord’s prior written consent. The consent of Landlord to any assignment or subletting shall not be construed as a waiver or release of Tenant from liability for the performance of all covenants and obligations to be performed by Tenant under this Lease. The transfer, whether a single transfer or multiple transfers, of fifty percent (50%) or more of the ownership interests of Tenant within a twelve (12) month period shall be deemed equivalent to an assignment or subletting requiring consent of Landlord. Any attempted assignment or subletting made without Landlord’s consent shall, at the option of Landlord, be deemed an Event of Default under this Lease. Landlord’s acceptance or collection of rent from any assignee, subtenant or occupant shall not be construed (a) as a consent to or acceptance of such assignee, subtenant or occupant as a tenant, (b) as a waiver by Landlord of any provision hereof, (c) as a waiver or release of Tenant from liability for the performance of any obligation to be performed under this Lease by Tenant, or (d) as relieving Tenant or any assignee, subtenant or occupant from the obligation of obtaining Landlord’s prior written consent to any subsequent assignment, subletting or occupancy. Tenant hereby assigns to Landlord any rent due from any assignee, subtenant or occupant of Tenant as security for Tenant’s performance of its obligations pursuant to this Lease; provided, however, that Tenant shall have the right to collect such rent as long as Tenant is not in Event of Default under the terms of this Lease. Tenant authorizes each such assignee, subtenant or occupant to pay such rent directly to Landlord if such assignee, subtenant or occupant receives written notice from Landlord specifying that such rent shall be paid directly to Landlord. In the event of Event of Default by any assignee of Tenant or any successor of Tenant in the performance of any of the terms hereof, Landlord may proceed directly against Tenant without the necessity of exhausting remedies against such assignee or successor. Landlord may consent to subsequent assignments or subletting of this Lease or amendments or modifications to this Lease with assignees of Tenant, without notifying Tenant, or any successor of Tenant, and without obtaining its or their consent thereto and such action shall not relieve Tenant of liability under this Lease. Tenant shall not mortgage this Lease without Landlord’s consent, which consent may be granted or withheld in Landlord’s reasonable discretion. All restrictions and obligations imposed pursuant to this Lease on Tenant shall be deemed to extend to any subtenant, assignee or occupant of Tenant, and Tenant shall cause such persons to comply with all such restrictions and obligations. Tenant shall pay to Landlord a Seven Hundred Fifty and 00/100 Dollar ($750.00) processing fee as well as expenses (including reasonable attorneys’ fees) incurred by Landlord in connection with Tenant’s request for Landlord to give its consent to any assignment, subletting, occupancy or mortgage, whether or not Landlord consents thereto.

9.2. Notwithstanding anything herein to the contrary, Tenant shall have the right, without Landlord’s consent, but upon prior written notice to Landlord to assign this Lease to (i) any parent, subsidiary or affiliate of Tenant, (ii) an entity which is the result of a consolidation, merger or other reorganization of Tenant, (iii) an entity acquiring all or substantially all of the stock or assets of Tenant; (iv) a capital stock institution which is the result of the conversion from a mutual institution to a capital stock institution and the sale or transfer of stock associated therewith, provided that as a result of such conversion the former holders of the mutual institution become the beneficial owners of the capital stock institution in the same pro-rata ownership (collectively, “Permitted Transferee”), provided such Permitted Transferee has a net worth and creditworthiness which are at least equal to or greater than those of Tenant on the date of execution of this Lease and provided that such Permitted Transferee assumes, in full, the obligations of Tenant under this Lease, and such assignment shall not relieve Tenant of its obligations hereunder.

9.3. If at any time Tenant intends to assign, sublet or otherwise transfer all or part of the Premises or this Lease, then Tenant shall give written notice to Landlord (“Sublease Proposal Notice”) of the area proposed to be assigned or sublet (the “Proposed Sublet Space”) and the term for which Tenant desires to sublet the Proposed Sublet Space, the name of the proposed subtenant or assignee and such other information as Landlord shall reasonably request.

-9-

9.4. After receipt of Tenant’s Sublease Proposal Notice, Landlord shall also have the right in its sole and absolute discretion, in addition to Landlord’s rights in Section 9.1, to elect: (a) to consent to the proposed sublease or assignment, (b) to reject the proposed sublease or assignment, or (c) to terminate this Lease with respect to the Proposed Sublet Space. Landlord shall exercise such right by sending Tenant written notice within thirty (30) days after Landlord’s receipt of the Sublease Proposal Notice. If the Proposed Sublet Space does not constitute the entire Premises and Landlord elects to terminate this Lease with respect to the Proposed Sublet Space, then (1) Tenant shall tender the Proposed Sublet Space to Landlord on a date specified in Landlord’s notice (which date shall not be more than sixty (60) days after the date of such notice) as if such specified date had been originally set forth in this Lease as the Lease Expiration Date with respect to the Proposed Sublet Space, and (2) as to all portions of the Premises other than the Proposed Sublet Space, this Lease shall remain in full force and effect except that the additional rent payable pursuant to ARTICLE III and the Fixed Minimum Rent payable pursuant to ARTICLE III shall be reduced pro rata. If the Proposed Sublet Space constitutes the entire Premises and Landlord elects to terminate this Lease, then (1) Tenant shall tender the Premises to Landlord on a date specified in Landlord’s notice (which date shall not be more than sixty (60) days after the date of such notice), and (2) the Term shall terminate on such specified date. Notwithstanding anything to the contrary in the foregoing provisions of this Section 9.4, Landlord shall not have the right to terminate this Lease with respect to the Proposed Sublet Space in the event Tenant proposes to assign this Lease to a corporation or other business entity Tenant is merged or consolidated into or to which substantially all of Tenant’s assets may be transferred, provided such successor entity has assumed in writing all of the obligations and liabilities of Tenant under this Lease.

9.5. In the event Landlord does not exercise its rights to sublet the Proposed Sublet Space from Tenant or to terminate this Lease with respect thereto, Tenant shall be entitled to seek Landlord’s consent to an acceptable assignee or subtenant for the Proposed Sublet Space, for a sublease term no longer than that set forth in the Sublease Proposal Notice, such consent shall be in Landlord’s absolute sole discretion. Such consent or permission pursuant to Section 9.1 may be withheld if (a) the subtenant or assignee is of a character or engaged in a business which is not in keeping with the standards of Landlord for the Shopping Center, (b) Tenant is in Event of Default under this Lease, (c) the Proposed Sublet Space is not regular in shape with appropriate means of ingress and egress and suitable for normal renting purposes, (d) in the reasonable judgment of Landlord, the assignee or sublessee does not have the financial capacity or experience to undertake the obligations of this Lease or the sublease, (e) such a sublease or assignment would violate any term or condition of any covenant or agreement of Landlord involving the Shopping Center, or any other tenant lease within the Shopping Center or (f) any other reason in Landlord’s absolute sole discretion. In the event the assignment or sublease for the assignee or subtenant designated in Tenant’s Sublease Proposal Notice (which assignment/sublease and assignee/subtenant are acceptable to and approved by Landlord) has not been executed by Tenant within one hundred fifty (150) days from the date of Tenant’s Sublease Proposal Notice, Tenant shall not be entitled to enter into such assignment or sublease without first submitting a new Sublease Proposal Notice to Landlord and affording Landlord an opportunity to exercise its rights as set forth in Section 9.4, including its subletting or termination rights.

9.6. If any sublease, assignment or other transfer (whether by operation of law or otherwise and whether consented to or not) provides that the subtenant, assignee or other transferee is to pay any amount in excess of the rent and other charges due under this Lease (except rent or other payments received which are attributable to the amortization of the cost of leasehold improvements made to the sublet or assigned portion of the Premises by Tenant for the subtenant or assignee, and other reasonable expenses incident to the subletting or assignment, including standard leasing commissions), then whether such excess is in the form of an increased monthly or annual rent, a lump sum payment, payment for the sale, transfer or lease of Tenant’s fixtures, leasehold improvements, furniture and other personal property, or any other form (and if the subleased or assigned space does not constitute the entire Premises, the existence of such excess shall be determined on a pro rata basis), then Tenant, after all expenses associated with subleasing the Premises are deducted; including but not limited to reasonable attorneys’ fees, brokerage fees, marketing expenses, processing fees, shall pay to Landlord fifty percent (50%) of any such excess as additional rent upon such terms as shall be specified by Landlord and in no event later than ten (10) days after Tenant’s receipt thereof. Tenant expressly waives any right that it might have to retain such fifty percent (50%) of the excess pursuant to the provisions of section 365(f) of the Bankruptcy Code. Landlord shall have the right to inspect and audit Tenant’s books and records relating to any sublease, assignment or other transfer. Any sublease, assignment or other transfer shall be affected on a form approved by Landlord.

9.7. Any sublease or assignment shall require Tenant and Sublessee/Assignee to execute Landlord’s standard consent to Sublease or Consent to Assignment document.

ARTICLE X. REPAIRS

10.1. Exterior Repairs: Landlord shall keep and maintain the roof and other exterior portions of the Premises (exclusive of doors, windows, glass, showcases and storefronts) in good repair, provided Tenant shall give Landlord written notice of the necessity for such repairs, and provided the damage thereto shall not have been caused by Tenant, its agents, contractors, invitees or employees, in which event Tenant shall be responsible therefore and shall promptly repair such damage. The provisions of this Section 10.1 shall not apply in the case of damage or destruction by fire or other casualty or by eminent domain in which

-10-

event the obligations of Landlord shall be as set forth in ARTICLE XXV (labeled Destruction) and ARTICLE XXVI (labeled Condemnation). Except as provided in this Section 10.1, Landlord shall have no obligation or liability for repair or maintenance of the Premises, or any part thereof, nor shall Landlord be under any liability to repair, maintain or replace any electrical, plumbing, heating, air conditioning or other mechanical installation, nor shall Landlord be obligated to make any improvements of any kind upon the Premises, or to make any repairs, replacements or improvements to any equipment, facilities or fixtures contained therein, all of which shall be the responsibility of Tenant as provided in Section 10.2.

10.2. Interior Repairs: Tenant, at Tenant’s sole cost and expense, shall keep the interior of the Premises, including but not limited to all doors, windows and glass, electrical, plumbing, heating, air conditioning and other mechanical installations and equipment used by or in connection with the Premises in clean, safe and sanitary condition and in good order and repair, including replacement thereof, and promptly replace any plate glass which may be broken or damaged with glass of like kind and quality, and will suffer no waste or injury thereto, and quit and surrender the Premises at the expiration of the Term in as good condition as when received, except for ordinary wear and tear. Without limitation of the generality of the foregoing, Tenant, at Tenant’s sole cost and expense, shall promptly make all repairs and replacements to (a) any pipes, lines, ducts, wires or conduits contained within the Premises, (b) Tenant’s signs, (c) any heating, air conditioning, electrical, ventilating or plumbing equipment installed in or serving the Premises, (d) all glass, window panes and doors, and (e) any other mechanical systems serving the Premises. Tenant shall be responsible, at Tenant’s sole cost and expense, for providing all janitorial, cleaning, pest and termite control services for the Premises. All such services shall be provided in accordance with standards customarily maintained for similar shopping centers and Tenant shall maintain, at Tenant’s sole cost and expense, service contracts therefor. Tenant shall provide Landlord with a copy of a fully executed maintenance contract covering heating, ventilation and air conditioning equipment, within the Premises and Tenant agrees to keep such contract in force during the Term of this Lease. Such contract shall be with a contractor licensed to do business in the jurisdiction where the Shopping Center is located and approved by Landlord, and shall cover all parts and labor. Tenant will not overload the electrical wiring and will not install any additional electrical wiring or plumbing unless it has first obtained Landlord’s written consent thereto, and if such consent is given, Tenant will install such wiring or plumbing at its own cost and expense. Tenant will repair promptly, at its own expense, any damage to the Premises or any other portion of the Shopping Center caused by bringing into the Premises or any other portion of the Shopping Center any property for Tenant’s use or by the installation, use or removal of such property, regardless of fault or by whom such damage shall be caused, unless caused by Landlord’s, its agents’, employees’ or contractors’ gross negligence or willful misconduct.

10.3. In the event Tenant shall not proceed promptly and diligently to make any repairs or perform any obligation imposed upon it by the preceding Sections within forty-eight (48) hours after receiving written notice from Landlord to make such repairs or perform such obligation (except in case of emergency, in which event no notice shall be required), then and in such event Landlord may, at its option, enter the Premises and do and perform the things specified in said notice at Tenant’s cost and expense, without liability on the part of Landlord for any loss or damage resulting from any such action by Landlord, and Tenant agrees to pay, as additional rent, promptly upon demand any cost or expense incurred by Landlord in taking such action, plus fifteen percent (15%) for overhead and administration.

ARTICLE XI. REMOVAL OF DATA AND TELECOMMUNICATIONS WIRES

11.1. Within thirty (30) days after the expiration or earlier termination of the Lease or at any time that any of the Wires (as defined herein) are no longer in active use by Tenant, Landlord may elect (“Election Right”) by written notice to Tenant to:

(a) Retain any or all wires, cables, and similar installations appurtenant thereto installed by or on behalf of Tenant (“Wires”) within the Premises or anywhere in the Shopping Center outside the Premises, including, without limitation, the plenums or risers of the Shopping Center;

(b) Remove any or all of the Wires and restore the Premises or the Shopping Center, as the case may be, to their condition existing prior to the installation of the Wires (“Wire Restoration Work”). Landlord, at its option, may perform such Wire Restoration Work at Tenant’s sole cost and expense; or

(c) Require Tenant to perform all or part of the Wire Restoration Work at Tenant’s sole cost and expense.

11.2. Tenant shall comply with all applicable laws with respect to the Wires, subject to Landlord’s right to elect to retain the Wires. In the event that Tenant discontinues the use of all or any part of the Wires or is no longer using all or any part of the Wires, Tenant shall within thirty (30) days thereafter, notify Landlord of same in writing, accompanied by a plan or other reasonable description of the current type, quantity, points of commencement and termination, and routes of the Wires to allow Landlord to determine if Landlord desires to retain same.

11.3. In the event Landlord elects to retain any or all of the Wires pursuant to Article 11.1(a) hereof, Tenant covenants that:

-11-

(a) Tenant shall be the sole owner of the Wires, Tenant shall have the right to surrender the Wires, and the Wires shall be free of all liens and encumbrances; and

(b) All Wires shall be left in good condition, working order, properly labeled and capped or sealed at each end and in each telecommunications/electrical closet and junction box, and in safe condition.

11.4. Notwithstanding anything to the contrary in ARTICLE IV of the Lease, Landlord may retain Tenant’s Security Deposit after the expiration or earlier termination of the Lease until one of the following events has occurred with respect to all of the Wires:

(a) Landlord elects to retain the Wires pursuant to Article 11.1(a);

(b) Landlord elects to perform the Wire Restoration Work pursuant to Article 11.1 (b) and the Wire Restoration Work is complete and Tenant has fully reimbursed Landlord for all costs related thereto; or

(c) Landlord elects to require Tenant to perform the Wire Restoration Work pursuant to Article 11.1 (c) and the Wire Restoration Work is complete and Tenant has paid for all costs related thereto.

11.5. In the event that Tenant fails or refuses to pay all costs of the Wire Restoration Work within thirty (30) days of Tenant’s receipt of Landlord’s notice requesting Tenant’s reimbursement for or payment of such costs or otherwise fails to comply with the provisions of this Article, Landlord may apply all or any portion of Tenant’s Security Deposit toward the payment of any costs or expenses relative to the Wire Restoration Work or Tenant’s obligations under this Article.

11.6. The retention or application of such Security Deposit by Landlord pursuant to this Article does not constitute a limitation on or waiver of Landlord’s right to seek further remedy under law or equity.

11.7. The provisions of this Article shall survive the expiration or earlier termination of the Lease.

ARTICLE XII. UTILITIES

12.1. Tenant, at its own expense, shall arrange with the appropriate utility companies for the provision of any and all utilities. Tenant shall pay promptly when due the charges for all utility services rendered or furnished to the Premises, including, without limitation, heat, water, sewer, telephone, gas and electricity (whether by meter or sub-meter). Landlord will provide and maintain the necessary mains and electrical conduits to bring water, gas and electricity to the perimeter of the Premises. Under no circumstances shall Landlord be liable to Tenant in damages or otherwise (a) if any utility shall become unavailable from any public utility company, public authority or any other person or entity supplying or distributing such utility, or (b) for any interruption in service of electricity, water, sewer, gas, heat, ventilation, telephone or air conditioning caused by fire, accidents, strikes, breakdowns, necessary maintenance, alterations, repairs, scarcity of labor materials, acts of God or any other causes; and the foregoing shall not constitute a termination of this Lease or an actual or constructive eviction and shall not entitle Tenant to terminate this Lease or to an abatement of rent payable hereunder.

12.2. If permitted by law, Landlord shall have the right at any time and from time to time during the Term to either continue to contract for service from the current utility service provider or contract for service from a different company or companies providing utility service each such company shall hereinafter be referred to as an “Alternate Service Provider”. Tenant shall cooperate with Landlord, the utility service provider, and any Alternate Service Provider at all times and, as reasonably necessary, shall allow Landlord, utility service provider, and any Alternate Service Provider reasonable access to the Premises’ pipes, electric lines, feeders, risers, wiring, and any other machinery within the Premises. Landlord shall in no way be liable or responsible for any loss, damage, or expense that Tenant may sustain or incur by reason of any change, failure, interference, disruption, or defect in the supply or character of the utility service furnished to the Premises, or if the quantity or character of the service supplied by the utility service provider or any Alternate Service Provider is no longer available or suitable for Tenant’s requirements, and no such change, failure, defect, unavailability, or unsuitability shall constitute an actual or constructive eviction, in whole or in part, or entitle Tenant to any abatement or diminution of rent, or relieve Tenant from any of its obligations under the Lease.

ARTICLE XIII. TENANT’S TAXES

13.1. Tenant shall pay before delinquency any business, rent or other taxes that are now or hereafter levied, assessed or imposed upon Tenant’s use or occupancy of the Premises, the conduct of Tenant’s business at the Premises, or Tenant’s equipment, fixtures, furnishings, inventory or personal property. If any such taxes are enacted, changed or altered so that any of such taxes are levied against Landlord, or the mode of collection of such taxes is changed so that Landlord is responsible for the collection or payment of such taxes, then Tenant shall pay as additional rent due hereunder the amount of any and all such taxes.

-12-

ARTICLE XIV. COMPLIANCE WITH LAWS

14.1. Tenant shall comply with all present and future laws, rules, regulations, orders, directions and requirements of all governmental departments, bodies, bureaus, agencies and officers, and with all rules, directions, requirements and recommendations of fire departments, the local board of fire underwriters and other fire insurance rating organizations for the area where the Shopping Center is situated, pertaining to the Premises or the use and occupancy thereof, including the making of such alterations, modifications and improvements as may be so required. In the event Tenant shall fail or neglect to comply with any of the aforesaid laws, rules, regulations, orders, directions, requirements or recommendations, Landlord or its agents may enter the Premises and take all such action and do all such work in or to the Premises as may be necessary in order to comply with such laws, rules, regulations, orders, directions, requirements or recommendations, and Tenant shall reimburse Landlord promptly upon demand for the expense incurred by Landlord in taking such action and performing such work. Tenant shall not do or suffer to be done, or keep or suffer to be kept, anything in, upon or about the Premises which will contravene Landlord’s policies insuring against loss or damage by fire or other hazards, including but not limited to public liability, or which will prevent Landlord from procuring such policies in companies reasonably acceptable to Landlord; and if anything done, omitted to be done or suffered to be done by Tenant, or kept or suffered by Tenant to be kept in, upon or about the Premises shall cause the cost of fire or other insurance on the Premises or other property of Landlord in the Shopping Center, in companies reasonably acceptable to Landlord, to be increased, Tenant will pay the amount of such increase promptly upon Landlord’s demand.

14.2. Tenant shall also make such alterations, modifications, additions, installations or improvements to the Premises as may be required for the safety and health of Tenant’s employees pursuant to the ▇▇▇▇▇▇▇▇-▇▇▇▇▇▇▇ Occupational Safety and Health Act of 1970 (OSHA), as the same may be amended or implemented from time to time; but no such alterations, modifications, additions, installations or improvements, or any other alteration, modification, addition, installation or improvement Tenant may wish to make, shall be made unless Landlord shall first have given written approval of the plans and specifications therefor, and shall have been protected, to Landlord’s satisfaction, against any cost or damage incident thereto, and unless Tenant shall first have secured all necessary building and other permits; and all thereof, when made, shall become the property of Landlord and shall remain upon and be surrendered with said Premises as a part thereof at the end of the Term of this Lease. Landlord agrees that it will not unreasonably withhold its consent to any such alterations, modifications, additions, installations or improvements. If Tenant should make any thereof without Landlord’s consent, Tenant hereby agrees to indemnify Landlord from any liability, which may devolve upon Landlord as a consequence thereof.

ARTICLE XV. NUISANCES

15.1. Tenant shall not permit any objectionable noise, offensive odors and sounds to be emitted from the Premises, nor do or permit anything tending to create a nuisance or to disturb any other tenants of the Shopping Center or occupants of neighboring property, nor do anything tending to injure the reputation of the Shopping Center.

ARTICLE XVI. REMODELING AND ALTERATIONS

16.1. Tenant accepts the Premises in its “AS IS” condition. Landlord is under no obligation to make any structural or other alterations, decorations, additions, improvements, renovations or other changes (collectively “Alterations”) in or to the Premises except as set forth in Exhibit B or otherwise expressly provided in this Lease.