Contract

Table of Contents

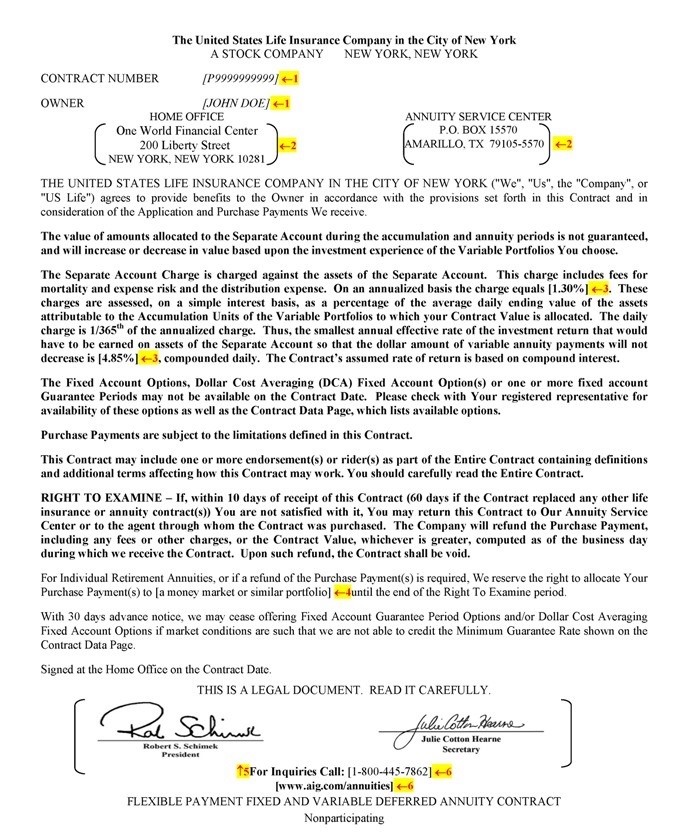

The United States Life Insurance Company in the City of New York A STOCK COMPANY NEW YORK, NEW YORK CONTRACT NUMBER [P9999999999] ?1 OWNER [XXXX XXX] ?1 HOME OFFICE ANNUITY SERVICE CENTER One World Financial Center P.O. BOX 15570 000 Xxxxxxx Xxxxxx ?0 XXXXXXXX, XX 00000-5570 ?2 NEW YORK, NEW YORK 10281 THE UNITED STATES LIFE INSURANCE COMPANY IN THE CITY OF NEW YORK (“We”, “Us”, the “Company”, or “US Life”) agrees to provide benefits to the Owner in accordance with the provisions set forth in this Contract and in consideration of the Application and Purchase Payments We receive. The value of amounts allocated to the Separate Account during the accumulation and annuity periods is not guaranteed, and will increase or decrease in value based upon the investment experience of the Variable Portfolios You choose. The Separate Account Charge is charged against the assets of the Separate Account. This charge includes fees for mortality and expense risk and the distribution expense. On an annualized basis the charge equals [1.30%] ?3. These charges are assessed, on a simple interest basis, as a percentage of the average daily ending value of the assets attributable to th the Accumulation Units of the Variable Portfolios to which your Contract Value is allocated. The daily charge is 1/365 of the annualized charge. Thus, the smallest annual effective rate of the investment return that would have to be earned on assets of the Separate Account so that the dollar amount of variable annuity payments will not decrease is [4.85%] ?3, compounded daily. The Contract’s assumed rate of return is based on compound interest. The Fixed Account Options, Dollar Cost Averaging (DCA) Fixed Account Option(s) or one or more fixed account Guarantee Periods may not be available on the Contract Date. Please check with Your registered representative for availability of these options as well as the Contract Data Page, which lists available options. Purchase Payments are subject to the limitations defined in this Contract. This Contract may include one or more endorsement(s) or rider(s) as part of the Entire Contract containing definitions and additional terms affecting how this Contract may work. You should carefully read the Entire Contract. RIGHT TO EXAMINE – If, within 10 days of receipt of this Contract (60 days if the Contract replaced any other life insurance or annuity contract(s)) You are not satisfied with it, You may return this Contract to Our Annuity Service Center or to the agent through whom the Contract was purchased. The Company will refund the Purchase Payment, including any fees or other charges, or the Contract Value, whichever is greater, computed as of the business day during which we receive the Contract. Upon such refund, the Contract shall be void. For Individual Retirement Annuities, or if a refund of the Purchase Payment(s) is required, We reserve the right to allocate Your Purchase Payment(s) to [a money market or similar portfolio] ?4until the end of the Right To Examine period. With 30 days advance notice, we may cease offering Fixed Account Guarantee Period Options and/or Dollar Cost Averaging Fixed Account Options if market conditions are such that we are not able to credit the Minimum Guarantee Rate shown on the Contract Data Page. Signed at the Home Office on the Contract Date. THIS IS A LEGAL DOCUMENT. READ IT CAREFULLY. ?5For Inquiries Call: [0-000-000-0000] ?6 [xxx.xxx.xxx/xxxxxxxxx] ?6 FLEXIBLE PAYMENT FIXED AND VARIABLE DEFERRED ANNUITY CONTRACT Nonparticipating US-803 (12/15) 1

| US-803 (12/15) | 1 |

Table of Contents

| Page 3-4 | ||||

| Page 5 | ||||

| Page 8 | ||||

| Page 9 | ||||

| Page 11 | ||||

| Page 11 | ||||

| Page 12 | ||||

| Page 13 | ||||

| Page 15 | ||||

| Page 17 | ||||

| Page 20 | ||||

| US-803 (12/15) | 2 |

Table of Contents

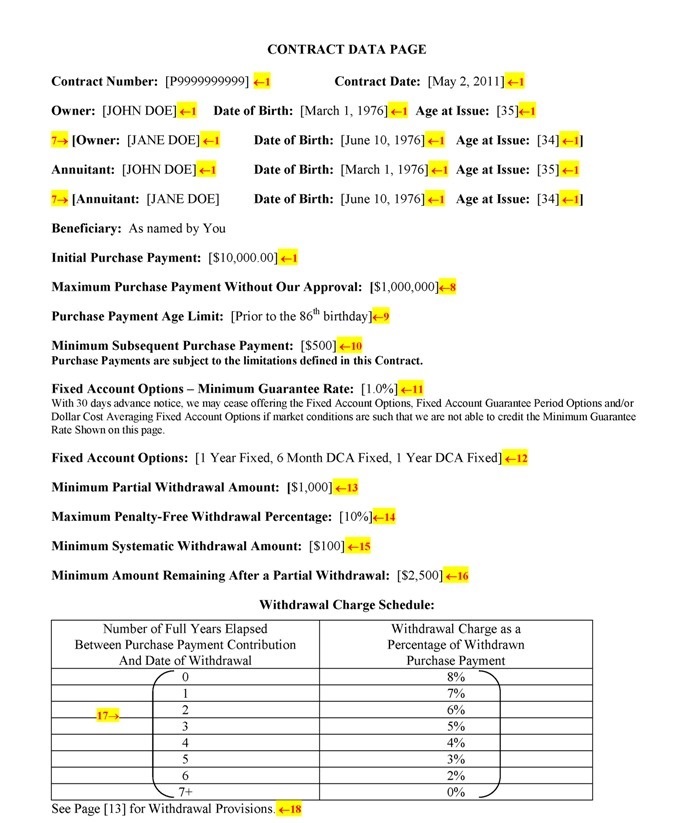

CONTRACT DATA PAGE Contract Number: [P9999999999] ?1 Contract Date: [May 2, 2011] ?1 Owner: [XXXX XXX] ?1 Date of Birth: [March 1, 1976] ?1 Age at Issue: [35]?1 7? [Owner: [XXXX XXX] ?1 Date of Birth: [June 10, 1976] ?1 Age at Issue: [34] ?1] Annuitant: [XXXX XXX] ?1 Date of Birth: [March 1, 1976] ?1 Age at Issue: [35] ?1 7? [Annuitant: [XXXX XXX] Date of Birth: [June 10, 1976] ?1 Age at Issue: [34] ?1] Beneficiary: As named by You Initial Purchase Payment: [$10,000.00] ?1 Maximum Purchase Payment Without Our Approval: [$1,000,000]?8 th Purchase Payment Age Limit: [Prior to the 86 birthday]?9 Minimum Subsequent Purchase Payment: [$500] ?10 Purchase Payments are subject to the limitations defined in this Contract. Fixed Account Options – Minimum Guarantee Rate: [1.0%] ?11 With 30 days advance notice, we may cease offering the Fixed Account Options, Fixed Account Guarantee Period Options and/or Dollar Cost Averaging Fixed Account Options if market conditions are such that we are not able to credit the Minimum Guarantee Rate Shown on this page. Fixed Account Options: [1 Year Fixed, 6 Month DCA Fixed, 1 Year DCA Fixed] ?12 Minimum Partial Withdrawal Amount: [$1,000] ?13 Maximum Penalty-Free Withdrawal Percentage: [10%]?14 Minimum Systematic Withdrawal Amount: [$100] ?15 Minimum Amount Remaining After a Partial Withdrawal: [$2,500] ?16 Withdrawal Charge Schedule: Number of Full Years Elapsed Withdrawal Charge as a Between Purchase Payment Contribution Percentage of Withdrawn And Date of Withdrawal Purchase Payment 0 8% 1 7% 17? 2 6% 3 5% 4 4% 5 3% 6 2% 7+ 0% See Page [13] for Withdrawal Provisions. ?18 US-803 (12/15) 3

| US-803 (12/15) | 3 |

Table of Contents

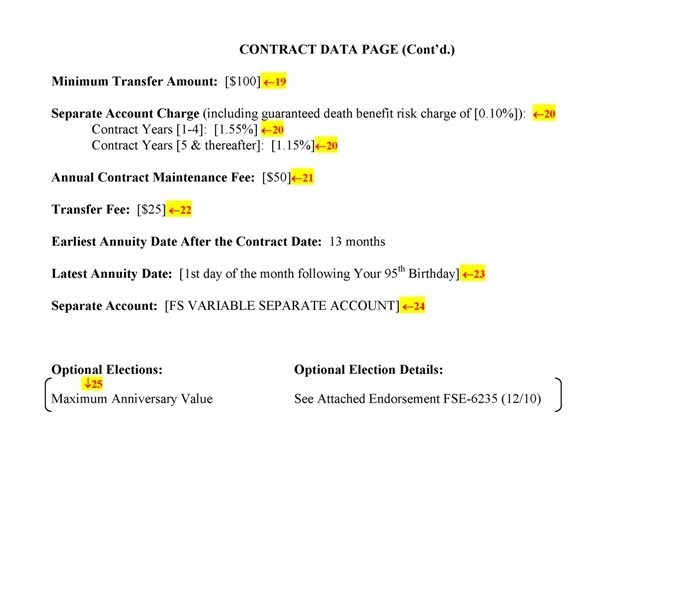

CONTRACT DATA PAGE (Cont’d.) Minimum Transfer Amount: [$100] ?19 Separate Account Charge (including guaranteed death benefit risk charge of [0.10%]): ?20 Contract Years [1-4]: [1.55%] ?20 Contract Years [5 & thereafter]: [1.15%]?20 Annual Contract Maintenance Fee: [$50]?21 Transfer Fee: [$25] ?22 Earliest Annuity Date After the Contract Date: 13 months Latest Annuity Date: [1st day of the month following Your 95th Birthday] ?23 Separate Account: [FS VARIABLE SEPARATE ACCOUNT] ?24 Optional Elections: Optional Election Details: ?25 Maximum Anniversary Value See Attached Endorsement FSE-6235 (12/10)

| US-803 (12/15) | 4 |

Table of Contents

Defined in this section are some of the words and phrases used in this Contract. These terms are capitalized when used in the Contract with the meaning set forth below.

ACCUMULATION UNIT

An Accumulation Unit is a unit of measure used to compute the Contract Value in a Variable Portfolio before the Annuity Date.

AGE

The Age of a person is the attained age as a person’s last birthday. Unless otherwise defined in an endorsement or rider to this Contract, in the case of Joint Owners/Annuitants, the age of the older person will be used to determine any age-driven benefit.

ANNUITANT

The Annuitant is the natural person(s) (collectively, “Joint Annuitants”) whose life/lives are used to determine the Annuity Income Payments under the Contract. If the Contract is in force and the Annuitant is alive on the date Annuity Income Payments begin, We will begin Annuity Income Payments to the Payee. This Contract cannot have Joint Annuitants if it is issued in connection with a tax-qualified retirement plan.

ANNUITIZATION

Annuitization is a series of periodic Annuity Income Payments. If you select Variable Annuitization, these periodic Annuity Income Payments vary in amount according to investment experience of one or more Variable Portfolios, as selected by You and such payments are made from the Company’s Separate Account. If You select Fixed Annuitization, these periodic Annuity Income Payments do not vary with investment experience and such payments are made from the Company’s general asset account.

ANNUITY DATE

The Annuity Date is the date on which Annuity Income Payments to the Payee begin. This date cannot be later than the Latest Annuity Date.

ANNUITY SERVICE CENTER

The Annuity Service Center is the address shown on Page 1 of this Contract where all Purchase Payments and requests regarding this Contract are to be sent.

ANNUITY UNIT

An Annuity Unit is a unit of measure determined on or after the Annuity Date and is used to compute Annuity Income Payments from the Variable Portfolio(s) if Variable Annuitization is selected.

BENEFICIARY

The Beneficiary is selected by You in Writing and will receive the Death Benefit under this Contract upon Your death.

BUSINESS DAY

Business Day is any day that We are open and the New York Stock Exchange (“NYSE”) is open for trading and generally ends at 4:00 p.m. Eastern Time. The Business Day is the day in which all financial transactions and requests are deemed to occur when received by Us.

| US-803 (12/15) | 5 |

Table of Contents

CONTINUATION DATE

The Continuation Date is the date on which We receive, at Our Annuity Service Center: (a) the Spousal Beneficiary’s Written request to continue the Contract in a form satisfactory to Us; and (b) Due Proof of Death of the Owner. If We receive (a) and (b) on different dates, the Continuation Date will be the later date.

CONTRACT ANNIVERSARY

The date that occurs on the same month and date as the Contract Date for each Contract Year. The first Contract Anniversary is one (1) year after the Contract Date on the same month and date of the following Contract Year.

CONTRACT DATE

The Contract Date is the date Your Contract is issued, as shown on the Contract Data Page. It is the date from which Contract Years and Contract Anniversaries are measured.

CONTRACT VALUE

The Contract Value is the sum of: (1) Your share of the Variable Portfolios’ Accumulation Unit Values; and (2) the value of amounts if any, allocated to any available Fixed Account Option(s).

CONTRACT YEAR

The one (1) year period starting from the Contract Date in one (1) calendar year and ending on the date preceding the Contract Anniversary in the following calendar year, and every year thereafter.

DOLLAR COST AVERAGING (DCA)

Dollar Cost Averaging is an optional program under which You authorize the systematic transfer of specified amounts or percentages from any Variable Portfolio(s) or any available Fixed Account Option into any Variable Portfolio(s) other than the source account.

FIXED ACCOUNT OPTION(S)

The Fixed Account Option(s) are investment options, if available under this Contract, that become part of the Company’s general asset account and are credited with a fixed rate of interest declared by the Company. The general asset account contains all the assets of the Company except for the Separate Account and other segregated asset accounts. The amount You have in any Fixed Account Option at a given time is a result of Purchase Payment(s) You have allocated to it or any part of Your Contract Value You have transferred to it.

GUARANTEE PERIOD

The Guarantee Period is the period for which a set rate of interest is credited to amounts allocated to any available Fixed Account Option(s). We determine in Our sole discretion the periods, if any, that will be offered.

IRC

IRC refers to the Internal Revenue Code of 1986, as amended, or as it may be amended or superseded.

JOINT OWNER

A Joint Owner is any person named as Joint Owner on the Application for a non-qualified contract and listed on the Contract Data Page, unless subsequently changed. The Joint Owner, if any, possesses an undivided interest in this Contract in conjunction with the Owner. All references within this Contract to Owner will also apply to the Joint Owner.

| US-803 (12/15) | 6 |

Table of Contents

LATEST ANNUITY DATE

The Latest Annuity Date is the first day of the month following the 95th Birthday of the Owner, shown on the Contract Data Page. If the Contract is owned by Joint Owners, the Latest Annuity Date is based on the older Owner’s date of birth. If the Owner is a non-natural person, the Latest Annuity Date is the first day of the month following the 95th Birthday of the Annuitant. If the Contract is owned by a non-natural person and has Joint Annuitants, the Latest Annuity Date is based on the older Annuitant’s date of birth. The Latest Annuity Date is the date upon which Annuity Income Payments must begin or the Contract must be surrendered.

OWNER

The Owner is the natural person or entity named in the Contract who is entitled to exercise all rights and privileges of ownership under the Contract. Owner means both Joint Owners, if applicable. If there are Joint Owners, the authorizations of both Joint Owners are required In Writing for all Contract changes and the exercise of any other rights of ownership.

PAYEE

The person receiving Annuity Income Payments under this Contract.

PURCHASE PAYMENTS

Purchase Payment(s) are payment(s) in U.S. currency made by or on behalf of the Owner to the Company to purchase the Contract.

REQUIRED DOCUMENTATION

Required Documentation must be received by Us at Our Annuity Service Center and is: (a) Due Proof of Death of the Owner before the Annuity Date; (b) an election form specifying the Annuity Income Payment options; and (c) any other documentation We may require.

SEPARATE ACCOUNT

The Separate Account is a segregated asset account named on the Contract Data Page. The Separate Account consists of Variable Portfolios, each investing in shares of the Underlying Fund(s). The assets of the Separate Account are not commingled with the general assets and liabilities of the Company. Income, gains and losses, whether or not realized, from assets allocated to the Separate Accounts shall be credited to or charged against the applicable Separate Account without regard to other income, gains, or losses of the Company. We will maintain Separate Account assets with a value at least equal to the amounts accumulated in accordance with the applicable agreements with respect to this Separate Account, and also the reserves for variable annuities in the course of payment. The portion of the assets of the Separate Account not exceeding the reserves and other contract liabilities shall not be chargeable with liabilities arising out of any other business of Ours. The value of amounts allocated to the Variable Portfolios of the Separate Account is not guaranteed.

SPOUSAL BENEFICIARY

The Spousal Beneficiary is the surviving spouse of the original deceased Owner. The Spousal Beneficiary is designated as the primary Beneficiary at the time of the Owner’s death and may continue the Contract as the Owner on the Continuation Date.

SUBSEQUENT PURCHASE PAYMENTS

Subsequent Purchase Payments are Purchase Payments made after the initial Purchase Payment.

UNDERLYING FUND

The Underlying Fund is the underlying investment portfolios in which the Variable Portfolio(s) invest.

| US-803 (12/15) | 7 |

Table of Contents

VARIABLE PORTFOLIO

A Variable Portfolio is one or more divisions of the Separate Account which provides for the variable investment options available under this Contract. Each Variable Portfolio has its own investment objective and is invested in the Underlying Fund(s). A Variable Portfolio is not chargeable with liabilities arising out of any other Variable Portfolio.

WE, OUR, US, THE COMPANY

We, Our, Us, The Company refers to The United States Life Insurance Company in the City of New York.

WITHDRAWAL(S)

Withdrawals are any amount(s) withdrawn by the Owner from the Contract Value, including any charges that include but are not limited to Withdrawal Charges, applicable to each such Withdrawal.

WRITTEN, IN WRITING

Written or In Writing refers to a written request or notice in acceptable form and content to Us, which is signed and dated and is received at Our Annuity Service Center.

YOU, YOUR

You, Your refers to the Owner.

PURCHASE PAYMENTS

Purchase Payments are flexible. This means that, subject to Company disclosed restrictions, You may change the amounts, frequency and/or timing of Purchase Payments. Purchase Payments can be made at any time after the Contract Date, but must be received at Our Annuity Service Center before the Purchase Payment Age Limit, as shown on the Contract Data Page. With instructions from You, Purchase Payments will be allocated to the Variable Portfolio(s) and/or Fixed Account Option(s), if available. We reserve the right, upon advance notice to You, to: 1) limit the maximum amount of Purchase Payments; and 2) discontinue acceptance of any subsequent Purchase Payment(s) received on or after the first Contract Anniversary, if an optional guaranteed living benefit is elected. We will apply these limitations in a uniform and non-discriminatory manner.

DOLLAR COST AVERAGING (DCA) FIXED ACCOUNT OPTION(S)

Any portion of a Purchase Payment allocated to the DCA Fixed Account Option(s), if available, must be transferred to the Variable Portfolio(s) within the specified DCA Fixed Account Option period. Upon termination of the DCA program, any amounts remaining in the DCA Fixed Account Option(s) will be transferred to the DCA target allocation(s) for the program being terminated. We reserve the right to impose a maximum contribution level on Purchase Payments allocated to a DCA Fixed Account Option(s) and/or change the terms and conditions of the DCA program at any time. We reserve the right to cease offering DCA Fixed Account Option(s). Upon annuitization, any amounts remaining in the DCA Fixed Account Option(s) will be applied to a Fixed Annuitization. The unit values credited and applied to Your Contract are determined on each date of transfer. The minimum contribution amount that may be allocated to the DCA Fixed Account Option(s) is $600 for the 6 month DCA and $1,200 for the 1 year DCA.

| US-803 (12/15) | 8 |

Table of Contents

CHANGES TO VARIABLE PORTFOLIO OFFERINGS

If the shares of an Underlying Fund should no longer be available for investment by the Separate Account, then We may substitute shares of another Underlying Fund, for shares already purchased, or to be purchased in the future. At any given time, some Variable Portfolios may not be available for receipt of Purchase Payment(s) or transfer(s). Substitutions may be necessary and will be carried out in accordance with any applicable state and/or federal laws or regulations.

MINIMUM CONTRACT VALUE

If Your Contract Value falls below the Minimum Amount Remaining After Any Partial Withdrawal, as shown on the Contract Data Page, as a result of taking partial Withdrawals, subject to applicable state and federal laws, rules and regulations, We may treat Your partial Withdrawal request as a request for a total Withdrawal and terminate Your Contract.

Your Contract provides for an accumulation phase and an income phase. During the accumulation phase, Your Purchase Payment(s) received prior to the annuity date are allocated among any available Fixed Account Option(s) and/or one or more of the Variable Portfolio(s) in Your Contract. During the income phase, payments under an Annuity Payment Option selected by You are made to You or Your designated Payee.

SEPARATE ACCOUNT ACCUMULATION VALUE

The Separate Account Accumulation Value under the Contract is the sum of the Accumulation Unit Values held in the Variable Portfolios for You. The Company does not hold itself out to be a trustee of the Separate Account.

NUMBER OF ACCUMULATION UNITS

Your Contract is credited with Accumulation Units of the Separate Account when amounts are allocated to the Variable Portfolio(s). For that portion of each Purchase Payment and/or transfer amount allocated to a Variable Portfolio, the number of Accumulation Units credited is equal to:

The sum of each Purchase Payment and/or transfer amount allocated to the Variable Portfolio reduced by any applicable premium taxes:

Divided by

The Accumulation Unit Value for that Variable Portfolio for the Business Day in which the Purchase Payment or transfer amount is allocated to the Variable Portfolio.

The number of Accumulation Units will be reduced for Withdrawals, Annuitizations, amounts transferred out of a Variable Portfolio, the Contract Maintenance Fee, if applicable, and applicable charges for any elected features as set forth in endorsements or riders to this Contract. Any reduction to the Contract Value will be made as of the Business Day in which We receive all requirements In Writing for the transaction, as appropriate.

| US-803 (12/15) | 9 |

Table of Contents

ACCUMULATION UNIT VALUE (AUV)

The AUV of a Variable Portfolio for any Business Day is determined as follows:

| 1. | We calculate the Net Investment Rate by dividing (a) by (b) minus (c) where: |

| (a) | is the Variable Portfolio’s income and capital gains and losses (whether realized or unrealized) on the current Business Day; |

| (b) | is the value of the Variable Portfolio for the immediately preceding Business Day; and |

| (c) | is the daily Separate Account charge. |

| 2. | We calculate the AUV by multiplying (d) by [1+(e)] where: |

| (d) | is the AUV of the immediately preceding Business Day; and |

| (e) | is the Net Investment Rate of the current Business Day. |

FIXED ACCOUNT ACCUMULATION VALUE

The Fixed Account Accumulation Value, if any, is the sum of all amounts allocated or transferred to the Fixed Account Option(s), if available, reduced by any applicable premium taxes, plus all interest credited to the Fixed Account Option(s) during the period that You have Contract Value allocated to the Fixed Account Option(s). This amount will be adjusted for Withdrawals, Annuitizations, transfers, the Contract Maintenance Fee, if applicable and allowed by Your state, and applicable charges for any elected features as set forth in endorsements/riders to this Contract. The Fixed Account Accumulation Value will not be less than the minimum values required by law in the state where this Contract is issued.

FIXED ACCOUNT GUARANTEE PERIOD OPTIONS AND INTEREST CREDITING

The portion of Your Contract Value within the Fixed Account Option(s), if any, is credited with interest at rates guaranteed by Us for the Guarantee Period(s) selected. Interest is credited on a daily basis at the then applicable effective interest rate for the applicable Guarantee Period. You may select from one or more Guarantee Periods which We may offer at any particular time. We reserve the right at any time to add or discontinue Guarantee Periods. A Written notification will be provided to the Owner at least 30 days prior to the discontinuation of a Guarantee Period. If You have allocated any part of Your initial Purchase Payment to a Guarantee Period, the percentage allocated, as well as the duration of the Guarantee Period, is shown on the Application or administrative election form as completed by You.

The interest rate applicable to the allocation of a Purchase Payment or transfer of Contract Value to a Fixed Account Option is the rate in effect for the applicable Guarantee Period at the time of the allocation or transfer. If You have allocated or transferred amounts at different times to any available Fixed Account Option(s), each allocation or transfer may have a unique effective interest rate associated with that amount. We guarantee that the effective annual rate of interest for any available Fixed Account Option(s), including any of the available Guaranteed Periods, will not be less than the Minimum Guarantee Rate as mandated by Your state, and shown on the Contract Data Page.

| US-803 (12/15) | 10 |

Table of Contents

We will deduct the following charges from the Contract:

CONTRACT MAINTENANCE FEE

The charge, as shown on the Contract Data Page, if applicable, will be deducted on each Contract Anniversary on or prior to the Annuity Date. It will also be deducted when the Contract Value is withdrawn in full if the Withdrawal is not on the Contract Anniversary. We reserve the right to waive the fee for Contract Values of $75,000.00 and up.

WITHDRAWAL CHARGE

The charge, as shown on the Contract Data Page, if any, may be deducted upon Withdrawal of any portion of the Contract Value that is not considered a Penalty-Free Withdrawal. See WITHDRAWAL PROVISIONS below.

SEPARATE ACCOUNT CHARGE

This charge, as shown on the Contract Data Page, on an annualized basis equals a percentage of the average daily ending value of the assets attributable to the Accumulation Units of the Variable Portfolio(s) to which all or part of the Contract Value is allocated. This charge compensates Us for the mortality and expense risk and the costs of contract distribution assumed by Us. We subtract this charge daily from the Separate Account.

TRANSFER FEE

We permit 15 free transfers between Variable Portfolios and/or available Fixed Account Option(s) each Contract Year. We may charge You a fee, as shown on the Contract Data Page, for each additional transfer in that Contract Year, except for transfers made as part of an automated transfer program.

Subject to applicable restrictions, You may transfer all or part of Your Contract Value amongst the Variable Portfolios and/or available Fixed Account Option(s) (unless otherwise noted). The minimum amount that can be transferred is subject to the Minimum Transfer Amount, as shown on the Contract Data page. The amount that can remain in a Variable Portfolio and/or available Fixed Account Option is subject to Company limits. We reserve the right to restrict Your transfer privileges.

Due to the risks that frequent transfers impose upon Owners and other investors in Variable Portfolio(s) and/or Underlying Funds, We or the manager of an Underlying Fund may limit transfer and impose other requirements to minimize these risks, including but not limited to, requiring a minimum amount that can be transferred, and an amount that can remain in a Variable Portfolio and/or available Fixed Account Option after a transfer.

TRANSFERS BEFORE THE ANNUITY DATE

Before the Annuity Date, transfers are subject to certain restrictions as indicated above and on the Contract Data Page. You may transfer all or a portion of Your Contract Value from one Variable Portfolio to another Variable Portfolio(s) or any available Fixed Account Option(s) other than the DCA Fixed Account Option(s). You may also transfer all or a portion of Your Contract Value from any available Fixed Account Option(s) to the Variable Portfolio(s) and/or any available Fixed Account Option(s) other than the DCA Fixed Account Option(s) of the Contract. A transfer to a Variable Portfolio will result in the redemption of Accumulation Units in a Variable Portfolio and the purchase of Accumulation Units in

| US-803 (12/15) | 11 |

Table of Contents

the other Variable Portfolio. Transfers will be effective at the end of the Business Day on which We receive Your completed Written transfer request.

Unless You instruct Us to make a transfer, Your allocation to any available Fixed Account Option(s) and Variable Portfolio(s) will remain unchanged, subject to the terms of the Contract. We reserve the right to terminate Your ability to transfer to any discontinued Fixed Account Option(s) and/or Variable Portfolio(s). A Written notification will be provided to You at Your last known address prior to any such termination of Your ability to transfer.

TRANSFERS AFTER THE ANNUITY DATE

On and after the Annuity Date, transfers into and out of any available Fixed Account Option(s) are not allowed. You may transfer all or a portion of Your Annuity Units from one Variable Portfolio to another Variable Portfolio(s). A transfer will result in the redemption of Annuity Units in a Variable Portfolio and the purchase of Annuity Units in the other Variable Portfolio. Transfers will be effective on the last Business Day of the month on which We receive Your Written request for the transfer.

On or before the Annuity Date and while You are living, You may withdraw all (“total Withdrawal”) or part of Your Contract Value under this Contract by informing Us In Writing. The Minimum Partial Withdrawal Amount is shown on the Contract Data Page.

Unless You tell Us otherwise in writing, Withdrawals will be deducted from the Contract Value in proportion to their allocation among any available Fixed Account Option(s) and the Variable Portfolio(s). Withdrawals will be based on values for the Business Day on which the Written request for Xxxxxxxxxx is received by Us. Payment of the total Withdrawal will terminate this Contract and We will have no further obligations under the Contract. Unless the SUSPENSION OF PAYMENTS or DEFERMENT OF PAYMENTS provisions are in effect, payment of Withdrawals will be made within seven calendar days.

WITHDRAWAL CHARGE

Withdrawals of all or a portion of the Contract Value may be subject to a Withdrawal Charge, as shown on the Contract Data Page. The Withdrawal Charge percentage applied to any Withdrawal will depend on how long the Purchase Payment to which the Withdrawal is attributed has been in the Contract. No Withdrawal Charge is deducted on an amount which is considered a Penalty-Free Withdrawal or a Purchase Payment no longer subject to a Withdrawal Charge.

For the purpose of determining the Withdrawal Charge applicable to a partial Withdrawal, the Withdrawal will be attributed to amounts in the following order: (1) any remaining Penalty-Free Withdrawal amount (except in the case of a total Withdrawal); (2) Purchase Payments not yet withdrawn and no longer subject to Withdrawal Charges; (3) Purchase Payments not yet withdrawn and still subject to Withdrawal Charges; and (4) any remaining Contract Value. A Purchase Payment, or portion thereof, is considered withdrawn when the Withdrawal incurs a Withdrawal Charge, and is assumed to be withdrawn on a first-in-first-out (FIFO) basis. The Withdrawal Charge will be assessed against the Variable Portfolio(s) and the available Fixed Account Option(s) in the same proportion that the remaining Contract Value is allocated unless You request that the Withdrawal come from a particular Variable Portfolio or available Fixed Account Option.

| US-803 (12/15) | 12 |

Table of Contents

PENALTY-FREE WITHDRAWALS

On any day in a Contract Year before the Annuity Date, You may make a partial Withdrawal of up to the Penalty-Free Withdrawal amount as of that day without incurring a Withdrawal Charge. The Maximum Penalty-Free Withdrawal Percentage is shown on the Contract Data Page.

Each Contract Year, the Penalty-Free Withdrawal amount is calculated as the Maximum Penalty-Free Withdrawal Percentage multiplied by the remaining Purchase Payments not yet withdrawn and still subject to Withdrawal Charges.

Although amounts withdrawn as Penalty-Free Withdrawals reduce the Contract Value, they do not reduce the remaining Purchase Payments for purposes of calculating future Penalty-Free Withdrawal amounts and Withdrawal Charges. Partial Withdrawals in a Contract Year that are in excess of the Penalty-Free Withdrawal amount incur a Withdrawal Charge applicable to the remaining Purchase Payments and reduce those Purchase Payments on a first-in-first-out (FIFO) basis.

If You choose to take less than the Penalty-Free Withdrawal amount during a Contract Year, You may not carry over the unused Penalty-Free Withdrawal amount in any subsequent Contract Years. If Your Contract Value is subject to Withdrawal Charges, a Penalty-Free Withdrawal is not available to You if You take a full Withdrawal.

SYSTEMATIC WITHDRAWAL PROGRAM

Prior to the Annuity Date, You may elect to participate in a Systematic Withdrawal Program by informing Us at Our Annuity Service Center. The Systematic Withdrawal Program allows You to make automatic Withdrawals from Your Contract monthly, quarterly, semiannually or annually. The Minimum Systematic Withdrawal Amount is shown on the Contract Data Page. Any amount withdrawn through the Systematic Withdrawal Program may be subject to a Withdrawal Charge as discussed in the WITHDRAWAL CHARGE and PENALTY-FREE WITHDRAWALS provisions. You may terminate Your participation in the Systematic Withdrawal Program at any time by sending Us a Written request.

Notwithstanding any provision of this Contract to the contrary, all payments of benefits under this Contract will be made in a manner that satisfies the requirements of IRC Section 72(s), as amended from time to time. If the Contract is owned by a trust or other non-natural person, We will treat the death of any Annuitant as the death of the “Primary Annuitant” and as the death of any Owner.

DUE PROOF OF DEATH

Due Proof of Death means any Written proof, which may include but is not limited to:

1. a certified copy of a death certificate; or

2. a certified copy of a decree of a court of competent jurisdiction as to the finding of death; or

3. a Written statement by a medical doctor who attended the deceased Owner at the time of death.

DEATH OF OWNER BEFORE THE ANNUITY DATE

Upon Your death, We will pay a Death Benefit to the Beneficiary upon Our receiving all Required Documentation. Unless You have previously designated a payment option on behalf of the Beneficiary, the Beneficiary must select one of the following options:

| US-803 (12/15) | 13 |

Table of Contents

| 1. | Immediately collect the Death Benefit in a lump sum payment. If a lump sum payment is elected, payment will be in accordance with any applicable laws and regulations governing payments on death; or |

| 2. | Collect the Death Benefit in the form of one of the Annuity Income Payment Options. If an Annuity Income Payment Option is desired, an option must be elected within 60 days of Our receipt of all Required Documentation. The Annuity Income Payments must be over the life of the Beneficiary or over a period not extending beyond the life expectancy of the Beneficiary. Consistent with applicable tax rules, payments under this option generally must begin within one year after the Owner’s death, otherwise, the Death Benefit will be paid in accordance with option 1 above; or |

| 3. | If eligible and You are the Spousal Beneficiary, You may continue the Contract (“Continuing Spouse”). If this option is elected, no Death Benefit is paid out to the Continuing Spouse on the Continuation Date; or |

| 4. | A payment option that is mutually agreeable between You and Us. |

The entire interest in the Contract will be distributed within the five year period specified under applicable laws and regulations, commencing with the date of death of the Owner unless option 2 or 3 was selected under DEATH OF OWNER BEFORE THE ANNUITY DATE.

Upon the Continuing Spouse’s death, the entire interest of the Contract must be distributed immediately under option 1, 2 or 4 as provided under DEATH OF OWNER BEFORE THE ANNUITY DATE.

AMOUNT OF DEATH BENEFIT

The amount of the Death Benefit is the Contract Value on the Business Day during which We receive all Required Documentation.

SPOUSAL BENEFICIARY CONTINUATION

If the Spousal Beneficiary continues the Contract on the Continuation Date (“Continuing Spouse”), the amount continued is the Death Benefit, which is the Contract Value on the Business Day during which We receive all Required Documentation.

DEATH OF OWNER OR ANNUITANT ON OR AFTER THE ANNUITY DATE

If any Owner or Annuitant dies on or after the Annuity Date and before the entire interest in the Contract has been distributed, We will continue to make payments of any remaining portion of the Annuity Income Payment(s) to the Beneficiary under the existing Annuity Income Payments, if a specified term was elected, upon Our receipt of all Required Documentation. For further information pertaining to death of the Annuitant, see ANNUITY INCOME PAYMENT OPTIONS.

BENEFICIARY

The Beneficiary is selected by the Owner. While the Owner is living and before the Annuity Date, the Owner may change the Beneficiary by Written Notice. A change in Beneficiary will take effect on the date We receive the Written Notice. If two or more persons are named as Beneficiaries under the Contract, those surviving the Owner will share equally unless otherwise specified by the Owner and each must elect to receive their respective portions of the Death Benefit according to the options listed under DEATH OF OWNER BEFORE THE ANNUITY DATE. Joint Owners, if applicable, shall be each other’s primary Beneficiary. Joint Annuitants, if any, when the Owner is a non-natural person, shall be

| US-803 (12/15) | 14 |

Table of Contents

each other’s primary Beneficiary. Any other Beneficiary designation will be treated as a contingent Beneficiary.

If the Annuitant survives the Owner, and there are no surviving Beneficiaries, the Annuitant will be deemed the Beneficiary. Joint Annuitants, if any, when the Owner is a trust or other non-natural person, shall be each other’s primary Beneficiary. Any other Beneficiary designation will be treated as a contingent Beneficiary.

If the Owner is also the Annuitant and there are no surviving Beneficiaries, upon Our receipt of all Required Documentation, We will pay the Death Benefit to the estate of the Owner in accordance with option 1, under DEATH OF OWNER BEFORE THE ANNUITY DATE.

ANNUITY DATE

You may specify an Annuity Date. You may change the Annuity Date at any time, at least seven days prior to the Annuity Date, by Written Notice. The Annuity Date must always be the first day of the calendar month. The Earliest Annuity Date After the Contract Date is shown on the Contract Date Page. The Annuity Date must not be beyond the Latest Annuity Date shown on the Contract Data Page. If no Annuity Date is specified by You, the Annuity Date will be the Latest Annuity Date.

PAYMENTS TO OWNER

Unless You request otherwise, We will make Annuity Income Payments to You. If You want the Annuity Income Payments under an Annuity Payment Option selected by You to be made to some other Payee, We will make such Annuity Income Payments subject to receipt of a Written request no later than thirty (30) days before the due date of the first Annuity Income Payment or subsequent Annuity Income Payment.

Any such request is subject to the rights of any assignee. No Annuity Income Payments available to or being paid to the Payee while the Annuitant is alive can be transferred, commuted, anticipated or encumbered.

BETTERMENT OF RATES

The amount of the Owner’s initial monthly payment will be at least equal to the monthly payment produced by the application of an amount equal to the Contract Value of this Contract to purchase any single consideration immediate annuity contract offered by the Company at the same time to the same class of annuitants.

FIXED ANNUITIZATION

If a Fixed Annuitization has been elected, the proceeds payable under this Contract less any applicable premium taxes, shall be applied to the payment of the fixed Annuity Income Payment option elected at rates which are at least equal to the annuity rates based upon the applicable tables in the Contract. Upon Annuitization, any amounts remaining in the DCA Fixed Account Option(s), if applicable, will be applied to a Fixed Annuitization. The unit values credited and applied to Your Contract are determined on each date of transfer.

AMOUNT OF FIXED ANNUITY INCOME PAYMENTS

The amount of each fixed Annuity Income Payment will be determined by applying the portion of the Contract Value allocated by You for Fixed Annuitization on the Annuity Date, less any applicable premium taxes, to the annuity factor applicable to the fixed Annuity Income Payment option chosen. In no event will the Fixed Annuitization be changed once it begins.

| US-803 (12/15) | 15 |

Table of Contents

AMOUNT OF VARIABLE ANNUITY INCOME PAYMENTS

| (a) | FIRST VARIABLE ANNUITY INCOME PAYMENT: The dollar amount of the first Variable Annuitization payment will be determined by applying the portion of the Contract Value allocated to the Variable Portfolio(s) on the Annuity Date, less any applicable premium taxes, to the annuity factor applicable to the variable Annuity Income Payment option chosen. If the Contract Value is allocated to more than one Variable Portfolio, the value of Your allocation in each Variable Portfolio is applied separately to the variable Annuity Income Payment option factor to determine the amount of the first Annuity Income Payment attributable to each Variable Portfolio. |

| (b) | NUMBER OF VARIABLE ANNUITY UNITS: The number of Annuity Units for each applicable Variable Portfolio is the amount of the first Annuity Income Payment attributable to that Variable Portfolio divided by the value of the applicable Annuity Unit for that Variable Portfolio as of the Annuity Date. The number of Annuity Units will not change as a result of investment experience. |

| (c) | VALUE OF EACH VARIABLE ANNUITY UNIT: The value of an Annuity Unit may increase or decrease from one month to the next. For any month, the value of an Annuity Unit of a particular Variable Portfolio is the value of that Annuity Unit as of the last Business Day of the preceding month, multiplied by the Net Investment Factor for that Variable Portfolio for the last Business Day of the current month. |

The Net Investment Factor for any Variable Portfolio for a certain month is determined by dividing (1) by (2) and multiplying by (3) where:

| (1) | is the Accumulation Unit Value of the Variable Portfolio determined as of the last Business Day at the end of that month, and |

| (2) | is the Accumulation Unit Value of the Variable Portfolio determined as of the last Business Day at the end of the preceding month, and |

| (3) | is a monthly discount factor of an assumed annualized investment rate of 3.50%. |

| (d) | SUBSEQUENT VARIABLE ANNUITY INCOME PAYMENTS: After the first Variable Annuitization payment, subsequent Variable Annuitization payments will vary in amount according to the investment performance of the applicable Variable Portfolio(s) in which You are invested. The amount may change from month to month. The amount of each subsequent payment for each Variable Portfolio is (1) multiplied by (2) where: |

| (1) | is the number of Annuity Units for each Variable Portfolio as determined for the first Annuity Income Payment, and |

| (2) | is the value of an Annuity Unit for that Variable Portfolio determined as of the last Business Day at the end of the month immediately preceding the month in which the Annuity Income Payment is due. |

We guarantee that the amount of each Variable Annuitization payments will not be affected by variations in expenses or mortality experience.

| US-803 (12/15) | 16 |

Table of Contents

ENTIRE CONTRACT

The Entire Contract between You and Us consists of this Contract, the Application for this Contract and any attached endorsement(s) and/or rider(s). Any change must be In Writing and approved by Us. Only Our President, Secretary, or one of Our Vice-Presidents can give Our approval. All statements made by the applicant for the issuance of this Contract shall, in absence of fraud, be deemed representations and not warranties.

CHANGE OF ANNUITANT

If the Owner is an individual, the Owner may change the Annuitant(s) at any time prior to the Annuity Date, subject to Our approval. To request such a change, the Owner must send a request In Writing at least thirty (30) days before the Annuity Date. If the Owner is a trust or other non-natural person, the Owner may not change the Annuitant. Any change of the Annuitant may have income tax consequences.

DEATH OF ANNUITANT

If the Owner is an individual, the Owner and Annuitant are different persons, and the Annuitant dies before the Annuity Date, the Owner becomes the Annuitant until the Owner elects a new Annuitant. If there are Joint Annuitants, upon the death of any Annuitant prior to the Annuity Date, the Owner may elect a new Joint Annuitant, subject to Our approval. However, if the Owner is a trust or other non-natural person, We will treat the death of any Annuitant as the death of the “Primary Annuitant” as defined in the IRC, and as the death of the Owner, as explained in the DEATH PROVISIONS.

MISSTATEMENT OF AGE OR SEX

You must, upon Our request, provide proof of the Annuitant’s birth date and sex. If the Age or sex of any Annuitant is misstated, We will adjust future Annuity Income Payments. The amount remaining to be paid will be the amount that should have been paid with the correct information. We will credit or charge the amount of any underpayment or overpayment against the next succeeding Annuity Income Payment(s), if any remain. We reserve the right to collect any overpayment directly from the Payee.

With respect to Contract issue Age and other age driven features in the Contract, should We discover a misstatement of Age such that You would not otherwise qualify for an Age-driven benefit, We may fully pursue Our remedies including possible revocation of any Age driven benefits. A Written notification will be provided to the Owner at least ten (10) days prior to the revocation of the Contract.

PROOF OF AGE, SEX, OR SURVIVAL

We may require satisfactory proof of correct Age or sex at any time. If any payment under this Contract depends on the Annuitant being alive, We may reasonably require satisfactory proof of survival.

DEFERMENT OF PAYMENTS

We may defer making payments, subject to state requirements, from the available Fixed Account Option(s) for up to six (6) months. Interest, subject to state requirements, will be credited during the deferral period.

SUSPENSION OF PAYMENTS

We may suspend or postpone any payments from the Variable Portfolios if any of the following occur:

| (a) | the NYSE is closed (other than customary weekend and holiday closings); |

| (b) | trading on the NYSE is restricted; |

| US-803 (12/15) | 17 |

Table of Contents

| (c) | an emergency exists such that it is not reasonably practical to dispose of securities in the Variable Portfolios or to determine the value of its assets; |

| (d) | the United States Securities and Exchange Commission, by order, so permits for the protection of Owners; or |

| (e) | We are on notice that this Contract is the subject of a court proceeding, an arbitration, a regulatory matter or other legal action. |

Conditions in (b) and (c) will be decided by or in accordance with rules of the United States Securities and Exchange Commission.

CONFORMITY WITH STATE LAWS

The provisions of this Contract will be interpreted by the laws of the State of New York, the state in which this Contract is delivered. Any provision which, on the Contract Date, is in conflict with the law of such state is amended to conform to the minimum requirements of such law. The paid-up annuity benefits, cash surrender benefits, and death benefits provided under this Contract are not less than those required by the state where the contract was issued.

CHANGES IN LAW

If the laws governing this Contract or the taxation of benefits under the Contract change, We will amend this Contract, subject to New York State Department of Financial Services approval, to comply with any changes.

ASSIGNMENT / CHANGE OF OWNER

Unless restricted by federal tax law, this Contract can be assigned before the Annuity Date, but We will not be bound by an assignment or change of Owner unless the request for assignment is In Writing and is recorded. Your rights and those of any other person referred to in this Contract will be subject to the assignment. Certain assignments may be taxable. We do not assume any responsibility for the validity or tax consequences of any assignment. The assignment, unless otherwise specified by You, will take effect on the date that You signed the notice of assignment, subject to any payments made or actions taken by Us prior to Us receiving such assignment In Writing. We reserve the right to not recognize assignments or change of Owner if it changes the risk profile of the Owner of the Contract as determined in Our sole discretion.

INSURABLE INTEREST

Evidence must exist that the Owner(s), Annuitant(s) or Beneficiary(ies) will suffer a financial loss at the death of the life that triggers the Death Benefit. Generally, We consider an interest insurable if a familial relationship and/or economic interest exists. A familial relationship generally includes those persons related by blood or by law. An economic interest exists when the Owner has a lawful and substantial economic interest in having the life, health or bodily safety of the insured life preserved.

CLAIMS OF CREDITORS

To the extent permitted by law, no right or proceeds payable under this Contract will be subject to claims of creditors or legal process.

PREMIUM TAXES OR OTHER TAXES

We may deduct from Your Contract Value any premium tax or other taxes payable to a state or other government entity, if applicable. Should We advance any amount so due, We are not waiving any right to collect such amount at a later date. We will deduct any withholding taxes required by applicable law.

| US-803 (12/15) | 18 |

Table of Contents

WRITTEN NOTICE

Any notice We send to You will be sent to Your address shown in the Application unless You request otherwise.

PERIODIC REPORTS

At least once during each Contract Year, We will send You a statement of the account activity of the Contract. The statement will include all transactions which have occurred during the accounting period shown on the statement.

INCONTESTABILITY

This Contract will be incontestable after it has been in force for a period of two years from the Contract Date during the lifetime of any Owner who is required to provide Us with information concerning their such Owner’s identity. Accurate statements as to any Owner’s identity are required as a condition of issuing this Contract. The Incontestability of this Contract applies to any statements any Owner makes, except as otherwise stated in the Misstatement of Age or Sex Provision.

NONPARTICIPATING

This Contract does not share in Our surplus.

WAIVER

Our waiver of any of the terms and conditions under this Contract will not be deemed to constitute waiver of the right to enforce strict compliance.

| US-803 (12/15) | 19 |

Table of Contents

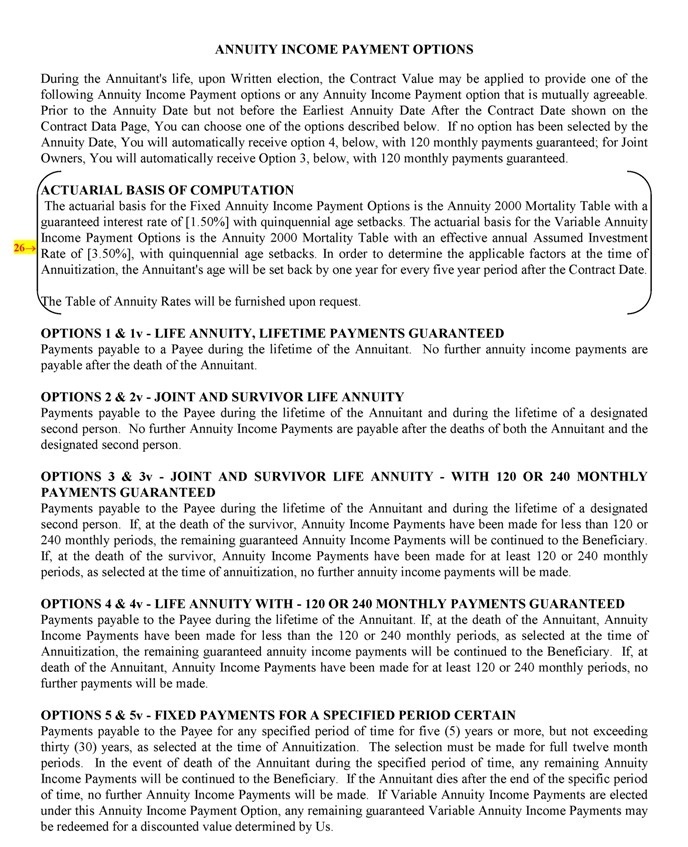

ANNUITY INCOME PAYMENT OPTIONS During the Annuitant’s life, upon Written election, the

Contract Value may be applied to provide one of the following Annuity Income Payment options or any Annuity Income Payment option that is mutually agreeable. Prior to the Annuity Date but not before the Earliest Annuity Date After the Contract Date

shown on the Contract Data Page, You can choose one of the options described below. If no option has been selected by the Annuity Date, You will automatically receive option 4, below, with 120 monthly payments guaranteed; for Joint Owners, You will

automatically receive Option 3, below, with 120 monthly payments guaranteed.

ACTUARIAL BASIS OF COMPUTATION

The actuarial basis for the Fixed Annuity Income Payment Options is the Annuity 2000 Mortality Table with a guaranteed interest rate of [1.50%] with quinquennial age setbacks. The

actuarial basis for the Variable Annuity Income Payment Options is the Annuity 2000 Mortality Table with an effective annual Assumed Investment 26? Rate of [3.50%], with quinquennial age setbacks. In order to determine the applicable factors at the

time of Annuitization, the Annuitant’s age will be set back by one year for every five year period after the Contract Date.

The Table of Annuity Rates will be

furnished upon request.

OPTIONS 1 & 1v—LIFE ANNUITY, LIFETIME PAYMENTS GUARANTEED

Payments payable to a Payee during the lifetime of the Annuitant. No further annuity income payments are payable after the death of the Annuitant.

OPTIONS 2 & 2v—JOINT AND SURVIVOR LIFE ANNUITY

Payments payable to the Payee during

the lifetime of the Annuitant and during the lifetime of a designated second person. No further Annuity Income Payments are payable after the deaths of both the Annuitant and the designated second person.

OPTIONS 3 & 3v—JOINT AND SURVIVOR LIFE ANNUITY—WITH 120 OR 240 MONTHLY PAYMENTS GUARANTEED

Payments payable to the Payee during the lifetime of the Annuitant and during the lifetime of a designated second person. If, at the death of the survivor, Annuity Income Payments

have been made for less than 120 or 240 monthly periods, the remaining guaranteed Annuity Income Payments will be continued to the Beneficiary. If, at the death of the survivor, Annuity Income Payments have been made for at least 120 or 240 monthly

periods, as selected at the time of annuitization, no further annuity income payments will be made.

OPTIONS 4 & 4v—LIFE ANNUITY WITH—120 OR 240

MONTHLY PAYMENTS GUARANTEED

Payments payable to the Payee during the lifetime of the Annuitant. If, at the death of the Annuitant, Annuity Income Payments have

been made for less than the 120 or 240 monthly periods, as selected at the time of Annuitization, the remaining guaranteed annuity income payments will be continued to the Beneficiary. If, at death of the Annuitant, Annuity Income Payments have been

made for at least 120 or 240 monthly periods, no further payments will be made.

OPTIONS 5 & 5v—FIXED PAYMENTS FOR A SPECIFIED PERIOD CERTAIN

Payments payable to the Payee for any specified period of time for five (5) years or more, but not exceeding thirty (30) years, as selected at the time of Annuitization.

The selection must be made for full twelve month periods. In the event of death of the Annuitant during the specified period of time, any remaining Annuity Income Payments will be continued to the Beneficiary. If the Annuitant dies after the end of

the specific period of time, no further Annuity Income Payments will be made. If Variable Annuity Income Payments are elected under this Annuity Income Payment Option, any remaining guaranteed Variable Annuity Income Payments may be redeemed for a

discounted value determined by Us.

| US-803 (12/15) | 20 |