CUSTODIAN CONTRACT

Exhibit (g)(i)

This Contract between The Select Sector SPDR Trust, a business trust organized and existing under the laws of the Commonwealth of Massachusetts, having its principal place of business at ▇▇▇ ▇▇▇▇▇▇▇▇ ▇▇▇▇▇▇, ▇▇▇▇▇▇, ▇▇▇▇▇▇▇▇▇▇▇▇▇, ▇▇▇▇▇, hereinafter called the “Trust”, and State Street Bank and Trust Company, a Massachusetts trust company, having its principal place of business at ▇▇▇ ▇▇▇▇▇▇▇▇ ▇▇▇▇▇▇, ▇▇▇▇▇▇, ▇▇▇▇▇▇▇▇▇▇▇▇▇, ▇▇▇▇▇, hereinafter called the “Custodian”,

WITNESSETH:

WHEREAS, the Trust is registered as an open-end management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”); and

WHEREAS, the Trust is authorized to issue shares in separate series, with each such series representing interests in a separate portfolio of securities and other assets; and

WHEREAS, the Trust intends to initially offer shares (the “Shares”) in nine (9) series, The Basic Industries Select Sector SPDR Fund, The Consumer Services Select Sector SPDR Fund, The Consumer Staples Select Sector SPDR Fund, The Cyclical/Transportation Select Sector SPDR Fund, The Energy Select Sector SPDR Fund, The Financial Select Sector SPDR Fund, The Industrial Select Sector SPDR Fund, The Technology Select Sector SPDR Fund, and The Utilities Select Sector SPDR Fund (such series together with all other series subsequently established by the Trust and made subject to this Contract in accordance with paragraph 17, being herein referred to as the “Fund(s)”);

WHEREAS, the Trust will issue and redeem shares of each Fund only in aggregations of shares known as “Creation Units” (currently 50,000 shares in the case of each Fund) principally in kind for portfolio securities of the respective Fund, as more fully described in the prospectus and statement of additional information of the Trust (together, the “Prospectus”) included in its registration statement on Form N-1A (the “Registration Statement”) (Reg. Nos. 333-57791; 811-08837);

NOW THEREFORE, in consideration of the mutual covenants and agreements hereinafter contained, the parties hereto agree as follows:

| 1. | Employment of Custodian and Property to be Held by It |

The Trust hereby employs the Custodian as the custodian of the assets of the Funds of the Trust pursuant to the provisions of the Declaration of Trust. The Trust on behalf of the Fund(s) agrees to deliver to the Custodian all securities and cash of the Funds, and all payments of income, payments of principal or capital distributions received by it with respect to all securities owned by the Fund(s) from time to time, and the consideration received by it for such new or treasury Shares as may be issued or sold from time to time. The Custodian shall not be responsible for any property of a Fund held or received by the Fund and not delivered to the Custodian.

1

Upon receipt of “Proper Instructions” (within the meaning of Article 4), the Custodian shall on behalf of the applicable Fund(s) from time to time employ one or more sub-custodians, but only in accordance with an applicable vote by the Board of Trustees of the Trust on behalf of the applicable Fund(s), and provided that the Custodian shall have no more or less responsibility or liability to the Trust on account of any actions or omissions of any sub-custodian so employed than any such sub-custodian has to the Custodian.

| 2. | Duties of the Custodian with Respect to Property of the Trust Held By the Custodian |

| 2.1 | Holding Securities. The Custodian shall hold and physically segregate for the account of each Fund all non-cash property, including all securities owned by such Fund, other than (a) securities which are maintained pursuant to Section 2.10 in a clearing agency registered with the United States Securities and Exchange Commission (the “SEC”) under Section 17A of the Exchange Act, which acts as a securities depository, or in the book-entry system authorized by the U.S. Department of the Treasury and certain federal agencies (each, a “U.S. Securities System”) and (b) commercial paper of an issuer for which State Street Bank and Trust Company acts as issuing and paying agent (“Direct Paper”) which is deposited and/or maintained in the Direct Paper System (the “Direct Paper System”) of the Custodian pursuant to Section 2.11. |

| 2.2 | Delivery of Securities. The Custodian shall release and deliver securities owned by a Fund held by the Custodian or in a Securities System account of the Custodian or in the Custodian’s Direct Paper book entry system account (“Direct Paper System Account”) only upon receipt of Proper Instructions from the Trust on behalf of the applicable Fund, which may be continuing instructions when deemed appropriate by the parties, and only in the following cases: |

| 1) | Upon sale of such securities for the account of the Fund and receipt of payment therefor; |

| 2) | Upon the receipt of payment in connection with any repurchase agreement related to such securities entered into by the Fund; |

| 3) | In the case of a sale effected through a Securities System, in accordance with the provisions of Section 2.10 hereof; |

| 4) | To the depository agent in connection with tender or other similar offers for securities of the Fund; |

| 5) | To the issuer thereof or its agent when such securities are called, redeemed, retired or otherwise become payable; provided that, in any such case, the cash or other consideration is to be delivered to the Custodian; |

2

| 6) | To the issuer thereof, or its agent, for transfer into the name of the Fund or into the name of any nominee or nominees of the Custodian or into the name or nominee name of any agent appointed pursuant to Section 2.9 or into the name or nominee name of any sub-custodian appointed pursuant to Article 1; or for exchange for a different number of bonds, certificates or other evidence representing the same aggregate face amount or number of units; provided that, in any such case, the new securities are to be delivered to the Custodian; |

| 7) | Upon the sale of such securities for the account of the Fund, to the broker or its clearing agent, against a receipt, for examination in accordance with “street delivery” custom; provided that in any such case, the Custodian shall have no responsibility or liability for any loss arising from the delivery of such securities prior to receiving payment for such securities except as may arise from the Custodian’s own negligence or willful misconduct; |

| 8) | For exchange or conversion pursuant to any plan of merger, consolidation, recapitalization, reorganization or readjustment of the securities of the issuer of such securities, or pursuant to provisions for conversion contained in such securities, or pursuant to any deposit agreement; provided that, in any such case, the new securities and cash, if any, are to be delivered to the Custodian; |

| 9) | In the case of warrants, rights or similar securities, the surrender thereof in the exercise of such warrants, rights or similar securities or the surrender of interim receipts or temporary securities for definitive securities; provided that, in any such case, the new securities and cash, if any, are to be delivered to the Custodian; |

| 10) | For delivery in connection with any loans of securities made by the Fund, but only against receipt of adequate collateral as agreed upon from time to time by the Custodian and the Trust on behalf of the Fund, which may be in the form of cash or obligations issued by the United States government, its agencies or instrumentalities, except that in connection with any loans for which collateral is to be credited to the Custodian’s account in the book-entry system authorized by the U.S. Department of the Treasury, the Custodian will not be held liable or responsible for the delivery of securities owned by the Fund prior to the receipt of such collateral; |

| 11) | For delivery as security in connection with any borrowings by the Trust on behalf of the Fund requiring a pledge of assets by the Trust on behalf of the Fund, but only against receipt of amounts borrowed; |

| 12) | For delivery in accordance with the provisions of any agreement among the Trust on behalf of the Fund, the Custodian and a broker-dealer registered under the Securities Exchange Act of 1934 (the “Exchange Act”) and a member of The National Association of Securities Dealers, Inc. (“NASD”), relating to compliance with the rules of The Options Clearing Corporation and of any registered national securities exchange, or of any similar organization or organizations, regarding escrow or other arrangements in connection with transactions by the Fund of the Trust; |

3

| 13) | For delivery in accordance with the provisions of any agreement among the Trust on behalf of the Fund, the Custodian, and a futures commission merchant registered under the Commodity Exchange Act, relating to compliance with the rules of the Commodity Futures Trading Commission (“CFTC”) and/or any contract market, or any similar organization or organizations, regarding account deposits in connection with transactions by the Fund of the Trust; |

| 14) | Upon receipt of instructions from the transfer agent for the Trust (the “Transfer Agent”) for delivery to such Transfer Agent or to the holders of Shares in connection with distributions in kind, as may be described from time to time in the Prospectus, in satisfaction of requests by holders of Shares for repurchase or redemption; and |

| 15) | For any other proper trust purpose, but only upon receipt of Proper Instructions from the Trust on behalf of the applicable Fund specifying the securities of the Fund to be delivered, setting forth the purpose for which such delivery is to be made, declaring such purpose to be a proper trust purpose, and naming the person or persons to whom delivery of such securities shall be made. |

| 2.3 | Registration of Securities. Securities held by the Custodian (other than bearer securities) shall be registered in the name of the Fund or in the name of any nominee of the Trust on behalf of the Fund or of any nominee of the Custodian which nominee shall be assigned exclusively to the Fund, unless the Trust has authorized in writing the appointment of a nominee to be used in common with other registered investment companies having the same investment adviser as the Fund, or in the name or nominee name of any agent appointed pursuant to Section 2.9 or in the name or nominee name of any sub-custodian appointed pursuant to Article 1. All securities accepted by the Custodian on behalf of the Fund under the terms of this Contract shall be in “street name” or other good delivery form. If, however, the Trust directs the Custodian to maintain securities in “street name”, the Custodian shall utilize its best efforts only to timely collect income due the Trust on such securities and to notify the Trust on a best efforts basis only of relevant corporate actions including, without limitation, pendency of calls, maturities, tender or exchange offers. |

| 2.4 | Bank Accounts. The Custodian shall open and maintain a separate bank account or accounts in the name of each Fund of the Trust, subject only to draft or order by the Custodian acting pursuant to the terms of this Contract, and shall hold in such account or accounts, subject to the provisions hereof, all cash received by it from or for the account of the Fund, other than cash maintained by the Fund in a bank account established and used in accordance with Rule 17f-3 under the Investment Company Act of 1940, as amended (the “1940 Act”). Funds held by the Custodian for a Fund may be deposited by it to its credit as Custodian in the Banking Department of the Custodian or in such other banks or trust companies as it may in its discretion deem necessary or desirable; provided, however, that every such bank or trust company shall be qualified to act as a custodian under the 1940 Act and that each such bank or trust company and the funds to be |

4

| deposited with each such bank or trust company shall on behalf of each applicable Fund be approved by vote of a majority of the Board of Trustees of the Trust. Such funds shall be deposited by the Custodian in its capacity as Custodian and shall be withdrawable by the Custodian only in that capacity. |

| 2.5 | Determination of Fund Deposit, etc. Subject to and in accordance with the directions of the investment adviser for the Funds, the Custodian shall determine for each Fund after the end of each trading day on the New York Stock Exchange, in accordance with the respective Fund’s policies as adopted from time to time by the Board of Trustees and in accordance with the procedures set forth in the Prospectus, (i) the identity and weighting of the securities in the Deposit Securities and the Fund Securities, (ii) the Cash Component (including the Dividend Equivalent Amount), and (iii) the amount of cash redemption proceeds (all as defined in the Registration Statement) required for the issuance or redemption, as the case may be, of Shares in Creation Unit aggregations of such Fund on such date. The Custodian shall provide or cause to be provided this information to the Funds’ distributor and other persons according to the policy established by the Trust’s Board of Trustees and shall disseminate such information on each day that the American Stock Exchange is open, including through the facilities of the National Securities Clearing Corporation, prior to the opening of trading on the American Stock Exchange. |

| 2.6 | Collection of Income. Subject to the provisions of Section 2.3, the Custodian shall collect on a timely basis all income and other payments with respect to registered securities held hereunder to which each Fund shall be entitled either by law or pursuant to custom in the securities business, and shall collect on a timely basis all income and other payments with respect to bearer securities if, on the date of payment by the issuer, such securities are held by the Custodian or its agent thereof and shall credit such income, as collected, to such Fund’s custodian account. Without limiting the generality of the foregoing, the Custodian shall detach and present for payment all coupons and other income items requiring presentation as and when they become due and shall collect interest when due on securities held hereunder. Income due each Fund on securities loaned pursuant to the provisions of Section 2.2 (10) shall be the responsibility of the Trust. The Custodian will have no duty or responsibility in connection therewith, other than to provide the Trust with such information or data as may be necessary to assist the Trust in arranging for the timely delivery to the Custodian of the income to which the Fund is properly entitled. |

| 2.7 | Payment of Trust Monies. Upon receipt of Proper Instructions from the Trust on behalf of the applicable Fund, which may be continuing instructions when deemed appropriate by the parties, the Custodian shall pay out monies of a Fund in the following cases only: |

| 1) | Upon the purchase of domestic securities, options, futures contracts or options on futures contracts for the account of the Fund but only (a) against the delivery of such securities or evidence of title to such options, futures contracts or options on futures contracts to the Custodian (or any bank, banking firm or trust company doing business in the United States or abroad which is qualified under the 1940 Act, as amended, to act as a custodian and has been designated by the Custodian |

5

| as its agent for this purpose) registered in the name of the Fund or in the name of a nominee of the Custodian referred to in Section 2.3 hereof or in proper form for transfer; (b) in the case of a purchase effected through a U.S. Securities System, in accordance with the conditions set forth in Section 2.10 hereof; (c) in the case of a purchase involving the Direct Paper System, in accordance with the conditions set forth in Section 2.11; (d) in the case of repurchase agreements entered into between the Trust on behalf of the Fund and the Custodian, or another bank, or a broker-dealer which is a member of NASD, (i) against delivery of the securities either in certificate form or through an entry crediting the Custodian’s account at the Federal Reserve Bank with such securities or (ii) against delivery of the receipt evidencing purchase by the Fund of securities owned by the Custodian along with written evidence of the agreement by the Custodian to repurchase such securities from the Fund or (e) for transfer to a time deposit account of the Trust in any bank, whether domestic or foreign; such transfer may be effected prior to receipt of a confirmation from a broker and/or the applicable bank pursuant to Proper Instructions from the Trust as defined herein; |

| 2) | In connection with conversion, exchange or surrender of securities owned by the Fund as set forth in Section 2.2 hereof; |

| 3) | For the redemption or repurchase of Creation Unit aggregations of Shares issued as set forth in Article 4 hereof; |

| 4) | For the payment of any expense or liability incurred by the Fund, including but not limited to the following payments for the account of the Fund: interest, taxes, management, accounting, transfer agent and legal fees, and operating expenses of the Trust whether or not such expenses are to be in whole or part capitalized or treated as deferred expenses; |

| 5) | For the payment of any dividends on Shares declared pursuant to the governing documents of the Trust; |

| 6) | For repayment of loans made to a Fund or upon redelivery of collateral for loans of securities made by a Fund or for payment in connection with a foreign exchange transaction; |

| 7) | For any other proper Trust purpose, but only upon receipt of Proper Instructions from the Trust on behalf of the Fund specifying the amount of such payment, setting forth the purpose for which such payment is to be made, declaring such purpose to be a proper Trust purpose, and naming the person or persons to whom such payment is to be made. |

| 2.8 | [Reserved]. |

| 2.9 | Appointment of Agents. The Custodian may at any time or times, in compliance with the 1940 Act, in its discretion appoint (and may at any time remove) any other bank or trust company which is itself qualified under the 1940 Act to act as a custodian, as its agent to carry out such of the provisions of this Article 2 as the Custodian may from time to time direct; provided, however, that the appointment of any agent shall not relieve the Custodian of its responsibilities or liabilities hereunder. |

6

| 2.10 | Deposit of Trust Assets in U.S. Securities Systems. The Custodian may deposit and/or maintain securities owned by a Fund in a U.S. Securities System in accordance with applicable Federal Reserve Board and SEC rules and regulations, if any, and subject to the following provisions: |

| 1) | The Custodian may keep securities of the Fund in a U.S. Securities System provided that such securities are represented in an account of the Custodian in the U.S. Securities System (the “U.S. Securities System Account”) which account shall not include any assets of the Custodian other than assets held as a fiduciary, custodian or otherwise for customers; |

| 2) | The records of the Custodian with respect to securities of the Fund which are maintained in a U.S. Securities System shall identify by book-entry those securities belonging to the Fund; |

| 3) | The Custodian shall pay for securities purchased for the account of the Fund upon (i) receipt of advice from the U.S. Securities System that such securities have been transferred to the U.S. Securities System Account, and (ii) the making of an entry on the records of the Custodian to reflect such payment and transfer for the account of the Fund. The Custodian shall transfer securities sold for the account of the Fund upon (i) receipt of advice from the U.S. Securities System that payment for such securities has been transferred to the U.S. Securities System Account, and (ii) the making of an entry on the records of the Custodian to reflect such transfer and payment for the account of the Fund. Copies of all advices from the U.S. Securities System of transfers of securities for the account of the Fund shall identify the Fund, be maintained for the Fund by the Custodian and be provided to the Trust at its request. Upon request, the Custodian shall furnish the Trust on behalf of the Fund confirmation of each transfer to or from the account of the Fund in the form of a written advice or notice and shall furnish to the Trust on behalf of the Fund copies of daily transaction sheets reflecting each day’s transactions in the U.S. Securities System for the account of the Fund; |

| 4) | The Custodian shall provide the Trust with any report obtained by the Custodian on the U.S. Securities System’s accounting system, internal accounting control and procedures for safeguarding securities deposited in the U.S. Securities System; |

| 5) | The Custodian shall have received from the Trust on behalf of the Fund the initial or annual certificate, as the case may be, required by Article 14 hereof; |

| 6) | Anything to the contrary in this Contract notwithstanding, the Custodian shall be liable to the Trust for the benefit of the Fund for any loss or damage to the Fund resulting from use of the U.S. Securities System by reason of any negligence, misfeasance or misconduct of the Custodian or any of its agents or of any of its or |

7

| their employees or from failure of the Custodian or any such agent to enforce effectively such rights as it may have against the U.S. Securities System; at the election of the Trust, it shall be entitled to be subrogated to the rights of the Custodian with respect to any claim against the U.S. Securities System or any other person which the Custodian may have as a consequence of any such loss or damage if and to the extent that the Fund has not been made whole for any such loss or damage. |

| 2.11 | Trust Assets Held in the Custodian’s Direct Paper System. The Custodian may deposit and/or maintain securities owned by a Fund in the Direct Paper System of the Custodian subject to the following provisions: |

| 1) | No transaction relating to securities in the Direct Paper System will be effected in the absence of Proper Instructions from the Trust on behalf of the Fund; |

| 2) | The Custodian may keep securities of the Fund in the Direct Paper System only if such securities are represented in the Direct Paper System Account which account shall not include any assets of the Custodian other than assets held as a fiduciary, custodian or otherwise for customers; |

| 3) | The records of the Custodian with respect to securities of the Fund which are maintained in the Direct Paper System shall identify by book-entry those securities belonging to the Fund; |

| 4) | The Custodian shall pay for securities purchased for the account of the Fund upon the making of an entry on the records of the Custodian to reflect such payment and transfer of securities to the account of the Fund. The Custodian shall transfer securities sold for the account of the Fund upon the making of an entry on the records of the Custodian to reflect such transfer and receipt of payment for the account of the Fund; |

| 5) | The Custodian shall furnish the Trust on behalf of the Fund confirmation of each transfer to or from the account of the Fund, in the form of a written advice or notice, of Direct Paper on the next business day following such transfer and shall furnish to the Trust on behalf of the Fund copies of daily transaction sheets reflecting each day’s transaction in the Direct Paper System for the account of the Fund; |

| 6) | The Custodian shall provide the Trust on behalf of the Fund with any report on its system of internal accounting control as the Trust may reasonably request from time to time. |

| 2.12 | Segregated Account. The Custodian shall upon receipt of Proper Instructions from the Trust on behalf of each applicable Fund establish and maintain a segregated account or accounts for and on behalf of each such Fund, into which account or accounts may be transferred cash and/or securities, including securities maintained in an account by the Custodian pursuant to Section 2.10 hereof, (i) in accordance with the provisions of any |

8

| agreement among the Trust on behalf of the Fund, the Custodian and a broker-dealer registered under the Exchange Act and a member of the NASD (or any futures commission merchant registered under the Commodity Exchange Act), relating to compliance with the rules of The Options Clearing Corporation and of any registered national securities exchange (or the CFTC or any registered contract market), or of any similar organization or organizations, regarding escrow or other arrangements in connection with transactions by the Fund, (ii) for purposes of segregating cash or securities in connection with options purchased, sold or written by the Fund or commodity futures contracts or options thereon purchased or sold by the Fund, (iii) for the purposes of compliance by the Fund with the procedures required by Investment Company Act Release No. 10666, or any subsequent release of the SEC, or interpretative opinion of the staff of the SEC relating to the maintenance of segregated accounts by registered investment companies, (iv) for purposes of segregating cash deposits, representing 115% of missing Deposit Securities, made pending delivery of such missing Deposit Securities and utilized by the Trust to cover costs of acquiring such missing Deposit Securities as provided for in the Prospectus, and (v) for other proper trust purposes, but only, in the case of clause (v), upon receipt of Proper Instructions from the Trust on behalf of the applicable Fund setting forth the purpose or purposes of such segregated account and declaring such purpose to be a proper trust purpose. |

| 2.13 | Ownership Certificates for Tax Purposes. The Custodian shall execute ownership and other certificates and affidavits for all federal and state tax purposes in connection with receipt of income or other payments with respect to securities of each Fund held by it and in connection with transfers of securities. |

| 2.14 | Proxies. The Custodian shall, with respect to the securities held hereunder, cause to be promptly executed by the registered holder of such securities, if the securities are registered otherwise than in the name of the Fund or a nominee of the Fund, all proxies, without indication of the manner in which such proxies are to be voted, and shall promptly deliver to the Fund such proxies, all proxy soliciting materials and all notices relating to such securities. |

| 2.15 | Communications Relating to Fund Securities. Subject to the provisions of Section 2.3, the Custodian shall transmit promptly to the Trust for each Fund all written information (including, without limitation, pendency of calls and maturities of securities and expirations of rights in connection therewith and notices of exercise of call and put options written by the Trust on behalf of any Fund and the maturity of futures contracts purchased or sold by a Fund) received by the Custodian from issuers of the securities being held for such Fund. With respect to tender or exchange offers, the Custodian shall transmit promptly to a Fund all written information received by the Custodian from issuers of the securities held by such Fund whose tender or exchange is sought and from the party (or his agents) making the tender or exchange offer. If the Trust desires to take action with respect to any tender offer, exchange offer or any other similar transaction, the Trust shall notify the Custodian at least three business days prior to the date on which the Custodian is to take such action. |

9

| 3. | Payments for Repurchases or Redemptions and Sales of Shares of the Trust |

From such funds and securities as may be available for the purpose but subject to the limitations of the Declaration of Trust and any applicable votes of the Board of Trustees of the Trust pursuant thereto, the Custodian shall, upon receipt of instructions from the Transfer Agent, make funds and securities available for payment to, or in accordance with the instructions of, Authorized Participants (as defined in the Prospectus) who have delivered to the Transfer Agent a Proper Instructions for the redemption or repurchase of their Shares, in Creation Unit aggregations, which shall have been accepted by the Transfer Agent, the applicable Fund Securities (as defined in the Prospectus) (or such securities in lieu thereof as may be designated by the investment adviser of the Trust in accordance with the Prospectus) for such Fund and the cash redemption payment, if applicable, less any applicable cash redemption transaction fee. The Custodian will transfer the applicable Trust Securities to or on the order of the Authorized Participant through the Clearing Process (as defined in the Prospectus) or, at the election of the Authorized Participant, outside the Clearing Process through the DTC system (as defined in the Prospectus). Any cash redemption payment (less any applicable cash redemption transaction fees) due to the Authorized Participant on redemption shall be effected through the Clearing Process or through wire transfer in the case of redemptions effected outside of the Clearing Process through the DTC system.

| 4. | Proper Instructions |

Proper Instructions as used throughout this Contract means a writing signed or initialed by one or more person or persons as the Board of Trustees shall have from time to time authorized. Each such writing shall set forth the specific transaction or type of transaction involved, including a specific statement of the purpose for which such action is requested. Oral instructions will be considered Proper Instructions if the Custodian reasonably believes them to have been given by a person authorized to give such instructions with respect to the transaction involved. The Trust shall cause all oral instructions to be confirmed in writing. Proper Instructions may include communications effected directly between electro-mechanical or electronic devices provided that the Trust and the Custodian agree to security procedures, including but not limited to, the security procedures selected by the Trust in the Funds Transfer Addendum attached hereto. For purposes of this Section, Proper Instructions shall include instructions received by the Custodian pursuant to any three-party agreement which requires a segregated asset account in accordance with Section 2.12.

| 5. | Actions Permitted without Express Authority |

The Custodian may in its discretion, without express authority from the Trust on behalf of each applicable Fund:

| 1) | make payments to itself or others for minor expenses of handling securities or other similar items relating to its duties under this Contract, provided that all such payments shall be accounted for to the Trust on behalf of the Fund; |

| 2) | surrender securities in temporary form for securities in definitive form; |

| 3) | endorse for collection, in the name of the Fund, checks, drafts and other negotiable instruments; and |

10

| 4) | in general, attend to all non-discretionary details in connection with the sale, exchange, substitution, purchase, transfer and other dealings with the securities and property of the Fund except as otherwise directed by the Board of Trustees of the Trust. |

| 6. | Evidence of Authority |

The Custodian shall be protected in acting upon any instructions, notice, request, consent, certificate or other instrument or paper believed by it to be genuine and to have been properly executed by or on behalf of the Trust. The Custodian may receive and accept a certified copy of a vote of the Board of Trustees of the Trust as conclusive evidence (a) of the authority of any person to act in accordance with such vote or (b) of any determination or of any action by the Board of Trustees pursuant to the Declaration of Trust as described in such vote; and such vote may be considered as in full force and effect until receipt by the Custodian of written notice to the contrary.

| 7. | Duties of Custodian with Respect to the Books of Account and Calculation of Net Asset Value, Net Income and Other Information |

The Custodian shall keep the books of account of each Fund and compute the net asset value per Share of the outstanding Shares. The Custodian shall transmit the net asset value per share of each Fund to the Transfer Agent, the Distributor, the American Stock Exchange (the “AMEX”) and to such other entities as directed in writing by the Trust. If directed in writing by the Trust to do so, the Custodian shall also calculate daily the net income of the Fund as described in the Prospectus and shall advise the Trust, the Distributor and the Transfer Agent daily of the total amounts of such net income and, if instructed in writing by an officer of the Trust to do so, shall advise the Transfer Agent periodically of the division of such net income among its various components. The calculations of the net asset value per Share and the daily income of each Fund shall be made at the time or times described from time to time in the Prospectus. The Custodian shall on each day a Fund is open for the purchase or redemption of Shares of such Fund compute the number of Shares of each Deposit Security (as defined in the Prospectus) to be included in the current Trust Deposit, the Dividend Equivalent Payment (as defined in the Prospectus) and the Fund Securities (as defined in the Prospectus) and shall transmit such information to the AMEX.

| 8. | Records |

The Custodian shall with respect to each Fund create and maintain all records relating to its activities and obligations under this Contract in such manner as will meet the obligations of the Trust under the 1940 Act, with particular attention to Section 31 thereof and Rules 31a-1 and 31a-2 thereunder. All such records shall be the property of the Trust and shall at all times during the regular business hours of the Custodian be open for inspection by duly authorized officers, employees or agents of the Trust and employees and agents of the SEC. The Custodian shall, at the Trust’s request, supply the Trust with a tabulation of securities owned by each Fund and held by the Custodian and shall, when requested to do so by the Trust and for such compensation as shall be agreed upon between the Trust and the Custodian, include certificate numbers in such tabulations.

11

| 9. | Opinion of Trust’s Independent Accountant |

The Custodian shall take all reasonable action, as the Trust on behalf of each applicable Fund may from time to time request, to obtain from year to year favorable opinions from the Trust’s independent accountants with respect to its activities hereunder in connection with the preparation of the Trust’s Form N-1A, and Form N-SAR or other annual reports to the SEC and with respect to any other requirements thereof.

| 10. | Report to Trust by Independent Public Accountants |

The Custodian shall provide the Trust, on behalf of each of the Funds at such times as the Trust may reasonably require, with reports by independent public accountants on the accounting system, internal accounting control and procedures for safeguarding securities, futures contracts and options on futures contracts, including securities deposited and/or maintained in a U.S. Securities System relating to the services provided by the Custodian under this Contract such reports, shall be of sufficient scope and in sufficient detail, as may reasonably be required by the Trust to provide reasonable assurance that any material inadequacies would be disclosed by such examination, and, if there are no such inadequacies, the reports shall so state.

| 11. | Compensation of Custodian |

The Custodian shall receive from the Trust such compensation for the Custodian’s services provided pursuant to this Agreement as may be agreed to from time to time in a written fee schedule approved by the parties and described in the then current Prospectus, and initially set forth as a “Unitary Fee” in the Custody, Accounting, Transfer Agent, Stock Transfer, Fund Administration and Advisory Fee Schedule to this Agreement.

| 12. | Responsibility of Custodian |

So long as and to the extent that it is in the exercise of reasonable care, the Custodian shall not be responsible for the title, validity or genuineness of any property or evidence of title thereto received by it or delivered by it pursuant to this Contract and shall be held harmless in acting upon any notice, request, consent, certificate or other instrument reasonably believed by it to be genuine and to be signed by the proper party or parties, including any futures commission merchant acting pursuant to the terms of a two-party or three-party futures or options agreement. The Custodian shall be held to the exercise of reasonable care in carrying out the provisions of this Contract but shall be kept indemnified by and shall be without liability to the Trust for any action taken or omitted by it in good faith without negligence. It shall be entitled to rely on and may act upon advice of counsel (who may be counsel for the Trust) on all matters, and shall be without liability for any action reasonably taken or omitted pursuant to such advice.

If the Trust on behalf of a Fund requires the Custodian to take any action with respect to securities, which action involves the payment of money or which action may, in the opinion of the Custodian, result in the Custodian or its nominee assigned to the Trust or the Fund being liable for the payment of money or incurring liability of some other form, the Trust on behalf of the Fund, as a prerequisite to requiring the Custodian to take such action, shall provide indemnity to the Custodian in an amount and form satisfactory to it.

12

If the Trust requires the Custodian, its affiliates, subsidiaries or agents, to advance cash or securities for any purpose (including but not limited to securities settlements, foreign exchange contracts and assumed settlement) or in the event that the Custodian or its nominee shall incur or be assessed any taxes, charges, expenses, assessments, claims or liabilities in connection with the performance of this Contract except such as may arise from its or its nominee’s own negligent action, negligent failure to act or willful misconduct, any property at any time held for the account of the applicable Fund shall be security therefor and should the Trust fail to repay the Custodian promptly, the Custodian shall be entitled to utilize available cash and to dispose of such Fund’s assets to the extent necessary to obtain reimbursement.

In no event shall the Custodian be liable for indirect, special or consequential damages.

| 13. | Effective Period, Termination and Amendment |

This Contract shall become effective as of its execution, shall continue in full force and effect until terminated as hereinafter provided, may be amended at any time by mutual agreement of the parties hereto and may be terminated by either party by an instrument in writing delivered or mailed, postage prepaid to the other party, such termination to take effect not sooner than thirty (30) after the date of such delivery or mailing; provided, however that the Custodian shall not with respect to a Fund act under Section 2.10 hereof in the absence of receipt of an initial certificate of the Secretary or an Assistant Secretary that the Board has approved the initial use of a particular Securities System by such Fund, as required by Rule 17f-4 under the 1940 Act and that the Custodian shall not with respect to a Fund act under Section 2.11 hereof in the absence of receipt of an initial certificate of the Secretary or an Assistant Secretary that the Board has approved the initial use of the Direct Paper System by such Fund; provided further, however, that the Trust shall not amend or terminate this Contract in contravention of any applicable federal or state regulations, or any provision of the Declaration of Trust, and further provided, that the Trust on behalf of one or more of the Trust’s may at any time by action of its Board (i) substitute another bank or trust company for the Custodian by giving notice as described above to the Custodian, or (ii) immediately terminate this Contract Agreement in the event of the appointment of a conservator or receiver for the Custodian by the Comptroller of the Currency or upon the happening of a like event at the direction of an appropriate regulatory agency or court of competent jurisdiction.

Upon termination of the Contract the Trust on behalf of each applicable Fund shall pay to the Custodian such compensation as may be due as of the date of such termination and shall likewise reimburse the Custodian for its reasonable costs, expenses and disbursements.

| 14. | Successor Custodian |

If a successor custodian for one or more Funds shall be appointed by the Board, the Custodian shall, upon termination, deliver to such successor custodian at the office of the Custodian, duly endorsed and in the form for transfer, all securities of each applicable Fund then held by it hereunder and shall transfer to an account of the successor custodian all of the securities of each such Fund held in a Securities System.

13

If no such successor custodian shall be appointed, the Custodian shall, in like manner, upon receipt of a Certified Resolution, deliver at the office of the Custodian and transfer such securities, funds and other properties in accordance with such resolution.

In the event that no written order designating a successor custodian or Certified Resolution shall have been delivered to the Custodian on or before the date when such termination shall become effective, then the Custodian shall have the right to deliver to a bank or trust company, which is a “bank” as defined in the 1940 Act, doing business in Boston, Massachusetts, or New York, New York, of its own selection, having an aggregate capital, surplus, and undivided profits, as shown by its last published report, of not less than $25,000,000, all securities, funds and other properties held by the Custodian on behalf of each applicable Fund and all instruments held by the Custodian relative thereto and all other property held by it under this Contract on behalf of each applicable Fund and to transfer to an account of such successor custodian all of the securities of each such Fund held in any Securities System. Thereafter, such bank or trust company shall be the successor of the Custodian under this Contract.

In the event that securities, funds and other properties remain in the possession of the Custodian after the date of termination hereof owing to failure of the Trust to procure the Certified Resolution to appoint a successor custodian, the Custodian shall be entitled to fair compensation for its services during such period as the Custodian retains possession of such securities, funds and other properties and the provisions of this Contract relating to the duties and obligations of the Custodian shall remain in full force and effect.

| 15. | Interpretive and Additional Provisions |

In connection with the operation of this Contract, the Custodian and the Trust on behalf of each of the Funds, may from time to time agree on such provisions interpretive of or in addition to the provisions of this Contract as may in their joint opinion be consistent with the general tenor of this Contract. Any such interpretive or additional provisions shall be in a writing signed by both parties and shall be annexed hereto, provided that no such interpretive or additional provisions shall contravene any applicable federal or state regulations or any provision of the Declaration of Trust of the Trust. No interpretive or additional provisions made as provided in the preceding sentence shall be deemed to be an amendment of this Contract.

| 16. | Additional Trusts |

In the event that the Trust establishes one or more series of Shares in addition to The Basic Industries Select Sector SPDR Fund, The Consumer Services Select Sector SPDR Fund, The Consumer Staples Select Sector SPDR Fund, The Cyclical/Transportation Select Sector SPDR Fund, The Energy Select Sector SPDR Fund, The Financial Select Sector SPDR Fund, The Industrial Select Sector SPDR Fund, The Technology Select Sector SPDR Fund, and The Utilities Select Sector SPDR Fund with respect to which it desires to have the Custodian render services as custodian under the terms hereof, it shall so notify the Custodian in writing, and if the Custodian agrees in writing to provide such services, such series of Shares shall become a Fund hereunder.

14

| 17. | Massachusetts Law to Apply |

This Contract shall be construed and the provisions thereof interpreted under and in accordance with laws of The Commonwealth of Massachusetts.

| 18. | Prior Contracts |

This Contract supersedes and terminates, as of the date hereof, all prior contracts between the Trust on behalf of each of the Funds and the Custodian relating to the custody of the Trust’s assets.

| 18A. | Notices |

Any notice, instruction or other instrument required to be given hereunder may be delivered in person to the offices of the parties as set forth herein during normal business hours or delivered prepaid registered mail or by telex, cable or telecopy to the parties at the following addresses or such other addresses as may be notified by any party from time to time.

| To the Trust: | The Select Sector SPDR Trust | |

| c/o State Street Bank and Trust Company | ||

| ▇▇▇ ▇▇▇▇▇▇▇▇ ▇▇▇▇▇▇ | ||

| ▇▇▇▇▇▇, ▇▇▇▇▇▇▇▇▇▇▇▇▇ ▇▇▇▇▇ | ||

| Attention: | ||

| Telephone: | ||

| Telecopy: | ||

| To the Custodian: | State Street Bank and Trust Company | |

| ▇▇▇▇ ▇▇▇▇▇▇▇▇ ▇▇▇▇▇ | ||

| ▇▇▇▇▇ ▇▇▇▇▇▇, ▇▇▇▇▇▇▇▇▇▇▇▇▇ ▇▇▇▇▇ | ||

| Attention: | ||

| Telephone: | ||

| Telecopy: | ||

Such notice, instruction or other instrument shall be deemed to have been served in the case of a registered letter at the expiration of five business days after posting, in the case of cable twenty-four hours after dispatch and, in the case of telex, immediately on dispatch and if delivered outside normal business hours commence and in the case of cable, telex or telecopy on the business day after the receipt thereof. Evidence that the notice was properly addressed, stamped and put into the post shall be conclusive evidence of posting.

15

| 19. | Reproduction of Documents |

This Contract and all schedules, exhibits, attachments and amendments hereto may be reproduced by any photographic, photostatic, microfilm, micro-card, miniature photographic or other similar process. The parties hereto all/each agree that any such reproduction shall be admissible in evidence as the original itself in any judicial or administrative proceeding, whether or not the original is in existence and whether or not such reproduction was made by a party in the regular course of business, and that any enlargement, facsimile or further reproduction of such reproduction shall likewise be admissible in evidence.

| 19A. | Data Access Services Addendum |

The Custodian and the Trust agree to be bound by the terms of the Data Access Services Addendum attached hereto.

| 20. | Shareholder Communications Election |

SEC Rule 14b-2 requires banks which hold securities for the account of customers to respond to requests by issuers of securities for the names, addresses and holdings of beneficial owners of securities of that issuer held by the bank unless the beneficial owner has expressly objected to disclosure of this information. In order to comply with the rule, the Custodian needs the Trust to indicate whether it authorizes the Custodian to provide the Trust’s name, address, and share position to requesting companies whose securities the Trust owns. If the Trust tells the Custodian “no”, the Custodian will not provide this information to requesting companies. If the Trust tells the Custodian “yes” or does not check either “yes” or “no” below, the Custodian is required by the rule to treat the Trust as consenting to disclosure of this information for all securities owned by the Trust or any funds or accounts established by the Trust. For the Trust’s protection, the Rule prohibits he requesting company from using the Trust’s name and address for any purpose other than corporate communications. Please indicate below whether the Trust consents or objects by checking one of the alternatives below.

16

| YES [ ] | The Custodian is authorized to release the Trust’s name, address, and share positions. | |

| NO [ ] | The Custodian is not authorized to release the Trust’s name, address, and share positions. | |

| 21. | Limitation of Liability |

The Declaration of Trust dated June 10, 1998, establishing the Trust, which is hereby referred to and a copy of which is on file with the Secretary of The Commonwealth of Massachusetts, provides that the name The Select Sector SPDR Trust means the Trustees from time to time serving (as Trustees but not personally) under such Declaration of Trust. It is expressly acknowledged and agreed that the obligations of the Trust hereunder shall not be binding upon any of the shareholders, Trustees, officers, employees or agents of the Trust, personally, but shall bind only the trust property of the Trust, as provided in its Declaration of Trust. The execution and delivery of this Agreement have been authorized by the Trustees of the Trust and signed by an officer of the Trust, acting as such, and neither such authorization by such Trustees nor such execution and delivery by such officer shall be deemed to have been made by any of them individually or to impose any liability on any of them personally, but shall bind only the trust property of the Trust as provided in its Declaration of Trust.

IN WITNESS WHEREOF, each of the parties has caused this instrument to be executed in its name and behalf by its duly authorized representative and its seal to be hereunder affixed as of the first day of December, 1998.

| ATTEST | THE SELECT SECTOR SPDR TRUST | |

| /s/ ▇▇▇▇▇▇▇ ▇. ▇▇▇▇▇▇▇▇▇ | ||

| /s/ ▇.▇. ▇▇▇▇▇▇, ▇▇. | ||

| By: ▇. ▇. ▇▇▇▇▇▇, ▇▇. | ||

| Treasurer | ||

| ATTEST | ||

| /s/ ▇▇▇▇▇▇▇ ▇. ▇▇▇▇▇▇▇▇▇ | STATE STREET BANK AND TRUST COMPANY | |

| /s/ ▇▇▇▇▇▇ ▇. ▇▇▇▇▇ | ||

| By: ▇▇▇▇▇▇ ▇. ▇▇▇▇▇ | ||

| Executive Vice President | ||

17

FUNDS TRANSFER ADDENDUM

OPERATING GUIDELINES

1. OBLIGATION OF THE SENDER: State Street is authorized to promptly debit Client’s (as named below) account(s) upon the receipt of a payment order in compliance with the selected Security Procedure chosen for funds transfer and in the amount of money that State Street has been instructed to transfer. State Street shall execute payment orders in compliance with the Security Procedure and with the Client’s instructions on the execution date provided that such payment order is received by the customary deadline for processing such a request, unless the payment order specifies a later time. All payment orders and communications received after this time will be deemed to have been received on the next business day.

2. SECURITY PROCEDURE: The Client acknowledges that the Security Procedure it has designated on the Selection Form was selected by the Client from Security Procedures offered by State Street. The Client shall restrict access to confidential information relating to the Security Procedure to authorized persons as communicated in writing to State Street. The Client must notify State Street immediately if it has reason to believe unauthorized persons may have obtained access to such information or of any change in the Client’s authorized personnel. State Street shall verify the authenticity of all instructions according to the Security Procedure.

3. ACCOUNT NUMBERS: State Street shall process all payment orders on the basis of the account number contained in the payment order. In the event of a discrepancy between any name indicated on the payment order and the account number, the account number shall take precedence and govern.

4. REJECTION: State Street reserves the right to decline to process or delay the processing of a payment order which (a) is in excess of the collected balance in the account to be charged at the time of State Street’s receipt of such payment order; (b) if initiating such payment order would cause State Street, in State Street’s sole judgment, to exceed any volume, aggregate dollar, network, time, credit or similar limits upon wire transfers which are applicable to State Street; or (c) if State Street, in good faith, is unable to satisfy itself that the transaction has been properly authorized.

5. CANCELLATION OR AMENDMENT: State Street shall use reasonable efforts to act on all authorized requests to cancel or amend payment orders received in compliance with the Security Procedure provided that such requests are received in a timely manner affording State Street reasonable opportunity to act. However, State Street assumes no liability if the request for amendment or cancellation cannot be satisfied.

6. ERRORS: State Street shall assume no responsibility for failure to detect any erroneous payment order provided that State Street complies with the payment order instructions as received and State Street complies with the Security Procedure. The Security Procedure is established for the purpose of authenticating payment orders only and not for the detection of errors in payment orders.

7. INTEREST AND LIABILITY LIMITS: State Street shall assume no responsibility for lost interest with respect to the refundable amount of any unauthorized payment order, unless State Street is notified of the unauthorized payment order within thirty (30) days of notification by State Street of the acceptance of such payment order. In no event shall State Street be liable for special, indirect or consequential damages, even if advised of the possibility of such damages and even for failure to execute a payment order.

8. AUTOMATED CLEARING HOUSE (“ACH”) CREDIT ENTRIES/PROVISIONAL PAYMENTS: When a Client initiates or receives ACH credit and debit entries pursuant to these Guidelines and the rules of the National Automated Clearing House Association and the New England Clearing House Association, State Street will act as an Originating Depository Financial Institution and/or Receiving Depository Institution, as the case may be, with respect to such entries. Credits given by State Street with respect to an ACH credit entry are provisional until State Street receives final settlement for such entry from the Federal Reserve Bank. If State Street does not receive such final settlement, the Client agrees that State Street shall receive a refund of the amount credited to the Client in connection with such entry, and the party making payment to the Client via such entry shall not be deemed to have paid the amount of the entry.

9. CONFIRMATION STATEMENTS: Confirmation of State Street’s execution of payment orders shall ordinarily be provided within 24 hours notice which may be delivered through State Street’s proprietary information systems, such as, but not limited to Horizon and GlobalQuest®, or by facsimile or callback. The Client must report any objections to the execution of a payment order within 30 days.

FUNDS TRANSFER ADDENDUM

Security Procedure(s) Selection Form

Please select one or more of the funds transfer security procedures indicated below.

☐SWIFT

SWIFT (Society for Worldwide Interbank Financial Telecommunication) is a cooperative society owned and operated by member financial institutions that provides telecommunication services for its membership. Participation is limited to securities brokers and dealers, clearing and depository institutions, recognized exchanges for securities, and investment management institutions. SWIFT provides a number of security features through encryption and authentication to protect against unauthorized access, loss or wrong delivery of messages, transmission errors, loss of confidentiality and fraudulent changes to messages. SWIFT is considered to be one of the most secure and efficient networks for the delivery of funds transfer instructions.

Selection of this security procedure would be most appropriate for existing SWIFT members.

☐Standing Instructions

Standing Instructions may be used where funds are transferred to a broker on the Client’s established list of brokers with which it engages in foreign exchange transactions. Only the date, the currency and the currency amount are variable. In order to establish this procedure, State Street will send to the Client a list of the brokers that State Street has determined are used by the Client. The Client will confirm the list in writing, and State Street will verify the written confirmation by telephone. Standing Instructions will be subject to a mutually agreed upon limit. If the payment order exceeds the established limit, the Standing Instruction will be confirmed by telephone prior to execution.

☐Remote Batch Transmission

Wire transfer instructions are delivered via Computer-to-Computer (CPU-CPU) data communications between the Client and State Street. Security procedures include encryption and or the use of a test key by those individuals authorized as Automated Batch Verifiers.

Clients selecting this option should have an existing facility for completing CPU-CPU transmissions. This delivery mechanism is typically used for high-volume business.

☐Global Horizon Interchange Funds Transfer Service

Global Horizon Interchange Funds Transfer Service (FTS) is a State Street proprietary microcomputer-based wire initiation system. FTS enables Clients to electronically transmit authenticated Fedwire, CHIPS or internal book transfer instructions to State Street.

This delivery mechanism is most appropriate for Clients with a low-to-medium number of transactions (5-75 per day), allowing Clients to enter, batch, and review wire transfer instructions on their PC prior to release to State Street.

☐Telephone Confirmation (Callback)

Telephone confirmation will be used to verify all non-repetitive funds transfer instructions received via untested facsimile or phone. This procedure requires Clients to designate individuals as authorized initiators and authorized verifiers. State Street will verify that the instruction contains the signature of an authorized person and prior to execution, will contact someone other than the originator at the Client’s location to authenticate the instruction.

Selection of this alternative is appropriate for Clients who do not have the capability to use other security procedures.

☐Repetitive Wires

For situations where funds are transferred periodically (minimum of one instruction per calendar quarter) from an existing authorized account to the same payee (destination bank and account number) and only the date and currency amount are variable, a repetitive wire may be implemented. Repetitive wires will be subject to a mutually agreed upon limit. If the payment order exceeds the established limit, the instruction will be confirmed by telephone prior to execution. Telephone confirmation is used to establish this process. Repetitive wire instructions must be reconfirmed annually.

This alternative is recommended whenever funds are frequently transferred between the same two accounts.

FUNDS TRANSFER ADDENDUM

☐Transfers Initiated by Facsimile

The Client faxes wire transfer instructions directly to State Street Mutual Fund Services. Standard security procedure requires the use of a random number test key for all transfers. Every six months the Client receives test key logs from State Street. The test key contains alpha-numeric characters, which the Client puts on each document faxed to State Street. This procedure ensures all wire instructions received via fax are authorized by the Client.

We provide this option for Clients who wish to batch wire instructions and transmit these as a group to State Street Mutual Fund Services once or several times a day.

☐Automated Clearing House (ACH)

State Street receives an automated transmission or a magnetic tape from a Client for the initiation of payment (credit) or collection (debit) transactions through the ACH network. The transactions contained on each transmission or tape must be authenticated by the Client. Clients using ACH must select one or more of the following delivery options:

☐Global Horizon Interchange Automated Clearing House Service

Transactions are created on a microcomputer, assembled into batches and delivered to State Street via fully authenticated electronic transmissions in standard NACHA formats.

☐Transmission from Client PC to State Street Mainframe with Telephone Callback

☐Transmission from Client Mainframe to State Street Mainframe with Telephone Callback

☐Transmission from DST Systems to State Street Mainframe with Encryption

☐Magnetic Tape Delivered to State Street with Telephone Callback

State Street is hereby instructed to accept funds transfer instructions only via the delivery methods and security procedures indicated. The selected delivery methods and security procedure(s) will be effective for payment orders initiated by our organization.

Key Contact Information

Whom shall we contact to implement your selection(s)?

| CLIENT OPERATIONS CONTACT | ALTERNATE CONTACT | |

| Name | Name | |

| Address | Address | |

| City/State/Zip Code | City/State/Zip Code | |

| Telephone Number | Telephone Number | |

| Facsimile Number | Facsimile Number | |

SWIFT Number

Telex Number

INSTRUCTION(S)

TELEPHONE CONFIRMATION

Client The Select SPDR Trust

Investment Manager State Street Bank and Trust Company

Authorized Initiators

Please Type or Print

Please provide a listing of your staff members who are currently authorized to INITIATE wire transfer instructions to State Street:

| NAME SIGNATURE |

TITLE (Specify whether position | SPECIMEN | ||

| is with Client or Investment Manager) |

||||

Authorized Verifiers

Please Type or Print

Please provide a listing of your staff members who will be CALLED BACK to verify the initiation of repetitive wires of $10 million or more and all non repetitive wire instructions:

| NAME LIMITATION (IF ANY) |

CALLBACK PHONE NUMBER | DOLLAR |

DATA ACCESS SERVICES ADDENDUM TO CUSTODIAN AGREEMENT

AGREEMENT between The Select Sector SPDR Trust (the “Customer”) and State Street Bank and Trust Company (“State Street”).

PREAMBLE

WHEREAS, State Street has been appointed as custodian of certain assets of the Customer pursuant to a certain Custodian Agreement (the “Custodian Agreement”) dated as of December 1, 1998;

WHEREAS, State Street has developed and utilizes proprietary accounting and other systems, including State Street’s proprietary Multicurrency HORIZONSM Accounting System, in its role as custodian of the Customer, and maintains certain Customer-related data (“Customer Data”) in databases under the control and ownership of State Street (the “Data Access Services”); and

WHEREAS, State Street makes available to the Customer certain Data Access Services solely for the benefit of the Customer, and intends to provide additional services, consistent with the terms and conditions of this Agreement.

NOW, THEREFORE, in consideration of the mutual covenants and agreements herein contained, and for other good and valuable consideration, the parties agree as follows:

| 1. | SYSTEM AND DATA ACCESS SERVICES |

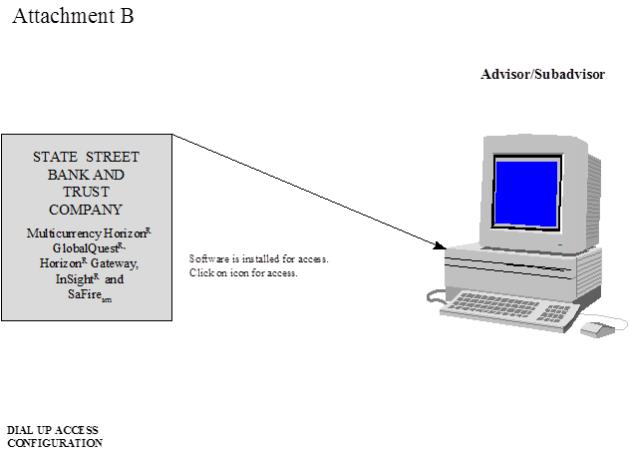

(a) System. Subject to the terms and conditions of this Agreement, State Street hereby agrees to provide the Customer with access to State Street’s Multicurrency HORIZONSM Accounting System and the other information systems (collectively, the “System”) as described in Attachment A, on a remote basis for the purpose of obtaining reports and information, solely on computer hardware, system software and telecommunication links as listed in Attachment B (the “Designated Configuration”) of the Customer, or certain third parties approved by State Street that serve as independent auditors, investment advisors or investment managers (“Investment Advisor”), or in other service capacities, of the Customer or other third parties such as the Customer’s independent auditors, solely with respect to the Customer or on any designated substitute or back-up equipment configuration with State Street’s written consent, such consent not to be unreasonably withheld.

(b) Data Access Services. State Street agrees to make available to the Customer the Data Access Services subject to the terms and conditions of this Agreement and data access operating standards and procedures as may be issued by State Street from time to time. The ability of the Customer to originate electronic instructions to State Street on behalf of the Customer in order to (i) effect the transfer or movement of cash or securities held under custody by State Street or (ii) transmit accounting or other information (such transactions are referred to herein as “Client Originated Electronic Financial Instructions”), and (iii) access data for the purpose of reporting and analysis, shall be deemed to be Data Access Services for purposes of this Agreement.

(c) Additional Services. State Street may from time to time agree to make available to the Customer additional Systems that are not described in the attachments to this Agreement. In the absence of any other written agreement concerning such additional systems, the term “System” shall include, and this Agreement shall govern, the Customer’s access to and use of any additional System made available by State Street and/or accessed by the Customer.

| 2. | NO USE OF THIRD PARTY SYSTEMS-LEVEL SOFTWARE |

State Street and the Customer acknowledge that in connection with the Data Access Services provided under this Agreement, the Customer will have access, through the Data Access Services, to Customer Data and to functions of State Street’s proprietary systems; provided, however that in no event will the Customer have direct access to any third party systems-level software that retrieves data for, stores data from, or otherwise supports the System.

| 3. | LIMITATION ON SCOPE OF USE |

a. Designated Equipment; Designated Location. The System and the Data Access Services shall be used and accessed solely on and through the Designated Configuration at the offices of the Customer or the Investment Advisor located in Boston, Massachusetts (“Designated Location”).

b. Designated Configuration; Trained Personnel. State Street shall be responsible for supplying, installing and maintaining the Designated Configuration at the Designated Location. State Street and the Customer agree that each will engage or retain the services of trained personnel to enable both parties to perform their respective obligations under this Agreement. State Street agrees to use commercially reasonable efforts to maintain the System so that it remains serviceable, provided, however, that State Street does not guarantee or assure uninterrupted remote access use of the System.

c. Scope of Use. The Customer will use the System and the Data Access Services only for the processing of securities transactions, the keeping of books of account for the Customer and accessing data for purposes of reporting and analysis. The Customer shall not, and shall cause its employees and agents not to (i) permit any third party to use the System or the Data Access Services, (ii) sell, rent, license or otherwise use the System or the Data Access Services in the operation of a service bureau or for any purpose other than as expressly authorized under this Agreement, (iii) use the System or the Data Access Services for any fund, trust or other investment vehicle without the prior written consent of State Street, (iv) allow access to the System or the Data Access Services through terminals or any other computer or telecommunications facilities located outside the Designated Locations, (v) allow or cause any information (other than Fund holdings, valuations of Fund holdings, and other information reasonably necessary for the management or distribution of the assets of the Customer) transmitted from State Street’s databases, including data from third party sources, available through use of the System or the Data Access Services to be redistributed or retransmitted to another computer, terminal or other device for other than use for or on behalf of the Customer or (vi) modify the System in any way, including without limitation, developing any software for or attaching any devices or computer programs to any equipment, system, software or database which forms a part of or is resident on the Designated Configuration.

d. Other Locations. Except in the event of an emergency or of a planned System shutdown, the Customer’s access to services performed by the System or to Data Access Services at the Designated Location may be transferred to a different location only upon the prior written consent of State Street. In the event of an emergency or System shutdown, the Customer may use any back-up site included in the Designated Configuration or any other back-up site agreed to by State Street, which agreement will not be unreasonably withheld. The Customer may secure from State Street the right to access the System or the Data Access Services through computer and telecommunications facilities or devices complying with the Designated Configuration at additional locations only upon the prior written consent of State Street and on terms to be mutually agreed upon by the parties.

e. Title. Title and all ownership and proprietary rights to the System, including any enhancements or modifications thereto, whether or not made by State Street, are and shall remain with State Street.

f. No Modification. Without the prior written consent of State Street, the Customer shall not modify, enhance or otherwise create derivative works based upon the System, nor shall the Customer reverse engineer, decompile or otherwise attempt to secure the source code for all or any part of the System.

g. Security Procedures. The Customer shall comply with data access operating standards and procedures and with user identification or other password control requirements and other security procedures as may be issued from time to time by State Street for use of the System on a remote basis and to access the Data Access Services. The Customer shall have access only to the Customer Data and authorized transactions agreed upon from time to time by State Street and, upon notice from State Street, the Customer shall discontinue remote use of the System and access to Data Access Services for any security reasons cited by State Street; provided, that, in such event, State Street shall, for a period not less than 180 days (or such other shorter period specified by the Customer) after such discontinuance, assume responsibility to provide accounting services under the terms of the Custodian Agreement.

h. Inspections. State Street shall have the right to inspect the use of the System and the Data Access Services by the Customer and the Investment Advisor to ensure compliance with this Agreement. The on-site inspections shall be upon prior written notice to the Customer and the Investment Advisor and at reasonably convenient times and frequencies so as not to result in an unreasonable disruption of the Customer’s or the Investment Advisor’s business.

| 4. | PROPRIETARY INFORMATION |

a. Proprietary Information. The Customer acknowledges and State Street represents that the System and the databases, computer programs, screen formats, report formats, interactive design techniques, documentation and other information made available to the Customer by State Street as part of the Data Access Services and through the use of the System constitute copyrighted, trade secret, or other proprietary information of substantial value to State Street. Any and all such information provided by State Street to the Customer shall be deemed proprietary and confidential information of State Street (hereinafter “Proprietary Information”). The Customer agrees that it will hold such Proprietary Information in the strictest confidence and secure and protect it in a manner consistent with its own procedures for the protection of its own confidential information and to take appropriate action by instruction or agreement with its employees who are permitted access to the Proprietary Information to satisfy its obligations hereunder. The Customer further acknowledges that State Street shall not be required to provide the Investment Advisor with access to the System unless it has first received from the Investment Advisor an undertaking with respect to State Street’s Proprietary Information in the form of Attachment C to this Agreement. The Customer shall use all commercially reasonable efforts to assist State Street in identifying and preventing any unauthorized use, copying or disclosure of the Proprietary Information or any portions thereof or any of the logic, formats or designs contained therein.

b. Cooperation. Without limitation of the foregoing, the Customer shall advise State Street immediately in the event the Customer learns or has reason to believe that any person to whom the Customer has given access to the Proprietary Information, or any portion thereof, has violated or intends to violate the terms of this Agreement, and the Customer will, at its expense, co-operate with State Street in seeking injunctive or other equitable relief in the name of the Customer or State Street against any such person.

c. Injunctive Relief. The Customer acknowledges that the disclosure of any Proprietary Information, or of any information which at law or equity ought to remain confidential, will immediately give rise to continuing irreparable injury to State Street inadequately compensable in damages at law. In addition, State Street shall be entitled to obtain immediate injunctive relief against the breach or threatened breach of any of the foregoing undertakings, in addition to any other legal remedies which may be available.

d. Survival. The provisions of this Section 4 shall survive the termination of this Agreement.

| 5. | LIMITATION ON LIABILITY |

a. Limitation on Amount and Time for Bringing Action. The Customer agrees that any liability of State Street to the Customer or any third party arising out of State Street’s provision of Data Access Services or the System under this Agreement shall be limited to the amount paid by the Customer for the preceding 24 months for such services. In no event shall State Street be liable to the Customer or any other party for any special, indirect, punitive or consequential damages even if advised of the possibility of such damages. No action, regardless of form, arising out of this Agreement may be brought by the Customer more than two years after the Customer has knowledge that the cause of action has arisen.

b. Limited Warranties. NO OTHER WARRANTIES, WHETHER EXPRESS OR IMPLIED, INCLUDING, WITHOUT LIMITATION, THE IMPLIED WARRANTIES OF MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE, ARE MADE BY STATE STREET.

c. Third-Party Data. Organizations from which State Street may obtain certain data included in the System or the Data Access Services are solely responsible for the contents of such data, and State Street shall have no liability for claims arising out of the contents of such third-party data, including, but not limited to, the accuracy thereof.

d. Regulatory Requirements. As between State Street and the Customer, the Customer shall be solely responsible for the accuracy of any accounting statements or reports produced using the Data Access Services and the System and the conformity thereof with any requirements of law.

e. Force Majeure. Neither party shall be liable for any costs or damages due to delay or nonperformance under this Agreement arising out of any cause or event beyond such party’s control, including without limitation, cessation of services hereunder or any damages resulting therefrom to the other party, or the Customer as a result of work stoppage, power or other mechanical failure, computer virus, natural disaster, governmental action, or communication disruption.

| 6. | INDEMNIFICATION |

The Customer agrees to indemnify and hold State Street harmless from any loss, damage or expense including reasonable attorney’s fees, (a “loss”) suffered by State Street arising from (i) the negligence or willful misconduct in the use by the Customer of the Data Access Services or the System, including any loss incurred by State Street resulting from a security breach at the Designated Location or committed by the Customer’s employees or agents or the Investment Advisor and (ii) any loss resulting from incorrect Client Originated Electronic Financial Instructions. State Street shall be entitled to rely on the validity and authenticity of Client Originated Electronic Financial Instructions without undertaking any further inquiry as long as such instruction is undertaken in conformity with security procedures established by State Street from time to time.

| 7. | FEES |

Fees and charges for the use of the System and the Data Access Services and related payment terms shall be as set forth in the Custody Fee Schedule in effect from time to time between the parties (the “Fee Schedule”). Any tariffs, duties or taxes imposed or levied by any government or governmental agency by reason of the transactions contemplated by this Agreement, including, without limitation, federal, state and local taxes, use, value added and personal property taxes (other than income, franchise or similar taxes which may be imposed or assessed against State Street) shall be borne by the Customer. Any claimed exemption from such tariffs, duties or taxes shall be supported by proper documentary evidence delivered to State Street.

| 8. | TRAINING, IMPLEMENTATION AND CONVERSION |