LEASE AGREEMENT by and between TCG INDUSTRIAL SHILOH LLC, a Delaware limited liability company, as Landlord and INOGEN, INC., a Delaware corporation, as Tenant 600 Shiloh Road Plano, Texas 75074

Exhibit 10.1

by and between

TCG INDUSTRIAL SHILOH LLC,

a Delaware limited liability company,

as Landlord

and

INOGEN, INC.,

a Delaware corporation,

as Tenant

000 Xxxxxx Xxxx

Xxxxx, Xxxxx 00000

Table of Contents

|

|

|

|

|

Page |

|

|

|

|

|

|

|

|

|

|

|

|

|

Article I |

|

|

1 |

|

|

|

|

|

|

|

|

Article II |

|

|

4 |

|

|

|

|

|

|

|

|

Article III |

|

|

4 |

|

|

|

|

|

|

|

|

Article IV |

|

|

5 |

|

|

|

|

|

|

|

|

Article V |

|

|

5 |

|

|

|

|

|

|

|

|

Article VI |

|

TENANT'S RESPONSIBILITY FOR TAXES, OTHER REAL ESTATE CHARGES AND INSURANCE EXPENSES |

|

6 |

|

|

|

|

|

|

|

Article VII |

|

|

7 |

|

|

|

|

|

|

|

|

Article VIII |

|

|

11 |

|

|

|

|

|

|

|

|

Article IX |

|

|

11 |

|

|

|

|

|

|

|

|

Article X |

|

|

13 |

|

|

|

|

|

|

|

|

Article XI |

|

|

14 |

|

|

|

|

|

|

|

|

Article XII |

|

|

16 |

|

|

|

|

|

|

|

|

Article XIII |

|

|

18 |

|

|

|

|

|

|

|

|

Article XIV |

|

|

18 |

|

|

|

|

|

|

|

|

Article XV |

|

|

19 |

|

|

|

|

|

|

|

|

Article XVI |

|

|

20 |

|

|

|

|

|

|

|

|

Article XVII |

|

|

21 |

|

|

|

|

|

|

|

|

Article XVIII |

|

|

22 |

|

|

|

|

|

|

|

|

Article XIX |

|

|

23 |

|

|

|

|

|

|

|

|

Article XX |

|

|

24 |

|

|

|

|

|

|

|

|

Article XXI |

|

|

26 |

|

|

|

|

|

|

|

|

Article XXII |

|

|

27 |

|

|

|

|

|

|

|

|

Article XXIII |

|

|

30 |

|

|

|

|

|

|

|

|

Article XXIV |

|

|

35 |

|

|

|

|

|

|

|

|

Article XXV |

|

|

35 |

|

|

|

|

|

|

|

|

Article XXVI |

|

|

35 |

|

|

|

|

|

|

|

|

Article XXVII |

|

|

36 |

|

|

|

|

|

|

|

|

Article XXVIII |

|

|

36 |

|

|

|

|

|

|

|

|

Article XXIX |

|

|

36 |

|

|

|

|

|

|

|

|

Article XXX |

|

|

37 |

|

|

|

|

|

|

|

Exhibit A (The Premises); Exhibit B (The Project); Exhibit C (Move-Out Standards); Exhibit D (Rules and Regulations); Exhibit E (Form of Hazardous Materials Disclosure Certificate); Exhibit F (Commencement Date Certificate); Exhibit G (Option to Extend Addendum); Exhibit H (Improvement Addendum); Exhibit I (Right of First Offer)

Article I

BASIC PROVISIONS and certain definitions

1.1Definitions. The following list sets out certain defined terms and certain financial and other information pertaining to this Lease Agreement (this "Lease"):

(a)"Landlord": TCG Industrial Shiloh LLC, a Delaware limited liability company

c/o Trident Capital Group

Attn: Xxxxx Xxxxxx

00 Xxxxx Xxxxxx, Xxxxx 000

Xxxxxxxxx, Xxxxxxxxxxxxx 00000

(c)"Tenant": Inogen, Inc., a Delaware corporation

(d)Tenant's notice address:

Inogen, Inc.

000 Xxxxxx Xxxxx

Xxxxxx, XX 00000

Attn: Xxxxx Xxxxxxxxx, President & Xxx Xxxxxxxxx, CFO

(f)"Premises":

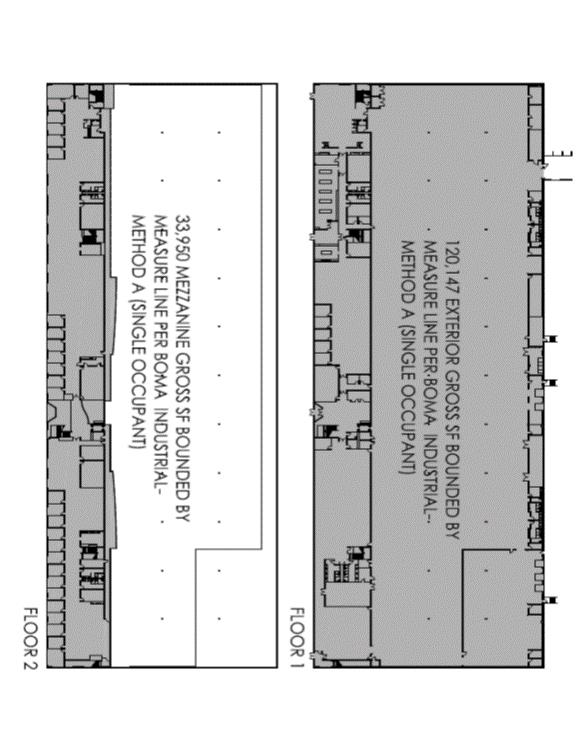

(i)The “Initial Premises” is that portion of the Building containing approximately 53,603 square feet of leasable area, as described or shown on Exhibit A attached to this Lease and commonly known as 000 Xxxxxx Xxxx, Xxxxx, Xxxxx 00000.

(ii)The “Must Take Space” is that portion of the Building containing approximately 100,494 square feet of leasable area, as described or shown on Exhibit A attached to this Lease and commonly known as 000 Xxxxxx Xxxx, Xxxxx, Xxxxx 00000

(iii)Any statement of square footage set forth in this Lease or that may have been used in calculating Base Rent, Tenant's Proportionate Share and/or Operating Costs is an approximation which Landlord and Tenant agree is reasonable, and the Base Rent and Tenant's Proportionate Share based thereon are not subject to revision whether or not the actual square footage is more or less.

(iv)Prior to the Must Take Date (hereinafter defined), the term “Premises” includes only the Initial Premises. On the Must Take Date, the Premises are automatically expanded to include the Must Take Space.

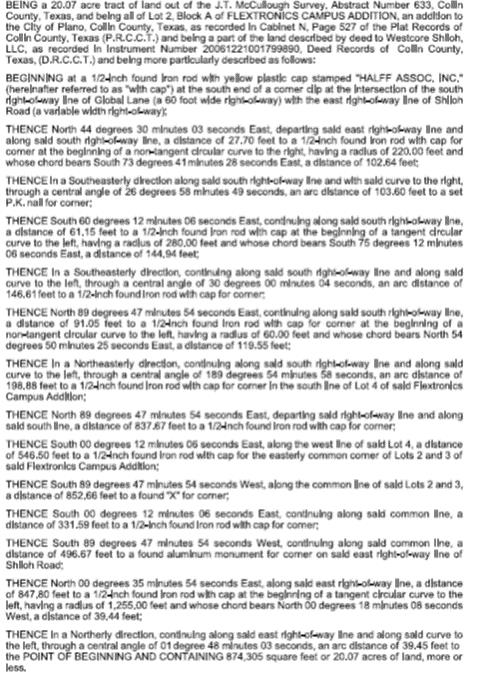

(g)"Building": 000 Xxxxxx Xxxx, Xxxxx, Xxxxx 00000, containing approximately 154,097 square feet of leasable area.

(h)"Project": Landlord's property located in the City of Plano, County of Collin, State of Texas, consisting of approximately 321,238 square feet of leasable area, which property is described or shown on Exhibit B attached to this Lease. With regard to Exhibit B, the parties agree that Exhibit B is attached solely for the purpose of locating the Building and the Premises within the Project and that no representation, warranty, or covenant is to be implied by any other information shown on Exhibit B (i.e., any indication as to existing or future buildings, access, tenants or prospective tenants, etc., is subject to change at any time).

(i)"Tenant's Proportionate Share": Tenant's Proportionate Share of the Project shall be a fraction, the numerator of which is the total floor area (all of which is deemed "leasable") in the Premises and the denominator of which is the total leasable floor area of all buildings in the Project at the time when the respective charge was incurred. Tenant's Proportionate Share of the Building shall be a fraction with the same said numerator, but the denominator of which shall be the total leasable floor area of the Building at the time when the respective charge was incurred. As of the date of this Lease: (a) the total floor area of the Premises shall be as provided for in

1

Section 1.1(e); (b) the total leasable floor area of all buildings in the Project shall be as provided for in Section 1.1(g); (c) prior to the Must Take Date, the Tenant's Proportionate Share of the Project shall be 16.69%, and, following the Must Take Date, the Tenant’s Proportionate Share of the Project shall be 47.97%, subject to adjustment as provided below, and (d) prior to the Must Take Date, the Tenant's Proportionate Share of the Building shall be 34.79%, and, following the Must Take Date, the Tenant’s Proportionate Share of the Building shall be 100.00%, subject to adjustment as provided below. At such time, if ever, any space is added to or subtracted from the Premises and/or the Building or any of the buildings in the Project, or if buildings are added to or removed from the Project, the Tenant's Proportionate Share shall be adjusted accordingly. Landlord's system for measurement of total leasable floor area shall be as determined by Landlord.

(j)"Permitted Use": as defined in Section 5.1 of this Lease.

(k)"Lease Term": Commencing on the 120th day following Landlord’s delivery of possession of the Initial Premises to Tenant (the “Commencement Date”) and continuing until 5:00 p.m. on the last day of the 132nd full calendar month following the Commencement Date (the "Expiration Date"). At the request of Landlord, Tenant shall execute and deliver to Landlord on or after the Commencement Date a completed certificate in substantially the form attached hereto as Exhibit F (the "Commencement Date Certificate"). If the Commencement Date does not occur on the first day of a calendar month, then for purposes of Rent payments, "month 1" shall commence on the Commencement Date and shall end at the conclusion of the last calendar day of the following calendar month (for example, if the Commencement Date is February 10th, then "month 1" in the Rent chart would begin on February 10th and would end upon the conclusion of business on March 31st) and, in such event the Rent for "month 1" shall be pro-rated based on the actual number of days in such "month 1"; the balance of any Base Rent abatement (or free rent) for "month 1", if any, shall be credited to the first calendar month in which Tenant is actually required to pay Base Rent (for example, if Tenant is entitled to five (5) months of Base Rent abatement and the Commencement Date occurs on February 10th, then a Base Rent abatement equal to nine (9) days shall be credited for the month of July). The “Must Take Date” is January 1, 2021; provided, Tenant may elect to occupy the Must Take Space any time on or after July 1, 2020 by providing Landlord at least ninety (90) days prior written notice, and the date that is thirty (30) days following the date set forth in such notice shall be the Must Take Date.

(l) "Option Period": Landlord hereby grants to Tenant two (2) options to extend the term of this Lease for five (5) years each, each commencing when the prior term expires, as more particularly set forth in and in accordance with the terms of Exhibit G attached hereto.

(m)"Base Rent": Base Rent shall be the sum of the amounts set forth below and shall be paid as follows during the respective months of the Lease Term:

Initial Premises:

|

Months of Lease Term |

Base Rent/Month |

|

1 – 12 |

$39,085.52* |

|

13 – 18 |

$40,062.66 |

|

19 – 30 |

$41,064.23 |

|

31 – 42 |

$42,090.83 |

|

43 – 54 |

$43,143.10 |

|

55 – 66 |

$44,221.68 |

|

67 – 78 |

$45,327.22 |

|

79 – 90 |

$46,460.40 |

|

91 – 102 |

$47,621.91 |

|

103 – 114 |

$48,821.46 |

|

115 – 126 |

$50,032.77 |

|

127 – 132 |

$51,283.59 |

*Base Rent for the Initial Premises for the period commencing on the Commencement Date and ending six (6) months thereafter will be conditionally abated in accordance with Section 30.16.

2

|

Months of Lease Term |

Base Rent/Month |

|

1 – 12 |

N/A+ |

|

Must Take Date – 18 |

$75,108.80+** |

|

19 – 30 |

$76,986.52 |

|

31 – 42 |

$78,911.18 |

|

43 – 54 |

$80,883.96 |

|

55 – 66 |

$82,906.06 |

|

67 – 78 |

$84,978.71 |

|

79 – 90 |

$87,103.18 |

|

91 – 102 |

$89,280.76 |

|

103 – 114 |

$91,512.78 |

|

115 – 126 |

$93,800.60 |

|

127 – 132 |

$96,145.61 |

+Base Rent for the Must Take Space shall commence on the Must Take Date (subject to adjustment as provided in Section 1.1(k)).

**Base Rent for the Must Take Space for the period commencing on the Must Take Date and ending six (6) months thereafter will be conditionally abated in accordance with Section 30.16.

(n)Estimated Monthly Payment. The following table is provided as an estimate of Tenant's initial monthly payment broken down into its components and this table does not reflect any taxes, if applicable, that apply to such payments. Tenant acknowledges that the estimates contained in this table do not supersede the specific provisions contained elsewhere in this Lease and may be adjusted annually or more often by Landlord as provided for in Article IX below.

|

Base Rent |

$39,085.52 |

|

Estimate for Initial Operating Costs |

$2,054.78 |

|

Estimate for Initial Real Estate Charges |

$6,923.72 |

|

Estimate for Initial Insurance Expenses |

$402.02 |

|

ESTIMATED TOTAL INITIAL MONTHLY PAYMENT |

$48,466.04 |

(o)"Prepaid Rent": $48,466.04, being the Base Rent plus an estimate of Tenant's obligations for Operating Costs, Real Estate Charges and Insurance Expenses for the first full month of the Lease Term plus a prorated amount for any partial month between the Commencement Date and the first day of such first full month, if the Commencement Date is not the first day of a calendar month, such Prepaid Rent being due and payable not later than five (5) business days following mutual execution and delivery of this Lease.

(p)"Security Deposit": $170,800.35, such Security Deposit being due and payable within five (5) business days of mutual execution and delivery of this Lease and being subject to the applicable provisions of Section 23.8 and Article XXVII of this Lease.

(q)"Rent": as defined in Section 9.1 of this Lease.

1.2Address for Rent Payments All amounts payable by Tenant to Landlord shall, until further notice from Landlord, be paid to Landlord pursuant to the following instructions:

3

Account Name:

Financial Institution:

ACH Routing Number:

Wire Routing Number:

Account Number:

2.1Grant and Acceptance. Landlord leases the Premises to Tenant and Tenant accepts the Premises from Landlord for the Lease Term, upon and subject to the terms and conditions set forth in this Lease.

Article III

DELIVERY OF PREMISES; RELOCATION OF PREMISES

3.1Acceptance of Premises. EXCEPT AS OTHERWISE EXPRESSLY PROVIDED IN THIS LEASE, THE PREMISES ARE LEASED "AS IS", WITH TENANT ACCEPTING ALL DEFECTS, IF ANY; AND LANDLORD MAKES NO WARRANTY OF ANY KIND, EXPRESS OR IMPLIED, WITH RESPECT TO THE PREMISES (WITHOUT LIMITATION, LANDLORD MAKES NO WARRANTY AS TO THE HABITABILITY, FITNESS OR SUITABILITY OF THE PREMISES FOR A PARTICULAR PURPOSE, NOR AS TO COMPLIANCE WITH ANY LAWS, RULES OR REGULATIONS, NOR AS TO THE ABSENCE OF ANY TOXIC OR OTHERWISE HAZARDOUS SUBSTANCES). Notwithstanding any provision of this Lease to the contrary, Landlord represents and warrants that Landlord is the fee title owner of the Premises and has the right to lease the Premises on the terms and conditions set forth in this Lease. This Section 3.1 is subject to any contrary requirements under applicable law; however, in this regard, Tenant acknowledges that it has been given the opportunity to inspect the Premises and to have qualified experts inspect the Premises prior to the execution of this Lease. Notwithstanding the foregoing, Landlord warrants (but does not represent) that as of the Commencement Date (i) the electrical, mechanical, plumbing, and HVAC systems serving the Premises as of the date of this Lease shall be in good operating condition and repair, other than to the extent of any damage or failure caused by Tenant or Tenant Parties or any portion thereof affected by the Initial Alterations; however, if any portion of the HVAC system must be replaced pursuant to the foregoing, the provisions of Section 11.2 shall apply; and (ii) the Premises, Building and Common Areas are in compliance with applicable laws, including without limitation The Americans with Disabilities Act of 1990, 42 U.S.C. Section 12101 et seq., and the regulations issued pursuant thereto, subject to the provisions of Section 10.5(b).

3.2Delay in Delivery. If this Lease is executed before the Initial Premises or the Must Take Space become vacant, or if any present tenant or occupant of the Initial Premises or Must Take Space holds over, and Landlord has not provided possession of the Initial Premises prior to October 1, 2019, Landlord shall not be deemed to be in default under this Lease; and in such event, Tenant agrees to accept possession of the Initial Premises or the Must Take Space (as applicable) at such time as Landlord is able to turn over possession of the same to Tenant. Notwithstanding the foregoing provisions of this Section 3.2, if the delivery of possession does not occur on or before October 1, 2019 for any reason other than force majeure or the act or omission of any Tenant Party, then Tenant may offset from its Base Rent obligations first accruing following the Commencement Date, an amount equal to $13,000 per month.

3.3Early Possession. If available, Tenant may occupy the Initial Premises as of September 1, 2019 (the "Early Possession Date"), even though the Early Possession Date is prior to the Commencement Date of the Lease, for the purpose of constructing the Initial Alterations (as defined in Exhibit H) and installing Tenant’s furniture, fixtures, equipment, and voice and data cabling ("Early Possession"). The obligation to pay Base Rent and Tenant’s Proportionate Share of Shared Expenses shall be abated for the period from the Early Possession Date to the Commencement Date. All other terms of this Lease, however, including, but not limited to, the obligation to carry the insurance required by this Lease, shall be in effect during the Early Possession period. Such Early Possession shall not change the Expiration Date of the Lease Term.

4

Article IV

BASE RENT

4.1Base Rent. Tenant shall pay to Landlord Base Rent in monthly installments in the amount(s) specified in Section 1.1(l) of this Lease. The first such monthly installment shall be due and payable not later than five (5) business days after the date of mutual execution and delivery of this Lease (as stated in Section 1.1(o) of this Lease), and subsequent installments shall be due and payable on or before the first day of each calendar month during the Lease Term.

Article V

PERMITTED USE; TENANT'S FINANCIAL STATEMENTS

5.1Permitted Use of Premises. The Premises shall be used only for general office, customer contact center and warehousing, including research and development and light assembly, and any legal use incidental thereto. Tenant's use of the Premises is further subject to Article X of this Lease and to all other provisions hereof. Notwithstanding anything to the contrary in this Lease, in no event shall any portion of the Premises be used for any marijuana or marijuana related business (including, but not limited to, the cultivation, manufacture, processing, storage or sale of cannabis or cannabis-related products). Tenant acknowledges that the specification of a "permitted use" means only that Landlord has no objection to the specified use and does not include any representation or warranty by Landlord as to whether or not such specified use complies with applicable laws and/or requires special governmental permits. In this regard, Tenant acknowledges that Section 1.1(j) of this Lease is subject to Sections 3.1 and 10.5 of this Lease.

5.2Tenant Financial Statements. Tenant shall, within ten (10) days after a request from Landlord, deliver to Landlord such financial statements of Tenant as are reasonably required by Landlord, including, but not limited to, financial statements for the past three years, but not more frequently than once per lease year (except in connection with a direct or indirect proposed sale of the Premises or financing or refinancing with respect to the Premises, in which case such limitation shall not apply). Tenant represents and warrants to Landlord that all such financial statements provided in connection with this Lease including, without limitation, any that have been provided prior to the date of this Lease, are true, complete and correct as of the date thereof. Tenant further agrees to cooperate with any request by Landlord for Tenant's written permission or other cooperation in connection with Landlord's obtaining a credit report or similar information regarding Tenant from third-party sources. Landlord anticipates that its request for the additional information prescribed in this Section 5.2 will be limited either to a potential sale or financing of the Building or of all or a portion of the Project or to Landlord's concern as to the continuing financial ability of Tenant to perform its obligations under this Lease. Tenant acknowledges and agrees that any financial statements submitted by Tenant to Landlord at any time in connection with this Lease are being relied upon by Landlord in entering into this Lease and extending any credit to Tenant and, to the extent that such financial statements, or any financial statements provided by Tenant to landlord subsequent to the execution of this Lease, are materially false or incorrect, it shall be deemed a Tenant default, and Landlord, upon or after discovery of such, may terminate this Lease or pursue any other applicable default remedies set forth in this Lease. Further, Landlord specifically reserves all rights it may have to object to a discharge or reorganization by Tenant in any bankruptcy proceeding filed by or against Tenant based upon such materially false or incorrect financial statements. Notwithstanding the forgoing, this Section 5.2 will apply if, and only if, Tenant ceases to be a publicly traded corporation.

5.3Confidentiality. Landlord shall use good faith efforts to keep confidential all non‑public financial statements supplied by Tenant; provided, however, that Landlord has the right to reveal such information to mortgagees, prospective purchasers and prospective mortgagees (and their respective agents) and to Landlord's managers, officers, personnel, affiliates, partners, directors, advisors, accountants, attorneys, members, and consultants, Landlord’s successors and assigns, and as may be required by law, including, without limitation, securities regulations, or by legal process; and, provided further, that Landlord and Landlord's affiliates have the right to include, disclose, or otherwise publicize Tenant's name as one of Landlord's or Landlord's affiliates' tenants in any of Landlord's marketing materials, press releases, presentations, or other disclosures. The following materials and information are not considered "non‑public financial statements" for purposes of this Lease and will not be subject to the restrictions set for in the preceding sentence: (i) information which is or becomes generally available to the public other than as a result of a wrongful disclosure by Landlord; (ii) information which reasonably can be demonstrated to be known to Landlord prior to its disclosure by Tenant hereunder; (iii) information which becomes available to Landlord on a non-confidential basis from sources other than Tenant; and (iv) information which Landlord may be compelled to disclose by court order or applicable law.

5

Article VI

TENANT'S RESPONSIBILITY FOR TAXES,

OTHER REAL ESTATE CHARGES AND INSURANCE EXPENSES

6.1Personal Property. Tenant shall be liable for all taxes and assessments of any kind or nature levied against personal property and trade fixtures placed by Tenant in the Premises. If any such taxes are levied against Landlord or Landlord's property and if Landlord elects to pay the same or if the assessed value of Landlord's property is increased by inclusion of personal property and trade fixtures placed by Tenant in the Premises and Landlord elects to pay the taxes based on such increase, Tenant shall pay to Landlord upon demand that part of such taxes for which Tenant is liable under this Section 6.1.

6.2Real Estate Charges and Insurance Expenses. Tenant shall also be liable for Tenant's Proportionate Share of all Real Estate Charges (as defined below) and Insurance Expenses (as defined below) related to the Project or Landlord's ownership of the Project. All payments for which Tenant is liable pursuant to this Article VI shall be considered for all purposes to be Additional Rent (as defined in Section 9.1 below) under this Lease and shall be payable as provided for under Article IX. "Real Estate Charges" shall include ad valorem taxes, general and special assessments, improvement bond or bonds, levy or tax, parking surcharges, any tax or excise on rents, any franchise or gross margins or receipt tax, any tax or charge for governmental services (such as street maintenance or fire protection), any tax, exaction or other charge imposed in connection with the ownership, operation, leasing or use of the Project, any tax or charge which replaces or is in addition to any of such above-described Real Estate Charges, any tax or charge which is implemented after the date of this Lease and is reasonably determined by Landlord to have been assessed in lieu of the whole or part of any of such above-described Real Estate Charges, and any fees paid by Landlord to consultants, attorneys and other professionals who monitor, negotiate and/or contest any or all above-described Real Estate Charges; provided, however, that Real Estate Charges shall not be deemed to include any capital stock, estate, inheritance or general income tax or any CPACE assessments (Commercial Property Assessed Clean Energy). Real Estate Charges shall expressly include (a) the franchise tax set forth in V.T.C.A. Tax Code Section 171.0001 et seq., as the same may be amended or recodified from time to time, and (b) any new taxes levied against Landlord and/or the Project in lieu of or in substitution of any ad valorem taxes on the Project or otherwise as a result of property tax reform in the State of Texas. "Insurance Expenses" shall include all premiums, deductibles and other expenses incurred by Landlord for liability (including umbrella) insurance, property insurance and business interruption insurance (including, without limitation and to the extent deemed appropriate by Landlord, environmental coverage, pollution coverage, mold coverage, terrorism coverage and whatever other special coverages and/or endorsements that Landlord, in Landlord's reasonable discretion, may from time to time consider appropriate in connection with Landlord's ownership, management or operation of the Project). Landlord shall have the right to reasonably reduce or terminate any such insurance or coverage at any time, provided that Landlord shall maintain commercially reasonably insurance consistent with best practices.

6.3Separate Assessments. Landlord may, if Landlord deems it appropriate to do so, attempt to obtain separate assessments for Tenant's obligations pursuant to Section 6.1 and, with respect to Section 6.2, for such of the Real Estate Charges as are readily susceptible of separate assessment; and if Landlord does attempt to so obtain separate assessments, Tenant shall cooperate with Landlord's efforts. To the extent of a separate assessment, Tenant agrees to pay such assessment before it becomes delinquent and to keep the Premises free and clear from any liens or attachments; moreover, as to all periods of time during the Lease Term, this covenant of Tenant shall survive the termination of this Lease.

6.4Right to Contest. Tenant agrees that, as between Tenant and Landlord, Landlord has the sole and absolute right to contest taxes levied against the Premises and the Project (other than taxes levied directly against Tenant's personal property within the Premises). Accordingly, Tenant, to the maximum extent permitted by law, irrevocably waives any and all rights that Tenant may have to receive from Landlord a copy of notices received by Landlord regarding the appraisal or reappraisal, for tax purposes, of all or any portion of the Premises or the Project. Additionally, Tenant, to the maximum extent permitted by law, hereby assigns to Landlord any and all rights of Tenant to protest or appeal any governmental appraisal or reappraisal of the value of all or any portion of the Premises or the Project. To the maximum extent permitted by law, Tenant agrees that it will not protest or appeal any such appraisal or reappraisal before a governmental taxing authority without the express written authorization of Landlord. TENANT HEREBY WAIVES ALL RIGHTS TO PROTEST THE APPRAISED VALUE OF THE PROJECT OR TO APPEAL THE SAME AND ALL RIGHTS TO RECEIVE NOTICES OF REAPPRAISALS AS SET FORTH IN SECTIONS 41.413 AND 42.015 OF THE TEXAS TAX CODE.

6

6.5Adjustment of Prorated Amounts. At such time as Landlord has reason to believe that at some time within the immediately succeeding twelve (12) month period Tenant will owe Landlord any amounts pursuant to one or more of the preceding sections of this Article VI, Landlord may direct that Tenant prepay monthly a pro rata portion of the prospective future payment as provided for in Article IX which amount may be adjusted by Landlord from time to time. In the event Landlord determines that the total of the monthly payments pursuant to this Section 6.5 for any appropriate period is not equal to the total of payments required from Tenant for either Real Estate Charges or Insurance Expenses, or both, pursuant to previous sections in this Article VI, then Tenant shall pay to Landlord any deficiency or Landlord shall refund, credit to Tenant or offset against the next due and owing payments from Tenant any overpayment, as the case may be, as provided for in Article IX. Real Estate Charges for tax years commencing prior to or extending beyond the Lease Term shall be prorated to coincide with the corresponding Commencement Date or expiration date of this Lease. If the Building is not separately assessed, Real Estate Charges allocated to the Building shall be an equitable proportion of the Real Estate Charges for all of the land and improvements included within the tax parcel assessed.

7.1Definition. The term "Common Area" is defined for all purposes of this Lease as that part of the Project intended for the common use of all tenants and their employees and other invitees, including among other facilities (as such may be applicable to the Project), parking areas, private streets and alleys, landscaping, curbs, sidewalks, lighting facilities and the like, as they may exist from time to time, but excluding (i) space in buildings (now or hereafter existing) designated for rental for commercial purposes, as the same may exist from time to time, (ii) streets and alleys maintained by a public authority, (iii) areas within the Project which may from time to time not be owned by Landlord (unless subject to a cross-access agreement benefiting the area which includes the Premises), and (iv) areas leased to any other tenant or otherwise restricted by Landlord. In addition, although the roof(s) of the building(s) in the Project are not literally part of the Common Area, they will be deemed to be so included solely for purposes of (A) Landlord's ability to prescribe rules and regulations regarding same, and (B) Tenant's obligations to pay Operating Costs with respect thereto. Landlord reserves the right to change from time to time the dimensions, size and location of the Common Area, as well as the dimensions, identities, locations, number, size and types of any buildings, signs or other improvements in the Project, including, without limitation, driveways, entrances, parking spaces, parking areas, loading areas, ingress, egress, direction of traffic, walkways and landscape areas; provided, however, that no such changes will materially and adversely impair the access to the Premises or the number of parking spaces serving the Building. For example, and without limiting the generality of the immediately preceding sentence, Landlord may from time to time substitute for any parking area other areas reasonably accessible to the tenants of the Project. Landlord retains the right to construct additional buildings and other improvements within the Common Area, provided that such additions and/or improvements do not materially interfere with or diminish Tenant’s rights under this Lease.

7.2Use of Common Area. Tenant and its employees and invitees, and when duly authorized pursuant to the provisions of this Lease, its subtenants and licensees, shall have the nonexclusive right to use the Common Area (expressly excluding roofs of buildings in the Project) as constituted from time to time, such use to be in common with Landlord, other tenants in the Project and other persons permitted by Landlord to use the same, and subject to such reasonable rules and regulations governing use as Landlord may from time to time prescribe. For example, and without limiting the generality of Landlord's ability to establish rules and regulations governing all aspects of the Common Area, Tenant agrees as follows:

(a)If Landlord designates specific parking areas for Tenant and Tenant's employees, then Tenant shall comply with Landlord's designation and shall institute procedures to ensure that its employees also comply. In the event Tenant or its employees fail to park their cars in designated parking areas as aforesaid, after written notice to Tenant and an opportunity to cure, then Landlord at its option may charge Tenant Fifty Dollars ($50.00) per day per car parked in any area other than those designated, as and for liquidated damages, and Tenant shall pay such charges in accordance with Additional Rent pursuant to Section 9.2 of this Lease. Tenant also authorizes Landlord to cause any car which is not parked in the designated parking areas to be towed from the Project.

(b)Tenant shall not take any action which would unreasonably interfere with the rights of other Project tenants or their invitees to use the Common Area.

7

(c)Landlord may temporarily close any part of the Common Area for such periods of time as may be necessary to make repairs or alterations or during construction or to prevent the public from obtaining prescriptive rights; provided, Landlord will use commercially reasonable efforts to minimize interference with Tenant’s use of or access to the Premises in connection with the exercise of such rights.

(d)Subject to Tenant’s rights as set forth in Section 7.2(e) below, the use of the roof of the Building is hereby reserved to Landlord for any and all purposes and in all respects in its reasonable discretion. Subject to Tenant’s rights as set forth in Section 7.2(e) below, Landlord shall have the right to use, possess, lease, convey interests in, alter, construct on, or otherwise manage the roof in its reasonable discretion, provided the same does not materially or unreasonably interfere with Tenant's use of the Premises for the Permitted Use or Tenant’s parking rights. Furthermore, Landlord shall have the exclusive rights to use, possess, lease, convey interests in, alter, transfer, construct on, or otherwise manage the portions of the Project other than the Premises and the parking areas provided the same does not materially and unreasonably interfere with Tenant's use of the Premises for the Permitted Use or Tenant’s parking rights. Without limitation of the foregoing, Landlord shall have the right to enter into one or more antenna, tower, communication, solar panel or similar leases or licenses with one or more third parties pursuant to which Landlord shall lease or license space on the roof of the Building or other portions of the Project other than the Premises and the parking areas for antenna, tower, communication, solar panel or other rights and uses (each an “Ancillary Lease”). Tenant agrees that (i) any tenant or licensee under any Ancillary Lease and their respective agents, employees, contractors, representatives and invitees shall have the right to (a) access the areas on and about the Project (other than the Premises), including, without limitation, the parking areas, on a temporary basis for purposes of performing any installations, maintenance, repairs and replacements of any improvements, provided such access does not materially or unreasonably interfere with Tenant's use of the Premises for the Permitted Use or Tenant’s parking rights, (b) access and enter upon the roof of the Building and other areas of the Project other than the Premises and the parking areas of the Project and (c) perform any and all installation, maintenance, repair or replacement of any antennae, towers, panels, communication installations and related fixtures or appurtenances (collectively, the “Ancillary Rights”) and (ii) Landlord shall be permitted to enter into any and all agreements (including, without limitation, easement agreements) with respect to the Project as Landlord deems necessary or advisable in connection with any Ancillary Lease and the Ancillary Rights. In no event shall Tenant or any of its employees, affiliates agents, subtenants, concessionaires, contractors, consultants, visitors or invitees of any kind, access or go upon the roof of the Building or cause or permit any penetration of such roof without the express prior written consent of Landlord which consent shall not be unreasonably conditioned, delayed or withheld, and subject to a license agreement in form satisfactory to Landlord, each in Landlord's reasonable discretion. If Tenant demonstrates to Landlord's satisfaction (in Landlord's reasonable discretion) both an actual need to use the roof and adequate procedures and safeguards to assure that no damage is done to the roof(s) (such as proper reattachment and sealing in connection with HVAC repair or replacement), all roof warranties are preserved in full, and also agrees to execute a license agreement in form satisfactory to Landlord (in Landlord's sole and absolute discretion), then Landlord may grant Tenant access to the roof(s) solely for such purpose, all in Landlord's sole and absolute discretion.

(e)Provided that Tenant complies with the terms of this Section 7.2(e), Tenant may, at its risk and expense, install a satellite dish and related wiring (collectively, the "Satellite Dish") on the roof of the Building at a location approved by Landlord, which shall not be unreasonably withheld, conditioned or delayed. Before installing the Satellite Dish, Tenant shall submit to Landlord for its reasonable approval plans and specifications which (1) specify in detail the design, location, size, and frequency of the Satellite Dish and (2) are sufficiently detailed to allow for the installation of the Satellite Dish in a good and workmanlike manner and in accordance with all laws. If Landlord approves of such plans, Tenant shall install (in a good and workmanlike manner), maintain and use the Satellite Dish in accordance with all laws and shall obtain all permits required for the installation and operation thereof; copies of all such permits must be submitted to Landlord before Tenant begins to install the Satellite Dish. Tenant shall thereafter maintain all permits necessary for the maintenance and operation of the Satellite Dish while it is on the Building and operate and maintain the Satellite Dish in such a manner so as not to unreasonably interfere with any other satellite, antennae, or other transmission facility on the Building's roof. Landlord may require that Tenant screen the Satellite Dish with a parapet wall or other screening device acceptable to Landlord. Tenant shall maintain the Satellite Dish and the screening therefor in good repair and condition. Tenant may only use the Satellite Dish in connection with Tenant's business. Tenant shall not allow any third party (other than a Permitted Transferee or approved assignee or subtenant of the Premises) to use such equipment, whether by sublease, license, occupancy agreement or otherwise. Tenant shall, at its risk and expense, remove the Satellite Dish, within five days after the occurrence of any of the following events: (A) the termination of Tenant's right to possess the Premises; (B) the

8

termination of the Lease; (C) the expiration of the Lease Term; or (D) Tenant's vacating the Premises. If Tenant fails to do so, Landlord may remove the Satellite Dish and store or dispose of it in any manner Landlord deems appropriate without liability to Tenant; Tenant shall reimburse Landlord for all costs incurred by Landlord in connection therewith within ten days after Landlord's request therefor. Tenant shall repair any damage to the Building caused by or relating to the Satellite Dish, including that which is caused by its installation, maintenance, use, or removal. All work relating to the Satellite Dish shall, at Tenant's expense, be coordinated with Landlord's roofing contractor so as not to affect any warranty for the Building's roof.

7.3Maintenance of Common Area. Landlord shall be responsible for the operation, management and maintenance of the Common Area, the manner of maintenance and the expenditures therefore (which shall be included in Operating Costs) to be in the reasonable discretion of Landlord, but to be generally in keeping with similar first- class flex /research and development properties within the same geographical area as the Project. Without limiting the generality of the immediately preceding sentence, Tenant acknowledges that LANDLORD MAKES NO REPRESENTATION, COVENANT OR WARRANTY REGARDING WHETHER OR NOT LANDLORD WILL PROVIDE SECURITY SERVICES, OR IF SO, WHAT FORM OF SECURITY SERVICES WILL BE PROVIDED.

7.4Operating Costs; Tenant's Payment of Operating Costs.

(a)In addition to the Rent and other charges prescribed in this Lease, Tenant shall pay to Landlord, as Additional Rent required pursuant to this Lease, Tenant's Proportionate Share of the actual cost of Landlord's management, operation and maintenance of the Common Area, as well as other shared costs of any kind which may be incurred by Landlord in its discretion in connection with the operation, cleaning, security, maintenance, ownership, management, and repair of the Building and the Project (collectively, the "Operating Costs"), all calculations, determinations, allocations, and decisions shall be made in accordance with GAAP, consistently applied, including, without limitation, all costs of the following: lighting, painting, cleaning, policing, inspecting, and repairing Common Area elements; trash removal (except as paid directly by Tenant or otherwise administered pursuant to Section 10.4 of this Lease); insect and pest treatments and eradication (whether in the Common Area or for the Building or the Project); security (if and to the extent Landlord elects to provide security); roof repairs and maintenance; environmental protection improvements or devices and health and safety improvements and devices which may be required by applicable laws enacted or first enforced after the Commencement Date (including the maintenance, and repair of same); environmental monitoring programs and devices; wages and salaries of all employees, agents, consultants and others engaged in operation, cleaning maintenance, repair, replacement and security of the Project but not above the title of Project manager; charges and assessments paid by Landlord pursuant to any owner's association, reciprocal easement, covenants or comparable document affecting the Building or the Project; any fees which Landlord pays for the management or asset management of the Project (not to exceed three percent (3%) of the Base Rent); utilities; snow and ice removal; the foregoing notwithstanding, monthly amortization of only those capital expenses or capital improvements made (i) to effect a net reduction or prevent a net increase in Operating Costs after considering the cost of any such amortization or (ii) to comply with laws promulgated or made applicable to the Project following the date of this Lease (such amortization to be calculated over the useful life of such improvement (as determined by Landlord in accordance with generally accepted accounting principles, consistently applied (“GAAP”)) at a rate of interest actual or imputed, at Landlord’s option, that Landlord would reasonably be required to pay to finance the cost of the item, applied on the unamortized balance (the “Permitted Capital Costs”); the cost of resurfacing and restriping parking areas and roadways; any other item stated in this Lease to be an Operating Cost, and the cost of any insurance for which Landlord is not reimbursed pursuant to Section 6.2. In addition, although the roof(s), canopies, sewer and water lines servicing the Project, fire-protection systems and devices, if any (such as sprinkler systems, if any), foundations and exterior surfaces of the building(s) in the Project are not literally part of the Common Area, Landlord and Tenant agree that all non-capital costs (other than Permitted Capital Costs) incurred by Landlord with respect to all Building sewer (including septic systems, if applicable) and water lines and other equipment (including maintenance, and repair of same), fire-protection equipment and devices (including maintenance, and repair of same), exterior painting and for roof and canopy maintenance, repair and replacement shall be included as Operating Costs pursuant to this Section 7.4, to the extent not specifically allocated to Tenant under this Lease nor to another tenant pursuant to its lease. The charges contemplated in this Section 7.4, however, shall not include any expenses paid or reimbursed by Tenant pursuant to Article VI of this Lease. Operating Costs shall expressly exclude: (i) costs of alterations of tenant spaces (including all tenant improvements to such spaces); (ii) costs of capital improvements, capital repairs or capital replacements except for Permitted Capital Costs; (iii) depreciation, interest and principal payments on mortgages, and other debt costs, if any; (iv) real estate brokers'

9

leasing commissions or compensation and advertising and other broker marketing expenses; (v) costs of other services or work performed for the singular benefit of another tenant or occupant (other than for Common Area); (vi) legal, space planning, construction, and other expenses incurred in procuring tenants for the Building or renewing or amending leases with existing tenants or occupants of the Building (other than Tenant); (vii) costs of advertising and public relations and promotional costs and attorneys' fees associated with the leasing of the Building; (viii) any expense for which Landlord actually receives reimbursement from insurance, condemnation awards, other tenants, (other than through the payment of additional rent under such tenants' leases) or any other source; (ix) costs incurred in connection with the sale, financing, refinancing, mortgaging, or other change of ownership of the Building; (x) Real Estate Charges or Insurance Expenses, which are passed through to Tenant separately; (xi) costs, fines, interest, penalties, legal fees or costs of litigation incurred due to the late payments of utility bills and other costs incurred by Landlord's failure to make such payments when due unless caused by Tenant's failure to pay on time; (xii) any attorneys' fees incurred by Landlord in connection with any lease or proposed lease at the Project; (xiii) reserves of any kind; (xiv) costs arising from Landlord's charitable or political contributions; (xv) wages, salaries, benefits, or other costs of employees above the grade of building manager; and (xvi) any costs necessitated by or resulting from the gross negligence or willful misconduct of Landlord, or its agents, contractors, or employees.

(b)Tenant shall make payment to Landlord for Tenant's Proportionate Share of Operating Costs based upon the estimated annual cost of Operating Costs, payable in advance at the same time each month as Base Rent is payable, but subject to adjustment after the end of the year on the basis of the actual costs for such year as provided for under Article IX. With regard to the charges contemplated in this Section 7.4, Tenant further agrees that unless within two (2) years after Landlord's delivery to Tenant of the annual statement related to any such charges (“Reconciliation Statement”), Tenant delivers to Landlord a written assertion of one or more specific errors or a written request for further detail regarding a specific charge, then the assessment and/or statement shall be deemed correct in all respects. In addition, Tenant further agrees that if it so asserts error or requests further information within such period, Tenant will nevertheless pay all amounts charged by Landlord pending a resolution thereof.

(c)Tenant shall have the right within two (2) years following its receipt of the Reconciliation Statement of the actual amount of Operating Costs for the prior calendar year to provide Landlord with written notice ("Tenant’s Notice") that Tenant desires to audit such of Landlord's books of account and records as pertain to and contain information concerning Operating Costs for the applicable calendar year in order to verify the accuracy of the amounts thereof. Tenant shall have the right to inspect within Dallas County, at reasonable times and in a reasonable manner consistent with standard auditing guidelines, during the 90 day period following Tenant’s receipt of requested information, which request shall be within 30 days following Landlord’s receipt of the Tenant’s Notice, to audit such books of account and records. Tenant agrees that any information obtained during an inspection by Tenant of Landlord's books of account and records shall be kept in confidence by Tenant and its agents and employees and shall not be disclosed to any other parties, except to Tenant's attorneys, accountants and other consultants or as may be required during litigation. Any parties retained by Tenant to inspect Landlord's books of account and records shall (i) be a CPA, (ii) be a nationally, regionally or locally recognized accounting or operating expense audit firm and have experience with auditing operating expenses or common area maintenance expenses for industrial properties and (iii) such accounting or audit firm may be compensated on a contingency fee or commission basis. If Tenant does not timely provide Landlord with Tenant’s Notice, or if Tenant timely provides Tenant’s Notice and thereafter Tenant does not dispute any item or items included in the determination of the Operating Costs for a particular calendar year by delivering a written notice to Landlord generally describing in reasonable detail the basis of such dispute within 90 days after Tenant’s receipt of all requested relevant information, Tenant shall be deemed to have approved such statement. If Landlord and Tenant determine that Operating Costs for the year in question were less than stated by more than five percent (5%), Landlord, within thirty (30) days after its receipt of paid invoices therefor from Tenant, shall reimburse Tenant for the reasonable amounts paid by Tenant or to be paid by Tenant to third parties in connection with such audit by Tenant provided that such fees shall not exceed $5,000.00 per year audited. In the event the results of the audit (taking into account, if applicable, the results of any additional review caused by Landlord) reveal that Tenant has overpaid obligations for a preceding period , the amount of such overpayment shall be credited against Tenant’s subsequent installment of Base Rent, Real Estate Charges or other payments due to Landlord under the Lease, except if the Lease has terminated or expired, then Landlord shall pay such amount to Tenant within thirty (30) days of completion of such audit. In the event that such results show that Tenant has underpaid its obligations for a preceding period, the amount of such underpayment shall be paid by Tenant to Landlord within thirty (30) days of completion of such audit.

10

Article VIII

RULES AND REGULATIONS; PARKING

8.1Rules and Regulations. During the Lease Term and subject to the rules and regulations for the Project attached hereto as Exhibit D, as reasonably modified by Landlord from time to time (the "Rules"), Tenant shall be entitled to use the Common Area parking lot of the Project. Landlord shall apply the Rules and Regulations in a non-discriminatory manner among all tenants in the Project. In the event of a conflict between the Rules and this Lease, this Lease shall prevail.

8.2Parking. Tenant shall have the exclusive right to use all 420 parking spaces serving the Building. Tenant's parking rights are the personal rights of Tenant, and Tenant shall not transfer, assign or otherwise convey its parking rights separate and apart from this Lease. In addition to the parking spaces serving the Building, Tenant shall have the non-exclusive right to use up to one hundred twenty (120) spaces, subject to availability (as determined by Landlord in its sole discretion) but in no event less than thirty (30) parking spaces in the parking lot serving the building located at 000 Xxxxxx Xxxx, Xxxxx, Xxxxx (the “640 Building”); provided, in no event shall Tenant have the right to use any of the parking spaces located in the first three rows of parking spaces closest to the 640 Building. Tenant shall have access to these thirty (30) parking spaces for the full term of this Lease and any extension thereof. Landlord shall not be responsible for enforcing Tenant's parking rights against any third parties.

Article IX

PROVISIONS APPLICABLE TO ALL RENTS

9.1Rent. For purposes of this Lease, the term "Rent," "Rents," "Rental" or "Rentals" shall be deemed to include Base Rent (Sections 1.1(l)) and 4.1 of this Lease), Tenant's required payments for Real Estate Charges and Insurance Expenses (Article VI of this Lease), Operating Costs (Section 7.4 of this Lease) and Additional Rent. Landlord and Tenant agree that each provision of this Lease for determining Rent adequately and sufficiently describes to Tenant the method by which such Rent is to be computed. Any and all sums of money or charges to be paid by Tenant pursuant to the provisions of this Lease other than Base Rent are hereby designated as and included in the term "Additional Rent." A failure to pay Additional Rent shall be treated in all events as the failure to pay Rent. Landlord and Tenant agree that each provision of this Lease for determining charges, amounts, and Additional Rent payments by Tenant is commercially reasonable, and as to each such charge or amount, constitutes a "method by which the charge is to be computed" for purposes of Section 93.012 (Assessment of Charges) of the Texas Property Code, as such section now exists or as it may be hereafter amended or succeeded.

9.2Payment of Rent. Except as otherwise set forth in Section 1.1(m) and Section 30.16 of this Lease, Rent shall accrue from the Commencement Date and shall be payable to Landlord at Landlord's address specified in Section 1.2 of this Lease, or at any other address which Landlord may subsequently designate in a written notice to Tenant.

9.3Tenant's Proportionate Share. Tenant shall pay to Landlord Tenant's Proportionate Share of the Operating Costs, Real Estate Charges and Insurance Expenses (collectively, the "Shared Expenses") as set forth above. Further, Tenant shall during each calendar year pay to Landlord an estimate of Tenant's Proportionate Share of the Shared Expenses as hereinafter set forth. Beginning on the Commencement Date, Tenant shall pay to Landlord each month on the first day of the month an amount equal to one-twelfth (1/12) of Tenant's Proportionate Share of the Shared Expenses for the calendar year in question as reasonably estimated by Landlord, with an adjustment to be made between the parties at a later date as hereinafter provided. If the Commencement Date is not the first day of a calendar month, Tenant shall pay a prorated portion of Tenant's Proportionate Share of the Shared Expenses for such partial month on the Commencement Date. Furthermore, Landlord may from time to time (but not more often than twice annually) furnish Tenant with notice of a re-estimation of the amount of Tenant's Proportionate Share and Tenant shall commence paying its re-estimated Tenant's Proportionate Share on the first day of the month following receipt of said notice. As soon as practicable following the end of any calendar year, Landlord shall submit to Tenant a statement setting forth the exact amount of Tenant's Proportionate Share of the Shared Expenses for the calendar year just completed and the difference, if any, between Tenant's Proportionate Share of the actual Shared Expenses for the

11

calendar year just completed and the estimated amount of Tenant's Proportionate Share of the Shared Expenses which were paid for such year. Such statement shall also set forth the amount of the estimated Shared Expenses reimbursement for the new calendar year computed in accordance with the foregoing provisions. To the extent that Tenant's Proportionate Share of the actual Shared Expenses for the period covered by such statement is higher than the estimated payments which Tenant previously paid during the calendar year just completed, Tenant shall pay to Landlord the difference within thirty (30) days following receipt of said statement from Landlord. To the extent that Tenant's Proportionate Share of the actual Shared Expenses for the period covered by the applicable statement is less than the estimated payments which Tenant previously paid during the calendar year just completed, Landlord shall at its option either refund said amount to Tenant within thirty (30) days or credit the difference against Tenant's next payment of Shared Expenses. In addition, with respect to the monthly reimbursement, until Tenant receives such statement, Tenant's monthly reimbursement for the new calendar year shall continue to be paid at the then current rate, but Tenant shall commence payment to Landlord of the monthly installments of reimbursement on the basis of the statement beginning on the first day of the month not less than thirty (30) days following the month in which Tenant receives such statement.

9.4Survival of Proportionate Share. Tenant's obligation with respect to Tenant's Proportionate Share of the Shared Expenses shall survive the expiration or early termination of this Lease and Landlord shall have the right to retain the Security Deposit (if any), or so much thereof as it deems necessary, to secure payment of Tenant's Proportionate Share of the actual Shared Expenses for the portion of the final calendar year of the Lease during which Tenant was obligated to pay such expenses. If Tenant occupies the Premises for less than a full calendar year during the first or last calendar years of the Lease Term, Tenant's Proportionate Share for such partial year shall be calculated by proportionately reducing the Shared Expenses to reflect the number of months in such year during which Tenant occupied the Premises. Tenant shall pay Tenant's Proportionate Share within fifteen (15) days following receipt of notice thereof.

9.5Due Dates for Rent; Late Charge. The parties agree that each monthly installment of Base Rent and Tenant's monthly payments for the Shared Expenses are payable on or before the first day of each calendar month. Any such payment of Rent which is not received on or before the first day of a particular calendar month shall be deemed past-due. The parties further agree that each annual adjustment payment from Tenant (such as the payments prescribed in Sections 6.5, 7.4 and 9.3) is payable within thirty (30) days after receipt of Landlord's written statement requesting such payment from Tenant; and any such prescribed payment which is not so received shall be deemed past-due. All Rent shall be due and payable in advance, without demand, offset or deduction of any nature except as may be provided for in this Lease. In the event any Rent which is payable pursuant to this Lease is not actually received by Landlord within five (5) days after its due date for any reason whatsoever (including, but not limited to, a failure in the United States mails), or if any Rent payment is by check which is returned for insufficient funds, then in addition to the past due amount, Tenant shall pay to Landlord a late charge in an amount equal to five percent (5%) of the Rent then due, in order to compensate Landlord for its administrative and other overhead expenses. Any such late charge shall be payable as Additional Rent under this Lease and shall be payable immediately on demand. If any Rent is paid by check which is returned for insufficient funds, Tenant shall immediately make the required payment to Landlord in the form of a cashier's check or money order; moreover, Tenant shall also pay Landlord the amounts specified above in this Section 9.4, plus an additional fee of $100.00 to compensate Landlord for its expense and effort in connection with the dishonored check. Notwithstanding the foregoing, the late charge referenced above shall not be charged with respect to the first occurrence (but not any subsequent occurrence) during any 12-month period that Tenant fails to make payment when due, until five days after Landlord delivers written notice of such delinquency to Tenant.

12

Article X

USE AND CARE OF PREMISES

10.1Term of Use. Tenant shall commence business operations in the Premises on or immediately after the Commencement Date.

10.2Permitted Use. The Premises may be used only for the purpose or purposes specified in Section 5.1 above, and for no other purpose.

10.3Certain Prohibited Uses. Tenant shall not conduct or give notice of any fire, auction (public or private), "going-out-of-business," "lost-our-lease," "moving," bankruptcy or similar sale at or on the Premises. Tenant shall not permit any objectionable noises, odors, vibrations, dust, gas, exhaust or smoke to emanate from the Premises (or from any facility or equipment servicing the Premises); nor, except as otherwise expressly provided in this Lease, place or permit any radio or television antenna, satellite dish, loudspeaker or amplifier on the roof or exterior walls or outside the Premises or where the same can be seen or heard from outside the Premises; nor place any antenna, equipment, awning or other projection on the exterior of the Premises or Building; nor take any other action which would constitute a nuisance or would unreasonably interfere with, disturb or endanger Landlord or other tenants of the Project or occupants or owners of adjacent or nearby properties, or unreasonably interfere with their use of their respective premises; nor permit any unlawful or immoral practice to be carried on or committed on the Premises; nor do or permit anything which would void Tenant's or Landlord's insurance, increase the cost of insurance or cause the disallowance of sprinkler credits. If Tenant causes any increase in the cost of insurance on the Premises or the Project, then Tenant shall pay to Landlord the amount of such increase as Additional Rent.

10.4Care of Premises by Tenant. Tenant shall take good care of the Premises and shall operate in the Premises in a safe, careful and proper manner; shall not commit or suffer waste in or about the Premises, nor to any facility or equipment for which Tenant is responsible pursuant to Section 11.2 of this Lease; shall not cause damage or permit any trucks or vehicles visiting the Premises to cause any damage to the Premises or any other portion of the Building (and, if any such damage should occur, shall immediately repair same or, if Landlord so elects, reimburse Landlord for Landlord's cost in repairing same); and shall keep the Premises free of insects, rodents, vermin and other pests. Tenant shall keep the Premises secure, Tenant hereby acknowledging that security is Tenant's responsibility and that Tenant is not relying on any representation or warranty by Landlord in this regard. Tenant shall not overload the floors in the Premises, nor deface or injure the Premises. Tenant shall keep the Premises and all loading areas adjacent to the Premises neat, clean and free from dirt and rubbish at all times. Tenant shall store all trash and garbage within the Premises, or in a trash dumpster or similar container approved by Landlord in Landlord's reasonable discretion; and if Landlord is not arranging for trash pick-up as part of the services for which Tenant pays pursuant to Section 7.4 above, then Tenant shall arrange for the regular pick-up of such trash and garbage at Tenant's expense. Receiving and delivery of goods and merchandise and removal of garbage and trash shall be made only in the manner and areas prescribed by Landlord. Outside storage, including, without limitation, storage of containers, trailers, trucks and other vehicles, is prohibited without Landlord's prior written consent which may be withheld in Landlord's reasonable discretion.

10.5Tenant's Compliance with Law. Tenant shall procure at its sole expense any permits and licenses required for the transaction of business in the Premises and shall otherwise comply with all applicable federal, state, county and municipal laws, ordinances, governmental regulations and all recorded easements, covenants and restrictions. In addition, if the nature of Tenant's business makes it advisable for Tenant to take any extra precautions (for example, in the case of equipment requiring special safety training for employees, Tenant's compliance with all required educational programs and procedures), Tenant shall take all such extra precautions. Without limiting the generality of the foregoing Tenant further agrees as follows:

13

(a)Tenant shall not commence business operations in the Premises without having first obtained any and all permits or approvals necessary for the lawful operation of Tenant's business in the Premises from the appropriate governmental authority;

(b)The following will govern Landlord’s and Tenant’s obligations with respect to Governmental Requirements (hereinafter defined):

(i)If any federal, state or local laws, ordinances, orders, rules, regulations or requirements (including the federal Americans with Disabilities Act of 1990 ("ADA"), as the same may have been or may be amended from time to time, and all federal, state, county and municipal laws, ordinances, codes and regulations which relate in any way to the matters regulated by the ADA (collectively, the "ADA-based Laws")) (collectively, "Governmental Requirements") in existence as of the date of this Lease require an alteration or modification of the Premises (a "Code Modification") and such Code Modification (1) is not made necessary as a result of the specific use being made by Tenant of the Premises (as distinguished from an alteration or improvement which would be required to be made by the owner of any industrial building comparable to the Building irrespective of the use thereof by any particular occupant), and (2) is not made necessary as a result of any alteration of the Premises by Tenant, such Code Modification shall be performed by Landlord, at Landlord's sole cost and expense.

(ii)If, as a result of one or more Governmental Requirements that are not in existence as of the date of this Lease, it is necessary from time to time during the Lease Term, to perform a Code Modification to the Building or the Project that (1) is not made necessary as a result of the specific use being made by Tenant of the Premises (as distinguished from an alteration or improvement which would be required to be made by the owner of any industrial building comparable to the Building irrespective of the use thereof by any particular occupant), and (2) is not made necessary as a result of any alteration of the Premises by Tenant, such Code Modification shall be performed by Landlord and cost thereof shall be included in Operating Costs.

(iii)If, as a result of one or more Governmental Requirements, it is necessary from time to time during the Lease Term to perform a Code Modification to the Building or the Project that is made necessary as a result of the specific use being made by Tenant of the Premises or as a result of any alteration of the Premises by Tenant, such Code Modification shall be the sole and exclusive responsibility of Tenant in all respects; provided, however, that Tenant shall have the right to retract its request to perform a proposed alteration in the event that the performance of such alteration would trigger the requirement for a Code Modifications.

(c)Tenant shall be responsible for compliance with all federal, state, county and municipal laws and regulations relating to health and safety, including without limitation the federal Occupational Safety and Health Act of 1970 ("OSHA"), as the same may have been or may be amended from time to time, and any and all other federal, state, county and municipal laws, ordinances, codes and regulations which relate in any way to the matters regulated by OSHA; and

(d)At Landlord's request, Tenant shall deliver to Landlord copies of all necessary permits and licenses and proof of Tenant's compliance with all such laws, ordinances, governmental regulations and extra precautions. Any use or occupancy of the Premises by or on behalf of Tenant prior to the Commencement Date shall be subject to each and every obligation of Tenant under this Lease.

Article XI

MAINTENANCE AND REPAIR OF PREMISES

11.1Maintenance by Landlord. Landlord shall at Landlord's expense (subject to Section 7.4 above) keep the foundation, the structural elements of all exterior walls and the roof of the Premises in good repair, reasonable wear and tear excepted. As used in this Lease, the term "exterior walls" shall specifically exclude: plate glass; windows, doors and other exterior openings; dock bumpers, dock plates or levelers; office entries or store fronts; window and door frames, closure devices, locks and hardware; interior lighting, heating, air-conditioning, plumbing

14

and other electrical, mechanical and electromotive installation equipment and fixtures; signs, placards, or other advertising media of any type; and interior painting or other treatment of interior walls, all of which are to be maintained, repaired and replaced by Tenant or at Tenant's sole cost, provided, however, that Landlord will be responsible for performing adequate preventative maintenance on the HVAC (as defined below) for the Premises, subject to the provisions of Article XVIII, Article XIX, and Article XXIII of this Lease. Landlord, however, shall not be required to make any repairs or replacements occasioned by (a) the failure of Tenant to perform its obligations under this Lease or (b) the act or negligence of Tenant, its agents, employees, subtenants, licensees and concessionaires (including, but not limited to, roof leaks resulting from Tenant's installation, replacement or maintenance of air-conditioning equipment or any other roof penetration or placement), provided that if Landlord, in its sole discretion, determines to make such repairs or replacements, Landlord shall have no liability to Tenant for any loss or damage which may result to its stock or business by reason of such repairs or replacements and Tenant shall pay to Landlord upon demand, as Additional Rent hereunder, the cost of such repairs or replacements plus a one-time charge in an amount equal to ten percent (10%) of the cost of any such repair or replacement required to be made by Tenant which Tenant, after notice and an opportunity to cure, failed to complete, in order to compensate Landlord for its administrative and other overhead expenses. If the Premises should become in need of repairs required to be made by Landlord hereunder, Tenant shall give immediate written notice thereof to Landlord, and Landlord shall have a reasonable time after receipt by Landlord of such written notice in which to make such repairs. Tenant waives the right to make repairs at Landlord's expense under any applicable Laws. Notwithstanding the foregoing provisions of this Section 11.1, if, during the Lease Term, Landlord’s roofing consultant recommends that Landlord replace the roof membrane, Landlord will perform such work and replace such roof at Landlord’s sole cost and expense and shall not include the cost thereof in Operating Costs. Landlord shall keep the Premises and all parking areas, driveways, sidewalks, landscape areas, service-ways and loading areas adjacent to the Premises neat, clean and free from dirt, rubbish, ice or snow at all times. Landlord shall maintain and keep in good working order, condition and repair, during the term of this Lease, as the same may be extended, all structural portions of the Building/Project, including the foundation, roof, exterior walls, stairwells, columns, and beams (collectively, “Building Structure”) and the mechanical, electrical, life safety, plumbing, and sprinkler systems that do not exclusively serve the Premises (collectively, “Building Systems”). In addition, Landlord shall maintain and keep in good working order, condition and repair (including snow/ice removal) all Common Areas during the term, as the same may be extended.

11.2Maintenance by Tenant. Tenant shall keep the Premises in good, clean and habitable condition and shall at its sole cost and expense make all needed repairs and replacements, including replacement of cracked or broken glass, except for repairs and replacements required to be made by Landlord under the provisions of Section 11.1, Article XVIII and Article XIX. Without limiting the coverage of the previous sentence, it is understood that Tenant's responsibilities therein include all items which are expressly excluded from Landlord's responsibility in Section 11.1 above, as well as the maintenance, repair and replacement of all of the following facilities and equipment, to the extent exclusively servicing the Premises: interior lighting, fire-protection sprinkler systems, plumbing, exhaust systems, and other electrical, mechanical and electromotive installation, equipment and fixtures. In addition, Tenant's responsibilities shall also include all maintenance, repairs and replacements of ducts, conduits, pipes and wiring, and any sewer stoppage located in, under and above the Premises, regardless of when or how the defect or other cause for repair or replacement occurred or became apparent. Tenant shall give Landlord prompt written notice of any leaks or water damage and any need for repair or replacement as contemplated in this Section 11.2, especially if such repair or replacement is necessary for maintaining health and safety (such as the fire-protection sprinkler system). If any maintenance, repairs or replacements required to be made by Tenant hereunder are not made within ten days after written notice delivered to Tenant by Landlord (or less than ten days, in the case of a situation which by its nature requires an immediate response or a response within less than ten days), Landlord may at its option perform such maintenance, repairs or replacements without liability to Tenant for any loss or damage which may result to its stock or business by reason of such maintenance, repairs or replacements; and Tenant shall pay to Landlord upon demand, as Additional Rent hereunder, the cost of such repairs plus a one-time charge in an amount equal to ten percent (10%) of the cost of any such maintenance, repair or replacement, in order to compensate Landlord for its administrative and other overhead expenses. At the expiration or earlier termination of this Lease, Tenant shall surrender the Premises broom-clean and in good condition, free of debris and of Tenant's personal property and equipment excepting reasonable wear and tear and losses required to be restored by Landlord in Section 11.1, Article XVIII and Article XIX of this Lease, and in accordance with the Move-Out Standards set forth in Exhibit C to this Lease; and without limiting the generality of the foregoing, Tenant agrees that it shall repair all damage which may be caused to the Premises by the removal of Tenant's property; moreover, Tenant shall remove all of Tenant's signage and repair all damage caused by the installation, operation or removal of same. Any of Tenant's property not removed by Tenant from the Premises

15

on or before the expiration of this Lease shall be deemed abandoned and Landlord may dispose of or remove such property, at its sole election, without any liability whatsoever to Tenant for damages therefor. Notwithstanding the foregoing provisions of this Section 11.2 and subject to the provisions of Section 11.3, to the extent Tenant requests that Landlord replace a HVAC unit serving the Premises and Landlord’s HVAC Contractor agrees that such unit must be replaced (except to the extent replacement is necessitated by Tenant's negligence or willful misconduct, in which case Tenant shall be responsible for all costs), Landlord shall pay the cost of such replacement, it being understood and agreed that the cost of said improvement or replacement shall be amortized over a term of fifteen (15) years, beginning on the first day of the calendar month after the calendar month in which the replacement occurs, which amortization shall be based upon equal payments of principal and interest over said fifteen (15) year term, and interest shall be at a rate equal to eight percent (8%) per annum. Throughout that portion of the Lease Term (as it may be extended) during which such amortization occurs, Tenant shall pay, as Additional Rent, simultaneously with its payment of each installment of Base Rent hereunder, beginning on the first day of the first calendar month after the replacement is installed, the amortized amount, including interest as specified above.