PURCHASE AND SALE AGREEMENT SCOTT’S LIQUID GOLD-INC., SELLER HAVANA GOLD, LLC, PURCHASER November 21, 2012

EXHIBIT 10.24

XXXXX’X LIQUID GOLD-INC., SELLER

HAVANA GOLD, LLC, PURCHASER

November 21, 2012

TABLE OF CONTENTS

| Page | ||||||

| ARTICLE 1 PURCHASE AND SALE; LEASEBACK | 1 | |||||

| Section 1.1 |

Purchase and Sale | 1 | ||||

| Section 1.2 |

Purchase Price; Payment of the Purchase Price | 1 | ||||

| Section 1.3 |

Personal Property | 1 | ||||

| Section 1.4 |

Leaseback to Seller | 2 | ||||

| ARTICLE 2 CLOSING |

3 | |||||

| Section 2.1 |

Closing | 3 | ||||

| Section 2.2 |

Seller’s Closing Items | 3 | ||||

| Section 2.3 |

Purchaser’s Closing Items | 4 | ||||

| Section 2.4 |

Other Closing Documents | 4 | ||||

| Section 2.5 |

Conditions to Purchaser’s Obligations | 5 | ||||

| ARTICLE 3 CLOSING AND POST-CLOSING ADJUSTMENTS |

11 | |||||

| Section 3.1 |

Closing Adjustments | 11 | ||||

| Section 3.2 |

Collection of Receivables | 12 | ||||

| Section 3.3 |

Leasing Commissions | 13 | ||||

| Section 3.4 |

Post-Closing Apportionments | 13 | ||||

| ARTICLE 4 DEFAULT |

14 | |||||

| Section 4.1 |

Default and Termination | 14 | ||||

| ARTICLE 5 CASUALTY AND CONDEMNATION |

14 | |||||

| Section 5.1 |

Casualty | 14 | ||||

| Section 5.2 |

Condemnation | 15 | ||||

| ARTICLE 6 OPERATION OF THE PROPERTY; LEASING; TERMINATION OF CONTRACTS |

15 | |||||

| ARTICLE 7 GENERAL DISCLAIMER; ENVIRONMENTAL RELEASE |

17 | |||||

| Section 7.1 |

General Disclaimer | 17 | ||||

| Section 7.2 |

Environmental Report; Environmental Release | 19 | ||||

| ARTICLE 8 MISCELLANEOUS |

19 | |||||

| Section 8.1 |

Special Districts | 19 | ||||

| Section 8.2 |

Confidentiality, Distribution of Information | 20 | ||||

| Section 8.3 |

Authority of Seller and Purchaser | 20 | ||||

| Section 8.4 |

Brokers | 20 | ||||

| Section 8.5 |

Assignability | 21 | ||||

| Section 8.6 |

Notices | 21 | ||||

| Section 8.7 |

Binding Effect | 23 | ||||

| Section 8.8 |

Entire Agreement; Modification | 23 | ||||

| Section 8.9 |

Headings | 23 | ||||

| Section 8.10 |

No Merger | 23 | ||||

i

| Section 8.11 |

Counterparts | 23 | ||||

| Section 8.12 |

Severability | 23 | ||||

| Section 8.13 |

No Waiver | 23 | ||||

| Section 8.14 |

U.S. Dollars | 23 | ||||

| Section 8.15 |

Construction of Agreement | 23 | ||||

| Section 8.16 |

Governing Law; Attorneys’ Fees | 23 | ||||

| Section 8.17 |

Recordation | 24 | ||||

| Section 8.18 |

Relationship of Parties | 24 | ||||

| Section 8.19 |

Exhibits; Section References | 24 | ||||

| Section 8.20 |

Date of This Agreement | 24 | ||||

| Section 8.21 |

Intentionally Omitted | 24 | ||||

| Section 8.22 |

Time of Essence | 24 | ||||

| Section 8.23 |

OFAC Representation of Purchaser | 24 | ||||

| Section 8.24 |

Cap on Limited Representations of Seller | 24 | ||||

| Section 8.25 |

Section 1031 Exchange | 25 |

| Exhibits: |

||

| Exhibit A - |

Legal Description | |

| Exhibit B - |

Forms of Closing Documents | |

| Exhibit C - |

Tenant Estoppel Letter | |

| Exhibit D - |

Seller’s Certificate | |

| Exhibit E - |

Copies Provided to Purchaser | |

| Exhibit F - |

Form of Seller Leases |

ii

THIS PURCHASE AND SALE AGREEMENT (“Agreement”) is entered into by XXXXX’X LIQUID GOLD-INC., a Colorado corporation (the “Seller”), and HAVANA GOLD, LLC, a Colorado limited liability company (the “Purchaser”).

ARTICLE 1

PURCHASE AND SALE; LEASEBACK

Section 1.1 Purchase and Sale. Subject to the terms and provisions in this Agreement, Seller agrees to sell to Purchaser and Purchaser agrees to purchase from Seller the parcel of land described in Exhibit A to this Agreement, and the buildings, fixtures and other improvements located on that land, known as the “Xxxxx’x Liquid Gold Campus”, with an address of 0000 Xxxxxx Xxxxxx, Xxxxxx, Xxxxxxxx 00000 (the “Property”), along with (i) all easements, servitudes and other rights now belonging or appertaining to the Property, (ii) all right, title and interest of the Seller in and to any land lying in the bed of any street, road, avenue or alley, open or closed, adjoining the Property and to their center line, and (iii) the Personal Property described in Section 1.3.

Section 1.2 Purchase Price; Payment of the Purchase Price. The purchase price of the Property and Personal Property is $9,500,000.00 (the “Purchase Price”). The Purchase Price (subject to the prorations to be made under this Agreement) is payable by Purchaser as follows:

a. Deposit. Within one (1) business day after the execution of this Agreement by all parties hereto, Purchaser shall deliver a deposit payment in the amount of $1,000,000.00 (together with all interest earned thereon, the “Deposit”) to Chicago Title Insurance Company (the “Escrow Agent”), at its offices at 0000 Xxxxxxxx Xx., Xxxxx 0000, Xxxxxx, XX 00000, Attention: Xx. Xxxxxx Xxxx. The Deposit is to be held by the Escrow Agent pursuant to the provisions of this Agreement. Unless this Agreement has been properly terminated by Purchaser pursuant to Section 2.5d(i) below, the Deposit shall be nonrefundable to Purchaser after the final day of the Inspection Period (as hereinafter defined), except in the event of an uncured Seller default or as otherwise specifically provided in Section 2.5 or Article 5.

b. Balance of Purchase Price. The balance of the Purchase Price of $8,500,000.00 shall be paid to Seller on the Closing Date (as hereinafter defined) in immediately available good funds, which payment shall be made by wire transfer to the Escrow Agent on or before 2:00 p.m. Mountain Time on the Closing Date, and the Escrow Agent shall deliver both the balance of the Purchase Price and the Deposit to Seller.

Section 1.3 Personal Property. Included in the sale of the Property is all of the Seller’s right, title and interest in and to the following (the “Personal Property”):

a. Leases. All leases and rental agreements in effect as of the Closing (as hereinafter defined) with respect to the Property (the “Leases”), together with any security deposits and guaranties of any Leases;

-1-

b. Contracts. The service, supply, leasing, maintenance and other contracts entered into in connection with the operation, leasing, maintenance and repair of the Property and the Personal Property, except those which Purchaser requests in writing during the Inspection Period that Seller terminate, subject to Article 6 (the “Contracts”);

c. Licenses, Permits and Warranties. To the extent they may be transferred by Seller and are in existence and effect (i) all licenses, permits, approvals and authorizations required for the ownership, use and operation of the Property; and (ii) warranties covering any portion of the Property;

d. Surveys and Plans. All existing surveys, blueprints, drawings, plans and specifications (including, without limitation, structural, HVAC, mechanical and plumbing plans and specifications) in Seller’s possession;

e. Leasing Materials. All tenant lists, lease files, lease booklets, manuals and promotional and advertising materials concerning the Property or used in connection with the operation of the Property, exclusive of any internal books and records of Seller maintained at any of Seller’s offices, internal appraisals and/or evaluations of the Property, budgets and any other privileged or proprietary information; and

f. Other Personal Property. All other tangible and intangible personal property owned by Seller and used in connection with the Property, including, without limitation and to the extent assignable to Purchaser, the furniture, fixtures, inventory, equipment, operating supplies, tools, machinery and other personal property which are now located on or attached to the Property, but excluding (i) any names or marks of Seller or any affiliates of Seller, (ii) the accounts and other property reserved by Seller under Section 3.1.e below, and (iii) any personal property used in or related to the conduct of Seller’s business, including without limitation the furniture, fixtures, inventory, equipment, operating supplies, tools, machinery and other personal property located in the first floor mailroom, the third floor computer room, or on the fourth or fifth floors of the office building commonly known as Building A, or in the warehouses commonly known as Buildings B, C and D (collectively, the “Other Personal Property”). The parties shall agree prior to the final day of the Inspection Period upon the list of the Other Personal Property to be included in the sale and conveyed to Purchaser hereunder.

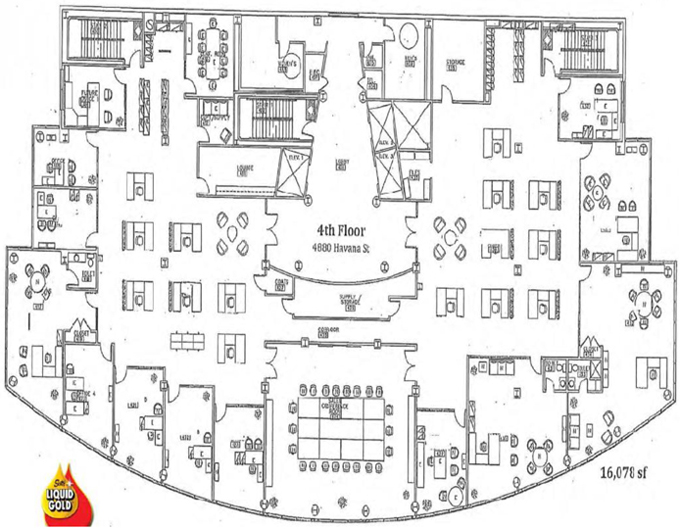

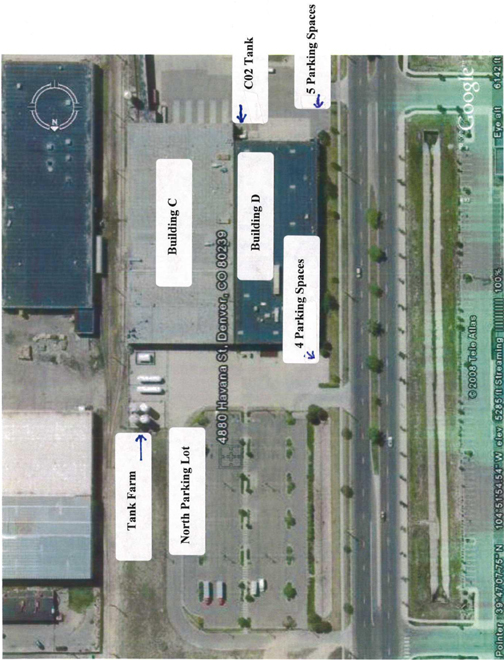

Section 1.4 Leaseback to Seller. At the Closing, Seller and Purchaser shall enter into one or more leases in substantially the form of Exhibit F-1 and Exhibit F-2 attached hereto and incorporated herein by this reference (collectively, the “Seller Leases”), pursuant to which Purchaser shall lease to Seller portions of the buildings and land included within the Property, consisting of approximately 113,620 square feet of warehouse and manufacturing space within the buildings known as Buildings C and D, approximately 16,078 square feet of office space on the fourth floor of the building known as Building A and the computer room located on the third floor of that Building, associated underground and surface parking, the tank farm, and the railroad tracks, in each case at the locations shown on the site plan attached to the Seller Leases, for the term, at the rental rates, and on the other conditions set forth in the Seller Leases.

-2-

ARTICLE 2

CLOSING

Section 2.1 Closing. The closing of the purchase and sale of the Property (“Closing”) shall be held on the date that is ninety (90) days from the final day of the Inspection Period, or on such earlier date as the parties may agree in writing (the “Closing Date”), at 10:00 a.m. Mountain Time, at the offices of the Escrow Agent. Purchaser shall have a one-time option to extend the Closing Date by up to 30 days, by delivery of written notice to Seller on or before the date that is 15 days prior to the originally scheduled Closing Date, specifying the date to which Purchaser elects to extend the Closing. Time is of the essence with respect to the obligations of Seller and Purchaser to close the purchase and sale pursuant to this Agreement on the Closing Date, except as expressly provided in this Agreement.

Section 2.2 Seller’s Closing Items. At the Closing, Seller agrees to execute, deliver and/or provide to Purchaser, or cause to be executed, delivered and provided to Purchaser, the following with respect to the Property:

a. Deed. A special warranty deed (the “Deed”) conveying fee title to the Property to Purchaser, subject to the Permitted Exceptions (as hereinafter defined), substantially in the form attached as Exhibit B-1 to this Agreement;

b. Assignment of Leases. An assignment to and assumption by Purchaser of the Leases for the Property and any lease guaranties or similar rights, including the Leases which are listed on the Rent Roll (as hereinafter defined) and those executed in accordance with Article 6, substantially in the form attached as Exhibit B-2 to this Agreement;

c. Assignment of Contracts. An assignment to and assumption by Purchaser of the Contracts delivered or made available to Purchaser during the Inspection Period (except those which Purchaser requests in writing during the Inspection Period that Seller terminate and that have been terminated in accordance with Article 6 below), and of those entered into in accordance with Article 6, substantially in the form attached as Exhibit B-3 to this Agreement;

d. Xxxx of Sale. A xxxx of sale transferring Seller’s interest in the other Personal Property to Purchaser, substantially in the form attached as Exhibit B-4 to this Agreement;

e. Non-Foreign Affidavit. An affidavit stating that Seller is not a “foreign person” within the meaning of Section 1445 of the Internal Revenue Code, substantially in the form attached as Exhibit B-5 to this Agreement;

f. Tenant Estoppel Letters. The tenant estoppel letters to be obtained in accordance with Section 2.5b, and any Seller’s certificate, if Seller so elects, delivered pursuant to Section 2.5b, substantially in the forms attached as Exhibit C to this Agreement; provided that if any Lease provides for a different form of tenant estoppel letter, the form attached to such Lease shall be used;

g. Seller Leases. The Seller Leases, substantially in the form attached as Exhibits F-1 and F-2 to this Agreement;

-3-

h. Leases and Contracts. Originals of all Leases, Contracts and other similar documentary items of Personal Property in the possession of Seller, as well as any and all building plans, surveys, site plans, landscaping plans, development plans, specifications and drawings concerning the Property which are in the possession of Seller; provided, if an original is not available, a photocopy will be acceptable;

i. Authorization Documents. Certified copies of resolutions or other authorizing documentation approving the execution and delivery of this Agreement and the other documents delivered and to be delivered under it by Seller, the performance by Seller of its obligations under this Agreement and such other documents and the consummation by Seller of the transactions contemplated hereby, including, without limitation, certificates of incumbency;

j. Owner’s Title Policy. The Title Policy referred to in Section 2.5c, which may be delivered a reasonable time after the Closing if that is the customary practice of the Title Insurer (as hereinafter defined), provided that a marked pro forma policy or marked commitment reflecting the exceptions to be contained in the policy is delivered at the Closing;

k. Notices to Tenants. A notice to the tenants of the Property informing them of the sale of the Property to Purchaser; and

l. Other Property. Any bonds, warranties or guarantees which are applicable to the Property and Personal Property and which are in Seller’s possession or control and, to the extent in the possession or control of Seller and except as may be retained by Seller pursuant to the Seller Leases, all keys and combinations to locks for the Property with identification of the lock to which each key or combination fits.

Section 2.3 Purchaser’s Closing Items. At the Closing, Purchaser agrees to execute, deliver and/or provide to Seller, or cause to be executed, delivered and/or provided to Seller, the following:

a. Authorization Documents. Certified copies of resolutions or other authorizing documentation approving the execution and delivery of this Agreement and the other documents delivered and to be delivered under it by Purchaser, the performance by Purchaser of its obligations under this Agreement and such other documents and the consummation by Purchaser of the transactions contemplated hereby, including, without limitation, certificates of incumbency;

b. Purchase Price. The balance of the Purchase Price as provided in Section l.2b;

c. Assignments. The assignment and assumption agreements executed and delivered by Seller pursuant to Section 2.2b and 2.2c; and

d. Seller Leases. The Seller Leases executed and delivered by Seller pursuant to Section 2.2g.

Section 2.4 Other Closing Documents. In addition to the documents referred to in Sections 2.2 and 2.3, each party agrees to execute and deliver at the Closing such other documents as may be required by this Agreement, or as may be agreed upon during the Inspection Period, or as may be necessary to carry out its obligations under this Agreement.

-4-

Section 2.5 Conditions to Purchaser’s Obligations. The obligation of Purchaser to purchase the Property pursuant to this Agreement is subject to the fulfillment on or prior to the Closing Date, as provided below, of each of the following conditions, except to the extent waived by Purchaser:

a. Seller’s Representations and Warranties. All representations and warranties of Seller set forth in Section 2.5d(iii) shall be true in all material respects as of the Closing Date;

b. Tenant Estoppel Letters. Seller shall have obtained estoppel letters substantially in the form (and a qualification such as to a tenant’s actual knowledge shall be acceptable) attached hereto as Exhibit C from the following tenants: Alstom Power, Inc. and Tetra Tech, Inc. Seller shall provide copies of the estoppel letters (with the information inserted by Seller) to Purchaser prior to their delivery to the tenants, and Purchaser shall have two business days after they are delivered to suggest any changes to the estoppel letters. Seller agrees to use reasonable efforts to obtain estoppel letters from all tenants which occupy space in the buildings by three business days prior to the Closing, and shall deliver copies of the signed estoppel letters to Purchaser within two business days after they are received by Seller. If on the Closing Date Seller has not obtained estoppel letters from all such tenants, Seller may elect, subject to its right to extend the Closing as provided below, to execute and deliver to Purchaser at the Closing its own certificate in the form attached as Exhibit D with respect to space leased to tenants who have not delivered estoppel letters. Seller shall be deemed to have represented and warranted that to the actual knowledge of the Employees (as defined in Section 2.5d(iii)) each item of information contained in its certificate delivered to Purchaser as to each of those Leases is accurate, which representations and warranties shall survive for a period terminating on the earlier of (i) one year from the Closing Date or (ii) the date on which Purchaser has received an executed estoppel letter signed by the tenant under the Leases in question confirming such item of information. If Seller has not obtained estoppel letters from all such tenants by the Closing Date, Seller may adjourn the Closing Date for up to 30 days to allow it additional time to satisfy this requirement (but without waiving the right to deliver its own certificates at the end of the adjournment period), by giving written notice to Purchaser which is delivered at least two days prior to the scheduled Closing Date. Seller and Purchaser agree to cooperate with each other and to use good faith efforts for up to three months after the Closing to obtain any tenant estoppel letters which have not been obtained by the Closing with respect to Leases which will still be in effect for at least six months after the Closing.

c. Title Evidence; Survey.

(i) Title Evidence. Seller has delivered or within seven days after the date of this Agreement shall deliver to Purchaser a preliminary title insurance commitment (the “Commitment”) issued by the Escrow Agent as the title insurer (the “Title Insurer”) showing the status of record title to the Property, together with copies of all recorded documents listed as exceptions to title on Schedule B-2 of the Commitment (collectively, the “Exception Documents”). Seller shall pay the base premium for an “extended” owner’s title insurance policy, which policy shall be an ALTA Owner’s Policy - 2006 (the “Title Policy”), to be issued to Purchaser pursuant to the Commitment, and Purchaser shall pay the cost, if any, for the endorsements it wants to the Title Policy. Seller agrees to deliver to the Escrow Agent at the Closing a mechanic’s lien affidavit reasonably acceptable to the Title Insurer certifying that all work on the Property requested by Seller or its employees or agents has been paid in full or that provision has been made by Seller for payment in full in the ordinary course of business. The Commitment and the Exception Documents, together with any New Survey (as hereinafter defined) that Purchaser elects to obtain pursuant to subsection (vi) below, are referred to as the “Title Materials.”

-5-

(ii) Title Objections; Permitted Encumbrances. If, from its review of the Title Materials, Purchaser believes that any encroachment on the Property or any exception to title shown in the Title Materials would, in Purchaser’s reasonable judgment, adversely affect the Property (“Title Objections”), Purchaser shall deliver to Seller written notice (the “Objection Notice”) of the Title Objections no later than 10 days after it has received the Commitment and the Exception Documents. During the seven-day period following Seller’s receipt of the Objection Notice, Seller may elect (but shall have no obligation) to remove or cure or, with Purchaser’s consent, which consent shall not be unreasonably withheld, to obtain at Seller’s expense title insurance over any Title Objections (the “Cure Period”). If Seller does not elect to or is unable to remove or cure or, with Purchaser’s consent, to obtain title insurance over all such Title Objections prior to the end of the Cure Period, Seller shall so notify Purchaser in writing and Purchaser may, by written notice (the “Election Notice”) given to Seller within five days after such notice is given by Seller elect:

(1) if requested by Seller, to grant Seller an additional period of up to 30 days to cure or remove or, if applicable, to obtain title insurance over all uncured or unremoved Title Objections and, if Closing is scheduled to occur during such time period, the date of Closing shall be extended accordingly; or

(2) to waive all uncured or unremoved Title Objections; or

(3) to terminate this Agreement, whereupon the Deposit shall be returned to Purchaser, after which Seller and Purchaser shall have no further obligation or liability hereunder except as otherwise expressly provided in this Agreement.

If Seller does not receive an Objection Notice within such 10-day period, or after receiving an Objection Notice does not receive an Election Notice within such five-day period referred to above, Purchaser shall be deemed to have accepted the status of title to the Property as disclosed by the Title Materials, and to have waived any uncured and unremoved Title Objections.

(iii) Permitted Exceptions. Any matter that is disclosed in the Title Materials, and to which Purchaser does not object pursuant to subsection (ii) or (iv) (or to which Purchaser so objects but subsequently waives or consents to title insurance over) other than the Liens (as defined in subsection (v)) shall be “Permitted Exceptions.”

(iv) Additional Defect of Title. If, at any time prior to the Closing, Purchaser receives written notice or written evidence (including without limitation a revised Commitment) of any encumbrance on or defect in title to the Property that is not a Permitted Exception and that was not disclosed in the Title Materials, and which would otherwise qualify for an Objection Notice (an “Additional Title Objection”), Purchaser shall give Seller written notice of the Additional Title Objection no later than five days after the date on which Purchaser receives written notice or written evidence of it, which shall be subject to the same rights, requirements, elections and waivers as an Objection Notice and Election Notice given under subsection (ii).

-6-

(v) Seller’s Obligation to Remove Certain Liens. Notwithstanding anything to the contrary in this Section 2.5c. Seller shall be obligated to remove from title to the Property at Closing, and without any extension of the Closing Date, (a) any deeds of trust and mortgages and (b) other monetary liens which do not exceed an aggregate amount of $10,000 (provided Seller shall be deemed to have “removed” the monetary liens if the Title Insurer is willing to issue the title policy without exception for the monetary liens), which in either case encumber the Property as of Closing (collectively, the “Liens”), and Purchaser agrees that Seller may use the proceeds of the Purchase Price for that purpose. Furthermore, the Liens shall not constitute Permitted Exceptions regardless of whether they are disclosed by the Title Materials or objected to by Purchaser, and Purchaser shall have no obligation to object to the Liens under either subsection (ii) or (iv).

(vi) Survey. Seller has delivered to Purchaser an existing ALTA/ACSM Land Survey prepared by Drexel, Barrell & Co. dated February 27, 2008 (the “Prior Survey”). Purchaser shall be responsible for obtaining and paying for any update of the Prior Survey desired by Purchaser (the “New Survey”). If Purchaser does elect to obtain a New Survey, the failure to obtain it during the time period provided for Purchaser’s review of the Title Materials and issuance of an Objection Notice shall not extend that period. In addition, the Title Policy shall only insure over those standard exceptions that relate to survey matters to the extent that Purchaser obtains and furnishes to the Title Insurer a New Survey that is acceptable to the Title Insurer for such purpose.

d. Inspection of the Property.

(i) Access Prior to Closing; Rent Roll; Inspection Period. At any time prior to the Closing Date, Purchaser and its authorized agents and employees shall have the right to enter the Property during reasonable business hours for the purposes of conducting environmental and other studies and inspections, provided that those operations are conducted in such a manner as not to damage the Property. Seller shall, within seven days after the date of this Agreement, provide Purchaser a list of all Contracts in effect on the date of this Agreement and a rent roll (the “Rent Roll”) for the last calendar month ending prior to the date of this Agreement, listing all of the existing Leases, the status of rental payment by all tenants under those Leases, the amount of security deposits held under each of those Leases, any leasing commissions owed or payable under those Leases, and whether any notice of default (which has not been cured) has been given to or received from any tenants under those Leases. Within seven days after the date of this Agreement, Seller shall make available at Seller’s offices, for inspection and copying by Purchaser, copies of all of the items listed on Exhibit E that are in the possession of Seller. The Contracts, the Rent Roll and the other materials listed on Exhibit E are together referred to as the “Inspection Materials.” Seller makes no warranty or representation as to the accuracy, correctness or completeness of the information contained in any of the Inspection Materials. The same are being provided to Purchaser for Purchaser’s informational purposes only with the understanding and agreement that Purchaser will undertake its own soils, environmental, and other evaluations, and obtain other studies and reports, in order to satisfy itself with the condition of the Property. Seller shall retain ownership of all Inspection Materials delivered to Purchaser pursuant to this Section prior to Closing. All entries, studies and inspections shall be conducted so as not to disturb any tenants or unreasonably interfere with the operation or management of the Property. Purchaser shall advise Seller at least 24 hours in advance of any such entry, study or inspection and of the name or names of the persons who will be making, and the nature of, the entry, study or inspection. Seller or its authorized employee or agent shall have the right to be present during each such entry, study and inspection and at any time

-7-

Purchaser or its agents or employees discusses or wants to discuss any of the Leases with any tenants; provided that Seller’s presence shall not be required as long as Seller has been given the 24 hour advance notice. All entries on and inspections or studies of the Property shall be at the sole risk and expense of Purchaser, and Purchaser shall indemnify and hold Seller harmless from and against any and all liens, claims, demands, injuries, damages, costs, expenses (including also reasonable attorney’s fees) or liability incurred by or asserted against Seller or the Property as a result of, or in any way arising out of, any of those entries, inspections or studies occurring prior to the Closing, which obligations shall survive the Closing or any termination of this Agreement for a period of one year.

If for any reason Purchaser, in its sole discretion, is not satisfied with the Leases, Contracts, Inspection Materials, environmental inspections, studies or reports, or any other items it reviews or if it determines that the Property is not suitable for Purchaser’s intended use, Purchaser shall have the right to terminate this Agreement by giving notice to Seller to that effect on or before the date which is 30 days from the date of this Agreement (the “Inspection Period”), time being of the essence, in which event this Agreement shall terminate and neither party shall have any further obligations or liability under this Agreement except as expressly provided herein; otherwise Purchaser shall be deemed to be satisfied with the condition of the Property and its suitability for Purchaser’s use and this Agreement shall continue in full force and effect.

If this Agreement is terminated in whole or in part for any reason, then (a) within 30 days after termination, Purchaser shall repair any damage caused by any of those entries, inspections or studies so as to restore the Property which is the subject of the termination as nearly as possible to its same condition before the damage, (b) within the same 30 day period Purchaser shall return to Seller originals (including copies delivered to Purchaser in lieu of originals) of all documents it obtained from Seller with respect to that Property, and (c) Purchaser shall maintain in confidence as required in Section 8.2 the information it obtained about the Property.

(ii) Sale “As Is”. Purchaser agrees and acknowledges that, except as set forth in subsection (iii) and as provided further in Article 7:

(1) Purchaser is acquiring the Property in its “as is” condition;

(2) Purchaser is relying upon the results of its own investigation concerning the Property; and

(3) SELLER HAS NOT MADE AND DOES NOT MAKE ANY REPRESENTATIONS OR WARRANTIES, EXPRESS OR IMPLIED, TO PURCHASER OR TO ANY OTHER PERSON OR ENTITY ABOUT THE PHYSICAL CONDITION OF THE PROPERTY OR ITS SUITABILITY FOR ANY USE OR PURPOSE, INCLUDING BUT NOT LIMITED TO CURRENT OR PAST COMPLIANCE WITH ENVIRONMENTAL AND HAZARDOUS WASTE LAWS, AND PURCHASER SHALL MAKE ITS OWN DETERMINATION AS TO THE CONDITION OF THE PROPERTY AND ITS SUITABILITY FOR PURCHASER’S PURPOSES, AS TO WHETHER HAZARDOUS OR TOXIC MATERIALS WERE USED, RELEASED OR STORED ON THE PROPERTY OR CONSTITUTE A PRESENT HAZARD WITH RESPECT TO THE PROPERTY, AND OTHERWISE.

-8-

(iii) Limited Representations of Seller. Notwithstanding anything herein to the contrary, Seller warrants and represents to Purchaser that to the current actual knowledge of Xxxx X. Xxxxxxxxx and Xxxxxxx X. Xxxxxx (the “Employees”), without inquiry or investigation:

(1) Except as (i) revealed in any environmental reports obtained by Purchaser or made available to Purchaser by Seller or (ii) would not have a material adverse effect on the Property or the business of Seller operated thereon, (x) neither the Property nor Seller are in material violation of any Environmental Law (as hereinafter defined) and they are not subject to any pending or threatened litigation or inquiry by any governmental authority or to any remedial action or obligations under any Environmental Law; (y) no underground storage tanks are now located on the Property; and (z) no hazardous substances or toxic wastes have been disposed of or are now located on the Property in violation of applicable Environmental Law. As used herein, the term “Environmental Law” shall mean any law, statute, ordinance, rule, regulation, order or determination of any governmental authority or agency affecting the Property and pertaining to the environment including, but not limited to, the Comprehensive Environmental Response, Compensation and Liability Act of 1982 and the Resource Conservation and Recovery Act of 1986.

(2) There is no litigation pending or threatened against or with respect to the Property that does or could materially adversely affect the Property or Seller’s ability to consummate this sale.

(3) There is no condemnation or similar proceeding currently pending or threatened against the Property.

(4) The list of Contracts and the Rent Roll to be furnished to Purchaser under Section 2.5d(i) shall be complete and correct in all material respects.

(5) Seller owns title to the Property and the landlord’s interest in the Leases described on the Rent Roll delivered to Purchaser.

(6) The Leases are in full force and effect without current material default by Seller, except as may be disclosed in documents (including tenant estoppel letters) made available to Purchaser; no party has been granted any license, lease, or other material right relating to the use or possession of the Property except pursuant to the Leases, the Permitted Exceptions, or except as otherwise disclosed in writing to Purchaser.

(7) There are no contracts, other than this Agreement, or other material obligations, other than those matters set forth in the Title Materials, Leases and Contracts, outstanding (i) for the sale, exchange or transfer of the Property or any portion thereof or the business operated thereon by Seller, or (ii) creating or imposing any material burdens, obligations or restrictions on the use or operation of the Property and the business conducted on it.

(8) There are no management agreements, leasing agent agreements, building service agreements, or other agreements to which Seller is a party or an assignee, relating to the operation or management of the Property which will survive Closing and be binding on Purchaser, except for those made available to Purchaser.

-9-

(9) Seller has received no written notice that the use, operation and occupancy of the Property violates any material zoning, building, administrative or other law, ordinance, order or regulation or any restrictive covenant applicable to the Property which is currently outstanding.

(10) There is no action or proceeding pending that is designed to levy any special assessments against the Property; and

(11) Neither Seller nor any beneficial owner of Seller is (i) listed on the Specially Designated Nationals and Blocked Persons List maintained by OFAC (as defined below) pursuant to the Order (as defined below) and/or on any other list of terrorists or terrorist organizations maintained pursuant to any of the rules and regulations of OFAC or pursuant to any other applicable Orders (such lists are collectively referred to as the “Lists”); (ii) a person who has been determined by competent authority to be subject to the prohibitions contained in the Orders; or (iii) owned or controlled by, or acts for or on behalf of, any person on the Lists or any other person who has been determined by competent authority to be subject to the prohibitions contained in the Orders. The term “Order” shall mean the requirements of Executive Order No. 133224, 66 Fed. Reg. 49079 (Sept. 25, 2001) and other similar requirements contained in the rules and regulations of the Office of Foreign Assets Control, Department of the Treasury (“OFAC”) and in any enabling legislation or other Executive Orders or regulations in respect thereof (the Order and such other rules, regulations, legislation, or orders are collectively called the “Orders”).

Seller shall advise Purchaser in writing if, subsequent to the date of this Agreement and prior to the Closing, any of the representations and warranties set forth in this subsection (iii) is no longer true or correct in any material respect, unless Purchaser already has that knowledge. These warranties and representations, as supplemented or amended by any such subsequent disclosure, shall be deemed restated at Closing and shall survive Closing for a period of one year. In addition, Purchaser shall not be entitled to terminate this Agreement because of (i) any default by landlord under any Lease which is cured or waived in writing by the tenant by Closing, which cure or waiver (or a condition to it) does not impose any post-Closing obligation on Purchaser, or (ii) if the default is a non-monetary, non-material default under a Lease. “Made available to Purchaser” as used in this Section includes those things made available to Purchaser for its review or furnished to Purchaser either prior to or after the date of this Agreement. Under no circumstances shall any of the Employees have any personal liability for any of the above representations and warranties.

The representations and warranties set forth in this subsection (iii) shall be subject to the limitations set forth in Section 8.24.

e. Remedy for Failure of a Condition. In the event that one or more of the conditions set forth in this Section 2.5 has not been satisfied or waived by Purchaser on or before the Closing Date, then unless otherwise agreed to by Seller and Purchaser, Purchaser’s exclusive remedy shall be to request the Escrow Agent to return the Deposit to Purchaser, whereupon this Agreement shall terminate and neither party shall have any further rights or obligations under this Agreement except as expressly provided in this Agreement, including without limitation the rights of Purchaser under Section 4.1 (including Purchaser’s remedies for breaches of Seller’s representations and warranties which are discovered by Purchaser after the Closing).

-10-

ARTICLE 3

CLOSING AND POST-CLOSING ADJUSTMENTS

Section 3.1 Closing Adjustments. The following are to be apportioned at the Closing on a per diem basis through and including 12:01 a.m. of the Closing Date (provided that the Purchase Price is received by Seller no later than 2:00 p.m. Mountain Time on the Closing Date, otherwise the prorations shall be made as of 12:01 a.m. of the day on which the Closing actually occurs) with respect to the Property:

a. Taxes and Assessments. Real estate taxes, personal property taxes and all assessments (special and general) for the year of the Closing, provided that any special assessments that are due and payable at the time of the Closing shall be paid by Seller. If the rate or amount of these taxes has not been fixed prior to the Closing Date, the adjustment shall be upon the basis of the mill levy for the preceding year applied to the latest assessed valuation, which shall be considered a final settlement between the parties.

b. Utilities. Unless final meter readings are obtained up to the Closing Date (for which Seller shall be solely responsible), water and sewer service charges, and charges for all other public utilities, including, without limitation, electricity and gas. The right to the return of any deposits with utility companies shall be retained by Seller, and Seller shall not receive any credit at Closing for those deposits. Purchaser agrees to promptly make any replacement deposits which may be required by the utility companies in order for Seller to obtain a refund of those deposits.

c. Rents. Base rents, fixed rents, additional rents (including without limitation charges for increases in operating expenses), and any other rents paid or payable for the billing period in progress on the Closing Date; it being agreed that to the extent, on the Closing Date, any additional rents or other rents have not been determined for that billing period, then each such item shall be adjusted retroactively to the Closing Date (and the adjustment paid) no later than 30 days after those rents have been determined. Payments or reimbursements on account of operating expenses such as real estate taxes, utility charges and any other payments, reimbursements or contributions by tenants under the Leases shall be prorated as follows: the amount of any other rents, payments, reimbursements or contributions to be made by any tenant shall be made in accordance with the Leases as of Closing, and Purchaser shall promptly pay to Seller Seller’s pro rata portion of those rents, payments, reimbursements or contributions (based upon apportionment being made as of the Closing Date) promptly after the date when those rents, payments, reimbursements or contributions are received from the tenant. If Seller collected estimated amounts of prepayments in excess of any tenant’s pro rata share, Seller shall promptly remit the excess to Purchaser after notice from Purchaser and after the excess is verified by Seller. Seller shall not receive credit at the Closing for any delinquent rent; however, Purchaser shall promptly pay to Seller its pro-rata portions of those rents promptly after receipt by Purchaser in accordance with Section 3.2.

d. Permit and License Fees. Permit fees and license fees with respect to permits and licenses assigned to Purchaser.

e. Operating Accounts. All funds in any operating accounts, reserve accounts or any other accounts pertaining to the Property on the Closing Date shall be retained by Seller, and Purchaser shall not receive any credit for any of these funds.

-11-

f. Contracts. Charges and payments then due or which have accrued on all Contracts (subject to Section 3.3).

g. Security Deposits. The security deposits and advance rents shall not be apportioned, but instead shall be retained by Seller and, to the extent not forfeited or applied to tenant’s obligations under the Leases prior to the Closing, credited against the Purchase Price.

h. Closing Costs: Attorneys’ Fees. All real estate recording and documentary fees payable in connection with the conveyance of the Property shall be paid by Purchaser. All costs and expenses incurred for closing services, such as closing fees and document preparation fees charged by the Escrow Agent (but not the premium for the Title Policy), shall be paid in equal shares by Seller and Purchaser. Except as otherwise expressly provided in this Agreement, each party shall pay its own attorney’s fees and other expenses incurred in the preparation of this Agreement and the sale of the Property.

i. Other Apportionments. Such other items as are customarily apportioned by the Escrow Agent at a closing of the sale of a commercial property in Denver, Colorado.

Section 3.2 Collection of Receivables. “Receivables” means all rental payments, expense reimbursements and other monetary obligations of any kind due and owing or to become due and owing by tenants to Seller for the period prior to the Closing Date under the Leases. Purchaser shall undertake reasonable efforts on behalf of Seller to collect all Receivables for a period of six months from the Closing Date (which shall include the submission of monthly invoices and follow-up invoices, and may (but need not) include the commencement or continuation of litigation or other proceedings), it being agreed that any monies received by Purchaser from and after the Closing Date from any person liable for any portion of the Receivables to be collected by Purchaser shall be applied (after payment of all reasonable costs of collection, including reimbursement to Seller or Purchaser of any legal fees or collection costs reasonably incurred by either of them) as follows, (unless the tenant properly identifies the payment as being for a specific item): first to the payment of monies owed to Seller and Purchaser for the billing period in progress on the Closing Date, second to any current sums and arrearages owed to Purchaser (relating to billing periods after the billing period in progress as of the Closing Date), and last to the balance of the Receivables. All monies received by Purchaser which are to be applied to Receivables owed to Seller shall be held in trust by Purchaser for the benefit of Seller and remitted to Seller promptly after receipt.

Notwithstanding the foregoing, Seller shall retain the right to collect (in such manner as it shall deem appropriate) (a) Receivables due from tenants who have vacated the Property prior to the Closing Date, and (b) subject to the limitations imposed in this Section 3.2, those Receivables listed on the Rent Roll; and Purchaser shall not be required to undertake any collection efforts with respect to those Receivables. With respect to any pending litigation or other proceedings to collect any Receivables from tenants in occupancy on the Closing Date, Purchaser shall have the option of either (i) continuing the litigation or proceedings (the costs of which shall be equitably apportioned between Seller and Purchaser, based upon the amounts ultimately paid to each, and reimbursed out of the first monies collected, if any) and Purchaser shall be substituted as the plaintiff, if necessary, or (ii) of not continuing the litigation, whereupon Seller may continue such litigation in its own name and at its sole cost and expense, provided that such litigation shall not result in the eviction of the tenant or the termination of its Lease without Purchaser’s consent, and all sums collected by Seller as a result of the litigation (after payment of all costs and expenses of Seller and Purchaser) shall be applied in full satisfaction of the applicable Receivables.

-12-

If within 60 days following the Closing Date any of the Receivables to be collected by Purchaser and paid to Seller have not been collected and paid to Seller and Purchaser is not making reasonable efforts to collect those Receivables, then Seller may undertake its own efforts to collect those Receivables, including the commencement of litigation and other proceedings (but Seller shall not seek to evict any tenant or terminate any Lease), and in which event all sums collected by Seller as a result of such litigation (after payment of all costs and expenses of Seller and Purchaser) shall be applied in full satisfaction of the applicable Receivables. Purchaser and Seller shall reasonably cooperate with each other in the collection of Receivables and shall execute any documents reasonably requested by the other to collect those Receivables.

Section 3.3 Leasing Commissions. Seller shall be responsible for the payment of all leasing commissions and referral fees relating to the Leases entered into prior to the date of this Agreement, other than commissions or fees due or payable (a) as a result of the exercise of renewal options or other options or rights under Leases entered into prior to the date of this Agreement which are exercised on or after the date of this Agreement, or (b) as a result of any Leases executed on or after the date of this Agreement and any renewal, expansion or other modification of Leases executed on or after the date of this Agreement, or (c) as a result of the execution of the pending Lease Agreement with Denver Transit Contractors, LLC or its affiliates, a copy of which has been provided to Purchaser (the “Pending Warehouse Lease”), each of which shall be Purchaser’s responsibility. Purchaser shall reimburse Seller at the Closing to the extent Seller has paid any such leasing commissions or referral fees which are the responsibility of Purchaser. Each party agrees to indemnify, defend and hold the other harmless from and against any and all liability for leasing commissions, referral fees and other costs and expenses owed by it under this Section.

Section 3.4 Post-Closing Apportionments. Seller and Purchaser agree to use reasonable efforts to calculate all apportionments required under this Article 3 (and to make the applicable payments resulting from those calculations) with respect to those items of income and expense which are not known, have not been received or cannot be accurately or finally determined on the Closing Date by no later than 30 days after the Closing Date. Each other item of income and expense which is subject to apportionment under this Article 3 but which is not known, have not been received or cannot be accurately or finally determined on the Closing Date shall be apportioned retroactive to the Closing Date, and the payment made on such apportionment within 30 days after the date that the apportionment becomes ascertainable, i.e., the date by which each party, in its good faith business judgment, has sufficient information to make the apportionment. The parties agree that each party shall have the right following Closing, on reasonable written notice to the other, from time to time to review the books and records of such other party pertaining solely to the operations of the Property to the extent necessary to confirm the amounts of adjustments payable to Seller and/or Purchaser following the Closing.

Purchaser and Seller shall cooperate as necessary following the Closing in order to promptly and in good faith discharge their respective obligations under this Article 3. Notwithstanding the foregoing, any claim for an adjustment under Section 3.1 shall be valid only if made in writing with reasonable specificity within six months of the Closing Date, except in the case of items of

-13-

adjustment which at the expiration of that period are subject to pending litigation or administrative proceedings. Claims with respect to items of adjustment which are subject to litigation or administrative proceedings will be valid if made on or before the later to occur of (i) the date that is 1 year after the Closing Date and (ii) the date that is 180 days after a final order is issued in such litigation or administrative hearing. Both parties shall use good faith efforts to resolve any disputed claims promptly. The provisions of this Article 3, including but not limited to Section 3.3, shall survive the Closing.

ARTICLE 4

DEFAULT

Section 4.1 Default and Termination.

a. Purchaser’s Default. If Purchaser defaults in its obligation to close, to timely make the Deposit, or otherwise commits a material default under this Agreement, Seller shall have the right (i) if the default occurs prior to or at Closing, as Seller’s exclusive remedy, except as expressly set forth elsewhere herein, to terminate this Agreement and to demand payment of, collect and retain the Deposit as liquidated damages; or (ii) if the default occurs after Closing, to obtain any equitable or legal remedy for that default including, but not limited to, specific performance and actual money damages (but not consequential or punitive damages), and to obtain from Purchaser reasonable attorneys’ fees incurred in connection with obtaining any such remedy.

b. Seller’s Default. If Seller defaults in its obligation to close or otherwise commits a material default under this Agreement, Purchaser shall have, as its exclusive remedies, the right (i) if the default occurs prior to or at Closing, (a) to terminate this Agreement and to obtain the return of the Deposit or (b) if Seller has failed to close as required under this Agreement, to obtain specific performance to require Seller to convey such title to the Property as it is required to convey under this Agreement, without any reduction in the Purchase Price, and (c) to obtain from Seller reasonable attorneys’ fees incurred in connection with obtaining any such remedy; or (ii) if the default occurs or a material breach of a representation or warranty made in Section 2.5d(iii) is discovered after Closing, to obtain any equitable or legal remedy for that default including, but not limited to, specific performance and actual money damages (but not consequential or punitive), and to obtain from Seller reasonable attorneys’ fees incurred in connection with obtaining any such remedy.

c. Termination of Agreement. Upon termination of this Agreement in the manner set forth in this Section and the receipt of the Deposit as provided above, neither party shall have any further obligations or liabilities hereunder except as otherwise provided in this Agreement.

ARTICLE 5

CASUALTY AND CONDEMNATION

Section 5.1 Casualty. In the event that after the date of this Agreement and prior to the Closing Date any of the improvements on the Property are damaged by fire or other casualty, Seller shall notify Purchaser and Purchaser shall have the option either (a) to terminate this Agreement by notice given to Seller within 10 days after Purchaser receives the notice of the casualty (but only if the right to terminate exists hereunder), or (b) to proceed to Closing, paying Seller the entire Purchase Price for the Property and (i) to the extent the

-14-

damage has not been repaired prior to the Closing, receiving a credit on the Purchase Price equal to the amount of the deductible applicable to that casualty and receiving all of Seller’s rights with respect to recovery for such unrepaired damage caused by the fire or casualty under Seller’s existing insurance policies, without compromise, or (ii) if Seller and Purchaser agree at or prior to the Closing, receiving a credit on the Purchase Price of the amount they estimate will be required to repair the damage (which shall be a final settlement). In the event Purchaser elects to terminate this Agreement as provided above, the Deposit shall be returned to Purchaser by the Escrow Agent and neither party shall have any further liability or obligation to the other except as expressly provided in this Agreement. The right of termination due to any such fire or other casualty shall only exist if the damage caused by the casualty is material and either has not been completely repaired prior to the Closing, or an amount sufficient to complete the repairs has not been deposited (which Seller shall have no obligation to do) with the Escrow Agent in escrow to be used for the purpose of making the repairs, or the parties have not agreed upon a credit against the Purchase Price for the amount of the deductible and an assignment to Purchaser of all of Seller’s rights with respect to recovery for such unrepaired damage under Seller’s existing insurance policies. A material casualty is one that results in damage to the improvements on any of the Property, the cost to repair of which is in excess of $250,000.00. If the casualty is not material and has not been completely repaired prior to the Closing, then at the Closing Purchaser shall receive a credit on the Purchase Price equal to the amount of the deductible applicable to that casualty under Seller’s existing insurance policies, and to the extent the damage has not been repaired prior to the Closing Purchaser shall receive all of Seller’s rights with respect to recovery for such unrepaired damage under Seller’s existing insurance policies, or if the damage or other casualty is not covered under Seller’s existing insurance policies, or if Seller and Purchaser so agree under this Section 5.1b(ii), then Purchaser shall receive a credit on the Purchase Price equal to the amount Seller and Purchaser agree it will cost to repair the damage.

Section 5.2 Condemnation. If, between the date of this Agreement and Closing, any portion of the Property that is of such size and configuration or character to be, in Purchaser’s reasonable judgment, material to the operation of the Property is taken in condemnation (a “Material Taking”), Purchaser shall have the right by written notice given to Seller prior to or at Closing to terminate this Agreement. In the event of such a termination of this Agreement, Purchaser shall be entitled to the return of the Deposit, after which Purchaser and Seller shall have no further liability or obligation under this Agreement, except as otherwise provided in this Agreement. If, between the date of this Agreement and Closing, any portion of the Property is taken in condemnation that is not a Material Taking, Purchaser may not terminate this Agreement in whole or in part for that reason, and Seller and Purchaser shall perform their respective obligations under this Agreement, except with respect to the part of the Property so taken; and Seller shall be entitled to all the condemnation proceeds and the Purchase Price shall be decreased by the amount of those condemnation proceeds, or Purchaser at its option can elect to require Seller to assign those proceeds to Purchaser at the Closing, in which case the amount so assigned shall not be deducted from the Purchase Price.

ARTICLE 6

OPERATION OF THE PROPERTY; LEASING; TERMINATION OF CONTRACTS

Seller agrees that between the date of this Agreement and the Closing Date, (a) Seller shall, subject only to conditions beyond Seller’s reasonable control, continue to operate and maintain the Property in its present condition and consistent with its previous operations of the Property, ordinary

-15-

wear and tear excepted, provided that Seller shall not enter into any new contracts (other than Leases) which cannot be terminated on 30 days’ notice without Purchaser’s prior written consent, which shall not be unreasonably withheld or delayed, (b) Seller shall not initiate or consent to any proposed changes in the zoning of all or any part of the Property, (c) Seller shall maintain in full force or effect its existing insurance coverage on the Property as disclosed to Purchaser pursuant to this Agreement, and (d) Seller shall not voluntarily create or consent to any liens or other encumbrances against the Property except as expressly permitted in this Agreement.

From the date of this Agreement until the end of the Inspection Period, before entering into any new Leases for space at the Property, Seller shall provide Purchaser with a term sheet for each new Lease and with respect to any new Leases, Seller shall not enter into the new Lease without Purchaser’s approval, which approval shall not be unreasonably withheld; provided, however, that Purchaser agrees that the Pending Warehouse Lease has been previously approved.

However, after the end of the Inspection Period until the Closing Date, Seller shall not without Purchaser’s prior written approval, which shall not be unreasonably withheld or delayed: (i) voluntarily terminate, modify, renew, or accept a surrender (in whole or in part) of any of the Leases, or (ii) enter into any new Leases. Purchaser shall notify Seller in writing within five days after its receipt of each proposed termination, modification or renewal of an existing Lease or proposed new Lease of either its approval or disapproval, including the cost of all tenant improvement work and leasing commissions to be incurred in connection with the Lease.

At least ten days before the end of the Inspection Period, Purchaser shall deliver a notice to Seller specifying which, if any, of the Contracts it intends to assume and which Purchaser requests that Seller terminate. Within three days after receipt of Purchaser’s notice, Seller (if it has not already done so) shall advise Purchaser whether any of the Contracts specified by Purchaser cannot be terminated or can be terminated only with the payment of a fee or penalty which Seller is unwilling to pay and:

a. With respect to those Contracts which cannot be terminated, Purchaser shall deliver notice to Seller, within two business days of receipt of Seller’s notice, that Purchaser has either agreed to assume those Contracts or has elected to terminate this Agreement, in which latter instance, the Deposit and any interest accrued on it shall be refunded to Purchaser and neither Seller nor Purchaser shall have any further liability to the other except as expressly provided in this Agreement; and

b. With respect to those Contracts which can be terminated, but only with the payment of a fee or penalty which Seller is unwilling to pay, Purchaser shall deliver notice of Seller within two business days of receipt of Seller’s notice, that Purchaser has either agreed to pay the termination fee or penalty or has elected to terminate this Agreement, in which latter instance, the Deposit and any interest accrued on it shall be refunded to Purchaser and neither Seller nor Purchaser shall have any further liability to the other except as expressly provided in this Agreement.

-16-

ARTICLE 7

GENERAL DISCLAIMER; ENVIRONMENTAL RELEASE

Section 7.1 General Disclaimer. EXCEPT AS OTHERWISE EXPRESSLY STATED IN THIS AGREEMENT OR IN ANY AGREEMENT OR INSTRUMENT EXECUTED AND DELIVERED BY SELLER TO PURCHASER AT THE CLOSING, INCLUDING BUT NOT LIMITED TO REPRESENTATIONS AND WARRANTIES SET FORTH IN SECTION 2.5 OF THIS AGREEMENT AND THE LIMITED WARRANTY OF TITLE EXPRESSLY SET FORTH IN THE DEED (COLLECTIVELY, THE “SURVIVING REPRESENTATIONS”), SELLER HEREBY EXPRESSLY DISCLAIMS ANY AND ALL REPRESENTATIONS AND WARRANTIES OF ANY KIND OR CHARACTER, EXPRESS OR IMPLIED, WITH RESPECT TO THE PROPERTY, OR AS TO THE PHYSICAL, STRUCTURAL OR ENVIRONMENTAL CONDITION OF THE PROPERTY OR ITS COMPLIANCE WITH LAWS, AND PURCHASER AGREES TO ACCEPT THE PROPERTY, “AS IS, WHERE IS, WITH ALL FAULTS”. WITHOUT LIMITING THE GENERALITY OF THE PRECEDING SENTENCE OR ANY OTHER DISCLAIMER SET FORTH HEREIN, SELLER AND PURCHASER HEREBY AGREE THAT, EXCEPT FOR THE SURVIVING REPRESENTATIONS, SELLER HAS NOT MADE AND IS NOT MAKING ANY REPRESENTATIONS OR WARRANTIES, EXPRESS OR IMPLIED, WRITTEN OR ORAL, AS TO (A) THE NATURE OR CONDITION, PHYSICAL OR OTHERWISE, OF THE PROPERTY OR ANY ASPECT THEREOF, INCLUDING, WITHOUT LIMITATION, ANY WARRANTIES OF HABITABILITY, SUITABILITY, MERCHANTABILITY OR FITNESS FOR A PARTICULAR USE OR PURPOSE, OR THE ABSENCE OF REDHIBITORY OR LATENT VICES OR DEFECTS IN THE PROPERTY, (B) THE NATURE OR QUALITY OF CONSTRUCTION, STRUCTURAL DESIGN OR ENGINEERING OF THE IMPROVEMENTS OR THE STATE OF REPAIR OR LACK OR REPAIR OF ANY OF THE IMPROVEMENTS, (C) THE QUALITY OF THE LABOR OR MATERIALS INCLUDED IN THE IMPROVEMENTS, (D) THE SOIL CONDITIONS, DRAINAGE CONDITIONS, TOPOGRAPHICAL FEATURES, ACCESS TO PUBLIC RIGHTS-OF-WAY, AVAILABILITY OF UTILITIES OR OTHER CONDITIONS OR CIRCUMSTANCES WHICH AFFECT OR MAY AFFECT THE PROPERTY OR ANY USE TO WHICH THE PROPERTY MAY BE PUT, (E) ANY CONDITIONS AT OR WHICH AFFECT OR MAY AFFECT THE PROPERTY WITH RESPECT TO ANY PARTICULAR PURPOSE, USE, DEVELOPMENT POTENTIAL OR OTHERWISE, (F) THE AREA, SIZE, SHAPE, CONFIGURATION, LOCATION, CAPACITY, QUANTITY, QUALITY, CASH FLOW, EXPENSES OR VALUE OF THE PROPERTY OR ANY PART THEREOF, (G) THE NATURE OR EXTENT OF TITLE TO THE PROPERTY, OR ANY EASEMENT, SERVITUDE, RIGHT-OF-WAY, POSSESSION, LIEN, ENCUMBRANCE, LICENSE, RESERVATION, CONDITION OR OTHERWISE THAT MAY AFFECT TITLE TO THE PROPERTY, (H) ANY ENVIRONMENTAL, GEOLOGICAL, STRUCTURAL, OR OTHER CONDITION OR HAZARD OR THE ABSENCE THEREOF HERETOFORE, NOW OR HEREAFTER AFFECTING IN ANY MANNER THE PROPERTY, INCLUDING BUT NOT LIMITED TO, THE PRESENCE OR ABSENCE OF ASBESTOS OR ANY ENVIRONMENTALLY HAZARDOUS SUBSTANCE ON, IN, UNDER OR ADJACENT TO THE PROPERTY, OR (I) THE COMPLIANCE OF THE PROPERTY OR THE OPERATION OR USE OF THE PROPERTY WITH ANY APPLICABLE RESTRICTIVE COVENANTS, OR WITH ANY LAWS, ORDINANCES OR REGULATIONS OF ANY GOVERNMENTAL BODY (INCLUDING SPECIFICALLY, WITHOUT LIMITATION, ANY ZONING LAWS OR REGULATIONS, ANY BUILDING CODES, ANY ENVIRONMENTAL LAWS, AND THE AMERICANS WITH DISABILITIES ACT OF 1990, 42 U.S.C. 12101 ET SEQ.), AND PURCHASER SHALL DETERMINE ALL SUCH MATTERS ON ITS OWN BEHALF DURING THE INSPECTION PERIOD. THE PROVISIONS OF THIS ARTICLE 7 SHALL BE BINDING ON PURCHASER AND EACH OF ITS PERMITTED ASSIGNEES AND SHALL SURVIVE THE CLOSING.

-17-

DURING THE INSPECTION PERIOD, PURCHASER WILL BE GIVEN THE OPPORTUNITY TO INSPECT THE PROPERTY AND PERSONAL PROPERTY, AND THE LEASES, CONTRACTS AND OTHER MATERIALS (INCLUDING, WITHOUT LIMITATION, TITLE MATERIALS) RELATING TO THE PROPERTY AND PERSONAL PROPERTY THAT PURCHASER DEEMS NECESSARY TO INSPECT AND REVIEW IN CONNECTION WITH THIS AGREEMENT, AND PURCHASER WILL RETAIN SUCH ENVIRONMENTAL CONSULTANTS, STRUCTURAL ENGINEERS AND OTHER EXPERTS AS IT DEEMS NECESSARY TO INSPECT THE PROPERTY AND REVIEW SUCH MATERIALS. PURCHASER IS RELYING ON ITS OWN INVESTIGATION AND THE ADVICE OF ITS EXPERTS REGARDING THE PROPERTY, AND UPON ITS REVIEW OF LEASES, CONTRACTS, AND OTHER MATERIALS, AND NOT ON ANY REPRESENTATIONS OR WARRANTIES OF SELLER, THE MANAGERS OF THE PROPERTY, OR ANY REAL ESTATE BROKER OR AGENT REPRESENTING OR PURPORTING TO REPRESENT SELLER (OTHER THAN THE SURVIVING REPRESENTATIONS). PURCHASER ACKNOWLEDGES THAT SELLER MAKES ABSOLUTELY NO REPRESENTATIONS OR WARRANTIES WITH RESPECT TO THE ACCURACY OR COMPLETENESS OF ANY INFORMATION, REPORTS (INCLUDING, WITHOUT LIMITATION, ENVIRONMENTAL AND ENGINEERING REPORTS) OR OTHER MATERIALS DELIVERED TO PURCHASER, EXCEPT AS MAY BE EXPRESSLY SET FORTH IN THE SURVIVING REPRESENTATIONS, AND THAT THE PURCHASE PRICE REFLECTS THE FACT THAT THIS IS AN “AS IS, WHERE IS” TRANSACTION.

UPON CLOSING, PURCHASER SHALL ASSUME THE RISK THAT ADVERSE MATTERS, INCLUDING BUT NOT LIMITED TO, CONSTRUCTION DEFECTS AND ADVERSE PHYSICAL AND ENVIRONMENTAL CONDITIONS, MAY NOT HAVE BEEN REVEALED BY PURCHASER’S INVESTIGATIONS, AND PURCHASER, UPON CLOSING, SHALL BE DEEMED TO HAVE WAIVED, RELINQUISHED AND RELEASED SELLER (AND SELLER’S OFFICERS, DIRECTORS, SHAREHOLDERS, EMPLOYEES AND AGENTS) FROM AND AGAINST ANY AND ALL CLAIMS, DEMANDS, CAUSES OF ACTION (INCLUDING CAUSES OF ACTION IN TORT), LOSSES, DAMAGES, LIABILITIES, COSTS AND EXPENSES (INCLUDING REASONABLE ATTORNEYS’ FEES) OF ANY AND EVERY KIND OR CHARACTER, KNOWN OR UNKNOWN, WHICH PURCHASER MIGHT HAVE ASSERTED OR ALLEGED AGAINST SELLER (AND SELLER’S OFFICERS, DIRECTORS, SHAREHOLDERS, EMPLOYEES AND AGENTS) AT ANY TIME BY REASON OF OR ARISING OUT OF THE PHYSICAL AND ENVIRONMENTAL CONDITIONS OF THE LAND OR IMPROVEMENTS, ANY LATENT OR PATENT CONSTRUCTION DEFECTS, VIOLATIONS OF ANY APPLICABLE LAWS AND ANY AND ALL OTHER ACTS, OMISSIONS, EVENTS, CIRCUMSTANCES OR MATTERS REGARDING THE PROPERTY EXCEPT AS EXPRESSLY SET FORTH IN THIS AGREEMENT OR IN ANY DOCUMENT EXECUTED BY SELLER AT CLOSING AND EXCEPT FOR TORT CLAIMS AGAINST THE OWNER OF THE PROPERTY DUE TO EVENTS WHICH OCCURRED DURING SELLER’S PERIOD OF OWNERSHIP OF THE PROPERTY, FOR WHICH CLAIMS SELLER SHALL REMAIN LIABLE.

-18-

Section 7.2 Environmental Report; Environmental Release.

a. Environmental Report. Notwithstanding anything contained in this Agreement to the contrary, Purchaser may engage a consultant to perform a Phase I or similar environmental evaluation of the Property (the “Report”), and Purchaser shall provide Seller with a copy of any Report it obtains as soon as it is prepared but no later than 10 days prior to the Closing Date.

b. Environmental Release.

(1) Release. WITHOUT LIMITING THE PROVISIONS OF SUBPARAGRAPH 2.5D(II) ABOVE AND NOTWITHSTANDING ANYTHING TO THE CONTRARY CONTAINED IN THIS AGREEMENT EXCEPT AS PROVIDED IN SUBPARAGRAPH 2.5D(III) ABOVE, PURCHASER HERBY RELEASES SELLER AND SELLER’S PARTNERS’ OFFICERS, DIRECTORS, SHAREHOLDERS, TRUSTEES, PARTNERS, EMPLOYEES, MANAGERS AND AGENTS FROM ANY AND ALL CLAIMS, DEMANDS, CAUSES OF ACTIONS, LOSSES, DAMAGES, LIABILITIES, COSTS AND EXPENSES (INCLUDING WITHOUT LIMITATION ATTORNEYS’ FEES), WHETHER KNOWN OR UNKNOWN, LIQUIDATED OR CONTINGENT, ARISING FROM OR RELATING TO THE ENVIRONMENTAL CONDITIONS ON OR AFFECTING THE PROPERTY, WHETHER THE SAME ARE A RESULT OF NEGLIGENCE OR OTHERWISE, AND ALL CLAIMS UNDER ANY ENVIRONMENTAL LAWS OF THE UNITED STATES, THE STATE IN WHICH THE PROPERTY IS LOCATED OR ANY POLITICAL SUBDIVISION THEREOF, AS ANY OF THOSE ENVIRONMENTAL LAWS MAY BE AMENDED FROM TIME TO TIME AND ANY REGULATIONS, ORDERS, RULES OF PROCEDURES OR GUIDELINES PROMULGATED IN CONNECTION WITH SUCH ENVIRONMENTAL LAWS, REGARDLESS OF WHETHER THEY ARE IN EXISTENCE ON THE DATE OF THIS AGREEMENT. PURCHASER ACKNOWLEDGES THAT PURCHASER HAS BEEN REPRESENTED BY INDEPENDENT LEGAL COUNSEL OF PURCHASER’S SELECTION AND PURCHASER IS GRANTING THIS RELEASE OF ITS OWN VOLITION AND AFTER CONSULTATION WITH PURCHASER’S COUNSEL.

(2) Survival. Purchaser and Seller agree that the provisions of this Section 7.2b shall survive Closing.

ARTICLE 8

MISCELLANEOUS

Section 8.1 Special Districts . Purchaser hereby agrees and acknowledges that as of the date of this Agreement, the Property, or portions of it, is or may be included within certain districts and other quasi-municipal corporations organized and existing under the laws of the State of Colorado (collectively, the “Districts”), and that as a result of such inclusion the Property and the rights and interests of Purchaser in it are subject to (i) current and future taxation by the Districts for all purposes for which the Districts are authorized to tax, and (ii) any and all actions other than taxation, such as imposition of impact fees, that the Districts lawfully may take that may affect the Property and/or the rights and interests of Purchaser in it.

-19-

Section 8.2 Confidentiality, Distribution of Information. Purchaser and Seller acknowledge the importance of confidentiality regarding this transaction. Without the prior written consent of the other, except as may be required in connection with required disclosures under securities or other laws applicable to one of the parties, neither party shall disclose to any person (other than their partners, members, the wholly owned affiliates of said partners or members, or the officers, boards, attorneys, lender, accountants, and employees of said party, said partner, said member, or said wholly owned affiliates, or any others who have a need to know in connection with the acquisition of the Property and who such party advises in writing of this confidentiality requirement or as otherwise required by law) any of the terms or provisions of this Agreement. This provision and restriction also applies to a disclosure of any information previously or hereafter received or learned by Purchaser or any of its partners, trustees, agents or representatives (including also the Brokers) about or concerning the Property or the operations of the Property, which is not available to the general public including without limitation any investigations or tests conducted by Purchaser and any leases, operating reports, rent rolls or other documents reviewed by Purchaser or any such persons. This provision shall terminate upon the completion of the Closing.

Section 8.3 Authority of Seller and Purchaser.

a. Purchaser. Purchaser represents and warrants that, as of the date of this Agreement and as of the date of Closing, Purchaser is and shall be a duly organized and validly existing limited liability company under the laws of the State of Colorado, is and shall be in good standing under the laws of that state, and has and shall have full and lawful right and authority to execute and deliver this Agreement and to consummate and perform the transactions contemplated in it. Furthermore, Purchaser represents and warrants that the person or persons executing this Agreement and any documents required under it on behalf of Purchaser have the authority to do so. Purchaser also represents and warrants that the consummation and performance of the transactions contemplated by this Agreement will not constitute a default or result in the breach of any term or provision of any contract or agreement to which Purchaser is a party so as to adversely affect the consummation of these transactions.

b. Seller. Seller represents and warrants that, as of the date of this Agreement and as of the date of Closing, Seller is and shall be a duly organized and validly existing corporation under the laws of the State of Colorado, is and shall be in good standing under the laws of that state, and has and shall have full and lawful right and authority to execute and deliver this Agreement and to consummate and perform the transactions contemplated in it. Furthermore, Seller represents and warrants that the person or persons executing this Agreement and any documents required under it on behalf of Seller have the authority to do so. Seller also represents and warrants that the consummation and performance of the transactions contemplated by this Agreement will not constitute a default or result in the breach of any term or provision of any contract or agreement to which Seller is a party so as to adversely affect the consummation of these transactions.

Section 8.4 Brokers. Seller represents and warrants to Purchaser that no broker or finder has been engaged in connection with the sale contemplated by this Agreement, other than Xxxx Xxxxx of Unique Properties, LLC (“Seller’s Broker”), whose commission shall be paid by Seller pursuant to a separate agreement. Purchaser represents and warrants to Seller that no broker or finder has been engaged by Purchaser in connection with the sale

-20-

contemplated by this Agreement, other than Xxx Xxxxx and Xxx Xxxxxxx of Unique Properties, LLC (“Purchaser’s Broker,” and together with Seller’s Broker, the “Brokers”), whose commission shall be paid by Seller’s Broker. Each party further represents and warrants to the other that no other person or entity claims or will claim any commission, finder’s fee or other amounts by, through, under or as a result of any relationship with such party because of this transaction. Each party agrees to hold the other party harmless from and against any and all costs, expenses, claims, losses or damages, including also reasonable attorneys’ fees, resulting from any breach of the representations and warranties contained in this Section.

Section 8.5 Assignability.

a. Purchaser’s Assignability. Except as provided in Section 8.25 or to an Affiliate, as defined below, Purchaser shall not have the right to assign all or any part of its interest or rights under this Agreement without the prior written consent of Seller, which may be granted or withheld in Seller’s sole discretion. Any attempted assignment by Purchaser without such prior written consent, including assignments that would otherwise occur by operation of law, shall be without force or effect as against Seller. Notwithstanding the foregoing provisions, Purchaser shall have the right to assign this Agreement without the consent of Seller to any entity controlling, controlled by or under common control with Purchaser (each, an “Affiliate”), provided Purchaser delivers to Seller at least 5 days prior to the Closing a copy of the assignment under which the Affiliate assignee assumes all of the Purchaser’s obligations under this Agreement. Any assignment made in violation of the terms of this Section shall be void and of no force and effect. For purposes of this Section, an assignment by Purchaser shall include, but not be limited to, a transfer or transfers by any means of more than 55% in the aggregate of the voting stock or voting interest in Purchaser.

b. Seller’s Assignability. Seller may assign all or any part of its rights and obligations hereunder without the consent, written or otherwise, of Purchaser or any other person or entity, as long as the assignee assumes the obligations of Seller under this Agreement and has the capacity to perform Seller’s obligations under this Agreement.

Section 8.6 Notices. All notices required or permitted under this Agreement shall be given by registered or certified mail, postage prepaid, by recognized overnight courier, or by hand delivery, directed as follows:

-21-

If intended for Seller, to:

XXXXX’X LIQUID GOLD-INC.

0000 Xxxxxx Xxxxxx

Xxxxxx, Xxxxxxxx 00000

Attn: Xxxxx X. Xxxxxx

E-mail: xxxxxxx@xxxxxx.xxx

with a copy to:

XXXXX’X LIQUID GOLD-INC.

0000 Xxxxxx Xxxxxx

Xxxxxx, Xxxxxxxx 00000

Attn: Xxxx X. Xxxxxxxxx

E-mail: xxxxxxxxxx@xxxxxx.xxx

and with a copy to:

Xxxxxxxxx X. Xxxxxxx

Holland & Xxxx LLP

Suite 3200

000 Xxxxxxxxxxx Xxxxxx

Xxxxxx, XX 00000

E-mail: xxxxxxxx@xxxxxxxxxxx.xxx

If intended for Purchaser, to:

Havana Gold, LLC

0000 Xxxxxxx Xxxxxx

Xxxxxx, XX 00000

Attn: Xxxxxx Xxxxxxxxx

E-mail: xxxxxxxxxx@xxxxxxxxxxxxxx.xxx

and with a copy to:

Xxxxxxx X. Xxxxx

0000 X. Xxxxxxxx Xxx., #000

Xxxxxxxxx Xxxxxxx, XX 00000

E-mail: xxxxxxx@xxx.xxx

Any notice delivered by mail in accordance with this Section shall be deemed to have been delivered (i) upon being deposited in any post office or postal box regularly maintained by the United States postal service, but, in the case of intended recipients who have an e-mail address listed above, only if concurrently with that deposit a copy of the notice is sent by e-mail to that intended recipient, and if that copy is not sent by e-mail to any intended recipient who has an e-mail address listed above, the notice shall not be deemed to have been delivered until actually received by the intended recipient; or (ii) the next business day after being deposited with a recognized overnight courier service; or (iii) upon receipt or refusal to accept delivery if hand-delivered. Either party, by notice given as above, may change the address to which future notices or copies of notices may be sent.

-22-

Section 8.7 Binding Effect. Subject to Section 8.5, this Agreement shall be binding upon and shall inure to the benefit of the parties hereto and their respective heirs, executors, personal representatives, successors and permitted assigns.

Section 8.8 Entire Agreement; Modification. This Agreement constitutes the entire agreement between the parties with respect to the subject matter of this Agreement and may not be modified in any manner except by an instrument in writing signed by both parties. This Agreement supersedes and replaces all earlier agreements or understandings of the parties, whether written or oral.

Section 8.9 Headings. The headings herein are inserted only for convenient reference and do not define, limit or prescribe the scope of this Agreement or any Section or subsection.

Section 8.10 No Merger. The representations, covenants and agreements contained herein shall not merge into the various documents executed and delivered at the Closing and shall survive Closing, except as limited in this Agreement.

Section 8.11 Counterparts. This Agreement may be executed in any number of counterparts which together shall constitute a final Agreement.

Section 8.12 Severability. If any provision of this Agreement or its application to any person or situation, to any extent, shall be held invalid or unenforceable, the remainder of this Agreement, and the application of that provision to persons or situations other than those to which it has been held invalid or unenforceable, shall not be affected, but shall continue valid and enforceable to the fullest extent permitted by law.