Lease Between The Taming Of The Shrewsbury, LLC, O’Neill Partners, LLC, and Chanski, LLC, as tenants in common, as Landlord And Valeritas, LLC, as Tenant

Exhibit 10.22

Lease Between

The Taming Of The Shrewsbury, LLC, X’Xxxxx Partners, LLC, and Chanski, LLC,

as tenants in common, as Landlord

And

Valeritas, LLC, as Tenant

| ARTICLE 1 - REFERENCE, DEFINITIONS AND EXHIBITS |

5 | |||

| 1.1 Definitions |

5 | |||

| 1.2 Effect of Reference to Definitions |

12 | |||

| 1.3 Exhibits |

12 | |||

| ARTICLE 2 - LEASED PREMISES, TERM AND COMMENCEMENT OF TERM |

13 | |||

| 2.1 Leased Premises |

13 | |||

| 2.2 Term |

13 | |||

| ARTICLE 3 - RENT, ITS DETERMINATION, COMMENCEMENT AND METHOD OF PAYMENT |

13 | |||

| 3.1 Basic Rent |

13 | |||

| 3.2 Additional Rent |

13 | |||

| 3.3 Payment on Account of Operating Expenses |

14 | |||

| 3.4 Rent |

15 | |||

| 3.5 Lease to be Deemed Net |

15 | |||

| 3.6 Tenant’s Right to Seek Abatement |

15 | |||

| 3.7 Landlord’s Right to Seek Abatement |

16 | |||

| ARTICLE 4 - PREPAID RENT AND SECURITY DEPOSIT |

16 | |||

| ARTICLE 5 - UTILITIES AND SERVICES |

16 | |||

| 5.1 Utilities |

16 | |||

| 5.2 Access |

17 | |||

| 5.3 Maintenance and Repair-Landlord |

17 | |||

| 5.4 Demising Walls: Landlord’s Responsibility |

18 | |||

| ARTICLE 6 - INSURANCE |

18 | |||

| 6.1 Required Coverage |

18 | |||

| 6.2 Writing and Disposition of Insurance Policies |

19 | |||

| 6.3 Mutual Waiver of Subrogation |

19 | |||

| 6.4 Blanket Policies |

19 | |||

| 6.5 Landlord’s Insurance Covenants |

19 | |||

| ARTICLE 7 - ADDITIONAL COVENANTS |

20 | |||

| 7.1 Performing Obligations |

20 | |||

| 7.2 Use |

20 | |||

| 7.3 Maintenance and Repair |

20 | |||

| 7.4 Compliance with Laws |

20 | |||

| 7.5 Payment for Tenant’s Work |

21 | |||

| 7.6 Indemnity |

21 | |||

| 7.7 Personal Property at Tenant’s Risk |

22 | |||

| 7.8 Payment of Landlord’s Cost of Enforcement |

22 | |||

| 7.9 Yield Up |

22 | |||

2

| 7.10 Subordination |

22 | |||

| 7.11 Estoppel Certificates |

22 | |||

| 7.12 Nuisance |

23 | |||

| 7.13 Changes and Alterations |

23 | |||

| 7.14 Financial Statements |

24 | |||

| 7.15 Signage |

24 | |||

| ARTICLE 8 - QUIET ENJOYMENT |

25 | |||

| ARTICLE 8.1 COMPLEMENTARY BUSINESSES |

25 | |||

| ARTICLE 9 - DAMAGE AND EMINENT DOMAIN |

25 | |||

| 9.1 Fire and Other Casualty |

25 | |||

| 9.2 Eminent Domain |

26 | |||

| ARTICLE 10 - DEFAULTS BY TENANT AND REMEDIES |

27 | |||

| 10.1 The Condition |

27 | |||

| 10.2 Reimbursement of Landlord’s Expenses |

27 | |||

| 10.3 Damages |

28 | |||

| 10.4 Mitigation |

28 | |||

| 10.5 Claims in Bankruptcy |

28 | |||

| 10.6 Late Charge |

29 | |||

| 10.7 Landlord’s Right to Cure Defaults |

29 | |||

| 10.8 Effect of Waiver’s of Default |

29 | |||

| ARTICLE 11 - ASSIGNMENT AND SUBLETTING |

29 | |||

| 11.1 Assignment of Lease by Tenant |

29 | |||

| 11.2 Subletting by Tenant |

30 | |||

| ARTICLE 12 - NOTICES |

31 | |||

| ARTICLE 13 - NOTICE OF LEASE |

31 | |||

| ARTICLE 14 - APPLICABLE LAW, SEVERABILITY, CONSTRUCTION |

31 | |||

| ARTICLE 15 - SUCCESSORS AND ASSIGNS, ETC. |

31 | |||

| ARTICLE 16 - LANDLORD’S ACCESS |

32 | |||

| ARTICLE 17 - CONDITION OF PREMISES |

33 | |||

| 17.1 Landlord’s Work |

33 | |||

| 17.2 Plans and Specifications |

33 | |||

| 17.3 Performance and Completion of Landlord’s Work |

33 | |||

| 17.4 Landlord’s Performance |

35 | |||

| 17.5 Tenant’s Delay |

35 | |||

| 17.6 Arbitration |

36 | |||

3

| ARTICLE 18 - WARRANTY REGARDING BROKER |

37 | |||

| ARTICLE 19 - HAZARDOUS MATERIALS |

37 | |||

| ARTICLE 20 - EXTENSION TERMS |

38 | |||

| ARTICLE 21 - FORCE MAJEURE |

38 | |||

| ARTICLE 22 - HOLDOVER EXTENSION TERMS |

39 | |||

| ARTICLE 23 - MISCELLANEOUS |

39 | |||

4

ARTICLE I.—REFERENCE, DEFINITIONS AND EXHIBITS

1.1 Definitions:

| Landlord: | The Taming Of The Shrewsbury, LLC, a Massachusetts limited liability company, X’Xxxxx Partners, LLC, a Hawaii limited liability company, and Chanski, LLC, a Florida limited liability company, as tenants in common. | |

| Original Address of Landlord: | c/o VinCo Properties, Inc. 000 Xxxxxxxxxxxxx Xxxxxx, Xxxxx 0 Xxxxxx, Xxxxxxxxxxxxx 00000 Facsimile: (000) 000-0000 | |

| Tenant: | Valeritas, LLC | |

| Original Address of Tenant: | 0000X Xxxx Xxxxxx Xxxxxx, XX 00000 Facsimile: | |

| Address of Tenant after Term Commencement Date: | 0000X Xxxx Xxxxxx Xxxxxx, XX 00000 | |

| Term Commencement Date: | March 1, 2007. As of the Term Commencement Date, Landlord is required to deliver all of the existing offices and labs (excluding the Class 100 “clean room”) cleaned, with carpets shampooed and stains removed, walls cleaned with paint touched-up where necessary, and with demising walls from floor to roof between the large “clean room” space and the engineering offices as well as the demising walls from floor to roof between the large “clean room” and the cafeteria and quality labs, installed and spackled to final coat.

If the Term Commencement Date is delayed as a result of delay or other fault on the part of the Landlord, other than as a result of Force Majeure or unless caused by a Tenant Delay as defined in Section 17.5, Landlord shall be responsible for paying, from March 1, 2007 to the actual Term Commencement Date, Twenty Thousand Dollars ($20,000.00) per month due from Tenant to its current landlord, as a result of Tenant’s inability to vacate its current leased premises at 000 Xxxxxxxx Xxxx, Xxxxxxxxxx, XX on or before March 1, 2007. | |

5

| Interim Expenses | Starting on the Term Commencement Date and continuing until the Substantial Completion Date (as defined in Section 17.3 hereof), Tenant shall pay to the Landlord a sum of Ten Thousand Dollars ($10,000) per month (“Interim Rent”), representing all amounts due from Tenant during such interim period, including all utilities, taxes, rent, additional rent, CAM, or other charges. | |

| Substantial Completion Rent | Commencing on the Substantial Completion Date, Tenant shall no longer pay the Interim Rent, but, rather, shall pay all Additional Rent as set forth in Section 3.2. Tenant shall not, however, be responsible for paying Basic Rent until the Rent Commencement Date, as defined below. | |

| Rent Commencement Date: | Three (3) months after the Substantial Completion Date. | |

| Original Lease Term: | Ten (10) years and three (3) months commencing on the Substantial Completion Date. | |

Basic Rent:

| Period |

Annual Basic Rent |

Monthly Basic Rent |

||||||

| First Lease Year |

667,440.00 | 55,620.00 | ||||||

| Second Lease Year |

676,710.00 | 56,392.50 | ||||||

| Third Lease Year |

685,980.00 | 57,165.00 | ||||||

| Fourth Lease Year |

695,250.00 | 57,937.50 | ||||||

| Fifth Lease Year |

704,520.00 | 58,710.00 | ||||||

| Sixth Lease Year |

713,790.00 | 59,482.50 | ||||||

| Seventh Lease Year |

723,060.00 | 60,255.00 | ||||||

| Eighth Lease Year |

732,330.00 | 61,027.50 | ||||||

| Ninth Lease Year |

741,600.00 | 61,800.00 | ||||||

| Tenth Lease Year |

750,870.00 | 62,572.50 | ||||||

| First Extension Term |

||||||||

| Eleventh Lease Year |

760,140.00 | 63,345.00 | ||||||

6

| Twelfth Lease Year |

769,410.00 | 64,117.50 | ||||||

| Thirteenth Lease Year |

778,680.00 | 64,890.00 | ||||||

| Fourteenth Lease Year |

787,950.00 | 65,662.50 | ||||||

| Fifteenth Lease Year |

797,220.00 | 66,435.00 | ||||||

| Second Extension Term |

||||||||

| Sixteenth Lease Year |

806,490.00 | 67,207.50 | ||||||

| Seventeenth Lease Year |

815,760.00 | 67,980.00 | ||||||

| Eighteenth Lease Year |

825,030.00 | 68,752.50 | ||||||

| Nineteenth Lease Year |

834,300.00 | 69,525.00 | ||||||

| Twentieth Lease Year |

843,570.00 | 70,297.50 |

| Lease Year: | A period of twelve (12) successive calendar months with the first Lease Year commencing on the Rent Commencement Date. Notwithstanding the foregoing: (i) if the Rent Commencement Date is a day other than the first day of a calendar month, then the initial fractional calendar month together with the next succeeding twelve (12) calendar months shall constitute the first Lease Year and each succeeding Lease Year shall start on the anniversary of the first day of the first full calendar month of the first Lease Year; and (ii) if the expiration of the Lease Term or the earlier termination of this Lease does not coincide with the termination of such a 12-month period, Lease Year shall mean the portion of such 12-month period before such expiration or termination. | |

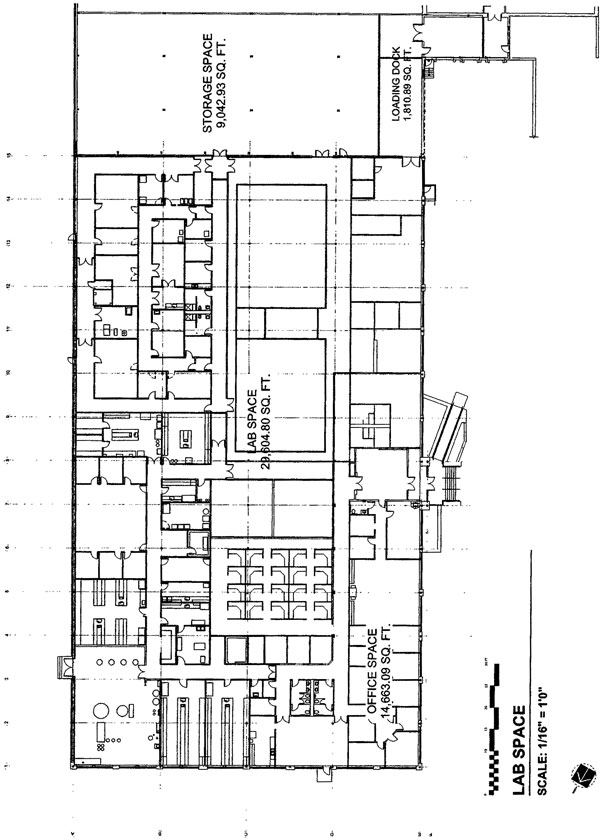

| Leased Premises: | 46,350 rentable square feet of space in the Building shown on Exhibit A attached hereto. | |

| Right of First Refusal: | Tenant shall have a right of first refusal to lease a minimum of 10,000 square feet of warehouse space in the Building, which is contiguous to the Leased Premises, on an “as-is” basis. If at any time during the Lease Term, the Landlord intends to enter into a proposed lease (a “Proposed Lease”) for warehouse space with anyone (a “Proposed Tenant”), and said Proposed Lease would result in there being less than 10,000 square feet of available warehouse space which is contiguous to the Leased Premises, Landlord shall first offer to Tenant the right to add either the entire Proposed Lease Space, or 10,000 square feet of contiguous warehouse space (the “Contiguous Space”), at the Tenant’s discretion, to the Leased Premises upon the following terms and conditions. | |

7

| In any instance in which a Proposed Lease would result in there being less than 10,000 square feet of available warehouse space which is contiguous to the Leased Premises, Landlord shall notify Tenant of its intention to enter into such a Proposed Lease. Such notice shall be in writing (the “Offer Notice”) and shall provide Tenant with specific information concerning the amount of square footage of warehouse space which Landlord intends to lease, as well as the specific location of such space (the “Offered Space”). In order to send the Offer Notice, Landlord does not need to have negotiated a lease with the Proposed Tenant but must have either a signed letter of intent or a signed term sheet from the Proposed Tenant.

If Tenant, within fourteen (14) days after receipt of Landlord’s Offer Notice, indicates in writing its unconditional agreement to exercise its rights under this Lease to lease either the entire Proposed Lease Space, or the Contiguous Space, at the Tenant’s discretion (“Tenant’s Notice”) in its “as-is” condition, the Proposed Lease Space or the Contiguous Space (as elected by the Tenant) shall be included within the Leased Premises and leased to Tenant pursuant to the provisions of this Lease, including, without limitation, the provisions relating to the rights and obligations of the parties with respect to alterations. However, (i) the Basic Rent payable under this Lease shall be increased by the amount of rent attributable to the Contiguous Space or Proposed Lease Space (depending on which the Tenant has elected to lease) at a rental rate of $5.50 per square foot NNN during the first five (5) Lease Years; $6.05 per square foot NNN during Lease Years 6-10; $6.66 per square foot NNN during the first Extension Term; and $7.32 per square foot NNN during the second Extension Term, and (ii) Tenant shall pay Additional Rent for Impositions and Operating Expenses based on Tenant’s Proportionate Share of the Building as adjusted to reflect the increase in the rentable square footage of space in the Leased Premises. Landlord shall construct sheet rocked primed, spackled, and final coated demising walls as necessary and provide heat to the Contiguous Space or Proposed Lease Space, otherwise the Contiguous Space or Proposed Lease Space shall be delivered to Tenant in its “as-is” condition. Time shall be of the essence with respect to the giving of Tenant’s Notice. Tenant must accept either the entire Proposed Lease Space or the entire 10,000 square feet of Contiguous Space at any one time if it desires to accept any such space and may not exercise its right with respect to less than the 10,000 square feet of Contiguous Space. |

8

| The parties shall immediately execute an amendment to this Lease stating the addition of the warehouse space or part of it to the Leased Premises. If Tenant fails to provide Landlord with Tenant’s Notice within the fourteen (14) day period described above, Landlord thereafter shall have the right to lease the Proposed Lease Space and/or the Contiguous Space to the Proposed Tenant or any other tenant on any terms Landlord deems appropriate. The provisions of this section shall be operative each time any lease for any portion of the warehouse space shall expire and Landlord intends to enter into a Proposed Lease for such space with a Proposed Tenant. | ||

| Lease Term: | The Original Lease Term, as the same may have been extended or earlier terminated in accordance with the terms and condition of this Lease. | |

| Option to Extend Original Lease Term: | Two (2) options to extend for five (5) years each as more particularly set forth in Article 20 below. | |

| Brokers: | Xxxxxxxx Xxxxx Xxxxx & Partners LLC | |

| Building: | The building known as 000 Xxxxxx Xxxxxxxx, Xxxxxxxxxx, Xxxxxxxxxxxxx containing approximately 80,000 rentable square feet of space located on the Site. | |

| Parking: | Tenant shall have the right to use, in common with others entitled thereto, the parking spaces in the parking lot located on the Site for the purpose of parking automobiles, subject to reasonable rules and regulations which may be promulgated by Landlord from time to time. | |

| Permitted Uses: | Executive and general office use, research and development, manufacturing, and laboratory use, and for no other purpose; subject in all cases to applicable legal requirements. | |

| Site or Property: | The approximately 6.3 acre site located in the Town of Shrewsbury, Massachusetts, having an address of 000 Xxxxxx Xxxxxxxx, Xxxxxxxxxx, Xxxxxxxxxxxxx, and all the buildings and improvements now or hereafter located thereon (including, without limitation, the Leased Premises, the Building, all roads, driveways, pavement, parking areas, landscaping, and utilities). A legal description of the boundaries of the Site is attached hereto as Exhibit B. | |

9

| Force Majeure: | Strikes, lockouts, labor disputes, acts of God, inability to obtain labor or materials or reasonable substitutes therefore for reasons beyond the reasonable control of Landlord, governmental restrictions, governmental regulations, governmental controls, delay in issuance of permits beyond the reasonable control of Landlord, enemy or hostile governmental action, civil commotion, fire or other casualty, and other causes beyond the reasonable control of Landlord. | |

| Impositions: | All taxes including real estate taxes (which term shall include payments in lieu of real estate taxes), assessments, water and sewer rents, rates and charges, levies, license and permit fees and other governmental charges, general and special, ordinary and extraordinary, foreseen and unforeseen, of any kind and nature whatsoever, which at any time during the Lease Term may be assessed, levied, confirmed, imposed upon, or may become due and payable out of or in respect of, or become a lien upon, all or any portion of the Site (including all improvements thereto), other than: (i) municipal, state and federal income taxes (if any) assessed against Landlord; or (ii) municipal, state or federal capital levy, gift, estate, succession, inheritance or transfer taxes of Landlord; or (iii) corporation excess profits or franchise taxes imposed upon any corporate owner of the Site; or (iv) any income, profits or revenue tax, assessment or charge imposed upon the Rent payable by Tenant under this Lease; or (v) penalties due to Landlord’s lateness or failure to pay taxes, assessments or charges when due (unless such lateness is due to Tenant being late in any payment due under this Lease), (vi) taxes separately assessed or levied upon any improvements or alterations made by Landlord or other tenants in the leased premises being leased exclusively to another tenant in the Building, provided, however, that if at any time during the Lease Term the methods of taxation prevailing at the commencement of the Lease Term shall be altered so that in lieu of or as a substitute for the whole or any part of the taxes, assessments, levies or charges now levied, assessed or imposed on real estate and the improvements thereon, there shall be levied, assessed and imposed a tax, assessment, levy, imposition or charge, wholly or partially as a capital levy or otherwise, on the rents received therefrom, or measured by or based in whole or in part upon the Site and imposed upon Landlord, then all such taxes, assessments, levies, impositions or charges or the part thereof so measured or based, shall be deemed to be included within the term “Impositions” for the purposes hereof. Landlord represents that, as of the date of this Lease, the Landlord has not entered into a tax treaty with the Town of Shrewsbury which makes the Site currently subject to any tax abatements or special assessments. In addition to the foregoing, the term “Impositions” shall include any | |

10

| new tax of a nature not presently in effect as of the date of this Lease, but which may be hereafter levied, assessed, or imposed upon Landlord or all or any portion of the Site, if such tax shall be based on or arise out of the Lease, the ownership of the Site (or any portion thereof), or the use or occupation of all or any portion of the Site except that any such new tax which is billed and assessed separately upon any leased premises, use or occupation of another tenant in the Building shall not be included in the Impositions. Notwithstanding anything contained in this Lease to the contrary, Tenant shall pay one hundred percent (instead of Tenant’s Proportionate Share) of any tax which is billed and assessed separately upon the Leased Premises or the use or occupation of the Tenant. | ||

| Tenant’s Proportionate Share of the Building: | 57.94% | |

| Tenant’s Proportionate Share of the Property: | 80% | |

| Operating Expenses: | The term “Operating Expenses” shall mean all aggregate expenses incurred in the operation, maintenance, repair, replacement, and management of the Leased Premises (whether incurred by the Tenant or the Landlord), including without limitation, the following: utilities supplied to the Leased Premises; all insurance obtained and relating to or otherwise in connection with Landlord’s ownership or the occupancy and operation of all or any portion of the Leased Premises, the foregoing to include, without limitation, all risk insurance against damage by fire or other casualty, liability insurance, rent loss insurance, and any insurance required by Landlord’s Mortgagee; services obtained for the benefit of the Site (including, without limitation, window cleaning, rubbish removal, snow removal and grounds maintenance); repairs, replacement, repainting, maintenance, supplies and the like for the Site; a management fee in the amount of three and one half percent (3.5%) of the gross rental receipts from the Property; legal fees and expenses; auditing fees and expenses; and depreciation (on a straight line basis) for capital expenditures made by Landlord to improve services provided to Tenant or to reduce operating expenses (in Landlord’s reasonable judgment) amortized on a straight line basis over the useful life of the applicable capital improvement with Tenant being responsible for the payment of only the portion allocable to the Lease Term. The following items shall be excluded from Operating Expenses: principal or interest payments on any mortgages or other financing arrangements, leasing commissions and depreciation for the Site, except as specifically provided above. | |

11

| Landlord’s Work: | The work described on Exhibit C attached hereto. | |

| Landlord’s Mortgagee: | Any party holding a mortgage on the Site including, without limitation, the Leased Premises, given as security for indebtedness owed by the Landlord to the holder of the mortgage. | |

| Landlord’s Construction Representative: | Xxxxx Xxxxxxx Crocini Consulting, LLC 000 Xxxxx Xx #0X Xxxxxx, XX 00000 Tel: (000) 000-0000 Fax: Email: xxxxx@xxxxxxx.xxx | |

| Tenant’s Construction Representative: | Xxxxx Xxxx | |

| Tel: 000-000-0000, Ext. 222 Fax: 000-000-0000 | ||

1.2 Effect of Reference to Definitions. Any reference in this Lease to any term defined above shall be deemed, to the extent possible, to mean and include all aspects of the definition set forth above for such term.

1.3 Exhibits. The exhibits listed in this Section and attached to this Lease are incorporated by reference and are a part of this Lease.

Exhibit A: Floor Plan of the Leased Premises

Exhibit B: Legal Description of the Boundaries of the Site

Exhibit C: Landlord’s Work

Exhibit D: Term Commencement Date Letter

12

ARTICLE II—LEASED PREMISES, TERM AND COMMENCEMENT OF TERM

2.1 Leased Premises. Landlord hereby LEASES to Tenant and Tenant hereby leases and rents from Landlord, subject to and with the benefit of the terms, covenants, conditions and provisions of this Lease, the Leased Premises, together with all easements, rights or privileges necessary in connection with the use of the Leased Premises for the Permitted Uses.

2.2 Term. TO HAVE AND TO HOLD the Leased Premises for the Lease Term commencing on the Term Commencement Date, subject to the terms, covenants, agreements and conditions contained in this Lease.

ARTICLE III—RENT, ITS DETERMINATION, COMMENCEMENT AND METHOD OF PAYMENT

3.1 Basic Rent. Commencing on the Rent Commencement Date and continuing thereafter on the first day of each and every calendar month occurring during the Lease Term, Tenant shall pay Basic Rent to Landlord (or to such other person as Landlord by written notice instructs Tenant to make such payments for Landlord’s benefit and account) in advance in the amounts set forth in Section 1.1 above without notice, billing or demand therefor and without any deduction, set-off, credit or abatement of any kind. The monthly payment of Basic Rent for any partial calendar month occurring during the Lease Term shall be pro rated on a daily basis using the actual number of calendar days in said month. Tenant shall pay each monthly installment of Basic Rent at the Original Address of Landlord set forth above or at such other place as Landlord may by written notice to Tenant direct, such notice to be effective upon receipt.

3.2 Additional Rent. Commencing on the Substantial Completion Date and continuing throughout the Lease Term, Tenant shall also pay Additional Rent as follows (such payments to be made when requisitioned, except as otherwise stated):

| (i) | Tenant’s Proportionate Share of all Impositions, all such payments to be made when due based upon an invoice received by Tenant from Landlord together with copies of the bills for the Impositions for the applicable period, but in any event prior to any date on which interest or penalties would begin to accrue on account of such Impositions if not paid according to the xxxx for such Impositions (estimated fiscal year 2007 real estate taxes on the Property are approximately $0.79 per rentable square foot, or $36,617.00 allocable to the Leased Premises); and |

| (ii) | Tenant’s Proportionate Share of all Operating Expenses. |

Commencing on the Substantial Completion Date and continuing throughout the Lease Term, Tenant shall also pay Additional Rent as follows (such payments to be made when requisitioned, except as otherwise stated): (i) to the extent not paid directly by Tenant pursuant to the provisions of Article 5 hereof, one hundred (100) percent of all utilities

13

(including, without limitation, electricity, gas, telephone, water and sewer charges) supplied to or consumed at the Leased Premises during the Lease Term as measured by separate meters therefor (or prorated if and when separate meters are not in place); and (ii) one hundred (100%) percent of any Imposition which is billed and assessed separately upon the Leased Premises or the use or occupation of the Tenant.

All monetary obligations of Tenant under this Lease, except for the obligation to pay Basic Rent, shall be deemed obligations to pay Additional Rent, unless such presumption is repugnant to the context.

3.3 Payment on Account of Operating Expenses. Tenant shall make estimated monthly payments to Landlord to cover Tenant’s Proportionate Share of the Operating Expenses that the Tenant is expected to owe as Additional Rent during the current calendar year and each subsequent calendar year thereafter falling entirely or partly within the Lease Term. The initial estimated amount of Tenant’s Proportionate Share of the Operating Expenses expected to be incurred for the first calendar year of the Lease Term is $69,525.00. At the beginning of each calendar year thereafter, Landlord shall submit to Tenant a statement setting forth Landlord’s reasonable estimates (based on costs of which Landlord is aware and other reasonable assumptions of Landlord) of the amount of Operating Expenses that are expected to be incurred during such calendar year, and the computation of Tenant’s share of such anticipated Operating Expenses. Tenant shall pay to Landlord on the first day of each month following receipt of such statement an appropriate amount to amortize on a monthly basis Tenant’s Proportionate Share of the anticipated Operating Expenses, with appropriate adjustments if any period includes less than one (1) full month. If at any time during the Lease Term Landlord in Landlord’s discretion determines it appropriate to revise the estimates of Operating Expenses that have been submitted, then Landlord may submit such revised estimates to Tenant, and then commencing with the next monthly payment to be made by Tenant, appropriate adjustment shall be made to the amount being paid by Tenant on account of Tenant’s Proportionate Share of anticipated Operating Expenses provided, however, that Landlord shall not make such adjustments more than twice in any calendar year. Within ninety (90) days after the expiration of each calendar year during the Lease Term, Landlord shall submit to Tenant a statement certifying (i) Tenant’s Proportionate Share of the actual Operating Expenses incurred during the preceding calendar year, (ii) the aggregate amount of the estimated payments made by Tenant on account thereof, and (iii) any credit to which Tenant is entitled. If Tenant is entitled to any credit, Tenant shall deduct the amount of the overpayment from its next estimated payment or payments for Operating Expenses for the then current year. If the Tenant’s credit is equal to or greater than ten (10) percent of the aggregate amount paid in the preceding year, Landlord shall reduce the anticipated operating expenses on a going-forward basis by an amount equal to the credited amount. If Tenant’s actual liability for such Operating Expenses exceeds the aggregate amount of the estimated payments made by Tenant on account thereof, then Tenant shall pay to Landlord within thirty (30) calendar days the total amount of such deficiency as Additional Rent due hereunder. Tenant’s liability for Tenant’s share of the Operating Expenses for the last calendar year falling entirely or partly within the Lease Term shall survive the expiration of the Lease Term. Similarly, Landlord’s obligation to refund to Tenant the excess, if any, of the amount of Tenant’s actual liability therefor shall survive the expiration of the Lease Term.

14

With respect to Operating Expenses which Landlord allocates to the entire Property, Tenant’s “Proportionate Share” shall be the percentage set forth in Section 1.1 of this Lease as Tenant’s Proportionate Share of the Property as reasonably adjusted by Landlord in the future for changes in the physical size of the Leased Premises; and, with respect to Operating Expenses which Landlord allocates only to the Building, Tenant’s “Proportionate Share” shall be the percentage set forth in Section 1.1 of this Lease as Tenant’s Proportionate Share of the Building as reasonably adjusted by Landlord in the future for changes in the physical size of the Leased Premises or the Building. Landlord may equitably increase Tenant’s Proportionate Share for any item of expense or cost reimbursable by Tenant that relates to a repair, replacement, or service that benefits only the Leased Premises or only a portion of the Property or Building or that varies with occupancy or use. The estimated Operating Expenses for the Premises set forth above are only estimates, and Landlord makes no guaranty or warranty that such estimates will be accurate.

Tenant or an independent, certified public accountant designated by Tenant shall have the right, during regular business hours and after giving fifteen (15) days’ advance written notice to Landlord, to inspect and audit Landlord’s books and records relating to the Operating Expenses billed during any calendar year falling within the Lease Term for a period of one (1) year following the receipt by Tenant of any statement submitted pursuant to this Section. If as a result of such audit it becomes clear that an error was made in the calculation of Tenant’s Proportionate Share of Operating Expenses, then an appropriate adjustment shall be made within thirty (30) days of Landlord’s receipt from Tenant of a copy of such audit together with Tenant’s demand for reimbursement and, if the amount by which Landlord over-charged Tenant exceeds ten (10%) percent of Tenant’s Proportionate Share of Operating Expenses, then Landlord shall pay the reasonable actual out-of-pocket costs and expenses paid by Tenant for the audit.

3.4 Rent. References in this Lease to “Rent” or “rent” shall be deemed to include both Basic Rent and Additional Rent when the context so allows.

3.5 Lease to be Deemed Net. This Lease shall be deemed and construed to be an absolutely net lease and Tenant shall accordingly pay to Landlord, absolutely net, the Basic Rent and Additional Rent, free of any off-sets or deductions of any kind.

3.6 Tenant’s Right to Seek Abatement. If Tenant occupies more than fifty-one (51%) percent of the rentable area of the Building or if the Leased Premises is separately assessed for real estate taxes, then Tenant shall have the right, upon prior written notice to Landlord, to seek a reduction in the valuation of the Leased Premises assessed for tax purposes and to contest in good faith by appropriate proceedings, at Tenant’s expense, the amount or validity in whole or in part of any Imposition or of the method by which any Imposition is calculated, assessed or imposed; and may defer payment thereof if allowed by law, provided that (i) Tenant shall provide Landlord with security reasonably satisfactory to Landlord to assure payment of contested items; and (ii) Tenant shall immediately pay such contested item or items if the protection of the Leased Premises or of the Landlord’s interest therein from any lien or claim shall, in the reasonable judgment of Landlord, require such payment.

15

3.7 Landlord’s Right to Seek Abatement. Landlord shall have the right to seek a reduction in the valuation of the Site or any of the Building assessed for tax purposes and to prosecute any action or proceeding theretofore commenced by Tenant. To the extent to which any tax refund payable as a result of any proceeding which Landlord or Tenant may institute, or payable by reason of compromise or settlement of any such proceeding, may be based upon a payment made by Tenant, then Tenant shall be authorized to collect the same (or the appropriate portion thereof), subject, however, to Tenant’s obligation to reimburse Landlord forthwith for Tenant’s Proportionate Share of any expense incurred by Landlord in connection therewith.

Landlord shall not be required to join in any proceedings referred to in Section 3.6 hereof unless the provisions of any law, rule or regulation at the time in effect shall require that such proceedings be brought by or in the name of Landlord, in which event Landlord shall join in such proceedings or permit the same to be brought in its name. Landlord shall not be subjected to any liability for the payment of any costs or expenses in connection with any such proceedings, and Tenant shall indemnify and save harmless Landlord from any such costs and expenses. Tenant shall be entitled to any refund of its share of any Imposition and penalties or interest thereon received by Landlord that has been paid by Tenant, or that has been paid by Landlord but previously reimbursed in full by Tenant.

ARTICLE 4—PREPAID RENT AND SECURITY DEPOSIT

Upon the signing of this lease, Tenant shall pay to Landlord One Hundred Thousand Dollars ($100,000.00), representing a security deposit as security for Tenant’s full performance of all terms and conditions under this Lease. Upon the Substantial Completion Date, the Tenant shall pay to Landlord an additional One Hundred Thousand Dollars ($100,000.00), representing additional security for Tenant’s full performance of all terms and conditions under this Lease (collectively, the “Security Deposit”). Upon the exercise of the outstanding warrants that will raise approximately $90,000,000 or achievement of $4,000,000 in sales revenue, whichever event comes first, the Security Deposit shall be reduced to One Hundred Thousand Dollars ($100,000). Upon default by Tenant hereunder, the Landlord shall have the right, without the giving of any notice, to apply all or any portion of the Security Deposit to cure such default which right shall be in addition to all other rights and remedies. Within thirty (30) days of the later to occur of the last day of the Lease Term or the date that Tenant yields up the Leased Premises pursuant to the terms of this Lease, Landlord shall return to Tenant the Security Deposit less any amounts which Landlord may have deducted pursuant to the terms of this Lease.

ARTICLE 5—UTILITIES AND SERVICES

5.1 Utilities. Tenant shall make arrangements with appropriate utility or service companies for its own service for any utilities and/or services that are to serve the Leased Premises exclusively or directly and that can be billed to Tenant directly, and Tenant shall promptly pay all costs with respect to same, such payments to be made, to the extent possible, directly to the utility or service provider or to the appropriate party charged with collecting the same, the foregoing to include all charges for such utilities or services. All internal utilities shall be separately metered. All costs for external utilities that are not separately metered shall be included in Operating Expenses, and Tenant shall be responsible for Tenant’s Proportionate Share thereof. Landlord shall be under no obligation to furnish any utilities or services to the

16

Leased Premises and shall not be liable for any interruption or failure in the supply of any such utilities or services to the Leased Premises. No interruption or failure of utilities shall result in the termination of this Lease; provided, however, that if (i) an interruption or cessation of utilities shall occur, except if the same is due to any act or neglect of Tenant or Tenant’s agents, employees, contractors or invitees or any person claiming by, through or under Tenant (a “Service Interruption”), and (ii) such Service Interruption occurs or continues as a result of the negligence or wrongful conduct of the Landlord or Landlord’s agents, employees or contractors, and (iii) such Service Interruption continues for more than one (1) full business day after Landlord shall have received notice thereof from Tenant, and (iv) as a result of such Service Interruption, the conduct of Tenant’s normal operations in the Leased Premises are materially and adversely affected, then there shall be an abatement of one day’s Rent for each day during which such Service Interruption continues after such one (1) business day; provided, however, that if any part of the Leased Premises is reasonably useable for Tenant’s normal business operations or if Tenant conducts all or any part of its operations in any portion of the Leased Premises notwithstanding such Service Interruption, then the amount of each daily abatement of Base Rent shall only be proportionate to the nature and extent of the interruption of Tenant’s normal operations or ability to use the Leased Premises.

5.2 Access. Tenant shall have access to the Leased Premises twenty-four hours a day, seven days a week, three hundred sixty-five days per year, and Tenant shall be solely responsible, at Tenant’s sole cost and expense, for security for the Leased Premises.

5.3 Maintenance and Repair—Landlord. Prior to the Term Commencement Date, Landlord shall install on the grounds of the Property a fully operational automatic irrigation system (sprinklers), as part of Landlord’s Work described on Exhibit C attached hereto. Landlord shall be responsible for the maintenance, repair and replacement of the Building’s roof, public areas, exterior walls, windows, foundation, and structural walls of the Building and all Building plumbing, mechanical, and electrical systems existing in the Building as of the date hereof or installed by Landlord prior to the Term Commencement Date (but specifically excluding any supplemental heating, ventilation or air conditioning equipment or systems installed by Tenant), except that Landlord shall in no event be responsible to Tenant for any condition in the Leased Premises or the Building caused by any act or neglect of Tenant, its invitees or contractors. Landlord shall also keep and maintain all common facilities in a good and clean order, condition and repair, free of snow and ice and accumulation of dirt and rubbish, and shall keep and maintain all landscaped areas on the Property in a neat and orderly condition, to a commercially reasonable standard equal to or exceeding that of comparable first-class office and research and development properties in the greater Worcester, Massachusetts area. The costs of any such maintenance, repair and replacement by Landlord shall be Operating Expenses and be paid in accordance with Section 3.3 hereof, provided, however, that costs that are required to be capitalized for federal income tax purposes shall be amortized on a straight line basis over a period equal to the lesser of the useful life thereof for federal income tax purposes or ten (10) years and included in Operating Expenses only to the extent of the amortized amount for the respective calendar year. The terms “walls” and “windows” as used in this Section 5.3 shall not include glass or plate glass, doors or overhead doors, special store fronts, dock bumpers, dock plates or levelers, or office entries, all of which shall be maintained by Tenant. Landlord shall not be responsible to make any improvements or repairs to the Building or Property other than as

17

expressly provided in this Section 5.3, unless expressly provided otherwise in this Lease. Tenant shall promptly give Landlord written notice of any repair required by Landlord pursuant to this Section 5.3, after which Landlord shall have a reasonable opportunity to repair such item. Landlord shall never be liable for any failure to make repairs which Landlord has undertaken to make under the provisions of this Section 5.3 or elsewhere in this Lease, unless Tenant has given notice to Landlord of the need to make such repairs, and Landlord has failed to commence to make such repairs within a reasonable time after receipt of such notice, or fails to proceed with reasonable diligence to complete such repairs.

5.4 Demising Walls: Landlord’s Responsibility. It shall be the Landlord’s exclusive responsibility to erect demising walls and/or connecting doors between the Leased Premises and the warehouse space. If the Landlord fails to erect such walls and/or doors after notification by the Tenant of the need for the same, the Tenant shall have the right, but not the responsibility, to erect such walls and/or doors without further consent or permission from the Landlord. The Landlord shall be solely and exclusively responsible for all heating and cooling costs incurred by Landlord or Tenant as a result of the lack of such walls and/or doors.

ARTICLE 6—INSURANCE

6.1 Required Coverage. Tenant covenants and agrees with Landlord that during the Lease Term the following insurance shall be obtained by Tenant and carried at Tenant’s sole expense:

(a) Tenant’s commercial general liability insurance insuring and indemnifying Tenant, Landlord, and Landlord’s Mortgagee against liability for injury to persons and damage to property which may be claimed to have occurred upon the Leased Premises or the sidewalks, ways and other real property adjoining said Leased Premises and covering all Tenant’s obligations under this Lease and with limits at least as high as the amounts respectively stated below, or such higher limits in any case as may reasonably be required in case of increase in risk or as may be customarily carried in Massachusetts by prudent occupants of similar property, as determined by Landlord in its reasonable discretion: not less than commercial general liability insurance in the amount of $1,000,000 per occurrence, $2,000,000 general aggregate, $1,000,000 per accident combined single limit for automobile liability, $2,000,000 in excess liability coverage, and $1,000,000 for property damage.

(b) Workmen’s Compensation covering all Tenant’s employees, contractors and agents working on the Premises.

(c) Insurance insuring all of Tenant’s personal property, chattels, inventory, trade fixtures, furniture, furnishings, machinery, equipment, goods, supplies and stock of every kind and description stored, kept, installed or used in or upon the Leased Premises against damage, loss or destruction by fire, explosion, water damage or other casualty, in an amount at least equal to the replacement cost of such insured property.

(d) Such additional insurance (including, without limitation, rent loss insurance) as Landlord’s Mortgagee shall reasonably require provided that such insurance is in an amount, of the type, and customary for comparable properties.

18

6.2 Writing and Disposition of Insurance Policies. All insurance required under Section 6.1 above shall be written with companies reasonably satisfactory to Landlord and in forms customarily in use from time to time in the Greater Boston area. Tenant shall furnish the Landlord with duplicates of said policies, and said policies shall (i) name Landlord and Landlord’s Mortgagee as named insureds, as their respective interests may appear, and (ii) provide that the coverage thereunder may not lapse or be canceled without twenty (20) days prior written notice to Landlord, Landlord’s Mortgagee and Tenant.

6.3 Mutual Waiver of Subrogation. Landlord and Tenant each hereby releases the other, its officers, directors, employees and agents, from any and all liability or responsibility (to the other or anyone claiming through or under them by way of subrogation or otherwise) for any loss or damage to property covered by valid and collectible insurance, even if such loss or damage shall have been caused by the fault or negligence of the other party, or anyone for whom such party may be responsible. However, this release shall be applicable and in force and effect only with respect to loss or damage (a) actually recovered from an insurance company and (b) occurring during such time as the releaser’s insurance policies shall contain a clause or endorsement to the effect that any such release shall not adversely affect or impair said policies or prejudice the right of the releaser to recover thereunder. Landlord and Tenant each agrees that any fire and extended coverage insurance policies will include such a clause or endorsement as long as the same shall be obtainable without extra costs, or, if extra cost shall be charged therefor, so long as the other party pays such extra cost. If extra cost shall be chargeable therefor, each party shall advise the other party and of the amount of the extra cost, and the other party, at its election, may pay the same, but shall not be obligated to do so.

6.4 Blanket Policies. Nothing contained herein shall prevent Tenant from taking out insurance of the kind and in the amounts provided for herein under a blanket insurance policy or policies covering properties other than the Leased Premises, provided however, that any such policy or policies of blanket insurance (a) shall specify therein, or Tenant shall furnish Landlord with the written statement from the insurers under such policy or policies, specifying the amount of the total insurance allocated to the Leased Premises, which amounts shall not be less than the amounts required herein, and (b) amounts so specified shall be sufficient to prevent any of the insureds from being a co-insurer within the terms of the applicable policy or policies, and provided further, however, that any such policy or policies of blanket insurance shall, as to the Leased Premises, otherwise comply as to endorsements and coverage with the provisions herein.

6.5 Landlord’s Insurance Covenants. Landlord covenants and agrees that during the Lease Term it shall obtain the following insurance:

(a) All risk insurance against damage by fire or other casualty in an amount at least equal to the replacement costs of the Building as determined from time to time by Landlord or (at Landlord’s election or upon Tenant’s request) by appraisal made at the expense of Tenant by an accredited insurance appraiser approved by Landlord;

19

(b) Commercial general liability insurance covering liability for injury to persons and damage to property which may be claimed to have occurred upon the Property or the sidewalks, ways and other real property adjoining the Property caused by Landlord with limits at least as high as the following amounts: $1,000,000 per occurrence, $2,000,000 general aggregate;

(c) Workmen’s Compensation covering all Landlord’s employees and Landlord shall cause all contractors and agents working for Landlord on the Property to carry workmen’s compensation insurance covering their employees as may be required by law;

(d) Rent loss insurance with a limit at least equal to one (1) year’s worth of Rent due under this Lease; and

(e) Such additional insurance as Landlord’s Mortgagee shall reasonably require.

Tenant shall pay the Tenant’s Proportionate Share (57.94 percent) of the cost of such insurance as an Operating Expense. At the request of Tenant, Landlord will provide to Tenant copies of certificates or the relevant portions of such policies to evidence the fact that Landlord is maintaining the insurance required by this Section 6.5.

ARTICLE 7—ADDITIONAL COVENANTS

Tenant covenants and agrees during the Lease Term and such further time as Tenant occupies the Leased Premises or any part thereof:

7.1 Performing Obligations. To perform fully, faithfully and punctually all of the obligations of Tenant set forth in this Lease; and to pay when due Rent and all charges, rates and other sums which by the terms of this Lease are to be paid by Tenant.

7.2 Use. To use the Leased Premises only for the Permitted Uses, and for no other purposes.

7.3 Maintenance and Repair—Tenant. At Tenant’s expense, and except for Landlord’s obligations set forth in Section 5.3 hereof, reasonable wear and tear and damage from fire or other casualty, to keep the Leased Premises, including all interior and exterior glass, clean, neat and in good order, repair and condition, and to keep the Leased Premises in as good condition, order and repair as the same are at the Term Commencement Date or thereafter may be put, reasonable wear and use and damage by fire or other casualty only excepted, it being understood that the foregoing exception for reasonable wear and use shall not relieve Tenant from the obligation to keep the Leased Premises in good order, repair and condition including, without limitation, all necessary and ordinary non-structural repairs, replacements and the like. Tenant also agrees to abide by reasonable rules and regulations that Landlord may adopt from time to time.

7.4 Compliance with Laws. At Tenant’s expense, to comply promptly with all present and future laws, ordinances, orders, rules, regulations and requirements of all federal, state and municipal governments, departments, commissions, boards and officials, foreseen and unforeseen, ordinary as well as extraordinary, which may be applicable to the Leased Premises

20

or to Tenant’s use, occupancy or presence in or at the Leased Premises or the Site, including all laws with respect to the handling, storage and disposal of any hereinafter defined Hazardous Materials, except that the Tenant may defer compliance so long as the validity of any such law, ordinance, order, rule, regulation or requirement shall be contested by Tenant in good faith and by appropriate legal proceedings, and:

(a) If by the terms of such law, ordinance, order, rule regulation or requirement, compliance therewith pending the prosecution of any such proceeding may legally be delayed without the incurrence of any lien, charge or liability of any kind against the Leased Premises or Site and without subjecting Tenant or Landlord to any liability, civil or criminal, for failure so to comply therewith, Tenant may delay compliance therewith until the final determination of such proceeding, or

(b) If any lien, charge or civil liability would be incurred by reason of any such delay, Tenant nevertheless may contest as aforesaid and delay as aforesaid, provided that such delay would not subject Landlord to criminal liability or fine, and Tenant (i) furnishes to Landlord security, reasonably satisfactory to Landlord, against any loss or injury by reason of such contest or delay, and (ii) prosecutes the contest with due diligence.

To the best of Landlord’s knowledge, as of the date of this Lease the Building is in compliance with all applicable laws, rules and regulations.

7.5 Payment for Tenant’s Work. To pay promptly when due the entire cost of any work at or on the Leased Premises undertaken by Tenant so that the Leased Premises shall at all times be free of liens for labor and materials; promptly to clear the record of any notice of any such lien; to procure all necessary permits and before undertaking such work; to do all of such work in a good and workmanlike manner, employing materials of good quality and complying with all governmental requirements; and to save Landlord harmless and indemnified from all injury, loss, claims or damage to any person or property occasioned by or growing out of such work.

7.6 Indemnity. To save Landlord harmless and indemnified from, and to defend Landlord against, all injury, loss, claims or damage (including reasonable attorneys’ fees) to any person or property while on the Leased Premises unless arising from any act, omission, fault, negligence or other misconduct of Landlord, or its agents, servants, employees, or contractors; to save Landlord harmless and indemnified from, and to defend Landlord against, all injury, loss, claims or damage (including reasonable attorneys’ fees) to any person or property anywhere occasioned by any act, omission, neglect or default of Tenant or Tenant’s agents, servants, employees, contractors, guests, invitees or licensees unless arising from any act, omission, fault, negligence or other misconduct of Landlord, or its agents, servants, employees, or contractors. Landlord shall save Tenant harmless and indemnified from, and defend Tenant against, all injury, loss, claims or damage (including reasonable attorneys’ fees) to any person while on the Leased Premises to the extent caused by the act, omission, fault, negligence or other misconduct of Landlord and not caused by any contributory act or omission of Tenant.

21

7.7 Personal Property at Tenant’s Risk. That all personal property, equipment, inventory and the like from time to time upon the Leased Premises shall be at the sole risk of Tenant; and that Landlord shall not be liable for any damage which may be caused to such property or the Leased Premises or to any person for any reason including, without limitation, the bursting or leaking of or condensation from any plumbing, cooling or heating pipe or fixture.

7.8 Payment of Cost of Enforcement. Each Party covenants to pay on demand the other Party’s expenses, including reasonable attorneys’ fees, incurred in enforcing any obligation under this Lease or in curing any default by Tenant under this Lease, provided that the Party claiming under this Section is successful in enforcing such obligation or has a right under this Lease to cure such default.

7.9 Yield Up. At the termination of this Lease, peaceably to yield up the Leased Premises clean and in good order, repair and condition, reasonable wear and tear and damage by fire or casualty excepted and remove all equipment, furniture and personal property; and at either Landlord’s or Tenant’s option, to remove any and all of Tenant’s trade fixtures, provided however, that Tenant shall restore any damage caused by such removal and provided further that if Tenant fails so to restore the Leased Premises, then Tenant shall pay all of Landlord’s costs to make such restoration.

7.10 Subordination. Within fifteen (15) days after written request by Landlord to Tenant, to execute and deliver all such instruments as may reasonably be requested to subordinate this Lease to any mortgages or deeds of trust securing notes or bonds executed by Landlord and to all advances made thereunder and to the interest thereon and all renewals, replacements and extensions thereof, provided that the mortgagee or trustee shall agree to recognize this Lease in the event of foreclosure and perform all of the covenants contained herein to be performed by Landlord, if Tenant is not in default beyond the expiration of any period allowed for the cure of such default. Any such mortgagee or trustee may at any time subordinate its mortgage or deed of trust to this Lease, without Tenant’s consent, by notice in writing to Tenant and thereupon this Lease shall be deemed prior to such mortgage or deed of trust without regard to their respective dates of execution, delivery and recording; and in that event such mortgagee or trustee shall have the same rights with respect to the Lease as though it had been executed and delivered (and notice thereof recorded) prior to the execution and delivery and recording of the mortgage or deed of trust. Landlord agrees to use commercially reasonable efforts to obtain a recognition and non-disturbance agreement from the present mortgagee of record in a form reasonably satisfactory to Tenant.

7.11 Estoppel Certificates. From time to time, for delivery to a prospective purchaser or mortgagee of the Leased Premises or the Site or to any assignee of any mortgage of the Leased Premises or the Site or to the Massachusetts Development Finance Agency or to any other lender or prospective lender of the Tenant, within ten (10) days after written request by Landlord to Tenant or by Tenant to Landlord, the party receiving the request shall execute, acknowledge and deliver to the other party a statement in writing certifying: (a) that this Lease is unamended (or, if there have been any amendments, stating the amendments); (b) that it is then in full force and effect and without any existing defaults, if that be the fact; (c) a description of the leased premises; (d) the term of the lease and any existing purchase or renewal options; (e) the rent and

22

additional rent due and the dates to which Rent and any other payments to Landlord have been paid; (f) the amounts of any security deposits paid pursuant to this lease; (g) any defenses, offsets and counterclaims which Tenant, at the time of the execution of said statement, believes that Tenant has with respect to Tenant’s obligation to pay Rent and to perform any other obligations under this Lease or that there are none, if that be the fact; and (h) such other data as may reasonably be requested. Any prospective purchaser or mortgagee of the Leased Premises, or portion thereof, or any assignee of any mortgagee of the Leased Premises, or portion thereof or the Massachusetts Development Finance Agency or any other lender or prospective lender of the Tenant, may rely upon such statement.

7.12 Nuisance. At all times during the Lease Term and such further time as the Tenant occupies the Leased Premises, not to injure, overload, deface or otherwise harm the Leased Premises; nor commit any nuisance; nor to do or suffer any waste to the Leased Premises; nor permit the emission of any objectionable noise or odor; nor make any use of the Leased Premises which is improper, or contrary to any law or ordinance or which will invalidate any insurance policy or other applicable legal requirement covering the Leased Premises or any portion thereof, including, without limitation, the handling, storage and disposal of any hazardous material.

7.13 Changes and Alterations. Except as otherwise explicitly set forth herein, Tenant shall have no authority, without the express written consent of Landlord to alter, remodel, reconstruct, demolish, add to, improve or otherwise change the Leased Premises, except that Tenant shall have such authority, without the consent of Landlord, to build substructures; add, remove, or modify internal wiring; erect or remove non-load bearing walls; add or remove internal doors; construct internal clean room(s); make repairs to the Leased Premises and do such other things as are appropriate to comply with the obligations imposed on Tenant under other provisions of this Lease.

Except as otherwise outlined herein, Tenant shall not construct or permit any alterations, installations, additions or improvements including any interior or exterior signs (“Alterations”) to the Leased Premises or the Building without having first submitted to Landlord plans and specifications therefor for Landlord’s approval, which approval shall not be unreasonably withheld or delayed provided that:

(a) if the improvement involves a sign or will otherwise be visible from the exterior then the improvement must be compatible with the architectural and aesthetic qualities of the Leased Premises and the Site; and

(b) the improvement must be non-structural and have no effect on the plumbing, heating (and cooling), mechanical, electrical or other systems or services in the Leased Premises, and the improvement (except for signs) must be entirely within the Leased Premises; and

(c) the change, when completed will not materially adversely affect the value of the Leased Premises or the Site; and

23

(d) Tenant demonstrates to Landlord’s satisfaction that the improvement will be made in accordance with applicable legal requirements using good quality materials and good quality construction practices and will not result in any liens on the Leased Premises; and

(e) as soon as such work is completed, Tenant will have prepared and provide Landlord with “as-built” plans (in form acceptable to Landlord) showing all such work; and

(f) Tenant will comply with any rules or requirements reasonably promulgated by Landlord in connection with the doing of any work, and if requested by Landlord, Tenant will obtain and maintain Builder’s Risk insurance in connection with such work.

Tenant shall have the right to make minor alterations from time to time in the interior of the Leased Premises without obtaining Landlord’s prior written consent therefor, provided that all of such work conforms to all of the above requirements in all respects (except for the requirement in subsection (a) to obtain Landlord’s prior written consent and the requirement in subsection (e) to provide “as-built” plans to Landlord), and further provided that Tenant provides Landlord with a written description of such work (and such other data as Landlord may request) not later than 30 days after each such alteration is made.

7.14 Financial Statements. Within ten (10) days of Landlord’s request, Tenant shall furnish Landlord its most recent statement of income and balance sheet for the immediately preceding fiscal year certified by an independent certified public accountant and prepared in accordance with generally accepted accounting principles consistently applied. Nothing contained in this Section shall be construed to require the Tenant to create or commission the creation of a financial statement, but rather Tenant is obligated only to produce to Landlord (upon request) a copy of the most current existing financial statement.

7.15 Signage. Tenant, at Tenant’s sole cost and expense, shall have the right to install signage in its lobby, on any Building directory, on the exterior of the Building, and on the pylon sign for the Building at the highest level and the largest allowed for sign panels of lessees or occupants of the Building, provided that Tenant obtains all necessary permits, complies with all applicable laws, complies with Section 7.13 of this Lease, and obtains the prior written consent of the Landlord (which consent shall not be unreasonably withheld or delayed provided that Tenant delivers to Landlord reasonably detailed plans and specifications for the sign).

Tenant’s right to erect signage on the Route 9 side of the Property shall be an exclusive right. Landlord agrees that no other signage will be authorized or permitted on the Route 9 side of the Property. Tenant shall also have the right to erect signage on the Chestnut Street side of the Property. Landlord agrees that Tenant’s signage on the Chestnut Street side of the Property shall be the most prominent signage, both in terms of size and placement. Landlord may allow two other building tenants to erect signage on the Chestnut Street side of the Property, subject to Tenant’s approval of the size, placement, and appearance of said signage, which approval shall not be unreasonably withheld.

24

ARTICLE 8—QUIET ENJOYMENT

Landlord covenants that Tenant on paying the Rent and performing Tenant’s obligations under this Lease shall peacefully and quietly have, hold and enjoy the Leased Premises throughout the Lease Term or until it is terminated as in this Lease provided without hindrance by Landlord or by anyone claiming by, through or under Landlord.

ARTICLE 8.1 – COMPLEMENTARY BUSINESSES

Landlord covenants that it shall not, during the Lease Term (or any extension thereto), lease any other space in the Building for a use that would materially interfere with the Tenant’s use of the Leased Premises for executive and general office use, research and development, manufacturing, and laboratory use. Landlord agrees further that, to the extent that Landlord leases other space in the Building, such other leased premises shall have separate utilities and separate heating, ventilating and air conditioning systems designed to avoid any cross-contamination between the Leased Premises and such other leased premises.

ARTICLE 9—DAMAGE AND EMINENT DOMAIN

9.1 Fire and Other Casualty. In the event that at any time during the term hereof (including any extended term) the Leased Premises are totally damaged or destroyed by fire or other casualty or substantially damaged so as to render them or a material portion thereof untenantable, then there shall be a just and proportionate abatement of the Rent payable hereunder until the Leased Premises are made suitable for Tenant’s occupancy, and the Lease Term shall be extended, without the necessity of further action by any party, for a period equal to the time during which Rent so abated. In the event of such substantial (or total) damage to the Leased Premises, Landlord shall proceed at its expense and with reasonable diligence to repair and restore the Leased Premises to substantially the same condition they were in immediately prior to such casualty. Notwithstanding the foregoing, if Landlord in its sole discretion determines that timely restoration is not possible or practical or that there are or will be insufficient insurance proceeds available to Landlord to accomplish same, then Landlord shall have the right to terminate this Lease by written notice given to Tenant within ninety (90) days after the occurrence of such casualty.

If Landlord proceeds with the repair and restoration of the Leased Premises, in the event the Leased Premises have not been restored to a condition substantially suitable for their intended purpose within one hundred eighty (180) days following said casualty, then either Landlord or Tenant shall have the right to terminate this Lease by giving notice thereof to the other party within thirty (30) days after the expiration of such period (as so extended) provided that such restoration is not completed within such period. This Lease shall cease and come to an end without further liability or obligation on the part of either party thirty (30) days after such giving of notice unless within such thirty-day period Landlord substantially completes such restoration. Such right of termination shall be Tenant’s sole and exclusive remedy at law or in equity for Landlord’s failure so to complete such restoration, and time shall be of the essence with respect thereto.

25

9.2 Eminent Domain. Landlord reserves for itself all rights to any damages or awards with respect to the Leased Premises and the leasehold estate hereby created by reason of any exercise of the right of eminent domain, or by reason of anything lawfully done in pursuance of any public or other authority; and by way of confirmation Tenant grants and assigns to Landlord all Tenant’s rights to such damages so reserved, except as otherwise provided herein. Tenant covenants to execute and deliver any instruments confirming such assignment as Landlord may from time to time reasonably request. If all the Leased Premises are taken by eminent domain, this Lease shall terminate when Tenant is required to vacate the Leased Premises or such earlier date as the Tenant is required to begin the payments of rent to the taking authority. If a partial taking by eminent domain results in so much of the Leased Premises being taken as to render the Leased Premises or a material portion thereof unsuitable for Tenant’s continued use and occupancy as determined by either party in its reasonable discretion, either Landlord or Tenant may elect to terminate this Lease as of the date when the Tenant is required to vacate the portion of the Leased Premises so taken, by written notice to the other given not more than ninety (90) days after the date on which Tenant or Landlord, as the case may be, receives notice of the taking. For purposes of this paragraph, a “material portion” of the Leased Premises shall mean in excess of twenty-five percent (25%) of the total square footage of the Leased Premises. If a partial taking by eminent domain does not result in such portion of the Leased Premises as aforesaid being taken, then this Lease shall not be terminated or otherwise affected by any exercise of the right of eminent domain.

Whenever any portion of the Lease Premises shall be taken by any exercise of the right of eminent domain, and if this Lease shall not be terminated in accordance with the provisions of this Section 9.2, Landlord shall, at its expense, proceeding with all reasonable dispatch, provided sufficient condemnation proceeds are available therefor (or, if not, provided Tenant provides additional funds needed above the amount of the condemnation proceeds available) do such work as may be required to restore the Leased Premises or what remains thereof (not including Tenant’s trade fixtures, business equipment and furniture) as nearly as may be to the condition they were in immediately prior to such taking, and Tenant shall at its expense, proceeding with all reasonable dispatch, do such work to its trade fixtures, business equipment and furniture, as may be required. A just proportion of the Rent payable hereunder, according to the nature and extent of the taking shall be abated from the time Tenant is required to vacate that portion of the Leased Premises taken. If the Premises have not been restored to a condition substantially suitable for their intended purpose within two hundred seventy (270) days following said taking, then either Landlord or Tenant shall have the right to terminate this Lease by giving notice thereof to the other party within thirty (30) days after the expiration of such period provided that such restoration is not completed within such period. This Lease shall cease and come to an end without further liability or obligation on the part of either party thirty (30) days after such giving of notice unless, within such thirty-day period, Landlord substantially completes such restoration. Such right of termination shall be Tenant’s sole and exclusive remedy at law or in equity for Landlord’s failure so to complete such restoration, and time shall be of the essence with respect thereto.

Landlord warrants and represents that it is unaware of any currently pending or potential governmental takings or planned takings of any of the Leased Premises.

26

ARTICLE 10—DEFAULTS BY TENANT AND REMEDIES

10.1 The Condition. This Lease is made on the condition that if any default by Tenant continues, in case of payment of Rent or other monetary payments due hereunder for more than seven (7) business days after written notice thereof to Tenant (provided, however, that Tenant shall be entitled to only two (2) such notices during each calendar year and if, subsequently in any such calendar year, Tenant does not make a payment of Rent within seven (7) business days of such payment being due, Landlord shall have all the rights set forth herein without the need of any notice), or in the case of a non-monetary default for more than thirty (30) days after written notice thereof to Tenant (provided, however, that if such default is susceptible of being cured but such cure cannot be accomplished with reasonable diligence within said period of time and if Tenant commences to cure such default promptly after receipt of notice thereof from Landlord and thereafter prosecutes the curing of such default with reasonable diligence, such period of time shall be extended for such additional time as may be necessary to cure such default with reasonable diligence, but not to exceed an additional thirty (30) days); or if Tenant becomes insolvent, makes any assignment for the benefit of creditors, commits any act of bankruptcy or files a petition under any bankruptcy or insolvency law; or if such a petition filed against Tenant is not dismissed within thirty (30) days; or if a receiver or similar officer becomes entitled to Tenant’s interest in this Lease and it is not returned to Tenant within thirty (30) days; or if Tenant’s interest in this Lease is taken on execution or other process of law in any action against Tenant; or if Tenant fails to obtain any insurance required to be maintained by Tenant pursuant to this Lease or any such insurance shall be cancelled or terminated or shall expire or shall be reduced or materially changed, except, in each case, as permitted in this Lease; of if Tenant shall fail to occupy or shall vacate the Leased Premises or shall fail to continuously operate its business at the Leased Premises for the Permitted Use set forth herein, whether or not Tenant is in monetary or other default under this Lease; or if Tenant shall fail to execute any instrument of subordination or attornment or any estoppel certificate within the time periods set forth in Sections 7.10 and 7.11 respectively following Landlord’s request for the same, then Landlord may immediately or at any time thereafter and without demand or further notice make entry and repossess the Leased Premises as of Landlord’s former estate, without prejudice to any other remedies, and thereupon this Lease shall terminate; and in case of such termination, or termination by legal proceedings for default, Landlord may remove all of Tenant’s property from the Leased Premises and store the same in any public warehouse or other suitable location all at the expense and risk of Tenant, and Tenant shall indemnify Landlord during the remaining period before this Lease would otherwise expire against all loss or damage suffered by reason of the termination, the loss or damage, if any, for each lease month to be paid at the end thereof, or as otherwise herein provided.

10.2 Reimbursement of Landlord’s Expenses. In the case of termination of this Lease pursuant to Section 10.1, Tenant shall reimburse Landlord for all reasonable expenses arising out of such termination, including without limitation, all costs incurred in preparing the Plans and performing Landlord’s Work, all costs incurred in collecting amounts due from Tenant under this Lease (including reasonable attorneys’ fees, costs of litigation and the like); all expenses incurred by Landlord in attempting to relet the Leased Premises or parts thereof (including

27

advertisements, brokerage commissions, Tenant’s allowances, lease inducements, costs of preparing space, and the like); and all Landlord’s other reasonable expenditures necessitated by the termination. The reimbursement from Tenant shall be due and payable immediately from time to time upon notice from Landlord that an expense has been incurred, without regard to whether the expense was incurred before or after the termination.

10.3 Damages. Notwithstanding any other provisions hereof, Landlord may elect by written notice to Tenant within four months following such termination to be indemnified for loss of Rent by a lump sum payment representing the then present value of the amount of Rent that would have been paid in accordance with this Lease for the remainder of the Lease Term minus the then present value of the aggregate fair market rent payable for the Leased Premises for the remainder of the Lease Term (if less than the Rent payable hereunder), estimated as of the date of the termination, and taking into account reasonable projections of vacancy and time required to relet the Leased Premises. For the purposes of this Section 10.3, the “remainder of the Lease Term” shall not include any Extension Terms available to Tenant under Section 20 of this Lease except to the extent that the extension option for any such Extension Term has already been exercised by Tenant in accordance with the provisions of Section 20. (For the purposes of calculating the Rent that would have been paid hereunder for the lump sum payment calculation described herein, the last full year’s Additional Rent under this Lease is to be deemed constant for each year thereafter. The Federal Reserve discount rate (or equivalent) shall be used in calculating present values.) Should the parties be unable to agree on a fair market rent, the matter shall be submitted, upon the demand of either party, to the Boston, Massachusetts office of the American Arbitration Association, with a request for arbitration in accordance with the rules of the Association by a single arbitrator who shall be an MAI appraiser with at least ten years experience as an appraiser of suburban commercial real estate in the Eastern Massachusetts area. The parties agree that a decision of the arbitrator shall be conclusive and binding upon them. Should Landlord fail to make the election provided for in this Section 10.3, Tenant shall indemnify Landlord for the loss of Rent by a payment at the end of each month which would have been included in the Lease Term, representing the difference between the Rent that would have been paid in accordance with this Lease and the Rent actually derived from the Leased Premises by Landlord for such month (the amount of Rent deemed derived shall be the actual amount less any portion thereof attributable to Landlord’s reletting expenses described in Section 10.2 that have not been reimbursed by Tenant thereunder).

10.4 Mitigation. Landlord shall use commercially reasonable efforts to relet the Leased Premises, which efforts shall be subject to the reasonable requirements of Landlord to lease to high quality tenants and to develop the Building and the Site in a harmonious manner with an appropriate mix of uses, tenants, floor areas and terms of tenancies, and the like. It is agreed that hiring a reputable leasing broker to lease the Premises. listing the premises at commercially reasonable rates, and cooperating in good faith with such broker shall satisfy the requirement that Landlord use commercially reasonable efforts to relet.

10.5 Claims in Bankruptcy. Nothing herein shall limit or prejudice the right of Landlord to prove and obtain in a proceeding for bankruptcy, insolvency, arrangement or reorganization, by reason of the termination, an amount equal to the maximum allowed by the statute of law in effect at the time when, and governing the proceedings in which, the damages are to be proved, whether or not the amount is greater to, equal to, or less than the amount of the loss or damage which Landlord has suffered.

28

10.6 Late Charge. If any payment of Basic Rent, Additional Rent, or other payment due from Tenant to Landlord is not paid when due, then Landlord may, at its option, without notice and in addition to all other remedies hereunder, impose a late charge on Tenant equal to 1.5% of the amount in question for each month (prorated for any partial month) during which said delinquency continues, provided that no late charge will be imposed for Basic Rent payments less than ten days late, up to one time in any calendar year. Such late charge shall constitute Additional Rent hereunder payable upon demand.