Contract

Exhibit 6.16

| 7.2018 ecommerce worldpay BANK CARD MERCHANT AGREEMENT This Bank Card Merchant Agreement is made among WORLDPAY, LLC (“Processor”) having its principal office at 0000 Xxxxxxxxx Xxxx Xxxxx, Xxxxxx Xxxxxxxx, XX 00000-0000, the Member Bank and SlideBelts, Inc. (“Merchant”) having its principal office at 4818 Golden Foothill Pkwy, Unit 9, El Xxxxxx Xxxxx, XX 00000 XXX. Processor, Member Bank and Merchant hereby agree as follows: I. Processor and/or Member Bank participates in programs affiliated with MasterCard, VISA, Discover, and Other Networks which enable holders of Cards to purchase goods and services from selected merchants located in the United States by use of their Cards. II. Merchant wishes to participate in the MasterCard, VISA, Discover, and the Other Networks systems at its United States locations by entering into contracts with Cardholders for the sale of goods and services through the use of Cards. NOW, THEREFORE, in consideration of the foregoing recitals and of the mutual promises hereinafter set forth, the parties agree as follows: 1. Definitions. For the purposes of this Agreement, the following terms shall have the meanings set forth below: Account shall mean an open checking account at Fifth Third Bank or its affiliate, or at another financial institution acceptable to Processor which Processor or its agent can access through the ACH system. Account Change means a change in the Account or the financial institution where the Account is located. ACH shall mean the Federal Reserve's Automated Clearing House ("ACH") system. Agreement means this Bank Card Merchant Agreement, the Merchant Price Schedule, and each exhibit, schedule, and addendum attached hereto or referencing this Agreement, as well as all documents and other materials incorporated herein by reference. Association means VISA, MasterCard, Discover, or any Other Network, as the same are defined herein. Cards shall mean MasterCard, VISA, Discover and Other Network cards, account numbers assigned to a cardholder, or other methods of payment accepted by Processor, for which pricing is set forth in the Agreement. Cardholder shall mean any person authorized to use the Cards or the accounts established in connection with the Cards. Data Incident shall mean any alleged or actual compromise, unauthorized access, disclosure, theft, or unauthorized use of Card or Cardholder information, regardless of cause, including without limitation, a breach of or intrusion into any system, or failure, malfunction, inadequacy, or error affecting any server, wherever located, or hardware or software of any system, through which Card information resides, passes through, and/or could have been compromised. Discover shall mean Discover Financial Services, LLC. Event of Default shall mean each event listed in Section 13. Float Event shall mean a circumstance where Processor, for whatever reason, advances settlement or any amounts and/or delays the assessment of any fees. Force Majeure Event shall mean, labor disputes, fire, weather or other casualty, power outages, and funding delays, however caused, governmental orders or regulations, or any other cause, whether similar or dissimilar to the foregoing, beyond Processor’s reasonable control. Initial Term shall mean 5 years from the 1st day of the calendar month following the later of the date Processor executes this Agreement or the first date that all of Merchant’s locations receive the Services from Processor. MasterCard shall mean MasterCard International, Inc. Member Bank (also known as Acquirer) shall mean a member of VISA, MasterCard and/or Other Networks, as applicable, that provides sponsorship services in connection with this Agreement. As of the commencement of this Agreement, the Member Bank shall be Fifth Third Bank, an Ohio banking corporation. Merchant Supplier shall mean a third party other than Processor or Member Bank used by Merchant in connection with the Services received hereunder, including but not limited to, Merchant’s software providers, equipment providers, and/or third party processors. Operating Regulations means the by-laws, operating regulations and/or all other rules, policies and procedures of VISA, MasterCard, Discover, and/or Other Networks as in effect from time to time. Other Network shall mean any network or card association other than VISA, MasterCard, or Discover that is identified in the Merchant Price Schedule and in which Merchant participates hereunder. PCI shall mean the Payment Card Industry Data Security Standard. Rules Summary means the Bank Card Merchant Rules and Regulations, which are incorporated into this Agreement by reference Service shall mean any and all services described in, and provided by Processor pursuant to, this Agreement. Service Delivery Process means Processor’s then standard methods of communication, service and support, including but not limited to communication via an online Merchant portal, email communication, statement notices, other written communications, etc. VISA shall mean VISA USA, Inc. 2. Rules Summary; Operating Regulations. Merchant acknowledges receipt and review of the Rules Summary, which are incorporated into this Agreement by reference. Merchant agrees to fully comply with all of the terms and obligations in the then current Rules Summary, as changed or updated by Processor from time to time, at Processor’s sole reasonable discretion with notice in accordance with the Service Delivery Process. The Rules Summary is a summary of key Operating Regulations that govern this Agreement. In the event there is a change in the Rules Summary by Processor that is not related to or based on a corresponding Association rule or requirement, such provision will not be binding on Merchant. Merchant agrees to participate in the Associations in compliance with, and subject to, the Operating Regulations. Without limiting the foregoing, Merchant agrees that it will fully comply with any and all confidentiality and security requirements of the USA Patriot Act (or similar law, rule or regulation), VISA, MasterCard, Discover, and/or Other Networks, including but not limited to PCI, the VISA Cardholder Information Security Program, the MasterCard Site Data Protection Program, and any other program or requirement that may be published and/or mandated by the Associations. Should any Operating Regulation(s) not be publicly available or otherwise made available to the Merchant, such unavailability shall not alter or limit Merchant’s obligation to comply with the Operating Regulations. Notwithstanding Processor’s assistance in understanding the Operating Regulations, Merchant expressly acknowledges and agrees that it is assuming the risk of compliance with all provisions of the Operating Regulations, regardless of whether Merchant has possession of those provisions. Both MasterCard and VISA make excerpts of their respective Operating Regulations available on their internet sites. Merchant acknowledges responsibility for any liability resulting from its decision not to participate in optional Association programs, including but not limited to any increased Data Incident liability resulting from its decision not to participate in an Association EMV program. In the event Merchant chooses to participate in an optional Association program, including but not limited to an EMV program, Merchant acknowledges and agrees that it shall be responsible for (i) ensuring compliance with any applicable program requirements and/or Operating Regulations applicable to such program, including but not limited to making any updates to its point of sale equipment and (ii) any cost associated with its participation in the applicable program, including any costs assessed to Merchant by Processor. 3. Application; Change in Business. Merchant represents that all information supplied by Merchant in connection with its application or other request for services is complete and accurate. In accordance with Section 326 of the USA Patriot Act, Processor is required to review and record information from the documents used in identifying new merchant customers. The preceding sentence is intended to inform Merchant of Processor’s procedures and of Processor’s Confidential Page 1 of 11 BCMA —SlideBelts, Inc..r0 |

| Merchant

Suppliers that should have been reported to Processor pursuant to Section 22, (ii) that first occurred, whether or not discovered

by Merchant, more than 30 days prior to Processor's receipt of written notice from Merchant or (iii) that were caused due

to errors in data provided by Merchant to Processor. C. Processor's liability related to or arising out of this Agreement

shall in no event exceed an amount equal to the lesser of (i) actual monetary damages incurred by Merchant or (ii) fees paid

to and retained by Processor for the particular Services in question for the three calendar months immediately preceding the

date on which Processor received a written notice from Merchant detailing Processor's material nonperformance under this Agreement.

For avoidance of doubt, the cap on Processor’s liability set forth in the immediately preceding sentence will not limit

Processor’s obligation to settle funds due to Merchant under this Agreement. D. Processor shall not be deemed to be

in default under this Agreement or liable for any delay or loss in the performance, failure to perform, or interruption of

any Services to the extent resulting from a Force Majeure Event. Upon such an occurrence, performance by Processor shall be

excused until the cause for the delay has been removed and the Processor has had a reasonable time to again provide the Services.

No cause of action, regardless of form, shall be brought by either party more than 1 year after the cause of action arose,

other than one for the nonpayment of fees and amounts due Processor under this Agreement. Any restriction on Processor’s

liability under this Agreement shall apply in the same manner to Member Bank. In the event that Merchant has a claim against

Member Bank in connection with the Services provided under this Agreement, Merchant shall proceed against Processor (subject

to the limitations and restrictions herein), and not against Member Bank, unless otherwise specifically required by the Operating

Regulations. 25. Controlling Documents. This Agreement (including all addenda and schedules and exhibits hereto and all documents

and materials referenced herein) supersedes any and all other agreements, oral or written, between the parties hereto with

respect to the subject matter hereof, and sets forth the complete and exclusive agreement between the parties with respect

to the Services and, unless specifically provided for herein, other services are not included as part of this Agreement. If

there is a conflict between the Bank Card Merchant Agreement and an addendum or schedule or exhibit hereto, the addendum or

schedule or exhibit shall control. If there is a conflict between the Rules Summary and this Agreement, the Rules Summary

shall control. If there is a conflict between Operating Regulations and this Agreement, the Operating Regulations shall control.

If there is a conflict between the Operating Regulations and the Rules Summary, the Operating Regulations shall control. 26.

Regulatory Remedial Right. Processor may suspend or cease providing any Service in this Agreement if: (i) in Processor’s

reasonable opinion, such Service, or the business of Merchant, violates or would violate the Operating Regulations, or any

federal, state or local statute or ordinance, or any regulation, order or directive of any governmental agency or court; (ii)

Merchant is accused by any federal, state or local jurisdiction of a violation of any applicable statute or ordinance or any

regulation, order or directive of any governmental agency or court, or if Processor reasonably believes, based upon the opinion

of its legal counsel, that Merchant may be in violation of any of the foregoing; and/or (iii) in Processor’s reasonable

opinion, Merchant’s activities may result in increased regulatory scrutiny or reputational harm. Processor may also

suspend or cease providing any Service in this Agreement to Merchant if directed to do so by Member Bank. Should Merchant

not process sales transactions through Processor's system for a period of 1 year or more, Processor may remove Merchant from

Processor’s systems without notice, without relieving Merchant from any of Merchant's obligations under this Agreement.

27. Conversion; Deconversion. Merchant shall take all necessary steps to, and shall, promptly convert to Processor’s

system for the Services in this Agreement not later than 90 days after the execution of this Agreement by Processor. Processor

agrees that it shall not charge Merchant for Processor’s standard and customary internal testing and conversion preparation

only, in connection with Merchant’s initial conversion to Processor’s system at the commencement of this Agreement,

and as determined by Processor in its sole reasonable discretion. The foregoing shall not be deemed to limit Merchant’s

obligation to pay any third party fees and expenses incurred by Processor in connection with Merchant’s conversion,

which shall remain the sole responsibility of Merchant. Merchant agrees to be responsible for all direct and indirect costs

(including but not limited to those incurred by Processor, its affiliates and/or agents) in connection with and/or related

to Merchant's conversion from Processor at the termination of this Agreement and/or related to any conversion or programming

effort affecting the Services after Merchant's initial conversion to Processor. 28. Confidential Information. A. Confidential

Information Supplied by Processor. Merchant acknowledges that Processor will be providing Merchant with certain confidential

information, including but not limited to, this Agreement, third party audit reports, and information relating to the finances,

systems, methods, techniques, programs, devices and operations of Processor and/or the Associations. Merchant shall not disclose

any such confidential information to any person or entity (other than to those employees and Merchant Suppliers of Merchant

who participate directly in the performance of this Agreement and need access to such information). Without limiting the foregoing,

Merchant agrees that it will fully comply with any and all confidentiality and security requirements of the USA Patriot Act

(or similar law, rule or regulation), VISA, MasterCard, Discover, and/or Other Networks. B. Confidential Information Supplied

by Merchant. Processor acknowledges that Merchant will be providing Processor with certain confidential information, including

information relating to the methods, techniques, programs, devices and operations of Merchant. Such confidential information

does not include transaction information which has been de-identified or aggregated. Processor will not disclose confidential

and proprietary information about Merchant to any person or entity (other than to those employees and agents of Processor

who participate directly in the performance of this Agreement and need access to such information). Merchant acknowledges

receipt of the Worldpay, LLC privacy notice (“Privacy Notice”). Merchant should direct any questions or requests

for another copy of the Privacy Notice to a Processor customer service representative or Merchant’s primary relationship

manager, if applicable. Notwithstanding anything to the contrary in the Privacy Notice or this Agreement, Processor may use,

disclose, share, and retain any information provided by Merchant and/or arising out of the Services, during the term and thereafter,:

(a) with Merchant's franchisor, Merchant's franchisee(s), association(s) to which Merchant belongs and/or belonged as of the

commencement of this Agreement, (b) with any affiliate of Merchant; (c) in response to subpoenas, warrants, court orders or

other legal processes; (d) in response to requests from law enforcement agencies or government entities; (e) to comply with

applicable laws or regulations; (f) with Processor’s affiliates, partners and agents; (g) to perform analytic services

for Merchant, Processor and/or others including but not limited to analyzing, tracking, and comparing transaction and other

data to develop and provide insights for such parties as well as for developing, marketing, maintaining and/or improving Processor’s

products and services; and/or (h) to offer or provide the Services hereunder. C. Miscellaneous. The parties acknowledge that

the injury that would be sustained by the party disclosing information as a result of the violation of this Section 28 cannot

be compensated solely by money damages, and therefore agrees that the disclosing party shall be entitled to seek injunctive

relief and any other remedies as may be available at law or in equity in the event of a violation of the provisions contained

in this Section 28. The restrictions contained in this Section 28 shall not apply to any information which becomes a matter

of public knowledge, other than through a violation of this Agreement or other agreements between the parties. D. Publicity.

Merchant and Processor agree that they will work together to issue a mutually agreeable joint press release after the execution

of this agreement and/or after the conversion of Merchant to Processor’s Services. In any event, Merchant acknowledges

and agrees that Processor may make public the execution of this Agreement by Merchant and/or any of Merchant’s affiliates,

and/or the Services that may be or have been provided under the Agreement. Merchant agrees that Processor may include Merchant’s

name and logo on a list of Processor’s customers, which may be made public. Merchant agrees that, upon Processor’s

request, Merchant will provide testimonial information related to the Services received by Merchant hereunder. 29. Financial

Statements. If at any time Merchant is not a publicly traded company, Merchant shall provide Processor with an audited financial

statement for Merchant's most recent fiscal year end and/or quarterly financial statements prepared and certified by Merchant's

chief financial officer within 15 days of Processor’s request therefore. 30. No Waiver. If either party waives in writing

an unsatisfied condition, representation, warranty, undertaking or agreement (or portion thereof) set forth herein, the waiving

party shall thereafter be barred from recovering, and thereafter shall not seek to recover, any damages, claims, losses, liabilities

or expenses, including, without limitation, legal and other expenses, from the other party in respect of the matter or matters

so waived. Except as otherwise specifically provided for in this Agreement, the failure of any party to promptly enforce its

rights herein shall not be construed to be a waiver of such rights unless agreed to in writing. Any rights and remedies specifically

provided for in any addendum or schedule or exhibit are in addition to those rights and remedies set forth in this Agreement

and/or available to Processor at law or in equity. 31. Compliance with Law. Confidential Page 5 of 11 BCMA —SlideBelts, Inc..r0 |

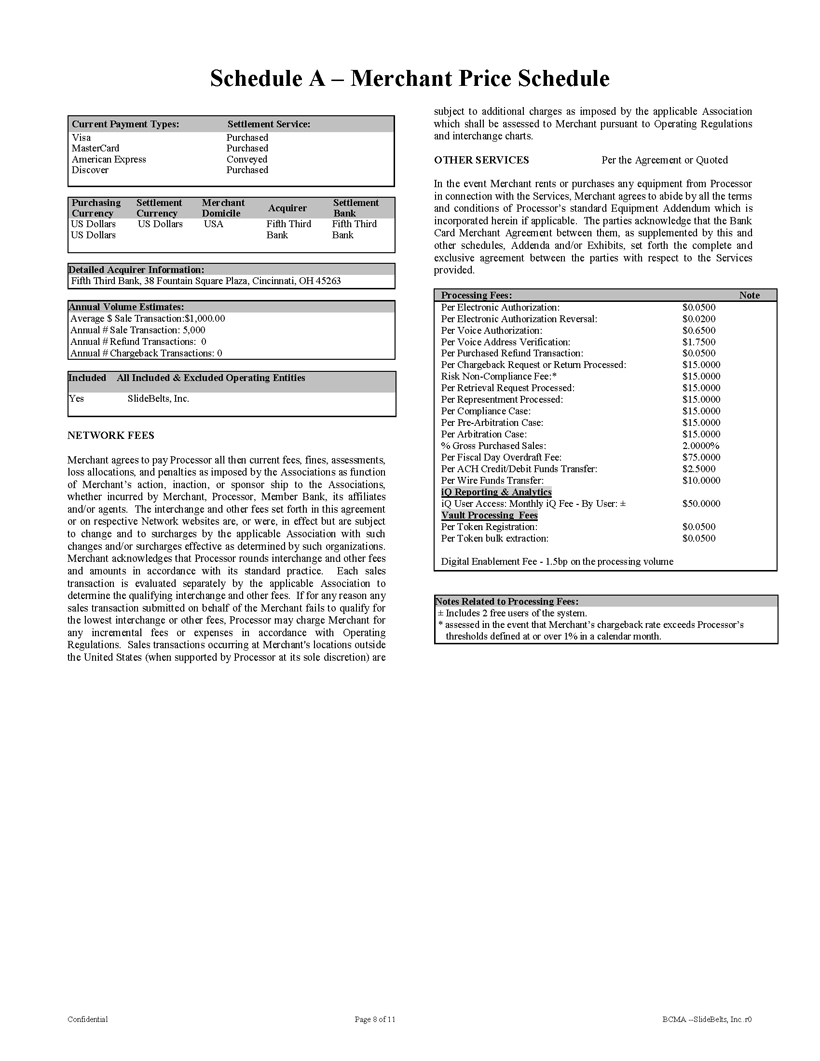

| Schedule

A – Merchant Price Schedule Current Payment Types: Settlement Service: Visa MasterCard American Express Discover Purchased

Purchased Conveyed Purchased Purchasing Currency Settlement Currency Merchant Domicile Acquirer Settlement Bank US Dollars

US Dollars US Dollars USA Fifth Third Bank Fifth Third Bank Detailed Acquirer Information: Fifth Third Bank, 00 Xxxxxxxx Xxxxxx

Xxxxx, Xxxxxxxxxx, XX 00000 Annual Volume Estimates: Average $Sale Transaction:$1,000.00 Annual # Sale Transaction: 5,000

Annual # Refund Transactions: 0 Annual # Chargeback Transactions: 0 Included All Included & Excluded Operating Entities

Yes SlideBelts, Inc. NETWORK FEES Merchant agrees to pay Processor all then current fees, fines, assessments, loss allocations,

and penalties as imposed by the Associations as function of Merchant’s action, inaction, or sponsor ship to the Associations,

whether incurred by Merchant, Processor, Member Bank, its affiliates and/or agents. The interchange and other fees set forth

in this agreement or on respective Network websites are, or were, in effect but are subject to change and to surcharges by

the applicable Association with such changes and/or surcharges effective as determined by such organizations. Merchant acknowledges

that Processor rounds interchange and other fees and amounts in accordance with its standard practice. Each sales transaction

is evaluated separately by the applicable Association to determine the qualifying interchange and other fees. If for any reason

any sales transaction submitted on behalf of the Merchant fails to qualify for the lowest interchange or other fees, Processor

may charge Merchant for any incremental fees or expenses in accordance with Operating Regulations. Sales transactions occurring

at Merchant's locations outside the United States (when supported by Processor at its sole discretion) are subject to additional

charges as imposed by the applicable Association which shall be assessed to Merchant pursuant to Operating Regulations and

interchange charts. OTHER SERVICES Per the Agreement or Quoted In the event Merchant rents or purchases any equipment from

Processor in connection with the Services, Merchant agrees to abide by all the terms and conditions of Processor’s standard

Equipment Addendum which is incorporated herein if applicable. The parties acknowledge that the Bank Card Merchant Agreement

between them, as supplemented by this and other schedules, Addenda and/or Exhibits, set forth the complete and exclusive agreement

between the parties with respect to the Services provided. Processing Fees: Note Per Electronic Authorization: $0.0500 Per

Electronic Authorization Reversal: $0.0200 Per Voice Authorization: $0.6500 Per Voice Address Verification: $1.7500 Per Purchased

Refund Transaction: $0.0500 Per Chargeback Request or Return Processed: $15.0000 Risk Non-Compliance Fee:* $15.0000 Per Retrieval

Request Processed: $15.0000 Per Representment Processed: $15.0000 Per Compliance Case: $15.0000 Per Pre-Arbitration Case:

$15.0000 Per Arbitration Case: $15.0000% Gross Purchased Sales: 2.0000% Per Fiscal Day Overdraft Fee: $75.0000 Per ACH Credit/Debit

Funds Transfer: $2.5000 Per Wire Funds Transfer: $10.0000 iQ Reporting & Analytics iQ User Access: Monthly iQ Fee - By

User: ± $50.0000 Vault Processing Fees Per Token Registration: $0.0500 Per Token bulk extraction: $0.0500 Digital Enablement

Fee - 1.5bp on the processing volume Notes Related to Processing Fees: ± Includes 2 free users of the system. * assessed

in the event that Merchant’s chargeback rate exceeds Processor’s thresholds defined at or over 1% in a calendar

month. Confidential Page 8 of 11 BCMA —SlideBelts, Inc..r0 |

| Schedule B - Merchant Value-Added Services This addendum reflects optional services that are not part of Schedule A within the Agreement, but which provide additional value to Merchant’s business (“Value-Added Services”) above and beyond Processor’s core products. The Value-Added Services are offerings to which Merchant may opt-in at will. For avoidance of doubt, if there are any discrepancies between this addendum and the Agreement, this addendum shall control, and the terms and conditions included in this addendum can only be changed upon the written consent of both Processor and Merchant. The parties agree as follows: 1. Definitions: Fraud Screen: An automated process provided by Processor wherein certain submitted authorizations are evaluated for potential fraud per Merchant definable criteria. Some authorizations may be declined as a result. 2. Pricing: The following pricing shall apply to the Value-Added Services: Pricing: Fraud Toolkit * Per Authorization Submitted to Fraud Screen Essential: $0.0400 Extended (Essential + Extended): $0.07 Premium (Essential + Extended + Premium): $0.1200 Data Security Service ? eProtect Request Fee: $0.0500 eProtect Enhanced - Card Security Code: $0.0500 Notes Related to Pricing ? See Paragraph 6 below for definition of this service. * Merchant’s use of this service is subject to the terms set out in paragraph 7 below. 3. Opt-Out and Changes to Value-Added Services: Upon thirty (30) days written notice to Merchant, Processor may alter or discontinue any or all of the Value-Added Services, including but not limited to changing the price(s) or the feature functionality set(s). Upon written notice to Processor, Merchant shall have the immediate right to opt-out of the use of any or all of the Value-Added Services at any time. A decision to opt-out shall be the exclusive remedy of Merchant with regard to a change in the Value-Added Services and opting out of the Value-Added Services shall not be considered an Event of Default. 4. Termination: Notwithstanding Section 13 (Default) of the Agreement, should Processor determine, in its sole discretion that a breach of this Value-Added Services addendum by Merchant leads to or has the potential to lead to a breach of the Agreement, Processor shall have the option to immediately cease providing the Value-Added Services and/or to terminate the Agreement per the applicable terms of the Agreement. 5. No Warranty: In accordance with Section 24 (Limit of Liability; Force Majeure) of the Agreement, the Value-Added Services are provided “as is.” Processor provides no express or implied warranties with respect to the Value-Added Services, including without limitation the implied warranties of merchantability or fitness for a particular purpose. 6. Card Not Present eCommerce Data Security Service. Processor offers a number of different security products, tools and services including, but not limited to the Card Not Present eCommerce Data Security (collectively referred to as “Security Services”). The Merchant may utilize any or all individual Security Service products as a means to address some of the risks associated with accepting, transporting and storing cardholder data within and throughout their environment. Merchant will be billed based on product usage and/or as otherwise set forth in the Agreement. Processor may utilize and/or license technology from third parties as part of providing Security Services. In addition, all or portions of the Security Services may be directly or indirectly provided by third parties to Merchant. Merchant agrees that it shall not acquire any interest in (ownership, intellectual property or otherwise) any of the third party provider software used by Processor to provide the Security Services. Merchant shall not, and shall have no right to, own, copy, distribute, sub-lease, sub-license, assign or otherwise Confidential Page 9 of 11 BCMA —SlideBelts, Inc..r0 SlideBelts, Inc. |

| Fraud Toolkit into their native mobile apps. ▪ For further details on SSL Certificate hosting, please refer to below paragraph labeled “SSL Certificate Hosting” Rule Optimization (As-Needed) Rules Optimization Service (Optional) ▪ A per review rule optimization after launch with the goal of minimizing fraud while maximizing good sales. ▪ Transaction Review: A review of Merchant specific data. ▪ Rule Suggestions – Provide suggestions to create/modify rules based on the data that is reviewed to eliminate additional fraud. $3,000.00 (per instance) SSL Certificate Hosting: As part of installing the Service and opting for Masked Profiling, Merchant must purchase from a third party provider (a “Certificate Authority”) and deliver to Processor, for installation on Processor’s’ server cluster, a Secure Sockets Layer Certificate to authenticate Merchant’s website (a “Certificate”). Merchant represents and warrants that Merchant has all rights necessary to deliver the Certificate to Processor and Processor has the right to install the Certificate on third party server cluster as necessary to provide the Enhanced Profiling service. Merchant will provide to Processor a list of any information required by the Certificate Authority that may be necessary for Processor to install the Certificate on Processor’s server cluster. Any such information provided by Processor constitutes Processor Confidential Information, which Merchant may disclose solely to the Certificate Authority provided that the Certificate Authority is subject to confidentiality restrictions at least as protective as those contained in this Agreement, and such information is sufficiently marked with a legend or similar designation indicating its confidential and proprietary nature. Merchant understands that if Merchant fails to maintain Merchant license to the Certificate, Merchant customer, or end user, may receive an error notification indicating that the Certificate has expired and the action executed by Merchant customer or end user may not be secure or accurate. Merchant agrees that Merchant has the sole responsibility to maintain the license for the Certificate, and Merchant assumes all risk arising out of or relating to Merchant’s failure to maintain the license for the Certificate. Worldpay, LLC Signature: Name: Title: Date: SlideBelts, Inc. Signature: Name: Title: Date: Confidential Page 11 of 11 BCMA —SlideBelts, Inc..r0 SlideBelts, Inc. |