BARCLAYS PLC, as Issuer, THE BANK OF NEW YORK MELLON, LONDON BRANCH, as Trustee and Paying Agent and THE BANK OF NEW YORK MELLON SA/NV, LUXEMBOURG BRANCH, as Dated Subordinated Debt Security Registrar FIFTH SUPPLEMENTAL INDENTURE Dated as of June 27,...

Exhibit 4.4

Execution version

as Issuer,

THE BANK OF NEW YORK MELLON, LONDON BRANCH,

as Trustee and Paying Agent

and

THE BANK OF NEW YORK ▇▇▇▇▇▇ ▇▇/NV, LUXEMBOURG BRANCH,

as Dated Subordinated Debt Security Registrar

Dated as of June 27, 2023

To the Dated Subordinated Debt Securities Indenture, dated as of May 9, 2017, between

Barclays PLC and The Bank of New York Mellon, London Branch, as Trustee

$1,500,000,000 7.119% Fixed-to-Floating Rate Subordinated Callable Notes due 2034

TABLE OF CONTENTS

| Page | ||||||

| ARTICLE I |

| |||||

| DEFINITIONS AND OTHER PROVISIONS OF GENERAL APPLICATION |

| |||||

| SECTION 1.01 |

Definitions | 2 | ||||

| SECTION 1.02 |

Effect of Headings | 7 | ||||

| SECTION 1.03 |

Separability Clause | 8 | ||||

| SECTION 1.04 |

Benefits of Instrument | 8 | ||||

| SECTION 1.05 |

Relation to Base Indenture | 8 | ||||

| SECTION 1.06 |

Construction and Interpretation | 8 | ||||

| ARTICLE II |

| |||||

| 7.119% FIXED-TO-FLOATING RATE SUBORDINATED CALLABLE NOTES DUE 2034 |

| |||||

| SECTION 2.01 |

Creation of Series; Establishment of Form | 9 | ||||

| SECTION 2.02 |

Interest | 10 | ||||

| SECTION 2.03 |

Payment of Principal, Interest and Other Amounts | 10 | ||||

| SECTION 2.04 |

Optional Redemption | 11 | ||||

| SECTION 2.05 |

Regulatory Event Redemption | 11 | ||||

| SECTION 2.06 |

Notice of Redemption | 11 | ||||

| SECTION 2.07 |

Additional Amounts and FATCA Withholding Tax | 12 | ||||

| SECTION 2.08 |

Acknowledgement with respect to Treatment of EEA BRRD Liabilities | 12 | ||||

| SECTION 2.09 |

Acknowledgement with Respect to Treatment of BRRD Liabilities | 13 | ||||

| ARTICLE III |

| |||||

| AMENDMENTS TO THE BASE INDENTURE |

| |||||

| SECTION 3.01 |

Amendments to the Base Indenture | 13 | ||||

| ARTICLE IV |

| |||||

| MISCELLANEOUS PROVISIONS |

| |||||

| SECTION 4.01 |

Effectiveness | 14 | ||||

| SECTION 4.02 |

Original Issue | 14 | ||||

| SECTION 4.03 |

Ratification and Integral Part | 15 | ||||

| SECTION 4.04 |

Priority | 15 | ||||

| SECTION 4.05 |

Not Responsible for Recitals or Issuance of Securities | 15 | ||||

| SECTION 4.06 |

Successors and Assigns | 15 | ||||

| SECTION 4.07 |

Counterparts | 15 | ||||

| SECTION 4.08 |

Governing Law | 15 | ||||

| ANNEX I – Interest Terms of the Securities |

I-1 | |||||

| EXHIBIT A – Form of Global Note |

A-1 | |||||

-i-

FIFTH SUPPLEMENTAL INDENTURE, dated as of June 27, 2023 (the “Fifth Supplemental Indenture”), among BARCLAYS PLC, a public limited company registered in England and Wales (herein called the “Company”), having its registered office at ▇ ▇▇▇▇▇▇▇▇▇ ▇▇▇▇▇, ▇▇▇▇▇▇ ▇▇▇ ▇▇▇, ▇▇▇▇▇▇ ▇▇▇▇▇▇▇, THE BANK OF NEW YORK MELLON, LONDON BRANCH, a New York banking corporation, as Trustee (herein called the “Trustee”) and Paying Agent, having a Corporate Trust Office at ▇▇▇ ▇▇▇▇▇ ▇▇▇▇▇▇▇▇ ▇▇▇▇▇▇, ▇▇▇▇▇▇ ▇▇▇▇ ▇▇▇, ▇▇▇▇▇▇ ▇▇▇▇▇▇▇, and THE BANK OF NEW YORK ▇▇▇▇▇▇ ▇▇/NV, LUXEMBOURG BRANCH, as Dated Subordinated Debt Security Registrar, having an office at ▇-▇ ▇▇▇ ▇▇▇▇▇▇ ▇▇▇▇▇▇▇, ▇▇▇▇▇▇▇ ▇▇▇▇▇▇▇▇ – ▇▇▇▇▇▇▇, ▇▇▇▇▇▇▇▇▇▇, ▇▇▇▇, ▇▇▇▇▇▇▇▇▇▇, to the DATED SUBORDINATED DEBT SECURITIES INDENTURE, dated as of May 9, 2017, between the Company and the Trustee, as heretofore amended and supplemented (the “Base Indenture” and, together with this Fifth Supplemental Indenture, the “Indenture”).

RECITALS OF THE COMPANY

WHEREAS, the Company and the Trustee are parties to the Base Indenture, which provides for the issuance by the Company from time to time of its Dated Subordinated Debt Securities in one or more series;

WHEREAS, Section 9.01 of the Base Indenture permits supplements thereto without the consent of Holders of Dated Subordinated Debt Securities to establish the form or terms of Dated Subordinated Debt Securities of any series as permitted by Sections 2.01 and 3.01 of the Base Indenture and to add to, change or eliminate any of the provisions of the Base Indenture with respect to Dated Subordinated Debt Securities issued on or after the date hereof;

WHEREAS, as contemplated by Section 3.01 of the Base Indenture, the Company intends to issue a new series of Dated Subordinated Debt Securities, to be known as the Company’s “7.119% Fixed-to-Floating Rate Subordinated Callable Notes due 2034” (the “Securities”) under the Indenture;

WHEREAS, the Company and the Trustee desire to amend Section 1.15, Section 5.04(d), and Section 13.01(d) of the Base Indenture with respect to Dated Subordinated Debt Securities issued on or after the date hereof; and

WHEREAS, the Company has taken all necessary corporate action to authorize the execution and delivery of this Fifth Supplemental Indenture;

NOW, THEREFORE, THIS FIFTH SUPPLEMENTAL INDENTURE WITNESSETH:

For and in consideration of the premises and the other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the Company, the Trustee and the Dated Subordinated Debt Security Registrar mutually agree as follows with regard to the Securities:

-1-

ARTICLE I

DEFINITIONS AND OTHER PROVISIONS OF GENERAL APPLICATION

SECTION 1.01 Definitions. Except as otherwise expressly provided or unless the context otherwise requires, all terms used in this Fifth Supplemental Indenture that are defined in the Base Indenture shall have the meanings ascribed to them in the Base Indenture.

The following terms used in this Fifth Supplemental Indenture have the following respective meanings with respect to the Securities only:

“2018 Order” means the U.K. Banks and Building Societies (Priorities on Insolvency) Order 2018, as may be amended or replaced from time to time.

“Bail-in Legislation” has the meaning set forth in Section 2.08 hereof.

“Base Indenture” has the meaning set forth in the first paragraph of this Fifth Supplemental Indenture.

“Benchmark” has the meaning set forth in Annex I of this Fifth Supplemental Indenture.

“Benchmark Replacement” means the first alternative set forth in the order below that can be determined by the Company or its designee (in consultation with the Company) as of the Benchmark Replacement Date:

(1) the sum of: (a) the alternate rate of interest that has been selected or recommended by the Relevant Governmental Body as the replacement for the then-current Benchmark for the applicable Corresponding Tenor (if any) and (b) the Benchmark Replacement Adjustment;

(2) the sum of: (a) the ISDA Fallback Rate and (b) the Benchmark Replacement Adjustment; and

(3) the sum of: (a) the alternate rate of interest that has been selected by the Company or its designee (in consultation with the Company) as the replacement for the then-current Benchmark for the applicable Corresponding Tenor giving due consideration to any industry-accepted rate of interest as a replacement for the then- current Benchmark for U.S. dollar-denominated floating rate notes at such time and (b) the Benchmark Replacement Adjustment.

“Benchmark Replacement Adjustment” means the first alternative set forth in the order below that can be determined by the Company or the Company’s designee (in consultation with the Company) as of the Benchmark Replacement Date:

(1) the spread adjustment (which may be a positive or negative value or zero) that has been (i) selected or recommended by the Relevant Governmental Body or (ii) determined by the Company or the Company’s designee (in consultation with the Company) in accordance with the method for calculating or determining such spread adjustment that has been selected or recommended by the Relevant Governmental Body, in each case for the applicable Unadjusted Benchmark Replacement;

-2-

(2) if the applicable Unadjusted Benchmark Replacement is equivalent to the ISDA Fallback Rate, then the ISDA Fallback Adjustment;

(3) the spread adjustment (which may be a positive or negative value or zero) that has been selected by the Company or its designee (in consultation with the Company) giving due consideration to industry-accepted spread adjustments (if any), or method for calculating or determining such spread adjustment, for the replacement of the then-current Benchmark with the applicable Unadjusted Benchmark Replacement for U.S. dollar-denominated floating rate notes at such time.

“Benchmark Replacement Conforming Changes” has the meaning set forth in Annex I of this Fifth Supplemental Indenture.

“Benchmark Replacement Date” means the earliest to occur of the following events with respect to the then-current Benchmark:

(1) in the case of clause (1) or (2) of the definition of “Benchmark Transition Event,” the later of (a) the date of the public statement or publication of information referenced therein and (b) the date on which the administrator of the Benchmark permanently or indefinitely ceases to provide the Benchmark; or

(2) in the case of clause (3) of the definition of “Benchmark Transition Event,” the date of the public statement or publication of information referenced therein.

For the avoidance of doubt, if the event giving rise to the Benchmark Replacement Date occurs on the same day as, but earlier than, the Reference Time in respect of any determination, the Benchmark Replacement Date will be deemed to have occurred prior to the Reference Time for such determination.

“Benchmark Transition Event” means the occurrence of one or more of the following events with respect to the then-current Benchmark:

(1) a public statement or publication of information by or on behalf of the administrator of the Benchmark announcing that such administrator has ceased or will cease to provide the Benchmark, permanently or indefinitely, provided that, at the time of such statement or publication, there is no successor administrator that will continue to provide the Benchmark;

(2) a public statement or publication of information by the regulatory supervisor for the administrator of the Benchmark, the central bank for the currency of the Benchmark, an insolvency official with jurisdiction over the administrator for the Benchmark, a resolution authority with jurisdiction over the administrator for the Benchmark or a court or an entity with similar insolvency or resolution authority over the administrator for the Benchmark, which states that the administrator of the Benchmark has ceased or will cease to provide the Benchmark permanently or indefinitely, provided that, at the time of such statement or publication, there is no successor administrator that will continue to provide the Benchmark; or

(3) a public statement or publication of information by the regulatory supervisor for the administrator of the Benchmark announcing that the Benchmark is no longer representative.

-3-

“BRRD” has the meaning set forth in Section 2.08 hereof.

“BRRD Party” has the meaning set forth in Section 2.08 hereof.

“Business Day” means any weekday, other than one on which banking institutions are authorized or obligated by law, regulation or executive order to close in London, England or in the City of New York, United States.

“Calculation Agent” means The Bank of New York Mellon, New York, or its successor appointed by the Company.

“Capital Regulations” means, at any time, the laws, regulations, requirements, standards, guidelines and policies relating to capital adequacy and/or minimum requirement for own funds and eligible liabilities and/or loss absorbing capacity for credit institutions of either (i) the PRA and/or (ii) any other national or European authority, in each case then in effect in the United Kingdom (or in such other jurisdiction in which the Company may be organized or domiciled) and applicable to the Group including, U.K. CRD.

“Company” has the meaning set forth in the first paragraph of this Fifth Supplemental Indenture, and includes any successor entity.

“Compounded Daily SOFR” has the meaning set forth in Annex I of this Fifth Supplemental Indenture.

“Corresponding Tenor” with respect to a Benchmark Replacement means a tenor (including overnight) having approximately the same length (disregarding business day adjustments) as the applicable tenor for the then-current Benchmark.

“designee” means an affiliate or any other agent of the Company.

“DTC” means The Depository Trust Company, or any successor clearing system.

“EEA Bail-in Power” has the meaning set forth in Section 2.08 hereof.

“EEA BRRD Liability” has the meaning set forth in Section 2.08 hereof.

“EU Bail-in Legislation Schedule” has the meaning set forth in Section 2.08 hereof.

“EU CRD” means: (i) Regulation (EU) No 575/2013 of the European Parliament and of the Council of 26 June 2013 on prudential requirements for credit institutions and investments firms, as amended before IP completion day; and (ii) Directive 2013/36/EU of the European Parliament and of the Council of 26 June 2013 on access to the activity of credit institutions and the prudential supervision of credit institutions and investment firms, amending Directive 2002/87/EC and repealing Directives 2006/48/EC and 2006/49/EC, as amended before IP completion day.

“Fifth Supplemental Indenture” has the meaning set forth in the first paragraph of this Fifth Supplemental Indenture.

-4-

“Fixed Rate Period Interest Payment Date” has the meaning set forth in Annex I of this Fifth Supplemental Indenture.

“Floating Rate Period Interest Payment Date” has the meaning set forth in Annex I of this Fifth Supplemental Indenture.

“Indenture” has the meaning set forth in the first paragraph of this Fifth Supplemental Indenture.

“Interest Determination Date” means the second USGS Business Day (as defined below) preceding the applicable Floating Rate Period Interest Payment Date.

“Interest Payment Date” means any of the Fixed Rate Period Interest Payment Dates or the Floating Rate Period Interest Payment Dates, as applicable.

“ISDA” means the International Swaps and Derivatives Association, Inc. or any successor thereto.

“ISDA Definitions” means the 2006 ISDA Definitions published by ISDA as amended or supplemented from time to time, or any successor definitional booklet for interest rate derivatives published from time to time.

“ISDA Fallback Adjustment” means the spread adjustment (which may be a positive or negative value or zero) that would apply for derivatives transactions referencing the ISDA Definitions to be determined upon the occurrence of an index cessation event with respect to the Benchmark for the applicable tenor.

“ISDA Fallback Rate” means the rate that would apply for derivatives transactions referencing the ISDA Definitions to be effective upon the occurrence of an index cessation date with respect to the Benchmark for the applicable tenor excluding the applicable ISDA Fallback Adjustment.

“IP completion day” has the meaning given in the U.K. European Union (Withdrawal Agreement) Act 2020.

“Issue Date” has the meaning set forth in Section 2.01(f) hereof.

“Junior Obligations” means the obligations of the Company (as issuer or borrower, as the case may be) in respect of the 5.875% Fixed Rate Resetting Perpetual Subordinated Contingent Convertible Securities, the 7.750% Fixed Rate Resetting Perpetual Subordinated Contingent Convertible Securities, the 8% Fixed Rate Resetting Perpetual Subordinated Contingent Convertible Securities (issued in 2019), the 7.125% Fixed Rate Resetting Perpetual Subordinated Contingent Convertible Securities, the 6.375% Fixed Rate Resetting Perpetual Subordinated Contingent Convertible Securities, the 6.125% Fixed Rate Resetting Perpetual Subordinated Contingent Convertible Securities, the 4.375% Fixed Rate Resetting Perpetual Subordinated Contingent Convertible Securities, the 8.875% Fixed Rate Resetting Perpetual Subordinated Contingent Convertible Securities, the 8.3% Fixed Rate Resetting Perpetual Subordinated Contingent Convertible Securities, the 8% Fixed Rate Resetting Perpetual Subordinated Contingent Convertible Securities (issued in 2022), the 9.250% Fixed Rate Resetting Perpetual Subordinated Contingent Convertible Securities and the 7.300% Fixed Rate Resetting Perpetual Subordinated Contingent Convertible Securities, for the time being outstanding and any other obligations of the Company which rank or are expressed to rank pari passu with any of such obligations.

-5-

“NY Federal Reserve’s Website” means the website of the Federal Reserve Bank of New York at ▇▇▇▇://▇▇▇.▇▇▇▇▇▇▇▇▇▇.▇▇▇ (or any successor website).

“Par Redemption Date” means June 27, 2033.

“Parity Obligations” means the obligations of the Company (as issuer or borrower, as the case may be) in respect of the 4.375% Fixed Rate Subordinated Notes due 2024, the 5.20% Fixed Rate Subordinated Notes due 2026, the 4.836% Fixed Rate Subordinated Callable Notes due 2028, the Singapore dollar-denominated 3.750% Fixed Rate Resetting Subordinated Callable Notes due 2030, the 5.088% Fixed-to-Floating Rate Subordinated Notes due 2030, the sterling-denominated 3.750% Fixed Rate Resetting Subordinated Callable Notes due 2030, the 1.125% Fixed Rate Resetting Subordinated Callable Notes due 2031, the 8.407% Fixed Rate Resetting Subordinated Callable Notes due 2032, the 3.564% Fixed Rate Resetting Subordinated Callable Notes due 2035 and the 3.811% Fixed Rate Resetting Subordinated Callable Notes due 2042 of the Company for the time being outstanding and any other obligations of the Company which rank or are expressed to rank pari passu with any of such obligations.

“Reference Time” means (1) if the Benchmark is Compounded Daily SOFR, for each USGS Business Day, 3:00 p.m. (New York time) on the next succeeding USGS Business Day, and (2) if the Benchmark is not Compounded Daily SOFR, the time determined by the Company or its designee (in consultation with the Company) in accordance with the Benchmark Replacement Conforming Changes.

“Regular Record Date” means the close of business on the Business Day immediately preceding each Interest Payment Date (or, if the Securities are held in definitive form, the close of business on the 15th Business Day preceding each Interest Payment Date).

“Relevant EEA Resolution Authority” has the meaning set forth in Section 2.08 hereof.

“Relevant Governmental Body” means the Federal Reserve and/or the Federal Reserve Bank of New York (“NY Federal Reserve”), or a committee officially endorsed or convened by the Federal Reserve and/or the NY Federal Reserve or any successor thereto.

“secondary non-preferential debts” shall have the meaning given to it in the 2018 Order and any other law or regulation applicable to the Company which is amended by the 2018 Order, as each may be amended or replaced from time to time.

“Securities” has the meaning set forth in the Recitals to this Fifth Supplemental Indenture.

-6-

“Senior Creditors” means creditors of the Company: (i) who are unsubordinated creditors; (ii) who are subordinated creditors (whether in the event of a winding-up or administration of the Company or otherwise) other than (x) those whose claims by law rank, or by their terms are expressed to rank, pari passu with or junior to the claims of the holders of the Securities or (y) those whose claims are in respect of Parity Obligations or Junior Obligations; or (iii) who are creditors in respect of any secondary non-preferential debts.

“Stated Maturity” has the meaning set forth in Section 2.01(g) hereof.

“Tier 2 Capital” means Tier 2 Capital for the purposes of the Capital Regulations;

“Trustee” has the meaning set forth in the first paragraph of this Fifth Supplemental Indenture, and includes any successor entity.

“U.K. CRD” means the legislative package consisting of:

(i) the U.K. CRD Regulation;

(ii) the law of the United Kingdom or any part of it (as amended or replaced in accordance with domestic law from time to time), which immediately before IP completion day implemented Directive 2013/36/EU of the European Parliament and of the Council of 26 June 2013 on access to the activity of credit institutions and the prudential supervision of credit institutions and investment firms, amending Directive 2002/87/EC and repealing Directives 2006/48/EC and 2006/49/EC and its implementing measures, such Directive as amended before IP completion day; and

(iii) direct EU legislation (as defined in the Withdrawal Act), which immediately before IP completion day implemented EU CRD as it forms part of domestic law of the United Kingdom by virtue of the Withdrawal Act and as the same may be amended or replaced in accordance with domestic law from time to time.

“U.K. CRD Regulation” means Regulation (EU) No 575/2013 of the European Parliament and of the Council of 26 June 2013 on prudential requirements for credit institutions and investments firms, as amended before IP completion day, as it forms part of domestic law of the United Kingdom by virtue of the Withdrawal Act and as the same may be further amended or replaced in accordance with domestic law from time to time.

“Unadjusted Benchmark Replacement” means the Benchmark Replacement excluding the Benchmark Replacement Adjustment.

“USGS Business Day” means any day except for a Saturday, Sunday or a day on which the Securities Industry and Financial Markets Association or any successor thereto (“SIFMA”) recommends that the fixed income departments of its members be closed for the entire day for purposes of trading in U.S. government securities.

“Withdrawal Act” means the United Kingdom European Union (Withdrawal) Act 2018, as amended.

SECTION 1.02 Effect of Headings. The Article and Section headings herein are for convenience only and shall not affect the construction hereof.

-7-

SECTION 1.03 Separability Clause. In case any provision in this Fifth Supplemental Indenture shall be invalid, illegal or unenforceable, the validity, legality and enforceability of the remaining provisions shall not in any way be affected or impaired thereby.

SECTION 1.04 Benefits of Instrument. Nothing in this Fifth Supplemental Indenture, express or implied, shall give to any Person, other than the parties hereto and their successors hereunder and the Holders, any benefit or any legal or equitable right, remedy or claim under the Indenture.

SECTION 1.05 Relation to Base Indenture. This Fifth Supplemental Indenture constitutes an integral part of the Base Indenture. Except for the provisions set out in Article III, all provisions of this Fifth Supplemental Indenture are expressly and solely for the benefit of the Holders and Beneficial Owners of the Securities and the Trustee and any such provisions shall not be deemed to apply to any other Dated Subordinated Debt Securities issued under the Base Indenture and shall not be deemed to amend, modify or supplement the Base Indenture for any purpose other than with respect to the Securities. The provisions set out in Article III apply to Dated Subordinated Debt Securities authenticated, delivered and issued on or after the date of this Fifth Supplemental Indenture.

SECTION 1.06 Construction and Interpretation. Unless the context otherwise requires:

(a) the words “hereof”, “herein” and “hereunder” and words of similar import, when used in this Fifth Supplemental Indenture, refer to this Fifth Supplemental Indenture as a whole and not to any particular provision of this Fifth Supplemental Indenture;

(b) the terms defined in the singular have a comparable meaning when used in the plural, and vice versa;

(c) the terms “U.S. dollars” and “$” refer to the lawful currency for the time being of the United States;

(d) references herein to a specific Section, Article or Exhibit refer to Sections or Articles of, or an Exhibit to, this Fifth Supplemental Indenture;

(e) wherever the words “include”, “includes” or “including” are used in this Fifth Supplemental Indenture, they shall be deemed to be followed by the words “without limitation;”

(f) references to a Person are also to its successors and permitted assigns; and

(g) the use of “or” is not intended to be exclusive unless expressly indicated otherwise.

-8-

ARTICLE II

7.119% FIXED-TO-FLOATING RATE SUBORDINATED CALLABLE NOTES DUE

2034

SECTION 2.01 Creation of Series; Establishment of Form.

(a) There is hereby established a new series of Dated Subordinated Debt Securities under the Base Indenture entitled the “7.119% Fixed-to-Floating Rate Subordinated Callable Notes due 2034”.

(b) The Securities shall be issued initially in the form of one or more registered Global Securities that shall be deposited with DTC on the Issue Date. The Global Securities shall be registered in the name of Cede & Co. and executed and issued in substantially the form attached hereto as Exhibit A.

(c) The Company shall issue the Securities in an aggregate principal amount of $1,500,000,000. The Company may from time to time, without the consent of the Holders of the Securities, issue additional securities of such series having the same ranking and same interest rate, Stated Maturity, redemption terms and other terms as the Securities described in this Fifth Supplemental Indenture, except for the price to the public and Issue Date. Any such additional securities subsequently issued shall rank equally and ratably with the Securities in all respects, so that such further securities shall be consolidated and form a single series with the applicable series of the Securities.

(d) Any proposed transfer of an interest in Securities held in the form of a Global Security shall be effected through the book-entry system maintained by DTC.

(e) The Securities shall not have a sinking fund.

(f) The Securities shall be issued on June 27, 2023 (the “Issue Date”).

(g) The stated maturity of the principal of the Securities shall be June 27, 2034 (the “Stated Maturity”).

(h) The Securities shall be redeemable prior to their Stated Maturity in accordance with Section 11.09 of the Base Indenture and Sections 2.04 and 2.05 hereof.

(i) Section 11.09 of the Base Indenture shall apply to the Securities.

(j) The Securities shall be issued in minimum denominations of $200,000 in principal amount and integral multiples of $1,000 in excess thereof.

(k) The Securities shall constitute the Company’s direct, unsecured and subordinated obligations and shall at all times rank pari passu without any preference among themselves. In the event of a winding-up or administration of the Company, the claims of the Trustee (on behalf of the Holders of the Securities but not the rights and claims of the Trustee in its personal capacity under the Indenture) and the Holders of the Securities against the Company, in respect of such Securities (including any damages or other amounts (if payable)) shall: (i) be subordinated to the claims of all Senior Creditors; (ii) rank at least pari passu with the claims in respect of Parity Obligations and with the claims of all other subordinated creditors of the Company (if any) which in each case by law rank, or by their terms are expressed to rank, pari passu with the Securities; and (iii) rank senior to the Company’s ordinary shares, preference shares and any junior subordinated obligations (including Junior Obligations) or other securities which in each case either by law rank, or by their terms are expressed to rank, junior to the Securities.

-9-

SECTION 2.02 Interest.

(a) The interest rate on the Securities shall be, or shall be determined, as set forth in Annex I hereto.

(b) The interest so payable, and punctually paid or duly provided for, on any Interest Payment Date shall, as provided in the Indenture, be paid to the Person in whose name the relevant Security (or any Predecessor Dated Subordinated Security) is registered at the close of business on the Regular Record Date for such interest.

(c) By acquiring the Securities, each Holder and Beneficial Owner (i) acknowledges, accepts, consents and agrees to be bound by the Company’s or its designee’s determination of a Benchmark Transition Event, a Benchmark Replacement Date, the Benchmark Replacement, the Benchmark Replacement Adjustment and any Benchmark Replacement Conforming Changes, including as may occur without any prior notice from the Company and without the need for the Company to obtain any further consent from such Holder or Beneficial Owner, (ii) waives any and all claims, in law and/or in equity, against the Trustee, any paying agent and the Calculation Agent or the Company’s designee for, agree not to initiate a suit against the Trustee, any paying agent and the Calculation Agent or the Company’s designee in respect of, and agree that none of the Trustee, any paying agent or the Calculation Agent or the Company’s designee will be liable for, the determination of or the failure to determine any Benchmark Transition Event, any Benchmark Replacement Date, any Benchmark Replacement, any Benchmark Replacement Adjustment and any Benchmark Replacement Conforming Changes, and any losses suffered in connection therewith and (iii) agrees that none of the Trustee, any paying agent or the Calculation Agent or the Company’s designee will have any obligation to determine any Benchmark Transition Event, any Benchmark Replacement Date, any Benchmark Replacement, any Benchmark Replacement Adjustment and any Benchmark Replacement Conforming Changes (including any adjustments thereto), including in the event of any failure by the Company to determine any Benchmark Transition Event, any Benchmark Replacement Date, any Benchmark Replacement, any Benchmark Replacement Adjustment and any Benchmark Replacement Conforming Changes.

SECTION 2.03 Payment of Principal, Interest and Other Amounts.

(a) Payments of principal of and interest on the Securities shall be made in such coin or currency of the United States of America as at the time of payment is legal tender for payment of public and private debts and such payments on Securities represented by a Global Security shall be made through one or more Paying Agents appointed under the Base Indenture to DTC or its nominee, as the Holder or Holders of the Global Security. Initially, the Paying Agent for the Securities shall be The Bank of New York Mellon, London Branch, ▇▇▇ ▇▇▇▇▇ ▇▇▇▇▇▇▇▇ ▇▇▇▇▇▇, ▇▇▇▇▇▇ ▇▇▇▇ ▇▇▇, ▇▇▇▇▇▇ ▇▇▇▇▇▇▇ and the Place of Payment in respect of the Securities shall be the Corporate Trust Office of the Trustee, which as of the date hereof is hereby designated for purposes of the Securities initially as the office or agency of the Trustee located at said address. The Dated Subordinated Debt Security Registrar shall initially be The Bank of New York ▇▇▇▇▇▇ ▇▇/NV, Luxembourg Branch, ▇-▇ ▇▇▇ ▇▇▇▇▇▇ ▇▇▇▇▇▇▇, ▇▇▇▇▇▇▇ ▇▇▇▇▇▇▇▇ – ▇▇▇▇▇▇▇, ▇▇▇▇▇▇▇▇▇▇, ▇▇▇▇, ▇▇▇▇▇▇▇▇▇▇ (which location shall also be a Place of Payment for purposes of Section 3.05(a) of the Base

-10-

Indenture). The Company at any time and from time to time may change the Paying Agent, the Dated Subordinated Debt Security Registrar or, subject to Section 9.01 of the Base Indenture, the Place of Payment, without prior notice to the Holders of the Securities, and in such an event the Company may act as Paying Agent or Dated Subordinated Debt Security Registrar.

(b) Payments of principal of and interest on the Securities represented by a Global Security shall be made by wire transfer of immediately available funds; provided, however, that in the case of payments of principal, such Global Security is first surrendered to the Paying Agent. If a date of redemption or repayment or the Stated Maturity is not a Business Day, the Company may pay interest and principal and/or any amount payable upon redemption or repayment of the Securities on the next succeeding Business Day, but interest on that payment will not accrue during the period from and after the date of redemption or repayment or such Stated Maturity.

SECTION 2.04 Optional Redemption. Subject to Section 2.06 of this Fifth Supplemental Indenture and Sections 11.10 and 11.11 of the Base Indenture, the Company may, at the Company’s option, redeem the Securities then Outstanding, in whole but not in part, on the Par Redemption Date at a redemption price equal to 100% of their principal amount, together with accrued but unpaid interest, if any, on the principal amount of the Securities to be redeemed to (but excluding) the date fixed for redemption.

SECTION 2.05 Regulatory Event Redemption. Subject to Section 2.06 of this Fifth Supplemental Indenture and Sections 11.10 and 11.11 of the Base Indenture, the Company may, at the Company’s option, at any time, redeem the Securities, in whole but not in part, at a redemption price equal to 100% of their principal amount, together with accrued but unpaid interest, if any, on the principal amount of the Securities to be redeemed to (but excluding) the date fixed for redemption, if, on or after the Issue Date, there occurs a change in the regulatory classification of the Securities that results in, or would be likely to result in the whole or any part of the outstanding aggregate principal amount of the Securities at any time being excluded from or ceasing to count towards, the Group’s Tier 2 Capital.

SECTION 2.06 Notice of Redemption.

(a) Before the Company may redeem the Securities pursuant to Section 11.09 of the Base Indenture and/or pursuant to Sections 2.04 and 2.05 hereof, the Company shall deliver via DTC (or, if the Securities are definitive Securities, to the Holders at their addresses shown on the Dated Subordinated Debt Security Register) prior notice of not less than fifteen (15) days, nor more than sixty (60) days, to the Holders of the Securities. The Company shall deliver written notice of such redemption of the Securities to the Trustee at least five (5) Business Days prior to the date on which the relevant notice of redemption is sent to Holders (unless a shorter notice period shall be satisfactory to the Trustee). Such notice shall specify the Company’s election to redeem the Securities and the date fixed for such redemption and shall be irrevocable except in the limited circumstances described in paragraph (b) of this Section 2.06.

(b) If the Company has delivered a notice of redemption pursuant to paragraph (a) of this Section 2.06, but prior to the payment of the redemption amount with respect to such redemption the Relevant U.K. Resolution Authority exercises its U.K. Bail-in Power with respect to the Securities, such redemption notice shall be automatically rescinded and shall be of no force and effect, and no payment in respect of the redemption amount shall be due and payable.

-11-

(c) If the event specified in paragraph (b) of this Section 2.06 occurs, the Company shall promptly deliver notice to the Holders of the Securities via DTC (or, if the Securities are definitive Securities, to the Holders at their addresses shown on the shown on the Dated Subordinated Debt Security Register) and to the Trustee directly, specifying the occurrence of the relevant event.

SECTION 2.07 Additional Amounts and FATCA Withholding Tax. The Company agrees, to the extent the Company has actual knowledge of such information, to provide the Paying Agent with sufficient information about any modification to the terms of the Securities for the purposes of determining whether FATCA Withholding Tax applies to any payment of principal or interest on the Securities.

SECTION 2.08 Acknowledgement with respect to Treatment of EEA BRRD Liabilities. Notwithstanding and to the exclusion of any other term of the Base Indenture, this Fifth Supplemental Indenture or any other agreements, arrangements, or understanding between the BRRD Party, on the one hand, and the Company, on the other hand, the Company acknowledges and accepts that an EEA BRRD Liability arising under the Base Indenture and this Fifth Supplemental Indenture may be subject to the exercise of EEA Bail-in Powers by the Relevant EEA Resolution Authority, and acknowledges, accepts, and agrees to be bound by:

(a) the effect of the exercise of EEA Bail-in Powers by the Relevant EEA Resolution Authority in relation to any EEA BRRD Liability that (without limitation) may include and result in any of the following, or some combination thereof:

(i) the reduction of all, or a portion, of the EEA BRRD Liability or outstanding amounts due thereon;

(ii) the conversion of all, or a portion, of the EEA BRRD Liability into shares, other securities or other obligations of the BRRD Party or another person, and the issue to or conferral on the Company of such shares, securities or obligations;

(iii) the cancellation of the EEA BRRD Liability; or

(iv) the amendment or alteration of any interest, if applicable, thereon, the maturity or the dates on which any payments are due including by suspending payment for a temporary period.

(b) the variation of the terms of the Base Indenture or this Fifth Supplemental Indenture, as deemed necessary by the Relevant EEA Resolution Authority, to give effect to the exercise of EEA Bail-in Powers by the Relevant EEA Resolution Authority in respect of the BRRD Party.

For these purposes:

“Bail-in Legislation” means in relation to a member state of the European Economic Area which has implemented, or which at any time implements, the BRRD, the relevant implementing law, regulation, rule or requirement as described in the EU Bail-in Legislation Schedule from time to time.

-12-

“BRRD” means the EU Directive 2014/59/EU of the European Parliament and of the Council establishing a framework for the recovery and resolution of credit institutions and investment firms of May 15, 2014, as amended or replaced from time to time (including as amended by Directive (EU) 2019/879 of the European Parliament and of the Council of May 20, 2019).

“BRRD Party” means The Bank of New York ▇▇▇▇▇▇ ▇▇/NV, Luxembourg Branch, solely and exclusively in its role as Dated Subordinated Debt Security Registrar under the Base Indenture and this Fifth Supplemental Indenture. For the avoidance of doubt, The Bank of New York Mellon, London Branch, as Trustee and Paying Agent and in any other capacity under the Base Indenture or this Fifth Supplemental Indenture is not a BRRD Party under the Base Indenture or this Fifth Supplemental Indenture.

“EEA Bail-in Power” means any Write-down and Conversion Powers as defined in the EU Bail-in Legislation Schedule, in relation to the relevant Bail-in Legislation.

“EEA BRRD Liability” means a liability of the BRRD Party to the Company under the Base Indenture or this Fifth Supplemental Indenture, if any, in respect of which the EEA Bail-in Power may be exercised.

“EU Bail-in Legislation Schedule” means the document described as such, then in effect, and published by the Loan Market Association (or any successor person) from time to time at ▇▇▇▇://▇▇▇.▇▇▇.▇▇.▇▇▇.

“Relevant EEA Resolution Authority” means the resolution authority with the ability to exercise any EEA Bail-in Powers in relation to the BRRD Party.

SECTION 2.09 Acknowledgement with Respect to Treatment of BRRD Liabilities. Any references to the “Trustee” in Section 13.02 of the Base Indenture shall be deemed to refer to the Trustee and The Bank of New York ▇▇▇▇▇▇ ▇▇/NV, Luxembourg Branch.

ARTICLE III

AMENDMENTS TO THE BASE INDENTURE

SECTION 3.01 Amendments to the Base Indenture.

(a) Section 1.15 of the Base Indenture is hereby amended and restated in its entirety to read as follows:

“Section 1.15 Calculation Agent. If the Company appoints a Calculation Agent pursuant to Section 3.01 with respect to any series of Dated Subordinated Debt Securities, any determination of the interest rate on, or other amounts in relation to, such series of Dated Subordinated Debt Securities in accordance with the terms of such series of Dated Subordinated Debt Securities by such Calculation Agent shall (in the absence of manifest error) be binding on the Company, the Trustee, all Holders and all holders of Coupons and (in the absence of manifest error) no liability to the Holders or holders of Coupons shall attach to the Calculation Agent in connection with the exercise or non-exercise by it of its powers, duties and discretions. None of the Company, the Calculation Agent, the Trustee or any paying agent shall be responsible for determining whether manifest error has occurred or any liability therefor.”

-13-

(b) Section 5.04(d) of the Base Indenture is hereby amended and restated in its entirety to read as follows:

“(d) Subject to applicable law and except as otherwise provided as contemplated by Section 3.01 with respect to any series of Dated Subordinated Debt Securities, no Holder or Beneficial Owner may exercise, claim or plead any right of set-off, compensation, retention or netting in respect of any amount owed to it by the Company arising under, or in connection with, the Dated Subordinated Debt Securities and this Dated Subordinated Debt Securities Indenture or any supplemental indenture hereto and each Holder and Beneficial Owner shall, by virtue of its holding of any Dated Subordinated Debt Security, be deemed to have waived all such rights of set-off, compensation, retention and netting. Notwithstanding the foregoing, if any amounts due and payable to any Holder or Beneficial Owner of the Dated Subordinated Debt Securities by the Company in respect of, or arising under, the Dated Subordinated Debt Securities or this Dated Subordinated Debt Securities Indenture or any supplemental indenture hereto are discharged by set-off, compensation, retention or netting, such Holder or Beneficial Owner shall, subject to applicable law and except as otherwise provided as contemplated by Section 3.01 with respect to any series of Dated Subordinated Debt Securities, immediately pay to the Company an amount equal to the amount of such discharge (or, in the event of its winding-up or administration, the liquidator or administrator of the Company, as the case may be) and, until such time as payment is made, shall hold an amount equal to such amount in trust for the Company (or the liquidator or administrator of the Company, as the case may be) and, accordingly, any such discharge shall be deemed not to have taken place. By its acquisition of the Dated Subordinated Debt Securities, each Holder and Beneficial Owner agrees to be bound by these provisions relating to waiver of set-off, compensation, retention and netting.”

(a) Section 13.01(d) of the Base Indenture is hereby amended and restated in its entirety to read as follows:

“(d) Upon the exercise of the U.K. Bail-in Power by the Relevant U.K. Resolution Authority with respect to a particular series of Dated Subordinated Debt Securities, the Company shall provide a written notice to DTC as soon as practicable regarding such exercise of the U.K. Bail-in Power for purposes of notifying Holders and Beneficial Owners of such occurrence. The Company shall also deliver a copy of such notice to the Trustee for information purposes. Any delay or failure by the Company in delivering any notice referred to in this paragraph shall not affect the validity and enforceability of the U.K. Bail-in Power.”

ARTICLE IV

MISCELLANEOUS PROVISIONS

SECTION 4.01 Effectiveness. This Fifth Supplemental Indenture shall become effective upon its execution and delivery.

SECTION 4.02 Original Issue. The Securities may, upon execution of this Fifth Supplemental Indenture, be executed by the Company and delivered by the Company to the Trustee for authentication, and the Trustee shall, upon delivery of a Company Order, authenticate and deliver such Securities as in such Company Order provided.

-14-

SECTION 4.03 Ratification and Integral Part. The Base Indenture as supplemented and amended by this Fifth Supplemental Indenture, is in all respects ratified and confirmed, including without limitation all the rights, immunities and indemnities of the Trustee, and this Fifth Supplemental Indenture shall be deemed an integral part of the Base Indenture in the manner and to the extent herein and therein provided.

SECTION 4.04 Priority. This Fifth Supplemental Indenture shall be deemed part of the Base Indenture in the manner and to the extent herein and therein provided. The provisions of this Fifth Supplemental Indenture shall, with respect to the Securities and subject to the terms hereof, supersede the provisions of the Base Indenture to the extent the Base Indenture is inconsistent herewith.

SECTION 4.05 Not Responsible for Recitals or Issuance of Securities. The recitals contained herein and in the Securities, except the Trustee’s certificate of authentication, shall be taken as the statements of the Company, and neither the Trustee nor any authenticating agent assumes any responsibility for their correctness. The Trustee makes no representations as to the validity or sufficiency of this Fifth Supplemental Indenture or of the Securities, except that the Trustee represents and warrants that it has duly authorized, executed and delivered this Fifth Supplemental Indenture. Neither the Trustee nor any authenticating agent shall be accountable for the use or application by the Company of the Securities or the proceeds thereof.

SECTION 4.06 Successors and Assigns. All covenants and agreements in the Base Indenture, as supplemented and amended by this Fifth Supplemental Indenture, by the Company shall bind its successors and assigns, whether so expressed or not.

SECTION 4.07 Counterparts. This Fifth Supplemental Indenture may be executed manually, by facsimile or by electronic signature in any number of counterparts, each of which so executed shall be deemed to be an original, but all such counterparts shall together constitute but one and the same instrument.

SECTION 4.08 Governing Law. This Fifth Supplemental Indenture and the Securities shall be governed by and construed in accordance with the laws of the State of New York, except for the subordination provisions set forth in Section 12.01 of the Base Indenture and in the Global Securities, and the waiver of set-off provisions set forth in Section 5.04(d) of the Base Indenture, as amended by this Fifth Supplemental Indenture, which shall be governed by and construed in accordance with English law.

[Signature Page Follows]

-15-

IN WITNESS WHEREOF, the parties hereto have caused this Fifth Supplemental Indenture to be duly executed as of the day and year first above written.

| BARCLAYS PLC | ||||

| By: | /s/ ▇▇▇▇▇▇ ▇▇▇▇▇ | |||

| Name: | ▇▇▇▇▇▇ ▇▇▇▇▇ | |||

| Title: | Director, Capital Markets Execution | |||

| THE BANK OF NEW YORK MELLON, LONDON BRANCH, AS TRUSTEE AND PAYING AGENT | ||||

| By: | /s/ ▇▇▇▇▇▇▇ ▇▇ ▇▇▇▇▇ | |||

| Name: | ▇▇▇▇▇▇▇ ▇▇ ▇▇▇▇▇ | |||

| Title: | Authorised Signatory | |||

| THE BANK OF NEW YORK ▇▇▇▇▇▇ ▇▇/NV, LUXEMBOURG BRANCH, AS DATED SUBORDINATED DEBT SECURITY REGISTRAR | ||||

| By: | /s/ ▇▇▇▇▇▇▇ ▇▇ ▇▇▇▇▇ | |||

| Name: | ▇▇▇▇▇▇▇ ▇▇ ▇▇▇▇▇ | |||

| Title: | Authorised Signatory | |||

[Signature Page to Fifth Supplemental Indenture]

ANNEX I

Interest Terms of the Securities

Interest Terms of the Securities

| Fixed Interest Rate | From (and including) the Issue Date to (but excluding) the Par Redemption Date (such date falling one year prior to the Stated Maturity) (the “Fixed Rate Period”), the Securities will bear interest at a rate of 7.119% per annum (the “Fixed Interest Rate”). | |

| Floating Interest Rate: | From (and including) the Par Redemption Date to (but excluding) the Stated Maturity (the “Floating Rate Period”), the Securities will bear interest at the applicable Floating Interest Rate (as defined below).

The Floating Interest Rate for any Floating Rate Interest Period (as defined below) will be equal to the Benchmark (as defined below), as determined on the Interest Determination Date, plus 3.57% per annum (the “Margin”) (the “Floating Interest Rate”). The Floating Interest Rate will be calculated quarterly on the Interest Determination Date occurring during the Floating Rate Period. | |

| Floating Rate Interest Period: | During the Floating Rate Period, each interest period on the Securities will begin on (and include) a Floating Rate Period Interest Payment Date (as defined below) and end on (but exclude) the next succeeding Floating Rate Period Interest Payment Date (each, a “Floating Rate Interest Period”); provided that the first Floating Rate Interest Period will begin on (and include) the Par Redemption Date and will end on (but exclude) September 27, 2033. | |

| Fixed Rate Period Interest Payment Dates: |

During the Fixed Rate Period, interest on the Securities will accrue at the Fixed Interest Rate and will be payable semi-annually in arrear on June 27 and December 27 in each year, from (and including) December 27, 2023 up to (and including) the Par Redemption Date (each, a “Fixed Rate Period Interest Payment Date”); provided that if any Fixed Rate Period Interest Payment Date would fall on a day that is not a Business Day, the Company will pay interest on the next succeeding Business Day, but interest on that payment will not accrue during the period from and after the scheduled Fixed Rate Period Interest Payment Date. | |

| Floating Rate Period Interest Payment Dates: |

During the Floating Rate Period, interest on the Securities will accrue at the applicable Floating Interest Rate and will be payable quarterly in arrear on September 27, 2033, December 27, 2033, March 27, 2034 and the Stated Maturity (each a “Floating Rate Period Interest Payment Date”); provided that if | |

I-1

| any scheduled Floating Rate Period Interest Payment Date, other than the Stated Maturity, would fall on a day that is not a Business Day, such Floating Rate Period Interest Payment Date will be postponed to the next succeeding Business Day, except that if that Business Day falls in the next succeeding calendar month, the Floating Rate Period Interest Payment Date will be the immediately preceding Business Day. | ||

| Par Redemption Date | June 27, 2033 (the “Par Redemption Date”). | |

| Calculation Agent: | The Bank of New York Mellon, New York, or its successor appointed by the Company. | |

| Calculation of the Benchmark: | The “Benchmark” means, initially, Compounded Daily SOFR; provided that if a Benchmark Transition Event and related Benchmark Replacement Date have occurred with respect to SOFR or the then-current Benchmark, then “Benchmark” means the applicable Benchmark Replacement.

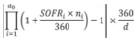

“Compounded Daily SOFR” means, in relation to a Floating Rate Interest Period, the rate of return of a daily compound interest investment (with SOFR as reference rate for the calculation of interest) during the related Observation Period and will be calculated by the Calculation Agent on the related Interest Determination Date as follows:

Where:

“d” means, in relation to any Observation Period, the number of calendar days in such Observation Period;

“d0” means, in relation to any Observation Period, the number of USGS Business Days in such Observation Period;

“i” means, in relation to any Observation Period, a series of whole numbers from one to d0, each representing the relevant USGS Business Day in chronological order from (and including) the first USGS Business Day in such Observation Period;

“ni” means, in relation to any USGS Business Day “i” in the relevant Observation Period, the number of calendar days from (and including) such USGS Business Day “i” up to (but excluding) the following USGS Business Day; | |

I-2

| “Observation Period” means, in respect of each Floating Rate Interest Period, the period from (and including) the date which is two USGS Business Days prior to the first day of such Floating Rate Interest Period to (but excluding) the date which is two USGS Business Days prior to the Interest Payment Date for such Floating Rate Interest Period; provided that the first Observation Period shall commence on (and include) the date which is two USGS Business Days prior to the Par Redemption Date;

“SOFR” means, in relation to any day, the rate determined by the Calculation Agent in accordance with the following provisions:

(1) the daily Secured Overnight Financing Rate for trades made on such day available at or around the Reference Time on the NY Federal Reserve’s Website;

(2) if the rate specified in (1) above is not available at or around the Reference Time for such day (and a Benchmark Transition Event and its related Benchmark Replacement Date have not occurred), the daily Secured Overnight Financing Rate in respect of the last USGS Business Day for which such rate was published on the NY Federal Reserve’s Website;

“SOFRi” means, in relation to any USGS Business Day “i” in the relevant Observation Period, SOFR in respect of such USGS Business Day; and

“USGS Business Day” means any day except for a Saturday, Sunday or a day on which SIFMA recommends that the fixed income departments of its members be closed for the entire day for purposes of trading in U.S. government securities.

Notwithstanding clauses (1) and (2) of the definition of “SOFR” above, if the Company or its designee (in consultation with the Company) determine on or prior to the relevant Interest Determination Date that a Benchmark Transition Event and related Benchmark Replacement Date have occurred with respect to SOFR, then the “Benchmark Transition Provisions” set forth below will thereafter apply to all determinations of the rate of interest payable on the Securities during the Floating Rate Period.

In accordance with and subject to the Benchmark Transition Provisions, after a Benchmark Transition Event and related Benchmark Replacement Date have occurred, the amount of interest that will be payable on the Securities during each Floating Rate Interest Period will be determined by reference to a rate per annum equal to the Benchmark Replacement plus the Margin. |

I-3

| Benchmark Transition Provisions: | If the Company or its designee (in consultation with the Company) determines that a Benchmark Transition Event and related Benchmark Replacement Date have occurred prior to the applicable Reference Time in respect of any determination of the Benchmark on any date, the applicable Benchmark Replacement will replace the then-current Benchmark for all purposes relating to the Securities during the Floating Rate Period in respect of such determination on such date and all determinations on all subsequent dates; provided that, if the Company or its designee (in consultation with the Company) are unable to or do not determine a Benchmark Replacement in accordance with the provisions below prior to 5:00 p.m. (New York time) on the relevant Interest Determination Date or if there is a Derecognition Risk (as defined below), the interest rate for the related Floating Rate Interest Period will be equal to the interest rate in effect for the immediately preceding Floating Rate Interest Period, or in the case of the Interest Determination Date prior to the first Floating Rate Period Interest Payment Date, the Fixed Interest Rate.

In connection with the implementation of a Benchmark Replacement, the Company or its designee (in consultation with the Company) will have the right to make changes to: (1) any Interest Determination Date, Floating Rate Period Interest Payment Date, Reference Time, business day convention or Floating Rate Interest Period, (2) the manner, timing and frequency of determining the rate and amounts of interest that are payable on the Securities during the Floating Rate Period, and the conventions relating to such determination and calculations with respect to interest, (3) rounding conventions, (4) tenors, and (5) any other terms or provisions of the Securities during the Floating Rate Period, in each case that the Company or its designee (in consultation with the Company) determine, from time to time, to be appropriate to reflect the determination and implementation of such Benchmark Replacement in a manner substantially consistent with market practice (or, if the Company or its designee (in consultation with the Company) decide that implementation of any portion of such market practice is not administratively feasible or determine that no market practice for use of the Benchmark Replacement exists, in such other manner as the Company or its designee (in consultation with the Company) determine is appropriate (acting in good faith)) (the “Benchmark Replacement Conforming Changes”). Any Benchmark Replacement Conforming Changes will apply to the Securities for all future Floating Rate Interest Periods. |

I-4

| The Company will promptly give notice of the determination of the Benchmark Replacement, the Benchmark Replacement Adjustment and any Benchmark Replacement Conforming Changes to the Trustee, any paying agent, the Calculation Agent and Holders; provided that failure to provide such notice will have no impact on the effectiveness of, or otherwise invalidate, any such determination.

Any determination, decision or election relating to the Benchmark not made by the Calculation Agent will be made on the basis described above. The Calculation Agent shall have no liability for not making any such determination, decision or election. In addition, the Company may designate an entity (which may be its affiliate) to make any determination, decision or election that the Company has the right to make in connection with the determination of the Benchmark.

Notwithstanding the foregoing, no Benchmark Replacement will be adopted if and to the extent that the Company determines, in its sole discretion, that such Benchmark Replacement prejudices, or could reasonably be expected to prejudice, after the application of the applicable Benchmark Replacement Adjustment, the Benchmark Replacement Conforming Changes and the further decisions and determinations as set out under this section, the then current capital or eligible liabilities qualification of the Securities, in each case for the purposes of and in accordance with the Capital Regulations (“Derecognition Risk”). | ||

| Day Count: | 30/360, Following, Unadjusted, for the Fixed Rate Period.

Actual/360, Modified Following, Adjusted, for the Floating Rate Period. | |

| Rounding: | All percentages resulting from any calculation in connection with any interest rate on the Securities shall be rounded, if necessary, to the nearest one hundred thousandth of a percentage point, with five one-millionths of a percentage point rounded upward (for example, 9.876545% (or 0.09876545) would be rounded to 9.87655% (or 0.0987655)), and all U.S. dollar amounts would be rounded to the nearest cent, with one-half cent being rounded upward.

The interest rate on the Securities during a Floating Rate Interest Period will in no event be higher than the maximum rate permitted by law or lower than 0% per annum. | |

I-5

EXHIBIT A

Form of Global Note

THIS SECURITY IS A GLOBAL REGISTERED SECURITY WITHIN THE MEANING OF THE INDENTURE HEREINAFTER REFERRED TO AND IS REGISTERED IN THE NAME OF A DEPOSITARY OR A NOMINEE THEREOF. THIS SECURITY MAY NOT BE EXCHANGED IN WHOLE OR IN PART FOR A SECURITY REGISTERED, AND NO TRANSFER OF THIS SECURITY IN WHOLE OR IN PART MAY BE REGISTERED, IN THE NAME OF ANY PERSON OTHER THAN SUCH DEPOSITARY OR A NOMINEE THEREOF, EXCEPT IN THE LIMITED CIRCUMSTANCES DESCRIBED IN THE INDENTURE.

UNLESS THIS SECURITY IS PRESENTED BY AN AUTHORIZED REPRESENTATIVE OF THE DEPOSITORY TRUST COMPANY, A NEW YORK CORPORATION (OR ANY SUCCESSOR CLEARING SYSTEM) (“DTC”), TO BARCLAYS PLC, OR ITS AGENT FOR REGISTRATION OF TRANSFER, EXCHANGE OR PAYMENT, AND ANY CERTIFICATE ISSUED IS REGISTERED IN THE NAME OF CEDE & CO. OR IN SUCH OTHER NAME AS IS REQUESTED BY AN AUTHORIZED REPRESENTATIVE OF DTC (AND ANY PAYMENT IS MADE TO CEDE & CO. OR TO SUCH OTHER ENTITY AS IS REQUESTED BY AN AUTHORIZED REPRESENTATIVE OF DTC), ANY TRANSFER, PLEDGE OR OTHER USE HEREOF FOR VALUE OR OTHERWISE BY OR TO ANY PERSON IS WRONGFUL INASMUCH AS THE REGISTERED OWNER HEREOF, CEDE & CO., HAS AN INTEREST HEREIN.

This Security is one of a duly authorized issue of securities of the Company (as defined below) (herein called the “Securities” and each, a “Security”) issued and to be issued in one or more series under and governed by the Dated Subordinated Debt Securities Indenture, dated as of May 9, 2017 (as heretofore amended and supplemented, the “Base Indenture”), as supplemented and amended by the Fifth Supplemental Indenture, dated as of June 27, 2023 (the “Fifth Supplemental Indenture” and, together with the Base Indenture, the “Indenture”).

The rights of the Holder and Beneficial Owners of this Security are, to the extent and in the manner set forth in Section 12.01 of the Base Indenture and in the subordination provisions of this Security, subordinated to the claims of other creditors of the Company, and this Security is issued subject to the provisions of that Section 12.01 and to the subordination provisions of this Security, and the Holder of this Security, by accepting the same, agrees to, and shall be bound by, such provisions. The provisions of Section 12.01 of the Base Indenture and the terms of this paragraph are governed by, and shall be construed in accordance with, English law.

Notwithstanding and to the exclusion of any other term of the Securities or any other agreements, arrangements, or understandings between the Company and any Holder or Beneficial Owner of the Securities or the Trustee on behalf of the Holders, by acquiring the Securities, each Holder and Beneficial Owner of the Securities acknowledges, accepts, agrees to be bound by, and consents to, the exercise of any U.K. Bail-in Power by the Relevant U.K. Resolution Authority (as those terms are defined in the Base Indenture) and the provisions set forth in Section 13.01 of the Base Indenture, as amended by the Fifth Supplemental Indenture.

A-1

In accordance with Article 14 of the Base Indenture, each Holder and Beneficial Owner of the Securities that acquires the Securities in the secondary market shall be deemed to acknowledge, agree to be bound by, and consent to, the same provisions set forth in the Securities and the Indenture to the same extent as the Holders and Beneficial Owners of the Securities that acquire the Securities upon their initial issuance, including, without limitation, with respect to the acknowledgement and agreement to be bound by, and consent to, the terms of the Securities, including in relation to the provisions contained in Section 5.03, Section 5.04(d), Section 12.01 and Section 13.01 of the Indenture.

A-2

7.119% Fixed-to-Floating Rate Subordinated Callable Notes due 2034

| No. 00[•] | $[•] |

CUSIP NO. 06738E CH6

ISIN NO. US06738ECH62

COMMON CODE NO. 264367107

BARCLAYS PLC, a company duly incorporated and existing under the laws of England and Wales (herein called the “Company”, which term includes any successor Person under the Indenture hereinafter referred to), for value received, hereby promises to pay to Cede & Co., or registered assigns, the principal sum of $[•] ([•]) on June 27, 2034 (the “Maturity Date”), except as otherwise provided herein, and to pay interest thereon, in accordance with the terms hereof. Interest shall accrue on this Security from June 27, 2023 (the “Issue Date”) or from the most recent Interest Payment Date (as defined below) to which interest has been paid or duly provided for, until the principal hereof is paid or made available for payment. From (and including) the Issue Date to (but excluding) June 27, 2033 (the “Par Redemption Date”) (the “Fixed Rate Period”), the Securities will bear interest at a rate of 7.119% per annum (the “Fixed Interest Rate”). During the Fixed Rate Period, interest will be payable semi-annually in arrear on June 27 and December 27 in each year, commencing on December 27, 2023 (each a “Fixed Rate Period Interest Payment Date”). From (and including) the Par Redemption Date to (but excluding) the Maturity Date (the “Floating Rate Period”), interest will accrue on the Securities at a floating rate equal to the Benchmark (as defined below and such term being subject to the provisions of Annex I to the Fifth Supplemental Indenture) as determined on the Interest Determination Date, plus 3.57% per annum (the “Margin”). During the Floating Rate Period, interest will be payable quarterly in arrear on September 27, 2033, December 27, 2033, March 27, 2034, and the Maturity Date (each a “Floating Rate Period Interest Payment Date” and together with the Fixed Rate Period Interest Payment Dates, each an “Interest Payment Date”).

The “Benchmark” means, initially, Compounded Daily SOFR; provided that if a Benchmark Transition Event and related Benchmark Replacement Date have occurred with respect to SOFR or the then-current Benchmark, then “Benchmark” means the applicable Benchmark Replacement.

“Compounded Daily SOFR” means, in relation to a Floating Rate Interest Period, the rate of return of a daily compound interest investment (with SOFR as reference rate for the calculation of interest) during the related Observation Period and will be calculated by the Calculation Agent on the related Interest Determination Date as follows:

Where:

“d” means, in relation to any Observation Period, the number of calendar days in such Observation Period;

“d0” means, in relation to any Observation Period, the number of USGS Business Days in such Observation Period;

A-3

“i” means, in relation to any Observation Period, a series of whole numbers from one to d0, each representing the relevant USGS Business Day in chronological order from (and including) the first USGS Business Day in such Observation Period;

“ni” means, in relation to any USGS Business Day “i” in the relevant Observation Period, the number of calendar days from (and including) such USGS Business Day “i” up to (but excluding) the following USGS Business Day;

“Observation Period” means, in respect of each Floating Rate Interest Period, the period from (and including) the date which is two USGS Business Days prior to the first day of such Floating Rate Interest Period to (but excluding) the date which is two USGS Business Days prior to the Interest Payment Date for such Floating Rate Interest Period; provided that the first Observation Period shall commence on (and include) the date which is two USGS Business Days prior to the Par Redemption Date;

“SOFR” means, in relation to any day, the rate determined by the Calculation Agent in accordance with the following provisions:

(1) the daily Secured Overnight Financing Rate for trades made on such day, available at or around the Reference Time on the NY Federal Reserve’s Website;

(2) if the rate specified in (1) above is not available at or around the Reference Time for such day (and a Benchmark Transition Event and its related Benchmark Replacement Date have not occurred), the daily Secured Overnight Financing Rate in respect of the last USGS Business Day for which such rate was published on the NY Federal Reserve’s Website;

“SOFRi” means, in relation to any USGS Business Day “i” in the relevant Observation Period, SOFR in respect of such USGS Business Day; and

“USGS Business Day” means any day except for a Saturday, Sunday or a day on which the Securities Industry and Financial Markets Association or any successor thereto (“SIFMA”) recommends that the fixed income departments of its members be closed for the entire day for purposes of trading in U.S. government securities.

Notwithstanding clauses (1) and (2) of the definition of “SOFR” above, if the Company or its designee (in consultation with the Company) determines on or prior to the relevant Interest Determination Date that a Benchmark Transition Event and related Benchmark Replacement Date have occurred with respect to SOFR, then the “Benchmark Transition Provisions” set forth in Annex I to the Fifth Supplemental Indenture will thereafter apply to all determinations of the rate of interest payable on the Securities during the Floating Rate Period.

In accordance with and subject to the Benchmark Transition Provisions, after a Benchmark Transition Event and related Benchmark Replacement Date have occurred, the amount of interest that will be payable on the Securities during each Floating Rate Interest Period will be determined by reference to a rate per annum equal to the Benchmark Replacement plus the Margin, provided that, if the Company or its designee (in consultation with the Company) are unable to or do not timely determine a Benchmark Replacement in accordance with the Benchmark Transition Provisions or if there is a Derecognition Risk, the interest rate for the related Floating Rate Interest Period will be equal to the interest rate in effect for the immediately preceding Floating Rate Interest Period, or in the case of the Interest Determination Date prior to the first Floating Rate Period Interest Payment Date, the Fixed Interest Rate.

A-4

By its acquisition of the Securities, each Holder and Beneficial Owner (i) will acknowledge, accept, consent and agree to be bound by the Company’s or its designee’s determination of a Benchmark Transition Event, a Benchmark Replacement Date, the Benchmark Replacement, the Benchmark Replacement Adjustment and any Benchmark Replacement Conforming Changes, including as may occur without any prior notice from the Company and without the need for the Company to obtain any further consent from such Holder and Beneficial Owner, (ii) will waive any and all claims, in law and/or in equity, against the Trustee, any paying agent and the Calculation Agent or the Company’s designee for, agree not to initiate a suit against the Trustee, any paying agent and the Calculation Agent or the Company’s designee in respect of, and agree that none of the Trustee, any paying agent or the Calculation Agent or the Company’s designee will be liable for, the determination of or the failure to determine any Benchmark Transition Event, any Benchmark Replacement Date, any Benchmark Replacement, any Benchmark Replacement Adjustment and any Benchmark Replacement Conforming Changes, and any losses suffered in connection therewith and (iii) will agree that none of the Trustee, any paying agent or the Calculation Agent or the Company’s designee will have any obligation to determine any Benchmark Transition Event, any Benchmark Replacement Date, any Benchmark Replacement, any Benchmark Replacement Adjustment and any Benchmark Replacement Conforming Changes (including any adjustments thereto), including in the event of any failure by the Company to determine any Benchmark Transition Event, any Benchmark Replacement Date, any Benchmark Replacement, any Benchmark Replacement Adjustment and any Benchmark Replacement Conforming Changes.

Subject to the limitations specified on the reverse of this Security, interest on the Securities shall be computed and payable in arrear on the basis of a 360-day year of twelve 30-day months during the Fixed Rate Period and on the basis of the actual number of days in each Floating Rate Interest Period and a 360-day year during the Floating Rate Period.

The Calculation Agent, initially the Bank of New York Mellon, New York (the “Calculation Agent”), will determine the Benchmark in any circumstance where the Calculation Agent is so required under the terms of the Securities and the Indenture, in accordance with the provisions set forth in Annex I to the Fifth Supplemental Indenture.

All calculations made by the Calculation Agent for the purposes of calculating the interest rate on the Securities shall be conclusive and binding on the Holders of the Securities, the Company and the Trustee, absent manifest error. None of the Company, the Calculation Agent, the Trustee or any paying agent shall be responsible for determining whether manifest error has occurred or any liability therefor.

If any scheduled Fixed Rate Period Interest Payment Date would fall on a day that is not a Business Day (as defined below), the Company will pay interest on the next succeeding Business Day, but interest on that payment will not accrue during the period from and after the scheduled Fixed Rate Period Interest Payment Date.

A-5

If any scheduled Floating Rate Period Interest Payment Date, other than the applicable Maturity Date, would fall on a day that is not a Business Day, such Floating Rate Period Interest Payment Date will be postponed to the next succeeding Business Day, except that if that Business Day falls in the next succeeding calendar month, the Floating Rate Period Interest Payment Date will be the immediately preceding Business Day.

If the Maturity Date or a date of redemption or repayment is not a Business Day, the payment of interest and principal and/or any amount payable upon redemption or repayment of the Securities will be made on the next succeeding Business Day, but interest on that payment will not accrue during the period from and after such Maturity Date or date of redemption or repayment. If the Securities are redeemed, unless the Company defaults on payment of the Redemption Price, interest will cease to accrue on the Redemption Date on the Securities called for redemption. A “Business Day” means any weekday, other than one on which banking institutions are authorized or obligated by law, regulation or executive order to close in London, England or in the City of New York, United States.

The interest so payable, and punctually paid or duly provided for, on any Interest Payment Date shall, as provided in the Indenture, be paid to the Person in whose name the relevant Security (or any Predecessor Dated Subordinated Security) is registered at the close of business on the Regular Record Date for such interest.

No repayment of the principal amount of the Securities or payment of interest on the Securities shall become due and payable after the exercise of any U.K. Bail-in Power by the Relevant U.K. Resolution Authority, unless such repayment or payment would be permitted to be made by the Company under the laws and regulations of the United Kingdom and the European Union applicable to the Company.

Upon the exercise of the U.K. Bail-in Power by the Relevant U.K. Resolution Authority with respect to the Securities, the Company shall provide a written notice to DTC as soon as practicable regarding such exercise of the U.K. Bail-in Power for purposes of notifying holders of such occurrence. The Company shall also deliver a copy of such notice to the Trustee for information purposes. Any delay or failure by the Company in delivering any notice referred to in this paragraph shall not affect the validity and enforceability of the U.K. Bail-in Power.

Payments of principal of and interest, if any, on the Securities shall be made in such coin or currency of the United States of America as at the time of payment is legal tender for payment of public and private debts and such payments shall be made through one or more Paying Agents appointed under the Indenture to the Holder or Holders of this Security. Initially, the Paying Agent for the Securities shall be The Bank of New York Mellon, London Branch, ▇▇▇ ▇▇▇▇▇ ▇▇▇▇▇▇▇▇ ▇▇▇▇▇▇, ▇▇▇▇▇▇ ▇▇▇▇ ▇▇▇, ▇▇▇▇▇▇ ▇▇▇▇▇▇▇ and the Place of Payment in respect of the Securities shall be the Corporate Trust Office of the Trustee, which as of the date hereof is hereby designated for purposes of the Securities initially as the office or agency of the Trustee located at said address. Initially, the Dated Subordinated Debt Security Registrar for the Securities shall be The Bank of New York ▇▇▇▇▇▇ ▇▇/NV, Luxembourg Branch, ▇-▇ ▇▇▇ ▇▇▇▇▇▇ ▇▇▇▇▇▇▇, ▇▇▇▇▇▇▇ ▇▇▇▇▇▇▇▇ – ▇▇▇▇▇▇▇, ▇▇▇▇▇▇▇▇▇▇, ▇▇▇▇, ▇▇▇▇▇▇▇▇▇▇ (which location shall also be a Place of Payment for purposes of Section 3.05(a) of the Base Indenture). The Company at any time and from time to time may change the Paying Agent or, subject to Section 9.01 of the Base Indenture, the Place of Payment, and the Dated Subordinated Debt Security Registrar without prior notice to the Holders of the Securities, and in such an event the Company may act as Paying Agent or Dated Subordinated Debt Security Registrar. Payments of principal of and interest on the Securities shall be made by wire transfer of immediately available funds; provided, however, that in the case of payments of principal, this Security is first surrendered to the Paying Agent.

A-6

This Security shall be governed by and construed in accordance with the laws of the State of New York, except for the subordination provisions referred to herein and set forth in Section 12.01 of the Base Indenture and the waiver of set-off provisions referred to herein and set forth in Section 5.04(d) of the Base Indenture, as amended by the Fifth Supplemental Indenture, which shall be governed by and construed in accordance with English law.

Reference is hereby made to the further provisions of this Security set forth on the reverse hereof, which further provisions shall for all purposes have the same effect as if set forth at this place.

All terms used in this Security which are defined in the Indenture and not otherwise defined herein shall have the meanings assigned to them in the Indenture, as defined herein.

THIS SECURITY IS NOT A DEPOSIT LIABILITY OF BARCLAYS PLC AND IS NOT COVERED BY THE U.K. FINANCIAL SERVICES COMPENSATION SCHEME OR INSURED BY THE UNITED STATES FEDERAL DEPOSIT INSURANCE CORPORATION, THE CANADA DEPOSIT INSURANCE CORPORATION OR ANY OTHER GOVERNMENTAL AGENCY OF THE UNITED STATES, THE UNITED KINGDOM, CANADA, OR ANY OTHER JURISDICTION.

Unless the certificate of authentication hereon has been executed by the Trustee referred to on the reverse hereof, directly or through an Authenticating Agent, by manual, facsimile or electronic signature of an authorized signatory, this Security shall not be entitled to any benefit under the Indenture or be valid or obligatory for any purpose.

A-7

IN WITNESS WHEREOF, the Company has caused this instrument to be duly executed.