Contract

Exhibit 4.08

THIS WARRANT AND THE UNDERLYING SECURITIES HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “ACT”), OR UNDER THE SECURITIES LAWS OF ANY STATE. THESE SECURITIES MAY NOT BE OFFERED, SOLD OR OTHERWISE TRANSFERRED, PLEDGED OR HYPOTHECATED EXCEPT AS PERMITTED UNDER THE ACT AND APPLICABLE STATE SECURITIES LAWS IN ACCORDANCE WITH APPLICABLE REGISTRATION REQUIREMENTS OR AN EXEMPTION THEREFROM. THE ISSUER OF THESE SECURITIES MAY REQUIRE AN OPINION OF COUNSEL REASONABLY SATISFACTORY TO THE ISSUER THAT SUCH OFFER, SALE, TRANSFER, PLEDGE OR HYPOTHECATION OTHERWISE COMPLIES WITH THE ACT AND ANY APPLICABLE STATE SECURITIES LAWS. THIS WARRANT MUST BE SURRENDERED TO THE COMPANY OR ITS TRANSFER AGENT AS A CONDITION PRECEDENT TO THE SALE, TRANSFER, PLEDGE OR HYPOTHECATION OF ANY INTEREST IN ANY OF THE SECURITIES REPRESENTED HEREBY.

VERISILICON HOLDINGS CO., LTD.

WARRANT TO PURCHASE PREFERENCE SHARES

| Holder: | or its assigns. | |

| Warrant Shares: | shares of the Company’s Series E Preference Shares. | |

| Warrant Exercise Price: | $1.91 per share. | |

| Issue Date: | October , 2009. | |

| Expiration Date: | The earlier of (i) 7 years after the Issue Date, or (ii) immediately prior to the consummation of a Change of Control (as defined herein) or an IPO (as defined herein). | |

THIS WARRANT CERTIFIES THAT, for value received, the receipt and adequacy of which is hereby acknowledged, the Holder is entitled to subscribe for and purchase, subject to the provisions and upon the terms and conditions hereinafter set forth, shares of fully paid and nonassessable Series E Preference Shares of VeriSilicon Holdings Co., Ltd., a Cayman Islands company (the “Company”), at the Warrant Exercise Price (subject to adjustments from time to time, as specified in Section 5 hereof) as set forth above. The term “Warrant” as used herein shall include this Warrant and any warrants delivered in substitution or exchange therefore as provided herein. This Warrant is a series of warrants (collectively, the “Warrants”) issued in connection with the transactions described in the Series E Preference

Shares and Warrant Purchase Agreement, dated as of October , 2009 by and among the Company and the purchasers described therein (the “Purchase Agreement”). The Holder of this Warrant is subject to certain restrictions set forth in the Purchase Agreement and the Amended and Restated Members Agreement, dated as of October , 2009, by and among the Company and the other parties named therein (the “Members Agreement”).

1. Term and Expiration. The purchase right represented by this Warrant is exercisable, in whole or in part, at any time and from time to time from the Issue Date through the Expiration Date. In the event of a Change of Control (as defined herein) or an IPO (as defined herein), the Company shall notify the Holder at least five (5) days prior to the consummation of such event or transaction.

2. Warrant Exercise Price.

(a) Type of Warrant Share Issuable Upon Exercise. This Warrant shall be exercisable only for shares of the Company’s Series E Preference Shares.

(b) Warrant Exercise Price. The Warrant Exercise Price shall be $1.91, which is equal to the price per share at which the Company’s Series E Preference Shares was sold in a financing in October 2009 pursuant to the Purchase Agreement. The Warrant Exercise Price shall thereafter be subject to further adjustments from time to time as specified in Section 5 hereof.

3. Method of Exercise; Cash Payment; Issuance of New Warrant. Subject to Section 1 hereof, the purchase right represented by this Warrant may be exercised by the Holder hereof, in whole or in part and from time to time, at the election of the Holder hereof, by:

(a) the surrender of this Warrant (with the notice of exercise substantially in the form attached hereto as Exhibit A duly completed and executed) at the principal executive offices of the Company and accompanied by payment to the Company, by (i) certified or bank check acceptable to the Company, (ii) cancellation by the Holder of indebtedness or other obligations of the Company to the Holder or (iii) by wire transfer to an account designated by the Company, or any combination of (i), (ii) and (iii), of an amount equal to the then applicable Warrant Exercise Price multiplied by the number of shares then being purchased,

(b) exercise of the right provided for in Section 11 hereof, together with the surrender of this Warrant (with the notice of exercise substantially in the form attached hereto as Exhibit A duly completed and executed) at the principal executive offices of the Company;

The person or persons in whose name(s) any certificate(s) representing the shares of Warrant Shares shall be issuable upon exercise of this Warrant shall be deemed to have become the holder(s) of record of, and shall be treated for all purposes as the record holder(s) of, the shares represented thereby (and such shares shall be deemed to have been issued) immediately prior to the close of business on the date or dates upon which this Warrant is exercised. In the

2

event of any exercise of the rights represented by this Warrant, certificates for the shares of Warrant Shares so purchased shall be delivered to the Holder hereof as soon as possible and in any event within twenty (20) days after such exercise and, unless this Warrant has been fully exercised or expired, a new warrant having the same terms as this Warrant and representing the remaining portion of such shares, if any, with respect to which this Warrant shall not then have been exercised shall also be issued to the Holder hereof as soon as possible and in any event within such twenty-day period.

4. Reservation of Shares. During the period within which the rights represented by this Warrant may be exercised, the Company will at all times have authorized, and reserved for the purpose of the issuance upon exercise of the purchase right evidenced by this Warrant a sufficient number of shares of its capital stock to provide for the exercise of the rights represented by this Warrant.

5. Adjustment of Warrant Exercise Price and Number of Shares. The number and kind of securities purchasable upon the exercise of this Warrant and the Warrant Exercise Price shall be subject to adjustment to the nearest whole share (one-half and greater being rounded upward) and nearest cent (one-half cent and greater being rounded upward) from time to time upon the occurrence of certain events, as follows. Each of the adjustments provided by the subsections below shall be deemed separate adjustments and any adjustment of this Warrant pursuant to any subsection of this Section 5 shall preclude additional adjustments for the same event or transaction by the remaining subsections.

(a) Reclassification. In case of any reclassification or change of securities of the class issuable upon exercise of this Warrant (other than a change in par value, from par value to no par value, from no par value to par value, as a result of a subdivision or combination, or in connection with a Change of Control or an IPO) into the same or a different number or class of securities, the Company shall duly execute and deliver to the Holder of this Warrant a new warrant (in form and substance reasonably satisfactory to the Holder of this Warrant), so that the Holder of this Warrant shall thereafter be entitled to receive upon exercise of this Warrant, at a total purchase price not to exceed that payable upon the exercise of the unexercised portion of this Warrant, and in lieu of the shares of Warrant Shares theretofore issuable upon exercise of this Warrant, the kind and amount of shares of stock, other securities, money and property receivable upon such reclassification or change by a holder of the number of shares then purchasable under this Warrant. The Company or the surviving entity shall deliver such new warrant as soon as possible and in any event within twenty (20) days after such reclassification or change. Such new warrant shall provide for adjustments that shall be as nearly equivalent as may be practicable to the adjustments provided for in this Section 5. The provisions of this subparagraph (a) shall similarly apply to successive reclassifications or changes.

(b) Share Splits or Combination of Shares. If the Company at any time while this Warrant remains outstanding and unexpired shall subdivide (by stock split) or combine (by reverse stock split) its outstanding shares of capital stock into which this Warrant is exercisable, the Warrant Exercise Price shall be proportionately decreased in the case of a subdivision or

3

increased in the case of a combination, effective at the close of business on the date the subdivision or combination becomes effective and the number of shares of Warrant Shares issuable upon exercise of this Warrant shall be proportionately increased in the case of a subdivision or decreased in the case of a combination, and in each case to the nearest whole share, effective at the close of business on the date the subdivision or combination becomes effective. The provisions of this subparagraph (b) shall similarly apply to successive subdivisions or combinations of outstanding shares of capital stock into which this Warrant is exercisable.

(c) Share Dividends and Other Distributions. If the Company at any time while this Warrant is outstanding and unexpired shall (i) pay a dividend with respect to Warrant Shares payable in Warrant Shares, then (A) the Warrant Exercise Price shall be adjusted, from and after the date of determination of shareholders entitled to receive such dividend or distribution (the “Record Date”), to that price determined by multiplying the Warrant Exercise Price in effect immediately prior to such date of determination by a fraction (1) the numerator of which shall be the total number of shares of Warrant Shares outstanding immediately prior to such dividend or distribution, and (2) the denominator of which shall be the total number of shares of Warrant Shares outstanding immediately after such dividend or distribution and (B) the number of shares of Warrant Shares issuable upon exercise of this Warrant shall be proportionately adjusted, to the nearest whole share, from and after the Record Date by multiplying the number of shares of Warrant Shares purchasable hereunder immediately prior to such Record Date by a fraction (1) the numerator of which shall be the total number of shares of Warrant Shares outstanding immediately after such dividend or distribution, and (2) the denominator of which shall be the total number of shares of Warrant Shares outstanding immediately prior to such dividend or distribution; or (ii) make any other distribution with respect to Warrant Shares (except any distribution specifically provided for in Sections 5(a) and 5(b) hereof), then, in each such case, provision to this Warrant shall be made by the Company such that the Holder of this Warrant shall receive upon exercise of this Warrant (in addition to the number of shares of stock receivable upon exercise of this Warrant) a proportionate share of any such dividend or distribution (without payment of any additional consideration therefor) as though it were the holder of all shares of Warrant Shares remaining issuable upon exercise of this Warrant as of the Record Date fixed for the determination of the shareholders of the Company entitled to receive such dividend or distribution. The provisions of this subparagraph (c) shall similarly apply to successive stock dividends and other distributions by the Company.

(d) (d) Issuance of Additional Ordinary Shares. In the event that the Company shall at any time make an issuance of Additional Ordinary Shares (as such term is defined in the Company’s Amended and Restated Memorandum of Association and Amended and Restated Articles of Association, as may be amended from time to time, the “Memorandum of Association”) without consideration or for a consideration per share less than the per share conversion price of the Warrant Shares in effect on the date of and immediately prior to such issue, then the price at which the Warrant Shares may be converted into Ordinary Shares shall be subject to the same adjustment as set forth in the then current Memorandum of Association.

4

(e) Redemption. In the event that all of the outstanding shares of the securities issuable upon exercise of this Warrant are redeemed in accordance with the Company’s Memorandum of Association, this Warrant shall thereafter be exercisable for a number of shares of the Company’s Ordinary Shares equal to the number of Ordinary Shares that would have been received if this Warrant had been exercised in full immediately prior to such redemption and the securities received thereupon had been simultaneously converted into Ordinary Shares.

6. Notice of Adjustments. Whenever the Warrant Exercise Price or the number of shares of Warrant Shares purchasable hereunder shall be adjusted pursuant to Section 5 hereof, the Company shall issue a certificate signed by its Chief Executive Officer, or such other executive officer of the Company as the Chief Executive Officer may designate, setting forth, in reasonable detail, the event requiring the adjustment, the amount of the adjustment, the method by which such adjustment was calculated, and the Warrant Exercise Price and the number of shares of Warrant Shares purchasable hereunder after giving effect to such adjustment, and shall cause copies of such certificate to be delivered to the Holder of this Warrant within five (5) days after the occurrence of the event resulting in such adjustment at such Holder’s last known address in accordance with Section 14 hereof.

7. Fractional Shares. No fractional shares will be issued in connection with any exercise hereunder, but in lieu of such fractional shares the Company shall pay the Holder in cash or by check the amount determined by multiplying such fractional share by the fair market value of one share of Warrant Shares as determined in accordance with Section 11(d) hereof.

8. Legends; Compliance with the Act; Restrictions on Transferability.

(a) Legends. The Holder of this Warrant, by acceptance hereof, agrees that the shares of Warrant Shares issued upon exercise of this Warrant (unless registered under the Act and any applicable state securities laws) shall be stamped or imprinted with the same legend(s) as Section 3 of the Purchase Agreement.

(b) Compliance with the Act. The Holder of this Warrant, by acceptance hereof, makes to the Company the same representations and warranties as Section 4 of the Purchase Agreement.

(c) Transferability of the Warrant. Subject to provisions of this Warrant with respect to compliance with the Act, title to this Warrant may be transferred in compliance with Sections 2.2, 2.3, and 2.4 of the Members Agreement.

(d) Method of Transfer. With respect to any offer, sale, transfer or other disposition of this Warrant or any shares of Warrant Shares acquired pursuant to the exercise of this Warrant prior to registration of such Warrant or shares, the Holder hereof shall prior to such offer, sale, transfer or other disposition:

(i) surrender this Warrant at the principal executive offices of the Company or provide evidence reasonably satisfactory to the Company of the loss, theft or destruction of this Warrant and an indemnity agreement reasonably satisfactory to the Company,

5

(ii) pay any applicable transfer taxes or establishing to the satisfaction of the Company that such taxes have been paid,

(iii) deliver a written assignment to the Company in substantially the form attached hereto as Exhibit B duly completed and executed prior to transfer, describing briefly the manner thereof, and

(iv) deliver a written opinion of such Holder’s counsel, or other evidence, if reasonably requested by the Company, to the effect that such offer, sale, transfer or other disposition may be effected without registration or qualification (under the Securities Act as then in effect and any applicable state securities law then in effect) of this Warrant or the shares of Warrant Shares.

As promptly as practicable and no later than five (5) days after receiving the items set forth above, the Company shall notify the Holder that it may sell, transfer or otherwise dispose of this Warrant or such shares, all in accordance with the terms of the notice delivered to the Company. If a determination has been made pursuant to this Section 8(d) that the opinion of counsel for the Holder or other evidence is not reasonably satisfactory to the Company, the Company shall so notify the Holder promptly with details of such determination. Notwithstanding the foregoing, this Warrant or such underlying Warrant Shares may, as to such federal laws, be offered, sold or otherwise disposed of in accordance with Rule 144 under the Securities Act, provided that the Holder shall furnish such information as the Company may reasonably request to provide a reasonable assurance that the provisions of Rule 144 have been satisfied. Each certificate representing this Warrant or such shares thus transferred (except a transfer pursuant to Rule 144 or an effective registration statement) shall bear a legend as to the applicable restrictions on transferability in order to ensure compliance with applicable federal and state securities laws, unless in the aforesaid opinion of counsel for the Holder, such legend is not required in order to ensure compliance with such laws. Upon any partial transfer of this Warrant, the Company will issue and deliver to such new holder a new warrant (in form and substance similar to this Warrant) with respect to the portion transferred and will issue and deliver to the Holder a new warrant (in form and substance similar to this Warrant) with respect to the portion not transferred as soon as possible and in any event within twenty (20) days after such transfer.

9. No Rights as Shareholders; Information. No holder of this Warrant, as such, prior to exercise hereof shall be entitled to vote or receive dividends or be deemed the holder of shares, nor shall anything contained herein be construed to confer upon the Holder of this Warrant, as such, any of the rights of a shareholder of the Company or any right to vote for the election of directors or upon any matter submitted to shareholders at any meeting thereof, or to receive notice of meetings, or to receive dividends or subscription rights or otherwise until this Warrant shall have been exercised and the shares of Warrant Shares purchasable upon the exercise hereof shall have become deliverable, as provided herein.

6

10. “Market Stand-Off” Agreement. Each Holder, and its successors and assigns, agrees to comply with Section 2.16 of the Members Agreement.

11. Right to Convert Warrant into Shares; Non-Cash Net Exercise.

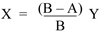

(a) Right to Convert. In addition to and without limiting the rights of the Holder under the terms of this Warrant, the Holder shall have the right to convert this Warrant or any portion thereof (the “Net Exercise Right”) into shares of Warrant Shares as provided in this Section 11 at any time or from time to time during the term of this Warrant. Upon exercise of the Net Exercise Right with respect to a particular number of shares of Warrant Shares subject to this Warrant (the “Converted Warrant Shares”), the Company shall deliver to the Holder (without payment by the Holder of any exercise price or any cash or other consideration) (X) that number of fully paid and nonassessable shares of Warrant Shares equal to the (Y) Converted Warrant Shares multiplied by the quotient obtained by dividing the result of (B) fair market value of one share of Warrant Shares less (A) the Warrant Exercise Price per share by (B) the fair market value of one share of Warrant Shares all on the Conversion Date (as herein defined).

Expressed as a formula such conversion shall be computed as follows:

| Where: | X | = | the number of shares of Warrant Shares that may be issued to holder | |||

| Y | = | the number of shares of Warrant Shares that are being surrendered pursuant to this Net Exercise Right (i.e., the Converted Warrant Shares) | ||||

| A | = | the Warrant Exercise Price per share | ||||

| B | = | the fair market value of one share of Warrant Shares | ||||

No fractional shares shall be issuable upon exercise of the Net Exercise Right, and, if the number of shares of Warrant Shares issued or to be issued determined in accordance with the foregoing formula is other than a whole number, the Company shall pay to the Holder an amount in cash equal to the fair market value of the resulting fractional share on the Conversion Date (as hereinafter defined). For purposes of this Section 11, shares issued pursuant to the Net Exercise Right shall be treated as if they were issued upon the exercise of this Warrant.

7

(b) Method of Exercise. The Net Exercise Right may be exercised by the Holder by the surrender of this Warrant at the principal office of the Company together with the notice of exercise substantially in the form attached hereto as Exhibit A duly completed and executed, specifying that the Holder thereby intends to exercise the Net Exercise Right and indicating the number of shares subject to this Warrant which are being surrendered (referred to in Section 11(a) hereof as the Converted Warrant Shares) in exercise of the Net Exercise Right. Such conversion shall be effective upon receipt by the Company of this Warrant together with the aforesaid written statement, or on such later date as is specified therein (the “Conversion Date”)

(c) Automatic Exercise. If the Holder of this Warrant has not elected to exercise this Warrant prior to expiration of this Warrant pursuant to Section 1, then this Warrant shall automatically (without any act on the part of the Holder) be exercised pursuant to Section 11(a) effective immediately prior to the expiration of the Warrant to the extent such net issue exercise would result in the issuance of Converted Warrant Shares, unless Holder shall earlier provide written notice to the Company that the Holder desires that this Warrant expire unexercised. If this Warrant is automatically exercised, the Company shall notify the Holder of the automatic exercise as soon as reasonably practicable, and the Holder shall surrender the Warrant to the Company in accordance with the terms hereof.

(d) Determination of Fair Market Value. For purposes of this Section 11, “fair market value” of one share of Warrant Shares as of a particular date shall be deemed to be the price per share which the Company could obtain from a willing third-party buyer (not an existing shareholder, director or employee) for the Company’s authorized but unissued shares, as determined in good faith by the Board of Directors of the Company.

12. Certain Definitions. As used in this Warrant, “Change of Control” shall mean sale of all or substantially all of the assets of the Company or a merger or reorganization of the Company with or into any other corporation or corporations, in which transaction the Company’s shareholders immediately prior to such transaction own immediately after such transaction less than fifty percent (50%) of the equity securities of the surviving corporation or its parent, provided, however, that an equity financing with the principal purpose of raising capital shall not be deemed a Change of Control. As used in this Warrant, “IPO” shall mean a firm commitment underwritten initial public offering and sale of the Company’s Ordinary Shares.

13. Modification and Waiver; Effect of Amendment or Waiver. Except as expressly provided herein, neither this Warrant nor any term hereof may be amended, waived, discharged or terminated other than by a written instrument referencing this Warrant and signed by the Company and the holders of Warrants representing not less than a majority of the shares issuable upon exercise of any and all outstanding Warrants, which majority does not need to include the Holder. Any amendment, waiver, discharge or termination effected in accordance with this Section 13 shall be binding upon each holder of the Warrants, each future holder of such Warrants and the Company; provided, however, that no special consideration or inducement may be given to any such holder in connection with such consent that is not given ratably to all such holders, and that such amendment must apply to all such holders equally and ratably in

8

accordance with the number of shares issuable upon exercise of the Warrants. The Company shall promptly give notice to all holders of the Warrants of any amendment effected in accordance with this Section 13.

14. Notices. All notices and other communications required or permitted hereunder shall be in writing and shall be mailed by registered or certified mail, postage prepaid in the U.S. or by overnight courier to overseas, or otherwise delivered by hand or by messenger, addressed (i) if to the Holder, at the Holder’s address, as shown on Exhibit A to the Members Agreement, or at such other address as the Holder shall have furnished to the Company in writing, (ii) if to the Company, to 0000 Xxx Xxxxxxxxx Xxxxx, Xxxxx 000, Xxxxx Xxxxx, XX 00000, U.S.A., and addressed to the attention of the President, or at such other address as the Company shall have furnished to the Investors, with a copy (which shall not constitute notice) to Xxxxxx X. XxXxxxxxx, Esq., Xxxxxx Xxxxxxx Xxxxxxxx & Xxxxxx, P.C., 000 Xxxx Xxxx Xxxx, Xxxx Xxxx, XX 00000. Each such notice or other communication shall for all purposes of this Warrant be treated as effective or having been given when delivered if delivered personally or by overnight courier, or, if sent by mail, at the earlier of its receipt or 72 hours after the same has been deposited in a regularly maintained receptacle for the deposit of the United States mail, addressed and mailed as aforesaid.

15. Lost Warrants or Share Certificates. Upon receipt of evidence reasonably satisfactory to the Company of the loss, theft, destruction or mutilation of this Warrant or any stock certificate and, in the case of any such loss, theft or destruction, upon receipt of an indemnity agreement reasonably satisfactory to the Company, or in the case of any such mutilation upon surrender and cancellation of such mutilated Warrant or stock certificate, the Company will issue and deliver a new warrant (containing the same terms as this Warrant) or stock certificate, in lieu of the lost, stolen, destroyed or mutilated Warrant or stock certificate.

16. Descriptive Headings. The descriptive headings of the several paragraphs of this Warrant are inserted for convenience only and do not constitute a part of this Warrant. The language in this Warrant shall be construed as to its fair meaning without regard to which party drafted this Warrant.

17. Governing Law. This Warrant shall be construed and enforced in accordance with, and the rights of the parties shall be governed by, the laws of the State of California, without reference to principles governing choice or conflicts of laws.

18. Issue Taxes. The Company shall pay any and all issue and other taxes payable in respect of any issue or delivery of Warrant Shares upon the exercise of this Warrant that may be imposed under the laws of the United States of America or by any state, political subdivision or taxing authority of the United States of America; provided, however, that the Company shall not be required to pay any tax or taxes that may be payable in respect of any transfer involved in the issue or delivery of any Warrant or certificates for Warrant Shares in a name other than that of the registered holder of such Warrant, and no such issue or delivery shall be made unless and until the person or entity requesting the issuance thereof shall have paid to the Company the amount of such tax or shall have established to the satisfaction of the Company that such tax has been paid.

9

19. Severability. In the event that any one or more of the provisions contained in this Warrant shall for any reason be held to be invalid, illegal or unenforceable in any respect, such provision(s) shall be ineffective only to the extent of such invalidity, illegality or unenforceability, without invalidating the remainder of such provision or the remaining provisions of this Warrant and such invalidity, illegality or unenforceability shall not affect any other provision of this Warrant, which shall remain in full force and effect.

20. Attorneys’ Fees. If any action at law or in equity is necessary to enforce or interpret the terms of this Warrant, the prevailing party in such dispute shall be entitled to collect its reasonable attorneys’ fees, costs and disbursements in addition to any other relief to which it may be entitled.

[Remainder of Page Left Blank Intentionally]

10

IN WITNESS WHEROF, the parties hereto have caused this Warrant to be duly executed as of the issue date of this Warrant by its duly authorized officers.

| VERISILICON HOLDINGS CO., LTD. | ||

| A Cayman Islands Company | ||

| By: |

| |

| Title: |

| |

| Address: | ||

Accepted and Agreed:

| By: |

| |

| Title: |

| |

[SIGNATURE PAGE TO WARRANT]

EXHIBIT A

NOTICE OF EXERCISE

To: VeriSilicon Holdings Co., Ltd. (the “Company”)

1. The undersigned hereby:

| ¨ | elects to purchase shares of Warrant Shares (as defined in the Warrant) of the Company pursuant to the terms of the attached Warrant, and tenders herewith payment of the purchase price of such shares in full; or | |

| ¨ | elects to exercise its net issuance rights pursuant to Section 11 of the attached Warrant with respect to shares Warrant Shares. | |

2. Please issue a certificate or certificates representing said shares in the name of the undersigned or in such other name or names as are specified below:

(Name)

(Address)

(City, State)

3. The undersigned represents that the aforesaid shares being acquired for the account of the undersigned for investment and not with a view to, or for resale in connection with, the distribution thereof and that the undersigned has no present intention of distributing or reselling such shares, all except as in compliance with applicable securities laws.

|

|

| (Date) |

|

|

| (Signature) |

| Signature must be guaranteed by a commercial bank or trust company or a member firm of a major stock exchange if shares of Warrant Shares are to be issued, or securities are to be delivered, other than to or in the name of the registered holder of this Warrant. |

NOTICE: Signature must correspond in all respects with the name as written upon the face of the Warrant in every particular without alteration or any change whatever

EXHIBIT B

FORM OF ASSIGNMENT

FOR VALUE RECEIVED, the undersigned holder of the attached Warrant hereby sells, assigns and transfers unto whose address is and whose taxpayer identification number is the undersigned’s right, title and interest in and to the Warrant dated October , 2009 issued by VeriSilicon Holdings Co, Ltd., a Cayman Islands Company (the “Company”) to purchase shares of the Company’s stock, and does hereby irrevocably constitute and appoint attorney to transfer said Warrant on the books of the Company with full power of substitution in the premises.

In connection with such sale, assignment, transfer or other disposition of this Warrant, the undersigned hereby confirms that:

| ¨ | such sale, transfer or other disposition may be effected without registration or qualification (under the Securities Act as then in effect and any applicable state securities law then in effect) of this Warrant or the securities issuable thereunder and has attached hereto a written opinion of such Holder’s counsel to that effect; or | |

| ¨ | such sale, transfer or other disposition has been registered under the Securities Act of 1933, as amended, and registered and/or qualified under all applicable state securities laws. | |

|

|

| (Date) |

|

|

| (Signature) |

| Signature must correspond in all respects with the name as written upon the face of the Warrant in every particular without alteration or any change whatever. |