AMENDED AND RESTATED 2014 EQUITY INCENTIVE PLAN STOCK OPTION AWARD AGREEMENT

Exhibit 10.3

AMENDED AND RESTATED 2014 EQUITY INCENTIVE PLAN

|

Name:

|

||

|

Address:

|

||

|

Dear

|

:

|

|

Subject to your signature below, you have been granted an option (the “Option”) to purchase shares of common stock (“Common Stock”) of Cue Health Inc., a Delaware corporation (the “Company”),

pursuant to the Cue Health Inc. Amended and Restated 2014 Equity Incentive Plan (the “Plan”) and this Stock Option Award Agreement (the “Option Agreement”). Your Option is granted under and governed by the terms and conditions of the

Plan and this Option Agreement. Capitalized terms used but not defined in this Option Agreement shall have the same meaning as set forth in the Plan.

|

Grant Date:

|

Award Grant Date

|

|

Vesting Commencement Date:

|

Award Vesting Commencement Date

|

|

Type of Option:

|

Incentive Stock Option

Nonstatutory Stock Option

|

|

Number of Shares:

|

Award Shares #

|

|

Exercise Price per Share:

|

U.S. $ Award Purchase Price1

|

|

Term:

|

This Option shall expire on the date that is ten (10) years after the Grant Date of your Option (the “Expiration Date”) or the date that it is exercised pursuant to its terms, unless terminated earlier

pursuant to the terms of this Option Agreement or the Plan. Upon termination, exercise or expiration of this Option, all your rights hereunder shall cease.

|

1 To be fair market value of the Company’s common stock at time of grant

1

|

Vesting:

|

One fourth (1/4) of the total shares subject to this Option will vest on the last day of the month that includes the first anniversary of the Vesting Commencement Date of this Option and thereafter an

additional one forty-eighth (1/48) of the total shares subject to this Option will vest at the end of each month, provided that you are still employed with, or are still in the service of, the Company as of each such monthly vesting date.

If application of the vesting schedule causes a fractional share, such share shall be rounded down to the nearest whole share for each month except for the last month of such vesting period. For purposes of clarity, other than described

above, you shall not be entitled to any pro rata vesting upon termination.

The Company may delay the vesting of this Option to take into account leaves of absence changes in the number of hours worked, and other changes in your working status to the extent permitted by Company

policies, as in effect from time to time, and in such event your rights will be governed by the policies in effect at the time of any such leave of absence or other change.

|

|

Termination of Employment:

|

The following conditions apply to your Option in the event that your employment or service (your “Service”) with the Company is terminated prior to the Expiration Date. In no event, however, will the time

periods described herein extend the term of this Option beyond its Expiration Date or beyond the date this Option is otherwise cancelled pursuant to the provisions of the Plan. Unless provided otherwise in this Option Agreement or the

Plan, upon any termination of your employment with, or cessation of your service to the Company and/or its Affiliates the unvested portion of this Option shall be forfeited. For purposes of this Option, your Service will be deemed to have

terminated only if such termination constitutes a “separation from service” within the meaning of Code Section 409A.

a. Termination As a Result of Death or Disability. If your employment or service with the Company terminates by

reason of your death or Disability at a time when your employment or service could not otherwise have been terminated for Cause, then this Option will terminate on the earlier of: (i) the Expiration Date, or (ii) the date that is six (6)

months after the date of such termination of your employment or service by reason of your death or Disability.

b. Termination for Cause. If your employment or service with the Company is terminated for Cause, this Option (vested

and unvested) shall be forfeited immediately upon such termination, and you shall be prohibited from exercising your Option as of the date of such termination. For purposes of this Option, “Cause” shall have the same meaning as set forth

in your employment agreement with the Company, or, if you do not have an employment agreement with the Company that defines Cause, “Cause” shall mean a good faith finding by the Company that you have (i) failed, neglected, or refused to

perform the lawful employment duties related to your position or as from time to time assigned to you (other than due to disability within the meaning of Code Section 22(e)(3)); (ii) committed any willful, intentional, or grossly

negligent act having the effect of injuring the interest, business, or reputation of the Company or any Affiliate; (iii) violated or failed to comply in any material respect with the Company’s or an Affiliate’s published rules,

regulations, or policies, as in effect or amended from time to time, to the extent applicable to you; (iv) committed an act constituting a felony or misdemeanor involving moral turpitude, fraud, theft, or dishonesty; (v) misappropriated

or embezzled any property of the Company or an Affiliate (whether or not an act constituting a felony or misdemeanor); or (vi) breached any material provision of any applicable confidentiality, non-compete, non-solicit, general release,

covenant not-to-sue, or other agreement with the Company or any Affiliate.

|

2

|

c. Termination For a Reason Other than Cause, Death or Disability (e.g., resign or fired without Cause). If your employment or service with the Company is terminated other than for Cause or other than as a result of your death or Disability, then this Option will terminate on the earlier of: (i) the

Expiration Date, or (ii) the date that is ninety (90) days after the date of such termination.

d.

Determination of Cause After Termination. Notwithstanding the foregoing, if after your employment or service

terminates the Company determines that it could have terminated you for Cause had all relevant facts been known at the time of your termination, then the Company may terminate this Option immediately upon such determination, and you will be

prohibited from exercising this Option thereafter. In such event, you will be notified of the termination of this Option.

e.

Breach of Contract After Termination. If, after your employment or service is terminated for any reason, you breach

any material provision of any applicable confidentiality, non-compete, non-solicit, general release, covenant not-to-sue or other agreement with the Company or any Affiliate, or if the Company learns after the termination of your

employment or service that such breach occurred while you were employed or in service, then any portion of this Option that has not been previously forfeited or terminated and has not otherwise expired shall be forfeited immediately upon

the date of such breach, and you shall be prohibited from exercising this Option as of the date of such breach. If you exercised this Option after the breach but before the Company became aware of such breach, then you shall also become

obligated to repay to the Company any excess of the Fair Market Value of any Shares acquired upon the exercise of this Option after the date of such breach over the exercise price paid for such Shares, determined as of the date of

exercise. For the avoidance of doubt, the forfeiture and recoupment described in this paragraph shall be in addition to, and not in place of, any other remedies at law or equity available to the Company or any Affiliate for any such

breach.

|

3

|

Exercise:

|

You (or your estate, beneficiary or heir in the case of your death) may exercise this Option only if it has not been forfeited, terminated or has not otherwise expired, and only to the extent it is then

vested. To exercise this Option, you must complete the Notice of Stock Option Exercise in the form attached hereto as Exhibit A (the “Notice of Stock Option Exercise”) and the Investment

Representation Statement attached hereto as Exhibit B and return it to the address indicated on that form. The Notice of Stock Option Exercise will become effective upon its receipt by the Company.

If your beneficiary or heir, or such other person or persons as may acquire your rights under this Option by will or by the laws of descent and distribution, wishes to exercise this Option after your death, such person must contact the

Company and prove to the Company’s satisfaction that such person has the right and is entitled to exercise this Option. Your ability to exercise this Option may be restricted by the Company if required by applicable law. For

administration purposes, this Option may not be exercised as to fewer than ten percent (10%) of the total Shares underlying the total grant unless it is exercised as to all Shares remaining under the Option.

To exercise this Option, your Notice of Stock Option Exercise must be accompanied by payment of the exercise price through any of the following methods of payment listed in the attached Notice of Stock Option

Exercise.

|

|

Change of Control:

|

Notwithstanding any other provision of this Option Agreement, one fourth (1/4) of the total shares subject to this Option shall vest upon a Change of Control, provided that you are providing continuous

service to the Company prior to the date of the consummation of the Change of Control and your services to the Company are terminated without Cause (as determined in good faith by the Board) within twelve (12) months following such Change

of Control.

|

4

|

Transferability:

|

You may not transfer or assign this Option for any reason, other than as set forth in the Plan, unless otherwise permitted by the Board or Committee. Any attempted transfer or assignment of this Option,

other than as set forth in the Plan or as permitted by the Board or Committee, will be null and void.

|

|

Lockup Provision:

|

You agree that you will not, without the prior written consent of the managing underwriter (if any), during (a) the period commencing on the date of the final prospectus relating to the Company’s initial

public offering and ending on the date specified by the Company and the managing underwriter (such period not to exceed two hundred ten (210) days), or (b) during the ninety (90) day period following the effective date of any other

registration statement filed under the Securities Act of 1933, as amended (the “Securities Act”): (i) lend, offer, pledge, sell, contract to sell, sell any option or contract to purchase, purchase any option or contract to sell, grant any

option, right or warrant to purchase, or otherwise transfer or dispose of, directly or indirectly, any Shares acquired under this Option, or (ii) enter into any swap or other arrangement that transfers to another, in whole or in part, any

of the economic consequences of ownership of any Shares acquired under this Option, whether any such transaction described in clause (i) or (ii) above is to be settled by delivery of Shares or other securities, in cash or otherwise. The

underwriters in connection with the applicable offering are intended third‑party beneficiaries of this Stock Option Award Agreement and shall have the right, power and authority to enforce the provisions hereof as though they were a party

hereto. You further agree to execute such agreements as may be reasonably requested by the underwriters in connection with any applicable offering that are consistent with this market stand-off provision or that are necessary to give

further effect thereto. Any discretionary waiver or termination of the restrictions of any or all of such agreements by the Company or the underwriters shall apply to all stockholders subject to such agreements pro rata based on the number

of shares subject to such agreements.

|

|

Restrictions on Exercise, Issuance and Transfer of Shares:

|

a.

General. No individual may exercise the Option, and no shares of Common Stock subject to this Option will be issued, unless and until the

Company has determined to its satisfaction that such exercise and issuance will comply with all applicable federal and state securities laws, rules and regulations of the Securities and Exchange Commission, rules of any stock exchange on

which shares of Common Stock of the Company may then be traded, or any other applicable laws.

|

5

|

b. Securities Laws. You acknowledge that you are acquiring this Option, and the right to purchase the shares of

Common Stock subject to this Option, for investment purposes only and not with a view toward resale or other distribution thereof to the public which would be in violation of the Securities Act. You agree and acknowledge with respect to

any shares of Common Stock that have not been registered under the Securities Act, that: (i) you will not sell or otherwise dispose of such shares of Common Stock, except as permitted pursuant to a registration statement declared effective

under the Securities Act and qualified under any applicable state securities laws, or in a transaction which in the opinion of counsel for the Company is exempt from such required registration, and (ii) that a legend containing a statement

to such effect will be placed on the certificates evidencing such shares of Common Stock. Further, as additional conditions to the issuance of the shares of Common Stock subject to this Option, you agree (with such agreement being binding

upon any of your beneficiaries, heirs, legatees and/or legal representatives) to do the following prior to any issuance of such shares of Common Stock: (i) to execute and deliver to the Company such investment representations and

warranties as set forth in the Investment Representation Statement attached hereto as Exhibit B; (ii) to enter into a restrictive stock transfer agreement, stockholders’ agreement, investors’ rights

agreement or similar agreement restricting transfer of the Shares subject to this Option; and (iii) to take or refrain from taking such other actions as counsel for the Company may deem necessary or appropriate for compliance with the

Securities Act, and any other applicable federal or state securities laws, regardless of whether the shares of Common Stock have at that time been registered under the Securities Act, or otherwise qualified under any applicable state

securities laws.

c. Right of First Refusal. The shares issuable upon exercise of this Option are subject to a right of first refusal in

favor of the Company pursuant to the Company’s Bylaws, a copy of which is available to you upon request.

|

6

|

Miscellaneous:

|

a. Acceptance of this award shall constitute acknowledgement and renewed assent to any nondisclosure, confidentiality or invention assignment provisions

previously made by you to the Company.

b. This Option Agreement may be amended only by written consent signed by both you and the Company, unless the amendment is not to your detriment. In addition,

this Option Agreement may be amended or terminated by the Company or the Board without your consent in accordance with the provisions of the Plan.

c.

The tax treatment of this Option is not guaranteed. Neither the Company nor any of its designees shall be liable for any taxes, penalties or other monetary

amounts owed by any participant, employee, beneficiary or other person as a result of the grant, amendment, modification, exercise and/or payment of, or under, any award, notwithstanding any challenge made to the determination of Fair

Market Value by any taxing authority. By accepting this Option, you acknowledge and agree to the foregoing. Furthermore, you acknowledge that there may be adverse tax consequences upon exercise of the Option or disposition of the Shares

and that the Company has advised you to consult a tax adviser prior to such exercise or disposition.

d.

The failure of the Company to enforce any provision of this Option Agreement at any time shall in no way constitute a waiver of such provision or of any other

provision hereof.

e.

In the event any provision of this Option Agreement is held illegal, unenforceable or invalid for any reason, such illegality, unenforceability or invalidity

shall not affect the legality, enforceability or validity of the remaining provisions of this Option Agreement, and this Option Agreement shall be construed and enforced as if the illegal, unenforceable or invalid provision had not been

included in this Option Agreement.

f.

As a condition to the grant of this Option, you agree (with such agreement being binding upon your legal

representatives, guardians, legatees or beneficiaries) that this Option Agreement shall be interpreted by the Board or the Committee, as the case may be, and that any interpretation by the Board or the Committee of the terms of this

Option Agreement, and any determination made by the Board or Committee pursuant to this Option Agreement, shall be final, binding and conclusive.

|

7

|

g.

If, as a result of your exercise of this Option, you would own one percent (1.0%) or more of the Company’s then outstanding Common Stock (treating for this

purpose all shares of Common Stock issuable upon exercise of or conversion of outstanding options, warrants or convertible securities, as if exercised or converted), as a condition to such exercise you shall execute and deliver a joinder to

that certain Amended and Restated Voting Agreement and that certain Amended and Restated Right of First Refusal and Co-Sale Agreement, each dated as of December 20, 2017, by and between the Company and the stockholders named therein (as

each may be further amended or restated), as a condition to the issuance of shares hereunder.

h.

This Option Agreement may be executed in counterparts each of which shall be deemed an original and all of which shall constitute one and the same agreement.

This Option Agreement and the Notice of Stock Option Exercise Agreement may be executed and delivered by facsimile or PDF copy and, upon such delivery, be deemed effective.

|

8

BY SIGNING BELOW AND AGREEING TO THIS STOCK OPTION AWARD AGREEMENT, YOU AGREE TO ALL OF THE TERMS AND CONDITIONS DESCRIBED HEREIN AND IN THE PLAN. YOU ALSO ACKNOWLEDGE RECEIPT OF A COPY OF THE PLAN.

|

By:

|

|

||

|

Xxxx Xxxxxxx, President

|

AwardName, Optionee

|

9

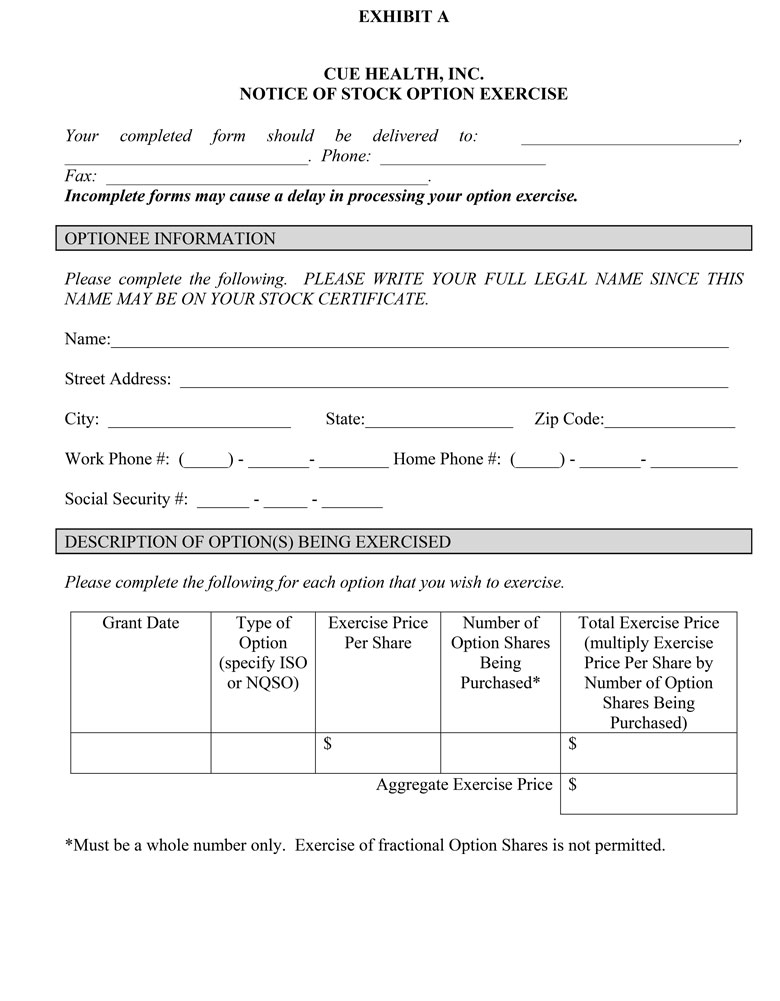

EXHIBIT ACUE HEALTH,

INC.NOTICE OF STOCK OPTION EXERCISEYour completed form should be delivered to:____________________________.Phone:Fax:.Incomplete forms may cause a delay in processing your option exercise.OPTIONEE INFORMATIONPlease complete the following. PLEASE

WRITE YOUR FULL LEGAL NAME SINCE THIS NAME MAY BE ON YOUR STOCK XXXXXXXXXXX.Xxxx:Street Address:City:State:Zip Code:Work Phone #:(_____) Home Phone #:(_____)Social Security #:______ - _____ - _______DESCRIPTION OF OPTION(S) BEING

EXERCISEDPlease complete the following for each option that you wish to exercise. Grant DateType of Option(specify ISO or NQSO)Exercise Price Per ShareNumber of Option Shares Being Purchased*Total Exercise Price (multiply Exercise Price Per Share

by Number of Option Shares Being Purchased)$$Aggregate Exercise Price$*Must be a whole number only.

1

Exercise of

fractional Option Shares is not permitted. METHOD OF PAYMENT OF OPTION EXERCISE PRICEPlease select only one: Cash Exercise. I am enclosing a check or money order payable to “Cue Health Inc.” for the Aggregate Exercise Price. Cancellation of

Indebtedness. Currently owed and payable to me in the amount of $_____________. CERTIFICATE INSTRUCTIONSPlease select only xxx.Xxxx(s) in which the certificate for the purchased shares will be issued:In my name onlyIn the names of my spouse

and myself as community propertyIn the names of my spouse and myself as joint tenants with the rights of survivorshipSpouse’s name (if applicable): _____________________________________________The certificate for the purchased shares should be

sent to the following address (complete only if to be sent to a different address than specified in Part 1):Street Address: _______________________________________________________________City: _____________________State:_________________Zip

Code:_______________METHOD OF SATISFYING TAX WITHHOLDING OBLIGATIONPlease select only one. You do not need to complete this Part if you are exercising only incentive stock options (ISOs) or if you are a non-employee director or

xxxxxxxxxx.Xxxx. I am enclosing a check or money order payable to “Cue Health Inc.” for the withholding tax xxxxxx.Xxx Amount Request. Please notify me of the amount of withholding taxes that will be due as a result of this option exercise.

I understand that, after receiving notification of the withholding tax amount, I must immediately remit to the Company a check or money order payable to “Cue Health Inc.” for that amount. I understand that the Company will not process my

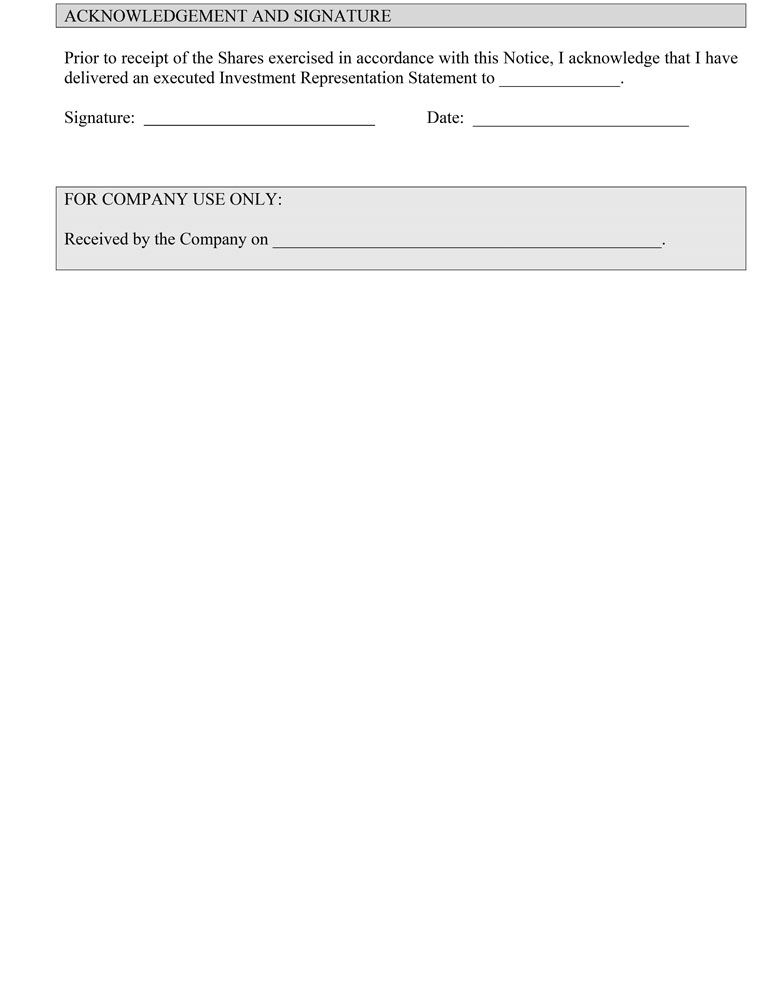

option exercise until it receives the check or money order covering the withholding tax amount due.I am not an employee.ACKNOWLEDGEMENT AND SIGNATUREPrior to receipt of the Shares exercised in accordance with this Notice, I acknowledge that I

have delivered an executed Investment Representation Statement to ______________.Signature: Date: _________________________FOR COMPANY USE ONLY:

Received by the Company

on _____________________________________________.

2

3

EXHIBIT B

INVESTMENT REPRESENTATION STATEMENT

|

OPTIONEE:

|

[Optionee Name, a resident of State of Residence (“Optionee”)]

|

|

ISSUER:

|

Cue Health Inc., a Delaware corporation

|

|

SECURITY:

|

[__________ shares of Common Stock (the “Shares”)]

|

|

DATE:

|

[________ __, 20__]

|

In connection with the exercise of any or all options under that certain Stock Option Award Agreement, dated [_____________ ___, 20__], between Optionee and Issuer, Issuer issued the Shares to

Optionee and, therefore, Optionee represents to the Issuer the following:

1. Optionee confirms that the Shares are being acquired by the Optionee for the Optionee’s own account, not as a nominee or agent, and not with a view to the resale or distribution of any

part thereof, and that Optionee has no present intention of selling, granting any participation in, or otherwise distributing the same. By executing this Agreement, Optionee further represents that Optionee does not presently have any contract,

undertaking, agreement or arrangement with any Person to sell, transfer or grant participations to such Person or to any third Person, with respect to any of the Shares.

2. Optionee has received a copy of the Cue Health Inc. Amended and Restated 2014 Equity Incentive Plan (the “Plan”), and understands that the Shares when issued will continue to be

subject to the Plan.

3. Optionee understands that the Shares remain subject to the provisions of the Stock Option Award Agreement between the Company and the Optionee, including, but not limited to the

Company’s Right of First Refusal with respect to the Shares.

4. Optionee has had an opportunity to discuss the Issuer’s business, management, financial affairs and the terms and conditions of the offering of the Shares with the Issuer’s management

and has had an opportunity to review the Issuer’s facilities.

5. Optionee understands that the Shares have not been, and will not be, registered under the Securities Act of 1933, as amended (“Securities Act”), by reason of a specific exemption from

the registration provisions of the Securities Act which depends upon, among other things, the bona fide nature of the investment intent and the accuracy of Optionee’s representations as expressed herein. Optionee understands that the Shares are

“restricted securities” under applicable U.S. federal and state securities laws and that, pursuant to these laws, Optionee must hold the Shares indefinitely unless they are registered with the Securities and

Exchange Commission and qualified by state authorities, or an exemption from such registration and qualification requirements is available. Optionee acknowledges that the Issuer has no obligation to register or qualify the Shares for resale except

as set forth in the Investors’ Rights Agreement, if any, of the Issuer. Optionee further acknowledges that if an exemption from registration or qualification is available, it may be conditioned on various requirements including, but not limited

to, the time and manner of sale, the holding period for the Shares, and on requirements relating to the Issuer which are outside of the Optionee’s control, and which the Issuer is under no obligation and may

not be able to satisfy.

1

6. Optionee understands that no public market now exists for the Shares, and that the Issuer has made no assurances that a public market will ever exist for the Shares.

7. Optionee understands that the Shares and any securities issued in respect of or exchange for the Shares, may bear one or all of the following legends:

“THE SHARES REPRESENTED BY THIS CERTIFICATE HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AND HAVE BEEN ACQUIRED FOR INVESTMENT AND NOT WITH A VIEW TO, OR IN CONNECTION WITH, THE SALE

OR DISTRIBUTION THEREOF. NO SUCH TRANSFER MAY BE EFFECTED WITHOUT AN EFFECTIVE REGISTRATION STATEMENT RELATED THERETO OR AN OPINION OF COUNSEL IN A FORM SATISFACTORY TO THE ISSUER THAT SUCH REGISTRATION IS NOT REQUIRED UNDER THE SECURITIES ACT OF

1933.”

8. Optionee is aware of the adoption of Rule 144 by the Securities and Exchange Commission, promulgated under the Securities Act, which permits limited public resale of shares acquired in

a non-public offering subject to the satisfaction of certain conditions.

9. Optionee further acknowledges and understands that if the Issuer is not satisfying the current public information requirement of Rule 144 at the time Optionee wishes to sell the Shares,

Optionee would be precluded from selling the Shares under Rule 144 even if the minimum holding period has been satisfied.

10. Optionee is fully aware of: (a) the highly speculative nature of the investment in the Shares; (b) the financial hazards involved; (c) the lack of liquidity of the Shares and the

restrictions on transferability of the Shares (e.g., that Optionee may not be able to sell or dispose of the Shares or use them as collateral for loans); (d) the qualifications and backgrounds of the management of the Issuer; and (e) the tax

consequences of investment in the Shares.

11. In addition, Optionee represents and warrants that:

| a. |

At no time was Optionee presented with or solicited by any leaflet, public promotional meeting, circular, newspaper or magazine article, radio or television advertisement, or any other form of general advertising.

|

2

| b. |

Optionee understands that, in transferring the Shares, the Issuer has relied upon the exemption from registration under the Securities Act contained in Section 4(2) and that, in an attempt to effect compliance with all the conditions

thereof and the applicable state law exemption, the Issuer is relying in good faith upon all of the foregoing representations and warranties on the part of the undersigned.

|

|

Very truly yours,

|

||

|

By:

|

||

|

Optionee Name

|

||

3

3