SOGOU INC. SERIES A PREFERRED SHARE PURCHASE AGREEMENT OCTOBER 2, 2010

Exhibit 10.38

SOGOU INC.

SERIES A PREFERRED

SHARE PURCHASE AGREEMENT

OCTOBER 2, 2010

TABLE OF CONTENTS

| 1. |

Definitions |

1 | ||||

| 2. |

Purchase and Sale of Securities. |

9 | ||||

| 2.1 |

Sale and Issuance of Series A Preferred Shares |

9 | ||||

| 2.2 |

Closing |

9 | ||||

| 3. |

Representations and Warranties of the Warrantors |

9 | ||||

| 3.1 |

Organization, Good Standing and Qualification |

9 | ||||

| 3.2 |

Corporate Structure; Subsidiaries |

10 | ||||

| 3.3 |

Capitalization |

10 | ||||

| 3.4 |

Authorization |

11 | ||||

| 3.5 |

Valid Issuance of Series A Preferred Shares and Conversion Shares |

11 | ||||

| 3.6 |

Governmental Approvals |

11 | ||||

| 3.7 |

Offering |

11 | ||||

| 3.8 |

Certain Regulatory Matters |

12 | ||||

| 3.9 |

Tax Matters |

12 | ||||

| 3.10 |

Charter Documents; Books and Records |

13 | ||||

| 3.11 |

Financial Statements |

13 | ||||

| 3.12 |

Changes |

14 | ||||

| 3.13 |

Actions and Governmental Orders |

15 | ||||

| 3.14 |

Liabilities |

15 | ||||

| 3.15 |

Commitments |

15 | ||||

| 3.16 |

Compliance with Laws and Governmental Orders |

17 | ||||

| 3.17 |

Title; Properties; Permits |

18 | ||||

| 3.18 |

Related Party Transactions |

19 | ||||

| 3.19 |

Intellectual Property |

19 | ||||

| 3.20 |

Compliance with Other Instruments |

20 | ||||

| 3.21 |

Insurance |

21 | ||||

| 3.22 |

Employee Matters |

21 | ||||

| 3.23 |

No Brokers |

22 | ||||

| 3.24 |

Disclosure |

22 | ||||

| 4. |

Representations and Warranties of the Purchasers |

22 | ||||

| 4.1 |

Authorization |

22 | ||||

| 4.2 |

Purchase Entirely for Own Account |

22 | ||||

| 4.3 |

Disclosure of Information |

22 | ||||

| 4.4 |

Accredited Investor |

23 | ||||

| 5. |

Conditions of Purchasers’ Obligations at Closing |

23 | ||||

| 5.1 |

Representations and Warranties |

23 | ||||

| 5.2 |

Performance |

23 | ||||

| 5.3 |

Proceedings and Documents |

23 | ||||

| 5.4 |

Government Approvals and Consents |

23 | ||||

| 5.5 |

Amended Memorandum and Articles |

23 | ||||

i

| 5.6 |

Investors’ Rights Agreement |

23 | ||||

| 5.7 |

Right of First Refusal and Co-Sale Agreement |

24 | ||||

| 5.8 |

Share Incentive Plan |

24 | ||||

| 5.9 |

Financial Statements |

24 | ||||

| 5.10 |

Board of Directors |

24 | ||||

| 5.11 |

Indemnification Agreement |

24 | ||||

| 5.12 |

Non-Competition, Non-Solicitation, Confidential Information, and Invention Assignment Agreements |

24 | ||||

| 5.13 |

Reserved |

24 | ||||

| 5.14 |

Legal Opinions |

24 | ||||

| 5.15 |

No Material Adverse Events |

24 | ||||

| 5.16 |

Restructuring |

25 | ||||

| 5.17 |

Business Plan and Budget |

25 | ||||

| 5.18 |

Waiver of Confidentiality Obligations in Business Contracts |

25 | ||||

| 5.19 |

Waiver of Employee Confidentiality and Non-competition Obligations |

25 | ||||

| 5.20 |

Alibaba Side Agreement |

25 | ||||

| 5.21 |

Bringdown Certificate |

26 | ||||

| 5.22 |

Due Diligence |

26 | ||||

| 6. |

Conditions of the Company’s Obligations at Closing |

26 | ||||

| 6.1 |

Representations and Warranties |

26 | ||||

| 6.2 |

Payment of Purchase Price |

26 | ||||

| 6.3 |

Performance |

26 | ||||

| 6.4 |

Investors’ Rights Agreement |

26 | ||||

| 6.5 |

Right of First Refusal and Co-Sale Agreement |

26 | ||||

| 6.6 |

Government Approvals and Consents |

26 | ||||

| 7. |

Covenants and Other Agreements |

27 | ||||

| 7.1 |

Use of Proceeds |

27 | ||||

| 7.2 |

Full-time Employment |

27 | ||||

| 7.3 |

Transfers and Licensing of Intellectual Property |

27 | ||||

| 7.4 |

Restructuring |

28 | ||||

| 7.5 |

Compliance with Applicable Laws |

28 | ||||

| 7.6 |

Confidentiality |

28 | ||||

| 7.7 |

Joint Lab Agreement |

29 | ||||

| 7.8 |

SAFE Registration |

29 | ||||

| 7.9 |

Management of Group Debt |

29 | ||||

| 7.10 |

Public Official Communication |

30 | ||||

| 7.11 |

Non-Compete |

30 | ||||

| 7.12 |

No Negotiation |

31 | ||||

| 8. |

Miscellaneous |

31 | ||||

| 8.1 |

Indemnification by the Warrantors |

31 | ||||

| 8.2 |

Successors and Assigns |

32 | ||||

| 8.3 |

Governing Law and Dispute Resolution |

32 | ||||

| 8.4 |

Counterparts |

32 | ||||

| 8.5 |

Titles and Subtitles |

33 | ||||

ii

| 8.6 |

Notices |

33 | ||||

| 8.7 |

Expenses |

33 | ||||

| 8.8 |

Amendments and Waivers |

33 | ||||

| 8.9 |

Severability |

33 | ||||

| 8.10 |

Entire Agreement |

33 | ||||

| 8.11 |

Specific Performance |

34 | ||||

| 8.12 |

No Waiver |

34 | ||||

| 8.13 |

Further Assurances |

34 |

SCHEDULE AND EXHIBITS

| SCHEDULE A |

Schedule of Purchasers | |

| SCHEDULE B |

Disclosure Schedule | |

| SCHEDULE 5.16(i) |

Assets and Liabilities Transferred from Group to Sohu | |

| SCHEDULE 5.16(ii) |

Assets and Liabilities Transferred from Sohu to Group | |

| SCHEDULE 5.16(iii) |

Restructuring Plan | |

| EXHIBIT A |

Amended and Restated Memorandum and Articles of Association | |

| EXHIBIT B |

Investors’ Rights Agreement | |

| EXHIBIT C |

Right of First Refusal and Co-Sale Agreement | |

| EXHIBIT D |

Share Incentive Plan | |

| EXHIBIT E |

Form of Director Indemnification Agreement | |

| EXHIBIT F |

Form of Employment Agreement

Form of Non-competition and Non-Solicitation Agreement

Form of Confidential Information and Invention Assignment Agreement | |

| EXHIBIT G |

reserved | |

iii

| EXHIBIT H |

Form of Opinion of Cayman Islands Special Counsel to the Company | |

| EXHIBIT I |

Form of Opinion of PRC Counsel to the Company | |

iv

SOGOU INC.

SERIES A PREFERRED SHARE PURCHASE AGREEMENT

THIS SERIES A PREFERRED SHARE PURCHASE AGREEMENT (the “Agreement”) is made as of October 2, 2010, by and among Sogou Inc., a company incorporated under the Laws of the Cayman Islands (the “Company”), Sogou (BVI) Limited, a company duly incorporated and existing under the Laws of the British Virgin Islands (“Sogou BVI”), Sogou Hong Kong Limited, a company duly incorporated and existing under the Laws of the Hong Kong S.A.R. (“Sogou HK”), Beijing Sogou Technology Development Co., Ltd. (北京搜狗科技发展有限公司), a limited liability company duly organized and existing under the Laws of the PRC (the “PRC Subsidiary”), Beijing Sogou Information Service Co., Ltd. (北京搜狗信息服务有限公司), a limited liability company duly organized and existing under the Laws of the PRC (“Sogou Information”), and the purchasers listed on Schedule A hereto (each of which is herein referred to as a “Purchaser” and, collectively, the “Purchasers,” and with the Company, Sogou BVI, Sogou HK, the PRC Subsidiary and Sogou Information, the “Parties,” and each, a “Party”). Xxxx.xxx Inc., a Delaware corporation (“Sohu”), is as signatory hereto and a Party to this Agreement solely for the purpose of Sections 3, 7.3, 7.4, 7.6, 7.7, 7.8, 7.9, 7.10, 7.11, 7.12 and 8.1 hereto.

RECITALS

| A. | The Company wishes to issue and sell Series A Preferred Shares, par value US$0.001 per share, of the Company (the “Preferred Shares”) to the Purchasers, and Sogou BVI, Sogou HK, the PRC Subsidiary, Sogou Information and Sohu wish to induce the Purchasers to subscribe for such Preferred Shares, pursuant to the terms and subject to the conditions of this Agreement. |

| B. | The Purchasers wish to invest in the Company by subscribing for the Preferred Shares to be issued by the Company pursuant to the terms and subject to the conditions of this Agreement. |

| C. | The Parties desire to enter into this Agreement and make the respective representations, warranties, covenants and agreements set forth herein on the terms and conditions set forth herein. |

AGREEMENT

NOW, THEREFORE, in consideration of the mutual promises and covenants herein and other consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties agree as follows:

1. Definitions. For purpose of this Agreement:

(a) The term “Action” means any notice, charge, claim, action, complaint, petition, investigation, suit or other proceeding, whether administrative, civil or criminal, whether at Law or in equity, and whether or not before any mediator, arbitrator or Governmental Authority.

1

(b) The term “Affiliate” means, with respect to a Person, any other Person that, directly or indirectly, Controls, is Controlled by or is under common Control with such Person.

(c) The term “Agreement” has the meaning set forth in the Preamble of this Agreement.

(d) The term “Alibaba” means Alibaba Investment Limited.

(e) The term “Amended Memorandum and Articles” has the meaning set forth in Section 5.5 hereof.

(f) The term “Ancillary Agreements” means, collectively, the Investors’ Rights Agreement, the Right of First Refusal & Co-Sale Agreement and the Indemnification Agreements, each as defined herein.

(g) The term “Arbitration Rules” has the meaning set forth in Section 8.3(b) hereof.

(h) The term “Board” or “Board of Directors” means the board of directors of the Company.

(i) The term “Business Day” means any weekday that the banks in the Cayman Islands, the Hong Kong S.A.R., the PRC, and the United States of America are generally open for business.

(j) The term “CFC” means controlled foreign corporation as defined in the Code.

(k) The term “Charter Documents” means, as to a Person, such Person’s certificate of incorporation, formation or registration (including, if relevant, certificates of change of name), memorandum of association, articles of association or incorporation, charter, by-laws, trust deed, trust instrument, partnership, operating agreement, limited liability company, joint venture or shareholders’ agreement or equivalent documents, and business license, in each case as amended.

(l) The term “Closing” has the meaning has set forth in Section 2.2 hereof.

(m) The term “Code” means the United States Internal Revenue Code of 1986, as amended.

(n) The term “Company” has the meaning set forth in the Preamble of this Agreement.

2

(o) The term “Company Officials” has the meaning set forth in Section 3.16(e) hereof.

(p) The term “Compliance Laws” has the meaning set forth in Section 3.16(d) hereof.

(q) The term “Confidential Information” has the meaning has set forth in Section 7.6(a) hereof.

(r) The term “Contract” means, as to any Person, any contract, agreement, undertaking, understanding, indenture, note, bond, loan, instrument, lease, mortgage, deed of trust, franchise, or license to which such Person is a party or by which such Person or any of its property is bound, whether oral or written.

(s) The term “Control” of a given Person means the power or authority, whether exercised or not, to direct the business, management and policies of such Person, directly or indirectly, whether through the ownership of voting securities, by contract or otherwise; provided, that such power or authority shall conclusively be presumed to exist upon possession of beneficial ownership or power to direct the vote of more than fifty percent (50%) of the votes entitled to be cast at a meeting of the members or shareholders of such Person or power to control the composition of a majority of the board of directors of such Person. The terms “Controlled” and “Controlling” have meanings correlative to the foregoing.

(t) The term “Conversion Shares” means Ordinary Shares issuable upon conversion of any Preferred Shares.

(u) The term “Disclosing Party” has the meaning has set forth in Section 7.6(c) hereof.

(v) The term “Disclosure Schedule” has the meaning set forth in Section 3 hereof.

(w) The term “Equity Securities” means, with respect to a Person, any shares, share capital, registered capital, ownership interest, equity interest, or other securities of such Person, and any option, warrant, or right to subscribe for, acquire or purchase any of the foregoing, or any other security or instrument convertible into or exercisable or exchangeable for any of the foregoing, or any equity appreciation, phantom equity, equity plans or similar rights with respect to such Person, or any Contract of any kind for the purchase or acquisition from such Person of any of the foregoing, either directly or indirectly.

(x) The term “FCPA” has the meaning set forth in Section 3.16(d)(ii) hereof.

(y) The term “Financial Statements” has the meaning set forth in Section 3.11 hereof.

(z) The term “Foreign Exchange Authorization” has the meaning set forth in Section 3.8(b) hereof.

3

(aa) The term “Government Approval” means any approval, authorization, release, order, or consent required to be obtained from, or any registration, qualification, designation, declaration, filing, notice, statement or other communication required to be filed with or delivered to, any Governmental Authority or any other Person, or any waiver of any of the foregoing.

(bb) The term “Governmental Authority” means any nation or government or any federation, province or state or any other political subdivision thereof; any entity, authority or body exercising executive, legislative, judicial, regulatory or administrative functions of or pertaining to government, including any government authority, agency, department, board, commission or instrumentality of the PRC, Hong Kong S.A.R., the Cayman Islands, the British Virgin Islands or any other country, or any political subdivision thereof, any court, tribunal or arbitrator, and any self-regulatory organization.

(cc) The term “Governmental Order” means any applicable order, ruling, decision, verdict, decree, writ, subpoena, mandate, precept, command, directive, consent, approval, award, judgment, injunction or other similar determination or finding by, before or under the supervision of any Governmental Authority.

(dd) The term “Group Companies” means, collectively, the Company, Sogou BVI, Sogou HK, the PRC Subsidiary and Sogou Information, together with each Subsidiary of the aforementioned entities, and each Person (other than a natural person) that is, directly or indirectly, Controlled by any of the foregoing, including but not limited to each joint venture in which any of the foregoing holds more than fifty percent (50%) of the voting power, and “Group” refers to all of Group Companies collectively.

(ee) The term “Hong Kong S.A.R.” means the Hong Kong Special Administrative Region.

(ff) The term “Indemnifiable Loss” has the meaning set forth in Section 8.1 hereof.

(gg) The term “Indemnification Agreement” has the meaning set forth in Section 5.11 hereof.

(hh) The term “Initial Public Offering” means the closing of the sale of Ordinary Shares (including American Depositary Receipts representing such shares) in the first firm-commitment underwritten public offering in the United States pursuant to an effective registration statement under the Securities Act or in an equivalent offering on an internationally recognized stock exchange other than in the United States.

(ii) The term “Intellectual Property” means any and all (i) patents, all patent rights and all applications therefor and all reissues, reexaminations, continuations, continuations-in-part, divisions, and patent term extensions thereof, (ii) inventions (whether patentable or not), discoveries, improvements, concepts, innovations and industrial models, (iii) registered and unregistered copyrights, copyright registrations and applications, author’s rights and works of authorship (including artwork of any kind and software of all types in whatever medium, inclusive of computer programs, source code, object code and executable code, and related documentation), (iv) URLs, domain names, web sites, web pages and any part thereof, (v) technical information, know-how, trade secrets, drawings, designs, design protocols, specifications for parts and devices, quality assurance and control procedures, design tools, manuals, research data concerning historic and current research and development efforts, including the results of successful and unsuccessful designs, databases and proprietary data, (vi) proprietary processes, technology, engineering, formulae, algorithms and operational procedures, (vii) trade names, trade dress, trademarks, domain names, and service marks, and registrations and applications therefor, and (viii) the goodwill of the business symbolized or represented by the foregoing, customer lists and other proprietary information and common-law rights.

4

(jj) The term “Investors’ Rights Agreement” means the Investors’ Rights Agreement to be entered into by and among the parties thereto on or prior to the Closing, in the form attached hereto as Exhibit B.

(kk) The term “Key Employee” means, with respect to the Group Companies, the president, chief executive officer, chief financial officer, chief operating officer, chief technical officer and chief legal officer, any other employee with responsibilities similar to any of the foregoing, and the additional employees set forth in Section 3.22(a) of the Disclosure Schedule.

(ll) The term “Knowledge” means, with respect to the Warrantors, the knowledge of each of Xxxx Xxxxxxxxx, Xxxx Xxxxxxx, Ru Xxxxx, Xx Xxxxxxx, Zhang Chaoyang and Xxxx Xxxx, and that knowledge which should have been acquired by each such individual after making such due inquiry and exercising such due diligence as a prudent business person would have made or exercised in the management of his or her business affairs, including but not limited to due inquiry of all officers, directors, employees, consultants and professional advisers (including attorneys, accountants and auditors) of the Group and of its Affiliates who could reasonably be expected to have knowledge of the matters in question, and where any statement in the representations and warranties hereunder is expressed to be given or made to a Person’s Knowledge, or so far as a party is aware, or is qualified in some other manner having a similar effect, the statement shall be deemed to be supplemented by the additional statement that such party has made such due inquiry and due diligence.

(mm) The term “Law” or “Laws” means any constitutional provision, statute or other law, rule, regulation, official policy or interpretation of any Governmental Authority and any Governmental Order.

(nn) The term “Liabilities” means, with respect to any Person, all debts, obligations, liabilities owed by such Person of any nature, whether accrued, absolute, contingent or otherwise, and whether due or to become due.

(oo) The term “Lien” means any mortgage, pledge, claim, security interest, encumbrance, title defect, lien, charge, easement, adverse claim, restrictive covenant, or other restriction or limitation of any kind whatsoever, including any restriction on the use, voting, transfer, receipt of income, or exercise of any attributes of ownership.

5

(pp) The term “Material Adverse Effect” means any (i) event, occurrence, fact, condition, change or development that has had, has, or could reasonably be expected to have a material adverse effect on the business, properties, employees, results of operations, conditions (financial or otherwise), assets or liabilities of the Group Companies taken as a whole, (ii) material impairment of the ability of any Group Company or Sohu to perform the material obligations of such Person hereunder or under any other Transaction Documents, as applicable, or (iii) material impairment of the validity or enforceability of this Agreement or any other Transaction Documents against any Group Company or Sohu.

(qq) The term “Material Contracts” has the meaning set forth in Section 3.15(a) hereof.

(rr) The term “Ordinary Shares” has the meaning set forth in Section 3.3(a) hereof.

(ss) The term “Party” and “Parties” has the meaning set forth in the Preamble of this Agreement.

(tt) The term “Permits” has the meaning set forth in Section 3.17(d) hereof.

(uu) The term “Permitted Liens” means (i) Liens for Taxes not yet delinquent or the validity of which are being contested and (ii) Liens incurred in the ordinary course of business, which (x) do not individually or in the aggregate materially detract from the value, use, or transferability of the assets that are subject to such Liens and (y) were not incurred in connection with the borrowing of money.

(vv) The term “Person” means any individual, corporation, partnership, limited partnership, proprietorship, association, limited liability company, firm, trust, estate or other enterprise or entity.

(ww) The term “PFIC” means a passive foreign investment company as defined in the Code.

(xx) The term “PRC” means the People’s Republic of China, but solely for the purposes of this Agreement and the other Transaction Documents, excluding the Hong Kong S.A.R., the Macau Special Administrative Region and the islands of Taiwan.

(yy) The term “PRC Subsidiary” has the meaning set forth in the Preamble of this Agreement.

(zz) The term “Preferred Shares” has the meaning set forth in the Recitals of this Agreement.

(aaa) The term “Principal Tribunal” has the meaning set forth in Section 8.3(c) hereof.

6

(bbb) The term “Prohibited Person” means any Person that is (i) a national or resident of any U.S. embargoed or restricted country, (ii) included on, or Affiliated with any Person on, the United States Commerce Department’s Denied Parties List, Entities and Unverified Lists; the U.S. Department of Treasury’s Specially Designated Nationals, Specially Designated Narcotics Traffickers or Specially Designated Terrorists, or the Annex to Executive Order No. 13224; the Department of State’s Debarred List; UN Sanctions, (iii) a member of any PRC military organization, or (iv) a Person with whom business transactions, including exports and re-exports, are restricted by a U.S. Governmental Authority, including, in each clause above, any updates or revisions to the foregoing and any newly published rules.

(ccc) The term “Public Official” means any employee of a Governmental Authority, an active member of a political party engaged in political or governmental activities, a political candidate, officer of a public international organization, or officer or employee of a state-owned enterprise, including a PRC state-owned enterprise.

(ddd) The term “Purchase Price” has the meaning set forth in Section 2.1 hereof.

(eee) The term “Purchaser” and “Purchasers” has the meaning set forth in the Preamble of this Agreement.

(fff) The term “Real Property” has the meaning set forth in Section 3.17(b) hereof.

(ggg) The term “Related Party” has the meaning set forth in Section 3.18 hereof.

(hhh) The term “Related Party Contracts” has the meaning set forth in Section 3.18 hereof.

(iii) The term “Representatives” has the meaning set forth in Section 3.16(d) hereof.

(jjj) The term “Restructuring” has the meaning set forth in Section 5.16 hereof.

(kkk) The term “Right of First Refusal & Co-Sale Agreement” means the Right of First Refusal & Co-Sale Agreement to be entered into by and among the parties thereto on or prior to the Closing, in the form attached hereto as Exhibit C.

(lll) The term “SAFE” means the State Administration of Foreign Exchange of the PRC.

(mmm) The term “Securities” means the Shares and the Conversion Shares.

(nnn) The term “Securities Act” means the U.S. Securities Act of 1933, as amended and interpreted from time to time.

(ooo) The term “Share Incentive Plan” has the meaning set forth in Section 5.8 hereof.

(ppp) The term “Social Insurance” has the meaning set forth in Section 3.22(b) hereof.

7

(qqq) The term “Sogou BVI” has the meaning set forth in the Preamble of this Agreement.

(rrr) The term “Sogou HK” has the meaning set forth in the Preamble of this Agreement.

(sss) The term “Sogou Information” has the meaning set forth in the Preamble of this Agreement.

(ttt) The term “Sohu” has the meaning set forth in the Preamble of this Agreement.

(uuu) The term “Statement Date” has the meaning set forth in Section 3.11 hereof.

(vvv) The term “Subsidiary” means, with respect to any specified Person, any Person of which the specified Person, directly or indirectly, owns or Controls more than fifty percent (50%) of the issued and outstanding authorized capital, share capital, voting interests or registered capital. For the avoidance of the doubt, a “variable interest entity” controlled by another entity shall be deemed a Subsidiary of that other entity.

(www) The term “Tax” means any national, provincial or local income, sales and use, excise, franchise, real and personal property, gross receipt, capital stock, production, business and occupation, disability, employment, payroll, severance or withholding tax or any other type of tax, levy, assessment, custom duty or charge imposed by any Governmental Authority, any interest and penalties (civil or criminal) related thereto or to the nonpayment thereof, and any loss or tax Liability incurred in connection with the determination, settlement or litigation of any Liability arising therefrom.

(xxx) The term “Tax Return” means any return, declaration, report, estimate, claim for refund, claim for extension, information return, or statement relating to any Tax, including any schedule or attachment thereto.

(yyy) The term “Transaction Documents” means this Agreement, the Ancillary Agreements, the Amended Memorandum and Articles, the exhibits attached to any of the foregoing and each of the agreements and other documents otherwise required in connection with implementing the transactions contemplated by any of the foregoing.

(zzz) The term “US GAAP” means the generally accepted accounting principles established by the Financial Accounting Standards Board of the United States, as amended from time to time.

(aaaa) The term “U.S. real property holding corporation” has the meaning as defined in the Code.

(bbbb) The term “Warrantors” has the meaning set forth in Section 3 hereof.

8

2. Purchase and Sale of Securities.

2.1 Sale and Issuance of Series A Preferred Shares. Subject to the terms and conditions of this Agreement, each Purchaser agrees, severally and not jointly, to subscribe for and purchase at the Closing and the Company agrees to sell and issue to each Purchaser at the Closing, that number of Preferred Shares set forth opposite such Purchaser’s name on Schedule A hereto, for a purchase price of US$0.625 per share, amounting to an aggregate subscription price set forth opposite such Purchaser’s name on Schedule A hereto (the “Purchase Price”).

2.2 Closing.

(a) The consummation of the purchase and sale of the Preferred Shares pursuant to Section 2.1 hereto (the “Closing”) shall take place at the offices of Sohu in Beijing as soon as practicable after all closing conditions specified in Section 5 and Section 6 hereof have been waived or satisfied (except those that by their nature cannot be satisfied until the Closing) and in no event later than October 24, 2010, or at such other time and place as the Company and Purchasers agree upon orally or in writing. If at the Closing any of the closing conditions specified in Section 5 of this Agreement shall not have been fulfilled or waived by all the Purchasers, the Purchasers shall, at their election, be relieved of all of their obligations under this Agreement without thereby waiving any other right the Purchasers may have by reason of such failure or such non-fulfillment.

(b) At the Closing, the Company shall deliver to each Purchaser a copy of the updated register of members of the Company, certified by the registered agent of the Company, reflecting the issuance to such Purchaser of the Preferred Shares being purchased by such Purchaser at the Closing, and a certificate representing the Preferred Shares being purchased by such Purchaser at such Closing, against payment of such Purchase Price therefor by wire transfer of immediately available funds by the Purchaser to a bank account designated in writing by the Company at least three (3) Business Days prior to the Closing.

3. Representations and Warranties of the Warrantors. Subject to such exceptions as set forth in the disclosure schedule attached hereto as Schedule B (the “Disclosure Schedule”) furnished to each Purchaser, each of the Company, Sogou BVI, Sogou HK, the PRC Subsidiary, Sogou Information and Sohu (collectively, the “Warrantors”) hereby, jointly and severally, represents and warrants to each Purchaser that each of the statements contained in this Section 3 is true and complete as of the date of this Agreement, and that each of such statements shall be true and complete on and as of the date of the Closing, with the same effect as if made on and as of the date of the Closing.

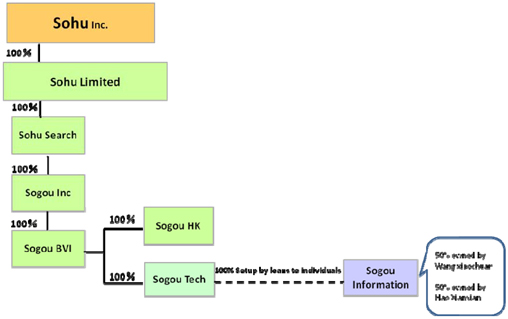

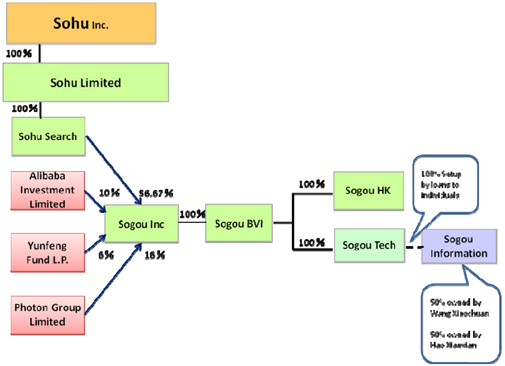

3.1 Organization, Good Standing and Qualification. The Company is duly organized, validly existing and in good standing under, and by virtue of, the Laws of the Cayman Islands.Sogou BVI is duly organized, validly existing and in good standing under, and by virtue of, the Laws of the British Virgin Islands and wholly-owned by the Company. Sogou HK is duly organized, validly existing and in good standing under, and by virtue of, the Laws of Hong Kong S.A.R and wholly-owned by Sogou BVI. The PRC Subsidiary is a wholly foreign-owned enterprise of Sogou BVI duly organized, validly existing and in good standing under, and by virtue of, the Laws of the PRC. Sogou Information is duly organized, validly existing and in good standing under, and by virtue of, the Laws of the PRC. Xxxx.xxx Inc. is a corporation duly organized, validly existing and in good standing under, and by virtue of, the Laws of the State of Delaware. Each of the Group Companies and Sohu has all requisite corporate power and authority to carry on its business as presently conducted and as proposed to be conducted and is duly qualified to transact business and is in good standing in each other jurisdiction in which the failure to so qualify would have a Material Adverse Effect.

9

3.2 Corporate Structure; Subsidiaries. Section 3.2 of the Disclosure Schedule sets forth a complete structure chart showing the Group Companies, and indicating the ownership and Control relationships among all Group Companies (i) as of the Closing and (ii) upon the completion of the Restructuring. Except as set forth on Section 3.2 of the Disclosure Schedule, no Group Company owns or Controls, or has ever owned or Controlled, directly or indirectly, any interest or share in any other Person or is or was a participant in any joint venture, partnership or similar arrangement. No Group Company is obligated to make any investment in or capital contribution in or on behalf of any other Person.

3.3 Capitalization

(a) The capitalization of each Group Company as described on Schedule 3.3 hereto is true and accurate.

(b) No Other Securities. Except as set forth in this Section 3.3, and except for (i) the conversion privileges of the Preferred Shares, (ii) certain rights provided in the Investors’ Rights Agreement and the Right of First Refusal & Co-Sale Agreement and (iii) awards issued or issuable under the Share Incentive Plan, there are no and at the Closing there shall not be any authorized or outstanding Equity Securities of any Group Company. No Group Company is a party or subject to any agreement that affects or relates to the voting or giving of written consents with respect to, or the right to cause the registration, redemption, or repurchase of, any Equity Security of such Group Company.

(c) Issuance and Status. All presently outstanding Equity Securities of each Group Company were duly and validly issued (or subscribed for) in compliance with all applicable Laws, preemptive rights of any Person, and applicable Contracts and are fully paid and non-assessable. All share capital of each Group Company is and as of the Closing shall be free of any and all Liens (except for any restrictions on transfer under the Transaction Documents). There are no (i) resolutions pending to increase the share capital of any Group Company or cause the liquidation, winding up, or dissolution of any Group Company or (ii) dividends which have accrued or been declared but are unpaid by any Group Company.

(d) Vesting. No Group Company’s Contracts relating to its Equity Securities provides for acceleration of vesting (or lapse of a repurchase right) or other changes in the vesting provisions or other terms of such agreement or understanding upon the occurrence of any event or combination of events. No Group Company has ever adjusted or amended the exercise price of any share options previously awarded, whether through amendment, cancellation, replacement grant, repricing, or any other means.

10

3.4 Authorization. Each Warrantor has all requisite power and authority to execute and deliver the Transaction Documents to which it is a party and to carry out and perform its obligations thereunder. All corporate action on the part of each Warrantor and their respective officers, directors and shareholders necessary for the authorization, execution and delivery of the Transaction Documents to which each is a party, the performance of all obligations of each Warrantor hereunder and thereunder, and the consummation of the transactions contemplated herein and therein (in the case of the Company, the authorization, issuance (or reservation for issuance), sale and delivery of the Preferred Shares) has been taken or will be taken prior to the Closing. This Agreement has been duly executed and delivered by each Warrantor. This Agreement constitutes, and when executed and delivered by the parties thereto the other Transaction Documents will constitute, valid and legally binding obligations of each Warrantor that is a party thereto, enforceable against such Warrantor in accordance with their respective terms, except (i) as limited by applicable bankruptcy, insolvency, reorganization, moratorium, and other Laws of general application affecting enforcement of creditors’ rights generally, and (ii) as limited by Laws relating to the availability of specific performance, injunctive relief, or other equitable remedies, and (iii) to the extent the indemnification provisions contained in the Investors’ Rights Agreement may be limited by applicable securities laws.

3.5 Valid Issuance of Series A Preferred Shares and Conversion Shares. The Preferred Shares being purchased by the Purchasers hereunder, when issued, sold and delivered in accordance with the terms of this Agreement for the consideration expressed herein, will be duly and validly issued, fully paid, and nonassessable, and will be free from any Liens (other than restrictions on transfer under the Transaction Documents and under applicable securities Laws). The Conversion Shares have been duly and validly reserved for issuance and, upon issuance in accordance with the terms of the Amended Memorandum and Articles, will be duly and validly issued, fully paid, and nonassessable and will be free from any Liens (other than restrictions on transfer under the Transaction Documents and under applicable securities Laws).

3.6 Governmental Approvals. No Government Approval on the part of any Group Company or Sohu is required on or prior to the Closing in connection with its valid execution, delivery, or performance of the transactions contemplated by this Agreement or the other Transaction Documents or the offer, sale, issuance or reservation for issuance of any Securities.

3.7 Offering. Subject in part to the truth and accuracy of the Purchasers’ representations set forth in Section 4 of this Agreement, the offer and sale of the Preferred Shares as contemplated by the Transaction Documents are exempt from the qualification, registration and prospectus delivery requirements of the Securities Act and any applicable securities Laws.

11

3.8 Certain Regulatory Matters.

(a) The Group Companies have obtained any and all Government Approvals required to be obtained on or prior to the Closing and have fulfilled any and all filings and registration requirements with applicable Governmental Authorities necessary in respect the Group Companies and their operations. All such filings and registrations with applicable Governmental Authorities required in respect of the Group Companies, including but not limited to the registrations with the Ministry of Commerce (or any predecessors), the State Administration of Industry and Commerce, SAFE, the Ministry of Industry and Information Technology, the Ministry of Culture, the General Administration for Press and Publication, the State Administration for Radio, Film and Television, tax bureau, customs authorities and the local counterparts of each of such Governmental Authorities, as applicable, have been duly completed in accordance with applicable Law. No Group Company has received any letter or notice from any applicable Governmental Authorities notifying it of the revocation of any Government Approval issued to it or the need for compliance or remedial actions in respect of the activities carried out directly or indirectly by any Group Company. Each Group Company has been conducting its business activities within the permitted scope of business or is otherwise operating its businesses in full compliance with all relevant Laws and Governmental Orders. No Group Company has reason to believe that any authorization of any Governmental Authority, license or permit requisite for the conduct of any part of its business which is subject to periodic renewal will not be granted or renewed by the relevant Governmental Authorities.

(b) Except as set forth in Section 3.8(b) of the Disclosure Schedule, each of the PRC Subsidiary and Sogou Information upon its formation has obtained any certificates, approvals, permits, licenses, registration receipts and any similar authority necessary under PRC Laws to conduct foreign exchange transactions (collectively, the “Foreign Exchange Authorization”) as now being conducted by it, the lack of which could cause a Material Adverse Effect, and believes it can obtain, without undue burden or expense, any such Foreign Exchange Authorization for the conduct of foreign exchange transactions as planned to be conducted. All existing Foreign Exchange Authorization held by the PRC Subsidiary and Sogou Information upon its formation are valid, and the PRC Subsidiary and Sogou Information upon its formation is not in default in any material respect under any of such Foreign Exchange Authorization.

3.9 Tax Matters

(a) Each Group Company (i) has timely filed all Tax Returns that are required to have been filed by it with any Governmental Authority, (ii) has timely paid all Taxes owed by it which are due and payable (whether or not shown on any Tax Return) and withheld and remitted to the appropriate Governmental Authority all Taxes which it is obligated to withhold and remit from amounts owing to any employee, creditor, customer or third party, and (iii) has not waived any statute of limitations with respect to Taxes or agreed to any extension of time with respect to a Tax assessment or deficiency other than, in the case of clauses (i) and (ii), unpaid Taxes that are in contest with Tax authorities by such Group Company in good faith or nonmaterial in amount.

(b) Each Tax Return referred to in paragraph (a) above was properly prepared in compliance with applicable Law and was (and will be) true, correct and complete in all material respects. None of such Tax Returns contains a statement that is false or misleading or omits any matter that is required to be included or without which the statement would be false or misleading. No reporting position was taken on any such Tax Return which has not been disclosed to the appropriate Tax authority or in such Tax Return, as may be required by Law. All records relating to such Tax Returns or to the preparation thereof required by applicable Law to be maintained by applicable Group Company have been duly maintained. No written claim has been made by a Government Authority in a jurisdiction where the Group does not file Tax Returns that any Group Company is or may be subject to taxation by that jurisdiction.

12

(c) The assessment of any additional Taxes with respect to the applicable Group Company for periods for which Tax Returns have been filed is not expected to exceed the recorded Liability therefor in the most recent balance sheet in the Financial Statements (as defined below), and there are unresolved questions or claims concerning any Tax Liability of any Group Company. Since the Statement Date (as defined below), no Group Company has incurred any liability for Taxes outside the ordinary course of business or otherwise inconsistent with past custom and practice. There is no pending dispute with, or notice from, any Tax authority relating to any of the Tax Returns filed by any Group Company, and to the Knowledge of the applicable Group Company and each of the Warrantors, there is no proposed Liability for a deficiency in any Tax to be imposed upon the properties or assets of any Group Company.

(d) No Group Company has been the subject of any examination or investigation by any Tax authority relating to the conduct of its business or the payment or withholding of Taxes that has not been resolved or is currently the subject of any examination or investigation by any Tax authority relating to the conduct of its business or the payment or withholding of Taxes. No Group Company is responsible for the Taxes of any other Person by reason of contract, successor liability or otherwise.

(e) No Group Company is or has ever been a PFIC. No Group Company anticipates that it will become a PFIC for the current taxable year or any future taxable year.

3.10 Charter Documents; Books and Records. The Charter Documents of each Group Company are in the form provided to the Purchasers. Each Group Company maintains its books of accounts and records in the usual, regular and ordinary manner, on a basis consistent with prior practice, and which permits its Financial Statements (as defined below) to be prepared in accordance with US GAAP.

3.11 Financial Statements. Section 3.11 of the Disclosure Schedule sets forth, and the Company has delivered to each of the Purchasers, the unaudited management accounts for the Group Companies for the twelve-month period ended December 31, 2008, the audited consolidated financial statements (balance sheet and income and cash flow statements) of the Group as of and for the twelve-month period ended December 31, 2009 and the unaudited consolidated financial statements (balance sheet and income and cash flow statements) of the Group reviewed by the Company’s auditor as of and for the six (6)-month period ended June 30, 2010 (the “Statement Date”) (collectively, the financial statements referred to above, the “Financial Statements”). The Financial Statements (i) have been prepared in accordance with the books and records of Group and in accordance with US GAAP (except that the unaudited Financial Statements may not contain all footnotes required by US GAAP), and (ii) fairly present, in all material respects, the financial condition and position of the Group as of the dates indicated therein and the results of operations and cash flows of the Group for the periods indicated therein subject in the case of the unaudited Financial Statements to normal year-end audit adjustments. No Group Company is owed any accounts receivables.

13

3.12 Changes. Since the Statement Date, the Group has operated its business in the ordinary course consistent with its past practice, there has not been any Material Adverse Effect or any material change in the way the Group conducts its business, no Group Company has entered into any transaction outside of the ordinary course of business consistent with its past practice, and there has not been by or with respect to any Group Company:

(a) any purchase, acquisition, sale, lease, disposal of or other transfer of any assets that are individually or in the aggregate material to its business, whether tangible or intangible, other than the purchase or sale of inventory in the ordinary course of business consistent with its past practice, and no acquisition (by merger, consolidation or other combination, or acquisition of stock or assets, or otherwise) of any business or other Person or division thereof;

(b) any waiver, termination, settlement or compromise of a valuable right or of a debt;

(c) any incurrence, creation, assumption, repayment, satisfaction, or discharge of (i) any material Lien (other than Permitted Liens) or (ii) any indebtedness or guarantee, or the making of any loan or advance (other than reasonable and normal advances to employees for bona fide expenses that are incurred in the ordinary course of business consistent with its past practice), or the making of any material investment or capital contribution (which shall include, without limitation, any investment or capital contribution in an amount exceeding (in any single or series of related transactions) US$500,000);

(d) any amendment to any Material Contract, any entering of any new Material Contract, or any termination of any Contract that would have been a Material Contract if in effect on the date hereof, or any amendment to any Charter Document, or any indication of any intention to amend, enter into or terminate any Material Contract, or any amendment to or waiver under any Charter Document;

(e) any employment, termination of employment, or material change in any compensation arrangement or agreement with any Key Employee of any Group Company (which shall include, without limitation, any change by more than ten percent (10%) of the aggregate annual compensation due to any Key Employee);

(f) any declaration, setting aside or payment or other distribution in respect of any Equity Securities, or any direct or indirect redemption, purchase or other acquisition of any Equity Securities;

(g) any material damage, destruction or loss, whether or not covered by insurance, adversely affecting the assets, properties, financial condition, operation or business of any Group Company (which shall include, without limitation, any damage, destruction or loss in an aggregate amount exceeding US$500,000);

(h) any material change in accounting methods or practices or any revaluation of any of its assets;

14

(i) except in the ordinary course of business consistent with its past practice, entry into any closing agreement in respect of material Taxes, settlement of any claim or assessment in respect of any material Taxes, or consent to any extension or waiver of the limitation period applicable to any claim or assessment in respect of any material Taxes, entry or change of any material Tax election, change of any method of accounting resulting in a material amount of additional Tax or filing of any material amended Tax Return;

(j) any commencement or settlement of any material Action; or

(k) any agreement or commitment to do any of the things described in this Section 3.12.

3.13 Actions and Governmental Orders. There is no Action pending or currently threatened against any Group Company or Sohu or, to the Knowledge of any Warrantor, any of the officers, directors or employees of any Group Company with respect to the businesses or proposed business activities of any Group Company, nor is any Warrantor aware of any basis for any of the foregoing, including with respect to any Action involving the prior employment of any of the employees of any Group Company, their use in connection with such Group Company’s business of any information or techniques allegedly proprietary to any of their former employers or their obligations under any agreements with prior employers. There is no Governmental Order in effect and binding on any Group Company or their respective assets or properties. There is no Action by any Group Company pending or which such Person intends to initiate against any third party. No Government Authority has at any time materially challenged or questioned in writing the legal right of any Group Company to conduct its business as presently being conducted or proposed to be conducted. No Group Company has received any opinion or memorandum or advice from legal counsel to the effect that it is exposed, from a legal standpoint, to any liability or disadvantage which may be material to its business.

3.14 Liabilities. No Group Company has any Liabilities except for (i) liabilities set forth in the Financial Statements that have not been satisfied since the Statement Date, and (ii) current liabilities incurred since the date of the most recent management accounts following the Statement Date in the ordinary course of the Group’s business consistent with its past practices that do not exceed US$500,000 in the aggregate.

3.15 Commitments.

(a) Section 3.15(a) of the Disclosure Schedule contains a complete and accurate list of each Contract to which a Group Company is bound that

(i) involves obligations (contingent or otherwise) of, or payments in excess of, US$500,000 individually or in the aggregate per annum or that has terms in excess of one (1) year,

(ii) restricts the ability of a Group Company to compete or to conduct or engage in any business or activity or in any territory,

(iii) relates to the sale, issuance, grant, exercise, award, purchase, repurchase or redemption of any Equity Securities,

15

(iv) involves any provisions providing exclusivity, “change in control”, “most favored nations”, rights of first refusal or first negotiation or similar rights, or grants a power of attorney, agency or similar authority,

(v) on which the business of any Group Company is substantially dependent or which is otherwise material to the business of any Group Company,

(vi) involves indebtedness, an extension of credit, a guaranty or assumption of any obligation, or the grant of a Lien in excess of US$500,000,

(vii) involves the lease, license, sale, use, disposition or acquisition of a material amount of assets or of a business,

(viii) involves the waiver, compromise, or settlement of any material dispute, claim, litigation or arbitration,

(ix) involves the ownership or lease of, title to, use of, or any leasehold or other interest in, any real or personal property (except for personal property leases involving payments of less than US$100,000 per annum),

(x) involves the establishment, contribution to, or operation of a partnership, joint venture, franchise or involving a sharing of profits or losses, or any investment in, loan to or acquisition or sale of the securities, equity interests or assets of any Person,

(xi) is with any Person listed in Section 3.22(a) of the Disclosure Schedule,

(xii) is entered into pursuant to the Restructuring described in Schedule 5.16 attached hereto,

(xiii) is with a Governmental Authority or state owned enterprise (except for any agreement or series of related agreements involving payments of less than US$100,000), or

(xiv) is otherwise material to any Group Company (collectively, the “Material Contracts”).

(b) A true, fully-executed copy of each Material Contract has been made available to the Purchasers. No Group Company is subject to any non-written Material Contracts. Each Material Contract is a valid and binding agreement of the Group Company that is a party thereto, the performance of which does not and will not violate any applicable Law or Governmental Order, and is in full force and effect, and such Group Company has duly performed all of its obligations under each Material Contract to the extent that such obligations to perform have accrued, and no breach or default, alleged breach or alleged default, or event which would (with the passage of time, notice or both) constitute a breach or default thereunder by such Group Company or, to the Knowledge of the Warrantors, any other party or obligor with respect thereto, has occurred, or as a result of the execution, delivery, and performance of the Transaction Documents will occur. No Group Company has given notice (whether or not written) that it intends to terminate a Material Contract or that any other party thereto has breached, violated or defaulted under any Material Contract. No Group Company has received any notice (whether written or not) that it has breached, violated or defaulted under any Material Contract or that any other party thereto intends to terminate such Material Contract.

16

3.16 Compliance with Laws and Governmental Orders.

(a) Except as set forth in Section 3.16 of the Disclosure Schedule, each Group Company has been and is in compliance with all Laws and all Governmental Orders that are applicable to it or to the conduct or operation of its business or the ownership or use of any of its assets or properties.

(b) No event has occurred and no circumstance exists that (with or without notice or lapse of time) (i) may constitute or result in a material violation by any Group Company of, or a material failure on the part of such Group Company to comply with, any Law or Governmental Order or (ii) may give rise to any obligation on the part of a Group Company to undertake, or to bear all or any portion of the cost of, any remedial action of any nature.

(c) No Group Company has received any notice from any Governmental Authority regarding (i) any actual, alleged, possible or potential violation of, or failure to comply with, any Law or Governmental Order or (ii) any actual, alleged, possible or potential obligation on the part of such Group Company to undertake, or to bear all or any portion of the cost of, any remedial action of any nature. To the Knowledge of the Warrantors, no Group Company is under investigation with respect to a violation of any Law or Governmental Order.

(d) Each Group Company and each of its directors, officers, employees, agents and other persons authorized to act on its behalf (collectively, “Representatives”), are in compliance with and have complied with all applicable anti-bribery, anti-corruption, anti-money laundering, recordkeeping and internal controls Laws (collectively, the “Compliance Laws”). Without limiting the foregoing, neither any Group Company, nor any Representative has, directly or indirectly, offered, authorized, promised, condoned, participated in, or received notice of any allegation of

(i) the making of any gift or payment of anything of value to any Public Official by any Person to obtain any improper advantage, affect or influence any act or decision of any such Public Official, or assist any Group Company in obtaining or retaining business for, or with, or directing business to, any Person,

(ii) the taking of any action by any Person which (1) would violate the Foreign Corrupt Practices Act of the United States of America (“FCPA”), as amended, if taken by an entity subject to the FCPA or (2) could reasonably be expected to constitute a violation of any applicable Compliance Law, or

(iii) the making of any false or fictitious entries in the books or records of any Group Company by any Person.

(e) none of the current or former Representatives of any Group Company (the “Company Officials”) are or were Public Officials. No Company Official has been involved on behalf of a Government Authority in decisions as to whether any Group Company or the Purchasers would be awarded business or that otherwise could benefit any Group Company or the Purchasers, or in the appointment, promotion, or compensation of persons who will make such decisions. No such Company Officials will use their government positions to influence acts or decisions of a government for the benefit of any Group Company or the Purchasers.

17

(f) No Group Company or Representative is a Prohibited Person, and no Prohibited Person will be given an offer to become an employee, officer, consultant or director of any Group Company. No Group Company has conducted or agreed to conduct any business, or entered into or agreed to enter into any transaction with a Prohibited Person.

(g) The business of each Group Company as now conducted and proposed to be conducted (including any business proposed to be conducted by entities that are not currently existing as of the Closing) are in compliance with all Laws and regulations that may be applicable, including without limitation all Laws of the PRC with respect to mergers, acquisitions, foreign investment and foreign exchange transactions.

3.17 Title; Properties; Permits.

(a) Title. The Group Companies have good and valid title to, or a valid leasehold interest in, all of their assets, whether real, personal or mixed, purported to be owned by them (including but not limited to all such assets reflected in the Financial Statements), free and clear of any Liens, other than Permitted Liens. The foregoing assets collectively represent in all material respects all assets, rights and properties necessary for the conduct of the business of the Group in the manner conducted during the periods covered by the Financial Statements. Except for leased items, no Person other than a Group Company owns any interest in any such assets. All leases of real or personal property to which a Group Company is a party are fully effective and afford the Group Company valid leasehold possession of the real or personal property that is the subject of the lease.

(b) Real Property. No Group Company owns any real property or has any easements, licenses, rights of way, or other interests in or to real property, except for the leasehold interests to real property listed on Section 3.17(b) of the Disclosure Schedule (“Real Property”). All such leasehold properties are held under valid, binding and enforceable leases of a Group Company. To the Knowledge of the Warrantors, all structures, improvements and appurtenances on the Real Property lie wholly within the boundaries of such Real Property and do not encroach upon the property of, or otherwise conflict with the property rights of, any adjoining property owner. To the Knowledge of the Warrantors, all structures and improvements on the Real Properties, and appurtenances thereto, and the roof, walls and other structural components which are part thereof, and the heating, air conditioning, plumbing and other mechanical facilities thereof, are in good condition and repair in all material respects (reasonable wear and tear excepted) and without structural defects. Except as set forth on Section 3.17(b) of the Disclosure Schedule, there are no real properties shared with any other Person which is not a Group Company, which are used in connection with the business of the Group.

(c) Personal Property. Section 3.17(c) of the Disclosure Schedule sets forth a complete and accurate list of all personal property owned or leased by a Group Company with an individual book or fair market value of US$20,000 or greater. All machinery, vehicles, equipment and other tangible personal property owned or leased by a Group Company are (i) in good condition and repair in all material respects (reasonable wear and tear excepted) and (ii) not obsolete or in need in any material respect of renewal or replacement, except for renewal or replacement in the ordinary course of business.

18

(d) Permits. Except as set forth in Section 3.17(d)(A) of the Disclosure Schedule, each Group Company has all material authorizations, approvals, permits, certificates and licenses, including without limitation any special approval or permits required under the Laws of the PRC (“Permits”) necessary for its respective business and operations as now conducted or planned to be conducted. Section 3.17(d)(B) of the Disclosure Schedule is a complete list of such Permits, together with the name of the entity issuing each such Permit. Except as specifically noted thereon, (i) each such Permit is valid and in full force and effect, (ii) no Group Company is in default or violation of any such Permit, (iii) no Group Company has received any written notice from any Governmental Authority regarding any actual or possible default or violation of any such Permit, (iv) each such Permit will remain in full force and effect upon the consummation of the transactions contemplated hereby for not less than one (1) year after the Closing, and (v) to the Knowledge of the Warrantors, no suspension, cancellation or termination of any such Permits is threatened or imminent.

3.18 Related Party Transactions. Except otherwise disclosed in Section 3.18 of the Disclosure Schedule, no officer, director or employee of any Group Company or any “affiliate” or “associate” (as those terms are defined in Rule 405 promulgated under the Securities Act) of any of them (each of the foregoing, a “Related Party”), has any Contract with any Group Company (each, a “Related Party Contract”) nor is there currently any proposed Related Party Contract. Each Related Party Contract is on terms and conditions as favorable to the applicable Group Company as would have been obtainable by it at the time in a comparable arm’s-length transaction with an unrelated party. Except otherwise disclosed in the Disclosure Schedule, no Related Party has any direct or indirect ownership interest in any Person (other than a Group Company) with which a Group Company is affiliated or with which a Group Company has a business relationship, or any Person (other than a Group Company) that competes with any Group Company (except that a Related Party may have a passive investment of less than 3% of the stock of any publicly traded company that engages in the foregoing). No Related Party has any interest, either directly or indirectly, in (i) any Person which purchases from or sells, licenses or furnishes to a Group Company any goods, property, intellectual or other property rights or services or (ii) any Contract to which a Group Company is a party or by which it may be bound or affected. None of the Group Companies is indebted, directly or indirectly, to any Related Party, in any amount whatsoever other than in connection with expenses or advances of expenses incurred in the ordinary course of business or relocation expenses of employees of such Group Company.

3.19 Intellectual Property.

(a) Each Group Company owns or otherwise has the sufficient right or license to use all Intellectual Property necessary for its business as currently conducted and presently planned to be conducted without any violation or infringement of the rights of others, free and clear of all Liens other than Permitted Liens. Section 3.19(a)A of the Disclosure Schedule contains a complete and accurate list of all material Intellectual Property owned, licensed to or used by each Group Company, whether registered or not, and a complete and accurate list of all licenses granted by any Group Company to any third party with respect to any Intellectual Property. Except as set forth in Section 3.19(a)B of the Disclosure Schedule, there is no pending or, to the Knowledge of any Warrantor, threatened, claim or litigation against any Group Company, contesting the right to use its Intellectual Property, asserting the misuse thereof, or asserting the infringement or other violation of any Intellectual Property of any third party. All material inventions and material know-how conceived by all employees of the Group and related to the businesses of the Group are “works made for hire”, and all right, title, and interest therein, including any applications therefore, have been transferred and assigned to, and are currently owned by, the Group.

19

(b) Neither Sohu nor any of its Affiliates owns any Intellectual Property that are necessary for the business as currently conducted and presently planned to be conducted by any Group Company.

(c) No proceedings or claims in which any Group Company alleges that any Person is infringing upon, or otherwise violating, any Group Company’s Intellectual Property rights are pending, and none has been served, instituted or asserted by any Group Company.

(d) To the Knowledge of the Warrantors, none of the Key Employees of any Group Company is obligated under any Contract, or subject to any judgment, decree or order of any court or administrative agency, that would interfere with the use of his or her best efforts to promote the interests of such Group Company or that would conflict with the business of such Group Company as presently conducted. It will not be necessary to utilize in the course of any Group Company’s business operations any inventions of any of the respective employees of any Group Company made prior to their employment by such Group Company, except for inventions that have been validly and properly assigned or licensed to the Group Company as of the date hereof.

(e) Each Group Company has taken all security measures that in the judgment of such Group Company are commercially prudent in order to protect the secrecy, confidentiality and value of their respective Intellectual Property.

3.20 Compliance with Other Instruments. No Group Company is in violation or default of any provision of its Charter Documents, or of any instrument, judgment, order, writ, decree or contract to which it is a party or by which it is bound, or, to its Knowledge, of any provision of any foreign or local statute, rule or regulation applicable to such Group Company, except such violations or defaults as are not reasonably expected to have a material adverse effect on its business or properties. The execution, delivery and performance by each Group Company and Sohu of and compliance by each with each of the Transaction Documents, and the consummation of the transactions contemplated hereby and thereby, will not result in (i) any such violation or default or be in conflict with or constitute, with or without the passage of time or the giving of notice or both, a default under (1) the Charter Documents of any Group Company, (2) any Material Contract, or (3) any applicable Law, (ii) the creation or imposition of any material Lien upon, or with respect to, any of the properties, assets or rights of any Group Company, or (iii) any termination, modification, cancellation, or suspension of any material right of, or any augmentation or acceleration of any material obligation of, any Group Company.

20

3.21 Insurance. Each Group Company has in full force and effect insurance coverage of such types and at the coverage levels as are prudent and customary for similarly situated companies. Section 3.21 of the Disclosure Schedule sets forth the material insurance policies and bonds maintained by each Group Company as well as the name of the insurer under each such policy and bond, the type of policy or bond, the coverage amount, any applicable deductible, and all material claims made under thereunder in the past three (3) years. There is no material claim pending thereunder as to which coverage has been questioned, denied or disputed. All premiums due and payable under all such policies and bonds have been timely paid, and each Group Company is otherwise in compliance in all material respects with the terms of such policies and bonds.

3.22 Employee Matters.

(a) Employees. Section 3.22(a) of the Disclosure Schedule enumerates each Key Employee of each Group Company as of the Closing. The title and compensation of each such Key Employee is as set forth in the schedule provided by the Company to the Investors (Xxxxx Xxx of Alibaba) in August 2010. Each such individual is currently devoting all of his or her business time to the conduct of the business of the Group. No such individual (and no group of employees) has given any notice of an intent to resign, and no Group Company has any intention of terminating the employment of any such individual or any group of employees. To the Knowledge of the Warrantors, no Key Employee of any Group Company is obligated under, or in material violation of any term of, any Contract or any Governmental Order relating to the right of any such individual to be employed by, or to contract with, such Group Company. No Group Company has received any notice alleging that any such violation has occurred. No Group Company is a party to any collective bargaining agreements or other Contract with any union or guild, and there are no labor unions, works council or other organizations representing any employee of any Group Company. No employee of the Group Companies is owed any back wages or other compensation for services.

(b) Actions; Compliance. There is no, and there has not been in the last three (3) years, any material Action relating to the violation or alleged violation of any Law by any Group Company pertaining to labor relations or employment matters, including any charge or complaint filed by an employee with any Governmental Authority or any Group Company. Each Group Company has complied in all material respects with all Laws relating to employment, wages, hours, overtime, working conditions, benefits, retirement, termination, Taxes, and health and safety. Each Group Company is in compliance with each Law relating to its provision of any form of social insurance (“Social Insurance”), and has paid, or made provision for the payment of, all Social Insurance contributions required under applicable Law. There has not been, and there is not now pending or, to the Knowledge of the Warrantors, threatened, any strike, union organization activity, lockout, slowdown, picketing, or work stoppage with respect to the employees of any Group Company or any unfair labor practice charge against any Group Company. There is no pending internal investigation related to any employee or consultant of any Group Company. Each of the employees of each Group Company is subject to a written employment agreement with such Group Company in full compliance with applicable Law, and each of the consultants of each Group Company is subject to an agreement to the extent required by applicable Law and in full compliance with applicable Law.

21

3.23 No Brokers. No Group Company or Sohu has any Contract with any broker, finder or similar agent with respect to the transactions contemplated by this Agreement or by any of the Transaction Documents, and none of them has incurred any Liability for any brokerage fees, agents’ fees, commissions or finders’ fees in connection with any of the Transaction Documents or the consummation of the transactions contemplated therein.

3.24 Disclosure. The Company and Sohu have provided the Purchasers with all the information regarding the Group Companies that is reasonably sufficient for deciding whether to purchase the Preferred Shares, including certain projections describing its proposed business plan, which was prepared in good faith. No representation or warranty of the Warrantors contained in this Agreement or any certificate furnished or to be furnished to the Purchasers at the Closing under this Agreement, when taken as a whole, contains any untrue statement of a material fact or omits to state a material fact necessary in order to make the statements contained herein or therein not misleading in light of the circumstances under which they were made. To the Knowledge of the Warrantors, there is no fact that the Warrantors have not disclosed to the Purchasers and that has had or would reasonably be expected to have an adverse effect upon the financial condition, operating results, assets, customer or supplier relations, employee relations or business prospects of any Group Company.

4. Representations and Warranties of the Purchasers. Each Purchaser, severally and not jointly, hereby represents and warrants to the Company that:

4.1 Authorization. Such Purchaser has full power and authority to enter into this Agreement and the Transaction Documents to which it is a party, and the Agreement constitutes, and when executed and delivered by the parties thereto each such Transaction Document will constitute, its valid and legally binding obligation, enforceable in accordance with its terms except (i) as limited by applicable bankruptcy, insolvency, reorganization, moratorium, and other laws of general application affecting enforcement of creditors’ rights generally, (ii) as limited by laws relating to the availability of specific performance, injunctive relief, or other equitable remedies, and (iii) to the extent the indemnification provisions contained in the Investors’ Rights Agreement may be limited by applicable securities Laws.

4.2 Purchase Entirely for Own Account. The Securities purchased hereunder will be acquired for investment for such Purchaser’s own account or the account of one or more of such Purchaser’s Affiliates, not as a nominee or agent, and not with a view to the distribution of any part thereof, and that such Purchaser has no present intention of selling, granting any participation in, or otherwise distributing the same.

4.3 Disclosure of Information. Purchaser has had an opportunity to ask questions and receive answers from the Company regarding the terms and conditions of the offering of the Preferred Shares and the business, properties and financial condition of the Group. Notwithstanding the foregoing, each Party acknowledges and agrees that the foregoing shall not in any way limit, reduce or affect the representations and warranties provided by the Warrantors in this Agreement or the right of the Purchasers to rely thereon.

22

4.4 Accredited Investor. Such Purchaser is an “accredited investor” within the meaning of Rule 501 of Regulation D, as presently in effect, under the Securities Act.

5. Conditions of Purchasers’ Obligations at Closing. The obligations of each Purchaser under Section 2.1 of this Agreement, unless otherwise waived in writing by all the Purchasers, are subject to the fulfillment on or before the Closing of each of the following conditions:

5.1 Representations and Warranties. Each of the representations and warranties of the Warrantors contained in Section 3 hereto shall be true and complete when made and shall be true and complete on and as of the Closing with the same effect as though such representations and warranties had been made on and as of the date of such Closing, except in either case for those representations and warranties that address matters only as of a particular date, which representations will have been true and complete as of such particular date.

5.2 Performance. Each Group Company and Sohu shall have performed and complied in all material respects with all agreements, obligations and conditions contained in the Transaction Documents that are required to be performed or complied with by it on or before the Closing.

5.3 Proceedings and Documents. All corporate, legal and other proceedings in connection with the transactions contemplated by this Agreement and the other Transaction Documents required to be taken by each Group Company and Sohu on or prior to the Closing shall have been completed in form and substance reasonably satisfactory to the Purchasers, and the Purchasers shall have received all such counterpart original and certified or other copies of such documents as it may have reasonably requested in connection with such proceedings.

5.4 Government Approvals and Consents. This Agreement and the other Transaction Documents, and the transactions contemplated hereby and thereby, shall not be prohibited by any Laws. All Government Approvals of any Governmental Authority or of any other third Person that are required to be obtained by any Group Company or Sohu on or prior to the Closing in connection with the consummation of the transactions contemplated by the Transaction Documents (including but not limited to those related to the lawful issuance and sale of the Preferred Shares and all waivers for any rights of first refusal, preemptive rights, put or call rights, or other rights triggered by Transaction Documents) shall have been duly obtained and effective as of the Closing.

5.5 Amended Memorandum and Articles. The Amended and Restated Memorandum and Articles of Association of the Company in the form attached hereto as Exhibit A (the “Amended Memorandum and Articles”) shall have been duly adopted by all necessary actions of the Board of Directors and/or the members of the Company and shall have been duly filed with the appropriate authority(ies) of the Cayman Islands, and such adoption shall have become effective prior to the Closing with no alternation or amendment.

5.6 Investors’ Rights Agreement. Each of the parties to the Investors’ Rights Agreement shall have executed and delivered such agreement to the Purchasers.

23

5.7 Right of First Refusal and Co-Sale Agreement. Each of the parties to the Right of First Refusal and Co-Sale Agreement shall have executed and delivered such agreement to the Purchasers.

5.8 Share Incentive Plan. The Company shall have duly adopted and made effective the Share Incentive Plan, in form and substance satisfactory to the Purchasers, to be attached hereto as Exhibit D (the “Share Incentive Plan”), by all necessary corporate action of the Board of Directors and shareholders of the Company.