KRW85,000,000,000 SENIOR FACILITIES AGREEMENT dated October 28, 2013 NET1 APPLIED TECHNOLOGIES KOREA -Borrower- THE BANKS AND FINANCIAL INSTITUTIONS IN SCHEDULE I -Original Lenders- HANA BANK -Facility Agent- HANA BANK -Security Agent- HANA DAETOO...

Exhibit 10.24

EXECUTION COPY

KRW85,000,000,000

dated October 28, 2013

NET1 APPLIED TECHNOLOGIES KOREA

-Borrower-

THE BANKS AND FINANCIAL INSTITUTIONS IN SCHEDULE I

-Original Lenders-

HANA BANK

-Facility Agent-

HANA BANK

-Security Agent-

HANA DAETOO SECURITIES CO., LTD.

-Mandated Lead

Arranger-

CONTENTS

- i -

| SCHEDULES | |

| SCHEDULE 1: | LENDERS AND THEIR COMMITMENTS |

| SCHEDULE 2: | CONDITIONS OF UTILISATION |

| SCHEDULE 3: | UTILISATION REQUEST |

| SCHEDULE 4: | FORM OF TRANSFER CERTIFICATE |

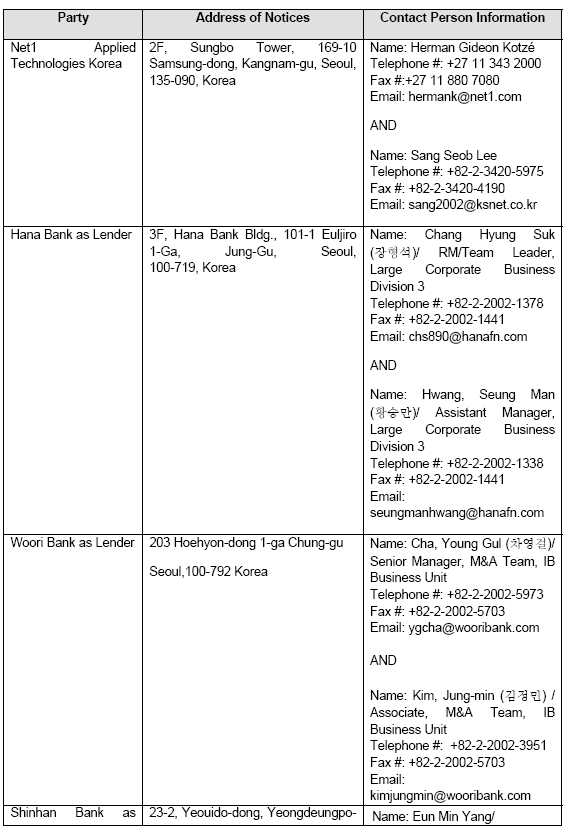

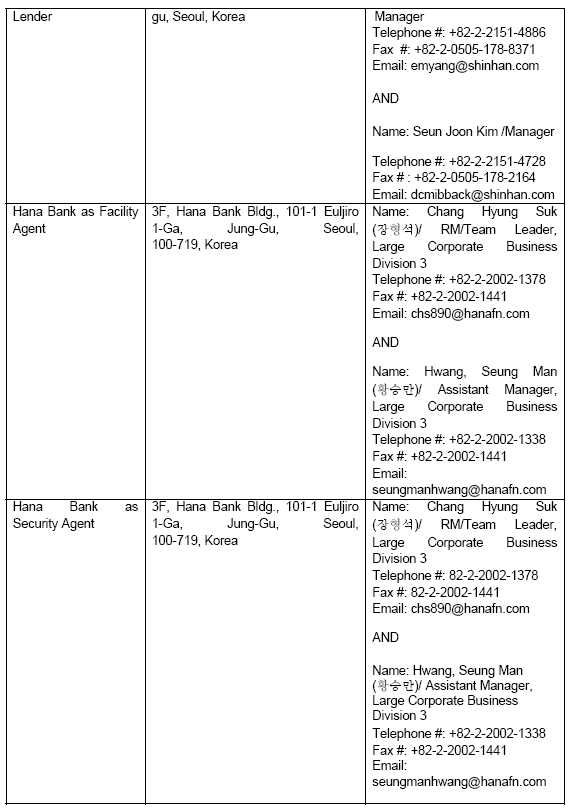

| SCHEDULE 5: | CONTACT DETAILS |

| SCHEDULE 6: | TIMETABLE |

| SCHEDULE 7: | FORM OF COMPLIANCE CERTIFICATE |

STAMP TAX

- iii -

THIS SENIOR FACILITIES AGREEMENT (the “Agreement”) is dated October 28, 2013 and made between:

| (1) |

NET 1 APPLIED TECHNOLOGIES KOREA, a corporation duly incorporated and existing under the laws of the Republic of Korea (“Korea”) with its registered office at 0X, Xxxxxx Xxxxx, 000-00 Xxxxxxx-xxxx, Xxxxxxx-xx, Xxxxx, 135-090, Korea as borrower (the "Borrower"); |

| (2) |

HANA BANK as facility agent of the Finance Parties (other than itself) (the “Facility Agent”); |

| (3) |

HANA BANK as security agent of the Secured Parties (other than itself) (the "Security Agent"); and |

| (4) |

THE BANKS AND FINANCIAL INSTITUTIONS named in Schedule I (Lenders and their Commitments) as lenders (collectively referred to as the “Original Lenders” and individually referred to as an “Original Lender”). |

IT IS AGREED as follows:

| 1. | |

| 1.1 |

Definitions |

|

In this Agreement: | |

|

“Account Kun-Pledge Agreement” means an account kun-pledge agreement to be entered into by the Borrower, the Security Agent and the Secured Parties pursuant to which the Borrower has agreed to create and perfect security interests in favour of the Secured Parties over the Proceeds Accounts. | |

|

"Administrative Party" means each of the Facility Agent and the Security Agent. | |

|

"Affiliate" means, in relation to any person, a Subsidiary of that person or a Holding Company of that person or any other Subsidiary of that Holding Company. | |

|

"Approved Treasury Investments" means: |

| (a) |

securities having maturities of not more than 12 months (from the date of the acquisition of or investment in such securities) issued or directly and fully guaranteed or insured by the government of Korea or any agency or instrumentality thereof (provided that the full faith and credit of the government of Korea is pledged in support thereof); |

| (b) |

time deposits and certificate of deposits of any commercial bank of recognised credit standing having maturities of not more than 12 months (from the date of the making or acquisition of or investment in such deposits or certificates of deposits), which bank has a rating of at least "AAA" by KR and/or KIS; and |

| (c) |

investments in money market funds substantially all the assets of which are comprised of securities of the types described in paragraphs (a) and (b) above, in each case freely tradable without restrictions and denominated and payable in KRW, not subject to any Security. |

| SENIOR FACILITIES AGREEMENT | Page 1 |

|

"Authorisation" means: |

|

| (a) |

an authorisation, consent, approval, resolution, licence, exemption, filing, notarisation, lodgement or registration; or |

| (b) |

in relation to anything which will be fully or partly prohibited or restricted by law if a Governmental Agency intervenes or acts in any way within a specified period after lodgement, filing, registration or notification, the expiry of that period without intervention or action. |

|

"Availability Period" means |

|

| (a) |

in relation to the Tranche A Facility and the Tranche B Facility, the period commencing from the Signing Date and ending on the date falling two (2) Months from the Signing Date; and |

| (b) |

in relation to the Tranche C Facility, the period commencing from the Initial Utilisation Date and ending on the date falling three (3) Months prior to the Final Repayment Date. |

|

"Available Commitment" means, in relation to a Facility, a Lender's Commitment under that Facility minus (subject as set out below);. |

|

| (a) |

the amount of its participations in any outstanding Loans under that Facility; and |

| (b) |

in relation to any proposed Utilisation, the amount of its participation in any Loans that are due to be made on or before the proposed Utilisation Date. |

|

For the purposes of calculating a Lender's Available Commitment in relation to any proposed Utilisation under the Tranche C Facility only, that Lender's participation in any Tranche C Facility Loan that are due to be prepaid on or before the proposed Utilisation Date shall not be deducted from a Lender's Commitment under the Tranche C Facility. |

|

|

"Available Facility" means, in relation to a Facility, the aggregate for the time being of each Lender's Available Commitment in respect of that Facility. |

|

|

“Bankruptcy Law” means: |

|

| (a) |

in relation to any entity incorporated or organised under the laws of Korea, the Debtor Rehabilitation and Bankruptcy Act of Korea; and |

| (b) |

in all other cases, any domestic or foreign law relating to bankruptcy, judicial management, moratorium, insolvency, reorganisation, administration or relief of debtors in effect in any jurisdiction. |

|

“Base Rate” means, with respect to each Interest Determination Date, the final quotation yield rate for a ninety-one (91) day Won-denominated negotiable certificates of deposit as published by the Korea Financial Investment Association established under the Financial Investment Services and Capital Markets Act or its successor. |

|

|

“Borrower Unit Kun-Pledge Agreement” means the unit kun-pledge agreement to be granted by the DutchCo in favor of the Secured Parties over all its units and ownership interests in the Borrower. |

|

|

"Business Day" means a day (other than a Saturday or Sunday) on which banks are open for general business in Seoul, Korea. |

|

|

"Charged Property" means all of the assets of the Borrower or the DutchCo which from time to time are, or are expressed to be, the subject of the Transaction Security. |

| SENIOR FACILITIES AGREEMENT | Page 2 |

|

“Commitment” means the Tranche A Facility Commitment, the Tranche B Facility Commitment and/or the Tranche C Facility Commitment. |

|

|

“Company” means KSNET, INC., a company incorporated and existing in Korea with its registered office at 0X, Xxxxxx Xxxxx, 000-00 Xxxxxxx-xxxx, Xxxxxxx-xx, Xxxxx, 135-090, Korea. |

|

|

“Company Share Kun-Pledge Agreement” means a share kun-pledge agreement to be granted by the Borrower in favour of the Secured Parties in relation to 13,560,157 shares as of the date hereof, representing 99.66% of the total issued and outstanding shares of the Company. |

|

|

"Credit Guarantee Fund Contribution" means an amount of contribution that is required to be made by Korean banks and financial institutions (including, but not limited to, National Agricultural Cooperative Federation and National Federation of Fisheries Cooperatives) and Korean branches of foreign banks and foreign financial institutions (as applicable) under the Credit Guarantee Fund Act of Korea, Technology Credit Guarantee Fund Act of Korea, Local Credit Guarantee Foundation Act of Korea or Agricultural and Fisheries Business Credit Guarantee Act and all regulations, rules, and decrees promulgated thereunder (as amended from time to time). |

|

|

"Default" means an Event of Default or any event or circumstance specified in Clause 21 (Events of Default) which would (with the expiry of a grace period, the giving of notice, the making of any determination under the Finance Documents pursuant to the terms thereof or any combination of any of the foregoing) be an Event of Default. |

|

|

“Distribution” means for any person: |

|

| (a) |

any dividends or other distributions (or interest on any unpaid dividends or other distributions) (whether in cash or in kind) on or in respect of its share capital (or any class of its share capital) paid by any member of the Group; and/or |

| (b) |

any payment paid by any member of the Group in respect of any redemption or reduction of any Equity Interest of any other member of the Group. |

|

“DutchCo” means Net 1 Applied Technologies Netherlands B.V. |

|

|

“Equity Interest” means, in relation to any person: |

|

| (a) |

any shares of any class or capital stock of or equity interest in such person or any depositary receipt in respect of such shares, capital stock or equity interest; |

| (b) |

any security convertible (whether at the option of the holder thereof or otherwise and whether such conversion is conditional or otherwise) into any such shares, capital stock, equity interest or depositary receipt, or any depositary receipt in respect of such shares; and |

| (c) |

any option, warrant or other right to acquire any such shares, capital stock, capital interest, securities or depositary receipts referred to in paragraphs (a) and (b) above. |

|

"Event of Default" means any event or circumstance specified as such in Clause 21 (Events of Default). |

|

|

“Existing Loan” means a loan extended to the Borrower pursuant to the Existing Loan Agreement or the principal amount outstanding for the time being of that loan. |

|

|

“Existing Loan Agreement” means a certain senior facilities agreement dated October 29, 2010 by and among the Borrower as holdco, Hana Daetoo Securities Co., Ltd. as mandated lead arranger, Hana Bank, Shinhan Bank and Woori Bank as lead arrangers, the financial institutions listed in the Schedule therein as lenders, and Hana Bank as agent and security agent. |

| SENIOR FACILITIES AGREEMENT | Page 3 |

|

"Facility" means the Tranche A Facility, the Tranche B Facility and/or the Tranche C Facility. |

|

|

"Facility Office" means the office or offices notified by a Lender to the Facility Agent in writing on or before the date it becomes a Lender (or, following that date, by not less than five (5) Business Days' written notice) as the office or offices through which it will perform its obligations under this Agreement. |

|

|

"Fee Letter" means any letter or letters referring to this Agreement or the Facility between one or more Finance Parties and the Borrower setting out any of the fees referred to in Clause 11 (Fees). |

|

|

"Final Repayment Date" means: |

|

| (a) |

in the case of the Tranche A Facility Loan and the Tranche Facility C Loan, the date falling five (5) years from the Initial Utilisation Date; and |

| (b) |

in the case of the Tranche B Facility Loan, the date falling one (1) year from the Initial Utilisation Date. |

|

"Finance Documents" means this Agreement, the Security Documents, any Fee Letter, any Utilisation Request and any other document designated as such by the Facility Agent and the Borrower. |

|

|

"Finance Party" means the Facility Agent, the Mandated Lead Arranger, the Security Agent or a Lender. |

|

|

"Financial Indebtedness" means, as to any person: |

|

| (a) |

all obligations of such person for borrowed money or with respect to deposits or advances of any kind having the commercial effect of a borrowing (excluding deposits by customers made in the ordinary course of business and on ordinary business terms); |

| (b) |

all obligations of such person evidenced by bonds, debentures, notes or similar instruments (excluding obligations of such person evidenced by notes or similar instruments issued in respect of “accounts payable” in the ordinary course of business); |

| (c) |

all obligations of such person upon which interest charges are customarily paid having the commercial effect of a borrowing; |

| (d) |

all Financial Indebtedness of any other person secured by any Security on any property owned by such first person, whether or not such Financial Indebtedness has been assumed by such person; |

| (e) |

all obligations of such person under conditional sale or other title retention agreements relating to property acquired by such person having the commercial effect of a borrowing (excluding agreements made in the ordinary course of business); |

| (f) |

all obligations of such person in respect of the deferred purchase price of property or services outstanding more than ninety (90) days after its customary date of payment; |

| (g) |

all guarantees by such person with respect to the Financial Indebtedness of other person(s); |

| SENIOR FACILITIES AGREEMENT | Page 4 |

| (h) |

all obligations which are required to be classified and accounted for as finance leases on the balance sheet of such person; |

| (i) |

any counter-indemnity obligation in respect of a guarantee, indemnity, bond, standby or documentary letter of credit or any other instrument issued by a bank or financial institution; |

| (j) |

all obligations, contingent or otherwise, of such person in respect of bankers’ acceptances issued by a bank or financial institution; |

| (k) |

any indebtedness for or in respect of receivables sold or discounted (other than any receivables to the extent they are sold on a non-recourse basis); |

| (l) |

any indebtedness for or in respect of any amount raised under any other transaction (including any forward sale or purchase agreement) having the commercial effect of a borrowing; |

| (m) |

any indebtedness for or in respect of shares or equity interests that are expressed to be redeemable; and |

| (n) |

any indebtedness for or in respect of any derivative transaction entered into in connection with protection against or benefit from fluctuation in any rate or price (and, when calculating the value of any derivative transaction, only the marked to market value shall be taken into account). |

|

“GAAP” means generally accepted accounting principles in Korea or the international financial reporting standards as adopted by and in effect from time to time in Korea, as applicable. |

|

|

"Governmental Agency" means any government or any governmental agency, semi- governmental or judicial entity or authority (including, without limitation, any stock exchange or any self-regulatory organisation established under statute). |

|

|

"Group" means the Borrower and the Company. |

|

|

"Holding Company" means, in relation to a company or corporation, any other company or corporation in respect of which it is a Subsidiary. |

|

|

"Indirect Tax" means any goods and services tax, consumption tax, value added tax or any tax of a similar nature. |

|

|

"Initial Utilisation Date" means the date on which the first Utilisation is made under this Agreement. |

|

|

“Intercompany Loan Agreement” means a certain intercompany loan agreement to be entered into by and between the Borrower and the Company pursuant to which the Borrower shall extend a credit facility to the Company in an aggregate amount not exceeding KRW 10,000,000,000 (the “Intercompany Loan”) for the purpose of meeting the working capital needs of the Company. |

|

|

“Interest Determination Date” means, in relation to any Loan, one (1) Business Day prior to the relevant Utilisation Date. |

|

|

“Interest Payment Date” means, in relation to an Interest Period, the last day of such Interest Period. |

| SENIOR FACILITIES AGREEMENT | Page 5 |

|

"Interest Period" means, in relation to a Loan, each period determined in accordance with Clause 10 (Interest Periods). |

|

|

"KIS" means Korea Investors Service, Inc. |

|

|

“Korea” means the Republic of Korea. |

|

|

"KR" means Korea Ratings. |

|

|

“KRW Proceeds Account” means the KRW account (number 100-910030-40504) opened in the name of the Borrower with the Security Agent and designated as “KRW Proceeds Account”. |

|

|

"Lender" means: |

|

| (a) |

the Original Lender; and |

| (b) |

any person which has become a Lender in accordance with Clause 22 (Changes to the Parties), |

|

which in each case has not ceased to be a Lender in accordance with the terms of this Agreement. |

|

|

"Loan" means the Tranche A Facility Loan, the Tranche B Facility Loan and/or the Tranche C Facility Loan. |

|

|

"Majority Lenders" means at any time: |

|

| (a) |

if any Loan is then outstanding, a Lender or Lenders whose participations in the Loan(s) then outstanding aggregate is equal to or more than 66 2/3% of the Loan(s); or |

| (b) |

if there is no Loan then outstanding, a Lender or Lenders whose Available Commitments aggregate is equal to or more than 66 2/3% of the Available Facility. |

|

"Margin" means, |

|

| (a) |

with respect to the Tranche A Facility Loan, 3.10% per annum; |

| (b) |

with respect to the Tranche B Facility Loan, 2.90% per annum; and |

| (c) |

with respect to the Tranche C Facility Loan, 3.10% per annum; |

|

"Material Adverse Effect" means a material adverse effect or change on: |

|

| (a) |

the business, operations, assets or financial condition of the Borrower; |

| (b) |

the ability of the Borrower to meet its payment obligations under the Finance Documents as they become due and payable; |

| (c) |

the validity, legality or enforceability of the Finance Documents or the rights or remedies of any Finance Party under the Finance Documents; or |

| (d) |

the validity, legality or enforceability of the Security expressed to be created pursuant to the Security Documents. |

|

"Month" means a period starting on one day in a calendar month and ending on the numerically corresponding day in the next calendar month, except that: |

|

| (a) |

subject to paragraph (c) below, if the numerically corresponding day is not a Business Day, that period shall end on the next Business Day in that calendar month in which that period is to end if there is one, or if there is not, on the immediately preceding Business Day; |

| SENIOR FACILITIES AGREEMENT | Page 6 |

| (b) |

if there is no numerically corresponding day in the calendar month in which that period is to end, that period shall end on the last Business Day in that calendar month; and |

|

| (c) |

if an Interest Period begins on the last Business Day of a calendar month, that Interest Period shall end on the last Business Day in the calendar month in which that Interest Period is to end. |

|

|

The above rules will apply only to the last Month of any period. |

||

|

“Operating Accounts” mean the operating accounts (number 000-000000-00000, number 000-000000-00000, number 000-000000-00000 and number 100-910030-11204) opened in the name of the Borrower with the Security Agent and designated as “Operating Account”. |

||

|

"Original Financial Statements" means the audited consolidated financial statements of the Borrower for the financial year ended 31 December 2012. |

||

|

"Party" means a party to this Agreement. |

||

|

"Permitted Administrative Payments" mean expenses, fees and out of pocket costs incurred by the Borrower in connection with the maintenance of its existence or administration, Tax, Indirect Tax, auditing, directors insurance, fees incurred by legal counsel and other fees, costs and expenses and liabilities of the Borrower associated with its activities as a Holding Company, provided that the aggregate amount of such costs, expenses and liabilities (excluding any amount of Taxes, Indirect Tax or any other payments payable by the Borrower pursuant to any applicable law) does not exceed KRW 1,000,000,000 in any financial year (or in case a financial year is less than a 12 month period, the applicable pro-rated amount). |

||

|

“Permitted Disposal” means any sale, transfer or other disposal: |

||

| (a) |

made in the ordinary course of business of the disposing person; |

|

| (b) |

of assets in exchange for other assets comparable or superior as to type, value and quality and for a similar purpose; |

|

| (c) |

of cash: |

|

| (i) |

to the extent permitted under this Agreement (including for the Permitted Administrative Payments); |

|

| (ii) |

any disposal of Approved Treasury Investments at arm's length in exchange for cash or other Approved Treasury Investments; |

|

| (iii) |

any disposal constituting the creation or realization of any Security permitted under paragraph (b) of Clause 20.4 (Negative pledge); or |

|

| (d) |

of assets, interests or rights as permitted by the Facility Agent (acting reasonably). |

|

|

“Permitted Indebtedness” means: |

||

| (a) |

Financial Indebtedness incurred under the Finance Document; |

|

| SENIOR FACILITIES AGREEMENT | Page 7 |

| (b) |

Financial Indebtedness to be repaid or discharged by the Initial Utilisation Date; or |

| (c) |

Financial Indebtedness as permitted by the Facility Agent (acting reasonably). |

|

“Proceeds Accounts” mean collectively, the USD Proceeds Account and the KRW Proceeds Account. |

|

|

“Repayment Instalment” means each instalment for repayment of the Tranche A Facility Loan referred to in Clause 6.1(a) (Repayment of Tranche A Facility Loan). |

|

|

"Repeating Representations" means each of the representations set out in Clause 17 (Representations) other than Clause 17.6 (Deduction of Tax), Clause 17.9 (Information), Clause 17.12 (No proceedings pending or threatened) and Clause 17.22 (Account). |

|

|

"Secured Obligations" means all obligations at any time due, owing or incurred by the Borrower to any Secured Party under the Finance Documents whether present or future, actual or contingent. |

|

|

"Secured Parties" means the Security Agent, the Facility Agent and each Lender from time to time party to this Agreement. |

|

|

"Security" means any mortgage, pledge, hypothecation, assignment by way of security, deposit arrangement, encumbrance, lien (statutory or other), preference, priority or other security agreement of any kind or nature whatsoever, including any conditional sale or other title retention agreement, any contractual right of set-off or any financing lease having substantially the same effect as any of the foregoing. |

|

|

"Security Documents" means: |

|

| (a) |

the Account Kun-Pledge Agreement; |

| (b) |

the Company Share Kun-Pledge Agreement; and |

| (c) |

the Borrower Unit Kun-Pledge Agreement, |

|

together with any other document designated as a “Security Document” by the Security Agent and the Borrower. |

|

|

“Signing Date” means the date on which this Agreement is executed by the Parties. |

|

|

"Specified Time" means a time determined in accordance with Schedule 6 (Timetable). |

|

|

“Sponsor” means NET 1 UEPS TECHNOLOGIES, INC. |

|

|

“Squeeze Out” means the procedures set out in the Commercial Act of Korea pursuant to which the Borrower may acquire and hold the remaining shares of the common stock of the Company representing 0.34% of the total issued and outstanding shares of the Company as of the date hereof by compulsorily acquiring shares from the minority shareholders of the Company by way of cash compensation. |

|

|

"Subsidiary" means, in relation to any company or corporation, a company or corporation: |

|

| (a) |

which is controlled, directly or indirectly, by the first mentioned company or corporation; |

| (b) |

more than half the issued equity share capital of which is beneficially owned, directly or indirectly, by the first mentioned company or corporation; or |

| SENIOR FACILITIES AGREEMENT | Page 8 |

| (c) |

which is a Subsidiary of another Subsidiary of the first mentioned company or corporation, |

|

and for this purpose, a company or corporation shall be treated as being controlled by another if that other company or corporation is able to direct its affairs and/or to control the composition of its board of directors or equivalent body. | |

|

"Tax" means any tax, levy, impost, duty or other charge or withholding of a similar nature (including any penalty or interest payable in connection with any failure to pay or any delay in paying any of the same). | |

|

“Total Commitments” means the aggregate of the Commitments, being KRW85,000,000,000 at the date of this Agreement. | |

|

“Tranche A Facility” means the KRW term loan facility made or to be made available under this Agreement as described in Clause 2.1 (The Facilities). | |

|

“Tranche B Facility” means the KRW term loan facility made or to be made available under this Agreement as described in Clause 2.1 (The Facilities). | |

|

“Tranche C Facility” means the KRW revolving credit facility made or to be made available under this Agreement as described in Clause 2.1 (The Facilities). | |

|

“Tranche A Facility Commitment” means: | |

| (a) |

in relation to the Original Lender, the amount set opposite its name under the heading “Tranche A Facility Commitment” in Schedule I (Lenders and Their Commitments) and the amount of any other Tranche A Facility Commitment transferred to it under this Agreement; and |

|

(b) |

in relation to any other Lender, the amount of any Tranche A Facility Commitment transferred to it under this Agreement, to the extent not cancelled, reduced or transferred by it under this Agreement. “Tranche B Facility Commitment” means: |

| (a) |

in relation to the Original Lender, the amount set opposite its name under the heading “Tranche B Facility Commitment” in Schedule I (Lenders and Their Commitments) and the amount of any other Tranche B Facility Commitment transferred to it under this Agreement; and |

|

(b) |

in relation to any other Lender, the amount of any Tranche B Facility Commitment transferred to it under this Agreement, to the extent not cancelled, reduced or transferred by it under this Agreement. “Tranche C Facility Commitment” means: |

| (a) |

in relation to the Original Lender, the amount set opposite its name under the heading “Tranche C Facility Commitment” in Schedule I (Lenders and Their Commitments) and the amount of any other Tranche C Facility Commitment transferred to it under this Agreement; and |

|

(b) |

in relation to any other Lender, the amount of any Tranche C Facility Commitment transferred to it under this Agreement, to the extent not cancelled, reduced or transferred by it under this Agreement. |

| SENIOR FACILITIES AGREEMENT | Page 9 |

|

“Tranche A Facility Loan” means a loan made or to be made under the Tranche A Facility or the principal amount outstanding for the time being of that loan. |

|

|

“Tranche B Facility Loan” means a loan made or to be made under the Tranche B Facility or the principal amount outstanding for the time being of that loan. |

|

|

“Tranche C Facility Loan” means a loan made or to be made under the Tranche C Facility or the principal amount outstanding for the time being of that loan. |

|

|

“Tranche A Facility Repayment Date” means the date falling 30, 42, 54 and 60 Months from the Initial Utilisation Date, respectively. |

|

|

“Transaction Security" means the Security created or expressed to be created pursuant to the Security Documents. |

|

|

"Transfer Certificate" means a certificate substantially in the form set out in Schedule 4 (Form of Transfer Certificate) or any other form agreed between the Facility Agent and the Borrower. |

|

|

"Transfer Date" means, in relation to a transfer, the later of: |

|

| (a) |

the proposed Transfer Date specified in the Transfer Certificate; and |

| (b) |

the date on which the Facility Agent executes the Transfer Certificate. |

|

"Unpaid Sum" means any sum due and payable but unpaid by the Borrower under the Finance Documents. |

|

|

“USD Proceeds Account” means the USD account (number 100-910014-72232) opened in the name of the Borrower with the Security Agent and designated as “USD Proceeds Account”. |

|

|

"Utilisation" means a utilisation of a Facility. |

|

|

"Utilisation Date" means the date of the Utilisation, being the date on which the relevant Loan is to be made. |

|

|

"Utilisation Request" means a notice substantially in the form set out in Schedule 3 (Utilisation Request). |

| 1.2 |

Construction |

| (a) |

Unless a contrary indication appears, any reference in this Agreement to: |

|

| (i) |

any "Administrative Party", the "Facility Agent", the “Security Agent”, "Mandated Lead Arranger", any "Finance Party", any “Secured Party”, any "Lender" or any "Party" shall be construed so as to include its successors in title and permitted transferees; |

|

| (ii) |

"assets" includes present and future properties, revenues and rights of every description; |

|

| (iii) |

a "Finance Document" or any other agreement or instrument is a reference to that Finance Document or other agreement or instrument as amended, novated, supplemented, extended or restated; |

|

| (iv) |

"including" shall be construed as "including without limitation"; |

|

| (v) |

"indebtedness" includes any obligation (whether incurred as principal or as surety) for the payment or repayment of money, whether present or future, actual or contingent; |

|

| SENIOR FACILITIES AGREEMENT | Page 10 |

| (vi) |

a Lender's "participation" in the Loan or an Unpaid Sum includes an amount representing the fraction or portion (attributable to such Lender by virtue of the provisions of this Agreement) of the total amount of the Loan or Unpaid Sum and the Lender's rights under this Agreement in respect thereof; | |

| (vii) |

“ordinary course of business” means, with respect to any person, the ordinary and usual course of normal day-to-day operations of the business consistent with the existing customs, practices and procedures; | |

| (viii) |

a "person" includes any individual, firm, company, corporation, government, state or agency of a state or any association, trust, joint venture, consortium or partnership (whether or not having separate legal personality); | |

| (ix) |

a "regulation" includes any regulation, rule, official directive, request or guideline (whether or not having the force of law) of any governmental, intergovernmental or supranational body, agency, department or regulatory, self-regulatory or other authority or organisation; | |

| (x) |

a provision of law is a reference to that provision as amended or re-enacted; and | |

| (xi) |

a time of day is a reference to Seoul time. |

| (b) |

Clause and Schedule headings are for ease of reference only. |

| (c) |

Unless a contrary indication appears, a term used in any other Finance Document or in any notice given under or in connection with any Finance Document has the same meaning in that Finance Document or notice as in this Agreement. |

| (d) |

A Default (other than an Event of Default) is "continuing" if it has not been remedied or waived and an Event of Default is "continuing" if it has not been waived. |

| (e) |

Where this Agreement specifies an amount in a given currency (the "specified currency") "or its equivalent", the "equivalent" is a reference to the amount of any other currency which, when converted into the specified currency utilising the Facility Agent's spot rate of exchange for the purchase of the specified currency with that other currency at or about 11 a.m. on the relevant date, is equal to the relevant amount in the specified currency. |

| 1.3 |

Currency Symbol and Definition |

|

“Korean Won” or "KRW" denote the lawful currency of the Korea. | |

| 2. | |

| 2.1 |

The Facilities |

|

Subject to the terms of this Agreement, the Lenders make available to the Borrower: |

| (a) |

the Tranche A Facility in an aggregate amount equal to the Tranche A Facility Commitment; |

| (b) |

the Tranche B Facility in an aggregate amount equal to the Tranche B Facility Commitment; and |

| (c) |

the Tranche C Facility in an aggregate amount equal to the Tranche C Facility Commitment. |

| SENIOR FACILITIES AGREEMENT | Page 11 |

| 2.2 |

Finance Parties' rights and obligations |

| (a) |

The obligations of the Finance Parties under the Finance Documents are several. Failure by a Finance Party to perform its obligations under the Finance Documents does not affect the obligations of any other Party under the Finance Documents. No Finance Party is responsible for the obligations of any other Finance Party under the Finance Documents. |

| (b) |

The rights of the Finance Parties under or in connection with the Finance Documents are separate and independent rights and any debt arising under the Finance Documents to a Finance Party from the Borrower shall be a separate and independent debt. |

| (c) |

A Finance Party may, except as otherwise stated in the Finance Documents, separately enforce its rights under the Finance Documents. |

| 3. | |

| 3.1 |

Purpose |

|

The Borrower shall apply all amounts borrowed by it under (i) the Tranche A Facility towards repayment of the Existing Loan in the amount of KRW 60,000,000,000, (ii) the Tranche B Facility towards repayment of the Existing Loan in the amount of KRW 15,000,000,000 together with any accrued interest thereon, expenses, fees and any other amounts due and payable in respect of the Existing Loan and (iii) the Tranche C Facility towards financing the Borrower’s working capital needs (including interest expenses and related transaction costs under the Finance Documents). |

|

| 3.2 |

Monitoring |

|

No Finance Party is bound to monitor or verify the application of any amount borrowed pursuant to this Agreement. |

|

| 4. | |

| 4.1 |

Initial conditions precedent |

|

The Borrower may not deliver a Utilisation Request unless the Facility Agent has received all of the documents and other evidence listed in Part 1 of Schedule 2 (Conditions of Utilisation) in form and substance reasonably satisfactory to the Facility Agent unless otherwise waived by the Facility Agent. The Facility Agent shall notify the Borrower and the Lenders promptly upon being so satisfied. |

|

| 4.2 |

Further conditions precedent |

|

The Lenders will be obliged to comply with Clause 5.5 (Lenders’ participations) if on the date of a Utilisation Request and on the proposed Utilisation Date: |

| (a) |

no Default is continuing or would result from the proposed Loan; and |

| (b) |

the Repeating Representations to be made by the Borrower are true in all material respects; and |

| 4.3 |

Further conditions subsequent |

|

The Facility Agent shall have received all documents and evidence as set forth in Part 2 of Schedule 2 (Conditions of Utilisation) and all other requirements thereof shall have been fulfilled to its reasonable satisfaction. |

|

| 5. |

UTILISATION |

| 5.1 |

Delivery of the Utilisation Request |

| SENIOR FACILITIES AGREEMENT | Page 12 |

|

The Borrower may utilise a Facility by delivery to the Facility Agent of a duly completed Utilisation Request not later than the Specified Time. | |

| 5.2 |

Completion of the Utilisation Request |

| (a) |

The Utilisation Request is irrevocable and will not be regarded as having been duly completed unless: | |

| (i) |

it identifies the Facility to be utilized; | |

| (ii) |

the proposed Utilisation Date is a Business Day within the Availability Period ; | |

| (iii) |

the currency and amount of the Utilisation comply with Clause 5.4 (Currency and amount); and | |

| (iv) |

the account to which the Loan will be disbursed to the Borrower shall be the KRW Proceeds Account. | |

| (b) |

Only one (1) Loan may be requested in each Utilisation Request. | |

| 5.3 |

Maximum number of Utilisations |

|

Only one (1) Utilisation shall be made under the Tranche A Facility and the Tranche B Facility, respectively and one (1) Utilisation may be made under the Tranche C Facility on the Initial Utilisation Date. Subsequent Utilisations may be made under the Tranche C Facility on any Interest Payment Date during the Availability Period. | |

| 5.4 |

Currency and amount |

|

The currency specified in the Utilisation Request must be KRW. | |

| 5.5 |

Lenders' participations |

| (a) |

If the conditions set out in Clause 4 (Conditions of Utilisation) and 5.1 (Delivery of the Utilisation Request) to 5.4 (Currency and amount) above have been met, each Lender shall make its participation in each Loan available by the Utilisation Date through its Facility Office. |

| (b) |

The amount of each Lender's participation in each Loan will be equal to the proportion borne by its Available Commitment to the Available Facility immediately prior to making the Loan. |

| (c) |

The Facility Agent shall notify each Lender of the amount of each Loan and the amount of its participation in that Loan, in each case by the Specified Time. |

| 5.6 |

Cancellation of Commitment |

|

The Commitments which, at that time, are unutilised, shall be cancelled on the last day of the Availability Period applicable to that Facility. | |

| 6. | |

| 6.1 |

Repayment of Tranche A Facility Loan |

| (a) |

The Borrower shall repay the Tranche A Facility Loan made to it in instalments by repaying on each Tranche A Facility Repayment Date the amount set out opposite each Tranche A Facility Repayment Date below: |

| Tranche A Facility Repayment Date | Repayment Instalment (KRW) |

| The Interest Payment Date falling on the 30 Months after the Initial Utilisation Date | 10,000,000,000 |

| SENIOR FACILITIES AGREEMENT | Page 13 |

| The Interest Payment Date falling on the 42 Months after the Initial Utilisation Date | 10,000,000,000 |

| The Interest Payment Date falling on the 54 Months after the Initial Utilisation Date | 10,000,000,000 |

| The Final Repayment Date | 30,000,000,000 |

| (b) |

The Borrower may not reborrow any part of the Tranche A Facility which is repaid. |

| (c) |

The Borrower shall repay the Tranche A Facility Loan together with all accrued interest and other monies outstanding in connection with the Tranche A Facility Loan in full on the Final Repayment Date. |

| 6.2 |

Repayment of Tranche B Facility Loan |

|

The Borrower shall repay the Tranche B Facility Loan (together with all accrued interest and other monies outstanding in connection with the Tranche B Facility Loan) made to it in full on the Final Repayment Date. | |

| 6.3 |

Repayment of Tranche C Facility Loan |

|

The Borrower shall repay the Tranche C Facility Loan (together with all accrued interest and other monies outstanding in connection with the Tranche C Facility Loan) made to it in full on the Final Repayment Date. | |

| 7. | |

| 7.1 |

Illegality |

|

If, at any time, it becomes unlawful for a Lender to perform any of its obligations as contemplated by this Agreement or to fund or maintain its participation in any Loan: |

| (a) |

that Lender shall promptly notify the Facility Agent upon becoming aware of that event; |

| (b) |

upon the Facility Agent notifying the Borrower, the Commitment of that Lender will be immediately cancelled; and |

| (c) |

the Borrower shall repay that Lender's participation in the Loans on the last day of the Interest Period for each Loan occurring after the Facility Agent has notified the Borrower or, if earlier, the date specified by the Lender in the notice delivered to the Facility Agent (being no earlier than the last day of any applicable grace period permitted by law). |

|

If at any time the Borrower is required to prepay any Loan of a Lender affected in the manner described in this Clause 7.1, then the Borrower, on ten (10) Business Days’ (unless agreed otherwise by the Facility Agent) prior written notice to the Facility Agent and such Lender (an “Affected Lender”), may request the Affected Lender to (and such Affected Lender shall) transfer all (and not part only) of its rights and obligations under the relevant Finance Documents relating to the relevant portion of any Loan to be so prepaid (on terms that are agreeable to the Affected Lender and at the cost of the Borrower) to another Lender or to another bank or financial institution that is selected by the Borrower and that confirms its willingness to assume and does assume all the obligations of the Affected Lender. Such written notice from the Borrower described above shall specify an effective date for the replacement of such Affected Lender’s Commitment and Loans, which date shall not be later than the earlier of (i) sixty (60) days after the date such notice by the Borrower is given and (ii) the date (if applicable) by which the Affected Lender must be prepaid so as not to be in violation of the applicable law. |

| 7.2 |

Voluntary cancellation |

| SENIOR FACILITIES AGREEMENT | Page 14 |

|

The Borrower may, if it gives the Facility Agent not less than ten (10) Business Days' (or such shorter period as the Majority Lenders may agree) prior notice, cancel or reduce an Available Facility to zero or by such amount (being a minimum amount of KRW1,000,000,000 and in integral multiples of KRW100,000,000) as the Borrower may specify in such notice. Any such reduction under this Clause 7.2 shall reduce the Commitments of the Lenders rateably under that Available Facility. |

|

| 7.3 |

Voluntary prepayment of the Loan |

| (a) |

The Borrower may, if it gives the Facility Agent not less than five (5) Business Days' (unless agreed otherwise by the Facility Agent) prior notice, prepay on the last day of the Interest Period applicable thereto the whole or any part of the Tranche A Facility Loan, the Tranche B Facility Loan and/or the Tranche C Facility Loan as determined by the Borrower (but, if in part, being an amount that reduces the amount of the aggregate Loans subject to prepayment under this Clause 7.3 by a minimum amount of KRW1,000,000,000 and in integral multiples of KRW100,000,000). |

| (b) |

Any notice of prepayment given by the Borrower under this Clause 7.3 shall be irrevocable. |

| 7.4 |

Right of prepayment and cancellation in relation to a single Lender |

| (a) |

If: |

|

| (i) |

any sum payable to any Lender by the Borrower is required to be increased under paragraph (a) of Clause 12.2 (Tax gross-up); or |

|

| (ii) |

any Lender claims indemnification from the Borrower under Clause 12.3 (Tax indemnity) or Clause 13.1 (Increased costs), |

|

|

the Borrower may, whilst the circumstance giving rise to the requirement for that increase or indemnification continues, give the Facility Agent notice of cancellation of the Commitment of that Lender and its intention to procure the prepayment of that Lender's participation in the Loans. |

|

| (b) |

On receipt of a notice of cancellation referred to in paragraph (a) above, the Commitment of that Lender shall immediately be reduced to zero. |

| (c) |

On the last day of each Interest Period which ends after the Borrower has given notice of cancellation under paragraph (a) above, the Borrower shall prepay that Lender's participation in the relevant Loan. |

| 7.5 |

Restrictions |

| (a) |

Any notice of cancellation or prepayment given by any Party under these Clause 7 (Prepayment and cancellation) and Clause 8 (Mandatory prepayment) shall be irrevocable and, unless a contrary indication appears in this Agreement, shall specify the date or dates upon which the relevant cancellation or prepayment is to be made and the amount of that cancellation or prepayment. |

| (b) |

Any prepayment under this Agreement shall be made together with accrued interest on the amount prepaid together with, if applicable, the Prepayment Charge payable pursuant to Clause 7.6 (Prepayment Charge) and all other sums due and payable by the Borrower to the Finance Parties as a result of the Loans (or part thereof) being prepaid without premium or penalty. |

| (c) |

Unless a contrary indication appears in this Agreement, any part of the Loan which is prepaid may not be reborrowed except for the Tranche C Loan which may be redrawn at any time during the Availability Period (except when prepaid under Clause 8 hereunder, provided however the Tranche C Loan may be redrawn at any time during the Availability Period in case of prepayment with dividends on or in respect of the Borrower’s share capital in the Company. |

| SENIOR FACILITIES AGREEMENT | Page 15 |

| (d) |

The Borrower shall not repay or prepay all or any part of the Loans or reduce all or any part of the Commitment except at the times and in the manner expressly provided for in this Agreement. |

| (e) |

If any Commitment is reduced or cancelled in accordance with this Agreement, the amount of such reduction may not be subsequently reinstated. |

| (f) |

If the Facility Agent receives a prepayment notice under this Clause 7 (or Clause 8, if applicable) it shall promptly forward a copy of that notice to either the Borrower or the affected Lender, as appropriate. |

| (g) |

If all or part of a Loan under a Facility is repaid or prepaid and not available for redrawing, an amount of the Commitments in respect of that Facility will be deemed to be cancelled on the date of repayment or prepayment. Any cancellation under this paragraph (g) shall reduce the Commitment of the Lenders rateably under that Facility. |

| 7.6 |

Prepayment Charge |

|

Each voluntary prepayment pursuant to this Clause 7.3 (Voluntary prepayment of the Loan) in respect of the Tranche A Facility Loan and the Tranche B Facility Loan made on or before 18 Months from the Initial Utilisation Date shall be subject to payment of a prepayment charge (the “Prepayment Charge”) that is equal to 1% of the amount prepaid. For the avoidance of doubt, no Prepayment Charge shall be payable in respect of (i) any voluntary prepayment made after 18 Months from the Initial Utilisation Date, (ii) any voluntary prepayment in respect of the Tranche C Facility Loan, and (iii) any mandatory prepayment made pursuant to Clause 8 (Mandatory Prepayment), except for Clause 8.1(c). |

|

| 8. | |

| 8.1 |

Upon the occurrence of any of the following and subject to Clause 7.5 (Restrictions), the Borrower shall immediately notify the Facility Agent and prepay the Loans in accordance with this Clause 8 (Mandatory Prepayment): |

| (a) |

Disposal Proceeds. If the Borrower through one transaction or a series of related transactions receives any cash payments or proceeds (and the fair market value of all non-cash consideration (including, when received, the cash or cash equivalent proceeds of any deferred consideration, whether by way of adjustment to the purchase price or otherwise)) pursuant to the sale, disposition or transfer of any assets or properties (except for a Permitted Disposal), such proceeds less any taxes, costs and expenses properly incurred and payable by the Borrower in connection with such sale, disposition or transfer shall be deposited into the applicable Proceeds Accounts for application for mandatory prepayment on the immediately following Interest Payment Date. |

| (b) |

Public Equity Issuance Proceeds. If the Borrower receives any amount (in the form of cash and the fair market value of all non-cash consideration) in respect of any Public Equity Issuance, such amount less any taxes, costs and expenses properly incurred and payable by the Borrower in connection with that Public Equity Issuance shall be deposited into the applicable Proceeds Accounts for application for mandatory prepayment on the immediately following Interest Payment Date |

|

For the purpose of this Clause 8.1(b), “Public Equity Issuance” means any issuance or sale by the Borrower of any of the share capital or of any Equity Interests for the share capital of the Borrower, if the equity or capital contribution or the consideration for that sale or issuance derives directly or indirectly from any offer or sale constituting a public offering under the securities laws of the relevant jurisdiction after the date of this Agreement in which either or both retail and institutional investors are eligible to buy any share capital or Equity Interests for share capital of that Borrower. |

| SENIOR FACILITIES AGREEMENT | Page 16 |

| (c) |

Debt Issuance Proceeds. If the Borrower receives any cash (and in the case of any non- cash consideration including by way of set-off, the monetary value thereof) as a result of incurring any Financial Indebtedness after the Signing Date except for any Permitted Indebtedness, such amount less any taxes, costs and expenses properly incurred and payable by the Borrower in connection with that indebtedness shall be deposited into the applicable Proceeds Accounts for application for mandatory prepayment on the immediately following Interest Payment Date. In case such amount is to be used in prepaying the whole or any part of the Loans, such prepayment shall be deemed to be a voluntary prepayment under Clause 7.3 (Voluntary prepayment of the Loan) and the applicable Prepayment Charge shall be applicable on the Tranche A Loan, the Tranche B Loan and the Tranche C Loan. |

| (d) |

Equity Issuance or Shareholder Loan Proceeds. If the Borrower receives any amount as a result of issuing or selling any of the share capital or of any Equity Interests for the share capital of the Borrower directly or indirectly to the DutchCo or the Sponsor (except for the purpose of the Squeeze Out, the Intercompany Loan and/or the Permitted Administrative Payments), such amount less any taxes, costs and expenses properly incurred and payable by the Borrower in connection with such incurrence of direct or indirect debt, or issuance or sale of the share capital or Equity Interests for the share capital of the Borrower shall be deposited into the applicable Proceeds Accounts for application for mandatory prepayment on the immediately following Interest Payment Date. |

| (e) |

Distribution Proceeds. If the Borrower receives any proceeds of Distribution from the Company or any payment, prepayment or repayment of any sums due under the Intercompany Loan Agreement (except for such amounts received under the Intercompany Loan Agreement which shall be used for the purpose of Squeeze Out), such proceeds and/or sums less any taxes, costs and expenses properly incurred and payable by the Company in connection with making or distributing the Distribution or the payment, prepayment or repayment under the Intercompany Loan Agreement shall be deposited into the applicable Proceeds Accounts for application for mandatory prepayment on the immediately following Interest Payment Date. For the avoidance of doubt, any tax amounts paid or payable by the Company to the Borrower for the purpose of filing a consolidated tax return for the Group shall not be deemed to be a Distribution for the purpose of this Agreement. |

| 8.2 |

Application of Mandatory Prepayment |

| (a) |

Subject to Clause 8.2(c) below, a mandatory prepayment made under Clauses 8.1 (a), (b), (c) and (d) shall be applied in the following order: |

|

| (i) |

first, in prepayment of the Loans due and payable within twelve (12) Months from the date on which such prepayment is made and interest accrued thereon; and |

|

| (ii) |

secondly, in prepayment of the remaining Loans pro rata among the Tranche A Facility Loan, the Tranche B Facility Loan and the Tranche C Facility Loan and interest accrued thereon in inverse order of maturity, as applicable. |

|

| (b) |

Subject to Clause 8.2(c) below, a mandatory prepayment made under the Clause 8.1(e) shall be applied in the following order: |

|

| (i) |

first, in prepayment of the Tranche B Facility Loan in full and interest accrued thereon; |

|

| SENIOR FACILITIES AGREEMENT | Page 17 |

| (ii) |

secondly, in prepayment of the Tranche A Facility Loan due and payable within twelve (12) Months from the date on which such prepayment is made and interest accrued thereon; and | |

| (iii) |

thirdly, in prepayment of the remaining Loans pro rata among the Tranche A Facility Loan and the Tranche C Facility Loan and interest accrued thereon in inverse order of maturity, as applicable. |

| (c) |

The Borrower may, with notice to the Facility Agent, reserve an amount in the KRW Proceeds Account or the USA Proceeds Account, as applicable, equal to the aggregate of the interest payments for the Loans accruing and/or falling due within twelve (12) Months from the date on which the mandatory prepayment is made. | |

| (d) |

No amount may be withdrawn or transferred from the KRW Proceeds Account or the USD Proceeds Account, as applicable except; | |

| (i) |

to make the prepayment and/or applications required under this Clause 8.2 or as otherwise permitted under this Agreement; or | |

| (ii) |

with the prior consent of the Majority Lenders. | |

| 9. | |

| 9.1 |

Calculation of interest |

|

The rate of interest on each Loan for each Interest Period is the percentage rate per annum which is the aggregate of the applicable: |

| (a) |

Margin; and |

| (b) |

Base Rate. |

| 9.2 |

Payment of interest |

|

The Borrower shall pay accrued interest on each Loan on each Interest Payment Date. | |

| 9.3 |

Default interest |

|

If the Borrower fails to pay any amount payable by it under a Finance Document on its due date, interest shall accrue on the Unpaid Sum from the due date to the date of actual payment (both before and after judgment) at a rate which is (in the case of such Unpaid Sum being the principal of any Loan or any interest payable thereon) equal to the rate would otherwise be applicable to such Loan on such due date plus five per cent (5%) and (in the case of such Unpaid Sum being any and all other amounts due and payable) equal to the highest interest then applicable to any Loan on such due date plus five per cent (5%). | |

| 9.4 |

Notification of rates of interest |

|

The Facility Agent shall promptly notify the Lenders and the Borrower of the determination of a rate of interest under this Agreement. | |

| 9.5 |

Market Disruption |

|

If a Market Disruption Event occurs in relation to a Loan for any Interest Period, then the rate of interest on each Lender's share of that Loan for the Interest Period shall be the rate per annum which is the sum of |

| (i) |

the applicable Margin; and |

| (ii) |

the rate notified to the Facility Agent by that Lender as soon as practicable and in any event before interest is due to be paid in respect of that Interest Period to be that which expresses as a percentage rate per annum the cost to that Lender of funding its participation in that Loan from whatever source it may reasonable select. In this Agreement, "Market Disruption Event" means: |

| SENIOR FACILITIES AGREEMENT | Page 18 |

| (i) |

at or about 3:00 p.m., on the Interest Determination Date for the relevant Interest Period, the Base Rate is not capable of being determined in accordance with the definition of Base Rate or is zero or negative; or |

| (ii) |

before the close of business in Seoul on the Interest Determination Date for the relevant Interest Period, the Facility Agent receives notifications from two or more Lenders (whose participations in a Loan exceed 50% of that Loan) that the cost to it of funding its participation in the relevant Loan would be in excess of the Base Rate. |

| 9.6 |

Substitute basis of interest of funding |

| (a) |

If a Market Disruption Event occurs and the Facility Agent or the Borrower so requires, the Facility Agent and the Borrower shall enter into negotiations (for a period of not more than 30 days) with a view to agreeing a substitute basis for determining the rate of interest. |

| (b) |

Any substitute basis agreed pursuant to paragraph (a) above shall, with the prior consent of the Majority Lenders holding such Loan be binding on all Parties hereto. |

| (c) |

For the avoidance of doubt, in the event that no substitute basis is agreed at the end of the thirty (30) day period, the rate of interest shall continue to be determined in accordance with Clause 9.4(a). If a Market Disruption Event ceases to be continuing, the rate of interest on a Loan shall revert to the rate calculated in accordance with Clause 9.1 (Calculation of Interest) on the first day of the next Interest Period. |

| 10. | |

| 10.1 |

Interest Periods |

| (a) |

Subject to paragraphs (b) and (d) below, the Interest Period for a Loan shall be three (3) Months. |

| (b) |

An Interest Period for a Loan shall not extend beyond the Final Repayment Date applicable to such Loan. |

| (c) |

Each Interest Period for a Loan shall start on the relevant Utilisation Date or (if a Loan has already been made) on the last day of the preceding Interest Period of the Loan. |

| (d) |

The initial Interest Period for a Loan which is not made on the Initial Utilisation Date shall commence on the relevant Utilisation Date and end on the last day of then current Interest Period in effect for a Loan and each subsequent Interest Period for such Loan shall commence on the last day of the immediately preceding Interest Period. |

| 10.2 |

Non-Business Days |

|

If an Interest Period would otherwise end on a day which is not a Business Day, that Interest Period will instead end on the next Business Day in that calendar month (if there is one) or the preceding Business Day (if there is not). |

|

| 11. | |

| 11.1 |

Upfront fee |

|

The Borrower shall pay to each Lender an upfront fee in the amount and at the times agreed in a Fee Letter. |

|

| 11.2 |

Arrangement fee |

|

The Borrower shall pay to the Mandated Lead Arranger an arrangement fee in the amount and at the times agreed in a Fee Letter. |

| SENIOR FACILITIES AGREEMENT | Page 19 |

| 11.3 |

Facility Agent fee and Security Agent Fee |

|

The Borrower shall pay to the Facility Agent (for its own account) a facility agent fee and a security agent fee in the amount and at the times agreed in a Fee Letter. |

|

| 11.4 |

Commitment fee |

| (a) |

The Borrower shall pay to the Facility Agent, for the account of the Lender providing the Tranche C Facility, a fee computed at the rate of 0.30 per cent. per annum on such Lender’s Available Commitment for the period commencing on Initial Utilisation Date and ending on the last day of the Availability Period applicable. |

| (b) |

The accrued commitment fee is payable on the last day of each Interest Payment Date which ends during the Availability Period, on the last day of the relevant Availability Period and, if cancelled in full, on the cancelled amount of the relevant Lender’s Commitment at the time the cancellation is effective. |

| 12. | |

| 12.1 |

Tax definitions |

| (a) |

In this Clause 12: |

|

"Tax Credit" means a credit against, relief or remission for, or repayment of any Tax. |

|

|

"Tax Deduction" means a deduction or withholding for or on account of Tax from a payment under a Finance Document. |

|

|

"Tax Payment" means an increased payment made by the Borrower to a Finance Party under Clause 12.2 (Tax gross-up) or a payment under Clause 12.3 (Tax indemnity). |

|

| (b) |

Unless a contrary indication appears, in this Clause 12 a reference to "determines" or "determined" means a determination made in the absolute discretion of the person making the determination. |

| 12.2 |

Tax gross-up |

| (a) |

All payments to be made by the Borrower to any Finance Party under the Finance Documents shall be made free and clear of and without any Tax Deduction unless the Borrower is required to make a Tax Deduction, in which case the sum payable by the Borrower (in respect of which such Tax Deduction is required to be made) shall be increased to the extent necessary to ensure that such Finance Party receives a sum net of any deduction or withholding equal to the sum which it would have received had no such Tax Deduction been made or required to be made. |

| (b) |

The Borrower shall promptly upon becoming aware that the Borrower must make a Tax Deduction (or that there is any change in the rate or the basis of a Tax Deduction) notify the Facility Agent accordingly. Similarly, a Lender shall notify the Facility Agent on becoming so aware in respect of a payment payable to that Lender. If the Facility Agent receives such notification from a Lender it shall notify the Borrower. |

| (c) |

If the Borrower is required to make a Tax Deduction, the Borrower shall make that Tax Deduction and any payment required in connection with that Tax Deduction within the time allowed and in the minimum amount required by law. |

| (d) |

Within thirty (30) days of making either a Tax Deduction or any payment required in connection with that Tax Deduction, the Borrower making that Tax Deduction shall deliver to the Facility Agent for the Finance Party entitled to the payment evidence reasonably satisfactory to that Finance Party that the Tax Deduction has been made or (as applicable) any appropriate payment paid to the relevant taxing authority. |

| SENIOR FACILITIES AGREEMENT | Page 20 |

| 12.3 |

Tax indemnity |

| (a) |

Without prejudice to Clause 12.2 (Tax gross-up), if any Finance Party is required to make any payment of or on account of Tax on or in relation to any sum received or receivable under the Finance Documents or if any liability in respect of any such payment is asserted, imposed, levied or assessed against any Finance Party, the Borrower shall, within fifteen (15) Business Days of demand of the Facility Agent, promptly indemnify the Finance Party which suffers a loss or liability as a result against such payment or liability, together with any interest, penalties, costs and expenses payable or incurred in connection therewith, provided that this Clause 12.3 shall not apply to: |

|

| (i) |

any Tax imposed on and calculated by reference to the net income actually received or receivable by such Finance Party by the jurisdiction in which such Finance Party is incorporated; |

|

| (ii) |

any Tax imposed on and calculated by reference to the net income of the Facility Office of such Finance Party actually received or receivable by such Finance Party by the jurisdiction in which its Facility Office is located; or |

|

| (iii) |

the extent that such loss, liability or cost is compensated for by an increased payment under Clause 12.2 (Tax gross-up). |

|

| (b) |

A Finance Party intending to make a claim under paragraph (a) shall notify the Facility Agent of the event giving rise to the claim, whereupon the Facility Agent shall notify the Borrower thereof. |

|

| (c) |

A Finance Party shall, on receiving a payment from the Borrower under this Clause 12.3, notify the Facility Agent. |

|

| 12.4 |

Tax credit |

|

If the Borrower makes a Tax Payment and the relevant Finance Party determines that: |

| (a) |

a Tax Credit is attributable to that Tax Payment; and |

| (b) |

that Finance Party has obtained, utilised and retained that Tax Credit, |

|

the Finance Party shall pay an amount to the Borrower which that Finance Party determines will leave it (after that payment) in the same after-Tax position as it would have been in had the Tax Payment not been required to be made by the Borrower. |

| 12.5 |

Stamp taxes |

|

The Borrower shall: |

| (a) |

pay all stamp duty, registration and other similar Taxes payable in respect of any Finance Document; and |

| (b) |

within ten (10) Business Days of demand, indemnify each Finance Party against any cost, loss or liability that Finance Party incurs in relation to any stamp duty, registration or other similar Tax paid or payable in respect of any Finance Document. |

| 12.6 |

Indirect tax |

| (a) |

All amounts set out or expressed in a Finance Document to be payable by any Party to a Finance Party shall be deemed to be exclusive of any Indirect Tax. If any Indirect Tax is chargeable on any supply made by any Finance Party to any Party in connection with a Finance Document, that Party shall pay to the Finance Party (in addition to and at the same time as paying the consideration) an amount equal to the amount of the Indirect Tax. |

| SENIOR FACILITIES AGREEMENT | Page 21 |

| (b) |

Where a Finance Document requires any Party to reimburse a Finance Party for any costs or expenses, that Party shall also at the same time pay and indemnify the Finance Party against all Indirect Tax incurred by that Finance Party in respect of the costs or expenses to the extent the Finance Party reasonably determines that it is not entitled to credit or repayment in respect of the Indirect Tax. |

| 13. | |

| 13.1 |

Increased costs |

| (a) |

Subject to Clause 13.3 (Exceptions) the Borrower shall, within ten (10) Business Days of a demand by the Facility Agent, pay for the account of a Finance Party the amount of any Increased Costs incurred by that Finance Party or any of its Affiliates as a result of (i) the introduction of or any change in (or in the interpretation, administration or application of) any law or regulation or (ii) compliance with any law or regulation made after the date of this Agreement. The terms "law" and "regulation" in this paragraph (a) shall include, without limitation, any law or regulation concerning capital adequacy, liquidity, reserve assets or Tax. |

| (b) |

If at any time the Borrower is required to pay any additional amount to a Lender pursuant to the paragraph (a) above, then the Borrower, on ten (10) Business Days’ prior written notice to the Facility Agent and such Lender, may request that Lender to (and that Lender shall) transfer all (and not part only) of its rights and obligations under the relevant Finance Documents (on terms that are agreeable to that Lender and at the cost of the Borrower) to another Lender or to another bank or financial institution that is selected by the Borrower and that confirms its willingness to assume and does assume all the obligations of that Lender. |

| (c) |

In this Agreement "Increased Costs" means: |

| (i) |

a reduction in the rate of return from the Facility or on a Finance Party's overall capital; | |

| (ii) |

an additional or increased cost; or | |

| (iii) |

a reduction of any amount due and payable under any Finance Document, |

|

which is incurred or suffered by a Finance Party to the extent that it is attributable to the undertaking, funding or performance by such Finance Party of any of its obligations under any Finance Document or any participation of such Finance Party in the Loan or Unpaid Sum. | |

| 13.2 |

Increased cost claims |

| (a) |

A Finance Party intending to make a claim pursuant to Clause 13.1 (Increased costs) shall notify the Facility Agent of the event giving rise to the claim, following which the Facility Agent shall promptly notify the Borrower. |

| (b) |

Each Finance Party shall, as soon as practicable after a demand by the Facility Agent, provide a certificate confirming the amount of its Increased Costs. |

| 13.3 |

Exceptions |

|

Clause 13.1 (Increased costs) does not apply to the extent any Increased Cost is: |

| (a) |

attributable to a Tax Deduction required by law to be made by the Borrower; |

| (b) |

compensated for by Clause 12.3 (Tax indemnity) (or would have been compensated for under Clause 12.3 (Tax indemnity) but was not so compensated solely because one of the exclusions in paragraph (a) of Clause 12.3 (Tax indemnity) applied); |

| SENIOR FACILITIES AGREEMENT | Page 22 |

| (c) |

attributable to the wilful breach by the relevant Finance Party of any law or regulation; or |

| (d) |

such Increased Cost is attributable to a change to any law or regulation relating to the Credit Guarantee Fund Contribution. |

| 14. | |

| 14.1 |

Mitigation |

| (a) |

Each Finance Party shall, in consultation with the Borrower, take all reasonable steps to mitigate any circumstances which arise and which would result in any amount becoming payable under or pursuant to, or cancelled pursuant to, any of Clause 7.1 (Illegality), Clause 12 (Tax gross-up and indemnities) or Clause 13 (Increased costs), including: |

|

| (i) |

providing such information as the Borrower may reasonably request in order to permit the Borrower to determine its entitlement to claim any exemption or other relief (whether pursuant to a double taxation treaty or otherwise) from any obligation to make a Tax Deduction; and |

|

| (ii) |

in relation to any circumstances which arise following the date of this Agreement, transferring its rights and obligations under the Finance Documents to another Affiliate or Facility Office. |

|

| (b) |

Paragraph (a) above does not in any way limit the obligations of the Borrower under the Finance Documents. |

|

| 14.2 |

Limitation of liability |

| (a) |

The Borrower shall promptly indemnify each Finance Party for all costs and expenses reasonably incurred by that Finance Party as a result of steps taken by it under Clause 14.1 (Mitigation). |

| (b) |

A Finance Party is not obliged to take any steps under Clause 14.1 (Mitigation) if, in the opinion of that Finance Party (acting reasonably), to do so might be prejudicial to it. |

| 14.3 |

Conduct of business by the Finance Parties |

|

No provision of this Agreement will: |

| (a) |

interfere with the right of any Finance Party to arrange its affairs (tax or otherwise) in whatever manner it thinks fit; |

| (b) |

oblige any Finance Party to investigate or claim any credit, relief, remission or repayment available to it or the extent, order and manner of any claim; or |

| (c) |

oblige any Finance Party to disclose any information relating to its affairs (tax or otherwise) or any computations in respect of Tax. |

| 15. | |

| 15.1 |

Other indemnities |

|

The Borrower shall, within ten (10) Business Days of demand, indemnify each Secured Party against any cost, loss or liability incurred by that Secured Party as a result of: |

| (a) |

the occurrence of any Event of Default; |

| (b) |

the information produced or approved by the Borrower being misleading and/or deceptive in any material respect; |

| SENIOR FACILITIES AGREEMENT | Page 23 |

| (c) |

any enquiry, investigation, subpoena (or similar order) or litigation with respect to the Borrower or with respect to the transactions contemplated or financed under this Agreement; |

| (d) |

a failure by the Borrower to pay any amount due under a Finance Document on its due date or in the relevant currency; |

| (e) |

funding, or making arrangements to fund, its participation in a Loan requested by the Borrower in the Utilisation Request but not made by reason of the operation of any one or more of the provisions of this Agreement (other than by reason of gross negligence or wilful misconduct of that Finance Party); or |

| (f) |

a Loan (or part of a Loan) not being prepaid in accordance with a notice of prepayment given by the Borrower. |

| 15.2 | |

|

The Borrower shall promptly indemnify the Facility Agent against any cost, loss or liability incurred by the Facility Agent (acting reasonably) as a result of: |

| (a) |

investigating any event which it reasonably believes is a Default; or |

| (b) |

acting or relying on any notice, request or instruction which it reasonably believes to be genuine, correct and appropriately authorised. |

| 15.3 | |

|

The Borrower shall promptly indemnify the Secured Parties against any cost, loss or liability incurred by any of them as a result of: |

| (a) |

the taking, holding, protection or enforcement of the Transaction Security; |

| (b) |

the exercise of any of the rights, powers, discretions and remedies vested in the Secured Parties by the Finance Documents or by law; and |

| (c) |

any default by the Borrower or a member of the Group in the performance of any of the obligations expressed to be assumed by it in the Finance Documents. |

| 16. | |

| 16.1 |

Transaction expenses |

|

The Borrower shall, within ten (10) Business Days of demand, pay the Administrative Parties or the relevant Finance Parties: |

| (a) |

the amount of all costs and expenses (including, but not limited to, legal fees of counsel selected by the Mandated Lead Arranger in consultation with the Sponsor, travel, due diligence, financing feasibility report by third party consulting firm, appraisal of real estate and out-of-pocket expenses) reasonably incurred by any of them in connection with the negotiation, preparation, execution, syndication and perfection of: |

|

| (i) |

this Agreement and any other documents referred to in this Agreement and the Transaction Security; and |

|

| (ii) |

any other Finance Documents executed after the date of this Agreement; and |

|

| (b) |

any other expenses or fees incurred arising out of or relating to any transactions agreed by the Borrower, the Sponsor and the Finance Parties. |

|

|

Provided however, the Borrower shall only be responsible for such costs and expenses up to the aggregate amount of KRW 160,000,000 (including Indirect Taxes). |

||

| SENIOR FACILITIES AGREEMENT | Page 24 |

|

Reasonable evidence of such costs and expenses shall be provided to the Borrower. |

|

| 16.2 |

Amendment costs |

|

If the Borrower requests an amendment, waiver or consent, the Borrower shall, within ten (10) Business Days of demand, reimburse each of the Facility Agent and the Security Agent for the amount of all costs and expenses (including, but not limited to, legal fees) reasonably incurred by the Facility Agent and the Security Agent in responding to, evaluating, negotiating or complying with that request or requirement. |

|

| 16.3 |

Enforcement and preservation costs |

|

The Borrower shall, within ten (10) Business Days of demand, pay to each Secured Party the amount of all costs and expenses (including, but not limited to, legal fees) incurred by that Secured Party in connection with the enforcement of, or the preservation of any rights under, any Finance Document and the Transaction Security and any proceedings instituted by and against a Secured Party as a consequence of taking or holding the Transaction Security or enforcing these rights. Reasonable evidence of such costs and expenses shall be provided to the Borrower. |

|

| 17. | |

|

The Borrower makes the representations and warranties set out in this Clause 17 to each Finance Party on the date of this Agreement. |

|

| 17.1 |

Status |

| (a) |

It is a corporation, duly incorporated and validly existing under the laws of Korea. |

| (b) |

It has the power to own its assets and carry on its business as it is being conducted. |

| 17.2 |

Binding obligations |

|

The obligations expressed to be assumed by it in each Finance Document, are legal, valid, binding and enforceable obligations. |

|

| 17.3 |

Non-conflict with other obligations |

|