Contract for Operating Fast Loans (Online Signing Edition for Legal Person in 2021)

Exhibit 10.11

Contract No.: 0140200014-2022 (M.W.) Zi No. 00649

Contract for Operating Fast Loans

(Online Signing Edition for Legal Person in 2021)

Special Note: The Contract is made and concluded by lender and debtor through legal consultation on the basis of equality and voluntariness, and all the terms and conditions of the Contract are the true expression of the intention of the Parties. With a view to protect the legitimate rights and interests of the Borrower, the Lender hereby specially requests the Borrower to pay full attention to all clauses associated with the rights and obligations of the Parties, particularly those in bold.

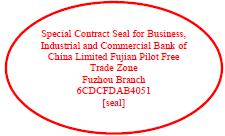

Lender: Fuzhou Branch of Fujian Pilot Free Trade Zone of Industrial and Commercial Bank of China Limited

Domicile (Address): _________________

Borrower: Fuzhou Yukai Trading Co., Ltd.

Legal Representative: Xxxxxx Xxxxx

Domicile (Address): _______________

Postcode: _________ Fax: _________ Tel: _________

E-mail: _________ Contact: _________ Mobile: _________

Alipay Account: __________________ Alitalk Account: __________________

[The Borrower is requested to fill in the above information accurately and completely to ensure that subsequent notices and legal documents are delivered timely]

Part I Basic Agreements

Article 1 Loan Purpose

The loan hereunder is used for the following purposes. Without the written consent of the Lender, the Borrower shall not misappropriate the loan for other purposes, and the Lender shall be entitled to supervise the use of the loan.

Loan purpose: Production and operation

Article 2 Amount and Term of Loan

2.1 The loan amount hereunder is RMB 3,000,000.00 (in words: RMB Three Million only) (in the case of any discrepancy, the amount in words shall prevail). The loan term hereunder counts from the date of withdrawal to April 14, 2023. The date of withdrawal shall be subject to the withdrawal instruction. The Borrower shall withdraw the loan at one time.

2.2 The term of loan under the Contract shall be valid from April 14, 2022 to April 14, 2023.

Article 3 Interest Rate, Interest and Expenses

3.1 [Determination Method of Interest Rates of RMB Loans]

The interest rate of loans hereunder is determined in the following way:

The interest rate of each loan is determined by the pricing benchmark plus floating points. If the loan term is within 60 months (inclusive), the pricing benchmark shall be the one-year loan prime rate (LPR) announced by the National Interbank Funding Center one working day prior to the date of withdrawal; if the loan term is within 12 months (inclusive), the number of floating points shall be zero (plus/minus) 0.000000 basis points (one basis point is 0.01%, similarly hereinafter); if the loan term is more than 12 months and less than 60 months (inclusive), the number of floating points shall be zero (plus/minus) 0.000000 basis points. If the loan term is more than 60 months, the pricing benchmark shall be the above-mentioned loan prime rate (LPR) of more than 5 years announced by the National Interbank Funding Center one working day prior to the date of withdrawal, and the number of floating points shall be zero (plus/minus) 0.000000 basis points. If there is no LPR issued by the National Interbank Funding Center on the working day before the rate determination day, the LPR issued by the National Interbank Funding Center on the working day before that working day shall count; and so on.

Upon issuance of each loan, the interest rate will be adjusted as per method A:

A. Assuming 12 (1/3/6/12) months is an interest period, the loan interest rate will be adjusted for each interest period, and the interests will accrue for each interest period. For the second or each following interest period, the rate determination day shall be the day when the prior interest period expires. On the rate determination day, the Lender will adjust the loan interest rate to the LPR issued by the National Interbank Funding Center on the working day before the rate determination day for the said period plus a margin. If there is no day in a month of the adjustment corresponding to the Utilization Date, the last day of the month shall count.

B. No adjustment will be made in the Loan Period.

3.2 The loan hereunder will accrue interest on a daily basis from the date of withdrawal, and the interest will be settled on a monthly basis. When the loan is due, the interest will be paid off along with the principal. Wherein, the daily interest rate = annual interest rate /360.

3.3 The overdue penalty interest rate hereunder is determined by adding 50.000000% to the original interest rate of loans, and the penalty interest rate for misappropriation of loans is determined by adding 50.000000% to the original interest rate of loans.

3.4 Annualized capital cost

The annualized capital cost of the Borrower includes the annualized interest rate of loans and the annualized capital cost of / as well as other expenditures. The receiver of the aforementioned / expenditures is not the Lender, and the concrete receiver is / .

The concrete interest rates and rates of the aforementioned expenditures are listed below (the following are for reference only, and the concrete interest rates and rates may be adjusted along with the clauses of the Contract, specifically subject to the relevant provisions of the Contract):

(1) The annualized interest rate of loans calculated in accordance with Article 3.1-3.3 of the Contract;

(2) / .

Article 4 Withdrawal

4.1 The Borrower shall withdraw the loan in one lump sum. Where the Borrower fails to withdraw the loan in one lump sum as agreed, the Lender shall be entitled to cancel all or part of the loan. After the Lender pays the loan funds to the Borrower’s withdrawal account specified herein, it will be deemed that the Lender has issued the loan to the Borrower in accordance with the provisions of the Contract.

4.2 The Borrower may withdraw the loan hereunder in the following ways (2):

(1) Withdraw the loan directly from the business outlets named by the Lender;

(2) Withdraw the loan through the E-banking of ICBC by self-service.

Article 5 Payment Method

The Borrower shall repay the loan hereunder in the following (1) way:

(1) The loan will be repaid in one lump sum when it is due;

(2) Others: __________

Article 6 Accounts

The Borrower shall open an account or designate the following account with the Lender as the special account for withdrawal and repayment:

Withdrawal account: 1402026119601206047

Repayment account: 1402026119601206047

Article 7 Guarantee

The loan guarantee hereunder is __________, and the principal information of the corresponding guarantee contract is specifically as below:

Name of the guarantee contract: __________ (No.: _________)

Guarantor: ___________________

The guarantee contract shall be concluded separately by and between the Lender and the Guarantor. Please refer to the above-mentioned guarantee contract for details.

Article 8 Channels for Complaint/Consultation

The channels for complaint/consultation about these Party A’s financial services (products) are listed below:

8.1 Business outlets

Reflect problems to the customer service manager and the person in charge of business outlets of Industrial and Commercial Bank of China or leave some messages through the customer opinion book.

8.2 Customer service telephone

Call the customer service hotline at (95588), and contact the representative of customer service via manual service.

8.3 Online banking and mobile banking

Contact the online customer service of Industrial and Commercial of Bank by logging in to personal online banking through the portal website (http: //xxx.xxxx.xxx.xx) or logging in to the mobile APP, i.e., “Corporate Mobile Banking of Industrial and Commercial Bank of China”.

8.4 Other channels / .

Article 9 Other Matters Agreed by the Parties.

Part II Specific Clauses

Article 1 Interest Rate and Interest

1.1 If the floating interest rate is employed for the loan hereunder, after the loan is overdue, the original way will still apply to the rules for adjustment of interest rates.

1.2 If the loan interest is settled on a monthly basis, the date of interest settlement shall be the 20th of each month; if interest is settled on a quarterly basis, the date of interest settlement shall be the 20th of the last month of each quarter; if the interest is settled every half a year, the date of interest settlement shall be June 20th and December 20th of each year.

1.3 The first interest period is from the date of withdrawal of the Borrower to the first date of interest settlement; the last interest period is from the day after the end of the previous interest period to the final date of repayment; the remaining interest period is from the day after the end of the previous interest period to the next date of interest settlement.

1.4 Interests = Principal × Daily interest rate × Elapsed days. If the average principal & interest applies to the repayment, the capital & interest amount repayable shall be calculated in the following formula:

Gross principal and interest of each period = (loan principal× interest rate of the period × (1+interest rate of the period) number of repayment periods) / ((1+ interest rate of the period) number of repayment periods -1)

1.5 If the People’s Bank of China adjusts the method for determining the loan interest rate, the relevant regulations of the People’s Bank of China shall prevail without any further notice from the Lender to the Borrower.

1.6 If the interest rate of loans determined while making and entering into the Contract is executed after being reduced by a certain basis point as per the loan prime rate (LPR) announced by the National Interbank Funding Center, the Lender shall be entitled to re-evaluate the interest rate concessions granted to the Borrower every year, and decide to cancel all or part of the interest rate concessions granted to the Borrower at its own discretion in line with the national policies, the Borrower’s credit status and the changes of loan guarantee, and notify the Borrower in a prompt manner.

1.7 Unless otherwise specified, the interest rate of loans herein shall be the annualized interest rate calculated by means of simple interest method.

Article 2 Issuance and Payment of Loans

2.1 The Borrower must be in line with the following preconditions before withdrawing the loan, otherwise, the Lender is not obliged to make any payment to the Borrower, unless the Lender consents to issue the loan ahead of schedule:

(1) Except for the credit loan, the Borrower has provided the corresponding guarantee at the request of the Lender, and has gone through the relevant guarantee formalities, and the Guarantor has not violated the provisions of the guarantee contract;

(2) At the time of withdrawal, the representations and warranties made by the Borrower hereunder are still true, accurate and complete, and there is no breach of contract hereunder or under other contracts concluded by and between the Borrower and the Lender;

(3) The proof materials furnished for the purpose of the loan are tally with the agreed purpose;

(4) Submit other materials as required by Lender.

(5) If the Borrower withdraws the loan through the E-banking of ICBC, the Corporate Customer Service Agreement of the E-banking of ICBC concluded by and between the Borrower and the Lender will remain valid throughout the loan term.

2.2 If the Borrower withdraws the loan through the business outlets named by the Lender, it shall submit the notice of withdrawal to the Lender at least 5 banking days ahead of time. Once the notice of withdrawal is submitted, it cannot be revoked without the written consent of the Lender.

2.3 If the Borrower withdraws the loan through the E-banking of ICBC, the Borrower shall sign the Corporate Customer Service Agreement of the E-banking of ICBC with the Lender, and promise to observe the Articles of Association of the E-banking of ICBC as well as relevant trading rules and operate it in accordance with relevant trading rules. The withdrawal instruction submitted by the Borrower through the E-banking of ICBC and confirmed by the Lender shall be considered as the receipt.

2.4 After the Borrower satisfies the preconditions of withdrawal or the Lender consents to advance the loan, the Lender shall transfer the loan to the Borrower’s withdrawal account specified herein, and in that case, it shall be deemed that the Lender has granted the loan to the Borrower in accordance with the provisions of the Contract.

2.5 In accordance with the relevant regulatory regulations and the management requirements of the Lender, if the loan is beyond a certain amount or conforms to other conditions, the Lender shall employ the entrusted payment method, and the Lender shall pay the loan to the payee who meets the purpose specified herein based on the Borrower’s withdrawal application and payment entrustment.

2.6 When handling the entrusted payment, the Borrower shall furnish the Lender with the account information of the payment object as well as the certification materials proving that the withdrawal meets the agreed purpose. The Borrower shall warrant that all information furnished to the Lender is true, complete and valid.

2.7 When handling the entrusted payment, the Lender only performs formal examination on the information of the payment object, the proof materials of the loan purpose as well as other materials furnished by the Borrower. Where the Lender fails to complete the entrusted payment in a prompt manner due to the untrue, inaccurate and incomplete information furnished by the Borrower, the Lender will not assume any liability.

2.8 The Lender shall be entitled to request the Borrower to supplement, replace, explain or re-submit the relevant materials if it finds any inconsistency or other defects in the relevant materials furnished by the Borrower through review. Before the Borrower submits the materials that conform to the management requirements of the Lender, the Lender shall be entitled to refuse the issuance and payment of the relevant funds.

2.9 Based on the loan purpose specified herein, the Lender shall be entitled to request the Borrower, independent intermediary agencies as well as other interested parties to issue a joint visa form as well as other relevant certification materials, and the Lender shall issue and pay the financing funds with these certification materials.

2.10 Upon the examination, if the Lender holds that the information furnished by the Borrower is tally with the agreed loan purpose and the withdrawal is in accordance with the Contract, it shall first transfer the loan to the Borrower’s withdrawal account specified herein, and then transfer the corresponding amount to the account of the payment object named by the Borrower based on the needs and the relevant business vouchers submitted by the Borrower.

2.11 Under any of the following circumstances, the Lender shall be entitled to re-determine the conditions for issuance and payment of the loan, or stop the issuance and payment of the loan:

(1) The Borrower presents false or invalid information to the Lender to obtain financing funds;

(2) The Borrower’s production and operation have undergone material adverse changes, the credit status has declined, or there is a breach of contract hereunder;

(3) The Borrower fails to withdraw and pay the financing funds in accordance with the provisions of the Contract, and the use of the financing funds is abnormal;

(4) The Borrower violates the Contract or relevant regulatory provisions, and evades the entrusted payment by breaking up the whole into parts;

(5) The withdrawal account or payment object’s account named by the Borrower is frozen or stopped by the competent authority from payment.

2.12 Where the Lender fails to complete the entrusted payment in a prompt manner as entrusted by the Borrower because the withdrawal account named by the Borrower or its payment object’s account is frozen or stopped by the competent authority from payment, the Lender will not assume any liability or influence the repayment obligations of the Borrower hereunder.

2.13 If the loan hereunder is paid by the Borrower independently, the Borrower promises to accept and actively cooperate with the Lender in the inspection and supervision of the use of financing funds, including the purpose, by means of account analysis, voucher inspection and on-site investigation, etc., and summarize and report the use of the loan on a regular basis at the request of the Lender.

2.14 If the information furnished by the Borrower to the Lender is untrue, incomplete or invalid, resulting in the loss of the Lender, the Borrower shall make compensation accordingly.

2.15 Where the Lender fails to issue and pay the loan in a prompt manner as specified herein, it shall assume the corresponding liability for breach of contract, unless otherwise provided herein.

2.16 Where the Lender fails to pay the corresponding amount on time due to unforeseeable, inevitable and insurmountable force majeure events such as war, natural disasters, or unexpected events such as system failure and communication failure of the Lender, the Lender will not assume any liability, but the Lender shall promptly notify the Borrower by telephone or in writing.

Article 3 Repayment

3.1 The Borrower shall repay the loan principal, interest as well as other payables in full and on time as specified herein. On the date of repayment and one bank working day prior to each date of interest settlement, the Borrower shall fully deposit the payable interest of current period, principal as well as other payables in the repayment account opened with the Lender, and the Lender shall be entitled to take the initiative to collect the amount on the date of repayment or date of interest settlement, or request the Borrower to cooperate with the relevant transfer formalities. Where the amount in the repayment account is insufficient to cover all due and payable amounts of the Borrower, the Lender shall be entitled to decide the order of repayment.

If the repayment account is reported as lost, frozen, stopped or canceled, or the Borrower needs to change the repayment account, the Borrower shall go through the formalities for changing the repayment account at the Lender. Before the change formalities come into effect, if the original repayment account cannot cover the full payment for transfer, the Borrower shall handle repayment at the Lender’s counter. Where the Borrower fails to go through the formalities for changing the repayment account or repay the loan at the Lender’s counter in a prompt manner, rendering it unable to pay off the principal and interest of the due loan as well as other expenses in full and on time, the Borrower shall be liable for breach of contract.

3.2 If the Borrower applies for prepayment of all or part of the loan, it shall submit a written application to the Lender, or submit the prepayment instruction to the Lender through the E-banking of ICBC.

3.3 If the Lender consents to repay the loan ahead of schedule, the Borrower shall pay off the loan principal, interest as well as other fees due and payable in accordance with the provisions of the Contract at the same time until the date of prepayment.

3.4 The Lender shall be entitled to recover the loan ahead of time based on the withdrawal of the Borrower’s funds. At the request of the Lender, the Borrower shall repay the loan in installments with reference to the repayment plan proposed by the Lender.

3.5 If the actual loan term is shortened due to the early repayment of the Borrower or the early recovery of the loan by the Lender in accordance with the provisions of the Contract, the corresponding grade of interest rate will not be adjusted, and the original interest rate of loans shall still apply.

Article 4 Guarantee

4.1 Except for credit loan, the Borrower shall furnish legal and effective guarantee recognized by the Lender for the fulfillment of its obligations hereunder.

4.2 In the event that the collateral hereunder is damaged, devalued, involved in property right disputes, sealed up or detained, or the Guarantor violates the provisions of the guarantee contract, or the financial condition of the Guarantor of warrandice is adversely changed, or the collateral and the Guarantor undergo other changes that are unfavorable to the creditor’s rights, the Borrower shall promptly notify the Lender and furnish other guarantees approved by the Lender separately.

4.3 The Lender shall have the right to re-value the security and to re-evaluate the guarantor’s guarantee, regularly or irregularly. If, in the opinion of the Lender, the security value decreases, the guarantor’s guarantee reduces, or the guarantor violates the guarantee contract, the Borrower shall provide additional guarantee to the extent of such decrease or reduce, or give other guarantee acceptable to the Lender.

4.4 If the loan hereunder provides pledge guarantee with accounts receivable, within the validity period of the Contract, the Lender shall be entitled to announce the early maturity of the loan, require the Borrower to repay part or all of the loan principal and interest forthwith, or add legal, effective and full guarantee recognized by the Lender:

(1) The bad debt rate of accounts receivable from the pledgor to the payer has increased for two consecutive months;

(2) The outstanding accounts receivable of the pledgor to the payer make up more than 5% of the balance of the accounts receivable to the payer;

(3) Trade disputes (including, without limitation, disputes on quality, technology and service) or debt disputes arise between the pledgor of accounts receivable and the payer or other third parties, resulting in accounts receivable that may not be paid on schedule.

Article 5 Representations and Warranties

The Borrower makes the following representations and warranties to the Lender, which are valid throughout the term of the Contract:

5.1 It is in possession of the Borrower’s subject qualifications, as well as the qualifications and capability to sign and fulfill the Contract in accordance with the law.

5.2 It has obtained all necessary authorizations or approvals for signing the Contract, and its signing and fulfillment of the Contract is not in violation of the provisions of the Articles of Association as well as relevant laws and regulations or in conflict with its obligations under other contracts.

5.3 It has paid other debts payable on schedule, and there is no malicious default on the principal and interest of bank loans.

5.4 It has a sound organizational structure and financial management system, and there is no material violations of laws and regulations during the production and operation in the last year; the current senior executives have no material bad records.

5.5 All documents and materials furnished by the Borrower to the Lender are true, accurate, complete and valid and free from any false records, material omissions or misleading statements.

5.6 The financial and accounting reports furnished by the Borrower to the Lender are prepared in line with Chinese accounting standards, which reflects the Borrower’s operating conditions and liabilities in a true, fair and complete manner, and there have been no material adverse changes in the financial condition of the Borrower since the date of the most recent financial and accounting statements.

5.7 The Borrower has not concealed the litigation, arbitration or claims involved from the Lender.

5.8 The Borrower has known and fully comprehended all the trading rules of the electronic banking system such as the online banking of Industrial and Commercial Bank of China associated with the Contract.

Article 6 The Borrower’s Commitments

6.1 The loan shall be withdrawn and used based on the term and purpose specified herein, and shall not flow into the securities market and futures market in any form or be used for the development of fixed assets, equity investment and real estate projects or for the purchase of stocks, bonds, wealth management products, investment account trading products, financial derivatives and asset management products, or for the purchase of houses and the repayment of housing mortgage loans, or loans, or other projects that are prohibited by laws and regulations of other countries.

6.2 The Borrower shall pay off the loan principal, interest as well as other payables in accordance with the provisions of the Contract.

6.3 The Borrower shall accept and actively cooperate with the Lender’s inspection and supervision over the use of the loan funds, including the purpose, by means of account analysis, voucher inspection and on-site investigation, and summarize and report the use of the loan funds on a regular basis at the request of the Lender.

6.4 The Borrower shall accept the Lender’s credit inspection, furnish true, accurate and complete financial information as well as other information reflecting the Borrower’s debt-paying capability in a timely manner at the Lender’s request, including all bank accounts, bank account numbers, deposit balances, and so on, and actively assist and cooperate with the Lender in investigating, understanding and supervising its production, operation and financial condition.

6.5 Where there are outstanding loan principal and interest as well as other payables due (including being announced to be due forthwith) hereunder, dividends and bonuses shall not be distributed in any form.

6.6 When there are merger, division, capital reduction, changes in equity, pledge of equity, transfer of material assets and creditor’s rights, material foreign investment, substantial increase in debt financing or other actions that may adversely influence the rights and interests of the Lender, the Borrower shall get the written consent of the Lender beforehand or make arrangements that conform to the management requirements of the Lender for the realization of the creditor’s rights.

6.7 Under any of the following circumstances, the Borrower will inform the Lender in a prompt manner:

(1) The Borrower changes its name, official seal, Articles of Association, domicile, legal representative or person in charge, mailing address as well as other matters;

(2) The Borrower goes out of business, is dissolved, liquidated, suspends business for rectification, has its business license revoked, is revoked or applies for (is applied for) bankruptcy;

(3) The Borrower is involved or may be involved in material economic disputes, litigation, arbitration, or its assets are sealed up, detained or enforced, or the judicial organs, taxation, industry and commerce and other authorities are entitled to file a case for investigation or take punishment measures in accordance with legal provisions;

(4) The Borrower’s shareholders, directors and current senior executives or partners and investors are suspected in material cases or economic disputes;

(5) There are merger, division, capital reduction, changes in equity, pledge of equity, joining or withdrawing from partnership, transfer of material assets and creditor’s rights, material foreign investment, substantial increase in debt financing as well as other matters that may adversely influence the rights and interests of the Lender.

6.8 The Borrower will disclose related party relationships and related transactions to the Lender in a timely, comprehensive and accurate manner.

6.9 The Borrower will timely sign for all sorts of notices sent by the Lender or served by other means.

6.10 The Borrower will not dispose of its own assets in a way that reduces its solvency and it will provide guarantee to a third party without prejudicing the rights and interests of the Lender.

6.11 If the loan hereunder is issued by credit, the Borrower will submit the information of external guarantee to the Lender in a complete, true and accurate way on a regular basis, and sign the account supervision agreement at the request of the Lender. If the provision of external guarantee may influence the fulfillment of its obligations hereunder, the Borrower will get the written consent of the Lender.

6.12 The order of repayment of the Borrower’s debts hereunder takes precedence over the Borrower’s debts to its shareholders, legal representatives or persons in charge, partners, principal investors or key managers, and it is at least equal to the similar debts of other creditors of the Borrower.

6.13 The Borrower has been aware of and fully comprehended all the trading rules of online banking of ICBC as well as other electronic banking systems associated with the Contract; it will keep the customer certificates and passwords in good custody. Any operation using the Borrower’s customer numbers (card numbers), passwords or customer certificates shall be considered as the Borrower’s own actions, and the resulting electronic information records shall serve as the evidence to prove and handle the debtor-creditor relationship hereunder.

6.14 Where the repayment funds of the Borrower (including, without limitation, the funds acquired by the Lender through deduction and disposal of collateral, etc.) are insufficient to pay off all debts of the Borrower to the Lender hereunder as well as under other contracts, the Lender shall be entitled to decide the order of payment.

6.15 Strengthen environmental and social risk management and undertakes to accept the supervision and inspection by the Lender. To submit the environmental and social risk report to the Lender if requested.

Article 7 The Lender’s Commitments

7.1 It will issue the loan to the Borrower in accordance with the provisions of the Contract.

7.2 It will keep confidential the non-public data and information furnished by the Borrower, unless otherwise prescribed by laws and regulations, required by the competent authority or otherwise specified herein.

Article 8 Breach of Contract

8.1 Under any of the following circumstances occurs, it will constitute the Borrower’s breach of contract:

(1) The Borrower fails to repay the loan principal and interest as well as other payables hereunder as agreed, or fails to fulfill any other obligations hereunder, or violates the representations, warranties or commitments hereunder;

(2) The guarantee hereunder changes against the creditor’s rights of the Lender, or the Guarantor violates the provisions of the guarantee contract, and the Borrower fails to furnish other guarantees that conform to the management requirements of the Lender;

(3) There appear bad records in the Lender or other financial institutions;

(4) The Borrower fails to pay off any other debt after maturity (including being announced as early maturity), or fails to fulfill or violates its obligations under other agreements, which has influenced or may influence the fulfillment of its obligations hereunder;

(5) The financial indicators such as the Borrower’s profitability, debt paying capability, operating capability and cash flow are beyond the agreed standards, or the deterioration has influenced or may influence the fulfillment of its obligations hereunder;

(6) Significant adverse changes have taken place in the ownership structure, production and operation, foreign investment and other aspects of the Borrower, which has influenced or may influence the fulfillment of its obligations hereunder;

(7) The Borrower is involved in or may be involved in material economic disputes, litigation, arbitration, or its assets are sealed up, detained or enforced, or it is investigated and punished by judicial organs or administrative organs in accordance with the law, or it is exposed by the media for violating relevant national regulations or policies, which has influenced or may influence the fulfillment of its obligations hereunder;

(8) The Borrower’s principal investors and key managers are abnormally changed, disappeared or their personal freedom is investigated or restricted by judicial organs in accordance with the law, which has influenced or may influence the fulfillment of its obligations hereunder;

(9) The Borrower obtains funds or credit from the Lender by taking advantage of false contracts with related parties or transactions with no actual transaction background, or intentionally evades the creditor’s rights of the Lender through related party transactions;

(10) The Borrower has been or may be closed, dissolved, liquidated, closed for rectification, business license revoked, revoked or filed for bankruptcy;

(11) The Borrower causes liability accidents and material environmental and social risk events in violation of the provisions on food safety, production safety, environmental protection as well as other laws and regulations associated with environmental and social risk management, regulatory provisions or industry standards, which has influenced or may influence the fulfillment of its obligations hereunder;

(12) If the loan hereunder is issued by credit, the Borrower’s credit rating, profit level, asset-liability ratio, net cash flow from operating activities as well as other indicators are not in conformity to the Lender’s credit loan conditions; or the Borrower sets mortgage (pledge) guarantee to others or provides external guarantee with its effective operating assets without the written consent of the Lender, which has influenced or may influence the fulfillment of its obligations hereunder;

(13) Under other circumstances that may adversely influence the realization of the creditor’s rights of the Lender hereunder.

8.2 In the event that the Borrower breaches the Contract, the Lender shall be entitled to take one or more of the following measures:

(1) To require the Borrower to correct the breach of contract within a time limit;

(2) To stop issuing loans as well as other financing funds to the Borrower in accordance with the provisions of the Contract as well as other contracts between the Lender and the Borrower, and partially or completely cancel the unpaid loans as well as other financing funds of the Borrower;

(3) To announce that the outstanding loan as well as other financing funds hereunder as well as under other contracts between the Lender and the Borrower are due forthwith, and recover the outstanding funds immediately;

(4) To require the Borrower to compensate the losses suffered by the Lender due to its breach of contract, including, without limitation, the expenses incurred by the Lender in realizing the creditor’s rights hereunder, such as attorney fees, auction fees, and expenses incurred in applying for an execution certificate issued by a notary office;

(5) To take other remedies prescribed by law, regulations or agreed herein or deemed necessary by the Lender.

8.3 Where the Borrower fails to repay the loan when it is due (including being announced to be due forthwith), the Lender shall be entitled to charge a penalty interest at the rate of overdue penalty interest specified herein from the overdue date. For the interest (including penalty interest) charged because the Borrower fails to repay the loan on time, compound interest shall be calculated based on the overdue penalty interest rate. Penalty interest/compound interest shall apply to the interests accrued hereunder.

8.4 Where the Borrower fails to use the loan based on the purpose specified herein, the Lender shall be entitled to charge penalty interest on the misappropriated part based on the penalty interest rate of the misappropriated loan specified herein from the date when the loan is misappropriated, and the interest (including penalty interest) not paid on time during the misappropriated period shall be compounded based on the penalty interest rate of the misappropriated loan. Penalty interest/compound interest shall apply to the interests accrued hereunder.

8.5 In the event that the Borrower is under the above-mentioned circumstances in Articles 8.3 and 8.4 simultaneously, the penalty interest rate shall be the heavier one, and must not be concurrently imposed.

8.6 Where the Borrower fails to repay the loan principal, interest (including penalty interest and compound interest) or other payables on time, the Lender shall be entitled to make an announcement for through the media for collection.

8.7 If there is any change in the controlling or controlled relationship between the related party of the Borrower and the Borrower, or other circumstances other than Items (1) and (2) in Article 8.1 above happen to the related party of the Borrower, which has influenced or may influence the fulfillment of the obligations of the Borrower hereunder, the Lender shall be entitled to take various measures provided herein.

Article 9 Automatic Cancellation of Commitment

9.1 If the Borrower’s credit conditions deteriorate, the Lender may automatically cancel the non-utilized part of the commitment made to the Borrower without prior notice.

9.2 The Borrower’s credit conditions will deteriorate if any circumstance pursuant to Clauses 8.1 and 8.7 of Part II of this Contract occurs to the Borrower.

Article 10 Deduction

10.1 Where the Borrower fails to repay the debts due hereunder (including being announced to be due forthwith) as agreed, the Borrower consents that the Lender shall deduct the corresponding amount from all local and foreign currency accounts opened by the Borrower in Industrial and Commercial Bank of China to pay off the debts until all debts of the Borrower hereunder are paid off.

10.2 If the deduction amount is not tally with the currency of the Contract, it shall be converted at the exchange rate applicable to the Lender on the date of deduction. The interest as well as other expenses incurred from the date of deduction to the date of payment (the date when the Lender converts the deduction amount into the currency of the Contract and actually pays off the debts hereunder in compliance with the national policy for management of foreign exchanges), and the difference resulting from exchange rate fluctuations during this period shall be undertaken by the Borrower.

Article 11 Transfer of Rights and Obligations

11.1 The Lender shall be entitled to transfer part or all of its rights hereunder to a third party, and the Lender’s transfer behavior does not require the consent of the Borrower. The Borrower shall transfer any rights and obligations hereunder without the written consent of the Lender.

11.2 The Lender or Industrial and Commercial Bank of China Limited (“ICBC”) may authorize or entrust other branches of ICBC to fulfill the rights and obligations hereunder based on the needs of operation and management, or assign the loan creditor’s rights hereunder to other branches of ICBC to undertake and manage these rights and obligations, and the Borrower hereby expresses its recognition. The Lender does not have to get the consent of the Borrower for the above-mentioned actions. Other branches of ICBC, which undertake the rights and obligations of the Lender, shall enjoy the right to exercise all the rights hereunder and to file a lawsuit, submit to arbitration or apply for compulsory execution in the name of this institution for disputes hereunder.

Article 12 Effectiveness, Change and Rescission

12.1 The Contract shall come into force after conforming to the following conditions simultaneously and remain valid until the date when all obligations of the Borrower hereunder are fulfilled:

(1) The Contract is affixed with the electronic signature of the Borrower and confirmed by the Lender;

(2) The loan application submitted by the Borrower is in line with the management requirements of the Lender and is approved by the Lender upon examination.

The Lender may confirm the Contract by displaying the validity status of the Contract in the electronic banking system.

12.2 In the event that the contractual elements such as loan amount and term are displayed incorrectly in the electronic banking system of ICBC on account of system failure or force majeure, the Lender shall be entitled to make corrections and inform the Borrower in a prompt manner.

12.3 The Borrower has been aware of and fully comprehended all the trading rules of the online banking of ICBC as well as other electronic banking systems associated with the Contract; the Borrower shall properly keep the customer certificates and passwords, and any operation using the Borrower’s customer numbers (card numbers), passwords or customer certificates shall be deemed as the Borrower’s own actions, and the resulting electronic information records shall serve as certificates to prove and handle the financing relationship hereunder. The electronic signature affixed by the Borrower on the Contract with the online banking certificate through the E-banking of ICBC shall be considered as the signature of the Borrower itself or authorized by the Borrower.

12.4 Any changes to the Contract shall be made in written form (including electronic data form) by all Parties through amicable negotiation. The changed clauses or agreements constitute a part of the Contract and shall be equally authentic in respect of legal effect. Except for the changed part, the remaining clauses of the Contract shall still remain valid; the original clauses shall still valid before the changed part comes into effect.

12.5 The Parties shall discuss and amend relevant provisions promptly in the event that the provisions hereof do not conform to the laws, regulations or policies of the State in full or in part due to any change to the said laws, regulations or policies.

12.6 In the case that any clause herein is held to be invalid or unenforceable, the validity and enforceability of the remaining clauses shall not be affected, nor shall it affect the validity of the entire Contract.

12.7 The modification and termination of the Contract shall not affect the right of each contracting Party to claim compensation for their losses. The termination of the Contract shall not affect the validity of the dispute resolution provisions hereof.

Article 13 Governing Law and Dispute Resolution

The conclusion, effectiveness, interpretation, performance and dispute resolution of and in connection with the Contract shall be governed by the laws of the People’s Republic of China. Any and all disputes arising out of or in connection with the performance of the Contract shall be settled via amicable negotiation by the Parties first. In the case that no settlement can be reached through such consultation, the dispute shall be submitted to the court where the Lender is located or where the Contract is signed for litigation.

Both Parties consent that when any dispute incurred hereunder is brought to court for litigation, the court may resort to audio-visual transmission technology, asynchronous trial as well as other means, and both Parties raise no objection in this regard.

Article 14 Confirmation of Address for Service of Judgment/Ruling Documents

14.1 The Borrower agrees that the address stated in the first page of the Contract will be its address for legal instruments in case of any dispute arising out of the Contract. The Borrower consents that the judicial authority may serve all legal documents electronically by use of the electronic contact information recorded on the front page of the Contract, such as fax, mobile number, e-mail, account number of WeChat, Alipay Account, Alitalk Account, etc. The above-mentioned legal documents include, without limitation, summons, notice of hearing, judgment, ruling, conciliation statement, notice of deadline for fulfillment, etc.

14.2 The Borrower agrees that the judicial organs may serve legal instruments in any one or more of the above ways. If more than one way is taken by the judicial organs to deliver legal instruments to the Borrower, the date of service shall be the date whichever happens the earliest.

14.3 The above-mentioned service-related agreements are applicable to all stages of litigation, arbitration as well as other judicial procedures, including, without limitation, the first trial, second trial, retrial, execution and supervision procedures.

14.4 The Borrower shall ensure that the address, fax, mobile, email and other information first above stated in the Contract is true and effective. In the case of any change to the same, the Borrower shall send prompt written notice to the Lender, or any notice delivered to the former address shall be deemed valid (including electronic delivery), and the Borrower shall be legally liable for all the consequences.

Article 15 Entire Contract

Part I (Basic Agreements) and Part II (Specific Clauses) of the Contract together constitute a complete Contract for Operating Fast Loans, and the same words in the two parts are provided with the same meaning. The Borrower’s loan is bound by the two parts mentioned above.

Article 16 Notices

16.1 The Borrower promises that the address as well as relevant electronic contact information reserved at the Lender are verified to be accurate. The Lender shall be deemed to have fulfilled the obligation of notification to the Borrower by sending relevant documents to the address reserved by the Borrower or the address notified by the Borrower in written form.

16.2 Except by letter, the Borrower consents to accept telephone, e-mail, SMS, WeChat as well as other electronic methods as the Lender’s notification and collection methods. Where there is any change in the address or relevant electronic contact information reserved by the Borrower at the Lender, the Borrower shall be obliged to inform the Lender in writing in a timely manner. If the notice and collection documents sent by the Lender at the original reserved address or related electronic contact information are still valid due to the borrower’s failure to notify the Lender in a timely manner, the Borrower shall undertake the legal consequences incurred thereby.

16.3 If the Lender sends relevant notice to the Borrower, the notice shall be deemed to have been served to all Borrowers when it is served to any Borrower.

Article 17 Special Provisions for VAT

17.1 Each of the interests and sums (subject to specific contract) paid by the Borrower to the Lender hereunder shall be tax-inclusive.

17.2 Where the Borrower requests the Lender to issue VAT invoices, it shall file to the Lender registration information, including the full name, taxpayer identity number or social credit code, address, phone, bank or account number of the Borrower. The Borrower shall ensure that the information provided to the Lender is true, accurate and complete and that relevant supporting materials are provided at the request of the Lender, from time to time as required in the bank notices or website announcements of the Lender.

17.3 If the Borrower receives VAT invoices, it shall provide the Lender with a power of attorney stamped with its seal, designate the recipient, and specify the ID number and other information of the recipient. The designated recipient shall receive VAT invoices by presenting the original ID card. If the designated recipient changes, the Borrower shall issue a power of attorney stamped with its seal to the Lender again. If the Borrower chooses to receive VAT invoices by mail, it shall also provide accurate and deliverable mail information. If the mailing information changes, the Lender shall be notified in writing in a timely manner.

17.4 If the Lender fails to issue VAT invoices in time due to Force Majeure such as natural disasters, government actions, social abnormal events or tax authorities’ reasons, the Lender shall have the right to delay the invoicing without any liability.

17.5 After the Borrower receives its copy of the VAT invoices, or if the Borrower cannot receive its copy of the VAT invoices or delays in receiving the same, causing the failure to seek for tax deduction, due to the loss, breakage or delay occurring after the Lender has delivered the same to a third-party delivery service provider for delivery, the Lender shall be not responsible for compensating the Borrower for related economic losses.

17.6 In accordance with applicable laws and regulations as well as relevant policies, if the VAT credit note needs to be issued for return after sales, suspension of the services which are taxable, incorrect invoicing, or the deduction or invoicing copy which is unauthenticated, and the Borrower is required to submit the Information Form for Issuing Special VAT Credit Note to the tax authority, the Borrower shall do the same; until the tax authority reviews it and send a notice the Lender, the Lender will issue the special VAT credit note.

17.7 When the Contract is performed, in case of any change to applicable tax rates, the Lender shall have the right to adjust the contract price according to the change to applicable tax rates.

Article 18 Miscellaneous

18.1 The Lender’s failure to exercise or delay in exercising any right hereunder will neither constitute a waiver or change of this right or other rights, nor influence its further exercise of this right or other rights.

18.2 In the case that any clause herein is held to be invalid or unenforceable, the validity and enforceability of the remaining clauses shall not be affected, nor shall it affect the validity of the entire Contract.

18.3 The appendixes hereto as well as any its supplementation, amendment, or modification shall constitute as the integral part of the Contract and have the same legal force and effect as the body of the Contract.

18.4 The terms “related party”, “related party relationship”, “related party transaction”, “individual principal investor” and “key managers” mentioned herein are provided with the same meanings as those in Accounting Standards for Business Enterprises No.36 - Related Party Disclosure (C.K. [2006] No.3) promulgated by the Ministry of Finance as well as subsequent revisions to these Standards.

18.5 The environmental and social risks mentioned herein refer to the hazards as well as related risks that the Borrower and its important related parties may cause to the environment and society in the construction, production and business activities, including environmental and social problems associated with energy consumption, pollution, land, health, safety, resettlement, ecological protection, climate change, etc.

18.6 The documents and vouchers on the loan hereunder prepared by the Lender in line with its business rules will constitute effective evidence to prove the creditor-debtor relationship between the Borrower and the Lender, and shall be binding upon the Borrower.

18.7 In the Contract, (1) all references to the Contract shall include revisions or supplements to the Contract; (2) the titles of clauses are for reference only; they will neither constitute any interpretation of the Contract, nor any restriction on the contents and scope under the titles; (3) where the date of withdrawal and date of repayment fall upon non-working days of the bank, these dates shall be postponed to the next working days of the bank.

Both Parties confirm that the Borrower and the Lender have conducted full negotiation about all the clauses of the Contract. The Lender has requested the Borrower to pay special attention to all the clauses associated with the rights and obligations of the Parties and get a comprehensive and accurate understanding of these clauses, and besides, it has explained the relevant clauses at the request of the Borrower. The Borrower has carefully read and fully comprehended all the clauses of the Contract (including the Part I (Basic Agreements) and Part II (Specific Clauses). Both the Borrower and the Lender have the same understanding of all clauses hereof and raise no objection to the contents in relation to the Contract.

Lender:

Borrower: Fuzhou Yukai Trading Co., Ltd.

Place of Signing: Fuzhou City, Fujian Province

Date of Signing: April 14, 2022

Media No.: 6915492174

Customer Authentication Type: Xxxx

Authentication Timestamp: 20220414165755257261