Form of RESTRICTED STOCK UNIT AWARD AGREEMENT

Exhibit 10.1

Form of

RESTRICTED STOCK UNIT AWARD AGREEMENT

THIS RESTRICTED STOCK UNIT AWARD AGREEMENT (this “Agreement”), dated as of the _____ day of ___________, between Hilltop Holdings Inc., a Maryland corporation (the “Company”), and _____________ (the “Participant”).

In consideration of the mutual promises and covenants made herein and the mutual benefits to be derived herefrom, the parties hereto agree as follows:

|

(a) Subject to the provisions of this Agreement and to the provisions of the Hilltop Holdings Inc. 2012 Equity Incentive Plan (the “Plan”), the Company hereby grants to the Participant as of ________________ (the “Grant Date”), an Award under the Plan of __________ Restricted Stock Units (the “Awarded Units”). Each Awarded Unit shall be a notional Share, with the value of each Awarded Unit being equal to the Fair Market Value of a Share at any time. All capitalized terms used herein, to the extent not defined, shall have the meanings set forth in the Plan. |

|

(b) Subject to the terms and conditions of this Agreement, the Awarded Units shall vest and no longer be subject to any restriction (other than the restrictions set forth in Section 4(b) below) according to the provisions set forth in Exhibit A, with the period during which any of the Awarded Units remain unvested being the “Restriction Period”, provided that the Participant is employed by (or, if the Participant is a director or consultant, is providing services to) the Company or any of its Subsidiaries or Affiliates on the Vesting Date (as defined in Exhibit A). |

|

(c) Notwithstanding the foregoing, in the event of the Participant’s Termination of Employment during the Restriction Period: |

|

(i) due to death or Disability (as defined below), a prorated portion of the Awarded Units granted hereunder shall immediately vest and no longer be subject to restriction, with such proration determined by multiplying the total number of the Awarded Units granted hereunder by a fraction, the numerator of which is the number of months during the Restriction Period that the Participant was employed, including the full vesting month in which the Participant’s death or Disability occurs, and the denominator of which is ____________; or |

|

(ii) by the Company without Cause (as defined below) or due to Retirement (as defined below), a prorated portion of the Awarded Units granted hereunder shall remain outstanding and eligible for vesting at the end of the Restriction Period, with such proration determined by multiplying the total number of the Awarded Units granted hereunder by a fraction, the numerator of which is the number of months during the Restriction Period that the Participant was employed, including the full month in which the Participant’s Termination of Employment or Retirement occurs, and the denominator of which is ____________; provided that any Awarded Units that remain outstanding shall be vested and no longer subject to restriction at the end of the |

Performance Based (Section 16)

Restriction Period according to the provisions set forth in Exhibit A (and shall be forfeited at the end of the Restriction Period if the conditions for vesting as set forth in Exhibit A are not achieved). |

Except as specifically provided in (i) and (ii) immediately above, in the event of the Participant’s Termination of Employment during the Restriction Period, all unvested Awarded Units shall be forfeited by the Participant for no consideration effective immediately upon such termination. Upon forfeiture, all of the Participant’s rights with respect to the forfeited Awarded Units shall cease and terminate, without any further obligation on the part of the Company. For purposes of this Agreement, employment with the Company shall include employment with the Company’s Subsidiaries and those of its successors. Nothing in this Agreement or the Plan shall confer upon the Participant any right to continue in the employ of the Company or any of its Subsidiaries or Affiliates or interfere in any way with the right of the Company or any such Subsidiaries or Affiliates to terminate the Participant’s employment at any time.

|

(d) To the extent not previously forfeited, the Awarded Units shall immediately no longer be subject to restriction and vest in full at the greater of (i) “Target” (as defined in Exhibit A) or (ii) the projected actual results based upon results through the Change in Control, upon the Participant’s Termination of Employment without Cause within six (6) months preceding or twelve (12) months following a Change in Control. |

|

(e) For purposes of this Agreement, the following terms are defined as set forth below: |

|

(i) “Cause” means any of the following: (A) the Participant shall have committed a felony or an intentional act of gross misconduct, moral turpitude, fraud, embezzlement, theft, dishonesty, misappropriation, or criminal conduct; (B) the Company shall have been ordered or directed by any federal, state or administrative regulatory agency with jurisdiction to terminate or suspend the Participant’s employment; (C) after being notified in writing by the Company to cease any particular activity, the Participant shall have continued such activity; or (D) deliberate failure on the part of the Participant (1) to perform the Participant’s principal employment duties, (2) to comply with the policies of the Company and its Affiliates in any material respect, or (3) to follow specific reasonable directions received from the Company and its Affiliates. |

|

(ii) “Disability” means a permanent disability within the meaning of Section 22(e)(3) of the Code, excluding, for purposes of this definition, the last sentence thereof. |

|

(iii) “Retirement” means the Participant’s Termination of Employment for any reason other than by the Company for Cause on or after the Participant has attained age ________ and completed at least _______ years of continuous service as an employee of the Company or any of its Affiliates. |

|

(f) Awarded Units that have become vested pursuant to the terms of this Section 1 are collectively referred to herein as “Vested RSUs.” All other Awarded Units are collectively referred to herein as “Unvested RSUs.” |

Performance Based (Section 16)

Subject to the provisions of the Plan and this Agreement, as soon as practicable following the date on which (but in no event more than two and a half (2½) months following the close of the calendar year in which) the Awarded Units vest in accordance with Section 1 above, the Company shall convert the Vested RSUs into the number of whole Shares equal to the number of Vested RSUs, subject to the provisions of the Plan and this Agreement, including, without limitation, the forfeiture provisions of Section 1(c), and the clawback provisions of Section 15, and shall either electronically register such Shares in the Participant’s name or issue certificates for the number of Shares equal to the Vested RSUs in the Participant’s name. Notwithstanding the foregoing, the Company shall convert any Awarded Units that become Vested RSUs as a result of the Participant’s death into the number of whole Shares equal to the number of Vested RSUs within thirty (30) days following the Participant’s death, subject to the provisions of the Plan and this Agreement. The Company shall electronically register such Shares, or issue certificates for the number of Shares, equal to the Vested RSUs in the Participant’s name or in the name of such person or persons to whom the Participant’s rights under the Award passed by will or the applicable laws of descent and distribution. From and after the date of registration or receipt of such Shares, the Participant, or such person or persons to whom the Participant’s rights under the Award passed by will or the applicable laws of descent and distribution, as the case may be, shall have full rights of transfer or resale with respect to such Shares, subject to Section 4(b) hereof and applicable state and federal regulations.

During the lifetime of the Participant, the Shares received upon conversion of Vested RSUs shall only be received by the Participant or the Participant’s legal representative. If the Participant dies prior to the date his or her Vested RSUs are converted into Shares as described in Section 2 above, the Shares relating to such converted Vested RSUs may be received by any individual who is entitled to receive the property of the Participant pursuant to the applicable laws of descent and distribution.

|

(a) Subject to the provisions of the Plan and this Agreement, the Unvested RSUs shall not be transferable by the Participant by means of sale, assignment, exchange, encumbrance, pledge, or otherwise. |

|

(b) Notwithstanding anything to the contrary contained herein, for the one year period immediately following the end of the Restriction Period, the Vested RSUs (and the Shares received upon the conversion of the Vested RSUs under Section 2) shall not be transferable by the Participant by means of sale, assignment, exchange, or otherwise, provided that (i) nothing in this Section 4(b) shall prevent the Participant from pledging or encumbering such Shares during such one year period so long as such pledge or encumbrance cannot cause a transfer or sale of the Shares until after the expiration of such one year period; (ii) in the event of the Participant’s death during such one year period, such restrictions shall terminate on the Participant’s death and the Shares may be transferred to the individual who is entitled to receive the property of the Participant pursuant to the applicable laws of descent and distribution; (iii) nothing in this Section 4(b) shall |

Performance Based (Section 16)

prevent the sale or transfer of the Shares on, in connection with, or after a Change in Control; and (iv) nothing in this Section 4(b) shall prevent the withholding of Shares deliverable upon vesting of the Awarded Units as provided in Section 8 below. |

The Participant will have no rights as a stockholder with respect to any Shares covered by this Agreement until the electronic registration of, or the issuance of certificates for, such Shares in the Participant’s name with respect to the Awarded Units. The Awarded Units shall be subject to the terms and conditions of this Agreement regarding such Shares. No adjustment shall be made for dividends or other rights for which the record date is prior to the registration of, or the issuance of certificates for, such Shares in the Participant’s name.

|

6. Adjustments. |

Adjustments to the Awarded Units (or any of the Shares covered by the Awarded Units), if any, shall be made in accordance with Section 3(d) of the Plan.

The Committee may, in its discretion, require the Participant to represent to, and agree with, the Company in writing that such person is acquiring the Shares without a view toward the distribution thereof. The certificates for such Shares may include any legend that the Committee deems appropriate to reflect any restrictions on transfer. Notwithstanding any other provision of the Plan or this Agreement, the Company shall not be required to issue or deliver any certificate or certificates for Shares under the Plan prior to fulfillment of all of the following conditions: (i) listing, or approval for listing upon notice of issuance, of such Shares on the Applicable Exchange; (ii) any registration or other qualification of such Shares of the Company under any state or federal law or regulation, or the maintaining in effect of any such registration or other qualification that the Committee shall, in its absolute discretion upon the advice of counsel, deem necessary or advisable; and (iii) obtaining any other consent, approval or permit from any state or federal governmental agency that the Committee shall, in its absolute discretion after receiving the advice of counsel, determine to be necessary or advisable. Notwithstanding any of the provisions hereof, the Participant hereby agrees that he or she will not acquire any Shares, and that the Company will not be obligated to issue any Shares to the Participant hereunder, if the issuance of such Shares shall constitute a violation by the Participant or the Company of any provision of any law or regulation of any governmental authority. Any determination in this connection by the Company shall be final, binding and conclusive. The obligations of the Company and the rights of the Participant are subject to all applicable laws, rules and regulations.

No later than the date as of which an amount with respect to this Agreement first becomes includible in the gross income of the Participant or subject to withholding for federal, state, local or foreign income or employment or other tax purposes, the Participant shall pay to the Company or the applicable Affiliate, or make arrangements satisfactory to the Company regarding the payment of, any federal, state, local or foreign taxes of any kind required by applicable law and regulations to be withheld with respect to such amount. Unless the Participant has made

Performance Based (Section 16)

separate arrangements satisfactory to the Company, the Company may elect, but shall not be obligated, to withhold Shares deliverable upon vesting of the Awarded Units having a Fair Market Value on the date of withholding equal to the minimum amount (or, if permitted by applicable law and the Company, such higher withholding rate to the extent consistent with equity accounting in accordance with Generally Accepted Accounting Principles) required to be withheld for tax purposes, all in accordance with such procedures as the Committee establishes. The obligations of the Company under this Agreement and the Plan shall be conditional on compliance by the Participant with this Section 8, and the Company and its Affiliates shall, to the extent permitted by law, have the right to deduct any such taxes from any payment otherwise payable to the Participant. The Committee may establish such procedures as it deems appropriate, including making irrevocable elections, for the settlement of withholding obligations with Shares.

|

9. Notices. |

All notices and other communications under this Agreement shall be in writing and shall be given by hand delivery to the other party or by e-mail, facsimile, overnight courier or registered or certified mail, return receipt requested, postage prepaid, addressed as follows:

If to the Participant: At the most recent home address and/or e-mail address maintained by the Company in its personnel records.

If to the Company:Hilltop Holdings Inc.

_____________

_____________

Attention:_____________

Facsimile:_____________

or to such other address, e-mail or facsimile number as any party shall have furnished to the other in writing in accordance with this Section 9. Notice and communications shall be effective when actually received by the addressee.

The terms of this Agreement shall be binding upon the Participant and upon the Participant’s heirs, executors, administrators, personal representatives, transferees and successors in interest, and upon the Company and its successors and assignees. Notwithstanding anything to the contrary in this Agreement, neither this Agreement nor any rights granted herein shall be assignable by the Participant.

The interpretation, performance and enforcement of this Agreement shall be governed by, and construed in accordance with, the laws of the State of Maryland, without reference to principles of conflict of laws. In addition to the terms and conditions set forth in this Agreement, this Award is subject to the terms and conditions of the Plan, as it may be amended from time to time, which are hereby incorporated by reference.

Performance Based (Section 16)

|

12. Severability. |

The invalidity or enforceability of any provision of this Agreement shall not affect the validity or enforceability of any other provision of this Agreement.

In the event of any conflict between this Agreement and the Plan, the Plan shall control. In the event of any ambiguity in this Agreement, or any matters as to which this Agreement is silent, the Plan shall govern, including, without limitation, the provisions thereof pursuant to which the Committee has the power, among others, to (i) interpret the Plan; (ii) prescribe, amend and rescind rules and regulations relating to the Plan; and (iii) make all other determinations deemed necessary or advisable for the administration of the Plan. The Participant hereby agrees to accept as binding, conclusive and final all decisions or interpretations of the Committee upon any question arising under this Agreement.

|

14. Amendment. |

This Agreement may be unilaterally amended or modified by the Committee at any time; provided that no amendment or modification shall, without the Participant’s written consent, materially impair the rights of the Participant as provided by this Agreement, except such an amendment made to cause the terms of this Agreement or the Awarded Units granted hereunder to comply with applicable law (including tax law), Applicable Exchange listing standards or accounting rules. The waiver by either party of compliance with any provision of this Agreement shall not operate or be construed as a waiver of any other provision of this Agreement, or of any subsequent breach by such party of a provision of this Agreement.

|

15. Clawback. |

All Awarded Units granted pursuant to this Agreement shall be subject to any clawback, recoupment or forfeiture provisions (i) required by law or regulation and applicable to the Company or its Subsidiaries or Affiliates as in effect from time to time or (ii) set forth in any policies adopted or maintained by the Company or any of its Subsidiaries or Affiliates as in effect from time to time.

|

16. Headings. |

The headings of paragraphs herein are included solely for convenience of reference and shall not affect the meaning or interpretation of any of the provisions of this Agreement.

|

17. Counterparts. |

This Agreement may be executed in multiple counterparts, which together shall constitute one and the same Agreement. A manually or electronically signed copy of this Agreement delivered by facsimile, e-mail or other means of electronic transmission shall be deemed to have the same legal effect as delivery of an original signed copy of this Agreement.

Performance Based (Section 16)

The Company may, in its sole discretion, deliver any documents related to the Award by electronic means or request the Participant’s consent to participate in the Plan by electronic means. The Participant hereby consents to receive all applicable documentation by electronic delivery and to participate in the Plan through an on-line (and/or voice activated) system established and maintained by the Company or a third party vendor designated by the Company.

|

19. Data Privacy. |

The Participant acknowledges and consents to the collection, use, processing and transfer of personal data as described in this Section 19. The Company, its Affiliates, and the Participant’s employer hold certain personal information about the Participant, including the Participant’s name, home address and telephone number, date of birth, social security number or other employee identification number, salary, nationality, job title, any Shares or directorships held in the Company, details of all entitlement to Shares awarded, canceled, purchased, vested, unvested or outstanding in the Participant’s favor, for the purpose of managing and administering the Plan (“Data”). The Company and its Affiliates may transfer Data amongst themselves as necessary for the purpose of implementation, administration and management of the Participant’s participation in the Plan, and the Company and its Affiliates may each further transfer Data to any third parties assisting the Company or any such Affiliate in the implementation, administration and management of the Plan. The Participant acknowledges that the transferors and transferees of such Data may be located anywhere in the world and hereby authorizes each of them to receive, possess, use, retain and transfer the Data, in electronic or other form, for the purposes of implementing, administering and managing the Participant’s participation in the Plan, including any transfer of such Data as may be required for the administration of the Plan and/or the subsequent holding of Shares on the Participant’s behalf to a broker or to other third party with whom the Participant may elect to deposit any Shares acquired under the Plan (whether pursuant to the Award or otherwise).

|

20. Entire Agreement. |

This Agreement, together with the Plan, supersede any and all other prior understandings and agreements, either oral or in writing, between the parties with respect to the subject matter hereof and constitute the sole and only agreements between the parties with respect to said subject matter. All prior negotiations and agreements between the parties with respect to the subject matter hereof are merged into this Agreement. Each party to this Agreement acknowledges that no representations, inducements, promises or agreements, orally or otherwise, have been made by any party or by anyone acting on behalf of any party, which are not embodied in this Agreement or the Plan, and that any agreement, statement or promise that is not contained in this Agreement or the Plan shall not be valid or binding or of any force or effect.

The Awarded Units granted under this Agreement are intended to be exempt from Section 409A of the Code, and the provisions of this Agreement will be administered, interpreted and construed accordingly. Notwithstanding anything to the contrary contained herein, in the

Performance Based (Section 16)

event any distribution made on account of the Participant’s Termination of Employment as provided in Section 1 above is deemed to be subject to (and not otherwise exempt from) the requirements of Section 409A of the Code and the Participant is deemed a “specified employee” (within the meaning of Section 409A of the Code and the regulations issued thereunder), then the Participant shall not be entitled to any such distributions that are subject to Section 409A of the Code until the earliest of: (i) the first day of the seventh month following the Participant’s Termination of Employment; (ii) the date of the Participant’s death; or (iii) such earlier date as complies with the requirements of Section 409A of the Code.

By:

Name:

Title:

Agreed and acknowledged:

PARTICIPANT

___________________________

Name:

Performance Based (Section 16)

EXHIBIT A

The Awarded Units shall vest in 20__ in accordance with the provisions set forth below on the date that the Committee has certified the extent that the Performance Metrics set forth below have been attained for the Performance Period (as defined below) (the “Vesting Date”), subject to the terms and conditions of the Agreement (including, without limitation, the forfeiture provisions set forth in Section 1 and Section 5 of the Agreement). Any Awarded Units outstanding on the Vesting Date that are not vested in accordance with this Exhibit A or pursuant to Section 1(c), Section 1(d) or Section 5 of the Agreement shall be immediately forfeited as of the Vesting Date. The Committee shall certify the extent that the Performance Metrics have been attained in 20__ prior to ________, 20__.

|

1. |

Performance Period: ________, 20__ – ________, 20__. |

|

2. |

Performance Metrics: Achievement of the performance metrics set forth in this paragraph 2 of this Exhibit A shall be determined by the Committee, in its sole discretion. |

Subject to the terms and conditions of the Agreement and this Exhibit A, the percentage of Awarded Units that potentially vest (the “Reference Amount”) shall be determined based on the achievement by the Company of GAAP cumulative earnings per share for the Performance Period of at least $_____ per share (the “Target Aggregate EPS”):

|

Threshold |

Target |

Stretch |

|

|

Aggregate EPS |

___% of Target Aggregate EPS |

___% of Target Aggregate EPS |

___% of Target Aggregate EPS |

|

Reference Amount |

___% of Awarded Units |

___% of Awarded Units |

___% of Awarded Units |

Attainment between Threshold and Target and Target and Stretch Performance Metrics shall be subject to straight-line interpolation. Performance Metric achievement below the Threshold level shall result in forfeiture of all Awarded Units.

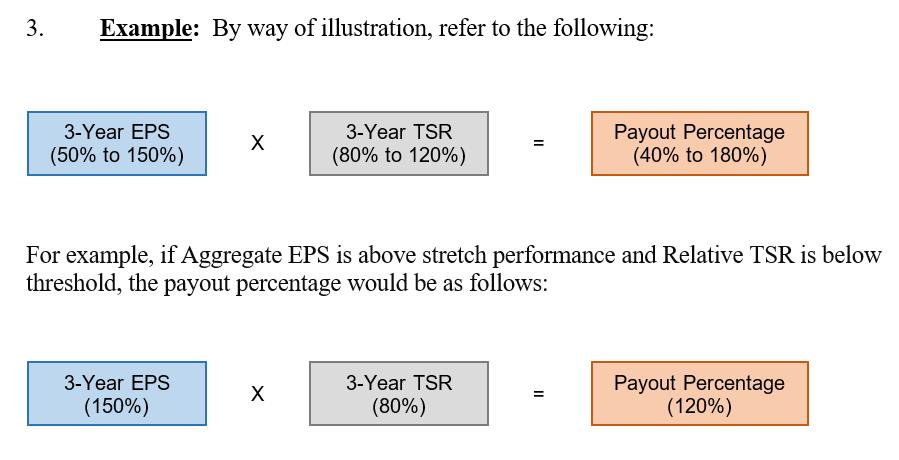

Modifier to Primary Performance Metric

Following the completion of the Performance Period, the Reference Amount determined in accordance with the Primary Performance Metric above will be adjusted by the TSR Modifier (as described below). A Participant’s earned Awarded Units (if any) shall be equal to the Reference Amount multiplied by the TSR Modifier for the Performance Period. The TSR Modifier will be determined based on the Company’s ___ year performance (with TSR measurement being made at the end of the Performance Period) as measured against the ___ year performance of the companies comprising the KBW Regional Banking Index over the same period.

Performance Based (Section 16)

|

Threshold |

Target |

Stretch |

|||||

|

Relative TSR |

___% Percentile |

___% Percentile |

___% Percentile |

||||

|

TSR Modifier |

___% of Reference Amount for Threshold and below |

___% of Reference Amount |

___% of Reference Amount and above |

For performance between the threshold level and target level, a proportionate fraction of the TSR Modifier between ___% and ___% will be applied, and for performance between the target level and the stretch level, a proportionate fraction of the TSR modifier between ___% and ___% will be applied. In no event shall more than ___% of the number of Awarded Units set forth in the Award Agreement be eligible to be earned.

TSR shall be calculated on a per share basis as the quotient of (i) (Ending Price plus Dividends per Share Paid minus Beginning Price), divided by (ii) the Beginning Price, where:

|

· |

Ending Price means the average closing share price of the Company’s Common Stock over the 20 trading days immediately preceding January 1, 20__. |

|

· |

Dividends per Share Paid means cumulative dividends per share of Common Stock paid by the Company between January 1, 20__ and December 31, 20__. Dividends are assumed to be reinvested on the ex-dividend date. |

|

· |

Beginning Price means the average closing share price of the Company’s Common Stock over the 20 trading days immediately preceding January 1, 20__. |

The KBW Regional Banking Index is comprised of those companies that make up the KBW Regional Banking Index on the first day of the performance period) with the following exceptions:

|

· |

If a company has been acquired as of the end of the performance period the company will be removed from the index. |

|

· |

If a company goes bankrupt during the performance period the company will be included in the ranking at -100%. |

Performance Based (Section 16)

Performance Based (Section 16)