SHARE EXCHANGE AGREEMENT by and among BAY PEAK 6 ACQUISITION CORP. ASIA LEECHDOM HOLDING CORP. TIANJIN BOAI PHARMACEUTICALS CO., LTD. TIANJIN BOAI LEECHDOM TECHNIQUE CO., LTD THE SHAREHOLDER OF ASIA LEECHDOM HOLDING CORP. and THE FOUNDERS OF TIANJIN...

| SHARE EXCHANGE AGREEMENT |

| by and among |

| BAY PEAK 6 ACQUISITION CORP. |

| ASIA LEECHDOM HOLDING CORP. |

| TIANJIN BOAI PHARMACEUTICALS CO., LTD. |

| TIANJIN BOAI LEECHDOM TECHNIQUE CO., LTD |

| THE SHAREHOLDER OF |

| ASIA LEECHDOM HOLDING CORP. |

| and |

| THE FOUNDERS OF |

| TIANJIN BOAI PHARMACEUTICALS CO., LTD. |

| Dated as of November 30, 2009 |

TABLE OF CONTENTS

| ARTICLE I EXCHANGE OF SHARES | 1 | |

| 1.1. | Exchange by the Shareholder | 1 |

| 1.2. | The Shares | 2 |

| 1.3. | Closing. | 2 |

| 1.4. | Section 368 Reorganization. | 2 |

| ARTICLE II REPRESENTATIONS AND WARRANTIES OF THE SHAREHOLDER | 2 | |

| 2.1. | Good Title. | 2 |

| 2.2. | Power and Authority | 3 |

| 2.3. | No Conflicts | 3 |

| 2.4. | Litigation | 3 |

| 2.5. | No Finder’s Fee | 3 |

| 2.6. | Purchase Entirely for Own Account. | 3 |

| 2.7. | Available Information | 3 |

| 2.8. | Non-Registration | 3 |

| 2.9. | Restricted Securities | 3 |

| 2.10. | Accredited Investor | 4 |

| 2.11. | Legends | 4 |

| 2.12. | Additional Legend; Consent. | 5 |

| 2.13. | Disclosure. | 5 |

| ARTICLE III REPRESENTATIONS AND WARRANTIES OF THE ALH PARTIES | 5 | |

| 3.1. | Organization, Standing and Power. | 5 |

| 3.2. | Subsidiaries; Equity Interests | 5 |

| 3.3. | Capital Structure. | 6 |

| 3.4. | Authority; Execution and Delivery; Enforceability | 6 |

| 3.5. | No Conflicts; Consents. | 7 |

| 3.6. | Taxes | 7 |

| 3.7. | Benefit Plans. | 8 |

| 3.8. | Litigation | 8 |

| 3.9. | Compliance with Applicable Laws | 8 |

| 3.10. | Brokers | 8 |

| 3.11. | Contracts. | 8 |

| 3.12. | Title to Properties | 9 |

| 3.13. | Intellectual Property | 9 |

| 3.14. | Labor Matters | 9 |

| 3.15. | Financial Statements. | 9 |

| 3.16. | Insurance | 10 |

| 3.17. | Transactions with Affiliates and Employees. | 10 |

| 3.18. | Solvency | 10 |

| 3.19. | Application of Takeover Protections. | 10 |

| 3.20. | Investment Company. | 10 |

| 3.21. | Foreign Corrupt Practices. | 11 |

| 3.22. | Absence of Certain Changes or Events | 11 |

| 3.23. | Disclosure. | 12 |

| 3.24. | No Undisclosed Events, Liabilities, Developments or Circumstances | 12 |

| 3.25. | No Additional Agreements. | 12 |

| ARTICLE IV REPRESENTATIONS AND WARRANTIES OF THE FOUNDERS | 12 | |

i

TABLE OF CONTENTS

| 4.1. | Acquisition of BOAI | 12 |

| 4.2. | Consents and Approvals. | 12 |

| 4.3. | Filings and Registrations | 13 |

| ARTICLE V REPRESENTATIONS AND WARRANTIES OF BP6 | 13 | |

| 5.1. | Formation Related to Bankruptcy Plan | 13 |

| 5.2. | Organization, Standing and Power. | 13 |

| 5.3. | Subsidiaries; Equity Interests | 14 |

| 5.4. | Capital Structure. | 14 |

| 5.5. | Authority; Execution and Delivery; Enforceability | 14 |

| 5.6. | No Conflicts; Consents. | 15 |

| 5.7. | Taxes | 15 |

| 5.8. | Benefit Plans. | 15 |

| 5.9. | ERISA Compliance; Excess Parachute Payments. | 16 |

| 5.10. | Litigation | 16 |

| 5.11. | Compliance with Applicable Laws | 16 |

| 5.12. | Contracts. | 16 |

| 5.13. | Title to Properties | 16 |

| 5.14. | Intellectual Property | 17 |

| 5.15. | Labor Matters | 17 |

| 5.16. | Undisclosed Liabilities | 17 |

| 5.17. | Financial Statements. | 17 |

| 5.18. | Transactions With Affiliates and Employees. | 17 |

| 5.19. | Solvency | 17 |

| 5.20. | Application of Takeover Protections. | 18 |

| 5.21. | Investment Company. | 18 |

| 5.22. | Foreign Corrupt Practices. | 18 |

| 5.23. | Absence of Certain Changes or Events | 18 |

| 5.24. | Certain Registration Matters | 19 |

| 5.25. | Disclosure. | 19 |

| 5.26. | No Undisclosed Events, Liabilities, Developments or Circumstances | 19 |

| 5.27. | No Additional Agreements. | 20 |

| ARTICLE VI CONDITIONS TO CLOSING | 20 | |

| 6.1. | BP6 Conditions Precedent. | 20 |

| 6.2. | ALH and Shareholder Conditions Precedent | 21 |

| ARTICLE VII COVENANTS | 23 | |

| 7.1. | Blue Sky Laws. | 23 |

| 7.2. | Public Announcements. | 23 |

| 7.3. | Fees and Expenses. | 23 |

| 7.4. | Continued Efforts | 23 |

| 7.5. | Exclusivity. | 23 |

| 7.6. | Access. | 24 |

| 7.7. | Preservation of Business | 24 |

| 7.8. | Indemnification and Insurance | 24 |

| 7.9. | Preparation of Disclosure Letters | 25 |

| 7.10. | Financing | 25 |

| 7.11. | Registration Under the Exchange Act; Listing. | 25 |

ii

TABLE OF CONTENTS

| 7.12. | Piggy-Back Registration Rights | 25 |

| 7.13. | Financial Reporting; Inspection of Books and Records. | 26 |

| 7.14. | Lock-Up of Shares and Transfer Restrictions. The Founders and | 26 |

| 7.15. | Legal Counsel. | 27 |

| 7.16. | Break-Up Fees. | 27 |

| 7.17. | Board Composition. | 27 |

| 7.18. | Approval by Bay Peak Nominee | 27 |

| ARTICLE VIII MISCELLANEOUS | 27 | |

| 8.1. | Notices. | 27 |

| 8.2. | Amendments; Waivers; No Additional Consideration. | 28 |

| 8.3. | Termination | 28 |

| 8.4. | Replacement of Securities | 29 |

| 8.5. | Remedies | 29 |

| 8.6. | Limitation of Liability | 29 |

| 8.7. | Interpretation | 29 |

| 8.8. | Severability. | 30 |

| 8.9. | Counterparts; Facsimile Execution | 30 |

| 8.10. | Entire Agreement; Third Party Beneficiaries. | 30 |

| 8.11. | Governing Law. | 30 |

| 8.12. | Assignment. | 30 |

| Annex A | Definitions |

| Exhibit 1 | Final Decree |

| Exhibit 2 | Form of Share Allocation Agreement |

iii

This SHARE EXCHANGE AGREEMENT (this “Agreement”), dated as of November 30, 2009, is by and among BAY PEAK 6 ACQUISITION CORP., a Nevada corporation (“BP6”), ASIA LEECHDOM HOLDING CORP., a New Jersey corporation (“ALH”), TIANJIN BOAI PHARMACEUTICALS CO., LTD., a company organized under the laws of the People’s Republic of China and a wholly owned subsidiary of ALH (“BOAI”), TIANJIN BOAI LEECHDOM TECHNIQUE CO., LTD, a company organized under the laws of the People’s Republic of China and a wholly owned subsidiary of BOAI (“BOAI Technique” and together with ALH and BOAI, the “ALH Parties”), XXXXX TO (formally known as Chenghai Du), the sole shareholder of ALH (the “Shareholder”), and XXXXXXXX XXX AND XXXXXXXX XXXX (such individuals being referred to herein as the “Founders”). Each of the parties to this Agreement is individually referred to herein as a “Party” and collectively, as the “Parties.” Capitalized terms used herein that are not otherwise defined herein shall have the meanings ascribed to them in Annex A hereto.

BACKGROUND

A.

ALH has 100,000 shares of common stock, $nil par value per share (the “ALH Stock”), issued and outstanding, all of which are held by the Shareholder. The Shareholder has agreed to transfer all of his shares of ALH Stock in exchange for a number of newly issued shares of the Common Stock, $.001 par value, of BP6 (the “BP6 Stock”) determined as set forth herein. The number of shares of BP6 Stock issuable to the Shareholder hereunder is referred to herein as the “Shares.”

B.

The exchange of BP6 Stock for ALH Stock is intended to constitute a reorganization within the meaning of Section 368 of the Internal Revenue Code of 1986, as amended.

C.

The Board of Directors of each of BP6 and the ALH Parties have determined that it is desirable to effect this plan of reorganization and share exchange.

AGREEMENT

NOW, THEREFORE, in consideration of the foregoing and the respective representations, warranties, covenants and agreements set forth herein, and intending to be legally bound hereby, the Parties agree as follows:

ARTICLE I

Exchange of Shares

1.1.

Exchange by the Shareholder. At the Closing, the Shareholder shall sell, transfer, convey, assign and deliver to BP6 his ALH Stock free and clear of all Liens in exchange for the number of shares of BP6 Stock determined at Closing in accordance with Section 1.2 below (the “Exchange”).

1.2.

The Shares. The number of Shares issuable by BP6 to the Shareholder at Closing shall be determined as follows: (a) if BP6 has USD$10 million in cash at the Closing, including proceeds of the Financing, but not including any cash held by the ALH Parties prior to the Closing, then the Shareholder shall be entitled to receive Shares equal to 83.5% of all the issued and outstanding common stock of BP6 immediately following consummation of the Transactions and (b) if BP6 has USD$30 million in cash at the Closing, including proceeds of the Financing, but not including any cash held by the ALH Parties prior to the Closing, then the Shareholder shall be entitled to receive Shares equal to 61.0% of all the issued and outstanding common stock of BP6 immediately following consummation of the Transactions, and (c) if the cash in BP6 at the Closing is between USD$10 million and USD$30 million, the number of shares issuable to the Shareholder shall be adjusted accordingly.

1.3.

Closing. The closing (the “Closing”) of the transactions contemplated hereby (the “Transactions”) shall take place at the offices of Pillsbury Xxxxxxxx Xxxx Xxxxxxx LLP in San Francisco, CA commencing at 9:00 a.m. local time on the second business day following the satisfaction or waiver of all conditions to the obligations of the Parties pursuant to Article V of this Agreement to consummate the Transactions (other than conditions with respect to actions that the respective parties will take at Closing) or such other date and time as the Parties may mutually determine, provided that such closing shall not occur after March 31, 2010 without the express written consent of BP6 or ALH (the “Closing Date”).

1.4.

Section 368 Reorganization. For U.S. federal income tax purposes, the Transactions are intended to constitute a “reorganization” within the meaning of Section 368(a)(1)(B) of the Code. The Parties to this Agreement hereby adopt this Agreement as a “plan of reorganization” within the meaning of Sections 1.368 -2(g) of the United States Treasury Regulations, and agree to file and retain such information as shall be required under Xxxxxxx 0.000 -0X xx xxx Xxxxxx Xxxxxx Treasury Regulations. Notwithstanding the foregoing or anything else to the contrary contained in this Agreement, the Parties acknowledge and agree that no Party is making any representation or warranty as to the qualification of the Transactions as a reorganization under Section 368 of the Code or as to the effect, if any, that any transaction consummated prior to, on or after the Closing Date has or may have on any such reorganization status. The Parties acknowledge and agree that each (a) has had the opportunity to obtain independent legal and tax advice with respect to the Transactions and this Agreement, and (b) is responsible for paying its own Taxes, including without limitation, any adverse Tax consequences that may result if the transaction contemplated by this Agreement is determined not to qualify as a reorganization under Section 368 of the Code.

ARTICLE II

Representations and Warranties of the

Shareholder

The Shareholder hereby represents and warrants to BP6 as follows.

2.1.

Good Title. The Shareholder is the record and beneficial owner, and has good title to his ALH Stock, with the right and authority to sell and deliver such ALH Stock. Upon delivery of any certificate or certificates duly assigned, representing the same as herein contemplated and/or upon registering of BP6 as the new owner of such ALH Stock in the share register of XXX, XX0 will receive good title to such ALH Stock, free and clear of all Liens at the Closing.

-2-

2.2.

Power and Authority. The Shareholder has the legal power, capacity and authority to execute and deliver this Agreement and each Transaction Document to be delivered by him hereunder and to perform his obligations hereunder and thereunder, and to consummate the Transactions. All acts required to be taken by the Shareholder to enter into this Agreement, to deliver each Transaction Document to which he is a party and to carry out the Transactions have been properly taken. This Agreement constitutes a legal, valid and binding obligation of the Shareholder, enforceable against the Shareholder in accordance with the terms hereof.

2.3.

No Conflicts. The execution and delivery of this Agreement by the Shareholder and the performance by the Shareholder of his obligations hereunder in accordance with the terms hereof: (a) will not require the consent of any third party or Governmental Entity under any Laws; (b) will not violate any Laws applicable to the Shareholder; and (c) will not violate or breach any contractual obligation to which the Shareholder is a party.

2.4.

Litigation. There is no pending proceeding against the Shareholder that involves the Shares or that challenges, or may have the effect of preventing, delaying or making illegal, or otherwise interfering with, any of the Transactions and, to the knowledge of the Shareholder, no such proceeding has been threatened, and no event or circumstance exists that is reasonably likely to give rise to or serve as a basis for the commencement of any such proceeding.

2.5.

No Finder’s Fee. The Shareholder has not created any obligation for any finder’s, investment banker’s or broker’s fee in connection with the Transactions.

2.6.

Purchase Entirely for Own Account. The BP6 Stock proposed to be acquired by the Shareholder hereunder will be acquired for investment for his own account, and not with a view to the resale or distribution of any part thereof, and the Shareholder has no present intention of selling or otherwise distributing the BP6 Stock, except in compliance with applicable securities laws.

2.7.

Available Information. The Shareholder has such knowledge and experience in financial and business matters that he is capable of evaluating the merits and risks of investment in BP6.

2.8.

Non-Registration. The Shareholder understands that the BP6 Stock has not been registered under the Securities Act and, if issued in accordance with the provisions of this Agreement, will be issued by reason of a specific exemption from the registration provisions of the Securities Act which depends upon, among other things, the bona fide nature of the investment intent and the accuracy of the Shareholder’s representations as expressed herein. The non-registration shall have no prejudice with respect to any rights, interests, benefits and entitlements attached to the BP6 Stock in accordance with BP6’s charter documents or the laws of its jurisdiction of incorporation.

2.9.

Restricted Securities. The Shareholder understands that the Shares are characterized as “restricted securities” under the Securities Act inasmuch as this Agreement contemplates that, if acquired by the Shareholder pursuant hereto, the Shares would be acquired in a transaction not involving a public offering. The issuance of the Shares hereunder have not been registered under the Securities Act or the securities laws of any state of the U.S. and that the issuance of the BP6 Stock is being effected in reliance upon an exemption from registration afforded under Section 4(2) of the Securities Act for transactions by an issuer not involving a public offering. The Shareholder further acknowledges that if the Shares are issued to the Shareholder in accordance with the provisions of this Agreement, such Shares may not be resold without registration under the Securities Act or the existence of an exemption therefrom. The Shareholder represents that he is familiar with Rule 144 promulgated under the Securities Act, as presently in effect, and understands the resale limitations imposed thereby and by the Securities Act.

-3-

2.10.

Accredited Investor. The Shareholder is an “accredited Investor” within the meaning of Rule 501 under the Securities Act and the Shareholder was not organized for the specific purpose of acquiring the Shares.

2.11.

Legends. The Shareholder hereby agrees with BP6 that the BP6 Stock will bear the following legend or one that is substantially similar to the following legend:

THE SECURITIES REPRESENTED BY THIS CERTIFICATE HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR ANY STATE SECURITIES LAWS AND NEITHER SUCH SECURITIES NOR ANY INTEREST THEREIN MAY BE OFFERED, SOLD, PLEDGED, ASSIGNED OR OTHERWISE TRANSFERRED EXCEPT (1) PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE SECURITIES ACT AND APPLICABLE STATE SECURITIES LAWS OR (2) PURSUANT TO AN AVAILABLE EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND APPLICABLE STATE SECURITIES LAWS, IN WHICH CASE THE HOLDER MUST, PRIOR TO SUCH TRANSFER, FURNISH TO THE COMPANY AN OPINION OF COUNSEL, WHICH COUNSEL AND OPINION ARE REASONABLY SATISFACTORY TO THE COMPANY, THAT SUCH SECURITIES MAY BE OFFERED, SOLD, PLEDGED, ASSIGNED OR OTHERWISE TRANSFERRED IN THE MANNER CONTEMPLATED PURSUANT TO AN AVAILABLE EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND APPLICABLE STATE SECURITIES LAWS.

THE SECURITIES REPRESENTED BY THIS CERTIFICATE ARE ALSO SUBJECT TO RESTRICTIONS ON TRANSFER SET FORTH IN THAT CERTAIN SHARE EXCHANGE AGREEMENT DATED AS OF NOVEMBER 30, 2009 BY AND AMONG THE HOLDER AND CERTAIN OTHER PARTIES THERETO.

-4-

2.12.

Additional Legend; Consent. Additionally, the BP6 Stock will bear any legend required by the “blue sky” laws of any state to the extent such laws are applicable to the securities represented by the certificate so legended. The Shareholder consents to BP6 making a notation on its records or giving instructions to any transfer agent of BP6 Stock in order to implement the restrictions on transfer of the Shares.

2.13.

Disclosure. This Agreement, the schedules hereto and any certificate attached hereto or delivered in accordance with the terms hereof by or on behalf of the Shareholder in connection with the Transactions, when taken together, do not contain any untrue statement of a material fact or omit any material fact necessary in order to make the statements contained herein and/or therein not misleading at the Closing pursuant to this Agreement.

ARTICLE III

Representations and Warranties of the ALH

Parties

Subject to the exceptions set forth in the ALH Disclosure Letter (regardless of whether or not the ALH Disclosure Letter is referenced below with respect to any particular representation or warranty), each of the ALH Parties severally (and not jointly) represents and warrants as follows to BP6.

3.1.

Organization, Standing and Power. Each of the ALH Parties, and each of their respective subsidiaries, is duly organized, validly existing and in good standing under the laws of the jurisdiction in which it is organized and has the corporate power and authority and possesses all governmental franchises, licenses, permits, authorizations and approvals necessary to enable it to own, lease or otherwise hold its properties and assets and to conduct its businesses as presently conducted, other than such franchises, licenses, permits, authorizations and approvals the lack of which, individually or in the aggregate, has not had and would not reasonably be expected to have a material adverse effect on any of the ALH Parties, a material adverse effect on the ability of any of the ALH Parties to perform its obligations under this Agreement or on the ability of any of the ALH Parties to consummate the Transactions (a “ALH Material Adverse Effect”). Each of the ALH Parties, and their respective subsidiaries, is duly qualified to do business in each jurisdiction where the nature of its business or its ownership or leasing of its properties make such qualification necessary except where the failure to so qualify would not reasonably be expected to have a ALH Material Adverse Effect. ALH has delivered to BP6 true and complete copies of the ALH Charter, the ALH Bylaws, and the comparable charter, organizational documents and other constituent instruments of each of its subsidiaries, in each case as amended through the date of this Agreement.

3.2.

Subsidiaries; Equity Interests.

(a)

ALH owns 100% of the outstanding equity interests of BOAI, which in turn owns 100% of the outstanding equity and economic interests of BOAI Technique. All of such outstanding equity interests have been validly issued and are fully paid and nonassessable and are as of the date of this Agreement owned as set forth above free and clear of all Liens.

-5-

(b)

Except for its interests in BOAI and BOAI Technique, ALH does not as of the date of this Agreement own, directly or indirectly, any capital stock or other securities of, or have any beneficial ownership interest in, or hold any equity or similar interest, or have any investment in any corporation, limited liability company, partnership, limited partnership, joint venture or other company, person or other entity.

3.3.

Capital Structure. The authorized capital stock of ALH consists of 100,000 shares of common stock, no par value. As of the date hereof, 100,000 shares of common stock are issued and outstanding. Except as set forth above, no shares of capital stock or other voting securities of ALH are issued, reserved for issuance or outstanding. ALH is the sole record and beneficial owner of all of the issued and outstanding capital stock of each of its subsidiaries. All outstanding shares of the capital stock of ALH and each of its subsidiaries are duly authorized, validly issued, fully paid and nonassessable and not subject to or issued in violation of any purchase option, call option, right of first refusal, preemptive right, subscription right or any similar right under any provision of the New Jersey Business Corporation Act, the ALH Charter, the ALH Bylaws or any Contract to which ALH is a party or otherwise bound. There are not any bonds, debentures, notes or other indebtedness of ALH or any of its subsidiaries having the right to vote (or convertible into, or exchangeable for, securities having the right to vote) on any matters on which holders of ALH’s capital stock or the capital stock of any of its subsidiaries may vote (“Voting ALH Debt”). Except as set forth in the ALH Disclosure Letter, as of the date of this Agreement, there are not any options, warrants, rights, convertible or exchangeable securities, “phantom” stock rights, stock appreciation rights, stock-based performance units, commitments, Contracts, arrangements or undertakings of any kind to which ALH or any of its subsidiaries is a party or by which any of them is bound (a) obligating ALH or any of its subsidiaries to issue, deliver or sell, or cause to be issued, delivered or sold, additional shares of capital stock or other equity interests in, or any security convertible or exercisable for or exchangeable into any capital stock of or other equity interest in, ALH or any of its subsidiaries or any Voting ALH Debt, (b) obligating ALH or any of its subsidiaries to issue, grant, extend or enter into any such option, warrant, call, right, security, commitment, Contract, arrangement or undertaking or (c) that give any person the right to receive any economic benefit or right similar to or derived from the economic benefits and rights occurring to holders of the capital stock of ALH or of any of its subsidiaries. As of the date of this Agreement, there are not any outstanding contractual obligations of ALH to repurchase, redeem or otherwise acquire any shares of capital stock of ALH.

3.4.

Authority; Execution and Delivery; Enforceability. Each of the ALH Parties has all requisite corporate power and authority to execute and deliver this Agreement and to consummate the Transactions. The execution and delivery by each of the ALH Parties of this Agreement and the consummation by the ALH Parties of the Transactions have been duly authorized and approved by the Board of Directors of each of the ALH Parties and no other corporate proceedings on the part of any ALH Party are necessary to authorize this Agreement and the Transactions. When executed and delivered, this Agreement will be enforceable against each of the ALH Parties, as applicable, in accordance with its terms, except as such enforcement may be limited by bankruptcy, insolvency or other similar laws affecting the enforcement of creditors’ rights generally or by general principles of equity

-6-

3.5.

No Conflicts; Consents.

(a)

The execution and delivery by the ALH Parties of this Agreement does not, and the consummation of the Transactions and compliance with the terms hereof will not, conflict with, or result in any violation of or default (with or without notice or lapse of time, or both) under, or give rise to a right of termination, cancellation or acceleration of any obligation or to loss of a material benefit under, or result in the creation of any Lien upon any of the properties or assets of any of the ALH Parties or any of its subsidiaries under, any provision of (i) the ALH Charter, the ALH Bylaws or the comparable charter or organizational documents of any of its subsidiaries, (ii) any Contract to which any of the ALH Parties or any of their respective subsidiaries is a party or by which any of their respective properties or assets is bound or (iii) subject to the filings and other matters referred to in Section 3.5(b), any material judgment, order or decree or material Law applicable to any of the ALH Parties or any of their respective subsidiaries or their respective properties or assets, other than, in the case of clauses (ii) and (iii) above, any such items that, individually or in the aggregate, have not had and would not reasonably be expected to have a ALH Material Adverse Effect.

(b)

Except for any required filings under applicable “Blue Sky” or state securities commissions, and any registrations, notices or filings required to be made in order to comply with the currency and exchange control requirements imposed by the Chinese and Hong Kong governments and/or PRC or Hong Kong law, if any, no Consent of, or registration, declaration or filing with, or permit from, any Governmental Entity is required to be obtained or made by or with respect to any of the ALH Parties or any of their respective subsidiaries in connection with the execution, delivery and performance of this Agreement or the consummation of the Transactions.

3.6.

Taxes.

(a)

Each of the ALH Parties and their respective subsidiaries has timely filed, or has caused to be timely filed on its behalf, all Tax Returns required to be filed by it, and all such Tax Returns are true, complete and accurate, except to the extent any failure to file or any inaccuracies in any filed Tax Returns, individually or in the aggregate, have not had and would not reasonably be expected to have a ALH Material Adverse Effect. All Taxes shown to be due on such Tax Returns, or otherwise owed, have been timely paid, except to the extent that any failure to pay, individually or in the aggregate, has not had and would not reasonably be expected to have a ALH Material Adverse Effect. There are no unpaid taxes in any material amount claimed to be due by the taxing authority of any jurisdiction, and the officers of ALH know of no basis for any such claim.

(b)

The ALH Financial Statements reflect an adequate reserve for all Taxes payable by the ALH Parties and their respective subsidiaries (in addition to any reserve for deferred Taxes to reflect timing differences between book and Tax items) for all Taxable periods and portions thereof through the date of such financial statements. No deficiency with respect to any Taxes has been proposed, asserted or assessed against any of the ALH Parties or their respective subsidiaries, and no requests for waivers of the time to assess any such Taxes are pending, except to the extent any such deficiency or request for waiver, individually or in the aggregate, has not had and would not reasonably be expected to have a ALH Material Adverse Effect.

-7-

3.7.

Benefit Plans.

(a)

Except as set forth in the ALH Disclosure Letter, none of the ALH Parties has or maintains any collective bargaining agreement or any bonus, pension, profit sharing, deferred compensation, incentive compensation, stock ownership, stock purchase, stock option, phantom stock, retirement, vacation, severance, disability, death benefit, hospitalization, medical or other plan, arrangement or understanding (whether or not legally binding) providing benefits to any current or former employee, officer or director of any ALH Party or any of its subsidiaries (collectively, “ALH Benefit Plans”). As of the date of this Agreement, there are not any severance or termination agreements or arrangements between ALH or any of its subsidiaries and any current or former employee, officer or director of any of the ALH Parties or their respective subsidiaries, nor does any of the ALH Parties or their respective subsidiaries have any general severance plan or policy.

(b)

Since December 31, 2008, there has not been any adoption or amendment in any material respect by any of the ALH Parties or their respective subsidiaries of any ALH Benefit Plan.

3.8.

Litigation. Except as set forth in the ALH Disclosure Letter, there is no Action against or affecting ALH or any of its subsidiaries or any of their respective properties which (a) adversely affects or challenges the legality, validity or enforceability of any of this Agreement or the Shares or (b) could, if there were an unfavorable decision, individually or in the aggregate, have or reasonably be expected to result in a ALH Material Adverse Effect. None of the ALH Parties or their respective subsidiaries, nor any director or officer thereof (in his or her capacity as such), is or has been the subject of any Action involving a claim or violation of or liability under federal or state securities laws or a claim of breach of fiduciary duty.

3.9.

Compliance with Applicable Laws. Except as set forth in the ALH Disclosure Letter, ALH and each of its subsidiaries have conducted their business and operations in compliance with all applicable Laws, including those relating to occupational health and safety and the environment, except for instances of noncompliance that, individually and in the aggregate, have not had and would not reasonably be expected to have a ALH Material Adverse Effect. None of the ALH Parties has not received any written communication during the past two years from a Governmental Entity that alleges that such Party is not in compliance in any material respect with any applicable Law. This Section 3.9 does not relate to matters with respect to Taxes, which are the subject of Section 3.6.

3.10.

Brokers. Except as set forth in the ALH Disclosure Letter, no broker, investment banker, financial advisor or other person is entitled to any broker’s, finder’s, financial advisor’s or other similar fee or commission in connection with the Transactions based upon arrangements made by or on behalf of any of the ALH Parties or their respective subsidiaries.

3.11.

Contracts. Except as disclosed in the ALH Disclosure Letter, there are no Contracts that are material to the business, properties, assets, condition (financial or otherwise), results of operations or prospects of ALH and its subsidiaries taken as a whole. Neither ALH nor any of its subsidiaries is in violation of or in default under (nor does there exist any condition which upon the passage of time or the giving of notice would cause such a material violation of or default under) any material Contract to which it is a party or by which it or any of its properties or assets is bound, except for such violations or defaults that would not, individually or in the aggregate, reasonably be expected to result in a ALH Material Adverse Effect.

-8-

3.12.

Title to Properties. Except as set forth in the ALH Disclosure Letter, neither ALH nor any of its subsidiaries own any real property. ALH and each of its subsidiaries has sufficient title to, or valid leasehold interests in, all of its properties and assets used in the conduct of its businesses. All such assets and properties, other than assets and properties in which ALH or any of its subsidiaries has leasehold interests, are free and clear of all Liens other than those set forth in the ALH Disclosure Letter and except for Liens that, in the aggregate, do not and will not materially interfere with the ability of ALH and its subsidiaries to conduct business as currently conducted.

3.13.

Intellectual Property. The ALH Parties and their respective subsidiaries own, or are validly licensed or otherwise have the right to use, all Intellectual Property Rights which are material to the conduct of the business of the ALH Parties and their respective subsidiaries taken as a whole. The ALH Disclosure Letter sets forth a description of all Intellectual Property Rights which are material to the conduct of the business of the ALH Parties and their respective subsidiaries taken as a whole. There are no claims pending or, to the knowledge of any of the ALH Parties, threatened that any of the ALH Parties and their respective subsidiaries is infringing or otherwise adversely affecting the rights of any person with regard to any Intellectual Property Right. To the knowledge of the ALH Parties, no person is infringing the rights of any of the ALH Parties or any of their respective subsidiaries with respect to any Intellectual Property Right.

3.14.

Labor Matters. There are no collective bargaining or other labor union agreements to which any of the ALH Parties and their respective subsidiaries is a party or by which any of them is bound. No material labor dispute exists or, to the knowledge of the ALH Parties, is imminent with respect to any of the employees of the ALH Parties.

3.15.

Financial Statements. ALH has delivered to BP6 its audited consolidated financial statements for the fiscal years ended June 30, 2009 and 2008 and its unaudited consolidated financial statements for the three months ended September 30, 2009 (the “ALH Financial Statements”). The ALH Financial Statements have been prepared in accordance with GAAP applied on a consistent basis throughout the period indicated. The ALH Financial Statements fairly present in all material respects the financial condition and operating results of ALH and its subsidiaries, on a consolidated basis, as of the dates, and for the periods, indicated therein. ALH does not have any material liabilities or obligations, contingent or otherwise, other than (a) liabilities or obligations indicated in the ALH Financial Statements and (b) liabilities incurred in the ordinary course of business subsequent to September 30, 2009, and (c) obligations under contracts and commitments incurred in the ordinary course of business and not required under GAAP to be reflected in the ALH Financial Statements, which, in both cases, individually and in the aggregate, would not be reasonably expected to result in a ALH Material Adverse Effect.

-9-

3.16.

Insurance. Except as set forth in the ALH Disclosure Letter, the ALH Parties and their respective subsidiaries are insured by insurers of recognized financial responsibility against such losses and risks and in such amounts as are prudent and customary in the businesses in which the ALH Parties and their respective subsidiaries are engaged and in the geographic areas where they engage in such businesses. The ALH Parties have no reason to believe that they will not be able to renew its and its subsidiaries’ existing insurance coverage as and when such coverage expires or to obtain similar coverage from similar insurers as may be necessary to continue its business on terms consistent with market for ALH’s and such subsidiaries’ respective lines of business.

3.17.

Transactions with Affiliates and Employees. Except as set forth in the ALH Disclosure Letter and the ALH Financial Statements, none of the officers or directors of the ALH Parties and, to the knowledge of ALH, none of the employees of any of the ALH Parties is presently a party to any transaction with any ALH Party or any of its subsidiaries (other than for services as employees, officers and directors), including any Contract or other arrangement providing for the furnishing of services to or by, providing for rental of real or personal property to or from, or otherwise requiring payments to or from any officer, director or such employee or, to the knowledge of ALH, any entity in which any officer, director, or any such employee has a substantial interest or is an officer, director, trustee or partner.

3.18.

Solvency. Based on the financial condition of the ALH Parties and their respective subsidiaries taken as a whole as of the Closing Date (and assuming that the Closing shall have occurred), (a) ALH’s fair saleable value of its assets exceeds the amount that will be required to be paid on or in respect of ALH’s existing debts and other liabilities (including known contingent liabilities) as they mature, (b) ALH’s assets do not constitute unreasonably small capital to carry on its business for the current fiscal year as now conducted and as proposed to be conducted including its capital needs taking into account the particular capital requirements of the business conducted by ALH, and projected capital requirements and capital availability thereof, and (c) the current cash flow of ALH, together with the proceeds ALH would receive, were it to liquidate all of its assets, after taking into account all anticipated uses of the cash, would be sufficient to pay all amounts on or in respect of its debt when such amounts are required to be paid. The ALH Parties do not intend to incur debts beyond their ability to pay such debts as they mature (taking into account the timing and amounts of cash to be payable on or in respect of its debt).

3.19.

Application of Takeover Protections. ALH has taken all necessary action, if any, in order to render inapplicable any control share acquisition, business combination, poison pill (including any distribution under a rights agreement) or other similar anti-takeover provision under the ALH Charter, the ALH Bylaws or the laws of its jurisdiction of organization that is or could become applicable to the Shareholder as a result of the Shareholder and ALH fulfilling their obligations or exercising their rights under this Agreement, including, without limitation, the issuance of the Shares and the Shareholder’s ownership of the Shares.

3.20.

Investment Company. None of the ALH Parties is an affiliate of, and immediately following the Closing will not have become, an “investment company” within the meaning of the Investment Company Act of 1940, as amended.

-10-

3.21.

Foreign Corrupt Practices. None of the ALH Parties, nor any subsidiaries, nor, to ALH’s knowledge, any director, officer, agent, employee or other person acting on behalf of any ALH Party or any subsidiaries has, in the course of its actions for, or on behalf of, any ALH Party (a) used any corporate funds for any unlawful contribution, gift, entertainment or other unlawful expenses relating to political activity; (b) made any direct or indirect unlawful payment to any foreign or domestic government official or employee from corporate funds; (c) violated or is in violation of any provision of the U.S. Foreign Corrupt Practices Act of 1977, as amended; or (d) made any unlawful bribe, rebate, payoff, influence payment, kickback or other unlawful payment to any foreign or domestic government official or employee.

3.22.

Absence of Certain Changes or Events. Except as disclosed in the ALH Financial Statements or in the ALH Disclosure Letter, from the date of the ALH Financial Statements to the date of this Agreement, each of the ALH Parties has conducted its business only in the ordinary course, and during such period there has not been:

(a)

any change in the assets, liabilities, financial condition or operating results of any ALH Parties or any of their respective subsidiaries, except changes in the ordinary course of business that have not caused, in the aggregate, a ALH Material Adverse Effect;

(b)

any damage, destruction or loss, whether or not covered by insurance, that would have a ALH Material Adverse Effect;

(c)

any waiver or compromise by any ALH Party or any of its subsidiaries of a valuable right or of a material debt owed to it;

(d)

any satisfaction or discharge of any lien, claim, or encumbrance or payment of any obligation by any ALH Party or any of its subsidiaries, except in the ordinary course of business and the satisfaction or discharge of which would not have a ALH Material Adverse Effect;

(e)

any material change to a material Contract by which any ALH Party or any of its subsidiaries or any of its respective assets is bound or subject;

(f)

any mortgage, pledge, transfer of a security interest in, or lien, created by any ALH Party or any of its subsidiaries, with respect to any of its material properties or assets, except liens for taxes not yet due or payable and liens that arise in the ordinary course of business and do not materially impair such ALH Party’s or its subsidiaries’ ownership or use of such property or assets;

(g)

any loans or guarantees made by any ALH Party or any of its subsidiaries to or for the benefit of its employees, officers or directors, or any members of their immediate families, other than travel advances and other advances made in the ordinary course of its business;

(h)

any alteration of any ALH Party’s method of accounting or the identity of its auditors;

-11-

(i)

any declaration or payment of dividend or distribution of cash or other property to the Shareholder or any purchase, redemption or agreements to purchase or redeem any ALH Stock;

(j)

any issuance of equity securities to any officer, director or affiliate, except pursuant to existing ALH stock option plans; or

(k)

any arrangement or commitment by any ALH Party or any of its subsidiaries to do any of the things described in this Section 3.22.

3.23.

Disclosure. All disclosure provided to BP6 regarding the ALH Parties, its business and the Transactions, furnished by or on behalf of any ALH Party (including the ALH Parties’ representations and warranties set forth in this Agreement) is true and correct and does not contain any untrue statement of a material fact or omit to state any material fact necessary in order to make the statements made therein, in light of the circumstances under which they were made, not misleading at the Closing pursuant to this Agreement.

3.24.

No Undisclosed Events, Liabilities, Developments or Circumstances. No event, liability, development or circumstance has occurred or exists, or is contemplated to occur with respect to any ALH Party or any of their respective subsidiaries, or their respective businesses, properties, prospects, operations or financial condition, that would be required to be disclosed by any ALH Party under applicable securities laws on a registration statement on Form S-1 filed with the SEC relating to an issuance and sale by ALH of its ALH Stock and which has not been publicly announced.

3.25.

No Additional Agreements. Except as set forth in the ALH Disclosure Letter, ALH does not have any agreement or understanding with the Shareholder with respect to the Transactions other than as specified in this Agreement.

ARTICLE IV

Representations and Warranties of the

Founders

Each of the Founders hereby represents and warrants to BP6, the Shareholder and the ALH Parties as follows.

4.1.

Acquisition of BOAI. The transfer by the Founders of their equity and economic interests in BOAI to ALH (the “Acquisition”) has been fully consummated and is in full force and effect under the Laws of the PRC and ALH is the sole registered and beneficial owner of all such equity and economic interests of BOAI.

4.2.

Consents and Approvals. All consents, approvals, authorizations or licenses required under PRC law in respect of the Acquisition have been duly obtained from the relevant PRC Governmental Entities and are in full force and effect. None of the Founders is in receipt of any letter or notice from any relevant PRC Governmental Entity notifying him or her of the revocation, or otherwise questioning the validity, of the Acquisition, or the need for compliance or remedial actions in respect of the Acquisition.

-12-

4.3.

Filings and Registrations. All filings and registrations with PRC Governmental Entities required in respect of the Acquisition, including, without limitation, registration with the Ministry of Commerce, the State Administration of Industry and Commerce, the State Administration for Foreign Exchange, tax bureau and customs authorities or corresponding provincial or municipal branches of such governmental authorities, where applicable, have been duly completed in accordance with relevant PRC Law.

ARTICLE V

Representations and Warranties of BP6

Subject to the exceptions set forth in the BP6 Disclosure Letter (regardless of whether or not the BP6 Disclosure Letter is referenced below with respect to any particular representation or warranty), BP6 represents and warrants as follows to the Shareholder and the ALH Parties.

5.1.

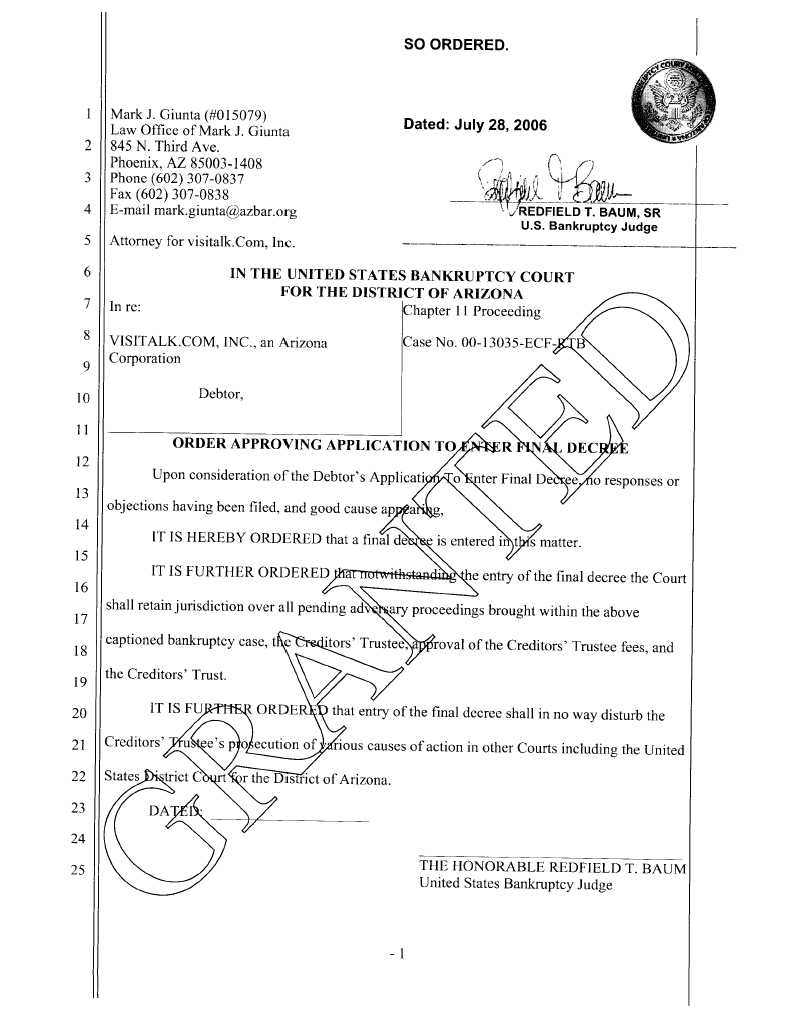

Formation Related to Bankruptcy Plan. BP6 was originally incorporated with the name VT French Services, Inc. (“VTF”). VTF was formed as part of the implementation of a Chapter 11 reorganization plan (the “Visitalk Plan”) of Xxxxxxxx.xxx, Inc. (“Xxxxxxxx.xxx”). VTF was incorporated in Arizona on September 3, 2004 as a wholly owned subsidiary of Visitalk Capital Corporation (“VCC”). The Visitalk Plan was confirmed by the Bankruptcy Court and deemed effective on September 17, 2004. The Final Decree closing the Xxxxxxxx.xxx Chapter 11 case was entered by the Bankruptcy Court on July 28, 2006 and is attached as Exhibit 1 (the “Final Decree”). With the entry of the Final Decree, VTF has no liabilities of any kind related to any Xxxxxxxx.xxx claimants or shareholders. The Visitalk Plan further authorized VCC to distribute 846,147 of VTF’s shares held by VCC to 201 creditors of Xxxxxxxx.xxx. In addition, the Visitalk Plan authorized the issuance of newly designated warrants to purchase shares of VTF common stock, in various ratios in accordance with the Visitalk Plan, to 330 creditors and claimants of Xxxxxxxx.xxx (the “Plan Warrants”). The distribution of these securities under the Visitalk Plan was exempt from registration under the Securities Act of 1933, as authorized by Section 1145 of the Bankruptcy Code. VTF changed the state of incorporation from Arizona to Nevada and adopted a change of name to Bay Peak 6 Acquisition Corp. effective October 1, 2008.

5.2.

Organization, Standing and Power. BP6 is duly organized, validly existing and in good standing under the laws of the State of Nevada and has full corporate power and authority and possesses all governmental franchises, licenses, permits, authorizations and approvals necessary to enable it to own, lease or otherwise hold its properties and assets and to conduct its businesses as presently conducted, other than such franchises, licenses, permits, authorizations and approvals the lack of which, individually or in the aggregate, has not had and would not reasonably be expected to have a material adverse effect on BP6, a material adverse effect on the ability of BP6 to perform its obligations under this Agreement or on the ability of BP6 to consummate the Transactions (a “BP6 Material Adverse Effect”). BP6 is duly qualified to do business in each jurisdiction where the nature of its business or its ownership or leasing of its properties makes such qualification necessary and where the failure to so qualify would reasonably be expected to have a BP6 Material Adverse Effect. BP6 has delivered to ALH true and complete copies of the BP6 Charter and the BP6 Bylaws.

-13-

5.3.

Subsidiaries; Equity Interests. BP6 does not own, directly or indirectly, any capital stock, membership interest, partnership interest, joint venture interest or other equity interest in any person.

5.4.

Capital Structure. The authorized capital stock of BP6 consists of 190,000,000 shares of common stock, $.001 par value, and 10,000,000 shares of undesignated preferred stock, $.001 par value. As of the Closing Date (a) 2,438,105 shares of BP6’s common stock will be issued and outstanding, (b) no shares of preferred stock will be issued and outstanding, and (c) no shares of BP6’s common stock or preferred stock will be held by BP6 in its treasury. Except as set forth in the BP6 Disclosure Letter, no shares of capital stock or other voting securities of BP6 are issued, reserved for issuance or outstanding. All outstanding shares of the capital stock of BP6 are, and all such shares that may be issued prior to the date hereof will be when issued, duly authorized, validly issued, fully paid and nonassessable and not subject to or issued in violation of any purchase option, call option, right of first refusal, preemptive right, subscription right or any similar right under any provision of the Nevada Revised Statutes, the BP6 Charter, the BP6 Bylaws or any Contract to which BP6 is a party or otherwise bound. Except as set forth in the BP6 Disclosure Letter, there are not any bonds, debentures, notes or other indebtedness of BP6 having the right to vote (or convertible into, or exchangeable for, securities having the right to vote) on any matters on which holders of BP6’s common stock may vote (“Voting BP6 Debt”). Except as set forth in the BP6 Disclosure Letter, as of the date of this Agreement, there are not any options, warrants, rights, convertible or exchangeable securities, “phantom” stock rights, stock appreciation rights, stock-based performance units, commitments, Contracts, arrangements or undertakings of any kind to which BP6 is a party or by which it is bound (a) obligating BP6 to issue, deliver or sell, or cause to be issued, delivered or sold, additional shares of capital stock or other equity interests in, or any security convertible or exercisable for or exchangeable into any capital stock of or other equity interest in, BP6 or any Voting BP6 Debt, (b) obligating BP6 to issue, grant, extend or enter into any such option, warrant, call, right, security, commitment, Contract, arrangement or undertaking or (c) that give any person the right to receive any economic benefit or right similar to or derived from the economic benefits and rights occurring to holders of the capital stock of BP6. As of the date of this Agreement, there are not any outstanding contractual obligations of BP6 to repurchase, redeem or otherwise acquire any shares of capital stock of BP6. The stockholder list provided to ALH is a current stockholder and such list accurately reflects all of the issued and outstanding shares of the BP6’s common stock.

5.5.

Authority; Execution and Delivery; Enforceability. The execution and delivery by BP6 of this Agreement and the consummation by BP6 of the Transactions have been (or at Closing will have been) duly authorized and approved by the Board of Directors of BP6 and the holders of a majority of its capital stock and no other corporate proceedings on the part of BP6 are necessary to authorize this Agreement and the Transactions. This Agreement constitutes a legal, valid and binding obligation of BP6, enforceable against BP6 as applicable, in accordance with its terms, except as such enforcement may be limited by bankruptcy, insolvency or other similar laws affecting the enforcement of creditors’ rights generally or by general principles of equity.

-14-

5.6.

No Conflicts; Consents.

(a)

The execution and delivery by BP6 of this Agreement does not, and the consummation of Transactions and compliance with the terms hereof will not, contravene, conflict with or result in any violation of or default (with or without notice or lapse of time, or both) under, or give rise to a right of termination, cancellation or acceleration of any obligation or to loss of a material benefit under, or to increased, additional, accelerated or guaranteed rights or entitlements of any person under, or result in the creation of any Lien upon any of the properties or assets of BP6 under, any provision of (i) the BP6 Charter or BP6 Bylaws, (ii) any material Contract to which BP6 is a party or by which any of its properties or assets is bound or (iii) subject to the filings and other matters referred to in Section 5.6(b), any material Order or material Law applicable to BP6 or its properties or assets, other than, in the case of clauses (ii) and (iii) above, any such items that, individually or in the aggregate, have not had and would not reasonably be expected to have a BP6 Material Adverse Effect.

(b)

No Consent of, or registration, declaration or filing with, or permit from, any Governmental Entity is required to be obtained or made by or with respect to BP6 in connection with the execution, delivery and performance of this Agreement or the consummation of the Transactions, other than filings under state “blue sky” laws, as may be required in connection with this Agreement and the Transactions.

5.7.

Taxes.

(a)

BP6 has timely filed, or has caused to be timely filed on its behalf, all Tax Returns required to be filed by it, and all such Tax Returns are true, complete and accurate, except to the extent any failure to file, any delinquency in filing or any inaccuracies in any filed Tax Returns, individually or in the aggregate, have not had and would not reasonably be expected to have a BP6 Material Adverse Effect. All Taxes shown to be due on such Tax Returns, or otherwise owed, have been timely paid, except to the extent that any failure to pay, individually or in the aggregate, has not had and would not reasonably be expected to have a BP6 Material Adverse Effect.

(b)

The BP6 Financial Statements reflect an adequate reserve for all Taxes payable by BP6 (in addition to any reserve for deferred Taxes to reflect timing differences between book and Tax items) for all Taxable periods and portions thereof through the date of such financial statements. No deficiency with respect to any Taxes has been proposed, asserted or assessed against BP6, and no requests for waivers of the time to assess any such Taxes are pending, except to the extent any such deficiency or request for waiver, individually or in the aggregate, has not had and would not reasonably be expected to have a BP6 Material Adverse Effect.

(c)

There are no Liens for Taxes (other than for current Taxes not yet due and payable) on the assets of BP6. BP6 is not bound by any agreement with respect to Taxes.

5.8.

Benefit Plans. BP6 does not, and since its inception never has, maintained or contributed to any bonus, pension, profit sharing, deferred compensation, incentive compensation, stock ownership, stock purchase, stock option, phantom stock, retirement, vacation, severance, disability, death benefit, hospitalization, medical or other plan, arrangement or understanding (whether or not legally binding) providing benefits to any current or former employee, officer or director of BP6. As of the date of this Agreement, there are not any employment, consulting, indemnification, severance or termination agreements or arrangements between BP6 and any current or former employee, officer or director of BP6, nor does BP6 have any general severance plan or policy.

-15-

5.9.

ERISA Compliance; Excess Parachute Payments. BP6 does not, and since its inception never has, maintained or contributed to any “employee pension benefit plans” (as defined in Section 3(2) of ERISA), “employee welfare benefit plans” (as defined in Section 3(1) of ERISA) or any other BP6 benefit plan for the benefit of any current or former employees, consultants, officers or directors of BP6.

5.10.

Litigation. There is no Action against or affecting BP6 or any subsidiary or any of their respective properties which (a) adversely affects or challenges the legality, validity or enforceability of either of this Agreement or the Shares or (b) could, if there were an unfavorable decision, individually or in the aggregate, have or reasonably be expected to result in a BP6 Material Adverse Effect. Neither BP6 nor any subsidiary, nor any director or officer thereof (in his or her capacity as such), is or has been the subject of any Action involving a claim or violation of or liability under federal or state securities laws or a claim of breach of fiduciary duty.

5.11.

Compliance with Applicable Laws. BP6 is in compliance with all applicable Laws, including those relating to occupational health and safety, the environment, export controls, trade sanctions and embargoes, except for instances of noncompliance that, individually and in the aggregate, have not had and would not reasonably be expected to have a BP6 Material Adverse Effect. BP6 has not received any written communication during the past two years from a Governmental Entity that alleges that BP6 is not in compliance in any material respect with any applicable Law. This Section 5.11 does not relate to matters with respect to Taxes, which are the subject of Section 5.7.

5.12.

Contracts. Except as set forth in the BP6 Disclosure Letter, there are no Contracts that are material to the business, properties, assets, condition (financial or otherwise), results of operations or prospects of BP6 taken as a whole. BP6 is not in violation of or in default under (nor does there exist any condition which upon the passage of time or the giving of notice would cause such a material violation of or default under) any Contract to which it is a party or by which it or any of its properties or assets is bound, except for violations or defaults that would not, individually or in the aggregate, reasonably be expected to result in a BP6 Material Adverse Effect.

5.13.

Title to Properties. BP6 has good title to, or valid leasehold interests in, all of its properties and assets used in the conduct of its businesses. All such assets and properties, other than assets and properties in which BP6 has leasehold interests, are free and clear of all Liens, except for Liens that, in the aggregate, do not and will not materially interfere with the ability of BP6 to conduct business as currently conducted. BP6 has complied in all material respects with the terms of all material leases to which it is a party and under which it is in occupancy, and all such leases are in full force and effect. BP6 enjoys peaceful and undisturbed possession under all such material leases.

-16-

5.14.

Intellectual Property. BP6 does not own, nor is validly licensed nor otherwise has the right to use, any Intellectual Property Rights. No claims are pending or, to the knowledge of BP6, threatened that BP6 is infringing or otherwise adversely affecting the rights of any person with regard to any Intellectual Property Right.

5.15.

Labor Matters. There are no collective bargaining or other labor union agreements to which BP6 is a party or by which it is bound. No material labor dispute exists or, to the knowledge of BP6, is imminent with respect to any of the employees of BP6.

5.16.

Undisclosed Liabilities. BP6 has no liabilities or obligations of any nature (whether accrued, absolute, contingent or otherwise) required by GAAP to be set forth on a balance sheet of BP6 or in the notes thereto. The BP6 Disclosure Letter sets forth all financial and contractual obligations and liabilities (including any obligations to issue capital stock or other securities of BP6) due after the date hereof. All liabilities of BP6 shall be paid off and shall in no event remain liabilities of BP6, ALH or the Shareholder following the Closing.

5.17.

Financial Statements. BP6 has delivered to ALH and Shareholder its unaudited consolidated financial statements for period ending August 31, 2008 (the “BP6 Financial Statements”). The BP6 Financial Statements fairly present in all material respects the financial condition and operating results of BP6, as of the dates, and for the periods, indicated therein. BP6 does not have any material liabilities or obligations, contingent or otherwise, other than (a) liabilities or obligations indicated in the BP6 Financial Statements and (b) liabilities incurred in the ordinary course of business subsequent to August 31, 2008, and (c) obligations under contracts and commitments incurred in the ordinary course of business and not required under GAAP to be reflected in the BP6 Financial Statements, which, in both cases, individually and in the aggregate, would not be reasonably expected to result in a BP6 Material Adverse Effect.

5.18.

Transactions With Affiliates and Employees. None of the officers or directors of BP6 and, to the knowledge of BP6, none of the employees of BP6 is presently a party to any transaction with BP6 or any subsidiary (other than for services as employees, officers and directors), including any Contract or other arrangement providing for the furnishing of services to or by, providing for rental of real or personal property to or from, or otherwise requiring payments to or from any officer, director or such employee or, to the knowledge of BP6, any entity in which any officer, director, or any such employee has a substantial interest or is an officer, director, trustee or partner.

5.19.

Solvency. Based on the financial condition of BP6 as of the Closing Date (and assuming that the Closing shall have occurred), (a) BP6’s fair saleable value of its assets exceeds the amount that will be required to be paid on or in respect of BP6’s existing debts and other liabilities (including known contingent liabilities) as they mature, (b) BP6’s assets do not constitute unreasonably small capital to carry on its business for the current fiscal year as now conducted and as proposed to be conducted, including its capital needs, taking into account the particular capital requirements of the business conducted by BP6, and projected capital requirements and capital availability thereof, and (c) the current cash flow of BP6, together with the proceeds BP6 would receive, were it to liquidate all of its assets, after taking into account all anticipated uses of the cash, would be sufficient to pay all amounts on or in respect of its debt when such amounts are required to be paid. BP6 does not intend to incur debts beyond its ability to pay such debts as they mature (taking into account the timing and amounts of cash to be payable on or in respect of its debt).

-17-

5.20.

Application of Takeover Protections. BP6 has taken all necessary action, if any, in order to render inapplicable any control share acquisition, business combination, poison pill (including any distribution under a rights agreement) or other similar anti-takeover provision under the BP6’s charter documents or the laws of its state of incorporation that is or could become applicable to the Shareholder as a result of the Shareholder and BP6 fulfilling their obligations or exercising their rights under this Agreement, including, without limitation, the issuance of the Shares and the Shareholder’s ownership of the Shares.

5.21.

Investment Company. BP6 is not, and is not an affiliate of, and immediately following the Closing will not have become, an “investment company” within the meaning of the Investment Company Act of 1940, as amended.

5.22.

Foreign Corrupt Practices. Neither BP6, nor to BP6’s knowledge, any director, officer, agent, employee or other person acting on behalf of BP6 has, in the course of its actions for, or on behalf of, BP6 (a) used any corporate funds for any unlawful contribution, gift, entertainment or other unlawful expenses relating to political activity; (b) made any direct or indirect unlawful payment to any foreign or domestic government official or employee from corporate funds; (c) violated or is in violation of any provision of the U.S. Foreign Corrupt Practices Act of 1977, as amended; or (d) made any unlawful bribe, rebate, payoff, influence payment, kickback or other unlawful payment to any foreign or domestic government official or employee.

5.23.

Absence of Certain Changes or Events. Except as disclosed in the BP6 Financial Statements or the BP6 Disclosure Letter, from the date of the BP6 Financial Statements to the date of this Agreement, BP6 has conducted its business only in the ordinary course, and during such period there has not been:

(a)

any change in the assets, liabilities, financial condition or operating results of BP6 from that reflected in the BP6 Financial Statements, except changes in the ordinary course of business that have not caused, in the aggregate, a BP6 Material Adverse Effect;

(b)

any damage, destruction or loss, whether or not covered by insurance, that would have a BP6 Material Adverse Effect;

(c)

any waiver or compromise by BP6 of a valuable right or of a material debt owed to it;

(d)

any satisfaction or discharge of any lien, claim, or encumbrance or payment of any obligation by BP6, except in the ordinary course of business and the satisfaction or discharge of which would not have a BP6 Material Adverse Effect;

-18-

(e)

any material change to a material Contract by which BP6 or any of its assets is bound or subject;

(f)

any material change in any compensation arrangement or agreement with any employee, officer, director or stockholder;

(g)

any resignation or termination of employment of any officer of BP6;

(h)

any mortgage, pledge, transfer of a security interest in or lien created by BP6 with respect to any of its material properties or assets, except liens for taxes not yet due or payable and liens that arise in the ordinary course of business and that do not materially impair BP6’s ownership or use of such property or assets;

(i)

any loans or guarantees made by BP6 to or for the benefit of its employees, officers or directors, or any members of their immediate families, other than travel advances and other advances made in the ordinary course of its business;

(j)

any declaration, setting aside or payment or other distribution in respect of any of BP6’s capital stock, or any direct or indirect redemption, purchase, or other acquisition of any of such stock by BP6;

(k)

any alteration of BP6’s method of accounting or the identity of its auditors;

(l)

any issuance of equity securities to any officer, director or affiliate, except pursuant to existing BP6 stock option plans; or

(m)

any arrangement or commitment by BP6 to do any of the things described in this Section 5.23.

5.24.

Certain Registration Matters. Except as set forth in the XX0 Xxxxxxxxxx Xxxxxx, XX0 has not granted or agreed to grant to any person any rights (including “piggy-back” registration rights) to have any securities of BP6 registered with the SEC or any other governmental authority that have not been satisfied.

5.25.

Disclosure. All disclosure provided to the Shareholder regarding BP6, its business and the Transactions, furnished by or on behalf of BP6 (including BP6’s representations and warranties set forth in this Agreement) is true and correct and does not contain any untrue statement of a material fact or omit to state any material fact necessary in order to make the statements made therein, in light of the circumstances under which they were made, not misleading.

5.26.

No Undisclosed Events, Liabilities, Developments or Circumstances. No event, liability, development or circumstance has occurred or exists, or is contemplated to occur with respect to BP6, its subsidiaries or their respective businesses, properties, prospects, operations or financial condition, that would be required to be disclosed by BP6 under applicable securities laws on a registration statement on Form S-1 filed with the SEC relating to an issuance and sale by BP6 of its common stock and which has not been publicly announced.

-19-

5.27.

No Additional Agreements. BP6 does not have any agreement or understanding with the Shareholder with respect to the Transactions other than as specified in this Agreement.

ARTICLE VI

Conditions to Closing

6.1.

BP6 Conditions Precedent. The obligations of the Shareholder and the ALH Parties to enter into and complete the Closing are subject, at the option of the Shareholder and the ALH Parties, to the fulfillment on or prior to the Closing Date of the following conditions, any one or more of which may be waived by the ALH Parties and the Shareholder in writing.

(a)

Representations and Covenants. The representations and warranties of BP6 contained in this Agreement shall be true in all material respects on and as of the Closing Date with the same force and effect as though made on and as of the Closing Date. BP6 shall have performed and complied in all material respects with all covenants and agreements required by this Agreement to be performed or complied with by BP6 on or prior to the Closing Date. BP6 shall have delivered to the Shareholder and ALH a certificate, dated the Closing Date, to the foregoing effect.

(b)

Litigation. No action, suit or proceeding shall have been instituted before any court or governmental or regulatory body or instituted or threatened by any governmental or regulatory body to restrain, modify or prevent the carrying out of the Transactions or to seek damages or a discovery order in connection with such Transactions, or which has or may have, in the reasonable opinion of ALH or the Shareholder, a materially adverse effect on the assets, properties, business, operations or condition (financial or otherwise) of BP6.

(c)

Consents. All material consents, waivers, approvals, authorizations or orders required to be obtained, and all filings required to be made, by BP6 for the authorization, execution and delivery of this Agreement and the consummation by it of the Transactions shall have been obtained and made by BP6, except where the failure to receive such consents, waivers, approvals, authorizations or orders or to make such filings would not have a BP6 Material Adverse Effect.

(d)

No Material Adverse Change. There shall not have been any occurrence, event, incident, action, failure to act, or transaction since the date of the BP6 Financial Statements which has had or is reasonably likely to cause a BP6 Material Adverse Effect.

(e)

Post-Closing Capitalization. At, and immediately after, the Closing, the authorized capitalization, and the number of issued and outstanding shares of the capital stock of BP6, as indicated on a schedule to be delivered by the Parties at or prior to the Closing, shall be acceptable to ALH and the Shareholder.

(f)

Secretary’s Certificate. BP6 shall have delivered to ALH a certificate, signed by its Secretary or other authorized officer, certifying that the attached copies of the BP6 Charter, the BP6 Bylaws and resolutions of its Board of Directors approving this Agreement and the Transactions are all true, complete and correct and remain in full force and effect.

-20-

(g)

Good Standing Certificate. BP6 shall have delivered to ALH a certificate of good standing of BP6 dated within five (5) business days of Closing issued by the Secretary of State of Nevada.

(h)

Resignations and Appointments. BP6 shall have delivered to ALH (i) a letter of resignation from each director and officer of BP6 resigning from all of their respective positions effective upon the Closing and (ii) evidence of appointment of those new directors and officers of BP6 designated by ALH, effective as of the Closing.

(i)

Payoff Letters and Releases. BP6 shall have delivered to ALH such payoff letters and releases relating to liabilities of BP6 as ALH shall request, in form and substance satisfactory to ALH.

(j)

Lien Searches. If requested, BP6 shall have delivered to ALH the results of UCC, judgment lien and tax lien searches with respect to BP6, the results of which indicate no liens on the assets of BP6.

(k)

Release. BP6 shall have delivered to ALH a duly executed release by the current directors and officers of BP6 and by Bay Peak, LLC (“Bay Peak”) and VCC in favor of BP6, ALH and the Shareholder, in form and substance satisfactory to ALH.

(l)

Shareholders’ List. ALH shall have received a shareholders’ list of BP6 as certified by BP6’s Secretary or transfer agent, dated within three (3) calendar days of the Closing Date.

(m)

Issuance of Shares. BP6 shall have issued the Shares to the Shareholder on the stock ledger of BP6 in accordance with Section 1.2 and shall have delivered a copy of such stock ledger to ALH and the Shareholder. At or within 10 business days following the Closing, BP6 shall deliver to the Shareholder a certificate representing the new shares of BP6 Stock issued to the Shareholder.

(n)

Completion of Financing. At the Closing, BP6 shall consummate a financing with gross proceeds of not less than USD$10,000,000 nor more than USD$30,000,000 through the call of outstanding warrants and the issuance of shares of BP6 Stock upon exercise of such warrants (the “Financing”).

6.2.

ALH and Shareholder Conditions Precedent. The obligations of BP6 to enter into and complete the Closing is subject, at the option of BP6, to the fulfillment on or prior to the Closing Date of the following conditions, any one or more of which may be waived by BP6 in writing.

(a)

Representations and Covenants. The representations and warranties of the Shareholder, the Founders and the ALH Parties contained in this Agreement shall be true in all material respects on and as of the Closing Date with the same force and effect as though made on and as of the Closing Date. The Shareholder, the Founders and the ALH Parties shall have performed and complied in all material respects with all covenants and agreements required by this Agreement to be performed or complied with by the Shareholder, the Founders and the ALH Parties on or prior to the Closing Date. Each of the ALH Parties, the Founders and the Shareholder shall have delivered to BP6 a certificate, dated the Closing Date, to the foregoing effect.

-21-

(b)

Litigation. No action, suit or proceeding shall have been instituted before any court or governmental or regulatory body or instituted or threatened by any governmental or regulatory body to restrain, modify or prevent the carrying out of the Transactions or to seek damages or a discovery order in connection with such Transactions, or which has or may have, in the reasonable opinion of BP6, a materially adverse effect on the assets, properties, business, operations or condition (financial or otherwise) of the ALH Parties.

(c)

Consents. All material consents, waivers, approvals, authorizations or orders required to be obtained, and all filings required to be made, by the Shareholder or the ALH Parties for the authorization, execution and delivery of this Agreement and the consummation by them of the Transactions, shall have been obtained and made by the Shareholder, the Founders or the ALH Parties, except where the failure to receive such consents, waivers, approvals, authorizations or orders or to make such filings would not have an ALH Material Adverse Effect.

(d)

No Material Adverse Change. There shall not have been any occurrence, event, incident, action, failure to act, or transaction since the date of the ALH Financial Statements which has had or is reasonably likely to cause an ALH Material Adverse Effect.

(e)

Post-Closing Capitalization. At, and immediately after, the Closing, the authorized capitalization, and the number of issued and outstanding shares of the capital stock of BP6, as indicated on a schedule to be delivered by the Parties at or prior to the Closing, shall be acceptable to BP6.

(f)

Satisfactory Completion of Due Diligence. BP6 shall have completed its legal, accounting and business due diligence of the Shareholder, the Founders and the ALH Parties and the results thereof shall be satisfactory to BP6 in its sole and absolute discretion.

(g)

Secretary’s Certificate. ALH shall have delivered to BP6 a certificate, signed by its Secretary or other authorized officer, certifying that the attached copies of the ALH Charter, the ALH Bylaws and resolutions of its Board of Directors approving this Agreement and the Transactions are all true, complete and correct and remain in full force and effect.

(h)

Good Standing Certificate. ALH shall have delivered to BP6 a certificate of good standing of ALH dated within five (5) business days of Closing issued by the New Jersey Division of Revenue.

(i)

Delivery of Audit Report and Financial Statements. ALH shall have completed the ALH Financial Statements and shall have received an audit report from an independent audit firm that is registered with the Public Company Accounting Oversight Board. The form and substance of the ALH Financial Statements shall be satisfactory to BP6 in its sole and absolute discretion.

(j)

Delivery of PRC Legal Opinion. ALH shall have received an opinion from its legal counsel in the People’s Republic of China that confirms the legality under Chinese law of the restructuring being effected by ALH in connection with the Transactions and the enforceability of this Agreement and that is otherwise satisfactory to ALH, the Shareholder, and BP6.

-22-

(k)

Share Transfer Documents. The Shareholder shall have delivered to BP6 the original certificate(s) representing its ALH Stock, accompanied by a duly executed stock transfer power for transfer by the Shareholder of his ALH Stock to BP6.

(l)

Completion of Financing. The Financing shall have been completed or shall be completed simultaneously with the Closing.

(m)