LEASE AGREEMENT BETWEEN W2007 SEATTLE OFFICE SECOND AND SPRING BUILDING REALTY, LLC, A DELAWARE LIMITED LIABILITY COMPANY, AS LANDLORD, AND AVALARA, INC., A WASHINGTON CORPORATION, AS TENANT, DATED AUGUST 14, 2014

Exhibit 10.16

BETWEEN

W2007 SEATTLE OFFICE SECOND AND SPRING BUILDING REALTY, LLC,

A DELAWARE LIMITED LIABILITY COMPANY,

AS LANDLORD,

AND

AVALARA, INC.,

A WASHINGTON CORPORATION,

AS TENANT,

DATED AUGUST 14, 2014

The submission of this Lease by Landlord, its broker, agent or representative, for examination or execution by Tenant, does not constitute an option or offer to lease the Premises upon the terms and conditions contained herein or a reservation of the Premises in favor of Tenant; it being intended hereby that notwithstanding the preparation of space plans and/or tenant improvements plans, etc., and/or the expenditure by Tenant of time and/or money while engaged in negotiations in anticipation of it becoming the Tenant under this Lease, or Tenant’s forbearing pursuit of other leasing opportunities, or even Tenant’s execution of this Lease and submission of same to Landlord, that this Lease shall become effective and binding upon Landlord only upon the execution hereof by Landlord and its delivery of a fully executed counterpart hereof to Tenant. No exception to the foregoing disclaimer is intended, nor shall any be implied, from expressions of Landlord’s willingness to negotiate in good faith with respect to any of the terms and conditions contained herein.

Second & Spring

Avalara, Inc.

BASIC LEASE INFORMATION

| Lease Date: | August 14, 2014 | |

| Landlord: | W2007 SEATTLE OFFICE SECOND AND SPRING BUILDING REALTY, LLC, a Delaware limited liability company | |

| Tenant: | AVALARA, INC., a Washington corporation | |

| Building: | The office building commonly known as Second & Spring, and whose street address is 0000 0xx Xxxxxx, Xxxxxxx, Xxxxxxxxxx, and which contains a total of approximately 133,490 rentable square feet of space. | |

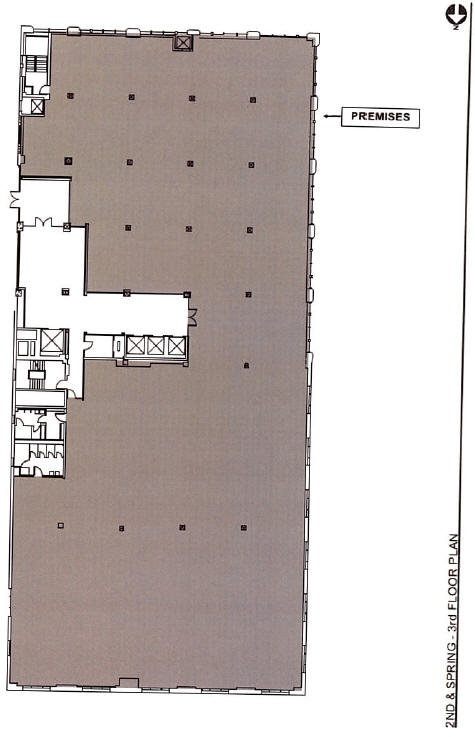

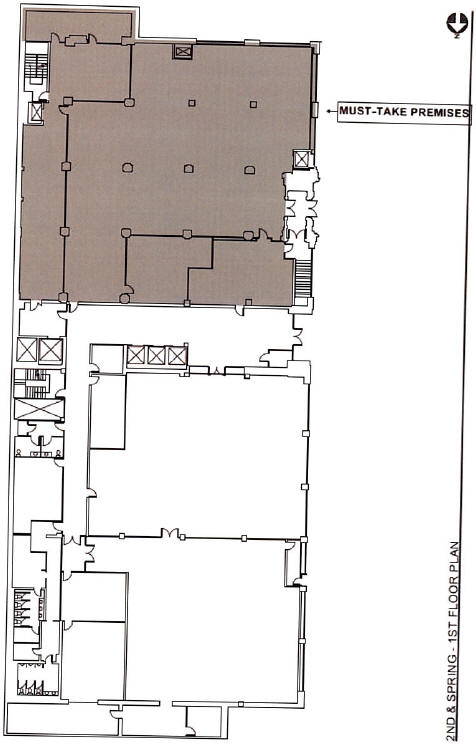

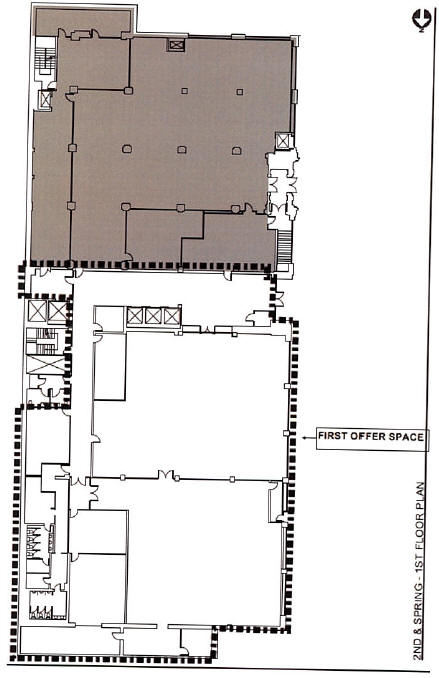

| Premises: | The Premises shall contain a total of approximately 36,420 rentable square feet of space, comprised of the following:

The “Initial Premises” contains approximately 24,546 rentable square feet of space and comprises the entire rentable area of the third (3rd) floor of the Building, and is commonly known as Suite 300.

The “Must-Take Premises” contains approximately 11,874 rentable square feet of space located on the first (1st) floor of the Building, and is commonly known as Suite 105.

The Premises are outlined on the floor plan(s) attached to the Lease as Exhibit A.

Landlord and Tenant stipulate that the number of rentable square feet in the Premises set forth above is conclusive and shall be binding upon them, and that Landlord shall have the right from time to time to remeasure the Building based on Landlord’s then-current measurement standard. | |

| Land/Project: | The land on which the Building is located (the “Land”) is described on Exhibit B attached hereto. The term “Project” shall collectively refer to the Building, the Land and the driveways, the Parking Facility (as defined in Exhibit G attached hereto), and similar improvements and easements associated with the foregoing or the operation thereof. | |

| Term: | Ninety (90) full calendar months, plus, if the Commencement Date (as defined below) occurs on other than the first day of a month, any partial month from the Commencement Date to the end of the month in | |

| (i) | Second & Spring Avalara, Inc. |

| which the Commencement Date falls, starting on the Commencement Date and ending at 5:00 p.m. local time on the last day of the ninetieth (90th) full calendar month following the Commencement Date (the “Expiration Date”), subject to adjustment and earlier termination as provided in the Lease, and extension of the Term as set forth in, and in accordance with, Exhibit I attached hereto.

| ||

| Commencement Date: | January 1, 2015, which Commencement Date is subject to extension due to Commencement Date Delays (as that term is defined in Section 5.1 of the Tenant Work Letter).

| |

| Notwithstanding anything herein, the “Commencement Date” shall not occur until all of the following have occurred: (a) Landlord has substantially completed Landlord’s Work; (b) Landlord has delivered actual possession and control of the Premises to Tenant; and (c) Landlord has delivered a fully executed copy of this Lease to Tenant.

| ||

| In addition, the “Must-Take Commencement Date” shall be the date that is ninety (90) days following the date on which Landlord delivers the Must-Take Premises to Tenant with the Landlord Work (as that term is defined in the Tenant Work Letter) in the Must-Take Premises substantially complete.

| ||

| Basic Rent: | Basic Rent shall be the following amounts for the following periods of time: |

| Period During the Term |

Annual Basic Rent |

Monthly Installment of Basic Rent |

Annual Rental Rate Per Rentable Square Foot |

|||||||||

| January 1, 2015 through the day |

||||||||||||

| immediately prior to the Must-Take Commencement Date * |

$ | 810,018.00 | ** | $ | 67,501.50 | ** | $ | 33.00 | ||||

| Must-Take Commencement Date through December 31, 2015 |

$ | 1,201,860.00 | ** | $ | 100,155.00 | ** | $ | 33.00 | ||||

| January 1, 2016 through December 31, 2016 |

$ | 1,238,280.00 | $ | 103,190.00 | $ | 34.00 | ||||||

| January 1, 2017 through December 31, 2017 |

$ | 1,274,700.00 | $ | 106,225.00 | $ | 35.00 | ||||||

| January 1, 2018 through December 31, 2018 |

$ | 1,311,120.00 | $ | 109,260.00 | $ | 36.00 | ||||||

| (ii) | Second & Spring Avalara, Inc. |

| January 1, 2019 through December 31, 2019 |

$ | 1,347,540.00 | $ | 112,295.00 | $ | 37.00 | ||||||

| January 1, 2020 through December 31, 2020 |

$ | 1,383,960.00 | $ | 115,330.00 | $ | 38.00 | ||||||

| January 1, 2021 through December 31, 2021 |

$ | 1,420,380.00 | $ | 118,365.00 | $ | 39.00 | ||||||

| January 1, 2022 through June 30, 2022 |

$ | 1,456,800.00 | $ | 121,400.00 | $ | 40.00 |

| * | The Basic Rent for this period is based on the 24,546 rentable square feet of the Initial Premises only. On and following the Must-Take Commencement Date, the Basic Rent set forth in the chart above is based on the 36,420 rentable square feet of the entire Premises. In the event that the Must-Take Commencement Date does not occur until after January 1, 2016, then the foregoing schedule of Basic Rent shall be modified to reflect the same, which modification shall be confirmed in writing by Landlord to Tenant. |

| ** | The Basic Rent with respect to the Initial Premises is subject to abatement from January 1, 2015 through June 30, 2015, and the Basic Rent with respect to the Must-Take Premises is subject to abatement for the first five (5) full months of the Term following the Must-Take Commencement Date, all subject to the terms and conditions set forth in Exhibit H attached hereto. Such abatement of Basic Rent shall not apply with respect to the Additional Monthly Basic Rent, as described below. |

In addition, the monthly Basic Rent amounts identified herein shall be subject to increase by the amount of the Additional Monthly Basic Rent in the event that Tenant utilizes any portion of the Additional Improvement Allowance, as more particularly set forth in Section 2.1.2 of the Tenant Work Letter attached hereto as Exhibit B.

| Security Deposit: | None. | |

| Letter of Credit: | $242,800.00. | |

| Rent: | Basic Rent, Additional Rent (as defined below), and all other sums that Tenant may owe to Landlord or otherwise be required to pay under the Lease. | |

| Permitted Use: | General office use only. | |

| Tenant’s Proportionate Share: | Initially, 18.3879%, which is the percentage obtained by dividing (a) the number of rentable square feet in the Initial Premises as stated above by (b) 133,490. | |

| Effective as of the Must-Take Commencement Date, Tenant’s Proportionate Share shall equal 27.2829%, which is the percentage obtained by dividing (i) the number of rentable square feet in the | ||

| (iii) | Second & Spring Avalara, Inc. |

| Premises as stated above by (ii) 133,490. | ||

| Base Year: | The calendar year 2015. | |

| Parking Pass Ratio: | One (1) unreserved parking pass for every 2,000 rentable square feet of the Premises then leased by Tenant. | |

| Initial Liability | ||

| Insurance Amount: | Three Million Dollars ($3,000,000.00) | |

| Tenant’s Address: | Prior to and after the Commencement Date: | |

| Avalara, Inc. 000 Xxxxxx Xxxx XX, Xxxxx 000 Xxxxxxxxxx Xxxxxx, Xxxxxxxxxx 00000 Attention: Real Estate | ||

| with a copy of any notice of default to: | ||

| Avalara, Inc. 000 Xxxxxx Xxxx XX, Xxxxx 000 Xxxxxxxxxx Xxxxxx, Xxxxxxxxxx 00000 Attention: Real Estate with a copy of any default notice to the Attention: Legal Department | ||

| Landlord’s Address: | For all Notices:

Talon Portfolio Services, LLC 0000 Xxxxx Xxxxxx, Xxxxx 0000 Xxxxxxx, Xxxxxxxxxx 00000 Attention: Lease Administration | |

| (iv) | Second & Spring Avalara, Inc. |

| With a copy to: | ||

| W2007 Seattle Office Second and Spring Building Realty, LLC x/x Xxxxxx Xxxxxx Xxxxxxx, X.X.X. 000 Xxxxx Xxxxxxxx Xxxxxx, Xxxxx 0000 Xxxxxxx, Xxxxxxxx 00000 Attention: Xx. Xxx Xxxxxxxx Xx. Xxxxxxx Xxxxxx Xxxxxx Xxxx, Esq. | ||

| With a copy to: | ||

| Pircher, Xxxxxxx & Xxxxx 0000 Xxxxxxx Xxxx Xxxx, Xxxxx 0000 Xxx Xxxxxxx, Xxxxxxxxxx 00000-0000 Attention: Real Estate Notices (SCS) | ||

| Landlord’s Address: | For Payment of Rent: | |

| W2007 Seattle Office Second and Spring Building Realty, LLC X.X. Xxx 000000 Xxxxxx, Xxxxx 00000-0000 | ||

| (v) | Second & Spring Avalara, Inc. |

TABLE OF CONTENTS

| Page | ||||||

| 1. |

Definitions and Basic Provisions | 1 | ||||

| 2. |

Lease Grant | 1 | ||||

| (a) Generally | 1 | |||||

| (b) Must-Take Premises | 2 | |||||

| 3. |

Lease Term | 2 | ||||

| (a) In General | 2 | |||||

| (b) Termination Right Based on Landlord’s Failure to Timely Deliver the Must-Take Premises | 2 | |||||

| (c) Beneficial Occupancy | 3 | |||||

| 4. |

Rent | 3 | ||||

| (a) Payment | 3 | |||||

| (b) Operating Costs; Taxes | 3 | |||||

| (c) Cost Pools | 11 | |||||

| 5. |

Delinquent Payment; Handling Charges | 11 | ||||

| 6. |

Letter of Credit | 11 | ||||

| (a) General Provisions | 11 | |||||

| (b) Drawings under Letter of Credit | 12 | |||||

| (c) Use of Proceeds by Landlord | 12 | |||||

| (d) Additional Covenants of Tenant | 13 | |||||

| (e) Nature of Letter of Credit | 13 | |||||

| (f) Transfer of Letter of Credit | 14 | |||||

| 7. |

Landlord’s Obligations | 14 | ||||

| (a) Services | 14 | |||||

| (b) Excess Utility Use | 15 | |||||

| (c) Landlord’s Repairs | 15 | |||||

| (d) Restoration of Services; Abatement | 16 | |||||

| (e) General Abatement | 16 | |||||

| 8. |

Improvements; Alterations; Repairs; Maintenance | 17 | ||||

| (a) Improvements; Alterations | 17 | |||||

| (b) Repairs; Maintenance | 18 | |||||

| (c) Performance of Work | 19 | |||||

| (d) Mechanic’s Liens | 19 | |||||

| (e) Tenant’s Security System | 20 | |||||

| 9. |

Use | 20 | ||||

| (vi) | Second & Spring Avalara, Inc. |

| 10. |

Assignment and Subletting | 21 | ||||

| (a) Transfers | 21 | |||||

| (b) Consent Standards | 21 | |||||

| (c) Request for Consent | 21 | |||||

| (d) Conditions to Consent | 22 | |||||

| (e) Attornment by Subtenants | 22 | |||||

| (f) Cancellation | 23 | |||||

| (g) Additional Compensation | 23 | |||||

| (h) Permitted Transfers | 23 | |||||

| 11. |

Insurance; Waivers; Subrogation; Indemnity | 24 | ||||

| (a) Tenant’s Insurance | 24 | |||||

| (b) Landlord’s Insurance | 26 | |||||

| (c) No Subrogation; Waiver of Property Claims | 26 | |||||

| (d) Waiver | 26 | |||||

| (e) Indemnities | 27 | |||||

| 12. |

Subordination; Attornment; Notice to Landlord’s Mortgagee | 28 | ||||

| (a) Subordination | 28 | |||||

| (b) Attornment | 28 | |||||

| (c) Notice to Landlord’s Mortgagee | 28 | |||||

| (d) Landlord’s Mortgagee’s Protection Provisions | 29 | |||||

| 13. |

Rules and Regulations | 29 | ||||

| 14. |

Condemnation | 30 | ||||

| (a) Total Taking | 30 | |||||

| (b) Partial Taking – Tenant’s Rights | 30 | |||||

| (c) Partial Taking – Landlord’s Rights | 30 | |||||

| (d) Temporary Taking | 30 | |||||

| (e) Award | 30 | |||||

| 15. |

Fire or Other Casualty | 30 | ||||

| (a) Repair Estimate | 30 | |||||

| (b) Tenant’s Rights | 31 | |||||

| (c) Landlord’s Rights | 31 | |||||

| (d) Repair Obligation | 31 | |||||

| (e) Abatement of Rent | 31 | |||||

| 16. |

Personal Property Taxes | 32 | ||||

| 17. |

Events of Default | 32 | ||||

| (a) Payment Default | 32 | |||||

| (b) Abandonment | 32 | |||||

| (c) Subordination | 32 | |||||

| (d) Estoppel | 32 | |||||

| (e) Insurance | 32 | |||||

| (vii) | Second & Spring Avalara, Inc. |

| (f) Mechanic’s Liens | 32 | |||||

| (g) Misrepresentation | 32 | |||||

| (h) OFAC/FCPA Representation | 33 | |||||

| (i) Other Defaults | 33 | |||||

| (j) Insolvency | 33 | |||||

| 18. |

Remedies | 33 | ||||

| (a) Termination of Lease | 33 | |||||

| (b) Termination of Possession | 33 | |||||

| (c) Perform Acts on Behalf of Tenant | 34 | |||||

| 19. |

Payment by Tenant; Non-Waiver; Cumulative Remedies | 34 | ||||

| (a) Payment by Tenant | 34 | |||||

| (b) No Waiver | 35 | |||||

| (c) Cumulative Remedies | 35 | |||||

| 20. |

Surrender of Premises | 35 | ||||

| 21. |

Holding Over | 35 | ||||

| 22. |

Certain Rights Reserved by Landlord | 36 | ||||

| (a) Building Operations | 36 | |||||

| (b) Security | 36 | |||||

| (c) Current and Prospective Insurers, Purchasers, Investors and Mortgagees | 36 | |||||

| (d) Prospective Tenants | 36 | |||||

| 23. |

Intentionally Omitted | 37 | ||||

| 24. |

Interior Signage | 37 | ||||

| 25. |

Telecommunications and Communications | 37 | ||||

| (a) Tenant’s Telecommunications Providers | 37 | |||||

| (b) Cable Work | 38 | |||||

| (c) Landlord’s Reserved Rights | 38 | |||||

| (d) Removal Obligations | 39 | |||||

| 26. |

Miscellaneous | 39 | ||||

| (a) Landlord Transfer | 39 | |||||

| (b) Landlord’s Liability | 39 | |||||

| (c) Force Majeure | 40 | |||||

| (d) Brokerage | 40 | |||||

| (e) Estoppel Certificates | 41 | |||||

| (f) Notices | 41 | |||||

| (g) Separability | 41 | |||||

| (h) Amendments; Binding Effect; No Electronic Records | 41 | |||||

| (i) Quiet Enjoyment | 42 | |||||

| (j) No Merger | 42 | |||||

| (k) Entire Agreement | 42 | |||||

| (viii) | Second & Spring Avalara, Inc. |

| (l) Waiver of Jury Trial | 42 | |||||

| (m) Governing Law | 42 | |||||

| (n) Recording | 42 | |||||

| (o) Water or Mold Notification | 42 | |||||

| (p) Joint and Several Liability | 43 | |||||

| (q) Financial Reports | 43 | |||||

| (r) Attorneys’ Fees | 43 | |||||

| (s) Confidentiality | 43 | |||||

| (t) Authority | 44 | |||||

| (u) Hazardous Materials | 44 | |||||

| (v) List of Exhibits | 45 | |||||

| (w) OFAC/FCPA Representation | 45 | |||||

| (x) Survival of Obligations | 46 | |||||

| (y) Intentionally Omitted | 46 | |||||

| (z) Landlord Default | 46 | |||||

| (aa) Business Days | 46 | |||||

| (bb) Terms; Captions | 46 | |||||

| (cc) Bicycle Parking | 47 | |||||

| (dd) Removal of Property | 47 |

| (ix) | Second & Spring Avalara, Inc. |

INDEX

| Abated Base Rent Income Tax Amount |

Exhibit D | |||

| Abated Base Rent Payment Amount |

Exhibit D | |||

| Abated Rent |

Exhibit H | |||

| Acceptable Change |

18 | |||

| Acceptable Changes |

18 | |||

| Additional Allowance |

2 | |||

| Additional Insureds |

24 | |||

| Additional Monthly Basic Rent |

2 | |||

| Additional Rent |

4 | |||

| Advocate Arbitrators |

2, 4 | |||

| Affiliate |

1 | |||

| Alterations |

17 | |||

| Anticipated Delivery Date |

Exhibit K | |||

| Approved Working Drawings |

Exhibit D | |||

| Architect |

Exhibit D | |||

| Award |

2, 4 | |||

| Base, shell and Core |

Exhibit D | |||

| Basic Lease Information |

1 | |||

| blocked person |

45 | |||

| Budget Estimate |

Exhibit D | |||

| Building’s Structure |

1 | |||

| Building’s Systems |

1 | |||

| Business Days |

46 | |||

| Cable Problems |

39 | |||

| Cable Work |

38 | |||

| Cable(s) |

38 | |||

| Casualty |

30 | |||

| Claims |

27 | |||

| Code |

Exhibit D | |||

| Common Areas |

1 | |||

| Comparison Buildings |

1 | |||

| Comparison Leases |

Exhibit I, Exhibit I | |||

| Construction Drawings |

Exhibit D | |||

| Contract |

Exhibit D | |||

| Contract Price |

Exhibit D | |||

| Contractor |

Exhibit D | |||

| Coordination Fee |

Exhibit D | |||

| Cost Pools |

11 | |||

| Damage Notice |

31 | |||

| Default Rate |

11 | |||

| Delivery Termination Date |

2 | |||

| Disabilities Acts |

20 | |||

| Economic Terms |

Exhibit K | |||

| Election Date |

Exhibit K | |||

| Engineers |

Exhibit D |

| (x) | Second & Spring Avalara, Inc. |

| Event of Default |

32 | |||

| Exercise Notice |

Exhibit I | |||

| Expiration Date |

i | |||

| Extension Option |

Exhibit I | |||

| Final LC Expiration Date |

11 | |||

| Final Payment Application |

Exhibit D | |||

| Final Space Plan |

Exhibit D | |||

| Final Working Drawings |

Exhibit D | |||

| First Offer Notice |

Exhibit K | |||

| First Offer Period |

Exhibit L | |||

| First Offer Space |

Exhibit L | |||

| GAAP |

24 | |||

| Hazardous Materials |

44 | |||

| Holidays |

15 | |||

| HVAC |

14 | |||

| include |

1 | |||

| includes |

1 | |||

| including |

1 | |||

| Land |

i | |||

| Landlord |

1 | |||

| Landlord Parties |

1 | |||

| Landlord Party |

1 | |||

| Landlord’s Final Retention |

Exhibit D | |||

| Landlord’s Mortgagee |

28 | |||

| Landlord’s Work |

Exhibit D | |||

| Law |

1 | |||

| Laws |

1 | |||

| LC Proceeds Account |

12 | |||

| Lease |

1 | |||

| Letter of Credit |

11 | |||

| Letter of Credit Amount |

11 | |||

| Minimum Financial Requirement |

12 | |||

| Money Rates |

33 | |||

| Mortgage |

28 | |||

| Neutral Arbitrator |

2, 4 | |||

| O&M Information |

Exhibit D | |||

| Objection Notice |

10 | |||

| Objection Period |

10 | |||

| Operating Costs |

4 | |||

| Operating Costs and Tax Statement |

8 | |||

| Operating Costs Excess |

3 | |||

| Option Term |

Exhibit I | |||

| Original Tenant |

1 | |||

| Outside Agreement Date |

2, 4 | |||

| Over-Allowance Amount |

Exhibit D | |||

| Parking Facility |

Exhibit G |

| (xi) | Second & Spring Avalara, Inc. |

| Payment Application |

4 | |||

| Permitted Transfer |

23 | |||

| Permitted Transferee |

23 | |||

| Prime Rate |

33 | |||

| Prohibited Person |

45 | |||

| Project |

i | |||

| Property Management Office |

Exhibit C | |||

| Punch-list Items |

Exhibit E | |||

| Renewal or Replacement LC |

12 | |||

| Rent Credit Election Notice |

Exhibit D | |||

| Rent Credit Option |

Exhibit D | |||

| Repair Period |

31 | |||

| Review |

9 | |||

| Review Notice |

9 | |||

| Right of First Offer |

Exhibit L | |||

| SDNs |

45 | |||

| Security Deposit Laws |

13 | |||

| Specifications |

Exhibit D | |||

| Standard Improvement Package |

Exhibit D | |||

| Superior Rights |

Exhibit L | |||

| Taking |

30 | |||

| Tangible Net Worth |

24 | |||

| Tax Excess |

7 | |||

| Taxes |

7 | |||

| Telecommunications Services |

37 | |||

| Tenant |

1 | |||

| Tenant Improvement Allowance |

Exhibit D | |||

| Tenant Improvement Allowance Items |

Exhibit D | |||

| Tenant Improvements |

Exhibit D | |||

| Tenant Parking Passes |

Exhibit G | |||

| Tenant Parties |

1 | |||

| Tenant Party |

1 | |||

| Tenant Work Letter |

Exhibit D | |||

| Tenant’s Accountant |

9 | |||

| Tenant’s Agents |

Exhibit D | |||

| Tenant’s Election Notice |

Exhibit K | |||

| Tenant’s Off-Premises Equipment |

1 | |||

| Tenant’s Security System |

20 | |||

| Termination Date |

1 | |||

| Termination Notice |

1 | |||

| Termination Option |

1 | |||

| The Law of Real Estate Agency |

40 | |||

| Third Party Offer |

Exhibit K, Exhibit K | |||

| Transfer |

21 |

| (xii) | Second & Spring Avalara, Inc. |

LEASE

This Lease Agreement (this “Lease”) is entered into as of August 14, 2014 between W2007 SEATTLE OFFICE SECOND AND SPRING BUILDING REALTY, LLC, a Delaware limited liability company (“Landlord”), and AVALARA, INC., a Washington corporation (“Tenant”).

1. Definitions and Basic Provisions. The definitions and basic provisions set forth in the Basic Lease Information (the “Basic Lease Information”) are incorporated herein by reference for all purposes. Additionally, the following terms shall have the following meanings when used in this Lease: “Affiliate” means any person or entity which, directly or indirectly, through one or more intermediaries, controls, is controlled by, or is under common control with the party in question; “Building’s Structure” means the Building’s exterior walls, roof, elevator shafts, footings, foundations, structural portions of load-bearing walls, structural floors and subfloors, and structural columns and beams; “Building’s Systems” means the Building’s HVAC (as defined below), security, life-safety, plumbing, electrical, and mechanical systems; “Comparison Buildings” means first class office buildings in the Seattle, Washington central business district area; “include”, “includes” or “including” shall be deemed, as the context indicates, to be followed by the words “but (is/are) not limited to” or “without limitation”; “Laws” means all federal, state, and local laws, codes, ordinances, rules, requirements and regulations, all court orders, governmental directives, and governmental orders and all interpretations of the foregoing, and all restrictive covenants and conditions affecting the Project, and “Law” means any of the foregoing; “Tenant’s Off-Premises Equipment” means any of Tenant’s equipment or other property that may be located on the grounds of the Project (other than inside the Premises); and “Tenant Parties” means all of the following persons: Tenant; any assignees claiming by, through, or under Tenant; any subtenants claiming by, through, or under Tenant; and any of their respective agents, contractors, employees, licensees, guests and invitees, and “Tenant Party” means any of the foregoing. “Original Tenant” means the Tenant originally named in this Lease. “Landlord Parties” means all of the following persons: Landlord, Landlord’s Mortgagees (as defined below), and any of their respective partners, members, directors, officers, trustees, shareholders, successors and assigns, agents, employees, independent contractors, licensees, guests and invitees, and “Landlord Party” means any of the foregoing.

2. Lease Grant.

(a) Generally. Subject to the terms of this Lease, Landlord leases to Tenant, and Tenant leases from Landlord, the Premises. Tenant shall also have the non-exclusive right to use in common with Landlord and the other tenants of the Project those portions of the Project that are provided by Landlord for use in common with Landlord and the other tenants of the Project, such as entrances, lobbies, restrooms, ground floor corridors, elevators and elevator foyers, loading and unloading areas, plazas, ramps, drives, stairs, and access ways and service ways (collectively, the “Common Areas”). The outline of the Premises is set forth in Exhibit A attached hereto. The parties hereto hereby acknowledge that the purpose of Exhibit A is to show the approximate location of the Premises in the Building, only, and such Exhibit is not meant to constitute an agreement, representation or warranty as to the construction of the Premises, the precise area thereof or the specific location of the Common Areas, or the elements thereof or of the accessways to the Premises or the Project.

| 1 | Second & Spring Avalara, Inc. |

(b) Must-Take Premises. Effective as of Must-Take Commencement Date, Tenant shall accept delivery of the Must-Take Premises from Landlord and the Must-Take Premises shall become part of the Premises for all purposes hereunder, and all references in this Lease to the “Premises” shall thereafter include the Must-Take Premises. Tenant’s obligation to pay Basic Rent for the Must-Take Premises, and to pay Tenant’s Proportionate Share of any increase in Operating Costs and Taxes (as those terms are defined in Section 4. below) with respect to the Must-Take Premises, shall commence on the Must-Take Commencement Date.

3. Lease Term.

(a) In General. The terms and conditions and provisions of this Lease shall be effective as of the date of this Lease. The Commencement Date, Must-Take Commencement Date, Expiration Date and Term of this Lease shall be as set forth in the Basic Lease Information of this Lease. By occupying the Premises or any portion thereof, Tenant shall be deemed to have accepted the Premises in their condition as of the date of such occupancy, subject to other provisions of this Lease, including the performance of punch-list items that remain to be performed by Landlord, if any. Prior to occupying the Premises, Tenant shall execute and deliver to Landlord a letter substantially in the form of Exhibit E attached hereto confirming (1) the Commencement Date and the Expiration Date of the initial Term, (2) that Tenant has accepted the Premises, and (3) that Landlord has performed all of its obligations with respect to the Premises (except for punch-list items specified in such letter); however, the failure of the parties to execute such letter shall not defer the Commencement Date or otherwise invalidate this Lease. Occupancy of the Premises by Tenant prior to the Commencement Date shall be subject to all of the provisions of this Lease including those requiring the payment of Basic Rent and Additional Rent (each as defined below).

(b) Termination Right Based on Landlord’s Failure to Timely Deliver the Must-Take Premises. Notwithstanding the foregoing, if Landlord is unable to tender possession of the Premises and/or Must-Take Premises with the Landlord’s Work to be performed therein substantially complete on or before January 1, 2016 (the “Delivery Termination Date”), which date shall not be subject to delays for any reason (including force majeure), then Tenant may terminate this Lease by delivering to Landlord notice thereof at any time before the earlier of (1) fifteen (15) days following the Delivery Termination Date, as such date may be so extended, or (2) the date on which Landlord tenders possession of the Premises and/or Must-Take Premises to Tenant with the Landlord’s Work to be performed therein substantially complete. Notwithstanding the foregoing to the contrary, the Delivery Termination Date shall be extended day-for-day each day Landlord is delayed in delivering possession of the Must-Take Premises to Tenant with the Landlord’s Work to be performed therein substantially complete due solely to delays caused by Tenant or Tenant’s Agents (as defined in Exhibit D). The termination right afforded to Tenant under this Section 3(b) shall be Tenant’s sole recourse for Landlord’s failure to timely tender possession of the Must-Take Premises to Tenant with the Landlord’s Work to be performed therein substantially complete on or before the Delivery Termination Date, as such date may be so extended. Time is of essence for the delivery of Tenant’s termination notice under this Section 3(b); accordingly, if Tenant fails to timely deliver such notice, Tenant’s right to terminate this Lease under this Section 3(b) shall expire.

| 2 | Second & Spring Avalara, Inc. |

(c) Beneficial Occupancy. Tenant shall have the right to occupy the Initial Premises prior to the Commencement Date, provided that (A) a certificate of occupancy, or a temporary certificate of occupancy (or the equivalent of either) shall have been issued by the appropriate governmental authorities permitting Tenant’s use and occupancy of the Initial Premises for the Permitted Use, and (B) all of the terms and conditions of the Lease shall apply, other than Tenant’s obligation to pay Basic Rent, and Tenant’s Proportionate Share of the Operating Costs Excess plus Tenant’s Proportionate Share of the Tax Excess (as defined below), as though the Commencement Date had occurred.

4. Rent.

(a) Payment. Tenant shall timely pay Rent to Landlord, without notice, demand, deduction or setoff (except as otherwise expressly provided herein), by good and sufficient check drawn on a national banking association delivered to Landlord’s address provided for in the Basic Lease Information, by wire transfer as provided for in the Basic Lease Information, or to such other address or by wiring instructions provided in a notice delivered by Landlord to Tenant, accompanied by all applicable state and local sales or use taxes. The obligations of Tenant to pay Rent and other sums to Landlord and the obligations of Landlord under this Lease are independent obligations. Subject to the provisions of Exhibit H attached hereto, Basic Rent, adjusted as herein provided, shall be payable monthly in advance. The monthly installment of Basic Rent for the first calendar month of the Term for which Basic Rent is due to Landlord hereunder shall be payable within two (2) Business Days following Tenant’s receipt of a fully executed copy of this Lease; thereafter, Basic Rent shall be payable on the first day of each month beginning on the first day of the second full calendar month of the Term for which Basic Rent is due to Landlord. The monthly Basic Rent for any partial month at the beginning of the Term shall equal the product of 1/365 of the annual Basic Rent in effect during the partial month and the number of days in the partial month and shall be due on the Commencement Date. Payments of Basic Rent for any fractional calendar month at the end of the Term shall be similarly prorated. Subject to the provisions of Exhibit H attached hereto, Tenant shall pay Additional Rent at the same time and in the same manner as Basic Rent.

Notwithstanding the foregoing, Tenant shall not be required to pay Basic Rent, Annual Additional Rent or any other charges hereunder until Tenant receives from Landlord a completed and executed W-9 taxpayer identification form. Landlord acknowledges and agrees that Tenant, at Tenant’s option, shall have the right to pay amounts due under this Lease to Landlord via electronic funds transfer, and that Landlord shall reasonably cooperate with Tenant, if necessary, to establish that manner of payment by Tenant.

(b) Operating Costs; Taxes.

(1) Tenant shall pay to Landlord Tenant’s Proportionate Share of any increase in Operating Costs (as defined below) for each calendar year and partial calendar year falling within the Term over the Operating Costs for the Base Year (the “Operating Costs Excess”). Tenant shall not pay any charges for Operating Costs prior to the end of the Base

| 3 | Second & Spring Avalara, Inc. |

Year. Landlord may make a good faith estimate of Tenant’s Proportionate Share of the Operating Costs Excess to be due by Tenant for any calendar year or part thereof during the Term. During each calendar year or partial calendar year of the Term (after the Base Year), Tenant shall pay to Landlord, in advance concurrently with each monthly installment of Basic Rent, an amount equal to the estimated Tenant’s Proportionate Share of the Operating Costs Excess for such calendar year or part thereof divided by the number of months therein. From time to time, Landlord may estimate and re-estimate Tenant’s Proportionate Share of the Operating Costs Excess to be due by Tenant and deliver a copy of the estimate or re-estimate to Tenant. Thereafter, the monthly installments of Tenant’s Proportionate Share of the Operating Costs Excess payable by Tenant shall be appropriately adjusted in accordance with the estimations so that, by the end of the calendar year in question, Tenant shall have paid all of the Additional Rent as estimated by Landlord. Any amounts paid based on such an estimate shall be subject to adjustment as herein provided when actual Operating Costs are available for each calendar year. “Additional Rent,” as used herein, shall mean, collectively, Tenant’s Proportionate Share of the Operating Costs Excess plus Tenant’s Proportionate Share of the Tax Excess (as defined below).

(2) The term “Operating Costs” means all expenses and disbursements (subject to the limitations set forth below) that Landlord incurs in connection with the ownership, operation, maintenance, repair and replacement of the Project, determined in accordance with sound accounting principles consistently applied, including the following costs: (A) wages and salaries of all on-site employees at or below the grade of general manager engaged in the operation, maintenance or security of the Project (together with Landlord’s reasonable allocation of expenses of off-site employees at or below the grade of senior building manager who perform a portion of their services in connection with the operation, maintenance or security of the Project), including taxes, insurance and benefits relating thereto; (B) all supplies and materials used in the operation, maintenance, repair, replacement and security of the Project; (C) costs for improvements (as distinguished from replacement of parts or components installed in the ordinary cause of business) made to the Project that, although capital in nature, are expected to reduce the normal operating costs (including all utility costs) of the Project or to enhance safety or security of the Property or its occupants, as amortized using a commercially reasonable interest rate over the time period reasonably estimated by Landlord to recover the costs thereof taking into consideration the anticipated cost savings, as determined by Landlord using its good faith, commercially reasonable judgment, as well as capital improvements made in order to comply with any Law hereafter promulgated by any governmental authority or any interpretation hereafter rendered with respect to any existing Law, to promote safety or to maintain the quality of the Project, as amortized using a commercially reasonable interest rate over the useful economic life of such improvements as determined by Landlord in its reasonable discretion; (D) cost of all utilities, except the cost of utilities reimbursable to Landlord by the Project’s tenants other than pursuant to a provision similar to this Section 4(b); (E) insurance expenses; (F) repairs, replacements, and general maintenance of the Project; (G) fair market rental and other costs with respect to the management office for the Building; (H) service, maintenance and management contracts with independent contractors for the operation, maintenance, management, repair, replacement, or security of the Project (including alarm service, window cleaning, and elevator maintenance); (I) Parking Facility operation, repair, restoration and maintenance; and (J) payments made or charges incurred under any reciprocal easement agreement, transportation management agreement, cost-sharing agreement or other covenant, condition, restriction or similar document affecting or benefiting the Property whether now or hereafter in effect.

| 4 | Second & Spring Avalara, Inc. |

Notwithstanding anything herein to the contrary, Operating Costs shall not include costs for:

(i) capital improvements made to the Project, other than capital improvements described in Section 4(b)(2)(C) above and items that are generally considered maintenance and repair items, such as painting of common areas, replacement of carpet in elevator lobbies, and the like;

(ii) repair, replacements and general maintenance paid by proceeds of insurance or by Tenant or other third parties;

(iii) depreciation;

(iv) leasing commissions;

(v) legal expenses for services, other than those that benefit the Project tenants generally (e.g., tax disputes);

(vi) renovating or otherwise improving space for occupants of the Project or vacant space in the Project;

(vii) Taxes;

(viii) federal income taxes imposed on or measured by the income of Landlord from the operation of the Project;

(ix) depreciation or amortization on the Building;

(x) debt service, rental under any ground or underlying lease, or interest, principal, points, and fees on any encumbrance, Mortgage, or other debt instrument encumbering the Building except loans made to Landlord for capital improvements described in Section 4(b)(2)(C) above;

(xi) Taxes (as defined below);

(xii) attorneys’ fees and expenses, brokerage commissions, advertising costs, or other related expenses incurred in connection with the leasing of the Building including lease concessions, rental abatements, and construction allowances;

(xiii) the cost of any improvements, repairs, or equipment that would be properly classified as capital expenditures (including the repair of structural portions of the roof, foundations, floors, and exterior walls of the Building), except as specifically provided in Section 4(b)(2)(C) above;

(xiv) the cost (including permit, license, and inspection fees) of decorating and painting, improving for tenant occupancy, or altering for tenant occupancy portions of the Building to be demised, or available to be demised, to tenants;

(xv) any deductible under Landlord’s insurance policies in excess of a commercially reasonable deductible;

| 5 | Second & Spring Avalara, Inc. |

(xvi) costs of insurance in excess of insurance that is customarily carried by prudent institutional owners of Comparison Buildings;

(xvii) costs for which Landlord is reimbursed or entitled to be reimbursed by condemnation or insurance proceeds, other tenants, or any other source (other than through this Operating Costs provision and similar provisions in other leases in the Building);

(xviii) costs to repair or replace the Project resulting from any Casualty (as defined below) (other than the amount of any commercially reasonable insurance deductibles);

(xix) rentals incurred in leasing equipment that if purchased rather than rented would have constituted a capital expenditure that is not specifically included in Operating Costs in accordance with the provisions of Section 4(b)(2)(C) above;

(xx) any bad debt loss or rent loss; any reserves;

(xxi) costs incurred in connection with the operation of the business entity constituting Landlord, as distinguished from the costs of operating the Project;

(xxii) costs of selling, syndicating, financing, mortgaging, or hypothecating any of Landlord’s interest in the Building; and costs of defending any lawsuits with any mortgagee;

(xxiii) amounts paid to Landlord or Landlord’s Affiliates for the provision of goods or services that would otherwise be included in Operating Costs to the extent such costs exceed the fair market value of such goods or services;

(xxiv) the amount of any political or charitable contributions;

(xxv) the cost of any “tenant relations” parties or promotions;

(xxvi) the cost of repairs, alterations, additions, improvements, or replacements made to (a) comply with any Laws in effect as of the date of this Lease, or (b) rectify or correct any damage caused by the gross negligence or willful misconduct of Landlord or any Landlord Party;

(xxvii) costs incurred in installing, operating, and maintaining any specialty improvement not normally installed, operated, and maintained in Comparison Buildings, including an observatory, a luncheon club, or athletic or recreational facilities (except to the extent available to tenants of the Building without charge);

(xxviii) the cost of wages, salaries, bonuses, and other compensation of all employees above the grade of general manager (including asset managers, leasing agents, promotional directors, officers, directors, and executives of Landlord), including taxes, insurance, and benefits relating thereto;

(xxix) the cost of labor and employees with respect to personnel not located at the Building on a full time basis unless such costs are appropriately allocated between the Building and the other responsibilities of such personnel;

| 6 | Second & Spring Avalara, Inc. |

(xxx) costs, fines, penalties, and interest incurred due to violation by Landlord of the terms and conditions of any lease, or any Laws, or due to violation by any other tenant in the Project of the terms and conditions of any lease, ground lease, mortgage or deed of trust, or other covenants, conditions, or restrictions encumbering the Project, or any Laws;

(xxxi) interest, penalties, or other costs arising out of Landlord’s failure to make timely payment of its obligations;

(xxxii) property management fees in excess of three percent (3%) of the gross income produced by the Project;

(xxxiii) costs incurred to test, survey, clean up, contain, xxxxx, remove, or otherwise remedy Hazardous Materials (as defined below) or mold from the Project;

(xxxiv) costs of acquiring artwork;

(xxxv) costs of providing utilities (including HVAC service, electricity, water, gas, fuel, steam, lighting, and sewer), janitorial service, or other benefits to other tenants to an extent in excess of the utilities, janitorial service, and other benefits, if any, to which Tenant is entitled under this Lease at no additional charge;

(xxxvi) Landlord’s general overhead expenses not related to the Project;

(xxxvii) legal fees, accountants’ fees, and other expenses incurred in connection with disputes with Tenant, other tenants or occupants of the Project, or associated with the enforcement of any leases or defense of Landlord’s title or interest in the Project or any part thereof, other than those that benefit the Project tenants generally (e.g., tax disputes);

(xxxviii) any compensation paid to clerks, attendants, or other persons in commercial concessions operated by Landlord in the Building; and

(xxxix) advertising and promotional expenses, and the cost of acquiring and installing signs in or on the Building identifying the owner of the Building or any other tenant or occupant of the Building.

Operating Costs for the Base Year only shall not include market-wide labor-rate increases due to extraordinary circumstances, including boycotts and strikes; utility rate increases due to extraordinary circumstances, including conservation surcharges, boycotts, embargoes or other shortages; or amortized costs relating to capital improvements.

Tenant shall also pay Tenant’s Proportionate Share of any increase in Taxes for each calendar year and partial calendar year falling within the Term over the Taxes for the Base Year (the “Tax Excess”). Tenant shall not pay any charges for Taxes prior to the end of the first Base Year. Tenant shall pay Tenant’s Proportionate Share of the Tax Excess in the same manner as provided above for Tenant’s Proportionate Share of the Operating Costs Excess (both on an estimated and actual basis as provided therein). “Taxes” means taxes, assessments, and governmental charges or fees whether federal, state, county or municipal, and whether they be by taxing districts or authorities presently taxing or by others, subsequently created or otherwise, and any other taxes

| 7 | Second & Spring Avalara, Inc. |

and assessments (including nongovernmental assessments for common charges under a restrictive covenant or other private agreement that are not treated as part of Operating Costs) now or hereafter attributable to the Project (or its operation), excluding, however, penalties and interest thereon. Notwithstanding anything to the contrary contained in this Lease, there shall be excluded from Taxes any excess profits taxes, franchise taxes, gift taxes, inheritance and succession taxes, estate taxes, documentary transfer taxes, federal or state income, corporate, capital stock, or capital gains taxes, penalties incurred as a result of Landlord’s failure to pay taxes or to file any tax or informational returns and other taxes to the extent applicable to Landlord’s general or net income (as opposed to rents, receipts, or income attributable to operations at the Project); provided, that if the present method of taxation changes so that in lieu of or in addition to the whole or any part of any Taxes, there is levied on Landlord a capital tax directly on the rents received therefrom or a franchise tax, assessment, or charge based, in whole or in part, upon such rents for the Project, then all such taxes, assessments, or charges, or the part thereof so based, shall be deemed to be included within the term “Taxes” for purposes hereof. If an assessment is payable in installments, Taxes for the year shall include the amount of the installment and any interest due and payable during that year. For purposes of computing Taxes, any special assessment shall be deemed to have been paid in the maximum number of installments permitted by Law, and Taxes shall be deemed to include all interest that would have been payable in connection therewith as a result of paying such special assessment in the maximum number of installments permitted by Law. For all other Taxes, the Taxes for that year shall, at Landlord’s election, include either the amount accrued, assessed or otherwise imposed for the year or the amount due and payable for that year, provided that Landlord’s election shall be applied consistently throughout the Term. If there is a change in Taxes for any year of the Term, then Taxes for that year will be retroactively adjusted and Landlord shall provide Tenant, as applicable, with a credit or a statement of any deficiency based on the adjustment. Tenant shall pay any such deficiency within thirty (30) days after receipt of the statement from Landlord. Taxes shall include the costs of consultants retained in an effort to lower taxes and all costs incurred in disputing any taxes or in seeking to lower the tax valuation of the Project. For property tax purposes, Tenant waives all rights to protest or appeal the appraised value of the Premises, as well as the Project, and all rights to receive notices of re-appraisement. To the extent the same is in Landlord’s possession, Landlord shall provide a copy of the then-current tax xxxx to Tenant upon request.

(3) By April 1 of each calendar year, or as soon thereafter as practicable, Landlord shall furnish to Tenant a statement of Operating Costs for the previous year, in each case adjusted as provided in Section 4(b)(4) below, and of the Taxes for the previous year (the “Operating Costs and Tax Statement”). If Tenant’s estimated payments of Tenant’s Proportionate Share of the Operating Costs Excess and/or Tax Excess, as the case may be, under this Section 4(b) for the year covered by the Operating Costs and Tax Statement exceed Tenant’s Proportionate Share of the Operating Costs Excess and/or Tax Excess, as the case may be, as indicated in the Operating Costs and Tax Statement, then Landlord shall promptly credit or reimburse Tenant for such applicable excess; likewise, if Tenant’s estimated payments of Tenant’s Proportionate Share of the Operating Costs Excess or Tax Excess, as the case may be, under this Section 4(b) for such year are less than Tenant’s Proportionate Share of the Operating Costs Excess and/or Tax Excess, as the case may be, as indicated in the Operating Costs and Tax Statement, then Tenant shall pay Landlord such deficiency within thirty (30) days after receipt of the Operating Costs and Tax Statement. No delay in providing any Operating Costs and Tax Statement shall be deemed a default by Landlord or a waiver of Landlord’s right to require payment of Tenant’s Obligations for actual or estimated Operating Costs Excess or Tax Excess.

| 8 | Second & Spring Avalara, Inc. |

(4) With respect to any calendar year or partial calendar year in which the Building is not occupied to the extent of one hundred percent (100%) of the rentable area thereof, or Landlord is not supplying services to one hundred percent (100%) of the rentable area thereof, the Operating Costs for such period that vary with the occupancy of the Building shall, for the purposes hereof, be increased to the amount that would have been incurred had the Building been occupied to the extent of one hundred percent (100%) of the rentable area thereof and Landlord had been supplying services to one hundred percent (100%) of the rentable area thereof; provided, however, in no event shall Tenant be obligated to pay for services that are not provided to unoccupied portions of the Building, and the terms of the immediately foregoing sentence shall not apply to services are provided to unoccupied portions of the building. If a category of Operating Costs is first incurred in a calendar year after the Base Year, then for purposes of calculating the Operating Costs Excess for such calendar year (and the following calendar years) the Operating Costs for the Base Year shall be deemed to be increased to include the amount that Landlord reasonably estimates would have been incurred by Landlord for such category of Operating Costs in the Base Year if Landlord had incurred such category of Operating Costs in the Base Year. Conversely, if in a calendar year subsequent to the Base Year, Landlord no longer incurs a category of Operating Costs, then for purposes of calculating the Operating Costs Excess for such calendar year (and the following calendar year), Operating Costs for such Base Year shall be deemed to be decreased by the amount that Landlord actually incurred for such category of Operating Costs in the Base Year. The adjustments to the Operating Costs for the Base Year provided for in the preceding two sentences shall not be deemed to require a recalculation of the Operating Costs Excess for any calendar year prior to the calendar year in question.

(5) Tenant may once, within one hundred eighty (180) days after receiving the Operating Costs and Tax Statement, give Landlord notice (the “Review Notice”) that Tenant intends to have Landlord’s records of the Operating Costs and Taxes for the calendar year covered by the Operating Costs and Tax Statement reviewed (the “Review”) for the sole purpose of determining whether the Operating Costs and Tax Statement is accurate; provided that as a condition to Tenant’s exercise of its right of Review set forth in this Section 4(b)(5), Tenant shall not be permitted to withhold payment of, and Tenant shall timely pay to Landlord, the full amount as required by the provisions of this Section 4 in accordance with such Operating Costs and Tax Statement. However, such payment may be made under protest pending the outcome of the Review. If Tenant retains an agent to review Landlord’s records, the agent shall be with a CPA firm licensed to do business in the State of Washington (working on a non-contingency fee basis) and its fees shall not be contingent in whole or in part, upon the outcome of the review (“Tenant’s Accountant”). Within a reasonable time after receipt of the Review Notice (not to exceed thirty (30) days), Landlord shall make available to Tenant’s Accountant during normal business hours all pertinent records with respect to the Operating Costs and Tax Statement for the calendar year that is the subject of the Review Notice and that are reasonably necessary for Tenant’s Accountant to conduct the Review. If any records are maintained at a location other than the office of the Building, Tenant’s Accountant may either inspect the records at such other location or Tenant may pay for the reasonable cost of copying

| 9 | Second & Spring Avalara, Inc. |

and shipping the records. Except as otherwise expressly hereinafter provided, Tenant shall be solely responsible for all costs, expenses and fees incurred for the Review. Within sixty (60) days after the records are made available to Tenant’s Accountant (the “Objection Period”), Tenant shall have the right to give Landlord notice (an “Objection Notice”) stating in reasonable detail any objection to Landlord’s Operating Costs and Tax Statement for that year. If Tenant fails to provide Landlord with a Review Notice with respect to the Operating Costs and Tax Statement for any calendar year within the one hundred eighty (180) day period described above, or fails to give Landlord an Objection Notice within the sixty (60) day period described above, Tenant shall be deemed to have approved the Operating Costs and Tax Statement and shall be barred from raising any claims regarding the Operating Costs and Tax Statement for that year. If Landlord agrees with Tenant’s Objection Notice, then Landlord shall credit the amount of any overpayment by Tenant in respect of Operating Costs and Taxes against the Rent next payable under this Lease; provided, that if the Term shall have expired, then any overpayment for which Tenant may otherwise have received a credit shall be refunded to Tenant within thirty (30) days after receipt of said certification at Tenant’s last known address after deducting the amount of Rent and any other payments due. If Landlord disagrees with Tenant’s Objection Notice, then Landlord shall give to Tenant notice thereof within thirty (30) days after Landlord’s receipt of Tenant’s Objection Notice, which notice shall set forth in reasonable detail the reasons for such disagreement, and Landlord and Tenant shall attempt to resolve the disagreement. If Landlord and Tenant cannot mutually agree on the resolution of the disagreement within thirty (30) days after Tenant’s receipt of Landlord’s notice of disagreement, then Landlord and Tenant shall jointly choose an independent certified public accountant located in Seattle, Washington who has not represented either Landlord, Tenant, or their respective Affiliates, in the preceding five (5) years to resolve the disagreement, whose determination shall be binding on the parties hereto. If the parties are unable to agree upon such independent certified public accountant, then either Landlord or Tenant shall have the right to petition for the appointment of the independent accountant by the Presiding Judge of the Superior Court of King County, Washington and the decision of such Judge (and the determination of the accountant appointed by such Judge) shall be final and binding upon the parties, and not subject to appeal of any kind. If the final determination shall disclose that the Operating Costs and Tax Statement for the calendar year in question were overstated by more than five percent (5%), then Landlord shall reimburse Tenant, within thirty (30) days after Landlord receives notice of such final determination, for the reasonable costs of the independent certification or reimburse Tenant (as applicable) the cost of Tenant’s accountant’s review, up to a maximum of Five Thousand and 00/100 Dollars ($5,000.00) per review (but each party shall pay the cost of its respective attorney’s fees); otherwise, the cost of the audit and arbitration shall be paid by Tenant. If Operating Costs and/or Taxes for the calendar year are less than reported, Landlord shall provide Tenant with a credit against the payment of Rent next due in the amount of the overpayment by Tenant; provided, however, if the Term shall have expired, then any overpayment for which Tenant may otherwise have received a credit shall be refunded to Tenant within thirty (30) days after receipt of said certification at Tenant’s last known address after deducting the amount of Rent and any other payments due. Likewise, if Landlord and Tenant determine that Operating Costs and/or Taxes for the calendar year are greater than reported, Tenant shall pay Landlord the amount of any underpayment in Tenant’s Pro Rata Share thereof within thirty (30) days. Tenant acknowledges and agrees that any records reviewed under this provision constitute confidential information of Landlord that shall not be disclosed to anyone other than Tenant’s Accountant and the principals

| 10 | Second & Spring Avalara, Inc. |

of Tenant who receive the results of such Review. Before making any records available for review, Landlord may require Tenant and Tenant’s Accountant to execute a reasonable confidentiality agreement, in which event Tenant shall cause the same to be executed and delivered to Landlord within ten (10) days after receiving it from Landlord, and if Tenant fails to do so, the Objection Period shall be reduced by one (1) day for each day by which such execution and delivery follows the expiration of such thirty (30)-day period.

(c) Cost Pools. Landlord shall have the right, from time to time, to equitably allocate some or all of the Operating Costs and/or Taxes for the Project among different portions or occupants of the Project (the “Cost Pools”), in Landlord’s reasonable discretion. Such Cost Pools may include, but shall not be limited to, the office space tenants of the Project and the retail space tenants (if any) of the Project. The Operating Costs and/or Taxes within each such Cost Pool shall be allocated and charged to the tenants as determined by Landlord in accordance with sound real estate management principles, consistently applied.

5. Delinquent Payment; Handling Charges. All past due payments required of Tenant hereunder that are not received by Landlord on or before five (5) days after the date the payment is due (i) shall bear interest from the date due until paid at the lesser of twelve percent (12%) per annum or the maximum lawful rate of interest (such lesser amount is referred to herein as the “Default Rate”); and (ii) Landlord, in addition to all other rights and remedies available to it, may charge Tenant a fee equal to five percent (5%) of the delinquent payment to reimburse Landlord for its cost and inconvenience incurred as a consequence of Tenant’s delinquency. In no event, however, shall the charges permitted under this Section 5 or elsewhere in this Lease, to the extent they are considered to be interest under applicable Law, exceed the maximum lawful rate of interest. Notwithstanding the foregoing, the late fee referenced above shall not be charged with respect to the first occurrence (but shall be charged with respect to any subsequent occurrence) during any twelve (12)-month period in which Tenant fails to make payment when due, until five (5) days after Landlord delivers written notice of such delinquency to Tenant.

6. Letter of Credit.

(a) General Provisions. Concurrently with Tenant’s execution of this Lease, Tenant shall deliver to Landlord, as collateral for the full performance by Tenant of all of its obligations under this Lease and for all losses and damages Landlord may suffer as a result of Tenant’s failure to comply with one or more provisions of this Lease, a standby, unconditional negotiable, irrevocable, transferable letter of credit (the “Letter of Credit”) substantially in the form of Exhibit L attached to this Lease and containing the terms required herein, in the face amount set forth for the Letter of Credit in the Basic Lease Information (the “Letter of Credit Amount”), naming Landlord as beneficiary, issued (or confirmed) by a financial institution acceptable to Landlord in Landlord’s reasonable discretion, permitting multiple and partial draws thereon, and otherwise in form acceptable to Landlord in its sole discretion. Tenant shall cause the Letter of Credit to be continuously maintained in effect (whether through replacement, renewal or extension) in the Letter of Credit Amount through the date (the “Final LC Expiration Date”) that is ninety (90) days after the scheduled expiration date of the Lease Term, as it may be extended from time to time. If the Letter of Credit held by Landlord expires before the Final LC Expiration Date (whether by reason of a stated expiration date or a notice of

| 11 | Second & Spring Avalara, Inc. |

termination or nonrenewal given by the issuing bank), Tenant shall deliver a new Letter of Credit or certificate of renewal or extension to Landlord not less than sixty (60) days before the expiration date of the Letter of Credit then held by Landlord. In addition, if, at any time before the Final LC Expiration Date, the financial institution that issued (or confirmed) the Letter of Credit held by Landlord fails to meet the “Minimum Financial Requirement” (as defined below), then, within five (5) Business Days after Landlord’s demand, Tenant shall deliver to Landlord, in replacement of such Letter of Credit, a new Letter of Credit issued (or confirmed) by a financial institution that meets the Minimum Financial Requirement and is otherwise acceptable to Landlord in Landlord’s reasonable discretion, whereupon Landlord shall return to Tenant the Letter of Credit that is being replaced. For purposes hereof, a financial institution shall be deemed to meet the “Minimum Financial Requirement” on a particular date if and only if, as of such date, such financial institution (a) has not been placed into receivership by the FDIC; and (b) has a financial strength that, in Landlord’s good faith judgment, is not less than that which is then generally required by Landlord and its Affiliates as a condition to accepting letters of credit in support of new leases. Any new Letter of Credit or certificate of renewal or extension (a “Renewal or Replacement LC”) shall comply with all of the provisions of this Section 6, shall be irrevocable, transferable and shall remain in effect (or be automatically renewable) through the Final LC Expiration Date upon the same terms as the Letter of Credit that is expiring or being replaced.

(b) Drawings under Letter of Credit. Upon an Event of Default by Tenant or, if Landlord is prohibited by applicable Laws from providing notice to Tenant of Tenant’s failure to comply with one or more provisions of this Lease, then upon any such failure by Tenant and lapse of the specified cure period without the necessity of providing notice to Tenant, Landlord may, without prejudice to any other remedy provided in this Lease or by applicable Laws, draw on the Letter of Credit and use all or part of the proceeds to (a) satisfy any amounts due to Landlord from Tenant, and (b) satisfy any other damage, injury, expense or liability caused by Tenant’s failure to so comply. In addition, if Tenant fails to furnish a Renewal or Replacement LC complying with all of the provisions of this Section 6 when required hereunder, Landlord may draw upon the Letter of Credit and hold the proceeds thereof (and such proceeds need not be segregated) in accordance with the terms of this Section 6 (the “LC Proceeds Account”).

(c) Use of Proceeds by Landlord. The proceeds of the Letter of Credit shall constitute Landlord’s sole and separate property (and not Tenant’s property or the property of Tenant’s bankruptcy estate) and Landlord may, immediately upon any draw (and without notice to Tenant), apply or offset the proceeds of the Letter of Credit against (a) any Rent payable by Tenant under this Lease that is not paid when due; (b) all losses and damages that Landlord has suffered or that Landlord reasonably estimates that it may suffer as a result of Tenant’s failure to comply with one or more provisions of this Lease; (c) any costs incurred by Landlord in connection with this Lease (including attorneys’ fees), which costs the Tenant is obligated to pay or reimburse; and (d) any other reasonable amount that Landlord may spend or become obligated to spend by reason of Tenant’s failure to comply with this Lease and that Tenant is obligated to pay or reimburse under this Lease or under applicable Laws. Provided that Tenant has performed all of its obligations under this Lease, Landlord shall pay to Tenant, within sixty (60) days after the Final LC Expiration Date, the amount of any proceeds of the Letter of Credit received by Landlord and not applied as provided above; provided, however, that if, before the

| 12 | Second & Spring Avalara, Inc. |

expiration of such sixty (60) day period, a voluntary petition is filed by Tenant, or an involuntary petition is filed against Tenant by any of Tenant’s or Guarantor’s creditors, under the Federal Bankruptcy Code, then such payment shall not be required until either all preference issues relating to payments under this Lease have been resolved in such bankruptcy or reorganization case or such bankruptcy or reorganization case has been dismissed, in each case pursuant to a final court order not subject to appeal or any stay pending appeal.

(d) Additional Covenants of Tenant. If, for any reason, the amount of the Letter of Credit becomes less than the Letter of Credit Amount, Tenant shall, within five (5) days thereafter, provide Landlord with additional letter(s) of credit in an amount equal to the deficiency (or a replacement letter of credit in the total Letter of Credit Amount), and any such additional (or replacement) letter of credit shall comply with all of the provisions of this Section 6, and if Tenant fails to comply with the foregoing, notwithstanding any contrary provision of this Lease, such failure shall constitute an incurable Default by Tenant. Tenant further covenants and warrants that it will neither assign nor encumber the Letter of Credit or any part thereof and that neither Landlord nor its successors or assigns will be bound by any such assignment, encumbrance, attempted assignment or attempted encumbrance. The use, application or retention of the Letter of Credit, or any portion thereof, by Landlord shall not prevent Landlord from exercising any other right or remedy provided by this Lease or by any applicable Laws, it being intended that Landlord shall not first be required to proceed against the Letter of Credit, and shall not operate as a limitation on any recovery to which Landlord may otherwise be entitled. Tenant agrees not to interfere in any way with payment to Landlord of the proceeds of the Letter of Credit, either prior to or following a “draw” by Landlord of any portion of the Letter of Credit, regardless of whether any dispute exists between Tenant and Landlord as to Landlord’s right to draw upon the Letter of Credit, provided that nothing herein shall affect Tenant’s rights and remedies after the Letter of Credit is drawn if Tenant disputes Landlord’s right to draw on the Letter of Credit or to apply any portion of the proceeds thereof. No condition or term of this Lease shall be deemed to render the Letter of Credit conditional to justify the issuer of the Letter of Credit in failing to honor a drawing upon such Letter of Credit in a timely manner. Tenant agrees and acknowledges that, in the event Tenant becomes a debtor under any chapter of the Bankruptcy Code, neither Tenant, nor any trustee, nor Tenant’s bankruptcy estate shall have any right to restrict or limit Landlord’s claim and/or rights to the Letter of Credit and/or the proceeds thereof under the provisions of this Lease by application of Section 502(b)(6) of the U.S. Bankruptcy Code or otherwise.

(e) Nature of Letter of Credit. Landlord and Tenant (a) acknowledge and agree that in no event shall the Letter of Credit or any renewal thereof, any substitute therefor or any proceeds thereof (including the LC Proceeds Account) be deemed to be or treated as a “security deposit” under any Law applicable to security deposits in the commercial context (“Security Deposit Laws”); (b) acknowledge and agree that the Letter of Credit (including any renewal thereof, any substitute therefor or any proceeds thereof) is not intended to serve as a security deposit and shall not be subject to the Security Deposit Laws; and (c) waive any and all rights, duties and obligations either party may now or, in the future, will have relating to or arising from the Security Deposit Laws. Tenant hereby waives the provisions of all provisions of Law, now or hereafter in effect, which (i) establish the time frame by which Landlord must refund a security deposit under a lease, and/or (ii) provide that Landlord may claim from the security deposit only those sums reasonably necessary to remedy defaults in the payment of rent,

| 13 | Second & Spring Avalara, Inc. |

to repair damage caused by Tenant or to clean the Premises, it being agreed that Landlord may, in addition, claim those sums specified above in this Section 6 and/or those sums reasonably necessary to compensate Landlord for any loss or damage caused by Tenant’s breach of this Lease or the acts or omission of Tenant or any other Tenant Parties, including any damages Landlord suffers following termination of this Lease.

(f) Transfer of Letter of Credit. The Letter of Credit shall provide that Landlord, its successors and assigns, may, at any time with notice to Tenant but without first obtaining Tenant’s consent thereto, transfer (one or more times) all or any portion of its interest in and to the Letter of Credit to another party, person or entity, but only as a part of the assignment by Landlord of its rights and interests in and to this Lease or in connection with Landlord’s financing of the Property or the Project. In the event of a transfer of Landlord’s interest in the Building, Landlord shall transfer the Letter of Credit, in whole or in part, to the transferee and thereupon Landlord shall, without any further agreement between the parties, be released by Tenant from all liability therefor arising after such transfer, and it is agreed that the provisions hereof shall apply to every transfer or assignment of the whole or any portion of said Letter of Credit to a new landlord. Landlord shall remain liable to Tenant, however, for the refund of any prior withdrawals from the Letter of Credit as and to the extent such refund is required under this Lease or applicable Laws, but only to the extent that such refundable amount has not been transferred to the Landlord’s successor in interest. In connection with any such transfer of the Letter of Credit by Landlord, Tenant shall, at Tenant’s sole cost and expense, execute and submit to the issuing or confirming financial institution such applications, documents and instruments as may be necessary to effectuate such transfer, and Tenant shall be responsible for paying such financial institution’s transfer and processing fees in connection therewith.

7. Landlord’s Obligations.

(a) Services. Landlord shall furnish to Tenant (1) domestic water at those points of supply provided for general use of tenants of the Building; (2) heated and refrigerated air-conditioning (“HVAC”); (3) janitorial service to the Premises five (5) days per week other than Holidays (as defined below), for Building-standard installations and such window washing as may from time to time be reasonably required; (4) passenger elevators for ingress and egress to the floor on which the Premises are located, in common with other tenants, provided that Landlord may reasonably limit the number of operating elevators during nonbusiness hours and Holidays; and (5) electrical current during normal business hours for equipment that does not require more than 110 volts and whose electrical energy consumption does not exceed normal office usage. Subject to the provisions of Section 15 below, Landlord shall maintain the Common Areas of the Building in reasonably good order and condition. If Tenant desires any of the services specified in clause (2) of this Section 7(a) above, (A) at any time other than between 7:00 a.m. and 6:00 p.m. on weekdays (other than Holidays), and 8:00 a.m. to 1:00 p.m. on Saturdays (other than Holidays) or (B) on Sunday or Holidays, then such services shall be supplied to Tenant on weekdays upon the request of Tenant delivered to Landlord before 2:00 p.m. and on Saturdays, Sundays and Holidays upon request of Tenant delivered to Landlord before 2:00 p.m. on the Business Day preceding such extra usage, and Tenant shall pay to Landlord the cost of such services at the Building’s then-prevailing rates then charged by Landlord within thirty (30) days after Landlord has delivered to Tenant an invoice therefor. As

| 14 | Second & Spring Avalara, Inc. |

of the date of this Lease, the current rate for after-hours HVAC service is $70.00 per hour (subject to change from time-to-time following 30-day written notice to Tenant). The costs incurred by Landlord in providing after-hours HVAC service to Tenant shall include Landlord’s actual costs (without markup) for electricity, water, sewage, water treatment, labor, metering, filtering, and maintenance reasonably allocated by Landlord to providing such service. “Holidays” means New Year’s Day, Xxxxxx Xxxxxx Xxxx Xx. Day, President’s Day, Memorial Day, Independence Day, Labor Day, Thanksgiving Day, and Christmas Day.

(b) Excess Utility Use. Landlord shall not be required to furnish electrical current for equipment that requires more than 110 volts or other equipment whose electrical energy consumption exceeds normal office usage. If Tenant’s requirements for or consumption of electricity exceed the electricity to be provided by Landlord as described in Section 7(a) above, Landlord shall, at Tenant’s expense, make reasonable efforts to supply such service through the then-existing feeders and risers serving the Building and the Premises, and Tenant shall pay to Landlord the actual, reasonable cost of such service within thirty (30) days after Landlord has delivered to Tenant an invoice therefor, together with reasonable supporting evidence. Landlord may determine the amount of such additional consumption and potential consumption by any verifiable method, including installation of a separate meter in the Premises installed, maintained, and read by Landlord, at Tenant’s expense. Tenant shall not install any electrical equipment requiring special wiring or requiring voltage in excess of 110 volts unless approved in advance by Landlord, which approval shall not be unreasonably withheld. Tenant shall not install any electrical equipment requiring voltage in excess of Building capacity unless approved in advance by Landlord, which approval may be withheld in Landlord’s sole discretion. The use of electricity in the Premises shall not exceed the capacity of existing feeders and risers to, or wiring in, the Premises. Any risers or wiring required to meet Tenant’s excess electrical requirements shall, upon Tenant’s written request, be installed by Landlord, at Tenant’s cost, if, in Landlord’s judgment, the same are necessary and shall not cause permanent damage to the Building or the Premises, cause or create a dangerous or hazardous condition, entail excessive or unreasonable alterations, repairs, or expenses, or interfere with or disturb other tenants of the Building. If Tenant uses machines or equipment in the Premises (other than typical desktop computers, lap top computers (which are currently used by all Tenant employees), scanners, fax machines, communal printers, and desktop printers and similar desktop equipment) that materially and unreasonably affect the temperature otherwise maintained by the air-conditioning system or otherwise overload any utility, then after 30 days’ notice to Tenant, Landlord may install supplemental air-conditioning units or other supplemental equipment in the Premises, and the reasonable, actual, out of pocket cost thereof, including the cost of installation, operation, use, and maintenance, in each case plus an administrative fee of five percent (5%) of such cost, shall be paid by Tenant to Landlord within thirty (30) days after Landlord has delivered to Tenant an invoice therefor, together with reasonable supporting evidence.

(c) Landlord’s Repairs. Landlord shall repair and maintain in good order, repair and condition, the cost of which shall be included in Operating Costs to the extent permitted in Section 4 above, the Building’s Structure, the Building’s Systems and the common areas of the Building and Project (but not including any non-base building facilities installed in the Premises); provided, however, to the extent such maintenance and repairs are caused by the willful act of any Tenant Party, then subject to the waiver of subrogation provision in this Lease,

| 15 | Second & Spring Avalara, Inc. |