AGREEMENT OF LEASE

AGREEMENT OF LEASE

between

RBM CHERRY ROAD PARTNERS

Landlord

and

XXXXXX MEDICAL TECHNOLOGY, INC.

Tenant

Dated: As of December 31, 2013

Premises:

Office Building 1

First Floor of Office Building 2

0000 Xxxxxx Xxxx

Xxxxxxx, Xxxxxxxxx 00000

TABLE OF CONTENTS

Page

REFERENCE PAGE.............................................................................................................................................................. | 3 | |

ARTICLE I GLOSSARY...................................................................................................................................................... | 5 | |

ARTICLE II DEMISE, PREMISES, TERM, RENT......................................................................................................... | 11 | |

14 | ||

18 | ||

22 | ||

ARTICLE VI REPAIRS........................................................................................................................................................ | 25 | |

ARTICLE VII [RESERVED]............................................................................................................................................... | 26 | |

26 | ||

ARTICLE IX SUBORDINATION, NON-DISTURBANCE AND ATTORNMENT....................................................... | 28 | |

30 | ||

ARTICLE XI INSURANCE, PROPERTY LOSS OR DAMAGE, REIMBURSEMENT.............................................. | 30 | |

ARTICLE XII DESTRUCTION BY FIRE OR OTHER CAUSE.................................................................................... | 32 | |

ARTICLE XIII EMINENT DOMAIN................................................................................................................................. | 33 | |

ARTICLE XIV ASSIGNMENT, SUBLETTING, MORTGAGE, ETC. ......................................................................... | 33 | |

ARTICLE XV ACCESS TO PREMISES............................................................................................................................ | 35 | |

36 | ||

36 | ||

38 | ||

39 | ||

ARTICLE XX NO REPRESENTATIONS BY LANDLORD........................................................................................... | 40 | |

40 | ||

41 | ||

ARTICLE XXIII NO WAIVER........................................................................................................................................... | 41 | |

ARTICLE XXIV WAIVER OF TRIAL BY JURY............................................................................................................. | 41 | |

42 | ||

42 | ||

42 | ||

ARTICLE XXVIII [RESERVED]........................................................................................................................................ | 44 | |

ARTICLE XXIX [RESERVED]........................................................................................................................................... | 44 | |

ARTICLE XXX SIGNS......................................................................................................................................................... | 44 | |

ARTICLE XXXI BROKER................................................................................................................................................... | 44 | |

ARTICLE XXXII INDEMNITY............................................................................................................................................ | 44 | |

ARTICLE XXXIII RESERVED............................................................................................................................................ | 45 | |

46 | ||

ARTICLE XXXV TENANT LABS........................................................................................................................................ | 46 | |

46 | ||

ARTICLE XXXVII MISCELLANEOUS............................................................................................................................. | 46 | |

EXHIBITS:

Exhibit A Legal Description

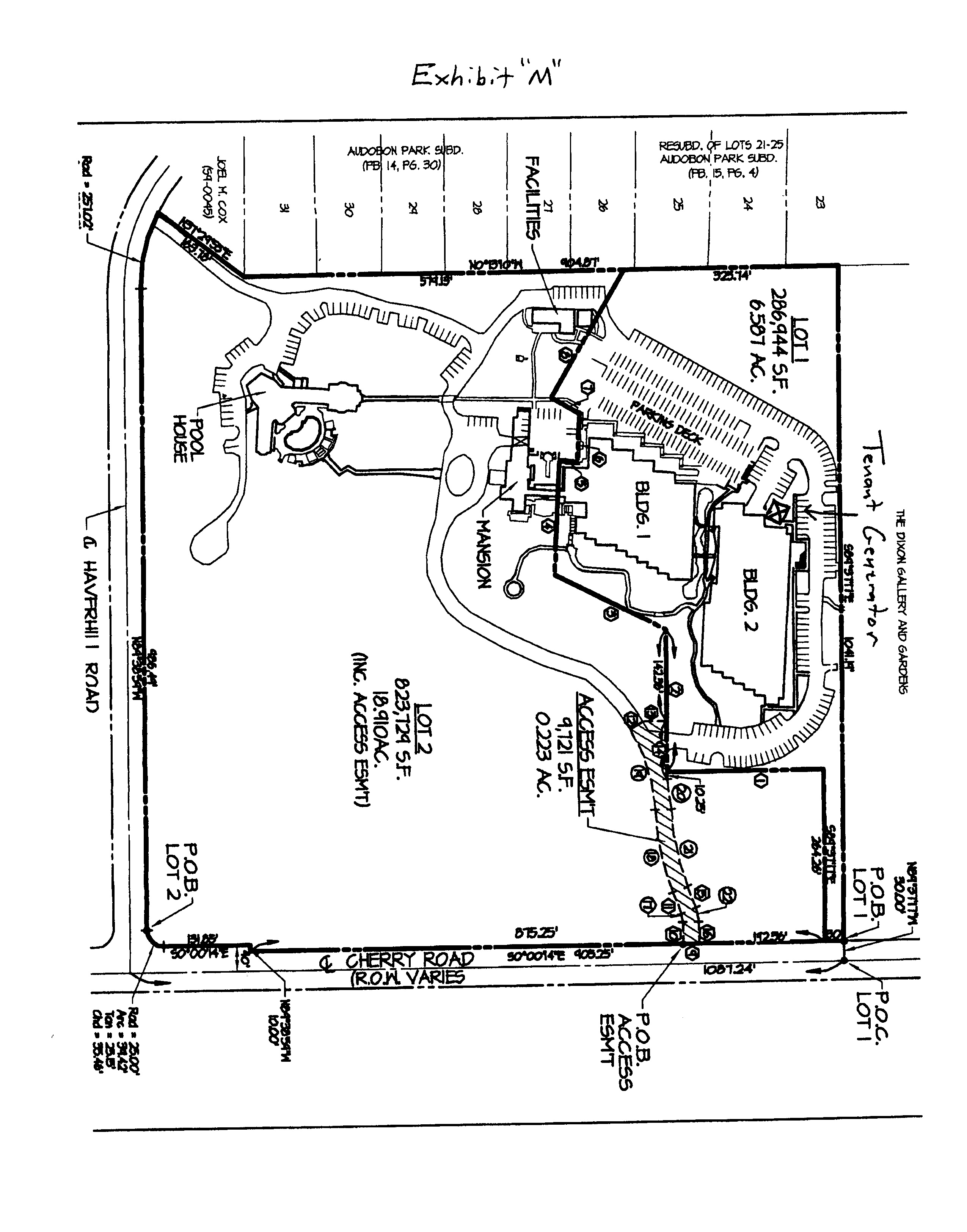

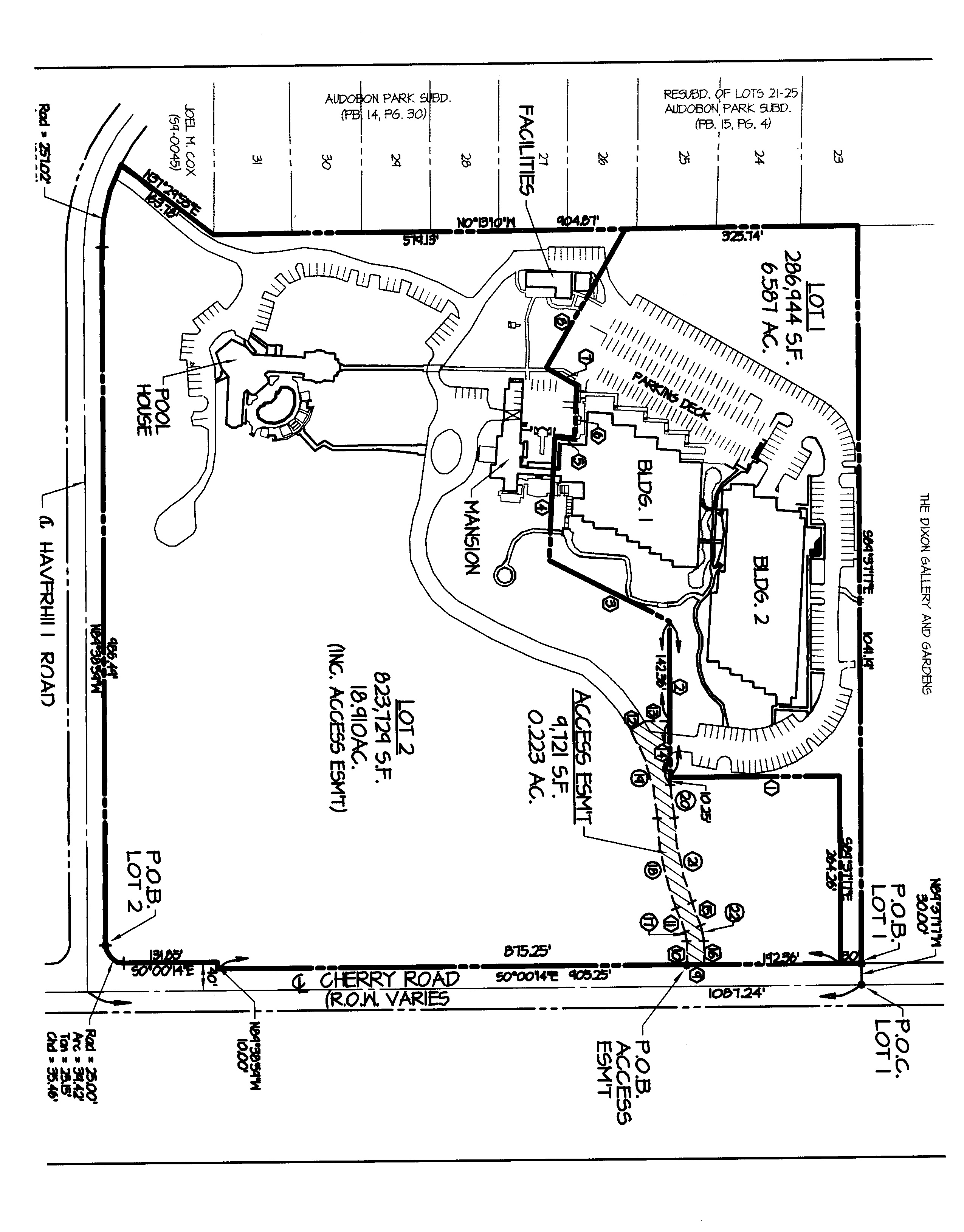

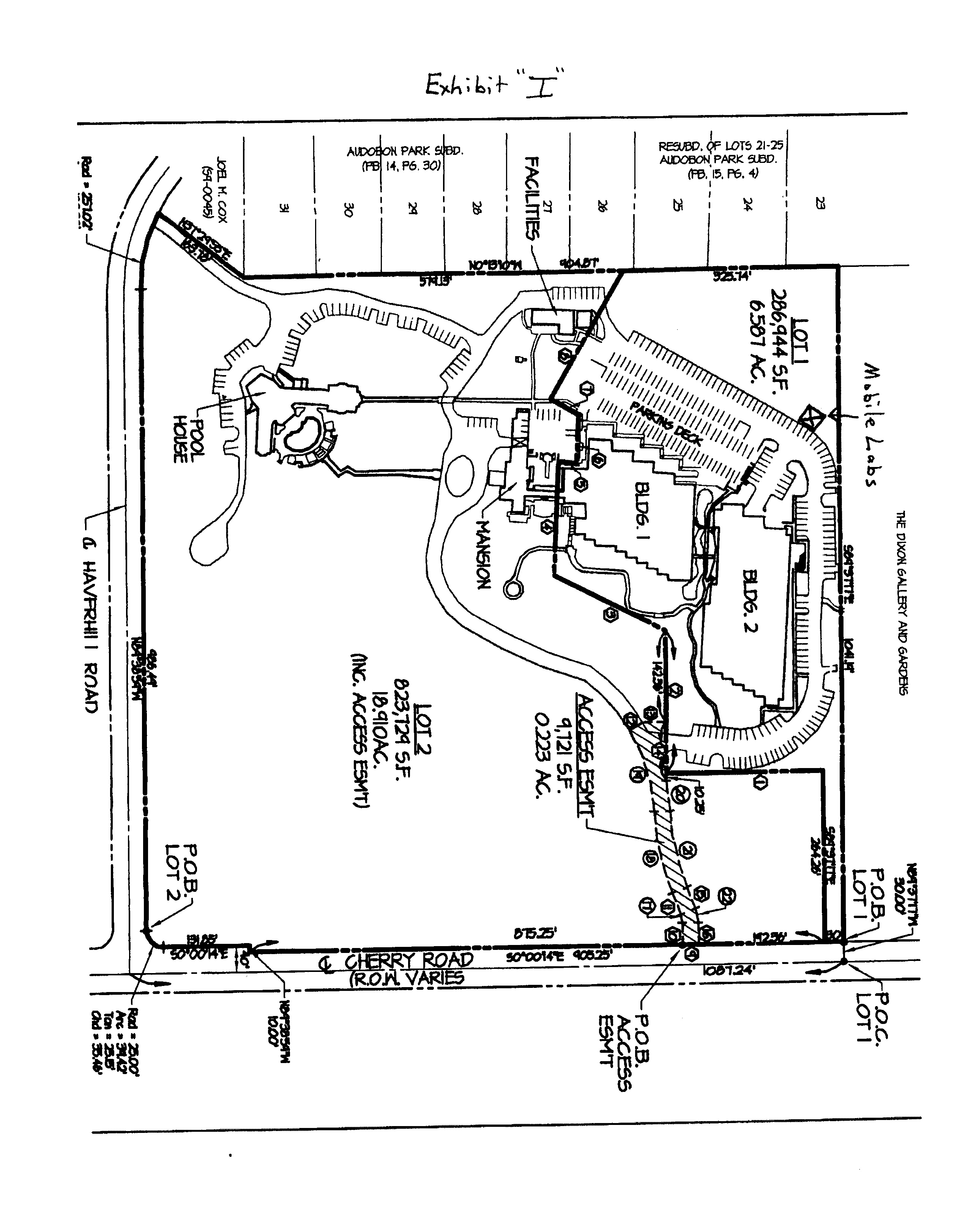

Exhibit B Plat Showing Building 1, Building 2 and Driveway

Exhibit C Rules and Regulations

Exhibit D Acceptance of Premises

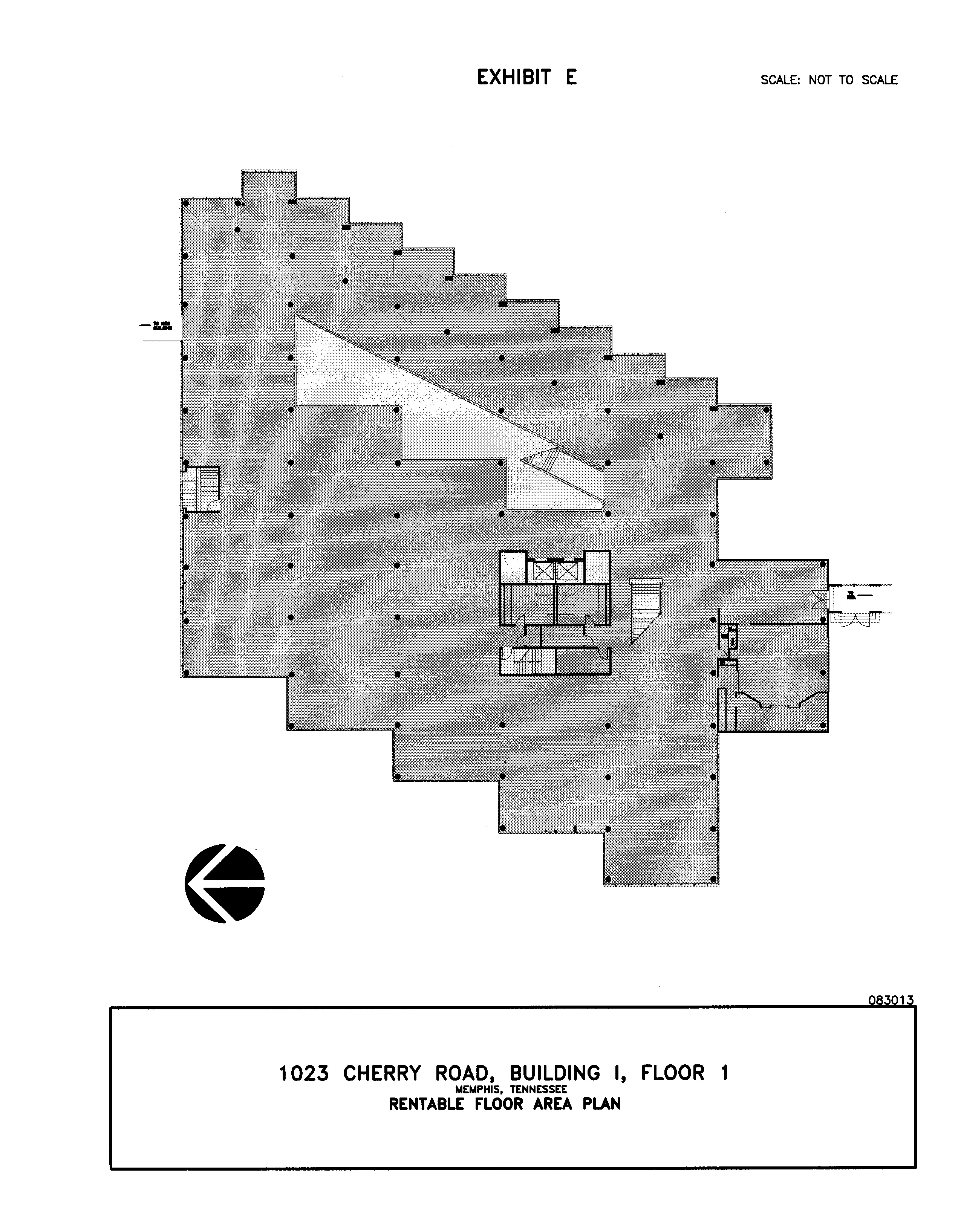

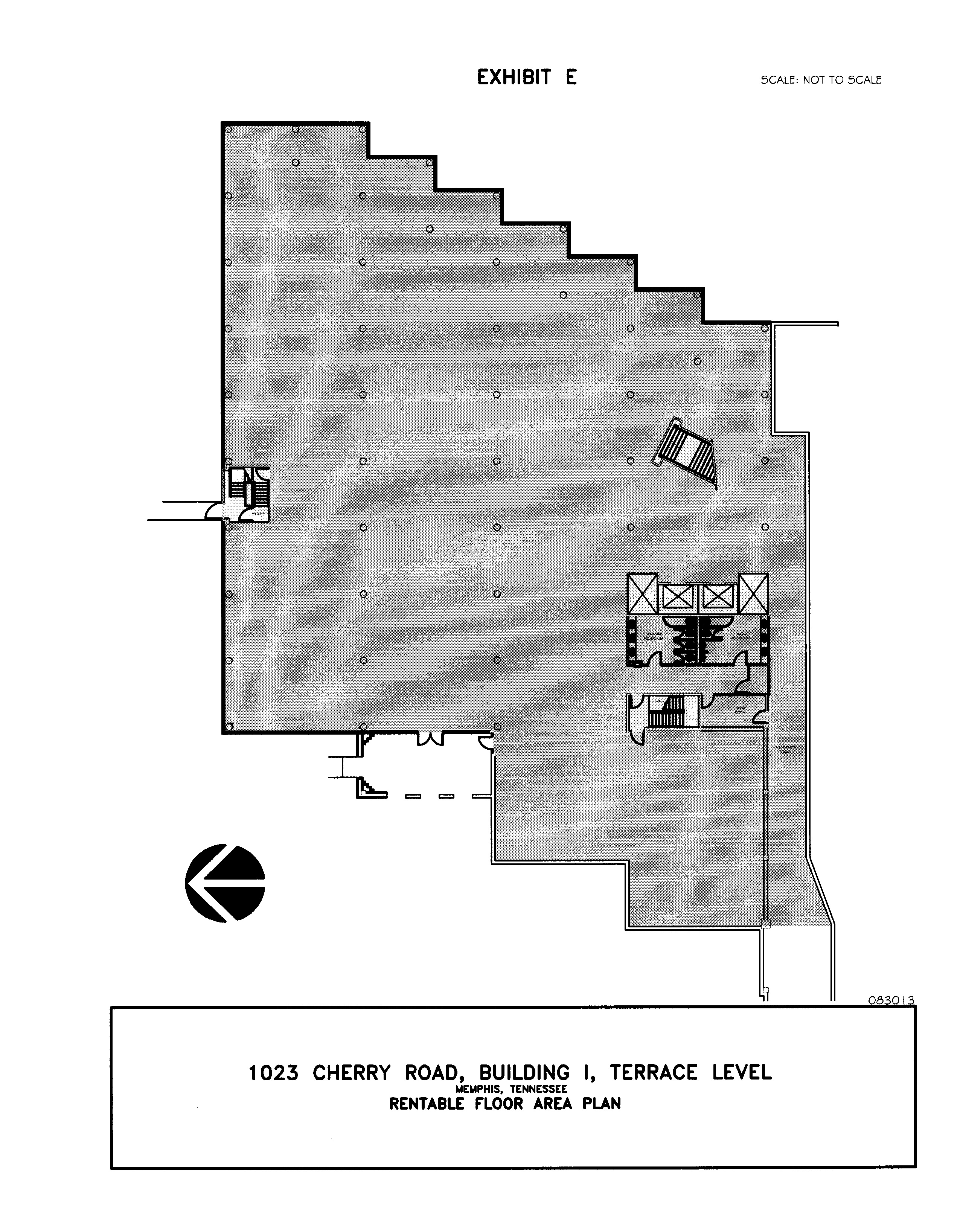

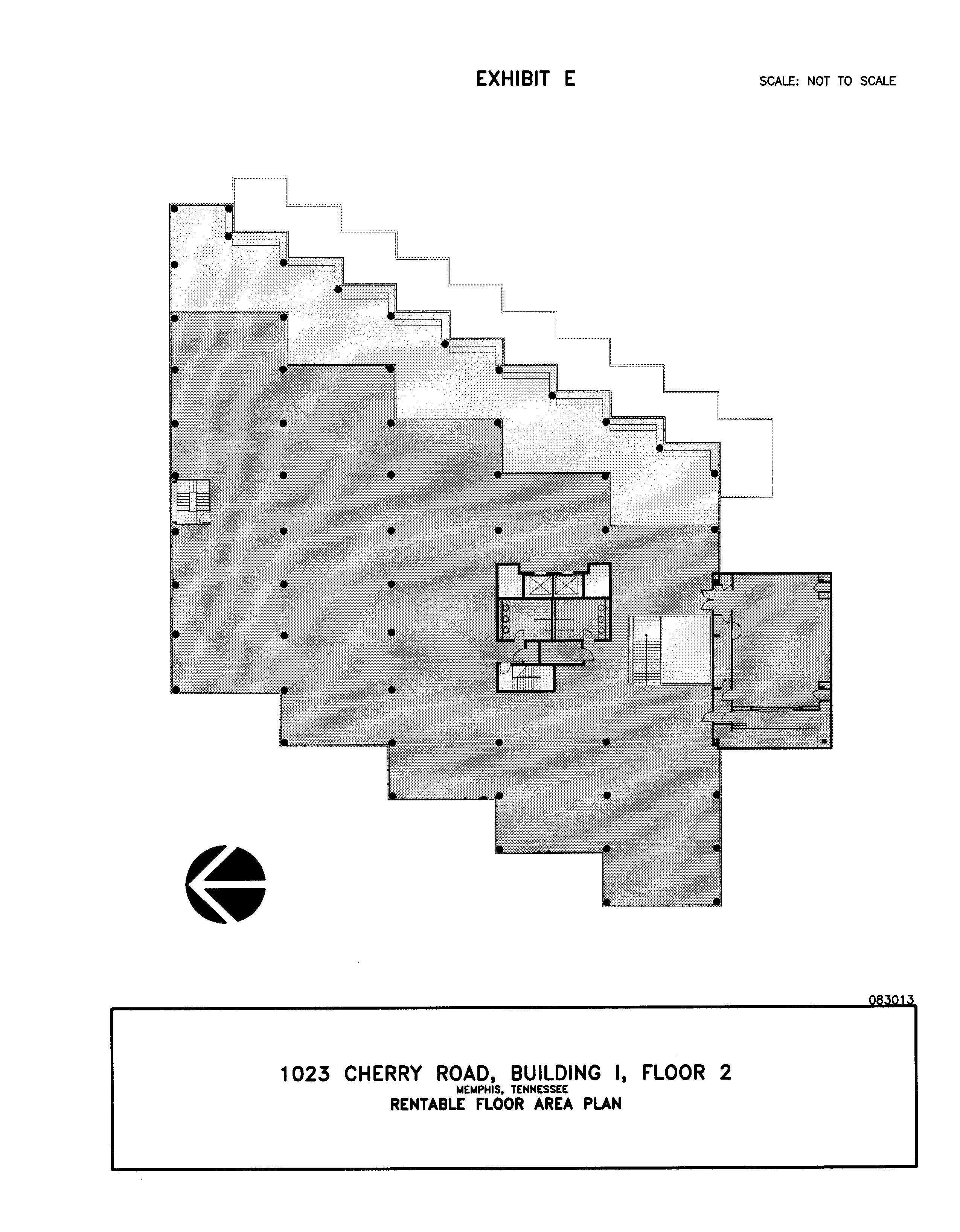

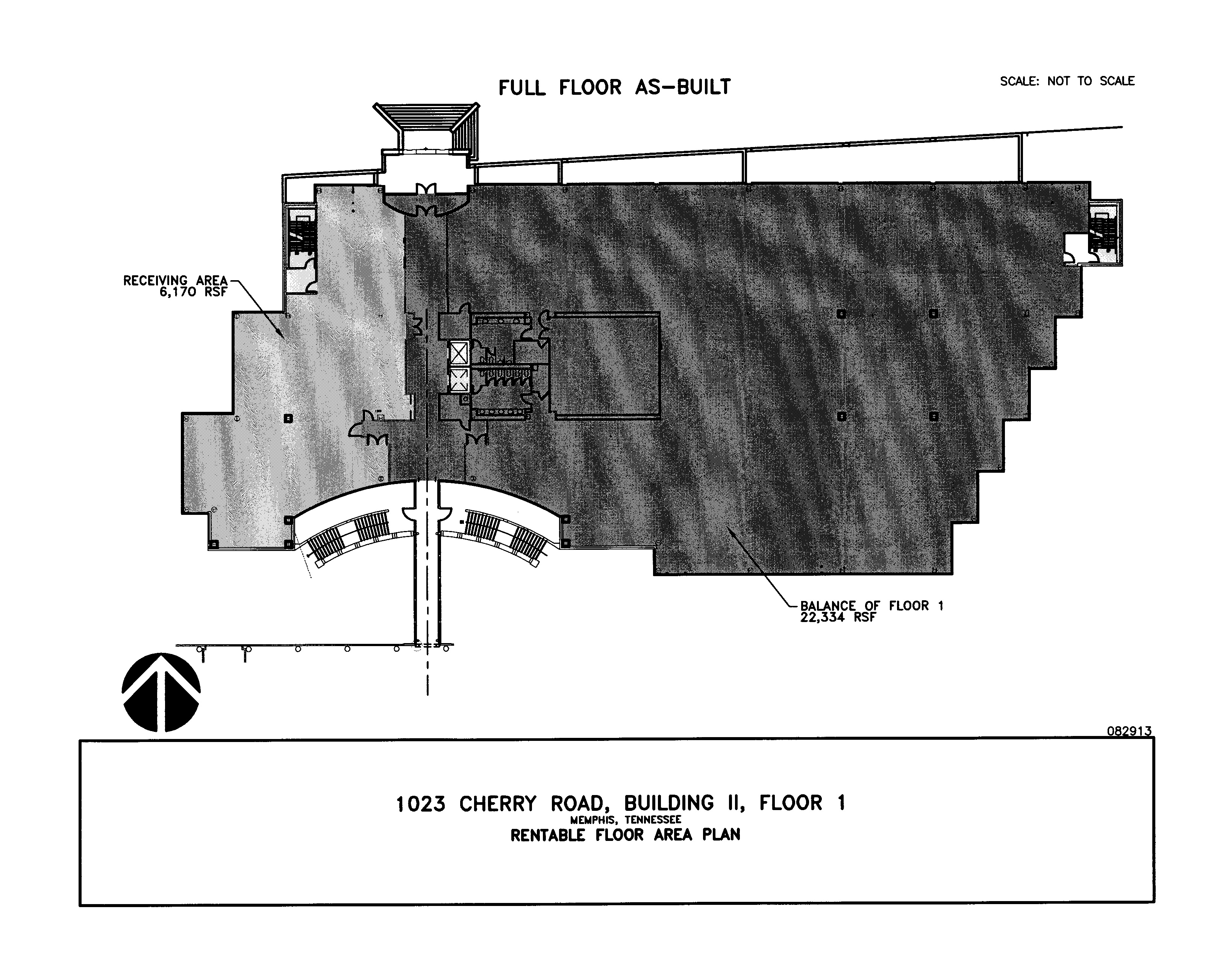

Exhibit E Floor Plans

Exhibit F Tenant Design and Construction Standards

Exhibit G Tenant’s Reserved Parking Spaces

Exhibit H Work Letter Agreement

Exhibit I Mobile Labs Parking Area

Exhibit J Access Parcel

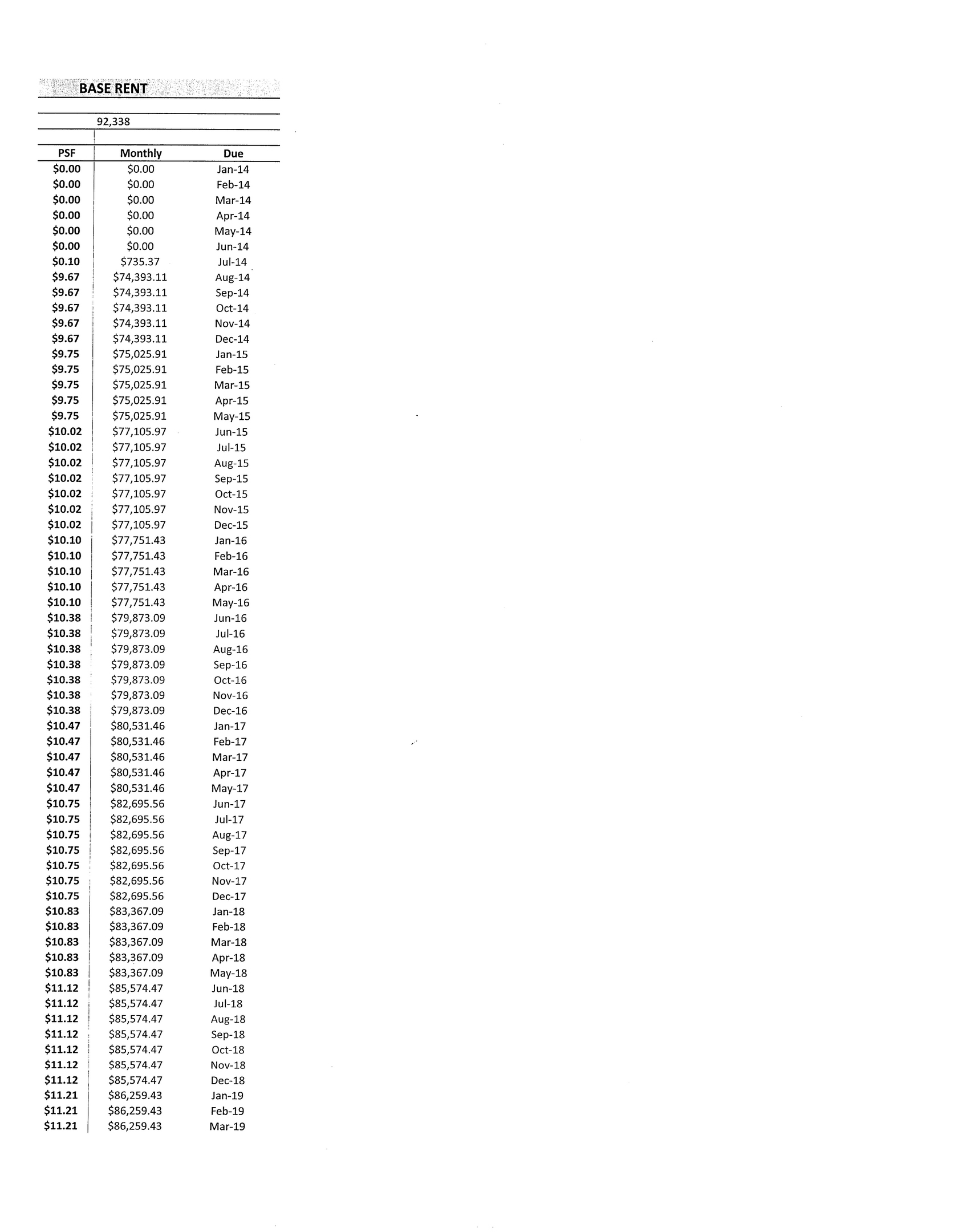

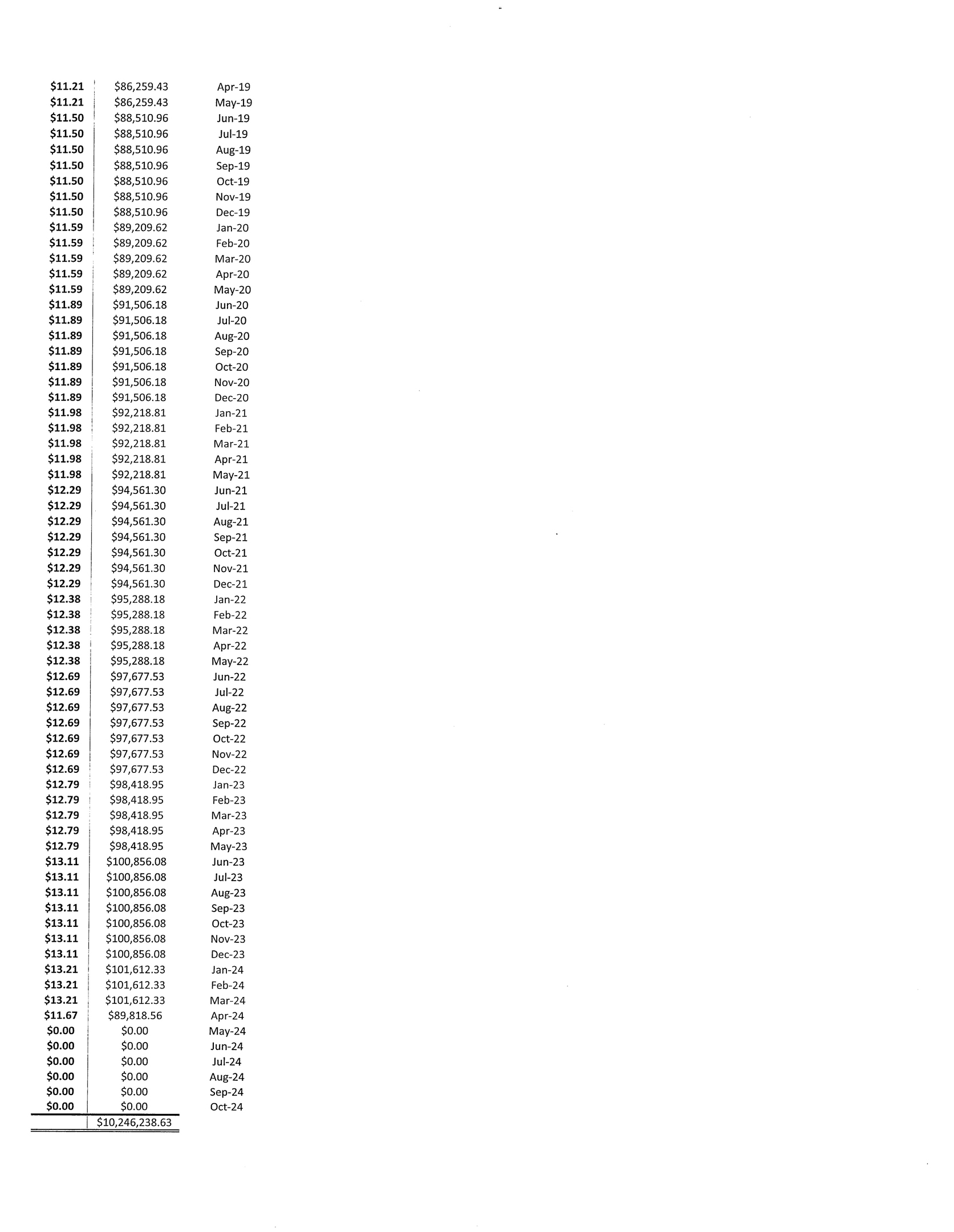

Exhibit K Base Rent Schedule

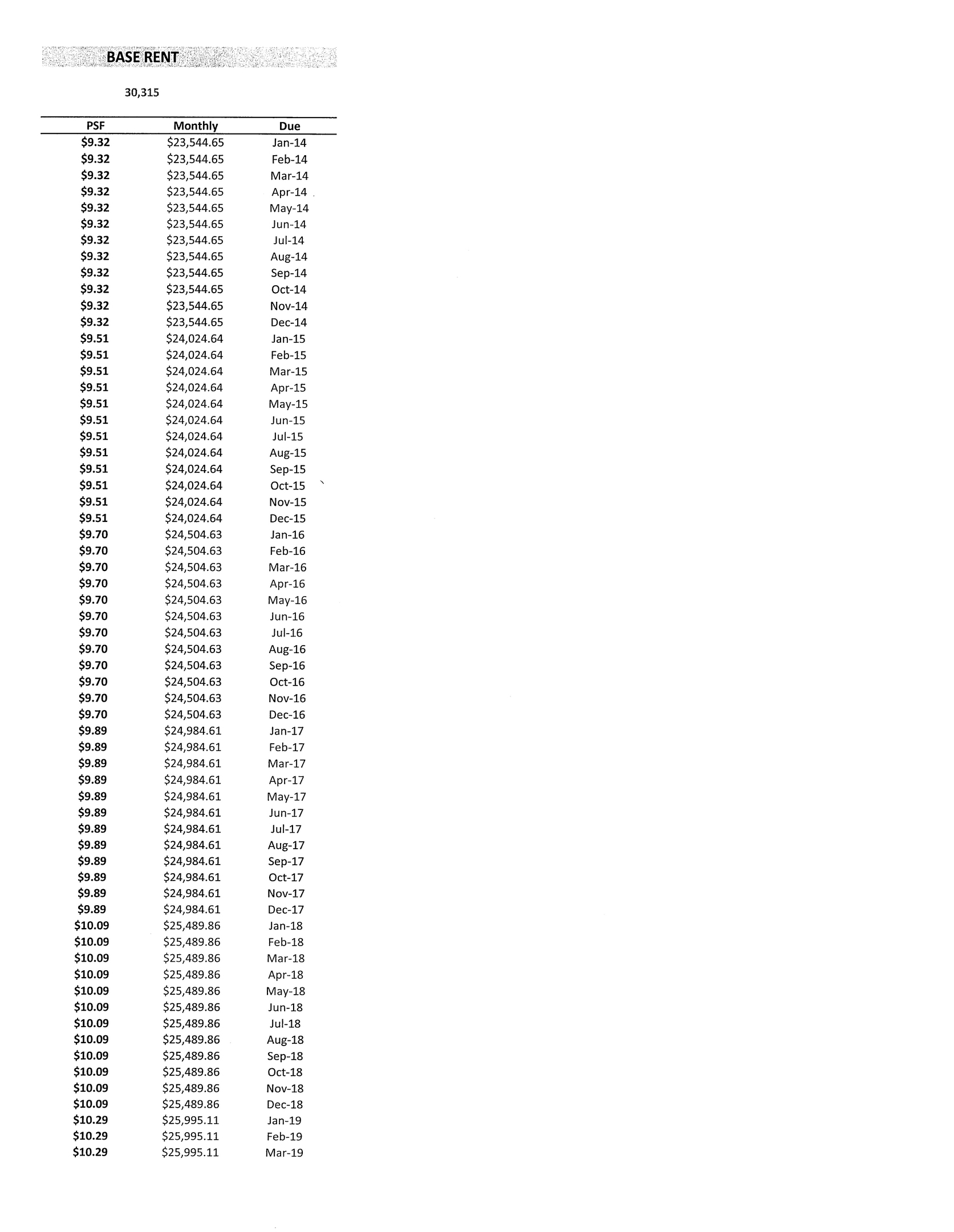

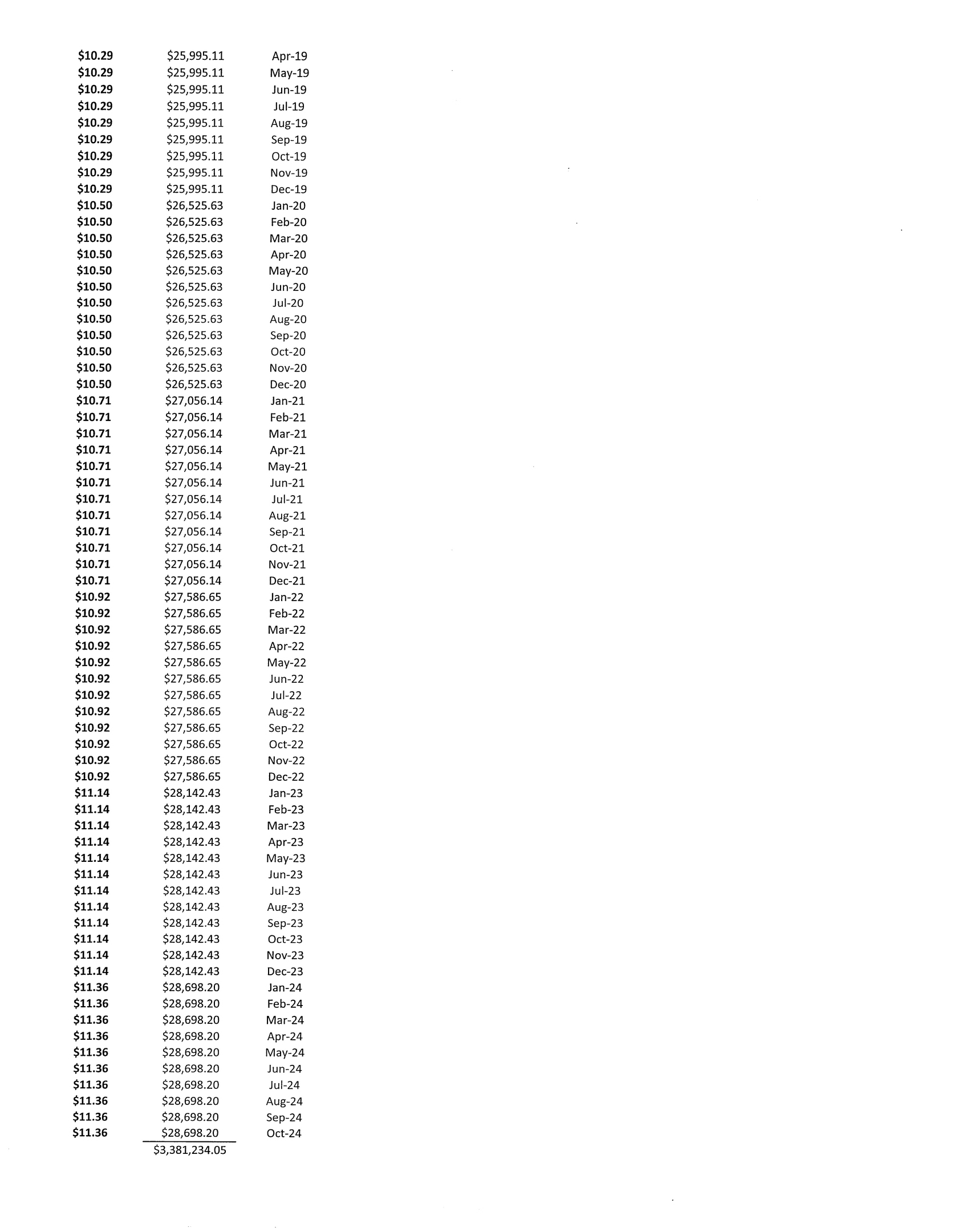

Exhibit L Base Rent Schedule for Selected Expansion Space

Exhibit M Location of Tenant Generators

2

AGREEMENT OF LEASE, made as of the 31st day of December, 2013, between RBM CHERRY ROAD PARTNERS, a Tennessee general partnership (“Landlord”), and XXXXXX MEDICAL TECHNOLOGY, INC., a Delaware corporation (“Tenant”).

REFERENCE PAGE

In addition to other terms elsewhere defined in this Lease, the following terms whenever used in this Lease shall have the meanings set forth in this Reference Page.

(1) | Premises: All of Building 1, plus the first floor of Building 2, as shown on the floor plans attached hereto as Exhibit “E”, excluding, however, any portions thereof which are defined as Common Area(s). In the event that Selected Expansion Space shall be leased by Tenant in accordance with Section 2.8, then such area shall become a part of the Premises. It is acknowledged that no part of the Adjacent Property shall be a part of the Premises. |

(2) | Commencement Date: January 1, 2014. |

(3) | Expiration Date: October 31, 2024, subject to adjustment pursuant to any of the terms, conditions or covenants of this Lease (including, but not limited to, the terms and provisions of Section 2.7 hereof). |

(4) | Term: One Hundred Thirty (130) months, unless extended or terminated sooner as described and permitted herein, beginning on the Commencement Date and expiring on the Expiration Date. |

(5) | Base Rent (or Base Rental): The amounts set forth in the schedules provided in Exhibit “K”, subject to adjustment pursuant to Section 2.8 or as otherwise specified herein. |

(6) |

(7) | Landlord’s Proportionate Share: Landlord’s Proportionate Share of the Real Property shall be 0% during the first three (3) years of the Term, then shall be the difference between 100% and Tenant’s Proportionate Share for the remainder of the Term. |

(8) | Calendar Year: For the purpose of this Lease, Calendar Year shall be a period of twelve (12) months commencing on each January 1 during the Term occurring on and after January 1, 2014. |

(9) | Base Year: A period of twelve (12) months comprising Calendar Year 2014. |

(10) |

3

without limitation, those specific uses and activities described in Section 4.1 of this Lease. The Landlord shall take no action during the Term of this Lease to effect any change to the Restrictive Covenants without the prior written consent of the Tenant.

(11) |

(12) | Landlord’s Broker: CB Xxxxxxx Xxxxx Memphis, LLC |

0000 Xxxxxxxx Xxxx Xxxxxxxxx, Xxxxx 0000

Xxxxxxx, Xxxxxxxxx 00000

Attention: Xxx Xxxxxxx

(13) | Tenant’s Broker: NONE |

(14) | Landlord’s Notice RBM Cherry Road Partners |

Address: 0000 Xxxxxx Xxxx

Xxxxxxx, Xxxxxxxxx 00000

Attention: Xxxxx Xxxxxx

Email: xxxxx@xxxxxx.xxx

Fax: 000-000-0000

With Copy to: Xxxxxxxxxxx X. Xxxxxxxxx

Xxxxxxxx Xxxxx, PLLC

0000 Xxxxxx Xxxxxx, Xxxxx 000

Xxxxxxx, XX 00000

Email: xxxxxxxxxx@xxxxxxxx.xxx

Fax: 000-000-0000

(15) | Tenant’s Notice Xxxxxx Medical Technology, Inc. |

Address: 0000 Xxxxxx Xxxx

Xxxxxxx, Xxxxxxxxx 00000

Attention: Chief Operating Officer

Email: xxxxxx.xxxxx@xxx.xxx

Fax: 000-000-0000

With Copies to: Xxxxxx Medical Technology, Inc.

0000 Xxxxxx Xxxx

Xxxxxxx, Xxxxxxxxx 00000

Attention: General Counsel

Email: xxx.xxxxxxxx@xxx.xxx

Fax: 000-000-0000

And: Xxxxx X. Xxxxx

Baker, Donelson, Bearman, Xxxxxxxx & Xxxxxxxxx, P.C.

000 Xxxxxxx Xxxxxx, Xxxxx 0000

Xxxxxxx, Xxxxxxxxx 00000

Email: xxxxxx@xxxxxxxxxxxxx.xxx

Fax: 000-000-0000

(16) | Address for Payment RBM Cherry Road Partners |

of Rent: 0000 Xxxxxx Xxxx

Xxxxxxx, Xxxxxxxxx 00000

Attention: Xxxxxxxx Xxxxxx

4

The parties hereto, for themselves, their legal representatives, successors and assigns, hereby agree as follows:

ARTICLE I

GLOSSARY

The following terms shall have the meanings indicated below:

“Access Easement” shall have the meaning set forth in Section 4.3.

“Access Parcel” shall have the meaning set forth in Section 4.3.

“ADA” shall mean the Americans With Disabilities Act of 1990, as modified and supplemented from time to time.

“Additional Rent” shall have the meaning set forth in Section 2.2.

“Adjacent Property” shall mean the real property south of and adjacent to the Land, consisting of approximately 18.910 acres, as shown on Exhibit “B” attached hereto.

“Adjacent Property Utility Payment” shall mean the payment by Landlord to Tenant of ten percent (10%) of Tenant’s aggregate annual MLGW payments in connection with Building 1 only during the Term, which shall be payable by Landlord to Tenant within ten (10) days after receipt of a Building 1 Utility Statement.

“Alterations” shall mean alterations, installations, improvements, additions, or other physical changes in or about the Premises; provided, however, that the term “Alterations” shall exclude those made by Landlord or Tenant in accordance with and pursuant to any provisions of this Lease in order to prepare the Premises and Common Area for Tenant’s initial occupancy including, without limitation, Tenant's Work as defined in the Work Letter Agreement attached as Exhibit "H" hereto.

“Applicable Rate” shall mean the lesser of (x) four percentage points above the then current Base Rate, or (y) the maximum rate permitted by applicable law.

“Approved Examiner” shall have the meaning set forth in Section 3.5.

“ASHRAE” shall mean the American Society of Heating, Refrigeration and Air-Conditioning Engineers.

“Bankruptcy Code” shall mean 11 U.S.C. Section 101 et seq., or any statute, federal or state, of similar nature and purpose.

“Base Lease” shall have the meaning set forth in Section 3.2.

“Base Rate” shall mean the “Prime Rate” of interest as published in The Wall Street Journal.

“Building 1” shall mean that certain three (3) story office building located on the Land and having an address of 0000 Xxxxxx Xxxx, Xxxxxxx, Xxxxxxxxx 00000, and all of the equipment and other improvements and appurtenances related thereto of every kind and description now located or hereafter erected, constructed or placed upon the Land and any and all alterations, renewals, and replacements thereof, additions thereto and substitutions therefor. Building 1 is located as shown on Exhibit “B” attached hereto.

5

“Building 1 Utility Statement” shall mean a statement containing a summary of MLGW utility payments made by Tenant in connection with Building 1 only for each Operating Year, which shall be delivered by Tenant to Landlord within thirty (30) days following each Operating Year.

“Building 2” shall mean that certain two (2) story office building located on the Land and having an address of 0000 Xxxxxx Xxxx, Xxxxxxx, Xxxxxxxxx 00000, and all of the equipment and other improvements and appurtenances related thereto of every kind and description now located or hereafter erected, constructed or placed upon the Land and any and all alterations, renewals, and replacements thereof, additions thereto and substitutions therefor. Building 2 is located as shown on Exhibit “B” attached hereto.

“Building Insurance” shall have the meaning set forth in Section 11.2.

“Building Standard Condition” shall mean the condition of the Premises as of the date of this Lease (reasonable wear and tear excepted), plus any Alterations approved by Landlord and Tenant's Work, except to the extent Landlord’s approval is conditioned upon Tenant’s removal of the approved Alteration prior to the Expiration Date.

“Building Systems” shall mean the base building mechanical, electrical, sanitary, heating, air conditioning, ventilating, elevator, plumbing, life-safety (including fire alarm and monitoring system that services the Adjacent Property to the extent the hardware of such system is located on the Real Property) and other service systems of the Buildings, including service systems included as part of Tenant’s Work and Major Mechanicals; provided, however, that “Building Systems” shall specifically exclude all Non-Standard Building Installations.

“Buildings” shall mean Building 1 and Building 2.

“Business Days” shall mean all days, excluding Saturdays, Sundays and all days observed as holidays by the State of Tennessee or the federal government.

“Common Area” shall mean any and all portions of the Land and the improvements thereon not part of Building 1 or Building 2; provided, however, in the event that another tenant leases space on the second floor of Building 2 and Tenant is occupying some (but not all) of the second floor of Building 2, then this definition may be expanded to include certain interior portions of Building 2 as set forth in Section 2.8 herein. Common Area includes all landscaping, fountains and related water works, walkways, sidewalks, parking lots, parking garages, parking decks, loading platforms, driveways, trash removal facilities, mechanical, electrical and utility rooms and service areas on the Land, regardless of whether they are part of Building 1 or Building 2.

“Control” shall have the meaning set forth in Section 14.2.

“Deficiency” shall have the meaning set forth in Section 18.2.

“EDGE Board” shall have the meaning set forth in Section 3.2.

“Event of Default” shall have the meaning set forth in Section 17.1.

“Excluded Operating Expenses” shall have the meaning set forth in Section 6.1.

“Expansion Area” shall have the meaning set forth in Section 2.8.

“Expansion Option” shall have the meaning set forth in Section 2.8.

“Expansion Option Term” shall have the meaning set forth in Section 2.8.

“Expansion Option Termination Fee” shall have the meaning set forth in Section 2.8(d).

"Expansion Space Allowance" shall have the meaning set forth in Section 2.8(b).

6

“FDA” means the U.S. Food and Drug Administration.

“Foreclosure” shall have the meaning set forth in Section 9.3.

“Government Authority (Authorities)” shall mean the United States of America, the State of Tennessee, the County of Shelby, the City of Memphis, any political subdivision thereof and any agency, department, commission, board, bureau or instrumentality of any of the foregoing, now existing or hereafter created, having jurisdiction over the Real Property or any portion thereof.

“HVAC” shall mean heat, ventilation and air conditioning.

“HVAC System” shall mean the Building Systems providing HVAC.

“Hazardous Materials” shall have the meaning set forth in Section 8.2.

“Land” shall mean the land containing approximately 6.587 acres of real estate located in Shelby County, Tennessee, and more particularly described in Exhibit “A”.

“Landlord” on the date as of which this Lease is made, shall mean RBM Cherry Road Partners, a Tennessee general partnership, its successors and assigns.

“Landlord Indemnitees” shall mean Landlord, its trustees, partners, shareholders, officers, directors, employees, agents and contractors and the Manager.

“Landlord’s Tax Payment” shall have the meaning set forth in Section 3.2(a).

“Landlord’s Operating Payment” shall have the meaning set forth in Section 3.3(a).

“Lease Termination Fee” shall have the meaning set forth in Section 2.9.

“Lease Termination Option” shall have the meaning set forth in Section 2.9.

“Lessor” shall mean the EDGE Board, or any other governmental or quasi-governmental entity authorized to acquire fee title to property and enter into lease agreements with owners in order to qualify such property for state and local PILOT programs.

“License Agreement” shall have the meaning set forth in Section 4.3.

“MLG&W” shall mean Memphis, Light, Gas and Water Division, a municipal public utility serving Memphis and Shelby County, Tennessee.

“Major Mechanical” shall mean HVAC systems (including HVAC boilers, HVAC chillers, HVAC controls and HVAC water towers), elevators, electrical switch gears and life safety generators. “Major Mechanical” does not include plumbing (drains, pipes, fixtures), lighting, doors, windows, fire alarm systems and any Non-Standard Building Installations.

“Major Mechanical Replacement” means the replacement of a Major Mechanical for which the following conditions are satisfied and for which notice that such conditions have been satisfied has been provided to Landlord in advance of the commencement of any work to replace such Major Mechanical:

(a) the replaced Major Mechanical is not working at the time notice of replacement is provided to Landlord;

7

(b) Fifteen Thousand Dollars ($15,000) or more has been spent by Tenant on repairing (not maintenance contract costs) the replaced Major Mechanical within the past 6 months; provided, however, that if there is a catastrophic failure to a Major Mechanical which renders such Major Mechanical unable to be repaired, then satisfaction of this condition (b) will not be required for the replacement of a Major Mechanical to be considered a Major Mechanical Replacement; and

(c) The cost to repair and put the replaced Major Mechanical in good working condition is more than Fifteen Thousand Dollars ($15,000) as quoted by a vendor who has made all or a portion of such repairs over the past six (6) months.

“Major Mechanical Replacement Event” shall have the meaning set forth in Section 6.3(b).

“Market Rental Rate” shall have the meaning set forth in Section 2.7.

“Mobile Labs” shall have the meaning set forth in Section 4.1(xiv).

“Mortgage(s)” shall mean any trust deed, trust indenture or mortgage which may now or hereafter affect the Real Property, the Buildings, and all renewals, extensions, supplements, amendments, modifications, consolidations and replacements thereof or thereto, substitutions therefor, and advances made thereunder.

“Mortgagee(s)” shall mean any trustee under, or mortgagee or holder of, a Mortgage.

“Non-Standard Building Installations” shall mean (i) the Security System, (ii) any low voltage installations that are part of Tenant’s Work, (iii) any specialty rooms, labs and installations that are part of such Tenant’s Work, including without limitation anything regulated by the FDA, (iv) Tenant’s Generators, and (v) Alterations made by Tenant after the date of this Lease not included as Tenant’s Work under the Work Letter Agreement.

“Notice(s)” shall have the meaning set forth in Section 26.1.

“Office Use” shall mean those uses which are included in the definition of Office Square Footage as such term is used in the Restrictive Covenants.

“Operating Hours” shall mean 6:00 a.m. to 7:00 p.m. on Business Days.

“Operating Year” shall mean each calendar year that includes any part of the Term.

“Parties” shall have the meaning set forth in Section 37.2.

“Person or Person(s)” shall mean any natural person or persons, a partnership, a corporation, a limited liability company, a limited partnership and any other form of business or legal association or entity.

“Persons Within Landlord’s Control” shall mean and include Landlord, all of Landlord’s respective principals, officers, agents, contractors, servants, employees, licensees and invitees.

“Persons Within Tenant’s Control” shall mean and include Tenant, all of Tenant’s respective principals, officers, agents, contractors, servants, employees, licensees and invitees.

“PILOT” shall have the meaning set forth in Section 3.2.

"PILOT Documents" shall have the meaning set forth in Section 3.2.

“PILOT Incentives” shall have the meaning set forth in Section 3.2.

8

“Real Property” shall mean Xxxxxxxx 0, Xxxxxxxx 0 and the Land.

“Register’s Office” shall mean the Shelby County, Tennessee Register’s Office.

“Reimbursable Operating Expenses” shall have the meaning set forth in Section 3.1(a).

“Reimbursable Taxes” shall have the meaning set forth in Section 3.1(b).

“Renewal Option” shall have the meaning set forth in Section 2.7.

“Renewal Rental Rate” shall have the meaning set forth in Section 2.7.

“Rentable Square Feet” or "RSF" shall mean the actual measurement of rentable area in accordance with the American National Standard Method for Measuring Floor Area in Office Buildings, ANSI/BOMA Z65.1-1996 or any successor standard adopted on or before the Commencement Date and reasonably agreed to by Landlord and Tenant.

“Rental” shall mean and be deemed to include Base Rent, Additional Rent and any other sums payable by Tenant hereunder.

“Requirements” shall mean (i) all present and future laws, rules, ordinances, regulations, statutes, requirements, codes and executive orders, extraordinary as well as ordinary, retroactive and prospective, of all Governmental Authorities now existing or hereafter created, and of any applicable fire rating bureau, or other body exercising similar functions, affecting the Real Property, or any street, avenue or sidewalk comprising a part or in front thereof or any vault in or under the same, or requiring removal of any encroachment, or affecting the maintenance, use or occupation of the Real Property, (ii) all requirements, obligations and conditions of all instruments of record on the date of this Lease including, without limitation, the Restrictive Covenants, and (iii) all requirements, obligations and conditions imposed by the carrier of Tenant’s hazard insurance policy (or policies) for the Buildings.

“Restrictive Covenants” shall mean those restrictions, building lines and easements of record in Plat Book 92, Page 47, as rerecorded in Plat Book 95, Page 32; Plat Book 126, Page 22; Plat Book 131, Page 1; Plat Book 143, Page 65; Plat Book 145, Page 22, as rerecorded in Plat Book 148, Page 15, as rerecorded in Plat Book 155, Page 8, as rerecorded in Plat 188, Page 11, as rerecorded in Plat Book 204, Page 29; and in Plat Book 187, Page 64, all in the Register’s Office of Shelby County, Tennessee.

“Rules and Regulations” shall mean the rules and regulations annexed hereto as Exhibit “C”, and such other and further reasonable rules and regulations as Landlord and Landlord’s agents may from time to time adopt, on notice to Tenant to be given in accordance with the terms of this Lease.

“Second Entrance” shall have the meaning set forth in Section 2.8(d).

“Security System” shall mean the security and access system(s) in use in the Buildings and located at various locations on the Real Property as of the Commencement Date, if any, and any subsequent additions and modifications made thereto by Tenant from time to time.

“Selected Expansion Space” shall have the meaning set forth in Section 2.8.

“Shared Use Documents” shall have the meaning set forth in Section 4.3.

“Sublease Additional Rent” shall have the meaning set forth in Section 14.4.

“Successor Landlord” shall have the meaning set forth in Section 9.3.

“Taxes” shall mean the aggregate amount of (i) all personal property taxes levied on personal property of Tenant located on the Real Property, and (ii) all real estate taxes or payments in lieu of taxes, and any general or special

9

assessments (exclusive of penalties and interest thereon) imposed upon the Real Property or any portion thereof and the various estates therein, including, without limitation, each of the following: (a) assessments made upon or with respect to any “air” and “development” rights now or hereafter appurtenant to or affecting the Real Property; and (b) any assessments levied after the date of this Lease for public benefits to all or any portion of the Real Property; provided that if, because of any change in the taxation of real estate, any other tax or assessment, however denominated (including, without limitation, any profit, sales, use, occupancy, gross receipts or rental tax), is imposed upon Landlord, Tenant or the owner of all or any portion the Real Property, or the occupancy, rents or income therefrom, in substitution for any of the foregoing Taxes or for an increase in any of the foregoing Taxes, such other tax or assessment shall be deemed part of Taxes.

“Tax Year” shall mean each period of twelve (12) months, commencing on the first day of January of each year, that includes any part of the Term, or such other period of twelve (12) months as may be duly adopted as the fiscal year for real estate tax purposes by the City of Memphis and Shelby County.

“Tenant”, on the date as of which this Lease is made, shall mean the Tenant named in this Lease, but thereafter “Tenant” shall mean only the tenant under this Lease at the time in question; provided, however, that the Tenant named in this Lease and any permitted successor tenant hereunder shall not be released from liability hereunder in the event of any assignment of this Lease unless released in writing by the Landlord, in its sole discretion.

“Tenant Appeal Period” shall have the meaning set forth in Section 3.2(b)(i).

"Tenant's Generators" shall have the meaning set forth in Section 5.7.

“Tenant Indemnitees” shall mean Tenant, its trustees, partners, shareholders, officers, directors, employees, agents and contractors.

“Tenant’s Property” shall mean Tenant’s equipment, furniture, furnishings and other movable items of personal property.

“Tenant’s Operating Statement” shall mean a statement containing a computation of Reimbursable Operating Expenses delivered by Tenant to Landlord pursuant to Section 3.3(a).

“Tenant's Reserved Parking Spaces” shall have the meaning set forth in Section 4.2.

“Tenant’s Statement” shall mean either a Tenant’s Operating Statement or a Tenant’s Tax Statement.

“Tenant’s Tax Statement” shall mean a statement containing a computation of Reimbursable Taxes delivered by Tenant to Landlord pursuant to Section 3.2(a).

“Term” shall mean the period from the Commencement Date through the Expiration Date.

“Untenantable” shall mean that the Premises are unfit for the Permitted Use.

“Utility Discount Programs” shall have the meaning set forth in Section 3.7.

“Utility Easement” shall have the meaning set forth in Section 4.3.

“Work Letter Agreement” shall have the meaning set forth in Section 5.1.

10

ARTICLE II

DEMISE, PREMISES, TERM, RENT

Section 2.1. Landlord hereby leases to Tenant and Tenant hereby leases from Landlord the Premises for the Term to commence on the Commencement Date and to end on the Expiration Date. The Commencement Date shall be January 1, 2014 (which beginning date shall be memorialized by an executed Acceptance of Premises in the form attached hereto as Exhibit “D”).

Section 2.2. Tenant shall pay to Landlord, in lawful money of the United States of America, without notice or demand, by good and sufficient check drawn to Landlord’s order on a bank or trust company with an office in the United States of America, at the office of Landlord or at such other place as Landlord may designate from time to time, by wire transfer to an account designated by Landlord or direct draft from Tenant’s account through bank draft, ACH transfer, or other equivalent funds transfer to Landlord’s designated account (or other payment mechanism acceptable to Landlord), the following:

(a) the Base Rent as set forth in and in accordance with the Base Rent Schedule provided in Exhibit “K” attached hereto, subject to adjustment pursuant to Section 2.8, which shall be payable in monthly installments of Base Rent in advance on the first day of each and every calendar month during the Term as indicated therein; and

(b) additional rent (“Additional Rent”) consisting of all other sums of money as shall become due from and be payable by Tenant hereunder.

Section 2.3. [RESERVED]

Section 2.4. If the Expiration Date is other than the last day of a calendar month, Rental for such month shall be prorated on a per diem basis.

Section 2.5. Tenant shall pay the Base Rent and Additional Rent when due without abatement, deduction, counterclaim, setoff or defense for any reason whatsoever, except said abatement as may be occasioned by the occurrence of any event permitting an abatement of Base Rent as specifically set forth in this Lease. Any payment made by Tenant to Landlord on account of Base Rent may be credited by Landlord to the payment of any late charges then due and payable and to any Base Rent or Additional Rent then past due before being credited to Base Rent currently due.

Section 2.6. Tenant shall pay to Landlord as Additional Rent, concurrently, upon proper notice to Tenant hereunder, with payment of Base Rent or Additional Rent to Landlord, all taxes (including but not limited to any and all sales, rent or excise taxes) directly imposed upon Base Rent or Additional Rent, as levied or assessed by any governmental or political body or subdivision thereof against Landlord, but specifically excluding any taxes based upon the income or profits of Landlord including, without limitation, income taxes.

Section 2.7. Provided Tenant is not in default (beyond any cure periods hereunder) under this Lease at the time an option is exercised, Landlord grants Tenant two (2) options to renew this Lease, with respect to the portion of the Premises then leased by Tenant, with each option being for an additional term of five (5) years, upon the same terms and conditions as set forth herein (the first renewal term commencing at the end of the initial Term and the second renewal term commencing at the end of the first renewal term, if previously exercised, each of which must be exercised in accordance with the notice requirements provided hereunder), except that the rental rates in each case shall be determined in accordance with the provisions of this Section 2.7 as shown below (the “Renewal Option”). Each option shall be exercised by Tenant’s delivery of written notice to Landlord at least ten (10) months prior to the then-current Expiration Date.

11

(a) The renewal Base Rent rates for each option period shall be equal to ninety-five percent (95%) of the Market Rental Rate (as defined hereinafter) (such rate being hereinafter referred to as the “Renewal Rental Rate”). The “Market Rental Rate” is the rental rate then being charged by landlords (including Landlord) for office space in the East Memphis office submarket on new and renewal leases to tenants of a similar credit quality to Tenant for space of similar quality and size as the Premises, taking into account all relevant factors, including without limitation, age, extent and quality of tenant improvements, leasing commissions, length of term, amenities of the Buildings and the Real Property, reasonable projections of Base Rent, Additional Rent and allowances or concessions that have been granted such as abatements, lease assumptions and leasehold improvement allowances.

(b) Within thirty (30) days after Tenant’s exercise of each of the options to renew, Landlord shall notify Tenant in writing of the Renewal Rental Rate for that renewal period as determined by the above definition. Tenant shall have thirty (30) days from the receipt of Landlord’s notice to either accept or dispute Landlord’s determination of the Renewal Rental Rate. In the event that Tenant disputes Landlord’s determination, Tenant shall so notify Landlord and advise Landlord of Tenant’s determination of the Renewal Rental Rate for the option period as determined by the above definition. If Landlord and Tenant cannot agree upon the Renewal Rental Rate within thirty (30) days of Tenant’s original notice of its intent to exercise its Renewal Option, the following dispute resolution mechanisms shall be utilized:

The parties, within ten (10) days thereafter, shall each select an MAI-certified commercial real estate appraiser with a minimum of ten (10) years’ experience in the Memphis market (each party to pay the cost of the appraiser selected by it). Each appraiser, within thirty (30) days after selection, shall present to the other his or her determination of the Market Rental Rate. If the Market Rental Rates determined by each appraiser are within ten percent (10%) of each other, then the Renewal Rental Rate for the option period shall be equal to ninety-five (95%) of the average of the two (2) Market Rental Rates as determined by the parties’ appraisers. If the appraisers’ determinations are greater than ten percent (10%) apart, then the appraisers shall jointly select, within ten (10) days thereafter, a third MAI-certified commercial real estate appraiser with a minimum of ten (10) years’ experience in the Memphis market, with the cost of the third appraiser to be divided equally between Landlord and Tenant. Within thirty (30) days after appointment, the third appraiser shall announce his or her determination of the Market Rental Rate. The Renewal Rental Rate shall be equal to ninety-five (95%) of the average of the Market Rental Rate determined by the two appraisers whose determinations are numerically closest to each other (disregarding the determination of the appraiser whose determination is further apart from either of the others). Notwithstanding the foregoing, in the event that the third appraiser’s determination is exactly in the middle of the first two appraisers’ determinations, then the Renewal Rental Rate shall be equal to ninety-five (95%) of the third appraiser’s determination of the Market Rental Rate.

(c) Landlord and Tenant shall execute an amendment to this Lease within the earlier of (i) thirty (30) days after the determination of the Renewal Rental Rate or (ii) the Expiration Date, which amendment shall set forth the extended Term and all other terms and conditions applicable to the renewal period, and shall establish the Renewal Rental Rate as the annual Base Rent for the renewal period.

(d) Except for the Renewal Rental Rate as set forth above, this Lease, and all of the terms and conditions hereof, shall remain in full force and effect throughout the entire renewal term(s).

Section 2.8. During the first three (3) years of the Term (the “Expansion Option Term”), Tenant shall have the exclusive option (the “Expansion Option”) to expand the Premises to include all or some portion (but not less than 15,000 Rentable Square Feet) of the second floor of Building 2 as designated by mutual agreement of Landlord and Tenant (the second floor of Building 2 containing approximately 30,315 Rentable Square Feet) (the “Expansion Area”) by providing Landlord written notice, given at any time prior to the expiration of the Expansion Option Term, of its intent to lease all or a portion of the Expansion Area. Tenant may exercise this Expansion Option multiple times during the Expansion Option Term. During the Expansion Option Term, Landlord will not lease the Expansion Area to any other prospective tenant; and, unless the Expansion Option is timely exercised, Tenant shall not have the right to occupy or use the Expansion Area during the Term. In the event the Expansion Option is exercised during the Expansion Option Term, all or a portion (but not less than 15,000 Rentable Square Feet) of the Expansion Area (as designated by mutual agreement of Landlord and Tenant) (the “Selected Expansion Space”) shall be leased by Landlord to Tenant (and shall become part of the Premises) pursuant to and in accordance with the following terms and conditions:

12

(a)The Base Rent payable for the Selected Expansion Space shall be calculated based upon the Base Rent Schedule for Selected Expansion Space attached hereto as Exhibit “L”.

(b)Landlord shall give Tenant an improvement allowance with regard to the Selected Expansion Space (the "Expansion Space Allowance") equal to a pro rata portion of $20.00 per RSF of the Selected Expansion Space (determined by taking the number of months remaining in the Term upon Tenant's exercise of the Expansion Option, dividing such number by 130 and then multiplying such number by $20.00). The payment of the Expansion Space Allowance shall be made pursuant to the applicable terms and conditions of the Work Letter Agreement.

(c)The term of the lease for the Selected Expansion Space shall coincide with the Term remaining under this Lease at the time of Tenant's exercise of the Expansion Option (including any time periods under a Renewal Option).

(d)At the end of the Expansion Option Term, if Tenant has not elected to lease 100% of the Expansion Area, then Tenant will remit to Landlord an amount equal to $500,000 (the “Expansion Option Termination Fee”). Furthermore, at that time, Landlord shall have the right for the remainder of the Term to elect to recapture a portion of the ground floor of Building 2 for the purposes of creating a second building entrance, vestibule and elevator lobby so that access to the second floor can be achieved for third party tenants (the “Second Entrance”). The exact location(s) and design of the Second Entrance shall be determined in the reasonable discretion of Landlord with Landlord involving Tenant and communicating with Tenant during the determination of said location and design of the Second Entrance; provided, however, that Landlord agrees not to permit any signage for such third party tenant(s) to be placed on the east façade of Building 2. All costs in connection with the creation of the Second Entrance shall be solely borne by Landlord, including, without limitation, any and all actual, documented out of pocket costs incurred by Tenant as a direct result of the creation and/or construction of the Second Entrance including, without limitation, reconfiguring of Tenant's existing floor plans in the Premises and/or movement of Tenant's fixtures, equipment or employees. All construction and related activities as to the Second Entrance shall be conducted by Landlord, and anyone acting by or through Landlord, in a good and workmanlike manner, shall be made to a standard consistent with the then existing design and classification of the Premises and shall be made with minimal disruption to Tenant and Tenant's business activities on the Premises and Common Area.

(e)Tenant’s Proportionate Share shall be increased proportionately according to the number of Rentable Square Feet in the Selected Expansion Space. It is agreed that Tenant’s exercise of its option to lease the entire Expansion Area would add an additional 25% to Tenant’s Proportionate Share (bringing that number up to 100%); likewise, Tenant’s leasing anything less than the entire Expansion Area would add a pro-rata amount to Tenant’s Proportionate Share.

Section 2.9 Tenant shall have the one (1) time right to terminate this Lease, which termination shall be effective May 31, 2021 (the “Lease Termination Option”), for a lump sum payment to Landlord on or prior to such date of:

(a) | $4,444,579 in consideration of the termination of the Lease with respect to the initial Premises (consisting of all of Building 1 and the first floor of Building 2); plus |

(b) | in the event that Tenant has exercised any Expansion Option, the product of: RSF in Tenant’s Selected Expansion Space divided by the total Expansion Area RSF, multiplied by $1,566,414 (together with (a), the “Lease Termination Fee”). |

In order to exercise the Lease Termination Option, Tenant must not be in default under this Lease (beyond and applicable cure periods under this Lease) and must deliver to Landlord written notice of its intent to exercise such option prior to September 1, 2020. If written notice is not received by Landlord prior to September 1, 2020, or if

13

payment of the Lease Termination Fee is not delivered on or prior to May 31, 2021, then this Lease Termination Option shall be null and void.

ARTICLE III

REIMBURSABLE OPERATING EXPENSES AND TAXES

Section 3.1. For the purposes of this Article III, the following terms shall have the meanings set forth below:

(a) “Reimbursable Operating Expenses” shall mean the aggregate of all actual costs, expenses and disbursements paid by Tenant with respect to the following: (i) casualty insurance required to be provided by Tenant under this Lease; (ii) operation and repair of Building Systems including repair and maintenance of Major Mechanicals; (iii) pest control, guard, watchman or other security personnel service (excluding the Security System), fire extinguishers, the costs of operation, cleaning, repair, and maintenance of the existing power generators used to power the Buildings’ life safety equipment, but specifically excluding Tenant’s Generators; (iv) exterior and interior landscaping, irrigation, lighting and tree care; (v) waste removal; and (vi) gas, electricity, oil, steam, water, sewer and other utilities furnished to the Buildings, and utility taxes, less the Adjacent Property Utility Payment. Notwithstanding the foregoing, Reimbursable Operating Expenses shall not include (a) any repair and maintenance of any elevators or (b) any Excluded Operating Expenses.

(b) “Reimbursable Taxes” shall mean all real estate taxes or payments in lieu of taxes, and any general or special assessments (exclusive of penalties and interest thereon) (i) during the term of any PILOT Documents (hereinafter defined), based upon and calculated specifically for the portion of the Real Property not leased to Tenant, or (ii) after the term of any PILOT Documents, allocable to the percentage of the total RSF of the Buildings not leased to Tenant, either of which are paid by Tenant; provided that if, because of any change in the taxation of real estate, any other tax or assessment, however denominated (including, without limitation, any profit, sales, use, occupancy, gross receipts or rental tax), is imposed upon Landlord, Tenant or the owner of all or any portion the Real Property, or the occupancy, rents or income therefrom, in substitution for any of the foregoing Reimbursable Taxes or for an increase in any of the foregoing Reimbursable Taxes, such other tax or assessment shall be deemed part of Reimbursable Taxes to the extent (i) paid by Tenant and (ii) allocable to that portion of the Real Property not occupied by Tenant, or, as applicable, allocable to the percentage of the total RSF of the Buildings not leased to Tenant.

Section 3.2. Tenant shall be solely responsible for the payment of all Taxes accruing during the Term, and such obligation shall survive the expiration or earlier termination of this Lease.

(a) Landlord shall reimburse Tenant all Reimbursable Taxes accruing on or after January 1, 2017 for such Tax Year and for each successive Tax Year during the Term (“Landlord’s Tax Payment”). Landlord’s Tax Payment shall be payable by Landlord to Tenant within ten (10) days after receipt of a Tenant’s Tax Statement, which shall be delivered to Landlord within sixty (60) days following any such applicable Tax Year (or, for purposes of the final Landlord’s Tax Payment, on or after the first day of the year following the expiration or earlier termination of the Term.

(b) (i) Tenant, in its discretion, shall exclusively be eligible to institute tax reduction or other proceedings to reduce Taxes during the period a Tax xxxx is received until no later than thirty (30) days prior to the date such appeal must be filed (each a “Tenant Appeal Period”). If, after a Tenant’s Tax Statement has been sent to Landlord, a refund of Taxes is actually received by or on behalf of Tenant or Landlord, then, promptly after receipt of such refund, Landlord’s Tax Payment shall be adjusted appropriately (taking into account Tenant’s expenses therefor).

(ii) In the event Tenant does not contest any increase in ad valorem Taxes applicable to the Real Property during any Tenant Appeal Period, Tenant shall promptly notify Landlord of such decision on or prior

14

to the expiration of such Tenant Appeal Period so that Landlord shall have the right to contest any such increase. Regardless of which party initiates an appeal, the appealing party shall keep the other party informed of the steps being taken. Each party agrees to fully cooperate with the other in prosecuting any appeal. During the pendency of any such contest, both Landlord and Tenant shall take all actions required to prevent the execution/enforcement by the taxing authorities of any rights against Landlord, Tenant and/or the Real Property. If, after a Tenant’s Tax Statement has been sent to Landlord, a refund of Taxes is actually received as a result of a contest made by Landlord, then, promptly after receipt of such refund, Landlord’s Tax Payment shall be adjusted appropriately. All actual, documented out of pocket costs incurred by either party in connection with an appeal shall be prorated between Tenant and Landlord based on Tenant’s Proporationate Share and Landlord’s Proportionate Share at the time such costs and expenses are incurred.

(iii) Landlord will cooperate with Tenant in seeking to obtain a property tax reduction/partial abatement with respect to all or a portion of the Real Property and other incentives (collectively, the “PILOT Incentives”) under the Payment-In-Lieu Of Taxes (“PILOT”) program of The Economic Development Growth Engine Industrial Development Board of the City of Memphis and County of Shelby, Tennessee (the “EDGE Board”). Landlord agrees to provide Tenant and the EDGE Board such information concerning Landlord and the Real Property as may be reasonably required by Tenant or the EDGE Board in connection with the PILOT application. Landlord and Tenant understand that the PILOT program will require (i) that Landlord convey the Real Property (including the Premises) to the EDGE Board, (ii) that the EDGE Board lease the same back to Landlord pursuant to a Real Property Lease Agreement (the “Base Lease”), and (iii) that Landlord and Tenant enter into other related PILOT Incentives documents as required by the EDGE Board or its counsel (together with the Base Lease, the "PILOT Documents"). Landlord agrees to cooperate with the Tenant's documentation of the PILOT (including any documentation and actions necessary during and throughout the term of the PILOT Documents); provided, however, that Landlord shall have the right to review and negotiate all PILOT Documents in its reasonable discretion. Landlord acknowledges that only Tenant shall enjoy any ad valorem tax reductions and abatements applicable to the Premises and Real Property as a result of Tenant’s PILOT and that no portion of the Real Property unoccupied by Tenant shall receive tax abatements under Tenant’s PILOT. All costs associated with the PILOT application and placing the Real Property into the PILOT program shall be paid by Tenant as incurred. Furthermore, Tenant shall reimburse Landlord (or directly pay) for any and all actual, documented costs and expenses that it incurs in connection therewith, including without limitation Landlord’s reasonable legal fees and the costs of obtaining a leasehold policy of title insurance in the name of Landlord (and, if applicable, an updated or endorsed Mortgagee loan policy), including all endorsements reasonably required by Landlord. All benefits accruing from the placing the Real Property into the PILOT program with respect to the Premises will inure to Tenant’s benefit. Tenant shall, upon request of the EDGE Board or Landlord, give its consent to (x) any mortgage financing which Landlord seeks to place against the Real Property; (y) any sale and assignment by Landlord of its leasehold interest and option to purchase as contained in the PILOT Documents; and (z) any easements over or across portions of the Real Property for utilities and/or ingress and egress provided such easements do not unreasonably interfere with Tenant’s operations at the Premises. Any such consents shall be given in writing within ten (10) business days following receipt by Tenant of such request. Tenant shall indemnify, defend and hold Landlord harmless from and against any loss, cost or damages, including reasonable attorneys’ fees and court costs, arising out of failure of Tenant to timely deliver any such requested consent. Upon conveyance of the Real Property by Landlord to the EDGE Board, Tenant shall, to the extent provided in subparagraph (A) below, assume all of the obligations of Landlord in its capacity as lessee under the terms of the PILOT Documents with respect to the Real Property (other than those obligations that are expressly imposed upon Landlord under the terms and provisions of this Lease), and shall agree to indemnify, defend and hold Landlord harmless from and against any and all liabilities, expenses, claims, charges or losses which may arise from the negotiation, execution and implementation of the PILOT Documents and its operation except as to Landlord's negligence or willful acts or omissions. All of the obligations of the Landlord with respect to the PILOT Incentives, the PILOT, and the PILOT Documents, contained anywhere in this Lease shall be binding upon Landlord, and their respective heirs, personal representatives, successors and assigns.

In the event the PILOT transaction is completed, the following provisions shall become part of this Lease:

15

(A) Pursuant to the foregoing provisions, Tenant shall assume all of the obligations of Landlord applicable to the Real Property subject to the PILOT Documents in its capacity as a lessee under the terms of the PILOT Documents (other than those obligations that are expressly imposed upon Landlord under the terms and provisions of this Lease), including without limitation the payment as and when due of (I) all Basic Rent and Additional Rent (including the PILOT payments) (each as defined in the PILOT Documents) and other charges which shall be due with respect to the Real Property subjected to the PILOT Documents, (II) all costs and expenses to exercise the Purchase Option (as defined in the PILOT Documents (including the option price of $1,000.00, recording expenses and attorneys’ fees), and (III) all indemnification and reimbursement due from Landlord to the EDGE Board under the PILOT Documents, except to the extent the same are attributable to the acts or omissions of Landlord. Such assumed obligations by Tenant shall be subject to the following provisions:

1. Such assumed obligations shall not xxxxx unless (and only to the extent that) an abatement is expressly provided under the terms of the PILOT Documents.

2. Tenant shall at all times throughout the term of the PILOT Documents cause the Real Property and/or the Premises to constitute a “Project” within the meaning of Section 7-53-101 of the Tennessee Code Annotated.

(B) Landlord shall at all times be responsible and fully liable for any and all claims, damages, expenses, liability and demands suffered by Tenant resulting from Landlord's negligence, intentional misconduct or failure to perform any of the lessee's obligations under the PILOT Documents that are expressly imposed upon Landlord under the terms and provisions of this Lease, including, but not limited to, Landlord’s obligation to execute such documents (with such reasonable assurances and indemnities from Tenant as Landlord may reasonably require), respond to notice or notify Tenant, or take such other ministerial acts as may be required under the PILOT Documents, all at Tenant’s cost and expense. Landlord shall take no action intended to terminate or void the PILOT Documents unless Tenant has so requested or is in default (with any applicable cure period having expired) under any material term or provision of this Lease, and Landlord shall not be liable for any damages which may be suffered by Tenant unless the same are suffered as a direct and proximate result of the gross negligence or willful misconduct of Landlord. Notwithstanding the above, Landlord shall have no liability for the Landlord's obligations under the PILOT Documents that are specifically assumed by the Tenant under this Lease.

(C) Tenant shall undertake full responsibility to monitor the termination date of the PILOT Documents and shall take all necessary steps to exercise, on behalf of Landlord, the option to repurchase the Real Property as provided in the PILOT Documents, at its termination. Tenant shall give notice to Landlord in a timely fashion to allow Landlord to take necessary steps to join with Tenant in the exercise of the option, and Tenant shall indemnify Landlord against any loss which may arise as a result of the failure of Tenant to initiate actions to exercise the PILOT Documents purchase option.

(D) Within ten (10) days after the receipt of any real property tax and/or payment in lieu of tax bills from either the Shelby County Trustee or the City of Memphis Treasurer, the Landlord shall provide a copy of such bills to the Tenant.

(c) Tenant shall pay to Landlord within thirty (30) days after demand as Additional Rent any occupancy tax or rent tax now in effect or hereafter enacted, if payable by Landlord in the first instance or hereafter required to be paid by Landlord.

(d) In the event that Landlord receives notice of an assessment change or reassessment of the Real Property, Landlord shall promptly send notice to Tenant pursuant to the notice provisions of this Lease.

16

(e) If the Commencement Date or the Expiration Date occurs on a date other than January 1 or December 31, respectively, Landlord’s Tax Payment under this Article III for the Tax Year in which such Commencement Date or Expiration Date occurs shall be apportioned in that percentage which the number of days in the period from the Commencement Date to December 31 or from January 1 to the Expiration Date, as the case may be, both inclusive, bears to the total number of days in such Tax Year. If the Commencement Date or the Expiration Date occurs on a date other than January 1 or December 31, respectively, any Landlord’s Operating Payment under this Article III for the Operating Year in which such Commencement Date or Expiration Date occurs shall be apportioned in that percentage which the number of days in the period from the Commencement Date to December 31 or from January 1 to the Expiration Date, as the case may be, both inclusive, bears to the total number of days in such Operating Year. In the event of a termination of this Lease, any Landlord’s Tax Payment and Landlord’s Operating Payment under this Article III shall be paid or adjusted within thirty (30) days after submission of a Tenant’s Statement. The rights and obligations of Landlord and Tenant under the provisions of Article III with respect to any Landlord’s Tax Payment shall survive the expiration or termination of this Lease.

Section 3.3. (a) Landlord shall reimburse Tenant a portion of Reimbursable Operating Expenses accruing on or after January 1, 2017 for such Operating Year and for each successive Operating Year during the Term in an amount (“Landlord’s Operating Payment”) equal to Landlord’s Proportionate Share of the Reimbursable Operating Expenses. Landlord’s Operating Payment shall be payable by Landlord to Tenant within ten (10) days after receipt of a Tenant’s Operating Statement, which shall be delivered to Landlord within sixty (60) days following any such applicable Operating Year pursuant to Section 3.3(c).

(b) Following each Operating Year, Landlord shall deliver to Tenant an Adjacent Property Utility Payment within ten (10) days after receipt of a Building 1 Utility Statement.

(c) Within sixty (60) days following the end of each applicable Operating Year, Tenant shall furnish to Landlord a Tenant’s Operating Statement for such Operating Year. Each such year-end Tenant’s Operating Statement shall be accompanied by a computation of Reimbursable Operating Expenses prepared by a qualified professional employee or agent of Tenant from which Tenant shall make, in reasonably sufficient itemized detail, the computation of Landlord’s Proportionate Share of the Reimbursable Operating Expenses due.

(d) Tenant shall pay to the appropriate taxing authority, as and when due, any and all taxes due with respect to Tenant’s personal property in the Premises.

Section 3.4. Tenant’s failure to timely render any Tenant’s Statement with respect to any Tax Year or Operating Year shall not prejudice its right thereafter to render a Tenant’s Statement with respect thereto or with respect to any subsequent Tax Year or Operating Year, as the case may be.

Section 3.5. Any Tenant’s Statement sent to Landlord shall be conclusively binding upon Landlord unless, within ninety (90) days after such Tenant’s Statement is sent, Landlord shall send a written notice to Tenant objecting to such Tenant’s Statement and specifying, to the extent reasonably practicable, the respects in which such Tenant’s Statement is disputed. If Landlord shall send such notice with respect to a Tenant’s Statement, Landlord may select and pay an independent certified public accountant or a member of an independent firm which is engaged in the business of auditing lease escalation clauses (an “Approved Examiner”) provided that such Approved Examiner is not and has not during the Term been affiliated with, a shareholder in, an officer, director, partner, or employee of, Landlord, and such Approved Examiner may, during normal Operating Hours and upon reasonable advance written notice to Tenant, examine Tenant’s books and records relating to the Reimbursable Operating Expenses and Reimbursable Taxes to determine the accuracy of Tenant’s Statement. Landlord recognizes the confidential nature of Tenant’s books and records, and agrees that any information obtained by an Approved Examiner during any examination shall be maintained in strict confidence by such Approved Examiner, without revealing same to any Person except Landlord and/or those advisors of Landlord who also agree to keep such information confidential. If, after such examination, such Approved Examiner shall dispute such Tenant’s Statement, either party may refer the decision of the issues raised to a reputable independent firm of certified public accountants, selected by Tenant (provided that such independent firm is not and has not during the Term been affiliated with, a shareholder in, an officer, director, partner, or employee of, Tenant), and

17

approved by Landlord, which approval shall not be unreasonably withheld or delayed, and the decision of such accountants shall be conclusively binding upon the parties. The fees and expenses involved in resolving such dispute shall be borne by Landlord, unless the final determination is that Tenant’s Statement overstated Reimbursable Operating Expenses and/or Reimbursable Taxes by more than five percent (5%), in which case Tenant shall pay the reasonable fees and expenses involved in resolving the dispute including, without limitation, the costs and expenses of Landlord's Approved Examiner and of the independent firm of certified public accountants selected by Tenant. Notwithstanding the giving of such notice by Landlord, and pending the resolution of any such dispute, Landlord shall pay to Tenant when due the amount shown on any such Tenant’s Statement, as provided in this Article III. Landlord shall pay the amount of any underpayment to Tenant and Tenant shall refund the amount of any overpayment to Landlord, within thirty (30) days after resolution of such dispute.

Section 3.6. Landlord shall be responsible for (a) the maintenance, repair and replacement of the front gate and access driveway located on the Access Parcel (as defined hereinafter) which are both located on the Adjacent Property and (b) the entrance landscaping, irrigation, lighting, seasonal decorations and tree care, each situated on and around the access drive located on the Adjacent Property to the same standard and care as required of Tenant (as to other items) under Section 6.1 hereunder. Following each Operating Year, Landlord shall deliver to Tenant a statement containing a summary of the costs and expenses incurred by Landlord in connection therewith within thirty (30) days following each Operating Year; and fifty percent (50%) of such costs and expenses shall be payable by Tenant to Landlord within ten (10) days after receipt of such statement.

Section 3.7 Landlord shall allow Tenant (and cooperate with Tenant) to place all necessary items for the care, use and maintenance of the Premises and Real Property in Tenant's name and under Tenant's control pursuant to the terms of this Lease, including, without limitation, Tenant placing the utilities servicing the Premises and Real Property in Tenant's name. In addition, Landlord will reasonably cooperate with Tenant with respect to Tenant's participation in any utility or other incentive program related to the Premises and/or Real Property, including, without limitation, any grant or utility cost discount programs offered by Memphis Light Gas and Water and/or the Tennessee Valley Authority (the "Utility Discount Programs").

ARTICLE IV

USE AND OCCUPANCY

Section 4.1. Tenant shall use and occupy the Premises for the Permitted Use and for no other purpose without the prior written consent of Landlord, which may be withheld or conditioned in Landlord’s sole, but reasonable, discretion. Tenant and Tenant’s use of the Premises shall comply in all respects with the Restrictive Covenants; however, the Landlord shall not take any action during the Term of this Lease to effect any change to the Restrictive Covenants without prior written notice to Tenant, and such change shall not materially interfere with Tenant’s use and occupancy of the Premises; and Tenant shall indemnify Landlord against any loss, cost or damage (including costs of defense and reasonable attorneys’ fees) arising as a result of the failure of the Tenant or Tenant’s use of the Premises to so comply. The Permitted Use hereunder shall also include the following uses and activities:

(i) | Perform simulated use testing of “Products” (e.g. medical devices, medical products, medical implants, biologic implants, biologic products, and related or similar products) and materials to determine the physical, chemical and mechanical properties of samples. Product samples for such simulated-use testing may be fabricated or assembled in the lab. Lab tests conducted on-site may include the use of mechanical test machines for fatigue testing, tensile testing, and similar tests. During these tests, Products are mechanically broken, damaged and/or crushed in these machines. Mechanical testing may also include use of slaughterhouse products (including, among other things, pork shoulder and bovine femur) and human cadaver tissues in simulated use scenarios. |

(ii) The simulated product testing requires the use of hydraulic oil, including the disposal of used oil.

(iii) Perform metallography and material analysis of Products received from suppliers and other specimen parts. Perform specimen preparation of product parts, including metal, ceramic and polymer materials,

18

for laboratory usage. These procedures will include grinding, wet polishing and etching metal parts. These procedures may also include the use of hydrofluoric acid, nitric acid and hydrochloric acid. A byproduct of these tests is particulate that will enter into the drainage system.

(iv) Perform benchtop tests, such as FTIR (Fourier transform infrared spectroscopy), x-ray diffraction (State of Tennessee certified radiation), DSC (differential scanning calorimetry), light microscopy, dissolution, set-time, curing temperature, particle size, surface area and scanning electron microscopy to analyze sample materials using, among other techniques, image analysis and chemical identification. Liquid nitrogen and carbon tetrachloride are used in some of these analyses.

(v) Perform testing on joint replacement Products to analyze the friction, lubrication and wear of the joints. To simulate human bodily fluids, the tests are performed using a bovine serum. The chemical sodium azide is used as a preservative in these tests.

(vi) Perform general cell culture. Materials used in the cell culture process include, among other things, bovine serum, osteosarcoma cells, rat marrow cells, antibiotics, human stem cells, mouse derived fibroblasts (cells of connective tissue), carbon dioxide, buffer solutions, culture media, protolytic enzyme inhibitors and DMSO (dimethyl sulfoxide).

(vii) Perform analysis of Products that are retrieved from the field after active usage. This will include preparation such as cutting, and any variety of the various tests and procedures discussed above. In order to perform the analysis, the product retrieved from the field may be delivered to the facility along with human bone and tissue. Permanent (e.g. metal or polymer) implant specimens received by the facility will be sterilized before delivery. Biological implant specimens are typically received non-sterile and fixed in formalin.

(viii) Perform analysis for the FDA, product release and quality control. This will include any variety of the various tests and procedures discussed above.

(ix) Perform analysis on competitive Products. This will include any variety of the various tests and procedures discussed above.

(x) Utilize and store the following gases in compressed states (i) nitrogen, (ii) argon, (iii) oxygen, and (iv) carbon dioxide.

(xii) Perform product demonstrations and education for surgeons, sales representatives and new employees of Xxxxxx Medical Technology, Inc. with sawbones (synthetic material which mimics the human body) and human cadavers being utilized.

(xiii) Utilize rapid prototype development machines, or similar processes and/or procedures, to create various Products at the facility for research and analysis. The use of small scale saw xxxxx and lathes will be used in the creation of parts and Products for research and in other non-saleable goods (i.e., test procedures only). Other materials used in product formulation activities may include, but are not limited to, calcium sulfate, calcium phosphate, polymer powders, glycolic acid, bone marrow aspirate, processed (non-fixed) human bone, porcine and bovine bone, tissue and tendon, and ethanol. No Products produced in the laboratory will be used for commercial sales purposes.

(xiv) Park mobile labs on the Land (in such areas designated in or agreed upon pursuant to Section 4.2) for use in product demonstration and education which may include any of the uses and activities described above (“Mobile Labs”).

(xv) And all other current and future procedures and processes related to the research and development of medical devices, medical products, medical implants, biologic implants, biologic products, and related or similar products.

19

Notwithstanding the foregoing, (a) Tenant’s use and occupancy of the Premises shall at all times be in compliance with the Requirements, including without limitation all rules and regulations of the FDA, and (b) the Premises shall not be used for any purpose that would violate the certificate of occupancy of the Buildings, create unreasonable or excessive elevator, parking or floor loads, or loud noises, excessive vibrations or offensive odors; materially impair or interfere with any of the Buildings’ operations; materially interfere with the use of the other areas of Building 2 by any other tenants; or materially impair the appearance of the Buildings.

Section 4.2. As long as Tenant continues to lease all of Building 1 and, at a minimum, the entire first floor of Building 2, Landlord shall keep and provide seventy-five percent (75%) of the existing parking spaces located upon the Real Property for Tenant’s use (or an incremental proportionate share of the total parking spaces located upon the Real Property if Tenant exercises the Expansion Option). Notwithstanding the foregoing or any other provision in this Lease, during the first three (3) years of the Term, Landlord shall keep and provide one hundred percent (100%) of the existing parking spaces located on the Real Property for Tenant's use. Such parking shall include the exclusive use of the two-story parking deck immediately west of Building 1, and shall also include surface parking in areas and parking within the garage beneath Building 2 designated from time to time by Landlord (subject to Tenant's Reserved Parking Spaces, as defined below). Parking within the garage beneath Building 2 as well as the surrounding surface parking spaces of Building 2 shall be allocated on a pro rata basis to be shared by Tenant with other tenant(s) of Building 2, if any. In no event shall Tenant be permitted to use any parking spaces located on the Adjacent Property. Tenant also may park and operate its Mobile Labs in the areas designated and as shown on Exhibit “I” attached hereto, or in other locations mutually agreeable to Landlord and Tenant. Further, Tenant may, in Tenant's reasonable discretion, and at Tenant's sole cost, reconfigure the surface parking area and/or the Premises to provide adequate space for the ingress, egress, and parking of the Mobile Labs; provided, however, that any loss of parking spaces in connection therewith shall be deducted from Tenant’s share of parking spaces hereunder in the event that there is another tenant(s) in Building 2. With respect to any and all parking spaces designated by Landlord for the use of the Tenant, the Tenant shall have guaranteed, exclusive use of such spaces during Operating Hours. If Landlord is unable to provide such use, the Tenant shall have the right, in addition to any other rights under this Lease or otherwise, at Landlord's expense, to tow any impediments, including, but not limited to vehicles and equipment. Landlord shall not allow any third-parties to use any of the parking spaces designated for use by Tenant hereunder for any reason during Operating Hours, unless approved in the sole discretion of the Tenant. With respect to all of the parking spaces specifically designated to the Tenant in the garage beneath Building 2, Tenant shall have guaranteed, exclusive use of such spaces at all times during the Term of this Lease. Tenant shall be allowed ten (10) reserved and marked parking spaces in the garage beneath Building 2 as shown on Exhibit “G” hereto for Tenant's exclusive use (the "Tenant's Reserved Parking Spaces") at all times, and the installation and maintenance of any signage indicating Tenant’s Reserved Parking Spaces shall be at Tenant’s sole discretion, cost and expense.

Notwithstanding anything in this Section 4.2 or the Lease to the contrary and in addition to Landlord's obligations under this Section 4.2, Tenant shall control all access and use of the parking lot, parking spaces (both surface spaces and spaces located within the two-story parking deck immediately west of Building 1 and the garage beneath Building 2), drives/road and Common Areas located on the Real Property; provided, however, that Tenant agrees to provide for and permit the reasonable use of such parking lot, parking spaces, drives/road and Common Areas located on the Real Property to other tenants of Building 2 (if any) with the use of parking spaces by other tenants of Building 2 based upon the percentage of the Buildings occupied by specific tenants of Building 2.

Section 4.3. The Real Property and Adjacent Property are encumbered by certain agreements related to the upkeep and maintenance of the Real Property, Adjacent Property and a portion of the Adjacent Property described in Exhibit “J” attached hereto (the “Access Parcel”) with such agreements being identified by name, date and Register’s Office recording number as follows: (i) Access Easement Agreement dated as of September 18, 2003 recorded at 03196359 in the Register Office (“Access Easement”), (ii) Utility and Drainage Easement Agreement dated as of September 18, 2003 recorded at 03196360 in the Register’s Office (“Utility Easement”) and (iii) Revocable License Agreement dated as of September 18, 2003 recorded at 03196361 in the Register’s Office (“License Agreement”) (the Access Easement, Utility Easement and License Agreement are collectively referred to as the “Shared Use Documents”).

In order to provide Tenant with suitable access from Cherry Road to the Real Property and the use of certain drainage and utility easements and license rights benefitting the Real Property, Landlord hereby grants Tenant the right to use

20

and enjoy, during the Term of this Lease (including any renewal terms under the Renewal Option under Section 2.7 of this Lease or otherwise) and to the full extent allowed and exercisable by Landlord thereunder, all of Landlord's rights, easements, uses and licenses (including, without limitation, access, maintenance and self-help rights right thereunder) contained in the Shared Use Documents with such granting of rights under the Shared Use Documents being irrevocable by Landlord, its successor and/or assigns (or any party succeeding to Landlord's rights under this Lease in any manner) during the Term of this Lease (including any renewal terms under the Renewal Option under Section 2.7 of this Lease or otherwise). In addition, Landlord and Tenant agree that (i) the rights granted to Tenant and obligations of Landlord under this Section 4.3 shall be clearly referenced (including by Register's Office recording numbers) in the Memorandum of Lease to be recorded pursuant to Section 34.1 of this Lease and such Memorandum of Lease shall also include an identification of both the Real Property and Adjacent Property, (ii) the Shared Use Documents shall not be amended, modified, cancelled, revoked or otherwise altered in any way during the Term of this Lease (including any renewal terms under the Renewal Option under Section 2.7 of this Lease or otherwise) without the written consent of Tenant, (iii) Landlord shall, at all times during the Term of this Lease (including any renewal terms under the Renewal Option under Section 2.7 of this Lease or otherwise), fully comply with all obligations and requirements of the fee owner of the Real Property under the Shared Use Documents irrespective of whether Landlord retains fee ownership in the Real Property or if fee ownership is transferred to the Lessor (EDGE Board) and Landlord retains a leasehold interest in the Real Property, (iv) if Landlord fails to comply with its obligations under the Shared Use Documents, or is otherwise in default thereunder, Tenant shall, in addition to all other remedies available at law or in equity, have the right to perform such obligations or cure such default on behalf of Landlord and be reimbursed by Landlord upon demand for the actual costs thereof together with interest at the Base Rate, (v) Landlord shall exercise its rights under the Shared Use Documents in such a manner so as not to unreasonably interfere with, obstruct or delay the conduct and operations of the business of Tenant at any time conducted on the Real Property, including, without limitation, access to and from the Real Property and Premises (Tenant shall have a right of access over, under, in and across the Access Parcel with such right of access being non-exclusive and shall be for the purposes of passage by Tenant and its agents, contractors, employees, licensees and invitees to have egress, ingress and access over and across the Access Parcel and for any other rights contained in the Shared Use Documents) and (vi) both Landlord and Tenant agree that all actions taken under the Shared Use Documents shall be lawful and in conformance with all Requirements.

In the event of a violation or threat thereof of any of the provisions of this Section 4.3, Landlord agrees that such violation or threat thereof shall cause the Tenant to suffer irreparable harm and Tenant shall have no adequate remedy at law. As a result, in the event of a violation or threat thereof of any of the provisions of this Section 4.3, Tenant, in addition to all remedies available at law or otherwise under this Lease, shall be entitled to injunctive or other equitable relief to enjoin a violation or threat thereof of Section 4.3 of this Lease.

In the event that there is a conflict between any of the Shared Use Documents and this Lease, the terms of this Lease shall control.

21

ARTICLE V

INITIAL CONSTRUCTION AND ALTERATIONS

Section 5.1. Landlord and Tenant agree that the construction of Tenant’s Work, as defined in the Work Letter Agreement attached hereto as Exhibit “H” and incorporated herein (the “Work Letter Agreement”), shall be performed in accordance with the terms and conditions of the Work Letter Agreement. TENANT HEREBY ACCEPTS THE PREMISES “AS IS, WHERE IS,” AND WITHOUT ANY WARRANTY, EXPRESS OR IMPLIED, EXCEPT AS OTHERWISE SET FORTH IN THIS LEASE.

Section 5.2. (a) Except as otherwise set out in Section 5.2(f) hereof and except for the improvements, construction and alternations made by Tenant pursuant to the terms and conditions of the Work Letter Agreement, Tenant shall not make or permit to be made any Alterations without Landlord’s prior written consent, which consent shall not be unreasonably withheld, conditioned or delayed. Reference is made to Exhibit “F” hereto, which contains the “Tenant Design and Construction Standards” applicable to the Buildings, which is incorporated by reference in this Lease. Landlord reserves the right to make reasonable changes and additions thereto.