INVESTMENT MANAGEMENT AGREEMENT among

Exhibit 10.1

among

WESTLAKE CHEMICAL CORPORATION,

WESTLAKE CHEMICAL OPCO LP,

and

Dated as of August 1, 2017

This INVESTMENT MANAGEMENT AGREEMENT (this “Agreement”) is made as of August 1, 2017, among WESTLAKE CHEMICAL CORPORATION, a Delaware corporation (“Westlake”), WESTLAKE CHEMICAL OPCO LP, a Delaware limited partnership (“OpCo”), and WESTLAKE CHEMICAL PARTNERS LP, a Delaware limited partnership (“MLP”).

1.Investment Manager. OpCo and MLP hereby appoint Westlake as their agent with the power and discretion to act as investment manager (the “Investment Manager”) with respect to their excess cash, and direct the Investment Manager to invest such excess cash for the duration(s) either of them may specify from time to time.

(a) The Investment Manager will have the authority, as agent for and in the name of OpCo and MLP, to make investment decisions, to arrange for the executions of purchases and sales, and generally to manage the investment of the excess cash of OpCo and MLP on a fully discretionary basis (subject to compliance with the Investment Guidelines referred to in Section 3(a) below).

(b) All funds and other assets comprising the investments of OpCo and MLP, (the “Portfolios”) shall be held in the name of the Investment Manager either directly by the Investment Manager or by appropriate banks, trust companies, brokers, dealers or other custodians (each a “Custodian”), and all payments in respect of investment transactions shall be handled directly between the Investment Manager and its respective Custodians. OpCo and MLP consent to the commingling of the Portfolios with funds and other assets comprising investments of the Investment Manager and its other direct and indirect subsidiaries.

(c) In the event that either OpCo or MLP requests any cash from its Portfolio earlier than the duration(s) specified in Section 1 above, the Investment Manager may liquidate the necessary portion of the Portfolio in a prudent and efficient manner to minimize any loss of capital and investment income complying with such request and transfer the requested cash to the order of OpCo or MLP, as the case may be. Notwithstanding any of the foregoing, OpCo and MLP shall receive the Earnings as calculated in Section 3(c) below.

(a) Investment Guidelines. The Investment Manager shall adhere to the Investment Guidelines attached hereto as “Annex A” when investing excess cash on behalf of OpCo or MLP.

(b) OpCo and MLP shall each reimburse the Investment Manager for their allocable shares of any fees and expenses paid by the Investment Manager with respect to managing their respective Portfolios, including, but not limited to costs of consultants and other professionals, whether related or unrelated to the Investment Manager.

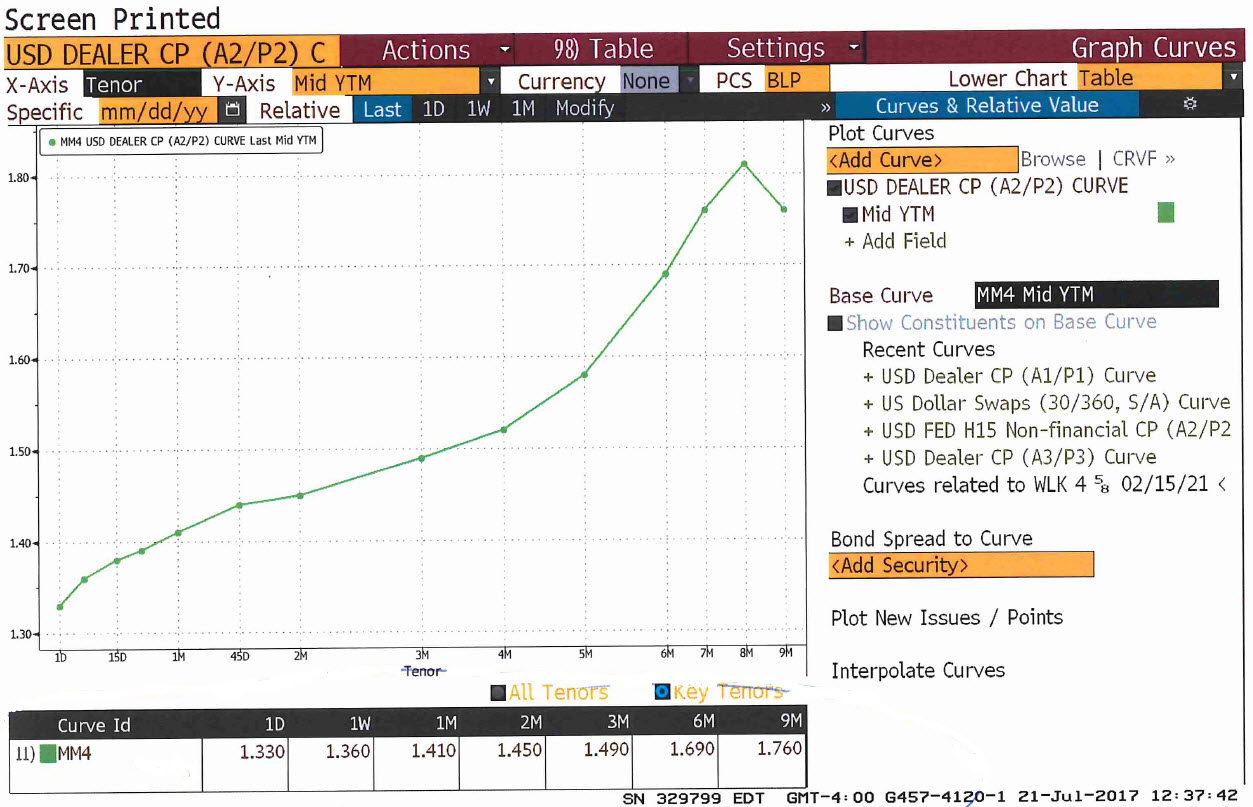

(c) The Investment Manager shall pay each of OpCo and MLP based on the sum of (a) the then applicable interest curve for A2/P2 US-dollar denominated commercial paper as published by Bloomberg and (b) five basis point, multiplied by the total balance of their respective Portfolio for any applicable one-day, one-week, one-month, three-month, six-month or nine-month duration (“Earnings”). A sample screen shot of the interest curve is attached hereto as “Annex B”.

4. No Joint Venture, etc. The parties hereto acknowledge that this Agreement shall not create and shall not be construed to create a relationship of joint tenancy, joint venturers, co-partners, employer and employee, master and servant or any similar relationship between the parties hereto.

(a) None of Westlake, its affiliates or any of their respective members, managers, partners, directors, officers and employees and the legal representatives of any of them (each, an “Indemnified Affiliate”) shall be liable to OpCo, Westlake Chemical OpCo GP LLC, Westlake Chemical Partners LP or Westlake Chemical Partners GP LLC, for any mistakes of judgment or acts or omissions arising out of or in connection with any investment made or held by OpCo and MLP, as the case maybe, hereunder or this Agreement except in the case of a liability resulting from Westlake’s or such Indemnified Affiliate’s own fraud, gross negligence, willful misconduct or bad faith. Each Indemnified Affiliate may consult with counsel and accountants in respect of OpCo’s and MLP’s affairs and be fully protected and justified in any action or inaction that is taken in accordance with the advice or opinion of such counsel and accountants.

(b) To the fullest extent permitted by law, OpCo and MLP shall indemnify and hold harmless Westlake and its Indemnified Affiliates (each, an “IM Indemnitee”), against any loss, cost or expense suffered or sustained by an IM Indemnitee by reason of any acts, omissions or alleged acts or omissions arising out of, or in connection with OpCo and MLP, as the case may

2

be, any investment made or held by OpCo and MLP, as the case may be, or this Agreement, including, without limitation, any judgment, award, settlement, reasonable attorneys’ fees and other costs or expenses incurred in connection with the defense of any actual or threatened action, proceeding, or claim, provided that such acts, omissions or alleged acts or omissions upon which such actual or threatened action, proceeding or claim are based were not made in bad faith or did not constitute fraud, willful misconduct or gross negligence by such IM Indemnitee. Each of OpCo and MLP shall, in the sole discretion of Westlake, advance to any IM Indemnitee reasonable attorneys’ fees and other costs and expenses incurred in connection with the defense of any action or proceeding that arises out of such conduct. In the event that any advance described in the preceding sentence is made by OpCo and MLP, the IM Indemnitee receiving such advance shall agree to reimburse OpCo and MLP for such fees, costs and expenses to the extent that it shall be determined that it was not entitled to indemnification under this Agreement.

(c) The provisions of this Section 6 shall survive any termination of this Agreement.

(a) This Agreement shall terminate upon the termination date set forth in a notice of termination delivered by the Investment Manager to OpCo and MLP, as the case may be, or by OpCo and MLP, as the case may be, to the Investment Manager, not less than 30 days prior to the termination date set forth therein.

(b) Upon any such termination of this Agreement, OpCo or MLP, as the case may be, shall pay the Investment Manager (i) all fees and expenses that have been incurred by the Investment Manager prior to the date of such termination and to the extent reimbursable under Section 4(b), and (ii) any fees and expenses that have accrued to the Investment Manager as of the date of such termination.

(c) Upon any such termination of this Agreement, Westlake shall cause to be paid to OpCo or MLP, as the case may be, (i) OpCo’s or MLP’s Earnings, if any, and (ii) OpCo’s or MLP’s respective Portfolio.

7. Miscellaneous.

(a) Notices. All notices, reports and other communications given pursuant to this Agreement shall be in writing and shall be (i) sent by e-mail or (ii) accomplished by any other method agreed upon by the parties hereto in writing. Notice given in any other manner shall be effective when received by the addressee or its agent.

3

(b) Assignment. This Agreement shall be binding upon and inure to the benefit of the parties and their respective successors and permitted assigns. No party to this Agreement may assign or delegate its rights or duties under this Agreement, except to the extent expressly provided herein, without the consent of the other parties hereto.

(c) Amendment; Waiver. Except as otherwise provided herein, this Agreement may not be amended except by a written instrument signed by the parties hereto. Neither the failure nor delay on the part of any party hereto to exercise any right, remedy, power or privilege under this Agreement shall operate as a waiver thereof. No waiver shall be effective unless it is in writing and is signed by the party asserted to have granted such waiver.

(d) Severability. Any provision of this Agreement which is prohibited or unenforceable in any jurisdiction shall, as to such jurisdiction only, be ineffective to the extent of such prohibition or unenforceability without invalidating the remaining provisions hereof, and any such prohibition or unenforceability in any jurisdiction shall not invalidate or render unenforceable such provision in any other jurisdiction.

(e) Entire Agreement. This Agreement constitutes the entire agreement between the parties hereto with respect to the subject matter hereof and supersedes any prior agreement or understanding between them with respect to such subject matter.

(f) Reliance by Third Parties. The signatures of Westlake shall be sufficient to bind OpCo and MLP, as the case may be, with respect to matters provided for under this Agreement.

(g) Governing Law. This Agreement shall be governed by and construed in accordance with the laws of the State of Texas, without regard for the principles of conflict of laws thereof.

(h) Jurisdiction; Consent to Service of Process. With respect to any judicial proceeding involving any dispute, controversy or claim arising out of or relating to this Agreement, each of the parties hereto irrevocably and unconditionally agrees (i) to be subject to the jurisdiction of the courts of the State of Texas and of the United States District Court for the Southern District of Texas, and any courts appealable from any such courts, (ii) that, to the fullest extent permitted by applicable law, service of process may be made on any party hereto by prepaid certified mail with a validated proof of mailing receipt constituting evidence of valid service and (iii) that service made pursuant to the immediately preceding clause (ii) shall, to the fullest extent permitted by applicable law, have the same legal force and effect as if served upon such party personally within the State of Texas.

4

WESTLAKE CHEMICAL CORPORATION |

By: /S/ M. XXXXXX XXXXXX Name: M. Xxxxxx Xxxxxx Title: Executive Vice President & Chief Financial Officer |

WESTLAKE CHEMICAL OPCO LP By: Westlake Chemical OpCo GP LLC, its general partner |

By: /S/ M. XXXXXX XXXXXX Name: M. Xxxxxx Xxxxxx Title: Executive Vice President & Chief Financial Officer |

By: Westlake Chemical Partners GP LLC, its general partner |

By: /S/ M. XXXXXX XXXXXX Name: M. Xxxxxx Xxxxxx Title: Executive Vice President & Chief Financial Officer |

Annex A

Investment Guidelines

Westlake Chemical Corporation

This Corporate Cash Investing Policy shall limit investment activities of Westlake Chemical Corporation (WCC) in order to insure safety, liquidity, and preservation of capital.

Summary of Policies:

a) | WCC shall restrict its cash investments to maturities less than 366 days from the date of settlement. The average weighted maturity shall be consistent with the cash needs of the corporation as determined by its cash forecast. |

b) | WCC shall restrict its excess cash to the following categories of investments: |

i) | Direct obligations of the United States of America, or any agency thereof, or obligations guaranteed as to principal and interest by the United States of America, maturing not more than one year from the date of acquisition thereof; |

ii) | Domestic certificates of deposit and banker’s acceptances issued by any bank or trust company organized under the laws of the United States of America or any state thereof and having: surplus and undivided profits of at least $500,000,000, an individual rating from Fitch of B/C or better, and maturing not more than one year from the date of acquisition thereof. |

iii) | Time deposits, Eurodollar and Yankee certificates of deposit issued by any bank having capital, surplus, and undivided profits of at least $500,000,000 and short term ratings of A-2 (S&P) or P-2 (Xxxxx’x) or better, maturing not more than six months from the date of acquisition thereof. |

iv) | Commercial paper rated A-2 (S&P) or P-2 (Xxxxx’x) or better, maturing not more than 120 days from the date of acquisition thereof, and |

v) | Dollar denominated money market funds as approved by management. |

c) | WCC shall at no time borrow funds from any institution in order to use such funds for speculative purposes. |

d) | WCC will diversify external cash investments consistent with liquidity, safety, and preservation of capital. |

e) | This investment policy may be changed or modified, as required, by the WCC CFO. |

Approved by:

/S/ XXXX HOLY

Xxxx Holy

Xxxx Holy

Treasurer

August 1, 2017

Annex B

A2/P2 Commercial Paper interest curve