Business Purchase Agreement

Exhibit 2.1

|

relating to

|

|

| the Fugro Trenching Business | |

|

between

|

|

| Fugro N.V.

(as the Seller)

|

|

|

and

|

|

|

Global Marine Systems Limited

(as the Purchaser)

|

|

|

and

|

|

|

Global Marine Holdings LLC

(as the Purchaser Parent)

|

|

|

Dated 11 October 2017

|

|

Contents

|

Clause

|

|

Page

|

|

1

|

DEFINITIONS AND INTERPRETATION

|

6

|

|

2

|

SALE, PURCHASE and TRANSFER

|

6

|

|

2.1

|

Sale and Purchase

|

6

|

|

2.2

|

Business Assets

|

7

|

|

2.3

|

Employees

|

8

|

|

2.4

|

Business Agreements

|

8

|

|

2.5

|

Working Capital

|

8

|

|

3

|

CONSIDERATION

|

8

|

|

3.1

|

Purchase Consideration

|

8

|

|

3.2

|

Completion

|

9

|

|

3.3

|

Equity Consideration

|

10

|

|

3.4

|

Value Added Tax

|

10

|

|

4

|

CONDITIONS PRECEDENT

|

12

|

|

4.1

|

Conditions

|

12

|

|

5

|

RESPONSIBILITY FOR SATISFACTION

|

13

|

|

5.1

|

General

|

13

|

|

5.2

|

Cooperation to complete the Transaction

|

13

|

|

5.3

|

Satisfaction and waiver of Completion Conditions

|

13

|

|

6

|

PRE-COMPLETION COVENANTS

|

14

|

|

6.1

|

General conduct of the Trenching Business

|

14

|

|

6.2

|

General conduct of the Global Business

|

15

|

|

6.3

|

Access to the Trenching Business

|

16

|

|

6.4

|

Business agreements

|

16

|

|

6.5

|

Transfer of Business Agreements

|

17

|

|

6.6

|

Post-Completion Financial Statements

|

18

|

|

6.7

|

Symphony

|

21

|

|

6.8

|

Pre-Completion notices regarding warranties

|

21

|

|

7

|

COMPLETION

|

22

|

|

7.1

|

Completion date and place

|

22

|

|

7.2

|

Bring down certificate

|

22

|

|

7.3

|

Transfer of the Aggregate WC Amount

|

22

|

|

7.4

|

Completion actions

|

22

|

|

7.5

|

Symphony

|

25

|

|

7.6

|

Delivery of the Trenchers

|

26

|

| 7.7 |

Insurance

|

26 |

|

7.8

|

Breach of Completion obligations

|

26

|

|

8

|

POST-COMPLETION OBLIGATIONS

|

27

|

|

8.1

|

Use of names

|

27

|

|

8.2

|

Records and record retention

|

27

|

|

8.3

|

Insurance

|

28

|

|

8.4

|

Marine diesel oil, lubes, vessel spares and general consumables

|

29

|

|

8.5

|

ROV IP

|

29

|

|

8.6

|

JV Compliance

|

30

|

|

8.7

|

Post-Completion SEC assistance

|

30

|

|

9

|

LIMITATION OF LIABILITY

|

30

|

|

9.2

|

Maximum liability

|

31

|

|

9.3

|

Time limitation

|

31

|

|

9.4

|

Mitigation of Losses

|

31

|

|

9.5

|

Applicable clauses of the W&I Agreement

|

31

|

|

9.6

|

No double claims

|

31

|

|

10

|

RESTRICTIONS

|

32

|

|

10.1

|

Non-compete

|

32

|

|

11

|

CONFIDENTIALITY

|

33

|

|

11.1

|

Announcements

|

33

|

|

11.2

|

Confidentiality undertaking

|

33

|

|

12

|

MISCELLANEOUS

|

34

|

|

12.1

|

Further assurances

|

34

|

|

12.2

|

Local transfer documents

|

34

|

|

12.3

|

Entire agreement

|

35

|

|

12.4

|

No assignment

|

35

|

|

12.5

|

Waiver

|

35

|

|

12.6

|

Amendment

|

35

|

|

12.7

|

Third-party rights

|

35

|

|

12.8

|

No Remedy

|

36

|

|

12.9

|

Rescission

|

36

|

|

12.10

|

Method of payment

|

36

|

|

12.11

|

Costs

|

36

|

|

12.12

|

Interest

|

36

|

|

12.13

|

Notices

|

36

|

|

12.14

|

Counterparts

|

37

|

|

13

|

GOVERNING LAW AND DISPUTE RESOLUTION

|

37

|

|

13.1

|

Governing law

|

37

|

3

|

13.2

|

Jurisdiction and forum

|

37

|

|

13.3

|

Other disputes

|

38

|

|

Schedules

|

|

|

Schedule 1

|

Definitions and interpretation

|

|

Schedule 2

|

Business Assets

|

|

Schedule 3

|

Vessel

|

|

Schedule 4

|

FSY ASTA

|

|

Schedule 5

|

Employees

|

|

Schedule 6

|

Vendor Loan

|

|

Schedule 7

|

Warranty and Indemnity Agreement

|

|

Schedule 8

|

Parties’ details for Notices

|

|

Schedule 9

|

Map of Restricted Territory

|

|

Schedule 10

|

Global LLC Agreement

|

|

Schedule 11

|

Xxxx of Sale

|

|

Schedule 12

|

Protocol of Delivery and Acceptance

|

|

Schedule 13

|

Debenture Deed of Postponement

|

|

Schedule 14

|

Interim Period Result Calculation

|

|

Schedule 15

|

FFAG ASTA

|

|

Schedule 16

|

FSSL ASTA

|

|

Schedule 17

|

Certificate of Compliance

|

|

Schedule 18

|

Xxxxxxx Agreement

|

|

Schedule 19

|

Business Agreements

|

|

Schedule 20

|

Bring Down Certificates

|

|

Schedule 21

|

Technical Documentation for the Symphony

|

4

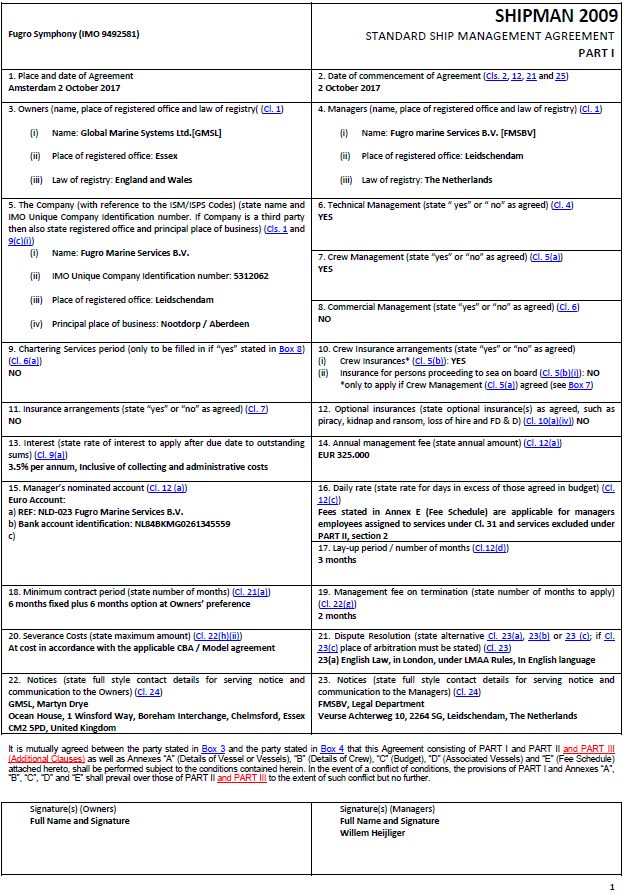

THIS AGREEMENT IS DATED 11 OCTOBER 2017 AND MADE BETWEEN:

| (1) |

Fugro N.V., a public limited liability company incorporated in the Netherlands, with corporate seat in Leidschendam, and registered address at Veurse Xxxxxxxxx 00, 0000 XX Leidschendam, the Netherlands, registered with the trade register of the Dutch Chamber of Commerce with number 27120091 (the “Seller” or “Fugro”);

|

| (2) |

Global Marine Systems Limited, a private limited liability company incorporated and registered in England and Wales, with company number 01708481 whose registered address is at Xxxxx Xxxxx, 0 Xxxxxxxx Xxx, Xxxxxxx Interchange, Chelmsford, Xxxxx XX0 0XX, Xxxxxx Xxxxxxx (the “Purchaser” or “GMSL”);

|

and

| (3) |

Global Marine Holdings, LLC, a limited liability company incorporated in Delaware with its registered address at 000 Xxxxxxx Xxxxxxx, Xxxxx 000, Xxxxxxx, XX 00000-0000, Xxxxxx Xxxxxx (the “Purchaser Parent” or “Global”),

|

WHEREAS:

| (A) |

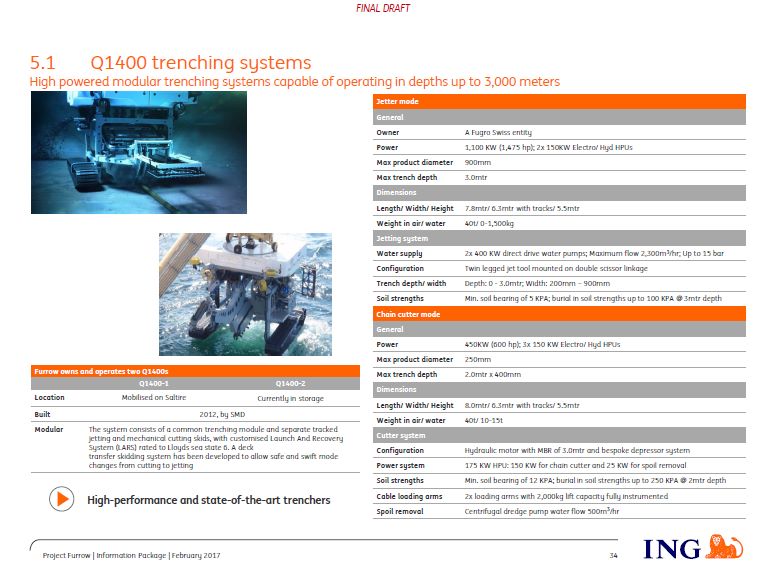

The Seller directly or indirectly operates its trenching business and activities through certain assets listed in Schedule 2 (Business Assets), including associated normalized working capital, the Business Agreements (if any) and the Employees (such assets, Business Agreements (if any) and Employees collectively, the “Trenching Business”);

|

| (B) |

The Purchaser and the Purchaser Parent directly or indirectly operate a worldwide business, focused on specialist subsea services across the telecom, oil and gas and offshore power sectors and actively participate in joint ventures carrying out similar activities (the “Global Business”);

|

| (C) |

The Seller and the Purchaser Parent entered into a confidentiality letter dated 23 January 2017 (the “Confidentiality Agreement”), pursuant to which certain confidential information relating to the Trenching Business was made available to the Purchaser and its Representatives;

|

| (D) |

The Seller and the Purchaser Parent entered into an additional confidentiality letter dated 7 March 2017 (the “Global Confidentiality Agreement”), pursuant to which certain confidential information relating to the Global Business was made available to the Seller and its Representatives;

|

5

| (E) |

The Seller and the Purchaser entered into a non-binding Business Combination Term Sheet dated 7 July 2017 (the “Term Sheet”), describing the principal terms and conditions of a proposed business combination between Fugro and Global involving effectively the sale by Fugro of the Trenching Business to GMSL in exchange for an equity interest in Global and the Vendor Loan;

|

| (F) |

Save as explicitly set out in this Agreement, the Seller, the Purchaser and the Purchaser Parent have obtained all internal and external approvals and consents required for the transactions contemplated by this Agreement; and

|

| (G) |

Now, in consideration of the foregoing, the Seller wishes to sell and procure the transfer of the Trenching Business to the Purchaser and to acquire an equity interest in Global and enter into the Vendor Loan as lender, and the Purchaser wishes to purchase and acquire the Trenching Business from the Seller and have the Seller acquire an equity interest in Global and enter into the Vendor Loan as borrower, on the terms and subject to the conditions set out in this Agreement and the W&I Agreement entered into at the date hereof (the ‘‘Transaction’’).

|

IT IS AGREED AS FOLLOWS:

| 1 |

DEFINITIONS AND INTERPRETATION

|

In this Agreement, unless the context otherwise requires, the definitions and provisions of Schedule 1 (Definitions and interpretation) apply throughout.

| 2 |

SALE, PURCHASE AND TRANSFER

|

| 2.1 |

Sale and Purchase

|

| 2.1.1 |

Subject to the terms and conditions of this Agreement, the Seller shall procure that the Business Sellers sell the Trenching Business to the Purchaser and the Purchaser hereby agrees to purchase the Trenching Business from the Business Sellers, which sale comprises all of the rights, obligations, title and interest of the Seller’s Group in and to:

|

| (a) |

the Business Assets, free from any Encumbrances;

|

| (b) |

the Employees;

|

| (c) |

Goodwill;

|

| (d) |

the Business Agreements (if any); and

|

6

| (e) |

the Trenching Business information and the Trenching Business records to be delivered to the Purchaser pursuant to Clause 6 (Pre Completion Covenants) and Clause 7 (Completion).

|

| 2.2 |

Business Assets

|

| 2.2.1 |

On the Completion Date, the Seller shall procure the transfer by the relevant Business Seller and the Purchaser shall accept the transfer of, all Business Assets to the Purchaser in accordance with Clause 7.4 (Completion actions).

|

| 2.2.2 |

Any rights and assets of any member of the Seller’s Group which are not expressly included in Clause 2.1.1 are excluded from the sale and transfer of the Trenching Business pursuant to this Agreement.

|

| 2.2.3 |

Unless explicitly provided otherwise in this Agreement, nothing in this Agreement shall be construed as acceptance by the Purchaser of any liability, debt or other obligation of the Seller or any member of the Seller’s Group (whether accrued, absolute, contingent, known or unknown) for anything done or omitted to be done before the Completion Date in the course of, or in connection with, the Trenching Business and the Seller shall:

|

| (a) |

indemnify the Purchaser against all Losses suffered or incurred by any member of the Purchaser’s Group, including the Excluded Liabilities, arising out of or in connection with any such thing; and

|

| (b) |

perform any obligation falling due for performance, or which should have been performed, before the Completion Date, including the Excluded Liabilities.

|

| 2.2.4 |

The Seller agrees with the Purchaser that it will, or will procure that the relevant member of the Seller’s Group shall, in accordance with its or their normal practice, pay, satisfy or discharge all debts, liabilities and obligations relating to the Trenching Business which are not expressly assumed by the Purchaser or a member of the Purchaser’s Group under this Agreement. If the Purchaser becomes aware that the Seller has failed to comply with this Clause 2.2.4 and reasonably believes that this failure may damage the goodwill of the Trenching Business as carried on by the Purchaser after the Completion Date, it may give notice of that fact to the Seller. If the Seller does not provide evidence that the liability in question is disputed on reasonable grounds in a form reasonably satisfactory to the Purchaser within fifteen (15) Business Days after the date of such notice, the Purchaser may satisfy such liability on the relevant member of the Seller’s Group’s behalf and shall be entitled to immediate reimbursement from the Seller or the relevant member of the Seller’s Group of the amount paid by the Purchaser to satisfy such liability. This Clause 2.2.4 does not apply to any debts, liabilities and obligations relating to either (i) employees as these are exclusively governed by Schedule 5 (Employees), or (ii) Business Agreements.

|

7

| 2.3 |

Employees

|

| 2.3.1 |

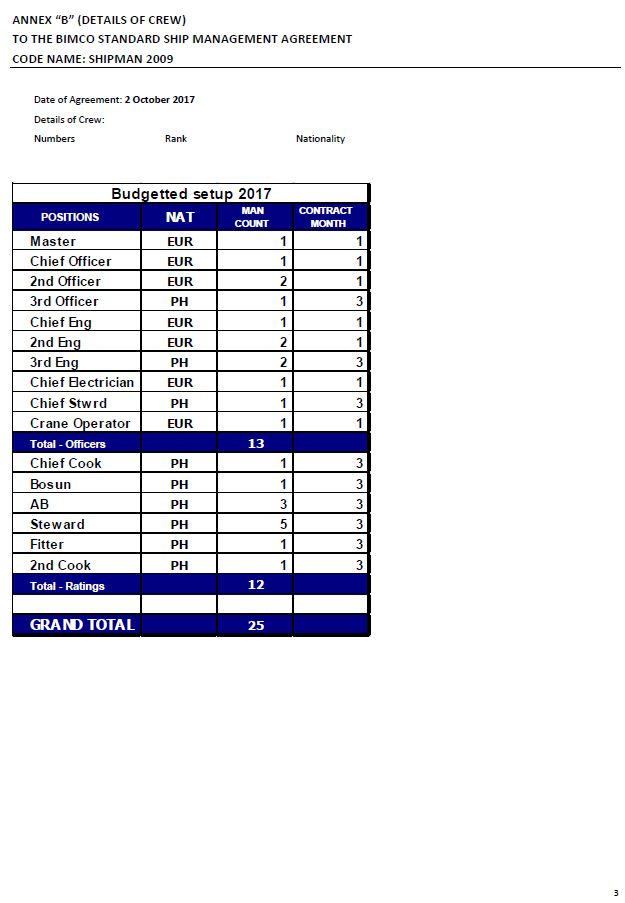

The Employees will transfer with the Trenching Business by operation of Law in accordance with the Transfer of Employment (Protection of Employment) Regulations 2006 (“TUPE”).

|

| 2.3.2 |

Schedule 5 (Employees) shall apply with respect to the Employees.

|

| 2.4 |

Business Agreements

|

With effect as of the Completion Date, the Seller shall procure the transfer by the relevant member of the Seller’s Group, and the Purchaser shall accept such transfer and the assumption of the Business Agreements by the Purchaser, pursuant to Clause 6.5 (Transfer of Business Agreements).

| 2.5 |

Working Capital

|

Parties agree that, subject to Clause 8.4 (Marine diesel oil, lubes, vessel spares and general consumables),

| (a) |

the Symphony has associated normalized working capital of GBP 1,900,000 (one million nine hundred thousand pound sterling) (the “Symphony WC Amount”); and

|

| (b) |

the Q1400 Trenching System has associated normalized working capital of GBP 200,000 (two hundred thousand pound sterling) (the “Xxxxxxxx XX Amount”).

|

| 3 |

CONSIDERATION

|

| 3.1 |

Purchase Consideration

|

| (a) |

The aggregate purchase consideration for the Trenching Business shall consist of (a) the procuring by GMSL (in accordance with Clause 3.2.1 below) of the issue of 43,882,283 Class A-2 Units of Global, representing 23.6% of the aggregate number of Class A Units, Class A-1 Units and Class A-2 Units of Global (the “Equity Consideration”), as set forth in the Fourth Amended and Restated Limited Liability Agreement of Global to be dated as of the Completion Date in the form of Schedule 10 (Global LLC Agreement) (the “Global LLC Agreement”), which Equity Consideration is issuable as consideration for the Trenching Business other than the Q1400 Trenching System, and (b) USD 7,500,000 (seven million five hundred thousand US dollars) (the “Q1400 Consideration”), which is payable as consideration for the Q1400 Trenching System, (together the “Purchase Consideration”). The Purchase Consideration of USD 72,500,000 (seventy-two million five hundred thousand US dollars) (including an agreed value for the Equity Consideration of USD 65,000,000 (sixty-five million US dollars)) shall be allocated amongst the Business Assets in accordance with Schedule 2 (Business Assets) and each member of the Seller’s Group and each member of the Purchaser’s Group shall adopt such allocation for all purposes, including in respect of Tax.

|

8

| 3.2 |

Completion

|

| 3.2.1 |

At Completion, the Purchase Consideration shall, in accordance with Clause 7 (Completion), be discharged as follows:

|

| (a) |

GMSL shall procure that Global issues the Equity Consideration to Fugro Consultants International N.V. and Global undertakes that it will issue and allot the Consideration Shares to Fugro Consultants International N.V. in accordance with this sub-clause; and

|

| (b) |

the Q1400 Consideration shall be paid in cash. The Seller agrees that on Completion Fugro Financial Resources B.V. shall lend to the Purchaser an amount (the “Loan Amount”) equal to the Q1400 Consideration by way of the Vendor Loan, which shall be entered into at Completion. The Seller and the Purchaser additionally agree that the Purchaser shall hold the Q1400 Consideration to the order of the Seller and Fugro Financial Resources B.V. and Fugro Financial Resources B.V. shall, immediately thereafter, advance such sum to the Purchaser in accordance with the terms of the Vendor Loan.

|

| 3.2.2 |

At Completion, Fugro shall, or shall cause that the relevant member of the Seller’s Group shall, pay an amount equal to the aggregate of the Symphony WC Amount, the Xxxxxxxx XX Amount and the Adjustment Amount (together the “Aggregate WC Amount”) to GMSL in accordance with Clause 7.3 (Transfer of the Aggregate WC Amount). If the Adjustment Amount is a negative amount and exceeds the aggregate of the Symphony WC Amount and the Xxxxxxxx XX Amount, the Purchaser shall pay to the Seller an amount equal to such excess.

|

| 3.2.3 |

No later than two (2) Business Days prior to Completion, the Seller and the Purchaser, acting reasonably and in good faith, shall jointly calculate the Adjustment Amount by completing the deemed interim period result calculation in accordance with Schedule 14 (Interim Period Result Calculation) to reflect:

|

9

| (i) |

the Barclays Bank spot rate for the purchase of pound sterling (GBP) with the relevant original currency at 12:00 am on the date of such calculation;

|

| (ii) |

the number of days during the period as from the Signing Date (excluded) through the Completion Date (included);

|

| (iii) |

the number of days during the period as from the Signing Date (excluded) through the Completion Date (included) during which the Symphony was employed by a member of the Seller’s Group, either on operations, in transit or in standby;

|

| (iv) |

any charter fees (excluding VAT and other Taxes) paid by any member of the Purchaser’s Group to any member of the Seller’s Group to hire the Symphony as from the Signing Date (excluded) through the Completion Date (included); and

|

| (v) |

the actual direct cash costs for the removal of the trencher which is or was located on the Saltire around the date of this Agreement (and the Parties acknowledge that all other costs associated with the initial physical removal of the trencher including the cost of delivering the trencher to a port for demobilisation and any reinstatement of the physical state of the Saltire shall remain solely with the Seller’s Group).

|

| 3.2.4 |

Fugro shall not have any right of set-off of the payment obligation set out in Clauses 3.2.2 and 7.3 (Transfer of the Aggregate WC Amount) against the obligation of Global and GMSL pursuant to Clause 3.2.1 and these payments may not be aggregated and discharged by way of set-off by Fugro. Fugro shall have the right of set-off of the payment obligation set out in Clauses 3.2.2 and 7.3 (Transfer of the Aggregate WC Amount) against the obligation of Global and GMSL pursuant to Clause 6.6.2 and these payments may be aggregated and discharged by way of set-off by Fugro

|

| 3.3 |

Equity Consideration

|

Purchaser and Global shall procure that, from Completion, Fugro Consultants International N.V., shall have the rights, preferences and obligations with respect to the Equity Consideration issued to it as set forth in the Global LLC Agreement.

| 3.4 |

Value Added Tax

|

| 3.4.1 |

All amounts set out in this Agreement, including the Purchase Consideration, are exclusive of VAT (if any).

|

10

| 3.4.2 |

The Seller and the Purchaser shall each take the position, and shall use all reasonable efforts to secure, that the sale and transfer of the Trenching Business by the Business Sellers to the Purchaser is treated for VAT purposes in the following manner:

|

| (a) |

in the case of the sale and transfer of the Symphony at a time when the Symphony is located in UK territorial waters, as the supply, acquisition or import (as the case may be) of a qualifying ship (as defined in Group 8 of Schedule 8 to the UK Value Added Tax Act 1994) in respect of which VAT is chargeable at the zero percent rate pursuant to section 30 of the UK Value Added Tax Xxx 0000;

|

| (b) |

in the case of the sale and transfer of the Symphony at a time when the Symphony is located in international waters (i.e. outside the 12 nautical mile limit), as the supply, acquisition or import (as the case may be) in respect of which no VAT is chargeable; and

|

| (c) |

in the case of the sale and transfer of the Trenching Business other than the Symphony, as neither a supply of goods nor services pursuant to the provisions of Article 5 1995/1268 Value Added Tax (Special Provisions) Order 1995 (Article 5) but solely to the extent that such part of the Trenching Business is located in the UK at the time of such sale and transfer.

|

| 3.4.3 |

If, after the Completion Date, HMRC or another relevant Tax Authority determines in writing that the sale and transfer of any part of the Trenching Business is or should have been treated for VAT purposes other than as set out in Clause 3.4.2 above, such that the relevant Business Seller was or becomes liable to account for an amount of VAT, the Purchaser shall, in addition to any amounts expressed in this Agreement to be payable or otherwise discharged by the Purchaser, pay an amount equal to any such VAT (including any penalties and interest, other than penalties or interest arising solely from the failure of any member of the Seller’s Group to comply with this Clause) to the Seller or the relevant Business Seller against production of a valid VAT invoice (or equivalent, if any) by the Seller or the relevant Business Seller.

|

| 3.4.4 |

The Purchaser shall procure that any amounts of VAT which the Purchaser is obliged to pay to the Seller or the relevant Business Seller under the preceding Clause 3.4.3 in respect of the sale and transfer of any part of the Trenching Business carried out pursuant to this Agreement will be paid to the Seller (or the relevant Business Seller) within ten (10) Business Days of receipt of the above determination and against production of a valid VAT invoice by Seller or the relevant Business Seller.

|

11

| 3.4.5 |

The Parties will cooperate in good faith in (i) determining whether a relevant exemption or reduction, zero rating or a reverse charge mechanism for VAT purposes applies or may apply in respect of a sale and transfer of an asset under this Agreement, and (ii) fulfilling any relevant formalities and producing reasonably required or supporting information or documentation to ensure the application of the relevant treatment for VAT purposes.

|

| 4 |

CONDITIONS PRECEDENT

|

| 4.1 |

Conditions

|

Completion shall be conditional on:

| (a) |

the condition precedent set out in Clause 4.1.1 being satisfied (or waived in accordance with Clause 5.3.2) on or before the Longstop Date; and

|

| (b) |

the conditions precedent in Clauses 4.1.2, 4.1.3 and 4.1.4 being satisfied up to and including the Completion Date (or waived in accordance with Clause 5.3.2),

|

(together the “Completion Conditions”, and each of them a “Completion Condition”):

| 4.1.1 |

The delivery by the Seller to the Purchaser of the Required Post-Completion Financial Statements pursuant to the terms of Clause 6.6.1(a) and the accounting firm consents pursuant to the terms of Clause 6.6.1(c);

|

| 4.1.2 |

Between the Signing Date and the Completion Date, neither the Symphony nor the trenchers described in Schedule 2 (Business Assets) are damaged, destroyed or subject to any Encumbrance, forfeiture, arrest, seizure or confiscation, the effect of which results in, or is reasonably expected to result in:

|

| (a) |

a requirement for any repair or replacement spend of more than USD 7,500,000 (seven million five hundred thousand US dollars) in aggregate; or

|

| (b) |

the Symphony being out of commission or otherwise unavailable for use for longer than forty-five (45) days after the Completion Date;

|

| 4.1.3 |

Between the Signing Date and the Completion Date no change, state of facts, event or circumstance having occurred which, in each case individually or in the aggregate, has or is reasonably likely to have a Material Adverse Effect; and

|

12

| 4.1.4 |

no Law shall have been enacted by any Governmental Authority, and no restraining Governmental Order or permanent injunction or other Governmental Order shall have been enacted, proposed or put in place, in each case which would prohibit, materially restrict or materially delay Completion.

|

| 5 |

RESPONSIBILITY FOR SATISFACTION

|

| 5.1 |

General

|

| 5.1.1 |

Each of the Parties shall use its best efforts to ensure satisfaction of and compliance with each of the Completion Conditions including by co-operating fully in all actions necessary to procure the satisfaction of the Completion Conditions.

|

| 5.1.2 |

The Parties shall keep each other reasonably informed as to progress towards the satisfaction of the Completion Condition listed in Clause 4.1.1.

|

| 5.2 |

Cooperation to complete the Transaction

|

In the event that any administrative or judicial action or proceeding is instituted (or threatened to be instituted) by a Government Authority or any other person challenging (any part of) the Transaction, each Party shall cooperate in all respects with the other Party and use its best efforts to defend, contest and resist any such action or proceeding and to have vacated, lifted, reversed or overturned any order, whether temporary, preliminary or permanent, that is in effect and that reasonably prohibits, prevents or restricts the consummation of the Transaction.

| 5.3 |

Satisfaction and waiver of Completion Conditions

|

| 5.3.1 |

Each Party shall inform the other Party in writing promptly, but in any event within two (2) Business Days of becoming aware of (i) the satisfaction of any Completion Condition, or (ii) any circumstance that will or is likely to result in a failure to satisfy any Completion Conditions on or before the Longstop Date.

|

| 5.3.2 |

The Completion Conditions may only be waived by written agreement between the Seller and the Purchaser.

|

| 5.3.3 |

If any of the Completion Conditions are not satisfied or waived in accordance with this Clause 5.3 by the Longstop Date, this Agreement shall terminate and cease to have effect from the Longstop Date except for:

|

| (a) |

the Surviving Provisions; and

|

| (b) |

any rights, remedies, obligations or liabilities of the Parties that have accrued up to the date of termination, including the right to claim damages in respect of any breach of the Agreement which existed at or before the date of termination.

|

13

| 6 |

PRE-COMPLETION COVENANTS

|

| 6.1 |

General conduct of the Trenching Business

|

| 6.1.1 |

The Seller shall, and to the extent applicable shall cause the relevant members of the Seller’s Group to, procure that, between Signing and Completion, the Trenching Business shall be conducted in the ordinary course consistent with past practice, with a view to preserve the value of the Trenching Business as a going concern.

|

| 6.1.2 |

Without limiting the generality of the foregoing Clause 6.1.1, save (i) in so far as expressly contemplated in this Agreement, or (ii) as agreed or consented to by the Purchaser in writing (such consent not to be unreasonably withheld or delayed), the Seller shall, and to the extent applicable shall procure that the relevant member of the Seller’s Group shall, procure that, between Signing and Completion, no action in respect of the Trenching Business shall be taken to:

|

| (a) |

sell, transfer or otherwise dispose of or agree to dispose of any of the material Business Assets or any interest in them or any material part of the Trenching Business or actively discontinue or cease to operate all or a material part of the Trenching Business;

|

| (b) |

materially modify, waive any provisions of, or terminate any of the Business Agreements;

|

| (c) |

amend (or agree to amend) the terms and conditions of employment of any of the Employees or dismiss without cause or take any steps to dismiss without cause any of the Employees or provide or agree to provide any non-contractual benefit to any Employee or their dependants;

|

| (d) |

engage, employ or agree or offer to employ, transfer or second persons to work in the Trenching Business full-time or part-time;

|

| (e) |

vary (or agree to vary) the salary, related costs or benefits of an Employee;

|

| (f) |

create, or agree to create, any Encumbrance over any of the Business Assets;

|

| (g) |

transfer or second any Employee to work wholly or partly in a part of the business of the Seller’s Group other than the Trenching Business;

|

14

| (h) |

fail to comply with any member of the Seller’s Group’s material obligations under the contract of employment of any Employee, under statute, common law or under any agreement with any trade union in relation to any Employee;

|

| (i) |

take any action that is likely to endanger its present business organisations, lines of business and its relationships with customers, suppliers and other third parties; or

|

| (j) |

fail to take any action required to maintain any of its insurances relating to the Trenching Business or the Business Assets in force or knowingly do anything to make any such policy of insurance void or voidable.

|

| 6.1.3 |

All requests to take any action restricted by Clause 6.1.2 shall be made by the Seller by e-mail to both:

|

Xxx.Xxxxxxx@xxxxxxxxxxxx.xxxxx

Xxxx.Xxxxxxxxx@xxxxxxxxxxxx.xxxxx

together with such information as may be reasonably required by the Purchaser to consider the request and indicating the designated Representative to whom the response should be addressed. A response to a request for consent of any matter as set forth in Clause 6.1.2 shall be provided by e-mail to the designated Representative of the Seller’s Group as soon as reasonably practicable and in any case within three (3) Business Days after the time of sending the request.

| 6.2 |

General conduct of the Global Business

|

| 6.2.1 |

The Purchaser shall, and to the extent applicable shall cause the relevant members of the Purchaser’s Group to, procure that, between Signing and Completion, each member of the Purchaser’s Group carries on the Global Business in the ordinary course, consistent with past practice.

|

| 6.2.2 |

Without limiting the generality of the foregoing Clause 6.2.1, save (i) in so far as expressly contemplated in this Agreement, or (ii) as agreed or consented to by the Seller in writing (such consent not to be unreasonably withheld or delayed), the Purchaser shall, and to the extent applicable shall cause the relevant member of the Purchaser’s Group to, procure that between Signing and Completion none of the actions set out in paragraphs 8.1(b) to 8.1(k) of Schedule 3 to the W&I Agreement are taken by any member of the Purchaser’s Group.

|

| 6.2.3 |

All requests to take any action restricted by Clause 6.2.2 shall be made by the Purchaser by e-mail to both:

|

15

x.xxxxxxxxxxx@xxxxx.xxx

X.xXxxx@xxxxx.xxx

together with such information as may be reasonably required by the Seller to consider the request and indicating the designated Representative to whom the response should be addressed. A response to a request for consent of any matter as set forth in Clause 6.2.2 shall be provided by e-mail to the designated Representative of the Purchaser’s Group as soon as reasonably practicable and in any case within three (3) Business Days after the time of sending the request.

| 6.2.4 |

The Purchaser further undertakes to keep the Seller updated in relation to any further developments relating to the Quintillion Dispute (as defined in the W&I Agreement) which occur between Signing and Completion, including the sharing of any legal opinion received in relation to the same (subject to any restrictions as may be reasonably required by the Purchaser to preserve any legal advice privilege or litigation privilege which may apply to such materials).

|

| 6.3 |

Access to the Trenching Business

|

| 6.3.1 |

Subject to the terms of the Confidentiality Agreement and Clause 6.3.2, the Seller undertakes to procure that from the Signing Date until the Completion Date or, if applicable and earlier, termination of this Agreement, the Seller shall procure that the Business Sellers will, during normal business hours and upon timely written request, furnish, or cause to be furnished, to the Purchaser and its Representatives access to: (a) the Employees, (b) the office facilities in Aberdeen, and (c) such books and records of or other information relating to the Trenching Business as the Purchaser may from time to time reasonably request, including in connection with any preparations for the operation of the Trenching Business as of Completion.

|

| 6.3.2 |

The obligation of the Seller under Clause 6.3.1 shall be subject to the right of the relevant Business Seller to refuse access to the extent that such access would cause unreasonable and undue disruption to the Business Seller’s operations, including the Trenching Business.

|

| 6.4 |

Business agreements

|

| 6.4.1 |

Any Trenching Agreements entered into between Signing and Completion will only constitute Business Agreements if the Purchaser’s prior written consent (at its sole discretion) is obtained.

|

| 6.4.2 |

With respect to Trenching Agreements entered into by the Seller’s Group between Signing and Completion which the Purchaser agrees shall constitute Business Agreement pursuant to Clause 6.4.1, the Seller shall use reasonable efforts to procure that such agreements shall be assigned or transferred to the Purchaser in accordance with Clause 6.5.

|

16

| 6.5 |

Transfer of Business Agreements

|

| 6.5.1 |

Between Signing and Completion, the Seller and the Purchaser shall both use reasonable efforts to procure the assignment or transfer of the benefit of all the Business Agreements from the relevant members of the Seller’s Group to Purchaser with effect as at Completion or as soon as practicably possible thereafter.

|

| 6.5.2 |

To the extent any Business Agreement cannot be transferred from the relevant member of the Seller’s Group to the Purchaser at Completion, because any required third party consent or approval has not been obtained prior to Completion or in respect of which any required third party consent or approval has been refused as of Completion:

|

| (a) |

the Seller shall use reasonable efforts with the reasonable co-operation of the Purchaser to obtain such consent;

|

| (b) |

unless and until any such Business Agreement is assigned, the relevant member of the Seller’s Group shall continue its corporate existence and shall hold such Business Agreement and any monies, goods or other benefits received thereunder as trustee for Purchaser and its successors in title absolutely;

|

| (c) |

the Seller shall procure that the relevant member of the Seller’s Group gives all such assistance as the Purchaser shall reasonably require to enable the Purchaser to enforce its rights under such Business Agreement and (without limitation) shall provide access to all relevant books, documents and other information in relation to such Business Agreement as such member of the Purchaser’s Group may require from time to time; and

|

| (d) |

to the extent that the Purchaser is lawfully able to do so, the Purchaser shall perform the obligations of the relevant member of the Seller’s Group under such Business Agreement in the name of the member of the Seller’s Group as agent or sub-contractor and shall indemnify the relevant member of the Seller’s Group in respect thereof. To the extent that the Purchaser is not lawfully able to do so, the Seller shall procure that the relevant member of the Seller’s Group shall, subject to being indemnified by the Purchaser for any Losses the relevant member of the Seller’s Group may incur in connection therewith, at the Purchaser’s cost do all such things as the Purchaser may reasonably require to enable due performance of such Business Agreement.

|

17

| 6.5.3 |

If any required third party consent to assignment or novation of a Business Agreement is refused, or otherwise not obtained on terms reasonably satisfactory to the Purchaser within sixty (60) Business Days of the Completion Date, the Purchaser shall be entitled, at its sole discretion, to require the Seller to procure that the relevant member of the Seller’s Group serves proper notice to terminate that Business Agreement, provided that the Business Agreement provides for such termination.

|

| 6.5.4 |

Nothing in this Clause 6.5 or elsewhere in this agreement shall have the effect of making any member of the Purchaser’s Group liable in any way under any guarantees or warranties given by the Seller or any member of the Seller’s Group in relation to goods sold or services rendered by any member of the Seller’s Group before the Completion Date, the liability for which shall remain absolutely with the relevant member of the Seller’s Group.

|

| 6.6 |

Post-Completion Financial Statements

|

| 6.6.1 |

The Seller shall use its best efforts to:

|

| (a) |

deliver to the Purchaser as soon as practicable (with a view toward delivery no later than sixty (60) days after the date of this Agreement):

|

| (i) |

the audited financial statements of the Trenching Business for the years ended on December 31, 2016 and December 31, 2015 prepared in accordance with IFRS as adopted by the IASB and the unaudited but reviewed interim financial statements of the Trenching Business for the nine (9) month period that ended on September 30, 2017 with comparative figures for the nine (9) months period that ended on September 30, 2016 for the Trenching Business that, pursuant to Rule 3-05(b) of Regulation S-X under the Securities Act of 1933, as amended (“Regulation S-X”), Purchaser’s corporate parent will be required to file with the Securities and Exchange Commission (the “SEC”) on Form 8-K as a result of the Transaction; and

|

| (ii) |

an unaudited reconciliation to U.S. GAAP of (A) the income statement of the Trenching Business for the year that ended December 31, 2016 contained in the above-noted audited financial statements, (B) the income statement of the Trenching Business for the nine (9) month period that ended on September 30, 2017 contained in the above-noted interim financial statements and (C) the balance sheet of the Trenching Business as of September 30, 2017 contained in the above-noted interim financial statements,

|

18

(collectively the financial statements in sub-clause (a)(i) and (a)(ii) above being referred to as the “Required Post-Completion Financial Statements”); provided however, that

| (1) |

if the U.S. GAAP revenue of the Trenching Business for the year that ended on December 31, 2016 exceeded USD 50,000,000 (fifty million US dollars), the Required Post-Completion Financial Statements as defined above shall also include the audited financial statements of the Trenching Business for the year that ended on December 31, 2014 prepared in accordance with IFRS as adopted by the IASB for the Trenching Business that, pursuant to Rule 3-05(b) of Regulation S-X, Purchaser’s corporate parent will be required to file with the SEC on Form 8-K as a result of the Transaction;

|

| (2) |

if the Trenching Business is not a Foreign Business, all financial statements of the Trenching Business referred to above shall be prepared in accordance with U.S. GAAP (as opposed to IFRS);

|

| (3) |

if Completion were to occur on or after 1 April 2018, the Seller shall deliver to the Purchaser (x) in addition to the financial statements referred to above, the audited financial statements of the Trenching Business for the year ended on December 31, 2017 prepared in accordance with IFRS as adopted by the IASB for the Trenching Business that, pursuant to Rule 3-05(b) of Regulation S-X, Purchaser’s corporate parent will be required to file with the SEC on Form 8-K as a result of the Transaction and (y) in lieu of the reconciliation referred to in clause (ii) above, a reconciliation to U.S. GAAP of the income statement of the Trenching Business for the year that ended December 31, 2017 and the balance sheet of the Trenching Business as of December 31, 2017 contained in such financial statements; and

|

| (4) |

if any financial statements are to be delivered pursuant to clause (1), (2) and/or (3) above, such financial statements shall be deemed to fall within the definition of “Required Post-Completion Financial Statements” for purposes of this Agreement; and

|

19

| (b) |

cause the Required Post-Completion Financial Statements, when delivered:

|

| (i) |

to present fairly, in all material respects, the financial position of the Trenching Business on a stand-alone basis as of the respective dates thereof, and the results of its operations and its cash flows for the respective periods then ended in conformity with International Financial Reporting Standards as issued by the International Accounting Standards Board; and

|

| (ii) |

to have been prepared in accordance with IFRS, as adopted by the IASB, applied on a consistent basis throughout the periods covered; and

|

| (c) |

obtain all the consents required from the audit firm or firms engaged by the Seller in connection with the Required Post-Completion Financial Statements for Purchaser’s corporate parent to file the Required Post-Completion Financial Statements with the SEC, and all other consents required for the inclusion of their audit reports and review reports in any other required filing by Purchaser or its corporate parent with the SEC or the New York Stock Exchange. Purchaser shall use its best efforts to cooperate with Seller in obtaining the above-noted consents.

|

| 6.6.2 |

Parties shall in good faith continue to discuss after the Signing Date to what extent the financial statements referred to above are actually required to be filed by the Purchaser’s corporate parent under Regulation S-X. If Parties jointly conclude in good faith that the Purchaser’s corporate parent does not require any part of the information described above pursuant to Regulation S-X, the Seller shall no longer be required to provide such information or financial statement and such information or financial statement shall be deemed to no longer fall within the definition of “Required Post-Completion Financial Statements” for purposes of this Agreement. The Completion Condition set out in Clause 4.1.1 shall be deemed satisfied if Parties jointly conclude in good faith that the Purchaser’s corporate parent is not required to file the Required Post-Completion Financial Statements pursuant to Regulation S-X.

|

| 6.6.3 |

The Purchaser shall pay directly or reimburse the Seller for any and all reasonable and documented expenses incurred by Seller and other members of the Seller’s Group to unaffiliated third parties in connection with Seller’s performance of its obligations under this Clause 6.6 (Post-Completion Financial Statements) and Clause 8.7 (Post-Completion SEC assistance), including costs incurred from the accountant, auditor and contractors required for the purpose of preparing the Required Post-Completion Financial Statements.

|

20

| 6.6.4 |

For the avoidance of doubt and without prejudice to the Purchaser’s rights to claim under the W&I Agreement in case of a breach of the Fugro Warranties included in paragraph 1 (Incorporation, authority, corporate action) up to and including paragraph 9 (Tax) of schedule 2 (Fugro Warranties) of the W&I Agreement, the BPA or any other Transaction Agreement, the Purchaser and Global shall have no right or ability to renegotiate, challenge or adjust the Purchase Consideration or the other terms and conditions of the Transaction on the basis of information which is contained in the Required Post-Completion Financial Statements and/or any additional statements provided pursuant to Clause 8.7 (Post Completion SEC assistance). GMSL and Global shall solely use the Required Post-Completion Financial Statements for the required filing of the Purchaser’s corporate parent with the SEC pursuant to the U.S. federal securities laws and not for any other purpose.

|

| 6.7 |

Symphony

|

As from the date that (i) the Symphony has completed the activities it is working on at the date of this Agreement near Libya, and (ii) the Symphony is no longer within the Libyan exclusive economic zone, and subject to the prior approval of the customer for which activities are carried out using the Symphony at the relevant dates that such representatives are on board of the Symphony, the Purchaser has the right to place two (2) representatives on board the Symphony at the Purchaser’s sole risk and expense at a suitable port. These representatives are on board for the purpose of familiarisation and in the capacity of observers only, and they shall not interfere in any respect with the operation or schedule of the Symphony. The Purchaser and the Purchaser’s representatives shall sign the Vessel Seller’s P&I Club’s standard letter of indemnity prior to their embarkation.

| 6.8 |

Pre-Completion notices regarding warranties

|

In the period as from the date of this Agreement until Completion:

| 6.8.1 |

The Seller shall inform the Purchaser in writing promptly, but in any event within five (5) Business Days, of becoming aware of any circumstance that constitutes a breach of a Fugro Warranty (as defined in the W&I Agreement) or will or is likely to constitute a breach of a Repeated Fugro Warranty (as defined in the W&I Agreement) as at Completion.

|

| 6.8.2 |

The Purchaser shall inform the Seller in writing promptly, but in any event within five (5) Business Days, of becoming aware of any circumstance that constitutes a breach of a GMSL Warranty (as defined in the W&I Agreement) of will or is likely to constitute a breach of a Repeated GMSL Warranty (as defined in the W&I Agreement) as at Completion.

|

21

| 7 |

COMPLETION

|

| 7.1 |

Completion date and place

|

Subject to Clause 7.8.3, Completion shall take place on the date falling five (5) Business Days after the Completion Condition in Clause 4.1.1 has been satisfied or waived (provided that the Completion Conditions in Clauses 4.1.2, 4.1.3 and 4.1.4 have also been satisfied or waived as at such date) or such other date, time or location as may be agreed in writing by the Seller and the Purchaser.

| 7.2 |

Bring down certificate

|

On the third Business Day before Completion, the Seller and the Purchaser shall procure that the following actions are taken:

| (a) |

the Seller shall deliver to the Purchaser a certificate in the form attached as Schedule 20 (Bring down certificate), duly executed by the Seller; and

|

| (b) |

the Purchaser shall deliver to the Seller a certificate in the form attached as Schedule 20 (Bring down certificate), duly executed by the Purchaser.

|

| 7.3 |

Transfer of the Aggregate WC Amount

|

On the Completion Date, Fugro shall transfer, or shall procure the transfer of, an amount equal to the Aggregate WC Amount to the account no with IBAN XX00XXXX00000000000000 and SWIFT code XXXXXX00, in the name of GMSL, with reference to “Project Furrow”. The amount due must be credited to the account on the Completion Date and with value on such date.

| 7.4 |

Completion actions

|

At Completion, the Seller and the Purchaser shall procure that the following actions are taken in the following sequence:

| (a) |

the Purchaser shall deliver to the Seller a copy of the Certificate of Compliance duly executed on the Completion Date or the last Business Date before the Completion Date by:

|

| (i) |

Ian Xxxxx XXXXXXX (in his capacity as director of Huawei Marine Systems Co., Limited, in his capacity of director of Huawei Marine Networks Co. Limited and in his capacity as director of SB Submarine Systems Co. Limited);

|

22

| (ii) |

Xxxx Xxxxxxxx FAGERSTAL (in his capacity as director of Huawei Marine Systems Co., Limited, in his capacity of director of Huawei Marine Networks Co. Limited and in his capacity as director of SB Submarine Systems Co. Limited);

|

| (iii) |

Xxxxxxx Xxxxxxx XXXXXXXXX (in his capacity as director of Huawei Marine Systems Co., Limited and in his capacity of director of Huawei Marine Networks Co. Limited);

|

| (iv) |

Xxxxx Xxxxx XXXXXXX-XXXXX (in his capacity as director of SB Submarine Systems Co. Limited); and

|

| (v) |

Xxxxxx Xxx (in his capacity as managing director of SB Submarine Systems Co. Limited).

|

| (b) |

the Seller shall procure that Fugro Consultants International N.V. executes and delivers to the Purchaser a copy of the Global LLC Agreement and the Purchaser Parent shall deliver to the Seller a copy of the Global LLC Agreement duly executed by each of the other required signatories to such agreement;

|

| (c) |

the Purchaser Parent shall:

|

| (i) |

issue the Equity Consideration to Fugro Consultants International N.V.;

|

| (ii) |

procure that the name of Fugro Consultants International N.V. is recorded on the books and records of Global as the owner of the Equity Consideration; and

|

| (iii) |

appoint Xxxx xxx Xxxx and Xxxxx Xxxxxxxxxxx as Directors of Global.

|

| (d) |

the relevant members of the Seller’s Group, on the one hand, and the Purchaser or the Purchaser Parent (or relevant member of the Purchaser’s Group), on the other hand, shall enter into the following agreements:

|

| (i) |

the Vendor Loan and the Trencher Lien Agreement;

|

| (ii) |

the Service Framework Agreement;

|

| (iii) |

the Xxxxxxx Agreement;

|

| (iv) |

the FFAG ASTA;

|

23

| (v) |

the FSSL ASTA;

|

| (vi) |

the FSY ASTA;

|

| (vii) |

the Protocol of Delivery and Acceptance confirming date and time of delivery of the Symphony; and

|

| (viii) |

the Debenture Deed of Postponement;

|

| (e) |

the Purchaser shall deliver to the Seller a copy of the Debenture Deed of Postponement duly executed by Barclays Bank plc;

|

| (f) |

the Seller shall procure that the Business Sellers shall, and the Purchaser shall, do the following:

|

| (i) |

to the extent that they are not located at the Symphony or held by third parties at Completion, transfer the Business Assets (save as specifically contemplated by this Clause 7) held by the relevant Business Seller to the Purchaser at Completion by the relevant Business Seller delivering the aforesaid Business Assets to the Purchaser or giving the Purchaser access or the keys and passes (and any other form of access) to the locations where the aforesaid Business Assets are situated, and title documents and other evidence of ownership whereupon the aforesaid Business Assets shall be at the Purchaser’s full disposal; and

|

| (ii) |

those Business Assets which are held by third parties at Completion shall be transferred to the Purchaser at Completion by virtue of this Agreement (which shall constitute a deed as required under Netherlands Law) and by notices from the relevant Business Seller or the Purchaser, given also on behalf of the relevant Business Seller or the Purchaser, to the said third parties that the latter shall from then on hold the said Business Assets for the Purchaser, such notices to be delivered to the third parties within ten (10) Business Days after Completion.

|

| (g) |

At or before Completion, the Seller shall procure the delivery to the Purchaser of, or make available to the Purchaser:

|

| (i) |

a xxxx of sale in the form of Schedule 11 (Xxxx of Sale) duly notarially attested;

|

24

| (ii) |

evidence that all necessary corporate, shareholder and other action has been taken by the Vessel Seller to authorise the sale of the Symphony pursuant to this Agreement;

|

| (iii) |

a power of attorney of the Vessel Seller appointing one or more representatives to act on behalf of the Vessel Seller in the performance of the sale of the Symphony, duly notarially attested;

|

| (iv) |

a certificate or transcript of registry issued by the Bahamas Maritime Authority on 29 September 2017, evidencing the Vessel Seller’s ownership of the Symphony and that the Symphony is free from registered encumbrances and mortgages, with the original to be sent to the Purchaser as soon as possible after Completion;

|

| (v) |

a declaration of Class or Class maintenance certificate depending on Classification Society issued on within three (3) Business Days prior to the Completion Date confirming that the Symphony is in Class, free of condition or recommendations; and

|

| (vi) |

the Vessel Seller’s certificate of good standing dated 22 September 2017.

|

| 7.5 |

Symphony

|

| 7.5.1 |

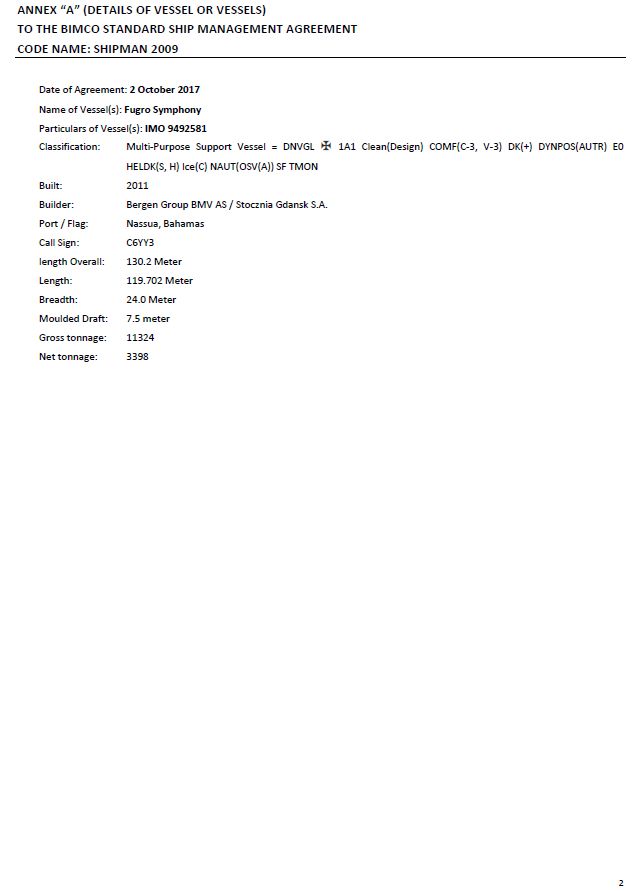

The Symphony shall, subject to the terms and conditions of this Agreement and unless otherwise agreed between the Parties in writing, be delivered to the Purchaser at the Completion Date in the port of Montrose (Scotland) as she was at the time of Inspection, fair wear and tear excepted.

|

| 7.5.2 |

All spare parts, unbroached stores, provisions, radio/navigation/safety equipment and spare equipment (including spare tail-end shaft(s) and/or spare propeller(s)/propeller blade(s), if any) belonging to, and located at, the Symphony at the time of Inspection shall become the Purchaser’s property without extra payment, provided that (i) the library and forms exclusively for use by the Vessel Seller, (ii) captain’s, officers’ and crew’s personal belongings including the slop chest, (iii) the survey equipment on board of the Symhony, and (iv) the Star IPS software package on board the Symphony, are excluded from the sale of the Symphony and will not become Purchaser’s property.

|

| 7.5.3 |

Forwarding charges, if any, shall be for the Purchaser’s account. The Seller is not required to replace spare parts including spare tail-end shaft(s) and spare propeller(s)/propeller blade(s) which are taken out of spare and used as replacement prior to delivery. Unused stores and provisions shall be included in the sale and be taken over by the Purchaser without extra payment.

|

25

| 7.5.4 |

Subject to the Purchaser entering to the Ship Management agreement under the Service Framework Agreement, the Seller shall use its best efforts to cause that the Purchaser is provided access via STAR IPS to electronic copies of the documents set out in part 1 of Schedule 21 (Technical Documentation for the Symphony).

|

| 7.5.5 |

The Seller shall use its best efforts to provide to the Purchaser at, or as soon as possible after, the Completion Date the documents set out in part 2 of Schedule 21 (Technical Documentation for the Symphony), but in any event within one month of Completion, unless such documents are unavailable or located at the Symphony at the Completion Date. Such documents shall be provided in the form in which they are available to the Seller.

|

| 7.6 |

Delivery of the Trenchers

|

The trenchers described in Schedule 2 (Business Assets) shall, subject to the terms and conditions of this Agreement and unless otherwise agreed between the Parties in writing, be delivered to the Purchaser at the Completion Date by FSSL giving access or the keys and passes (and any other form of access or authorisation required for access) to the storage facility located in Montrose (Scotland).

| 7.7 |

Insurance

|

Until Completion, the Seller shall procure that all insurance policies of the Trenching Business which are due to terminate or expire prior to Completion will be renewed, extended or allowed to terminate or expire in accordance with past practice.

| 7.8 |

Breach of Completion obligations

|

| 7.8.1 |

If the Seller or the Purchaser breaches any obligation under Clause 7.3 (Transfer of the Aggregate WC Amount) or Clause 7.4 (Completion actions) thereby a “Defaulting Party”, and such breach results in Completion not occurring in full compliance with Clause 7.1 (Completion date and place), Clause 7.3 (Transfer of the Aggregate WC Amount) or Clause 7.4 (Completion actions), then, in addition and without prejudice to any other rights and remedies available to it, the non-Defaulting Party shall be entitled to effect Completion on the Completion Date insofar as practicable having regard to the defaults that have occurred.

|

26

| 7.8.2 |

If on the date in accordance with Clause 7.1 (Completion date and place) on which Completion should occur, the Seller or the Purchaser is in breach of any of their respective obligations under Clause 7.3 (Transfer of the Aggregate WC Amount) or Clause 7.4 (Completion actions), and such breach results in Completion not occurring in accordance with Clause 7.1 (Completion date and place), Clause 7.3 (Transfer of the Aggregate WC Amount) or Clause 7.4 (Completion actions), then, without prejudice to any other rights and remedies available to it, the non-Defaulting Party shall be entitled by Notice served on the Defaulting Party to terminate this Agreement.

|

| 7.8.3 |

Further to Clause 7.8.1 and Clause 7.8.2, in the event the non-Defaulting Party chooses, in such Party’s sole discretion, not to effect Completion in accordance with Clause 7.8.1 or not to terminate the Agreement in accordance with Clause 7.8.2, a new date for Completion may be set by such non-Defaulting Party, in which case the provisions of Clause 7.3 (Transfer of the Aggregate WC Amount) and Clause 7.4 (Completion actions) shall apply to Completion as so deferred. If on the new date set for Completion in accordance with this Clause 7.8.3, the Defaulting Party breaches any of its obligations under Clause 7.3 (Transfer of the Aggregate WC Amount) or Clause 7.4 (Completion actions), the non-Defaulting Party shall be entitled by Notice served on the Defaulting Party to terminate this Agreement.

|

| 8 |

POST-COMPLETION OBLIGATIONS

|

| 8.1 |

Use of names

|

The Purchaser shall not, and shall procure that no member of the Purchaser’s Group shall, after Completion, use in any way whatsoever, by means of trade names, domain names, registered or unregistered trademarks, logos or otherwise, the name ‘Fugro’, or any abbreviation thereof, or any name, logo or lettering which is similar to the same. Without prejudice to the foregoing provisions of this Clause 8.1 (Use of names), the Purchaser shall, as soon as practicable after the Completion, but in any event within six (6) months after the Completion, procure that the name Fugro, or any abbreviation thereof, or any name, logo or lettering which is similar to the same, is removed from all products, business stationery, the Symphony and other Business Assets acquired by the Purchaser pursuant to this Agreement.

| 8.2 |

Records and record retention

|

| 8.2.1 |

For a period of five (5) years as of Completion, or such longer period as may be prescribed by Law, the Purchaser shall retain all books, records and other written information relating to the Trenching Business which are held by or on behalf of any member of the Purchaser’s Group pursuant to Completion and, to the extent reasonably required by the Seller, the Purchaser shall allow the Seller, upon reasonable notice, access during normal office hours to such books, records and other information, including the right to inspect and make copies (at the Seller’s expense).

|

27

| 8.2.2 |

For a period of five (5) years as of Completion, or such longer period as may be prescribed by Law, the Seller’s Group shall retain any books, records and other written information relating to the Trenching Business which are not held by or on behalf of any member of the Purchaser’s Group pursuant to Completion and, to the extent reasonably required by the Purchaser, the Seller shall allow the Purchaser, upon reasonable notice, access during normal office hours to such books, records and information, including the right to inspect and make copies (at the Purchaser’s expense).

|

| 8.2.3 |

As soon as reasonably possible after Completion, the Seller shall provide to the Purchaser an electronic copy of all project data and records relating to the Trenching Business available to the Seller’s Group that are reasonably required by the Purchaser, including copies of the relevant oil records and planned maintenance records of the Symphony, and the Seller hereby grants the exclusive right for the Purchaser and its successors in title and assignees to use such information in connection with carrying on the Trenching Business in succession to the Seller, provided that the Purchaser shall treat such project data and records as Confidential Information in accordance with, and subject to the exceptions contained in, Clause 11.2 (Confidentiality undertaking).

|

| 8.3 |

Insurance

|

| 8.3.1 |

The Purchaser acknowledges and agrees that as from Completion all insurance cover provided in relation to the Trenching Business pursuant to policies maintained by (any member of) the Seller’s Group, whether such policies are maintained with third party insurers or within the Seller’s Group, shall be terminated or shall no longer provide coverage to the Purchaser or the Trenching Business for any events, occurrences or accidents occurring after the Completion Date, and no third party or member of the Seller’s Group shall have any Liability or responsibility for any such events, occurrences or accidents under such policies occurring after the Completion Date.

|

| 8.3.2 |

If in the period as of the Completion Date up to 12:00 pm CET on the date which is six (6) months after the Completion Date, the Purchaser becomes aware of any events, occurrences or accidents that occurred prior to the Completion Date and pursuant to which the Trenching Business incurred damages resulting in out-of-pocket payments by the Trenching Business that may be covered by any insurance policy of the Seller’s Group, the Seller shall:

|

28

| (a) |

use its reasonable efforts to report such damages to the insurer and (subject to the insurer accepting to review the claim) seek compensation for such damages under such insurance policy, provided the Purchaser shall cooperate with the Seller and shall procure that the Trenching Business makes available to the Seller all information and documentation reasonably necessary to report and/or claim such damages; and

|

| (b) |

pay to the Purchaser any claim amounts it may receive from the insurer under such insurance policy in relation to such damages less any costs and expenses actually incurred in obtaining such recovery,

|

provided the Purchaser has notified the Seller as soon as reasonably practicable after becoming aware of any such event, occurrence or accident.

| 8.4 |

Marine diesel oil, lubes, vessel spares and general consumables

|

| 8.4.1 |

The Parties shall jointly cause that at Completion (save as otherwise agreed pursuant to any charter agreement entered into by the Parties at Completion) either (i) an officer of the Symphony, or (ii) an independent surveyor jointly appointed by the Parties, records and certifies the quantities of remaining bunkers (including marine diesel oil) and unused lubricating and hydraulic oils available at the vessel Symphony as at such date and inform the Parties thereof in writing.

|

| 8.4.2 |

The Purchaser shall within three (3) Business Days after Completion (save as otherwise agreed pursuant to any charter agreement entered into by the Parties at Completion) pay to the Seller, by way of a repayment of the relevant part of the Aggregate WC Amount, (and a corresponding reduction in the Purchase Consideration) the actual net price of the remaining bunkers (including marine diesel oil) and unused lubricating and hydraulic oils as referred to in Clause 8.4.1 (excluding barging expenses) as evidenced by invoices or vouchers for the quantities taken over.

|

| 8.5 |

ROV IP

|

The Seller hereby grants, or shall procure that the relevant member of the Seller’s Group will grant, to the Purchaser a paperless, worldwide, royalty-free licence to use the software installed on the date of this Agreement on the two (2) FCV 3000 ROV systems referred to in in Schedule 2 (Business Assets) on such FCV 3000 ROVs. For the avoidance of doubt, this license only allows the Purchaser to use such software on these two FCV 3000 ROV systems and the Seller is under no obligation to provide any updates of such software to the Purchaser. In case of a transfer of one or both of the FCV 3000 ROVs by the Purchaser to any other person, the Purchaser has the right to assign the license granted under this Clause to such person subject to the same restrictions as set out in this Clause.

29

| 8.6 |

JV Compliance

|

Purchaser shall use reasonable best efforts to procure that within six (6) months after the date of this Agreement its Chinese joint ventures Huawei Marine Systems Co. Limited and SB Submarine Systems Co. Limited implement and adhere to market standard compliance programs and Purchaser shall periodically inform the Seller of the status and all developments in respect thereof.

| 8.7 |

Post-Completion SEC assistance

|

| 8.7.1 |

The Seller shall deliver to Purchaser, as soon as practicable after the Completion Date, an unaudited income statement of the Trenching Business from September 30, 2017 until the Completion Date, which income statement shall be prepared in accordance with U.S. GAAP but which need not be audited or received by an independent accounting firm. In connection with the foregoing, the Purchaser agrees to provide the Seller access to available financial and other relevant information, as needed and if available, in order to prepare such required financial statements and make such other disclosures.

|

| 8.7.2 |

After the Completion Date, Seller agrees to reasonably assist Purchaser, as reasonably requested by Purchaser, in the preparation of any additional required financial statements or other disclosures relating to the Trenching Business required by the rules and regulations of the SEC, including if so required pro forma financial statements prepared by Purchaser or its corporate parent with respect to the Transaction, as contemplated by Article 11 of Regulation S-X. In connection with the foregoing, Seller agrees to provide the Purchaser access to available financial and other relevant information, as needed and if available, in order to prepare such required financial statements and make such other disclosures.

|

| 9 |

LIMITATION OF LIABILITY

|

| 9.1.1 |

If the Seller is liable towards the Purchaser under this Agreement, the Purchaser and the Purchaser Parent shall, after the Completion Date, as their sole and exclusive remedy have the right to claim the Losses suffered or incurred by them as a result, and shall not have the right to terminate or rescind this Agreement, or claim specific performance (nakoming) other than specific performance in respect of Clauses 8.1 (Use of names), 10 (Restrictions), and 11 (Confidentiality).

|

| 9.1.2 |

If the Seller is liable towards the Purchaser under this Agreement, the Seller may elect, in its sole discretion, to settle such claim either by: (i) paying such amount in cash in US dollars by electronic transfer of immediately available funds to the Purchaser; (ii) adjusting the number of Class A-2 Units held by Fugro in accordance with the terms of the Global LLC Agreement, or (iii) a combination of (i) and (ii).

|

30

| 9.2 |

Maximum liability

|

The aggregate liability of the Seller in respect of all claims under this Agreement and the W&I Agreement shall never exceed USD 72,500,000 (seventy-two million, five hundred thousand US dollars).

| 9.3 |

Time limitation

|

Fugro shall not be liable for a claim for Losses suffered or incurred by GMSL as a result of Breach of this Agreement unless a Notice of such claim is given by GMSL to Fugro specifying the matters set out in clause 6.2 of the W&I Agreement:

| (a) |

in the case of any claim under Clause 10.1 (Non-compete), within three (3) months after the end of the Restricted Period;

|

| (b) |

in the case of any other claim under or otherwise in connection with this Agreement, within fifteen (15) months after the Completion Date.

|

| 9.4 |

Mitigation of Losses

|

The Purchaser shall procure that all reasonable steps are taken and all reasonable assistance is given to avoid or mitigate any Losses which in the absence of mitigation might give rise to a liability in respect of any claim under this Agreement.

| 9.5 |

Applicable clauses of the W&I Agreement

|

Save as specifically provided in this Agreement, Clause 5 (Limitations of Liability) of the W&I Agreement shall mutatis mutandis limit any liability of the Seller under this Agreement.

| 9.6 |

No double claims

|

The Seller shall not be liable under or otherwise in connection with this Agreement and the W&I Agreement more than once in respect of the same Loss.

31

| 10 |

RESTRICTIONS

|

| 10.1 |

Non-compete

|

| 10.1.1 |

The Seller shall procure that during the Restricted Period no member of the Seller’s Group shall be engaged in the Restricted Territory in any vessel based trenching or cable lay services of the kind provided by the Trenching Business at the Completion Date.

|

| 10.1.2 |

The restrictions in Clause 10.1.1 shall not operate to prohibit any member of the Seller’s Group from:

|

| (a) |

undertaking any warranty or repair activities in respect of projects undertaken by FSSL;

|

| (b) |

completion of projects in progress at the Completion Date;

|

| (c) |

completion of projects tendered and awarded to a member of the Seller’s Group before the Completion Date and in respect of which the relevant client does not accept the transfer of the contract to the Purchaser;

|

| (d) |

undertaking any business activities as carried out by the Seller’s Group at the Signing Date (excluding the Trenching Business);

|

| (e) |

acquiring the whole or part of any business or joint-venture from a third party, or entering into a joint venture with a third-party, which business or joint venture is engaged in any activities set out in Clause 10.1.1, if the turnover generated by such activities does not exceed USD 10,000,000 (ten million US dollars) per annum calculated on a rolling 12 (twelve) month basis during the Restricted Period and comprises less than 25% (twenty-five percent) of the business;

|

| (f) |

acquiring or developing a business engaged in any activities set out in Clause 10.1.1 through a joint-venture in which the Seller does not have a controlling interest, provided the Seller shall procure that any board members of such joint-venture appointed by a member of the Seller’s Group will vote against proposals to acquire a business that is engaged in any activities set out in Clause 10.1.1 and of which business such activities generate more than 25% (twenty-five percent) of its total revenues; and

|

| (g) |

fulfilling any obligation pursuant to this Agreement or any other agreement entered into pursuant to this Agreement.

|

32

| 11 |

CONFIDENTIALITY

|

| 11.1 |

Announcements

|

No announcement, circular or other public communication in connection with the existence or the subject matter of this Agreement shall be made or issued by or on behalf of any member of the Seller’s Group or the Purchaser’s Group without the prior written approval of the Seller and the Purchaser. This shall not affect any announcement or circular required by Law or the rules of any recognised stock exchange on which the shares of either Party or an affiliate of it are listed, provided that the Party who (or whose affiliate) has an obligation to make an announcement or issue a circular shall consult with the other Party insofar as is reasonably practicable before complying with such an obligation.

| 11.2 |

Confidentiality undertaking

|

| 11.2.1 |

The Confidentiality Agreement shall cease to have any force or effect as of Completion.

|

| 11.2.2 |

Subject to Clause 11.1 (Announcements), each of the Parties shall treat as strictly confidential and not disclose or use any information contained in or received or obtained as a result of entering into this Agreement (or any agreement entered into pursuant to this Agreement) which relates to:

|

| (a) |

the provisions of this Agreement or any agreement entered into pursuant to this Agreement;

|

| (b) |

the negotiations relating to this Agreement (or any such other agreement); or

|

| (c) |

a Party to this Agreement or the business carried on by it or any member of its group of companies.

|

| 11.2.3 |

Clause 11.2.2 shall not prohibit disclosure or use of any information if and to the extent:

|

| (a) |

the disclosure or use is reasonably required to vest the full benefit of this Agreement in any Party;

|

| (b) |

the disclosure or use is required for the purpose of any legal proceedings arising out of this Agreement or any other agreement entered into under or pursuant to this Agreement or the disclosure is made to a Tax Authority in connection with the Tax affairs of the disclosing Party;

|

33

| (c) |

the disclosure is made to professional advisors of any Party on terms that these professional advisors undertake to comply with under the provisions of Clause 11.2.2 in respect of the information as if they were a party to this Agreement;

|

| (d) |

the disclosure is made to a Party’s auditors or the providers of finance, (indirect) shareholders, fund managers or (potential) investors, provided a similar duty of confidentiality is imposed on them;

|