Contract

REDACTED VERSION Certain identified information has been omitted from this document because it is not material and is customarily and actually treated as private or confidential, and has been marked with “[***]” to indicated where omissions have been made. Acquisition Agreement relating to the subscription of shares in XxxX TopCo and the acquisition of NGGH (as defined therein) Dated 27 March 2022 Lattice Group Limited and Luppiter Bidco Limited Ref: L-311850 Exhibit 4(b).1

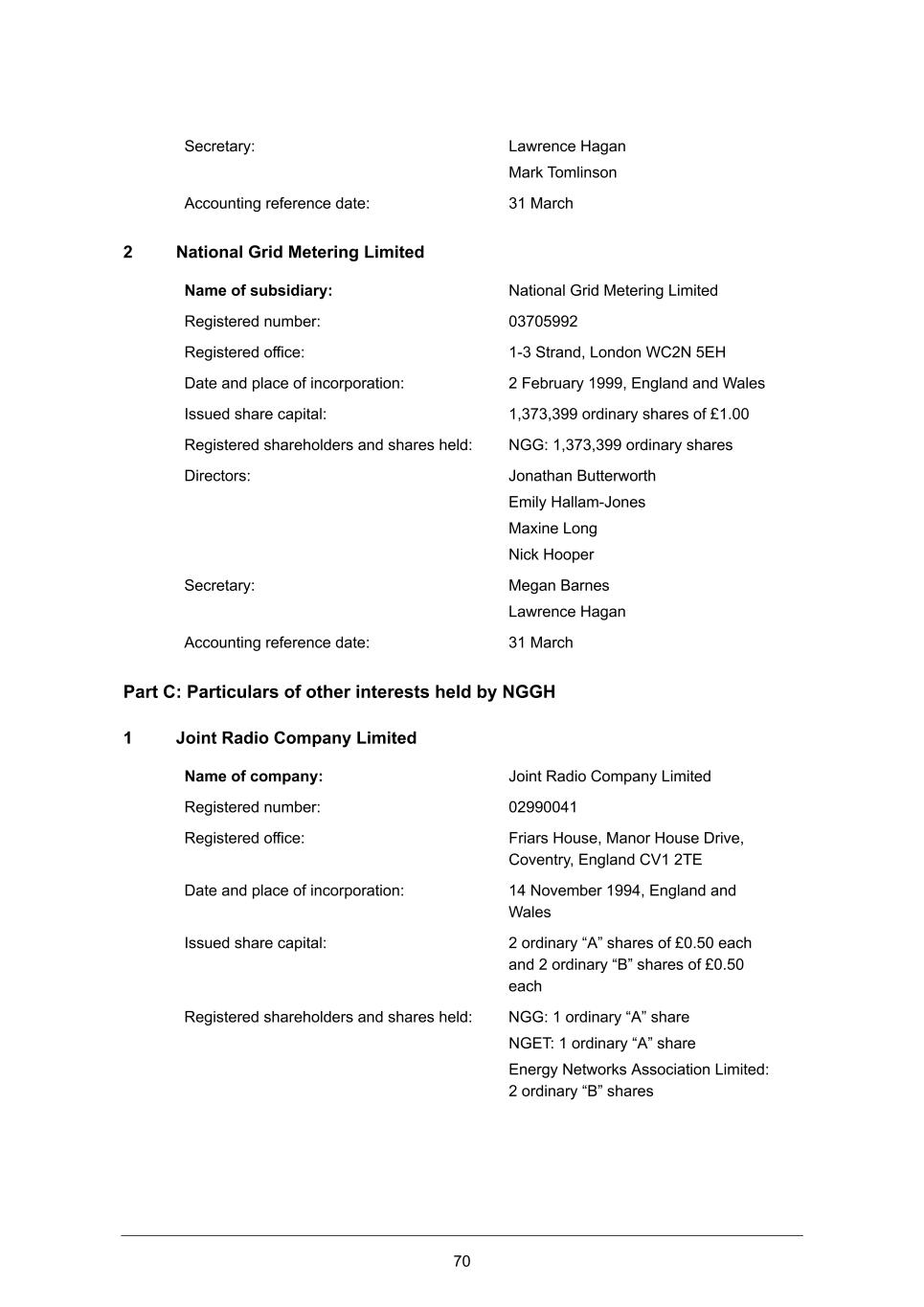

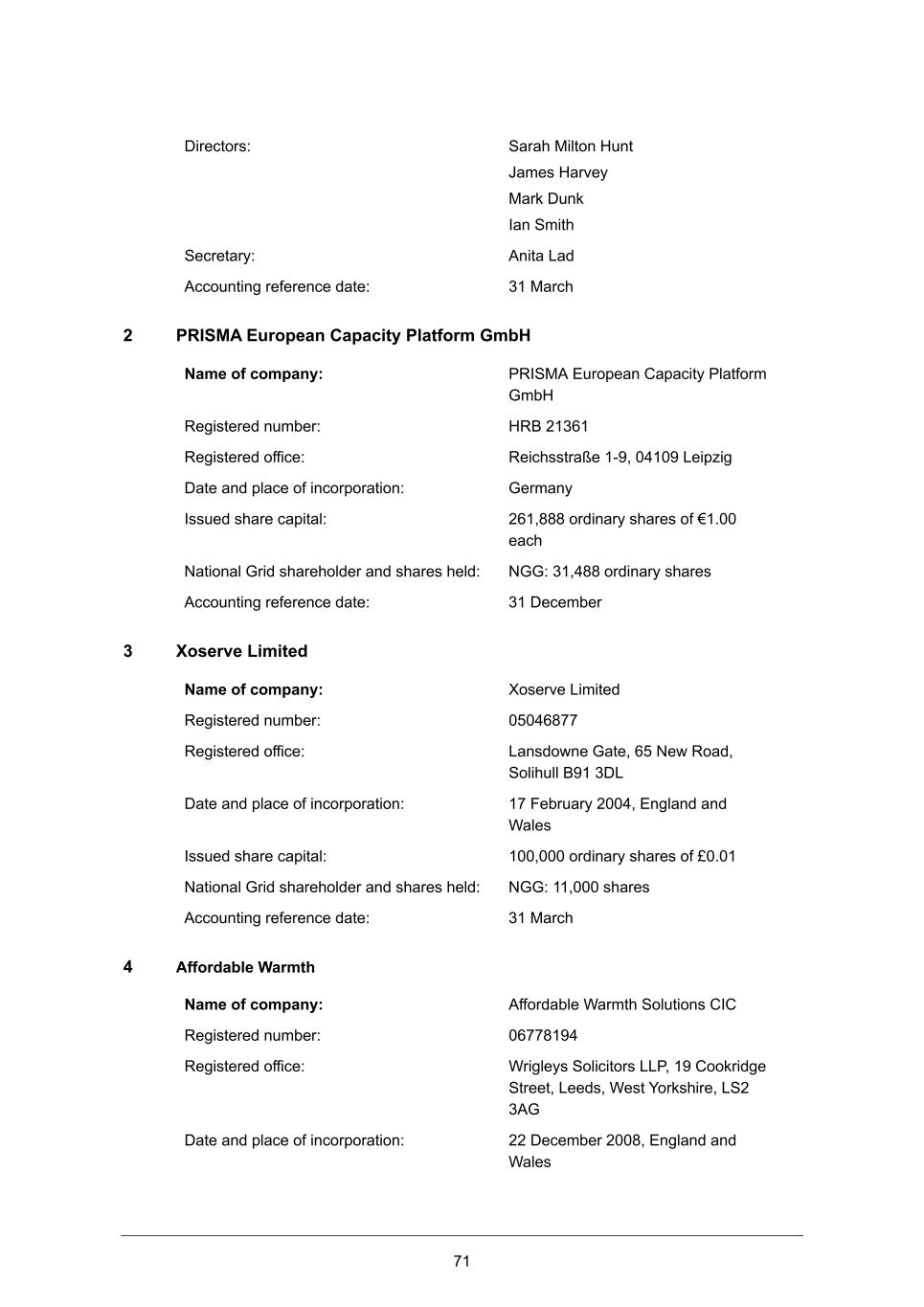

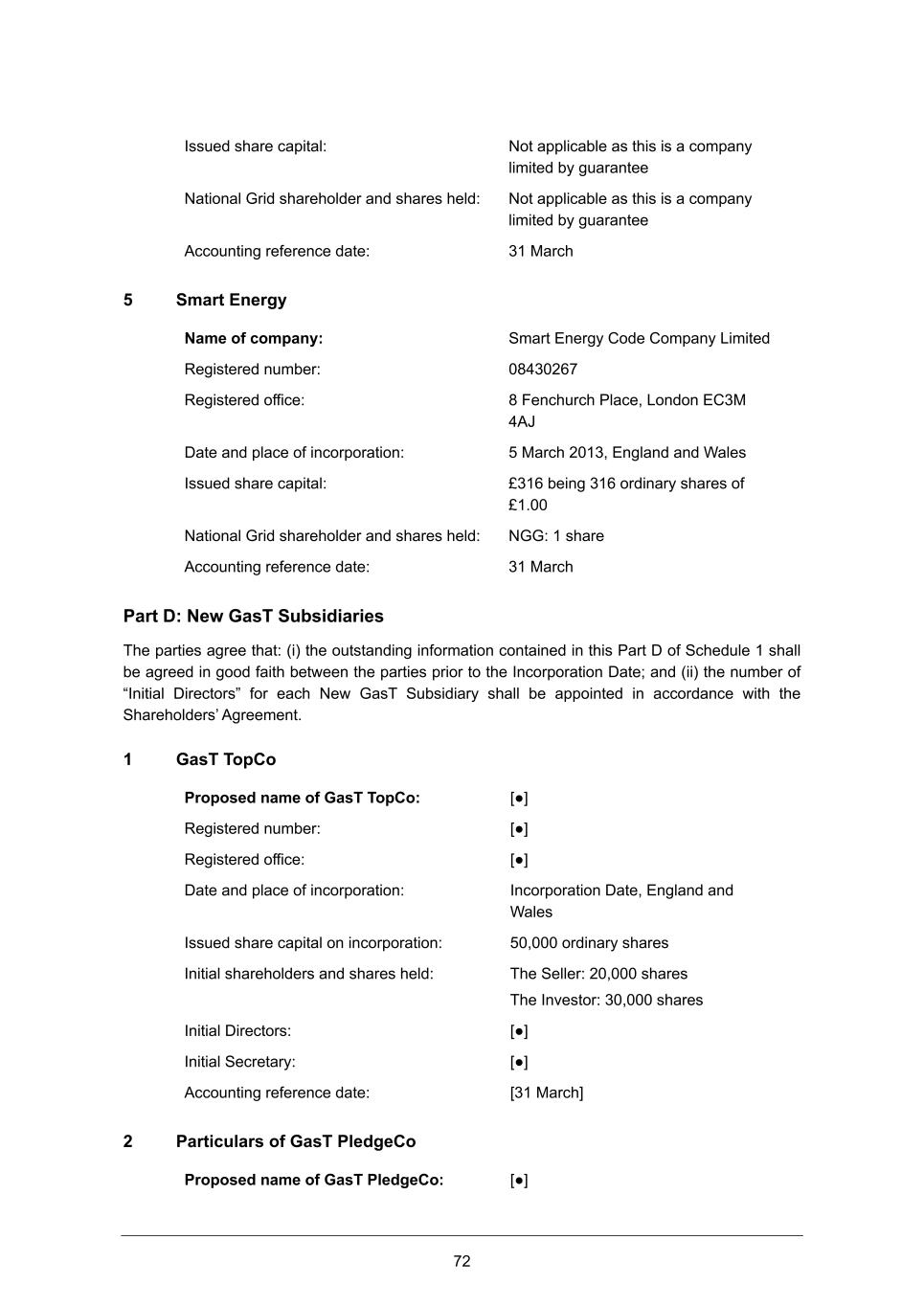

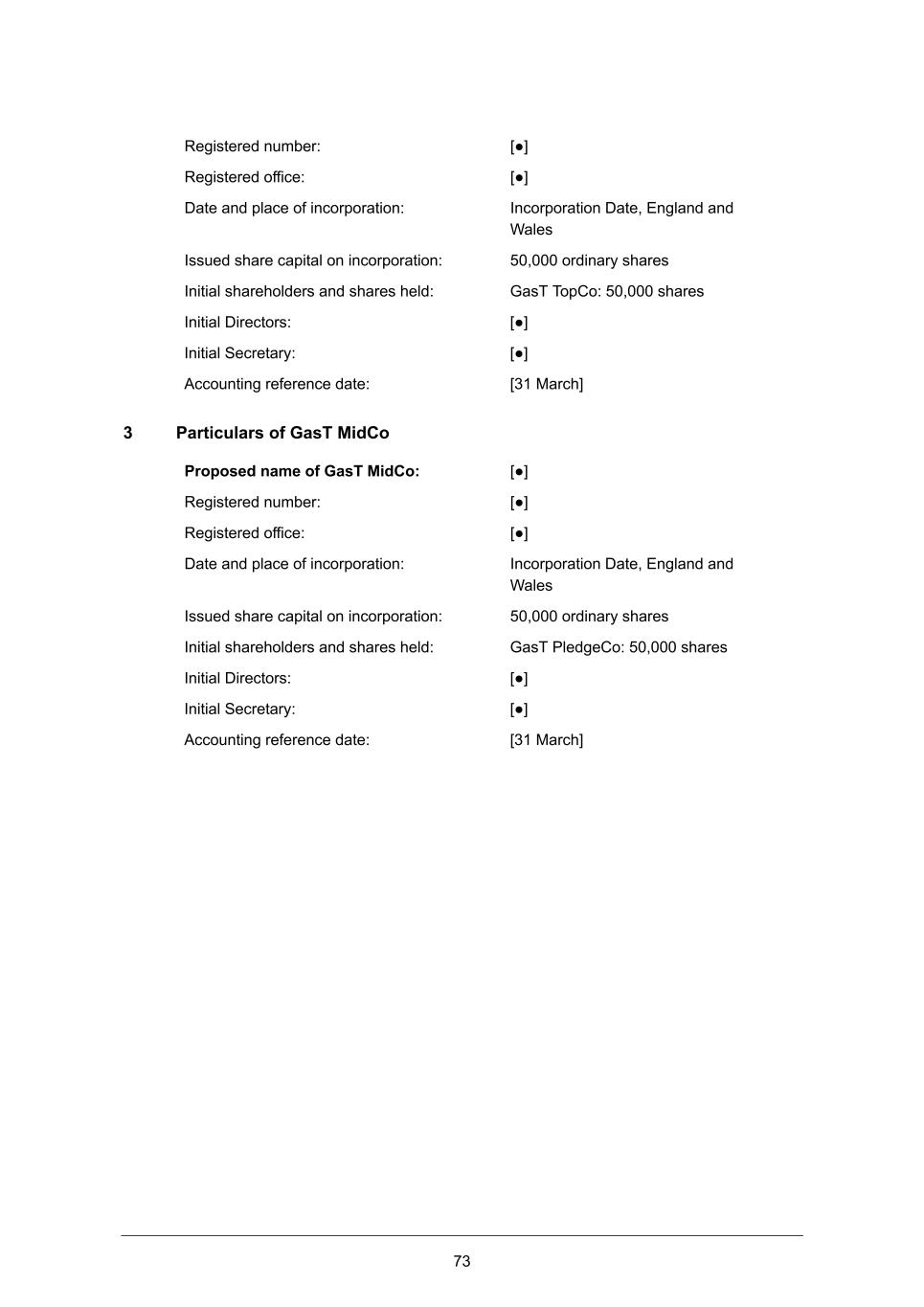

i Table of Contents Contents Page Acquisition Agreement ................................................................................................................... 1 1 Interpretation ......................................................................................................................... 1 2 Acquisition of the Businesses ........................................................................................... 21 3 Consideration ...................................................................................................................... 22 4 Conditions ............................................................................................................................ 23 5 Pre-Closing .......................................................................................................................... 30 6 Exchange and Closing ........................................................................................................ 36 7 Indemnity ............................................................................................................................. 38 8 Hive Out Agreement Warranty ........................................................................................... 40 9 Employee share plans ........................................................................................................ 40 10 Seller Trade Marks .............................................................................................................. 41 11 Leakage ................................................................................................................................ 42 12 Post-Closing Events ........................................................................................................... 43 13 Warranties ............................................................................................................................ 44 14 Limitation of Liability .......................................................................................................... 45 15 Claims ................................................................................................................................... 51 16 W&I Insurance Policy .......................................................................................................... 54 17 Confidentiality ..................................................................................................................... 55 18 Insurance ............................................................................................................................. 57 19 Other Provisions ................................................................................................................. 58 Schedule 1 The XxxX Group Companies .................................................................................... 69 Part A: NGGH ................................................................................................................................. 69 Part B: Subsidiaries of NGGH ...................................................................................................... 69 Part C: Particulars of other interests held by NGGH ................................................................. 70 Part D: New XxxX Subsidiaries .................................................................................................... 72 Schedule 2 Pre-Closing Steps ..................................................................................................... 74 Part A .............................................................................................................................................. 74

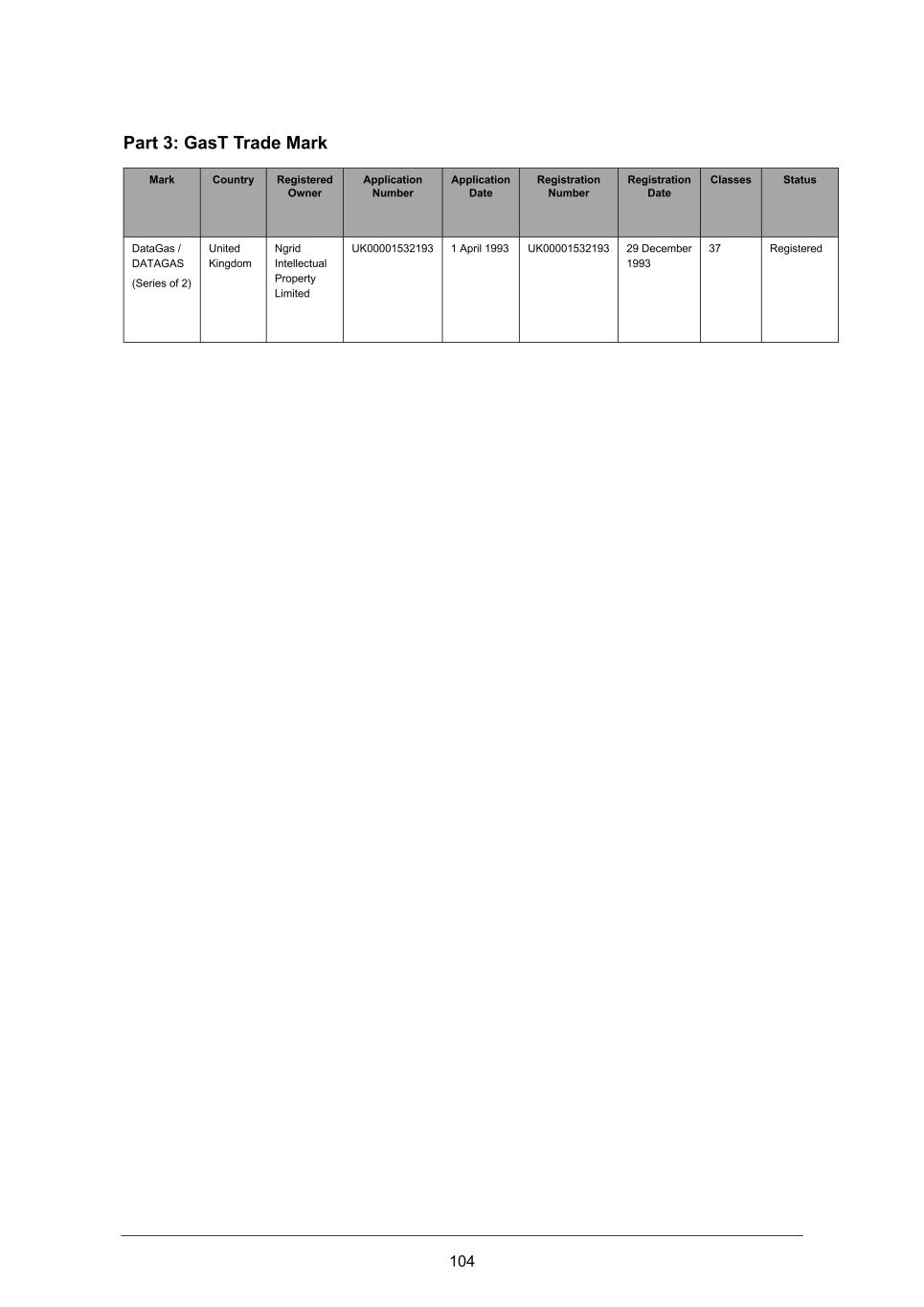

ii Part B .............................................................................................................................................. 74 Schedule 3 Closing Obligations (Clause 6) ................................................................................ 76 Schedule 4 NGGH Transfer (Clause 2.2) ..................................................................................... 79 Schedule 5 Permitted Leakage (Clause 1.1) ............................................................................... 81 Schedule 6 Warranties given by the Seller under Clause 13.1 ................................................. 83 Schedule 7 Warranties given by the Investor under Clause 13.3 ............................................. 95 Schedule 8 Warranties given by the New XxxX Subsidiaries under Clause 13.4 ................... 96 Schedule 9 Committee .................................................................................................................. 97 Schedule 10 Deed of Adherence .................................................................................................. 99 Schedule 11 Intellectual Property Rights .................................................................................. 101 Part 1: Use of Seller Trade Marks .............................................................................................. 101 Part 2: Owned Patents ................................................................................................................ 102 Part 3: XxxX Trade Xxxx ............................................................................................................. 104 Schedule 12 Locked Box Accounts ........................................................................................... 105

1 Acquisition Agreement This Agreement is made on 27 March 2022 between: (1) LATTICE GROUP LIMITED a company incorporated in England and Wales with registered number 03900804 and whose registered office is at 0-0 Xxxxxx, Xxxxxx, XX0X 0XX, Xxxxxx Xxxxxxx (the “Seller”); and (2) LUPPITER BIDCO LIMITED a company incorporated in England and Wales with registered number 13987703 and whose registered office is at Ropemaker Place, 00 Xxxxxxxxx Xxxxxx, Xxxxxx, XX0X 0XX, Xxxxxx Xxxxxxx (the “Investor”). Whereas: (A) Pursuant to this Agreement: (a) prior to the Closing Date: (i) the Seller has agreed to implement the Pre-Closing Steps in Part A of Schedule 2 and the parties have agreed to implement the Pre-Closing Steps in Part B of Schedule 2, including to incorporate and procure the incorporation of XxxX TopCo, XxxX PledgeCo and XxxX MidCo and to procure that such companies accede to this Agreement upon their incorporation; (ii) the Investor has agreed to subscribe for the Majority Owner Shares and the Seller has agreed to subscribe for the Minority Owner Shares on the terms and subject to the conditions of this Agreement; and (iii) the parties shall take the further actions attributed to them set out in Schedule 2 on the terms and subject to the conditions of this Agreement; and (b) on the Closing Date: (i) XxxX MidCo shall acquire the NGGH Shares; and (ii) the parties shall take the further actions attributed to them as set out in Schedule 3 and Schedule 4. (B) The Seller and the Investor have each agreed to enter into the Shareholders’ Agreement on the Closing Date to regulate their respective rights in the XxxX Group following Closing. (C) Following Closing, the parties have agreed to implement, and where relevant, procure that the XxxX Group shall implement, the Post-Closing Steps. It is agreed as follows: 1 Interpretation In this Agreement, unless the context otherwise requires, the provisions in this Clause 1 apply: 1.1 Definitions “£A” means an amount equal to the Investor’s Proportion of the amount of the stamp duty and SDRT payable as a result of the NGGH Transfer;

2 “£B” means an amount equal to the Seller’s Proportion of the amount of the stamp duty and SDRT payable as a result of the NGGH Transfer; “£L” means an amount equal to the XxxX MidCo Closing Utilisation Amount less the sum of (i) £M; and (ii) £P; “£M” means an amount equal to the principal amount of debt to be pushed down to NGG in accordance with Step 8 of Schedule 4; “£P” means the aggregate amount of upfront fees, commitment fees, agency and security trustee fees payable to creditors by XxxX MidCo under the XxxX MidCo Financing Documents on or around the Closing Date; “£X” means an amount equal to: (i) ((the Base Consideration less the XxxX MidCo Closing Net Proceeds Amount) multiplied by the Investor’s Proportion); plus (ii) an amount equal to the Additional Consideration multiplied by the Investor’s Proportion; minus (iii) the Investor’s Proportion of any Notified Leakage and Additional Notified Leakage; “£Y” means an amount equal to: (i) ((the Base Consideration less the XxxX MidCo Closing Net Proceeds Amount) multiplied by the Seller’s Proportion); plus (ii) an amount equal to the Additional Consideration multiplied by the Seller’s Proportion; minus (iii) the Seller’s Proportion of any Notified Leakage and Additional Notified Leakage; “9.14 Consent Transaction” has the meaning given in Clause 4.1.5; “Accounts” means the NGGH Accounts and the NGG Accounts; “Accounts Date” means 31 March 2021; “Additional Consideration” has the meaning given in Clause 3.1.3(ii); “Additional Leakage” has the meaning given in Clause 11.3; “Additional Notified Leakage” has the meaning given in Clause 11.3.2; “Affiliate” means, in relation to a party, any subsidiary undertaking of that party, any parent undertaking of that party and any subsidiary undertaking of any such parent undertaking; “Affiliate Contracts” means any agreement or arrangement between or among any members of the Seller’s Group, on the one hand, and any XxxX Group Company, on the other hand, but excluding any agreement which is a Transaction Document or which is a Terminating Affiliate Contract; “Agreed Form” means, in relation to any document, such document in the terms agreed between the Seller and the Investor and signed for identification by the Investor’s Lawyers and the Seller’s Lawyers with such alterations as may be agreed in writing between the Seller and the Investor from time to time;

3 “Announcement” means the announcement in the Agreed Form; “Anti-Corruption Laws” means: (i) the U.S. Foreign Corrupt Practices Act of 1977; (ii) the UK Xxxxxxx Xxx 0000; (iii) the UK Proceeds of Crime Xxx 0000; and (iv) any applicable anti-bribery, anti-corruption or anti-money laundering-related law or regulation enacted or in force in any jurisdiction, whether in connection with or arising from the OECD Convention on Combating Bribery of Foreign Public Officials in International Business Transactions or otherwise, in all cases as amended, supplemented or substituted from time to time; “B4 Notification” means a notification from NGG to the Authority pursuant to paragraphs (2) and (3) of standard special licence condition B4, in a form to be approved by the Investor, acting reasonably; “Base Consideration” means [***]; “BNPP Margin Waiver Facility” means the margin facility relating to the commodities trading account numbered [***] between BNP Paribas Commodity Futures Limited and NGG dated 26 February 2016, as novated from BNP Paribas Commodity Futures Limited to BNP Paribas SA on 1 February 2019 and as amended and restated from time to time, including on 21 February 2022; “Bring Down Disclosure Letter” has the meaning given in Clause 13.1.3; “Business Day” means a day which is not a Saturday, a Sunday or a public holiday in England or Luxembourg; “Business Policies” means the operational business policies and procedures of the XxxX Group approved by the board of directors of the XxxX Group Companies from time to time (including policies and procedures in relation to safety, anti-bribery and corruption and procurement); “Business Warranties” means the warranties set out in in Schedule 6 (excluding any Fundamental Warranties or Tax Warranties) and “Business Warranty” means any one of them; “Business Warranty Claim” means a claim for breach of a Business Warranty; “Businesses” means the Transmission Business and the Metering Business; “Captive Insurance Policies” means any and all policies issued by and/or reinsured by and/or participated in by, or where an indemnity is provided by, the Captive Insurer; “Captive Insurer” means National Grid Insurance Company (Isle of Man) Ltd; “CCL” means the tax known as climate change levy as levied in accordance with Schedule 6 to the Finance Xxx 0000; “CCL Claim” means a claim against the Seller for breach of or under Clause 7.3.1; “Claim” means a claim against the Seller for breach of or under this Agreement excluding: (i) any claim under Clause 7; (ii) a claim for breach of or under Clause 11; (iii) a CCL Claim

4 or Tax Claim; (iv) any claim against the Seller under, or for breach of, Clauses 5.1, 8, 10.1, 14.11.1 or 19.16 or (v) any claim for breach of the Seller’s obligations under Clause 2; “Closing” means the completion of the NGGH Transfer pursuant to Clause 6; “Closing Date” means the date on which Closing takes place; “CMA” means the Competition and Markets Authority; “CMA Competition Condition” has the meaning given in Clause 4.1.2; “CMA Merger Investigation” means an investigation by the CMA to determine whether to make a reference under Article 33 of the Enterprise Xxx 0000; “CMA Phase 2 Reference” means a reference of the Combination to the chair of the United Kingdom Competition and Markets Authority under Article 33 of the Enterprise Xxx 0000 for the constitution of a group under schedule 4 to the Enterprise and Regulatory Reform Xxx 0000; “Collective Bargaining Agreement” means the revised collective bargaining agreement relating to levels 1 – 8 staff pay for the period 1 April 2021 to 31 March 2022 with the Trade Unions; “Commercial NGM VDD Report” means the commercial due diligence report dated 9 November 2021 prepared by DNV Services UK Limited in respect of the Metering Business; “Competent Authority” means: (i) any person (whether autonomous or not) having legal and/or regulatory authority and/or enforcement powers, including the Secretary of State, XXXX, Ofgem and the Competition and Markets Authority; (ii) any court of law or tribunal in any jurisdiction; (iii) any Tax Authority; and/or (iv) any HSE Authority; “Compliance Statement” means a compliance statement prepared by each of NGG and NGGH and to be delivered to Ofgem prior to any dividends being declared by NGG and NGGH (respectively) pursuant to Step 8 of Schedule 4; “Confidentiality Agreement” means the confidentiality agreement dated 16 November 2021 as amended by a side letter dated 31 January 2022 between NG and Macquarie Global Infrastructure Fund SCSp (acting by its portfolio manager Macquarie Infrastructure and Real Assets (Europe) Limited) pursuant to which NG made available to Macquarie Global Infrastructure Fund SCSp (acting by its portfolio manager Macquarie Infrastructure and Real Assets (Europe) Limited) and/or the Investor certain confidential information relating to the XxxX Group; “Connected Person” has the meaning given in section 1122 of the CTA 2010; “Consent Condition” has the meaning given in Clause 4.1.5; “Consents Application” has the meaning given in Clause 4.2.7(i)(b); “CTA 2010” means Corporation Tax Xxx 0000; “Cyber VDD Report” means the cyber security due diligence report dated 26 January 2022 prepared by PricewaterhouseCoopers LLP; “Data Room” means the electronic data room hosted by Intralinks containing documents and information relating to the Existing XxxX Subsidiaries made available by the Seller online and recorded on a USB in the Agreed Form, the contents of which are listed in Schedule 1 to the Disclosure Letter;

5 “Deed of Adherence” means the deed of adherence to this Agreement to be entered into by each of XxxX TopCo, XxxX PledgeCo and XxxX MidCo in accordance with Part B of Schedule 2, substantially in the form set out in Schedule 10; “Deed of Guarantee” means a deed of guarantee in the Agreed Form between NGH1 and NGG relating to the Transitional Services Agreement; “Diligence Reports” means the Legal VDD Report, the Cyber VDD Report, the Financial VDD Report, the Real Estate VDD Report, the Commercial NGM VDD Report and the Environmental NGGT VDD Report; “Disclosed” means any fact, matter or circumstance fairly disclosed to the Investor in such manner and in sufficient detail to enable the Investor to assess the nature, scope and extent of the matter disclosed; “Disclosure Letter” means the letter dated on the same date as this Agreement from the Seller to the Investor disclosing information constituting exceptions to the Seller’s Warranties; “EIB Loans” means: (i) the £266,800,000 retail price index linked loan (outstanding principal amount as at 31 March 2021); and (ii) the £279,200,000 retail price index linked loan (outstanding principal amount as at 31 March 2021), each advanced to NGG under the finance contract dated 28 February 2007 between NGG as the borrower and the European Investment Bank as the bank (as amended from time to time); “Employees” means the employees of the Existing XxxX Subsidiaries and “Employee” means any one of them; “Encumbrance” means any claim, charge, mortgage, lien, option, equitable right, power of sale, pledge, hypothecation, retention of title, right of pre-emption, right of first refusal or other third party right or security interest of any kind or an agreement, arrangement or obligation to create any of the foregoing; “Environment” has the meaning given to it in paragraph 10.1 of Schedule 6; “Environmental NGGT VDD Report” means the environmental due diligence report dated 4 November 2021 prepared by DNV Services UK Limited in respect of the Transmission Business; “Equity Commitment Letters” means the letters in the Agreed Form, dated with the date of this Agreement addressed to the Seller, Luppiter Ventures 1 S.À X.X., Luppiter Ventures 2 S.À X.X. and the Investor (as applicable) [***]; “EU Competition Condition” has the meaning given in Clause 4.1.1; “Excess Cash Dividend” means a dividend in the amount of £225,000,000 to be declared and paid by NGGH to the Seller; “Existing Budget” means the existing budget in respect of the XxxX Group and contained in the column headed “2023E” in the Initial Business Plan;

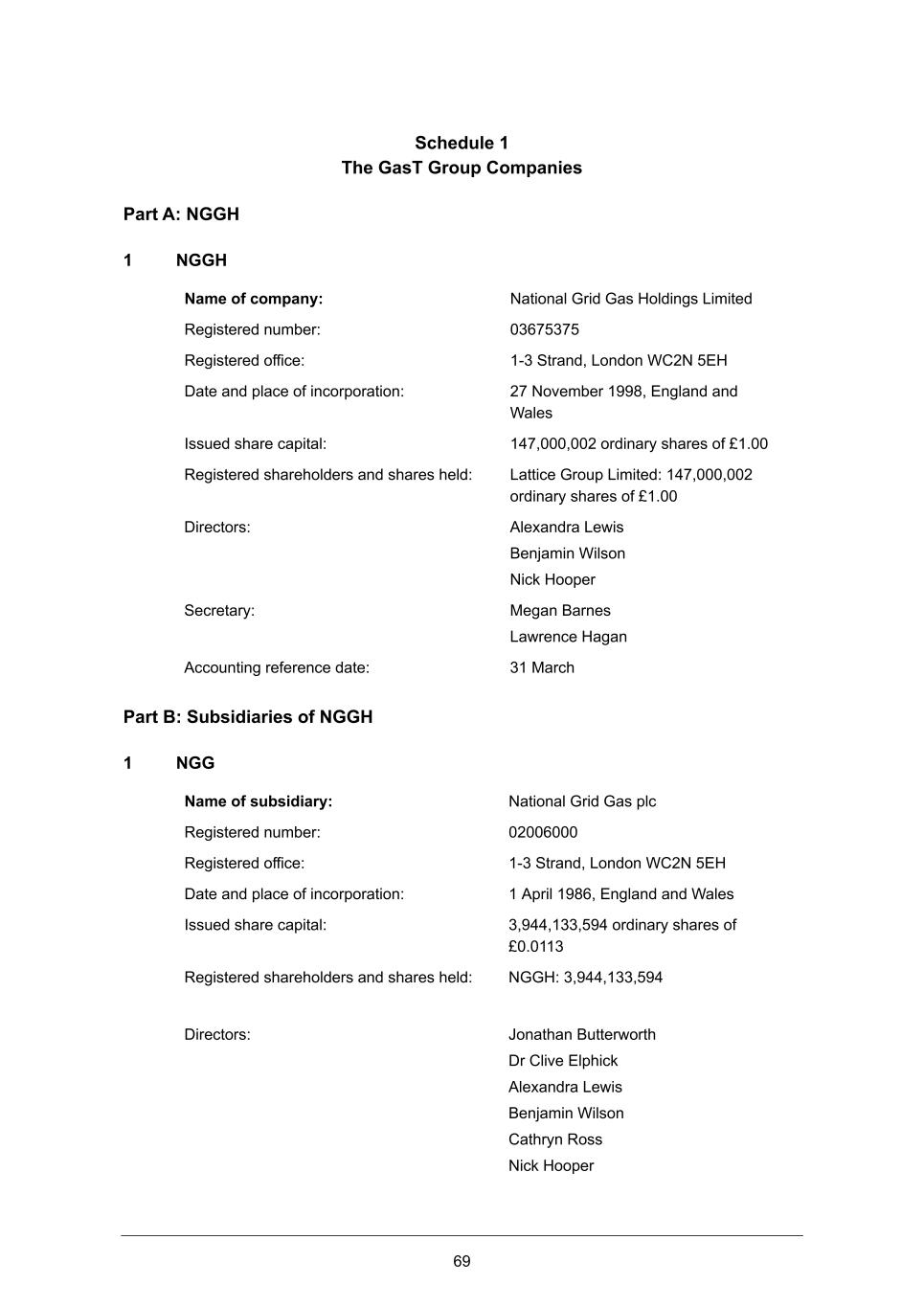

6 “Existing XxxX Subsidiaries” means NGGH and the subsidiaries listed in Part B of Schedule 1, and “Existing XxxX Subsidiary” means any one of them; “[***] Liability” means: (i) the liability of an Existing XxxX Subsidiary to pay or repay to [***] or any of its affiliates any amounts owed by that Existing XxxX Subsidiary by way of consideration for group relief surrendered to that Existing XxxX Subsidiary under Chapter IV Part X or the Income and Corporation Taxes Act 1988 (including where instructed to do so by or on behalf of the Seller (formerly Lattice Group plc) in accordance with the Seller’s procurement obligations under Clause 10 of a tax agreement dated 15 September 2000 between the Seller and [***] (the “[***] Group Relief Surrender”) and any liability to pay interest on such amounts accrued on or before the Locked Box Date; or (ii) any liability or increased liability to Taxation of an Existing XxxX Subsidiary arising (or that will arise as a result of the utilisation of any Investor’s Relief to mitigate the [***] Liability requested by the Seller in accordance with Clause 15.7) as a result of the utilisation by [***] or any of its Affiliates of a [***] Group Relief Surrender or any actions taken by, or taken by a XxxX Subsidiary at the instruction of, the Seller pursuant to Clause 15.7 (in each case, other than any interest accruing after the Locked Box Date); “[***] Liability Claim” has the meaning given to it in Clause 15.7; “[***] Overprovision” means the amount by which the [***] Liability is overprovided for in the Locked Box Accounts (including where no [***] Liability arises or is payable); “Financial VDD Report” means each volume of the financial due diligence report dated 19 November 2021 prepared by PricewaterhouseCoopers LLP as included in folder 1.5 of the Data Room; “FRS 101” means “FRS 101 Reduced Disclosure Framework” issued by the Financial Reporting Council; “Fundamental Warranties” means the warranties set out in paragraphs 1.1, 1.2, and 16 of Schedule 6 and “Fundamental Warranty” means any one of them; “Fundamental Warranty Claim” means any claim in respect of a breach of any of the Fundamental Warranties; “Further Acquisition Agreement” means the agreement between the Investor and the Seller to be entered into on the date hereof pursuant to which the Investor has the option to acquire from the Seller the Minority Owner Shares; “Further Excess Cash Dividend” has the meaning given in Clause 5.9; “Gas Forecasting GSA” means the gas forecasting general services agreement in the Agreed Form to be entered into between NGESO and NGG on or around 1 April 2022; “XxxX Group” means XxxX TopCo and any XxxX Group Companies from time to time; “XxxX Group Companies” means XxxX TopCo and its subsidiaries as listed in Schedule 1, together with any other subsidiaries of XxxX TopCo from time to time and “XxxX Group Company” means any one of them;

7 “XxxX Insurance Policies” means the River Humber Policy and any other insurance policies that may be held exclusively by and for the benefit of the XxxX Group Companies and “XxxX Insurance Policy” means any one of them; “XxxX Licence” means the transporter licence held by NGG in relation to NGG’s UK gas transmission business pursuant to section 7(2) of the Gas Xxx 0000; “XxxX MidCo” means the new company to be incorporated in accordance with Part B of Schedule 2 as a private limited company in England and Wales for the purposes of acquiring all of the issued share capital of NGGH; “XxxX MidCo Closing Net Proceeds Amount” means (i) the XxxX MidCo Closing Utilisation Amount less (ii) £P; “XxxX MidCo Closing Utilisation Amount” means £1,976,377,450; “XxxX MidCo Debt Commitment Letter” means the commitment letter in the Agreed Form in respect of the XxxX MidCo Financing Documents dated or about the date of this Agreement between, amongst others, the Investor, the Seller and the lenders named therein; “XxxX MidCo Financing Documents” means the Agreed Form ISFA, the Agreed Form Initial DSR LFA, the Agreed Form Hedging Letter, the Agreed Form Security Agreement, the Agreed Form Arrangement Fee Letter, the Agree Form Fee and Margin Letter, the Agreed Form CTA, the Agreed Form MDA, the Agreed Form STID and the Agreed Form ABA (each such term as defined in the XxxX MidCo Debt Commitment Letter), in each case, in the Agreed Form and appended to the XxxX MidCo Debt Commitment Letter; “XxxX OpCo Debt Commitment Letter” means the commitment letter in the Agreed Form in respect of the XxxX OpCo Facilities Agreement dated or about the date of this Agreement between, amongst others, the Investor, the Seller and the lenders named therein; “XxxX OpCo Facilities Agreement” means the term and revolving credit facilities agreement to be entered into by NGG as borrower in the Agreed Form and appended to the XxxX OpCo Debt Commitment Letter; “XxxX OpCo Netting Agreement” means the netting agreement to be entered into by, amongst others, NGG and XxxX MidCo and certain of the lenders under the XxxX MidCo Financing Documents and the XxxX OpCo Facilities Agreement in the Agreed Form; “XxxX PledgeCo” means the new company to be incorporated in accordance with Part B of Schedule 2 as a private limited company in England and Wales for the purposes of providing share security to creditors of XxxX MidCo; “XxxX PledgeCo Note” means the loan note in the Agreed Form in the amount of the XxxX TopCo Note Amount to be issued by XxxX MidCo to XxxX PledgeCo on Closing; “XxxX TopCo” means the new holding company to be incorporated in accordance with Part B of Schedule 2 as a private limited company in England and Wales; “XxxX TopCo Articles” means the proposed articles of incorporation for XxxX TopCo in the Agreed Form; “XxxX TopCo Note” means the loan note in the Agreed Form in the amount of the XxxX TopCo Note Amount to be issued by XxxX PledgeCo to XxxX TopCo on Closing; “XxxX TopCo Note Amount” means the sum of: (i) £A; plus (ii) £B; plus (iii) £X; plus (iv) £Y;

8 “XxxX Trade Xxxx” means the xxxx DATAGAS, including the trade xxxx registration set out in Part 3 of Schedule 11; “XXXX” means the Gas and Electricity Markets Authority, which includes its regulatory body Ofgem; “XXXX 2005 Consent A39” means the consent issued by XXXX dated 1 May 2005 in connection with Standard Special Condition A39 (Indebtedness); “XXXX 2005 Consent Variation” has the meaning given in Clause 4.2.8(ii)(b); “Group Relief” means any surrender of group relief pursuant to Part 5 or Part 5A CTA 2010 and any other Relief available between members of a group or connected or associated persons for any Tax purpose; “Group Tax Arrangement” means(i) the VAT group entered into pursuant to section 43(1) VATA 1994 with registration number 547 8630 11 of which National Grid ElectricityTransmission Plc is the representative member; and (ii) the group payment arrangement entered into pursuant to section 59F Taxes Management Xxx 0000 under which NGH1 is the nominated company (the “Group Payment Arrangement”); “Hazardous Substances” has the meaning given to it in paragraph 10.1 of Schedule 6; “Health and Safety Matters” has the meaning given to it in paragraph 10.1 of Schedule 6; “Hive Out Agreement” means the hive out agreement dated 30 September 2016 entered into between NGG and Cadent Gas Limited (formerly known as National Grid Gas Distribution Limited) relating to the sale of the distribution business from NGG to Cadent Gas Limited (the “Hive Out”); “Hive Out Agreement Warranty” means the warranty given by the Seller on the date of this agreement in respect of the Hive Out as set out in Clause 8; “HMRC” means Her Majesty’s Revenue and Customs; “HSE”, “HSE Authority”, “HSE Law”, “HSE Matters” and “HSE Permit” have the meanings given to them in paragraph 10.1 of Schedule 6; “IFRS” means the body of pronouncements issued by the International Accounting Standards Board (IASB) including International Financial Reporting Standards and interpretations approved by the IASB, International Accounting Standards and Standing Interpretations Committee interpretations approved by the predecessor International Accounting Standards Committee; “Incorporation Date” means the date of incorporation of XxxX TopCo in accordance with Part B of Schedule 2 agreed in writing between the Investor and the Seller as soon as possible after the date of this Agreement; “Indebtedness” means, in relation to any person, all loans or other financing liabilities, together with interest accrued but excluding trading debt or liabilities arising in the ordinary course of trading; “Indemnity Claim” means a claim against the Seller for breach of or under Clause 7; “Information Access Agreement” means the mutual information access agreement to be entered into between NGUK and NGG in respect of the information access services to be provided following Closing;

9 “Information Memorandum” means the document entitled “Project Jupiter Information Memorandum” dated 11 November 2021; “Initial Budget” means the initial budget for the XxxX Group to be prepared in accordance with Clause 5.6; “Initial Business Plan” means the initial business plan for the XxxX Group in the Agreed Form (which shall be the Initial Business Plan referred to in the Shareholders’ Agreement); “Initial Financing Plan” means the initial financing plan for the XxxX Group in the Agreed Form (which shall be the Initial Financing Plan referred to in the Shareholders’ Agreement); “Insurance Indemnity Deed” means the deed of indemnity in the Agreed Form to be entered into between NGG and the Captive Insurer in relation to the indemnification and reinsurance of certain insurance policies, to be entered into on Closing; “Intellectual Property Rights” means trade marks, service marks, rights in trade names, business names, logos and get-up, patents, rights in inventions, registered and unregistered design rights, copyrights, database rights, rights in domain names and URLs, and all other similar rights in any part of the world (including in Know-how) including, where such rights are obtained or enhanced by registration, any registration of such rights and applications and rights to apply for such registrations; “Investor Equity Amount” means an amount equal to the sum of the Investor Note Amount plus the Investor Subscription Amount; “Investor Note” means the loan note in the Agreed Form in the amount of the Investor Note Amount to be issued by XxxX TopCo to the Investor on Closing; “Investor Note Amount” means the sum of: (i) £X; plus (ii) £A; “Investor Subscription Amount” has the meaning given to it in Clause 3.1.1; “Investor’s Group” means the Investor and its subsidiaries from time to time (including, for the avoidance of doubt, the XxxX Group Companies with effect from Closing); “Investor’s Lawyers” means CMS Xxxxxxx XxXxxxx Nabarro Olswang LLP of Xxxxxx Place, 00 Xxxxxx Xxxxxx, Xxxxxx XX0X 0XX; “Investor’s Proportion” means 60 per cent., being the Investor’s proportional ownership of XxxX TopCo; “Investor’s Relief” has the meaning given in the Tax Indemnity; “IP Rights Agreement” means an agreement to be entered into between NGG and National Grid Carbon Limited to assign or perpetually licence certain intellectual property rights from research and design work carried out for National Grid Carbon Limited for CO2 transport in NGG’s Feeder 10 pipeline for a consideration of approximately £100,000; “Know-how” means non-trivial industrial and commercial information and techniques, in each case, in any form and not in the public domain, and including drawings, formulae, processes, methodologies, test results, reports, research, project reports and testing procedures, instruction and training manuals, tables of operating conditions, market forecasts, lists and particulars of customers and suppliers;

10 “KPMG Report” means the report dated 9 November 2021 prepared by KPMG entitled “Project Jupiter: GB Illustrative Macro Energy Transition Scenarios and potential regulatory implications”; “Lattice Dividend” means the dividend in the amount of £261,000,000 declared and paid by NGGH to the Seller in July 2021; “Lattice Note” means the loan note in the Agreed Form in the amount of the Lattice Note Amount to be issued by XxxX TopCo to the Seller on Closing; “Lattice Note Amount” means an amount equal to the sum of: (i) £B; plus (ii) £Y; “Lattice Promissory Note” means the promissory note in the Agreed Form in the amount of the Lattice Promissory Note Amount to be issued by the Seller to XxxX TopCo on Closing; “Lattice Promissory Note Amount” means the sum of £Y; “Laws” means the laws and regulations applicable to any member of the Seller’s Group or XxxX Group or any Shareholder (as appropriate) including, where applicable, the rules of any stock exchange on which the securities of a Shareholder are listed or other governmental or regulatory body to which a Shareholder is subject; “Leakage” means the following to the extent incurred by any Existing XxxX Subsidiary during the Locked Box Period: (i) any dividend or distribution (whether in cash or in kind) declared, paid or made or agreed to be paid or made by any Existing XxxX Subsidiary to or for the benefit of the Seller or any member of the Seller’s Group (other than a XxxX Group Company) or any of their respective Connected Persons; (ii) any payments made (including bonuses, loan repayments, management fees or monitoring fees) or agreed to be made by or on behalf of any Existing XxxX Subsidiary to the Seller or any member of the Seller’s Group (other than an Existing XxxX Subsidiary) or any of their respective Connected Persons; (iii) any assets transferred or agreed to be transferred by or on behalf of any Existing XxxX Subsidiary to the Seller or any member of the Seller’s Group (other than an Existing XxxX Subsidiary) or any of their respective Connected Persons if and to the extent such assets are transferred or agreed to be transferred at less than fair value or not on arm’s length terms; (iv) any liabilities assumed, indemnified or incurred or agreed to be assumed, indemnified or incurred (including under any guarantee, indemnity or other security) by or on behalf of any Existing XxxX Subsidiary to or for the benefit of the Seller or any member of the Seller’s Group (other than an Existing XxxX Subsidiary) or any of their respective Connected Persons, other than pursuant to agreements or arrangements on an arm’s length basis for at least fair value; (v) the waiver or agreement to waive by or on behalf of any Existing XxxX Subsidiary of any amount owed to that Existing XxxX Subsidiary by the Seller or any member of the Seller’s Group (other than an Existing XxxX Subsidiary) or any of their respective Connected Persons; (vi) any return of capital (whether by reduction of capital, redemption, purchase of shares or otherwise) declared, paid or agreed to be declared, paid or made by Existing XxxX Subsidiary to or for the benefit of the Seller or any member of the Seller’s Group;

11 (vii) any bonuses paid or payable including employers’ social security contributions (or any similar tax) paid or payable on such amounts in connection with the NGGH Transfer (but for the avoidance of doubt excluding any Transaction Bonuses); (viii) any professional fees, external expenses or other costs of the Seller or any member of the Seller’s Group or any of their Connected Persons relating to the implementation of the Steps Plan, entry into of this Agreement, the subscription for the Minority Owner Shares or the NGGH Transfer paid, or incurred, or agreed to be paid or incurred, by any Existing XxxX Subsidiary (but for the avoidance of doubt shall not include any such professional fees, external expenses or other costs incurred by any Existing XxxX Subsidiary for the benefit of the Existing XxxX Subsidiaries in connection with separation activities); and (ix) any Taxation paid or payable by any Existing XxxX Subsidiary (or which would be been paid or payable by any Existing XxxX Subsidiary but for the use of an Investor’s Relief) as a consequence of any of the matters referred to in paragraphs (i) to (viii) above) (except if and to the extent that such Taxation has already been taken into account under paragraphs (i) to (viii) above), in each case net of any Leakage Tax Saving and further does not include any Permitted Leakage; “Leakage Tax Saving” means: (i) the amount of any VAT arising in respect of the relevant Leakage which is recoverable as input tax by an Existing XxxX Subsidiary or the representative member of any VAT group of which it is a member; (ii) the amount by which a cash Tax liability for which an Existing XxxX Subsidiary would otherwise have been accountable or liable to be assessed in the accounting period in which the relevant Leakage occurs or the subsequent accounting period (and for these purposes it shall be deemed that the accounting reference date of each Existing XxxX Subsidiary remains 31 March) is or will be reduced (or extinguished) as a result of the utilisation of any Relief arising in respect of the relevant Leakage; (iii) the amount of any cash refund received or which will be received by an Existing XxxX Subsidiary from a Tax Authority in the accounting period in which the relevant Leakage occurs or the subsequent accounting period (and for these purposes it shall be deemed that the accounting reference date of each Existing XxxX Subsidiary remains 31 March) as a result of the relevant Leakage; “Legal VDD Report” means the legal due diligence report dated 1 December 2021 prepared by, amongst others, the Seller’s Lawyers; “Locked Box Accounts” means the unaudited consolidated accounts (being the profit and loss account, balance sheet statement and cashflow statement) of the Existing XxxX Subsidiaries for the 12 months ending on the Locked Box Date, as attached in Schedule 12; “Locked Box Date” means 31 March 2021; “Locked Box Period” means the period between 12.01 a.m. on the date following the Locked Box Date up to (and including) the Closing Date; “Long Stop Date” means 29 September 2023;

12 “Losses” means all losses, liabilities (including to Tax), costs (including legal costs and experts’ and consultants’ fees), charges, expenses, actions, proceedings, claims and demands; “Major Properties” means the 60 properties, comprising key strategic properties and a sample of other important properties to demonstrate that NGG has the land and rights required to run the Businesses and give an indication of the types of properties and rights in the portfolio, which are detailed in the Real Estate VDD Report; “Majority Owner Shares” means 30,000 Ordinary Shares to be issued and allotted by XxxX TopCo to the Investor pursuant to this Agreement; “Material Contracts” means an agreement, commitment or arrangement which: (i) is not included in any existing budget or business plan for the Existing XxxX Subsidiaries and associated with expenditure of £10,000,000 per annum (exclusive of VAT) or greater on an annual basis or £50,000,000 (exclusive of VAT) or greater over the duration of the relevant arrangement in accordance with its terms; or (ii) is not in the ordinary course of business and with a value of more than £1,000,000; “Metering Business” means the range of metering services, including the provision and maintenance of supply meter installations and devices for suppliers and/or consumers in the competitive metering market in Great Britain, principally but not exclusively undertaken by the Existing XxxX Subsidiaries through NGM; “Minority Owner Shares” means 20,000 Ordinary Shares to be issued and allotted by XxxX TopCo to the Seller pursuant to this Agreement; “New XxxX Subsidiaries” means XxxX TopCo, XxxX PledgeCo and XxxX MidCo, details of which are set out in Part D of Schedule 1 and “New XxxX Subsidiary” shall mean any one of them; “New NGH1 Indemnity” has the meaning given in Clause 4.2.8(ii)(c); “NG” means National Grid plc, a company incorporated in England and Wales with registered number 04031152 and whose registered office is at 0-0 Xxxxxx, Xxxxxx XX0X 0XX, Xxxxxx Xxxxxxx; “NG Loan Agreement” means the uncommitted loan agreement between NGG (as borrower/lender) and NG (as lender/borrower), under which each of NGG and NG make available to the other party an uncommitted loan facility; “NGESO” means National Grid Electricity System Operator Limited, a company incorporated in England and Wales with registered number 11014226 and whose registered office is at 1- 0 Xxxxxx, Xxxxxx XX0X 0XX, Xxxxxx Xxxxxxx; “NGET” means National Grid Electricity Transmission plc, a company incorporated in England and Wales with registered number 02366977 and whose registered office is at 0-0 Xxxxxx, Xxxxxx XX0X 0XX, Xxxxxx Xxxxxxx; “NGG” means National Grid Gas plc, a company incorporated in England and Wales with registered number 2006000 and whose registered office is at 0-0 Xxxxxx, Xxxxxx XX0X 0XX, Xxxxxx Xxxxxxx; “NGG Accounts” means the audited consolidated accounts of the Existing XxxX Subsidiaries listed in Part B of Schedule 1 (including the balance sheet, profit and loss

13 account and statement of comprehensive income and the notes to the accounts) as at, and for the 12-month period ended on, the Accounts Date; “NGG Deed Poll” means the deed poll to be entered into by NGG to undertake in favour of the trustees of NGG’s public bonds to comply with an additional leverage-based restriction set at 72.5%; “NGG-NGGH Loan Amendment Agreement” means the loan amendment agreement in the Agreed Form to be entered into by NGG and NGGH to amend the term loan agreement between such parties originally dated 10 December 2019 and most recently amended and restated on 29 November 2021; “NGG Payment Guarantee” means the NGH1 deed of guarantee in favour of Transco plc (now NGG), between NGH1, NGG, Blackwater F Limited, Blackwater G Limited, Blackwater SCA Limited and Blackwater 2 Limited dated 1 May 2005; “NGG Payment Guarantee Deed of Termination” means the deed of termination in the Agreed Form to be entered into by NGG and NGH1 on Closing, terminating the NGG Payment Guarantee; “NGG Replacement Payment Guarantee” means the deed of guarantee in favour of NGG in the Agreed Form to be entered into by NGG and NGH1 on Closing; “NGGH” means National Grid Gas Holdings Limited, a company incorporated in England and Wales with registered number 03675375 and whose registered office is at 0-0 Xxxxxx, Xxxxxx XX0X 0XX, Xxxxxx Xxxxxxx; “NGGH Accounts” means the audited company accounts of NGGH (including the balance sheet, profit and loss account and the notes to the accounts) as at, and for the 12-month period ended on, the Accounts Date; “NGGH Consideration” has the meaning given to it in Clause 3.1.3(ii); “NGGH Dividend” means the dividend in the amount of £316,421,864.40 declared and paid by NGGH to Lattice on 10 December 2021; “NGGH Shares” means all of the issued ordinary shares in the capital of NGGH; “NGGH Transfer” means the transfer of the NGGH Shares by the Seller to XxxX MidCo; “NGH1” means National Grid Holdings One plc, a company incorporated in England and Wales with registered number 02367004 and whose registered office is at 0-0 Xxxxxx, Xxxxxx, XX0X 0XX, Xxxxxx Xxxxxxx; “NGH1 Indemnity” means the deed of undertaking and indemnity dated 6 May 2005 given by NGH1 in favour of Transco Holdings plc (now NGGH) in connection with the XXXX 2005 Consent A39; “NGM” means National Grid Metering Limited, a company incorporated in England and Wales with registered number 3705992 and whose registered office is at 0-0 Xxxxxx, Xxxxxx, XX0X 0XX, Xxxxxx Xxxxxxx; “NGPH” means National Grid Property Holdings Limited, a company incorporated in England and Wales with registered number 03797578 and whose registered office is at 0-0 Xxxxxx, Xxxxxx, XX0X 0XX, Xxxxxx Xxxxxxx;

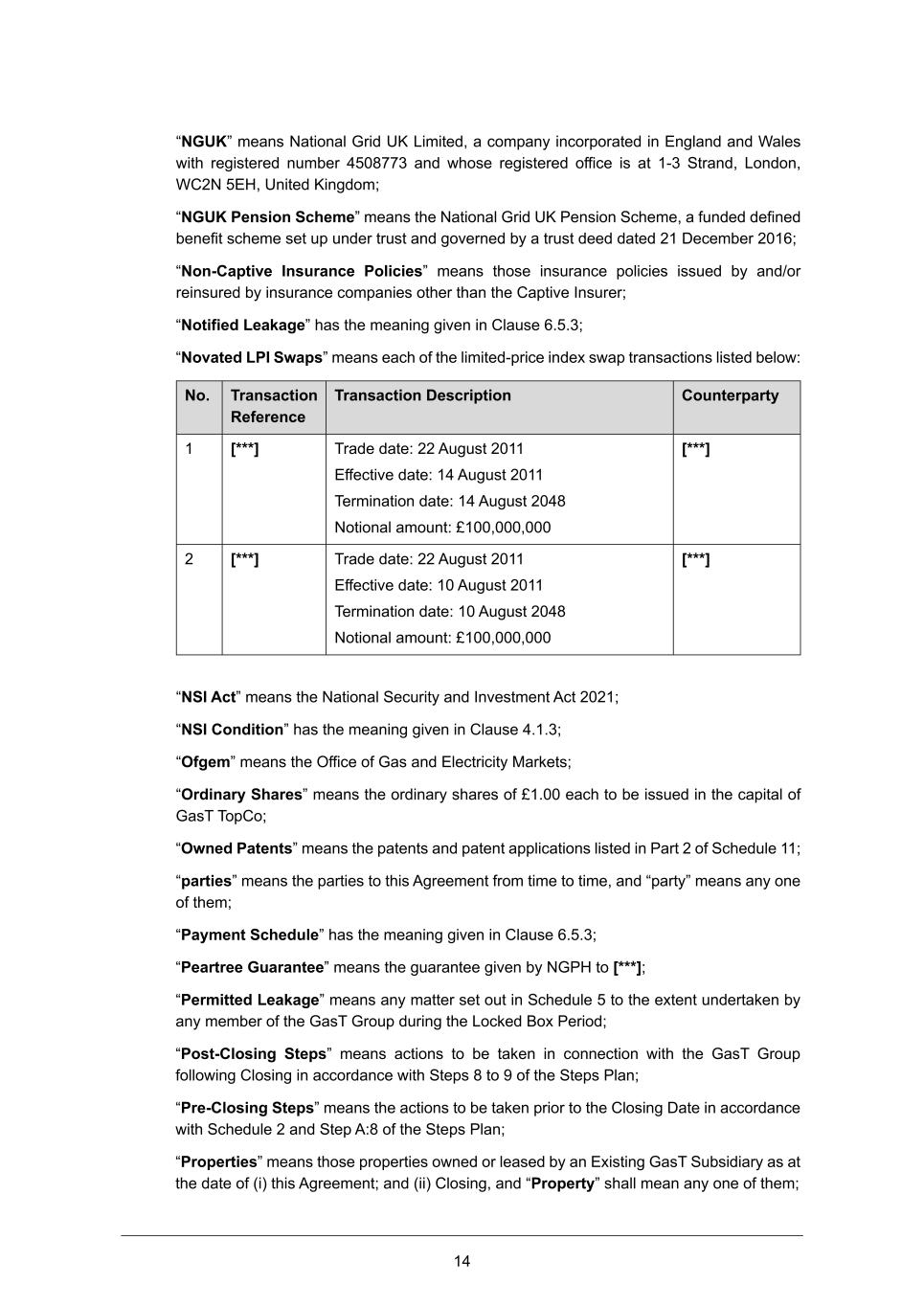

14 “NGUK” means National Grid UK Limited, a company incorporated in England and Wales with registered number 4508773 and whose registered office is at 0-0 Xxxxxx, Xxxxxx, XX0X 0XX, Xxxxxx Xxxxxxx; “NGUK Pension Scheme” means the National Grid UK Pension Scheme, a funded defined benefit scheme set up under trust and governed by a trust deed dated 21 December 2016; “Non-Captive Insurance Policies” means those insurance policies issued by and/or reinsured by insurance companies other than the Captive Insurer; “Notified Leakage” has the meaning given in Clause 6.5.3; “Novated LPI Swaps” means each of the limited-price index swap transactions listed below: No. Transaction Reference Transaction Description Counterparty 1 [***] Trade date: 22 August 2011 Effective date: 14 August 2011 Termination date: 14 August 2048 Notional amount: £100,000,000 [***] 2 [***] Trade date: 22 August 2011 Effective date: 10 August 2011 Termination date: 10 August 2048 Notional amount: £100,000,000 [***] “NSI Act” means the National Security and Investment Xxx 0000; “NSI Condition” has the meaning given in Clause 4.1.3; “Ofgem” means the Office of Gas and Electricity Markets; “Ordinary Shares” means the ordinary shares of £1.00 each to be issued in the capital of XxxX TopCo; “Owned Patents” means the patents and patent applications listed in Part 2 of Schedule 11; “parties” means the parties to this Agreement from time to time, and “party” means any one of them; “Payment Schedule” has the meaning given in Clause 6.5.3; “Peartree Guarantee” means the guarantee given by NGPH to [***]; “Permitted Leakage” means any matter set out in Schedule 5 to the extent undertaken by any member of the XxxX Group during the Locked Box Period; “Post-Closing Steps” means actions to be taken in connection with the XxxX Group following Closing in accordance with Steps 8 to 9 of the Steps Plan; “Pre-Closing Steps” means the actions to be taken prior to the Closing Date in accordance with Schedule 2 and Step A:8 of the Steps Plan; “Properties” means those properties owned or leased by an Existing XxxX Subsidiary as at the date of (i) this Agreement; and (ii) Closing, and “Property” shall mean any one of them;

15 “Real Estate VDD Report” means the real estate due diligence report dated 1 December 2021 prepared by DLA Piper LLP; “Regulatory Requirements” means any applicable requirement of law or of any Competent Authority; “Relevant Consent Entities” means those entities which will be Affiliates (as defined in the XxxX Licence) or Related Undertakings (as defined in the XxxX Licence) of NGG on the Closing Date, as notified in writing by the Investor to the Seller no later than 40 Business Days following the date of this Agreement, and for these purposes, excluding any XxxX Group Companies or a member of the Seller’s Group; “Relevant Period” has the meaning given to it in paragraph 10.1 of Schedule 6; “Relief” shall have the meaning given in the Tax Indemnity; “Reporting Accountants” means Deloitte LLP; “Restricted Person” means a person named on the “Specially Designated Nationals and Blocked Persons” list maintained by the Office of Foreign Assets Control of the U.S. Department of the Treasury, the Consolidated List of Persons and Entities subject to Financial Sanctions maintained by the European Commission, the Consolidated List of Financial Sanctions Targets in the UK maintained by the Office of Financial Sanctions Implementation of HM Treasury, or any similar list maintained pursuant to, or public announcement of sanctions designation under, any Sanctions, in all cases as amended, supplemented or substituted from time to time; “Restricted Shareholder” has such meaning as may be agreed between the parties in writing on or before the date of this Agreement; “River Humber Policy” means the standalone construction insurance programme in respect of the River Humber Pipeline Replacement Project held by and for the benefit of NGG; “Sanctions” means all economic, financial and trade embargoes and sanctions laws, regulations, rules and/or restrictive measures that are from time to time administered, enacted or enforced by: (i) the United Nations Security Council; (ii) the Office of Foreign Asset Control of the United States Treasury Department, the United States Department of State and any other U.S. government entity; (iii) the government of the United Kingdom; (iv) the European Union; and/or (v) any other jurisdiction applicable to any XxxX Group Company; “SDLT” means Stamp Duty Land Tax; “SDRT” means Stamp Duty Reserve Tax; “SDLT Provision” has the meaning given in Clause 14.7; “Secretary of State” means the Secretary of State for Business, Energy and Industrial Strategy; “Seller Note” means the loan note in the Agreed Form in the amount of the sum of £L plus £M to be issued by XxxX MidCo to the Seller on Closing;

16 “Seller Trade Marks” means any trade marks, service marks, business, company or trade names, logos, get-up, or URLs or domain names (“Names”), in each case, owned or registered by any member of the Seller’s Group (including any Names that include (in whole or in part) any of the marks “NATIONAL GRID” or “NATIONALGRID”, or that are colourably the same or similar to the NATIONAL GRID logo (as represented by EU trade xxxx registration no. 004533089)), and any marks which are confusingly similar to, or dilutive of, any such Names, but excluding the XxxX Trade Xxxx; “Seller’s Group” means the Seller and its holding companies and subsidiaries from time to time excluding, for the avoidance of doubt, the XxxX Group from the Closing Date; “Seller’s Insurance Policies” means all insurance policies (whether maintained with third party insurers or any member of the Seller’s Group) including the Captive Insurance Policies and the Non-Captive Insurance Policies, other than XxxX Insurance Policies, maintained by the Seller’s Group under which, immediately prior to the Closing Date, any XxxX Group Company is entitled to any benefit, and “Seller Insurance Policy” means any one of them; “Seller’s Lawyers” means Linklaters LLP of Xxx Xxxx Xxxxxx, Xxxxxx XX0X 0XX, Xxxxxx Xxxxxxx; “Seller’s Pension Schemes” means: (i) the NGUK Pension Scheme; and (ii) the Legal & General WorkSave Mastertrust, a defined contribution pension scheme set up under trust and governed by a trust deed and rules dated 5 December 2018; “Seller’s Proportion” means 40 per cent., being the Seller’s proportional ownership of XxxX TopCo; “Seller’s Warranties” means the warranties given by the Seller pursuant to Clause 13.1 and Schedule 6 and “Seller’s Warranty” means any one of them; “Senior Employee” means the employees comprising the executive committee as set out in the Information Memorandum, namely the chief executive officer, chief financial officer, system operations director, commercial director, asset director, construction director, operations director, metering director, chief people officer, general counsel, the safety, health, environment & assurance director and the chief information officer from time to time; “Separation Date” means the earlier of (i) the Commencement Date (as defined in the Transitional Services Agreement) as notified by the Seller to the Investor; and (ii) the Closing Date; “Separation Plan” means the “Jupiter Separation Blueprint” and addendums as disclosed in the Data Room (folder 6); “Shareholder” means any holder of Ordinary Shares from time to time having the benefit of the Shareholders’ Agreement; “Shareholders’ Agreement” means the shareholders’ agreement in the Agreed Form to be entered into on the Closing Date between the Seller, the Investor, XxxX TopCo, NGGH and certain other members of the XxxX Group; “Steps Plan” means the document prepared by PricewaterhouseCoopers LLP and entitled “Project Jupiter Accounting Steps Paper” in the Agreed Form; “Subscription Shares” means: (i) the Minority Owner Shares; and

17 (ii) the Majority Owner Shares; “Supplementary Scheme” means the National Grid UK Supplementary Benefits Scheme, an unfunded pension scheme set up under a trust and governed by a declaration of trust dated 1 July 1996 and the rules attached to a deed of amendment dated 21 February 2007; “Surviving Clauses” means Clauses 1, 4.2.8, 17 and 19.4 to 19.8 and “Surviving Clause” means any one of them; “Tax Authority” shall have the meaning given in the Tax Indemnity; “Tax Claim” means a claim against the Seller for breach of any of the Tax Warranties or for breach of or under the Tax Indemnity; “Tax Indemnity” means the deed of covenant against Taxation in the Agreed Form to be entered into between the Seller and the Investor at Closing; “Tax Period” shall have the meaning given in the Tax Indemnity; “Tax Warranties” means the warranties contained in paragraph 14 of Schedule 6; “Taxation” or “Tax” shall have the meaning given in the Tax Indemnity; “Terminating Affiliate Contracts” means: (i) the general services agreement between NGG and NGET dated 6 November 2002; (ii) the general services agreement between NGG, NGET and NG plc dated 24 October 2002; (iii) the general services agreement between NGUK and NGM for the provision of intragroup services dated 1 December 2016; (iv) the intra-group general services agreement entered into between NGESO and NGG dated 15 September 2020; and (v) the technical standards access agreement between NGG and National Grid Grain LNG Limited dated 6 January 2021; “Third Party Claim” shall have the meaning given in Clause 15.5; “Trade Unions” means together GMB, UNISON, UNITE and Prospect trade unions, and “Trade Union” shall mean any one of them; “Transaction” means the transactions contemplated by this Agreement including the change of Control (as that term is defined in the Shareholders’ Agreement) of NGG; “Transaction Bonus Letters” means the relevant letters entered into between certain Employees and NGG governing the payment of that Employee’s Transaction Bonus as disclosed in the Data Room (folder 27.20), and “Transaction Bonus Letter” means any one of them; “Transaction Bonuses” means the transaction bonuses to be paid by NGG on or around Closing to certain Employees in connection with the NGGH Transfer, each on the terms set out in the relevant Transaction Bonus Letter, and “Transaction Bonus” means any one of them; “Transaction Documents” means this Agreement, the Shareholders’ Agreement, the Disclosure Letter, the Bring Down Disclosure Letter, the Transitional Services Agreement,

18 the Transitional Trade Xxxx Licence Agreement, the Tax Indemnity, the Gas Forecasting GSA, the Information Access Agreement, the Insurance Indemnity Deed, the Deed of Guarantee, the NGG Replacement Payment Guarantee, the New NGH1 Indemnity (if any) and all agreements entered into pursuant to the foregoing, and “Transaction Document” means any one of them; “Transitional Services Agreement” means the agreement between NGUK and NGG in the Agreed Form to be entered into on or around the Separation Date in respect of the provision of certain services by the Seller’s Group to the XxxX Group Companies; “Transitional Trade Xxxx Licence Agreement” means the transitional trade xxxx licence agreement between Ngrid Intellectual Property Limited and NGGH, in the Agreed Form, to be entered into at Closing, pursuant to which certain Seller Trade Marks are licensed for use in relation to the Businesses for a transitional period after Closing; “Transmission Business” means the business, assets and liabilities together constituting the Existing XxxX Subsidiaries’ UK gas transmission business; “Ultimate Controller Undertaking” means, as set out in Standard Condition 45 and Standard Special Condition A26 of the XxxX Licence, legally enforceable undertakings in favour of NGG in the form specified by XXXX; “Unbundling Condition” has the meaning given in Clause 4.1.4; “Unconditional Consent” means a consent, approval or direction (as applicable) granted by XXXX to NGG in writing pursuant to the XxxX Licence, which: (i) has the effect of permitting arrangements, activities or anything else that would otherwise be prohibited or restricted by the XxxX Licence or would otherwise cause a breach of the XxxX Licence; (ii) where the revocation or expiration of the consent approval or direction (as applicable) would have a direct or indirect adverse legal or financial effect on the Investor or its Affiliates (including under any shareholder arrangements), or would mean that the identity and business activities of the Investor or its Affiliates would cause a breach of the XxxX Licence, such consent approval or direction (as applicable) is not revocable by XXXX or subject to time limits; and (iii) is not subject to any remedies, requirements or conditions. “UNC” means the uniform network code prepared by NGG together with other gas transporters in accordance with Standard Special Condition A11 of the XxxX Licence; “VAT” means: (i) within the UK, any value added tax imposed by the VAT Xxx 0000, (ii) within the European Union, such Taxation as may be levied in accordance with (but subject to derogations from) the Directive 2006/112/EC, and (iii) outside the UK or the European Union, any similar Taxation levied by reference to added value or sales; “VAT Claim” means a claim against the Seller for breach of or under Clause 7.3.2; “Vendor Model” means the financial model produced for the purposes of the NGGH Transfer and contained in the Data Room (document 27.1.2.3); “Voting Power of Attorney” means the power of attorney in the Agreed Form to be executed by the Seller in favour of XxxX MidCo to enable XxxX MidCo (pending registration of the

21 1.14.3 if the Obligor holds any voting securities in the capital of the other party, exercising all voting rights attaching to those securities; and 1.14.4 if the Obligor is party to any agreement relating to the management and control of the other person (including, in the case of the XxxX Group, the Shareholders’ Agreement), exercising all rights available to it under such agreement, in each case for the purposes set out in the relevant provision of this Agreement. The Investor shall use best endeavours to ensure that any person to whom it Transfers Shares (in each case, as defined in the Shareholders’ Agreement) shall give such covenants and undertakings as are required in order that such Transfer shall not prejudice the Investor’s ability to “procure” or “ensure” that another person performs (or refrains from performing) any act for the purposes of Clauses 15.6 (whilst the Seller continues to have potential liability in respect of Indemnity Claims), 15.7 (whilst the Seller continues to have potential liability for [***] Liability Claims) and 19.16.1 (whilst any amounts remain due and payable to the Seller or a member of the Seller’s Group) and Clause 6.2 (Tax Administration) (for a period of 7 years from Closing) of the Tax Indemnity. If the Investor ceases to be able to fulfil its obligations to “procure” or “ensure” the actions in Clause 6.2 (Tax Administration) of the Tax Indemnity, XxxX MidCo shall “procure” or “ensure” such actions as if it was a party to that Clause 6.2 (Tax Administration) (with references to “the Investor” changed to “XxxX MidCo” and with such other changes as are necessary). 1.15 Payments All payments to be made pursuant to or in connection with this Agreement shall be made in pounds Sterling, being the lawful currency of the United Kingdom, unless otherwise indicated. 2 Acquisition of the Businesses 2.1 Agreement to subscribe for the Subscription Shares 2.1.1 On and subject to the terms of this Agreement: (i) the Investor agrees to subscribe for the Majority Owner Shares; and (ii) the Seller agrees to subscribe for the Minority Owner Shares, each on the Incorporation Date. 2.1.2 The Subscription Shares shall be issued to the Investor and the Seller (as applicable) by XxxX TopCo as fully paid up and free from any Encumbrances and shall have the rights attached to them as specified in the XxxX TopCo Articles. 2.1.3 As soon as reasonably practicable following, and conditional upon, the incorporation of XxxX TopCo and the issue of the Subscription Shares, the New XxxX Subsidiaries shall implement the steps set out in Part B of Schedule 2. 2.2 Agreement to the NGGH Transfer 2.2.1 On and subject to the terms of this Agreement and subject to the implementation of the Pre-Closing Steps: (i) the Investor shall subscribe for the Investor Note;

22 (ii) the Seller shall subscribe for the Lattice Note; and (iii) the Seller shall sell and XxxX MidCo shall purchase the NGGH Shares, in each case as at and with effect from Closing. 2.2.2 The NGGH Shares shall be sold by the Seller with full title guarantee, free from Encumbrances and together with all rights and advantages attaching to them as at Closing (including the right to receive all dividends or distributions declared, made or paid on or after Closing). 2.2.3 The Seller shall procure that on or prior to Closing any and all rights of pre-emption over the NGGH Shares are waived irrevocably and unconditionally by the persons entitled thereto. 3 Consideration 3.1 Amount 3.1.1 The consideration to be paid by the Investor for the subscription of the Majority Owner Shares in accordance with this Agreement shall be the undertaking to pay £30,000.00 contained in paragraph 1.1.3 of Part B of Schedule 2 (the “Investor Subscription Amount”) and the subscription of the Investor Note. 3.1.2 The consideration to be paid by the Seller for the subscription of the Minority Owner Shares in accordance with this Agreement shall be the undertaking to pay £20,000.00 contained in paragraph 1.1.2 of Part B of Schedule 2 and the subscription of the Lattice Note. 3.1.3 Subject to Clauses 6.5.3 and 11.3, the consideration to be paid to the Seller by XxxX MidCo for the NGGH Transfer shall be: (i) the Base Consideration; plus (ii) an amount calculated by applying a rate of 5 per cent. per annum to the Base Consideration over the period from (and including) 1 April 2022 to (and including) the Closing Date, such amount to accrue daily, as notified pursuant to Clause 6.5 (the “Additional Consideration” and, together with the Base Consideration, the “NGGH Consideration”). 3.2 Settlement of Consideration The NGGH Consideration shall be settled by XxxX MidCo to the Seller pursuant to Clause 6 and Schedule 4. 3.3 Adjustment to NGGH Consideration If any payment is made by the Seller to XxxX MidCo in respect of any claim for Leakage or for any breach of this Agreement or pursuant to any indemnity or covenant to pay under this Agreement or the Tax Indemnity (or any agreement entered into under this Agreement or under the Tax Indemnity), the payment shall, if and to the extent permitted by law, be made by way of a reduction to the consideration paid by XxxX MidCo for the NGGH Shares under this Agreement, and the NGGH Consideration shall be deemed to have been reduced by the amount of such payment (up to a maximum of the NGGH Consideration).

23 4 Conditions 4.1 Conditions Precedent The NGGH Transfer is subject to and conditional upon satisfaction of the following conditions on or before the Long Stop Date: 4.1.1 To the extent that the Transaction either constitutes (or is deemed to constitute under Article 4(5)) a concentration falling within the scope of Council Regulation (EC) 139/2004 (as amended) (the "Regulation") or is to be examined by the European Commission as a result of a decision under Article 22(3) of the Regulation: (i) the European Commission taking a decision (or being deemed to have taken a decision) under Article 6(1)(b) or 6(2) of the Regulation declaring the Transaction compatible with the internal market; or (ii) the European Commission taking a decision (or being deemed to have taken a decision) to refer the whole or part of the Transaction to the competent authorities of one or more Member States under Articles 4(4) or 9(3) of the Regulation; and (a) each such authority taking a decision with equivalent effect to Clause 4.1.1(i) with respect to those parts of the Transaction referred to it; and (b) the European Commission taking any of the decisions under Clause 4.1.1(i) with respect to any part of the Transaction retained by it, (the “EU Competition Condition”). 4.1.2 To the extent that the Transaction satisfies the merger control jurisdictional thresholds under the United Kingdom Enterprise Act 2002 either: (i) the CMA having indicated in response to a briefing paper submitted by the Investor that it has no further questions at that stage in relation to the Transaction, unless the CMA prior to all other conditions set out in clauses 4.1.1, 4.1.3, 4.1.4 and 4.1.5 being satisfied indicates it may open an investigation into the Transaction or has further questions, in which case the condition set out in this Clause 4.1.2 shall be satisfied by the CMA subsequently indicating that it does not intend to open an investigation or has no further questions; or (ii) confirmation having been received in writing from the CMA that the CMA does not intend to make a CMA Phase 2 Reference in connection with the Transaction or any matters arising therefrom; or (iii) the period within which the CMA is required to decide whether the duty to make a CMA Phase 2 Reference applies with respect to the Transaction or any matters arising therefrom has expired without such a decision having been made; or (iv) where the Transaction or any part of it is subject to a CMA Phase 2 Reference, the CMA deciding that the Transaction or the part which is subject to a CMA Phase 2 Reference may proceed in accordance with section 36 of the Enterprise Act, (the “CMA Competition Condition”).

24 4.1.3 To the extent that the NGGH Transfer amounts to a notifiable acquisition within the meaning of the NSI Act, which must be notified to, and approved by, the Secretary of State prior to Closing, the Investor having notified the NGGH Transfer to the Secretary of State in accordance with the requirements of the NSI Act and either: (i) the Secretary of State subsequently notifying the Investor (before the end of the review period within which the Secretary of State may give a call-in notice under the NSI Act) that the notification is accepted and that no further action will be taken in relation to the NGGH Transfer; or (ii) in the event that a call-in notice is given in relation to the NGGH Transfer, the Secretary of State either: (a) giving a final notification confirming that no further action will be taken in relation to the NGGH Transfer under the NSI Act; or (b) making a final order permitting the NGGH Transfer to proceed, (the “NSI Condition”). 4.1.4 NGG having notified the Transaction to XXXX in accordance with the requirements of paragraphs 2 and 3 of Standard Special Condition B4 of the XxxX Licence, and XXXX having published a decision to continue to certify NGG pursuant to section 8N(9A) of the Gas Xxx 0000 and: (i) the continuing certification is not subject to any remedies, requirements, conditions or time limits; and (ii) GEMA’s decision (including for the avoidance of doubt the reasons for it) does not contain any indication that any such remedies, requirements or conditions may be imposed in the future (other than XXXX indicating in general terms that it will monitor the continued application of the basis for certification pursuant to section 8K of the Gas Act 1986), in either case that are not reasonably acceptable to the Investor (the “Unbundling Condition”). The parties agree (acting reasonably) that they shall deem the Unbundling Condition as satisfied if it is clear following notification by XXXX under section 8N(5) that Clause 4.1.4(i) and 4.1.4(ii) will be met. 4.1.5 If the Investor, following consultation with the Seller (each acting reasonably), notifies the Seller in writing, by no later than 40 Business Days following the date of this Agreement, that it reasonably believes that Relevant Consent Entities will, in the ordinary course of its business as carried on in the 12 months prior to the date of this Agreement, need to enter into transactions (within the meaning of Special Condition 9.14 of the XxxX Licence) which would be prohibited by Special Condition 9.14 of the XxxX Licence without XXXX consent being obtained by NGG under Special Condition 9.14.4(b) (such transactions being a “9.14 Consent Transactions”) following the Closing Date and provides reasonable evidence of the same to the Seller (subject to confidentiality restrictions), NGG obtaining consent from XXXX, pursuant to Special Condition 9.14.4(b) for such Relevant Consent Entities to enter into a 9.14 Consent Transaction and: (i) such consent is not subject to any requirements, conditions or time limits; and

25 (ii) such consent does not contain any indication that any such requirements or conditions may be imposed in the future, in either case that are not reasonably acceptable to the Investor (the “Consent Condition”). 4.2 Responsibility for Satisfaction EU Competition Condition, CMA Competition Condition and NSI Condition 4.2.1 The Seller and the Investor shall use reasonable endeavours to ensure the satisfaction of the conditions set out in Clauses 4.1.1, 4.1.2 and 4.1.3 as soon as reasonably practicable after the date of this Agreement and by the end of the Competent Authority’s initial period of review (as applicable) and in any event so as to enable satisfaction of such conditions before the Long Stop Date. This shall include, but not be limited to, each of the Seller and the Investor promptly providing such information in relation to itself and the Seller's Group or the Investor's Group (respectively), and any explanation or clarification of or further information in relation to any aspect of Clauses 4.1.1, 4.1.2 and 4.1.3 as may be reasonably necessary to procure the satisfaction of such conditions before the Long Stop Date, and the Investor proposing, negotiating, offering to commit and agreeing and executing any undertakings or conditions, in each case where necessary to ensure that the conditions in Clauses 4.1.1, 4.1.2 and 4.1.3 are satisfied as soon as possible and, in any event, prior to the Long Stop Date provided that this shall not require either party to take such action which would be likely to have such a detrimental effect on the current or future development of the business of that party that it would be unreasonable to expect that party to take it (including divestments or other remedies that are not reasonably acceptable to the parties). 4.2.2 The Investor shall give notice to the Seller of the satisfaction of the conditions set out in Clauses 4.1.1, 4.1.2 and 4.1.3 within two Business Days of becoming aware of the satisfaction of each condition, including a copy of the relevant documents which evidence such satisfaction. 4.2.3 The Seller and the Investor agree that all requests and enquiries from any Competent Authority, government, governmental, supranational or trade agency, court or other regulatory body which relate to the satisfaction of the conditions set out in Clauses 4.1.1, 4.1.2 and 4.1.3 shall be dealt with by the Seller and the Investor in consultation with each other and the Seller and the Investor shall promptly co- operate with and provide all necessary information and assistance reasonably required by such government, agency, court or body upon being requested to do so by the other. 4.2.4 The Seller and the Investor undertake to one another to: (i) prepare and submit the notifications to the Competent Authority which are necessary to obtain the relevant clearance for the conditions set out in Clauses 4.1.1, 4.1.2 and 4.1.3 as soon as reasonably practicable after the date of this Agreement; (ii) use reasonable endeavours to avoid any declaration of incompleteness by the Competent Authority or any other suspension of the time periods of clearance, consent or approval;

27 without limitation its partners, directors or management) and that Restricted Shareholder does not or will not provide such information: (i) due to constraints under applicable law, regulation or legally binding restriction; or (ii) on the basis that such request would result in such person disclosing additional information other than the pre-communicated scope of disclosable information as such person may notify the Seller on or prior to the date of this Agreement, then the Investor shall notify the Seller within two Business Days of becoming aware of such matter and shall use reasonable endeavours to, either: (i) replace any Restricted Shareholder with another direct or indirect shareholder of the Investor (the “Replacement Shareholder”); or (ii) reduce the direct or indirect interest of such Restricted Shareholder in the Investor and to seek to fund any shortfall arising from such reduction (the “Replacement Funding”), in either case within 40 Business Days of notifying the Seller pursuant to this Clause 4.2.5. If the Restricted Shareholder is not replaced with a Replacement Shareholder or the Replacement Funding is not secured within such 40 Business Days, then: (i) the Seller and the Investor agree that the Investor’s Proportion shall be reduced and the Seller’s Proportion will be increased to reflect the consequential reduction in funding available to the Investor, including the transfer of the relevant number of Majority Owner Shares to the Seller; and (ii) the parties, acting reasonably and in good faith, shall agree any consequential changes required to this Agreement and any applicable Transaction Documents to reflect any change to the Investor’s Proportion and Seller’s Proportion following operation of this Clause 4.2.5 including, but in no way limited to, amending the following provisions of the Further Acquisition Agreement: (a) the formulas used in the definition of “Further Acquisition Payment” to reflect the revised Investor’s Proportion and Seller’s Proportion; (b) the definition of “Relevant Leakage” to refer to the revised Investor’s Proportion; and (c) clause 2.2.1 to reflect the revised Seller’s Proportion, provided always that, in the event that the Investor’s Proportion following such reduction would not exceed 50 per cent., the Seller or the Investor may, in its absolute discretion give notice in writing to the other parties to terminate this Agreement and all Transaction Documents with immediate effect. Unbundling and Consent Condition 4.2.6 The parties shall use reasonable endeavours to ensure that the Unbundling Condition and the Consent Condition are satisfied as soon as possible and in any event so as to enable satisfaction of such conditions before the Long Stop Date save that neither party shall be required to take such action which would be likely to have such a detrimental effect on the current or future development of the business of that party that it would be unreasonable to expect that party to take it (including divestments or other remedies that are not reasonably acceptable to the parties). 4.2.7

28 (i) The Seller undertakes to procure that NGG: (a) submits the B4 Notification to XXXX as soon as reasonably practicable after the date of this Agreement subject to the Investor having provided all relevant information required for such B4 Notification; (b) subject to Clause 4.1.5, submits a formal request to XXXX as soon as reasonably practicable after the date of this Agreement, which specifies the consent required to satisfy the Consent Condition (the “Consents Application”); (c) regularly reviews with the Investor and its advisers progress towards satisfying the Unbundling Condition and the Consent Condition; (d) keeps the Investor informed of material contact with XXXX and provides the Investor with copies of all relevant documentation in relation thereto and gives the Investor the opportunity to participate in any calls or meetings with XXXX and to make oral submissions on such calls or at such meetings; (e) provides the Investor and its advisers with a reasonable opportunity to review and provide comments on drafts of any correspondence or communications prior to their submission to XXXX (redacting any commercially sensitive information), and takes account of any such comments. The Seller shall promptly provide the Investor with the final form of such correspondence or communications submitted to XXXX (redacting any commercially sensitive information); (f) responds as soon as reasonably practicable to requests from XXXX for additional information or documentation and to supplement such B4 Notification and/or the Consents Application as requested by XXXX; and (g) notifies the Investor of the satisfaction of the Unbundling Condition and the Consent Condition within two Business Days of becoming aware of satisfaction of each; (ii) The Investor shall: (a) use reasonable endeavours to provide all information required for the B4 Notification to NGG within 15 Business Days of the date of this Agreement; (b) use reasonable endeavours to secure satisfaction of the Unbundling Condition and the Consent Condition, including proposing, negotiating, offering to commit and agreeing and executing any undertakings or conditions, where necessary to ensure that the Unbundling Condition and the Consent Condition are satisfied as soon as possible and, in any event, prior to the Long Stop Date provided that this shall not require either party to take such action which would be likely to have such a detrimental effect on the current or future development of the business of that party that it would be

30 other under it, save for any claim arising from breach of any obligation contained in Clause 4.2. 5 Pre-Closing 5.1 The Seller’s Obligations in Relation to the Conduct of Businesses 5.1.1 The Seller undertakes to procure that between the date of this Agreement and the Closing Date each Existing XxxX Subsidiary shall carry on its business as a going concern in the ordinary course as carried on prior to the date of this Agreement, save in so far as agreed in writing by the Investor (such consent not to be unreasonably withheld or delayed). 5.1.2 The Seller undertakes to procure that between the date of this Agreement and the Closing Date NGG shall carry on its business in accordance with the XxxX Licence and all applicable law. 5.1.3 Pending agreement of the Initial Budget, the Investor and the Seller agree that the Businesses shall be conducted in all material respects in accordance with the Existing Budget. 5.1.4 Without prejudice to the generality of Clause 5.1.1 and subject to Clause 5.2, the Seller undertakes to procure that, between the date of this Agreement and the Closing Date, each Existing XxxX Subsidiary shall not except as expressly permitted by this Agreement or as may be required to give effect to and to comply with this Agreement without the prior written consent of the Investor (such consent not to be unreasonably withheld or delayed): (i) enter into, terminate or materially vary any Material Contract; (ii) enter into or materially vary any material Affiliate Contract; (iii) acquire, dispose of, or agree to acquire or dispose of, any material business asset with a fair market value of £50,000,000 or more (exclusive of VAT); (iv) commence or settle any litigation, arbitration, adjudication, other legal proceedings and/or material regulatory disputes where such matter is either outside the ordinary course of business or exceeds £5,000,000; (v) materially alter the terms and conditions of, or provide any new contractual benefits to any Employees or enter into new or renegotiate any existing framework agreements, recognition agreements or collective bargaining agreements with trade unions or any other body representing the Employees other than in the ordinary course as carried on prior to the date of this Agreement or as required by Laws; (vi) dismiss, save for misconduct reasons, any Senior Employee, or induce any Senior Employee to resign from their employment; (vii) make any change to its accounting or Tax practices or policies except as required by Laws; (viii) acquire or agree to acquire any share, shares or other interest in any joint venture, partnership or other incorporated or unincorporated association with another entity;