EXCHANGE AGREEMENT

This EXCHANGE AGREEMENT (this “Agreement”), dated as of May 3, 2021, is by and among The New You, Inc., a Nevada corporation (the “Parent”), ST Brands, Inc., a Wyoming incorporated company (the “Company”), and the shareholders of the Company (each a “Shareholder” and collectively the “Shareholders”). Each of the parties to this Agreement is individually referred to herein as a “Party” and collectively as the “Parties.”

BACKGROUND

The Company has 1,000 issued and outstanding common shares, (the “Common Shares”) outstanding, all of which are held by the Shareholders. The Shareholders have agreed to transfer the Common Shares to the Parent in exchange for the issuance, on a pro rata basis, of shares of Series A Preferred Stock of the Parent, par value $0.00001 (the “Series A”) to the Shareholders. The Shareholders of the Company who receive Series A, shall be known as Series A Shareholders (the “Series A Shareholders”) and shall be granted certain rights as detailed in, but not limited to, those set forth in Section 1.03 of this Agreement.

The Board of Directors of the Parent and the Company have determined that it is desirable to affect this share exchange.

AGREEMENT

NOW THEREFORE, for good and valuable consideration the receipt and sufficiency is hereby acknowledged, the Parties hereto intending to be legally bound hereby agree as follows:

ARTICLE I

Exchange of Shares

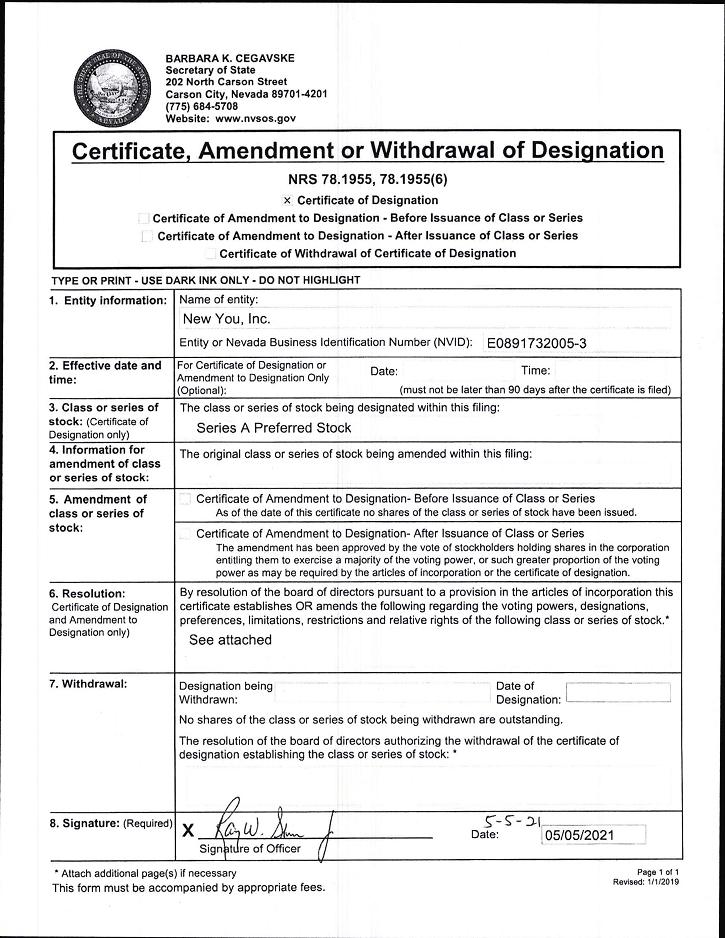

SECTION 1.01. Exchange by the Shareholders. At the Closing (as defined in Section 1.02), the Shareholders shall sell, transfer, convey, assign and deliver to the Parent all of the Common Shares free and clear of all Liens in exchange the Parent’s issuance to the Shareholders, on a pro rata basis, of shares of the Series A, as set forth in Schedule A attached hereto. The rights, preferences, and other attributes of the Series A shall be as set forth in the Parent’s Certificate of Designation of Series A Preferred Stock, the form of which is attached hereto as Exhibit B. The Parent’s Class of Series A Preferred Stock shall be convertible, as whole, to number of shares of common stock of the Parent equal to ninety percent (90%) of the issued and outstanding common stock of the Parent following such conversion, based upon the Parent’s number of issued and outstanding shares of common stock, on a fully diluted basis, as of the Initial Closing. The number of shares of Series A issuable to the Shareholders on each of the Initial Closing and each Subsequent Closing, as described below, shall be determined with reference to the cumulative documented annual revenues of the Company and the Company’s Acquired Material Businesses, as defined and described below.

SECTION 1.02. Initial Closing. The initial closing (the “Initial Closing”) of the transactions contemplated by this Agreement (the “Transactions”) shall take place at such location to be determined by the Company and Parent, commencing upon the satisfaction or waiver of all conditions and obligations of the Parties to consummate the Transactions contemplated hereby (other than conditions and obligations with respect to the actions that the respective Parties will take at Closing) or such other date and time as the Parties may mutually determine (the “Closing Date”).

| 1 |

SECTION 1.03. Subsequent Closings. For a period from the Initial Closing Date until no later than April 30, 2022, the Parent shall schedule closings upon its receipt of audited financial statements as described in subsections (a), (b), and (c), below (the “Subsequent Closings”) which shall take place remotely by exchange of documents and signatures (or their electronic counterparts). A Subsequent Closing may be demanded by the Series A Shareholders by electronic notice to the email address contained herein. The Company shall be deemed to have achieved a revenue milestone, as defined in Schedule A attached hereto, if the Company is able to provide written documentation of the achieved revenue milestone the Parent. Such written documentation shall be:

(a) The consolidated financial statements of the Company, and its existing subsidiaries, if any, for the Company’s last two years of operations, or such shorter period as the Company has been in existence, prepared in accordance with GAAP, and accompanied by the audit opinion of a PCAOB qualified independent accounting firm, together with financial statements for all subsequent interim periods prepared in accordance with GAAP and reviewed by a PCAOB qualified independent accounting firm, reflecting gross annual revenue earned by the Company (on a consolidated basis, as applicable) in an amount that meets or exceeds the applicable revenue milestone set forth in Schedule A.; or

(b) An executed definitive agreement reflecting the Company’s acquisition of a revenue-producing entity or business (an “Acquired Material Business”) accompanied by evidence of the closing of the Company’s acquisition of such Acquired Material Business in a form reasonably acceptable to the Parent, together with the financial statements of the Acquired Material Business for the Acquired Material Business’ last two years of operations, or such shorter period as the Acquired Material Business has been in existence, prepared in accordance with GAAP, and accompanied by the audit opinion of a PCAOB qualified independent accounting firm, together with financial statements for all subsequent interim periods prepared in accordance with GAAP and reviewed by a PCAOB qualified independent accounting firm, reflecting gross annual revenue earned by the Acquired Material Business (on a consolidated basis, as applicable) in an amount that, when aggregated with: (i) the revenues of the Company demonstrated in accordance with Section 1.03(a), and (ii) the revenues of any previously Acquired Material Business demonstrated in accordance with this Section 1.03(b), meets or exceeds the applicable revenue milestone set forth in Schedule A; or

(c) Upon the completion of the Parent’s audited consolidated financial statements for the fiscal year ended December 31, 2021 and the Parent’s receipt of an opinion thereon from the Parent’s PCAOB qualified independent accounting firm, the revenues of the Company and/or the Company’s Acquired Material Businesses, as reflected within the Parent’s financial statements, shall be applied toward the applicable revenue milestone as set forth on Schedule A.

Any such Subsequent Closing must occur on or before April 30, 2022

SECTION 1.04. Failure to Acknowledge. If conditions of Section 1.03 are provided to the Parent on or before April 30, 2022, but not acknowledged by the Parent, the Subsequent Closing shall be deemed to have occurred and the Series A Shareholders shall be entitled to the Series A that correspond with Schedule A attached hereto.

ARTICLE

II

Representations and Warranties of the Shareholders

Each Shareholder individually, hereby represents and warrants to the Parent, as follows:

SECTION 2.01. Good Title. The Shareholder is the record and beneficial owner, and has good and marketable title to its Common Shares, with the right and authority to sell and deliver such Common Shares to Parent as provided herein. Upon registering of the Parent as the new owner of such Common Shares in the membership register of the Company, the Parent will receive good title to such Common Shares, free and clear of all liens, security interests, pledges, equities and claims of any kind, voting trusts, member agreements and other encumbrances (collectively, “Liens”).

| 2 |

SECTION 2.02. Power and Authority. All acts required to be taken by the Shareholder to enter into this Agreement and to carry out the Transactions have been properly taken. This Agreement constitutes a legal, valid and binding obligation of the Shareholder, enforceable against such Shareholder in accordance with the terms hereof.

SECTION 2.03. No Conflicts. The execution and delivery of this Agreement by the Shareholder and the performance by the Shareholder of his obligations hereunder in accordance with the terms hereof: (i) will not require the consent of any third party or any federal, state, local or foreign government or any court of competent jurisdiction, administrative agency or commission or other governmental authority or instrumentality, domestic or foreign (“Governmental Entity”) under any statutes, laws, ordinances, rules, regulations, orders, writs, injunctions, judgments, or decrees (collectively, “Laws”); (ii) will not violate any Laws applicable to such Shareholder; and (iii) will not violate or breach any contractual obligation to which such Shareholder is a party.

SECTION 2.04. Finder’s Fee. The Shareholder, in his or her individual capacity, has not created any obligation for any finder’s, investment banker’s or broker’s fee in connection with the Transactions that the Company or the Parent will be responsible for.

SECTION 2.05. Purchase Entirely for Own Account. The Series A proposed to be acquired by the Shareholder hereunder will be acquired for investment for his own account, and not with a view to the resale or distribution of any part thereof, and the Shareholder has no present intention of selling or otherwise distributing the Series A, except in compliance with applicable securities laws.

SECTION 2.06. Available Information. The Shareholder has such knowledge and experience in financial and business matters that it is capable of evaluating the merits and risks of an investment in the Parent.

SECTION 2.07. Non-Registration. The Shareholder understands that the Series A has not been registered under the Securities Act of 1933, as amended (the “Securities Act”) and, if issued in accordance with the provisions of this Agreement, will be issued by reason of a specific exemption from the registration provisions of the Securities Act which depends upon, among other things, the bona fide nature of the investment intent and the accuracy of the Shareholder’s representations as expressed herein.

SECTION 2.08. Restricted Securities. The Shareholder understands that the Series A is characterized as “restricted securities” under the Securities Act inasmuch as this Agreement contemplates that, if acquired by the Shareholder pursuant hereto, the Series A would be acquired in a transaction not involving a public offering. The Shareholder further acknowledges that if the Series A is issued to the Shareholder in accordance with the provisions of this Agreement, such Series A may not be resold without registration under the Securities Act or the existence of an exemption therefrom. The Shareholder represents that it is familiar with Rule 144 promulgated under the Securities Act, as presently in effect, and understands the resale limitations imposed thereby and by the Securities Act.

| 3 |

SECTION 2.09. Legends. It is understood that the Series A will bear the following legend or another legend that is similar to the following:

THE SHARES REPRESENTED BY THIS CERTIFICATE HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR APPLICABLE STATE SECURITIES LAWS. THE SHARES REPRESENTED BY THIS CERTIFICATE HAVE BEEN ACQUIRED FOR INVESTMENT AND MAY NOT BE OFFERED FOR SALE, SOLD, TRANSFERRED OR ASSIGNED IN THE ABSENCE OF AN EFFECTIVE REGISTRATION STATEMENT FOR THE SECURITIES UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR APPLICABLE STATE SECURITIES LAWS, OR AN OPINION OF COUNSEL, IN A FORM ACCEPTABLE TO THE COMPANY, THAT REGISTRATION IS NOT REQUIRED UNDER SAID ACT OR APPLICABLE STATE SECURITIES LAWS OR UNLESS SOLD PURSUANT TO RULE 144 UNDER SAID ACT.

and any legend required by the “blue sky” laws of any state to the extent such laws are applicable to the securities represented by the certificate so legended.

SECTION 2.10. Shareholder Acknowledgment. Each of the Shareholders acknowledges that he or she has read the representations and warranties of the Company set forth in Article III herein and such representations and warranties are, to the best of his or her knowledge, true and correct as of the date hereof.

ARTICLE

III

Representations and Warranties of the Company

The Company represents and warrants to the Parent, except as set forth in the disclosure schedules provided in connection herewith (the “Company Disclosure Schedules”), as follows:

SECTION 3.01. Organization, Standing and Power. The Company is duly organized, validly existing and in good standing under the laws of the State of Wyoming and has the corporate power and authority and possesses all governmental franchises, licenses, permits, authorizations and approvals necessary to enable it to own, lease or otherwise hold its properties and assets and to conduct its businesses as presently conducted, other than such franchises, licenses, permits, authorizations and approvals the lack of which, individually or in the aggregate, has not had and would not reasonably be expected to have a material adverse effect on the Company, a material adverse effect on the ability of the Company to perform its obligations under this Agreement or on the ability of the Company to consummate the Transactions (a “Company Material Adverse Effect”). The Company is duly qualified to do business in each jurisdiction where the nature of its business or its ownership or leasing of its properties make such qualification necessary, except where the failure to so qualify would not reasonably be expected to have a Company Material Adverse Effect. The Company has delivered to the Parent true and complete copies of the articles of organization and operating agreement of the Company, each as amended to the date of this Agreement (as so amended, the “Company Charter Documents”). The Company has no direct or indirect subsidiaries.

| 4 |

SECTION 3.02. Capital Structure. The share capital of the Company consists of 1000 common shares issued and outstanding. No other shares or other voting securities of the Company are issued, reserved for issuance or outstanding. All outstanding Common Shares are duly authorized, validly issued, fully paid and non-assessable and not subject to or issued in violation of any purchase option, call option, right of first refusal, preemptive right, subscription right or any similar right under any provision of the applicable corporate laws of its state of incorporation, the Company Charter Documents or any Contract (as defined in Section 3.04) to which the Company is a party or otherwise bound. There are no bonds, debentures, notes or other indebtedness of the Company having the right to vote (or convertible into, or exchangeable for, securities having the right to vote) on any matters on which holders of Common Shares may vote (“Voting Company Debt”). As of the date of this Agreement, there are no options, warrants, rights, convertible or exchangeable securities, “phantom” stock rights, stock appreciation rights, stock-based performance units, commitments, Contracts, arrangements or undertakings of any kind to which the Company is a party or by which the Company is bound (i) obligating the Company to issue, deliver or sell, or cause to be issued, delivered or sold, additional common shares or other equity interests in, or any security convertible or exercisable for or exchangeable into any common shares or other equity interest in, the Company or any Voting Company Debt, (ii) obligating the Company to issue, grant, extend or enter into any such option, warrant, call, right, security, commitment, Contract, arrangement or undertaking or (iii) that give any person the right to receive any economic benefit or right similar to or derived from the economic benefits and rights occurring to holders of the membership interests or capital stock of the Company.

SECTION 3.03. Authority; Execution and Delivery; Enforceability. The Company has all requisite corporate power and authority to execute and deliver this Agreement and to consummate the Transactions. The execution and delivery by the Company of this Agreement and the consummation by the Company of the Transactions have been duly authorized and approved by the Board of the Company and no other corporate proceedings on the part of the Company are necessary to authorize this Agreement and the Transactions. When executed and delivered, this Agreement will be enforceable against the Company in accordance with its terms, subject to bankruptcy, insolvency and similar laws of general applicability as to which the Company is subject.

SECTION 3.04. No Conflicts; Consents.

(a) The execution and delivery by the Company of this Agreement does not, and the consummation of the Transactions and compliance with the terms hereof and thereof will not, conflict with, or result in any violation of or default (with or without notice or lapse of time, or both) under, or give rise to a right of termination, cancellation or acceleration of any obligation or to loss of a material benefit under, or result in the creation of any Lien upon any of the properties or assets of the Company under any provision of (i) the Company Charter Documents, (ii) any material contract, lease, license, indenture, note, bond, agreement, permit, concession, franchise or other instrument (a “Contract”) to which the Company is a party or by which any of their respective properties or assets is bound or (iii) subject to the filings and other matters referred to in Section 3.04(b), any material judgment, order or decree (“Judgment”) or material Law applicable to the Company or its properties or assets, other than, in the case of clauses (ii) and (iii) above, any such items that, individually or in the aggregate, have not had and would not reasonably be expected to have a Company Material Adverse Effect.

(b) Except for required filings with the Securities and Exchange Commission (the “SEC”) and applicable “Blue Sky” or state securities commissions, no material consent, approval, license, permit, order or authorization (“Consent”) of, or registration, declaration or filing with, or permit from, any Governmental Entity is required to be obtained or made by or with respect to the Company in connection with the execution, delivery and performance of this Agreement or the consummation of the Transactions.

| 5 |

SECTION 3.05. Taxes.

(a) The Company has timely filed, or has caused to be timely filed on its behalf, all Tax Returns required to be filed by it, and all such Tax Returns are true, complete and accurate, except to the extent any failure to file or any inaccuracies in any filed Tax Returns, individually or in the aggregate, have not had and would not reasonably be expected to have a Company Material Adverse Effect. All Taxes shown to be due on such Tax Returns, or otherwise owed, have been timely paid, except to the extent that any failure to pay, individually or in the aggregate, has not had and would not reasonably be expected to have a Company Material Adverse Effect. There are no unpaid taxes in any material amount claimed to be due by the taxing authority of any jurisdiction, and the officers of the Company know of no basis for any such claim.

(b) If applicable, the Company has established an adequate reserve reflected on its financial statements for all Taxes payable by the Company (in addition to any reserve for deferred Taxes to reflect timing differences between book and Tax items) for all Taxable periods and portions thereof through the date of such financial statements. No deficiency with respect to any Taxes has been proposed, asserted or assessed against the Company, and no requests for waivers of the time to assess any such Taxes are pending, except to the extent any such deficiency or request for waiver, individually or in the aggregate, has not had and would not reasonably be expected to have a Company Material Adverse Effect.

(c) For purposes of this Agreement:

“Taxes” includes all forms of taxation, whenever created or imposed, and whether of the United States or elsewhere, and whether imposed by a local, municipal, governmental, state, foreign, federal or other Governmental Entity, or in connection with any agreement with respect to Taxes, including all interest, penalties and additions imposed with respect to such amounts.

“Tax Return” means all federal, state, local, provincial and foreign Tax returns, declarations, statements, reports, schedules, forms and information returns and any amended Tax return relating to Taxes.

SECTION 3.06. Benefit Plans. The Company does not have or maintain any collective bargaining agreement or any bonus, pension, profit sharing, deferred compensation, incentive compensation, share ownership, share purchase, share option, phantom stock, retirement, vacation, severance, disability, death benefit, hospitalization, medical or other plan, arrangement or understanding (whether or not legally binding) providing benefits to any current or former employee, officer or director of the Company (collectively, “Company Benefit Plans”). As of the date of this Agreement there are no severance or termination agreements or arrangements between the Company and any current or former employee, officer or director of the Company, nor does the Company have any general severance plan or policy.

SECTION 3.07. Litigation. There is no action, suit, inquiry, notice of violation, proceeding (including any partial proceeding such as a deposition) or investigation pending or threatened in writing against or affecting the Company, or any of its properties before or by any court, arbitrator, governmental or administrative agency, regulatory authority (federal, state, county, local or foreign), stock market, stock exchange or trading facility (“Action”) which (i) adversely affects or challenges the legality, validity or enforceability of any of this Agreement or the Series A or (ii) could, if there were an unfavorable decision, individually or in the aggregate, have or reasonably be expected to result in a Company Material Adverse Effect. Neither the Company nor any director or officer thereof (in his or her capacity as such), is or has been the subject of any Action involving a claim or violation of or liability under federal or state securities laws or a claim of breach of fiduciary duty.

| 6 |

SECTION 3.08. Compliance with Applicable Laws. The Company is in compliance with all applicable Laws, including those relating to occupational health and safety and the environment, except for instances of noncompliance that, individually and in the aggregate, have not had and would not reasonably be expected to have a Company Material Adverse Effect. This Section 3.08 does not relate to matters with respect to Taxes, which are the subject of Section 3.05.

SECTION 3.09. Brokers; Schedule of Fees and Expenses. Except for those brokers as to which the Company and Parent shall be solely responsible, no broker, investment banker, financial advisor or other person is entitled to any broker’s, finder’s, financial advisor’s or other similar fee or commission in connection with the Transactions based upon arrangements made by or on behalf of the Company.

SECTION 3.10. Contracts. Except as disclosed in the Company Disclosure Schedule, there are no Contracts that are material to the business, properties, assets, condition (financial or otherwise), results of operations or prospects of the Company and its subsidiaries taken as a whole. The Company is not in violation of or in default under (nor does there exist any condition which upon the passage of time or the giving of notice would cause such a violation of or default under) any Contract to which it is a party or by which it or any of its properties or assets is bound, except for violations or defaults that would not, individually or in the aggregate, reasonably be expected to result in a Company Material Adverse Effect.

SECTION 3.11. Title to Properties. The Company does not own any real property. The Company has sufficient title to, or valid leasehold interests in, all of its properties and assets used in the conduct of its businesses all of which are set forth on the Company Disclosure Schedule. All such assets and properties, other than assets and properties in which the Company has leasehold interests, are free and clear of all Liens other than those Liens that, in the aggregate, do not and will not materially interfere with the ability of the Company to conduct business as currently conducted.

SECTION 3.12. Labor Relations. No labor dispute exists or, to the knowledge of the Company, is imminent with respect to any of the employees of the Company, which could reasonably be expected to result in a Company Material Adverse Effect. None of the Company’s or its subsidiaries’ employees is a member of a union that relates to such employee’s relationship with the Company or such subsidiary, and neither the Company nor any of its subsidiaries is a party to a collective bargaining agreement, and the Company and its Subsidiaries believe that their relationships with their employees are good. To the knowledge of the Company, no executive officer of the Company or any subsidiary, is, or is now expected to be, in violation of any material term of any employment contract, confidentiality, disclosure or proprietary information agreement or non-competition agreement, or any other contract or agreement or any restrictive covenant in favor of any third party, and the continued employment of each such executive officer does not subject the Company or any of its subsidiaries to any liability with respect to any of the foregoing matters. The Company and its subsidiaries are in compliance with all U.S. federal, state, local and foreign laws and regulations relating to employment and employment practices, terms and conditions of employment and wages and hours, except where the failure to be in compliance could not, individually or in the aggregate, reasonably be expected to have a Company Material Adverse Effect.

SECTION 3.13. Insurance. The Company does not hold any insurance policy.

SECTION 3.14. Transactions With Affiliates and Employees. Except as set forth on the Company Disclosure Schedule, none of the officers or directors of the Company and, to the knowledge of the Company, none of the employees of the Company is presently a party to any transaction with the Company (other than for services as employees, officers and directors), including any contract, agreement or other arrangement providing for the furnishing of services to or by, providing for rental of real or personal property to or from, or otherwise requiring payments to or from any officer, director or such employee or, to the knowledge of the Company, any entity in which any officer, director, or any such employee has a substantial interest or is an officer, director, trustee or partner.

| 7 |

SECTION 3.15. Application of Takeover Protections. The Company has taken all necessary action, if any, in order to render inapplicable any control share acquisition, business combination, poison pill (including any distribution under a rights agreement) or other similar anti-takeover provision under the Company’s charter documents or the laws of its state of incorporation that is or could become applicable to the Shareholders as a result of the Shareholders and the Company fulfilling their obligations or exercising their rights under this Agreement, including, without limitation, the issuance of the Series A and the Shareholders’ ownership of the Series A.

SECTION 3.16. No Additional Agreements. The Company does not have any agreement or understanding with any Shareholder with respect to the Transactions other than as specified in this Agreement.

SECTION 3.17. Investment Company. The Company is not, and is not an affiliate of, and immediately following the Closing will not have become, an “investment company” within the meaning of the Investment Company Act of 1940, as amended.

SECTION 3.18. Disclosure. The Company confirms that neither it nor any person acting on its behalf has provided the Shareholders or their respective agents or counsel with any information that the Company believes constitutes material, non-public information, except insofar as the existence and terms of the proposed transactions hereunder may constitute such information and except for information that will be disclosed by the Parent under a current report on Form 8-K filed no later than four (4) business days after the Closing. The Company understands and confirms that the Parent will rely on the foregoing representations and covenants in effecting transactions in securities of the Parent. All disclosure provided to the Parent regarding the Company, its business and the Transactions, furnished by or on behalf of the Company (including the Company’s representations and warranties set forth in this Agreement) are true and correct and do not contain any untrue statement of a material fact or omit to state any material fact necessary in order to make the statements made therein, in light of the circumstances under which they were made, not misleading.

SECTION 3.19. Absence of Certain Changes or Events. Except in connection with the Transactions and as disclosed in the Company Disclosure Schedule, since inception, the Company has conducted its business only in the ordinary course, and during such period there has not been:

(a) any change in the assets, liabilities, financial condition or operating results of the Company, except changes in the ordinary course of business that have not caused, in the aggregate, a Company Material Adverse Effect;

(b) any damage, destruction or loss, whether or not covered by insurance, that would have a Company Material Adverse Effect;

(c) any waiver or compromise by the Company of a valuable right or of a material debt owed to it;

(d) any satisfaction or discharge of any lien, claim, or encumbrance or payment of any obligation by the Company, except in the ordinary course of business and the satisfaction or discharge of which would not have a Company Material Adverse Effect;

(e) any material change to a material Contract by which the Company or any of its assets is bound or subject;

| 8 |

(f) any mortgage, pledge, transfer of a security interest in, or lien, created by the Company, with respect to any of its material properties or assets, except liens for taxes not yet due or payable and liens that arise in the ordinary course of business and does not materially impair the Company’s ownership or use of such property or assets;

(g) any loans or guarantees made by the Company to or for the benefit of its employees, officers or directors, or any members of their immediate families, other than travel advances and other advances made in the ordinary course of its business;

(h) any alteration of the Company’s method of accounting or the identity of its auditors;

(i) any declaration or payment of dividend or distribution of cash or other property to the Shareholders or any purchase, redemption or agreements to purchase or redeem any Common Shares;

(j) any issuance of equity securities to any officer, director or affiliate; or

(k) any arrangement or commitment by the Company to do any of the things described in this Section.

SECTION 3.20. Foreign Corrupt Practices. Neither the Company, nor, to the Company’s knowledge, any member, director, officer, agent, employee or other person acting on behalf of the Company has, in the course of its actions for, or on behalf of, the Company (i) used any corporate funds for any unlawful contribution, gift, entertainment or other unlawful expenses relating to political activity; (ii) made any direct or indirect unlawful payment to any foreign or domestic government official or employee from corporate funds; (iii) violated or is in violation of any provision of the U.S. Foreign Corrupt Practices Act of 1977, as amended; or (iv) made any unlawful bribe, rebate, payoff, influence payment, kickback or other unlawful payment to any foreign or domestic government official or employee.

SECTION 3.21 Compliance. Neither the Company nor any subsidiary: (i) is in default under or in violation of (and no event has occurred that has not been waived that, with notice or lapse of time or both, would result in a default by the Company or any subsidiary under), nor has the Company or any subsidiary received written notice of a claim that it is in default under or that it is in violation of, any indenture, loan or credit agreement or any other agreement or instrument to which it is a party or by which it or any of its properties is bound (whether or not such default or violation has been waived), (ii) is in violation of any judgment, decree or order of any court, arbitrator or other governmental authority or (iii) is or has been in violation of any statute, rule, ordinance or regulation of any governmental authority, including without limitation all foreign, federal, state and local laws relating to taxes, environmental protection, occupational health and safety, product quality and safety and employment and labor matters, except in each case as could not have or reasonably be expected to result in a Company Material Adverse Effect.

SECTION 3.22 Regulatory Permits. The Company and its subsidiaries possess all certificates, authorizations and permits issued by the appropriate federal, state, local or foreign regulatory authorities necessary to conduct their respective businesses as described on the Company Disclosure Schedule, except where the failure to possess such permits could not reasonably be expected to result in a Company Material Adverse Effect (“Material Permits”), and neither the Company nor any subsidiary has received any written notice of proceedings relating to the revocation or modification of any Material Permit.

| 9 |

SECTION 3.23 Intellectual Property. The Company has, or has rights to use, all patents, patent applications, trademarks, trademark applications, service marks, trade names, trade secrets, inventions, copyrights, licenses and other intellectual property rights and similar rights necessary or required for use in connection with their respective businesses and which the failure to so have could have a Company Material Adverse Effect (collectively, the “Intellectual Property Rights”). All Intellectual Property Rights are set forth on the Company Disclosure Schedule. None of, and neither the Company nor any subsidiary has received a written notice that any of, the Intellectual Property Rights has expired, terminated or been abandoned, or is expected to expire or terminate or be abandoned, within two (2) years from the date of this Agreement. Neither the Company nor any subsidiary has received a written notice of a claim or otherwise has any knowledge that the Intellectual Property Rights violate or infringe upon the rights of any person, except as could not have or reasonably be expected to not have a Company Material Adverse Effect. All such Intellectual Property Rights are enforceable and there is no existing infringement by another person of any of the Intellectual Property Rights. The Company and its subsidiaries have taken reasonable security measures to protect the secrecy, confidentiality and value of all of their intellectual properties, except where failure to do so could not, individually or in the aggregate, reasonably be expected to have a Company Material Adverse Effect.

SECTION 3.24 Office of Foreign Assets Control. Neither the Company nor any of its Subsidiaries nor, to the Company’s knowledge, any member, director, officer, agent, employee or affiliate of the Company is currently subject to any U.S. sanctions administered by the Office of Foreign Assets Control of the U.S. Treasury Department (“OFAC”).

SECTION 3.25 U.S. Real Property Holding Corporation. The Company is not and has never been a U.S. real property holding corporation within the meaning of Section 897 of the Internal Revenue Code of 1986, as amended.

Section 3.26 Bank Holding Company Act. Neither the Company nor any of its subsidiaries or affiliates is subject to the Bank Holding Company Act of 1956, as amended (the “BHCA”) and to regulation by the Board of Governors of the Federal Reserve System (the “Federal Reserve”). Neither the Company nor any of its subsidiaries or affiliates owns or controls, directly or indirectly, five percent (5%) or more of the outstanding shares of any class of voting securities or twenty-five percent or more of the total equity of a bank or any entity that is subject to the BHCA and to regulation by the Federal Reserve. Neither the Company nor any of its subsidiaries or affiliates exercises a controlling influence over the management or policies of a bank or any entity that is subject to the BHCA and to regulation by the Federal Reserve.

SECTION 3.27 Money Laundering. The operations of the Company and its subsidiaries are and have been conducted at all times in compliance with applicable financial record-keeping and reporting requirements of the Currency and Foreign Transactions Reporting Act of 1970, as amended, applicable money laundering statutes and applicable rules and regulations thereunder (collectively, the “Money Laundering Laws”), and no action, suit or proceeding by or before any court or governmental agency, authority or body or any arbitrator involving the Company or any subsidiary with respect to the Money Laundering Laws is pending or, to the knowledge of the Company or any subsidiary, threatened

ARTICLE

IV

Representations and Warranties of the Parent

The Parent represents and warrants as follows to the Shareholders and the Company, that, except as set forth in the reports, schedules, forms, statements and other documents filed by the Parent with the U.S. Securities and Exchange Commission and publicly available prior to the date of the Agreement (the “Parent SEC Documents”) or specifically referenced on a disclosure schedule (the “Parent Disclosure Schedules”):

| 10 |

SECTION 4.01. Organization, Standing and Power. The Parent is duly organized, validly existing and in good standing under the laws of the State of Nevada and has full corporate power and authority and possesses all governmental franchises, licenses, permits, authorizations and approvals necessary to enable it to own, lease or otherwise hold its properties and assets and to conduct its businesses as presently conducted, other than such franchises, licenses, permits, authorizations and approvals the lack of which, individually or in the aggregate, has not had and would not reasonably be expected to have a material adverse effect on the Parent, a material adverse effect on the ability of the Parent to perform its obligations under this Agreement or on the ability of the Parent to consummate the Transactions (a “Parent Material Adverse Effect”). The Parent is duly qualified to do business in each jurisdiction where the nature of its business or their ownership or leasing of its properties make such qualification necessary and where the failure to so qualify would reasonably be expected to have a Parent Material Adverse Effect. The Parent has delivered to the Company true and complete copies of the articles of incorporation of the Parent, as amended to the date of this Agreement (as so amended, the “Parent Charter”), and the Bylaws of the Parent, as amended to the date of this Agreement (as so amended, the “Parent Bylaws”).

SECTION 4.02. Subsidiaries; Equity Interests. Except as set forth in the Parent SEC Documents, the Parent does not own, directly or indirectly, any capital stock, membership interest, partnership interest, joint venture interest or other equity interest in any person.

SECTION 4.03. Capital Structure. The authorized capital stock of the Parent consists of One Billion Four Hundred Million (1,400,000,000) shares of Parent Common Stock, par value $0.00001 per share, of which 43,328,296 shares are outstanding, and (100,000,000) shares of preferred stock, par value $0.00001 per share, of which 0 shares are issued and outstanding, and no shares of Parent Common Stock or preferred stock are held by the Parent in its treasury. Except as set forth in the Parent SEC Documents, no other shares of capital stock or other voting securities of the Parent were issued, reserved for issuance or outstanding. All outstanding shares of the capital stock of the Parent are, and all such shares that may be issued prior to the date hereof will be when issued, duly authorized, validly issued, fully paid and non-assessable and not subject to or issued in violation of any purchase option, call option, right of first refusal, preemptive right, subscription right or any similar right under any provision of the Nevada Revised Statutes, the Parent Charter, the Parent Bylaws or any Contract to which the Parent is a party or otherwise bound. Except as set forth in the Parent SEC Documents, there are no bonds, debentures, notes or other indebtedness of the Parent having the right to vote (or convertible into, or exchangeable for, securities having the right to vote) on any matters on which holders of Series A may vote (“Voting Parent Debt”). Except in connection with the Transactions, the Parent Disclosure Schedules or as described in the Parent SEC Documents, as of the date of this Agreement, there are no options, warrants, rights, convertible or exchangeable securities, “phantom” stock rights, stock appreciation rights, stock-based performance units, commitments, Contracts, arrangements or undertakings of any kind to which the Parent is a party or by which it is bound (i) obligating the Parent to issue, deliver or sell, or cause to be issued, delivered or sold, additional shares of capital stock or other equity interests in, or any security convertible or exercisable for or exchangeable into any capital stock of or other equity interest in, the Parent or any Voting Parent Debt, (ii) obligating the Parent to issue, grant, extend or enter into any such option, warrant, call, right, security, commitment, Contract, arrangement or undertaking or (iii) that give any person the right to receive any economic benefit or right similar to or derived from the economic benefits and rights occurring to holders of the capital stock of the Parent. As of the date of this Agreement, there are no outstanding contractual obligations of the Parent to repurchase, redeem or otherwise acquire any shares of capital stock of the Parent. Other than as set forth in the Parent SEC Documents, the Parent is not a party to any agreement granting any security holder of the Parent the right to cause the Parent to register shares of the capital stock or other securities of the Parent held by such security holder under the Securities Act. The stockholder list provided to the Company is a current stockholder list generated by its stock transfer agent, and such list accurately reflects all of the issued and outstanding shares of the Series A as at the Closing.

| 11 |

SECTION 4.04. Authority; Execution and Delivery; Enforceability. The execution and delivery by the Parent of this Agreement and the consummation by the Parent of the Transactions have been duly authorized and approved by the Board of Directors of the Parent and no other corporate proceedings on the part of the Parent are necessary to authorize this Agreement and the Transactions. This Agreement constitutes a legal, valid and binding obligation of the Parent, enforceable against the Parent in accordance with the terms hereof.

SECTION 4.05. No Conflicts; Consents.

(a) The execution and delivery by the Parent of this Agreement, does not, and the consummation of Transactions and compliance with the terms hereof and thereof will not, conflict with, or result in any violation of or default (with or without notice or lapse of time, or both) under, or give rise to a right of termination, cancellation or acceleration of any obligation or to loss of a material benefit under, or to increased, additional, accelerated or guaranteed rights or entitlements of any person under, or result in the creation of any Lien upon any of the properties or assets of the Parent under, any provision of (i) the Parent Charter or Parent Bylaws, (ii) any material Contract to which the Parent is a party or by which any of its properties or assets is bound or (iii) subject to the filings and other matters referred to in Section 4.05(b), any material Judgment or material Law applicable to the Parent or its properties or assets, other than, in the case of clauses (ii) and (iii) above, any such items that, individually or in the aggregate, have not had and would not reasonably be expected to have a Parent Material Adverse Effect.

(b) No Consent of, or registration, declaration or filing with, or permit from, any Governmental Entity is required to be obtained or made by or with respect to the Parent in connection with the execution, delivery and performance of this Agreement or the consummation of the Transactions.

SECTION 4.06. SEC Documents; Undisclosed and Liabilities.

(a) The Parent has filed all Parent SEC Documents required to be filed under the Securities Exchange Act of 1934 (the “’34 Act”).

(b) As of its respective filing date, each Parent SEC Documents complied in all material respects with the applicable requirements and guidelines of the ’34 Act, and did not contain any untrue statement of a material fact or omit to state a material fact required to be stated therein or necessary in order to make the statements therein, in light of the circumstances under which they were made, not misleading. Except to the extent that information contained in any Parent SEC Document has been revised or superseded by a later filed Parent SEC Document, none of the Parent SEC Documents contains any untrue statement of a material fact or omits to state any material fact required to be stated therein or necessary in order to make the statements therein, in light of the circumstances under which they were made, not misleading. The financial statements of the Parent included in the Parent SEC Documents have been prepared in accordance with the U.S. generally accepted accounting principles (“GAAP”) applied on a consistent basis during the periods involved (except as may be indicated in the notes thereto) and fairly present the financial position of Parent as of the dates thereof and the results of its operations and cash flows for the periods shown (subject, in the case of unaudited statements, to normal year-end audit adjustments).

| 12 |

(c) Except as set forth in the Parent SEC Documents, the Parent has no liabilities or obligations of any nature (whether accrued, absolute, contingent or otherwise) required by GAAP to be set forth on a balance sheet of the Parent or in the notes thereto. The Parent SEC Documents sets forth all financial and contractual obligations and liabilities (including any obligations to issue capital stock or other securities of the Parent) due after the date thereof.

SECTION 4.07. Information Supplied. None of the information supplied or to be supplied by the Parent for inclusion or incorporation by reference in any Parent SEC Document or report contains any untrue statement of a material fact or omits to state any material fact required to be stated therein or necessary in order to make the statements therein, in light of the circumstances under which they are made, not misleading.

SECTION 4.08. Absence of Certain Changes or Events. Except as disclosed in the filed Parent SEC Documents, from the date of the most recent audited financial statements included in the filed Parent SEC Documents to the date of this Agreement, the Parent has conducted its business only in the ordinary course, and during such period there has not been:

(a) any change in the assets, liabilities, financial condition or operating results of the Parent from that reflected in the Parent SEC Documents, except changes in the ordinary course of business that have not caused, in the aggregate, a Parent Material Adverse Effect;

(b) any damage, destruction or loss, whether or not covered by insurance, that would have a Parent Material Adverse Effect;

(c) any waiver or compromise by the Parent of a valuable right or of a material debt owed to it;

(d) any satisfaction or discharge of any lien, claim, or encumbrance or payment of any obligation by the Parent, except in the ordinary course of business and the satisfaction or discharge of which would not have a Parent Material Adverse Effect;

(e) any material change to a material Contract by which the Parent or any of its assets is bound or subject;

(f) any material change in any compensation arrangement or agreement with any employee, officer, director or stockholder;

(g) any resignation or termination of employment of any officer of the Parent;

(h) any mortgage, pledge, transfer of a security interest in, or lien, created by the Parent, with respect to any of its material properties or assets, except liens for taxes not yet due or payable and liens that arise in the ordinary course of business and do not materially impair the Parent’s ownership or use of such property or assets;

(i) any loans or guarantees made by the Parent to or for the benefit of its employees, officers or directors, or any members of their immediate families, other than travel advances and other advances made in the ordinary course of its business;

(j) any declaration, setting aside or payment or other distribution in respect of any of the Parent’s capital stock, or any direct or indirect redemption, purchase, or other acquisition of any of such stock by the Parent;

(k) any alteration of the Parent’s method of accounting or the identity of its auditors;

| 13 |

(l) any issuance of equity securities to any officer, director or affiliate, except pursuant to existing Parent stock option plans; or

(m) any arrangement or commitment by the Parent to do any of the things described in this Section 4.08.

SECTION 4.09. Taxes.

(a) The Parent has timely filed, or has caused to be timely filed on its behalf, all Tax Returns required to be filed by it, and all such Tax Returns are true, complete and accurate, except to the extent any failure to file, any delinquency in filing or any inaccuracies in any filed Tax Returns, individually or in the aggregate, have not had and would not reasonably be expected to have a Parent Material Adverse Effect. All Taxes shown to be due on such Tax Returns, or otherwise owed, has been timely paid, except to the extent that any failure to pay, individually or in the aggregate, has not had and would not reasonably be expected to have a Parent Material Adverse Effect.

(b) The most recent financial statements contained in the Parent SEC Documents reflect an adequate reserve for all Taxes payable by the Parent (in addition to any reserve for deferred Taxes to reflect timing differences between book and Tax items) for all Taxable periods and portions thereof through the date of such financial statements. No deficiency with respect to any Taxes has been proposed, asserted or assessed against the Parent, and no requests for waivers of the time to assess any such Taxes are pending, except to the extent any such deficiency or request for waiver, individually or in the aggregate, has not had and would not reasonably be expected to have a Parent Material Adverse Effect.

(c) There are no Liens for Taxes (other than for current Taxes not yet due and payable) on the assets of the Parent. The Parent is not bound by any agreement with respect to Taxes.

SECTION 4.10. Absence of Changes in Benefit Plans. From the date of the most recent financial statements included in the Parent SEC Documents to the date of this Agreement, there has not been any adoption or amendment in any material respect by Parent of any collective bargaining agreement or any bonus, pension, profit sharing, deferred compensation, incentive compensation, stock ownership, stock purchase, stock option, phantom stock, retirement, vacation, severance, disability, death benefit, hospitalization, medical or other plan, arrangement or understanding (whether or not legally binding) providing benefits to any current or former employee, officer or director of Parent (collectively, “Parent Benefit Plans”). Except as set forth in the Parent SEC Documents, as of the date of this Agreement there are not any employment, consulting, indemnification, severance or termination agreements or arrangements between the Parent and any current or former employee, officer or director of the Parent, nor does the Parent have any general severance plan or policy.

SECTION 4.11. ERISA Compliance; Excess Parachute Payments. The Parent does not, and since its inception never has, maintained, or contributed to any “employee pension benefit plans” (as defined in Section 3(2) of ERISA), “employee welfare benefit plans” (as defined in Section 3(1) of ERISA) or any other Parent Benefit Plan for the benefit of any current or former employees, consultants, officers or directors of Parent.

SECTION 4.12. Litigation. Except as disclosed in the Parent SEC Documents, there is no Action which (i) adversely affects or challenges the legality, validity or enforceability of any of this Agreement or the Series A or (ii) could, if there were an unfavorable decision, individually or in the aggregate, have or reasonably be expected to result in a Parent Material Adverse Effect. Neither the Parent nor any director or officer thereof (in his or her capacity as such), is or has been the subject of any Action involving a claim or violation of or liability under federal or state securities laws or a claim of breach of fiduciary duty.

| 14 |

SECTION 4.13. Compliance with Applicable Laws. Except as disclosed in the Parent SEC Documents, the Parent is in compliance with all applicable Laws, including those relating to occupational health and safety, the environment, export controls, trade sanctions and embargoes, except for instances of noncompliance that, individually and in the aggregate, have not had and would not reasonably be expected to have a Parent Material Adverse Effect. Except as set forth in the Parent SEC Documents, the Parent has not received any written communication during the past two years from a Governmental Entity that alleges that the Parent is not in compliance in any material respect with any applicable Law.

SECTION 4.14. Contracts. Except as disclosed in the Parent SEC Documents, there are no Contracts that are material to the business, properties, assets, condition (financial or otherwise), results of operations or prospects of the Parent taken as a whole. The Parent is not in violation of or in default under (nor does there exist any condition which upon the passage of time or the giving of notice would cause such a violation of or default under) any Contract to which it is a party or by which it or any of its properties or assets is bound, except for violations or defaults that would not, individually or in the aggregate, reasonably be expected to result in a Parent Material Adverse Effect.

SECTION 4.15. Title to Properties. The Parent has good title to, or valid leasehold interests in, all of its properties and assets used in the conduct of its businesses. All such assets and properties, other than assets and properties in which the Parent has leasehold interests, are free and clear of all Liens and except for Liens that, in the aggregate, do not and will not materially interfere with the ability of the Parent to conduct business as currently conducted. The Parent has complied in all material respects with the terms of all material leases to which it is a party and under which it is in occupancy, and all such leases are in full force and effect. The Parent enjoys peaceful and undisturbed possession under all such material leases.

SECTION 4.16. Intellectual Property. The Parent owns, or is validly licensed or otherwise has the right to use, all Intellectual Property Rights which are material to the conduct of the business of the Parent taken as a whole. No claims are pending or, to the knowledge of the Parent, threatened that the Parent is infringing or otherwise adversely affecting the rights of any person with regard to any Intellectual Property Right. To the knowledge of the Parent, no person is infringing the rights of the Parent with respect to any Intellectual Property Right.

SECTION 4.17. Labor Matters. There are no collective bargaining or other labor union agreements to which the Parent is a party or by which it is bound. No material labor dispute exists or, to the knowledge of the Parent, is imminent with respect to any of the employees of the Parent.

SECTION 4.18. Transactions With Affiliates and Employees. Except as set forth in the Parent SEC Documents, none of the officers or directors of the Parent and, to the knowledge of the Parent, none of the employees of the Parent is presently a party to any transaction with the Parent or any subsidiary (other than for services as employees, officers and directors), including any contract, agreement or other arrangement providing for the furnishing of services to or by, providing for rental of real or personal property to or from, or otherwise requiring payments to or from any officer, director or such employee or, to the knowledge of the Parent, any entity in which any officer, director, or any such employee has a substantial interest or is an officer, director, trustee or partner.

SECTION 4.19. Application of Takeover Protections. The Parent has taken all necessary action, if any, in order to render inapplicable any control share acquisition, business combination, poison pill (including any distribution under a rights agreement) or other similar anti-takeover provision under the Parent’s charter documents or the laws of its state of incorporation that is or could become applicable to the Shareholders as a result of the Shareholders and the Parent fulfilling their obligations or exercising their rights under this Agreement, including, without limitation, the issuance of the Series A and the Shareholders’ ownership of the Series A.

| 15 |

SECTION 4.20. No Additional Agreements. The Parent does not have any agreement or understanding with the Shareholders with respect to the Transactions other than as specified in this Agreement.

SECTION 4.21. Investment Company. The Parent is not, and is not an affiliate of, and immediately following the Closing will not have become, an “investment company” within the meaning of the Investment Company Act of 1940, as amended.

SECTION 4.22. Disclosure. The Parent confirms that neither it nor any person acting on its behalf has provided any Shareholder or its respective agents or counsel with any information that the Parent believes constitutes material, non-public information except insofar as the existence and terms of the proposed transactions hereunder may constitute such information and except for information that will be disclosed by the Parent under a current report on Form 8-K filed after the Closing. All disclosure provided to the Shareholders regarding the Parent, its business and the transactions contemplated hereby, furnished by or on behalf of the Parent (including the Parent’s representations and warranties set forth in this Agreement) are true and correct and do not contain any untrue statement of a material fact or omit to state any material fact necessary in order to make the statements made therein, in light of the circumstances under which they were made, not misleading.

SECTION 4.23. Certain Registration Matters. Except as specified in the Parent SEC Documents or on the Parent Disclosure Schedules, the Parent has not granted or agreed to grant to any person any rights (including “piggy-back” registration rights) to have any securities of the Parent registered with the SEC or any other governmental authority that have not been satisfied.

SECTION 4.24. Quotation Requirements. The Parent is, and has no reason to believe that it will not in the foreseeable future continue to be, in compliance with the requirements to maintain quotation on the OTCQB tier of the electronic marketplace maintained by OTC Markets Group, Inc.

SECTION 4.25. Series A. Upon issue to the Shareholders, the Series A will be duly and validly issued, fully paid and non-assessable shares of preferred stock in the capital of the Company.

ARTICLE

V

Deliveries

SECTION 5.01. Deliveries of the Shareholders.

(a) Concurrently herewith the Shareholders are delivering to the Parent this Agreement executed by the Shareholders.

(b) At or prior to the Closing, the Shareholders shall deliver to the Parent:

| (i) | This Agreement, executed by the Shareholders |

| (ii) | this Agreement which shall constitute a duly executed share transfer power for transfer by the Shareholders of their Common Shares to the Parent (which Agreement shall constitute a limited power of attorney in the Parent or any officer thereof to effectuate any Share transfers as may be required under applicable law, including, without limitation, recording such transfer in the share registry maintained by the Company for such purpose). |

| 16 |

SECTION 5.02. Deliveries of the Parent.

(a) Concurrently herewith, the Parent is delivering to the Shareholders and to the Company, a copy of this Agreement executed by the Parent.

(b) Promptly following the Closing, the Parent shall deliver to the Shareholders, certificates representing the new shares of Series A issued to the Shareholders set forth on Exhibit A.

(c) Following the Closing, the Parent shall, promptly, without delay, and as soon as practicable in consideration of, and in compliance with, all applicable securities laws and regulations, file an offering statement on Form 1-A for the Parent’s offering of not less than $20,000,000 worth of its common stock pursuant to Regulation A.

(d) One (1) business day following the Closing, the Parent shall appoint ▇▇▇▇▇ ▇▇▇▇▇▇▇▇▇▇ as the Executive Chairman of the Board of the Parent.

SECTION 5.03. Deliveries of the Company.

(a) Concurrently herewith, the Company is delivering to the Parent this Agreement executed by the Company.

(b) At or prior to the Closing, the Company shall deliver to the Parent:

| (i) | a certificate from the Company, signed by its Secretary or Assistant Secretary certifying that the attached copies of the Company’s Charter Documents and resolutions of the Board of Directors of the Company approving this Agreement and the Transactions, are all true, complete and correct and remain in full force and effect; and |

| (ii) | A Shareholder list, certified by the Company’s Secretary or President. |

| (iii) | Fully executed Definitive Agreements and financial exhibits which shall be used to compute the number of Series A shares granted to the Shareholders according to Schedule A. |

ARTICLE

VI

Conditions to Closing

SECTION 6.01. Shareholders and Company Conditions Precedent. The obligations of the Shareholders and the Company to enter into and complete the Closing is subject, at the option of the Shareholders and the Company, to the fulfillment on or prior to the Closing Date of the following conditions.

| 17 |

(a) Representations and Covenants. The representations and warranties of the Parent contained in this Agreement shall be true in all material respects on and as of the Closing Date with the same force and effect as though made on and as of the Closing Date. The Parent shall have performed and complied in all material respects with all covenants and agreements required by this Agreement to be performed or complied with by the Parent on or prior to the Closing Date. The Parent shall have delivered to the Shareholder and the Company, a certificate, dated the Closing Date, to the foregoing effect.

(b) Litigation. No action, suit or proceeding shall have been instituted before any court or governmental or regulatory body or instituted or threatened by any governmental or regulatory body to restrain, modify or prevent the carrying out of the Transactions or to seek damages or a discovery order in connection with such Transactions, or which has or may have, in the reasonable opinion of the Company or the Shareholders, a materially adverse effect on the assets, properties, business, operations or condition (financial or otherwise) of the Parent.

(c) No Material Adverse Change. There shall not have been any occurrence, event, incident, action, failure to act, or transaction since August 31, 2018 which has had or is reasonably likely to cause a Parent Material Adverse Effect.

(d) Post-Closing Capitalization. At, and immediately after, the Closing, the authorized capitalization, and the number of issued and outstanding shares of capital stock of the Parent, on a fully-diluted basis, shall be as described in the Parent SEC Documents.

(e) SEC Reports. The Parent shall have filed all reports and other documents required to be filed by Parent under the U.S. federal securities laws through the Closing Date.

(f) OTC Quotation. The Parent shall have maintained its status as a Company whose common stock is quoted on the OTCQB tier of the OTC Markets, and Parent shall not have received any notice that any reason shall exist as to why such status shall not continue immediately following the Closing.

(g) Deliveries. The deliveries specified in Section 5.02 shall have been made by the Parent.

(h) No Suspensions of Trading in Parent Common Stock. Trading in the Parent common stock shall not have been suspended by the SEC or any trading market (except for any suspensions of trading of not more than one trading day solely to permit dissemination of material information regarding the Parent) at any time since the date of execution of this Agreement.

(i) Satisfactory Completion of Due Diligence. The Company and the Shareholders shall have completed their legal, accounting and business due diligence of the Parent and the results thereof shall be satisfactory to the Company and the Shareholders in their sole and absolute discretion.

SECTION 6.02. Parent Conditions Precedent. The obligations of the Parent to enter into and complete the Closing are subject, at the option of the Parent, to the fulfillment on or prior to the Closing Date of the following conditions, any one or more of which may be waived by the Company in writing.

(a) Representations and Covenants. The representations and warranties of the Shareholders and the Company contained in this Agreement shall be true in all material respects on and as of the Closing Date with the same force and effect as though made on and as of the Closing Date. The Shareholders and the Company shall have performed and complied in all material respects with all covenants and agreements required by this Agreement to be performed or complied with by the Shareholders and the Company on or prior to the Closing Date. The Company shall have delivered to the Parent a certificate, dated the Closing Date, to the foregoing effect.

| 18 |

(b) Litigation. No action, suit or proceeding shall have been instituted before any court or governmental or regulatory body or instituted or threatened by any governmental or regulatory body to restrain, modify or prevent the carrying out of the Transactions or to seek damages or a discovery order in connection with such Transactions, or which has or may have, in the reasonable opinion of the Parent, a materially adverse effect on the assets, properties, business, operations or condition (financial or otherwise) of the Company.

(c) No Material Adverse Change. There shall not have been any occurrence, event, incident, action, failure to act, or transaction since the date hereof which has had or is reasonably likely to cause a Company Material Adverse Effect.

(d) Deliveries. The deliveries specified in Section 5.01 and Section 5.03 shall have been made by the Shareholders and the Company, respectively.

(e) Post-Closing Capitalization. At, and immediately after, the Closing, the authorized capitalization, and the number of issued and outstanding shares of the Company, on a fully-diluted basis, shall be described herein.

(f) Satisfactory Completion of Due Diligence. The Parent shall have completed its legal, accounting and business due diligence of the Company and the results thereof shall be satisfactory to the Parent in its sole and absolute discretion.

ARTICLE

VII

Covenants

SECTION 7.01. Public Announcements. The Parent and the Company will consult with each other before issuing, and provide each other the opportunity to review and comment upon, any press releases or other public statements with respect to the Agreement and the Transactions and shall not issue any such press release or make any such public statement prior to such consultation, except as may be required by applicable Law. Notwithstanding anything contained herein, the Parent shall make all necessary and customary filings and press releases in compliance with applicable securities laws.

SECTION 7.02. Fees and Expenses. All fees and expenses incurred in connection with this Agreement shall be paid by the Party incurring such fees or expenses, whether or not this Agreement is consummated.

SECTION 7.03. Continued Efforts. Each Party shall use commercially reasonable efforts to (a) take all action reasonably necessary to consummate the Transactions, and (b) take such steps and do such acts as may be necessary to keep all of its representations and warranties true and correct as of the Closing Date with the same effect as if the same had been made, and this Agreement had been dated, as of the Closing Date.

SECTION 7.04. Exclusivity. Each of the Parent and the Company shall not (and shall not cause or permit any of their affiliates to) engage in any discussions or negotiations with any person or take any action that would be inconsistent with the Transactions and that has the effect of avoiding the Closing contemplated hereby. Each of the Parent and the Company shall notify each other immediately if any person makes any proposal, offer, inquiry, or contact with respect to any of the foregoing.

| 19 |

SECTION 7.05. Filing of Current Report. The Parent shall file with the SEC, no later than four (4) business days of the Closing Date, a Current Report on Form 8-K disclosing the terms of this Agreement and other requisite disclosure regarding the Transactions.

SECTION 7.06. Access. Each Party shall permit representatives of any other Party to have full access to all premises, properties, personnel, books, records (including Tax records), contracts, and documents of or pertaining to such Party.

SECTION 7.07. Preservation of Business. From the date of this Agreement until the Closing Date, the Company shall operate only in the ordinary and usual course of business consistent with their respective past practices, and shall use reasonable commercial efforts to (a) preserve intact their respective business organizations, (b) preserve the good will and advantageous relationships with customers, suppliers, independent contractors, employees and other persons material to the operation of their respective businesses, and (c) not permit any action or omission that would cause any of their respective representations or warranties contained herein to become inaccurate or any of their respective covenants to be breached in any material respect.

ARTICLE

VIII

Miscellaneous

SECTION 8.01. Notices. All notices, requests, claims, demands and other communications under this Agreement shall be in writing and shall be deemed given upon receipt by the Parties at the following addresses (or at such other address for a Party as shall be specified by like notice):

If to the Parent, to:

▇▇▇▇ ▇▇▇▇▇▇ ▇▇▇▇▇, ▇▇▇▇▇ ▇

▇▇▇▇▇▇▇▇, ▇▇ ▇▇▇▇▇

Attn: ▇▇▇▇▇▇▇ ▇▇▇▇▇

With a copy to (which shall not constitute notice):

▇▇▇▇▇ Law Group

▇ ▇▇▇▇ ▇▇▇▇▇▇▇, ▇▇▇▇▇ ▇▇▇

▇▇▇▇, ▇▇ ▇▇▇▇▇

Attn: ▇▇▇ ▇▇▇▇▇▇▇, Esq.

| 20 |

If to the Company, to:

ST Brands, Inc.

▇▇ ▇▇▇▇ ▇▇▇▇▇▇, ▇▇▇▇ ▇▇▇▇▇

▇▇▇ ▇▇▇▇, ▇▇ ▇▇▇▇▇

Attn: ▇▇▇▇▇ ▇▇▇▇▇▇▇▇▇▇

With a copy to (which shall not constitute notice):

▇▇▇▇▇▇ Legal Corp.

▇▇ ▇▇▇▇▇▇ ▇▇▇▇▇▇, ▇▇▇ ▇▇▇▇▇

▇▇▇ ▇▇▇▇, ▇▇ ▇▇▇▇▇

Attn: ▇▇▇▇▇▇▇ ▇▇▇▇ ▇▇▇▇▇▇

If to the Shareholders at the addresses set forth in Exhibit A hereto.

SECTION 8.02. Amendments; Waivers; No Additional Consideration. No provision of this Agreement may be waived or amended except in a written instrument signed by the Company, Parent and the Shareholders. No waiver of any default with respect to any provision, condition or requirement of this Agreement shall be deemed to be a continuing waiver in the future or a waiver of any subsequent default or a waiver of any other provision, condition or requirement hereof, nor shall any delay or omission of any Party to exercise any right hereunder in any manner impair the exercise of any such right.

SECTION 8.03. Replacement of Securities. If any certificate or instrument evidencing any Series A is mutilated, lost, stolen or destroyed, the Parent shall issue or cause to be issued in exchange and substitution for and upon cancellation thereof, or in lieu of and substitution therefore, a new certificate or instrument, but only upon receipt of evidence reasonably satisfactory to the Parent of such loss, theft or destruction and customary and reasonable indemnity, if requested. The applicants for a new certificate or instrument under such circumstances shall also pay any reasonable third-party costs associated with the issuance of such replacement Series A. If a replacement certificate or instrument evidencing any Series A is requested due to a mutilation thereof, the Parent may require delivery of such mutilated certificate or instrument as a condition precedent to any issuance of a replacement.

SECTION 8.04. Remedies. In addition to being entitled to exercise all rights provided herein or granted by law, including recovery of damages, the Shareholders, Parent and the Company will be entitled to specific performance under this Agreement. The Parties agree that monetary damages may not be adequate compensation for any loss incurred by reason of any breach of obligations described in the foregoing sentence and hereby agrees to waive in any action for specific performance of any such obligation the defense that a remedy at law would be adequate.

SECTION 8.05. Limitation of Liability. Notwithstanding anything herein to the contrary, each of the Parent and the Company acknowledge and agree that the liability of the Shareholders arising directly or indirectly, under any transaction document of any and every nature whatsoever shall be satisfied solely out of the assets of the Shareholders, and that no trustee, officer, other investment vehicle or any other affiliate of the Shareholders or any investor, Shareholder or holder of shares of beneficial interest of the Shareholders shall be personally liable for any liabilities of the Shareholders.

SECTION 8.06. Interpretation. When a reference is made in this Agreement to a Section, such reference shall be to a Section of this Agreement unless otherwise indicated. Whenever the words “include,” “includes” or “including” are used in this Agreement, they shall be deemed to be followed by the words “without limitation.”

| 21 |

SECTION 8.07. Severability. If any term or other provision of this Agreement is invalid, illegal or incapable of being enforced by any rule or Law, or public policy, all other conditions and provisions of this Agreement shall nevertheless remain in full force and effect so long as the economic or legal substance of the Transactions contemplated hereby is not affected in any manner materially adverse to any Party. Upon such determination that any term or other provision is invalid, illegal or incapable of being enforced, the Parties shall negotiate in good faith to modify this Agreement so as to effect the original intent of the Parties as closely as possible in an acceptable manner to the end that Transactions contemplated hereby are fulfilled to the extent possible.

SECTION 8.08. Counterparts; Facsimile Execution. This Agreement may be executed in one or more counterparts, all of which shall be considered one and the same agreement and shall become effective when one or more counterparts have been signed by each of the Parties and delivered to the other Parties. Facsimile execution and delivery of this Agreement is legal, valid and binding for all purposes.

SECTION 8.09. Entire Agreement; Third Party Beneficiaries. This Agreement, taken together with the Company Disclosure Schedule, (a) constitutes the entire agreement, and supersede all prior agreements and understandings, both written and oral, among the Parties with respect to the Transactions and (b) are not intended to confer upon any person other than the Parties any rights or remedies.