AMENDMENT NO. 7 SECURITIES LENDING AGREEMENT

Exhibit (h)(8)(viii)

AMENDMENT NO. 7

Amendment No. 7, dated as of September 12, 2023 (“Amendment No. 7”), to the Securities Lending Agreement dated as of April 11, 2016 (“Agreement”), by and between JPMorgan Chase Bank, National Association (“X.X. Xxxxxx”) and each Equitable investment company identified in Annex A hereto (“Lender”).

NOW THEREFORE, X.X. Xxxxxx and Xxxxxx agree to modify and amend the Agreement as follows:

| 1. | Xxxxx X. Xxxxx A to the Agreement is deleted and replaced in its entirety by Annex A attached hereto. |

| 2. | Schedule 1. Schedule 1 to the Agreement, setting forth the Securities Lending Investment Guidelines, is deleted and replaced in its entirety by Schedule 1 hereto. |

| 3. | Schedule 4. Schedule 4 to the Agreement, setting forth the Limitations on Securities Available for Loan, Lending Accounts and Markets, is deleted and replaced in its entirety by Schedule 4 attached hereto. |

| 4. | Ratification. Except as modified and amended hereby, the Agreement is hereby ratified and confirmed in full force and effect in accordance with its terms. |

| 1290 Funds |

JPMorgan Chase Bank, N.A. | |||||||

| On behalf of each of their series listed on Annex A |

||||||||

| By: /s/ Xxxxx Xxxxx |

By: /s/ Xxxxxx Xxxxxxx | |||||||

| Name: Xxxxx Xxxxx Title: Chief Financial Officer Date: 9/12/23 |

Name: Xxxxxx Xxxxxxx Title: Managing Director Date: September 14, 2023 | |||||||

Schedule 1

X.X. Xxxxxx Xxxxx Bank, N.A. - Securities Lending Investment Guidelines

Separate Account For:

AXA: EQ ADVISORS TRUST 1290 FUNDS

| A. | PERMISSIBLE INVESTMENTS: Both fixed-income securities and other instruments with debt-like characteristics on a fixed rate7 and floating rate8 basis are permitted, including: |

| 1. |

| (a) | U.S. Treasury Securities 15 |

| ☐ | U.S. Treasury Bills, Notes, and Xxxxx 15a |

| ☐ | U.S. Treasury Inflation Protected Securities (TIPS) 15c |

| ☐ | CATEGORY NOT APPROVED FOR INVESTMENT |

| (b) | Non-U.S. Sovereign Government Securities 11 |

| ☐ | Government Bills, Notes and Bonds |

| ☐ | CATEGORY NOT APPROVED FOR INVESTMENT |

| (c) | U.S. Government Sponsored Securities or Obligations 14 |

| ☐ | U.S. Government Callable Debt 14a |

| ☐ | U.S. Government Non-Callable Debt 14b |

| ☐ | CATEGORY NOT APPROVED FOR INVESTMENT |

| (d) | Non-US Sovereign Agency Securities or Obligations 11a |

| ☐ | Commercial Paper |

| ☐ | Certificates of Deposit and Promissory Notes |

| ☐ | Medium-Term Notes |

| ☐ | CATEGORY NOT APPROVED FOR INVESTMENT |

| (e) | Corporate Securities or Obligations, not subordinated 1 |

| ☐ | Commercial Paper |

| ☐ | Promissory Notes |

| ☐ | Corporate Bonds, Medium Term Notes, Investment Agreements, Funding Agreements and Guaranteed Investment Contracts issued by Corporations |

| ☐ | CATEGORY NOT APPROVED FOR INVESTMENT |

| (f) | Debt Securities or Obligations issued by Financial Institutions 2 |

| ☐ | Commercial Paper |

| ☐ | Certificates of Deposit |

| ☐ | Time Deposits |

| ☐ | Notes, Xxxxxx’s Acceptances, Bank Notes (Bank Bills), Deposit Notes, and Promissory Notes issued by Financial Institutions, not subordinated. |

| ☐ | Bonds and Medium Term Notes |

| ☐ | CATEGORY NOT APPROVED FOR INVESTMENT |

1

| (g) | Structured Credit Securities issued by SPVs, Conduits or under similar structures backed by U.S. Government Agencies or U.S. Government-Sponsored Enterprises, not subordinated 10 |

*(where approved, this asset class requires specific agreement from the clients’ Chief Investment Officer or equivalent)

| ☐ | GNMA Mortgage Backed Securities (MBS) 10a |

| ☐ | GNMA Collateralized Mortgage Obligations (CMOs) 10b |

| ☐ | Mortgage Backed Securities (MBS), non-GNMA 10c |

| ☐ | Collateralized Mortgage Obligations (CMOs), non-GNMA 10d |

| ☐ | CATEGORY NOT APPROVED FOR INVESTMENT |

| (h) | Structured Credit Securities issued by SPVs, Conduits or under similar structures, not subordinated 12 |

*(where approved, this asset class requires specific agreement from the clients’ Chief Investment Officer or equivalent)

| ☐ | Asset Backed Commercial Paper 12c |

| ☐ | Asset Backed Securities (ABSs) 12b |

| ☐ | Asset Backed Securities (ABSs) Home Equity loans 12a |

| ☐ | Secured Master Notes 12d |

| ☐ | Corporate Structured Notes 12e |

| ☐ | CATEGORY NOT APPROVED FOR INVESTMENT |

| (i) | Debt Securities issued by Supranational issuers, not subordinated 3 |

| ☐ | CATEGORY APPROVED FOR INVESTMENT |

| ☐ | CATEGORY NOT APPROVED FOR INVESTMENT |

| (j) | Reverse Repurchase Agreements (Reverse Repos) 9 – See Appendix A |

| ☐ | CATEGORY APPROVED FOR INVESTMENT (where approved, acceptable collateral types MUST be selected in Appendix A) |

| ☐ | CATEGORY NOT APPROVED FOR INVESTMENT |

| (k) | Money Market Mutual Funds |

| ☐ | Shares of a U.S. SEC-Regulated Money Market Fund 16 |

(where approved, MUST select 2a-7 money market funds, non 2a-7 funds or both)

| ☐ | 2a-7 money market mutual funds |

| ☐ | Non-2a-7 money market mutual funds |

| ☐ | Shares of a Short Term Money Market Fund as defined by the European Securities and Markets Authority 17 |

| ☐ | Shares of a money market managed investment scheme registered by the Australian Securities and Investments Commission (ASIC) 18 |

| ☒ | Refer to Appendix B for non-standard clauses pertaining to this category |

| ☐ | CATEGORY NOT APPROVED FOR INVESTMENT |

| 2. | Currency |

Reverse Repurchase Agreement Collateral Currency

| ☐ | Collateral must be denominated in the same currency as the investment |

| ☐ | Collateral may be denominated in a different currency to the investment |

See Appendix A-XCCY for Cross Currency Reverse Repurchase Agreement Collateral Categories

All investments must be denominated in the currency of the cash collateral received.

| 3. |

| ☒ | Permissible investments are approved to be acquired through X.X. Xxxxxx or any of its affiliates |

| ☒ | Shares of a Money Market Mutual Fund managed by X.X. Xxxxxx or any of its affiliates are permissible |

| ☒ | Reverse Repurchase agreements with X.X. Xxxxxx or any of its affiliates as a counterparty are permissible |

| ☐ | Securities issued by X.X. Xxxxxx or any of its affiliates are not permissible |

| ☐ | X.X. Xxxxxx or any of its affiliates are not permissible for any of the above options in A.3. |

X.X Xxxxxx or its Affiliates may earn fees and profits from any of the above-listed activities. Lender acknowledges that such fees and profits are separate from, and in addition to, the fees that X.X. Xxxxxx earns under the Agreement and Lender hereby consents to the receipt by X.X. Xxxxxx or its Affiliates of such fees and profits.

| B. |

| 1. | There shall be no concentration limitation on (j), and (k). See section A.1. |

| 2. | For purposes of these guidelines, the term “issuer” means a given entity and its affiliates and an “affiliate” of an issuer means an entity controlling, controlled by, or under common control with, the issuer. |

| C. |

Fixed Rate Instruments and Floating Rate Instruments (including U.S. Government Securities) shall have a Final Maturity6 equal to 5 business days or fewer from the settlement date of the trade.

For extendible securities, X.X. Xxxxxx only regards these as acceptable in cases where the investing agent has control over the extension feature.

| D. | RATINGS GUIDELINES – all ratings referred to in Section D refer to the rating defined at the time of purchase. |

| 1. |

Except with respect to permitted collateral for reverse repurchase agreements, U.S. Treasury Securities, U.S Government Agency Debentures, U.S. Government Sponsored Securities or Obligations and as noted below, a permissible investment must have a minimum rating as provided by a Nationally Recognized Statistical Rating Organization (“NRSRO”) as follows:

Short Term Ratings designated below will be applied to investments maturing in 13 months or less from time of purchase.

In the event that an NRSRO, as designated below, does not provide a Short Term rating for an investment maturing in 13 months or less, a Tier One Long Term Credit Rating21 from that NRSRO will be deemed to have satisfied that NRSRO’s Short Term rating criteria.

| 2. | An investment without its own rating shall be considered to be rated if the issuer thereof is rated with respect to: (i) a class of short-term debt obligations, in the case of short-term ratings, or (ii) a class of long-term debt obligations, in the case of long-term ratings and in that case shall be deemed to bear the rating of the corresponding rated obligation. |

| 3. | Ratings Downgrades: In the event that a rating is downgraded by an NRSRO below the minimum requirement as indicated in section D: Ratings Guidelines, JPMorgan shall notify the Lender and await instructions as to whether the affected security or instrument should be sold. In the absence of a contrary instruction, JPMorgan shall take no action with respect to the downgraded security or instrument. In no event shall JPMorgan be liable for any consequences of a rating downgrade, including, but not limited to, retention of the affected security or instrument in the absence of a sale instruction from the Lender. |

| 4. | Some ratings may contain an annotation alongside the rating (for example: AAAm (S&P), Aaa-mf (Xxxxx’x), or AAAmmf (Fitch) for Money Market Mutual Funds) to denote the relevant rating agency has assigned the rating according to its specific criteria for the instrument. |

| (a) | U.S. Treasury Securities 15 |

| ☐ | ‘CATEGORY NOT APPROVED FOR INVESTMENT’ |

| (b) | Non-US Sovereign Government Securities 11 |

| ☐ | ‘CATEGORY NOT APPROVED FOR INVESTMENT’ |

| Minimum Short Term Ratings: | Minimum Ratings Based On: | |||||||||||||

| S&P | ☐ A-1 | ☐ NA | ☐ Any one | |||||||||||

| Xxxxx’x | ☐ P-1 | ☐ NA | ☐ Any two of three | |||||||||||

| Fitch | ☐ F-1 | ☐ NA | ☐ All selected ratings | |||||||||||

| Minimum Long Term Ratings: | Minimum Ratings Based On: | |||||||||||||

| S&P | ☐ AAA | ☐ AA- | ☐ A- | ☐ NA | ☐ Any one | |||||||||

| Xxxxx’x | ☐ Aaa | ☐ Aa3 | ☐ A3 | ☐ NA | ☐ Any two of three | |||||||||

| Fitch | ☐ AAA | ☐ AA- | ☐ A- | ☐ NA | ☐ All selected ratings | |||||||||

| (c) | U.S. Government Sponsored Securities or Obligations 14 |

| ☐ | ‘CATEGORY NOT APPROVED FOR INVESTMENT’ |

| (d) | Non-US Sovereign Agency Securities or Obligations 11a |

| ☐ | ‘CATEGORY NOT APPROVED FOR INVESTMENT’ |

| Minimum Short Term Ratings: | Minimum Ratings Based On: | |||||||||||||

| S&P | ☐ A-1 | ☐ NA | ☐ Any one | |||||||||||

| Xxxxx’x | ☐ P-1 | ☐ NA | ☐ Any two of three | |||||||||||

| Fitch | ☐ F-1 | ☐ NA | ☐ All selected ratings | |||||||||||

| Minimum Long Term Ratings: | Minimum Ratings Based On: | |||||||||||||

| S&P | ☐ AAA | ☐ AA- | ☐ A- | ☐ NA | ☐ Any one | |||||||||

| Xxxxx’x | ☐ Aaa | ☐ Aa3 | ☐ A3 | ☐ NA | ☐ Any two of three | |||||||||

| Fitch | ☐ AAA | ☐ AA- | ☐ A- | ☐ NA | ☐ All selected ratings | |||||||||

| (e) | Corporate Securities or Obligations, not subordinated 1 |

| ☐ | ‘CATEGORY NOT APPROVED FOR INVESTMENT’ |

| Minimum Short Term Ratings: | Minimum Ratings Based On: | |||||||||||||

| S&P | ☐ A-1 | ☐ NA | ☐ Any one | |||||||||||

| Xxxxx’x | ☐ P-1 | ☐ NA | ☐ Any two of three | |||||||||||

| Fitch | ☐ F-1 | ☐ NA | ☐ All selected ratings | |||||||||||

| Minimum Long Term Ratings: | Minimum Ratings Based On: | |||||||||||||

| S&P | ☐ AAA | ☐ AA- | ☐ A- | ☐ NA | ☐ Any one | |||||||||

| Xxxxx’x | ☐ Aaa | ☐ Aa3 | ☐ A3 | ☐ NA | ☐ Any two of three | |||||||||

| Fitch | ☐ AAA | ☐ AA- | ☐ A- | ☐ NA | ☐ All selected ratings | |||||||||

| (f) | Debt Securities issued by Financial Institutions or Obligations of Financial Institutions 2 |

| ☐ | ‘CATEGORY NOT APPROVED FOR INVESTMENT’ |

| Minimum Short Term Ratings: | Minimum Ratings Based On: | |||||||||||||

| S&P | ☐ A-1 | ☐ NA | ☐ Any one | |||||||||||

| Xxxxx’x | ☐ P-1 | ☐ NA | ☐ Any two of three | |||||||||||

| Fitch | ☐ F-1 | ☐ NA | ☐ All selected ratings | |||||||||||

| Minimum Long Term Ratings: | Minimum Ratings Based On: | |||||||||||||

| S&P | ☐ AAA | ☐ AA- | ☐ A- | ☐ NA | ☐ Any one | |||||||||

| Xxxxx’x | ☐ Aaa | ☐ Aa3 | ☐ A3 | ☐ NA | ☐ Any two of three | |||||||||

| Fitch | ☐ AAA | ☐ AA- | ☐ A- | ☐ NA | ☐ All selected ratings | |||||||||

| (g) | Structured Credit Securities issued by SPVs, conduits or under similar structures backed by U.S. Government Agencies or U.S. Government-Sponsored Enterprises 10 |

Ratings Requirement: AAA for all available ratings provided by S&P, Xxxxx’x, and Fitch

| ☐ | ‘CATEGORY NOT APPROVED FOR INVESTMENT’ |

| (h) | Structured Credit Securities issued by SPVs, conduits or under similar structures, not subordinated 12 |

| ☐ | ‘CATEGORY NOT APPROVED FOR INVESTMENT’ |

Asset Backed Securities (ABSs) 12a

Asset Backed Securities (ABSs) Home Equity loans 12b

Corporate Structured Notes 12e

Ratings Requirement: AAA for all available ratings provided by S&P, Xxxxx’x, and Fitch

Asset Backed Commercial Paper 12c Secured Master Notes 12d

| Minimum Short Term Ratings: | Minimum Ratings Based On: | |||||||||||||

| S&P | ☐ A-1 | ☐ NA | ☐ Any one | |||||||||||

| Xxxxx’x | ☐ P-1 | ☐ NA | ☐ Any two of three | |||||||||||

| Fitch | ☐ F-1 | ☐ NA | ☐ All selected ratings | |||||||||||

| Minimum Long Term Ratings: | Minimum Ratings Based On: | |||||||||||||

| S&P | ☐ AAA | ☐ AA- | ☐ A- | ☐ NA | ☐ Any one | |||||||||

| Xxxxx’x | ☐ Aaa | ☐ Aa3 | ☐ A3 | ☐ NA | ☐ Any two of three | |||||||||

| Fitch | ☐ AAA | ☐ AA- | ☐ A- | ☐ NA | ☐ All selected ratings | |||||||||

| (i) | Debt Securities issued by Supranational Entities, not subordinated 3 |

| ☐ | ‘CATEGORY NOT APPROVED FOR INVESTMENT’ |

| Minimum Short Term Ratings: | Minimum Ratings Based On: | |||||||||||||

| S&P | ☐ A-1 | ☐ NA | ☐ Any one | |||||||||||

| Xxxxx’x | ☐ P-1 | ☐ NA | ☐ Any two of three | |||||||||||

| Fitch | ☐ F-1 | ☐ NA | ☐ All selected ratings | |||||||||||

| Minimum Long Term Ratings: | Minimum Ratings Based On: | |||||||||||||

| S&P | ☐ AAA | ☐ AA- | ☐ A- | ☐ NA | ☐ Any one | |||||||||

| Xxxxx’x | ☐ Aaa | ☐ Aa3 | ☐ A3 | ☐ NA | ☐ Any two of three | |||||||||

| Fitch | ☐ AAA | ☐ AA- | ☐ A- | ☐ NA | ☐ All selected ratings | |||||||||

| (j) | Reverse Repurchase Agreements 9 (Reverse Repos) |

| ☐ | ‘CATEGORY NOT APPROVED FOR INVESTMENT’ |

Reverse Repurchase Agreements 9 (Reverse Repos) are subject to the reverse repurchase agreement collateral schedule list in Appendix A. Refer to Appendix A for a specific description of collateral types.

| (k) | Money Market Mutual Funds |

| ☐ | ‘CATEGORY NOT APPROVED FOR INVESTMENT’ |

| Minimum Short Term Ratings: | Minimum Ratings Based On: | |||||||||||||

| S&P | ☐ A-1 | ☐ NA | ☐ Any one | |||||||||||

| Xxxxx’x | ☐ P-1 | ☐ NA | ☐ Any two of three | |||||||||||

| Fitch | ☐ F-1 | ☐ NA | ☐ All selected ratings | |||||||||||

| Minimum Long Term Ratings: | Minimum Ratings Based On: | |||||||||||||

| S&P | ☐ AAA | ☐ AA- | ☐ A- | ☐ NA | ☐ Any one | |||||||||

| Xxxxx’x | ☐ Aaa | ☐ Aa3 | ☐ A3 | ☐ NA | ☐ Any two of three | |||||||||

| Fitch | ☐ AAA | ☐ AA- | ☐ A- | ☐ NA | ☐ All selected ratings | |||||||||

X.X. Xxxxxx aims to manage securities lending cash collateral in order to provide preservation of principal and maintain portfolio liquidity, while maximizing income in support of securities lending activities.

While X.X. Xxxxxx’x investment approach is a buy-and-hold strategy, under certain circumstances X.X. Xxxxxx may sell out of a position. If X.X. Xxxxxx were to sell out of a position, the client would receive 100% of any realized gain. Positions will not be sold before maturity at a loss unless specifically instructed to do so by the client or in the normal course of operating the securities lending portfolio. Investments are not guaranteed by X.X. Xxxxxx, and involve risk, including possible loss of principal. Xxxxxx assumes all risk of loss resulting from an investment. In the event of conflict between these investment guidelines and the Securities Lending Agreement, these investment guidelines shall govern.

Lender should regularly analyze these guidelines to determine their continued appropriateness, recognizing that all investments bear risk and that return of principal is not assured. Please indicate your acceptance of these guidelines by signing in the space provided below.

By signing this document, the client representative certifies that he/she is authorized to do so.

X.X. Xxxxxx Xxxxx Bank, N.A.

| Name: | Xxxxxx Xxxxxxx | |

| Title: | Managing Director | |

| Date: | September 14, 2023 | |

| Signed: | /s/ Xxxxxx Xxxxxxx | |

AXA: EQ ADVISORS TRUST 1290 FUNDS

| Name: | Xxxxx Xxxxx | |

| Title: | Chief Financial Officer | |

| Date: | 9/12/23 | |

| Signed: | /s/ Xxxxx Xxxxx | |

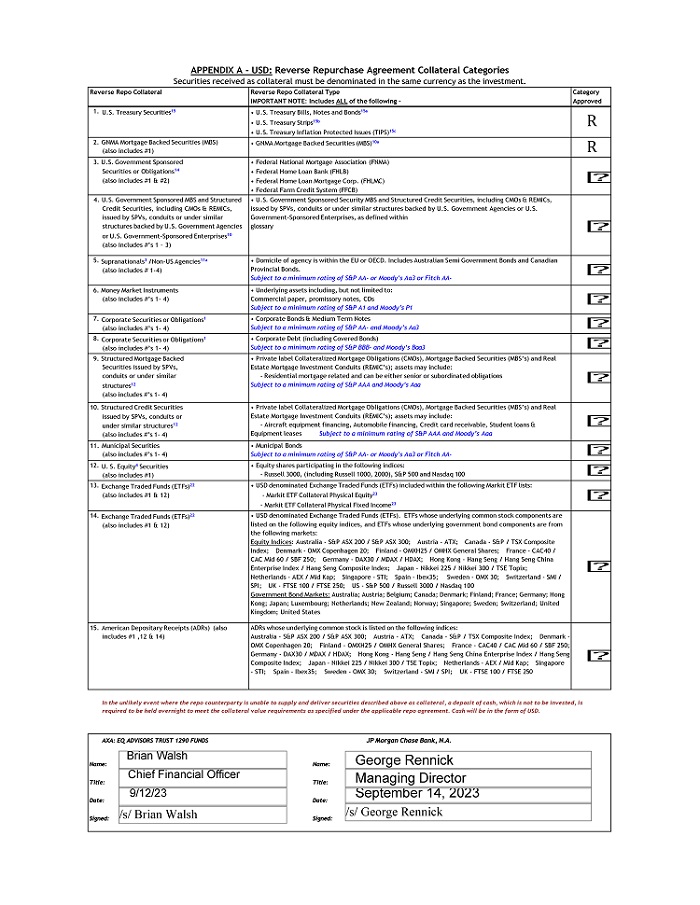

APPENDIX A - USD: Reverse Repurchase Agreement Collateral Categories Securities received as collateral must be denominated in the same currency as the investment. Reverse Repo Collateral Reverse Repo Collateral Type IMPORTANT NOTE: Includes ALL of the following — Category Approved 1. U.S. Treasury Securities15 •U.S. Treasury Bills, Notes and Bonds15a •U.S. Treasury Strips15b •U.S. Treasury Inflation Protected Issues (TIPS)15c R 2. GNMA Mortgage Backed Securities (MBS) (also includes #1) •GNMA Mortgage Backed Securities (MBS)10a R 3. U.S. Government Sponsored Securities or Obligations14 (also includes #1 & #2) •Federal National Mortgage Association (FNMA) •Federal Home Loan Bank (FHLB) •Federal Home Loan Mortgage Corp. (FHLMC) •Federal Farm Credit System (FFCB) 4. U.S. Government Sponsored MBS and Structured Credit Securities, including CMOs & REMICs, issued by SPVs, conduits or under similar structures backed by U.S. Government Agencies or U.S. Government-Sponsored Enterprises10 (also includes #’s 1 – 3) •U.S. Government Sponsored Security MBS and Structured Credit Securities, including CMOs & REMICs, issued by SPVs, conduits or under similar structures backed by U.S. Government Agencies or U.S. Government-Sponsored Enterprises, as defined within glossary 5. Supranationals3 /Non-US Agencies11a (also includes # 1-4) •Domicile of agency is within the EU or OECD. Includes Australian Semi Government Bonds and Canadian Provincial Bonds. Subject to a minimum rating of S&P AA- or Xxxxx’x Aa3 or Xxxxx XX- 6. Money Market Instruments (also includes #’s 1- 4) •Underlying assets including, but not limited to: Commercial paper, promissory notes, CDs Subject to a minimum rating of S&P A1 and Xxxxx’x P1 7. Corporate Securities or Obligations1 (also includes #’s 1- 4) •Corporate Bonds & Medium Term Notes Subject to a minimum rating of S&P AA- and Xxxxx’x Aa3 8. Corporate Securities or Obligations1 (also includes #’s 1- 4) •Corporate Debt (including Covered Bonds) Subject to a minimum rating of S&P BBB- and Xxxxx’x Baa3 9. Structured Mortgage Backed Securities issued by SPVs, conduits or under similar structures12 (also includes #’s 1— 4) •Private label Collateralized Mortgage Obligations (CMOs), Mortgage Backed Securities (MBS’s) and Real Estate Mortgage Investment Conduits (REMIC’s); assets may include: — Residential mortgage related and can be either senior or subordinated obligations Subject to a minimum rating of S&P AAA and Xxxxx’x Aaa 10. Structured Credit Securities issued by SPVs, conduits or under similar structures12 (also includes #’s 1— 4) •Private label Collateralized Mortgage Obligations (CMOs), Mortgage Backed Securities (MBS’s) and Real Estate Mortgage Investment Conduits (REMIC’s); assets may include: — Aircraft equipment financing, Automobile financing, Credit card receivable, Student loans & Equipment leasesSubject to a minimum rating of S&P AAA and Xxxxx’x Aaa 11. Municipal Securities (also includes #’s 1— 4) •Municipal Bonds Subject to a minimum rating of S&P AA- or Xxxxx’x Aa3 or Xxxxx XX- 12. U. S. Equity4 Securities (also includes #1) •Equity shares participating in the following indices: — Xxxxxxx 3000, (including Xxxxxxx 1000, 2000), S&P 500 and Nasdaq 100 13. Exchange Traded Funds (ETFs)22 (also includes #1 & 12) •USD denominated Exchange Traded Funds (ETFs) included within the following Markit ETF lists: -Markit ETF Collateral Physical Equity23 -Markit ETF Collateral Physical Fixed Income23 14. Exchange Traded Funds (ETFs)22 (also includes #1 & 12) •USD denominated Exchange Traded Funds (ETFs). ETFs whose underlying common stock components are listed on the following equity indices, and ETFs whose underlying government bond components are from the following markets: Equity Indices: Australia — S&P ASX 200 / S&P ASX 300; Austria — ATX; Canada — S&P / TSX Composite Index; Denmark — OMX Copenhagen 20; Finland — OMXH25 / OMHX General Shares; France — CAC40 / CAC Mid 60 / SBF 250; Germany—DAX30 / MDAX / HDAX; Hong Kong - Hang Seng / Hang Seng China Enterprise Index / Hang Seng Composite Index; Japan - Nikkei 225 / Nikkei 300 / TSE Topix; Netherlands — AEX / Mid Kap; Singapore — STI; Spain — Ibex35; Sweden — OMX 30; Switzerland — SMI / SPI; UK—FTSE 100 / FTSE 250; US—S&P 500 / Xxxxxxx 3000 / Nasdaq 100 Government Bond Markets: Australia; Austria; Belgium; Canada; Denmark; Finland; France; Germany; Hong Kong; Japan; Luxembourg; Netherlands; New Zealand; Norway; Singapore; Sweden; Switzerland; United Kingdom; United States 15. American Depositary Receipts (ADRs) (also includes #1 ,12 & 14) ADRs whose underlying common stock is listed on the following indices: Australia — S&P ASX 200 / S&P ASX 300; Austria — ATX; Canada — S&P / TSX Composite Index; Denmark — OMX Copenhagen 20; Finland — OMXH25 / OMHX General Shares; France — CAC40 / CAC Mid 60 / SBF 250; Germany — DAX30 / MDAX / HDAX; Hong Kong — Hang Seng / Hang Seng China Enterprise Index / Hang Seng Composite Index; Japan — Nikkei 225 / Nikkei 300 / TSE Topix; Netherlands — AEX / Mid Kap; Singapore — STI; Spain — Ibex35; Sweden — OMX 30; Switzerland — SMI / SPI; UK — FTSE 100 / FTSE 250 In the unlikely event where the repo counterparty is unable to supply and deliver securities described above as collateral, a deposit of cash, which is not to be invested, is required to be held overnight to meet the collateral value requirements as specified under the applicable repo agreement. Cash will be in the form of USD.

APPENDIX B: Non-Standard Clauses

DISCLAIMER: If there are any contradictions between this appendix and the rest of the guidelines, the wording in this appendix shall prevail.

Instrument K: Permissible Investments in Money Market Mutual Funds shall include only the Government Funds listed below:

| AGPXX | Invesco Government & Agency Portfolio | |

| DTRXX | Dreyfus Treasury Obligations Cash Management Fund | |

| FGTXX | Xxxxxxx Xxxxx Financial Square Government Fund | |

| FIGXX | Fidelity Investments Money Market Government Portfolio | |

| GVMXX | State Street Institutional US Government Money Market Fund | |

| HGGXX | HSBC US Government Money Market Fund | |

| INGXX | Western Asset Institutional Government Reserves Fund | |

| MVRXX | Xxxxxx Xxxxxxx Institutional Liquidity Fund- Government Portfolio | |

| TFDXX | Blackrock Liquidity FedFund | |

| TUGXX | RBC Funds Trust - US Government Money Market Fund | |

| WFFXX | Allspring Government Money Market Fund |

| AXA: EQ ADVISORS TRUST 1290 FUNDS | X.X. Xxxxxx Xxxxx Bank, N.A. | |||||||||

| Name: | Xxxxx Xxxxx | Name: | Xxxxxx Xxxxxxx | |||||||

| Title: | Chief Financial Officer | Title: | Managing Director | |||||||

| Date: | 9/12/23 | Date: | September 14, 2023 | |||||||

| Signed: | /s/ Xxxxx Xxxxx |

Signed: | /s/ Xxxxxx Xxxxxxx |

|||||||

GLOSSARY

| 1 | Corporate Securities or Obligations include: unsecured debt issued or guaranteed by a corporation defined as i) a legal personality used to conduct business that has legal independence from the people who create it and has legal rights and responsibilities and ii) an entity that has underlying operations, revenues, and cash flows that are expected to support the repayment of its debt. |

- Short Term Unsecured Debt: Commercial Paper issued by Corporations, including both registered and exempt (pursuant to Sections 3(a)(3) or 4(2) of the Securities Act of 1933) with a maturity less than 270 days.

- Term Unsecured Debt: Corporate Bonds, Medium Term Notes (“MTNs”) and Promissory Notes (“PNs”) issued by Corporations.

- Term Unsecured Debt: Investment Agreements (“IAs”), Funding Agreements (“FAs”) and Guaranteed Investment Contracts (“GICs”) issued by Corporations.

| 2 | Debt Securities issued by Financial Institutions or Obligations of Financial Institutions include: unsecured debt issued or guaranteed by a financial institution defined as i) an entity that provides financial services for its clients or members or ii) an entity that is under financial regulation from a government authority or iii) an entity that operates as a bank or broker-dealer or iv) an insurance company. |

- Short Term Unsecured Debt: Commercial Paper issued by Financial Institutions, including both registered and exempt (pursuant to Sections 3(a)(3) or 4(2) of the Securities Act of 1933).

- Term Unsecured Debt: Bonds, Notes, Xxxxxx’s Acceptances (“BAs”), Bank Notes (“BNs”), Certificates of Deposit (“CDs”), Deposit Notes (“DNs”) Medium Term Notes (“MTNs”), Promissory Notes (“PNs”) and Time Deposits (“TDs”) issued by Financial Institutions, not subordinated.

| 3 | Debt Securities issued by Supranational issuers include: Non-subordinated notes and bonds issued by specified Multilateral Development Banks (MDBs) that are institutions created by a group of countries that provide financing and professional advising for the purpose of development. MDBs have large memberships including both developed donor countries and developing borrower countries. |

| 4 | Equity: Equity shares registered on an exchange or exchanges. |

| 5 | Expected Maturity: The time period before which, based on the cash flows expected from assets transferred to the issuer, the particular security being acquired is expected to be fully paid off. The expected maturity is not the legal final maturity as the rating of the transaction is not based on repayment by the expected maturity. It should be noted that the actual maturity could be prior to or after the expected maturity noted at the time of purchase. |

| 6 | Final Maturity: for instruments with a specific maturity and for purposes of these guidelines, “final maturity” means the earliest/earlier of: (i) the date noted on the face of the instrument as the date on which the principal amount must be paid or (ii) in the case of an instrument with an unconditional put or unconditional demand feature, the date on which the principal amount of the instrument can be recovered by demand. |

| 7 | Fixed Rate Instruments: instruments (other than Structured Products) with an interest rate that will remain at a predetermined rate for the entire term of the loan. |

| 8 | Floating Rate Instruments: instruments (other than Structured Products) with a variable interest rate. The adjustments to the interest rate are usually made no less frequently than three months and are tied to a certain money-market index. These instruments are also referred to as a “floater”. |

| 9 | Reverse Repurchase Agreements (Reverse Repos) include: a transaction under which a lender (buyer / cash provider) agrees to purchase a security from a seller / cash receiver with a simultaneous agreement to resell the asset on a given date and at a pre-specified price. The result is simply a loan at a prescribed rate for a predetermined period while holding the asset as collateral. Reverse repos have their collateral defined either in Master Repo Agreements or in trade confirmations. Haircut levels are determined by the collateral type. |

| 10 | Structured Credit Securities issued by SPVs, conduits or under similar structures backed by U.S. Government Agencies or U.S. Government-Sponsored Enterprises include: |

| 10a | GNMA Mortgage Backed Securities (MBS) include pass-through certificates (GNMA Certificates) in book-entry form backed by residential mortgage loans, the full and timely payment of principal and interest of which is guaranteed by the Government National Mortgage Association. This category excludes Real Estate Mortgage Investment Conduit (REMIC), Collateralized Mortgage Obligations (CMOs), securities paying interest or principal only and similar derivative securities. |

| 10b | GNMA Collateralized Mortgage Obligations (CMOs) and Real Estate Mortgage Investment Conduits (REMICs) may include Sequential-Pay Classes, Planned Amortization Classes (PACs), Targeted Amortization Classes (TACs), Support Classes (“Companions”), Z-Bonds, Very Accurately Defined Maturity (VADMs), Floaters, Inverse Floaters, Interest Only, Principal Only, and Accrued Classes. |

| 10c | Mortgage Backed Securities (MBS) mortgage participation certificates (FNMA Certificates, FHLMC Certificates) in book-entry form backed residential mortgage loans, the full and timely payment of interest at the applicable certificate rate and the ultimate collection of principal of which are guaranteed by the Federal National Mortgage Association of the Federal Home Loan Mortgage Corporation. This category excludes Real Estate Mortgage Investment Conduit (REMIC), Collateralized Mortgage Obligations (CMOs), securities paying interest or principal only and similar derivative securities). |

| 10d | Collateralized Mortgage Obligations (CMOs) and Real Estate Mortgage Investment Conduits (REMICs) issued by FNMA and FHLMC. Types include, sequential-Pay Classes, Planned Amortization Classes (PACs), Targeted Amortization Classes (TACs), Support Classes (“Companions”), Z-Bonds, Very Accurately Defined Maturity (VADMs), Floaters, Inverse Floaters, Interest Only, Principal Only and Accrued Classes. |

| 11 | Sovereign Government Securities include: full faith and credit Sovereign obligations of any country other than the U.S. that is a member of the Organization for Economic Co-operation and Development or any country that is a member of the European Union, which shall include securities issued or guaranteed as to principal and interest by such a sovereign, or by its agencies, instrumentalities, establishments or the like. This includes bills, notes, and bonds. |

| 11a | Non-US Sovereign Agency Securities or Obligations include: Sovereign obligations of any country other than the U.S. that is a member of the Organization for Economic Co-operation and Development or any country that is a member of the European Union, which shall include securities issued by such a sovereign, or by its agencies, instrumentalities, establishments or the like. This includes Semi Government Bonds—securities issued by the financing authorities on behalf of the individual state and territory governments of Australia. This includes Provincial Bonds—securities issued by Canada’s provincial governments, backed by the issuing province as to the payment of principal and interest. This includes Commercial Paper, Certificates of Deposit, Medium Term Notes and Bonds that need to be defined by country. |

| 12 | Structured Credit Securities issued by SPVs, conduits or under similar structures include: debt securities that result from asset securitizations and are either based on pools of assets or collateralized by the cash flows from a specified pool of underlying assets. |

| 12a | Asset Backed Securities (ABSs) defined in Form S-3 of the U.S. Securities Exchange Commission (SEC) as a security that is primarily serviced by the cash flows of a discrete pool of receivables or other financial assets, either fixed or revolving, that by their terms convert into cash within a finite time period plus any rights or other assets designed to assure the servicing or timely distribution of proceeds to the security holders. Underlying assets must be: a) Aircraft equipment financing, b) Automobile financing, c) Credit card receivables, d) Student loans, e) Equipment leases. |

| 12b | Asset Backed Securities (ABSs) Home Equity loans defined in Form S-3 of the U.S. Securities Exchange Commission (SEC) as a security that is primarily serviced by the cash flows of a discrete pool of receivables or other financial assets, which may be either stand-alone items or extensions under a line of credit, that by the terms of the receivable assets or other financial assets convert into cash within a finite time period plus any rights or other assets designed to assure the servicing or timely distribution of proceeds to the security holders. Underlying assets must be residential mortgage related and can be either senior or subordinated obligations. |

| 12c | Asset Backed Commercial Paper (ABCPs): include programs composed of a bankruptcy-remote special purpose vehicle (SPV), or conduit, that issues commercial paper (CP) and uses the proceeds of such issuance primarily to obtain interests in various types of assets, either through asset purchase or secured lending transactions. An ABCP program includes key parties that perform various services for the conduit, credit enhancement that provides loss protection, and liquidity facilities provided by banks that assist in the timely repayment of CP. The repayment of CP issued by a conduit depends primarily on the cash collections received from the conduit’s underlying asset portfolio and a conduit’s ability to issue new CP. ABCPs can be registered and exempt (pursuant to Sections 3(a) (3) or 4(2) of the Securities Act of 1933). Underlying assets can be but are not limited to a) Aircraft equipment financing, b) Automobile financing, c) Credit card receivables, d) Student loans, e) Equipment leases and f) Trade receivables. |

| 12d | Secured Master Notes represent debt issued by Corporations or Financial Institutions secured by assets. They may include put options that accelerate their repayment. |

| 12e | Corporate Structured Notes are hybrid securities that represent a corporate debt obligation, usually issued by a financial institution, but also contains embedded derivatives component with characteristics that adjust the security’s risk/return profile. The return of a structured note is driven by underlying debt obligation and the derivatives embedded within it. Some structured notes are tailored to an investor’s risk and return expectations. Embedded derivatives include futures, options and swaps. SEC Rule 434 (Reg. § 230.434.) covering prospectus delivery requirements defines structured securities as “securities whose cash flow characteristics depend upon one or more indices or that have embedded forwards or options or securities where an investor’s investment return and the issuer’s payment obligations are contingent on, or highly sensitive to, changes in the value of underlying assets, indices, interest rates or cash flows.” |

| 13 | Structured Products are asset backed securities authorized for investment under these guidelines, including Structured Credit Securities issued by SPVs, conduits or similar structures backed by U.S. Government Agencies or U.S. Government-Sponsored Enterprises and Structured Credit Securities issued by SPVs, conduits or similar structures. |

| 14 | U.S. Government Sponsored Securities or Obligations include: fixed and floating rate senior debt securities issued by the Federal Home Loan Mortgage Corporation (FHLMC or Freddie Mac), the Federal National Mortgage Association (FNMA or Xxxxxx Xxx), Federal Farm Credit Banks (FFCB) or the Federal Home Loan Bank (FHLB) of the U.S. Government. |

| 14a | U.S. Government Callable Debt includes, |

| (a) | Non-amortizing U.S. Dollar-denominated senior debt securities of fixed maturity in book entry form |

| (b) | U.S. Dollar-denominated discount senior notes sold at a discount from their principal amount payable at maturity with an original maturity of 360 days or less in book entry form |

| 14b | U.S. Government Non-Callable Debt includes, |

| (a) | Non-amortizing U.S. Dollar-denominated senior debt securities of fixed maturity in book entry form |

| (b) | U.S. Dollar-denominated discount senior notes sold at a discount from their principal amount payable at maturity with an original maturity of 360 days or less in book entry form |

| 15 | U.S. Treasury Securities: include book-entry securities issued by the U.S. Treasury. |

| 15a | U.S. Treasury Bills, Notes, and Xxxxx include negotiable debt obligations issued pursuant to USC Title 31, Chapter 31, Section 3104 by the Department of the Treasury backed by the credit of the United States of America. |

| 15b | U.S. Treasury Strips include securities issued by the Department of the Treasury backed by the credit of the United States of America that represent either interest components or principal components stripped from underlying US treasury obligations under the program of the Department of the Treasury called “Separate Trading of Registered Interest and Principal Securities”. |

| 15c | U.S. Treasury Inflation Protected Securities (TIPS)issued by the Department of the Treasury backed by the credit of the United States of America where the principal is changed based on changes in the consumer price index. |

| 16 | U.S. SEC-Regulated Money Market Mutual Funds: include money market funds registered with the U.S. Securities and Exchange Commission as an investment company regulated by the Investment Company Act of 1940, as amended. |

| 16a | Government Funds: A Government Fund (referred to as a “government money market fund” in Rule 2a-7) invests at least 99.5% of its assets in cash, government securities and/or repurchase agreements fully collateralized with cash or government securities. A Government Fund is permitted to utilize amortized cost accounting to value portfolio securities and seeks to transact at a stable $1.00 NAV. A Government Fund is not required to implement liquidity fees and redemption gates but may reserve the ability to do so if disclosed in the Fund prospectus. |

| 16b | Institutional Prime Funds: An Institutional Prime Fund is a money market fund regulated under Rule 2a-7 that does not qualify as a “retail money market fund” or a “government money market fund” as defined in Rule 2a-7. An Institutional Prime Fund is required to value its portfolio securities based on current market value and must round its NAV per share to the nearest basis point (e.g., $1.0000), which means shares of the Fund may be priced at more or less than $1 as the value of the securities in the Fund fluctuates. This may result in a gain or loss on investment when redemptions are processed and may result in a capital gain or loss. An Institutional Prime Fund is subject to liquidity fees and redemption gates. |

| 17 | Short Term Money Market Mutual Funds: include money market funds authorized and regulated as a UCITS, conforming to the European Securities and Markets Authority (“ESMA”, previously known as the Committee of the European Securities Regulators) established definition of a Short Term Money Market Fund. |

| 18 | Australian-Regulated Money Market Mutual Funds: include money market funds registered with Australian Securities and Investments Commission (“ASIC”). A money market fund is a type of mutual fund that is required by law to invest in low-risk securities. These funds have relatively low risks compared to other mutual funds and pay dividends that generally reflect short-term interest rates. Unlike a “money market deposit account” at a bank, money market funds are not insured. All Money market mutual funds typically invest in government securities, certificates of deposits, commercial paper of companies, and other highly liquid and low-risk securities. They attempt to keep their net asset value (NAV) at a constant $1.00 per share and expect only the yield to go up and down. But a money market’s per share NAV may fall below $1.00 if the investments perform poorly. While investor losses in money market funds have been rare, they are possible. |

| 19 | Weighted Average Maturity (WAM) to Final: The average time it takes for securities in a portfolio to mature, weighted in proportion to the dollar amount that is invested in the portfolio. The calculation for Weighted Average Maturity to Final will be based on Final Maturity for both Fixed and Floating Rate Instruments except in the case of Structured Products, which will use Expected Maturity. |

| 20 | Weighted Average Maturity (WAM) to Reset: The average time it takes for securities in a portfolio to mature, weighted in proportion to the dollar amount that is invested in the portfolio. The calculation for Weighted Average Maturity by Reset will be based on Final Maturity for Fixed Rate Instruments or the Interest Reset date for Floating Rate Instruments. |

| 21 | Tier One Long Term Credit Rating: A credit rating within the highest Long Term rating category of a Nationally Recognized Statistical Rating Organization (“NRSRO”). |

Tier One Long Term Ratings consist of the following:

S&P: AAA, AA+, AA, AA-, A+, A, A-;

Xxxxx’x: Aaa, Aa1, Aa2, Aa3, A1, A2, A3;

Fitch: AAA, AA+, AA, AA-, A+, A, A-;

| 22 | Exchange Traded Funds (ETFs): ETFs are index-based investment products that allow you to buy or sell shares of entire portfolios of stock in a single securities. |

| 23 | Markit ETF Collateral : ETFs listed on the Markit Index & ETF Data Management website xxx.xxxxxx.xxx/Xxxxxxxxxxxxx/Xxxxxxx/XXX_Xxxxxxxxx_Xxxxx |

ANNEX

X.X. Xxxxxx Provides Diverse Financial Services and May Generate Profits as a Result

Potential conflicts of interest may arise whenever X.X. Xxxxxx has an actual or perceived economic or other incentive as securities lending agent to act in a way that benefits X.X. Xxxxxx because of relationships that X.X. Xxxxxx has with other clients or when X.X. Xxxxxx acts for its own account. Potential conflicts may arise, for example (to the extent the following activities are permitted in Lender’s account(s)) when: (1) X.X. Xxxxxx enters into Loans or Authorized Investments in the form of repurchase agreement transactions where an Affiliate is the counterparty; (2) X.X. Xxxxxx makes an Authorized Investment in an investment product, such as, without limitation, mutual fund, managed by X.X. Xxxxxx or an Affiliate; (3) a X.X. Xxxxxx entity obtains services, including trade execution and trade clearing, from an Affiliate such as, without limitation, X.X. Xxxxxx Securities LLC, X.X. Xxxxxx Securities plc or X.X. Xxxxxx Clearing Corp; (4) X.X. Xxxxxx receives payment as a result of purchasing an investment product for a client’s account; or (5) X.X. Xxxxxx receives payment for providing services (including shareholder servicing, recordkeeping or custody) with respect to investment products purchased or held as collateral for a client’s portfolio. Other potential conflicts may arise because of relationships that X.X. Xxxxxx has with other clients or when X.X. Xxxxxx acts for its own account.

Lender hereby authorizes X.X. Xxxxxx to act under the Agreement notwithstanding that X.X. Xxxxxx or an Affiliate may have a potential conflict of duty or interest in a transaction. In addition to the potential conflicts described above, this includes the fact that X.X. Xxxxxx may: (a) in its individual capacity or acting in a fiduciary capacity for other accounts, have transactions with the same institutions to which X.X. Xxxxxx may be lending Securities, or in which X.X. Xxxxxx may invest Cash Collateral, under this Agreement; (b) use EquiLend, a securities lending platform in which X.X. Xxxxxx has an equity interest (and therefore a financial interest in its success), to transact certain Loans with Borrowers that are EquiLend participants (it being understood that EquiLend will neither act as principal in, nor guarantee, any such Loan); (c) when making Authorized Investments as agent for Xxxxxx, enter into repurchase agreement transactions under which collateral and/or margin posted by the repurchase transaction seller is held by X.X. Xxxxxx, as custodian for such seller; (d) act as custodian for certain Xxxxxxxxx, and hold Collateral in the form of Securities posted for Loans by such Borrower; and (e) act as a counterparty to Lender in currency exchange transactions. X.X. Xxxxxx or its Affiliates may earn fees and profits from any of the above-listed activities. Lender acknowledges that such fees are separate from, and in addition to, the fees that X.X. Xxxxxx earns under this Agreement and Lender hereby consents to the receipt by X.X. Xxxxxx or its Affiliates of such fees. In connection with the foregoing, X.X. Xxxxxx shall not be bound to: (i) account to Lender for any fee or other sum received or profit made by X.X. Xxxxxx for its own account or the account of any other person or (ii) disclose any information concerning the specifics of any given transaction or arrangement listed above; provided that, as respects (i) above, X.X. Xxxxxx shall, upon request, promptly inform Lender of the relevant facts as the same relate to X.X. Xxxxxx’x fees as securities lending agent for Xxxxxx xxxxxxxxx.

ANNEX A

1290 VT Micro Cap Portfolio

1290 VT CONVERTIBLE SECURITIES PORTFOLIO

Equitable Conservative Growth MF/ETF Portfolio

1290 VT DoubleLine Opportunistic Bond Portfolio

1290 VT Equity Income Portfolio

1290 VT GAMCO Mergers & Acquisitions Portfolio

1290 VT GAMCO Small Company Value Portfolio

1290 VT High Yield Bond Portfolio

1290 VT Multi-Alternative Strategies Portfolio

1290 VT Natural Resources Portfolio

1290 VT Real Estate Portfolio

1290 VT Small Cap Value Portfolio

1290 VT SmartBeta Equity ESG Portfolio

1290 VT Socially Responsible Portfolio

ATM International Managed Volatility Portfolio

ATM Large Cap Managed Volatility Portfolio

ATM Mid Cap Managed Volatility Portfolio

ATM Small Cap Managed Volatility Portfolio

EQ/ 2000 Managed Volatility Portfolio

EQ/ 400 managed Volatility Portfolio

EQ/1290 VT Moderate Growth Allocation Portfolio

EQ/500 managed Volatility Portfolio

EQ/AB Dynamic Aggressive Growth

EQ/AB Dynamic Growth Portfolio

EQ/AB Dynamic Moderate Growth Portfolio

EQ/AB Short Duration Government Bond Portfolio

EQ/AB Small Cap Growth Portfolio

EQ/AB Sustainable U.S. Thematic Portfolio

EQ/All asset Growth Allocation Portfolio

EQ/American Century Mid Cap Value Portfolio

EQ/American Century Moderate Growth Allocation Portfolio

EQ/Capital Group Research Portfolio

EQ/Clearbridge Large Cap Growth ESG Portfolio

EQ/Clearbridge Select Equity Managed Volatility Portfolio

EQ/Common Stock Index Portfolio

EQ/Core Bond Index Portfolio

EQ/Emerging Markets Equity Plus Portfolio

EQ/Equity 500 Index Portfolio

EQ/Fidelity Institutional AM Large Cap Portfolio

EQ/Franklin Moderate Allocation Portfolio

EQ/Franklin Small Cap Value Managed Volatility Portfolio

EQ/Global Equity Managed Volatility Portfolio

EQ/Xxxxxxx Xxxxx Growth Allocation Portfolio

EQ/Xxxxxxx Xxxxx Mid Cap Value Portfolio

EQ/Xxxxxxx Xxxxx Moderate Growth Allocation

EQ/Intermediate Government Bond Portfolio

EQ/International Core Managed Volatility Portfolio

EQ/International Equity Index Portfolio

EQ/International Managed Volatility Portfolio

EQ/International Value Managed Volatility Portfolio

EQ/INVESCO XXXXXXXX PORTFOLIO

EQ/Invesco Global Portfolio

EQ/Invesco Global Real Assets Portfolio

EQ/Invesco Moderate Allocation Portfolio

EQ/Invesco Moderate Growth Allocation Portfolio

EQ/Janus Enterprise Portfolio

EQ/Large Cap Core Managed Volatility Portfolio

EQ/Large Cap Growth Index Portfolio

EQ/Large Cap Growth Managed Volatility Portfolio

EQ/Large Cap Value Index Portfolio

EQ/Large Cap Value Managed Volatility Portfolio

EQ/Lazard Emerging Markets Equity Portfolio

EQ/Long Term-Bond Portfolio

EQ/Xxxxxx Xxxxxx Growth Portfolio

EQ/MFS International Growth Portfolio

EQ/MFS International Intrinsic Value Portfolio

EQ/MFS Mid Cap Focused Growth Portfolio

EQ/MFS Technology Portfolio

EQ/MFS Utilities Series Portfolio

EQ/Mid Cap Index Portfolio

EQ/Mid Cap Value Managed Volatility Portfolio

EQ/Xxxxxx Xxxxxxx Small Cap Growth Portfolio

EQ/PIMCO Global Real Return Portfolio

EQ/PIMCO Real Return Portfolio

EQ/PIMCO Total Return ESG Portfolio

EQ/PIMCO Ultra Short Bond Portfolio

EQ/Quality Bond PLUS Portfolio

EQ/Small Company Index Portfolio

EQ/X. Xxxx Price Health Sciences Portfolio

EQ/Value Equity Portfolio

EQ/Wellington Energy Portfolio

Equitable Growth MF/ETF Portfolio

Equitable Moderate Growth MF/ETF Portfolio

EQ/Franklin Rising Dividends Portfolio

Multimanager Aggressive Equity Portfolio

Multimanager Core Bond Portfolio

Multimanager Technology Portfolio

EQ/Intermediate Corporate Bond Portfolio

1290 Funds Trust

1290 GAMCO Small/Mid Cap Value Fund

1290 High Yield Bond Fund

1290 Diversified Bond Fund

1290 Smart Beta Equity Fund

1290 Xxxxxx Xxxxxx Multi-Asset Income Fund

1290 Multi-Alternative Strategies Fund

1290 Retirement 2020 Fund

1290 Retirement 2025 Fund

1290 Retirement 2030 Fund

1290 Retirement 2035 Fund

1290 Retirement 2040 Fund

1290 Retirement 2045 Fund

1290 Retirement 2050 Fund

1290 Retirement 2055 Fund

1290 Retirement 2060 Fund

1290 Essex Small Cap Growth Fund

EACH OF THE AXA FUND LENDERS

LISTED ON ANNEX A HERETO

SCHEDULE 4

JPMorgan Chase Bank, N.A.

Securities Lending – Limitations on Securities Available for Loan, Lending Accounts and Markets

Limitations on Securities Available for Loan

The following limitations shall apply to X.X. Xxxxxx’x authority to lend Securities held in the Lending Accounts:

1. At the time of any Loan, the aggregate Market Value of Lender’s Securities on Loan after taking such Loan into account shall not exceed 30% of the aggregate Market Value of Lender’s total assets, including collateral for Loans.

2. No more than 90% of any Security held by Xxxxxx may be on loan at the time the Loan is initiated.

3. At the initiation of any Loan, the maximum rebate rate must be Overnight Bank Funding Rate (OBFR) minus 25 basis points on Loans collateralized with cash; on Loans collateralized with securities, the Lender will charge Borrowers a minimum 25 basis point fee.

Lending Accounts

| Lending Account Name |

Lending Account Numbers | |||

| 1290 VT Micro Cap Portfolio - Lord Xxxxxx |

G 24412 | |||

| 1290 VT Micro Cap Portfolio - Blackrock |

G 24413 | |||

| 1290 VT CONVERTIBLE SECURITIES PORTFOLIO - SSGA |

P 75009 | |||

| Equitable Conservative Growth MF/ETF Portfolio |

EIV69 | G 30204 | ||

| 1290 VT DoubleLine Opportunistic Bond Portfolio |

AHL95 | P 24225 | ||

| 1290 VT Equity Income Portfolio |

38944 | G 09834 | ||

| 1290 VT GAMCO Mergers & Acquisitions Portfolio |

35949 | G 09840 | ||

| 1290 VT GAMCO Small Company Value Portfolio |

43362 | G 09841 | ||

| 1290 VT High Yield Bond Portfolio - Post |

AEX34 | G 24420 | ||

| 1290 VT High Yield Bond Portfolio - AXA Investment Managers |

G 30168 | |||

| 1290 VT High Yield Bond Portfolio - FMG LCC |

G 23689 | |||

| 1290 VT Multi-Alternative Strategies Portfolio - FMG |

P 43360 | |||

| 1290 VT Natural Resources Portfolio - AB |

30497 | G 30170 | ||

| 1290 VT Real Estate Portfolio - AllianceBernstein |

ABD65 | G 30165 | ||

| 1290 VT Small Cap Value Portfolio - Horizon |

AEX33 | G 24419 | ||

| 1290 VT Small Cap Value Portfolio - Blackrock |

G 24417 | |||

| 1290 VT SmartBeta Equity ESG Portfolio |

ADF89 | P 75008 | ||

| 1290 VT Socially Responsible Portfolio - Blackrock |

38438 | G 08437 | ||

| ATM International Managed Volatility Portfolio - AllianceBernstein |

57784 | P 04048 | ||

| ATM International Managed Volatility Portfolio - Blackrock |

57785 | P 03730 | ||

| ATM Large Cap Managed Volatility Portfolio - AllianceBernstein |

P 04039 | |||

| ATM Large Cap Managed Volatility Portfolio - Blackrock |

P 03721 | |||

| ATM Mid Cap Managed Volatility Portfolio - AllianceBernstein |

P 04045 | |||

| ATM Mid Cap Managed Volatility Portfolio - Blackrock |

P 03727 | |||

| ATM Small Cap Managed Volatility Portfolio - AllianceBernstein |

P 04042 | |||

| ATM Small Cap Managed Volatility Portfolio - Blackrock |

P 03724 | |||

| EQ/2000 Managed Volatility Portfolio - AllianceBernstein |

P 04041 | |||

| EQ/400 managed Volatility Portfolio- Blackrock |

P 03726 | |||

| EQ/1290 VT Moderate Growth Allocation Portfolio |

EQP54 | P 93554 | ||

| EQ/2000 Managed Volatility Portfolio - Blackrock |

P 03723 | |||

| EQ/400 managed Volatility Portfolio - AllianceBernstein |

P 04044 | |||

| EQ/500 managed Volatility Portfolio - AllianceBernstein |

P 04038 | |||

| EQ/500 managed Volatility Portfolio - Blackrock |

P 03720 | |||

| EQ/AB Dynamic Aggressive Growth |

EKY83 | P 43358 | ||

| EQ/AB Dynamic Growth Portfolio |

AHL94 | P 24224 | ||

| EQ/AB Dynamic Moderate Growth Portfolio |

86997 | P 13896 | ||

| EQ/AB Short Duration Government Bond Portfolio |

ABV48 | G 23857 | ||

| EQ/AB Small Cap Growth Portfolio - Passive |

G 80447 | |||

| EQ/AB Small Cap Growth Portfolio - Active |

G 80446 | |||

| EQ/AB Sustainable U.S. Thematic Portfolio |

G 43883 | |||

| EQ/All Asset Growth AllocationPortfolio |

G 80448 | |||

| EQ/American Century Mid Cap Value Portfolio |

EMR57 | P 45410 | ||

| EQ/American Century Moderate Growth Allocation Portfolio |

EQP55 | P 93555 | ||

| EQ/Capital Group Research Portfolio |

15733 | G 08239 | ||

| EQ/Clearbridge Large Cap Growth ESG Portfolio |

G 08048 | |||

| EQ/Clearbridge Select Equity Managed Volatility Portfolio |

41986 | G 11251 | ||

| EQ/Clearbridge Select Equity Managed Volatility Portfolio - Blackrock |

53048 | P 03296 | ||

| EQ/Common Stock Index Portfolio - AllianceBernstein |

29812 | G 09751 | ||

| EQ/Core Bond Index Portfolio - SSgA |

12234 | G 07195 | ||

| EQ/Emerging Markets Equity Plus Portfolio - Alliance Xxxxxxxxx Passive |

30500 | G 30162 | ||

| EQ/Emerging Markets Equity Plus Portfolio - AXA FMG |

G 30161 | |||

| EQ/Emerging Markets Equity Plus Portfolio - Xxxxxxx Partners LLC |

30495 | G 30163 | ||

| EQ/Equity 500 Index Portfolio - AllianceBernstein |

5016 | G 05924 | ||

| EQ/Fidelity Institutional AM Large Cap Portfolio |

EMR58 | P 45411 | ||

| EQ/Xxxxxxxx Moderate Allocation Portfolio |

P 59483 | |||

| EQ/Franklin Samll Cap Value Managed Volatility Portfolio - Blackrock |

53039 | P 03287 | ||

| EQ/Xxxxxxxx Xxxxx Cap Value Managed Volatility Portfolio - Franklin |

41985 | G 11250 | ||

| EQ/Global Equity Managed Volatility- Blackrock Portfolio - MSCI EAFE |

53044 | P 03292 | ||

| EQ/Global Equity Managed Volatility Portfolio - Blackrock S&P 500 |

P 03377 | |||

| EQ/Global Equity Managed Volatility Portfolio - Xxxxxx Xxxxxxx |

9919 | G 06988 | ||

| EQ/ Global Equity Managed Volatility Portfolio - Invesco |

ACA07 | G 23895 | ||

| EQ/Xxxxxxx Xxxxx Growth Allocation Portfolio |

EQP58 | P 93558 | ||

| EQ/Xxxxxxx Xxxxx Mid Cap Value Portfolio |

EMR61 | P 45414 | ||

| EQ/Xxxxxxx Xxxxx Moderate Growth Allocation |

AHM44 | P 24447 |

| EQ/Intermediate Government Bond Portfolio - SSgA |

4276 | G 05334 | ||

| EQ/International Core Managed Volatility - Xxxxxxx |

AFE41 | G 24443 | ||

| EQ/International Core Managed Volatility Portfolio - Blackrock |

44730 | G 11564 | ||

| EQ/International Core Managed Volatility Portfolio - FMG LLC ETF |

G 11550 | |||

| EQ/International Core Managed Volatility Portfolio - MFS |

ACA05 | G 23893 | ||

| EQ/International Core Managed Volatility Portfolio - Federated Investors Inc |

46927 | G 11549 | ||

| EQ/International Equity Index Portfolio - AllianceBernstein |

29813 | G 09752 | ||

| EQ/International Managed Volatility - AllianceBernstein |

57782 | P 04047 | ||

| EQ/International Managed Volatility Portfolio - Blackrock |

57783 | P 03729 | ||

| EQ/International Value Managed Volatility - Blackrock |

9914 | G 06983 | ||

| EQ/International Value Managed Volatility Portfolio - Xxxxxx |

87030 | P 14003 | ||

| EQ/INVESCO XXXXXXXX PORTFOLIO |

40317 | G 10329 | ||

| EQ/Invesco Global Portfolio |

41988 | G 11253 | ||

| EQ/Invesco Global Real Assets Portfolio |

EMR62 | P 45415 | ||

| EQ/Invesco Moderate Allocation Portfolio |

AHM45 | P 24448 | ||

| EQ/Invesco Moderate Growth Allocation Portfolio |

EQP59 | P 93559 | ||

| EQ/Janus Enterprise Portfolio - Janus |

43593 | G 10330 | ||

| EQ/Large Cap Core Managed Volatility Portfolio - Capital Guardian |

AWZ88 | G 23905 | ||

| EQ/Large Cap Core Managed Volatility Portfolio - FMG LLC ETF |

G 11556 | |||

| EQ/Large Cap Core Managed Volatility Portfolio - GQG Partners LLC |

AFE39 | G 24441 | ||

| EQ/Large Cap Core Managed Volatility Portfolio - Xxxxxx Xxxxxx |

G 11555 | |||

| EQ/Large Cap Core Managed Volatility POrtfolio-Blackrock |

44753 | G 11567 | ||

| EQ/Large Cap Growth Index Portfolio - AllianceBernstein |

15731 | G 08237 | ||

| EQ/Large Cap Growth Managed Volatility - Blackrock |

44732 | G 11566 | ||

| EQ/ Large Cap Growth Managed Volatility Portfolio - FMG LLC ETF |

G 11554 | |||

| EQ/Large Cap Growth Managed Volatility Portfolio - Xxxxxx |

44715 | G 11553 | ||

| EQ/Large Cap Growth Managed Volatility Portfolio - Xxxxx Capital |

EEZ18 | G 23904 | ||

| EQ/Large Cap Growth Managed Volatility - HS Investment Partners |

EEW68 | P 88939 | ||

| EQ/Large Cap Value Index Portfolio - AB |

38463 | G 10983 | ||

| EQ/Large Cap Value Managed Volatility Portfolio-AllianceBernstein Active |

G 07193 | |||

| EQ/Large Cap Value Managed Volatility Portfolio-AllianceBernsten ATM |

52661 | G 00040 | ||

| EQ/Large Cap Value Managed Volatility Portfolio-Aristotle Cap Mangment LLC |

G 23902 | |||

| EQ/Large Cap Value Managed Volatility Portfolio-FMG |

G 23903 | |||

| EQ/ Large Cap Value Managed Volatility-MFS |

AFE40 | G 24442 | ||

| EQ/Lazard Emerging Markets Equity Portfolio |

EMR36 | P 45402 | ||

| EQ/Long-Term Bond Portfolio - AllianceBernstein |

EYM67 | G 38787 | ||

| EQ/Xxxxxx Xxxxxx Growth Portfolio |

G 10224 | |||

| EQ/MFS International Growth Portfolio |

34361 | G 10232 | ||

| EQ/MFS International Intrinsic Value Portfolio |

EMR37 | P 45403 | ||

| EQ/MFS Mid Cap Focused Growth Portfolio |

EMR34 | P 45400 | ||

| EQ/MFS Technology Portfolio |

EMR38 | P 45404 | ||

| EQ/MFS Utilities Series Portfolio |

EMR39 | P 45405 | ||

| EQ/Mid Cap Index Portfolio - AB |

21620 | G 08812 | ||

| EQ/Mid Cap Value Managed Volatility - Blackrock |

44731 | G 11565 | ||

| EQ/Mid Cap Value Managed Volatility Portfolio - FMG LLC ETF |

G 11552 | |||

| EQ/Mid Cap Value Managed Volatility Portfolio - Wellington |

44713 | G 11551 | ||

| EQ/Mid Cap Value Managed Volatility Portfolio - Diamond Hill |

ACA08 | G 23896 | ||

| EQ/Xxxxxx Xxxxxxx Small Cap Growth Portoflio |

AEX32 | G 24418 |

| EQ/Xxxxxx Xxxxxxx Small Cap Growth Portfolio-Blackrock |

G 24414 | |||

| EQ/PIMCO Global Real Return Portfolio |

ABD23 | G 30167 | ||

| EQ/PIMCO Real Return Portfolio |

EMR40 | P 45406 | ||

| EQ/PIMCO Total Return ESG Portfolio |

EMR41 | P 45407 | ||

| EQ/PIMCO Ultra Short Bond Portfolio |

34376 | G 10230 | ||

| EQ/Quality Bond PLUS - PIMCO |

ACA11 | G 23899 | ||

| EQ/Quality Bond Plus Portfolio- Alliance Xxxxxxxxx Passive |

G 30226 | |||

| EQ/Quality Bond PLUS Portfolio - AllianceBernstein |

5320 | G 05827 | ||

| EQ/Small Company Index Portfolio - AllianceBernstein |

57999 | G 07196 | ||

| EQ/X. Xxxx Price Health Sciences Portfolio |

EMR42 | P 45408 | ||

| EQ/Value Equity Portfolio |

9922 | G 06991 | ||

| EQ/Wellington Energy Portfolio |

EMR33 | P 45399 | ||

| Equitable Growth MF/ETF Portfolio |

G 43882 | |||

| Equitable Moderate Growth MF/ETF Portfolio |

G 43881 | |||

| EQ/Franklin Rising Dividends Portfolio |

EMR59 | P 45412 | ||

| Multimanager Aggressive Equity Portfolio - AllianceBernstein - ATM |

52766 | P 02708 | ||

| Multimanager Aggressive Equity Portfolio - ClearBridge |

20345 | G 08666 | ||

| Multimanager Aggressive Equity Portfolio - Scotia Institutional Asset Management US LTD |

25407 | G 09295 | ||

| Multimanager Aggressive Equity Portfolio - X. Xxxx Price |

25387 | G 09275 | ||

| Multimanager Aggressive Equity Portfolio - Westfield |

25395 | G 09283 | ||

| Multimanager Core Bond Portfolio - BlackRock |

25393 | G 09281 | ||

| Multimanager Core Bond Portfolio - PIMCO |

25404 | G 09292 | ||

| Multimanager Core Bond Portfolio - SSgA |

52767 | P 02709 | ||

| Multimanager Core Bond Portfolio- Doubleline |

AHH64 | P 22045 | ||

| Multimanger Technology Portfolio - FMG |

P 03700 | |||

| Multimanager Technology Portfolio - Allianz |

25396 | G 09284 | ||

| Multimanager Technology Portfolio - AB |

52778 | P 02720 | ||

| Multimanager Technology Portfolio - Wellington |

25390 | G 09278 | ||

| Multimanger Technology Portfolio - FMG |

P 03700 | |||

| EQ/Intermediate Corporate Bond Portfolio |

G 49012 | |||

| 1290 Funds: |

||||

| 1290 Diversified Bond Fund – Brandywine |

ENH81 | P 78337 | ||

| 1290 Xxxxxx Xxxxxx Multi-Asset Income Fund |

P 60811 | |||

| 1290 GAMCO Small/Mid Cap Value Fund |

AGM33 | P 91799 | ||

| 1290 High Yield Bond Fund |

P 91800 | |||

| 1290 Multi-AlternativeStrategies Fund – FMG LLC |

P 33351 | |||

| 1290 Retirement 2020 Fund |

P 67954 | |||

| 1290 Retirement 2025 Fund |

P 67955 | |||

| 1290 Retirement 2030 Fund |

P 67956 | |||

| 1290 Retirement 2035 Fund |

P 67957 | |||

| 1290 Retirement 2040 Fund |

P 67958 | |||

| 1290 Retirement 2045 Fund |

P 67959 | |||

| 1290 Retirement 2050 Fund |

P 67960 | |||

| 1290 Retirement 2055 Fund |

P 67961 | |||

| 1290 Retirement 2060 Fund |

P 67962 | |||

| 1290 Smartbeta Equity Fund |

AGM34 | P 67961 | ||

| 1290 Essex Small Cap Growth Fund |

G 45330 | |||

Eligible Markets

X.X. Xxxxxx may lend Securities in the following markets:

| Number |

Lending Markets |

Lender Approves (Check All That Apply) |

Additional Market Requirements | |||

| 1 | Australia | X | Yes - refer to Addendum (I) below | |||

| 2 | Austria | X | ||||

| 3 | Belgium | X | ||||

| 4 | Brazil | Yes - An additional agreement is required. Please contact your Sales Specialist or Relationship Manager for additional information. | ||||

| 5 | Canada | X | ||||

| 6 | Czech Republic | X | ||||

| 7 | Denmark | X | ||||

| 8 | Euroclear | X | ||||

| 9 | Finland | X | ||||

| 10 | France | X | Yes - refer to Addendum (II) below | |||

| 11 | Germany | X | ||||

| 12 | Greece | X | Yes - refer to Addendum (III) below | |||

| 13 | Hong Kong | X | ||||

| 14 | Hungary | X | Yes - refer to Addendum (III) below | |||

| 15 | Ireland | X | ||||

| 16 | Israel | X | ||||

| 17 | Italy | X | ||||

| 18 | Japan | X | Yes - refer to Addendum (III) below | |||

| 19 | Malaysia | Yes - An additional agreement is required. Please contact your Sales Specialist or Relationship Manager for additional information. | ||||

| 20 | Mexico | X | Yes - refer to Addendum (III) below | |||

| 21 | Netherlands | X | ||||

| 22 | New Zealand | X | ||||

| 23 | Norway | X | ||||

| 24 | Poland | X | Yes - refer to Addendum (IV) below | |||

| 25 | Portugal | X | ||||

| 26 | Singapore | X | Yes - refer to Addendum (III) below | |||

| 27 | South Africa | X | ||||

| 28 | South Korea | Yes - An additional agreement is required. Please contact your Sales Specialist or Relationship Manager for additional information. | ||||

| 29 | Spain | X | ||||

| 30 | Sweden | X | ||||

| 31 | Switzerland | X | ||||

| 32 | Taiwan | Yes - An additional agreement is required. Please contact your Sales Specialist or Relationship Manager for additional information. | ||||

| 33 | Thailand | X | Yes - refer to Addendum (V) below | |||

| 34 | Turkey | X | Yes - refer to Addendum (VI) below | |||

| 35 | United Kingdom | X | ||||

| 36 | United States | X |

Lender acknowledges that this Schedule 4 to the Securities Lending Agreement dated April 11, 2016 is effective as of the date specified below and that the relevant Addenda within this Schedule shall apply.

Each Lender severally and not jointly:

1290 FUNDS

on behalf of each of their series listed on Annex A

| By: | /s/ Xxxxx Xxxxx | |

| Name: Xxxxx Xxxxx | ||

| Title: Chief Financial Officer | ||

| Date: 9/12/23 |

Market Terms Schedule

| I. | Australia |

Xxxxxx acknowledges and accepts that:

| a) | with regards to any Institutional Share Offering (“ISO”) offered by an Australian issuer to Lender, Xxxxxx shall be solely responsible for informing X.X. Xxxxxx that Lender has (a) been invited to participate in such ISO and (b) intends to, or otherwise, exercise any rights in relation to Securities on Loan; |

| b) | due to the nature of an ISO, X.X. Xxxxxx will be unaware of such ISO arising and will therefore rely solely on Lender’s notification provided in (a) above; |

| c) | subject to Clause 4 hereof (Instructions), Xxxxxx must provide election Instructions to X.X. Xxxxxx: |

| i. | prior to market expiry where the timing of the ISO announcement makes it reasonably practicable to permit election Instructions to be given prior to such market expiry; and |

| ii. | in all other cases, prior to the applicable Cut-Off Time. |

Such election Instructions must specify whether Xxxxxx wishes to (i) take up the ISO; (ii) lapse the ISO; or (iii) lapse and take up any available cashbook build. Upon receipt, X.X. Xxxxxx shall use reasonable endeavours to forward such election Instructions to Borrower;

| d) | X.X. Xxxxxx shall not be liable to Lender in the event that: |

| iii. | Xxxxxx does not provide to X.X. Xxxxxx any election Instructions; or |

| iv. | Xxxxxx fails to provide X.X. Xxxxxx with timely election Instructions with respect to such an ISO, and X.X. Xxxxxx in its sole discretion does not take any action in relation to such election Instructions; or |

| v. | election Instructions were received by Borrower after market expiry of the ISO and Xxxxxxxx is unable to accept such election Instructions. |

| II. | France |

Xxxxxx acknowledges and accepts that when lending Securities issued by French issuers (“French Securities”), any additional tax credits (including, but not limited to, Credit d’Impot) that may be due to the holder of such French Securities had they not been on Loan over record date, will not form part of the manufactured Income (as defined in the applicable MSLA) that is collected from a Borrower on behalf of the Lender.

| III. | Greece, Hungary, Japan, Mexico, Singapore |

To the extent that Xxxxxx has approved in this Schedule that the following jurisdictions are eligible markets, Lender represents and warrants that it does not have a “permanent establishment” in:

| a) | Greece |

| b) | Hungary |

| c) | Japan |

| d) | Mexico |

| e) | Singapore |

| IV. | Poland |

Xxxxxx acknowledges and agrees that the following restrictions shall apply in respect of equity securities issued by Polish companies (“Polish Securities”):

| a) | the Journal of laws of Poland 2015, No.1272, which became effective in October 2015 (the “Act”) introduced pre-approval requirements from the Polish Government prior to any acquisition of significant shareholdings in certain Protected Companies (as defined by the Act and subject to change from time to time). In order to manage the transaction pre-approval requirements for the Lender, X.X. Xxxxxx will be limiting the securities lending program to actively lend only those Polish Securities where the Lender’s aggregate holding is less than 5%; |

| b) | as the list of Protected Companies impacted by the Act is subject to on-going change, this arrangement will be applied to all Polish Securities held through X.X. Xxxxxx that have been made eligible for lending in the program by the Lender. As Xxxxxx’s Lending Agent, X.X. Xxxxxx are unable to determine the Lender’s total aggregate size of holding in such Polish Securities, therefore Lender will be responsible for notifying X.X. Xxxxxx where Lender is either holding, or proposing to acquire a total holding of 5% or greater of voting capital in Polish Securities. Lenders are required to provide such notification to X.X. Xxxxxx no later than trade date of the acquisition transaction resulting in a 5% or above holding; and |

| c) | a failure to comply with the notification requirement could result in securities lending transactions being undertaken by X.X. Xxxxxx without Lender seeking the requisite pre- approval potentially resulting in penalties being levied against the Lender by the Polish Government for which the Lender is solely responsible. |

| V. | Thailand |

When lending Securities issued by Thai issuers (“Thai Securities”) Lender acknowledges and consents that the amount of all cash Distributions (as defined in Clause 2.7(a) above) payable to Lender with regard to Thai Securities on Loan may be credited to Xxxxxx’s cash account in Dollars on the payable date of such cash Distributions. The amount of the cash Distributions will be converted into Dollars using the foreign exchange rate agreed with the Borrower and based on the reference rate provided by X.X. Xxxxxx’x local subcustodian.

Lenders opting for the “Calc & Pay” service offered by X.X.Xxxxxx in its capacity as global custodian for the treatment of capital gains tax in Thailand (such service being, the “Calc & Pay Service”), should be aware that the applicable sub-custodian in Thailand has informed X.X.Xxxxxx (in its capacity as global custodian) that it will ignore loan and return transactions generated by the agency lending discretionary program for the purposes of any calculation required for the Calc & Pay Service.

| VI. | Turkey |

Lender represents and warrants that all:

| a) | Turkish equities in the Lending Account were purchased after 1st January, 2006 and are not subject to the “Non Resident Investment Fund” regime; and |

| b) | Turkish bonds in the Lending Account were issued after 1st January, 2006, |

and can be made available for lending under Applicable Law.

Xxxxxx acknowledges that it will promptly identify to X.X. Xxxxxx by notice, which notice may be oral, if the above representation and warranty ceases to be true. Upon such notice, X.X. Xxxxxx shall restrict the lending of the relevant Turkish Securities to Borrowers. In the event Lender fails to promptly notify X.X. Xxxxxx that the above representation and warranty ceases to be true, X.X. Xxxxxx shall not be liable for any Liabilities of Lender arising as a result of continued lending of such Turkish Securities.