THE GLlMPSE GROUP, INC. MASTER ACQUISITION AGREEMENT

Exhibit 10.16

THE GLlMPSE GROUP, INC.

THIS MASTER ACQUISITION AGREEMENT (this “Agreement”), dated as of November 8, 2016 (the “Effective Date”), is among THE GLIMPSE GROUP, INC., a Nevada corporation (the “Buyer”), KabaQ 3D Food Technologies, LLC, a Nevada limited liability corporation and direct and wholly owned subsidiary of Buyer (the ‘‘Designated Subsidiary”), and Xxxxx Xxxxx (the “Seller”).

| 1. | Certain Definitions. As used herein, the following capitalized terms will have the meanings set forth below: |

| (a) | “Assigned Assets” refers to the Technology, all Derivatives, all Intellectual Property Rights, all Embodiments and Business Assets, collectively. | |

| (b) | “Business Assets” means all business and marketing plans, worldwide marketing rights, software, customer and supplier lists, price lists, mailing lists, customer and supplier records and other confidential or proprietary information relating to the Technology or the Business, as well as all computers, office equipment and other tangible personal property owned (i.e., not leased) by the Seller immediately prior to the execution and delivery of this Agreement, including as specified in Appendix 1. | |

| (c) | “Derivative” means: (i) any derivative work of the Technology (as defined in Section 101 of the U.S. Copyright Act); (ii) all improvements, modifications, alterations, adaptations, enhancements and new versions of the Technology (the “Technology Derivatives”); and (iii) all technology, inventions, products or other items that, directly or indirectly, incorporate, or are derived from, any part of the Technology or any Technology Derivative. | |

| (d) | “Embodiment” means all documentation, drafts, papers, designs, schematics, diagrams, models, prototypes, source and object code (in any form or format and for all hardware and software platforms), computer-stored data, diskettes, manuscripts and other items describing all or any part of the Technology, any Derivative, any Intellectual Property Rights or any information related thereto or in which all of any part of the Technology, any Derivative, any Intellectual Property Right or such information is set forth, embodied, recorded or stored. |

| 1 |

| (e) | “Intellectual Property Rights” means, collectively, all worldwide patents, patent applications, patent rights, copyrights, copyright registrations, common law rights, moral rights, trade names, trademarks, service marks, domain names and registrations and/or applications for all of the foregoing, trade secrets, know-how, mask work rights, rights in trade dress and packaging, goodwill and all other intellectual property rights and proprietary rights relating in any way to the Technology, any Derivative or any Embodiment, whether arising under the laws of the United States of America or the laws of any other state, country or jurisdiction. | |

| (f) | “Technology” means all inventions, technology, algorithms, ideas, concepts, processes, business plans, documentation, financial projections, models and any other items, authored, conceived, invented, developed or designed by the Seller relating to the technology described in detail on Exhibit A hereto or Business of the Designated Subsidiary that is not otherwise owned by the Designated Subsidiary. |

| 2. | Acquisition. |

| (a) | At the Closing (as defined below), the Seller shall sell, transfer, assign and convey, to the Designated Subsidiary, and its successors and assigns, the Seller’s entire right, title and interest in and to the Assigned Assets and all rights of action, power and benefit belonging to or accruing from the Assigned Assets including the right to undertake proceedings to recover past and future damages and claim all other relief in respect of any acts of infringement thereof whether such acts shall have been committed before or after the date of this assignment, the same to be held and enjoyed by said Designated Subsidiary, for its own use and benefit and the use and benefit of its successors, legal representatives and assigns, as fully and entirely as the same would have been held and enjoyed by the Seller, had this assignment not been made, pursuant to the Xxxx of Sale in the form as attached hereto as Exhibit B (the “Xxxx of Sale”). | |

| (b) | In exchange for the Assigned Assets, at the Closing, Buyer shall pay to Seller the sum of $1.00 (the “Purchase Price”). In addition, pursuant to the terms and conditions herein, in return for the covenants and agreements of Seller herein, provided that the Closing occurs, the Seller shall be entitled to receive the payments as set forth in Section 12, subject to the terms and conditions therein. | |

| (c) | The Seller hereby appoints the Designated Subsidiary the attorney-in-fact of the Seller, with full power of substitution on behalf of the Seller to demand and receive any of the Assigned Assets and to give receipts and releases for the same, to institute and prosecute in the name of the Seller, but for the benefit of the Designated Subsidiary, any legal or equitable proceedings the Designated Subsidiary deems proper in order to enforce any rights in the Assigned Assets and to defend or compromise any legal or equitable proceedings relating to the Assigned Assets as the Designated Subsidiary shall deem advisable. The Seller hereby declares that the appointment made and powers granted hereby are coupled with an interest and shall be irrevocable by the Seller. | |

| (d) | The Seller hereby agrees that the Seller and the Seller’s successors and assigns will do, execute, acknowledge and deliver, or will cause to be done, executed, acknowledged and delivered such further acts, documents, or instruments confirming the conveyance of any of the Assigned Assets to the Designated Subsidiary as the Designated Subsidiary shall reasonably deem necessary, provided that the Designated Subsidiary shall provide all necessary documentation to the Seller. |

| 2 |

| 3. | Closing; Deliveries. |

| (a) | Subject to the satisfaction or waiver of the conditions herein, closing of the transactions contemplated herein (the “Closing”) shall be held on or before November 7, 2016 (the “Termination Date”) or at such time, date or place as the Seller and the Buyer may agree (the date of such Closing, the “Closing Date”). | |

| (b) | At the Closing: |

| (i) | The Seller shall deliver to the Buyer a duly executed copy of (i) the employment agreement, in the form as attached hereto as Exhibit C (the “Employment Agreement”) and (ii) the Option Agreement attached hereto as Exhibit D (the “Option Agreement”); | ||

| (ii) | The Buyer shall deliver to the Seller a duly executed copy of (A) the Employment Agreement and (B) the Option Agreement. | ||

| (iii) | The Seller shall deliver to Designated Subsidiary a duly executed copy of the Xxxx of Sale. | ||

| (iv) | The Designated Subsidiary shall deliver to Seller a duly executed copy of the Xxxx of Sale. | ||

| (v) | Buyer shall pay the Purchase Price to Seller, by wire transfer or check, at Buyer’s option. |

| 4. | Repre-5eptations apd Warranties. |

| (a) | Representations and Warranties of Seller. As an inducement to, and to obtain the reliance of the Buyer and the Designated Subsidiary, the Seller represents and warrants as of the date hereof and as of the Closing Date, as follows: |

| (i) | Assigned Assets. The Seller is the owner, inventor and/or author of, and can grant exclusive right, title and interest in and to, each of the Assigned Assets transferred by the Seller hereunder and that none of the Assigned Assets are subject to any dispute, claim, prior license or other agreement, assignment, lien, encumbrance or rights of any third party, or any other rights that might interfere with the Designated Subsidiary’s use, or exercise of ownership of, any of the Assigned Assets. The Seller further represents and warrants to the Buyer and the Designated Subsidiary that the Assigned Assets are free of any claim of any prior employer or third party client of the Seller or any school, university or other institution the Seller attended, if any, and that the Seller is not aware of any claims by any third party to any rights of any kind in or to any of the Assigned Assets. The Seller agrees to immediately notify the Buyer and Designated Subsidiary upon becoming aware of any such claims. | ||

| (ii) | Authorization; Enforcement: Validity. The Seller has full power and authority to enter into this Agreement, and each of the other agreements entered into by the parties on the Closing Date and attached hereto as exhibits to this Agreement (collectively, the “Transaction Documents”), the execution and delivery of this Agreement has been duly authorized, if applicable, and this Agreement constitutes a valid and legally binding obligation of the Seller. This Agreement has been, and each other Transaction Document shall be on the Closing Date, duly executed and delivered by the Seller and this Agreement constitutes, and each other Transaction Document upon its execution by Seller shall constitute the valid and binding obligations of Seller enforceable against Seller in accordance with their terms, except as such enforceability may be limited by general principles of equity or applicable bankruptcy insolvency, reorganization, moratorium, liquidation or similar laws relating to, or affecting generally, the enforcement of creditors’ rights and remedies. |

| 3 |

| (iii) | No Breach. The consummation of the transactions contemplated herein will not result in a breach of any past, current or future agreements (whether written or oral), license, law or regulation applicable to Seller, the Business or the Assigned Assets. No other person or entity has any rights to the Business or the Assigned Assets . |

| (b) | Representations and Warranties of Buyer and Designated Subsidiary. As an inducement to, and to obtain the reliance of the Seller except as set forth in the Buyer Schedules (as hereinafter defined), the Buyer and Designated Subsidiary represent and warrant, as of the date hereof and as of the Closing Date, as follows: |

| (i) | Organization and Qualification. The Buyer and its “Subsidiaries” (which for purposes of this Agreement means any entity in which the Buyer, directly or indirectly, owns 50% or more of the voting stock or capital stock or other similar equity interests), including Designated Subsidiary, are companies duly organized and validly existing in good standing under the laws of the jurisdiction in which they are incorporated, and have the requisite corporate power and authority to own their properties and to carry on their business as now being conducted. Each of the Buyer and its Subsidiaries is duly qualified as a foreign corporation to do business and is in good standing in every jurisdiction in which its ownership of property or the nature of the business conducted by it makes such qualification necessary, except to the extent that the failure to be so qualified or be in good standing could not reasonably be expected to have a Material Adverse Effect. As used in this Agreement, “Material Adverse Effect” means any material adverse effect on any of: (i) the business, properties, assets, operations, results of operations or financial condition of the Buyer and its Subsidiaries, taken as a whole, or (ii) the authority or ability of the Buyer to perform its obligations under the Transaction Documents. | ||

| (ii) | Authorization; Enforcement; Validity. (i) Each of the Buyer and the Designated Subsidiary has the requisite corporate power and authority to enter into and perform their obligations under the Transaction Documents, (ii) the execution and delivery of the Transaction Documents by each of the Buyer and the Designated Subsidiary and the consummation by them of the transactions contemplated hereby and thereby, has been duly authorized by the Buyer’s Board of Directors and the Designated Subsidiary’s governing body do not conflict with the Buyer’s Articles of Incorporation or Bylaws or Designated Subsidiary’s organizational documents, and do not require further consent, approval or authorization by the Buyer, its Board of Directors or its shareholders or Designated Subsidiary’s governing body, (iii) this Agreement has been, and each other Transaction Document shall be on the Closing Date, duly executed and delivered by the Buyer and Designated Subsidiary and (iv) this Agreement constitutes, and each other Transaction Document upon its execution on behalf of the Buyer and Designated Subsidiary, shall constitute, the valid and binding obligations of the Buyer and Designated Subsidiary enforceable against the Buyer and Designated Subsidiary in accordance with their terms, except as such enforceability may be limited by general principles of equity or applicable bankruptcy, insolvency, reorganization, moratorium, liquidation or similar laws relating to, or affecting generally, the enforcement of creditors’ rights and remedies. |

| 4 |

| 5. | Covenants. |

| (a) | Due Diligence Investigation. Prior to the Closing, the Seller shall afford to the Buyer and Designated Subsidiary and their authorized representatives and officers full access to the Assigned Assets in order that Buyer and Designated Subsidiary may have a full opportunity to make such reasonable investigation as it shall desire to make of the to be Assigned Assets, and the Seller will furnish Buyer and Designated Subsidiary with such additional data and other information as to the to be Assigned Assets as the Buyer shall from time to time reasonably request. As such, subject to applicable law, the Seller shall allow Buyer and Designated Subsidiary and their auditors, legal counsel and other authorized representatives all reasonable opportunity and access during normal business hours to inspect and investigate the to be Assigned Assets for purposes of conducting due diligence. The Buyer and Designated Subsidiary shall be responsible for any of its due diligence costs incurred in conjunction with the proposed due diligence under this Section 5(a). | |

| (b) | Further Assurances. Seller agrees that from time to time, whether before, at or after the Closing, Seller will take such other action as reasonably necessary to: |

| (i) | furnish, upon request to Buyer such information as Buyer may reasonably request; | ||

| (ii) | execute, acknowledge and deliver such contracts, deeds, or other documents as may be reasonably requested and necessary or appropriate to carry out the purposes and intent of this Agreement; | ||

| (iii) | effectuate the assignment of the Assigned Assets by the Seller to the Buyer; and | ||

| (iv) | perform any other acts deemed necessary to carry out the intent of this Agreement. |

| (c) | Non-Compete. |

| (i) | Provided that the Closing occurs, then as of the Closing and for a period of three (3) years thereafter (such applicable period, the “Non-Competition Period”), Seller shall not, either directly or indirectly, for Seller’s self or on behalf of or in conjunction with any other person, company, partnership, corporation, business, group, or other entity (each, a “Person”) (A) hire, employ, solicit or recruit to leave the Buyer’s or the Designated Subsidiary’s employ any employee, agent, or contract worker of the Buyer or the Associated Companies (as defined below) with whom Seller had contact during the course of Seller’s employment with the Buyer or the Designated Subsidiary; or (B) engage in or otherwise carry on, directly or indirectly (either as principal, agent, employee, employer, investor or shareholder) except for investments of no greater than 3% of the total outstanding shares in any publicly-traded company in a Competitive Business (as defined below), or act as a contractor, partner, member, financier or in any other individual or representative capacity of any kind whatsoever, of any Competitive Business (as defined below), or act as a contractor, partner, member, financier or in any other individual or representative capacity of any kind whatsoever, of any Competitive Business. | ||

| (ii) | Notwithstanding clause (B) of Section 5(c)(i), Seller may be a principal, agent, employee, employer, investor or shareholder in, and may act as a contractor, partner, member, financier or in any other individual or representative capacity to, either of Pandora Reality LLC or Pandora Arttirilmis ve sanal gerceklik teknolojileri (collectively, together with any Affiliates thereof, “Pandora”), provided that, as of the time of the actions by Seller in such capacity, Pandora is not engaging in any Competitive Business. The exclusion to the limitations set forth in clause (B) of Section S(c)(i) that are set forth in this Section S(c)(ii) shall immediately cease upon Pandora becoming engaged in any Competitive Business. |

| 5 |

| (iii) | For purposes of this Agreement, “Competitive Business” shall mean any activity which is competitive with any of the business activities in which, at the time of the Closing or at the time of the cessation of Seller’s employment by the Buyer, (a) the Buyer or the Associated Companies is engaged, (b) to Seller’s knowledge, the Buyer or the Associated Companies is actively developing plans or becomes active in developing plans to be engaged, or (c) any third party that directly benefits from services or products provided by the Buyer or any Associated Company is engaged or becomes, to Seller’s knowledge, actively engaged in developing plans to engage. | ||

| (iv) | References to the “Associated Companies” shall mean the Buyer’s direct and indirect subsidiaries, and any company in which the Buyer has an ownership interest. | ||

| (v) | References to the “Business of the Buyer” shall mean the actual or intended business of the Buyer during the Non-Competition Period. | ||

| (vi) | The “geographic area” applicable to this Section 5(c) is worldwide. Seller agrees that, due to the multi-jurisdictional nature of the businesses of the Buyer and the Associated Companies, a covenant not to compete encompassing this geographic area is reasonable in scope and necessary for the protection of the Buyer’s business and affairs. | ||

| (vii) | Except as otherwise set forth herein, all of the covenants in this Section 5(c) are severable and separate, and the unenforceability of any specific covenant shall not affect the provisions of any other covenant. If any provision of this Section 5(c) relating to the time period, scope, or geographic areas of the restrictive covenants shall be declared by a court of competent jurisdiction to exceed the maximum time period, scope, or geographic area, as applicable, that such court deems reasonable and enforceable, then this Agreement shall automatically be considered to have been amended and revised to reflect such determination. | ||

| (viii) | Seller has carefully read and considered the provisions of this Section 5(c) and, having done so, agrees that the restrictive covenants in this Section 5(c) impose a fair and reasonable restraint on Seller and are reasonably required to protect the interests of the Buyer and its officers, directors, employees, and stockholders. | ||

| (ix) | Notwithstanding the forgoing, in the event that Seller’s employment with the Buyer is terminated by the Buyer pursuant to Section 5(b) of the Employment Agreement (i.e., termination without cause), then (i) the “Non-Competition Period” shall be one (1) year from the date of termination of employment; and (ii) “Competitive Business” shall mean only the business of the Buyer or its Associated Companies that is carried in with respect to, and in connection with the Assigned Assets. |

| (d) | Future Transactions. Provided that the Closing occurs, Seller agrees to use his best efforts to cause any new transactions related to the food service industry, including, without limitation, restaurants, that involve, use or relate in any way to either the Business or the Assigned Assets (collectively, the “Future Opportunities”), to be directed towards Buyer or the Designated Subsidiary for the benefit of Buyer or the Designated Subsidiary. Seller specifically agrees (i) not to direct, directly or indirectly, any Future Opportunity, in any way, to Pandora or any third party; (ii) not to solicit, directly or indirectly, any Future Opportunity for the benefit of Pandora or any third party; and (iii) not to, directly or indirectly, undertake any actions that would result in Pandora or any third party receiving any benefit from any Future Opportunity. The covenants of the Seller set forth in this Section 5(c)(ix) are intended to supplement, and not replace, the other covenants of the Seller set forth herein, including the covenants set forth in Section 5(c). |

| 6 |

| 6. | Conditions Precedent to Seller’s Obligations to Close. The obligations of the Seller to consummate the transactions contemplated herein shall be subject to the fulfillment at or prior to Closing of the following additional conditions, except as the Seller may waive in writing: |

| (a) | Execution of Transaction Documents. This Agreement and all other agreements and documents required to be executed at the Closing shall have been duly executed by the Buyer and Designated Subsidiary. | |

| (b) | Compliance and Performance. The Buyer and Designated Subsidiary shall have complied with and performed in all material respects all of the terms, covenants, agreements and conditions contained in this Agreement which are required to be complied with and performed on or prior to Closing. | |

| (c) | No Governmental Prohibition. No order, statute, rule, regulation, executive order, injunction, stay, decree, judgment or restraining order shall have been enacted, entered, promulgated or enforced by any court or governmental or regulatory authority or instrumentality which prohibits the consummation of the transactions contemplated hereby. | |

| (d) | Approval by the Board of Directors of the Buyer. The Buyer’s board of directors shall have approved the transactions contemplated hereby. |

| 7. | Conditions Precedent to Buyer’s and Designated Subsidiary’ Obligations to Close. The obligations of Buyer and Designated Subsidiary to consummate the transactions contemplated herein shall be subject to the fulfillment at or prior to Closing of the following additional conditions, except as Buyer or Designated Subsidiary, where applicable, may waive in writing: |

| (a) | Satisfaction with Due Diligence. The Buyer and Designated Subsidiary shall have completed and be satisfied with, in Buyer’s sole discretion, its due diligence examination of all aspects of the Assigned Assets. | |

| (b) | Execution of Transaction Documents. This Agreement and all other agreements and documents required to be executed at the Closing shall have been duly executed by the Seller, thereby completing the assignment of the Assigned Assets to the Designated Subsidiary. | |

| (c) | Compliance and Performance. The Seller shall have complied with and performed in all material respects all of the terms, covenants, agreements and conditions contained in this Agreement which are required to be complied with and performed on or prior to Closing. | |

| (d) | Accuracy of Representations and Warranties. The representations and warranties of the Seller in this Agreement shall have been true and correct on the date hereof and such representations and warranties shall be true and correct on and at the Closing (except those, if any, expressly stated to be true and correct at an earlier date), with the same force and effect as though such representations and warranties had been made on and at the Closing. The Buyer shall be furnished with a certificate, signed by the Seller and dated the Closing Date, to the foregoing effect. | |

| (e) | No Governmental Prohibition. No order, statute, rule, regulation, executive order, injunction, stay, decree, judgment or restraining order shall have been enacted, entered, promulgated or enforced by any court or governmental or regulatory authority or instrumentality which prohibits the consummation of the transactions contemplated hereby. |

| 7 |

| 8. | Termination. |

| (a) | This Agreement may be terminated by the Seller if the conditions set forth in Section 6 have not been satisfied by the Termination Date, provided that such failure is not due to Seller’s breach of this Agreement. | |

| (b) | This Agreement may be terminated by Buyer if the conditions set forth in Section 7 have not been satisfied by the Termination Date, provided that such failure is not due to Buyer’s or Designated Subsidiary’s breach of this Agreement. |

| 9. | Confidentiality. |

| Each party hereto agrees with the others that, unless and until the transactions contemplated by this Agreement have been consummated, it and its representatives will hold in strict confidence all data and information obtained with respect to another party or any subsidiary thereof from any representative, officer, director or employee, or from any books or records or from personal inspection, of such other party, and shall not use such data or information or disclose the same to others, except (i) to the extent such data or information is published, is a matter of public knowledge, or is required by law to be published; or (ii) to the extent that such data or information must be used or disclosed in order to consummate the transactions contemplated by this Agreement. In the event of the termination of this Agreement, each party shall return to the other party all documents and other materials obtained by it or on its behalf and shall destroy all copies, digests, work papers, abstracts or other materials relating thereto, and each party will continue to comply with the confidentiality provisions set forth herein. |

| 10. | Indemnification; Survival. |

| (a) | Indemnification. Each party hereto shall jointly and severally indemnify and hold harmless the other party and such other party’s agents, beneficiaries, affiliates, representatives and their respective successors and assigns (collectively, the “Indemnified Persons”) from and against any and all damages, losses, liabilities, taxes and costs and expenses (including, without limitation, attorneys’ fees and costs) (collectively, “Losses”) resulting directly or indirectly from (a) any inaccuracy, misrepresentation, breach of warranty or nonfulfillment of any of the representations and warranties of such party in this Agreement, or any actions, omissions or statements of fact inconsistent with in any material respect any such representation or warranty, (b) any failure by such party to perform or comply with any agreement, covenant or obligation in this Agreement. | |

| (b) | Survival. All representations, warranties, covenants (including, but not limited to, non-solicitation and non-competition) and agreements of the parties contained herein or in any other certificate or document delivered pursuant hereto shall survive the date hereof until the expiration of the applicable statute of limitations or as otherwise provided herein. |

| 11. | Post-Transaction Restrictions. |

| (a) | No-Conflict. The Seller hereby represents and warrants to the Designated Subsidiary that it is not party to any written or oral agreement with any third party that would restrict its ability to enter into this Agreement or to perform the Seller’s obligations hereunder and that the Seller will not, by entering into this Agreement breach any non-disclosure, proprietary rights, non-competition, non-solicitation or other covenant in favor of any third party. | |

| (b) | Ability to Earn Livelihood: Consideration. Seller expressly agrees and acknowledges that the post-transaction restrictions contained in this Agreement and the Employment Agreement do not preclude Seller from earning a livelihood, nor do they unreasonably impose limitations on Seller’s ability to earn a living. Seller further agrees and acknowledges that the potential harm to the Buyer and to the Designated Subsidiary of the non-enforcement of these restrictions outweighs any harm to Seller of the enforcement of the restrictions by injunction or otherwise. |

| 8 |

| 12. | Special Covenants Regarding Future Transactions Involving Designated Subsidiary. Subject to the vesting provisions in Section 12(e), provided that the Closing occurs, Seller shall have the right to receive the payments set forth in Section 12(a), Section 12(b), Section 12(c) and Section 12(d). |

| (a) | Sale of All or Xxxx of Ownership or Assets in Designated Subsidiary. If, subsequent to the Closing, there is a sale of all or part of (i) the ownership of Designated Subsidiary (as a result of newly issued equity of the Designated Subsidiary or the sale by the Buyer of the equity of Designated Subsidiary held by Buyer), or (ii) the assets of Designated Subsidiary, resulting in cash, equity or other direct proceeds to the Buyer, the Seller shall receive ten percent (10%) of the net sale proceeds (net of specific transaction fees including brokerage commissions, legal fees, and other customary transactional fees related to the transaction) in kind. In other words, if the Buyer receives cash, stock, warrants, debt or combination of any or each, the Seller will receive ten percent (10%) of the same type of consideration received by the Buyer net of the fees described above. | |

| (b) | Change of Control. If the Buyer’s ownership interest in the Designated Subsidiary is diluted below fifty percent (50%) of the outstanding equity of the Designated Subsidiary (“Change of Control”) as a result of one or a series of transactions resulting in investment proceeds into the Designated Subsidiary, the Seller shall receive ten percent (I 0%) of the outstanding equity in the Designated Subsidiary immediately after the dilutive transaction(s) resulting in the Change of Control. | |

| (c) | Going Public Transaction. If a transaction is completed resulting in the Designated Subsidiary becoming a separate publicly traded entity (via initial public offering, spin-off, or reverse merger), the Seller shall receive ten percent (10%) of the outstanding equity in the Designated Subsidiary immediately prior to the transaction on a fully diluted basis; provided, however, that such ten percent (10%) shall be granted immediately before completion of a transaction for a qualified financing transaction defined as a firm commitment underwriting of $10,000,000 or more. | |

| (d) | Additional Payments. At the later to occur of (A) the three year anniversary of the Closing and (B) the date that the common stock of Buyer (the “Common Stock”) is (x) is listed on a national securities exchange and (y) has an average daily trading volume over the prior thirty Trading Days (as defined below) of at least 100,000 shares of Common Stock (the date of the satisfaction of the conditions in both clause (A) and clause (B), the “Trigger Date”), then Seller shall have the right to receive from Buyer, at the Buyer’s option, either (1) the sum of $750,000 (the “Additional Payment”), payable in cash via wire transfer to an account designated by Seller to be paid within ten business days of the Trigger Date; or (2) a number of shares of Common Stock equal to the Additional Payment divided by the volume weighted average Closing Sale Price (as defined below) for the Common Stock over the thirty Trading Days immediately prior to the Trigger Date, to be delivered by Buyer within ten business days of the Trigger Date. Notwithstanding the forgoing, the Additional Payment (as detailed above), to the extent not already paid, shall be due and payable within ten business days of a Buyer Sale (as defined below) occurring, and, for the avoidance of doubt, shall be payable in cash or shares of Common Stock, at the option of Buyer, as set forth above. | |

| (e) | Vesting. The rights of Seller to receive the payments set forth in Section 12(a), Section 12(b), Section 12(c) and Section 12(d) shall vest or be forfeited as follows (but, for the avoidance of doubt, the making of any such payments shall remain subject to the conditions set forth in Section 12(a), Section 12(b), Section 12(c) and Section 12(d), as applicable): |

| (i) | Seller shall vest in 3.33% out of the total 10% payable pursuant to Section 12(a), Section 12(b) or Section 12(c), and in 33.33% of the Additional Payment pursuant to Section 12(d), whether paid in cash or shares of Common Stock) on the first anniversary of the Closing Date. |

| 9 |

| (ii) | Seller shall vest in the remaining 6.67% out of the total 10% payable pursuant to Section 12(a), Section 12(b) or Section 12(c)d, and in the remaining 66.67% of the Additional Payment pursuant to Section 12(d) ratably each month of the twenty four months following the first anniversary of the Closing Date (i.e., 0.2779% per month out of the total 10%% payable pursuant to Section 12(a), Section 12(b) or Section 12(c), and 2.779% per month of the Additional Payment pursuant to Section 12(d), whether paid in cash or shares of Common Stock), commencing with the first monthly anniversary of the Closing Date, such that Seller is fully vested in the payments pursuant to Section 12(a), Section 12(b), Section 12(c) and Section 12(d) on the third anniversary of the Closing Date. | |

| (iii) | In the event that (A) Seller’s employment with Buyer is terminated (i) by Buyer pursuant to Section S(a) of the Employment Agreement (i.e., termination for Cause (as defined in the Employment Agreement), or (ii) by Seller pursuant to Section S(c) of the Employment Agreement without Good Reason (as defined in the Employment Agreement), or (B) Seller breaches any of the representations, warranties or covenants of Seller herein, then, in any such case, Seller shall forfeit the right to receive any of the payments set forth in Section 12(a), Section l 2(b), Section 12(c) and Section 12(d) to the extent not vested as of the time of the date of termination of Seller’s employment with Buyer or the time of the breach or any of the representations, warranties or covenants of Seller herein, as applicable. | |

| (iv) | In the event that Seller’s employment with Buyer is terminated (i) by Buyer pursuant to Section S(b) of the Employment Agreement (i.e., termination without Cause), or (ii) by Seller pursuant to Section S(c) o(the Employment Agreement with Good Reason, then Seller shall immediately vest in the rights to receive the payments set forth in Section 12(a), Section 12(b), Section 12(c) and Section 12(d). | |

| (v) | Notwithstanding the above, in the case of a Buyer Sale, all unvested payments, to the extent not already forfeited pursuant to Section (12)(e)(iii) or 12(e)(iv), shall become fully vested and due. |

| (f) | Definitions. For purposes herein: |

| (i) | “Affiliate” of a party means any person or entity that controls, is controlled by, or is under common control with, such party, whether through the ownership of equity interests, management, contract or otherwise, and for purposes of Seller, shall include Pandora. | |

| (ii) | “Buyer Sale” shall mean any of (i) a tender offer (or series of related offers) shall be made and consummated for the ownership of 50% or more of the outstanding voting securities of the Buyer, unless as a result of such tender offer more than 50% of the outstanding voting securities of the surviving or resulting corporation shall be owned in the aggregate by the stockholders of the Buyer (as of the time immediately prior to the commencement of such offer), any employee benefit plan of the Buyer or its subsidiaries, and their affiliates; (ii) the Buyer shall be merged or consolidated with another entity, unless as a result of such merger or consolidation more than 50% of the outstanding voting securities of the surviving or resulting entity shall be owned in the aggregate by the stockholders of the Buyer (as of the time immediately prior to such transaction), any employee benefit plan of the Buyer or its subsidiaries, and their affiliates; (iii) the Buyer shall sell substantially all of its assets to another entity that is not wholly owned by the Buyer, unless as a result of such sale more than 50% of such assets shall be owned in the aggregate by the stockholders of the Buyer (as of the time immediately prior to such transaction), any employee benefit plan of the Buyer or its subsidiaries and their affiliates; or (iv) a Person (as defined below) shall acquire 50% or more of the outstanding voting securities of the Buyer (whether directly, indirectly, beneficially or of record), unless as a result of such acquisition more than 50% of the outstanding voting securities of the surviving or resulting corporation shall be owned in the aggregate by the stockholders of the Buyer (as of the time immediately prior to the first acquisition of such securities by such Person), any employee benefit plan of the Buyer or its subsidiaries, and their affiliates. For purposes of this Agreement, ownership of voting securities shall take into account and shall include ownership as determined by applying the provisions of Rule 13d- 3(d)(1)(i) (as in effect on the date hereof) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). In addition, for such purposes, “Person” shall have the meaning given in Section 3(a)(9) of the Exchange Act, as modified and used in Sections 13(d) and 14(d) thereof; provided, however, that a Person shall not include (A) the Buyer or any of its subsidiaries; (B) a trustee or other fiduciary holding securities under an employee benefit plan of the Buyer or any of its subsidiaries; (C) an underwriter temporarily holding securities pursuant to an offering of such securities; or (D) an entity owned, directly or indirectly, by the stockholders of the Buyer in substantially the same proportion as their ownership of stock of the Buyer. |

| 10 |

| (iii) | “Trading Day” means any day on which the Common Stock is listed, quoted and traded on a national securities exchange. | |

| (iv) | “Closing Sale Price” means (i) the last closing trade price for the Common Stock on the primary national securities exchange on which the Common Stock is then traded (the “Principal Market”), as reported by xxx.xxxxxx.xxx (“Nasdaq”), or, if the Principal Market begins to operate on an extended hours basis and does not designate the closing trade price, then the last trade price of the Common Stock prior to 4:00 p.m., New York time, as reported by Nasdaq, or (ii) if the foregoing does not apply, the last trade price of the Common Stock in the over-the-counter market for such security as reported by Nasdaq, or (iii) if no last trade price is reported for the Common Stock by Nasdaq, the average of the bid and ask prices of any market makers for the Common Stock as reported by the OTC Markets, and provided that if the Closing Sale Price cannot be calculated for the Common Stock on a particular date on any of the foregoing bases, the Closing Sale Price of the Common Stock on such date shall be the fair market value as reasonably determined by the Board of Directors of the Buyer, and provided further that all such determinations to be appropriately adjusted for any stock dividend, stock split, stock combination or other similar transaction during the applicable calculation period. |

| 13. | Employment/Consulting and Officer/Director Positions. Other than as set forth in the Employment Agreement Seller shall not have a right to employment with Buyer or the Designated Subsidiary as an employee or an independent contractor or a right to serve as an officer or director of the Buyer or Designated Subsidiary. |

| 14. | Miscellaneous. |

| (a) | Governing Law. The validity, interpretation, construction and performance of this Agreement, and all acts and transactions pursuant hereto and the rights and obligations of the parties hereto shall be governed, construed and interpreted in accordance with the laws of the State of New York, without giving effect to principles of conflicts of law. | |

| (b) | Jurisdiction. Any legal action, suit or proceeding arising out of or relating to this Agreement or the transactions contemplated hereby may only be instituted in any state or federal court in the State of New York and each party waives any objection which such party may now or hereafter have to the laying of the venue of any such action, suit or proceeding, and irrevocably submits to the jurisdiction of any such court in any such action, suit or proceeding. | |

| (c) | WAIVER OF JURY TRIAL. EACH PARTY HERETO HEREBY WAIVES, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, ANY RIGHT IT MAY HAVE TO A TRIAL BY JURY IN ANY LEGAL PROCEEDING DIRECTLY OR INDIRECTLY ARISING OUT OF OR RELATING TO THIS AGREEMENT OR THE TRANSACTIONS CONTEMPLATED HEREIN (WHETHER BASED ON CONTRACT, TORT OR ANY OTHER THEORY). EACH PARTY HERETO (A) CERTIFIES THAT NO REPRESENTATIVE, AGENT OR ATTORNEY OF ANY OTHER PARTY HAS REPRESENTED, EXPRESSLY OR OTHERWISE, THAT SUCH OTHER PARTY WOULD NOT, IN THE EVENT OF LITIGATION, SEEK TO ENFORCE THE FOREGOING WAIYER AND (B) ACKNOWLEDGES THAT IT AND THE OTHER PARTIES HERETO HAVE BEEN INDUCED TO ENTER INTO THIS AGREEMENT BY, AMONG OTHER THINGS, THE MUTUAL WAIVERS AND CERTIFICATIONS IN THIS SECTION 14(c). | |

| (d) | Entire Agreement. This Agreement sets forth the entire agreement and understanding of the parties relating to the subject matter herein and supersedes all prior or contemporaneous discussions, understandings and agreements, whether oral or written, between them relating to the subject matter hereof. |

| 11 |

| (e) | Amendments and Waivers. No modification of or amendment to this Agreement, nor any waiver of any rights under this Agreement, shall be effective unless in writing signed by the parties to this Agreement. No delay or failure to require performance of any provision of this Agreement shall constitute a waiver of that provision as to that or any other instance. | |

| (f) | Successors and Assigns. Except as otherwise provided in this Agreement, this Agreement, and the rights and obligations of the parties hereunder, will be binding upon and inure to the benefit of their respective successors, assigns, heirs, executors, administrators and legal representatives. The Buyer and Designated Subsidiary may assign any of its rights and obligations under this Agreement. No other party to this Agreement may assign, whether voluntarily or by operation of law, any of its rights and obligations under this Agreement, except with the prior written consent of the Buyer and Designated Subsidiary. | |

| (g) | Notices. Any notice, demand or request required or permitted to be given under this Agreement shall be in writing and shall be deemed sufficient when delivered personally or by overnight courier or sent by email with return receipt requested and received, or 48 hours after being deposited in the U.S. mail as certified or registered mail with postage prepaid, addressed to the party to be notified at such party’s address as set forth on the signature page, as subsequently modified by written notice, or if no address is specified on the signature page, at the most recent address set forth in the Designated Subsidiary’s books and records. | |

| (h) | Severability. If one or more provisions of this Agreement are held to be unenforceable under applicable law, the parties agree to renegotiate such provision in good faith. In the event that the parties cannot reach a mutually agreeable and enforceable replacement for such provision, then (i) such provision shall be excluded from this Agreement, (ii) the balance of the Agreement shall be interpreted as if such provision were so excluded and (iii) the balance of the Agreement shall be enforceable in accordance with its terms. | |

| (i) | Construction. This Agreement is the result of negotiations between and has been reviewed by each of the parties hereto and their respective counsel, if any; accordingly, this Agreement shall be deemed to be the product of all of the parties hereto, and no ambiguity shall be construed in favor of or against any one of the parties hereto. | |

| U) | Counterparts. This Agreement may be executed in any number of counterparts, each of which when so executed and delivered shall be deemed an original, and all of which together shall constitute one and the same agreement. The execution and delivery of a facsimile or other electronic transmission of this agreement shall constitute delivery of an executed original and shall be binding upon the person whose signature appears on the transmitted copy. |

[Signature Page Follows]

| 12 |

IN WITNESS WHEREOF, the parties hereto have executed this Agreement as of the Effective Date.

| BUYER: | ||

| The GLIMPSE GROUP, INC | ||

| By: | /s/ Xxxxx Xxxxxxxx | |

| Name: | Xxxxx Xxxxxxxx | |

| Title : | President & CEO Address for Notices: | |

| THE GLIMPSE GROUP, INC. | ||

| Attn.: Chief Executive Officer | ||

| 000 Xxxxx Xxxxxx, Xxxxx 0000 | ||

| Xxx Xxxx, XX 00000 | ||

| Email: xxxxx@xxxxxxxxxxxxxxx.xxx | ||

| DESIGNATED SUBSIDIARY: | ||

| KabaQ 3D Food Technologies, LLC | ||

| By: | /s/ Xxxxx Xxxxxxxx | |

| Name: | Xxxxx Xxxxxxxx | |

| Title: | President | |

| THE GLIMPSE GROUP, INC. | ||

| Attn.: Chief Executive Officer | ||

| 000 Xxxxx Xxxxxx, Xxxxx 0000 | ||

| Xxx Xxxx, XX I 0022 | ||

| Email: xxxxx@xxxxxxxxxxxxxxx.xxx | ||

| SELLER: | ||

| By: | /s/ Xxxxx Xxxxx | |

| Name: | Xxxxx Xxxxx | |

| Address for Notices: Xxxxx Xxxxx | ||

| Email: xxxxx@xxxxxxxxxx.xxx | ||

| 13 |

EXHIBIT A

DETAILED DESCRITPION OF TECHNOLOGY OF SELLER

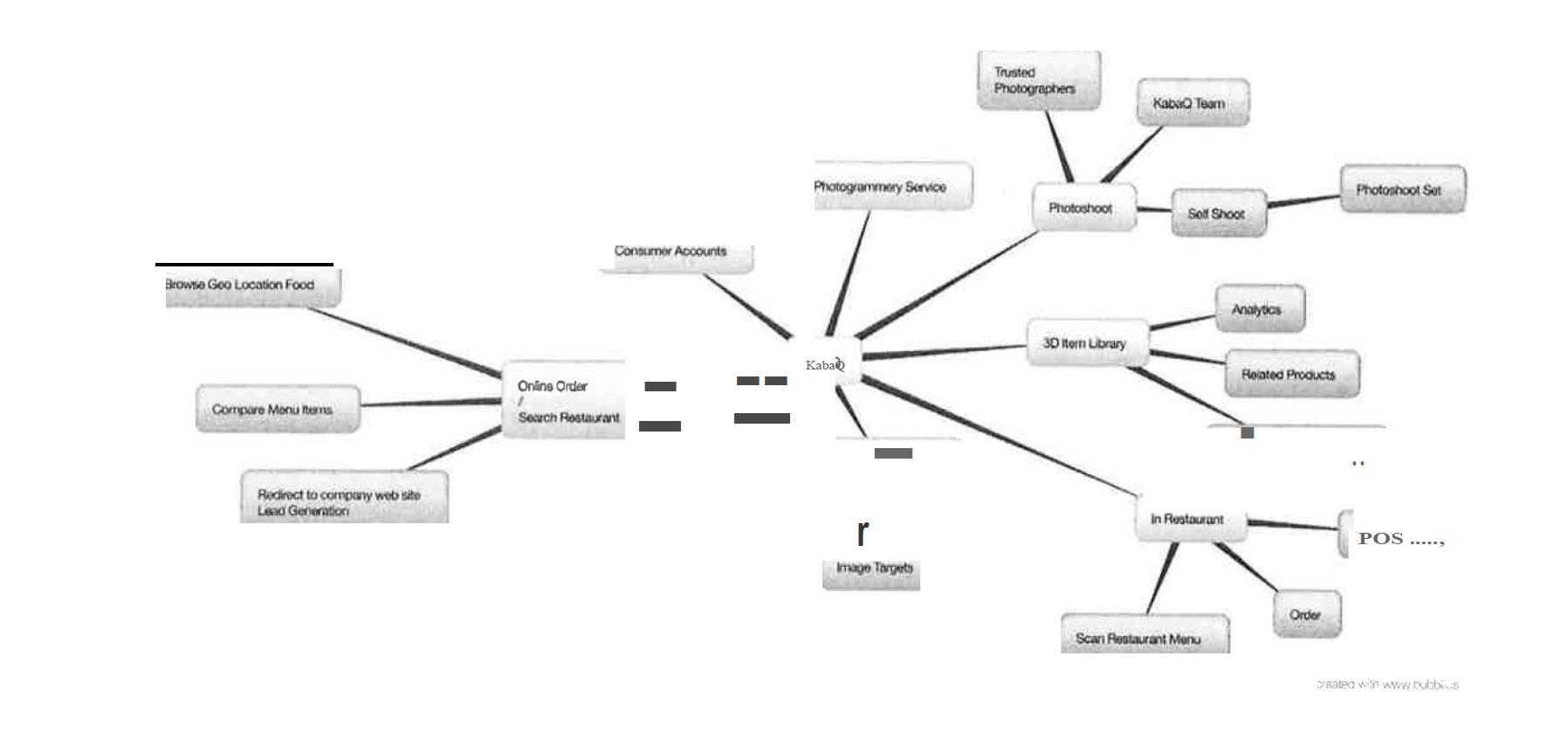

KabaQ is a 3D scan food platform with augmented and virtual reality technology software solution capabilities. KabaQ offering include, but are not limited to:

| ● | Using Photogrammetry services to convert food pictures to 3D models that can be used in virtual and augmented reality software. | |

| ● | B2C services for ordering food in restaurants or online orders through an application. | |

| ● | B2B services for brands to create marketing experiences around scanned food items | |

| ● | B2B services for selling 3D food models on the market. |

| 14 |

EXHIBITB

FORM OF XXXX OF SALE

| 15 |

EXHIBIT C

FORM OF EMPLOYMENT AGREEMENT

| 16 |

EXHIBITD

FORM OF OPTION AGREEMENT

| 17 |

Appendix 1

| a) | Software documents, business plan, kaba .io, 0xxxxxxxxxx.xxx, xxxxx://xxx.xxxxxxxx.xxx/xxxxxxxx/,xxxxx://xxxxxxx.xxx/xxxxxXxx, xxxxx://xxx.xxxxxxxxx.xxx/xxxxxxxx/, source codes for current version of kabaq app on ios and android stores. |

| b) | Seller, in his capacity as an investor in Pandora Reality, LLC has worked with PepsiCo on three projects in the last month, two of these related to the KabaQ Food application and one direct gamification augmented reality project. These three projects only were signed through Pandora Reality LLC and are excluded from this agreement. However, all additional contracts between KabaQ and PepsiCo will be signed with the Designated Subsidiary. | |

| No other contracts with Pandora Reality, LLC have signed related to augmented reality and virtual reality food services. Pandora is still in discussions with Hard Rock Cafe, KFC, Applebee’s and other PepsiCo related food providers. Any upcoming project related to KabaQ food services and products will be signed through KabaQ 3D Food Technologies, LLC (the Designated Subsidiary). | ||

| Pandora Reality, LLC does not own any augmented reality and virtual reality food service/industry IP, Software, License or Products. | ||

| Pandora Reality, LLC and its Turkey head quarters have been providing augmented and virtual reality software solutions since 2014. Pandora develops custom Augment Reality and Virtual Reality software projects related to customer needs. With this agreement, Glimpse is not acquiring ownership in any materials not related to 3D, virtual reality and augmented reality food services and products. |

| 18 |