Equity Pledge Agreement

Exhibit 10.4

▇▇▇ ▇▇▇▇ Chemical

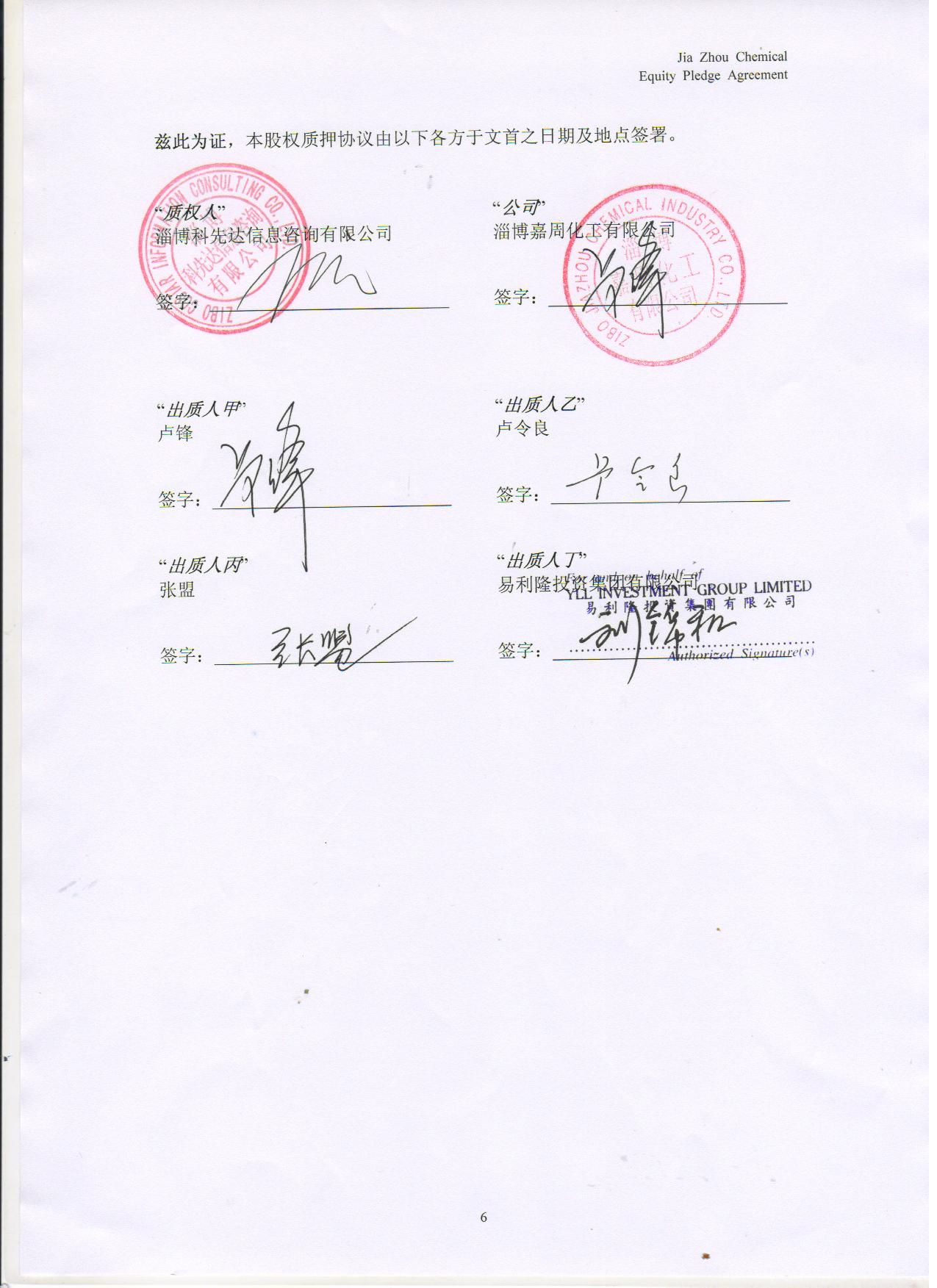

This Equity Pledge Agreement (“Agreement”) is entered into as of September 30, 2010 by and among:

“Pledgor A”

|

▇▇ ▇▇▇▇ (卢锋)

|

|

|

ID Card Number:

|

|

|

Address:

|

|

|

Telephone:

|

|

“Pledgor B”

|

Lu ▇▇▇▇ ▇▇▇▇▇(卢令良)

|

|

|

ID Card Number:

|

|

|

Address:

|

|

|

Telephone:

|

|

“Pledgor C”

|

▇▇▇▇▇ ▇▇▇▇(张盟)

|

|

|

ID Card Number:

|

|

|

Address:

|

|

|

Telephone:

|

|

“Pledgor D”

|

YLL Investment Group Limited

|

|

|

Represented By:

|

|

|

Address:

|

|

|

Telephone:

|

|

“Company”

|

Zi Bo ▇▇▇ ▇▇▇▇ Chemical Co., Ltd.

|

|

|

Address:

|

|

|

Represented By:

|

|

|

Telephone:

|

|

“Pledgee”

|

Zi Bo Costar Information Consulting Co., Ltd.

|

|

|

Address:

|

|

|

Represented By:

|

|

|

Telephone:

|

|

1

Pledgor A, Pledgor B, Pledgor C and Pledgor D are collectively referred to as “Pledgors”.

WHEREAS,

|

(1)

|

Pledgors are the registered shareholders of the Company. Pledgors legally hold all shares of the Company (“Company Shares”) and will hold all company shares on the date the parties execute this Agreement. Each Pledgor’s contribution of the Company’s Registered Capital and the Share Holding Proportion are identified in Exhibit I.

|

|

(2)

|

Pursuant to that certain Exclusive Management Consulting Services Agreement between Pledgee, the Company and the Pledgors dated as of September 30, 2010, the Pledgors have guaranteed the performance by the Company of its obligations under the Business Cooperation Agreements, as that term is defined therein, and have agreed to pledge all of the Company shares they own (the “Pledged Equity”) to secure that guarantee. This is the Equity Pledge Agreement referred to in Section 14 of the Management Services Agreement.

|

Through the friendly negotiation, the parties hereby agree:

ARTICLE 1

EQUITY PLEDGE

|

1.1

|

Pledgee will own priority of payment of the interest from the Pledged Equity converted into money, or the money from Pledged Equity’s auction or sale (“Pledge Right”). The effectiveness of the Pledge Right will extend to any bonus arising from the Pledged Equity.

|

|

1.2

|

The Pledgors shall cooperate with the Pledgee to register the Pledged Equity with competent equity-pledge registration authority within thirty (30) days following the execute date hereof, and shall provide the relevant registration certificate of the Pledged Equity to the Pledgee in the way satisfactory to the Pledgee. The bonus of Pledged Equity will be deposited into a bank account appointed and supervised by Pledgee.

|

|

1.3

|

The scope of the pledge guarantee hereby includes payment obligations of the Company under the Business Cooperation Agreements, any and all associated penal sum(s) and other expenses incurred in connection with the pledge guarantee as well as the expense of realizing the Pledgee's rights.

|

|

1.4

|

Pledgors will not hold Pledgee responsible for any decrease in value of the Pledged Equity during the period this Agreement is in effect.

|

|

1.5

|

If the Pledgors engage in activity to intentionally reduce the value of the Pledged Equity, Pledgee may auction or sell off the Pledged Equity, and Pledgors agree to use the money from the auction or sale of the Pledged Equity to pay off the debts guaranteed by the Pledged Equity in advance.

|

|

1.6

|

Pledgors may contribute additional capital into Company only with the prior written consent of Pledgee. This increased capital contribution regarded as additional Pledged Equity.

|

2

▇▇▇ ▇▇▇▇ Chemical

|

1.7

|

The period of Pledged Equity under this Agreement will commence on the date the Pledged Equity is registered with the local Administration of Industry and Commerce where the Company located, and ends on the date when the Pledgors pay off all the debt assumed under the Loan Agreement.

|

|

|

ARTICLE 2

|

|

|

WARRANTY AND COMMITMENT OF PLEDGOR

|

Pledgors hereby warrant and represent respectively and collectively to Pledgee as follows:

|

2.1

|

Pledgors have read this entire Agreement and understands the content contained herein.

|

|

2.2

|

All expressions of Pledgors’ intent contained in this Agreement are true.

|

|

2.3

|

Pledgors’ execution and fulfillment of this Agreement is voluntary.

|

|

2.4

|

Pledgors are the legal owner of the Pledged Equity and warrants that there is no current ownership dispute of Pledged Equity. Pledgors will be entitled to dispose of the Pledged Equity and any part of such equity.

|

|

2.5

|

With the exception of the pledge rights identified in this Agreement, there are no other outstanding pledge rights and benefits or third party’s pledge rights and benefits on the Pledged Equity identified in this Agreement.

|

|

2.6

|

All documents, information and reports provided by Pledgors to Pledgee were true, complete and effective at the time of their production and are true, complete and effective as of the date of execution of this Agreement.

|

|

2.7

|

Without the prior written agreement of Pledgee, Pledgors will not transfer the Pledged Equity, make any other agreement or pledge concerning the Pledged Equity or take any action that will dispose or negatively influence the Pledged Equity or Right.

|

|

2.8

|

Pledgors will immediately inform Pledgee in writing of any possible event or act which may affect the Pledge Right.

|

|

2.9

|

Pledgors will take every necessary measure and sign every necessary document to ensure the Pledge Right can be exercised and realized.

|

|

|

ARTICLE 3

|

|

|

WARRANTY AND COMMITMENT OF COMPANY

|

|

3.1

|

Company hereby agrees that it will take joint responsibility with Pledgors’ for the warranties and representations made by Pledgors to Pledgee in Article 2.

|

|

3.2

|

Company promises that it will not pass any resolutions concerning the Pledge Right which may have an affect on the exertion and realization of the Pledge Rights under this Agreement.

|

3

|

|

ARTICLE 4

|

|

|

LIFE AND TRANSFER OF AGREEMENT

|

|

|

4.1

|

This Agreement will be effective on the execution date of this Agreement, and will end on the date Pledgors fulfill the obligations under the Business Cooperation Agreements.

|

|

4.2

|

This Agreement is binding on all legal heirs and/or successors of the parties hereby.

|

|

4.3

|

This Agreement, nor any of the duties and obligations identified herein, can be transferred to a third party, except by Pledgee’s prior written consent.

|

|

|

ARTICLE 5

|

|

|

FORCE MAJEURE

|

|

5.1

|

“Force Majeure” under this Agreement is identified as war, fire acts of god, such as an earthquake or flood, as well as government order, government action, or related laws and regulations that are unforeseeable, irresistible and/or unavoidable events (“Force Majeure event”).

|

|

5.2

|

Any Party who fails to perform or fails all or any partial obligations under this Agreement (“Breaching Party”) due to a Force Majeure will not be held responsible for the breach if the Breaching Party has taken every effort to fulfill its other obligations under this Agreement. Once the Force Majeure event no longer prevents the Breaching Party from fulfilling its obligations under this Agreement, the Breaching Party agrees to recommence performance of its obligations. If the Force Majeure event has made fulfillment of this Agreement impossible, the Parties will make best efforts to fulfill the purpose of this Agreement in accordance with the requirement of the Pledgee.

|

|

|

ARTICLE 6

|

|

|

NOTICES

|

|

6.1

|

Any notice, request, demand or other communication required by this Agreement or made according to this Agreement will be delivered to the relevant Party in writing.

|

|

6.2

|

Notices given by personal delivery or mail will be deemed effective on the date of receipt. Notices given by facsimile transmission or email will be deemed effective on the date of transmission or, if the transmission date is not a working day or the transmission time is after regular business hours (defined as 9:00-18:00), then the effective date will be the first (1st) business day following the date of transmission.

|

|

|

ARTICLE 7

|

|

|

LIABILITIES FOR BREACH OF CONTRACT

|

|

7.1

|

If any Party to this Agreement fails in any of its representations, warranties or covenants under this Agreement, or if fails to perform any of its obligations under this Agreement, such failure will constitute a breach under this Agreement (“Breach”).

|

|

7.2

|

The Party that does not breach this Agreement (“Non-breaching Party”) will have the right to require the Breaching Party to rectify or take remedial actions within an agreed period. If the Breaching Party fails to rectify its breaching activities within the agreed period, the Non-Breaching Party has the right, at its own discretion, to choose one of the following remedies: (1) terminate this Agreement and require the Breaching party to compensate all the losses incurred to the other Party due to its Breach; or (2) require enforcement of the obligations of the Breaching Party under this Agreement and require compensation for all losses incurred to the other party due to the Breach.

|

4

|

|

ARTICLE 8

|

|

|

APPLICABLE LAWS AND SETTLEMENT OF DISPUTES

|

|

8.1

|

This Agreement will be governed by and construed in accordance with the laws of the People’s Republic of China.

|

|

8.2

|

In the event of a dispute arising from, or in connection with, this Agreement, the Parties will first attempt to resolve the dispute through friendly consultations. In the event that satisfactory resolution is not reached within thirty (30) days after the occurrence of such dispute, the parties will submit the dispute for resolution by arbitration to the China International Economic and Trade Arbitration Commission (“Commission”) in Shanghai, in accordance with the then-effective procedural rules of the Commission. The arbitration will be conducted in Chinese. The arbitral award will be final and binding upon all Parties. The arbitration fee will be borne by the losing Party. All other terms in this Agreement, other than the disputed portion of this Agreement, will remain effective.

|

|

|

ARTICLE 9

|

|

|

MISCELLANEOUS

|

|

9.1

|

This Agreement is written in Chinese and has four (4) counterparts, with each Party holding one (1) counterpart and the remaining one (1) counterpart used for the registration of the Pledged Equity.

|

|

9.2

|

The headings contained in this Agreement are inserted for convenience only and should not be interpreted as having any affect on the meaning or interpretation of this Agreement or any provision hereof.

|

|

9.3

|

This Agreement will take effect upon execution and will be binding on the Parties.

|

|

9.4

|

Each part of this Agreement is intended to be severable. If any term, covenant, condition or provision hereof is unlawful, invalid or unenforceable for any reason whatsoever, then all such remaining parts hereof will be valid and enforceable and have full force and effect as if the invalid or unenforceable part had not been included in the Agreement.

|

|

|

.

|

|

9.5

|

This Agreement may not be amended, altered or modified except by a subsequent written document signed by all Parties.

|

|

|

[The remainder of this page is intentionally left blank.]

|

5

▇▇▇ ▇▇▇▇ Chemical